Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - FBR & Co. | dex311.htm |

| EX-31.2 - EXHIBIT 31.2 - FBR & Co. | dex312.htm |

| EX-32.2 - EXHIBIT 32.2 - FBR & Co. | dex322.htm |

| EX-12.1 - EXHIBIT 12.1 - FBR & Co. | dex121.htm |

| EX-23.1 - EXHIBIT 23.1 - FBR & Co. | dex231.htm |

| EX-21.1 - EXHIBIT 21.1 - FBR & Co. | dex211.htm |

| EX-32.1 - EXHIBIT 32.1 - FBR & Co. | dex321.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2010

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-33518

FBR CAPITAL MARKETS CORPORATION

(Exact name of registrant as specified in its charter)

| Virginia | 20-5164223 | |

| (State or other jurisdiction of Incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 1001 Nineteenth Street North, Arlington, VA |

22209 | |

| (Address of principal executive offices) | (Zip Code) | |

(703) 312-9500

(Registrant’s telephone number, including area code)

Securities registered pursuant to section 12(b) of the act:

| Title of Each Class |

Name of Each Exchange on which Registered | |

| Common Stock, Par Value $0.001 | The NASDAQ Stock Market LLC (The NASDAQ Global Select MarketSM) |

Securities registered pursuant to section 12(g) of the act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act: Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act: Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K: x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

Large Accelerated Filer ¨ Accelerated Filer x Non-Accelerated Filer ¨ Smaller Reporting Company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes ¨ No x

The aggregate market value of FBR Capital Markets Corporation’s outstanding common stock held by non-affiliates as of June 30, 2010 was approximately $140.9 million. In determining this figure, the registrant has excluded all shares of common stock beneficially owned by its directors and executive officers and each person who beneficially owns 10% or more of FBR Capital Markets Corporation’s outstanding common stock. By doing so, the registrant does not admit that such persons are affiliates within the meaning of Rule 405 of the Securities Act of 1933, as amended, or for any other purpose.

On February 28, 2011, there were 62,354,677 shares of FBR Capital Markets Corporation common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

| Document |

Where Incorporated | |

| FBR Capital Markets Corporation 2010 Proxy Statement (to be filed with the Securities and Exchange Commission on or before April 30, 2011) |

Part III, Items 10, 11, 12, 13 and 14 |

Table of Contents

| Page | ||||||

| 1 | ||||||

| 2 | ||||||

| PART I |

||||||

| Item 1. |

3 | |||||

| Item 1A. |

11 | |||||

| Item 1B. |

24 | |||||

| Item 2. |

24 | |||||

| Item 3. |

24 | |||||

| Item 4. |

26 | |||||

| PART II |

||||||

| Item 5. |

27 | |||||

| Item 6. |

28 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

30 | ||||

| Item 7A. |

53 | |||||

| Item 8. |

53 | |||||

| Item 9. |

Changes In and Disagreements with Accountants on Accounting and Financial Disclosure |

53 | ||||

| Item 9A. |

53 | |||||

| Item 9B. |

54 | |||||

| PART III |

||||||

| Item 10. |

55 | |||||

| Item 11. |

55 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

55 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

55 | ||||

| Item 14. |

55 | |||||

| PART IV |

||||||

| Item 15. |

56 | |||||

| 59 | ||||||

| F-1 | ||||||

Table of Contents

Some of the statements contained in or incorporated by reference in this Form 10-K are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements are predictive in nature and can be identified by the use of forward-looking words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “goal,” “objective,” “potential,” “project,” “should,” “will” and “would” or the negative of these terms or other comparable terminology. Statements concerning projections, future performance developments, events, revenues, expenses, earnings, run rates, and any other guidance on present or future periods constitute forward-looking statements. Such statements include, but are not limited to, those relating to the effects of growth, our principal investing activities, levels of assets under management and our current equity capital levels. Forward-looking statements involve risks and uncertainties. You should be aware that a number of important factors could cause our actual results to differ materially from those in forward-looking statements. These factors include, but are not limited to:

| • | the risks identified under the section captioned “Risk Factors” in this Form 10-K; |

| • | general volatility of the capital markets and the possibility that an active public trading market for our common stock cannot be sustained; |

| • | deterioration in the business environment in the specific sectors of the economy in which we focus or a decline in the market for securities of companies within these sectors; |

| • | substantial fluctuations in our financial results; |

| • | our ability to retain our senior professionals; |

| • | pricing and other competitive pressures; |

| • | changes in laws and regulations and industry practices that adversely affect our sales and trading business; |

| • | incurrence of losses in the future; |

| • | the singular nature of our capital markets and strategic advisory engagements; |

| • | competition among financial services firms for business and personnel; |

| • | larger and more frequent capital commitments in our trading and underwriting businesses; |

| • | limitations on our access to capital; |

| • | malfunctioning or failure in our operations and infrastructure; |

| • | our entry into new business areas, including entry through strategic investments, acquisitions and joint ventures; |

| • | failure to achieve and maintain effective internal controls; |

| • | declines in the market value of our principal investments; |

| • | the loss of our exemption from registration as an investment company under the Investment Company Act of 1940, as amended (the “1940 Act”); |

| • | the overall environment for interest rates; |

| • | changes in our business strategy; and |

| • | availability, terms and deployment of capital. |

We will not necessarily update the information presented or incorporated by reference in this Form 10-K if any of these forward-looking statements turn out to be inaccurate, and there are no guarantees about our performance. This Form 10-K, including the consolidated financial statements and notes thereto and the documents incorporated by reference, should be read for a complete understanding of our business, an investment in our company and the risks and other uncertainties associated with that business or an investment in our company.

1

Table of Contents

FBR Capital Markets Corporation (“we,” “us,” “our company” or the “Company”) files annual, quarterly and current reports, proxy statements, information statements and other information with the United States Securities and Exchange Commission (the “SEC”). You may read and copy any document we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an internet site that contains annual, quarterly and current reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. Our electronic SEC filings are available to the public at http://www.sec.gov.

Our public internet site is http://www.fbr.com. We make available free of charge through our public internet site our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. We also make available through our public internet site statements of beneficial ownership of our equity securities filed by our directors, officers, 10% or greater shareholders and others under Section 16 of the Exchange Act.

We also make available on http://www.fbr.com (i) our Corporate Governance Guidelines, (ii) Statement of Business Principles (our code of business conduct and ethics), including any waivers, if any, therefrom granted to executive officers or directors, and (iii) the charters of the Audit, Compensation, and Nominating and Corporate Governance Committees of our Board of Directors. These documents are also available in print without charge to any person who requests them by writing or telephoning:

FBR Capital Markets Corporation

1001 Nineteenth Street North

Arlington, Virginia 22209

(703) 312-9500

Attention: Corporate Secretary

2

Table of Contents

PART I

| ITEM 1. | BUSINESS |

Overview

FBR Capital Markets Corporation is a full-service investment banking, institutional brokerage and asset management firm with a customer-focused and innovative approach to meeting our clients’ needs. In addition, we make principal investments, including merchant banking investments, with our own capital. We were formed in June 2006, and we completed the initial public offering of our common stock in June 2007. Since the founding of certain predecessor companies, we have grown from a boutique investment bank with primary expertise in financial institutions into a full-service U.S. investment bank for middle-market companies.

Through our principal operating subsidiaries, FBR Capital Markets & Co. (“FBR & Co.”), an SEC-registered broker-dealer, FBR Capital Markets International, Ltd. (“FBRIL”), a broker-dealer registered with the United Kingdom’s Financial Services Authority (“FSA”), and FBR Fund Advisers, Inc. (“FBR Fund Advisers”), an SEC-registered investment adviser, we have focused our business on providing:

| • | capital raising services, including underwriting and placement of public and private equity and debt; |

| • | financial advisory services, including merger and acquisition (“M&A”) advisory, restructuring, liability management, recapitalization and strategic alternative analysis; |

| • | institutional sales and trading services focused on equities, equity-linked securities, listed options, high-yield bonds, senior debt and bank loans; |

| • | research coverage; |

| • | asset management services through a family of mutual funds; and |

| • | principal investment returns to our shareholders through merchant banking and other direct investments that we make utilizing our own capital. |

We focus our capital markets business (investment banking and institutional brokerage) in the following industry sectors—consumer, diversified industrials, energy and natural resources, financial institutions, healthcare, insurance, real estate, and technology, media and telecommunications (“TMT”). We collectively refer to these sectors as our “core sectors.”

Our asset management business manages a family of mutual funds. As of December 31, 2010, we had approximately $1.6 billion in mutual fund assets under management.

We are a Virginia corporation that was initially formed as a consolidated subsidiary of Arlington Asset Investment Corp. (“Arlington Asset”), a separate publicly-traded corporation that invests primarily in mortgage-related assets. In July 2006, Arlington Asset contributed the subsidiaries that had historically conducted its capital markets and asset management business to us and we sold shares of our common stock in a private offering and a concurrent private placement to Crestview Partners (“Crestview”), a New York-based private equity firm. In this Form 10-K, we refer to this private offering and the concurrent private placement to Crestview as our “July 2006 private offering.” Since our July 2006 private offering, we have operated as an independent company with a separate board of directors. We became a publicly-traded company listed on The NASDAQ Global Select MarketSM (NASDAQ: FBCM) in June 2007. In May 2009, we repurchased shares of our common stock from Arlington Asset and, in October 2009, Arlington Asset sold its remaining shares of our common stock in a secondary public offering.

We are headquartered in Arlington, Virginia and also have offices in Boston, Dallas, Houston, Irvine, London, New York and San Francisco. The address of our principal executive offices is 1001 Nineteenth Street North, Arlington, Virginia 22209. Our telephone number is (703) 312-9500.

3

Table of Contents

Business Segments

Our business comprises three separate segments: capital markets, which includes investment banking and institutional brokerage and research; asset management; and principal investing, which includes merchant banking.

Financial information concerning our company for the fiscal years ended December 31, 2010, 2009, and 2008, including the amount of net revenues contributed by each segment in such periods, is set forth in our consolidated financial statements and the notes thereto in Part II, Item 8, of this Form 10-K. Information with respect to our operations by business segment is set forth under the captions “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Executive Overview” in Part II, Item 7, of this Form 10-K and in Note 14 to our consolidated financial statements in Part II, Item 8, of this Form 10-K.

Capital Markets

Our capital markets business is conducted by our investment banking and institutional brokerage professionals through our U.S. and United Kingdom broker-dealer subsidiaries. These professionals provide investment banking services, including capital raising and financial advisory services for our corporate issuer clients, and institutional brokerage services including sales, trading, and research services, to our institutional investor clients. We believe the capital markets transactions sourced by our investment banking professionals create the types of investment opportunities that our institutional brokerage clients seek, while our institutional brokerage clients provide demand for our investment banking clients’ securities issues, thus helping to provide these corporate issuers with the ability to meet their corporate financing needs. Since January 2008, we have reduced our total number of employees and made adjustments to our variable cost structure to better align our overall cost structure with current market conditions, while at the same time adding capabilities in convertible securities sales and trading, loan trading, restructuring and liability management advisory services, and high yield debt and listed options sales and trading.

Investment Banking

Our investment banking professionals, backed by their industry knowledge and our strong distribution platform, seek to establish and maintain relationships with our corporate clients and to provide them with capital raising and financial advisory services. We provide capital raising services in industry specific investment banking teams that operate across our core sectors: consumer, diversified industrials, energy and natural resources, financial institutions, insurance, real estate, healthcare, and TMT. These teams work closely with our equity, equity-linked and debt capital markets personnel in originating and executing capital markets transactions. In addition to our industry specific teams, our financial sponsors investment banking group delivers investment banking products and solutions to the private equity community and their portfolio companies, our M&A investment banking group delivers a broad range financial advisory services to our investment banking clients, and our restructuring finance and advisory group focuses on accessing the debt and equity capital markets to deliver client solutions inside and outside of insolvency proceedings.

As an investment bank with an ability to raise equity in the private capital markets, we are involved with companies early in their formation in order to establish relationships that will provide us with ongoing revenues as these companies’ corporate finance and financial advisory needs grow. We seek to provide our investment banking clients with the financing and advisory services that they will need at all stages of their corporate lifecycle. We have made, and expect to continue making, opportunistic acquisitions to complement our investment banking platform to increase our product offerings and add to the coverage in our core industry groups.

Capital Raising. We have developed a strong market presence, primarily in a book-managing role, as a leading underwriter of equity securities in the United States. We base our decision to underwrite an offering of a client’s securities on company and industry fundamentals, management’s track record, historical financial results, financial projections, and other factors, all backed by extensive due diligence. We offer a wide range of financial

4

Table of Contents

products and services designed to serve the needs of our investment banking clients, including private equity offerings, initial public, follow-on, and secondary offerings of common equity, convertible debt offerings, public and private preferred equity offerings, and high yield debt offerings and bank-loan syndication.

Strategic Advisory Services. Our financial advisory practice builds on our capital markets expertise and focuses on helping our investment banking clients to assess strategic alternatives, including advice on M&A, liability management and financial restructuring, and strategic partnerships. In addition, we provide valuation advice, fairness opinions, market comparable valuation analysis and other corporate finance advice, including advice with respect to dividend policies and evaluations of stock repurchase programs.

Institutional Brokerage and Research

Through our institutional brokerage professionals, we provide research and institutional sales and trading services to institutional investors in North America, Europe and elsewhere. We execute securities transactions for institutional investors such as mutual funds, insurance companies, hedge funds, banks, money managers and pension and profit-sharing plans, and our ability to work on multiple securities classes with clients enhances our overall brokerage relationships with our clients. We currently operate desks that cover the trading of equity securities, convertible securities, high-yield debt securities, loan products and listed options.

Institutional Brokerage. We believe our institutional brokerage professionals are distinguished by their in-depth understanding of the companies and industries in which we focus. Our traders and salespeople are required to develop detailed knowledge and relationships and provide trade execution and sales and trading services to a diverse institutional client base. Many of our institutional clients have been long-standing investors in transactions that our investment banking teams have brought to the capital markets and have continued a close relationship with us as they have grown in size and assets under management.

Our sales professionals work closely with our research analysts and our trading desks to provide the most up-to-date information to our institutional clients. Our sales, trading, and research professionals work together to maintain regular contact with the specialized portfolio managers and buy-side analysts of each institutional client. We make markets in NASDAQ and other securities, we trade listed securities and loan products, and we service the trading desks of major institutions in the United States, Europe and elsewhere.

Research. We understand the importance of research and the role quality research plays in the institutional brokerage process, particularly for accounts that do not maintain a large in-house research team. We seek to differentiate ourselves through originality of perspective, depth of insight, and our ability to uncover industry trends. We believe our unique viewpoint has helped us develop relationships with investor clients in both our primary distribution and secondary trading businesses.

Our research analysts operate under three guiding principles: (i) to provide objective, independent analysis of securities, their issuers, and their place in the capital markets; (ii) to identify attractive investment opportunities in the capital markets; and (iii) to communicate effectively the fundamentals of these investment opportunities to potential investors. To achieve these objectives, we believe that industry specialization is necessary and, as a result, we organize our research staff along industry lines. Each industry team works together to identify and evaluate industry trends and developments. Within industry groups, analysts are further subdivided into specific areas of focus so that they can maintain and apply specific industry knowledge to each investment opportunity they address.

After initiating coverage on a company, our analysts seek to maintain a long-term relationship with that company and a long-term commitment to ensure that new developments are effectively communicated to our sales force and institutional investors. Our research team analyzes major trends, publishes original research on new areas of growth, provides fundamental, company-specific coverage and works with our institutional clients to identify and evaluate public equity investment opportunities.

5

Table of Contents

Asset Management

Our SEC registered investment adviser subsidiaries principally manage a family of mutual funds. We are focused on expanding our asset management business and strive to utilize our intellectual capital, relationships and other resources, to achieve this goal. As of December 31, 2010, we had $1.6 billion in assets under management.

At December 31, 2010, we managed client assets through our ten mutual fund product lines that cover a range of sectors and asset classes. Through strict attention to relative valuation and careful security selection, our actively managed mutual funds strive both to participate in rising markets and preserve capital in down markets.

Principal Investing

Our principal investing activity consists primarily of investments in merchant banking investments, investments in publicly traded companies, and investments in short-term liquid instruments. We have historically made merchant banking investments in selected transactions that our investment banking group underwrites. This strategy involves putting our capital to work alongside the capital of our institutional clients.

Accounting, Administration and Operations

Our accounting, administration and operations personnel are responsible for financial controls, internal and external financial reporting, human resources and personnel services, office operations, information technology and telecommunications systems, the processing of securities transactions, and corporate communications. With the exception of payroll processing, which is performed by an outside service bureau, and customer account processing, which is performed by our clearing brokers, most data processing functions are performed internally. We believe that future growth will require implementation of new and enhanced communications and information systems and training of our personnel to operate such systems.

Compliance, Legal, and Risk Management

Our compliance, legal and risk management personnel (together with other appropriate personnel) are responsible for our compliance procedures with regard to the legal and regulatory requirements of our company and for our procedures with regard to our exposure to market, credit, operations, liquidity, compliance, legal, reputational and equity ownership risk. In addition, compliance personnel test for compliance by our personnel with our policies and procedures. Our legal personnel also provide legal service throughout our company, including advice on managing legal risk. The supervisory personnel in these areas have direct access to, and meet regularly with, our executive management and with the Audit Committee of our Board of Directors to ensure their independence in performing these functions. In addition to our internal compliance, legal, and risk management personnel, we outsource particular functions to outside consultants and attorneys for their particular expertise.

Competition

From 2008-2010, the financial services industry underwent a dramatic reshaping, as several major financial institutions consolidated, were forced to merge, declared bankruptcy, received substantial government assistance or were placed into conservatorship, all of which has resulted in significant upheaval in the competitive environment. These events accelerated a longstanding trend toward consolidation among companies in the financial services industry and created an environment of uncertainty among financial services firms of all sizes. As a full-service investment banking, institutional brokerage and asset management firm, all aspects of our business are intensely competitive. Our competitors are other traditional and online brokerage firms, investment banking firms, merchant banks and financial advisory firms. Some of our competitors have fundamentally changed their respective business models over the past two years, including, in certain cases, becoming

6

Table of Contents

commercial banks, and there has been significant movement of personnel, both among firms as well as out of the industry altogether. We compete with some of our competitors nationally and with others on a regional, product or business line basis. Many of our competitors have substantially greater capital and resources than we do and offer a broader range of financial products and services, and recent developments could result in our remaining competitors gaining even greater capital and other resources. We believe that the principal factors that allow us to compete effectively include the strength and extent of our client relationships, our reputation, the abilities of our professionals, our market focus and the relative quality and price of our services and products.

We have experienced intense price competition in some areas of our capital markets businesses, in particular, discounts in large block trades and trading commissions and spreads. The ability to execute trades electronically, through the Internet and through other alternative trading systems, has increased the pressure on trading commissions and spreads. We believe that this trend toward alternative trading systems will continue. We may experience competitive pressures in these and other areas in the future as some of our competitors seek to increase market share by reducing prices.

In our asset management business, we compete with many of the same firms as we do in the investment banking and brokerage businesses as well as with venture capital firms, large mutual fund companies, commercial banks and smaller niche players, including private hedge funds.

Competition is also intense for the recruitment and retention of qualified professionals. The performance of our business is in a large part dependent on the skills, expertise and performance of our employees. Our ability to continue to compete effectively in our businesses will depend upon our continued ability to attract new professionals and retain and motivate our existing professionals.

Risk Management

In conducting our business, we are exposed to a range of risks including, without limitation:

| • | Market risk. Market risk is the risk that a change in the level of one or more market prices, rates, indices, or other market factors, such as market liquidity, will result in losses for a position or portfolio. |

| • | Credit risk. Credit risk is the risk of loss due to an individual customer’s or institutional counterparty’s unwillingness or inability to pay its obligations. |

| • | Operations risk. Operations risk is the risk of loss resulting from systems failure, inadequate controls, human error, fraud or unforeseen catastrophes. |

| • | Liquidity risk. Liquidity risk is the risk that we may be unable to meet our obligations as they come due because of our inability to liquidate assets or obtain funding. Liquidity risk also includes the risk of having to sell assets at a loss to generate liquid funds. |

| • | Regulatory risk. Regulatory risk is the risk of loss, including fines, penalties or restrictions in our activities, from failing to comply with federal, state or local laws, rules and regulations pertaining to financial services activities. |

| • | Legal risk. Legal risk is the risk of loss, disruption or other negative effect on our operations or condition that arises from unenforceable contracts, lawsuits, adverse judgments, or adverse governmental or regulatory proceedings, or the threat thereof. |

| • | Reputational risk. Reputational risk is the risk that negative publicity regarding our practices, whether true or not, will cause a decline in the customer base, resulting in costly litigation, or reduce our revenues. |

We monitor market and business risk, including credit risk, operations, liquidity, regulatory, legal, and reputational risk through a number of control procedures designed to identify and evaluate the various risks to which our businesses and investments are exposed. We have established various committees to assess and

7

Table of Contents

manage risk associated with our investment banking, merchant banking and other activities. We review, among other things, business and transactional risks associated with investment banking potential clients and engagements. We seek to manage the risks associated with our investment banking and merchant banking activities by review and approval of transactions by the relevant committee, prior to accepting an engagement or pursuing a material investment transaction. Although we believe that our risk management program and our internal controls are appropriately designed to address the risks to which we are exposed, we cannot provide assurance that our risk management program or our internal controls will prevent or reduce such risks.

Insurance

We maintain insurance in types and amounts and with deductibles that management believes are customary for companies of similar size and engaged in similar businesses. However, the insurance market is volatile, and there can be no assurance that any particular coverage will be available in the future on terms acceptable to us.

Employees

As of December 31, 2010, we had 501 employees, in comparison to the 595 employees we had as of December 31, 2009. Our employees are not subject to any collective bargaining agreement and we consider our relationship with our employees to be good.

Regulation

Our business, as well as the financial services industry generally, is subject to extensive regulation in the United States and elsewhere. As a matter of public policy, regulatory bodies in the United States and the rest of the world are charged with safeguarding the integrity of the securities and other financial markets and with protecting the interests of customers participating in those markets. In light of current conditions in the financial markets and the economy, regulators have increased their focus on the regulation of the financial services industry. Proposals for legislation that could substantially intensify the regulation of the financial services industry are expected to be introduced in the U.S. Congress, in state legislatures and around the world. In the U.S., the SEC is the federal agency responsible for the administration of the federal securities laws. FBR & Co. and FBR Investment Services, Inc (“FBRIS”) are registered as broker-dealers with the SEC and the Financial Industry Regulatory Authority, Inc. (“FINRA”), a self-regulatory organization, and in all 50 states, Puerto Rico and the District of Columbia. Accordingly, FBR & Co. and FBRIS are subject to regulation and oversight by the SEC and FINRA, which is itself subject to oversight by the SEC and which adopts and enforces rules governing the conduct, and examines the activities, of its member firms, including FBR & Co. and FBRIS, and their registered representatives. State securities regulators also have regulatory or oversight authority over FBR & Co. and FBRIS. Our business may also be subject to regulation by non-U.S. governmental and regulatory bodies and self-regulatory authorities in other countries where we operate.

FBR Fund Advisers and FBR Investment Management, Inc. (“FBRIM”) are SEC-registered investment advisers. Registered investment advisers are subject to regulations under the Investment Advisers Act of 1940, as amended. Regulations under the Investment Advisers Act of 1940 relate to, among other things, recordkeeping and reporting requirements, disclosure requirements, limitations on agency cross and principal transactions between an adviser and advisory clients, as well as general anti-fraud prohibitions. In addition, certain investment funds that we manage are registered investment companies under the Investment Company Act of 1940, as amended. Those funds and the entities that serve as the funds’ investment advisers are subject to that act and the rules and regulations promulgated by the SEC under that act, which, among other things, regulate the relationship between a registered investment company and its investment adviser and prohibit or severely restrict principal transactions and joint transactions.

8

Table of Contents

Broker-dealers are subject to regulations that cover all aspects of the securities business, including sales methods, trade practices among broker-dealers, use and safekeeping of customers’ funds and securities, capital structure, record-keeping, the financing of customers’ purchases and the conduct and qualifications of directors, officers and employees. In particular, as a registered broker-dealer and member of various self-regulatory organizations, FBR & Co. and FBRIS are subject to the SEC’s uniform net capital rule, Rule 15c3-1. Rule 15c3-1 specifies the minimum level of net capital a broker-dealer must maintain and also requires that a significant part of its assets be kept in relatively liquid form. The SEC and various self-regulatory organizations impose rules that require notification when net capital falls below certain predefined criteria, limit the ratio of subordinated debt to equity in the regulatory capital composition of a broker-dealer and constrain the ability of a broker-dealer to expand its business under certain circumstances. Additionally, the SEC’s uniform net capital rule imposes certain requirements that may have the effect of prohibiting a broker-dealer from distributing or withdrawing capital and requiring prior notice to the SEC for certain withdrawals of capital.

Compliance with regulatory net capital requirements could limit those operations that require the intensive use of capital, such as underwriting and trading activities, and also could restrict our ability to withdraw capital from our affiliated broker-dealers, which in turn could limit our ability to pay dividends, repay debt and redeem or repurchase shares of our outstanding capital stock.

We believe that at all times FBR & Co. and FBRIS have been in compliance in all material respects with the applicable minimum net capital rules of the SEC and FINRA. A failure of a U.S. broker-dealer to maintain its minimum required net capital would require it to cease executing customer transactions until it came back into compliance, and could cause it to lose its FINRA membership, its registration with the SEC or require its liquidation. Further, the decline in any of our broker-dealer subsidiaries’ net capital below certain early warning levels, even though above minimum net capital requirements, could cause material adverse consequences to us and to our broker-dealer subsidiary.

FBR & Co. and FBRIS also are subject to “Risk Assessment Rules” imposed by the SEC which require, among other things, that certain broker-dealers maintain and preserve certain information, describe risk management policies and procedures and report on the financial condition of certain affiliates whose financial and securities activities are reasonably likely to have a material impact on the financial and operational condition of the broker-dealer. Certain “material associated persons” (as defined in the Risk Assessment Rules) of the broker-dealer and the activities conducted by such material associated persons may also be subject to regulation by the SEC. In addition, the possibility exists that, on the basis of the information it obtains under the Risk Assessment Rules, the SEC could seek authority over our unregulated subsidiaries either directly or through its existing authority over our regulated subsidiaries.

The research areas of investment banks have been and remain the subject of increased regulatory scrutiny. In 2002 and 2003, acting in part pursuant to a mandate contained in the Sarbanes-Oxley Act of 2002, the SEC, the NYSE and the NASD (now FINRA) adopted rules imposing heightened restrictions on the interaction between equity research analysts and investment banking personnel at member securities firms. In addition, in 2003 and 2004, several securities firms in the United States reached a settlement with certain federal and state securities regulators and self-regulatory organizations to resolve investigations into their equity research analysts’ alleged conflicts of interest. Under this settlement, the firms have been subject to certain restrictions and undertakings. As part of this settlement, restrictions have been imposed on the interaction between research and investment banking departments, and these securities firms are required to fund the provision of independent research to their customers. In connection with the research settlement, we have also subscribed to a voluntary initiative imposing restrictions on the allocation of shares in initial public offerings to executives and directors of public companies.

The effort to combat money laundering and terrorist financing is a priority in governmental policy with respect to financial institutions. The USA PATRIOT Act of 2001, as amended (the “PATRIOT Act”), contains anti-money laundering and financial transparency laws and mandates the implementation of various new

9

Table of Contents

regulations applicable to broker-dealers and other financial services companies, including standards for verifying client identification at account opening, and obligations to monitor client transactions and report suspicious activities. Through these and other provisions, the PATRIOT Act seeks to promote the identification of parties that may be involved in terrorism or money laundering. Anti-money laundering laws outside the United States contain some similar provisions. The obligation of financial institutions, including us, to identify their customers, watch for and report suspicious transactions, respond to requests for information by regulatory authorities and law enforcement agencies, and share information with other financial institutions, has required the implementation and maintenance of internal practices, procedures and controls which have increased, and may continue to increase, our costs, and any failure with respect to our programs in this area could subject us to serious regulatory consequences, including substantial fines, and potentially other liabilities.

Certain of our businesses are subject to compliance with laws and regulations of U.S. federal and state governments, non-U.S. governments, their respective agencies and/or various self-regulatory organizations or exchanges relating to the privacy of client information, and any failure to comply with these regulations could expose us to liability and/or reputational damage.

Additional legislation, changes in rules promulgated by the SEC and self-regulatory organizations or changes in the interpretation or enforcement of existing laws and rules, either in the United States or elsewhere, may directly affect the mode of our operation and profitability.

Our broker-dealer business is also subject to regulation by various foreign governments and regulatory bodies. FBR & Co. is registered with and subject to regulation by the Ontario Securities Commission in Canada. FBRIL, our United Kingdom brokerage subsidiary, is subject to regulation by FSA in the United Kingdom pursuant to the United Kingdom Financial Services and Markets Act of 2000 (as amended). Foreign regulation may govern all aspects of the investment business, including regulatory capital, sales and trading practices, conflicts of interest, research, use and safekeeping of customer funds and securities, record-keeping, margin practices and procedures, registration standards for individuals, periodic reporting and settlement procedures. The FSA has been pursuing an increased focus on the capital and liquidity strength of regulated firms, and has also expressed its intention to focus on management structures and the culture of supervisory responsibility within firms. It has also set out its views on best practice in the area of position valuation and risk control following a number of mis-marking incidents across the industry.

Many of the investment services that are subject to authorization and regulation by the FSA under the Financial Services and Markets Act of 2000 (as amended) are also subject to certain European Union (“EU”) directives covering, among other things, the organizational requirements and operating conditions for investment firms including customer protection requirements and conduct of business rules. These standards, requirements and rules are similarly implemented, under the same directives, throughout the EU and are broadly comparable in scope and purpose to the customer protection requirements imposed under SEC rules. Where such investment services fall outside the scope of these EU directives, local regulation in each jurisdiction, including those in which we operate, may still apply and in some cases may be more restrictive than the requirements of such directives.

The U.S. and non-U.S. government agencies and self-regulatory organizations, as well as state securities commissions in the United States, are empowered to conduct administrative proceedings that can result in censure, fine, the issuance of cease-and-desist orders or the suspension or expulsion of a broker-dealer or its directors, officers or employees. Occasionally, FBR & Co. has been subject to investigations and proceedings, and sanctions have been imposed for infractions of various regulations relating to its activities.

The Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act) was enacted on July 21, 2010. Among other things, the legislation expands the authority of our existing regulators; broadens the reporting and regulation of executive compensation; and expand the standards for market participants in dealing with clients and customers. The specific impact of the Dodd-Frank Act on our businesses, our clients and the markets in which we operate will depend on the manner in which the relevant agencies develop and implement the required rules and the reaction of market participants to these regulatory developments over the next several years.

10

Table of Contents

| ITEM 1A. | RISK FACTORS |

You should carefully consider the following risks and all of the other information contained in this Form 10-K, including the consolidated financial statements and the notes thereto included in Part II, Item 8, of this Form 10-K. If any of the risks, uncertainties, events or developments described below occurs, our business, financial condition or results of operation could be negatively impacted. In connection with the forward-looking statements that appear in this Form 10-K, you should also carefully review the cautionary statements included under the caption “Forward-Looking Statements.”

Risks Related to Adverse Market Conditions

Our businesses have been and may in the future be materially and adversely affected by financial market conditions and economic conditions generally.

As an investment bank, risk is an inherent part of our business. Our businesses are materially affected by conditions in the financial markets and economic conditions generally. Although market valuations recovered strongly in 2010, the liquidity seen in the markets prior to 2008 has not yet returned. Lower levels of liquidity continue to have a negative effect on trading volumes, particularly in the equity market, which has a direct negative impact on our cash equities trading business.

Our financial performance is highly dependent on the environment in which our businesses operate. A favorable business environment is generally characterized by, among other factors, high global gross domestic product growth, stable geopolitical conditions, transparent and efficient capital markets, liquid markets with active investors, low inflation, high business and consumer confidence and strong business earnings. Slowing growth, contraction of credit, increasing energy prices, declines in business or investor confidence or risk tolerance, increases in inflation, higher unemployment, outbreaks of hostilities or other geopolitical instability, corporate, political or other scandals that reduce investor confidence in capital markets and natural disasters, among other things, can affect the global financial markets. In addition, economic or political pressures in a country or region may cause local market disruptions and currency devaluations, which may also affect markets generally. In the event of changes in market conditions, such as interest or foreign exchange rates, equity, fixed income, commodity or real estate valuations, liquidity, availability of credit or volatility, our businesses could be adversely affected in many ways.

Our investment banking revenues are directly related to the number and size of the transactions in which we participate. Future market downturns that affect the size and number of capital raising transactions will likely have a similar negative impact on our investment banking business. Sustained market downturns and credit market dislocations and liquidity issues in the future would also likely lead to a decline in the volume of secondary market trading that we execute for our institutional brokerage clients and, therefore, to a decline in the revenues we receive from commissions and spreads earned from the trades we execute for our clients. In addition, because the fees that we charge for managing our mutual fund product lines are based on the value of assets under management, a market downturn that reduces the value of assets under management would reduce the revenues we receive from our asset management business. Heightened risk aversion among investors may cause them to shift their trading activity to higher quality and more liquid products, which are generally somewhat less profitable for us.

Risks Related to Our Business

Our financial results may fluctuate substantially from quarter to quarter.

We have experienced, and expect to experience in the future, significant quarterly variations in our revenues and results of operations. These variations may be attributed in part to the fact that our investment banking revenues are typically earned upon the successful completion of a transaction, the timing of which is uncertain and beyond our control. In most cases, we receive little or no payment for investment banking engagements that do not result in

11

Table of Contents

the successful completion of a transaction. As a result, our business is highly dependent on market conditions as well as the decisions and actions of our clients and interested third parties. For example, a client’s securities offering may be delayed or terminated because of adverse market conditions, failure to obtain necessary regulatory approvals or unexpected financial or other problems in the client’s business. If the parties fail to complete an offering in which we are participating as an underwriter or placement agent, we will earn little or no revenue from the transaction. This risk may be intensified by our focus on early-stage companies in certain sectors, as the market for securities of these companies may experience significant variations in the number and size of equity offerings as well as the after-market trading volume and prices of newly issued securities. More companies initiating the process of an initial public offering are simultaneously exploring M&A exit opportunities. Our investment banking revenues would be adversely affected in the event that an initial public offering for which we are acting as an underwriter is preempted by the company’s sale if we are not engaged as a strategic advisor in such sale. As a result, we are unlikely to achieve steady and predictable earnings on a quarterly basis.

We are dependent on our executive management team, and we may not be able to execute our business plan in the event that members of our executive management team are no longer available to us and we are unable to find suitable replacements for them or the members of our executive management team do not dedicate a sufficient amount of their professional time to our endeavors.

Certain members of our executive management team do not have employment agreements with us. We have no assurance that the services of our executive management team will continue to be available to the full extent of our needs. We believe that our success depends to a significant extent upon the experience of our executive management team, whose continued service is not guaranteed. If certain members of our executive management team leave our company or are otherwise no longer available to us or are not available to the full extent of our needs, we may not be able to replace them with suitable management and may be unable to execute our business plan.

We encounter intense competition for qualified professionals from other investment banking firms and from businesses outside the investment banking industry, such as hedge, private equity and venture capital funds, and our failure to hire qualified professionals and retain our existing professionals may materially impede the success and growth of our business.

Our people are our most valuable resource. Our ability to secure and maintain investment banking engagements depends upon the reputation, judgment, business generation capabilities and project execution skills of our professionals. Our professionals’ reputations and relationships with our clients are a critical element in obtaining and executing client engagements. Generally, we do not have employment or non-competition agreements with any of our professionals. We encounter intense competition for qualified professionals from other companies in the investment banking industry and from businesses outside the investment banking industry, such as hedge, private equity and venture capital funds. We may experience losses of investment banking, brokerage, research and other professionals and our failure to hire qualified professionals and retain our existing professionals may materially impede our success and growth. The departure or other loss of our key professionals who manage substantial client relationships or who possess substantial experience and expertise could impair our ability to secure or successfully complete engagements, which could materially adversely affect our business and results of operations. In addition, if any of our investment bankers or members of our executive management team were to join an existing competitor or form a competing company, some of our clients could choose to use the services of that competitor instead of our services. We may not be able to prevent our investment bankers or the members of our executive management team from resigning to join our competitors or from forming a competing company.

We depend on relatively few industries to generate a significant percentage of our revenue, which may limit our revenues and net income and may adversely affect our operating results.

We are dependent on revenues related to securities issued by companies in specific industry sectors. The diversified industrials, energy and natural resources, and financial institutions sectors account for the majority of

12

Table of Contents

our investment banking, asset management, institutional trading and research activities. Therefore, any downturn in the market for the securities of companies in these industry sectors, or factors affecting such companies, could adversely affect our operating results and financial condition. Additionally, the frequency and size of securities offerings can vary significantly from industry to industry due to economic, legislative, regulatory and political factors.

Underwriting and other capital raising transactions, strategic advisory engagements and related trading activities in our core sectors represent a significant portion of our businesses. This concentration of activity exposes us to the risk of substantial declines in revenues in the event of downturns in our core sectors. Future downturns in our core sectors could result in a decrease in the size or number of transactions we complete, which would reduce our investment banking revenues.

We also derive a significant portion of our revenues from institutional sales and trading transactions related to the securities of companies in these sectors. Our revenues from such institutional sales and trading transactions may decline when underwriting activities in these industry sectors decline, the volume of trading on the NASDAQ, the New York Stock Exchange (“NYSE”) or any other securities market or exchange declines, or when industry sectors or individual companies report results below investors’ expectations.

We have incurred losses in recent periods and may incur losses in the future.

We have incurred losses in recent periods. For the year ended December 31, 2010, we had a net loss of $37.6 million. We may incur losses in future periods. If we are unable to fund future losses, those losses may have a significant effect on our liquidity as well as our ability to operate.

In addition, we may incur significant expenses in connection with any expansion of our capital markets and asset management businesses or in connection with strategic acquisitions and investments. Accordingly, we will need to increase our revenues at a rate greater than our expenses to achieve and maintain profitability. If our revenues do not increase sufficiently, or even if our revenues increase but we are unable to manage our expenses, we will not achieve and maintain profitability in future periods.

Our failure to integrate and develop recently added capital markets capabilities or to expand our asset management business could negatively affect the growth of our business.

Our ability to develop our capital markets business depends upon expanding and enhancing the investment banking services we presently offer. We have recently added capabilities in restructuring, convertible securities sales and trading, bank loan syndication and trading, high yield debt sales and trading and listed options sales and trading. We intend to incur increased costs to support these capabilities. Our failure to successfully integrate these capabilities into our business could have an adverse impact on our business. Furthermore, our failure to develop these capabilities to satisfy anticipated near-term demand in our core sectors may harm our growth prospects.

Our ability to expand our asset management business depends on a variety of factors, including but not limited to our ability to identify traditional and/or alternative asset managers and strategies, within our company and externally, and our ability to deploy capital into investments in this area. We cannot guarantee that we will be able to successfully identify alternative asset managers and strategies or invest our own capital in alternative asset managers or strategies. Our inability to expand our asset management business could harm our growth prospects and could negatively impact the value of our common stock.

Pricing and other competitive pressures may impair the revenues and profitability of our institutional brokerage business.

We derive a significant portion of our revenues from our institutional brokerage business. Along with other firms, we have experienced intense price competition in this business in recent years. In particular, the ability to

13

Table of Contents

execute trades electronically and through alternative trading systems has increased the pressure on trading commissions and spreads. We expect pricing pressures in the business to continue. Decimalization in securities trading, introduced in 2000, has also reduced revenues and lowered margins within the equity sales and trading divisions of many firms, including ours. We believe we may experience competitive pressures in these and other areas in the future as some of our competitors seek to obtain market share by competing on the basis of price or use their own capital to facilitate client trading activities. In addition, we face pressure from our larger competitors, which may be better able to offer a broader range of complementary products and services to clients in order to win their trading business. If we are unable to compete effectively in these areas, the revenues from our sales and trading business may decline, and our business and results of operations may be adversely affected. Our research and institutional brokerage business also may be adversely affected by changes in laws and regulations and industry practices.

Our institutional brokerage revenues may decline due to competition from alternative trading systems.

Securities and futures transactions are now being conducted through the internet and other alternative, non-traditional trading systems, and it appears that the trend toward alternative trading systems will continue and probably accelerate. A dramatic increase in computer-based or other electronic trading may adversely affect our institutional brokerage revenues. The NYSE’s adoption of its hybrid market for trading securities may increase pressure on our institutional brokerage business as customers execute more of their NYSE-related trades electronically. Even if we were to develop our own electronic trading systems, we cannot assure you that the revenues generated by these systems will yield an adequate return on our investment, particularly given the relatively lower commissions arising from electronic trades. As a result, our institutional brokerage revenues could decline in the future, which would negatively impact our cash flows and the value of our common stock.

We face strong competition from larger firms, some of which have greater resources and name recognition, which may impede our ability to grow our business.

The brokerage and investment banking industries are intensely competitive and we expect them to remain so. We compete on the basis of a number of factors, including client relationships, reputation, the abilities of our professionals, market focus and the relative quality and price of our services and products. We have experienced intense price competition in some of our businesses, in particular discounts in large block trades and trading commissions and spreads. In addition, pricing and other competitive pressures in investment banking, including the trends toward increased focus by many larger investment banking companies on institutional equity offerings pursuant to Rule 144A, multiple book runners, co-managers and multiple financial advisors handling transactions, have continued and could adversely affect our revenues, even as the volume and number of investment banking transactions have started to increase. We believe we may experience competitive pressures in these and other areas in the future as some of our competitors seek to obtain market share by competing on the basis of price.

Many of our competitors in the brokerage and investment banking industries have a broader range of products and services, greater financial and marketing resources, larger customer bases, greater name recognition, more senior professionals to serve their clients’ needs, greater global reach and more established relationships with clients than we have. These larger and better capitalized competitors may be better able to respond to changes in the brokerage and investment banking industries, to compete for skilled professionals, to finance acquisitions, to fund internal growth and to compete for market share generally.

The scale of our competitors has increased in recent years as a result of substantial consolidation among companies in the brokerage and investment banking industries. In addition, a number of large commercial banks, insurance companies and other broad-based financial services firms have established or acquired underwriting or financial advisory practices and broker-dealers or have merged with other financial institutions. These firms have the ability to offer a wider range of products than we do, which may enhance their competitive position. They also have the ability to support investment banking with commercial banking, insurance and other financial services in an effort to gain market share, which has resulted, and could further result, in pricing pressure in our

14

Table of Contents

businesses. In particular, the ability to provide financing has become an important advantage for some of our larger competitors and, because we do not provide such financing, we may be unable to compete as effectively for clients in a significant part of the brokerage and investment banking market.

If we are unable to compete effectively with our competitors, our business, financial condition and results of operations will be adversely affected.

Our capital markets and strategic advisory engagements are singular in nature and our failure to obtain new engagements may harm our operating results.

Our investment banking clients generally retain us on a short-term, engagement-by-engagement basis in connection with specific capital markets or M&A transactions, rather than on a recurring basis under long-term contracts. As these transactions are typically singular in nature and our engagements with these clients may not recur, we must continuously seek out new engagements when our current engagements are successfully completed or are terminated. As a result, high activity levels in any period are not necessarily indicative of continued high levels of activity in any subsequent period. If we are unable to generate a substantial number of new engagements that generate fees from the successful completion of transactions, our business and results of operations would likely be adversely affected.

Larger and more frequent capital commitments in our trading and underwriting business increase the potential for us to incur significant losses.

We commit our capital to maintain trading positions in the equity, convertible securities, debt and listed options markets. We may enter into large transactions in which we commit our own capital as part of our client trading activities. The number and size of these large transactions may materially affect our results of operations in a given period. We may also incur significant losses from our trading activities due to market fluctuations and volatility in our results of operations. To the extent that we own assets, i.e., have long positions, in any of those markets, a downturn in the value of those assets or in those markets could result in losses. Conversely, to the extent we have sold assets we do not own, i.e., have short positions, in any of those markets, an upturn in those markets could expose us to potentially large losses as we attempt to cover our short positions by acquiring assets in a rising market.

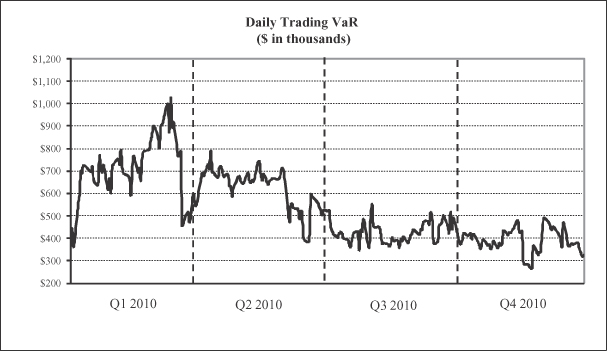

We use a number of quantitative measures to manage our exposure to market risk, including inventory position limits, scenario analysis, and value at risk, or VaR. VaR is a model that quantifies potential losses using historical data. Because the historical market prices used in our VaR analysis may not be an accurate measure of future market events and conditions, especially in highly stressful market environments, and because our VaR model measures the risk of a current net trading position and does not take into account future position changes arising from transaction and/or hedging activity, we could incur losses that are materially greater than our reported VaR, and our business, financial condition and results of operations could be adversely affected.

Before the recent turmoil in the financial markets, there had been a trend toward larger and more frequent commitments of capital by financial services firms in many of their activities. For example, in order to win business investment banks had increasingly been committing to purchase large blocks of stock from publicly traded issuers or significant shareholders, instead of the more traditional marketed underwriting process, in which marketing is typically completed before an investment bank commits to purchase securities for resale. We may undertake more block trades in the future. As a result, we will be subject to increased risk as we commit greater amounts of capital to facilitate primarily client-driven business and, therefore, may suffer losses even when economic and market conditions are generally favorable for others in the industry.

Limitations on our access to capital could impair our liquidity and our ability to conduct our businesses.

Liquidity, or ready access to funds, is essential to financial services firms. Failures of financial institutions have often been attributable in large part to insufficient liquidity. Liquidity is of particular importance to our

15

Table of Contents

trading business and perceived liquidity issues may affect our clients’ and counterparties’ willingness to engage in brokerage transactions with us. Our liquidity could be impaired due to circumstances that we may be unable to control, such as a general market disruption or an operational problem that affects our trading clients, third parties or us. Further, our ability to sell assets may be impaired if other market participants are seeking to sell similar assets at the same time.

FBR & Co. and FBRIS, which are domestic registered broker-dealers, are subject to the net capital requirements of the SEC and various self-regulatory organizations of which they are members. These requirements typically specify the minimum level of net capital a broker-dealer must maintain and also mandate that a significant part of its assets be kept in relatively liquid form. FBRIL, which is a registered broker-dealer in the United Kingdom, is also subject to the capital requirements of the FSA. Any failure to comply with these net capital requirements could impair our ability to conduct our core business as a brokerage firm.

Furthermore, FBR & Co., FBRIS and FBRIL are subject to laws that authorize regulatory bodies to block or reduce the flow of funds from them to us. As a holding company, we will depend on dividends, distributions and other payments from our subsidiaries to fund our obligations, including debt obligations. As a result, regulatory actions could impede access to funds that we need to make payments on our obligations, including debt obligations.

We are highly dependent on communications, information and other systems and third parties, and any systems failures could significantly disrupt our business.

Our business is highly dependent on communications, information and other systems, including systems provided by our clearing broker and by and for other third parties. Any failure or interruption of our systems, the systems of our clearing broker or third-party trading or information systems could cause delays or other problems in our securities trading activities, which could have a material adverse effect on our operating results and negatively affect the market price of our common stock.

In addition, our clearing broker provides elements of our principal disaster recovery system. We cannot assure you that we or our clearing broker will not suffer any systems failure or interruption, including one caused by a hurricane, earthquake, fire, other natural disaster, power or telecommunications failure, act of God, act of war, terrorist attack, pandemic or other emergency situation, or that our or our clearing broker’s back-up procedures and capabilities in the event of any such failure or interruption will be adequate. The occurrence of any failures or interruptions could significantly harm our business.

Our risk management policies and procedures may leave us exposed to unidentified or unanticipated risk, which could harm our business.

We have devoted significant resources to develop our risk management strategies and techniques and expect to continue to do so in the future. However, our risk management strategies and techniques may not be fully effective in mitigating our risk exposure in all market environments or against all types of risk, including risks that are unidentified or unanticipated.

We are exposed to the risk that third parties that owe us money, securities or other assets will not perform their obligations. These parties may default on their obligations to us due to bankruptcy, lack of liquidity, operational failure, breach of contract or other reasons. We are also subject to the risk that our rights against third parties may not be enforceable in all circumstances. Although we regularly review credit exposures to specific clients and counterparties and to specific industries and regions that we believe may present credit concerns, default risk may arise from events or circumstances that are difficult to detect or foresee. In addition, concerns about, or a default by, one institution could lead to significant liquidity problems, losses or defaults by other institutions, which in turn could adversely affect us. If any of the variety of instruments, processes and strategies we utilize to manage our exposure to various types of risk are not effective, we may incur losses.

16

Table of Contents

Strategic investments or acquisitions and joint ventures may result in additional risks and uncertainties in our business.

We intend to grow our core businesses through both internal expansion and through strategic investments, acquisitions or joint ventures. To the extent we make strategic investments or acquisitions or enter into joint ventures, we face numerous risks and uncertainties combining or integrating the relevant businesses and systems, including the need to combine accounting and data processing systems and management controls and to integrate relationships with customers and business partners. In the case of joint ventures, we are subject to additional risks and uncertainties in that we may be dependent upon, and subject to liability, losses or reputational damage relating to, systems, controls and personnel that are not under our control. In addition, conflicts or disagreements between us and our joint venture partners may negatively impact our businesses.

To the extent that we pursue business opportunities outside the United States, we will be subject to political, economic, legal, operational and other risks that are inherent in operating in a foreign country, including risks of possible nationalization, expropriation, price controls, capital controls, exchange controls and other restrictive governmental actions, as well as the outbreak of hostilities. In many countries, the laws and regulations applicable to the securities and financial services industries are uncertain and evolving, and it may be difficult for us to determine the exact requirements of local laws in every market. Our inability to remain in compliance with local laws in a particular foreign market could have a significant and negative effect not only on our businesses in that market but also on our reputation generally. We are also subject to the enhanced risk that transactions we structure might not be legally enforceable in the relevant jurisdictions.

Our due diligence may not reveal all of a portfolio company’s liabilities and may not reveal other weaknesses in a portfolio company’s business.

Before we make merchant banking investments, we assess the strength and skills of an entity’s management and other factors that we believe will determine the success of the investment. In making the assessment and otherwise conducting customary due diligence, we rely on the resources available to us and, in some cases, an investigation by third parties. This process is particularly important and subjective with respect to newly-organized entities because there may be little or no information publicly available about the company. We cannot assure you that our due diligence processes will uncover all relevant facts or risks about a company in which we make a merchant banking investment, or that any such investment will be successful. Any unsuccessful merchant banking investments may have a material adverse effect on our financial condition and results of operation.

In any potential merchant banking investment, we depend on management and have limited ability to influence management of portfolio companies.

We generally do not control the management, investment decisions or operations of the enterprises in which we make merchant banking investments. Management of those enterprises may decide to change the nature of their assets or business plan, or management may otherwise change in a manner that is not satisfactory to us. We typically have no ability to affect these management decisions, and as noted below, may have only limited ability to dispose of these investments.

We may make merchant banking investments that have limited liquidity, which may reduce the return on those investments to our stockholders.

The equity securities of a new publicly-held or privately-held entity in which we make a merchant banking investment are likely to be restricted as to resale and may otherwise be highly illiquid. We expect that there will be restrictions on our ability to resell the securities of any private or newly-public company that we acquire for a period of at least one year after we acquire those securities. Thereafter, a public market sale may be subject to volume limitations or dependent upon securing a registration statement for a secondary offering of the securities.

17

Table of Contents

The securities of newly-public entities may trade less frequently and in smaller volume than securities of companies that are more widely held and have more established trading patterns. Sales of these securities may cause their values to fluctuate more sharply. Because we have made and expect to make merchant banking investments through an affiliate of FBR & Co., a registered broker-dealer in the U.S., and FBRIL, a registered broker-dealer in the United Kingdom, our ability to invest in companies may be constrained by applicable securities laws and regulations and the rules of FINRA and similar self-regulatory organizations. FBR & Co.’s investment and trading activities are regulated by the SEC, FINRA and other governmental authorities, and FBRIL’s investment and trading activities are regulated by similar regulatory authorities in the United Kingdom, including the FSA. As a result, the rules of the SEC, FINRA, FSA and other governmental authorities and self-regulatory organizations may limit our ability to invest in the securities of companies whose securities are underwritten or privately placed by our broker-dealer affiliates.