Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TNS INC | a11-7511_18k.htm |

Exhibit 99.1

|

|

March 2011 TNS, Inc. |

|

|

The statements contained in this presentation that are not historical facts are forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on current expectations, forecasts and assumptions that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in, or implied by, the forward-looking statements. The Company has attempted, whenever possible, to identify these forward-looking statements using words such as “may,” “will,” “should,” “projects,” “estimates,” “expects,” “plans,” “intends,” “anticipates,” “believes,” and variations of these words and similar expressions. Similarly, statements herein that describe the Company’s business strategy, prospects, opportunities, outlook, objectives, plans, intentions or goals are also forward-looking statements. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors, including: the Company’s reliance upon a small number of customers for a significant portion of its revenue; competitive factors such as pricing pressures; uncertainties related to the updated international tax planning strategy implemented by the Company; the Company’s ability to grow its business domestically and internationally by generating greater transaction volumes, longer than expected sales cycles, customer delays in migration, acquiring new customers or developing new service offerings; fluctuations in the Company’s quarterly results because of the seasonal nature of the business and other factors outside of the Company’s control, including fluctuations in foreign exchange rates and the continuing impact of the current economic conditions; the Company’s ability to identify, execute or effectively integrate acquisitions; increases in the prices charged by telecommunication providers for services used by the Company; the Company’s ability to adapt to changing technology; the Company’s ability to refinance its senior secured credit facility and its ability to borrow funds in amounts sufficient to enable it to service its debt or meet its working capital and capital expenditure requirements; additional costs related to compliance with any Securities and Exchange Commission (SEC) rule changes or other corporate governance issues; and other risk factors described in the Company’s annual report on Form 10-K dated March 16, 2010 as filed with the SEC. In addition, the statements made in the presentation are made as of March 9, 2011. The Company expects that subsequent events or developments will cause its views to change. The Company undertakes no obligation to update any of the forward-looking statements made herein, whether as a result of new information, future events, changes in expectations or otherwise. These forward-looking statements should not be relied upon as representing the Company’s views as of any date subsequent to March 10, 2011. |

|

|

TNS Company Overview |

|

|

4 Connects 1,600+ financial communities worldwide TNS provides secure, mission critical connectivity and gateway services via a global network enabling our customers to exchange data and information and transact worldwide TNS at a Glance Low-latency/Highly secure data network Global PCI-DSS compliant network 3+ billion carrier ENUM queries per day 15+ billion payment transactions per year Serves 1,000+ carriers worldwide Connects over 100,000 ATMs and 3M POS terminals Embedded applications in millions of wireless mobile devices Connects 1,600+ financial institutions worldwide 1B ENUM entries with 75M unique numbers Average daily volume, ** Average annual volume*** *5+ billion SS7 messages **150+ million eCommerce transactions Largest independent telecom LIDB database Services/Support to customers in over 40 countries

|

|

|

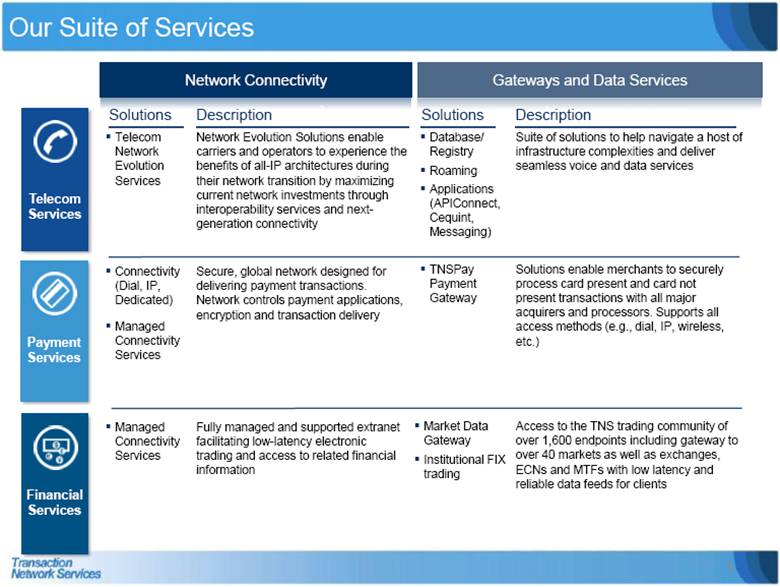

Our Suite of Services Solutions Description Telecom Network Evolution Services Network Evolution Solutions enable carriers and operators to experience the benefits of all-IP architectures during their network transition by maximizing current network investments through interoperability services and next-generation connectivity Connectivity (Dial, IP, Dedicated) Managed Connectivity Services Managed Connectivity Services Database/ Registry Roaming Applications (APIConnect, Cequint, Messaging) TNSPay Payment Gateway Secure, global network designed for delivering payment transactions. Network controls payment applications, encryption and transaction delivery Fully managed and supported extranet facilitating low-latency electronic trading and access to related financial information Suite of solutions to help navigate a host of infrastructure complexities and deliver seamless voice and data services Solutions enable merchants to securely process card present and card not present transactions with all major acquirers and processors. Supports all access methods (e.g., dial, IP, wireless, etc.) Description Solutions Market Data Gateway Institutional FIX trading Access to the TNS trading community of over 1,600 endpoints including gateway to over 40 markets as well as exchanges, ECNs and MTFs with low latency and reliable data feeds for clients Telecom Services Payment Services Financial Services 5 Network Connectivity Gateways and Data Services |

|

|

The Evolution of the TNS Platform 6 TSD FSD Payments AT&T Network Svcs Opennet (Italy) TranXact (Sprint) JPG Acquisition (France) UK-based CP gateway Cequint VeriSign CSG Global CNP gateway 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Optimization Global Connectivity and IP Convergence Solutions and Revenue Enhancement |

|

|

Provision “Anywhere to Anywhere” - TNS can get a client anywhere they need to go Global Footprint with Carrier Neutral Approach - TNS can route around obstacles in its path Global Managed Service - One stop shop for service delivery and monitoring Scalable, Flexible, Secure - TNS can securely handle volume of any size and any type of data Device Interoperability - TNS handles protocol conversion within the network The TNS Global IP-Network 7 |

|

|

Key Market Drivers and Strategy TNS Market Drivers Global demand for SECURE and RELIABLE connectivity continues to grow Networks converge to IP-based infrastructure Interoperability will become a premium due to new devices, networks and protocols Increased global demand for access to data with higher need for security and privacy Growth in eCommerce and other card-not-present payment solutions Increased demand for data roaming capabilities and types of devices needing connectivity Access to authoritative data and relevant information critical for differentiation TNS Growth Strategy Build solutions to help customers manage evolution of their networks Continue growth in global footprint – organically or through acquisitions – in all divisions Become the premier independent and global CNP & CP payment gateway provider Become the leading next-generation registry through our ENUM platform Develop/acquire solutions that will help customers drive revenue through the TNS network Leverage network and service expertise to other verticals 8 |

|

|

Segment Overview & Financial Information |

|

|

Growth Strategy Market Update Financial Performance End Points Accelerating demand in Asia Pacific region Growth in global demand from new assets classes (FX) Higher bandwidth/low latency demands for data needs Broadened demand to trade globally Rapid response and reliability critical factors of choice Unique routing requirements from different market Global FIX-based network carrying equities, fixed income, derivatives, FX and options transactions Speed to connectivity and stability of network Flexibility of customer/market designs Monitoring of customer network 15-years of providing superior support and service Why TNS Matters Financial Services Organic investment in new end points (AP) Competitive displacement (Europe / US) Investment in new solutions – BBS, Monitoring, etc. Continued focus on service resiliency and flexibility Increase geographically diverse disaster recovery design/ locations ($ in millions) $66.3 $63.6 $54.5 $65.2 Foreign currency effect: 2007-08 = $(0.2)M; 2008-09 = $(1.7)M; 2009-10 = $0.4M 10 |

|

|

Growth Strategy Market Update Why TNS Matters Financial Performance Consolidating legacy voice providers New competitive voice / data service offerings - VoIP Data usage / mobile growth globally Network evolution challenges – legacy to IP Mobile applications driving innovation NUVO’s (Network Unaffiliated Virtual Operators) Pressure on operator’s ARPU Differentiated service suite, largest authoritative CNAM Network reliability and cost efficiency TNS Registry is the root for North America SMS Superior support and service Network, Data and Gateway solutions together Statistics (2010) 1st ENUM Registry for migration to IP network – 1B ENUM entries with 75M unique numbers (NUVOs) Largest independent SS7 Intelligent Network delivering more than 5 billion messages daily Largest independent Carrier CNAM database with access to over 400 million records Carrier grade partner delivering 99.999% performance Telecommunication Services Leverage global IP footprint Be the leading telecom hubbing provider (IPX) Develop mobile apps and services utilizing the TNS registry (Cequint / ENUM) Expand wireless data network offerings (Roaming, IPX) Develop new uses for standard carrier data (Verification) 11 |

|

|

Rising cost of compliance with fraud and security (PCI) Economic malaise impacting transaction growth Accelerating card adoption in many markets Shift to broadband from leased lines (tier 2/3 merchants) Multi-national customers with cross border needs Continued search for mobile payment solution Alternative payments emerging at the POS Growth Strategy Market Update Independence and dedication to data transport offerings Front end (device and access) agnostic Network reliability, speed and value-adds Global network for cross border data transport Trusted partner for providing secure and compliant transaction networks Statistics (2010) 3M+ PoS devices 100,000+ ATMs worldwide 30,000 direct merchants and over 110 banks and card schemes around the globe on our CNP platform 150 million annual transactions through TNS eCommerce gateway £850 million/night settled in UK Financial Performance Why TNS Matters Payment Services Access other customer segments within payments (healthcare) Geographic expansion by expanding network connectivity Enhance integrated gateway for mobile, in-store and e- commerce payments Increase acquirer/processer connectivity globally Become premier independent global CNP gateway Foreign currency effect: 2007-08 = $(2.1)M; 2008-09 = $(13.6)M; 2009-10 = $0.8M 12 |

|

|

Financial Snapshot Adjusted Earnings(1) Revenue Breakout EBITDA(1) & EBITDA Margin Capital Structure CAGR 35.4% 13 CAGR 16.5% (1) EBITDA and Adjusted Earnings are non-GAAP measures. EBITDA and Adjusted Earnings exclude certain non-recurring charges and benefits previously disclosed ($ in millions) 12/31/2010 % of Cap. Cash $56.7 Revolving Credit Facility 49.4 Term Loan 358.1 Unamortized discount (3.9) Total Debt $403.6 77.8% Equity 115.3 22.2% Total Capitalization $518.9 100.0% $ millions $ millions |

|

|

2011 Outlook 14 Non-GAAP measure. Please see fourth quarter 2010 press release for reconciliation to comparable GAAP measures. Excluded from expenses in 2010 is $1.3 million, or $0.03 per share, in pre-tax charges related to severance . Excluded from expenses in 2010 and 2011 are $5.4 million, or $0.17 per share and $0.7 million, or $0.02 per share in pre -tax charges, of accelerated depreciation related to the CSG integration, respectively. Excluded from expenses in 2010 is a $0.7 million pre-tax charge, or $0.02 per share, related to Cequint acquisition costs expensed in accordance with the provisions of FASB ASC 805, Business Combinations $ in millions, except per share amounts |

|

|

2010-11 Adjusted Earnings Per Share Bridge 15 Proprietary & Confidential Midpoints of outlook ranges |

|

|

Intellectual capital and network coverage Communities of interest Benefits of network structure and scale in-house 5-year Revenue CAGR of ~17% 5-year EBITDA CAGR of ~22% 5-year FCF growth of ~30% Consistent EBITDA growth Recurring revenue stream Significant investment over the last three years in IP / MPLS infrastructure Global presence for cross border transacting Leading ENUM registry platform Significant operating leverage as all divisions utilize common support infrastructure and backbone Infrastructure for Growth Significant depth of industry knowledge throughout the world Building development centers of innovation (TNSPay, Registry, etc) Proven ability to solve complex issues for customers Skilled Employee Base Growing markets in Europe, LatAm and Asia Pac Gaining market share in many more mature geographies New products in Payments and TSD to feed growing global demand Cequint acquisition adds mobile caller ID products CNP platform – First direct card-not-present win in 2010 (Continental Airlines, USA) Roaming, messaging and clearing services TNS’ Investment Profile 16 Disciplined Approach to Profitability High Barriers to Entry Current Expansion Opportunities New and Expanded Service Offerings |