Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2010

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-15477

MAXWELL TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

95-2390133 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 9244 Balboa Avenue San Diego, California |

92123 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (858) 503-3300

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.10 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if and, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ¨ NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “accelerated filer”, “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer x | Non-accelerated filer ¨ | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ¨ NO x

The aggregate market value of Common Stock held by non-affiliates as of June 30, 2010 based on the closing price of the common stock on the NASDAQ Global Market was $277,132,381.

The number of shares of the registrant’s Common Stock outstanding as of March 2, 2011 was 27,769,689 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Specified portions of the registrant’s definitive Proxy Statement to be issued in conjunction with the registrant’s 2011 Annual Meeting of Stockholders, which is expected to be filed not later than 120 days after the registrant’s fiscal year ended December 31, 2010, are incorporated by reference into Part III of this Annual Report. Except as expressly incorporated by reference, the registrant’s Proxy Statement shall not be deemed to be a part of this Annual Report on Form 10-K.

Table of Contents

MAXWELL TECHNOLOGIES, INC.

INDEX TO ANNUAL REPORT ON FORM 10-K

For the fiscal year ended December 31, 2010

i

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Unless the context otherwise requires, all references to “Maxwell,” the “Company,” “we,” “us,” and “our” refer to Maxwell Technologies, Inc. and its subsidiaries; all references to “Maxwell SA” refer to our Swiss Subsidiary, Maxwell Technologies, SA; and all references to “PurePulse” refer to our non-operating subsidiary, PurePulse Technologies, Inc.

Some of the statements contained in this Annual Report on Form 10-K and incorporated herein by reference discuss our plans and strategies for our business or make other forward-looking statements, within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The words “anticipates,” “believes,” “estimates,” “expects,” “plans,” “intends,” “may,” “could,” “will,” “continue,” “seek,” “should,” “would” and similar expressions are intended to identify these forward-looking statements, but are not the exclusive means of identifying them. These forward-looking statements reflect the current views and beliefs of our management; however, various risks, uncertainties and contingencies could cause our actual results, performance or achievements to differ materially from those expressed in, or implied by, our statements. Such risks, uncertainties and contingencies include, but are not limited to, the following:

| • | risks related to our international operations including, but not limited to, our ability to adequately comply with the changing rules and regulations in countries where our business is conducted, our ability to oversee and control our foreign subsidiaries and their operations, our ability to effectively manage foreign currency exchange rate fluctuations arising from our international operations, and our ability to continue to comply with the U.S. Foreign Corrupt Practices Act as well as the anti-bribery laws of foreign jurisdictions and the terms and conditions of our settlement agreements with the Securities and Exchange Commission and the Department of Justice. |

| • | our ability to remain competitive and stimulate customer demand through successful introduction of new products, and to match our production capacity to customer demand; |

| • | dependence upon the sale of products to a small number of customers and vertical markets, some of which are heavily dependent on government funding or government subsidies which may or may not continue in the future; |

| • | successful acquisition, development and retention of key personnel; |

| • | our ability to effectively manage our reliance upon certain suppliers of key component parts and specialty equipment; |

| • | our ability to manage product quality problems; |

| • | our ability to protect our intellectual property rights and to defend claims against us; |

| • | our ability to effectively identify, enter into, manage and benefit from strategic alliances; |

| • | occurrence of a catastrophic event at any of our facilities; and, |

| • | our ability to obtain sufficient capital to meet our operating or other needs. |

Many of these factors are beyond our control. Additionally, there can be no assurance that we will not incur new or additional unforeseen costs or risks in connection with the ongoing conduct of our business. Accordingly, any forward-looking statements included herein do not purport to be predictions of future events or circumstances and may not be realized.

For a discussion of important risks associated with an investment in our securities, including factors that could cause actual results to differ materially from expectations referred to in the forward-looking statements, see Item 1A. “Risk Factors” of this document. We do not have any obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

1

Table of Contents

| Item 1. | Business |

Introduction

Maxwell was incorporated under the name Maxwell Laboratories, Inc. in 1965. The Company made an initial public offering of common stock in 1983, and changed its name to Maxwell Technologies, Inc. in 1996. Today, we develop, manufacture and market energy storage and power delivery products for transportation, industrial, telecommunications and other applications and microelectronic products for space and satellite applications. Our products are designed and manufactured to perform reliably with minimal maintenance for the life of the applications into which they are integrated. We believe that this “life-of-the-application” reliability gives our products a competitive advantage and enables them to command higher profit margins than commodity products. We focus on the following lines of high-reliability products:

| • | Ultracapacitors: Our primary focus is on ultracapacitors, energy storage devices that are characterized by high power density, long operational life and the ability to charge and discharge very rapidly. Our BOOSTCAP® ultracapacitor cells and multi-cell modules provide energy storage and power delivery solutions for applications in multiple industries, including transportation, automotive, telecommunications, renewable energy and industrial electronics. |

| • | High-Voltage Capacitors: Our CONDIS® high-voltage capacitors are designed and manufactured to perform reliably for decades in all climates. These products include grading and coupling capacitors and capacitive voltage dividers that are used to ensure the safety and reliability of electric utility infrastructure and other applications involving transport, distribution and measurement of high-voltage electrical energy. |

| • | Radiation-Hardened Microelectronic Products: Our radiation-hardened microelectronic products for satellites and spacecraft include single board computers and components, such as high-density memory and power modules. Many of these products incorporate our proprietary RADPAK® packaging and shielding technology and novel architectures that enable them to withstand the effects of environmental radiation and perform reliably in space. |

General Product Line Overview

Ultracapacitors

Ultracapacitors enhance the efficiency and reliability of devices or systems that generate or consume electrical energy. They differ from other energy storage and power delivery products in that they combine rapid charge/discharge capabilities typically associated with film and electrolytic capacitors with energy storage capacity generally associated with batteries. Although batteries store significantly more electrical energy than ultracapacitors, they cannot charge and discharge as rapidly and efficiently as ultracapacitors. Conversely, although electrolytic capacitors can deliver bursts of high power very rapidly, they have extremely limited energy storage capacity, and therefore cannot sustain power delivery for as much as a full second. Also, unlike batteries, which store electrical energy by means of a chemical reaction and experience gradual depletion of their energy storage and power delivery capability over hundreds to a few thousand charge/discharge cycles, ultracapacitors’ energy storage and power delivery mechanisms involve no chemical reaction, so they can be charged and discharged hundreds of thousands to millions of times with minimal performance degradation. This ability to store energy, deliver bursts of power and perform reliably for many years with little or no maintenance makes ultracapacitors an attractive energy-efficiency option for a wide range of energy-consuming and generating devices and systems.

2

Table of Contents

Based on potential volumes, we believe that the transportation industry represents the largest market opportunity for ultracapacitors. Transportation applications include braking energy recuperation and torque- augmentation systems for hybrid-electric buses, trucks and autos and electric rail vehicles, vehicle power network smoothing and stabilization, engine starting systems for internal combustion vehicles and burst power for idle stop-start systems.

Our ultracapacitor products have become a standard and often preferred energy storage solution for transportation applications such as hybrid-electric transit buses and electric rail systems and industrial electronics applications such as wind energy, telecommunications, information technology and automated utility meters in “smart grid” systems.

To reduce manufacturing cost and improve the performance of our ultracapacitor products, we developed a proprietary, solvent-free, process to produce the carbon film electrode material which accounts for a significant portion of the cost of ultracapacitor cells. This process has enabled us to become a low-cost producer of electrode material, and our favorable cost position has enabled us to market electrode material to other ultracapacitor manufacturers. Although we do not intend to license this electrode technology to other ultracapacitor or electrode manufacturers, we have licensed our proprietary cell architecture to manufacturers in China, Taiwan and Korea to expand and accelerate acceptance of ultracapacitor products in large and rapidly growing global markets.

High-Voltage Capacitors

High-voltage grading and coupling capacitors and capacitive voltage dividers are used mainly in the electric utility industry. Grading and coupling capacitors are key components of circuit breakers that prevent high-voltage arcing that can damage switches, step-down transformers and other equipment that transmits or distributes high-voltage electrical energy in electric utility infrastructure and high voltage laboratories. Capacitive voltage dividers measure voltage and power levels in overhead transmission lines. The market for these products consists of expansion, upgrading and maintenance of existing infrastructure and new infrastructure installations in developing countries. Such installations are capital-intensive and frequently are subject to regulation, availability of government funding and general economic conditions. For example, while North America has a large installed base of electric utility infrastructure, and has experienced power interruptions and supply problems, utility deregulation, government budget deficits, and other factors have limited recent capital spending in what historically has been a very large market for utility infrastructure components. We experienced a decline in sales of our high voltage products in 2010, which may correlate to global economic conditions, including limited credit availability to finance utility grid projects. However, we believe that credit availability and general global economic conditions have begun to improve and that our high voltage product sales may recover to a growth pattern in future years as projects to increase the availability of electrical energy in developing countries and infrastructure modernization and renovation in developed countries drive increased demand for our high-voltage products.

Radiation-Hardened Microelectronics

Radiation-hardened microelectronic products are used almost exclusively in space and satellite applications. Because satellites and spacecraft are extremely expensive to manufacture and launch, and space missions typically span years or even decades, and because it is impractical or impossible to repair or replace malfunctioning parts, the industry demands electronic components that are virtually failure-free. Because satellites and spacecraft routinely encounter ionizing radiation from solar flares and other natural sources, onboard microelectronic components must be able to withstand such radiation and continue to perform reliably. For that reason, suppliers of components for space applications historically used only special radiation-hardened silicon in the manufacture of such components. However, since the space market is relatively small and the process of producing “rad-hard” silicon is very expensive, only a few government-funded wafer fabrication facilities are capable of producing such material. In addition, because it takes several years to produce a rad-hard version of a new semiconductor, components using rad-hard silicon typically are several generations behind their current commercial counterparts in terms of density, processing power and functionality.

3

Table of Contents

To address the performance gap between rad-hard and commercial silicon and provide components with both increased functionality and significantly greater processing power, Maxwell and a few other specialty components suppliers have developed shielding, packaging, and other radiation mitigation techniques that allow sensitive commercial semiconductors to withstand space radiation effects and perform as reliably as components incorporating rad-hard semiconductors. Although this market is limited in size, the value proposition for high-performance, radiation-tolerant, components enables us to generate profit margins much higher than those for commodity electronic components.

Business Strategy

Our primary objective is to significantly increase the company’s revenue and profit margins by creating and satisfying demand for ultracapacitor-based energy storage and power delivery solutions. To accomplish this, we are focusing on:

Establishing and expanding market opportunities for ultracapacitors by:

| • | Collaborating with key existing and prospective customers in development of ultracapacitor-based solutions for strategic applications; |

| • | Demonstrating the efficiency, durability and safety of our ultracapacitor products through extensive internal and third party testing; |

| • | Integrating mathematical models for ultracapacitors into simulation software used by system designers; |

| • | Participating in a broad array of working groups, consortia and industry standards committees to disseminate knowledge of, and promote the use of, ultracapacitors; and |

| • | Manufacturing products that are environmentally compatible. |

Becoming a preferred ultracapacitor supplier by:

| • | Being a low-cost producer and demonstrating ultracapacitors’ value proposition; |

| • | Designing and manufacturing products with “life-of-the-application” durability; |

| • | Building a robust supply chain through global sourcing; |

| • | Achieving superior performance and manufacturing quality while reducing product cost; |

| • | Developing and deploying enabling technologies and systems, including cell-to-cell and module-to-module balancing and integrated charging systems, among others; |

| • | Marketing high-performance, low-cost electrode material to other manufacturers; and |

| • | Establishing and maintaining broad and deep protections of key intellectual property. |

We also seek to expand market opportunities and revenue for our high-voltage capacitors and radiation-hardened microelectronic products. While these products have highly specialized applications, we are a technology leader in the markets they serve, and thus are able to sell our products at attractive profit margins. To maintain and expand this competitive position we are leveraging our technological expertise to develop new products that not only meet the demands of our current markets, but also address additional applications. For example, our microelectronics group introduced an advanced single-board computer (SBC) for the space and satellite market, addressing an application that we did not previously serve. In 2005, Northrop Grumman Space Technologies, prime contractor for the National Polar-orbiting Operational Environmental Satellite System, the U.S. government’s next generation weather satellite constellation, selected our SCS750 SBC for spacecraft control and data management. In October 2007, Astrium, a subsidiary of EADS, selected the SCS750 to process images gathered by a satellite Astrium has contracted to produce for the European Space Agency’s “Gaia” astronomy mission.

4

Table of Contents

Products and Applications

Our products incorporate our know-how and proprietary energy storage and power delivery and microelectronics technologies at both the component and system levels for specialized, high-value applications that demand “life-of-the-application” reliability.

Ultracapacitors

Ultracapacitors, also known as electrochemical double-layer capacitors (EDLC) or supercapacitors, store energy electrostatically by polarizing an organic salt solution within a sealed package. Although ultracapacitors are electrochemical devices, no chemical reaction is involved in their energy storage mechanism. Their electrostatic energy storage mechanism is fully reversible, allowing ultracapacitors to be rapidly charged and discharged hundreds of thousands to millions of times with minimal performance degradation, even in the most demanding heavy charge/discharge applications.

Compared with electrolytic capacitors, which have very low energy storage capacity and discharge power too rapidly to be suitable for many power delivery applications, ultracapacitors have much greater energy storage capacity and can deliver energy over time periods ranging from fractions of a second to several minutes.

Compared with batteries, which require minutes or hours to fully charge or discharge, ultracapacitors discharge and recharge in as little as fractions of a second. Although ultracapacitors store only about five to ten percent as much electrical energy as a battery of comparable size, they can deliver or absorb electric energy up to 100 times more rapidly than batteries. Because they operate reliably through hundreds of thousands to millions of deep discharge cycles, compared with only hundreds to a few thousand equivalent cycles for batteries, ultracapacitors have significantly higher lifetime energy throughput, which equates to significantly lower cost on a life cycle basis.

We link our ultracapacitor cells together in multi-cell modules to satisfy energy storage and power delivery requirements of varying voltages. Both individual cells and multi-cell products can be charged from any primary energy source, such as a battery, generator, fuel cell, solar panel, wind turbine or electrical outlet. Virtually any device or system whose intermittent peak power demands are greater than its average continuous power requirement is a candidate for an ultracapacitor-based energy storage and power delivery solution.

Our ultracapacitor products have significant advantages over batteries, including:

| • | the ability to deliver up to 100 times more instantaneous power; |

| • | significantly lower weight per unit of electrical energy stored; |

| • | the ability to discharge deeper and recharge faster and more efficiently, minimizing energy loss; |

| • | the ability to operate reliably and continuously in extreme temperatures (-40 degrees C to +65 degrees C); |

| • | minimal to no maintenance requirements; |

| • | “life of the application” durability; and |

| • | minimal environmental issues associated with disposal because they contain no heavy metals. |

With no moving parts and no chemical reactions involved in their energy storage mechanism, ultracapacitors provide a simple, highly reliable, “solid state-like” solution to buffer short-term mismatches between power available and power required. Additionally, ultracapacitors offer the advantage of storing energy in the same form in which it is used, as electricity.

5

Table of Contents

Emerging applications, including increasing use of electric power in vehicles, wireless communication systems and growing demand for highly reliable, maintenance-free, back-up power for telecommunication information technology and industrial installations are creating significant opportunities for more efficient and reliable energy storage and power delivery products. In many applications, power demand varies widely from moment to moment, and peak power demand typically is much greater than the average power requirement. For example, automobiles require 10 times more power to accelerate than to maintain a constant speed, and forklifts require more power to lift a heavy pallet of material than to move from place to place within a warehouse.

Engineers historically have addressed transient peak power requirements by over-sizing the engine, battery or other primary energy source to satisfy all of a system’s power demands, including demands that occur infrequently and may last only fractions of a second. Sizing a primary power source to meet brief peak power requirements, rather than for average power requirements, is costly and inefficient. When a primary energy source is coupled with ultracapacitors, which can deliver or absorb brief bursts of high power on demand for periods of time ranging from fractions of a second to several minutes, the primary energy source can be smaller, lighter and less costly.

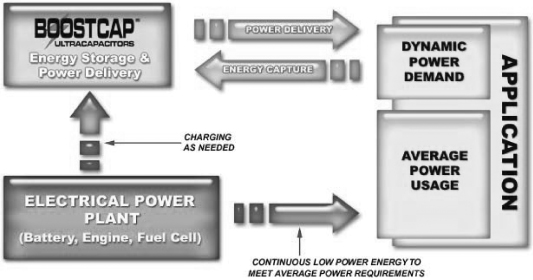

The following diagram depicts the separation of a primary energy storage source from a peak power delivery component to satisfy the requirements of a particular application. Components that enable this separation allow designers to optimize the size, efficiency and cost of the entire electrical power system.

Peak Power Application Model

Although conventional batteries have been the most widely used component for both energy storage and peak power delivery, ultracapacitors, advanced batteries and flywheels now enable system designers to separate and optimize these functions. Based in part on our ultracapacitor products’ declining cost, high performance and “life-of-the-application” durability, they are becoming a preferred solution for many energy storage and power delivery applications.

We offer our BOOSTCAP® ultracapacitors cells in cylindrical and prismatic form factors, ranging in capacitance from 5 to 3,000 farads. Applications such as hybrid-electric bus, truck and auto drive trains, electric rail systems and UPS systems require integrated modules consisting of up to hundreds of ultracapacitor cells. To facilitate adoption of ultracapacitors for these larger systems, we have developed integration technologies,

6

Table of Contents

including proprietary electrical balancing and thermal management systems and interconnect technologies. We have applied for patents for certain of these technologies. We offer a broad range of standard multi-cell modules to provide fully integrated solutions for applications requiring up to 1,500 volts of power. Our current standard multi-cell products each incorporate from six to 48 of our large cells to provide “plug and play” solutions for applications requiring from 16 to 125 volts. In addition, our multi-cell modules are designed to be linked together for higher voltage applications.

High-Voltage Capacitors

Electric utility infrastructure includes switches, circuit breakers, step-down transformers and measurement instruments that transmit, distribute and measure high-voltage electrical energy. High-voltage capacitors are used to protect these systems from high-voltage arcing. With operational lifetimes measured in decades, these applications require high reliability and durability.

Through our acquisition in 2002 of Montena Components Ltd., now known as Maxwell Technologies SA, and its CONDIS® line of high-voltage capacitor products, Maxwell has more than 20 years of experience in this industry, and is the world’s largest producer of such products for use in utility infrastructure. Engineers with specific expertise in high-voltage systems develop, design and test our high-voltage capacitor products in our development and production facility in Rossens, Switzerland. Our high-voltage capacitors are produced through a proprietary assembly and automated winding process to ensure consistent quality and reliability. We have upgraded and expanded our high-voltage capacitor production facility over the past five years to double its output capacity and significantly shorten order-to-delivery intervals.

We sell our high-voltage capacitor products to large systems integrators, which install and service power plants and electrical utility infrastructure worldwide.

Radiation-Hardened Microelectronic Products

Manufacturers of satellites and other spacecraft require microelectronic components and sub-systems that meet specific functional requirements and can withstand exposure to gamma rays, hot electrons and protons and other environmental radiation encountered in space. In the past, microelectronic components and systems for such special applications used only specially fabricated radiation-hardened silicon. However, the process of designing and producing rad-hard silicon is lengthy and expensive, and there are only a few specialty semiconductor wafer fabricators, so supplies of rad-hard silicon are limited. Therefore, demand for space-qualified components made with higher-performance, lower-cost commercial silicon, protected by shielding and other radiation mitigation techniques, has grown. Producing our components and systems incorporating radiation-hardened commercial silicon requires expertise in power electronics, circuit design, silicon selection, radiation shielding and quality assurance testing.

We design, manufacture and market radiation-hardened microelectronic products, including single-board computers and components such as memory and power modules, for the space and satellite markets. Using highly adaptable, proprietary, packaging and shielding technology and other radiation mitigation techniques, we design and manufacture products that allow satellite and spacecraft manufacturers to use powerful, low cost, commercial semiconductors that are protected with the level of radiation mitigation required for reliable performance in the specific orbit or environment in which they are to be deployed.

Manufacturing

Our internal manufacturing operations are conducted in production facilities located in San Diego, California, and Rossens, Switzerland. We have made substantial capital investments to outfit and expand our internal production facilities and incorporate mechanization and automation techniques and processes. We have trained our manufacturing personnel in advanced operational techniques, added information technology

7

Table of Contents

infrastructure and implemented new business processes and systems to increase our manufacturing capacity and improve efficiency, planning and product quality. All of our ultracapacitor electrode material is produced at our San Diego facility. We are in the process of installing new electrode fabrication equipment that will double current production capacity by the end of 2011. In 2007, we outsourced assembly of our 60mm diameter large cell ultracapacitors, and subsequently, assembly of large cell-based multi-cell modules, to Belton Technology Group (“Belton”), a contract manufacturer based in Shenzhen, China. During the first quarter of 2011, Belton installed a new large cell assembly module that doubled its previous production capacity, and further capacity expansion is scheduled to be completed during the second half of 2011. In 2010 we outsourced assembly of our mid-size “D-cell” ultracapacitor products and D-cell-based multi-cell modules to the Lishen Battery Company, China’s largest producer of lithium-ion batteries, based in Tianjin. With the completion of the above-noted electrode and large cell ultracapacitor capacity expansions, we believe that we will have sufficient capacity to meet near-term demand for all of our product lines.

Ultracapacitors

We currently produce 10-farad prismatic ultracapacitor cells on a production line in our San Diego facility. As noted above, we have outsourced assembly of all other cell types and multi-cell modules to contract manufacturers in Asia. To reduce cost, simplify assembly and facilitate automation, we have redesigned our ultracapacitor products to incorporate lower-cost materials and to reduce both the number of parts in a finished cell and the number of manufacturing process steps required to produce them. We intend to continue outsourcing future additional increments of cell and module assembly capacity to countries with low-cost labor, but plan to continue to produce our proprietary electrode material only in internal production facilities.

We produce electrode material for our BOOSTCAP® products, and for sale to other ultracapacitor manufacturers, such as Yeong-Long Technologies Co., Ltd., (“YEC”) and Shanghai Sanjiu Electric Equipment Company, Ltd., at our San Diego headquarters location. In 2007, we completed installation of an advanced carbon powder processing system as part of a major electrode capacity expansion that more than doubled previous electrode output without additional direct labor, and we are in the process of installing a new generation of electrode fabrication equipment that will enable us to double capacity. This expansion will give us sufficient capacity to support both our current ultracapacitor production requirements and external electrode demand in the near term. As demand increases, additional increments of electrode production capacity can be added within a few months of placing an order with our current equipment vendor. We intend to continue producing this proprietary material internally, and do not contemplate licensing our solvent-free electrode fabrication process to ultracapacitor electrode customers or competing suppliers of such material.

In 2003, we formed an ultracapacitor manufacturing and marketing alliance with YEC, an ultracapacitor manufacturer headquartered in Taichung, Taiwan, with manufacturing and sales operations in mainland China. We entered into this alliance to accelerate commercialization of our proprietary BOOSTCAP® ultracapacitors in China, and to utilize YEC’s production capabilities for assembly of certain Maxwell-branded ultracapacitor products. In 2006, we expanded our relationship with YEC to include supplying ultracapacitor electrode material produced in our San Diego manufacturing facility to YEC for incorporation into its own line of ultracapacitor products, and to assist YEC in establishing worldwide distribution and marketing.

High-Voltage Capacitors

We produce our high-voltage grading and coupling capacitors in our Rossens, Switzerland facility. We believe we are the only high-voltage capacitor producer that manufactures its products with stacking, assembly and automated winding processes. This enables us to produce consistent, high quality and highly reliable products, and gives us sufficient capacity to satisfy anticipated global customer demand. Using advanced demand-based techniques, we upgraded the assembly portion of the process to a “cell-based,” “just-in-time” design in 2004, doubling our production capacity without adding direct labor, and significantly shortening order-to-delivery intervals. This upgrade and subsequent capacity expansion also enabled us to manufacture products for the capacitive voltage divider market, which we did not previously serve.

8

Table of Contents

Radiation-Hardened Microelectronics Products

We produce our radiation-hardened microelectronics products in our San Diego production facility. We have reengineered our production processes for microelectronic products, resulting in substantial reductions in cycle time and a significant increase in yield. This facility maintains the QML-V and QML-Q certifications, issued by the Department of Defense procurement agency.

Our microelectronics production operations include die characterization, packaging and electrical, environmental and life testing. As a result of manufacturing cycle time reductions and operator productivity increases achieved over the past several years, we believe that this facility is capable of significantly increasing its current output with minimal additional direct labor or capital expenditure, and therefore, that we have ample capacity to meet foreseeable demand in the space and satellite markets.

Suppliers

We generally purchase components and materials, such as carbon powder, electronic components, dielectric materials and ceramic insulators from a number of suppliers. For certain products, such as our radiation-hardened microelectronic products and our high-voltage capacitors, we rely on a limited number of suppliers or a single supplier. Although we believe there are alternative sources for some of the components and materials that we currently obtain from a single source, there can be no assurance that we will be able to identify and qualify alternative suppliers in a timely manner. Therefore, in critical component areas, we “bank,” or store, critical high value materials, especially silicon die. We are working to reduce our dependence on sole and limited source suppliers through an extensive global sourcing effort.

Marketing and Sales

We market and sell our products through both direct and indirect sales organizations in North and South America, Europe and Asia for integration by OEM customers into a wide range of end products. Because the introduction of products based on emerging technologies requires customer acceptance of new and unfamiliar technical approaches, and because many OEM customers have rigorous vendor qualification processes, the design-in process and initial sale of our products often takes months or even years.

Our principal marketing strategy is to identify applications for which our products and technology offer a competitive value proposition, to become a preferred vendor on the basis of service and price, and to negotiate supply agreements that enable us to establish long-term relationships with key OEM and integrator customers. As these design-in sales tend to be technical and engineering-intensive, we organize customer-specific teams composed of sales, applications engineering and other technical and operational personnel to work closely with our customers across multiple disciplines to satisfy their requirements for form, fit, function and environmental needs. As time-to-market often is a primary motivation for our customers to use our products, the initial sale and design-in process typically evolves into ongoing account management to ensure on-time delivery, responsive technical support and problem-solving.

We design and conduct discrete marketing programs intended to position and promote each of our product lines. These include trade shows, seminars, advertising, product publicity, distribution of product literature, internet websites and “social media”. We employ marketing communications specialists and outside consultants to develop and implement our marketing programs, design and develop marketing materials, negotiate advertising media purchases, write and place product press releases and manage our marketing websites.

We have an alliance with YEC to assemble and market small cell BOOSTCAP® ultracapacitor products. In addition, we sell electrode material to YEC, both for Maxwell-branded products and for incorporation into YEC’s own ultracapacitor products, and to Shanghai Sanjiu Electric Equipment Company, which has licensed our large cell architecture and has introduced its own brand of ultracapacitor products in China.

9

Table of Contents

Competition

Each of our product lines has competitors, some of whom have longer operating histories, significantly greater financial, technical, marketing and other resources, greater name recognition and larger installed customer bases than we have. In some of the target markets for our emerging technologies, we face competition both from products utilizing well-established, existing technologies and other novel or emerging technologies.

Ultracapacitors

Our ultracapacitor products have two types of competitors: other ultracapacitor suppliers and purveyors of energy storage and power delivery solutions based on batteries or other technologies. Although a number of companies are developing ultracapacitor products and technology, our principal competitors in the supply of ultracapacitor or supercapacitor products are Panasonic, a division of Matsushita Electric Industrial Co., Ltd., NessCap Co., Ltd., LS Mtron, a unit of LS Cable, and Groupe Bollore. In the supply of ultracapacitor electrode material to other ultracapacitor manufacturers, our primary competitor is W.L. Gore & Associates, Inc. The key competitive factors in the ultracapacitor industry are price, performance (energy stored and power delivered per unit volume), durability and reliability, operational lifetime and overall breadth of product offerings. We believe that our ultracapacitor products and electrode material compete favorably with respect to all of these competitive factors.

Ultracapacitors also compete with products based on other technologies, including advanced batteries in power quality and peak power applications, and flywheels, thermal storage and batteries in back-up energy storage applications. We believe that ultracapacitors’ durability, long life, performance and value give them a competitive advantage over these alternative choices in many applications. In addition, integration of ultracapacitors with some of these competing products may provide optimized solutions that neither product can provide by itself. For example, a combined solution incorporating ultracapacitors with batteries for engine starting in diesel transit buses was designed by a customer and went into production in 2008.

High-Voltage Capacitors

Maxwell, through its acquisition in 2002 of Montena Components Ltd., now known as Maxwell Technologies SA, and its CONDIS® line of high-voltage capacitor products, is the world’s largest producer of high-voltage capacitors for use in electric utility infrastructure. Our principal competitors in the high-voltage capacitor markets are in-house production groups of certain of our customers and other independent manufacturers, such as the Coil Product Division of Trench Limited in Canada and Europe and Hochspannungsgeräte Porz GmbH in Germany. We believe that we compete favorably, both as a consistent supplier of highly reliable high-voltage capacitors, and in terms of our expertise in high-voltage systems design. Over the last ten years, our largest customer has transitioned from producing its grading and coupling capacitors internally to outsourcing substantially all of its requirements to us.

Radiation-Hardened Microelectronic Products

Our radiation-hardened single-board computers and components compete with the products of traditional radiation-hardened integrated circuit suppliers such as Honeywell Corporation, Lockheed Martin Corporation and BAE Systems. We also compete with commercial integrated circuit suppliers with product lines that have inherent radiation tolerance characteristics, such as National Semiconductor Corporation, Analog Devices Inc. and Temic Instruments B.V. in Europe. Our proprietary radiation-hardened technologies enable us to provide flexible, high function, cost-competitive, radiation-hardened products based on the most advanced commercial electronic circuits and processors. In addition, we compete with component product offerings from high reliability packaging houses such as Austin Semiconductor, Inc., Microsemi Corporation and Teledyne Microelectronics, a unit of Teledyne Technologies, Inc.

10

Table of Contents

Research and Development

We maintain active research and development programs to improve existing products and develop new products. For the year ended December 31, 2010, our research and development expenditures totaled approximately $17.7 million, compared with $16.0 million and $14.8 million in the years ended December 31, 2009 and December 31, 2008, respectively. In general, we focus our research and product development activities on:

| • | designing and producing products that perform reliably for the life of the end products or systems into which they are integrated; |

| • | making our products less expensive to produce so as to improve our profit margins and to enable us to reduce prices so that our products can penetrate new, price-enabled applications; |

| • | designing our products to have superior technical performance; |

| • | designing our products to be compact and light; and |

| • | designing new products that provide novel solutions to expand our market opportunities. |

Most of our current research, development and engineering activities are focused on material science, including activated carbon, electrolyte, electrically conducting and dielectric materials, ceramics and radiation-tolerant silicon and ceramic composites to reduce cost and improve performance, reliability and ease of manufacture. Additional efforts are focused on product design and manufacturing engineering and manufacturing processes for high-volume manufacturing.

Ultracapacitors

The principal focus of our ultracapacitor development activities is to increase power and energy density, extend operational life and reduce manufacturing cost. Our ultracapacitor designs focus on low-cost, high-capacity cells in standard sizes ranging from 5 to 3,000-farads, and corresponding multi-cell modules based on those form factors.

High-voltage capacitors

The principal focus of our high-voltage capacitor development efforts is to enhance performance and reliability while reducing the size, weight and manufacturing cost of our products. We also are directing our design efforts to develop high-voltage capacitors for additional applications.

Microelectronic products

The principal focus of our microelectronics product development activities is on circuit design, shielding and other radiation-hardened techniques that allow the use of powerful commercial silicon components in space and satellite applications that require ultra high reliability. We also focus on creating system solutions that overcome the basic failure mechanisms of individual components through architectural approaches, including redundancy, mitigation and correction. This involves expertise in system architecture, including algorithm and microcode development, circuit design and the physics of radiation effects on silicon electronic components.

Intellectual Property

We place a strong emphasis on inventing, protecting and exploiting proprietary technologies, processes and designs which bring intrinsic value and uniqueness to our product portfolio. In an effort to assist in protecting this added value and uniqueness, we place a high priority on obtaining patents to provide the broadest and strongest possible protection for those products and related technologies. Our future success will depend in part on our ability to protect our existing patents, secure additional patent protection in a manner that strengthens our

11

Table of Contents

overall patent portfolio and develop new technologies, processes and designs not currently claimed by the patents of third parties. As of December 31, 2010, we held 95 issued U.S. patents and 42 pending U.S. patent applications which relate to our core technologies, processes and designs. Of these issued patents, 66 relate to our ultracapacitor products and technology, five relate to our high voltage capacitor products and technology, and 24 relate to our microelectronics products and technology. Our subsidiary, PurePulse Technologies, Inc. (“PurePulse”), which suspended operations in 2002, holds ten issued U.S. patents. Our issued patents have various expiration dates ranging from 2014 to 2029.

Our pending patent applications and any future patent applications may not be allowed by the specific patent offices around the world in which we are seeking patents on advanced technologies and products. We routinely seek to protect our new developments and technologies by applying for patents in jurisdictions in which we strive to obtain a market advantage, including, most commonly, the United States and the principal countries of Europe and Asia. At present, with the exception of microcode architectures within our Radiation-hardened microelectronics product line, we do not rely on licenses from any third parties to produce our products.

Our existing patent portfolios and pending patent applications relate primarily to:

Ultracapacitors

| • | compositions of the electrode, including its formulation, design and fabrication techniques; |

| • | physical cell package designs as well as the affiliated processes used in cell assembly; |

| • | cell-to-cell and module-to-module interconnect technologies that minimize equivalent series resistance and enhance the functionality, performance and longevity of ultracapacitor products including system level electronics; and |

| • | module and system designs that facilitate applications of ultracapacitor technology. |

Microelectronics

| • | system architectures that enable commercial silicon products to be used in radiation-intense space environments; |

| • | technologies and designs that improve packaging densities while mitigating the effect of radiation on commercial silicon; |

| • | radiation-mitigation techniques that improve performance while protecting sensitive commercial silicon from the effects of environmental radiation in space; and |

| • | fault-tolerant computer systems with a plurality of processors which avoid deficiencies typically experienced by similar systems due to ionizing radiation. |

High Voltage Capacitors

| • | manufacture of capacitors in a manner which significantly reduces exposure of internal components to impurities, moisture and other undesirable materials in an effort to avoid longer manufacturing times and reduced performance characteristics without these technical advancements. |

Historically, our high-voltage capacitor products have been based on our know-how and trade secrets rather than on patents. We filed our first patent application covering our high-voltage capacitor technology in 2003, and we continue to pursue patent protection in addition to trade secret protection of certain aspects of our products’ design and production.

While our primary strategy for protecting our proprietary technologies, processes and designs is related to obtaining patents, we also apply for trademark registrations which identify the source of the products with the

12

Table of Contents

Company. Additionally, we promote our technologies, processes and designs in association with these registered trademarks to further distinguish our products from those of our competitors. As of December 31, 2010, we have eleven formal trademark registrations within the U.S.

Establishing and protecting proprietary products and technologies is a key element of our corporate strategy. Although we attempt to protect our intellectual property rights through patents, trademarks, copyrights, trade secrets and other measures, there can be no assurance that these steps will be adequate to prevent infringement, misappropriation or other misuse by third parties, or will be adequate under the laws of some foreign countries, which may not protect our intellectual property rights to the same extent as do the laws of the U.S.

We use employee and third party confidentiality and nondisclosure agreements to protect our trade secrets and unpatented know-how. We require each of our employees to enter into a proprietary rights and nondisclosure agreement in which the employee agrees to maintain the confidentiality of all our proprietary information and, subject to certain exceptions, to assign to us all rights in any proprietary information or technology made or contributed by the employee during his or her employment with us. In addition, we regularly enter into nondisclosure agreements with third parties, such as potential product development partners and customers, to protect any information disclosed in the pursuit of securing possible fruitful business endeavors.

Financial Information by Geographic Areas

| Year ending December 31, | ||||||||||||||||||||||||

| 2010 | 2009 | 2008 | ||||||||||||||||||||||

| Amount | Percent | Amount | Percent | Amount | Percent | |||||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||||||||

| Revenues from external customers located in: |

||||||||||||||||||||||||

| China |

$ | 30,835 | 25 | % | $ | 16,905 | 17 | % | $ | 12,123 | 15 | % | ||||||||||||

| Germany |

27,579 | 23 | % | 24,800 | 24 | % | 20,463 | 25 | % | |||||||||||||||

| United States |

22,248 | 18 | % | 25,534 | 25 | % | 23,184 | 29 | % | |||||||||||||||

| All other countries (1) |

41,220 | 34 | % | 34,076 | 34 | % | 24,669 | 31 | % | |||||||||||||||

| Total |

$ | 121,882 | 100 | % | $ | 101,315 | 100 | % | $ | 80,439 | 100 | % | ||||||||||||

| Long-lived assets: |

||||||||||||||||||||||||

| United States |

$ | 10,865 | 52 | % | $ | 7,131 | 40 | % | $ | 6,949 | 38 | % | ||||||||||||

| Switzerland |

5,259 | 25 | % | 7,824 | 44 | % | 9,285 | 51 | % | |||||||||||||||

| China |

4,786 | 23 | % | 2,859 | 16 | % | 1,921 | 11 | % | |||||||||||||||

| Total |

$ | 20,910 | 100 | % | $ | 17,814 | 100 | % | $ | 18,155 | 100 | % | ||||||||||||

| (1) | Revenue from external customers located in countries included in “All other countries” do not individually compromise more than 10% of total revenues for any of the years presented. |

Risks Attendant to Foreign Operations and Dependence

We have substantial operations in Switzerland, and we derive a significant portion of our revenues from sales to customers located outside the U.S. We expect our international sales to continue to represent a significant and increasing amount of our future revenues. As a result, our business will continue to be subject to certain risks, such as foreign government regulations, export controls, changes in tax laws, tax treaties, tariffs and freight rates. Additionally, as a result of our extensive international operations and significant revenue generated outside the U.S., the dollar amount of our current and future revenues, expenses and debt may be materially affected by fluctuations in foreign currency exchange rates. If we are unable to manage these risks effectively, it could impair our ability to achieve our targets for sales and profitability.

13

Table of Contents

Similarly, assets and liabilities of our Swiss subsidiary that are not denominated in its functional currency are subject to effects of currency fluctuations, which may affect our reported earnings.

Having substantial international operations increases the complexity of managing our financial reporting and internal controls and procedures. In addition, to the extent we are unable to respond effectively to political, economic and other conditions in the countries where we operate and do business, our results of operations and financial condition could be materially adversely affected. Moreover, changes in the mix of income from our domestic and foreign operations, expiration of tax holidays and changes in tax laws and regulations could increase our tax expense.

As a result of our international operations, we are subject to the U.S. Foreign Corrupt Practices Act (“FCPA”), which prohibits companies from making improper payments to foreign officials for the purpose of obtaining or keeping business, as well as the anti-bribery laws of other jurisdictions. As previously disclosed in our periodic filings, we conducted an internal review regarding payments made to our former independent sales agent in China with respect to sales of our high voltage capacitor products produced by our Swiss subsidiary. These payments violated the FCPA. In January 2011, we settled charges with the Securities and Exchange Commission (“SEC”) and Department of Justice (“DOJ”) related to this matter. In addition to a monetary settlement, the Company will periodically report to the SEC and DOJ on the Company’s internal compliance program concerning anti-bribery.

Backlog

Backlog for continuing operations for the year ended December 31, 2010 was approximately $21.3 million, compared with $48.3 million as of December 31, 2009. Backlog consists of firm orders for products that will be delivered within 12 months.

Significant Customers

There were no sales to one customer amounting to more than 10% of our total revenue for the year ended December 31, 2010. Sales to one customer amounted to approximately $9.7 million, or 10%, of our total revenue for the year ended December 31, 2009.

Government Regulation

Due to the nature of our operations and the use of hazardous substances in some of our manufacturing and research and development activities, we are subject to stringent federal, state and local laws, rules, regulations and policies governing workplace safety and environmental protection. These include the use, generation, manufacture, storage, air emission, effluent discharge, handling and disposal of certain materials and wastes. In the course of our historical operations, materials or wastes may have spilled or been released from properties owned or leased by us or on or under other locations where these materials and wastes have been taken for disposal. These properties and the materials and wastes spilled, released, or disposed thereon are subject to environmental laws that may impose strict liability, without regard to fault or the legality of the original conduct, for remediation of contamination resulting from such releases. Under such laws and regulations, we could be required to remediate previously spilled, released, or disposed substances or wastes, or to make capital improvements to prevent future contamination. Failure to comply with such laws and regulations also could result in the assessment of substantial administrative, civil and criminal penalties and even the issuance of injunctions restricting or prohibiting our activities. It is also possible that implementation of stricter environmental laws and regulations in the future could result in additional costs or liabilities to us as well as the industry in general. While we believe we are in substantial compliance with existing environmental laws and regulations, we cannot be certain that we will not incur substantial costs in the future.

In addition, certain of our microelectronics products are subject to International Traffic in Arms export regulations when they are sold to customers outside the U.S. We routinely obtain export licenses for such product shipments outside the U.S.

14

Table of Contents

Employees

As of December 31, 2010, we had 368 employees in four countries, as follows: 185 full-time, one part-time and 38 temporary employees in the U.S., 115 full-time, seven part-time and seven temporary employees in Switzerland, 12 full-time employees and one temporary employee in China and 2 full-time employees in Germany. We believe that approximately 30 percent of our employees in Switzerland are members of a labor union. Swiss law prohibits employers from inquiring into the union status of employees. We consider our relations with our employees to be good.

Available Information

We file annual, quarterly and special reports, proxy statements and other information with the Securities and Exchange Commission (“SEC”). Our SEC filings are available free of charge to the public over the Internet at the SEC’s website at http://www.sec.gov. Our SEC filings are also available free of charge on our website at http://www.maxwell.com as soon as reasonably practicable following the time that they are filed with the SEC. You may also read and copy any document we file with the SEC at the SEC’s Public Reference Room at 450 Fifth Street, NW, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The information found on our website is not part of this or any report that we file with the SEC.

Facilities

We have ongoing operations in San Diego, California and Rossens, Switzerland. In San Diego, we occupy a 45,000 square foot facility for research and manufacturing operations under a renewable lease that expires in July 2015. We occupy an 11,864 square foot facility located in San Diego for our corporate offices under a renewable lease expiring in July 2015. We have a 16,500 square foot production annex in San Diego under a lease extension that expires in May 2011. In addition, we have a 36,673 square foot facility in San Diego for our principle research and marketing operations under a renewable lease that expires December 2018. We also lease research, manufacturing and marketing facilities in Rossens, Switzerland, occupying 68,620 square feet, under a renewable lease that expires in December 2019 and we have two additional five year options thereafter. We believe that we have sufficient floor space to support forecasted increases in production volume and, therefore, that our facilities are adequate to meet our needs for the foreseeable future.

15

Table of Contents

| Item 1A. | Risk Factors |

An investment in our common stock involves a high degree of risk. Our business, financial condition and results of operations could be seriously harmed if potentially adverse developments, some of which are described below, materialize and cannot be resolved successfully. In any such case, the market price of our common stock could decline and you may lose all or part of your investment in our common stock.

The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties, including those not presently known to us or that we currently deem immaterial, may also result in decreased revenues, increased expenses or other adverse impacts that could result in a decline in the price of our common stock. You should also refer to the other information set forth in this Annual Report on Form 10-K, including our consolidated financial statements and the related notes.

Our business is subject to unique risks related to its international operations including the risk that we will be unable to adequately comply with the changing rules and regulations in countries where our business is conducted.

We derive a significant portion of our revenue and earnings from international operations. Such operations outside the U.S. are subject to special risks and restrictions, including: fluctuations in currency values and foreign currency exchange rates, import and export requirements and trade policy, anti-corruption laws, tax laws (including U.S. taxes on foreign subsidiaries), foreign exchange controls and cash repatriation restrictions, data privacy requirements, labor laws, and anti-competition regulations, and other potentially detrimental domestic and foreign governmental practices or policies affecting U.S. companies doing business abroad. Compliance with these U.S. and foreign laws and regulations increases the costs of doing business in foreign jurisdictions and these costs may continue to increase in the future as a result of changes in such laws and regulations or in their interpretation. Furthermore, we have implemented policies and procedures designed to ensure compliance with these laws and regulations, but there can be no assurance that our employees, contractors, or agents will not violate such laws and regulations or our policies. Any such violations could individually or in the aggregate materially adversely affect our financial condition or operating results.

Our success could be negatively impacted if we fail to control, oversee and direct foreign subsidiaries and their operations.

We currently own foreign subsidiaries located within Europe and a representative office located in Shanghai where the employees and cultures represent some vast differences from those employees and cultures within the United States. While the cultural values and philosophies of the people located in Europe are generally viewed to be in alignment with that of U.S. persons, there are still some significant differences. For example, the respective European data privacy laws take a harsher position regarding the protection of employee personal data and, consequently, there is less information shared with the U.S. parent corporation regarding employees working for our European subsidiaries. Additionally, the people and the systems our foreign entities use, including, notably, our Swiss subsidiary and the representative office located in Shanghai, utilize a primary language other than English for communications.

Our exposure to fluctuations in foreign currency exchange rates arising from international operations could result in reduced gross margins or even financial losses.

Our primary exposure to movements in foreign currency exchange rates relates to non-U.S. dollar denominated sales in Europe as well as non-U.S. dollar denominated operating expenses incurred throughout the world. Weakening of foreign currencies relative to the U.S. dollar will adversely affect the U.S. dollar value of our foreign currency-denominated sales and earnings, and generally will lead us to raise international pricing, potentially reducing demand for our products. In some circumstances, due to competition or other reasons, we may decide not to raise local prices to the full extent of the strengthening of the U.S. dollar, or at all, which

16

Table of Contents

would adversely affect the U.S. dollar value of our foreign currency denominated sales and earnings. Conversely, a strengthening of foreign currencies, while generally beneficial to our foreign currency-denominated sales and earnings, could cause us to realize a reduction in its overall gross margin. Additionally, strengthening of foreign currencies may also increase our cost of product components denominated in those currencies, thus also adversely affecting earnings.

Our business activities are subject to the U.S. Foreign Corrupt Practices Act (“FCPA”) and other anti-bribery laws, as well as the restrictions agreed to in our respective settlements with the Securities and Exchange Commission (“SEC”) and Department of Justice (“DOJ”). If we fail to comply with the laws and regulations or the terms of either settlement agreement, then we could be subject to civil and/or criminal penalties as well as further expenses related to an additional internal investigation.

Due to our status as a U.S. issuer, we are subject to the FCPA, which prohibits companies from making improper payments to foreign officials for the purpose of obtaining or retaining business. During 2009 and 2010, we conducted an internal review into the nature of certain payments made to an independent third party sales agent in China with respect to sales of our high voltage capacitor products produced by our Swiss subsidiary, Maxwell SA.

According to court documents, Maxwell SA, engaged a Chinese agent to sell products in China, and from at least July 2002 through May 2009, paid more than $2.5 million to this agent to secure contracts with Chinese customers. The agent in turn used Maxwell SA’s money to bribe officials at state-owned entities in connection with sales contracts. In its books and records, the Company mischaracterized the payments as sales-commission expenses.

In January 2011, we reached settlements with the SEC and DOJ with respect to charges asserted by the SEC and DOJ relating to this matter. We settled civil charges with the SEC, agreeing to an injunction against further violations of the FCPA. Under the terms of the settlement with the SEC, we will pay a total of $6.35 million in profit disgorgement and prejudgment interest, in two installments, with $3.175 paid in the first quarter of 2011, and the remaining $3.175 million payable in the first quarter of 2012. Under the terms of the settlement with the DOJ, we will pay a total of $8.0 million in penalties in three installments, with $3.5 million paid in the first quarter of 2011, and $2.25 million payable in the first quarters of 2012 and 2013. As part of the settlement, we entered into a three-year deferred prosecution agreement (“DPA”) with the DOJ. If we remain in compliance with the terms of the DPA, at the conclusion of the term, the charges against us will be dismissed with prejudice. Further, under the terms of the agreements, we will periodically report to the SEC and DOJ on our internal compliance program concerning anti-bribery.

Our failure to comply with any terms or conditions of the respective settlement agreements, including, notably, payment obligations or ongoing compliance obligations, could result in additional criminal and/or civil penalties as well as continued expenses related to additional investigations and defense costs for addressing such a default.

We depend upon component and product manufacturing and logistical services provided by third parties, many of whom are located outside of the U.S.

Substantially all of our components and products are manufactured in whole or in part by a few third-party manufacturers. Many of these manufacturers are located outside of the U.S., and are concentrated in several general locations. We have also outsourced much of our transportation and logistics management. While these arrangements may lower operating costs, they also reduce our direct control over production and distribution. It is uncertain what affect such diminished control will have on the quality or quantity of products delivered, or our flexibility to respond to changing conditions. In addition, we rely on third-party manufacturers to adhere to the terms and conditions of the agreements in place with each party. Although arrangements with such manufacturers may contain provisions for warranty expense reimbursement, we may remain responsible to the customer for

17

Table of Contents

warranty service in the event of product defects. Any unanticipated product defect or warranty liability, whether pursuant to arrangements with contract manufacturers or otherwise, could adversely affect our reputation, financial condition and operating results.

To remain competitive and stimulate customer demand, we must introduce and commercialize new products successfully as well as adequately educate our prospective customers on the products we offer.

Our ability to compete successfully depends heavily on our ability to ensure a continuing and timely introduction of innovative new products and technologies to the marketplace. We believe that we are unique in that we are the technology leader for the technologies we deliver and typically must first educate the customer regarding the implementation of our solution in their systems before the customer is capable of designing in our products. As a result, we must make significant investments in research and development efforts as well as sales and marketing efforts, including applications engineering resources. By contrast, many of our competitors seek to compete primarily through aggressive pricing and very low cost structures. If we are unable to continue to develop and sell innovative new products or if we are unable to effectively educate the prospective customer on the value proposition offered by the implementation of our products, then our ability to maintain a competitive advantage could be negatively affected and our financial condition and operating results could be adversely affected.

The successful management of new product introductions will be necessary for our growth.

Given our position as the technology leader for the products and solutions we offer, there are a considerable number of new product concepts in the pipeline. Our ability to effectively manage and accurately determine which new products to pursue and which new products to abandon will be necessary for us to meet our growth targets. There are a number of reasons why a new product concept may be abandoned, including greater than anticipated development costs, technical difficulties, regulatory obstacles, competition, inability to prove the original concept, lack of demand, and the need to divert focus, from time to time, to other initiatives with perceived opportunities for better returns. Commercial success frequently depends on being the first provider of the technology to the market, and many of our competitors are also making considerable investments in similar new energy storage technology. Consequently, if we are not able to fund our research and development activities appropriately and deliver new products to the markets we serve on a timely basis, our growth and operations will be harmed. Additionally, as the market leader for the technology markets we practice, competitors follow us closely and follow our lead thereby requiring us to move on to the next innovation quickly enough to continue to serve as the market leader for technology.

Competition in the energy storage domain has significantly affected, and will continue to affect, our sales.

Many companies are engaged in or are starting to engage in designing, developing and producing energy storage solutions as a consequence of the push for clean energy solutions, including, most notably, government funding opportunities associated with pursuing such clean energy solutions. Consequently, more companies are pursuing opportunities in the energy storage domain and such new parties are entering the markets in which we currently do business as competitors. The success of these new competitors could render our existing products less competitive, resulting in reduced sales compared to our expectations or past results. For example, significant amounts of U.S. government funds are being invested in development of batteries which exhibit better performance characteristics as well as allow for low cost manufacturing efforts. An increasing number of parties are submitting proposals for and receiving this government funding and, consequently, these new better performing batteries that include power delivery functionality could compete for market share with our existing ultracapacitor products.

18

Table of Contents

Our success depends largely on the acquisition of, as well as continued service and availability of, key personnel.

Much of our future success depends on the continued availability and service of key personnel, including our senior executive management team as well as highly skilled employees in technical, marketing and staff positions. Due to the complexity and immaturity of the technologies involved in the product lines produced and the markets we serve, we may be unable to find the right personnel with the background needed to achieve our goals and objectives. As the market leader for the technologies we develop, there are limited opportunities to hire personnel from competitors or from companies who have worked closely with similar or identical technology. Consequently, we seek to hire individuals who are capable of performing in an environment where they are expected to create with limited resources and references to past experiences. We may struggle to find such gifted personnel who also thrive in a high growth business atmosphere and who are capable of keeping pace with the fast environment encouraged by the technologies we create and the markets we serve. These uniquely talented personnel are in high demand in the technology industry and competition for acquiring such individuals is intense. Some of our scientists and engineers are the key developers of our products and technologies and are recognized as leaders in their area of expertise. Without first attracting the personnel with the appropriate baseline skill sets and then retaining such personnel, we could fail to maintain our technological and competitive advantage.

Our inability to manage rapid growth in personnel, including development and training of such personnel in an immature industry, as well as to map out succession planning, could impede our success.

Our business has grown rapidly. This growth has placed, and any future growth would continue to place, a significant strain on our limited personnel, management and other resources. Also, due to the learning curve associated with the immature products and services provided by us and the anticipated rapid growth of our product demands and revenues, we face risks related to managing personnel in such a growth environment. We may fail to accurately gauge the growth in personnel required at the appropriate time without incurring the additional cost and expense of the additional personnel before they are needed. We will also need to determine how to best add this new talent and transfer information and know-how without sacrificing the ongoing demands of the business. For example, each new hire will need to learn quickly about our products and technology. Since there is limited information available in the public domain, this information will need to be passed from existing personnel to new personnel all while the existing personnel continues to complete their ongoing job duties. Additionally, our ability to grow management talent below the senior executive level will be imperative to achieving our goals. In a smaller organization, the senior executive management team is capable of handling and being involved in several tasks and decision making forums. However, once the Company makes significant progress toward meeting its growth targets, the time constraints will be felt more severely by the senior executive team and some of the tasks they are currently capable of handling on their own will need to be transferred to the management team reporting to them. Accordingly, growing the next level of management and identifying key personnel for succession planning will become critical to our ongoing success.

Our success as a reliable supplier to our customers is highly dependent upon our ability to effectively manage our reliance upon certain suppliers of key component parts and specialty equipment.