Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PERDOCEO EDUCATION Corp | d8k.htm |

Credit Suisse

Global Services Conference

March 15, 2011

Exhibit 99.1 |

Gary

E. McCullough President and Chief Executive Officer

|

The

Company has included some non-GAAP financial measures in this presentation to discuss the

Company's financial results and outlook. As a general matter, the Company

uses these non-GAAP measures in addition to and in conjunction with

results presented in accordance with GAAP. Among other things, the Company

may use such non-GAAP financial measures in addition to and in conjunction with corresponding

GAAP measures, to help analyze the performance of its core business, in connection

with the preparation of annual budgets, and in measuring performance for

some forms of compensation. In addition, the Company believes that

non-GAAP financial measures are used by analysts and others in the investment community to

analyze the Company's historical results and in providing estimates of future

performance and that failure to report these non-GAAP measures could

result in confusion among analysts and others and a misplaced perception

that the Company's results have underperformed or exceeded expectations.

These non-GAAP financial measures reflect an additional way of viewing aspects

of the Company's operations that, when viewed with the GAAP results and the

reconciliations to corresponding GAAP financial measures,

provide

a

more

complete

understanding

of

the

Company's

results

of

operations

and

the

factors

and trends affecting the Company's business. However, these non-GAAP measures

should be considered as a supplement to, and not as a substitute for, or

superior to, the corresponding measures calculated in accordance with

GAAP. Non-GAAP Financial Measures |

Safe

Harbor During this presentation, we will make forward-looking statements subject to known

and unknown risks and uncertainties that could cause actual performance to differ materially

from that expressed or implied by the statements. These statements are based on

information currently available to us. Some factors that could cause actual results and

performance to differ are: Our ability to comply with the extensive regulatory requirements and accreditation

requirements for school operations

Changes and uncertainties in student lending markets and federal and state student

financial aid programs

Financial and operating results, including new student starts

Our ability to manage and grow our business in current and changing economic, political,

regulatory and competitive environments

Litigation, claims and administrative proceedings involving the company

Other risks described from time to time in our press releases and our filings with the

Securities and Exchange Commission

We undertake no obligation to publicly release any revisions to forward-looking statements to

reflect events or expectations after the date of this presentation. We provide a detailed

discussion of risk factors in our SEC filings and encourage you to review the filings.

|

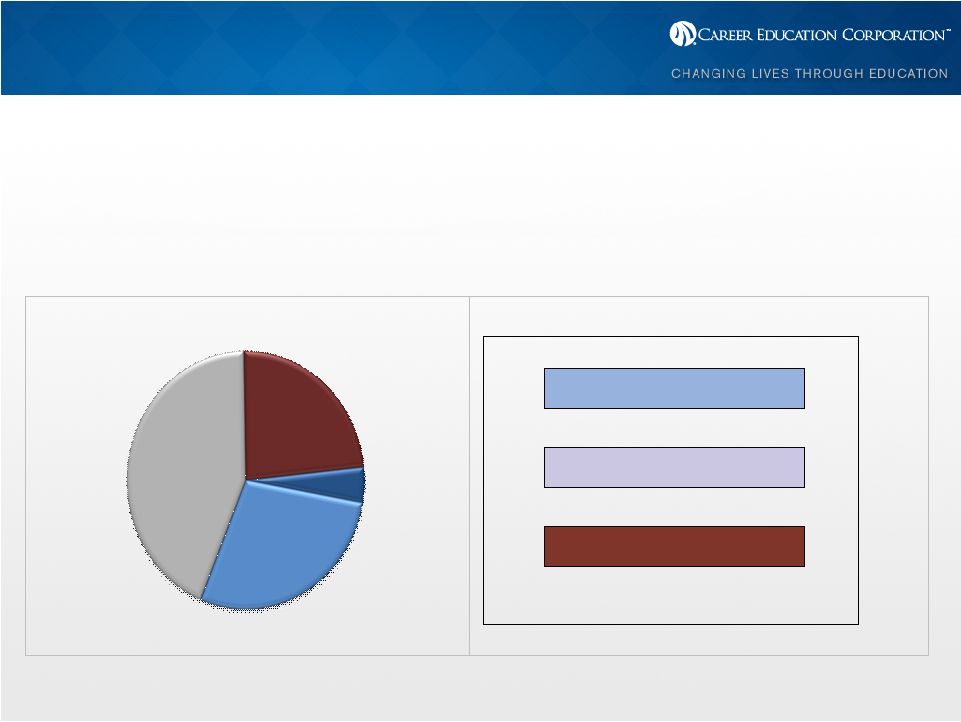

Career Education Overview

Purpose: To change lives through education

Purpose: To change lives through education

Nearly 117,000 Students

Over 500,000 Graduates

21 to 30

42%

Under 21

16%

Over 30

42%

Students by Age

Bachelors

31%

Masters

6%

Certificate

21%

Associates

42%

Students by Degree Type

Note: Demographics and student population data as of December 31, 2010.

|

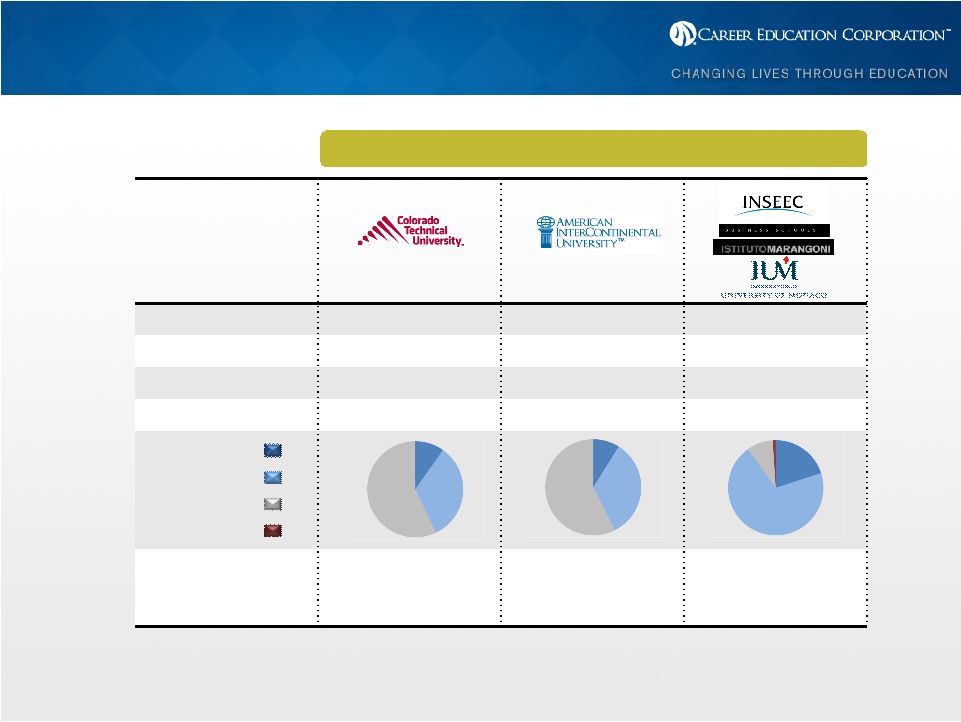

Population

30,900

20,000

12,300

% Online

83%

84%

N/A

# of Campuses

5

5

13

Accreditation

Regional

Regional

Various European

Program Emphasis

Business, IT, Health,

Protective Services

Business, IT

Education,

Protective Services

Business, Design

Bachelors

Masters

Certificate

Associates

University

Career Education: Diversified Portfolio

Note: Demographics and student population data as of December 31, 2010.

|

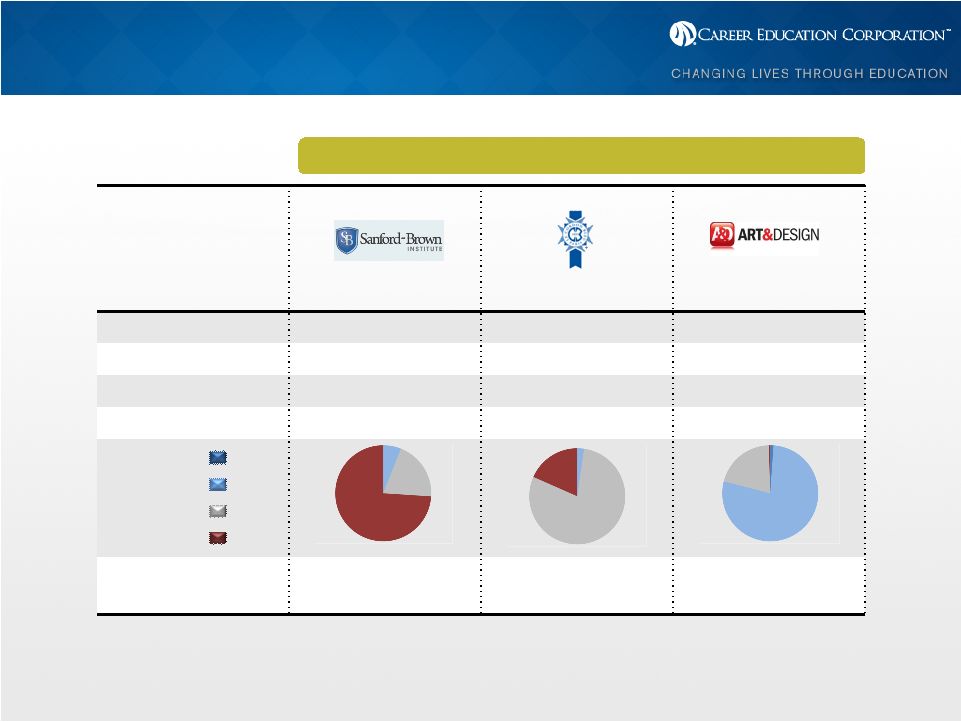

Career Education: Diversified Portfolio

Population

29,000

13,100

11,500

% Online

<1%

2%

16%

# of Campuses

39

18

14

Accreditation

National

National

National

Program Emphasis

Health

Culinary

Design, Photography

Bachelors

Masters

Certificate

Associates

Career-Focused

TM

Note: Demographics and student population data as of December 31, 2010.

|

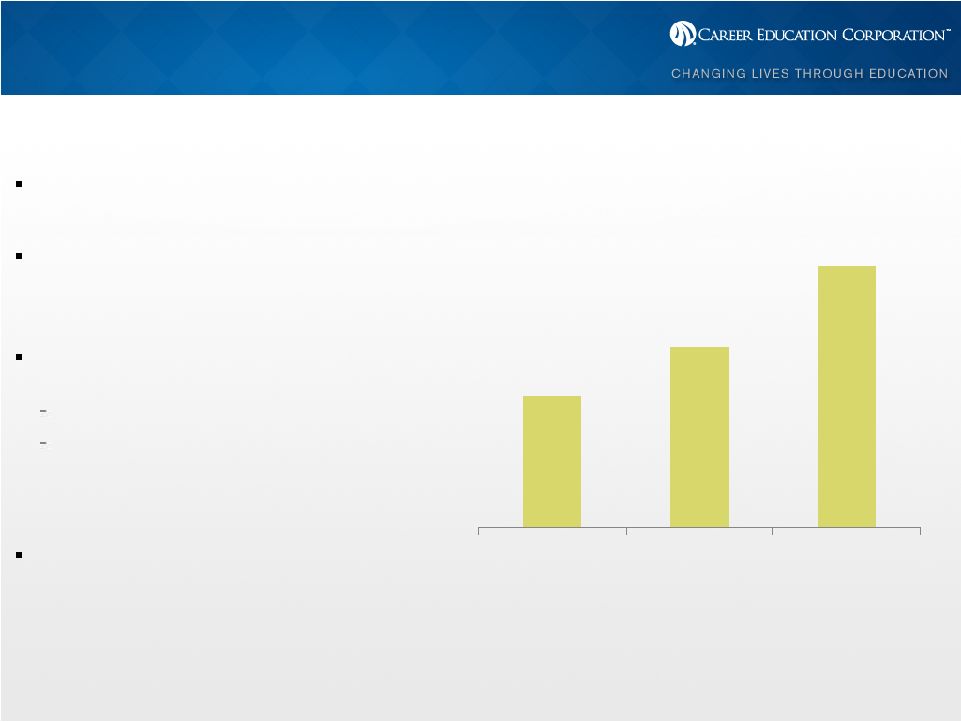

2008

– 2010: Key Accomplishments

Grew Revenue 28%

Increased Student Population 19% from

98,000 to nearly 117,000

Expanded Operating Margins 820 basis

points to 17.1%

EPS growth of 142%

Cumulative Free Cash Flow of

approximately

$500M

since

2008

(2)

Transformed Company Culture and

Values

Revenue Trend &

Adjusted Margin (%)

(1)

$1.66

$1.83

$2.12

2008

2009

2010

8.9%

14.1%

17.1%

(1)

Adjusted margins are based on continuing operations and exclude significant items as noted in

“Appendix -- GAAP to Non GAAP Reconciliation”. (2)

“Free Cash Flow” is defined as cash flows from operating activities less capital

expenditures. |

2010

Performance Highlights Focus on

Student

Success

Growth with

Disciplined

Investment

Operational

Effectiveness

Strong

Balance

Sheet

Required completion of College Prep Course for online students

Increased Career Services personnel by 21%; Academics by 17%

Placement in line with 2009

Developed modified Culinary Arts model

Grew Student Population by 11%

Opened six Sanford-Brown schools

Generated $145M of free cash flow

Repurchased 5.4M shares of stock totaling $155M

Continued shared services expansion

Completed teach out of AIU Los Angeles

Aligned workforce in response to market dynamics

Further reduced employee turnover

$450M cash and short-term investments

No debt |

Regulatory Environment

Remain

hopeful

the

Department

will

make

constructive

changes

to

proposed

rules

Overwhelming response to the DoE on Gainful Employment

Awaiting “Dear Colleague”

letter for Incentive Compensation Clarity

Conflicting

rules

which

require

institutions

to

“thread

the

eye

of

the

needle”

Gainful Employment: Encourages reduction in tuition

90/10: Encourages higher tuition levels to avoid penalty

Rules

will

likely

result

in

unintended

negative

consequences

Disproportionate impact on schools with diverse student population/open

enrollment Retroactive application

Institutions are unable to limit student borrowing levels to cost of

education |

Why

CEC? Diversified Model

Disciplined Approach

Respond to all Challenges

-

Private Lending Market

-

Negotiated Rulemaking

-

Gainful Employment

University, Health Education, Culinary Arts,

Art & Design

Focus on programs with strong outcomes

Strong European platform

Online education remains fastest growing

segment in Education Market

Financial Resources

Strong balance sheet

-

$450M cash/no debt

-

2010 free cash flow of $145M

“Build”

versus “Buy”

for expansion

Select strategic M&A

Shared Services/proactive cost management

Returned ~$370M to shareholders through

share repurchase in last 3 years

Agile Management Team |

Mike Graham

EVP & Chief Financial Officer |

2010 Operating Margin

Disciplined Approach

Health Start-Ups

M&A

Increase in Career Services &

Academics

Responsive to Market

Conditions

Shared Services

Fixed & Metric based

reductions

Modified Culinary Model

Ended Extended Student

Payment Programs for New

Students

Adjusted Operating Income

(Margin %)

(1)

8.9%

14.1%

17.1%

2008

2009

2010

+520 bps

+300 bps

(1) Adjusted margins are based on continuing operations and exclude significant items as noted in

“Appendix -- GAAP to Non GAAP Reconciliation”. |

Culinary Model

2010

Highlights

More

Sustainable

Positioning

Key

Changes

Grew student population by 20%

Increased adjusted operating margin by 560 basis points to

11.5%

Leverage strong kitchen curriculum

Competitive tuition between higher priced institutions and tax

payer subsidized community colleges

Ended student payment plan for incoming Culinary students

12 month certificate program with tuition of approximately

$17,500

Emphasis on practical hands-on kitchen skills

Shift of focus from Associate degree to Certificate

Average education cost reduction of 50%

Emphasis on 450 critical cooking competencies, less on

General Education subjects

Will continue Associate degrees in Chicago and Pasadena and

online Bachelors degree program

Teach out LCB Pittsburgh |

Uses of Cash

Share Repurchase

•

Remain Committed to Returning Cash to

Shareholders

•

As of March 4, 2011, $201M

authorization remaining

High ROI Strategic Investments

•

High Return Projects

•

Health Education Start Ups

•

Completion of Chicago-area Real Estate

optimization

•

Critical Student Services –

Faculty,

Career Services, IT Systems

Strong Balance Sheet

•

Maintain appropriate ED ratios

•

Limited Future Receivable Growth

from Extended Payment Plans

•

Disciplined Capital Expenditures

M&A

•

Potential for accretive tuck-in

acquisitions across University, Career

Focused and International

•

New Locations

•

New Programs Areas

•

Build versus Buy Mindset |

2011 Milestones

2010 Results

2011 Milestones

Revenue ($B)

$2.12

(2% - 5%)

Operating Income ($M)

$363

Operating Margin:

GAAP %

11.6%

Normalized %

17.1%

14% - 16% |

QUESTIONS? |

Appendix: GAAP to NON GAAP

Unaudited Reconciliation of GAAP to Non-GAAP Items

(1)

(In millions, except per share amounts)

2008

2009

2010

Operating

Earnings per

Operating

Earnings per

Operating

Earnings per

Income

Diluted Share

(2)

Income

Diluted Share

(2)

Income

Diluted Share

(2)

As Reported

$114.8

$1.04

$229.0

$1.73

$246.4

$2.06

Reconciling Items:

Asset Impairment

(3)

6.8

0.05

2.5

0.02

67.8

0.55

Legal Settlement

(4)

6.3

0.05

-

-

40.8

0.33

Severance & Stay

6.6

0.05

1.5

0.01

7.7

0.06

Remaining Lease Obligations for Vacated Space

11.6

0.08

14.3

0.11

-

-

Performance-based

Compensation Related to Plan Outperformance

(5)

-

-

23.1

0.17

-

-

Termination of Insurance

Policies (6)

-

-

(12.0)

(0.09)

-

-

Gain from Termination of

Affiliate Relationship (7)

-

(0.03)

-

-

-

-

Adjusted to Exclude

Significant Items $146.1

$1.24

$258.4

$1.95

$362.7

$3.00

Diluted Weighted Average Shares Outstanding

90,089

86,418

80,850

Footnotes:

(1)

The Company believes it is useful to present non-GAAP financial measures which exclude certain

significant items as a means to understand the performance of its core business. As a

general matter, the Company uses non-GAAP financial measures in conjunction with results presented in accordance with GAAP to help analyze the performance

of its core business, assist with preparing the annual operating plan, and measure performance for

some forms of compensation. In addition, the Company believes that non- GAAP financial

information is used by analysts and others in the investment community to analyze the Company's historical results and to provide estimates of future

performance and that failure to report non-GAAP measures could result in a misplaced perception

that the Company's results have underperformed or exceeded expectations. Non-GAAP financial

measures when viewed in a reconciliation to corresponding GAAP financial measures, provides an additional way of viewing the Company's results of

operations and the factors and trends affecting the Company's business. Non-GAAP financial

measures should be considered as a supplement to, and not as a substitute for, or superior to,

the corresponding financial results presented in accordance with GAAP. (2)

Earnings per share based on continuing operations.

(3)

Fourth quarter 2010 includes a $67.8 million pretax trade name impairment within Culinary Arts.

The $2.5 million asset impairment in 2009 resulted from the carrying value exceeding the fair

value for one of our owned facilities. In 2008, we recorded $6.8 million in asset impairment charges related to the reduction in asset carrying value for one of

our leased facilities within Culinary Arts and the write off of a trade name within Health Education.

|

Appendix: GAAP to NON GAAP

Footnotes:

(4)

A $40.8 million charge was recorded in 2010 and $6.3 million, net in 2008 related to the settlements

of legal matters within Culinary Arts and Health Education. (5)

The 2009 performance-based compensation related to plan outperformance by segment was: Corporate

- $11.3, Health Education - $4.3, Culinary Arts - $2.1 million, Colorado Technical

University - $1.9, American Intercontinental University - $1.8, and Art & Design - $1.7.

(6)

A $12.0 million payment was received in the fourth quarter 2009 related to the termination of certain

insurance policies. (7)

Gain from Termination of Affiliate Relationship is recorded within other income on the consolidated

statement of operations. |