Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - A. M. Castle & Co. | c13962exv31w2.htm |

| EX-32.1 - EXHIBIT 32.1 - A. M. Castle & Co. | c13962exv32w1.htm |

| EX-31.1 - EXHIBIT 31.1 - A. M. Castle & Co. | c13962exv31w1.htm |

| EX-23.1 - EXHIBIT 23.1 - A. M. Castle & Co. | c13962exv23w1.htm |

| EX-21.1 - EXHIBIT 21.1 - A. M. Castle & Co. | c13962exv21w1.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

THE SECURITIES EXCHANGE ACT OF 1934

| For the fiscal year ended December 31, 2010 | Commission File Number: 1-5415 |

A. M. CASTLE & CO.

(Exact name of registrant as specified in its charter)

| Maryland | 36-0879160 | |

| (State or other jurisdiction of | (I.R.S. Employer Identification No.) | |

| incorporation or organization) |

| 3400 North Wolf Road, Franklin Park, Illinois | 60131 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code

(847) 455-7111

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Common Stock - $0.01 par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of

the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or

15(d) of the Act.

Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by

Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for

such shorter period that the registrant was required to file such reports), and (2) has been

subject to such filing requirements for the past 90 days.

Yes

þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its

corporate Web site, if any, every Interactive Data File required to be submitted and posted

pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period

that the registrant was required to submit and post such files). Yes

o No

o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is

not contained herein, and will not be contained, to the best of registrant’s knowledge, in

definitive proxy or information statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a

non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated

filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

(check one):

| Large Accelerated Filer o | Accelerated Filer þ | Non-Accelerated Filer o | Smaller Reporting Company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the

Exchange Act). Yes o No þ

The aggregate market value of the voting and non-voting common equity held by non-affiliates

computed by reference to the price at which the common equity was last sold, or the average bid and

asked price of such common equity, as of the last business day of the registrant’s most recently

completed second fiscal quarter is $230,163,537.

The number of shares outstanding of the registrant’s common stock on March 1, 2011 was 22,979,410

shares.

DOCUMENTS INCORPORATED BY REFERENCE

| Documents Incorporated by Reference | Applicable Part of Form 10-K | |

Proxy Statement furnished to Stockholders in connection with registrant’s Annual Meeting of Stockholders to be held April 28, 2011. |

Part III |

TABLE OF CONTENTS

Table of Contents

Disclosure Regarding Forward-Looking Statements

Information provided and statements contained in this report that are not purely historical are

forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as

amended (“Securities Act”), Section 21E of the Securities Exchange Act of 1934, as amended

(“Exchange Act”), and the Private Securities Litigation Reform Act of 1995. Such forward-looking

statements only speak as of the date of this report and the Company assumes no obligation to update

the information included in this report. Such forward-looking statements include information

concerning our possible or assumed future results of operations, including descriptions of our

business strategy. These statements often include words such as “believe,” “expect,” “anticipate,”

“intend,” “predict,” “plan,” or similar expressions. These statements are not guarantees of

performance or results, and they involve risks, uncertainties, and assumptions. Although we

believe that these forward-looking statements are based on reasonable assumptions, there are many

factors that could affect our actual financial results or results of operations and could cause

actual results to differ materially from those in the forward-looking statements, including those

risk factors identified in Item 1A “Risk Factors” of this report. All future written and oral

forward-looking statements by us or persons acting on our behalf are expressly qualified in their

entirety by the cautionary statements contained or referred to above. Except for our ongoing

obligations to disclose material information as required by the federal securities laws, we do not

have any obligations or intention to release publicly any revisions to any forward-looking

statements to reflect events or circumstances in the future or to reflect the occurrence of

unanticipated events.

INDUSTRY AND MARKET DATA

In this report, we rely on and refer to information and statistics regarding the metal service

center industry and general manufacturing markets. We obtained this information and these

statistics from sources other than us, such as Purchasing magazine and the Institute of Supply

Management, which we have supplemented where necessary with information from publicly available

sources and our own internal estimates. We have used these sources and estimates and believe them

to be reliable.

PART I

| ITEM 1 | — Business |

In this annual report on Form 10-K, “the Company,” “we” or “our” refer to A. M. Castle & Co., a

Maryland corporation, and its subsidiaries included in the consolidated financial statements,

except as otherwise indicated or as the context otherwise requires.

Business and Markets

Company Overview

The Company is a specialty metals (89% of net sales) and plastics (11% of net sales) distribution

company serving customers on a global basis. The Company provides a broad range of products and

value-added processing and supply chain services to a wide array of customers, principally within

the producer durable equipment, oil and gas, aerospace, heavy industrial equipment, industrial

goods, construction equipment, retail, marine and automotive sectors of the global economy.

Particular focus is placed on the aerospace and defense, oil and gas, power generation, mining,

heavy industrial equipment manufacturing, marine, office furniture and fixtures, safety products,

life sciences applications, transportation and general manufacturing industries.

The Company’s primary metals service center and corporate headquarters are currently located in

Franklin Park, Illinois. In January 2011, the Company executed a new lease agreement to move

the Company’s corporate headquarters to Oakbrook, Illinois during the second quarter of 2011.

The Company has 47 operational service centers located throughout North America (43), Europe

(3) and Asia (1). The Company’s service centers hold inventory and process and distribute

products to both local and export markets.

2

Table of Contents

Industry and Markets

Service centers act as supply chain intermediaries between primary producers, which deal in bulk

quantities in order to achieve economies of scale, and end-users in a variety of industries that

require specialized products in significantly smaller quantities and forms. Service centers also

manage the differences in lead times that exist in the supply chain. While original equipment

manufacturers (“OEM”) and other customers often demand delivery within hours, the lead time

required by primary producers can be as long as several months. Service centers also provide value

to customers by aggregating purchasing, providing warehousing and distribution services, and

processing material to meet specific customer needs.

The principal markets served by the Company are highly competitive. Competition is based on

service, quality, processing capabilities, inventory availability, timely delivery, ability to

provide supply chain solutions and price. The Company competes in a highly fragmented industry.

Competition in the various markets in which the Company participates comes from a large number of

value-added metals processors and service centers on a regional and local basis, some of which have

greater financial resources and some of which have more established brand names in the local

markets served by the Company.

The Company also competes to a lesser extent with primary metals producers who typically sell to

larger customers requiring shipments of large volumes of metal.

In order to capture scale efficiencies and remain competitive, many primary metal producers are

consolidating their operations and focusing on their core production activities. These producers

have increasingly outsourced metals distribution and inventory management to metals service

centers. This process of outsourcing allows them to work with a relatively small number of

intermediaries rather than many end customers. As a result, metals service centers, including the

Company, are now providing a range of services for their customers, including metal purchasing,

processing and supply chain solutions.

Recent Expansions and Consolidations

During May 2010, the Company opened a new branch in Lafayette, Louisiana to service the Company’s

oil and gas customers in that region.

During the fourth quarter of 2010, the Company consolidated 3 of its facilities into nearby

existing locations in order to effectively manage its operations, reduce operating costs and better

serve its customers.

Procurement

The Company purchases metals and plastics from many producers. Material is purchased in large lots

and stocked at its service centers until sold, usually in smaller quantities and typically with

some value-added processing services performed. The Company’s ability to provide quick delivery of

a wide variety of specialty metals and plastic products, along with its processing capabilities,

allows customers to lower their own inventory investment by reducing their need to order the large

quantities required by producers or their need to perform additional material processing services.

Some of the Company’s purchases are covered by long-term contracts and commitments, which generally

have corresponding customer sales agreements.

Orders are primarily filled with materials shipped from Company stock. The materials required to

fill non-stock orders are obtained from other sources, such as direct mill shipments to customers

or purchases from other distributors. Deliveries are made principally by third party logistics

providers. Common carrier delivery is used in areas not serviced directly by the Company’s fleet.

Employees

At December 31, 2010, the Company had 1,619 full-time employees. Of these, 284 are represented by

collective bargaining units, principally the United Steelworkers of America and International

Brotherhood of Teamsters.

3

Table of Contents

Business Segments

The Company distributes and performs processing on both metals and plastics. Although the

distribution processes are similar, the customer markets, supplier bases and types of products are

different. Additionally, the Company’s Chief Executive Officer, the chief operating

decision-maker, reviews and manages these two businesses separately. As such, these businesses are

considered reportable segments and are reported accordingly in the Company’s various public

filings. Neither of the Company’s reportable segments has any unusual working capital

requirements.

In the last three years, the percentages of total sales of the two segments were as follows:

| 2010 | 2009 | 2008 | ||||||||||

Metals |

89 | % | 89 | % | 92 | % | ||||||

Plastics |

11 | % | 11 | % | 8 | % | ||||||

| 100 | % | 100 | % | 100 | % | |||||||

Metals Segment

In its Metals segment, the Company’s marketing strategy focuses on distributing highly

engineered specialty grades and alloys of metals as well as providing specialized processing

services designed to meet very precise specifications. Core products include alloy, aluminum,

stainless, nickel, titanium and carbon. Inventories of these products assume many forms such

as plate, sheet, extrusions, round bar, hexagon bar, square and flat bar, tubing and coil.

Depending on the size of the facility and the nature of the markets it serves, a service center

is equipped as needed with bar saws, plate saws, oxygen and plasma arc flame cutting machinery,

water-jet cutting equipment, stress relieving and annealing furnaces, surface grinding

equipment, and sheet shearing equipment.

The Company’s customer base is well diversified and therefore, the Company does not have

dependence upon any single customer, or a few customers. Our customer base includes many

Fortune 500 companies as well as thousands of medium and smaller sized firms.

The Company’s broad network of locations provides same or next-day delivery to most of the

segment’s markets, and two-day delivery to virtually all of the rest.

Plastics Segment

The Company’s Plastics segment consists exclusively of a wholly-owned subsidiary that operates

as Total Plastics, Inc. (“TPI”), headquartered in Kalamazoo, Michigan, and its wholly-owned

subsidiaries. The Plastics segment stocks and distributes a wide variety of plastics in forms

that include plate, rod, tube, clear sheet, tape, gaskets and fittings. Processing activities

within this segment include cut-to-length, cut-to-shape, bending and forming according to

customer specifications.

The Plastics segment’s diverse customer base consists of companies in the retail

(point-of-purchase), marine, office furniture and fixtures, safety products, life sciences

applications, transportation and general manufacturing industries. TPI has locations throughout

the upper northeast and midwest regions of the U.S. and one facility in Florida from which it

services a wide variety of users of industrial plastics.

Joint Venture

The Company holds a 50% joint venture interest in Kreher Steel Co. (“Kreher”), a metals

distributor of bulk quantities of alloy, special bar quality and stainless steel bars,

headquartered in Melrose Park, Illinois. The Company’s equity in the earnings of this joint

venture is reported separately in the Company’s consolidated statements of operations.

4

Table of Contents

Access to SEC Filings

The Company makes available free of charge on or through its Web site at www.amcastle.com the

annual

report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments

to those reports as soon as reasonably practicable after such material is electronically filed with

or furnished to the U.S. Securities and Exchange Commission (the “SEC”). Information on our

website does not constitute part of this annual report on Form 10-K.

| ITEM 1A | — Risk Factors |

Our business, operations and financial condition are subject to various risks and uncertainties.

Current or potential investors should carefully consider the risks and uncertainties described

below, together with all other information in this annual report on Form 10-K and other documents

filed with the SEC, before making any investment decisions with respect to the Company’s

securities.

Our future operating results depend on the volatility of the prices of metals and plastics,

which could cause our results to be adversely affected.

The prices we pay for raw materials, both metals and plastics, and the prices we charge for

products may fluctuate depending on many factors, including general economic conditions (both

domestic and international), competition, production levels, import duties and other trade

restrictions and currency fluctuations. To the extent metals prices decline, we would generally

expect lower sales and possibly lower net income, depending on the timing of the price changes and

the ability to pass price changes onto our customers. To the extent we are not able to pass on to

our customers any increases in our raw materials prices, our operating results may be adversely

affected. In addition, because we maintain substantial inventories of metals in order to meet

short lead-times and the just-in-time delivery requirements of our customers, a reduction in our

selling prices could result in lower profitability or, in some cases, losses, either of which could

adversely impact our ability to remain in compliance with certain financial covenants in our loan

facilities, as well as result in us incurring impairment charges.

Disruptions or shortages in the supply of raw materials could adversely affect our operating

results and our ability to meet our customer demands.

Our business requires materials that are sourced from third party suppliers. If for any reason our

primary suppliers of metals should curtail or discontinue their delivery of raw materials to us at

competitive prices and in a timely manner, our operating results could suffer. Unforeseen

disruptions in our supply bases could materially impact our ability to deliver products to

customers. The number of available suppliers could be reduced by factors such as industry

consolidation and bankruptcies affecting steel, metals and plastics producers, or suppliers may be

unwilling or unable to meet our demand due to industry supply conditions generally. If we are

unable to obtain sufficient amounts of raw materials from our traditional suppliers, we may not be

able to obtain such raw materials from alternative sources at competitive prices to meet our

delivery schedules, which could have an adverse impact on our operating results. To the extent we

have quoted prices to customers and accepted orders for products prior to purchasing necessary raw

materials, or have existing contracts, we may be unable to raise the price of products to cover all

or part of the increased cost of the raw materials to our customers.

In some cases the availability of raw materials requires long lead times. As a result, we may

experience delays or shortages in the supply of raw materials. If unable to obtain adequate and

timely deliveries of required raw materials, we may be unable to timely supply customers with

sufficient quantities of products. This could cause us to lose sales, incur additional costs, or

suffer harm to our reputation.

Increases in freight and energy prices would increase our operating costs and we may be unable

to pass these increases on to our customers in the form of higher prices, which may adversely

affect our operating results.

We use energy to process and transport our products. The prices for and availability of energy

resources are subject to volatile market conditions, which are affected by political, economic and

regulatory factors beyond our control. Our operating costs increase if energy costs, including

electricity, diesel fuel and natural gas, rise. During periods of higher freight and energy costs,

we may not be able to recover our operating cost increases through price increases without reducing

demand for our products. In addition, we typically do not hedge our exposure to higher freight or

energy prices.

5

Table of Contents

We service industries that are highly cyclical, and any downturn in our customers’ industries

could reduce our revenue and profitability.

Many of our products are sold to customers in industries that experience significant fluctuations

in demand based on economic conditions, energy prices, consumer demand, availability of adequate

credit and financing, customer inventory levels, changes in governmental policies (including those

that would limit or reduce defense spending) and other factors beyond our control. As a result of

this volatility in the industries we serve, when one or more of our customers’ industries

experiences a decline, we may have difficulty increasing or maintaining our level of sales or

profitability if we are not able to divert sales of our products to customers in other industries.

We have made a strategic decision to focus sales resources on certain industries, specifically the

aerospace and defense and oil and gas industries. A downturn in these industries has had, and may

in the future continue to have, an adverse effect on our operating results. We are also

particularly sensitive to market trends in the manufacturing sector of the North American economy.

Our industry is highly competitive, which may force us to lower our prices and may have an

adverse effect on our operating results.

The principal markets that we serve are highly competitive. Competition is based principally on

price, service, quality, processing capabilities, inventory availability and timely delivery. We

compete in a highly fragmented industry. Competition in the various markets in which we

participate comes from a large number of value-added metals processors and service centers on a

regional and local basis, some of which have greater financial resources than we do and some of

which have more established brand names in the local markets we serve. We also compete to a lesser

extent with primary metals producers who typically sell to very large customers requiring shipments

of large volumes of metal. Increased competition could force us to lower our prices or to offer

increased services at a higher cost to us, which could have an adverse effect on our operating

results.

Our operating results are subject to the seasonal nature of our customers’ businesses.

A portion of our customers experience seasonal slowdowns. Historically, our revenues in the months

of July, November and December have been lower than in other months because of a reduced number of

shipping days and holiday or vacation closures for some customers. Consequently, our sales in the

first two quarters of the year are usually higher than in the third and fourth quarters. As a

result, analysts and investors may inaccurately estimate the effects of seasonality on our

operating results in one or more future quarters and, consequently, our operating results may fall

below expectations.

We may not be able to retain or expand our customer base if the United States manufacturing

industry continues to relocate production operations internationally.

Our customer base primarily includes manufacturing and industrial firms in the United States, some

of which are, or have considered, relocating production operations outside the United States or

outsourcing particular functions to locations outside the United States. Some customers have

closed their businesses as they were unable to compete successfully with foreign competitors.

Although we have facilities in Canada, Mexico, France, the United Kingdom, Singapore and China, the

majority of our facilities are located in the United States. To the extent our customers close or

relocate operations to locations where we do not have a presence, we could lose all or a portion of

their business.

General global economic, credit and capital market conditions have had and could continue to

have an adverse impact on our business, operating results and financial condition.

We are susceptible to macroeconomic downturns in the United States and abroad which has had, and in

the future may continue to have, an adverse effect on demand for our products and consequently the

operating results, financial condition and cash flows. Future negative economic conditions, as

well as a slow recovery period, could lead to reduced demand for our products, increased price

competition, reduced gross margins, increased risk of obsolete inventories and higher operating

costs as a percentage of revenue.

Disruption of the capital and credit markets may negatively impact our business, including our

ability to access additional financing at a time when we would like, or need, to access those

markets to run or expand our business. These events may also make it more costly for us to raise

capital through the issuance of our equity securities and could reduce our net income by increasing

our interest expense and other costs of capital. The diminished availability of credit and other

capital could also affect the industries we serve and could result in reduction in sales volumes

and increased credit and collection risks.

6

Table of Contents

We are vulnerable to interest rate fluctuations on our indebtedness, which could hurt our

operating results.

We are exposed to various interest rate risks that arise in the normal course of business. We

finance our operations with fixed and variable rate borrowings. Market risk arises from changes in

variable interest rates. Under our revolving credit facility, our interest rate on borrowings is

subject to changes based on fluctuations in the LIBOR and prime rates of interest. If interest

rates significantly increase, we could be unable to service our debt which could have an adverse

effect on our operating results.

We operate in international markets, which expose us to a number of risks.

Although a substantial majority of our business activity takes place in the United States, we serve

and operate in certain international markets, which expose us to political, economic and currency

related risks, including the potential for adverse change in the local political or social climate

or in government policies, laws and regulations, difficulty staffing and managing geographically

diverse operations, restrictions on imports and exports or sources of supply, and change in duties

and taxes. We operate in Canada, Mexico, France, and the United Kingdom, with limited operations

in Spain, Singapore and China. An act of war or terrorism or major pandemic event could disrupt

international shipping schedules, cause additional delays in importing our products into the United

States or increase the costs required to do so. In addition, acts of crime or violence in these

international markets could adversely affect our operating results. Fluctuations in the value of

the U.S. dollar versus foreign currencies could reduce the value of these assets as reported in our

financial statements, which could reduce our stockholders’ equity. If we do not adequately

anticipate and respond to these risks and the other risks inherent in international operations, it

could have a material adverse effect on our operating results.

We may not be able to realize the benefits we anticipate from our acquisitions.

Some of our growth has been through acquisitions, and we intend to continue to seek attractive

opportunities to acquire businesses in the future. Achieving the benefits of these acquisitions

depends on the timely, efficient and successful execution of a number of post-acquisition events,

including our integration of the acquired businesses. We may not be able to realize the benefits

we anticipate from our acquisitions. Factors that could affect our ability to achieve these

benefits include:

| • | difficulties in integrating and managing personnel, financial reporting and other systems used by the acquired businesses; |

| • | the failure of the acquired businesses to perform in accordance with our expectations; |

| • | failure to achieve anticipated synergies between our business units and the acquired businesses; |

| • | the loss of the acquired businesses’ customers; and |

| • | cyclicality of business. |

The presence of any of the above factors individually or in combination could result in future

impairment charges against the assets of the acquired businesses.

If the acquired businesses do not operate as we anticipate, it could adversely affect our operating

results and financial condition. As a result, there can be no assurance that the acquisitions will

be successful or will not, in fact, adversely affect our business.

Our business could be adversely affected by a disruption to our primary distribution hub.

Our largest facility, in Franklin Park, Illinois, serves as a primary distribution center that

ships product to our other facilities as well as external customers. Our business could be

adversely impacted by a major disruption at this facility due to unforeseen developments occurring

in or around the facility, such as:

| • | damage to or inoperability of our warehouse or related systems; |

| • | a prolonged power or telecommunication failure; |

| • | a natural disaster, environmental or public health issue; or |

| • | an airplane crash or act of war or terrorism on-site or nearby as the facility is located within seven miles of O’Hare International Airport (a major U.S. airport) and lies below certain take-off and landing flight patterns. |

A prolonged disruption of the services and capabilities of our Franklin Park facility and operation

could adversely impact our operating results.

7

Table of Contents

Damage to or a disruption in our information technology systems could impact our ability to

conduct business and/or report our financial performance.

We are implementing new enterprise-wide resources planning (“ERP”) systems over a period of several

years. While we have completed the conversions of substantially all of the Company’s North

American locations onto the new ERP system, we can provide no assurance that the continued

phased-implementation at the Company’s remaining facilities will be successful or will occur as

planned. Difficulties associated with the design and implementation of the new ERP system could

adversely affect our business, our customer service and our operating results.

We rely on information technology systems to provide inventory availability to our sales and

operating personnel, improve customer service through better order and product reference data and

monitor operating results. Difficulties associated with upgrades or integration with new systems

could lead to business interruption that could harm our reputation, increase our operating costs

and decrease profitability. In addition, any significant disruption relating to our current or new

information technology systems, whether due from such things as fire, flood, tornado and other

natural disasters, power loss, network failures, loss of data, security breaches and computer

viruses, or otherwise, may have an adverse effect on our business, our operating results and our

ability to report our financial performance in a timely manner.

A portion of our workforce is represented by collective bargaining units, which may lead to

work stoppages.

Approximately 18% of our U.S. employees are represented by unions under collective bargaining

agreements, including hourly warehouse employees at our primary distribution center in Franklin

Park, Illinois. As these agreements expire, there can be no assurance that we will succeed in

concluding collective bargaining agreements with the union to replace those that expire. Although

we believe that our labor relations have generally been satisfactory, we cannot predict how stable

our relationships with these labor organizations will be or whether we will be able to meet union

requirements without impacting our operating results and financial condition. The unions may also

limit our flexibility in dealing with our workforce. Work stoppages and instability in our union

relationships could negatively impact the timely processing and shipment of our products, which

could strain relationships with customers and adversely affect our operating results.

Market volatility could result in future asset impairments, which could have an adverse effect

on our operating results.

We review the recoverability of goodwill annually or whenever significant events or changes occur

which might impair the recovery of recorded costs, making certain assumptions regarding future

operating performance. We review the recoverability of definite lived intangible assets and other

long-lived assets whenever significant events or changes occur which might impair the recovery of

recorded costs, making certain assumptions regarding future operating performance. The results of

these calculations may be affected by the current or further declines in the market conditions for

our products, as well as interest

rates and general economic conditions. If impairment is determined to exist, we will incur

impairment losses, which will have an adverse effect on our operating results and our ability to

remain in compliance with certain financial covenants in our loan facilities.

8

Table of Contents

We could incur substantial costs in order to comply with, or to address any violations under,

environmental and employee health and safety laws, which could adversely affect our operating

results.

Our operations are subject to various environmental statutes and regulations, including laws and

regulations governing materials we use. In addition, certain of our operations are subject to

international, federal, state and local environmental laws and regulations that impose limitations

on the discharge of pollutants into the air and water and establish standards for the treatment,

storage and disposal of solid and hazardous wastes. Our operations are also subject to various

employee safety and health laws and regulations, including those concerning occupational injury and

illness, employee exposure to hazardous materials and employee complaints. Certain of our

facilities are located in industrial areas, have a history of heavy industrial use and have been in

operation for many years and, over time, we and other predecessor operators of these facilities

have generated, used, handled and disposed of hazardous and other regulated wastes. Currently

unknown cleanup obligations at these facilities, or at off-site locations at which materials from

our operations were disposed, could result in future expenditures that cannot be currently

quantified but which could have an adverse effect on our operating results.

We may face risks associated with current or future litigation and claims.

From time to time, we are involved in a variety of lawsuits, claims and other proceedings relating

to the conduct of our business. These suits concern issues including contract disputes, employment

actions, employee benefits, taxes, environmental, health and safety, personal injury and product

liability matters. Due to the uncertainties of litigation, we can give no assurance that we will

prevail on all claims made against us in the lawsuits that we currently face or that additional

claims will not be made against us in the future. While it is not feasible to predict the outcome

of all pending lawsuits and claims, we do not believe that the disposition of any such pending

matters is likely to have an adverse effect on our financial condition or liquidity, although the

resolution in any reporting period of one of more of these matters could have an adverse effect on

our operating results for that period. Also, we can give no assurance that any other lawsuits or

claims brought in the future will not have an adverse effect on our financial condition, liquidity

or operating results.

Increased regulation associated with climate change and greenhouse gas emissions could impose significant costs on the operations of our customers and suppliers, which could have a material

adverse impact on our results of operations, financial condition and cash flows.

Climate change regulation or some form of legislation aimed at reducing greenhouse gas, or GHG,

emissions is currently being considered in the United States as well as globally. As a metals and

plastics distributor, our operations do not emit significant amounts of GHG. However, the

manufacturing processes of many of our suppliers and customers are energy intensive and generate

carbon dioxide and other GHG emissions. Any adopted future climate change and GHG regulations may

impose significant costs on the operations of our customers and suppliers and indirectly impact

our operations. Until the timing, scope and extent of any future regulation becomes known, we

cannot predict the effect on our results of operations, financial condition and cash flows.

Ownership of our stock is concentrated, which may limit stockholders’ ability to influence

corporate matters.

Patrick J. Herbert, III, one of our directors, may be deemed to beneficially own approximately 23%

of our common stock. Accordingly, Mr. Herbert and his affiliates may have the voting power to

substantially control the outcome of matters requiring a stockholder vote including the election of

directors and the approval of significant corporate matters. Such a concentration of control could

adversely affect the market price of our common stock or prevent a change in control or other

business combinations that might be beneficial to the Company.

9

Table of Contents

We have various mechanisms in place that may prevent a change in control that stockholders may

otherwise consider favorable.

In addition to the high concentration of insider ownership described above, our charter and by-laws

and the Maryland General Corporation Law, or the MGCL, include provisions that may be deemed to

have antitakeover effects and may delay, defer or prevent a takeover attempt that stockholders

might consider to be in their best interests. For example, the MGCL, our charter and bylaws

require the approval of the holders of two-thirds of the votes entitled to be cast on the matter to

amend our charter (unless our Board of Directors has unanimously approved the amendment, in which

case the approval of the holders of a majority of such votes is required), contain certain advance

notice procedures for nominating candidates for election to our Board of Directors, and permit our

Board of Directors to issue up to 10,000,000 shares of preferred stock.

Furthermore, we are subject to the anti-takeover provisions of the MGCL that prohibit us from

engaging in a “business combination” with an “interested stockholder” for a period of five years

after the date of the transaction in which the person first becomes an “interested stockholder,”

unless the business combination or stockholder interest is approved in a prescribed manner. The

application of these and certain other provisions of our charter could have the effect of delaying

or preventing a change of control of the Company, which could adversely affect the market price of

our common stock.

| ITEM 1B | — Unresolved Staff Comments |

None.

10

Table of Contents

| ITEM 2 | — Properties |

The Company’s principal executive offices are currently located in its Franklin Park, Illinois

facility near Chicago, Illinois. During January 2011, the Company executed a new lease agreement

to move the Company’s corporate headquarters to Oakbrook, Illinois during the second quarter of

2011. All properties and equipment are sufficient for the Company’s current level of activities.

Distribution centers and sales offices are maintained at each of the following locations, most of

which are leased, except as indicated:

| Approximate | ||||

| Floor Area in | ||||

| Locations | Square Feet | |||

Metals Segment |

||||

North America |

||||

Arlington, Texas |

74,880 | (2) | ||

Bedford Heights, Ohio |

374,400 | (1) | ||

Birmingham, Alabama |

76,000 | (1) | ||

Blaine, Minnesota |

65,200 | (1) | ||

Charlotte, North Carolina |

116,500 | (1) | ||

Edmonton, Alberta |

50,553 | |||

Fairfield, Ohio |

138,000 | (2) | ||

Fairless Hills, Pennsylvania |

71,600 | (1) | ||

Franklin Park, Illinois |

522,600 | (1) | ||

Gardena, California |

117,000 | |||

Grand Prairie, Texas |

78,000 | (1) | ||

Hammond, Indiana (H-A Industries) |

243,000 | |||

Houston, Texas |

109,100 | (1) | ||

Kansas City, Missouri |

118,000 | |||

Kennesaw, Georgia |

87,500 | |||

Kent, Washington |

53,000 | |||

Lafayette, Louisiana |

5,000 | (1) | ||

Mississauga, Ontario |

60,000 | |||

Orange, Connecticut |

57,389 | |||

Paramount, California |

155,500 | |||

Point Claire, Quebec |

38,760 | |||

Santa Cantarina, Nuevo Leon, Mexico |

55,000 | |||

Saskatoon, Saskatchewan |

15,000 | |||

Selkirk, Manitoba |

50,000 | (1) | ||

Stockton, California |

60,000 | |||

Twinsburg, Ohio |

120,000 | |||

Wichita, Kansas |

148,800 | |||

Worcester, Massachusetts |

53,500 | (1) | ||

Europe (3) |

||||

Blackburn, England |

62,139 | |||

Letchworth, England |

40,000 | |||

Montoir de Bretagne, France |

38,944 | |||

Asia |

||||

Shanghai, China |

45,700 | |||

Sales Offices |

||||

Bilbao, Spain |

(Intentionally left blank) | |||

Fairfield, Ohio |

||||

Milwaukee, Wisconsin |

||||

Phoenix, Arizona |

||||

Singapore |

||||

Tulsa, Oklahoma |

||||

Total Metals Segment |

3,301,065 | |||

11

Table of Contents

| Approximate | ||||

| Floor Area in | ||||

| Locations | Square Feet | |||

Plastics Segment |

||||

Baltimore, Maryland |

24,000 | |||

Cleveland, Ohio |

8,600 | |||

Cranston, Rhode Island |

14,990 | |||

Detroit, Michigan |

22,000 | |||

Elk Grove Village, Illinois |

22,500 | |||

Fort Wayne, Indiana |

17,600 | |||

Grand Rapids, Michigan |

42,500 | (1) | ||

Harrisburg, Pennsylvania |

13,900 | |||

Indianapolis, Indiana |

13,500 | |||

Kalamazoo, Michigan |

81,000 | |||

Knoxville, Tennessee |

16,530 | |||

Maple Shade, New Jersey |

12,480 | |||

Mt. Vernon, New York |

30,000 | |||

New Philadelphia, Ohio |

15,700 | |||

Pittsburgh, Pennsylvania |

12,800 | |||

Rockford, Michigan |

53,600 | |||

Tampa, Florida |

17,700 | |||

Worcester, Massachusetts |

2,500 | |||

Total Plastics Segment |

421,900 | |||

GRAND TOTAL |

3,722,965 | |||

| (1) | Represents owned facility. | |

| (2) | During the fourth quarter of 2010, the Company consolidated these facilities into existing locations. Therefore, these locations were vacant at December 31, 2010. | |

| (3) | Upon the termination of the lease for one of the Company’s facilities in England during the fourth quarter of 2010, such facility was consolidated into an existing location. |

12

Table of Contents

| ITEM 3 | — Legal Proceedings |

The Company is a defendant in several lawsuits arising from the operation of its business. These

lawsuits are incidental and occur in the normal course of the Company’s business affairs. It is

the opinion of management, based on current knowledge, that no uninsured liability will result from

the outcome of this litigation that would have a material adverse effect on the consolidated

results of operations, financial condition or cash flows of the Company.

| ITEM 4 | — [Removed and reserved] |

Executive Officers of The Registrant

The following selected information for each of our current executive officers (as defined by

regulations of the SEC) was prepared as of March 7, 2011.

| Name and Title | Age | Business Experience | ||||

Michael H. Goldberg President and Chief Executive Officer |

57 | Mr. Goldberg was elected President and Chief Executive Officer in 2006. Prior to joining the registrant, he was Executive Vice President of Integris Metals (an aluminum and stainless steel metal service center) from 2001 to 2005. From 1998 to 2001, Mr. Goldberg was Executive Vice President of North American Metals Distribution Group, a division of Rio Algom LTD. | ||||

Stephen V. Hooks Executive Vice President and President, Castle Metals |

59 | Mr. Hooks began his employment with the registrant in 1972. He was elected to the position of Vice President — Midwest Region in 1993, Vice President - Merchandising in 1998, Senior Vice President—Sales & Merchandising in 2002 and Executive Vice President of the registrant and Chief Operating Officer of Castle Metals in 2004. In 2005, Mr. Hooks was appointed President of Castle Metals. | ||||

Scott F. Stephens Vice President, Chief Financial Officer and Treasurer |

41 | Mr. Stephens began his employment with the registrant in 2008 and was elected to the position of Vice President, Chief Financial Officer, and Treasurer. Formerly, he served as the CFO of Lawson Products, Inc. (a distributor of services, systems and products to the MRO and OEM marketplace) since 2004, and CFO of The Wormser Company from 2001 to 2004. | ||||

Patrick R. Anderson Vice President, Corporate Controller and Chief Accounting Officer |

39 | Mr. Anderson began his employment with the registrant in 2007 and was appointed to the position of Vice President, Corporate Controller and Chief Accounting Officer. Prior to joining the registrant, he was employed as a Senior Manager with Deloitte & Touche LLP (a global accounting firm) where he was employed from 1994 to 2007. | ||||

Albert J. Biemer Vice President, Corporate Supply Chain |

49 | Mr. Biemer began his employment with the registrant in 2001 and was appointed to the position of Vice President — Supply Chain. He was appointed Vice President, ERP Business Executive in 2007 and in 2010 was appointed as Vice President — Corporate Supply Chain. Prior to joining the registrant, he was employed as Vice President — Logistics for CSC, Ltd (a producer of carbon and alloy bar) since 2000. | ||||

Kevin B. Coughlin Vice President, Operations |

60 | Mr. Coughlin began his employment with the registrant in 2005 and was appointed to the position of Vice President-Operations. Prior to joining the registrant he was Director of Commercial Vehicle Electronics and Automotive Starter Motor Groups for Robert Bosch-North America from 2001 to 2004 and Vice President of Logistics and Services for the Skill-Bosch Power Tool Company from 1997 to 2000. | ||||

13

Table of Contents

| Name and Title | Age | Business Experience | ||||

Kevin P. Fitzpatrick Vice President, Human Resources |

46 | Mr. Fitzpatrick began his employment with the registrant in 2009 and was elected to the position of Vice President-Human Resources. Prior to joining the registrant he was Vice President-North American Human Resources and Administration for UPM-Kymmene Corporation (a forest industry company) since 2001. | ||||

Thomas L. Garrett Vice President and President, Total Plastics, Inc. |

48 | Mr. Garrett began his employment with Total Plastics, Inc., a wholly owned subsidiary of the registrant, in 1988 and was appointed to the position of Controller. In 1996, he was elected to the position of Vice President and in 2001 was appointed to the position of Vice President of the registrant and President of Total Plastics, Inc. | ||||

Kevin H. Glynn Vice President and Chief Information Officer |

47 | Mr. Glynn began his employment with the registrant in October 2010 as the Interim Chief Information Officer. In January 2011 he was appointed Vice President and Chief Information Officer. Prior to joining the registrant, he was employed as a Managing Principal at Laminar Group LLC (a management consulting company) from 2009 to 2010, Chief Operating Officer at IRON Solutions, Inc. (an information technology company specializing in data, software and media services for the agriculture equipment market) from 2008 to 2009 and as Senior Vice President and Chief Information Officer at CNH America, LLC (a manufacturer of agricultural and construction equipment) from 2006 to 2007. | ||||

G. Nicholas Jones Vice President and President, Castle Metals Oil & Gas |

43 | Mr. Jones began his employment with the registrant in December 2010 and was appointed to the position of Vice President, President Castle Metals Oil & Gas. Prior to beginning employment with the registrant, he was Vice President and GM — Eastern Hemisphere for Energy Alloys LLC (a global supplier of oilfield metals, services and solutions) since 2004. | ||||

Robert J. Perna Vice President, General Counsel and Secretary |

47 | Mr. Perna began his employment with the registrant in 2008 and was elected to the position of Vice President-General Counsel and Secretary. Prior to joining the registrant he was General Counsel, North America, CNH America, LLC (a manufacturer of agricultural and construction equipment) since 2007, and he also served as Associate General Counsel and Corporate Secretary for Navistar International Corporation (a manufacturer of commercial trucks and diesel engines) since 2001. | ||||

Blain A. Tiffany Vice President and President, Castle Metals Aerospace |

52 | Mr. Tiffany began his employment with the registrant in 2000 and was appointed to the position of District Manager. He was appointed Eastern Region Manager in 2003, Vice President — Regional Manager in 2005 and in 2006 was appointed to the position of Vice President — Sales. In 2007 Mr. Tiffany was appointed to the position of Vice President of the registrant and President of Castle Metals Plate. In 2009 Mr. Tiffany was elected to the Position of Vice President of the registrant and President of Castle Metals Aerospace. | ||||

14

Table of Contents

PART II

| ITEM 5 | — Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

The Company’s common stock trades on the New York Stock Exchange under the ticker symbol “CAS”. As

of March 1, 2011 there were approximately 1,081 shareholders of record. The Company used cash of

$1.4 million to pay cash dividends of $0.06 per share on its common stock in 2009. The 2009

dividend payments of $1.4 million were paid during the second quarter of 2009 and the Company

subsequently suspended the payment of dividends until further notice. No cash dividends were paid

on the Company’s common stock in 2010. The payment of dividends, if any, is at the discretion of the

Board of Directors and will depend on the Company’s earnings, capital requirements and financial

condition and such other factors as the Board of Directors may consider.

See Part III, Item 12, “Security Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters”, for information regarding common stock authorized for issuance under equity

compensation plans.

The Company did not purchase any of its equity securities during the fourth quarter of 2010.

Directors of the Company who are not employees may elect to defer receipt of up to 100% of their

cash retainer. A director who defers board compensation may select either an interest or a stock

equivalent investment option for amounts in the director’s deferred compensation account.

Disbursement of the stock equivalent unit account may be in shares of Company common stock or in

cash as designated by the director. If payment from the stock equivalent unit account is made in

shares of the Company’s common stock, the number of shares to be distributed will equal the number

of full stock equivalent units held in the director’s account. For the period covered by this

report, receipt of approximately 1,803 shares was deferred as payment for the 2010 board

compensation. In each case, the shares were acquired at prices ranging from $12.75 to $17.14 per

share, which represented the closing price of the Company’s common stock on the day as of which

such fees would otherwise have been paid to the director. Exemption from registration of the

shares is claimed by the Company under Section 4(2) of the Securities Act of 1933, as amended.

The following table sets forth the range of the high and low sales prices of shares of the

Company’s common stock for the periods indicated:

| 2010 | 2009 | |||||||||||||||

| Low | High | Low | High | |||||||||||||

First Quarter |

$ | 9.55 | $ | 14.19 | $ | 5.29 | $ | 13.09 | ||||||||

Second Quarter |

$ | 12.17 | $ | 19.29 | $ | 8.25 | $ | 12.87 | ||||||||

Third Quarter |

$ | 12.66 | $ | 16.09 | $ | 9.45 | $ | 13.48 | ||||||||

Fourth Quarter |

$ | 13.11 | $ | 19.20 | $ | 8.74 | $ | 14.41 | ||||||||

15

Table of Contents

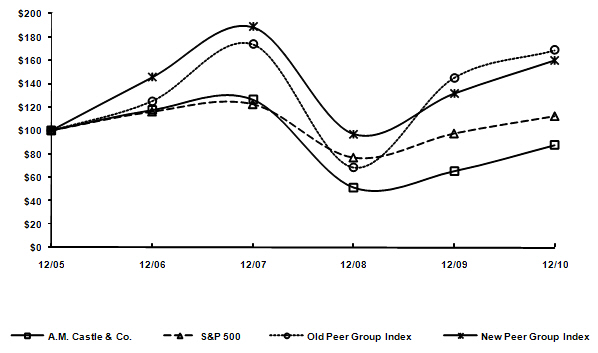

The following graph compares the cumulative total stockholder return on our common stock for the

five-year period ended December 31, 2010, with the cumulative total return of the Standard and

Poor’s 500 Index and to a peer group index. The comparison in the graph assumes the investment of

$100 on December 31, 2005. Cumulative total stockholder return means share price increases or

decreases plus dividends paid, with the dividends reinvested, and reflect market capitalization

weighting. The graph does not forecast future performance of our common stock. The Company moved

to a new peer group index during 2010 in conjunction with the establishment of a relative total

shareholder return performance measure under the Company’s long term compensation plan. The

Company believes this new peer group provides a more meaningful comparison of our stock

performance. The new peer group index is made up of companies in the metals industry or in the

industrial products distribution business, although not all of the companies included in the new

peer group index participate in all of the lines of business in which the Company is engaged and

some of the companies included in the peer group index also engage in lines of business in which

the Company does not participate. Additionally, the market capitalizations of many of the

companies in the peer group are quite different from that of the Company.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among A.M. Castle & Co., the S&P 500 Index

and Two Peer Group Index

Among A.M. Castle & Co., the S&P 500 Index

and Two Peer Group Index

| * | $100 invested on 12/31/05 in stock or index, including reinvestment of dividends. | |

| Fiscal year ending December 31. | ||

| Copyright© 2011 S&P, a division of The McGraw-Hill Companies Inc. All rights reserved. |

| 12/05 | 12/06 | 12/07 | 12/08 | 12/09 | 12/10 | |||||||||||||||||||

A. M. Castle & Co. |

$ | 100.00 | $ | 117.43 | $ | 126.51 | $ | 51.01 | $ | 64.90 | $ | 87.28 | ||||||||||||

S&P 500 |

100.00 | 115.80 | 122.16 | 76.96 | 97.33 | 111.99 | ||||||||||||||||||

Old Peer Group Index (a) |

100.00 | 125.21 | 173.86 | 68.53 | 145.09 | 168.58 | ||||||||||||||||||

Current Peer Group Index (b) |

100.00 | 145.48 | 188.57 | 97.05 | 131.63 | 160.08 | ||||||||||||||||||

| (a) | The Old Peer Group Index consists of Olympic Steel, Inc. and Reliance Steel & Aluminum Co. | |

| (b) | The Current Peer Group Index consists of the following companies: AEP Industries Inc.; AK Steel Holding Corp.; Allegheny Technologies Inc.; Amcol International Corp.; Applied Industrial Technologies Inc.; Carpenter Technology Corp.; Cliffs Natural Resources Inc.; Commercial Metals Company; Fastenal Company; Gibraltar Industries Inc.; Haynes International Inc.; Kaman Corp.; Lawson Products Inc.; MSC Industrial Direct Company Inc.; Nucor Corp.; Olin Corp.; Olympic Steel, Inc.; Quanex Building Products Corp.; Reliance Steel & Aluminum Co.; RTI International Metals Inc.; Schnitzer Steel Industries Inc.; Steel Dynamics Inc.; Stillwater Mining Company; Texas Industries Inc.; United States Steel Corp.; and Worthington Industries Inc. |

16

Table of Contents

| ITEM 6 | — Selected Financial Data |

The Selected Financial Data in the table below includes the results of the September 2006 and

January 2008 acquisitions of Transtar and Metals U.K., respectively, and the October 2007

divestiture of Metal Express.

| (dollars in millions, except per share data) | 2010 | 2009 | 2008 | 2007 | 2006 | |||||||||||||||

For the year ended December 31: |

||||||||||||||||||||

Net sales |

$ | 943.7 | $ | 812.6 | $ | 1,501.0 | $ | 1,420.4 | $ | 1,177.6 | ||||||||||

Net (loss) income from continuing operations |

(5.6 | ) | (26.9 | ) | (17.1 | ) | 51.8 | 55.1 | ||||||||||||

Basic (loss) earnings per common share from

continuing operations |

(0.25 | ) | (1.18 | ) | (0.76 | ) | 2.49 | 2.95 | ||||||||||||

Diluted (loss) earnings per common share from

continuing operations |

(0.25 | ) | (1.18 | ) | (0.76 | ) | 2.41 | 2.89 | ||||||||||||

Cash dividends declared per common share |

— | 0.06 | 0.24 | 0.24 | 0.24 | |||||||||||||||

As of December 31: |

||||||||||||||||||||

Total assets |

529.4 | 558.0 | 679.0 | 677.0 | 655.1 | |||||||||||||||

Long-term debt, less current portion |

61.1 | 67.7 | 75.0 | 60.7 | 90.1 | |||||||||||||||

Total debt |

69.1 | 89.2 | 117.1 | 86.5 | 226.1 | |||||||||||||||

Total stockholders’ equity |

313.5 | 318.2 | 347.3 | 385.1 | 215.9 | |||||||||||||||

17

Table of Contents

| ITEM 7 | — Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Amounts in millions except per share data

Information regarding the business and markets of A.M. Castle & Co. and its subsidiaries

(the “Company”), including its reportable segments, is included in Item 1 “Business” of this

annual report on Form 10-K.

The following discussion should be read in conjunction with Item 6 “Selected Financial Data”

and the Company’s consolidated financial statements and related notes thereto in Item 8

“Financial Statements and Supplementary Data”.

EXECUTIVE OVERVIEW

The Company’s long-term strategy is to become the foremost global provider of specialty metals

products and services and specialized supply chain solutions to targeted global industries.

During 2010, the following significant events occurred which impacted the Company’s operations and

financial results:

| • | Demand for the Company’s products increased in light of improvements in the overall economy resulting in a 16.1% increase in sales over 2009. | ||

| • | Successful management of working capital principally through reducing inventory and debt levels by approximately $40.0 million and $20.0 million, respectively, from 2009 to 2010. | ||

| • | Reduction in average Days’ Sales in Inventories (“DSI”) of approximately 46 days from 2009 to 2010. | ||

| • | Consolidation of 3 of the Company’s facilities into existing locations in order to effectively manage operations, reduce operating costs and better serve customers. |

Recent Market and Pricing Trends

The Company experienced increased demand from its customer base during 2010 in both the Metals and

Plastics segments, reflecting the improvement in the overall global economy compared to 2009.

Industry data indicates that U.S. service center steel and aluminum shipments were up between 20%

and 26% during 2010 compared to 2009 levels. Due to the late-cycle nature of the Company’s

business, results typically lag the general economic cycle by twelve months. Key end-use markets

that experienced significant increases in demand in the Company’s Metals segment include oil and

gas, general equipment and heavy industrial equipment. The Plastics segment experienced increased

demand across its primary end-use markets including office furniture, semiconductor, safety

products, life sciences applications and automotive compared to 2009.

Pricing across the majority of the Company’s markets strengthened throughout the year, albeit with

the usual volatility as a result of fluctuating commodity costs. The combination of factors above

positively impacted the Company’s operating results during 2010.

Changes in pricing can have a more direct impact on the Company’s operating results than changes in

volume due to certain factors including but not limited to:

| • | Changes in volume typically result in corresponding changes to the Company’s variable costs. However, as pricing changes occur, variable expenses are not directly impacted. |

| • | If surcharges are not passed through to the customer or are passed through without a mark-up, the Company’s profitability will be adversely impacted. |

18

Table of Contents

Current Business Outlook

Management uses the Purchaser’s Managers Index (“PMI”) provided by the Institute of Supply

Management (website is www.ism.ws) as an external indicator for tracking the demand outlook and

possible trends in its general manufacturing markets. The table below shows PMI trends from the

first

quarter of 2008 through the fourth quarter of 2010. Generally speaking, an index above 50.0

indicates growth in the manufacturing sector of the U.S. economy, while readings under 50.0

indicate contraction.

| YEAR | Qtr 1 | Qtr 2 | Qtr 3 | Qtr 4 | ||||||||||||

2008 |

49.2 | 49.5 | 47.8 | 36.1 | ||||||||||||

2009 |

35.9 | 42.6 | 51.5 | 54.6 | ||||||||||||

2010 |

58.2 | 58.8 | 55.4 | 56.8 | ||||||||||||

Material pricing and demand in both the Metals and Plastics segments of the Company’s business have

historically proven to be difficult to predict with any degree of accuracy. A favorable PMI trend

suggests that demand for some of the Company’s products and services, in particular those that are

sold to the general manufacturing customer base in the U.S., could potentially be at a higher level

in the near-term. The Company believes that its revenue trends typically correlate to the changes

in PMI on a six to twelve month lag basis.

RESULTS OF OPERATIONS: YEAR-TO-YEAR COMPARISONS AND COMMENTARY

Our discussion of comparative period results is based upon the following components of the

Company’s consolidated statements of operations.

Net Sales —The Company derives its sales from the processing and delivery of metals and plastics.

Pricing is established with each customer order and includes charges for the material, processing

activities and delivery. The pricing varies by product line and type of processing. From time to

time the Company may enter into fixed price arrangements with customers while simultaneously

obtaining similar agreements with its suppliers.

Cost of Materials — Cost of materials consists of the costs we pay suppliers for metals, plastics

and related inbound freight charges, excluding depreciation and amortization which are included in

operating costs and expenses discussed below. The Company accounts for inventory primarily on a

last-in-first-out (“LIFO”) basis. LIFO adjustments are calculated as of December 31 of each year.

Operating Costs and Expenses — Operating costs and expenses primarily consist of:

| • | Warehouse, processing and delivery expenses, including occupancy costs, compensation and employee benefits for warehouse personnel, processing, shipping and handling costs; |

| • | Sales expenses, including compensation and employee benefits for sales personnel; |

| • | General and administrative expenses, including compensation for executive officers and general management, expenses for professional services primarily related to accounting and legal advisory services, bad debt expense, data communication, computer hardware and maintenance and foreign currency gain or loss; and |

| • | Depreciation and amortization expenses, including depreciation for all owned property and equipment, and amortization of various intangible assets. |

19

Table of Contents

2010 Results Compared to 2009

Consolidated results by business segment are summarized in the following table for years 2010 and

2009.

Operating Results by Segment

| Year Ended December 31, | Fav / (Unfav) | |||||||||||||||

| 2010 | 2009 | $ Change | % Change | |||||||||||||

Net Sales |

||||||||||||||||

Metals |

$ | 841.1 | $ | 726.2 | $ | 114.9 | 15.8 | % | ||||||||

Plastics |

102.6 | 86.4 | 16.2 | 18.8 | % | |||||||||||

Total Net Sales |

$ | 943.7 | $ | 812.6 | $ | 131.1 | 16.1 | % | ||||||||

Cost of Materials |

||||||||||||||||

Metals |

$ | 631.1 | $ | 551.9 | $ | (79.2 | ) | (14.4 | )% | |||||||

% of Metals Sales |

75.0 | % | 76.0 | % | ||||||||||||

Plastics |

69.8 | 59.4 | (10.4 | ) | (17.5 | )% | ||||||||||

% of Plastics Sales |

68.0 | % | 68.8 | % | ||||||||||||

Total Cost of Materials |

$ | 700.9 | $ | 611.3 | $ | (89.6 | ) | (14.7 | )% | |||||||

% of Total Sales |

74.3 | % | 75.2 | % | ||||||||||||

Operating Costs and Expenses |

||||||||||||||||

Metals |

$ | 215.5 | $ | 206.4 | $ | (9.1 | ) | (4.4 | )% | |||||||

Plastics |

29.3 | 26.7 | (2.6 | ) | (9.7 | )% | ||||||||||

Other |

7.4 | 5.3 | (2.1 | ) | (39.6 | )% | ||||||||||

Total Operating Costs & Expenses |

$ | 252.2 | $ | 238.4 | $ | (13.8 | ) | (5.8 | )% | |||||||

% of Total Sales |

26.7 | % | 29.3 | % | ||||||||||||

Operating (Loss) Income |

||||||||||||||||

Metals |

$ | (5.5 | ) | $ | (32.1 | ) | $ | 26.6 | 82.9 | % | ||||||

% of Metals Sales |

(0.7 | )% | (4.4 | )% | ||||||||||||

Plastics |

3.6 | 0.3 | 3.3 | 1100 | % | |||||||||||

% of Plastics Sales |

3.5 | % | 0.3 | % | ||||||||||||

Other |

(7.4 | ) | (5.3 | ) | (2.1 | ) | (39.6 | )% | ||||||||

Total Operating (Loss) |

$ | (9.3 | ) | $ | (37.1 | ) | $ | 27.8 | 74.9 | % | ||||||

% of Total Sales |

(1.0 | )% | (4.6 | )% | ||||||||||||

“Other” includes costs of executive, legal and finance departments which are shared by both segments of the Company.

Net Sales:

Consolidated net sales were $943.7 million in 2010, an increase of $131.1 million, or 16.1%, versus

2009. Metals segment net sales during 2010 of $841.1 million were $114.9 million, or 15.8%, higher

than 2009. Higher net sales were primarily the result of higher shipping volumes. Average tons

sold per day increased 14.8% compared to the prior year. The increase in demand experienced in 2010

was driven primarily by alloy bar, carbon bar, SBQ bar and tubing products. Key end-use markets

that experienced increased demand in 2010 compared to 2009 include oil and gas, general equipment

and heavy industrial equipment.

Plastics segment net sales during 2010 of $102.6 million were $16.2 million, or 18.8%, higher than

2009 due to higher sales volume. The Plastics business also experienced increased sales volume

during 2010 reflecting strength in the office furniture and semiconductor end-use markets compared

to 2009.

20

Table of Contents

Cost of Materials:

Cost of materials (exclusive of depreciation and amortization) were $700.9 million, an increase of

$89.6 million, or 14.7%, compared to 2009. Material costs for the Metals segment were $631.1

million or 75.0% as a percent of net sales compared to $551.9 million or 76.0% as a percent of net

sales in 2009. The demand environment in 2010 was better than 2009, reflecting the recovery in the

global economic environment in 2010. The stronger demand experienced in 2010 provided an improved

pricing environment compared to 2009. The Metals segment recorded LIFO expense of $7.7 million,

which resulted in higher cost of materials in 2010, compared to a credit of $14.4 million, which

resulted in lower cost of materials in 2009.

Material costs for the Plastics segment were 68.0% as a percent of net sales in 2010 as compared to

68.8% for the same period last year. The stronger demand experienced in 2010 provided an improved

pricing environment compared to 2009.

During 2010 and 2009, a reduction in inventories resulted in a liquidation of applicable LIFO

inventory quantities carried at lower costs in prior years. On a consolidated basis, cost of

materials for 2010 and 2009 were lower by $12.5 million and $5.6 million, respectively, as a result

of the liquidations.

Operating Expenses and Operating (Loss) Income:

Operating costs and expenses increased $13.8 million, or 5.8%, compared to last year. Operating

costs and expenses for 2010 were $252.2 million, or 26.7% as a percent of net sales, compared to

$238.4 million, or 29.3% as a percent of net sales last year. Operating costs and expenses

included facility consolidation charges of $2.4 million for 2010 and goodwill impairment charges of

$1.4 million during 2009.

In response to the declining demand for its products resulting from continued challenges in the

global economy and the metals and plastics markets, the Company implemented numerous initiatives

during 2009 to align its cost structure with activity levels. The cost reduction actions taken in

2009 primarily focused on payroll related costs, the Company’s largest operating expense category,

resulting in reduced work weeks and furloughs, suspension of the Company’s 401(k) matching

contributions and executive salary reductions of at least 10 percent. Full workweeks and 401(k)

matching contributions were reinstated in January and April 2010, respectively, resulting in

overall increases in payroll related costs in 2010. Other factors that contributed to increased

payroll related costs in 2010 compared to 2009 included merit increases and headcount increases, as

well as higher incentive compensation earned in 2010.

The $13.8 million increase in operating expenses in 2010 compared to 2009 primarily relates to the

following:

| • | Warehouse, processing and delivery costs increased by $13.7 million of which $2.1 million is the result of higher payroll related expenses and facility consolidation charges contributed a $2.4 million increase. The balance of the cost increase is attributed to higher sales volumes as average tons sold per day increased 14.8% compared to the prior year; |

| • | Sales, general and administrative costs increased by $2.1 million. The increase is primarily comprised of $3.7 million of higher payroll related expenses, offset by a decrease of $1.6 million associated with improved customer credit experience in 2010 compared to the prior year; and |

| • | Depreciation and amortization and goodwill impairment charges decreased $0.6 million and $1.4 million, respectively. |

Consolidated operating loss for 2010 was $9.3 million compared to operating loss of $37.1 million

in 2009.

Other Income and Expense, Income Taxes and Net Income:

Interest expense was $5.0 million in 2010, a decrease of $1.5 million versus 2009 as a result of

reduced borrowings.

The Company recorded a tax benefit of $3.1 million and $16.3 million during 2010 and 2009,

respectively. The effective tax rate for 2010 and 2009 was 21.7% and 37.3%, respectively. The effective tax

rate, excluding goodwill impairment charges for 2009, was 38.5%. Higher tax on joint venture

income was offset by the rate differential on foreign income (loss), resulting in a decline in the

effective tax rate compared to 2009.

21

Table of Contents

Equity in earnings of the Company’s joint venture was $5.6 million in 2010 compared to $0.4 million

in 2009. The increase is a result of higher demand in virtually all of the joint venture’s end-use

markets, most notably the automotive and energy sectors, and higher pricing compared to last year.

Consolidated net loss for 2010 was $5.6 million, or $0.25 per diluted share, versus $26.9 million,

or $1.18 per diluted share, for 2009.

2009 Results Compared to 2008

Consolidated results by business segment are summarized in the following table for years 2009 and

2008.

Operating Results by Segment

| Year Ended December 31, | Fav / (Unfav) | |||||||||||||||

| 2009 | 2008 | $ Change | % Change | |||||||||||||

Net Sales |

||||||||||||||||

Metals |

$ | 726.2 | $ | 1,384.8 | $ | (658.6 | ) | (47.6 | )% | |||||||

Plastics |

86.4 | 116.2 | (29.8 | ) | (25.6 | )% | ||||||||||

Total Net Sales |

$ | 812.6 | $ | 1,501.0 | $ | (688.4 | ) | (45.9 | )% | |||||||

Cost of Materials |

||||||||||||||||

Metals |

$ | 551.9 | $ | 1,044.4 | $ | 492.5 | 47.2 | % | ||||||||

% of Metals Sales |

76.0% | 75.4% | ||||||||||||||

Plastics |

59.4 | 79.6 | 20.2 | 25.4 | % | |||||||||||

% of Plastics Sales |

68.8% | 68.5% | ||||||||||||||

Total Cost of Materials |

$ | 611.3 | $ | 1,124.0 | $ | 512.7 | 45.6 | % | ||||||||

% of Total Sales |

75.2% | 74.9% | ||||||||||||||

Operating Costs and Expenses |

||||||||||||||||

Metals |

$ | 206.4 | $ | 328.9 | $ | 122.5 | 37.2 | % | ||||||||

Plastics |

26.7 | 33.4 | 6.7 | 20.1 | % | |||||||||||

Other |

5.3 | 10.6 | 5.3 | 50.0 | % | |||||||||||

Total Operating Costs & Expenses |

$ | 238.4 | $ | 372.9 | $ | 134.5 | 36.1 | % | ||||||||

% of Total Sales |

29.3% | 24.8% | ||||||||||||||

Operating (Loss) Income |

||||||||||||||||

Metals |

$ | (32.1 | ) | $ | 11.5 | $ | (43.6 | ) | (379.1 | )% | ||||||

% of Metals Sales |

(4.4% | ) | 0.8% | |||||||||||||

Plastics |

0.3 | 3.2 | (2.9 | ) | (90.6 | )% | ||||||||||

% of Plastics Sales |

0.3% | 2.8% | ||||||||||||||

Other |

(5.3 | ) | (10.6 | ) | 5.3 | 50.0 | % | |||||||||

Total Operating (Loss) Income |

$ | (37.1 | ) | $ | 4.1 | $ | (41.2 | ) | (1,004.9 | )% | ||||||

% of Total Sales |

(4.6% | ) | 0.3% | |||||||||||||

“Other” includes costs of executive, legal and finance departments which are shared by both segments of the Company.

Net Sales:

Consolidated net sales were $812.6 million in 2009, a decrease of $688.4 million, or 45.9%, versus

2008.

22

Table of Contents

Metals segment net sales during 2009 of $726.2 million were $658.6 million, or 47.6%, lower than

2008. Decreased revenues were primarily the result of lower shipping volumes in light of continued

challenges in the global economy and the metals and plastics markets. Average tons sold per day

decreased 43.5% compared to the prior year. The softness experienced during 2009 was broad-based,

impacting virtually all end-markets and products compared to 2008. The Company also experienced

lower sales prices for its products during 2009; however, the impact of these price decreases on

net sales was partially mitigated by a changing sales mix as compared to 2008.

Plastics segment net sales during 2009 of $86.4 million were $29.8 million, or 25.6%, lower than

2008 due to lower sales volume. The Plastics business also experienced softer demand during 2009

across its primary end markets including retail, marine and automotive when compared to 2008.

Cost of Materials: