Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PNC FINANCIAL SERVICES GROUP, INC. | d8k.htm |

The PNC

Financial Services Group, Inc. Citigroup Financial Services Conference

March 9, 2011

Exhibit 99.1 |

2

Cautionary Statement Regarding Forward-Looking

Information and Adjusted Information

This

presentation

includes

“snapshot”

information

about

PNC

used

by

way

of

illustration.

It

is

not

intended

as

a

full

business

or

financial

review

and

should

be

viewed

in

the

context

of

all

of

the

information

made

available

by

PNC

in

its

SEC

filings.

The

presentation

also

contains

forward-looking

statements

regarding

our

outlook

or

expectations

for

earnings,

revenues,

expenses,

capital

levels,

liquidity

levels,

asset

quality

and/or

other

matters

regarding

or

affecting

PNC

and

its

future

business

and

operations.

Forward-looking

statements

are

necessarily

subject

to

numerous

assumptions,

risks

and

uncertainties,

which

change

over

time.

The

forward-looking

statements

in

this

presentation

are

qualified

by

the

factors

affecting

forward-looking

statements

identified

in

the

more

detailed

Cautionary

Statement

included

in

the

Appendix,

which

is

included

in

the

version

of

the

presentation

materials

posted

on

our

corporate

website

at

www.pnc.com/investorevents.

We

provide

greater

detail

regarding

some

of

these

factors

in

our

2010

Form

10-K,

including

in

the

Risk

Factors

and

Risk

Management

sections

of

that

report,

and

in

our

subsequent

SEC

filings

(accessible

on

the

SEC’s

website

at

www.sec.gov

and

on

or

through

our

corporate

website

at

www.pnc.com/secfilings).

We

have

included

web

addresses

here

and

elsewhere

in

this

presentation

as

inactive

textual

references

only.

Information

on

these

websites

is

not

part

of

this

presentation.

Future

events

or

circumstances

may

change

our

outlook

or

expectations

and

may

also

affect

the

nature

of

the

assumptions,

risks

and

uncertainties

to

which

our

forward-looking

statements

are

subject.

The

forward-looking

statements

in

this

presentation

speak

only

as

of

the

date

of

this

presentation.

We

do

not

assume

any

duty

and

do

not

undertake

to

update

those

statements.

In

this

presentation,

we

will

sometimes

refer

to

adjusted

results

to

help

illustrate

the

impact

of

certain

types

of

items,

such

as

our

third

quarter

2010

gain

related

to

the

sale

of

PNC

Global

Investment

Servicing

Inc.

(“GIS”),

the

acceleration

of

accretion

of

the

remaining

issuance

discount

on

our

TARP

preferred

stock

in

connection

with

the

first

quarter

2010

redemption

of

such

stock,

our

fourth

quarter

2009

gain

related

to

BlackRock’s

acquisition

of

Barclays

Global

Investors

(the

“BLK/BGI

gain”),

our

fourth

quarter

2008

conforming

provision

for

credit

losses

for

National

City,

and

integration

costs

in

the

2010

and

2009

periods.

This

information

supplements

our

results

as

reported

in

accordance

with

GAAP

and

should

not

be

viewed

in

isolation

from,

or

a

substitute

for,

our

GAAP

results.

We

believe

that

this

additional

information

and

the

reconciliations

we

provide

may

be

useful

to

investors,

analysts,

regulators

and

others

as

they

evaluate

the

impact

of

these

respective

items

on

our

results

for

the

periods

presented

due

to

the

extent

to

which

the

items

are

not

indicative

of

our

ongoing

operations.

We

may

also

provide

information

on

pretax

pre-provision

earnings

(total

revenue

less

noninterest

expense),

as

we

believe

that

pretax

pre-provision

earnings,

a

non-GAAP

measure,

is

useful

as

a

tool

to

help

evaluate

the

ability

to

provide

for

credit

costs

through

operations.

Where

applicable,

we

provide

GAAP

reconciliations

for

such

additional

information.

In

certain

discussions,

we

may

also

provide

information

on

yields

and

margins

for

all

interest-earning

assets

calculated

using

net

interest

income

on

a

taxable-equivalent

basis

by

increasing

the

interest

income

earned

on

tax-exempt

assets

to

make

it

fully

equivalent

to

interest

income

earned

on

taxable investments. We believe this adjustment may be useful when comparing yields and

margins for all earning assets. We may also use annualized,

proforma,

estimated

or

third

party

numbers

for

illustrative

or

comparative

purposes

only.

These

may

not

reflect

actual

results.

This

presentation

may

also

include

discussion

of

other

non-GAAP

financial

measures,

which,

to

the

extent

not

so

qualified

therein

or

in

the

Appendix,

is

qualified

by

GAAP

reconciliation

information

available

on

our

corporate

website

at

www.pnc.com

under

“About

PNC–Investor

Relations.” |

3

Today’s Discussion

PNC’s powerful franchise and ability to execute

delivered record results in 2010

PNC’s business model is designed to deliver

strong results and long-term value

PNC has momentum and is positioned to

achieve even greater shareholder value

PNC Continues to Build a Great Company.

PNC Continues to Build a Great Company. |

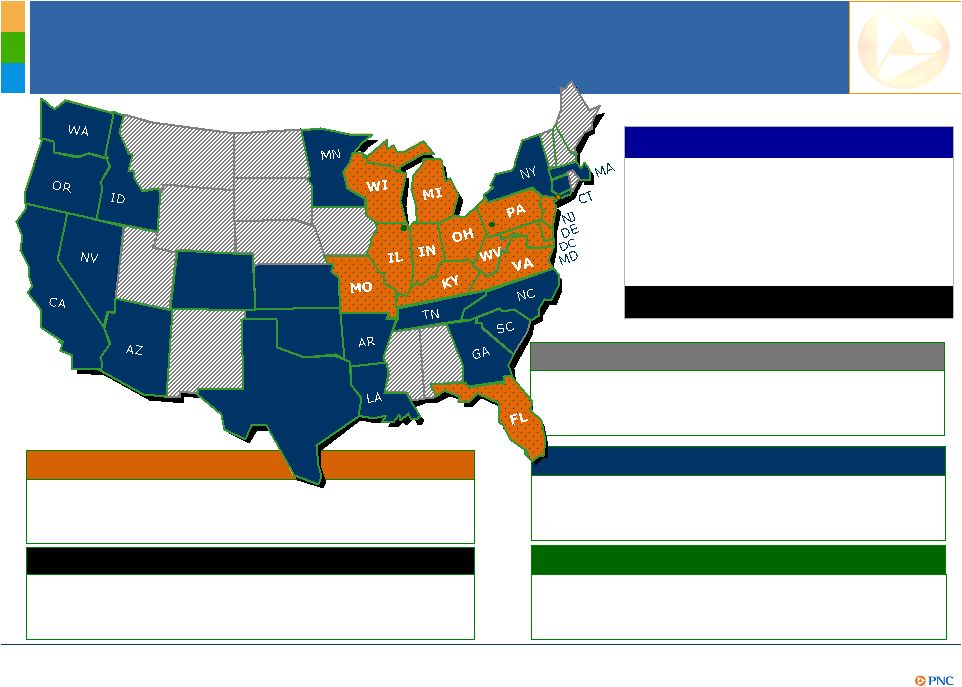

4

Footprint covering nearly 1/3 of the U.S.

population

Retail

Corporate & Institutional

A leader in serving middle-market

customers and government entities

One of the largest bank-held asset

managers in the U.S.

Asset Management

Residential Mortgage

National distribution capabilities

PNC’s Powerful Franchise

Dec. 31, 2010

U.S. Rank1

Deposits

$183B

6

Assets

$264B

6

Branches

2,470

5

ATMs

6,673

5

Record 2010 net income of $3.4B

(1)

Rankings

source:

SNL

DataSource;

Banks

headquartered

in

U.S.

Assets

rank

excludes

Morgan

Stanley

and

Goldman

Sachs.

CO

TX

KS

OK

BlackRock

A leader in investment management, risk

management and advisory services worldwide

A Powerful

Franchise

and Record

Results

th

th

th

th |

5

PNC’s Successful Business Model

Designed to

Deliver

Strong

Results

Staying core funded and disciplined in our deposit pricing

Returning to a moderate risk profile

Leveraging customer relationships and our strong brand to

grow high quality, diverse revenue streams

Creating positive operating leverage

1

while investing in

innovation

Remaining disciplined with our capital

Executing on our strategies

(1) A period to period dollar or percentage change when revenue growth exceeds expense

growth. |

6

PNC’s Higher Quality,

Differentiated Balance Sheet

Category (billions)

Dec. 31,

2010

Change from Dec. 31,

2008

Investment securities

$64

$21

48%

Core loans

1

136

(13)

(9%)

Distressed loans

2

15

(12)

(43%)

Other assets

49

(23)

(31%)

Total assets

$264

($27)

(9%)

Transaction deposits

$134

$23

21%

Retail CDs, time, savings

49

(33)

(40%)

Total deposits

$183

($10)

(5%)

Borrowed funds, other

$50

($22)

(30%)

Preferred equity

1

(7)

(92%)

Common equity

30

12

69%

Total liabilities and equity

$264

($27)

(9%)

Improving environment for

corporate loan demand

Slower pace of CRE decline

Relatively stable consumer

portfolio, opportunities for

credit card growth

Continued run-off of distressed

loans

2

when appropriate

Further low cost deposit

gathering

Additional run-off of higher cost

deposits

Possible shift from capital

accumulation to optimization

4

2011 expectations

3

(1)

Excludes

loans

assigned

to

the

Distressed

Assets

Portfolio

business

segment.

(2)

Represents

loans

assigned

to

the

Distressed

Assets

Portfolio

business

segment.

(3)

Refer

to

the

economic

assumptions

in

the

Cautionary

Statement

in

the

Appendix.

(4)

Subject

to

regulatory

approvals.

Designed to

Deliver

Strong

Results |

7

Returning to a Moderate Risk Profile

Nonperforming

loans³

to total

loans

Nonperforming

assets²

to total

assets

Net charge-

offs to average

loans

Allowance for

loan and lease

losses

4

to

loans

2010 reserves / NCOs

2.6

1.7

1.6

1.4

1.3

1.3

1.3

1.2

1.1

1.1

1.0

1.0

0.8

MTB

PNC

CMA

JPM

WFC

FITB

USB

BAC

RF

BBT

STI

KEY

COF

X

2010 key metrics

1

2.01%

2.55%

2.97%

3.68%

1.91%

2.65%

3.25%

3.27%

(1) As of or for the year ended December 31, 2010. Peers represents average of banks

identified in the Appendix. Sources: SNL DataSource. (2) Does not include

purchased impaired loans due to purchase accounting. Also does not include loans held for sale. (3) Nonperforming loans do not

include foreclosed and other assets. (4) Includes impairment reserves attributable to

purchased impaired loans. Loans PNC acquired from National City that were impaired are

purchased impaired loans. Designed to

Deliver

Strong

Results |

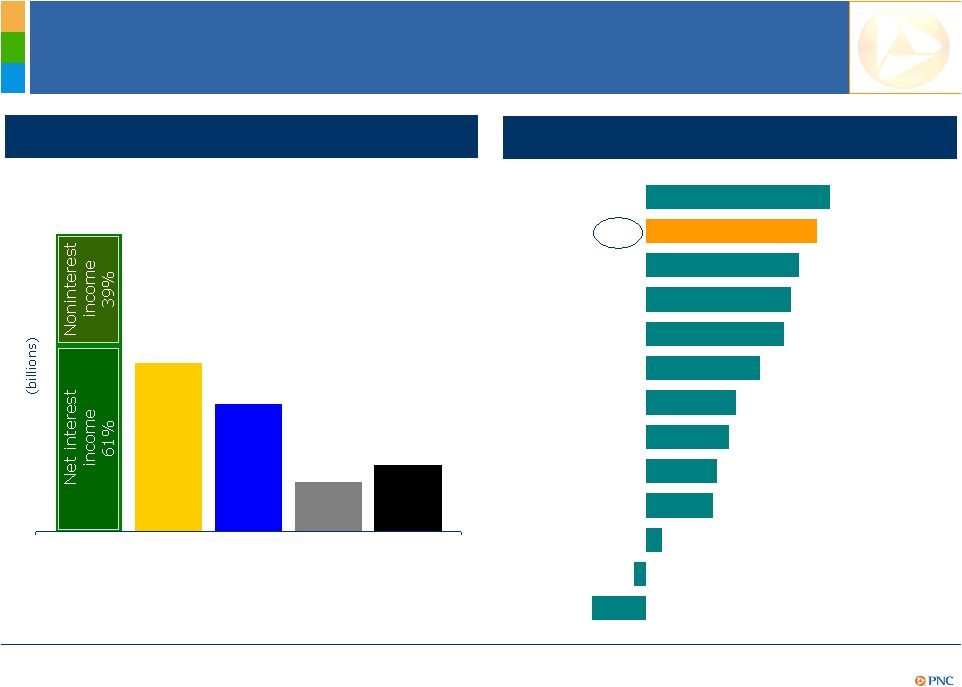

8

Strong Pretax Pre-Provision Earnings

1

and

Well-Controlled Expenses Drive Strong ROAA

Peer Source: SNL DataSource. (1) Total revenue less noninterest expense. PNC believes that

pre-tax, pre-provision earnings, a non-GAAP measure, is useful as a tool to

help evaluate our ability to provide for credit costs through operations. Total revenue and noninterest expense are

both from continuing operations on our consolidated income statement.

$15.2

$8.6

$6.6

Total

revenue

Noninterest

expense

Pretax

pre-

provision

earnings¹

Provision

Year ended December 31, 2010

Net

income

$2.5

$3.4

2010 return on average assets

1.37%

1.28%

1.14%

1.08%

1.03%

0.85%

0.67%

0.62%

0.53%

0.50%

0.12%

-0.09%

-0.40%

COF

PNC

USB

MTB

WFC

JPM

FITB

KEY

BBT

CMA

STI

BAC

RF

Designed to

Deliver

Strong

Results |

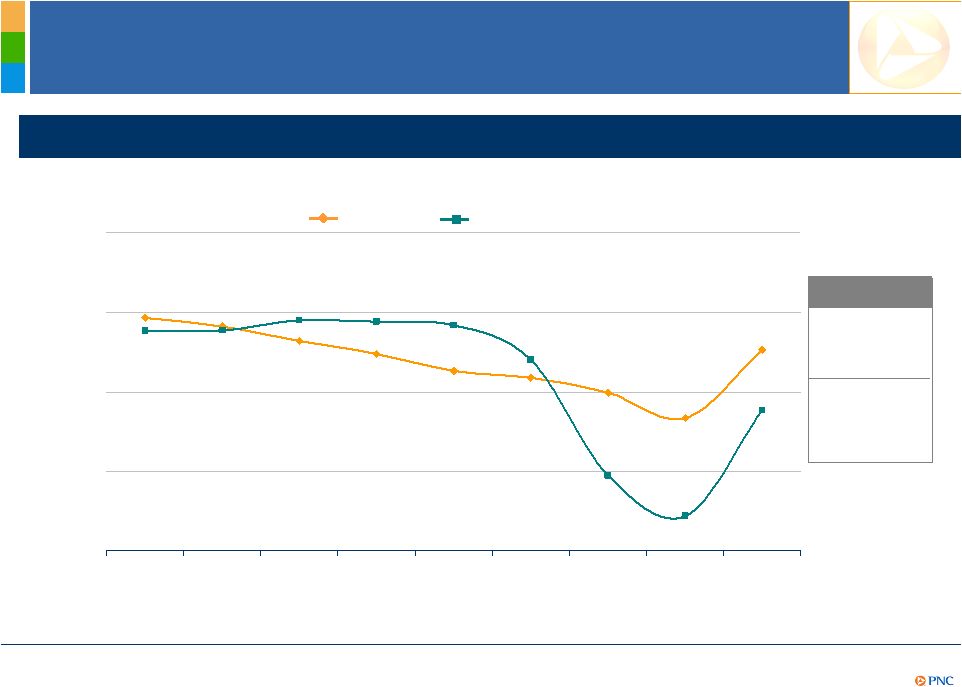

9

3.96%

4.35%

3.93%

4.24%

3.32%

3.38%

3.39%

3.45%

2.88%

3.15%

3.10%

2.90%

1Q10

2Q10

3Q10

4Q10

Net interest

margin

Provision-

adjusted NIM

4

Expect Core

1

and Provision-Adjusted

2

Net

Interest Income to Improve in 2011

(1) Core net interest income is total net interest income, as reported, less related purchase

accounting accretion. (2) Provision-adjusted net interest income is total net

interest income, as reported, less provision. (3) Net interest margin less (annualized purchase accounting

accretion/average interest-earning assets).

(4)

Net interest margin less (annualized provision/average interest-earnings assets). (5)

Refer to the economic assumptions in the Cautionary Statement in the Appendix. Further

information on (3) and (4) is provided in the Appendix. Positioned to

Achieve

Greater

Shareholder

Value

Although lower NII and NIM is

expected, core net interest

income

1

and core NIM

3

are

expected to increase

-

Balance sheet is positioned for

rising interest rates

-

Further opportunity to lower

deposit costs

Purchase accounting accretion

expected to decrease up to $700

million, resulting in lower net

interest income and NIM

Provision expected to decrease by

over $800 million, resulting in

higher provision-adjusted net

interest income

2

Full year provision-adjusted NIM

4

expected to improve

2011

expectations

5

(billions)

1Q10

2Q10

3Q10

4Q10

FY10

Core NII

1

$1.9

$1.9

$1.9

$1.9

$7.6

Purchase accounting

accretion

$.4

$.5

$.3

$.3

$1.6

Total NII

$2.4

$2.4

$2.2

$2.2

$9.2

Provision

.8

.8

.5

.4

2.5

Provision-adjusted NII

2

$1.6

$1.6

$1.7

$1.8

$6.7

Core NIM

3 |

10

Provision-Adjusted Net Interest Margin

1

Trend

3.43%

3.32%

3.14%

2.97%

2.76%

2.68%

3.03%

2.17%

2.49%3

3.26%

3.27%

3.40%

3.38%

3.33%

2.90%

1.45%

2.27%

0.94%

0.50%

1.50%

2.50%

3.50%

4.50%

2002

2003

2004

2005

2006

2007

2008

2009

2010

PNC provision-adjusted margin

1

vs. Peers

2

PNC

Peers

2

(1) Net interest margin less (provision/average interest-earning assets). (2) Peers

represents average of banks identified in the Appendix. Peer source: SNL DataSource.

(3) Excludes the 4Q08 conforming provision for credit losses of $504 million related to the National City acquisition as

average interest-earning assets do not reflect the National City acquisition because the

acquisition closed on December 31, 2008. Other acquisitions did not similarly impact

the ratio. Including the National City conforming provision, the provision-adjusted net interest margin was

2.04%. Further information on (1) and (3) is provided in the Appendix.

PNC

2.89%

Average

Peers²

2.69%

Positioned to

Achieve

Greater

Shareholder

Value |

11

Diversified Sources of Fee Income

YoY change in noninterest

income

1%

0%

-2%

-2%

-3%

-3%

-4%

-5%

-9%

-10%

-12%

-15%

-29%

PNC¹

STI

JPM

KEY

CMA

WFC

BBT

FITB

2

BAC

RF

COF

MTB

USB

Noninterest income

Year ended December 31, 2010

Diversified fee sources

Sales and service model

Customer growth

momentum

Regulatory headwinds

$5.9B

Asset

management

Consumer

services

Corporate

services

Deposit

service

charges

18%

21%

12%

18%

12%

Other³

19%

Residential

Mortgage

Peer

source:

SNL

DataSource.

Noninterest

income

is

from

continuing

operations.

(1)

Excludes

the

2009

$1,076

million

BLK/BGI

gain

recorded

in

noninterest

income.

The

year

over

year

change

including

the

gain

was

-17%.

Further

information

is

provided

in

the

Appendix.

(2)

Excludes

the

impact of the 2009 gain related to the sale of a business. (3) Other in this chart includes

net gains on sales of securities, net OTTI, gains on BlackRock transactions, and

other. 2011 drivers

Positioned to

Achieve

Greater

Shareholder

Value |

12

Disciplined Expense Management

2010 noninterest expense highlights

Expenses of $8.6 billion decreased 5% YoY

Integration costs totaled $387 million in 2010

Achieved acquisition cost savings of $1.8 billion annualized in 4Q10

Expenses

expected

to

be

down

in

2011,

but

magnitude

depends

on

investments

1

Aggressively adding talent in key markets across businesses

-

Asset Management Group

-

Corporate & Institutional Banking

-

Residential Mortgage Banking

Investing in products and services

-

Consumer payments model

-

Healthcare

Building out infrastructure

Positioned to

Achieve

Greater

Shareholder

Value

2011 outlook

(1) Subject to legal and regulatory contingencies. See Note 22 Legal Proceedings

included in Item 8 of PNC’s Form 10-K. Also refer to the economic assumptions

in the Cautionary Statement in the Appendix. |

13

Strong Momentum –

Retail Banking

Retail Banking

4Q09

4Q10

Checking relationships

Online bill payment active customers

5,390

5,465

4Q09

4Q10

780

977

Most of 2010 client growth occurred in

2H10 following conversions

4Q10 checking relationships up 27,000 in a

typically flat seasonal quarter

Customer engagement scores higher in

2H10 than 1H10

Workplace and University Banking channel

client acquisition up 20% in 2H10 vs. 2H09

Reached definitive agreement to acquire 19

branches in Tampa, FL in January 2011

Positioned to

Achieve

Greater

Shareholder

Value |

14

Regulatory changes are impacting revenue streams

Some competitors have chosen to increase fees and/or reduce customer choices

Products Designed to Accelerate

Retail Market Share Expansion

Positioned to

Achieve

Greater

Shareholder

Value

Industry challenge

PNC strategy

Expand market share and share of wallet by providing customers with more choices and

rewards

Announced new accounts to help customers save, manage money and avoid fees

-

Connects checking, credit, debit, and rewards

-

Expands Virtual Wallet features to reach a broader group of customers

-

An integrated view of your money that you cannot get anywhere else

-

The more business the customer does with PNC, the more they get in return

-

Free checking remains available with no balance requirement and free access to

PNC’s 6,673 ATM’s |

15

Strong Momentum –

Corporate & Institutional Banking

2009

2010

$1,137

$1,225

Treasury management revenue

1

(1) Consolidated PNC amounts.

Capital markets revenue

1

Corporate & Institutional Banking

2009

2010

85% of Corporate Banking relationship

managers sold to a new name in 2010, with

many bringing in five or more

All relationship managers cross-sold in

2010

Strong TM pipeline including healthcare

providers, gov’t agencies and middle

market companies

In terms of capital markets deals

-#2 middle market

deal bookrunner -#4 U.S. real estate bookrunner

-#4 U.S.

asset-based credit lead arranger

Harris Williams revenue increased $80

million in 2010 vs. 2009

$533

$618

Positioned to

Achieve

Greater

Shareholder

Value |

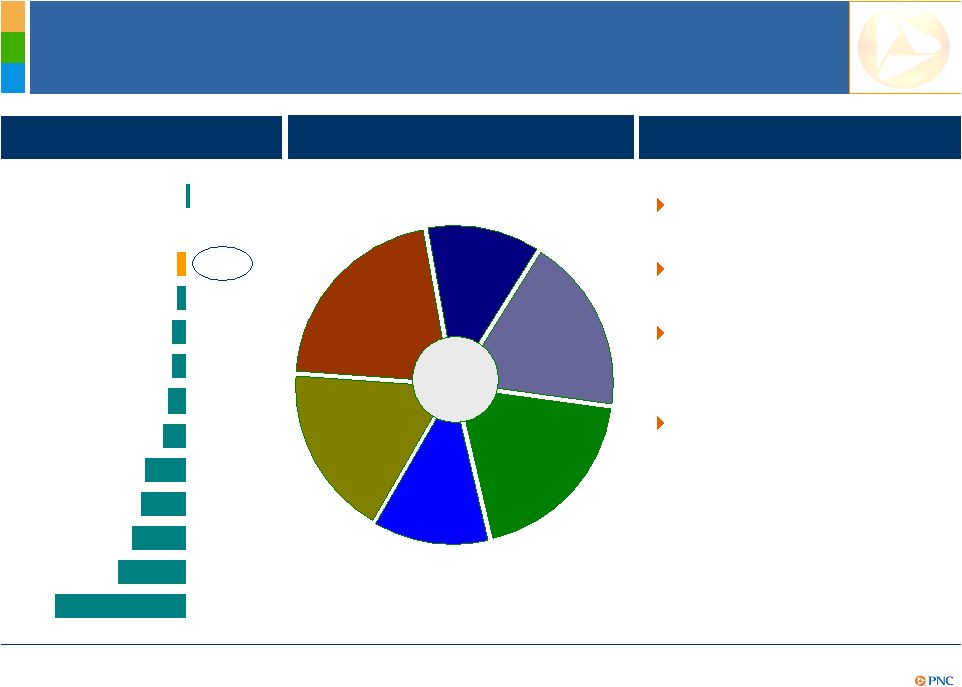

16

Strong Momentum –

Asset Management Group

Channel sales

1

+60%

$103B

2009 2010

Asset Management Group

Record sales year in 2010, including

60% YoY increase in channel sales, a

strategic focus for PNC

Total assets under administration of

$212 billion, discretionary assets under

management of $108 billion

Net asset flows up $3 billion in 2H10

versus 1H10

Significantly increased frontline talent

with 500 new hires in 2010,

approximately double prior year

2010 vs. 2009

Assets under management

$108B

Equity

Fixed income

Liquidity/other

+$6B

+$2B

($3B)

Positioned to

Achieve

Greater

Shareholder

Value

(1) Channel sales are new sales to clients who were referred to AMG by Retail Banking or

Corporate and Institutional Banking. |

17

Remaining Disciplined With Our Capital

4Q10 Tier 1 common ratio

2010

return

on

Tier

1

common

capital

1

10.1%

9.8%

9.8%

9.3%

9.1%

8.8%

8.6%

8.3%

8.1%

7.9%

7.8%

7.5%

6.6%

CMA

PNC

JPM

KEY

BBT

COF

BAC

WFC

STI

RF

USB

FITB

MTB

24.6%

17.8%

16.9%

16.0%

15.6%

15.1%

10.0%

8.0%

8.0%

4.6%

1.9%

-1.8%

-7.2%

COF

MTB

USB

PNC

WFC

JPM

FITB

KEY

BBT

CMA

STI

BAC

RF

Peer Source: SNL DataSource and company reports. MTB is estimated. Ratios as of year end. (1)

Return on tier 1 common capital calculated as net

income

divided

by

tier

1

common

capital.

Further

information

is

provided

in

the

Appendix.

Positioned to

Achieve

Greater

Shareholder

Value |

18

Possible Impact of Basel III

Tier 1 common ratio

9.8%

Under

current

rules

10.0%

(1)

Proforma

assumptions

may

change.

Proforma

assumes

current

common

stock

dividend

of

$.10

per

share

per

quarter

and

no

common

stock

repurchases.

Assumed

2011

net

income

of

$3.0

billion

and

2012

net

income

of

$3.4

billion

from

First

Call

mean

estimate

as

of

February

24,

2011.

The

First

Call

mean

estimate

is

used

for

illustrative

purposes

only

and

does

not

necessarily

reflect

management’s

expectations

and

may

not

reflect

actual

results.

Proforma

estimates

are

subject

to

change

depending

on

final

Basel

III

rules

and

final

regulatory

implementation.

Basel

III

proforma

assumptions

are

based

on

rules

in

current

form

and

also

include

lower

deferred

tax

assets

and

subinvestment

grade

securities

at

the

end

of

2012

and

the

impact

of

mortgage

servicing

rights

and

the

after-tax

treatment

of

our

BlackRock

investment.

PNC’s capital management priorities

12.6%

4Q10

Assumes full

Basel III

implementation

and without

benefit of multi-

year phase-in

Proforma

4Q12

1

Positioned to

Achieve

Greater

Shareholder

Value

Increase the return of capital to shareholders

via dividends and share repurchases; subject

to regulatory approval

Maintain ample capacity to meet the needs of

our clients and support organic business

growth

Continue to invest in innovative products and

services

Deploy capital for acquisitions that meet our

strategic criteria

Ensure capital adequacy in times of

uncertainty and regulatory compliance |

19

A Demonstrated Ability to Achieve

Greater Shareholder Value

Achieving greater shareholder value

As of quarter end. (1) Tangible book value per share calculated as book value per share less

total intangible assets per share. PNC believes that tangible book value, a

non-GAAP measure, is useful as a tool to help evaluate the amount, on a per share basis, of intangible assets

included in book value per common share. Further information is provided in the

Appendix. 4Q08

4Q10

4Q08

4Q10

Book value per share

Tangible book value per share

1

$39.44

$56.29

$13.10

$35.82

Positioned to

Achieve

Greater

Shareholder

Value

4Q08

4Q10

Stock price

$49.00

$60.72 |

20

Summary

PNC Continues to Build a Great Company.

PNC Continues to Build a Great Company.

PNC’s powerful franchise and ability to execute

delivered record results in 2010

PNC’s business model is designed to deliver

strong results and long-term value

PNC has momentum and is positioned to

achieve even greater shareholder value |

21

Cautionary Statement Regarding Forward-Looking

Information

Appendix

This

presentation

includes

“snapshot”

information

about

PNC

used

by

way

of

illustration

and

is

not

intended

as

a

full

business

or

financial

review.

It

should not be viewed in isolation but rather in the context of all of the information made

available by PNC in its SEC filings. We also make statements in this presentation, and

we may from time to time make other statements, regarding our outlook or expectations for

earnings, revenues, expenses, capital levels, liquidity levels, asset quality and/or other

matters regarding or affecting PNC and its future business and operations that are

forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Forward-looking statements are

typically

identified

by

words

such

as

“believe,”

“plan,”

“expect,”

“anticipate,”

“intend,”

“outlook,”

“estimate,”

“forecast,”

“will,”

“should,”

“project,”

“goal”

and other similar words and expressions. Forward-looking statements are subject to

numerous assumptions, risks and uncertainties, which change over time.

Forward-looking statements speak only as of the date they are made. We do not assume any

duty and do not undertake to update our forward- looking statements. Actual

results or future events could differ, possibly materially, from those that we anticipated in our forward-looking statements,

and future results could differ materially from our historical performance.

Our forward-looking statements are subject to the following principal risks and

uncertainties. We provide greater detail regarding some of these factors

in

our

2010

Form

10-K,

including

in

the

Risk

Factors

and

Risk

Management

sections

of

that

report,

and

in

our

subsequent

SEC

filings.

Our

forward-looking statements may also be subject to other risks and uncertainties, including

those that we may discuss elsewhere in this presentation or in

our

filings

with

the

SEC,

accessible

on

the

SEC’s

website

at

www.sec.gov

and

on

or

through

our

corporate

website

at

www.pnc.com/secfilings.

We

have

included

these

web

addresses

as

inactive

textual

references

only.

Information

on

these

websites

is

not

part

of

this

document.

•Our businesses and financial results are affected by business and economic conditions,

both generally and specifically in the principal markets in which we operate. In

particular, our businesses and financial results may be impacted by: o

Changes

in

interest

rates

and

valuations

in

the

debt,

equity

and

other

financial

markets.

o

Disruptions in the liquidity and other functioning of financial markets, including such

disruptions in the markets for real estate and other assets commonly securing financial

products. o

Actions by the Federal Reserve and other government agencies, including those that impact

money supply and market interest rates. o

Changes in our customers’, suppliers’

and other counterparties’

performance in general and their creditworthiness in particular.

o

A slowing or failure of the moderate economic recovery that began in mid-2009 and

continued throughout 2010. o

Continued effects of the aftermath of recessionary conditions and the uneven spread of the

positive impacts of the recovery on the economy in general and our customers in

particular, including adverse impact on loan utilization rates as well as delinquencies, defaults and customer ability

to meet credit obligations.

o

Changes in levels of unemployment.

o

Changes in customer preferences and behavior, whether as a result of changing business and

economic conditions, climate-related physical changes or legislative and regulatory

initiatives, or other factors. •Turbulence in significant portions of the US and

global financial markets could impact our performance, both directly by affecting our revenues and

the value of our assets and liabilities and indirectly by affecting our counterparties and the

economy generally. |

22

Cautionary Statement Regarding Forward-Looking

Information (continued)

Appendix

•We

will

be

impacted

by

the

extensive

reforms

provided

for

in

the

Dodd-Frank

Wall

Street

Reform

and

Consumer

Protection

Act

(“Dodd-Frank

Act”)

and ongoing reforms impacting the financial institutions industry generally. Further, as

much of the Dodd-Frank Act will require the adoption of implementing regulations by

a number of different regulatory bodies, the precise nature, extent and timing of many of these reforms and the impact

on us is still uncertain.

•Financial

industry

restructuring

in

the

current

environment

could

also

impact

our

business

and

financial

performance

as

a

result

of

changes

in

the

creditworthiness and performance of our counterparties and by changes in the competitive and

regulatory landscape. •Our results depend on our ability to manage current elevated

levels of impaired assets. •Given current economic and financial market conditions,

our forward-looking financial statements are subject to the risk that these conditions will be

substantially different than we are currently expecting. These statements are based on our

current view that the moderate economic recovery that began in mid-2009 and

continued throughout 2010 will slowly gather enough momentum in 2011 to lower the unemployment rate amidst continued

low interest rates.

•Legal and regulatory developments could have an impact on our ability to operate our

businesses or our financial condition or results of operations or our competitive

position or reputation. Reputational impacts, in turn, could affect matters such as business generation and retention, our ability to

attract and retain management, liquidity, and funding. These legal and regulatory

developments could include: o

Changes resulting from legislative and regulatory responses to the current economic and

financial industry environment. o

Other legislative and regulatory reforms, including broad-based restructuring of financial

industry regulation (such as those under the Dodd- Frank

Act)

as

well

as

changes

to

laws

and

regulations

involving

tax,

pension,

bankruptcy,

consumer

protection,

and

other

aspects

of

the

financial institution industry.

o

Unfavorable resolution of legal proceedings or other claims and regulatory and other

governmental investigations or other inquiries. In addition to matters relating

to PNC’s business and activities, such matters may also include proceedings, claims, investigations, or inquiries relating to

pre-acquisition business and activities of acquired companies, such as National

City. o

The results of the regulatory examination and supervision process, including our failure to

satisfy the requirements of agreements with governmental agencies.

o

Changes in accounting policies and principles.

o

Changes

resulting

from

legislative

and

regulatory

initiatives

relating

to

climate

change

that

have

or

may

have

a

negative

impact

on

our

customers’

demand for or use of our products and services in general and their creditworthiness in

particular. o

Changes

to

regulations

governing

bank

capital,

including

as

a

result

of

the

Dodd-Frank

Act

and

of

the

so-called

“Basel

III”

initiatives.

•Our business and operating results are affected by our ability to identify and

effectively manage risks inherent in our businesses, including, where

appropriate,

through

the

effective

use

of

third-party

insurance,

derivatives,

and

capital

management

techniques,

and

by

our

ability

to

meet

evolving

regulatory capital standards.

•The adequacy of our intellectual property protection, and the extent of any costs

associated with obtaining rights in intellectual property claimed by others, can impact

our business and operating results. •Our ability to anticipate and respond to

technological changes can have an impact on our ability to respond to customer needs and to meet

competitive demands.

•Our ability to implement our business initiatives and strategies

could affect our financial performance over the next several years.

•Competition can have an impact on customer acquisition, growth and retention, as well as

on our credit spreads and product pricing, which can affect market share, deposits and

revenues. |

23

Cautionary Statement Regarding Forward-Looking

Information (continued)

Appendix

•Our business and operating results can also be affected by widespread disasters,

terrorist activities or international hostilities, either as a result of the impact on

the economy and capital and other financial markets generally or on us or on our customers, suppliers or other counterparties

specifically.

•Also, risks and uncertainties that could affect the results anticipated in

forward-looking statements or from historical performance relating to our equity

interest in BlackRock, Inc. are discussed in more detail in BlackRock’s filings with the SEC, including in the Risk Factors sections of

BlackRock’s reports. BlackRock’s SEC filings are accessible on the SEC’s

website and on or through BlackRock’s website at www.blackrock.com. This material

is referenced for informational purposes only and should not be deemed to constitute a part of this document.

We grow our business in part by acquiring from time to time other financial services

companies, financial services assets and related deposits. Acquisitions present

us with risks in addition to those presented by the nature of the business acquired. These include risks and uncertainties

related

both

to

the

acquisition

transactions

themselves

and

to

the

integration

of

the

acquired

businesses

into

PNC

after

closing.

Acquisitions may be substantially more expensive to complete (including unanticipated costs

incurred in connection with the integration of the acquired company) and the

anticipated benefits (including anticipated cost savings and strategic gains) may be significantly harder or take longer to

achieve than expected. Acquisitions may involve our entry into new businesses or new

geographic or other markets, and these situations also present risks resulting from our

inexperience in those new areas. As a regulated financial institution, our pursuit of

attractive acquisition opportunities could be negatively impacted due to regulatory delays or other

regulatory issues. In addition, regulatory and/or legal issues relating to the

pre-acquisition operations of an acquired business may cause reputational harm to

PNC following the acquisition and integration of the acquired business into ours and may result in additional future costs or

regulatory limitations arising as a result of those issues.

Any annualized, proforma, estimated, third party or consensus numbers in this presentation are

used for illustrative or comparative purposes only and may not reflect actual

results. Any consensus earnings estimates are calculated based on the earnings projections made by analysts who cover

that

company.

The

analysts’

opinions,

estimates

or

forecasts

(and

therefore

the

consensus

earnings

estimates)

are

theirs

alone,

are

not

those

of

PNC or its management, and may not reflect PNC’s or other company’s actual or

anticipated results. |

24

Non-GAAP to GAAP Reconcilement

Appendix

For the three months ended

$ in millions

Dec. 31, 2010

Sept. 30, 2010

June 30, 2010

Mar. 31, 2010

Net interest margin, as reported

3.93%

3.96%

4.35%

4.24%

Provision for credit losses

$442

$486

$823

$751

Avg. interest earning assets

$223,795

$223,677

$224,580

$226,992

Annualized provision/Avg. interest earning assets

0.78%

0.86%

1.47%

1.34%

Provision-adjusted net interest margin (1)

3.15%

3.10%

2.88%

2.90%

$ in millions

2002

2003

2004

2005

2006

2007

2008

2009

2010

Net interest margin, as reported

3.99%

3.64%

3.22%

3.00%

2.92%

3.00%

3.37%

3.82%

4.14%

Provision for credit losses

$309

$177

$52

$21

$124

$315

$1,517

$3,930

$2,502

Avg. interest-earning assets

$55,345

$55,172

$61,821

$73,001

$77,692

$98,010

$114,484

$238,487

$224,749

Provision/Avg. interest-earning assets

0.56%

0.32%

0.08%

0.03%

0.16%

0.32%

1.33%

1.65%

1.11%

Provision-adjusted net interest margin (1)

3.43%

3.32%

3.14%

2.97%

2.76%

2.68%

2.04%

2.17%

3.03%

$504

Adjusted provision for credit losses

$1,013

Avg. interest-earning assets

$114,484

Adjusted provision/Avg. interest-earning assets

0.88%

Adjusted provision-adjusted net interest margin (2)

2.49%

(2)

The

adjustment

represents

provision

for

credit

losses

adjusted

for

the

4Q08

conforming

provision

related

to

the

National

City

acquisition

(as

average

interest-

earnings

assets

for

2008

do

not

reflect

the

National

City

acquisition

because

it

closed

on

December

31,

2008),

divided

by

average

interest-earning

assets.

Other

acquisitions did not similarly impact the ratio.

(1) The adjustment represents annual or annualized, as applicable, provision for credit losses

divided by average interest-earning assets. For the year ended

Conforming provision - National City

PNC

believes

that

provision-adjusted

net

interest

margin,

a

non-GAAP

measure,

is

useful

as

a

tool

to

help

evaluate

the

amount

of

credit

related

risk

associated

with

interest-earning assets. |

25

Non-GAAP to GAAP Reconcilement

Appendix

In millions except per share data

As of Dec. 31, 2008

As of Dec. 31, 2010

Common shareholders' equity

$17,490

$29,596

Common shares outstanding

443

526

Book value per

common share $39.44

$56.29

Intangible assets

$11,688

$10,753

Common shareholders' equity less intangible assets

$5,802

$18,843

Common shares outstanding

443

526

Tangible book

value per common share $13.10

$35.82

PNC

believes

that

tangible

book

value

per

common

share,

a

non-GAAP

measure,

is

useful

as

a

tool

to

help

evaluate

the

amount, on a per share basis, of intangible assets included in book value per common

share. $ in millions

Dec. 31, 2010

Sept. 30, 2010

June 30, 2010

Mar. 31, 2010

Net interest margin, as reported

3.93%

3.96%

4.35%

4.24%

Purchase accounting accretion

$344

$325

$540

$440

Purchase accounting accretion, if annualized

$1,365

$1,289

$2,166

$1,784

Avg. interest earning assets

$223,795

$223,677

$224,580

$226,992

Annualized purchase accounting accretion/Avg. interest earning assets

0.61%

0.58%

0.96%

0.79%

Core net interest margin (1)

3.32%

3.38%

3.39%

3.45%

(1)

PNC

believes

that

core

net

interest

margin,

a

non-GAAP

measure,

is

useful

as

a

tool

to

help

evaluate

the

impact

of

purchase

accounting

accretion

on net interest margin. The adjustment represents annualized purchase accounting

accretion divided by average interest-earning assets. For the three months

ended In millions

Dec. 31, 2009

Dec. 31, 2010

Noninterest income, as reported

$7,145

$5,946

-17%

Adjustment:

Gain on BlackRock/BGI transaction

1,076

-

-

Noninterest income, as adjusted

$6,069

$5,946

-2%

For the year ended

Year over Year

Change |

26

Non-GAAP to GAAP Reconcilement

Appendix

As of or for the three months ended

In millions

Dec. 31, 2010

Sept. 30, 2010

June 30, 2010

Mar. 31, 2010

Tier 1 common capital

$21,188

$20,437

$18,173

$17,562

Reported net income

820

1,103

803

671

Reported net income,

if annualized 3,253

4,376

3,221

2,721

Adjustments:

After-tax gain on sale of GIS

-

(328)

After-tax

impact of integration costs 51

62

65

73

Adjusted

net income $871

$837

$868

$744

Adjusted net income, if annualized

3,454

3,321

3,482

3,017

Return on tier 1 common capital

15.4%

21.4%

17.7%

15.5%

Adjusted return on tier 1 common capital

16.3%

16.2%

19.2%

17.2%

As of or for the year ended

In millions

Dec. 31, 2010

Dec. 31, 2009

Tier 1 common capital

$21,188

$13,941

Reported net income

3,397

2,403

Adjustments:

After-tax gain on BlackRock/BGI transaction

-

(687)

After-tax

gain on sale of GIS (328)

-

After-tax impact of integration costs 251

274

Adjusted net

income $3,320

$1,990

Return on tier 1 common capital

16.0%

17.2%

Adjusted return on tier 1 common capital

15.7%

14.3%

PNC believes that return on tier 1 common capital is useful as a tool to help measure and

assess a company's use of common equity, and that such information adjusted for the

impact of the BLK/BGI and GIS gains and integration costs may be useful due to the extent to which those items are not indicative of our

ongoing operations. After-tax adjustments are calculated using a marginal federal

income tax rate of 35% and include applicable income tax adjustments. The

after-tax gain on the sale of GIS and the after-tax BLK/BGI gain also reflect the

impact of state income taxes. Pretax amounts and tax benefit for adjustments are as

follows: (1) gain on sale of GIS for 3Q and full year 2010 is $639 million pretax with tax benefit of $311 million; (2) gain on BlackRock/BGI transaction

for full year 2009 is $1,076 million pretax with tax benefit of $389 million; (3)

integration costs for 1Q, 2Q, 3Q and 4Q 2010, respectively, are $113 million, $100

million, $96 million, and $78 million pretax with tax benefit of $40 million, $35 million, $34 million, and $27 million, respectively; and (4) integration costs

for full years 2010 and 2009, respectively, are $387 million and $421 million pretax with tax

benefit of $136 million and $147 million, respectively. |

27

Peer Group of Banks

Appendix

The PNC Financial Services Group, Inc.

PNC

BB&T Corporation

BBT

Bank of America Corporation

BAC

Capital One Financial, Inc.

COF

Comerica Inc.

CMA

Fifth Third Bancorp

FITB

JPMorgan Chase

JPM

KeyCorp

KEY

M&T Bank

MTB

Regions Financial Corporation

RF

SunTrust Banks, Inc.

STI

U.S. Bancorp

USB

Wells Fargo & Co.

WFC

Ticker |