Attached files

| file | filename |

|---|---|

| EX-32 - WEIS MARKETS, INC. 2010 ANNUAL REPORT ON FORM 10-K EXHIBIT 32 - WEIS MARKETS INC | wmk10k2010_ex32.htm |

| EX-23 - WEIS MARKETS, INC. 2010 ANNUAL REPORT ON FORM 10-K EXHIBIT 23 - WEIS MARKETS INC | wmk10k2010_ex23.htm |

| EX-31.1 - WEIS MARKETS, INC. 2010 ANNUAL REPORT ON FORM 10-K EXHIBIT 31.1 - WEIS MARKETS INC | wmk10k2010_ex31-1.htm |

| EX-31.2 - WEIS MARKETS, INC. 2010 ANNUAL REPORT ON FORM 10-K EXHIBIT 31.2 - WEIS MARKETS INC | wmk10k2010_ex31-2.htm |

| EX-21 - WEIS MARKETS, INC. 2010 ANNUAL REPORT ON FORM 10-K EXHIBIT 21 - WEIS MARKETS INC | wmk10k2010_ex21.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 25, 2010

OR

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from __________to_________

Commission File Number 1-5039

WEIS MARKETS, INC.

(Exact name of registrant as specified in its charter)

|

PENNSYLVANIA

|

24-0755415

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

1000 S. Second Street

|

||

|

P. O. Box 471

|

||

|

Sunbury, Pennsylvania

|

17801-0471

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant's telephone number, including area code: (570) 286-4571 Registrant's web address: www.weismarkets.com

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

|

Common stock, no par value

|

New York Stock Exchange

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated filer x

|

|

Non-accelerated filer ¨ (Do not check if a smaller reporting company)

|

Smaller reporting company ¨

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of Common Stock held by non-affiliates of the Registrant is approximately $402,000,000 as of June 26, 2010 the last business day of the most recently completed second quarter.

Shares of common stock outstanding as of March 10, 2011 - 26,898,443.

DOCUMENTS INCORPORATED BY REFERENCE: Selected portions of the Weis Markets, Inc. definitive proxy statement dated March 10, 2011 are incorporated by reference in Part III of this Form 10-K.

WEIS MARKETS, INC.

|

FORM 10-K

|

Page |

|

Part I

|

|

|

Item 1. Business

|

1

|

|

Item 1a. Risk Factors

|

3

|

|

Item 1b. Unresolved Staff Comments

|

5

|

|

Item 2. Properties

|

5

|

|

Item 3. Legal Proceedings

|

5

|

|

Executive Officers of the Registrant

|

6

|

|

Part II

|

|

|

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

7

|

|

Item 6. Selected Financial Data

|

8

|

|

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

|

9

|

|

Item 7a. Quantitative and Qualitative Disclosures about Market Risk

|

17

|

|

Item 8. Financial Statements and Supplementary Data

|

18

|

|

Item 9. Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

35

|

|

Item 9a. Controls and Procedures

|

35

|

|

Item 9b. Other Information

|

36

|

|

Part III

|

|

|

Item 10. Directors, Executive Officers and Corporate Governance

|

36

|

|

Item 11. Executive Compensation

|

36

|

|

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

36

|

|

Item 13. Certain Relationships and Related Transactions, and Director Independence

|

36

|

|

Item 14. Principal Accountant Fees and Services

|

36

|

|

Part IV

|

|

|

Item 15. Exhibits, Financial Statement Schedules

|

37

|

|

Item 15(c)(3). Schedule II - Valuation and Qualifying Accounts

|

39

|

|

Signatures

|

40

|

|

Exhibit 21 Subsidiaries of the Registrant

|

|

|

Exhibit 23 Consent of Grant Thornton LLP

|

|

|

Exhibit 31.1 Rule 13a-14(a) Certification - CEO

|

|

|

Exhibit 31.2 Rule 13a-14(a) Certification - CFO

|

|

|

Exhibit 32 Certification Pursuant to 18 U.S.C. Section 1350

|

WEIS MARKETS, INC.

Weis Markets, Inc. is a Pennsylvania business founded by Harry and Sigmund Weis in 1912 and incorporated in 1924. The Company is engaged principally in the retail sale of food in Pennsylvania and surrounding states. There was no material change in the nature of the Company's business during fiscal 2010. The Company’s stock has been traded on the New York Stock Exchange since 1965 under the symbol “WMK.” The Weis family currently owns approximately 65% of the outstanding shares. Robert F. Weis serves as Chairman of the Board of Directors, and Jonathan H. Weis, son of Robert F. Weis, serves as Vice Chairman and Secretary. Both are involved in the day-to-day operations of the business.

The Company's retail food stores sell groceries, dairy products, frozen foods, meats, seafood, fresh produce, floral, pharmacy services, deli products, prepared foods, bakery products, beer and wine, fuel and general merchandise items, such as health and beauty care and household products. In addition, customer convenience is addressed at many locations by offering services such as third parties providing in-store banks, post offices and take-out restaurants. The Company advertises through various media, including circulars, newspapers, radio, television and on-line via its website and recently launched mobile website. Printed circulars are used extensively on a weekly basis to advertise featured items. The Company utilizes a loyalty card program, “Weis Club

Preferred Shopper,” which allows customers to receive discounts, promotions and rewards. The Company currently owns and operates 164 retail food stores and a chain of 7 SuperPetz pet supply stores. The Company’s operations are reported as a single reportable segment.

The percentage of net sales contributed by each class of similar products for each of the previous five fiscal years was:

|

Year

|

Grocery

|

Meat

|

Produce

|

Pharmacy

|

Fuel

|

Pet Supply

|

Other

|

|||||||||||||||||||||

|

2010

|

53.90 | 16.06 | 15.28 | 8.89 | 2.28 | 1.11 | 2.48 | |||||||||||||||||||||

|

2009

|

54.37 | 16.21 | 14.92 | 8.98 | 1.66 | 1.73 | 2.13 | |||||||||||||||||||||

|

2008

|

54.10 | 16.08 | 14.68 | 9.13 | 2.01 | 2.05 | 1.95 | |||||||||||||||||||||

|

2007

|

53.76 | 16.09 | 14.82 | 9.77 | 1.35 | 2.34 | 1.87 | |||||||||||||||||||||

|

2006

|

53.52 | 15.99 | 14.99 | 10.22 | 0.98 | 2.55 | 1.75 | |||||||||||||||||||||

On August 23, 2009, the Company acquired eleven Giant Markets stores located in Broome County, New York including units in Binghamton, Vestal, Endicott, Endwell and Johnson City. Weis Markets, Inc. acquired the store locations and operations of Giant Markets in an effort to establish its retail presence in the Southern Tier of New York. Upon acquisition, these eleven stores began operating under the trade name of Weis Markets.

As of year end, Weis Markets, Inc. operated 24 stores in Maryland, 3 stores in New Jersey, 12 stores in New York, 120 stores in Pennsylvania and 2 stores in West Virginia, for a total of 161 retail food stores operating under the Weis Markets trade name. Weis Markets, Inc. also operated 1 Save-A-Lot and 2 Scot’s Lo-Cost retail food stores in Pennsylvania.

Page 1 of 40 (Form 10-K)

WEIS MARKETS, INC.

Item 1. Business: (continued)

All retail food store locations, except Scot’s Lo-Cost and Save-A-Lot, operate as conventional supermarkets. Scot’s Lo-Cost operates under a warehouse format, while Save-A-Lot’s format serves value-focused customers. The retail food stores range in size from 8,000 to 70,000 square feet, with an average size of approximately 48,000 square feet. The following summarizes the number of stores by size categories as of year-end:

| Square feet |

Number of stores

|

|||

|

55,000 to 70,000

|

43 | |||

|

45,000 to 54,999

|

72 | |||

|

35,000 to 44,999

|

27 | |||

|

25,000 to 34,999

|

14 | |||

|

Under 25,000

|

8 | |||

|

Total

|

164 | |||

The following schedule shows the changes in the number of retail food stores, total square footage and store additions/remodels as of year-end:

|

2010

|

2009

|

2008

|

2007

|

2006

|

||||||||||||||||

|

Beginning store count

|

164 | 154 | 154 | 156 | 158 | |||||||||||||||

|

New stores

|

— | 11 | 1 | — | 2 | |||||||||||||||

|

Relocations

|

— | — | — | 1 | 1 | |||||||||||||||

|

Closed stores

|

— | (1 | ) | (1 | ) | (2 | ) | (4 | ) | |||||||||||

|

Relocated stores

|

— | — | — | (1 | ) | (1 | ) | |||||||||||||

|

Ending store count

|

164 | 164 | 154 | 154 | 156 | |||||||||||||||

|

Total square feet (000’s), at year-end

|

7,887 | 7,888 | 7,402 | 7,301 | 7,311 | |||||||||||||||

|

Additions/major remodels

|

4 | 5 | 8 | 4 | 5 | |||||||||||||||

The Company supports its retail operations through a centrally located distribution facility, its own transportation fleet, three manufacturing facilities and its administrative offices. The Company is required to use a significant amount of working capital to provide for the necessary amount of inventory to meet demand for its products through efficient use of buying power and effective utilization of space in its distribution facilities. The manufacturing facilities consist of a meat processing plant, an ice cream plant and a milk processing plant.

The Company’s business is highly competitive. The number of competitors and the variety of competition experienced by the Company's stores vary by market area. National, regional and local food chains, as well as independent food stores comprise the Company's principal competition. The Company also faces substantial competition from convenience stores, membership warehouse clubs, specialty retailers, supercenters and large-scale drug and pharmaceutical chains. The Company competes on the basis of price, quality, location and service.

The Company currently has approximately 17,700 full-time and part-time associates.

Page 2 of 40 (Form 10-K)

WEIS MARKETS, INC.

Item 1. Business: (continued)

Trade Names and Trademarks. The Company has invested significantly in the development and protection of “Weis Markets” both as a trade name and a trademark and considers it to be an important asset. The Company is the exclusive licensee of more than 50 other trademarks registered and/or pending in the United States Patent and Trademark Office, including trademarks for its product lines and promotions such as Weis, Weis Quality, Weis 2 Go, Weis Wonder Chicken, Price Freeze, Weis Gas-n-Go, From The Field, Weis Baker’s Basket, Canyon River and Healthy Bites. Each trademark registration is for an initial period of 10 years and may be renewed so long as it is in continued use in commerce.

The Company considers its trademarks to be of material importance to its business and actively defends and enforces its rights.

The Company maintains a web site at www.weismarkets.com. The Company makes available, free of charge, on the “Corporate Information” section of its web site, its annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after the Company electronically files such material or furnishes it to the U.S. Securities and Exchange Commission (SEC).

Additionally, the Company’s annual reports and corporate governance materials, including governance guidelines; the charters of the Audit, Compensation and Disclosure Committees; and both the Code of Business Conduct and Ethics and the Code of Ethics for the CEO and CFO, may be found under the “Corporate Information” section of its web site. A copy of the foregoing corporate governance materials is available upon written request to the Company’s principal executive offices.

In addition to risks and uncertainties in the ordinary course of business common to all businesses, important factors are listed below specific to the Company and its industry, which could materially impact its future performance.

The Company’s industry is highly competitive. If the Company is unable to compete effectively, the Company’s financial condition and results of operations could be materially affected. The retail food industry is intensely price competitive, and the competition the Company encounters may have a negative impact on product retail prices. The financial results may be adversely impacted by a competitive environment that could cause the Company to reduce retail prices without a reduction in its product cost to maintain market share; thus reducing sales and gross profit margins.

The trade area of the Company is located within a region and subject to the economic, social and climate variables of that region. The Company’s stores are concentrated in central and northeast Pennsylvania, central Maryland, suburban Baltimore regions and New York’s Southern Tier. Changes in economic and social conditions in the Company’s operating regions, including the rate of inflation, population demographics and employment and job growth, affect customer shopping habits. These changes may negatively impact sales and earnings. In addition, employment conditions specifically may affect the Company’s ability to hire and train qualified associates. Business disruptions due to

weather and catastrophic events historically have been few. The Company’s geographic regions could receive an extreme variance in the amount of annual snowfall that may materially affect sales and expense results.

Food safety issues could result in the loss of consumer confidence in the Company. Customers count on the Company to provide them with wholesome food products. Concerns regarding the safety of food products sold in its stores could cause shoppers to avoid purchasing certain products from the Company, or to seek alternative sources of supply for all of their food needs, even if the basis for the concern is outside of the Company’s control. Any lost confidence on the part of its customers would be difficult and costly to reestablish. As such, any issue regarding the safety of any food items sold by the Company, regardless of the cause, could have a substantial and adverse effect on operations.

Page 3 of 40 (Form 10-K)

WEIS MARKETS, INC.

Item 1a. Risk Factors: (continued)

The failure to execute expansion plans could have a material adverse effect on the Company's business and results of its operations. In 2011, the Company expects to invest $110.0 million for capital expenditures, which includes all store, distribution and manufacturing projects, information technology and equipment purchases. Circumstances outside the Company’s control could negatively impact these anticipated capital investments. The Company cannot determine with certainty whether its new stores will be successful. The failure to expand by successfully opening new stores as planned, or the failure of a significant number of these stores to perform as planned, could have a material adverse

effect on the Company’s business and results of its operations.

Disruptions or security breaches in the Company’s information technology systems could adversely affect results. The Company’s business is increasingly dependent on information technology systems that are complex and vital to continuing operations. If the Company was to experience difficulties maintaining existing systems or implementing new systems, significant losses could be incurred due to disruptions in its operations. Additionally, these systems contain valuable proprietary data that, if breached, would have an adverse effect on the Company.

The Company is affected by certain operating costs which could increase or fluctuate considerably. Associate expenses contribute to the majority of its operating costs and therefore, the Company's financial performance is greatly influenced by increasing wage and benefit costs, a competitive labor market, regulatory wage increases and the risk of unionized labor disruptions of its non-union workforce. In addition, the rising rate of associate medical insurance costs continues to outpace the Company’s expenses as a whole. The Company's profit is particularly sensitive to the cost of oil. Oil prices directly affect the Company's

product transportation costs, as well as its utility and petroleum-based supply costs. The Company is extremely concerned about the continuing rise in bank interchange fees for accepting payment cards at the point of sale. As the use of payment cards grow and banks continue to raise their rates, this expense continues to decrease profit margins.

Various aspects of the Company’s business are subject to federal, state and local laws and regulations. The Company’s compliance with these regulations may require additional capital expenditures and could adversely affect the Company’s ability to conduct the Company’s business as planned. The Company is subject to various federal, state and local laws, regulations and administrative practices that affect the Company’s business. The Company must comply with numerous provisions regulating health and sanitation standards, food labeling, equal employment opportunity, minimum wages and licensing for the sale of food, drugs and alcoholic beverages. Management cannot predict either the nature

of future laws, regulations, interpretations or applications, or the effect either additional government regulations or administrative orders, when and if promulgated, or disparate federal, state, and local regulatory schemes would have on the Company’s future business. They could, however, require the reformulation of certain products to meet new standards, the recall or discontinuance of certain products not able to be reformulated, additional record keeping, expanded documentation of the properties of certain products, expanded or different labeling and/or scientific substantiation. Any or all of such requirements could have an adverse effect on the Company’s results of operations and financial condition.

Unexpected factors affecting self-insurance claims and reserve estimates could adversely affect the Company. The Company uses a combination of insurance and self-insurance to provide for potential liabilities for workers' compensation, general liability, vehicle accident, property and associate medical benefit claims. Management estimates the liabilities associated with the risks retained by the Company, in part, by considering historical claims experience, demographic and severity factors and other actuarial assumptions which, by their nature, are subject to a high degree of variability. Any projection of losses concerning workers’ compensation and general liability is subject to a high degree of

variability. Among the causes of this variability are unpredictable external factors affecting future inflation rates, discount rates, litigation trends, legal interpretations, benefit level changes and claim settlement patterns.

The Company is liable for associate health claims up to an annual maximum of $750,000 per member and for workers' compensation claims up to $2,000,000 per claim. Property and casualty insurance coverage is maintained with outside carriers at deductible or retention levels ranging from $100,000 to $1,000,000. Although the Company has minimized its exposure on individual claims, the Company, for the benefit of cost savings, has accepted the risk of an unusual amount of independent multiple material claims arising, which could have a significant impact on earnings.

Page 4 of 40 (Form 10-K)

WEIS MARKETS, INC.

Item 1a. Risk Factors: (continued)

Changes in tax laws may result in higher income tax. The Company's future effective tax rate may increase from current rates due to changes in laws and the status of pending items with various taxing authorities. Currently, the Company benefits from a combination of its corporate structure and certain state tax laws.

The Company is a controlled Company due to the common stock holdings of the Weis family. The Weis family’s share ownership represents approximately 65% of the combined voting power of the Company’s common stock as of December 25, 2010. As a result, the Weis family has the power to elect a majority of the Company’s directors and approve any action requiring the approval of the shareholders of the Company, including adopting certain amendments to the Company’s charter and approving mergers or sales of substantially all of the Company’s assets. Currently, two of the Company’s seven directors are members of the Weis family.

Item 1b. Unresolved Staff Comments:

There are no unresolved staff comments.

The Company currently owns and operates 81 of its retail food stores, and leases and operates 83 stores under operating leases that expire at various dates through 2028. SuperPetz leases all 7 of its retail store locations. The Company owns all trade fixtures and equipment in its stores and several parcels of vacant land, which are available as locations for possible future stores or other expansion.

The Company owns and operates one distribution center in Milton, Pennsylvania of approximately 1,110,000 square feet, and one in Northumberland, Pennsylvania totaling approximately 76,000 square feet. The Company also owns one warehouse complex in Sunbury, Pennsylvania totaling approximately 557,000 square feet. The Company operates an ice cream plant, meat processing plant and milk processing plant in 259,000 square feet at its Sunbury location.

Neither the Company nor any subsidiary is presently a party to, nor is any of their property subject to, any pending legal proceedings, other than routine litigation incidental to the business.

Page 5 of 40 (Form 10-K)

WEIS MARKETS, INC.

Executive Officers of the Registrant

The following sets forth the names and ages of the Company’s executive officers as of March 10, 2011, indicating all positions held during the past five years:

|

Name

|

Age

|

Title

|

|

Robert F. Weis (a)

|

91

|

Chairman of the Board

|

|

Jonathan H. Weis (b)

|

43

|

Vice Chairman and Secretary

|

|

David J. Hepfinger (c)

|

52

|

President and Chief Executive Officer

|

|

Scott F. Frost (d)

|

48

|

Senior Vice President, Chief Financial Officer and Treasurer

|

|

Harold G. Graber Jr. (e)

|

55

|

Senior Vice President of Real Estate and Development

|

|

James E. Marcil (f)

|

52

|

Senior Vice President of Human Resources

|

|

John J. Ropietski Jr. (g)

|

49

|

Senior Vice President of Operations

|

|

Kurt A. Schertle (h)

|

39

|

Senior Vice President of Sales and Merchandising

|

|

|

(a)

|

Robert F. Weis. The Company has employed Mr. Weis since 1946. Mr. Weis served as Chairman and Treasurer from 1995 until April 2002, at which time he was appointed Chairman of the Board.

|

|

|

(b)

|

Jonathan H. Weis. The Company has employed Mr. Weis since 1989. Mr. Weis served the Company as Vice President of Property Management and Development from 1996 until April 2002, at which time he was appointed as Vice President and Secretary. In January of 2004, the Board appointed Mr. Weis as Vice Chairman and Secretary.

|

|

|

(c)

|

David J. Hepfinger. Mr. Hepfinger joined the Company on March 1, 2008 as its President and Chief Operating Officer. Mr. Hepfinger has served the Company as President and Chief Executive Officer since January 1, 2009. Prior to joining the Company, Mr. Hepfinger worked for Price Chopper Supermarkets, a chain of supermarkets headquartered in Rotterdam, NY, for 32 years in various capacities including his last position as Senior Vice President Retail and Administration.

|

|

|

(d)

|

Scott F. Frost. The Company appointed Mr. Frost as Vice President, Chief Financial Officer and Treasurer on October 26, 2009 and he was promoted to Senior Vice President, Chief Financial Officer and Treasurer in January 2011. Mr. Frost served as Acting Chief Financial Officer, Controller, Assistant Treasurer and Assistant Secretary of the Company during the past five years.

|

|

|

(e)

|

Harold G. Graber Jr. Mr. Graber joined the Company in October 1989 as the Director of Real Estate. Mr. Graber served the Company as Vice President for Real Estate since 1996 and in February 2010, was promoted to Senior Vice President of Real Estate and Development.

|

|

|

(f)

|

James E. Marcil. Mr. Marcil joined the Company in September 2002 as Vice President of Human Resources. In February 2010, Mr. Marcil was promoted to Senior Vice President of Human Resources.

|

|

|

(g)

|

John J. Ropietski Jr. The Company hired Mr. Ropietski on June 30, 2008 as its Vice President of Store Operations. In February 2010, Mr. Ropietski was promoted to Senior Vice President of Operations. Prior to joining the Company, Mr. Ropietski worked for Price Chopper Supermarkets, a chain of supermarkets headquartered in Rotterdam, NY, for 25 years in various capacities including his last position as Regional Vice President.

|

|

|

(h)

|

Kurt A. Schertle. The Company hired Mr. Schertle on March 1, 2009 as its Vice President of Sales and Merchandising. In February 2010, Mr. Schertle was promoted to Senior Vice President of Sales and Merchandising. Prior to joining the Company, Mr. Schertle was President and Chief Operating Officer of Tree Top Kids, a specialty toy retailer, from 2007 until 2009. Mr. Schertle has more than 20 years of food retailing experience, mostly with SUPERVALU, where he worked in various capacities including his last position as a Senior Vice President for Marketing and Merchandising from 2005 until 2007.

|

Page 6 of 40 (Form 10-K)

WEIS MARKETS, INC.

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities:

The Company's stock is traded on the New York Stock Exchange (ticker symbol WMK). The approximate number of shareholders, including individual participants in security position listings, on December 25, 2010 as provided by the Company's transfer agent was 7,113. High and low stock prices and dividends paid per share for the last two fiscal years were:

|

2010

|

2009

|

|||||||||||||||||||||||

|

Stock Price

|

Dividend

|

Stock Price

|

Dividend

|

|||||||||||||||||||||

|

Quarter

|

High

|

Low

|

Per Share

|

High

|

Low

|

Per Share

|

||||||||||||||||||

|

First

|

$ | 36.92 | $ | 32.56 | $ | .29 | $ | 34.12 | $ | 22.67 | $ | .29 | ||||||||||||

|

Second

|

38.32 | 32.61 | .29 | 37.87 | 30.05 | .29 | ||||||||||||||||||

|

Third

|

38.46 | 32.56 | .29 | 37.67 | 30.51 | .29 | ||||||||||||||||||

|

Fourth

|

41.30 | 37.66 | .29 | 37.44 | 31.18 | .29 | ||||||||||||||||||

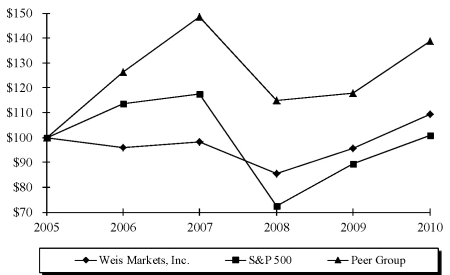

The following line graph compares the yearly percentage change in the cumulative total shareholder return on the Company’s common stock against the cumulative total return of the S&P Composite-500 Stock Index and the cumulative total return of a published group index for the Retail Grocery Stores Industry (“Peer Group”), provided by Value Line, Inc., for the period of five years. The graph depicts $100 invested at the close of trading on the last trading day preceding the first day of the fifth preceding year in Weis Markets, Inc. common stock, S&P 500, and the Peer Group. The cumulative total return assumes reinvestment of dividends.

Comparative Five-Year Total Returns

|

2005

|

2006

|

2007

|

2008

|

2009

|

2010

|

|||||||||||||||||||

|

Weis Markets

|

100.00 | 95.89 | 98.09 | 85.45 | 95.56 | 109.47 | ||||||||||||||||||

|

S&P 500

|

100.00 | 113.62 | 117.63 | 72.36 | 89.33 | 100.75 | ||||||||||||||||||

|

Peer Group

|

100.00 | 126.39 | 148.57 | 114.97 | 117.77 | 138.82 | ||||||||||||||||||

Page 7 of 40 (Form 10-K)

WEIS MARKETS, INC.

Item 6. Selected Financial Data:

The following selected historical financial information has been derived from the Company's audited consolidated financial statements. This information should be read in connection with the Company's Consolidated Financial Statements and the Notes thereto, as well as "Management's Discussion and Analysis of Financial Condition and Results of Operations," included in Item 7.

Five Year Review of Operations

|

52 Weeks

|

52 Weeks

|

52 Weeks

|

52 Weeks

|

52 Weeks

|

||||||||||||||||

|

(dollars in thousands, except shares,

|

Ended

|

Ended

|

Ended

|

Ended

|

Ended

|

|||||||||||||||

|

per share amounts and store information)

|

Dec. 25, 2010

|

Dec. 26, 2009

|

Dec. 27, 2008

|

Dec. 29, 2007

|

Dec. 30, 2006

|

|||||||||||||||

|

Net sales

|

$ | 2,620,378 | $ | 2,516,175 | $ | 2,422,361 | $ | 2,318,551 | $ | 2,244,512 | ||||||||||

|

Costs and expenses

|

2,515,062 | 2,419,824 | 2,354,780 | 2,243,587 | 2,162,569 | |||||||||||||||

|

Income from operations

|

105,316 | 96,351 | 67,581 | 74,964 | 81,943 | |||||||||||||||

|

Investment income

|

2,069 | 1,556 | 2,532 | 2,795 | 4,145 | |||||||||||||||

|

Income before provision for income taxes

|

107,385 | 97,907 | 70,113 | 77,759 | 86,088 | |||||||||||||||

|

Provision for income taxes

|

39,094 | 35,107 | 23,118 | 26,769 | 30,078 | |||||||||||||||

|

Net income

|

68,291 | 62,800 | 46,995 | 50,990 | 56,010 | |||||||||||||||

|

Retained earnings, beginning of year

|

827,042 | 795,473 | 779,760 | 760,531 | 735,865 | |||||||||||||||

| 895,333 | 858,273 | 826,755 | 811,521 | 791,875 | ||||||||||||||||

|

Less cumulative effect of change in accounting for income taxes

|

— | — | — | 452 | — | |||||||||||||||

|

Cash dividends

|

31,201 | 31,231 | 31,282 | 31,309 | 31,344 | |||||||||||||||

|

Retained earnings, end of year

|

$ | 864,132 | $ | 827,042 | $ | 795,473 | $ | 779,760 | $ | 760,531 | ||||||||||

|

Weighted-average shares outstanding, diluted

|

26,898,443 | 26,920,551 | 26,966,647 | 26,993,997 | 27,027,198 | |||||||||||||||

|

Cash dividends per share

|

$ | 1.16 | $ | 1.16 | $ | 1.16 | $ | 1.16 | $ | 1.16 | ||||||||||

|

Basic and diluted earnings per share

|

$ | 2.54 | $ | 2.33 | $ | 1.74 | $ | 1.89 | $ | 2.07 | ||||||||||

|

Working capital

|

$ | 233,389 | $ | 173,159 | $ | 158,932 | $ | 157,385 | $ | 147,451 | ||||||||||

|

Total assets

|

$ | 992,081 | $ | 916,515 | $ | 848,214 | $ | 840,069 | $ | 814,062 | ||||||||||

|

Shareholders’ equity

|

$ | 728,127 | $ | 690,764 | $ | 661,100 | $ | 648,228 | $ | 629,163 | ||||||||||

|

Number of grocery stores

|

164 | 164 | 154 | 154 | 156 | |||||||||||||||

|

Number of pet supply stores

|

7 | 25 | 29 | 31 | 31 | |||||||||||||||

Page 8 of 40 (Form 10-K)

WEIS MARKETS, INC.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations:

Overview

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A) is intended to help the reader understand Weis Markets, Inc., its operations and its present business environment. The MD&A is provided as a supplement to and should be read in conjunction with the consolidated financial statements and the accompanying notes thereto contained in “Item 8. Financial Statements and Supplementary Data” of this report. The following analysis should also be read in conjunction with the Financial Statements included in the 2010 Quarterly Reports on Form 10-Q and the 2009 Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission, as well as the cautionary statement captioned “Forward-Looking Statements”

immediately following this analysis. This overview summarizes the MD&A, which includes the following sections:

• Company Overview - a general description of the Company’s business and strategic imperatives.

• Results of Operations - an analysis of the Company’s consolidated results of operations for the three years presented in the Company’s consolidated financial statements.

• Liquidity and Capital Resources - an analysis of cash flows, aggregate contractual obligations, and off-balance sheet arrangements.

• Critical Accounting Estimates - a discussion of accounting policies that require critical judgments and estimates.

Company Overview

General

Weis Markets, Inc. was founded in 1912 by Harry and Sigmund Weis in Sunbury, Pennsylvania. Today, the Company ranks among the top 50 food and drug retailers in the United States in revenues generated. At the end of 2010, the Company operated 164 retail food stores in Pennsylvania and four surrounding states: Maryland, New Jersey, New York and West Virginia.

On August 23, 2009, the Company acquired eleven Giant Markets stores located in Broome County, New York including units in Binghamton, Vestal, Endicott, Endwell and Johnson City. Weis Markets, Inc. acquired the store locations and operations of Giant Markets in an effort to establish its retail presence in the Southern Tier of New York.

Company revenues are generated in its retail food stores from the sale of a wide variety of consumer products including groceries, dairy products, frozen foods, meats, seafood, fresh produce, floral, pharmacy services, deli products, prepared foods, bakery products, beer and wine, fuel, and general merchandise items, such as health and beauty care and household products. The Company supports its retail operations through a centrally located distribution facility, its own transportation fleet, three manufacturing facilities and its administrative offices. The Company's operations are reported as a single reportable segment.

Strategic Imperatives

The following strategic imperatives will ensure the success of the Company in the coming years:

|

|

·

|

Growth and Profitability – While the Company focuses on store sales growth, expense control, increased efficiencies, improvements in productivity and positive cash flow, it will continue to identify opportunities with new stores, additions to existing stores, remodels and acquisitions. The Company believes successfully planned growth will increase market share and operating profits, resulting in enhanced shareholder value.

|

|

|

·

|

Merchandising and Operational Differentiation – The Company has identified product pricing, shopping experience and customer focus to maintain its differentiation versus its competitors. Management is committed to offering its customers a strong combination of quality, service and value. As part of this commitment, it will continue to offer competitive prices on branded and private label products to meet and exceed our customers’ expectations.

|

Page 9 of 40 (Form 10-K)

WEIS MARKETS, INC.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations: (continued)

Company Overview, Strategic Imperatives (continued)

|

|

·

|

Talent Management – To keep pace with the Company’s growth and profitability focus, management is committed to developing future leaders utilizing its associates to increase bench strength, ensure succession preparedness, and improve overall associate performance.

|

|

|

·

|

Supply Chain – Management will continue to reshape and streamline its supply chain by improving inventory turns, cost per case, in-stock position and overall service levels, thereby building store sales capabilities.

|

|

|

·

|

Information Technology Initiatives – The Company will increase its investment in information technology to improve associate productivity and customer experience with user friendly, support driven systems. These technology investments will also improve the Company’s inventory management and shelf replenishment.

|

|

|

·

|

Sustainability – The Company is committed to operating sustainably. In 2010, the Company joined EPA’s GreenChill Partnership to facilitate its efforts to reduce ozone layer depleting refrigerant charges from its stores and curb greenhouse gases. Its remodeled Hanover store received GreenChill’s Silver Certification for reducing refrigerant discharges by 50% compared to the average American supermarket. The Company also began the construction of three new stores that will use 60% less refrigerant and is committed to reducing refrigerant discharges in all of its stores. In 2010, the Company also recycled 46.9 million pounds of cardboard, 126,000 pounds of waxed cardboard, and 1.6 million pounds of

plastic.

|

Results of Operations

|

Analysis of Consolidated Statements of Income

|

||||||||||||||||||||

|

(dollars in thousands except per share amounts)

|

||||||||||||||||||||

|

For the Fiscal Years Ended December 25, 2010

|

2010

|

2009

|

2008

|

Percent Changes

|

||||||||||||||||

|

December 26, 2009 and December 27, 2008

|

2010 vs.

|

2009 vs.

|

||||||||||||||||||

|

(52 weeks)

|

(52 weeks)

|

(52 weeks)

|

2009

|

2008

|

||||||||||||||||

|

Net sales

|

$ | 2,620,378 | $ | 2,516,175 | $ | 2,422,361 | 4.1 | % | 3.9 | % | ||||||||||

|

Cost of sales, including warehousing and distribution expenses

|

1,906,753 | 1,838,003 | 1,795,570 | 3.7 | 2.4 | |||||||||||||||

|

Gross profit on sales

|

713,625 | 678,172 | 626,791 | 5.2 | 8.2 | |||||||||||||||

|

Gross profit margin

|

27.2 | % | 27.0 | % | 25.9 | % | ||||||||||||||

|

Operating, general and administrative expenses

|

608,309 | 581,821 | 559,210 | 4.6 | 4.0 | |||||||||||||||

|

O, G & A, percent of net sales

|

23.2 | % | 23.1 | % | 23.1 | % | ||||||||||||||

|

Income from operations

|

105,316 | 96,351 | 67,581 | 9.3 | 42.6 | |||||||||||||||

|

Operating Margin

|

4.0 | % | 3.8 | % | 2.8 | % | ||||||||||||||

|

Investment income

|

2,069 | 1,556 | 2,532 | 33.0 | (38.5 | ) | ||||||||||||||

|

Investment income, percent of net sales

|

0.1 | % | 0.1 | % | 0.1 | % | ||||||||||||||

|

Income before provision for income taxes

|

107,385 | 97,907 | 70,113 | 9.7 | 39.6 | |||||||||||||||

|

Provision for income taxes

|

39,094 | 35,107 | 23,118 | 11.4 | 51.9 | |||||||||||||||

|

Effective tax rate

|

36.4 | % | 35.9 | % | 33.0 | % | ||||||||||||||

|

Net income

|

$ | 68,291 | $ | 62,800 | $ | 46,995 | 8.7 | % | 33.6 | % | ||||||||||

|

Net income, percent of net sales

|

2.6 | % | 2.5 | % | 1.9 | % | ||||||||||||||

|

Basic and diluted earnings per share

|

$ | 2.54 | $ | 2.33 | $ | 1.74 | 9.0 | % | 33.9 | % | ||||||||||

Net Sales

The Company's revenues are earned and cash is generated as merchandise is sold to customers at the point of sale. Discounts, except those provided by a vendor, are recognized as a reduction in sales as products are sold or over the life of a promotional program if redeemable in the future.

In the second quarter of 2010, management changed the method used to calculate comparable store sales. Refer to prior Form 10-K and Form 10-Q documents filed for the definition of the previous method used.

Page 10 of 40 (Form 10-K)

WEIS MARKETS, INC.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations: (continued)

Results of Operations (continued)

When calculating the percentage change in comparable store sales, the Company defines a new store to be comparable when it has been in operation for five full quarters. Relocated stores and stores with expanded square footage are included in comparable store sales since these units are located in existing markets and are open during construction. Planned store dispositions are excluded from the calculation. The Company only includes retail food stores in the calculation.

In 2010, comparable store sales increased 1.0% compared to 2009 and increased 1.9% in 2009 compared to 2008. The acquisition of the Binghamton based Giant Markets in August 2009 improved sales by $58.8 million.

The poor economy resulted in cautious customer spending in 2010. Many customers continue to focus on value and look for ways to save money over the long-term. To meet these needs, the Company continued to make significant investments in its “Price Freeze” and “Get Grillin’ Weis” promotional programs. The Company ran two successful 90-day “Price Freeze” programs in 2010. The programs froze 1,600 and 3,000 staple item prices, respectively. On average, the Company’s customers saved approximately $6 million with each “Price Freeze” program, by purchasing items that were included in each promotion, over the past 2 years. The Company launched a sixth round of “Price Freeze” on January

2, 2011. This program froze prices of approximately 2,400 staple items for a 90-day period. The “Get Grillin’ Weis” promotional program was a seasonal cross-merchandising program linking meat items to specific general merchandise items such as gas grills and patio furniture, as well as complementary grocery and perishable items. This program also lowered prices of approximately 400 staple items for a twelve-week period, resulting in $2.5 million in customer savings.

In addition to the “Price Freeze” and “Get Grillin’ Weis” programs, the Company ran “Weis Rewards” loyalty card programs in select regions, allowing customers to earn discounts ranging from 5% to 20% on a future purchase and expanded its “Gas Rewards” program to most markets. The “Gas Rewards” program allows Weis Club Preferred Shoppers card members to earn gas discounts resulting from their in-store purchases. Customers can redeem these gas discounts at Sheetz convenience stores, located in most of the Company’s markets, at Manley’s Mighty Mart Valero locations, in the Binghamton, NY market or at any of the fifteen Weis Gas-n-Go locations.

The Company continued to employ a disciplined marketing and advertising strategy to help maintain its market share and increase its profits. During 2010, the Company generated a 0.6% increase in average sales per customer transaction while the number of identical customer store visits declined by 0.7%.

Pharmacy sales increased 2.2% in 2010 versus 2009 and 2.2% in 2009 versus 2008. Prescriptions filled increased as a result of the strategic plan developed in late 2009 as the drugstore categories were being impacted by a severe cough/cold and flu season. The Company expanded its pharmacy-based immunization program to most stores and currently has 180 pharmacists who are certified by their respective Board of Pharmacy to administer vaccines. The Company also leveraged increased customer counts to drive trial usage and loyalty through existing marketing channels. Category expansion and better private brand penetration in key health care over-the-counter categories were successful in mitigating mass and chain drug store intrusion.

Produce sales increased 3.3% in 2010 compared to 2009 and 2.9% in 2009 compared to 2008. The 2010 results were attributable to an increase in produce units sold and product inflation. Dairy sales increased 3.2% in 2010 when compared with 2009, when the Company experienced significant price deflation in key dairy categories, notably eggs and milk. In 2009, dairy sales decreased 4.9% when compared with 2008. According to the USDA's Economic Research Service, the dairy deflationary pressures that affected sales in 2009 eased significantly in 2010.

Management remains confident in its ability to generate sales growth in a highly competitive environment, but also understands some competitors have greater financial resources and could use these resources to take measures which could adversely affect the Company's competitive position.

Page 11 of 40 (Form 10-K)

WEIS MARKETS, INC.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations: (continued)

Results of Operations (continued)

Cost of Sales and Gross Profit

Cost of sales consists of direct product costs (net of discounts and allowances), warehouse costs, transportation costs and manufacturing facility costs.

According to the latest U.S. Bureau of Labor Statistics’ report, the annual Seasonally Adjusted Food-at-Home Consumer Price Index increased 0.3% in 2010, 0.4% in 2009 and 6.4% in 2008. The annual Seasonally Adjusted Producer Price Index for Finished Consumer Foods increased 3.9% for 2010 compared to a decrease of 1.4% for 2009 and an increase of 6.8% in 2008. Despite the fluctuation of retail and wholesale prices, the Company maintained a gross profit rate of 27.2% in 2010.

Because of modest wholesale price inflation during the year, the Company experienced a LIFO charge of $2.9 million for 2010, compared to a gain of $826,000 in 2009 and a charge of $11.8 million in 2008. Wholesale prices peaked at the end of 2008 causing the large variance between 2009 and 2008. The Company is expecting moderate wholesale price inflation to occur in 2011.

The Company's profitability is particularly impacted by the cost of oil. Fluctuating fuel prices affect the delivered cost of product and the cost of other petroleum-based supplies such as plastic bags. Cost of sales was impacted by a 15.5% increase in the cost of diesel fuel used by the Company to deliver goods from its distribution center to its stores as compared to 2009. In 2009, the Company implemented routing software to improve loading patterns and reduce delivery mileage. The routing software was activated to 100% of the outbound shipments in 2010, and as a result, management realized a 1.8% reduction in fuel usage in 2010 compared to 2009. According to the U.S. Department of Energy, the average U.S. diesel fuel price increased $0.49 per gallon to $3.24 per gallon as of December 2010, compared to $2.75 per gallon as of December 2009. Based upon the U.S. Department of Energy’s current estimate, the Company is expecting diesel fuel prices to continue to increase in 2011.

Although the Company experienced product cost inflation for 2010, deflation in 2009 and inflation for 2008, management does not feel it can accurately measure the full impact of inflation and deflation on retail pricing due to changes in the types of merchandise sold between periods, shifts in customer buying patterns and the fluctuation of competitive factors.

Operating, General and Administrative Expenses

Business operating costs including expenses generated from administration and purchasing functions, are recorded in "Operating, general and administrative expenses." Business operating costs include items such as wages, benefits, utilities, repairs and maintenance, advertising costs and credits, rent, insurance, equipment depreciation, leasehold amortization and costs for outside provided services.

Employee-related costs such as wages, employer paid taxes, health care benefits and retirement plans, comprise over 60% of the total operating, general and administrative expenses. Employee-related costs increased 3.9% in 2010 compared to 2009 and 5.3% in 2009 compared to 2008, of which 3.6% and 2.1% of these increases, respectively, are related to the Giant Markets acquisition. As a percent of sales, employee-related costs decreased 0.1% in 2010 versus 2009.

The Company expensed $798,000 and $1.3 million in 2010 and 2009, respectively, due to adjustments made to the non-qualified supplemental executive retirement plan (see Note 6 Retirement Plans of Notes to the Consolidated Financial Statements) resulting from a rise in the equity market. In 2008, operating, general and administrative expenses were reduced by $2.0 million in adjustments made to the non-qualified supplemental executive retirement plan due to a decline in the equity market of which $2.7 million in adjustments occurred in the fourth quarter of 2008. In 2009, additional profit-sharing plan contributions of $1.1 million (see Note 6 Retirement Plans of Notes to the Consolidated Financial Statements) were made to compensate participants for the decline in the equity markets.

Page 12 of 40 (Form 10-K)

WEIS MARKETS, INC.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations: (continued)

Results of Operations (continued)

The Company’s self-insured health care benefits increased 5.9% in 2010 compared to 2009 and increased 4.6% in 2009 compared to 2008, of which 4.2% and 1.8% of these increases, respectively, are related to the Giant Markets acquisition. Management expects the trend of increasing health care benefit costs to continue. The Company is concerned about the potential impact that The Patient Protection and Affordable Care Act will have on its future operating expenses.

The Company’s interchange fees for accepting credit and debit cards increased 15.4% to $17.8 million in 2010 compared to 2009 and 7.9% to $15.4 million in 2009 compared to 2008, of which 4.4% and 2.6% of these increases, respectively, are related to the Giant Markets acquisition. The Company is uncertain about the implementation and impact of the Durbin Amendment to the Dodd-Frank Wall Street Reform and Consumer Protection Act, which authorizes the Federal Reserve to set rules to implement caps on debit card interchange fees.

Due to above average snowfall in the beginning of the year in the Mid-Atlantic states, the Company's operating region, snow removal costs increased $977,000 in 2010 compared to 2009.

Retail store profitability is sensitive to volatility in utility costs due to the amount of electricity and gas required to operate the Company's stores and facilities. The Company is responding to this volatility in operating costs by employing technologies, procurement strategies and associate energy awareness programs to manage and reduce consumption. In 2010, Pennsylvania deregulated electricity pricing and it was anticipated the average electric utility consumer would see a 30% increase in their utility bill. Through the associate energy awareness program, technology improvements and procurement, the

Company's electric utility expense in its Pennsylvania stores increased by only 13.7% in 2010 compared to 2009. Through the Company’s procurement strategy, with the added benefit of a declining market, electricity costs are expected to decline in 2011 versus 2010.

The Company may not be able to recover these rising expenses through increased prices charged to its customers. Any delay in the Company's response to unforeseen cost increases or competitive pressures that prevent its ability to raise prices may cause earnings to suffer. Management does not foresee a change in these trends in the near future.

Earnings were further impacted in 2010 by a $562,000 adjustment to liabilities for future expenses on closed SuperPetz stores. The Company incurred a pre-tax impairment loss of $1.7 million for leasehold improvements on one closed store facility in 2008.

The Company’s income benefited from the sale of cardboard salvage which increased $1.9 million in 2010 as market prices significantly increased, compared to 2009.

The Company recognized gift card breakage income of $103,000, $665,000 and $1.0 million as a credit against operating, general and administrative expenses during fiscal 2010, 2009 and 2008, respectively (See Note 1(r) Revenue Recognition of Notes to the Consolidated Financial Statements). Fiscal 2008 was the first year in which the Company recognized gift card breakage income, and therefore, the amount recognized includes the gift card breakage income related to gift cards sold since the inception of the gift card program in late 2002. The resolution of certain legal matters associated with gift card liabilities prompted management to initiate a change in accounting estimate.

Investment Income

The Company’s investments consist of short-term money market funds and marketable securities consisting of municipal bonds and equity securities. The Company classifies all of its marketable securities as available-for-sale. Due to declining yields on short-term money market funds, the Company experienced a $210,000 decrease in interest income in 2010 compared to 2009 and a $1.3 million decrease in interest income in 2009 compared to 2008. At the end of 2010, the Company began to invest more heavily in municipal bonds and expects higher returns in 2011.

Page 13 of 40 (Form 10-K)

WEIS MARKETS, INC.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations: (continued)

Results of Operations (continued)

Provision for Income Taxes

The effective income tax rate differs from the federal statutory rate of 35% primarily due to the effect of state taxes, net of permanent differences relating to tax-free income.

Income is earned by selling merchandise at price levels that produce revenues in excess of cost of merchandise sold and operating and administrative expenses. Although the Company may experience short term fluctuations in its earnings due to unforeseen short-term operating cost increases, it historically has been able to increase revenues and maintain stable earnings from year to year.

Liquidity and Capital Resources

Net cash provided by operating activities was $146.7 million in 2010 compared to $118.9 million in 2009 and $115.3 million in 2008. Working capital increased 34.8%, 9.0% and 1.0% in 2010, 2009 and 2008, respectively.

Net cash used in investing activities was $73.5 million in 2010 compared to $78.0 million in 2009, and $65.8 million in 2008. These funds were used primarily for property and equipment purchases in the three fiscal years presented. Property and equipment purchases, including the 2009 acquisition of a business, totaled $69.9 million in 2010 compared to $81.1 million in 2009 and $67.0 million in 2008. In 2009, the Company acquired eleven Giant Markets stores for $35.8 million. As a percentage of sales, capital expenditures were 2.7%, 2.1% and 2.8% in 2010, 2009 and 2008, respectively.

The Company’s capital expansion program includes the construction of new superstores, the expansion and remodeling of existing units, the acquisition of sites for future expansion, new technology purchases and the continued upgrade of the Company’s processing and distribution facilities. Management estimates that its current development plans will require an investment of approximately $110.0 million in 2011.

Net cash used in financing activities during 2010 was $31.2 million compared to $33.2 million in 2009 and $31.3 million in 2008. The majority of the financing activities consisted of dividend payments to shareholders. At December 25, 2010, the Company had outstanding letters of credit of $15.0 million. The letters of credit are maintained primarily to support performance, payment, deposit or surety obligations of the Company. The Company does not anticipate drawing on any of them.

Total cash dividend payments on common stock, on a per share basis, amounted to $1.16 per year in 2010, 2009 and 2008. Treasury stock purchases totaled $2,000 in 2010, compared to $2.0 million in 2009 and $181,000 in 2008. The Board of Directors’ 2004 resolution authorizing the repurchase of up to one million shares of the Company’s common stock has a remaining balance of 752,468 shares.

The Company has no other commitment of capital resources as of December 25, 2010, other than the lease commitments on its store facilities under operating leases that expire at various dates through 2028. The Company anticipates funding its working capital requirements and its $110.0 million capital expansion program through cash and investment reserves and future internally generated cash flows from operations. However, management is currently considering maintaining a credit facility to fund potential acquisitions.

The Company’s earnings and cash flows are subject to fluctuations due to changes in interest rates as they relate to available-for-sale securities and any future long-term debt borrowings. The Company’s marketable securities portfolio currently consists of municipal bonds, equity securities and other short-term investments. Other short-term investments are classified as cash equivalents on the Consolidated Balance Sheets.

Page 14 of 40 (Form 10-K)

WEIS MARKETS, INC.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations: (continued)

Liquidity and Capital Resources (continued)

The Company’s unrealized holding gains net of deferred taxes in 2010 were $405,000 (see Note 9 Comprehensive Income of Notes to the Consolidated Financial Statements). In 2009, the Company had unrealized holding gains net of deferred taxes of $68,000. The Company experienced a $2.8 million unrealized holding loss net of deferred taxes in 2008, primarily due to a decline in the value of the Company’s equity holdings. As of December 25, 2010, the Company had $8.4 million in gross unrealized holding gains in marketable securities (see Note 2 Marketable Securities of Notes to the Consolidated Financial Statements).

By their nature, these financial instruments inherently expose the holders to market risk. The extent of the Company’s interest rate and other market risk is not quantifiable or predictable with precision due to the variability of future interest rates and other changes in market conditions. However, the Company believes that its exposure in this area is not material.

Under its current policies, the Company invests primarily in high-grade marketable securities and does not use interest rate derivative instruments to manage exposure to interest rate fluctuations. Currently, the Company’s investment strategy of obtaining marketable securities with maturity dates between one and ten years helps to minimize market risk and to maintain a balance between risk and return. The equity securities owned by the Company consist primarily of stock held in large capitalized companies trading on public security exchange markets. The Company’s management continually monitors the risk associated with its marketable securities. A quantitative tabular presentation of risk exposure is located in “Item 7a. Quantitative and Qualitative Disclosures about Market Risk” of this

report.

Contractual Obligations

The following table represents scheduled maturities of the Company’s long-term contractual obligations as of December 25, 2010.

|

Payments due by period

|

||||||||||||||||||||

|

Less than

|

More than

|

|||||||||||||||||||

|

(dollars in thousands)

|

Total

|

1 year

|

1-3 years

|

3-5 years

|

5 years

|

|||||||||||||||

|

Operating leases

|

$ | 220,800 | $ | 28,362 | $ | 55,610 | $ | 49,011 | $ | 87,817 | ||||||||||

|

Total

|

$ | 220,800 | $ | 28,362 | $ | 55,610 | $ | 49,011 | $ | 87,817 | ||||||||||

Off-Balance Sheet Arrangements

The Company is not a party to any off-balance sheet arrangements that have, or are reasonably likely to have, a current or future effect on the Company’s financial condition, results of operations or cash flows.

Critical Accounting Estimates

The Company has chosen accounting policies that it believes are appropriate to accurately and fairly report its operating results and financial position, and the Company applies those accounting policies in a consistent manner. The Significant Accounting Policies are summarized in Note 1 to the Consolidated Financial Statements.

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires that the Company makes estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses. These estimates and assumptions are based on historical and other factors believed to be reasonable under the circumstances. The Company evaluates these estimates and assumptions on an ongoing basis and may retain outside consultants, lawyers and actuaries to assist in its evaluation. The Company believes the following accounting policies are the most critical because they involve the most significant judgments and estimates used in preparation of its consolidated financial statements.

Page 15 of 40 (Form 10-K)

WEIS MARKETS, INC.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations: (continued)

Vendor Allowances

Vendor allowances that relate to the Company's buying and merchandising activities are recorded as a reduction of cost of sales as they are earned, in accordance with its underlying agreement. Off-invoice and bill-back allowances are used to reduce direct product costs upon the receipt of goods. Promotional rebates and credits are accounted for as a reduction in the cost of inventory and recognized when the related inventory is sold. Volume incentive discounts are realized as a reduction of cost of sales at the time it is deemed probable and reasonably estimable that the incentive target will be reached. Long-term contract incentives, which require an exclusive vendor relationship, are allocated over the life of the contract. Promotional allowance funds for specific vendor-sponsored programs are recognized as a

reduction of cost of sales as the program occurs and the funds are earned per the agreement. Cash discounts for prompt payment of invoices are realized in cost of sales as invoices are paid. Warehouse and back-haul allowances provided by suppliers for distributing their product through our distribution system are recorded in cost of sales as the required performance is completed. Warehouse rack and slotting allowances are recorded in cost of sales when new items are initially set up in the Company's distribution system, which is when the related expenses are incurred and performance under the agreement is complete. Swell allowances for damaged goods are realized in cost of sales as provided by the supplier, helping to offset product shrink losses also recorded in cost of sales.

Store Closing Costs

The Company provides for closed store liabilities relating to the estimated post-closing lease liabilities and related other exit costs associated with the store closing commitments. The closed store liabilities are usually paid over the lease terms associated with the closed stores having remaining terms ranging from one to eight years. At December 25, 2010, closed store lease liabilities totaled $1.1 million. The Company estimates the lease liabilities, net of estimated sublease income, using the undiscounted rent payments of closed stores. Other exit costs include estimated real estate taxes, common area maintenance, insurance and utility costs to be incurred after the store closes over the remaining lease term. Store closings are generally completed within one year after the decision to close. Adjustments to

closed store liabilities and other exit costs primarily relate to changes in subtenants and actual exit costs differing from original estimates. Adjustments are made for changes in estimates in the period in which changes become known. Any excess store closing liability remaining upon settlement of the obligation is reversed to income in the period that such settlement is determined. Inventory write-downs, if any, in connection with store closings, are classified in cost of sales. Costs to transfer inventory and equipment from closed stores are expensed as incurred. Store closing liabilities are reviewed quarterly to ensure that any accrued amount that is no longer needed for its originally intended purpose is reversed to income in the proper period.

Self-Insurance

The Company is self-insured for a majority of its workers’ compensation, general liability, vehicle accident and associate medical benefit claims. The self-insurance liability for most of the workers’ compensation claims is determined based on historical data and an estimate of claims incurred but not reported. The other self-insurance liabilities are determined actuarially, based on claims filed and an estimate of claims incurred but not yet reported. The Company is liable for associate health claims up to an annual maximum of $750,000 per member and for workers compensation claims up to $2,000,000 per claim. Property and casualty insurance coverage is maintained with outside carriers at deductible or retention levels ranging from $100,000 to $1,000,000. Significant assumptions used in the development

of the actuarial estimates include reliance on the Company’s historical claims data including average monthly claims and average lag time between incurrence and reporting of the claim.

Page 16 of 40 (Form 10-K)

WEIS MARKETS, INC.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations: (continued)

Forward-Looking Statements

In addition to historical information, this Annual Report may contain forward-looking statements, which are included pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Any forward-looking statements contained herein are subject to certain risks and uncertainties that could cause actual results to differ materially from those projected. For example, risks and uncertainties can arise with changes in: general economic conditions, including their impact on capital expenditures; business conditions in the retail industry; the regulatory environment; rapidly changing technology and competitive factors, including increased competition with regional and national retailers; and price pressures. Readers are cautioned not to place undue reliance on forward-looking

statements, which reflect management's analysis only as of the date hereof. The Company undertakes no obligation to publicly revise or update these forward-looking statements to reflect events or circumstances that arise after the date hereof. Readers should carefully review the risk factors described in other documents the Company files periodically with the Securities and Exchange Commission.

|

(dollars in thousands)

|

Expected Maturity Dates

|

Fair Value

|

||||||||||||||||||||||||||||||

|

December 25, 2010

|

2011

|

2012

|

2013

|

2014

|

2015

|

Thereafter

|

Total

|

Dec. 25, 2010

|

||||||||||||||||||||||||

|

Rate sensitive assets:

|

||||||||||||||||||||||||||||||||

|

Fixed interest rate securities

|

$ | 2,040 | $ | — | $ | 4,045 | $ | 1,000 | $ | 3,000 | $ | 4,200 | $ | 14,285 | $ | 15,635 | ||||||||||||||||

|

Average interest rate

|

4.11 | % | — | 1.68 | % | 1.58 | % | 2.56 | % | 3.19 | % | 2.58 | % | |||||||||||||||||||

Other Relevant Market Risks

The Company’s equity securities at December 25, 2010 had a cost basis of $1,756,000 and a fair value of $10,124,000. The dividend yield realized on these equity investments was 4.72% in 2010. Market risk, as it relates to equities owned by the Company, is discussed within the “Liquidity and Capital Resources” section of “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained within this report.

The Company’s equity securities at December 25, 2010 had a cost basis of $1,756,000 and a fair value of $10,124,000. The dividend yield realized on these equity investments was 4.72% in 2010. Market risk, as it relates to equities owned by the Company, is discussed within the “Liquidity and Capital Resources” section of “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained within this report.

Page 17 of 40 (Form 10-K)

WEIS MARKETS, INC.

Item 8. Financial Statements and Supplementary Data:

WEIS MARKETS, INC.

CONSOLIDATED BALANCE SHEETS

|

(dollars in thousands)

|

||||||||

|

December 25, 2010 and December 26, 2009

|

2010

|

2009

|

||||||

|

Assets

|

||||||||

|

Current:

|

||||||||

|

Cash and cash equivalents

|

$ | 109,140 | $ | 67,065 | ||||

|

Marketable securities

|

25,759 | 18,079 | ||||||

|

Accounts receivable, net

|

53,302 | 52,215 | ||||||

|

Inventories

|

231,021 | 223,015 | ||||||

|

Prepaid expenses

|

6,439 | 6,254 | ||||||

|

Income taxes recoverable

|

2,712 | — | ||||||

|

Total current assets

|

428,373 | 366,628 | ||||||

|

Property and equipment, net

|

525,062 | 510,882 | ||||||

|

Goodwill

|

35,162 | 35,162 | ||||||

|

Intangible and other assets, net

|

3,484 | 3,843 | ||||||

|

Total assets

|

$ | 992,081 | $ | 916,515 | ||||

|

Liabilities

|

||||||||

|

Current:

|

||||||||

|

Accounts payable

|

$ | 134,278 | $ | 130,685 | ||||

|

Accrued expenses

|

28,803 | 30,227 | ||||||

|

Accrued self-insurance

|

19,163 | 21,998 | ||||||

|

Deferred revenue, net

|

6,922 | 6,731 | ||||||

|

Income taxes payable

|

— | 484 | ||||||

|

Deferred income taxes

|

5,818 | 3,344 | ||||||

|

Total current liabilities

|

194,984 | 193,469 | ||||||

|

Postretirement benefit obligations

|

14,622 | 13,850 | ||||||

|

Deferred income taxes

|

54,348 | 18,432 | ||||||

|

Total liabilities

|

263,954 | 225,751 | ||||||

|

Shareholders’ Equity

|

||||||||

|

Common stock, no par value, 100,800,000 shares authorized, 33,047,807 shares issued

|

9,949 | 9,949 | ||||||

|

Retained earnings

|

864,132 | 827,042 | ||||||

|

Accumulated other comprehensive income, net

|

4,903 | 4,628 | ||||||

| 878,984 | 841,619 | |||||||

|

Treasury stock at cost, 6,149,364 and 6,149,315 shares, respectively

|

(150,857 | ) | (150,855 | ) | ||||

|

Total shareholders’ equity

|

728,127 | 690,764 | ||||||

|

Total liabilities and shareholders’ equity

|

$ | 992,081 | $ | 916,515 | ||||

See accompanying notes to consolidated financial statements.

Page 18 of 40 (Form 10-K)

WEIS MARKETS, INC.

CONSOLIDATED STATEMENTS OF INCOME

|

(dollars in thousands, except shares and per share amounts)

|

||||||||||||

|

For the Fiscal Years Ended December 25, 2010,

|

2010

|

2009

|

2008

|

|||||||||

|

December 26, 2009 and December 27, 2008

|

(52 weeks)

|

(52 weeks)

|

(52 weeks)

|

|||||||||

|

Net sales

|

$ | 2,620,378 | $ | 2,516,175 | $ | 2,422,361 | ||||||

|

Cost of sales, including warehousing and distribution expenses

|

1,906,753 | 1,838,003 | 1,795,570 | |||||||||

|

Gross profit on sales

|

713,625 | 678,172 | 626,791 | |||||||||

|

Operating, general and administrative expenses

|

608,309 | 581,821 | 559,210 | |||||||||

|

Income from operations

|

105,316 | 96,351 | 67,581 | |||||||||

|

Investment income

|

2,069 | 1,556 | 2,532 | |||||||||

|

Income before provision for income taxes

|

107,385 | 97,907 | 70,113 | |||||||||

|

Provision for income taxes

|

39,094 | 35,107 | 23,118 | |||||||||

|

Net income

|

$ | 68,291 | $ | 62,800 | $ | 46,995 | ||||||

|

Weighted-average shares outstanding, basic and diluted

|

26,898,443 | 26,920,551 | 26,966,647 | |||||||||

|

Cash dividends per share

|

$ | 1.16 | $ | 1.16 | $ | 1.16 | ||||||

|

Basic and diluted earnings per share

|

$ | 2.54 | $ | 2.33 | $ | 1.74 | ||||||

See accompanying notes to consolidated financial statements.

Page 19 of 40 (Form 10-K)

WEIS MARKETS, INC.

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

|

Accumulated

|

||||||||||||||||||||||||||||

|

(dollars in thousands, except shares)

|

Other

|

Total

|

||||||||||||||||||||||||||

|

For the Fiscal Years Ended December 25, 2010,

|

Common Stock

|

Retained

|

Comprehensive

|

Treasury Stock

|

Shareholders’

|

|||||||||||||||||||||||

|

December 26, 2009 and December 27, 2008

|

Shares

|

Amount

|

Earnings

|

Income (Loss)

|

Shares

|

Amount

|

Equity