Attached files

Exhibit 10.2

Confidential

Canadian and Non-U.S. Subscribers Only

PAN AMERICAN GOLDFIELDS LTD.

SUBSCRIPTION DOCUMENTS

for

CANADIAN AND NON-U.S. SUBSCRIBERS ONLY

SUBSCRIPTION DOCUMENTS AND PROCEDURE

Each prospective investor for the Units of Pan American Goldfields Ltd. is required to complete, execute and return to the Company the following documents:

1. SUBSCRIPTION AGREEMENT: Please complete all open lines, date and sign on page 18.

2. REGISTRATION AND DELIVERY INSTRUCTIONS: Please complete the registration and delivery instructions on Schedule A.

3. ELIGIBILITY CERTIFICATE: If you are an Accredited Investor (within the meaning of National Instrument 45-106), please complete and sign the Eligibility Certificate attached as Schedule B.

4. PURCHASER QUESTIONNAIRE: Please complete, date and sign the Subscriber Questionnaire on Appendix A to Schedule B. All items must be completed.

RETURN the completed documents, with payment in full as provided herein.

1

Confidential

Canadian and Non-U.S. Subscribers Only

THIS PRIVATE PLACEMENT SUBSCRIPTION AGREEMENT (THE “AGREEMENT”) RELATES TO AN OFFERING OF SECURITIES IN AN OFFSHORE TRANSACTION TO PERSONS WHO ARE NOT U.S. PERSONS (AS DEFINED HEREIN) PURSUANT TO REGULATION S UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE “1933 ACT”).

NONE OF THE SECURITIES TO WHICH THIS AGREEMENT RELATES HAVE BEEN REGISTERED UNDER THE 1933 ACT, OR ANY U.S. STATE SECURITIES LAWS, AND, UNLESS SO REGISTERED, NONE MAY BE OFFERED OR SOLD, DIRECTLY OR INDIRECTLY, IN THE UNITED STATES OR TO U.S. PERSONS (AS DEFINED HEREIN) EXCEPT IN ACCORDANCE WITH THE PROVISIONS OF REGULATION S UNDER THE 1933 ACT, PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE 1933 ACT, OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE 1933 ACT AND IN EACH CASE ONLY IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS. IN ADDITION, HEDGING TRANSACTIONS INVOLVING THE SECURITIES MAY NOT BE CONDUCTED UNLESS IN COMPLIANCE WITH THE 1933 ACT.

PRIVATE PLACEMENT SUBSCRIPTION AGREEMENT

(Canadian and Non-U.S. Subscribers Only)

Pan American Goldfields Ltd.

Mountain View Center

12303 Airport Way, Suite 200

Broomfield, CO. 80021

Attention: Miguel Di Nanno, President

Dear Sirs:

Pan American Goldfields Ltd., (the “Company”) is offering, on an exempt private placement basis, up to an aggregate of 2,500,000 units of its own issue (each a “Unit”) to eligible investors (a “Subscriber”) at a subscription price of U.S. $0.20 per Unit. Each Unit will consist of one share of the Company’s common stock (each a “Share” or the “Common Stock”) and one share purchase warrant (each a “Warrant”) exercisable at $0.30 per Warrant Share, a copy of which is attached as Reference source not found.). Each Warrant to acquire additional Shares shall have a term of twenty-four (24) months after the date of this Agreement. Each Warrant entitles the holder thereof to purchase one Share of the Company (each a “Warrant Share”) for a period of two years. The Units are being offered solely to Canadian and Non-U.S. Subscribers via this subscription agreement (the “Agreement”) at U.S. $0.20 per Unit for an aggregate purchase price of U.S. $500,000 (the “Offering”). The Units, the Shares, the Warrants and the Warrant Shares are sometimes hereinafter referred to as the “Securities.” Subscriptions will be accepted only for an even number of Units and no fractional Units will be issued.

2

Confidential

Canadian and Non-U.S. Subscribers Only

The Company reserves the right to increase the size of the Offering without notice to investors or prospective investors.

1. Subscription.

1.1 Based upon the terms of this Agreement, the Subscriber hereby irrevocably subscribes for and agrees to purchase _____ Units from the Company at a subscription price of U.S. $0.20 per Unit, for aggregate consideration of U.S. $____ (the “Subscription Proceeds”).

1.2 Each Unit consists of:

(a) 1 Share; and

(b) 1 Warrant to purchase 1 Warrant Share. The Warrant shall expire twenty-four months (24) months after the date of this Agreement and shall be exercisable at $0.30 per share of Common Stock.

1.3 Payment:

(a) The Subscription Proceeds must accompany this Agreement and shall be paid by wire transfer of immediately available funds in U.S. dollars in accordance with the wire instructions attached hereto as Exhibit B. The Company has provided certain financial projections regarding the estimated use of the Subscription Proceeds in the “Use of Proceeds” section, attached hereto as Exhibit C.

(b) The Subscriber acknowledges and agrees that this Agreement, the Subscription Proceeds and any other documents delivered in connection herewith will be held by the Company or the Escrow Agent (as defined herein). In the event that this Agreement is not accepted by the Company for whatever reason within 30 days of the delivery of an executed Agreement by the Subscriber, this Agreement, the Subscription Proceeds and any other documents delivered in connection herewith will be returned to the Subscriber at the address of the Subscriber as set forth in this Agreement.

1.4 Documents Required from Subscriber:

(a) The Subscriber must complete, sign and return to the Company two (2) executed copies of this Agreement; and

(b) The Subscriber shall complete, sign and return to the Company as soon as possible, on request by the Company, any documents, questionnaires, notices and undertakings as may be required by regulatory authorities, the OTC Bulletin Board, stock exchanges and applicable law.

1.5 Escrow

The Subscription Proceeds shall be deposited by the Company in a bank account pursuant to the instructions in Exhibit B. The Subscriber acknowledges that the Subscription Proceeds will be deposited into an escrow account (the “Escrow Account”) at the Company’s corporate law firm, DLA Piper LLP (the “Escrow Agent”). The Subscriber agrees that the Escrow Agent shall have no accountability to the Subscriber whatsoever, and acknowledges that the Escrow Agent is merely the recipient for the Company and have no obligations to the Subscriber. The Subscriber agrees that submission of the Subscription Proceeds to the Escrow Agent in trust is to be deposited in an escrow fund and shall be the property of the Company at that point. The only duty the Escrow Agent shall have to the Subscriber is to deliver the Subscription Proceeds to the Company, all solely according to the Company’s instructions, and the Escrow Agent shall require no further instructions from the Subscriber in delivering the same to the Company.

3

Confidential

Canadian and Non-U.S. Subscribers Only

The proceeds of the Escrow Account shall be distributed in accordance with Section 1.6.

1.6 Closing

Closing of the offering of the Units shall occur in the following manner:

(a) The Escrow Agent shall release all or part of the U.S. $500,000.00 (Five Hundred Thousand Dollars) from the Escrow Account to the Company once the sum of the Subscription Proceeds deposited in the Escrow Account is equal to or greater than U.S. $250,000.00 (Two Hundred and Fifty Thousand Dollars) (the “Closing”).

(b) Unless otherwise agreed to by the Company and the Subscriber, on the Closing Date (as defined herein), (x) the Company shall irrevocably instruct its transfer agent to deliver to the Subscriber one or more stock certificates, free and clear of all restrictive and other legends (except as expressly provided in Section 3 hereof), evidencing the number of Shares the Subscriber is purchasing as is set forth on Subscriber’s signature page to this Agreement next to the heading “Shares Issued” within two (2) business days after the Closing Date (the “Subscribed Shares”) and (b) the Company shall issue to the Subscriber a Warrant pursuant to which the Subscriber shall have the right to acquire such number of Warrant Shares as is set forth on the Subscriber’s signature page to this Agreement next to the heading “Warrants Issued,” duly executed on behalf of the Company and registered in the name of the Subscriber. As used herein, the term “Closing Date” means the business day when all of the subscription documents have been executed and delivered by the applicable parties thereto, and all of the conditions set forth in Section 6 hereof are satisfied, or such other date as the parties may agree.

2. Conditions to Offer.

This Offering is being conducted on a “best efforts” basis. Closing of the Offering shall occur as described in and subject to the provisions of Section 1.6 hereof.

3. Representations, Warranties and Covenants.

3.1 Representation, Warranties and Covenants of the Subscriber. The Subscriber hereby represents and warrants to, and covenants with, the Company (which representation, warranties and covenants shall survive the closing of this Agreement) and acknowledges that the Company is relying thereon that:

4

Confidential

Canadian and Non-U.S. Subscribers Only

(a) The undersigned is resident, or if not an individual, has a head office, in the jurisdiction set out under the heading “Address of subscriber” above the signature set forth on the execution page of this Agreement, which address is the undersigned’s principal residence or place of business, and such address was not obtained or used solely for the purpose of acquiring the Securities.

(b) The Subscriber is not a “U.S. Person” (as such term is defined in Regulation S under the 1933 Act (“Regulation S”)) or person in the U.S. and the Securities are not being acquired, directly or indirectly, for the account or benefit of a U.S. Person or person in the U.S. At the time Subscriber executed and delivered this Agreement, Subscriber was outside the U.S. and is outside of the U.S. as of the date of the execution and delivery of this Agreement. Rule 902 of Regulation S of the 1933 Act includes the following people as a “U.S. person”:

|

|

(i)

|

any natural person resident in the U.S.;

|

|

|

(iv)

|

any trust of which any trustee is a U.S. person;

|

|

|

any non-discretionary account or similar account (other than an estate or trust) held by a dealer or other fiduciary for the benefit or account of a U.S. person;

|

|

|

any discretionary account or similar account (other than an estate or trust) held by a dealer or other fiduciary, organized, incorporated, or (if an individual) resident in the U.S.; and

|

|

|

(A)

|

organized or incorporated under the laws of any foreign jurisdiction; and

|

|

|

(B)

|

formed by a U.S. person principally for the purpose of investing in securities not registered under the Act, unless it is organized or incorporated, and owned by accredited investors (as defined in Rule 501(a) of the 1933 Act) who are not natural persons, estates or trusts.

|

|

|

(C)

|

Unless paragraph 3.1(d) below applies, it is purchasing the Securities as principal for its own account, not for the benefit of any other person, for investment only and not with a view to resale or distribution of all or any of the Securities and unless exempted by an order of the securities commission or similar regulatory authority of the Province or Territory in which it resides, it fully complies with one or more of the following criteria (please initial one or more as applicable) and it has completed the appropriate Schedules to this Agreement:

|

5

Confidential

Canadian and Non-U.S. Subscribers Only

|

_____

|

(ix) it is an “accredited investor” as such term is defined in NI 45-106 and has concurrently executed and delivered an Eligibility Certificate in the form attached as Schedule B to this Agreement; or

|

|

|

_____

|

(x) it is not a resident of Ontario and (please also insert the name of the person) is:

|

|

|

_____

|

(A) a director, executive officer or control person of the Company or of an affiliate of the Company; or

|

|

|

_____

|

(B) a spouse, parent, grandparent, brother, sister or child of ______________________________________, a person referred to in subparagraph (ii)(A) above; or

|

|

|

_____

|

(C) a parent, grandparent, brother, sister or child of the spouse of _________________________________, a person referred to in subparagraph (ii)(A) above; or

|

|

|

_____

|

(D) a close personal friend of ___________________ __________________, a person referred to in subparagraph (ii)(A) above; or

|

|

|

_____

|

(E) a close business associate of __________________ __________________, a person referred to in subparagraph (ii)(A) above; or

|

|

|

_____

|

(F) a founder of the Company or a spouse, parent, grandparent, brother, sister, child, close personal friend or close personal business associate of __________ _______________________________, a founder of the Company;

|

|

|

_____

|

(G) a parent, grandparent, brother, sister or child of the spouse of _________________________________, a founder of the Company;

|

|

6

Confidential

Canadian and Non-U.S. Subscribers Only

|

_____

|

(H) a person of which a majority of the voting securities are beneficially owned by, or a majority of the directors are persons or companies described in subparagraphs (ii)(A) to (ii)(G) above; or

|

|

|

_____

|

(I) a trust or estate of which all of the beneficiaries or a majority of the trustees are persons or companies described in subparagraphs (ii)(A) to (ii)(G) above; and if a resident of Saskatchewan, relying upon subparagraphs (ii)(D), (ii)(E), (ii)(F) where the subscriber is a close personal friend or close business associate of a founder of the Company, or (ii)(H) or (ii)(I) if the trade is based in whole or in part on a close personal friendship or close business association, the undersigned has concurrently executed and delivered to the Company a risk acknowledgment form in Form 45-106F5 in the form attached as Schedule C hereto.

|

|

|

_____

|

(xi) it is a resident of Ontario and (please also insert the name of the person) is:

|

|

|

_____

|

(A) a founder of the Company; or

|

|

|

_____

|

(B) an affiliate of ______________________________, a founder of the Company; or

|

|

|

_____

|

(C) a spouse, parent, brother, sister, grandparent or child of _______________________________________, an executive officer, director or founder of the Company; or

|

|

|

_____

|

(D) a control person of the Company;

|

|

|

_____

|

(xii) (please also insert the name of the person) is:

|

|

|

_____

|

(A) an employee, executive officer, director or consultant of the Company or a related entity of the Company;

|

|

7

Confidential

Canadian and Non-U.S. Subscribers Only

|

_____

|

(B) a trustee, custodian or administrator acting on behalf, or for the benefit of ________________________ ___________________, a person or company referred to in subparagraph (iv)(A) above;

|

|

_____

|

(C) a holding entity of __________________________, an individual referred to in subparagraph (iv)(A) above;

|

|

_____

|

(D) an RRSP or RRIF of _________________________ ______________________, an individual referred to in subparagraph (iv)(A) above;

|

|

_____

|

(E) the spouse of ______________________________, an individual referred to in subparagraph (iv)(A) above;

|

|

_____

|

(F) a trustee, custodian or administrator acting of behalf, or for the benefit of the spouse of _______________ __________________________, an individual referred to in subparagraph (iv(A) above;

|

|

_____

|

(G) a holding entity of the spouse of ____________ _____________________________, an individual referred to in subparagraph (iv)(A) above;

|

|

_____

|

(H) an RRSP or RRIF of the spouse of _____________ ____________________________, an individual referred to in subparagraph (iv)(A) above;

|

|

if participation in the trade is voluntary and for the purposes of this paragraph, the terms “executive officer,” “related entity,” “consultant,” “holding entity” and “permitted assign” have the meanings ascribed thereto in NI 45-106; or

|

|

8

Confidential

Canadian and Non-U.S. Subscribers Only

|

_____

|

(xiii) it is purchasing Securities for an aggregate acquisition cost of not less than Cdn. $150,000 cash and if it is a corporation, syndicate, partnership or other form of association or entity, it was not created or used solely to purchase or hold securities in reliance upon the exemption set forth in section 2.10 of NI 45-106; or

|

|

_____

|

(xiv) if it is a resident of any jurisdiction referred to in the preceding paragraphs but not purchasing thereunder, it is purchasing pursuant to an exemption from prospectus and registration requirements (particulars of which are enclosed herewith) available to it under applicable securities legislation and shall deliver to the Company such further particulars of the exemption(s) and the undersigned’s qualifications thereunder as the Company may request.

|

(c) if it is purchasing on behalf of a beneficial purchaser, it is duly authorized to enter into this Agreement and to execute and deliver all documentation in connection with the purchase on behalf of each beneficial purchaser and it acknowledges that the Company is required by law to disclose to certain regulatory authorities the identity of each beneficial purchaser of Securities, and:

|

|

(i)

|

if it is resident in, or otherwise subject to the securities legislation of any Province or Territory, it is an “accredited investor” as defined in NI 45-106 and has concurrently executed and delivered a Representation Letter in the form attached as

|

9

Confidential

Canadian and Non-U.S. Subscribers Only

|

|

(ii)

|

Schedule A to this Agreement and is either:

|

|

|

(A)

|

a trust company or trust corporation described in paragraph (p) of the definition of “accredited investor” in NI 45-106 (excluding a trust company or trust corporation registered under the laws of the Province of Prince Edward Island that is not registered under the Trust and Loan Companies Act (Canada) or under comparable legislation in another jurisdiction of Canada); or

|

|

|

(B)

|

a person acting on behalf of a fully managed account managed by that person, if that person is registered or authorized to carry on business as an adviser or the equivalent under the securities legislation of a jurisdiction of Canada or a foreign jurisdiction, and in Ontario, is purchasing a security that is not a security of an investment fund, as described in paragraph (q) of the definition of “accredited investor” in NI 45-106;

|

|

|

(iii)

|

and was not created or used solely to purchase or hold securities as an accredited investor in reliance upon the exemption contained in paragraph (m) of the definition of “accredited investor” in NI 45-106; or

|

|

|

(iv)

|

if it is acting for one or more disclosed principals, each of such principals is purchasing as a principal for its own account, not for the benefit of any other person, and not with a view to the resale or distribution of all or any of the Securities and each of such principals complies with paragraph 3.1(C) above as applicable to it by virtue of its place of residence;

|

(d) The Subscriber has the legal capacity and competence to enter into and execute this Subscription Agreement and to take all actions required pursuant hereto and, if the Subscriber is a corporation, it is duly incorporated and validly subsisting under the laws of its jurisdiction of incorporation and all necessary approvals by its directors, shareholders and others have been obtained to authorize execution and performance of this Subscription Agreement on behalf of the Subscriber.

(e) The Subscriber has sufficient liquid assets to sustain a loss of the Subscriber’s entire investment.

(f) The Company has not made any other representations or warranties to the undersigned with respect to the Company or rendered any investment advice except as contained herein.

(g) The undersigned has such knowledge and experience in financial, investment and business matters to be capable of evaluating the merits and risks of the prospective investment in the securities of the Company. The undersigned has consulted with such independent legal counsel or other advisers as the undersigned has deemed appropriate to assist the undersigned in evaluating the proposed investment in the Company. By accepting these documents, the undersigned agrees that the information contained herein, and in all related and ancillary documents, shall be kept confidential and will not be used for any other purpose other than in connection with considering the purchase of the Securities.

10

Confidential

Canadian and Non-U.S. Subscribers Only

(h) The Subscriber (i) has adequate means of providing for its current financial needs and possible personal contingencies and does not have a need for liquidity of this investment in the Securities; (ii) can afford (a) to hold the Securities for an indefinite period of time; and (b) to sustain a complete loss of the entire amount of the Subscription Proceeds for the Securities; and (iii) has not made an overall commitment to investments which are not readily marketable, which is disproportionate so as to cause such overall commitment to become excessive.

(i) The Subscriber has been afforded the opportunity to ask questions of, and receive answers from, the officers and/or directors of the Company acting on its behalf concerning the terms and conditions of this transaction and to obtain any additional information, to the extent that the Company possesses such information or can acquire it without unreasonable effort or expense, necessary to verify the accuracy of the information furnished; and the undersigned has received satisfactory answers to all such questions to the extent deemed appropriate in order to evaluate the merits and risks of an investment in the Company.

(j) The Subscriber acknowledges that the none of the Securities are currently registered under the 1933 Act and, except as provided in Section 10 hereof, the Company has not undertaken to register any of such securities under U.S. Federal or State law, and, unless so registered, none of them may be offered or sold in the United States or, directly or indirectly, to U.S. Persons, as that term is defined in Regulation S, except in accordance with the provisions of Regulation S, pursuant to an effective registration statement under the 1933 Act, or pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the 1933 Act and in each case in accordance with applicable state and provincial securities laws.

(k) The undersigned further understands that it is purchasing all such securities without being furnished any prospectus setting forth all of the information that may be required to be furnished under applicable securities laws and as a consequence, certain protections, rights and remedies provided in applicable securities legislation, including statutory rights of rescission or damages, may not be available to it.

(l) The undersigned further acknowledges that no agency, governmental authority, securities commission or similar regulatory body, stock exchange or other entity has reviewed, passed on or made any finding or determination as to the merit for investment of the Securities nor have any such agencies or governmental authorities made any recommendation or endorsement with respect to the Securities.

(m) The undersigned acknowledges that there are restrictions on its ability to resell the Securities and it is the responsibility of the undersigned to find out what those restrictions are and to comply with them before selling the Securities. The undersigned agrees not to sell, transfer, pledge or otherwise dispose of or encumber the Securities except pursuant to the applicable rules and regulations of applicable securities laws, including Regulation S, and prior to any such sale, transfer, pledge, disposition or encumbrance, the undersigned will, upon request, furnish the Company and its transfer agent with an opinion of counsel satisfactory to the Company in form and substance that registration or equivalent action under the 1933 Act and all other applicable securities laws is not required. In addition to resale restrictions imposed under U.S. securities laws, there are additional restrictions on the Subscriber’s ability to resell any of the Securities under Canadian provincial securities laws and Canada’s National Instrument 45-102, Resale of Securities (“NI 45-102”).

11

Confidential

Canadian and Non-U.S. Subscribers Only

(n) This Agreement has been duly executed and delivered and, when accepted by the Company, will constitute a legal, valid and binding obligation of the undersigned enforceable against it in accordance with the terms hereof.

(o) No prospectus or offering memorandum within the meaning of the securities laws has been delivered to, summarized for or seen by the Subscriber in connection with the sale of the Units and the Subscriber is not aware of any prospectus or offering memorandum having been prepared by the Company.

(p) It has not received, nor has it requested, nor does it have any need to receive, any offering memorandum (as defined in or contemplated by applicable securities legislation) or any other document (other than financial statements or any other continuous disclosure documents, the contents of which are prescribed by statute or regulation) describing the business and affairs of the Company which has been prepared for delivery to, and review by, prospective subscribers in order to assist them in making an investment decision in respect of the Securities (or any of them), and it has not become aware of any advertisement including, by way of example and not in limitation, advertisement in any printed media of general and regular circulation or on radio or television with respect to the distribution of the Units.

(q) The decision to execute this Subscription Agreement and acquire the Units hereunder has not been based upon any oral or written representation as to fact or otherwise made by or on behalf of the Company, and such decision is based entirely upon a review of information, including the risk factors described in the Company’s filings with the U.S. Securities and Exchange Commission (the “SEC”), (the adequacy of which is hereby acknowledged) about the Company that is available to any member of the public on the EDGAR database maintained by the SEC at www.sec.gov.

(r) There are risks associated with an investment in the Company, including, by way of example and not in limitation, the specific risks identified in the Company’s most recent periodic reports filed with the SEC and available for viewing at the SEC’s website at www.SEC.gov.

(s) The Subscriber is not acquiring the Units as a result of, and will not itself engage in any “directed selling efforts” (as that term is defined in Regulation S) in the United States in respect of the Securities which would include any activities undertaken for the purpose of, or that could reasonably be expected to have the effect of conditioning the market in the United States for the resale of any of the Securities; provided, however, that the Subscriber may sell or otherwise dispose of the Securities pursuant to registration thereof under the 1933 Act, and any applicable state and provincial securities laws or under an exemption from such registration requirements.

12

Confidential

Canadian and Non-U.S. Subscribers Only

(t) None of the Securities may be offered or sold by the Subscriber to a U.S. Person, or for the account or benefit of a U.S. Person (other than a distributor) prior to the end of the Distribution Compliance Period (as defined herein).

(u) The Subscriber understands and agrees that there may be material tax consequences to it of an acquisition, holding or disposition of the Securities. The Company gives no opinion and makes no representation with respect to the tax consequences under U.S., Canadian, state, provincial, local or foreign tax law of the acquisition, holding or disposition of the Securities and the Subscriber acknowledges that it is solely responsible for determining the tax consequences of its investment.

(v) Any offer and/or sale of any of the Securities prior to the expiration of a period of six (6) months after the date of original issuance of that respective Security (the six-month period hereinafter referred to as the “Distribution Compliance Period”), shall only be made in compliance with the safe harbor provisions set forth in Regulation S, pursuant to the registration provisions of the 1933 Act or an exemption therefrom, and that all offers and sales after the Distribution Compliance Period shall be made only in compliance with the registration provisions of the 1933 Act or an exemption therefrom, and in each case only in accordance with applicable state and provincial securities laws.

(w) If required by applicable securities legislation, regulations, rules, policies or orders or by any securities commission, stock exchange or other regulatory authority, the undersigned will execute, deliver, file and otherwise assist the Company in filing such reports, undertakings and other documents with respect to the issue of the Securities (including, without limitation, an Eligibility Certificate in the form attached as Schedule B).

(x) The undersigned hereby agrees that the Company will insert the following legends on the face of the Securities in compliance with applicable securities laws:

“Unless permitted under securities legislation, the holder of this security must not trade the security in Canada before the date that is 4 months and a day after the later of (i) _________________________ [insert the distribution date], and (B) the date the issuer became a reporting issuer in any province or territory of Canada.”

13

Confidential

Canadian and Non-U.S. Subscribers Only

“THESE SECURITIES WERE ISSUED IN AN OFFSHORE TRANSACTION TO PERSONS WHO ARE NOT U.S. PERSONS (AS DEFINED HEREIN) PURSUANT TO REGULATION S UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE “1933 ACT”). ACCORDINGLY, NONE OF THE SECURITIES TO WHICH THIS CERTIFICATE RELATES HAVE BEEN REGISTERED UNDER THE 1933 ACT, OR ANY U.S. STATE SECURITIES LAWS, AND, UNLESS SO REGISTERED, NONE MAY BE OFFERED OR SOLD IN THE UNITED STATES (AS DEFINED HEREIN) OR, DIRECTLY OR INDIRECTLY, TO U.S. PERSONS (AS DEFINED HEREIN), EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT OR PURSUANT TO AN EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE 1933 ACT AND IN EACH CASE ONLY IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS. IN ADDITION, HEDGING TRANSACTIONS INVOLVING THE SECURITIES MAY NOT BE CONDUCTED UNLESS IN ACCORDANCE WITH THE 1933 ACT. “UNITED STATES" AND "U.S. PERSON" ARE AS DEFINED BY REGULATION S UNDER THE 1933 ACT.”

(y) The undersigned has not purchased the Securities as a result of any form of general solicitation or general advertising, including advertisements, articles, notices or other communications published in any newspaper, magazine or similar media or broadcast over radio, television or other form of telecommunications, or any seminar or meeting whose attendees have been invited by general solicitation or general advertising.

(z) The undersigned certifies that each of the foregoing representations and warranties set forth in subsections (a) through (aa) inclusive of this Section 3.1 are true as of the date hereof and shall survive such date.

(aa) Representations, Warranties and Covenants of the Company. The Company hereby represents and warrants and covenants to the Subscriber that:

(bb) Organization and Good Standing. The Company is a corporation duly organized, validly existing and in good standing under the laws of the jurisdiction of its incorporation or organization (as applicable). The Company has all necessary corporate power and authority to own, lease, use and operate its properties and to carry on its business as now being conducted and presently proposed to be conducted. The Company and each of its subsidiaries is duly qualified to do business as a foreign corporation and is in good standing in each jurisdiction in which its ownership or leasing of assets, or the conduct of its business, makes such qualification necessary.

14

Confidential

Canadian and Non-U.S. Subscribers Only

(cc) Requisite Power and Authorization. The Company has all necessary corporate power and authority to execute and deliver this Agreement, to issue the Shares and the Warrants and to carry out the provisions of this Agreement. All corporate action on the part of the Company required for the lawful execution and delivery of this Agreement, issuance and delivery of the Shares and the Warrants and the performance by the Company of its obligations hereunder has been taken. Upon execution and delivery, this Agreement constitutes valid and binding obligations of the Company enforceable in accordance with their respective terms, except as enforcement may be limited by insolvency and similar laws affecting the enforcement of creditors’ rights generally and equitable remedies. The Shares, when issued in compliance with the provisions of this Agreement, and the Warrant Shares, if issued, when issued in compliance with the provisions of the Warrants, will be duly authorized and validly issued, fully paid, non-assessable, subject to no lien, claim or encumbrance and issued in compliance with federal securities laws and applicable state securities laws. No stockholder of the Company or other person has any preemptive, anti-dilution, “poison-pill” or similar right with respect to the Shares and the Warrants and, if issued, the Warrant Shares. The Company has reserved such number of shares of its Common Stock necessary for issuance of the Shares and the Warrant Shares.

(dd) SEC Documents. The Company has filed all of its SEC Filings (as defined herein) for the 12 month period preceding the date hereof. As of their respective filing dates, or such later date on which such reports were amended, the SEC Filings complied in all material respects with the requirements of the Exchange Act. The SEC Filings as of their respective dates, or such later date on which such reports were amended, when issued did not contain any untrue statement of a material fact or omit to state a material fact required to be stated therein or necessary to make the statements made therein, in light of the circumstances under which they were made, not misleading. The financial statements included in the SEC Filings comply as to form in all material respects with applicable accounting requirements and with the published rules and regulations of the SEC with respect thereto. Except as may be indicated in the notes to the financial statements included in the SEC Filings or, in the case of unaudited statements, as permitted by Form 10-Q of the SEC, such financial statements have been prepared in accordance with generally accepted accounting principles consistently applied and fairly present the consolidated financial position of the Company and any subsidiaries at the dates thereof and the consolidated results of their operations and consolidated cash flows for the periods then ended (subject, in the case of unaudited statements, to normal, recurring adjustments). As used herein, the term “SEC Documents” means the Company annual reports on Form 10-K for fiscal year ended February 28, 2010 (including any amendments thereto) and (ii) the Company’s quarterly reports on Form 10-Q for the 2010 fiscal year and the term “SEC Filings” means the SEC Documents, along with all other reports, schedules, forms, statements and other documents that the Company is required to file with the SEC pursuant to the reporting requirements of the Securities and Exchange Act of 1934, as amended, for the 12 month period preceding the date hereof.

15

Confidential

Canadian and Non-U.S. Subscribers Only

(ee) Capital Stock. The authorized capital stock of the Company consists of 200,000,000 shares of Common Stock, with no par value, and 20,000,000 shares of Preferred Stock, with no par value. As of January 31, 2011, there were 54,003,827 shares of Common Stock issued and outstanding and there was no issued and outstanding Preferred Stock. All outstanding shares of Common Stock have been duly authorized and validly issued and are fully paid and non-assessable. As of January 31, 2011, none of the authorized Common Stock is reserved for issuance, other than (i) 386,666 units consisting of 386,666 shares of Common Stock, and 193,333 warrants exercisable at $0.50 pursuant to a cancellation of debt and release agreement, (ii) 3,860,000 shares of Common Stock reserved for future issuance pursuant to 5,000,000 options approved under the Company’s 2009 stock option plan, (iii) 2,875,000 shares of Common Stock reserved for future issuance pursuant to options and awards which may be granted under the Company’s 2008 and 2007 stock option plans, and (iv) 25,826,733 shares of Common Stock reserved for future issuance pursuant to outstanding warrants. Attached hereto as Exhibit 3.2(d) is the Company capitalization table as of the date of the Agreement. Except as set forth in this paragraph 3.2(d) and Exhibit 3.2(d), the Company has no outstanding securities convertible into or exchangeable for Common Stock and no contracts, rights, options or warrants to purchase or otherwise acquire Common Stock or securities convertible into or exchangeable for Common Stock.

(ff) No Conflicts. The execution, delivery and performance of this Agreement by the Company and the consummation by the Company of the transactions contemplated hereby (including, without limitation, the issuance and reservation for issuance of the Warrant Shares) will not: (i) conflict with or result in a violation of any provision of the Company’s certificate of incorporation or bylaws or (ii) violate or conflict with, or result in a breach of any provision of, or constitute a default (or an event which with notice or lapse of time or both could become a default) under, or give to others any rights of termination, amendment, acceleration or cancellation of, any agreement, indenture, patent, patent license or instrument to which the Company or any of its subsidiaries is a party, or (iii) result in a violation of any law, rule, regulation, order, judgment or decree (including federal and state securities laws and regulations and regulations of any self-regulatory organizations to which the Company or its securities are subject) applicable to the Company or any of its subsidiaries or by which any property or asset of the Company or any of its subsidiaries is bound or affected. Neither the Company nor any of its subsidiaries is in default (and no event has occurred which with notice or lapse of time or both could put the Company or any of its subsidiaries in default) under, and, to the knowledge of the Company, neither the Company nor any of its subsidiaries has taken any action or failed to take any action that would give to others any rights of termination, amendment, acceleration or cancellation of, any agreement, indenture or instrument to which the Company or any of its subsidiaries is a party or by which any property or assets of the Company or any of its subsidiaries is bound or affected. Neither the Company nor its subsidiaries is in violation of any material law, rule ordinance or regulation of any governmental entity. Except as required under federal securities laws and any applicable state securities laws, rules or regulations, by the terms of this Agreement, or by any applicable trading market, the Company is not required to obtain any consent, authorization or order of, or make any filing or registration with, any court, governmental agency, regulatory agency, self regulatory organization or stock market or any third party in order for it to execute, deliver or perform any of its obligations under this Agreement or the Warrants in accordance with the terms hereof or thereof or to issue and sell the Shares and Warrants in accordance with the terms hereof and to issue the Warrant Shares upon exercise of the Warrants in accordance with the terms thereof.

16

Confidential

Canadian and Non-U.S. Subscribers Only

(gg) No Material Adverse Change. Since the date of the latest audited financial statements included in the SEC Documents, except as set forth in the SEC Documents, there has not been:

|

|

(i)

|

any changes in the assets, liabilities, financial condition, prospects or operations of the Company from that reflected in the financial statements except changes in the ordinary course of business which have not been, either in any individual case or in the aggregate, materially adverse to the Company and its subsidiaries taken as a whole;

|

|

|

(ii)

|

any material change, except in the ordinary course of business, in the contingent obligations of the Company whether by way of guarantee, endorsement, indemnity, warranty or otherwise; or

|

|

|

(iii)

|

any damage, destruction or loss, whether or not covered by insurance, materially and adversely affecting the properties or business of the Company.

|

(hh) Litigation. Except as described in the SEC Documents, there is no material action, suit, claim, proceeding, inquiry or investigation before or by any court, public board, government agency, self-regulatory organization or body pending, or, to the Company’s knowledge, threatened or contemplated, against the Company or any of its subsidiaries, or against any officer, director or employee of the Company or any such subsidiary in connection with such person’s employment therewith. Neither the Company nor any of its subsidiaries is a party to or subject to the provisions of, any order, writ, injunction, judgment or decree of any court or government agency or instrumentality which could reasonably be expected to have a material adverse effect on the Company, its assets, liabilities, financial condition or business prospects.

(ii) Contracts. The material contracts to which the Company is a party that have been filed as exhibits to the SEC Filings, have been duly and validly authorized, executed and delivered by the Company and constitute the legal, valid and binding agreements of the Company, enforceable by and against it in accordance with their respective terms, except as such enforceability may be limited by applicable bankruptcy, insolvency, reorganization, moratorium or other similar laws and judicial decisions of general application relating to enforcement of creditors’ rights generally, and the application of general equitable principles relating to or affecting the availability of remedies, and except as rights to indemnity or contribution may be limited by federal or state securities laws or the public policy underlying such laws.

(jj) Real Property. The Company has good and valid title to all items of tangible personal property (“Real Property”) used in its operations free and clear of all Liens (as defined herein). Any Real Property described in the SEC Filings as being leased by the Company or any subsidiary is held by the Company under valid, existing and enforceable leases. As used herein, the term “Liens” shall mean any security interests, liens, pledges, mortgages or other encumbrances, whether arising voluntarily, involuntarily or by operation of law. Attached hereto as Exhibit 3.2(i) is a list of all Real Property and leases used in the Company’s operations. Except as disclosed on Exhibit 3.2(i), there are no unrecorded covenants, deed restrictions, easements, leases, subleases or rights of occupancy or liens which encumber the Real Property, or any part thereof. There are no easements, rights of way or licenses which are not in full force and effect necessary for the operation of any of the parcels constituting the Real Property. The Company has the right of ingress and egress, through a public road or street, to and from each of the parcels comprising the Real Property. No utility easement or right of way which services any portion of the Real Property may be terminated by the owner or mortgagee of any property through which any such easement or right of way runs.

17

Confidential

Canadian and Non-U.S. Subscribers Only

(kk) Permits; Compliance. The Company and each of its subsidiaries is in possession of all material franchises, grants, authorizations, licenses, permits, easements, variances, exemptions, consents, certificates, approvals and orders issued by the appropriate federal, state local or foreign regulatory authorities necessary to own, lease and operate its properties and to carry on its business as it is now being conducted (collectively, the “Company Permits”), and there is no action pending or, to the knowledge of the Company, threatened regarding suspension or cancellation of any of the Company Permits. Neither the Company nor any of its subsidiaries is in conflict with, or in default or violation of, any of the Company Permits.

(ll) Certain Transactions. Except as set forth in the SEC Filings, to the knowledge of the Company there are no loans, leases, royalty agreements or other transactions between: (i) the Company or any of its subsidiaries or any of their respective customers or suppliers, and (ii) any officer, employee, consultant or director of the Company or any person owning five percent (5%) or more of the capital stock of the Company or five percent (5%) or more of the ownership interests of the Company or any of its subsidiaries or any member of the immediate family of such officer, employee, consultant, director, stockholder or owner or any corporation or other entity controlled by such officer, employee, consultant, director, stockholder or owner, or a member of the immediate family of such officer, employee, consultant, director, stockholder or owner.

(mm) No Brokers. Except as disclosed herein, no brokerage or finder’s fees or commissions are or will be payable by the Company to any broker, financial advisor or consultant, finder, placement agent, investment banker, bank or other person with respect to the Offering. To the knowledge of the Company, the Subscriber shall have no obligation with respect to any fees or with respect to any claims made by or on behalf of other persons for fees of a type contemplated herein that may be due in connection with the transactions contemplated by the Offering.

(nn) Internal Controls. The Company is in compliance with the provision of the Sarbanes-Oxley Act of 2002 currently applicable to the Company.

(oo) FCPA Matters. Neither the Company, nor any of its subsidiaries, nor, to the knowledge of the Company, any director, officer, agent, employee or other person acting on behalf of the Company or any Subsidiary has, in the course of his or her actions for, or on behalf of, the Company: (i) used any corporate funds for any unlawful contribution, gift, entertainment or other unlawful expenses relating to political activity, (ii) made any direct or indirect unlawful payment to any foreign or domestic government official or employee from corporate funds, (iii) violated or is in violation of any provision of the U.S. Foreign Corrupt Practices Act of 1977, as amended, or (iv) made any bribe, rebate, payoff, influence payment, kickback or other unlawful payment to any foreign or domestic governmental or private official or person.

18

Confidential

Canadian and Non-U.S. Subscribers Only

(pp) Non-Public Information. The Company has not disclosed to the Subscriber any information that would constitute material non-public information other than the existence of the transactions contemplated hereby.

(qq) Disclosure. All disclosure provided to the Subscriber or Andean regarding the Company, its business and the transactions contemplated hereby, furnished by or on behalf of the Company, were, as of the date made, true and correct and did not contain any untrue statement of material fact or omit to state any material fact necessary in order to make the statements made therein, in the light of the circumstances under which they were made, not misleading.

(rr) Survival. The representations, warranties and covenants of the Company shall survive the Final Closing and shall continue in full force and effect for the benefit of the Subscriber for a period of one (1) year following the Final Closing, all in accordance with this Agreement.

(ss) No Undisclosed Events, Liabilities, Developments or Circumstances. Except for the transactions contemplated hereby, no event, liability, development or circumstance has occurred or exists, or is contemplated to occur, with respect to the Company, its business, properties, prospects, operations or financial condition, that would be required to be disclosed by the Company under applicable securities laws on a registration statement on Form S-1 filed with the SEC relating to an issuance and sale by the Company of its Common Stock and which has not been publicly announced.

(tt) Use of Proceeds. The Company hereby covenants to use the monies raised from the Offering only as described in the “Use of Proceeds” section, attached hereto as Exhibit C.

(uu) The Company certifies that each of the foregoing representations and warranties set forth in this Section 3.2 are true as of the date hereof and shall survive such date.

4. Indemnification. The parties hereto understand that the Securities are being offered in reliance upon representation, warranties and covenants of each of the parties hereto, the exemptions under applicable securities laws; that the availability of such exemptions are, in part, dependent upon the truthfulness and accuracy of the representations made by the undersigned herein; that the Company will rely on such representations in accepting any subscriptions for the Securities, and that the Company may take such steps as it considers reasonable to verify the accuracy and truthfulness of such representations in advance of accepting or rejecting the undersigned’s subscription. The undersigned agrees to indemnify and hold harmless the Company against any reasonable damage, loss, expense or cost, including reasonable attorneys’ fees, sustained as a result of any misstatement or omission on the undersigned’s part in this Agreement.

19

Confidential

Canadian and Non-U.S. Subscribers Only

5. No Waiver. Notwithstanding any of the representations, warranties, acknowledgments or agreements made herein by the undersigned, the undersigned does not thereby, or in any manner, waive any rights granted to him under applicable securities laws.

6. Revocation. The undersigned agrees that he or she shall not cancel, terminate or revoke this Agreement or any agreement of the undersigned made hereunder, and this Agreement shall survive the death or disability of the undersigned.

7. Termination of Agreement. If the Company elects to cancel this Agreement, provided that it returns to the undersigned, without interest and without deduction, all sums paid by the undersigned, this Offering shall be null and void and of no further force and effect, and no party shall have any rights against any other party hereunder.

8. Risks of New Business. The undersigned has been advised that the Company is preparing to engage in mineral exploration operations and has commenced limited business operations to date and generated limited revenues. The Company will be subject to all of the risks inherent in a developing mining business and there is no assurance that the Company will succeed, become profitable or that investors in the Company will receive a return on all or any part of their investment. Moreover, mineral exploration operations are significantly volatile and uncertain, and there is no assurance that the market for metals explored for will be sustained.

THIS IS A HIGHLY SPECULATIVE INVESTMENT THAT SHOULD NOT BE MADE BY ANYONE WHO CANNOT AFFORD TO SUSTAIN A LOSS OF HIS ENTIRE INVESTMENT.

9. Miscellaneous.

9.1 All notices or other communications given or made hereunder shall be in writing and shall be mailed by registered or certified mail, return receipt requested, postage prepaid, to the undersigned at their address set forth below and to the Company.

9.2 This Agreement constitutes the entire agreement among the parties hereto with respect to the subject matter hereof and may be amended only by a writing executed by all parties.

9.3 The provisions of this Agreement shall survive the execution thereof.

9.4 This Agreement shall be governed by and construed in accordance with the domestic laws of the State of New York without giving effect to any choice or conflict of law provision or rule (whether of the State of New York or any other jurisdiction) that would cause the application of the laws of any jurisdiction other than the State of New York. The parties further: (a) agree that any legal suit, action or proceeding arising out of or relating to this Agreement shall be instituted exclusively in any Federal or State court of competent jurisdiction within the State of New York, (b) waive any objection that they may have now or hereafter to the venue of any such suit, action or proceeding, and (c) irrevocably consent to the in personam jurisdiction of any Federal or State court of competent jurisdiction within the State of New York in any such suit, action or proceeding. The parties each further agree to accept and acknowledge service of any and all process which may be served in any such suit, action or proceeding in a Federal or State court of competent jurisdiction within the State of New York, and that service of process upon the parties mailed by certified mail to their respective addresses shall be deemed in every respect effective service of process upon the parties, in any action or proceeding.

20

Confidential

Canadian and Non-U.S. Subscribers Only

10. Collection of Personal Information. The undersigned (on its own behalf and, if applicable, on behalf of any person for whose benefit the undersigned is subscribing) acknowledges and consents to the fact the Company is collecting the undersigned’s (and any beneficial purchaser’s) personal information for the purpose of completing the undersigned’s subscription. The undersigned (on its own behalf and, if applicable, on behalf of any person for whose benefit the undersigned is subscribing) acknowledges and consents to the Company retaining the personal information for as long as permitted or required by applicable law or business practices. The undersigned (on its own behalf and, if applicable, on behalf of any person for whose benefit the undersigned is subscribing) further acknowledges and consents to the fact the Company may be required by applicable securities laws and stock exchange rules to provide regulatory authorities any personal information provided by the undersigned respecting itself (and any beneficial purchaser). The undersigned hereby acknowledges and consents to the fact that (i) the undersigned’s (and any beneficial purchaser’s) personal information is being collected indirectly by securities regulatory authorities, including the Ontario Securities Commission, under the authority granted to such authorities in applicable securities legislation; and this information is being collected for the purposes of the administration and enforcement of the applicable securities legislation. The undersigned (on its own behalf and, if applicable, on behalf of any person for whose benefit the undersigned is subscribing) hereby acknowledges that the public official in Ontario who can answer questions about the Ontario Securities Commission’s indirect collection of such information is the Administrative Assistant to the Director of Corporate Finance, Suite 1903, Box 55, 20 Queen Street West, Toronto, Ontario M5H 3S8, who may be contacted at (416) 593-8086. By executing this Agreement, the undersigned is deemed to be consenting to the foregoing collection, use and disclosure of the undersigned’s (and any beneficial purchaser’s) personal information. The undersigned also consents to the filing of copies or originals of any of the undersigned’s documents described herein as may be required to be filed with any stock exchange or securities regulatory authority in connection with the transactions contemplated hereby. The undersigned represents and warrants that it has the authority to provide the consents and acknowledgments set out in this paragraph on behalf of all beneficial purchasers.

11. Not Proceeds of Crime. The undersigned (on its own behalf and, if applicable, on behalf of any person for whose benefit the undersigned is subscribing) represents and warrants that the funds representing the Subscription Proceeds which will be advanced by the undersigned to the Company hereunder will not represent proceeds of crime for the purposes of the Proceeds of Crime (Money Laundering) Act (Canada) (the “PCMLA”) and the undersigned (on its own behalf and, if applicable, on behalf of any person for whose benefit the undersigned is subscribing) acknowledges that the Company may in the future be required by law to disclose the undersigned’s name and other information relating to this Agreement and the undersigned’s subscription hereunder, on a confidential basis, pursuant to the PCMLA. To the best of its knowledge (a) none of the subscription funds to be provided by the undersigned (i) have been or will be derived from or related to any activity that is deemed criminal under the law of Canada, the United States of America, or any other jurisdiction, or (ii) are being tendered on behalf of a person or entity who has not been identified to the undersigned, and (b) it shall promptly notify the Company if the undersigned discovers that any of such representations ceases to be true, and to provide the Company with appropriate information in connection therewith.

21

Confidential

Canadian and Non-U.S. Subscribers Only

12. Certification. The undersigned has read this entire Agreement and certifies that every statement on the part of the undersigned is true and complete.

[Remainder of page intentionally left blank]

22

Confidential

Canadian and Non-U.S. Subscribers Only

IN WITNESS WHEREOF, the undersigned has executed this Agreement on the date their signature has been subscribed and sworn to below.

DATED as of this _____ day of ____________, 2011.

|

Number of Units to be purchased at U.S. $0.20 each:

|

||

|

Aggregate Subscription Proceeds:

|

$

|

|

|

Name (full legal name of subscriber):

|

(print name of subscriber) |

|

|

Address of subscriber

|

(address, including postal code)

(telephone number) (facsimile number) (e-mail address)

By: ________________________________________________________________________________________________________

(signature)

(if corporation, print name of authorized signatory) (official capacity) (social insurance number or federal corporate/business account number) |

23

Confidential

Canadian and Non-U.S. Subscribers Only

|

ACCEPTED as of the ________________ day of ____, 2011.

PAN AMERICAN GOLDFIELDS LTD.

|

|

Shares Issued:

|

||

|

By: _________________________________________________________

Name: Miguel Di Nanno

Title: President

|

Warrants Issued: ____________

|

24

Confidential

Canadian and Non-U.S. Subscribers Only

FORM OF SUBSCRIPTION

|

TO:

|

Pan American Goldfields Ltd.

|

Mountain View Center

12303 Airport Way, Suite 200

Broomfield, CO. 80021

Attention: Miguel Di Nanno, President:

The undersigned Holder of the within Warrants hereby subscribes for ____________ common shares (the “Shares”) of Pan American Goldfields Ltd. (the “Company”) pursuant to the Warrants within at US$0.30 per share on the terms specified in said Warrants. Capitalized terms used herein and not otherwise defined shall have the respective meanings set forth in the Warrant.

This subscription is accompanied by a certified cheque or bank draft payable to or to the order of the Company for the aggregate purchase price of the Shares.

The undersigned represents that, at the time of the exercise of these Warrants, all of the representations and warranties contained in the Subscription Agreement between the Company and the undersigned pursuant to which these Warrants were issued are true and accurate.

The undersigned hereby directs that the Shares be registered as follows:

|

NAME(S) IN FULL

|

ADDRESS(ES)

|

NUMBER OF SHARES

|

||

|

TOTAL:

|

(Please print full name in which share certificates are to be issued, stating whether Mr., Mrs. or Miss as applicable).

DATED this ________ day of __________________ , ______.

In the presence of:

25

Confidential

Canadian and Non-U.S. Subscribers Only

|

Signature of Witness

|

Signature of Warrant Holder

|

Please print your name and address in full below.

Name (Mr./Mrs./Miss)

Address _________________________________________________________________________

_________________________________________________________________________

26

Confidential

Canadian and Non-U.S. Subscribers Only

INSTRUCTIONS FOR SUBSCRIPTION

The signature to the subscription must correspond in every particular with the name written upon the face of the Warrant without alteration or enlargement or any change whatever. If there is more than one subscriber, all must sign. In the case of persons signing by agent or attorney or by personal representative(s), the authority of such agent, attorney or representative(s) to sign must be proven to the satisfaction of the Company. If the Warrant certificate and the form of subscription are being forwarded by mail, registered mail must be employed.

27

Confidential

Canadian and Non-U.S. Subscribers Only

EXHIBIT B

INSTRUCTIONS FOR WIRING FUNDS

|

For the Benefit of:

DLA Piper US LLP Trust Account - Pan American Goldfields Ltd.

Bank Name: Union Bank of California

ABA Number: 122000496

Swift code: BOFCUS33MPK

Account Number: 6470017579

Account Name: DLA Piper LLP (US)

DLA Piper US LLP Trust Account

Bank Address: 400 University Avenue Palo Alto, CA 94301

Contact Information:

DLA Piper LLP (US), Atten: Jeffery Thacker

Address: 4365 Executive Drive, Suite 1100

San Diego, California 92121

|

28

Confidential

U.S. Accredited.Investors Only

EXHIBIT C

USE OF PROCEEDS

|

Name

|

Amount

|

Reason

|

||

|

Equity financing

|

$

|

500,000

|

||

|

Total cash inflows

|

500,000

|

|||

|

Acquisition of exploration property

|

150,000

|

|||

|

Geological work

|

120,000

|

|||

|

Consultants' fee, legal, travel and related costs

|

30,000

|

Due diligence on prospective exploration property acquisition

|

||

|

General administration

|

100,000

|

|||

|

Total cash outflows

|

$

|

400,000

|

||

|

Working capital

|

$

|

100,000

|

||

|

Total

|

$

|

500,000

|

||

29

Confidential

Canadian and Non-U.S. Subscribers Only

EXHIBIT D

TECHNICAL REPORT SUMMARY

GEOLOGY AND MINERAL RESOURCES

CIENEGUITA PROJECT

CHIHUAHUA, MEXICO

|

1.0

|

EXECUTIVE SUMMARY

|

This technical report was prepared by Delve Consultants at the request of PAN AMERICAN GOLDFIELDS LTD. (“Panam”) (formerly, Mexoro Minerals Limited), a United States (Delaware) corporation, listed on the Over The Counter Bulletin Board as MXOM, in connection with its filings with British Columbia Securities Commission. The report was written in compliance with disclosure and reporting requirements set forth in the Canadian Securities Administrators’ National Instrument 43-101, Companion Policy 43-101CP, and Form 43-101F1. The resource estimate contained in Section 17.8 for the Cieneguita deposit was prepared by P & E Mining Consultants, Inc in April 2010. No mineral reserves were estimated. Mr. Durgin, Mr. Wood, Mr. Puritch and Mr. Yassa (the authors) are qualified persons under Canadian Securities ministrators’ National Instrument 43-101. The authors have independently investigated the data provided to them by Pan American Goldfields Limited to the extent deemed necessary in their professional judgment for him to be able to reasonably rely on this information.

1.1 Introduction

The Cieneguita project is located southwestern Chihuahua in northern Mexico, and is 375 km by road from the state capital, Chihuahua City. The project is about 30 km south of the town of Cerocahui, adjacent to the village of Cienequita. It is part of the Sierra Madre Occidental silver-gold belt. The centre of the property is located at latitude 27 degrees 8 minutes North and longitude 108 degrees 12 minutes (WGS 1984, UTM zone 12, 3003848N, 795718E).

1.2 Geology and Mineralization

At the Cieneguita project, disseminated gold-silver-lead-zinc mineralization is hosted by a diatreme breccia, which has the appearance of a coarse, poorly sorted, poorly consolidated felsic tuff. Disseminated pyrite, galena, sphalerite and chalcopyrite are spatially associated with widespread sericitic and peripheral argillic alteration. The diatreme body has the appearance of a flattened funnel, approximately 1200 meters long and 200 meters wide, and dips nearly vertically. Host rocks are andesitic volcanic rocks of lower Tertiary age. This is the first mineralized diatreme breccia described in the region.

30

Confidential

Canadian and Non-U.S. Subscribers Only

EXHIBIT D (continued)

1.3 Exploration and Mining History

In general, the region has a mining history dating to the early Spanish colonial days. The church at nearby Cerocahui was built in 1620. There was no significant mining activity in the immediate area of Cieneguita until Cominco drilled 51 diamond drill holes (6700m) in 1981 and 1982. Glamis Gold completed drilling programs in 1994 and 1997. From 1995 to 1998, the Cieneguita deposit was a producing gold mine operated by Glamis. From 1995 to 1998, an indicated 197,993 metric tonnes of oxidized ore grading at 2.27 grams per tonne gold (g/t Au) was mined

from the Cieneguita Property. Panam began its ongoing exploration and development program in December 2007.

1.4 Drilling and Sampling

The quality and technical specifications of sampling techniques and procedures of any drilling done prior to that of Panam are not well known. The precise hole locations of most of the earlier

generations of drilling cannot be ascertained with certainty due to mining activity and the passage of time having erased much of the prior survey grid. Panam initiated a diamond drilling program in December 2008, using GDA Servicios Mineros, as the contractor. The program was completed late in 2009 using two drill rigs. A total of 20,733 meters of HQ (2.5 inch core) drilling was completed in 103 drill holes. Core recovery has been excellent. All of the core in each hole has been photographed, logged in detail, split, sampled, and assayed by Chemex Laboratory for silver and gold as well as a suite of trace elements. In the area which has become the # 3 Pit, a program of closely spaced shallow ore definition drilling was completed in the second quarter of 2009. This program contained 133 holes, also HQ in size, for a total of 5420 meters.

1.5 Metallurgical Testing

Panam has processed more than 17,700 tons of material testing bulk sulfide flotation methods in

Minera Rio Tinto’s mill in Choix, Sinaloa, described in detail in Section 16. This testing was focused on achieving the best gold and silver recoveries for the in-house mineralization estimate in the # 3 Pit, currently being mined, with little emphasis on the base metals. Recoveries on the order of 95% of the gold and 85% of the silver seem achievable. Bench scale flotation testing was also done with the aim of enhancing both base and precious metal recoveries. This will be vital to the larger scale deposit from which recovery of gold, silver, lead, zinc and copper is anticipated. These test showed that, in producing a lead concentrate, a zinc concentrate, and perhaps a pyrite concentrate, very good recoveries will be possible. A conservative estimate of the anticipated metal recoveries is:

Au = 95%, Ag = 83%, Pb = 80%, Zn = 80%, Cu = 75%

31

Confidential

Canadian and Non-U.S. Subscribers Only

EXHIBIT D (continued)

1.6 Mineral Resource Estimation

There are two separate resource estimates. First, in the spring of 2009 an in-house krigged mineralization estimate was made for the small, higher grade # 3 Pit using a database of 5420 meters of drilling in 133 shallow holes and a few deeper exploration holes. Minesight modeling software was used. The block model is approximately 160 by 100 by 50 meters. Within this, using a density of 2.4 tonnes per cubic meter, and a cutoff grade of 1 g/t AuEq ( EuEq = Au g/t + (Ag g/t / 67), this figure was calculated at 658,451 tonnes at a grade of 1.793 g/t Au and 93.51 g/t Ag, or a gold -equivalent grade of 3.173 g/t. With a pit slope of 45 degrees, the strip ratio was calculated to be 0.59 to 1.

The large scale, lower grade, more formal resource estimate, which is the principal focus of this report, has been completed in a NI 43-101 compliant manner by P & E Mining Consultants, Inc. It is based on 17,833 meters of core drilling in 90 holes with an approximate spacing of 40 meters. The database has been carefully verified. Mining of the larger scale resource will be at a larger scale and include recoveries of all five metals - Au, Ag, Pb, Zn, Cu - as efficiently as possible. From the results of metallurgical testing by Panam and comparison with other projects, estimated metal recoveries used in the modeling are:

Au = 90%, Ag = 83%, Pb = 80%, Zn = 890%, Cu = 75%.

Based on sales of concentrates produced in pre-startup testing of 17,700 tons of material and general guidelines (there are no smelter contracts at this time), the following smelter paybacks are used in the estimate: Au = 95%, Ag = 95%, Pb = 70%, Zn = 70%, Cu = 80%.

24 month trailing average metal prices used are: Au = $945/oz, Ag = $14.75/g, Pb = $0.85/lb, Zn = $0.80/lb, Cu = $2.75.

In defining boundaries of mineralization in the estimation of the resource, mining and processing costs must be included, as well as the above factors. Based on mining engineering studies, assuming production rates of 1000 tons per day, and a 1.5 to 1 stripping ratio, mining and processing costs are estimated to be $24.50 per tonne. Thus the cutoff used for defining ore boundaries was $24.50.

32

Confidential

Canadian and Non-U.S. Subscribers Only

EXHIBIT D (continued)

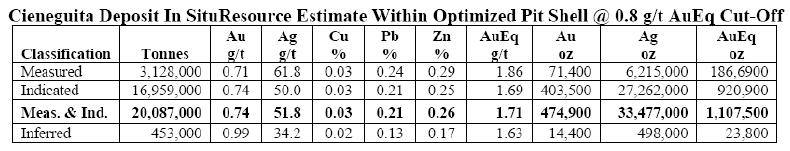

Modeling of the larger scale Cieneguita deposit using the drilling database, the price, recovery, and smelter return figures above and Gemcom modeling software produced the following resources:

1.7 Interpretation and Conclusions

From their review of data provided by Panam, the authors believe that the data generally provide an accurate and reasonable representation of the Cieneguita project. Panam’s exploration program has delineated a gold and silver resource with significant base metal values. These resources are classified as Measured & Indicated and Inferred Resources as defined by CIM. These have been estimated based on detailed and reliable exploration and testing information gathered using appropriate techniques and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed. Some portion of these resources may be upgraded to Proven and Probable Reserves as more data is obtained, more engineering and economic studies are completed and more sophisticated methods of deposit modeling are applied. It cannot be assumed that all such resources will be converted to Reserves, however the authors believe that such improvements will lead to definition of additional resources or reserves in higher categories for large portions of the deposit.

In addition, the resources described remain somewhat open to the northwest and in depth. The drilling program on which this resource calculation has been based was done at a nominal hole spacing of 40 meters. Additional drilling is clearly warranted both as infill of the known resource in some areas and as additional step-out drilling peripheral to the known resource. This is planned later in 2010.

33

Confidential

Canadian and Non-U.S. Subscribers Only

EXHIBIT 3.2(d)

CAPITALIZATION SPREAD SHEET

|

Number of

|

Number of

|

Number of

|

||||||||||

|

Shares

|

Options

|

Warrants

|

||||||||||

|

Balance, February 28, 2009

|

31,019,302 | 4,835,000 | 7,102,890 | |||||||||

|

Issued

|

22,734,525 | 2,060,000 | 22,887,500 | |||||||||

|

Cancelled/forfeited

|

- | (335,000 | ) | (4,609,490 | ) | |||||||

|

Exercised

|

- | - | - | |||||||||

|

Balance, February 28, 2010

|

53,753,827 | 6,560,000 | 25,380,900 | |||||||||

|

Issued

|

||||||||||||

|

Share subscription - Michael McKnight

|

250,000 | - | - | |||||||||

|

Warrants issued to new directors

|

- | - | 3,000,000 | |||||||||

|

Cancelled/forfeited

|

- | (825,000 | ) | (2,554,167 | ) | |||||||

|

Options granted - Miguel Di Nanno

|

1,000,000 | |||||||||||

|

Exercised

|

- | - | - | |||||||||

|

Balance, December 31, 2010

|

54,003,827 | 6,735,000 | 25,826,733 | |||||||||

34

Confidential

Canadian and Non-U.S. Subscribers Only

EXHIBIT 3.2(i)

REAL PROPERTY

Properties owned by Sunburst Mining de Mexico, a 100% subsidiary of Pan American Goldfields Ltd.

|

Encino Gordo

|

|||

|

Lot Name

|

Title Number

|

Area (Ha)

|

Term of Validity

|

|

Encino Gordo

|

225277

|

450.00

|

8/12/2005 to 8/11/2055

|

|

Encino Gordo

|

227125

|

382.00

|

5/17/2006 to 5/16/2056

|

Properties under option agreements with Sunburst Mining de Mexico,

|

Cieneguita

|

|||

|

Lot Name

|

Title Number

|

Area (Ha)

|

Term of Validity

|

|

Aurifero

|

196356

|

492.00

|

7/16/1993 to 7/15/2043

|

|

Aurifero Norte

|

196153

|

60.00

|

7/16/1993 to 7/15/2043

|

|

Aquilon Uno

|

208339

|

222.11

|

9/23/1998 to 9/22/2048

|

|

La Maravilla

|

190479

|

48.00

|

4/29/1991 to 4/24/2041

|

|

Encino Gordo

|

|||

|

Lot Name

|

Title Number

|

Area (Ha)

|

Term of Validity

|

|

La Paloma

|

220148

|

100.00

|

6/17/2003 to 6/16/2053

|

|

El Camuchin

|

220149

|

100.00

|

6/17/2003 to 6/16/2053

|

35

Confidential

Canadian and Non-U.S. Subscribers Only

EXHIBIT 3.2(i) (continued)

|

Machinery and Equipment

|

|

|

Description

|

Date

|

|

Acquired

|

|

|

Structures and belts

|

2/1/2007

|

|

Agglomerations and base

|

3/31/2007

|

|

BHD 8x20 ft. container

|

7/24/2007

|

|

BHD 8x20 ft. container

|

8/1/2007

|

|

3 Prefab metal containers

|

11/20/2007

|

|

Transportation Equipment

|

|

|

Description

|

Date

|

|

Acquired

|

|

|

Ford F-250 20355

|

4/29/2006

|

|

Ford F-250 20503

|

4/25/2006

|

|

Ford Lobo Deducible81850

|

8/26/2006

|

|

Housing trailer 0772

|

11/1/2006

|

|

Housing trailer 23361

|

11/1/2006

|

|

Ford F-250 Diesel 43477

|

6/26/2007

|

|

Ford F-250 30517

|

7/30/2007

|

|

Ford F-250 4X4 29899

|

6/5/2008

|

36

Confidential

Canadian and Non-U.S. Subscribers Only

SCHEDULE A

ALL SUBSCRIBERS

REGISTRATION AND DELIVERY INSTRUCTIONS

|