Attached files

| file | filename |

|---|---|

| 8-K - Avantair, Inc | v214420_8k.htm |

Avantair, Inc.

(OTCBB: AAIR)

Steven Santo, CEO

March 2011

SAFE HARBOR

This document contains forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended. All

statements, other

than statements of historical fact, including, without limitation, statements

regarding Avantair’s financial position, business strategy, plans, and

Avantair’s management’s objectives and its future operations, and

industry

conditions, are forward-looking statements. Although Avantair believes

that the expectations reflected in such forward-looking statements are

reasonable, Avantair can give no assurance that such expectations will

prove to

be correct. Important factors that could cause actual results to

differ materially from Avantair’s expectations (“Cautionary Statements”) as

described in Avantair’s public filings include, without limitation, the effect

of

existing and future laws and governmental regulations, the results of future

financing efforts, and the political and economic climate of the United

States. All subsequent written and oral forward-looking statements

attributable

to Avantair, or persons acting on Avantair’s behalf, are

expressly qualified in their entirety by the Cautionary Statements.

2

INVESTMENT HIGHLIGHTS

Industry leader in the light jet industry

Sole North American fleet provider of flight

hour time cards and fractional shares in the

Piaggio Avanti aircraft - the roomiest, quietest,

safest and most fuel efficient aircraft with the

lowest operating cost in the light jet category

Superior growth rate relative to private aviation

market; Avantair continues to gain market share

Taking market share from competitors

Gaining customers new to private air travel

Defensible competitive advantages - Piaggio

Avanti is technologically superior to other light jets

and is exclusive to Avantair

Recurring revenue stream via fractional share

and Axis Lease Program sales

Substantial operating leverage inherent to

business model, strategic initiatives designed to

achieve and drive sustainable profitability

3

FLEET STATISTICS

4

55 aircraft in fleet

4 new Piaggio Avanti II aircraft added

to Avantair’s operating certificate in

February 2010

52 additional Piaggio Avanti aircraft on

order through 2013

Realize economies of scale due to

larger fleet size

Reduces non-revenue repositioning

flights and charter costs

Leverages existing infrastructure

Fixed Base Operations in three key

hubs provide operating and

maintenance efficiencies and lower fuel

costs

BUSINESS MODEL: AWARD WINNING PROGRAMS

5

* Includes FET

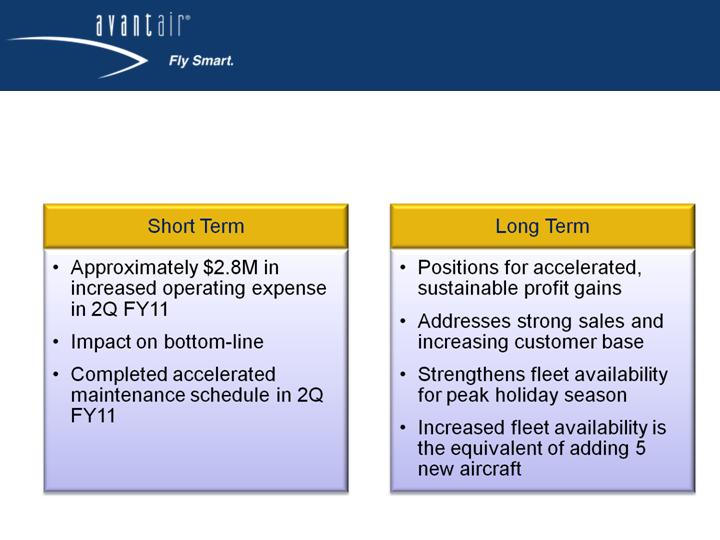

STRATEGIC INITIATIVES:

Supporting Sales Growth and Securing Sustainable Profits

6

Strategic acceleration of fleet maintenance

from 4Q FY10 to 2Q FY11

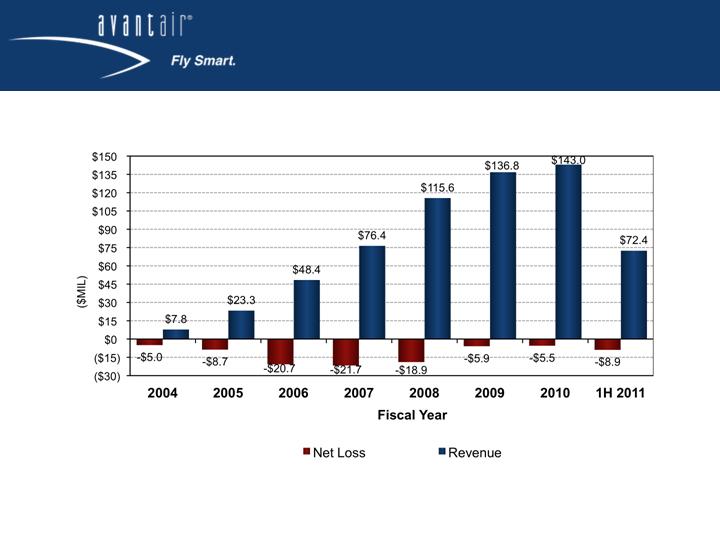

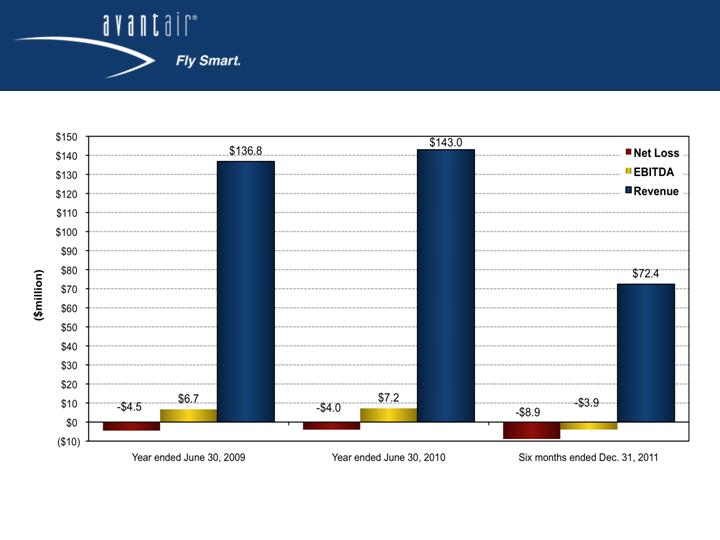

GROWING ANNUAL REVENUE AND OPERATING RESULTS

7

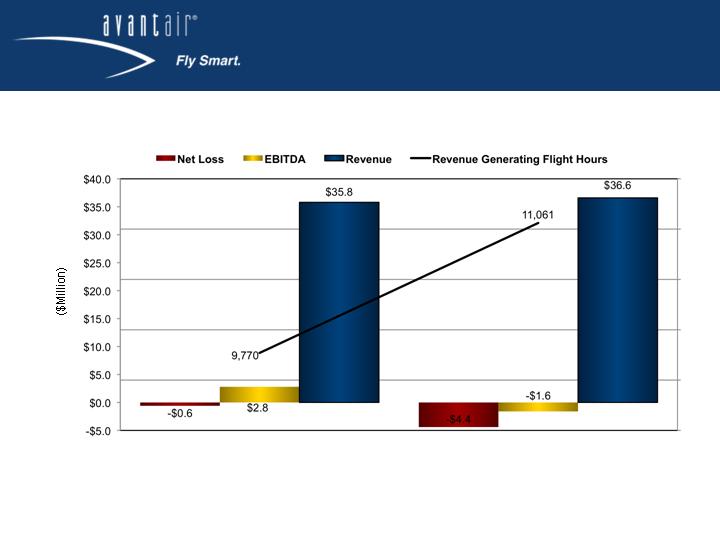

SECOND QUARTER FISCAL 2010 AND 2011

REVENUE AND OPERATING RESULTS

3 Months Ended December 31, 2010

3 Months Ended December 31, 2010

*

* Includes increased flight operations costs from the strategic acceleration of fleet maintenance to strengthen fleet availability in response to strong sales and

increasing customer base.

8

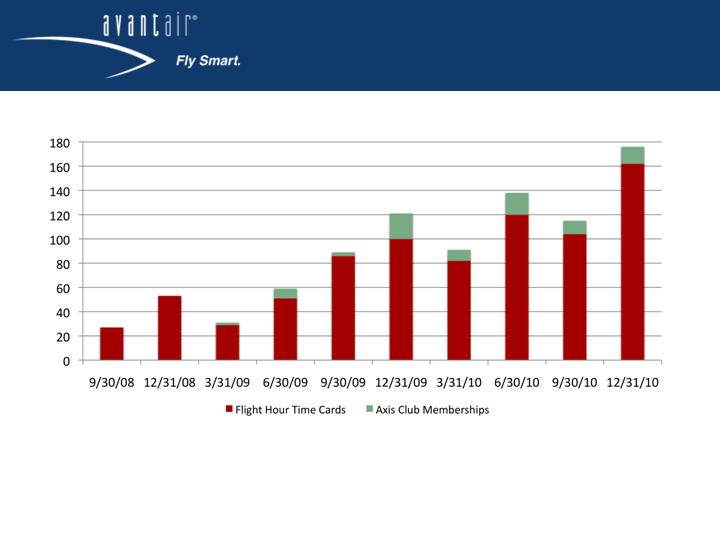

FLIGHT HOUR CARD & AXIS MEMBERSHIP SALES

9

Flight hour cards sold increased 62% YOY in the second quarter of fiscal 2011

LEAD GENERATION + CUSTOMER LOYALTY = SALES

10

90% renewal rate among fractional owners in fiscal 2010

~25% of new customer sales in fiscal 2010 were from customers new to

private air travel

“Overall, flight activity last month fell 0.5% year-over-year, with the Part

135 charter and Part 91K fractional segments seeing activity slump by

8.7% and 3%, respectively, compared with February

2010. Fractional

turboprop activity again bucked the decrease in both its aircraft

category and operational segment, climbing 5.8 percent over the same

month last year, thanks mainly to increased flying at Avantair.”*

Substantial marketing leverage generated as growing customer base

results in more customer referrals

* Source: Aviation International News (ARG/US ), March 2011

REALIZING EFFICIENCIES

11

Fleet expansion drives recurring maintenance and management fees

$37.2 million for 1H fiscal 2011, up 2.7% year-over-year

$73.0 million for fiscal 2010, up 3.2% year-over-year

Leverage opportunities

Fewer repositioning flights

Fewer charters

Decrease in overall costs of flight operations

Superior flight optimization technology

Fully integrated in March 2010, fleet additions expected to increase utility

Increasing utilization: expect to gain ~100 hours of revenue generating flight

capacity per aircraft

Automated flight tracking, scheduling and adding new legs to the trips provide

increasing efficiencies

COMPETITIVE ADVANTAGES

Sole fractional share / flight hour card fleet operator of the Piaggio Avanti

Lowest fuel burn and fuel surcharge*

Average of 40% more fuel efficient than comparable jets

Average of 35% less carbon emissions than comparable jets

TerraPass: Offset over 7.8 million pounds of carbon dioxide

Largest cabin in category

Short runway capability

Substantial leverage in business model

Increase in fleet size reduces operating costs

Opportunity for significant margin growth

Single type aircraft fleet

Lower maintenance and training costs

Fewer parts in inventory

Company-owned FBOs

* Source: Seasons Consulting, October 2010

12

ADDITIONAL

INFORMATION

EXPERIENCED MANAGEMENT TEAM

Steven F. Santo

Chief Executive Officer

Avantair Founder

Former Assistant District Attorney in NY

Former Managing Partner, Fields, Silver & Santo

Former CEO of Skyline Aviation, aircraft leasing company

Pilot for 20 years

Over 1,000 flight hours in the Piaggio Avanti

Richard Pytak

Chief Financial Officer

Former Treasurer at Gibraltar Industries

Former Senior Manager at PricewaterhouseCoopers

Kevin Beitzel

Chief Operating Officer

Former Executive VP of Maintenance and Operations

Over 20 years experience in aviation industry

16 years with US Airways

14

OUR BUSINESS

AVANTAIR PROGRAM SUMMARY

15

Avantair Fractional Ownership

Hourly Operating Cost*:

$2,610

(1/16th share)

Program Highlights:

One-time acquisition cost; no

hourly cost

Customizable fractional share sizes

5-year term

No restricted travel days

Expanded Primary Service Area

Lower operating cost per hour

than other fractional programs

AXIS Lease Program

Hourly Operating Cost*:

$3,676

Program Highlights:

Low upfront costs

Reduced hourly rates

2-year minimum lease

No restricted travel days

Customized share sizes

Attractive conversion options

available

No residual risk

Edge Time Card

Hourly Operating Cost*:

$4,515

(25 hour card)

Program Highlights:

All inclusive, one-time cost

15 or 25 hour cards available

12-month term

Only 10 restricted travel days per

year

Expanded Primary Service Area

Conversion options available

* Includes FET

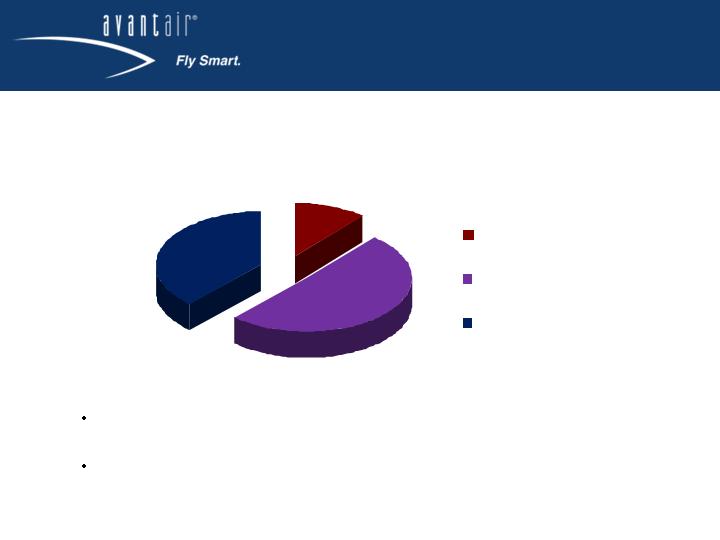

TOTAL MARKET SHARE

Five companies have 11.0% or more of the total market for

fractional aircraft, based upon unique owners

Avantair holds 11% market share

Source: Percentages are based on data derived from the 10-31-09 JetNet Fractional Report

16

11%

51%

38%

Fractional Aircraft Market Share

of Major Fractional Operators

Avantair

NetJets

Flight Options,

FlexJet, CitationAir

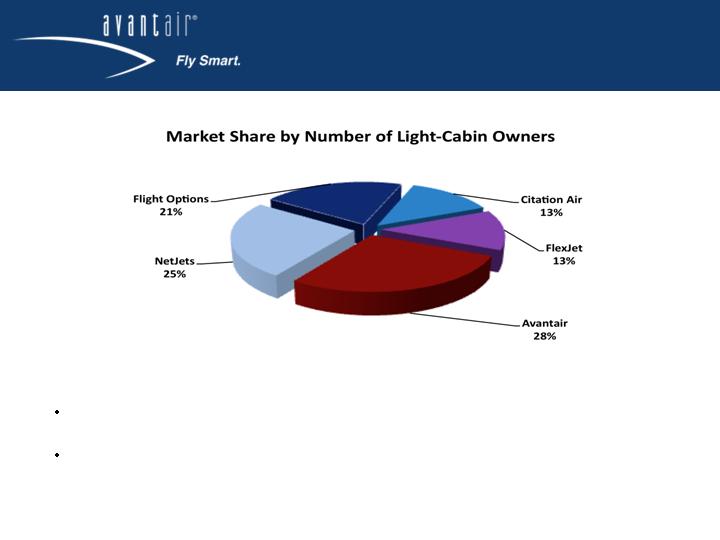

LIGHT-CABIN MARKET SHARE:

MEASURED BY NUMBER OF FRACTIONAL OWNERS

17

Source: AvData Fractional Aircraft Report, June 2010

Avantair has the highest market share of 28% as measured by number of

owners in the light-cabin category

Low hourly cost continues to attract former owners of shares in jets at the

competing fractionals to Avantair

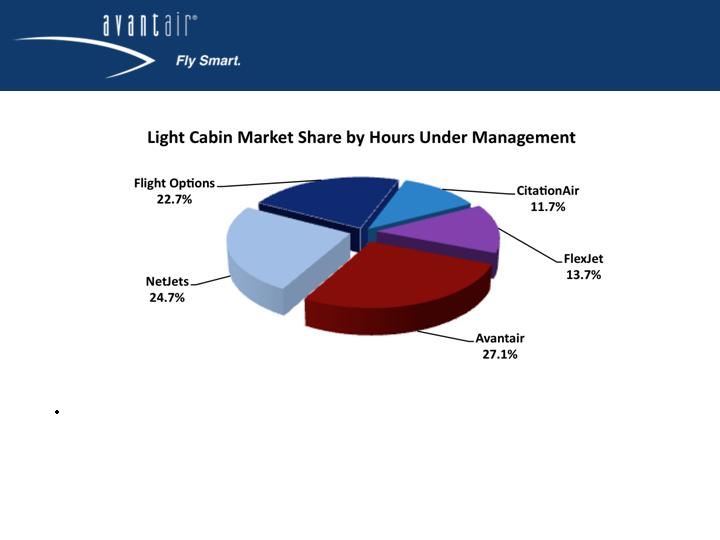

LIGHT-CABIN MARKET SHARE:

HOURS UNDER MANAGEMENT

18

Source: AMSTAT June 2010

** NetJets hours under management exclude the hours registered under Marquis Jet Holdings

Based on fractional hours under management in the light-cabin category,

Avantair has the highest market share of 27%

AVANTAIR FRACTIONAL OWNERSHIP

Year One Operating Cost Comparison

Aircraft Description:

Avantair

CitationAir

Flight Options

NetJets

NetJets

Flexjet

Make

Piaggio

Cessna

Embraer

Raytheon

Cessna

Bombardier

Model

Avanti

CJ3

Phenom 300

Hawker 400XP

Encore

Lear40XR

Acquisition Cost

$ 425,000

$ 518,432

$ 525,000

$ 165,000

$ 275,000

$ 560,000

Share Size

1/16

1/16

1/16

1/16

1/16

1/16

Maximum Hours per Year

50

50

50

50

50

50

Unit Operating Costs:

Occupied Hourly Rate

$0

$4,464

$1,400

$1,842

$1,837

$1,930

Fuel Surcharge/Hour*

$304

$228

$744

$753

$763

$1,048

Monthly Management Fee

$9,950

$ -

$6,500

$8,040

$9,194

$7,850

Year One Annual Operating Costs:

Occupied Hourly Cost

$ -

$ 223,200

$ 70,000

$ 92,100

$ 91,850

$ 96,500

Fuel Surcharge Cost

$ 15,200

$ 11,400

$ 37,200

$ 37,650

$ 38,150

$ 52,400

FET (7.5%)

$ 10,095

$ 17,595

$ 13,890

$ 16,967

$ 18,025

$ 18,233

Management Fee

$ 119,400

$ -

$ 78,000

$ 96,480

$ 110,328

$ 94,200

Total Annual Operating Costs

$ 144,695

$ 252,195

$ 199,090

$ 243,197

$ 258,353

$ 261,333

Effective Hourly Rate of Operation

$ 2,894

$ 5,044

$ 3,982

$ 4,864

$ 5,167

$ 5,227

Yearly Cost Savings With Avantair

44%

29%

42%

45%

46%

* Fuel surcharges based on July 2010

Prices subject to change

19

ECO-FRIENDLY OPERATIONS

Standard setting aircraft

First fleet in the industry to offset aircraft carbon emissions

Lowest fuel burn and carbon emissions in the industry

Burns average of 40% less fuel than competitors at 450 mph

Average of 35% less carbon emissions

Lower overall costs

TerraPass

Funds US clean energy and greenhouse gas reduction projects

Purchased flight TerraPass credits for all new owners

Offset over 7.8 million pounds of carbon dioxide

* Source: Aviation Research Group US (ARG/US ), October 2009

20

Luxurious Private Jet Travel with Minimum Carbon Footprint

REVENUE AND OPERATING RESULTS

21

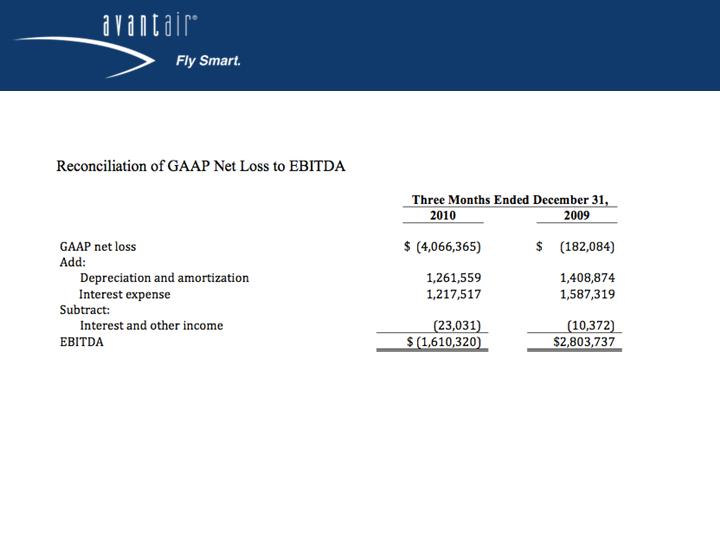

NON-GAAP MEASURES

22

The following table reflects the reconciliation of net loss, prepared in conformity with Generally Accepted Accounting Principles (GAAP) to the

non-GAAP financial measure of EBITDA.

The Company believes that the non-GAAP financial measure of EBITDA is useful to investors as it excludes certain non-cash expenses

that do not directly relate to the operation of aircraft. This measure is

a supplement to accounting principles generally accepted in the

United States used to prepare the Company’s financial statements and should not be viewed as a substitute for GAAP measures. In

addition, the Company’s non-GAAP measure

may not be comparable to non-GAAP measures of other companies.

SECOND QUARTER FISCAL 2011 HIGHLIGHTS

23

Total revenue increased to $36.6 million, up 2% year-over-year.

Flight hour cards sold increased 62% year-over-year to 162 in the second quarter of fiscal

Six new fractional shares and 14 new Axis Club Memberships were sold in the second quarter of fiscal

2011.

Revenue generating flight hours flown reached a new record of 11,061 hours, up 13% versus 9,770 hours

in Q2 FY 2010, and up 6% versus 10,418 hours in Q1 FY 2011.

Fractional owner hours flown increased to a new record of 8,671 up from 8,271 in Q2 FY 2010, and 8,498

in Q1 FY 2011.

Operating loss of ($2.9) million and an EBITDA loss of ($1.6) million, compared with an operating profit of

$1.4 million and EBITDA profit of $2.8 million for the second quarter of fiscal 2010. The

2011 loss is

attributed to a $2.8 million increase in maintenance expense as a result of an increase in fleet size and

the strategic acceleration of normal fleet maintenance costs in response to stronger sales, and an

increase in fractional flight

hours flown over standard fractional flight. The accelerated maintenance is

now completed and the company expects reduced operating expenses in future periods.

Net loss attributable to common stockholders was ($4.4) million, or ($0.17) per share, based on 26.4

million weighted-average shares outstanding versus a net loss of ($0.6) million, or ($0.02) per share,

based

on 24.6 million weighted average shares outstanding for Q2 FY 2010.

Retired approximately $6.9 million in short- and long-term debt.

Cash flow from operations for the six months ended December 31, 2010 was $3.3 million

THE PIAGGIO AVANTI

As the best value in the private aircraft industry, the Piaggio Avanti

offers an unparalleled combination of comfort, speed, performance,

safety and efficiency.

24

Avantair, Inc.

(OTCBB: AAIR)

Headquartered in

Clearwater, FL

727.538.7910

www.avantair.com