Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT DATED MARCH 11, 2011 - VOICE MOBILITY INTERNATIONAL INC | form8k.htm |

| EX-10.2 - FORM OF DEBENTURE - VOICE MOBILITY INTERNATIONAL INC | exhibit10-2.htm |

ASSET PURCHASE AGREEMENT

THIS AGREEMENT made as of the 16th day of February, 2011.

AMONG:

VOICE MOBILITY INTERNATIONAL, INC.,

a company

incorporated under the laws of the State of Nevada with its

principal

business office located at 107 – 645 Fort Street, Victoria,

British C

olumbia V8W 1G2; and

(the "Parent")

VOICE MOBILITY, INC., a company

incorporated under the laws of

Canada with its principal business office

located at 107 – 645 Fort Street,

Victoria, British Columbia V8W 1G2

(the "Purchaser")

AND

TAGLINE COMMUNICATIONS INC., a

company incorporated

under the laws of the Province of British Columbia with

its principal

business office located at 1600 – 609 Granville Street, P.O.

Box 10068,

Pacific Centre, Vancouver, British Columbia V7Y 1C3

(the "Vendor")

AND

THE EMPRISE SPECIAL OPPORTUNITIES

FUND, LIMITED

PARTNERSHIP, a limited partnership formed under the laws

of British

Columbia with its principal office at 1620 – 609 Granville

Street,

Vancouver, British Columbia V7Y 1C3

(the "Shareholder")

BACKGROUND:

A. The Vendor is the legal and beneficial owner of all of the Assets (defined below), consisting of all of the property, assets and undertaking of the Vendor's Business (defined below).

B. The Vendor wishes to sell, and the Purchaser wishes to purchase, subject to any exceptions set out in this Agreement, all of the Assets upon the terms and subject to the conditions contained in this Agreement.

C. The Shareholder is the legal and beneficial owner of all of the issued and outstanding shares of the Vendor, and is a party to this Agreement solely for the purpose of covenanting with the Vendor to indemnify the Purchaser in the manner provided in this Agreement.

D. The Purchaser is a wholly owned subsidiary of the Parent.

- 2 –

NOW THEREFORE THIS AGREEMENT WITNESSES that in consideration of the mutual covenants and agreements herein contained, and other good and valuable consideration, receipt of which is hereby acknowledged, it is agreed among the parties hereto as follows:

ARTICLE 1

INTERPRETATION

1.1 Defined Terms

In this Agreement, including the schedules hereto, unless there is something in the subject matter or context inconsistent therewith, the following terms and expressions will have the following meanings:

| (a) |

“Accounts Receivable” shall mean all accounts receivable, trade accounts, notes receivable, book debts and other debts due or accruing due from the Customers with respect to any services provided by the Vendor at or prior to the Closing Date. | |

| (b) |

"Adjustment Date" has the meaning ascribed to it in section 3.3. | |

| (c) |

"Assets" means all rights, title and interest of the Vendor, whether direct, indirect, beneficial, contingent, or otherwise, in all of the property and assets of every kind and description (except as provided in section 2.1(b)), wherever situate of the Vendor's Business and undertaking, as listed in Schedule "A" of this Agreement. | |

| (d) |

"Assumed Obligations" has the meaning ascribed to it in section 2.3. | |

| (e) |

“Books and Records” shall mean all books, records, files and documentation (in whatever medium and wherever situated) of the Vendor which pertain to the Assets, and for greater certainty, the phrase “Books and Records” shall include, without limitation, all approvals, authorizations, written Contracts, evidence or indication of ownership of the Vendor in and to any Asset. In the event any of the above books and records pertain to both the Business and the Assets or if the Vendor is required by law to keep originals of any such books and records, the phrase “Books and Records” shall mean copies thereof. | |

| (f) |

“Business” shall mean the business now and heretofore conducted by the Vendor consisting of the hosted communications service provided by the Vendor to the Customers under the "Tagline" brand name, and all operations, activities and functions necessary or incidental to the above. | |

| (g) |

"Business Day" means any day other than a day which is a Saturday, a Sunday or a statutory holiday in Vancouver, British Columbia. | |

| (h) |

“Closing” shall mean the completion of the transaction of purchase and sale, assignment and transfer contemplated herein by the delivery to the Purchaser of instruments of conveyance for the Assets, in form and substance satisfactory to the Purchaser, acting reasonably. | |

| (i) |

"Closing Date" means the date on or before March 3rd, 2011 on which the Closing occurs. |

- 3 –

| (j) |

"Consideration Shares" has the meaning ascribed to it in section 3.1. | ||

| (k) |

“Contracts” shall mean all written or oral contracts, agreements, indentures, instruments, commitments and orders made by or in favour of the Vendor in relation to the Business, and “Contract” shall mean any one of them. | ||

| (l) |

“Customers” shall mean all paying subscribers of the TagLine service provided by the Vendor, and “Customer” shall mean any one of them. | ||

| (m) |

"Encumbrances" means mortgages, charges, pledges, royalties, security interests, liens, encumbrances, actions, claims, demands and equities of any nature whatsoever or howsoever arising and any rights or privileges capable of becoming any of the foregoing. | ||

| (n) |

"Governmental Charges" means all taxes, customs, duties, rates, levies, assessments and other charges, together with penalties, interest and fines with respect thereto, payable to any federal, provincial, state, municipal, local or other governmental agency, authority, board, bureau or commission, domestic or foreign. | ||

| (o) |

"Material Adverse Effect" means any change, effect, event or occurrence that is, or could reasonably be expected to be, material and adverse to the value or condition of the Assets. | ||

| (p) |

"NDA" means the Confidentiality Agreement dated July 15, 2010, between the Vendor and the Purchaser. | ||

| (q) |

"NEX" means the NEX Board of the TSXV. | ||

| (r) |

"NEX Approval" means the acceptance for filing of this Agreement by the NEX. | ||

| (s) |

"Parent" means Voice Mobility International, Inc. | ||

| (t) |

"Person" means and includes any individual, corporation, partnership, firm, joint venture, syndicate, association, trust, government, governmental agency or board or commission or authority, and any other form of entity or organization. | ||

| (u) |

"Purchase Price" means the obligation of the Purchaser to make the cash payment and issue the Consideration Shares, as further described in section 3.1. | ||

| (v) |

"Purchaser" means Voice Mobility, Inc | ||

| (w) |

"Retained Liabilities" has the meaning ascribed to it in section 2.4. | ||

| (x) |

"Shareholder" means The Emprise Special Opportunities Fund, Limited Partnership. | ||

| (y) |

"Transfer Documents" means: | ||

| (i) |

all conveyance documents required to transfer title to a 100% interest in the Assets to the Purchaser, duly executed by the Vendor; | ||

- 4 –

| (ii) |

all documents necessary to discharge any Encumbrance registered against the Assets; and | ||

| (iii) |

all other documents required or contemplated to be delivered to the Purchaser to transfer title to a 100% interest in the Assets to the Purchaser. | ||

| (z) |

"TSXV" means the TSX Venture Exchange. | ||

| (aa) |

"Vendor" means Tagline Communications Inc. | ||

1.2 Best of Knowledge

Any reference herein to "the best of the knowledge" of the Vendor will mean the actual knowledge of the president of the Vendor and the knowledge which he would have if he had conducted a reasonably diligent inquiry into the relevant subject matter.

1.3 Schedules

The schedules which are attached to this Agreement are incorporated into this Agreement by reference and are deemed to be part hereof.

1.4 Currency

Unless otherwise indicated, all dollar amounts referred to in this Agreement are in lawful money of Canada.

1.5 Choice of Law and Attornment

This Agreement shall be governed by and construed in accordance with the laws of the Province of British Columbia and the laws of Canada applicable therein.

1.6 Interpretation Not Affected by Headings or Party Drafting

The division of this Agreement into articles, sections, paragraphs, subparagraphs and clauses and the insertion of headings are for convenience of reference only and shall not affect the construction or interpretation of this Agreement. The terms "this Agreement", "hereof", "herein", "hereunder" and similar expressions refer to this Agreement and the schedules hereto and not to any particular article, section, paragraph, subparagraph, clause or other portion hereof and include any agreement or instrument supplementary or ancillary hereto. Each party hereto acknowledges that it and its legal counsel have reviewed and participated in settling the terms of this Agreement, and the parties hereby agree that any rule of construction to the effect that any ambiguity is to be resolved against the drafting party shall not be applicable in the interpretation of this Agreement.

1.7 Number and Gender

In this Agreement, unless there is something in the subject matter or context inconsistent therewith:

| (a) |

words in the singular number include the plural and such words shall be construed as if the plural had been used, and vice versa; and |

- 5 –

| (b) |

any gender include all genders where the context or party referred to so requires, and the rest of the sentence shall be construed as if the necessary grammatical and terminological changes had been made. |

1.8 Time of Essence

Time is of the essence of this Agreement.

ARTICLE 2

PURCHASE AND SALE

2.1 Purchase of Assets

| (a) |

On the terms and subject to the fulfillment of the conditions hereof, the Vendor hereby agrees to sell, transfer and assign to the Purchaser, and the Purchaser hereby agrees to purchase and acquire from the Vendor at the Closing and for the Purchase Price, all of the Vendor's interest in the Assets, as described in Schedule "A". | |

| (b) |

Cash on hand or on deposit shall be specifically excluded from the purchase and sale of the Assets under this Agreement. To the extent that the Purchaser assumes any Contract which includes funds of the Vendor on deposit, such amount shall be added to the amount contemplated to be delivered to the Vendor pursuant to Article 3. |

2.2 Instruments of Conveyance

In order to effectuate more fully and completely the sale, assignment, conveyance and transfer of the Assets pursuant to the terms and conditions hereof, the Vendor shall deliver to the Purchaser such bills of sale, assignments and instruments of conveyance as requested by the Purchaser, acting reasonably, to permit the assignment, transfer and conveyance from the Vendor to the Purchaser and the acquisition by the Purchaser from the Vendor of all right, title and interest in, to and under the Assets, free and clear of all Encumbrances, as of the Closing Date.

2.3 Assumption of Obligations

The Purchaser hereby agrees with effect from the Closing Date, as part of the consideration for the Assets, to assume, discharge, satisfy, perform and fulfil in a timely manner, strictly in accordance with their terms, the obligations of the Vendor existing on or arising after the Closing under the Contracts (collectively, the “Assumed Obligations”).

2.4 Retained Liabilities

Except for the Assumed Obligations, Purchaser is not assuming and shall have no obligation to pay, perform or discharge any obligations or liabilities of Vendor related to the Business or otherwise, of any kind or nature, whether absolute, accrued, contingent or otherwise (collectively, the “Retained Liabilities”) including, without limiting the generality of the foregoing:

| (a) |

Liabilities incurred by Vendor in connection with this Agreement and the transactions contemplated by this Agreement, including, without limitation, counsel fees, and expenses pertaining to the performance by Vendor of its obligations under this Agreement; |

- 6 –

| (b) |

Any taxes of the Vendor (whether relating to periods before or after the transactions contemplated in this Agreement or incurred by Vendor in connection with this Agreement and the transactions provided for in this Agreement); | |

| (c) |

Liabilities in connection with or relating to any action, suit, claim, proceeding, demand, assessment or any judgment, cost, loss, liability, damage, deficiency or expense (whether or not arising out of third-party claims), including without limitation interest penalties, reasonable attorneys’ and accountants’ fees and all amounts paid in investigation, defence, or settlement of any of the foregoing; and | |

| (d) |

Costs and expenses incurred subsequent to the Closing. |

2.5 Risk of Loss

From the date hereof up to the Closing Date, the Assets shall be and shall remain at the risk of the Vendor. If, prior to the Closing Date, all or any material portion of the Assets are lost, transferred, destroyed or damaged by fire or other casualty or shall be appropriated, expropriated or seized by any governmental body or creditor, or if the Vendor is the subject of any bankruptcy proceeding or has a receiver or receiver-manager appointed in respect of its assets or undertaking, then the Purchaser shall have the option on or prior to the Closing Date to terminate this Agreement forthwith upon written notice to the Vendor to such effect.

2.6 Sale Subject to Financing

The Parties acknowledge and agree that the Closing of sale and the payment of Purchase Price shall be subject to the Purchaser having received financing in and amount at least equal to the cash portion of the Purchase Price payable hereunder either in advance of or concurrent with the Closing hereof.

ARTICLE 3

PAYMENT OF PURCHASE PRICE

3.1 Purchase Price

As consideration for its purchase of the Assets, the Purchaser shall assume the Assumed Obligations and shall pay the Purchase Price at the Closing in the following manner:

| (a) |

Pay to the Vendor CDN $425,000 by certified cheque or bankers draft payable at par in Vancouver to the order of the Vendor; and | |

| (b) |

Cause to be issued to the Vendor 1,000,000 common shares in the capital of the Parent at a deemed price of CDN $0.05 per share (the "Consideration Shares"). |

3.2 Consideration Shares

The Consideration Shares shall be issued as fully paid and non-assessable, and shall be registered in the name of the Vendor or pursuant to its written direction. The Vendor agrees and acknowledges that the issuance of the Consideration Shares is subject to the approval of the NEX, and shall be subject to a four month hold period, and the share certificates representing the Consideration Shares shall bear the appropriate legends. The Consideration Shares issuable to the Vendor shall be adjusted in the event of share splits, consolidations or other similar events affecting the capital of the Purchaser or in the event that the Purchaser is acquired (whether through a takeover bid, amalgamation, plan of arrangement or otherwise).

- 7 –

3.3 Post-Closing Adjustment

The amount of the Purchase Price shall be adjusted on February 28, 2011 (the "Adjustment Date") in the following manner:

| (a) |

Amounts received or paid by the Vendor under the Contracts prior to the Closing Date, including any Accounts Receivable, shall be adjusted pro rata for any portion of the payment earned or expense accrued under such Contract after the Closing Date, with the prorated amounts of such receipts and payments to be netted and the difference to be paid by the Vendor or the Purchaser to the other, as applicable, on the Adjustment Date; | |

| (b) |

Amounts received or paid by the Purchaser under the Contracts after the Closing Date shall be adjusted pro rata for any portion of the payment earned or the expense incurred under such Contract before the Closing Date, with the prorated amounts of such receipts and payments to be netted and the difference to be paid by the Purchaser or the Vendor to the other, as applicable, on the Adjustment Date; |

The amount of the Purchase Price shall be adjusted effective the Closing Date of this transaction which adjustment shall be settled and finalized on the Adjustment Date.

Any adjustment shall encompass all amounts paid by way of deposit or encompassing either receivables or payables to the debit or credit of either the Vendor or the Purchaser in relation to the said Assets and shall be pro-rated, calculated and setoff effective the Closing Date; with the net difference being payable at the Adjustment Date.

3.4 Transfer Taxes

The Purchaser shall be liable and shall pay any sales taxes, registration fees or other like charges properly payable upon and in connection with the sale, assignment, conveyance and transfer of the Assets from the Vendor to the Purchaser.

3.5 Tax Elections

The Vendor and the Purchaser shall jointly execute elections under s. 167 of the Excise Tax Act (Canada) and under s. 22 of the Income Tax Act (Canada) on the forms attached as Schedules "C" and "D" hereto, or otherwise prescribed for such purposes along with any documentation necessary or desirable in order to effect the transfer of the Assets by the Vendor without payment of any Goods and Services Tax or Harmonized Sales Tax, if applicable.

ARTICLE 4

REPRESENTATIONS AND

WARRANTIES

4.1 Representations and Warranties by the Vendor

The Vendor hereby represents and warrants to the Purchaser as follows, with the intent that the Purchaser will rely on these representations and warranties in entering into this Agreement, and in concluding the purchase and sale contemplated by this Agreement:

- 8 –

| (a) |

Corporate Authority and Binding Obligation. The Vendor has full corporate power and authority to enter into this Agreement and to sell, assign and transfer all of its interest in the Assets to the Purchaser in the manner contemplated herein and to perform all of the Vendor's obligations under this Agreement. The Vendor has taken all necessary or desirable corporate action to approve or authorize, validly and effectively, the entering into, and the execution, delivery and performance of, this Agreement and the sale and transfer of the Assets to the Purchaser. This Agreement is a legal, valid and binding obligation of the Vendor, enforceable against it in accordance with its terms subject to (i) bankruptcy, insolvency, moratorium, reorganization and other laws relating to or affecting the enforcement of creditors' rights generally, and (ii) the fact that equitable remedies, including the remedies of specific performance and injunction, may only be granted in the discretion of a court. | ||

| (b) |

Contractual and Regulatory Approvals. The Vendor is not under any obligation, contractual or otherwise, to request or obtain the consent of any person, and no permits, licences, certifications, authorizations or approvals of, or notifications to, any federal, provincial, state, municipal or local government or governmental agency, board, commission or authority are required to be obtained by the Vendor in connection with the execution, delivery or performance by the Vendor of this Agreement or the completion of any of the transactions contemplated herein, other than with respect to certain Contracts as noted on Schedule "A" hereto. | ||

| (c) |

Status and Governmental Licences. The Vendor is a corporation duly incorporated and validly subsisting in all respects under the Business Corporations Act (British Columbia). The Vendor has all necessary corporate power to own the Assets and to carry on its business as it is now being conducted. To the best of its knowledge, the Vendor holds all valid permits, licences, registrations, consents, authorizations, approvals, privileges, waivers, exemptions, orders, certificates, rulings, agreements and other concessions from, of or with all applicable governmental authorities required to hold, operate and use the Assets as now being held, operated and used by the Vendor. | ||

| (d) |

Compliance with Constating Documents, Agreements and Laws. The execution, delivery and performance of this Agreement and each of the other agreements contemplated or referred to herein by the Vendor, and the completion of the transactions contemplated hereby, will not constitute or result in a violation, breach or default, or cause the acceleration of any obligations, under: | ||

| (i) |

any term or provision of any of the articles, by-laws or other constating documents of the Vendor; | ||

| (ii) |

the terms of any indenture, agreement (written or oral), instrument or understanding or other obligation or restriction to which the Vendor is a party or by which it is bound except to the extent that the consent of any third party is required to assign any of the Contracts; or | ||

| (iii) |

any term or provision of any licences, registrations, or qualifications of the Vendor or any order of any court, governmental authority or regulatory body or any applicable law or regulation of any jurisdiction. | ||

- 9 –

| (e) |

Tax Matters. The Vendor has paid all Governmental Charges which are due and payable by it on or before the date hereof and will, on or before the Closing Date, pay all Governmental Charges which are due and payable by it to and including the Closing Date. Other than as set out below, there are no actions, suits, proceedings, investigations, enquiries or claims now pending or made or, to the best of the knowledge of the Vendor, threatened against the Vendor in respect of Governmental Charges. The Vendor is currently in discussions with the British Columbia Ministry of Finance with respect to a compliance review regarding certain P.S.T. issues. | |

| (f) |

Litigation. There are no actions, suits or proceedings, judicial or administrative (whether or not purportedly on behalf of the Vendor) pending or, to the best of the knowledge of the Vendor, threatened in writing, by or against or affecting the Vendor which relate to any of the Assets, at law or in equity, or before or by any court or any federal, provincial, state, municipal or other governmental department, commission, board, bureau, agency or instrumentality, domestic or foreign which, in any case, could reasonably be expected to have a Material Adverse Effect on any of the Assets. | |

| (g) |

Title to Assets. The Vendor is the recorded and beneficial owner of or has an exclusive title to all of the Assets, free and clear of any Encumbrances except those listed in Schedule "B" and those referenced in Schedule "A" in connection with the Contracts. | |

| (h) |

Compliance with Laws. The Vendor is not in violation in any material respect of any federal, provincial, state or other law, regulation or order of any government or governmental or regulatory authority, domestic or foreign. | |

| (i) |

Contracts. Except as otherwise expressly disclosed in this Agreement or in any schedule to this Agreement, there has not been any default in any obligation to be performed under any Contract, each of which is in good standing and in full force and effect, unamended, except as may be set forth in Schedule "A". | |

| (j) |

Books and Records. The Books and Records of the Vendor fairly and correctly set out and disclose in all material respects, in accordance with generally accepted accounting principles in Canada, the financial position of the Vendor and all material financial transactions of the Vendor relating to the Assets and the Vendor's Business have been accurately recorded in those Books and Records. | |

| (k) |

No Material Changes. Since the date of the most recent balance sheet delivered by the Vendor to the Purchaser, there has not been any material change in the financial condition of the Vendor's Business, its liabilities or the Assets, other than changes in the ordinary course of business, none of which has been materially adverse. | |

| (l) |

Employees. The Vendor is not a party to any collective agreement relating to the Vendor's Business with any labour union or other association of employees, and no part of the Vendor's Business has been certified as a unit appropriate for collective bargaining. There are no labour disputes, grievances, strikes or lockouts currently in existence or threatened in connection with the Assets. | |

| (m) |

Vendor's Residency. The Vendor is not a non-resident of Canada within the meaning of the Income Tax Act (Canada). |

- 10 –

| (n) |

Shareholders Authority. The Shareholder has full power and authority under the terms of its limited partnership agreement to enter into this Agreement and commit to the indemnification herein. | ||

| (o) |

Securities Law. The Vendor hereby represents and warrants to and covenants with the Purchaser (which representations, warranties and covenants shall survive the Closing) that: | ||

| (i) |

none of the Consideration Shares have been or, except as contemplated herein, will be registered under the Securities Act of 1933, as amended (the “1933 Act”), or under any state securities or “blue sky” laws of any state of the United States, and, unless so registered, may not be offered or sold in the United States or, directly or indirectly, to U.S. Persons, as that term is defined in Regulation S under the 1933 Act (“Regulation S”), except in accordance with the provisions of Regulation S, pursuant to an effective registration statement under the 1933 Act, or pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the 1933 Act and in each case only in accordance with applicable state and provincial securities laws; | ||

| (ii) |

the Vendor acknowledges that the Purchaser has not undertaken, and will have no obligation, to register any of the Consideration Shares under the 1933 Act or any other securities legislation; | ||

| (iii) |

the Vendor represents and warrants that the Vendor satisfies one of the categories of registration and prospectus exemptions provided in National Instrument 45- 106 (“NI 45-106”) adopted by the British Columbia Securities Commission (the “BCSC”) and other provincial securities commissions; | ||

| (iv) |

the decision to execute this Agreement and acquire the Consideration Shares has not been based upon any oral or written representation as to fact or otherwise made by or on behalf of the Purchaser and such decision is based entirely upon a review of any public information which has been filed by the Purchaser with the Securities and Exchange Commission (“SEC”) in compliance, or intended compliance, with applicable securities legislation; | ||

| (v) |

the Vendor and the Vendor’s advisor(s) have had a reasonable opportunity to ask questions of and receive answers from the Purchaser in connection with the distribution of the Consideration Shares hereunder, and to obtain additional information, to the extent possessed or obtainable without unreasonable effort or expense, necessary to verify the accuracy of the information about the Purchaser; | ||

| (vi) |

the books and records of the Purchaser were available upon reasonable notice for inspection, subject to certain confidentiality restrictions, by the Vendor during reasonable business hours at its principal place of business, and all documents, records and books in connection with the distribution of the Consideration Shares hereunder have been made available for inspection by the Vendor, the Vendor’s lawyer and/or advisor(s); | ||

| (vii) |

all of the information which the Vendor has provided to the Purchaser is correct and complete as of the date this Agreement is signed, and if there should be any change in such information prior to this Agreement being executed by the Purchaser, the Vendor will immediately provide the Purchaser with such information; | ||

- 11 –

| (viii) |

the Purchaser is entitled to rely on the representations and warranties of the Vendor contained in this Agreement; | ||

| (ix) |

the Purchaser will refuse to register any transfer of the Consideration Shares not made in accordance with the provisions of Regulation S, pursuant to an effective registration statement under the 1933 Act or pursuant to an available exemption from the registration requirements of the 1933 Act and in accordance with any other applicable securities laws; | ||

| (x) |

the Vendor has been advised to consult the Vendor’s own legal, tax and other advisors with respect to the merits and risks of an investment in the Consideration Shares and with respect to applicable resale restrictions, and it is solely responsible (and the Purchaser is not in any way responsible) for compliance with: | ||

| (A) |

any applicable laws of the jurisdiction in which the Vendor is resident in connection with the distribution of the Consideration Shares hereunder, and | ||

| (B) |

applicable resale restrictions; | ||

| (xi) |

in addition to resale restrictions imposed under U.S. securities laws, there are additional restrictions on the Vendor’s ability to resell any of the Consideration Shares in Canada under the Securities Act (British Columbia), and National Instrument 45-102 adopted by the BCSC; | ||

| (xii) |

the Vendor consents to the placement of a legend on any certificate or other document evidencing any of the Consideration Shares to the effect that such securities have not been registered under the 1933 Act or any state securities or “blue sky” laws and setting forth or referring to the restrictions on transferability and sale thereof contained in this Agreement such legend to be substantially as follows: | ||

|

“THE SECURITIES REPRESENTED HEREBY HAVE BEEN OFFERED IN AN OFFSHORE TRANSACTION TO PERSONS WHO ARE NOT U.S. PERSONS (AS DEFINED HEREIN) PURSUANT TO REGULATION S UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE “1933 ACT”). |

|

NONE OF THE SECURITIES REPRESENTED HEREBY HAVE BEEN REGISTERED UNDER THE 1933 ACT, OR ANY U.S. STATE SECURITIES LAWS, AND, UNLESS SO REGISTERED, NONE MAY BE OFFERED OR SOLD, DIRECTLY OR INDIRECTLY, IN THE UNITED STATES OR TO U.S. PERSONS (AS DEFINED HEREIN) EXCEPT IN ACCORDANCE WITH THE PROVISIONS OF REGULATION S UNDER THE 1933 ACT, PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE 1933 ACT, OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE 1933 ACT AND IN EACH CASE ONLY IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS. IN ADDITION, HEDGING TRANSACTIONS INVOLVING THE SECURITIES MAY NOT BE CONDUCTED UNLESS IN COMPLIANCE WITH THE 1933 ACT. “UNITED STATES” AND “U.S. PERSON” ARE AS DEFINED BY REGULATION S UNDER THE 1933 ACT. |

- 12 –

|

UNLESS PERMITTED UNDER SECURITIES LEGISLATION, THE HOLDER OF THIS SECURITY MUST NOT TRADE THE SECURITIES BEFORE [DATE THAT IS FOUR MONTHS AND A DAY AFTER THE DISTRIBUTION DATE]” |

| (xiii) |

the Purchaser has advised the Vendor that the Purchaser is relying on an exemption from the requirements to provide the Vendor with a prospectus to issue the Consideration Shares and, as a consequence of acquiring the Consideration Shares pursuant to such exemption certain protections, rights and remedies provided by the applicable securities legislation of British Columbia including statutory rights of rescission or damages, will not be available to the Vendor; | |

| (xiv) |

the statutory and regulatory basis for the exemption claimed for the offer and sale of the Consideration Shares, although in technical compliance with Regulation S, would not be available if the offering is part of a plan or scheme to evade the registration provisions of the 1933 Act; | |

| (xv) |

neither the SEC nor any other securities commission or similar regulatory authority has reviewed or passed on the merits of any of the Consideration Shares and no documents in connection with the sale of the Consideration Shares hereunder have been reviewed by the SEC or any state securities administrators; and | |

| (xvi) |

there is no government or other insurance covering any of the Consideration Shares. |

| (p) |

Acknowledgements. The Vendor hereby represents and warrants to and covenants with the Purchaser (which representations, warranties and covenants shall survive the Closing) that: | ||

| (i) |

the Vendor is not a U.S. Person, as defined by Regulation S, and the Vendor is not acquiring the Consideration Shares for the account or benefit of, directly or indirectly, any U.S. Person; | ||

| (ii) |

it has the legal capacity and competence to enter into and execute this Agreement and to take all actions required pursuant hereto and, if the Vendor is a corporate entity, it is duly incorporated and validly subsisting under the laws of its jurisdiction of incorporation and all necessary approvals have been obtained to authorize execution and performance of this Agreement on behalf of the Vendor; | ||

| (iii) |

the entering into of this Agreement and the transactions contemplated hereby do not result in the violation of any of the terms and provisions of any law applicable to, or, if the Vendor is a corporate entity, the constating documents of, the Vendor or of any agreement, written or oral, to which the Vendor may be a party or by which the Vendor is or may be bound; | ||

- 13 –

| (iv) |

the Vendor has received and carefully read this Agreement; | |

| (v) |

the Vendor is acquiring the Consideration Shares as principal for investment only and not with a view to resale or distribution; | |

| (vi) |

the Vendor is aware that an investment in the Purchaser is speculative and involves certain risks, including the possible loss of the entire investment; | |

| (vii) |

the Vendor has made an independent examination and investigation of an investment in the Consideration Shares and the Purchaser and has depended on the advice of its legal and financial advisors; | |

| (viii) |

the Vendor (i) has adequate net worth and means of providing for its current financial needs and possible personal contingencies, (ii) has no need for liquidity in this investment, and (iii) is able to bear the economic risks of an investment in the Consideration Shares for an indefinite period of time; | |

| (ix) |

the Vendor (i) is able to fend for itself; (ii) has such knowledge and experience in business matters as to be capable of evaluating the merits and risks of its prospective investment in the Consideration Shares; and (iii) can afford the complete loss of such investment; | |

| (x) |

the Vendor is outside the United States when receiving and executing this Agreement; | |

| (xi) |

the Vendor understands and agrees that offers and sales of any of the Consideration Shares prior to the expiration of the period specified in Regulation S (such period hereinafter referred to as the “Distribution Compliance Period”) shall only be made in compliance with the safe harbor provisions set forth in Regulation S, pursuant to the registration provisions of the 1933 Act or an exemption therefrom, and that all offers and sales after the Distribution Compliance Period shall be made only in compliance with the registration provisions of the 1933 Act or an exemption therefrom and in each case only in accordance with applicable state and provincial securities laws; | |

| (xii) |

the Vendor is not an underwriter of, or dealer in, the common shares of the Purchaser, nor is the Vendor participating, pursuant to a contractual agreement or otherwise, in the distribution of the Consideration Shares; | |

| (xiii) |

the Vendor is not aware of any advertisement of any of the Consideration Shares and is not acquiring the Consideration Shares as a result of any form of general solicitation or general advertising including advertisements, articles, notices or other communications published in any newspaper, magazine or similar media or broadcast over radio or television, or any seminar or meeting whose attendees have been invited by general solicitation or general advertising; | |

| (xiv) |

others will rely upon the truth and accuracy of the representations and warranties contained in this Agreement and agrees that if such representations and warranties are no longer accurate or have been breached, the Vendor shall immediately notify the Purchaser; |

- 14 –

| (xv) |

no person has made to the Vendor any written or oral representations: | ||

| (A) |

that any person will resell or repurchase any of the Consideration Shares; | ||

| (B) |

that any person will refund the purchase price of any of the Consideration Shares; | ||

| (C) |

as to the future price or value of any of the Consideration Shares; or | ||

| (D) |

that any of the Consideration Shares will be listed and posted for trading on any stock exchange or automated dealer quotation system or that application has been made to list and post any of the Consideration Shares of the Purchaser on any stock exchange or automated dealer quotation system; and | ||

| (xvi) |

the Vendor has provided to the Purchaser, along with an executed copy of this Agreement:, and such other supporting documentation that the Purchaser or its legal counsel may request to establish the Vendor’s qualification as a qualified investor. | ||

4.2 Representations and Warranties by the Purchaser and the Parent

The Purchaser hereby represents and warrants to the Vendor as follows, with the intent that the Vendor will rely on these representations and warranties in entering into this Agreement, and in concluding the purchase and sale contemplated by this Agreement:

| (a) |

Status, Corporate Authority and Binding Obligation. The Purchaser and the Parent are both corporations duly incorporated and validly subsisting and in good standing in all respects under the laws of the State of Nevada and the Laws of the Government of Canada. The Purchaser and the Parent have full corporate power and absolute authority to enter into this Agreement, to acquire the Assumed Obligations and to purchase the Assets from the Vendor in the manner contemplated herein and to perform all of the Purchaser's obligations under this Agreement. The Purchaser and the Parent have taken all necessary or desirable corporate actions to approve or authorize, validly and effectively, the entering into of, and the execution, delivery and performance of, this Agreement, the assumption of the Assumed Obligations and the purchase of the Assets by the Purchaser from the Vendor. This Agreement is a legal, valid and binding obligation of the Purchaser, enforceable against it in accordance with its terms subject to (i) bankruptcy, insolvency, moratorium, reorganization and other laws relating to or affecting the enforcement of creditors' rights generally and (ii) the fact that equitable remedies, including the remedies of specific performance and injunction, may only be granted in the discretion of a court. | |

| (b) |

Contractual and Regulatory Approvals. Except for the NEX Approval, the Purchaser and the Parent are not under any obligation, contractual or otherwise, to request or obtain the consent of any person, and no permits, licences, certifications, authorizations or approvals of, or notifications to, any federal, provincial, state, municipal or local government or governmental agency, board, commission or authority are required to be obtained by the Purchaser or the Parent in connection with the execution, delivery or performance by the Purchaser or the Parent of this Agreement or the completion of any of the transactions contemplated herein. |

- 15 –

| (c) |

Compliance with Constating Documents, Agreements and Laws. The execution, delivery and performance of this Agreement and each of the other agreements contemplated or referred to herein by the Purchaser and the Parent , and the completion of the transactions contemplated hereby, will not constitute or result in a violation or breach of or default under: | ||

| (i) |

any term or provision of any of the articles, by-laws or other constating documents of the Purchaser; | ||

| (ii) |

the terms of any indenture, agreement (written or oral), instrument or understanding or other obligation or restriction to which the Purchaser and the Parent are a party or by which it is bound, or | ||

| (iii) |

any term or provision of any licences, registrations or qualification of the Purchaser or the Parent, or any order of any court, governmental authority or regulatory body or any applicable law or regulation of any jurisdiction. | ||

| (d) |

Authorized and Issued Capital. The Parent has received authorization for the issuance of the 1,000,000 common shares to the Vendor; and | ||

| (e) |

Investment Canada Act. The Purchaser is not a "non-Canadian" for purposes of and within the meaning of the Investment Canada Act (Canada). | ||

ARTICLE 5

SURVIVAL OF AND LIMITATIONS ON

REPRESENTATIONS AND WARRANTIES

5.1 Survival of Warranties by the Vendor and Shareholder

The representations and warranties made by the Vendor and the Shareholder contained in this Agreement, or contained in any document or certificate given in order to carry out the transactions contemplated hereby, shall survive for a period of 24 months following the transfer by the Vendor to the Purchaser of the Vendor's interest in the Assets, provided for herein and, notwithstanding such transfer or any investigation made by or on behalf of the Purchaser or any other person or any knowledge of the Purchaser or any other person, shall continue in full force and effect for the benefit of the Purchaser for such period. Notwithstanding the foregoing, fundamental representations and warranties made by the Vendor and Shareholder shall survive for the applicable statutory period(s).

5.2 Survival of Warranties by Purchaser

The representations and warranties made by the Purchaser and contained in this Agreement, or contained in any document or certificate given in order to carry out the transactions contemplated hereby, shall survive for a period of 24 months following the transfer by the Vendor to the Purchaser of the Vendor's interest in the Assets, provided for herein and, notwithstanding such closing or any investigation made by or on behalf of the Vendor or any other person or any knowledge of the Vendor or any other person, shall continue in full force and effect for the benefit of the Vendor for such period. Notwithstanding the foregoing, fundamental representations and warranties made by the Purchaser shall survive for the applicable statutory period(s).

- 16 –

5.3 Limitations on Claims

| (a) |

Neither the Purchaser nor the Vendor shall be entitled to make a claim if the Purchaser or the Vendor, as applicable, has been advised in writing or otherwise has actual knowledge prior to the Closing Date of the inaccuracy, non-performance, non-fulfillment or breach which is the basis for such claim and the Purchaser or the Vendor, as applicable, completes the transactions hereunder notwithstanding such inaccuracy, non-performance, non-fulfillment or breach. | ||

| (b) |

The amount of any damages which may be claimed by the Purchaser or the Vendor, as applicable, pursuant to a claim shall be calculated to be the cost or loss to the Purchaser or the Vendor, as applicable, after giving effect to: | ||

| (i) |

any insurance proceeds available to the Purchaser or the Vendor, as applicable, in relation to the matter which is the subject of the claim, and | ||

| (ii) |

the value of any related, determinable tax benefits realized, or to be realized within a two year period following the date of incurring such cost or loss, by the Purchaser or the Vendor, as applicable, in relation to the matter which is the subject of the claim. | ||

ARTICLE 6

COVENANTS

6.1 Covenants by the Vendor and Shareholder

The Vendor covenants to the Purchaser that it will do or cause to be done the following:

| (a) |

Investigation of Assets. Prior to the Closing Date, the Vendor will provide access to and will permit the Purchaser or its representatives to make such investigation of the Assets as the Purchaser deems reasonably necessary or advisable to familiarize itself with such matters, and the Vendor shall furnish to the Purchaser during that period all such information as the Purchaser, or its representatives may reasonably request. | |

| (b) |

Transfer of the Assets. At or before the Closing Date, the Vendor will cause all necessary steps and corporate proceedings to be taken in order to permit the transfer of the Assets to the Purchaser. | |

| (c) |

Confidentiality. Prior to the Closing Date and, if the transaction contemplated hereby is not completed, the Vendor will keep confidential all information obtained by it relating to the transactions contemplated herein, in accordance with the terms and conditions contained in the NDA (previously defined). The Vendor further agrees that the disclosure by it of such information to any of its employees and representatives shall also be governed by the NDA. Notwithstanding the foregoing, the obligation to maintain the confidentiality of such information will not apply to the extent that disclosure of such information is required in connection with NEX filings or filing with securities regulatory authorities or filings with governmental or other applicable regulatory bodies relating to the transactions hereunder. If the transactions contemplated hereby are not consummated for any reason, the Vendor will return forthwith, without retaining any copies thereof, all information and documents obtained from the Purchaser. |

- 17 –

| (d) |

Representations and Warranties. The Vendor shall use all reasonable efforts to ensure that the representations and warranties by the Vendor and Shareholder in this Agreement are true and correct at the Closing and that the conditions to the obligations of the Purchaser in section 7.1 are fulfilled at the Closing, and will inform the Purchaser promptly of any state of facts which will result in any representation or warranty of the Vendor being untrue or incorrect or in any condition to the obligations of the Purchaser in section 7.1 being unfulfilled at the Closing. | |

| (e) |

Conduct of the Business. Until Closing, the Vendor shall conduct the Vendor's Business in the ordinary course and will use its best efforts to preserve the Assets intact, to keep available to the Purchaser its present employees and to preserve for the Purchaser its relationship with its suppliers, customers and others having business relations with it. | |

| (f) |

Transition Plan. During the period following the effective date of this Agreement, until the Closing Date, the Vendor shall cooperate with and assist the Purchaser in preparing a transition plan for the Vendor's Business following the sale of the Assets to the Purchaser, up until the Adjustment Date. | |

| (g) |

Service Provider. The Vendor shall inform the primary service provider of its "Tagline" platform of the proposed sale of the Assets to the Purchaser, and shall use commercially reasonable efforts to obtain assurances from such service provider for its full cooperation during the period of transition prior to and after the Closing Date. | |

| (h) |

Consents Procured. The Vendor shall diligently take all reasonable steps required to obtain, before Closing, all third party consents to the assignments of the Contracts and any other of the Assets for which a consent is required, or to replace non- transferable Contracts. If any Person whose consent is required does not consent to the sale, assignment, transfer and conveyance of any of the Contracts from the Vendor to the Purchaser or to the re-issuance of a new contract, then the Vendor shall, to the extent permitted by law, carry out and comply with the terms and provisions of any such Contracts as agent for the Purchaser at the Purchaser's expense and for the Purchaser's exclusive benefit. | |

| (i) |

Termination of Employees. At Closing the Vendor shall terminate the employment of all employees, and the Vendor shall indemnify and save harmless the Purchaser from and against all claims by any employee of the Vendor for wages, salaries, bonuses, pension or other benefits, severance pay, notice or pay in lieu of notice and holiday pay in respect of any period before the Closing Date. | |

| (j) |

Non Disclosure and Non-Competion. The Vendor and Shareholder recognize and confirm the importance to the Purchaser and necessity for confidentiality in relation to the Business and Assets sold hereunder and agree to maintain and not to disclose in any manner or form any confidential or proprietary information pertaining to the Business, except as provided for herein, and further that neither of them shall operate or compete, either directly or indirectly, or assist in any way, any other individual or entity, in any business or operation competitive to that being sold herein. Due to the nature and scope of the Business and Assets, it is understood and agreed that the restrictions herein shall not be confined to a specified area and shall be for a period of 3 years from the date hereof. This non-compete provision shall expire and be of no further force or effect if any such business or asset is acquired by the Vendor, the Shareholder, or any of their affiliates, from the Parent, the Purchaser or any of their affiliates, including any acquisition completed through the exercise of security over any of such assets or businesses. |

- 18 –

| (k) |

Change of Name. The Vendor agrees to cause its name to be changed to something other than containing the name “Tagline”, which change shall be effective no later than one month following closing. |

6.2 Covenants by the Purchaser

The Purchaser covenants to the Vendor that it will do or cause to be done the following:

| (a) |

Application for NEX Approval. Immediately upon signing of this Agreement, the Purchaser shall cause to be made all such filings as may be necessary to obtain NEX Approval. | |

| (b) |

Confidentiality. Prior to the Closing Date and, if the transaction contemplated hereby is not completed, the Purchaser will keep confidential all information obtained by it relating to the transactions contemplated herein, in accordance with the terms and conditions contained in the NDA (previously defined). The Purchaser further agrees that the disclosure by it of such information to any of its employees and representatives shall also be governed by the NDA. Notwithstanding the foregoing, the obligation to maintain the confidentiality of such information will not apply to the extent that disclosure of such information is required in connection with NEX filings or filing with securities regulatory authorities or filings with governmental or other applicable regulatory bodies relating to the transactions hereunder. If the transactions contemplated hereby are not consummated for any reason, the Purchaser will return forthwith, without retaining any copies thereof, all information and documents obtained from the Vendor. | |

| (c) |

Taxes. The Purchaser will be liable for and shall pay all provincial sales taxes and registration charges and transfer fees properly payable upon and in connection with the sale and transfer of the Assets by the Vendor to the Purchaser. At Closing, each of the Purchaser and the Vendor shall make the elections provided for by s. 167 of the Excise Tax Act and s. 22 of the Income Tax Act, respectively, in the forms attached as Schedule "C", Election Form GST44, and Schedule "D", Accounts Receivable Election. | |

| (d) |

Consents. The Purchaser shall at the request of the Vendor execute and deliver such applications for consent and such assumption agreements, and provide such information as may be necessary to obtain the consents referred to in section 6.1(h) and will assist and cooperate with the Vendor in obtaining the consents. |

- 19 –

ARTICLE 7

CONDITIONS AND CLOSING

7.1 Conditions to the Obligations of the Purchaser

All obligations of the Purchaser under this Agreement are subject to the fulfilment at or before the Closing Date of the following conditions:

| (a) |

Accuracy of Representations and Warranties and Performance of Covenants. The representations and warranties of the Vendor and Shareholder contained in section 4.1 of this Agreement shall be true and accurate on the date hereof and at the Closing Date with the same force and effect as though such representations and warranties had been made as of such date (except to the extent such representations and warranties are by their express terms made as of the date of this Agreement or another specific date, in which case such representations and warranties shall be true and correct of such date). In addition, the Vendor shall have complied with all covenants and agreements herein agreed to be performed or caused to be performed by it at or prior to the Closing Date. In addition, the Vendor and Shareholder shall have delivered to the Purchaser a certificate confirming that the facts with respect to each of the above-noted representations and warranties of the Vendor and Shareholder are as set out herein at the Closing Date and that the Vendor has performed all covenants required to be performed by it hereunder. | |

| (b) |

Material Adverse Changes. There will have been no change in the condition in any of the Assets, howsoever arising, except changes which have occurred in the ordinary course of business and which, individually or in the aggregate would not have a Material Adverse Effect. Without limiting the generality of the foregoing, no damage to or destruction of any material part of any of the Assets shall have occurred, whether or not covered by insurance. | |

| (c) |

No Restraining Proceedings. No order, decision or ruling of any court, tribunal or regulatory authority having jurisdiction shall have been made, and no action or proceeding shall be pending or threatened which, in the opinion of counsel to the Purchaser, is likely to result in an order, decision or ruling: |

| (i) |

to disallow, enjoin, prohibit or impose any limitations or conditions on the purchase and sale of the Assets contemplated hereby or the right of the Purchaser to own 100% interest in the Assets, or | |

| (ii) |

to impose any limitations or conditions which may have a Material Adverse Effect on the Assets. |

| (d) |

Contracts and Consents. All action required of the Vendor for the novation or assignment of each of the Contracts which are material to the Vendor's Business, and all consents required in connection therewith, shall have been completed and obtained, and all consents otherwise required to be obtained in order to carry out the transactions contemplated hereby in compliance with all laws and agreements binding upon the parties hereto shall have been obtained. | |

| (e) |

NEX Approval. The Purchaser shall have obtained NEX Approval. |

- 20 –

7.2 Waiver or Termination by Purchaser

The conditions contained in section 7.1 hereof are inserted for the exclusive benefit of the Purchaser and may be waived in whole or in part by the Purchaser at any time. The Vendor acknowledges that the waiver by the Purchaser of any condition or any part of any condition shall constitute a waiver only of such condition or such part of such condition, as the case may be, and shall not constitute a waiver of any covenant, agreement, representation or warranty made by the Vendor herein that corresponds or is related to such condition or such part of such condition, as the case may be. If any of the conditions contained in section 7.1 hereof are not fulfilled or complied with as herein provided, the Purchaser may, at or prior to the Closing Date at its option, rescind this Agreement by notice in writing to the Vendor and in such event the Purchaser shall be released from all obligations hereunder and, unless the condition or conditions which have not been fulfilled are reasonably capable of being fulfilled or caused to be fulfilled by the Vendor, then the Vendor shall also be released from all obligations hereunder.

7.3 Conditions to the Obligations of the Vendor

All obligations of the Vendor under this Agreement are subject to the fulfilment at or before the Closing Date of the following conditions.

| (a) |

Accuracy of Representations and Warranties and Performance of Covenants. The representations and warranties of the Purchaser contained in this Agreement or in any documents delivered in order to carry out the transactions contemplated hereby will be true and accurate on the date hereof and at the Closing Date with the same force and effect as though such representations and warranties had been made as of such date (except to the extent such representations and warranties are by their express terms made as of the date of this Agreement or another specific date, in which case such representations and warranties shall be true and correct of such date). In addition, the Purchaser shall have complied with all covenants and agreements herein agreed to be performed or caused to be performed by it at or prior to the Closing Date. In addition, the Purchaser shall have delivered to the Vendor a certificate confirming that the facts with respect to each of the representations and warranties of the Purchaser are as set out herein at the Closing Date and that the Purchaser has performed each of the covenants required to be performed by it hereunder. | |

| (b) |

No Restraining Proceedings. No order, decision or ruling of any court, tribunal or regulatory authority having jurisdiction shall have been made, and no action or proceeding shall be pending or threatened which, in the opinion of counsel to the Vendor, is likely to result in an order, decision or ruling, to disallow, enjoin or prohibit the purchase and sale of the Assets contemplated hereby. |

7.4 Waiver or Termination by Vendor

The conditions contained in section 7.3 hereof are inserted for the exclusive benefit of the Vendor and may be waived in whole or in part by the Vendor at any time. The Purchaser acknowledges that the waiver by the Vendor of any condition or any part of any condition shall constitute a waiver only of such condition or such part of such condition, as the case may be, and shall not constitute a waiver of any covenant, agreement, representation or warranty made by the Purchaser herein that corresponds or is related to such condition or such part of such condition, as the case may be. If any of the conditions contained in section 7.3 hereof are not fulfilled or complied with as herein provided, the Vendor may, at or prior to the Closing Date at its option, rescind this Agreement by notice in writing to the Purchaser and in such event the Vendor shall be released from all obligations hereunder and, unless the condition or conditions which have not been fulfilled are reasonably capable of being fulfilled or caused to be fulfilled by the Purchaser, then the Purchaser shall also be released from all obligations hereunder.

- 21 –

7.5 Closing

| (a) |

At the Closing, the Vendor shall deliver to the Purchaser: | ||

| (i) |

all deeds of conveyance, bills of sale, transfer and assignments, in form and content satisfactory to the Purchaser's counsel, appropriate to effectively vest a good and marketable title to the Assets in the Purchaser to the extent contemplated by this Agreement, and immediately registrable in all places where registration of such instruments is required; | ||

| (ii) |

all consents or approvals obtained by the Vendor for the purpose of validly assigning the Contracts; | ||

| (iii) |

possession of the Assets; | ||

| (iv) |

the certificate of the Vendor to be given under section 7.1(a); | ||

| (v) |

the elections under s. 167 of the Excise Tax Act and s. 22 of the Income Tax Act in the forms attached as the Schedule "C", Election Form GST44, and Schedule "D", Accounts Receivable Election, respectively; | ||

| (vi) |

duly executed releases of, or evidence to the reasonable satisfaction of the Purchaser as to the discharge of any and all liabilities which the Purchaser has not agreed to assume and which may be enforceable against any of the Assets being purchased under this Agreement; | ||

| (vii) |

certified copies of those resolutions of the shareholder(s) and directors of the Vendor required to be passed to authorize the execution, delivery and implementation of this Agreement and of all documents to be delivered by the Vendor under this Agreement; | ||

| (viii) |

a statement of the Assumed Obligations signed by the Vendor; | ||

| (ix) |

a non-competition agreement contemplated by section 6.1(j); and | ||

| (x) |

an officers certificate from the General Partner of the Shareholder verifying the authority of the Shareholder to enter into this agreement and provide the indemnification set forth herein. | ||

| (b) |

On the Closing Date the Purchaser shall deliver to the Vendor: | ||

| (i) |

a certified cheque or bank draft in the amount of CDN $425,000 payable to the Vendor for the cash component of the Purchase Price; | ||

| (ii) |

a certificate representing the Consideration Shares registered as directed by the Vendor in writing; | ||

- 22 –

| (iii) |

the elections under s. 167 of the Excise Tax Act and s. 22 of the Income Tax Act in the forms attached as Schedule "C", Election Form GST44, and Schedule "D", Accounts Receivable Election, respectively; and | |

| (iv) |

the certificate of the Purchaser to be given under section 7.3(a) hereof. |

ARTICLE 8

INDEMNIFICATION

8.1 Indemnification

| (a) |

The Vendor and the Shareholder hereby agree to indemnify and save the Purchaser harmless from and against any claims, demands, actions, causes of action, damage, loss, deficiency, cost, liability and expense which may be made or brought against the Purchaser or which the Purchaser may suffer or incur in respect of: | ||

| (i) |

any non-performance or non-fulfillment of any covenant or agreement on the part of the Vendor contained in this Agreement or in any document given in order to carry out the transactions contemplated hereby; | ||

| (ii) |

any misrepresentation, inaccuracy, incorrectness or breach of any representation or warranty made by the Vendor contained in this Agreement or contained in any document or certificate given in order to carry out the transactions contemplated hereby; | ||

| (iii) |

any obligations or liabilities of Vendor related to the operation of the Business prior to the Closing, of any kind or nature, whether absolute, accrued, contingent or otherwise; or | ||

| (iv) |

all reasonable costs and expenses including, without limitation, reasonable legal fees on a solicitor and client basis, incidental to or in respect of the foregoing. | ||

| (b) |

The Purchaser hereby agrees to indemnify and save the Vendor harmless from and against any claims, demands, actions, causes of action, damage, loss, deficiency, cost, liability and expense which may be made or brought against the Vendor or which the Vendor may suffer or incur in respect of: | ||

| (i) |

any non-performance or non-fulfillment of any covenant or agreement on the part of the Purchaser contained in this Agreement or in any document given in order to carry out the transactions contemplated hereby; | ||

| (ii) |

any misrepresentation, inaccuracy, incorrectness or breach of any representation or warranty made by the Purchaser contained in this Agreement or contained in any document or certificate given in order to carry out the transactions contemplated hereby; | ||

| (iii) |

any obligations or liabilities related to the operation of the Business after the Closing, of any kind or nature, whether absolute, accrued, contingent or otherwise; or | ||

- 23 –

| (iv) |

all reasonable costs and expenses including, without limitation, reasonable legal fees on a solicitor and client basis, incidental to or in respect of the foregoing. | ||

| (c) |

The obligations of indemnification by any party pursuant to paragraph (a) or (b) of this section will be subject to the limitations referred to in sections 5.3 and 8.2. | ||

8.2 Limitation on Indemnity

No claim of indemnity by any party under section 8.1 shall be valid unless written notice of the claim is given by the party claiming indemnity to the indemnifying party or parties before the earlier of 24 months after the Closing Date, or the expiration period of the representation or warranty in respect of which the claim is made; and

8.3 Duration of Indemnification Obligations

The indemnification obligations of the parties under this Article 8, in respect of the representations and warranties made by such party, shall be coterminous with the survival period in respect of the particular representation, warranty, or both, relating to the indemnification obligation.

ARTICLE 9

GENERAL PROVISIONS

9.1 Further Assurances

Each of the Vendor and the Purchaser hereby covenants and agrees that at any time and from time to time prior to and after the Closing Date it will, upon the request of the others, do, execute, acknowledge and deliver or cause to be done, executed, acknowledged and delivered all such further acts, deeds, assignments, transfers, conveyances and assurances as may be required for the better carrying out and performance of all the terms of this Agreement.

9.2 Remedies Cumulative

The rights and remedies of the parties under this Agreement are cumulative and in addition to and not in substitution for any rights or remedies provided by law. Any single or partial exercise by any party hereto of any right or remedy for default or breach of any term, covenant or condition of this Agreement does not waive, alter, affect or prejudice any other right or remedy to which such party may be lawfully entitled for the same default or breach.

9.3 Notices

| (a) |

Any notice, designation, communication, request, demand or other document, required or permitted to be given or sent or delivered hereunder to any party hereto shall be in writing and shall be sufficiently given or sent or delivered if it is: | ||

| (i) |

delivered personally to an officer or director of such party; | ||

| (ii) |

sent to the party entitled to receive it by registered mail, postage prepaid, mailed in Canada, or | ||

| (iii) |

sent by telecopy machine. | ||

| (b) |

Notices shall be sent to the following addresses or telecopy numbers: | ||

- 24 –

| (i) | in the case of the Vendor; | ||

| Tagline Communications Inc. | |||

| 1600 – 609 Granville Street | |||

| P.O. Box 10068, Pacific Centre | |||

| Vancouver, British Columbia V7Y 1C3 | |||

| Attention: | Scott Ackerman, Director | ||

| in the case of the Shareholder; | |||

| The Emprise Special Opportunities Fund, Limited Partnership | |||

| 1620 – 609 Granville Street | |||

| P.O. Box 10068, Pacific Centre | |||

| Vancouver, British Columbia V7Y 1C3 | |||

| Attention: | Jeff Durno, Chairman of Emprise Venture Opportunities | ||

| Management Inc., General Partner | |||

| in the case of the Purchaser: | |||

| Voice Mobility International, Inc. | |||

| 107 - 645 Fort Street | |||

| Victoria, British Columbia V8W 1G2 | |||

| Attention: | James Hutton, Chair and CEO | ||

|

or to such other address or telecopier number as the party entitled to or receiving such notice, designation, communication, request, demand or other document shall, by a notice given in accordance with this section, have communicated to the party giving or sending or delivering such notice, designation, communication, request, demand or other document. | |||

|

|

| ||

|

Any notice, designation, communication, request, demand or other document given or sent or delivered as aforesaid shall | |||

|

|

| ||

| (ii) |

if delivered as aforesaid, be deemed to have been given, sent, delivered and received on the date of delivery; | ||

|

|

| ||

| (iii) |

if sent by mail as aforesaid, be deemed to have been given, sent, delivered and received (but not actually received) on the fourth Business Day following the date of mailing, unless at any time between the date of mailing and the fourth Business Day thereafter there is a discontinuance or interruption of regular postal service, whether due to strike or lockout or work slowdown, affecting postal service at the point of dispatch or delivery or any intermediate point, in which case the same shall be deemed to have been given, sent, delivered and received in the ordinary course of the mails, allowing for such discontinuance or interruption of regular postal service, and | ||

| (c) |

if sent by telecopy machine, be deemed to have been given, sent, delivered and received on the date the sender receives the telecopy answer back confirming receipt by the recipient. |

- 25 –

9.4 Counterparts

This Agreement may be executed (by original or facsimile or electronic transmission) in several counterparts, each of which so executed shall be deemed to be an original, and such counterparts together shall constitute but one and the same instrument.

9.5 Expenses of Parties

Each of the parties hereto shall bear all expenses incurred by it in connection with this Agreement including, without limitation, the charges of their respective counsel, accountants, financial advisors and finders.

9.6 Brokerage and Finder's Fees

It is understood in the connection with the sale or purchase of the Assets, that (i) the Vendor shall indemnify the Purchaser and hold it harmless in respect of any claim for brokerage or other commissions relative to this Agreement or the transactions contemplated hereby which is caused by actions of the Vendor or any of its affiliates, and (ii) the Purchaser shall indemnify the Vendor and hold it harmless in respect of any claim for brokerage or other commissions relative to this Agreement or to the transactions contemplated hereby which is caused by actions of the Purchaser or any of its affiliates.

9.7 Announcements

No disclosure or announcement with respect to the transactions contemplated by this Agreement will be made by either party hereto without the prior written consent of the other party. The foregoing will not apply to any announcement made prior to Closing by any party, if required in order to comply with laws pertaining to timely disclosure, provided that such party consults with the other parties before making any such announcement.

9.8 Successors and Assigns

The rights of the Vendor hereunder shall not be assignable without the written consent of the Purchaser. The rights of the Purchaser hereunder shall not be assignable without the written consent of the Vendor. Subject to the foregoing, this Agreement shall be binding upon and enure to the benefit of the parties hereto and their respective successors and permitted assigns.

9.9 Entire Agreement

This Agreement and the schedules referred to herein constitute the entire agreement between the parties hereto and supersede all prior agreements, representations, warranties, statements, promises, information, arrangements and understandings, whether oral or written, express or implied, with respect to the subject matter hereof. None of the parties hereto shall be bound or charged with any oral or written agreements, representations, warranties, statements, promises, information, arrangements or understandings not specifically set forth in this Agreement or in the schedules, documents and instruments to be delivered on or before the Closing Date pursuant to this Agreement. The parties hereto further acknowledge and agree that, in entering into this Agreement and in delivering the schedules, documents and instruments to be delivered on or before the Closing Date, they have not in any way relied, and will not in any way rely, upon any oral or written agreements, representations, warranties, statements, promises, information, arrangements or understandings, express or implied, not specifically set forth in this Agreement or in such schedules, documents or instruments.

- 26 –

9.10 Waiver

Any party hereto which is entitled to the benefits of this Agreement may, and has the right to, waive any term or condition hereof at any time on or prior to the Closing Date; provided, however, that such waiver shall be evidenced by written instrument duly executed on behalf of such party.

- 27 –

9.11 Amendments

No modification or amendment to this Agreement may be made unless agreed to by the parties hereto in writing.

IN WITNESS WHEREOF the parties hereto have duly executed this Agreement under seal as of the day and year first written above.

| VOICE MOBILITY INTERNATIONAL, INC. | |||

| by: | /s/ James Hutton | ||

| Name: | James Hutton | ||

| Title: | Chairman and CEO | ||

| TAGLINE COMMUNICATIONS INC. | |||

| by: | /s/ Scott Ackerman | ||

| Name: | Scott Ackerman | ||

| Title: | Director | ||

| THE EMPRISE SPECIAL OPPORTUNITIES FUND, | |||

| LIMITED PARTNERSHIP | |||

| Per: | Emprise Venture Opportunities Management Inc., | ||

| General Partner | |||

| by: | /s/ Jeff Durno | ||

| Name: | Jeff Durno | ||

| Title: | Chairman | ||

Schedule "A"

LIST AND DESCRIPTION OF THE PURCHASED ASSETS

List of Assets:

| (a) |

all right, title and interest of the Vendor in, to and under the Contracts, listed below, including without limitation, any Contract with a Customer; | |

| (b) |

the Books and Records; | |

| (c) |

all Customer lists, files, data and information relating to Customers in the possession of the Vendor, including all Customer registration information collected in the course of conducting the Business, including but not limited to e-mail addresses, passwords, user names, credit card authorizations and information, postal addresses and phone numbers; | |

| (d) |

all right, title and interest of the Vendor in, to the web-site, email domain, domain names and other property associated with the uniform resource locator at “www.tagline.cc”; | |

| (e) |

all right and interest of the Vendor to all registered and unregistered trademarks, trade or brand names, copyrights, designs, restrictive covenants and other industrial or intellectual property used in connection with the Vendor's Business (the "Intangible Property"); | |

| (f) |

the prepaid expenses; | |

| (g) |

the goodwill of the Vendor's Business and the right of the Purchaser to represent itself as carrying on the Vendor's Business in continuation of and in succession to the Vendor and the right to use the name "Tagline" or any variation thereof as part of or in connection with the Vendor's Business (the "Goodwill"); and | |

| (h) |

all other property, assets and rights, immoveable or real, moveable or personal, tangible or intangible, owned by the Vendor or to which it is entitled in connection with the Assets. |

List of Contracts:

| 1. |

Subscriber Contracts: | |

| a. |

Detailed Customer Listing (To be attached at Closing) | |

| 2. |

Platform Supplier Contract: | |

| a. |

Parus Holdings Inc. | |

| 3. |

Credit Card Merchant and Gateway Services: | |

| a. |

Psi Gate | |

| b. |

Optimal Payments Corp. | |

| c. |

AMEX | |

| 4. |

Customer Support Contract: | |

| a. |

Tigertel Communications Inc. | |

| 5. |

Billing Services; | |

| a. |

TeleBill Inc. | |

| 6. |

Accounting Services Contract: | |

| a. |

Emprise Capital Corp. | |

| 7. |

Website/database hosting: | |

| a. |

Netkeepers, Integric Solutions Group Inc. | |

Schedule "B"

ENCUMBRANCES

NONE

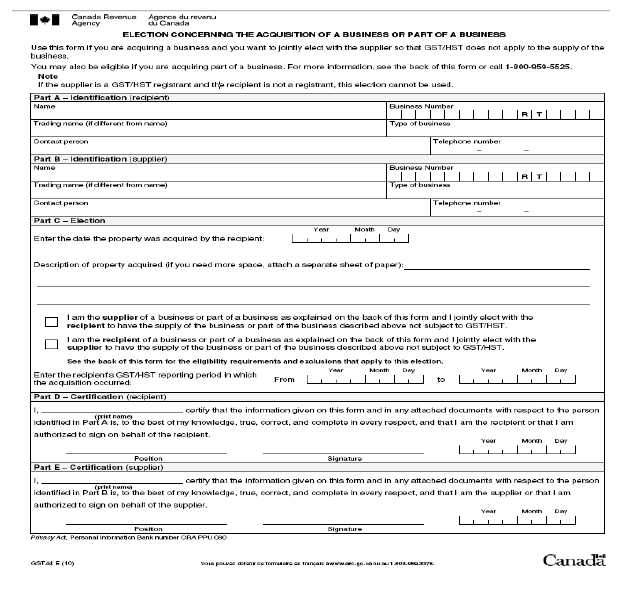

Schedule "C"

ELECTION FORM GST44

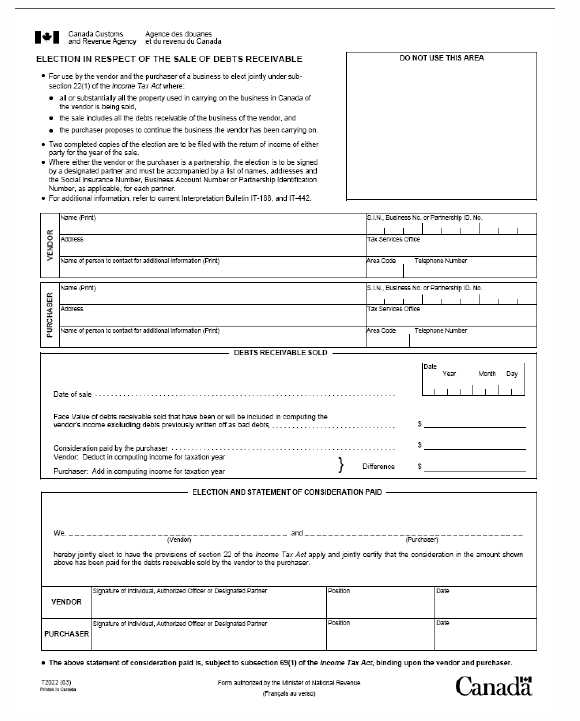

Schedule "D"

ACCOUNTS RECEIVABLE ELECTION