Attached files

| file | filename |

|---|---|

| 8-K - HEALTHSOUTH CORPORATION 8-K 03-08-2011 - Encompass Health Corp | form8k_03082011.htm |

Exhibit 99.1

The information contained in this presentation includes certain estimates, projections and other forward-

looking information that reflect our current views with respect to future events, strategy, capital

expenditures and financial performance. These estimates, projections and other forward-looking

information are based on assumptions that HealthSouth believes, as of the date hereof, are reasonable.

Inevitably, there will be differences between such estimates and actual events or results, and those

differences may be material.

looking information that reflect our current views with respect to future events, strategy, capital

expenditures and financial performance. These estimates, projections and other forward-looking

information are based on assumptions that HealthSouth believes, as of the date hereof, are reasonable.

Inevitably, there will be differences between such estimates and actual events or results, and those

differences may be material.

There can be no assurance that any estimates, projections or forward-looking information will be realized.

All such estimates, projections and forward-looking information speak only as of the date hereof.

HealthSouth undertakes no duty to publicly update or revise the information contained herein.

HealthSouth undertakes no duty to publicly update or revise the information contained herein.

You are cautioned not to place undue reliance on the estimates, projections and other forward-looking

information in this presentation as they are based on current expectations and general assumptions and

are subject to various risks, uncertainties and other factors, including those set forth in the Form 10-K for the

year ended December 31, 2010, and in other documents we previously filed with the SEC, many of which

are beyond our control, that may cause actual events or results to differ materially from the views, beliefs

and estimates expressed herein.

information in this presentation as they are based on current expectations and general assumptions and

are subject to various risks, uncertainties and other factors, including those set forth in the Form 10-K for the

year ended December 31, 2010, and in other documents we previously filed with the SEC, many of which

are beyond our control, that may cause actual events or results to differ materially from the views, beliefs

and estimates expressed herein.

Note Regarding Presentation of Non-GAAP Financial Measures

The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G

under the Securities Exchange Act of 1934. Schedules are attached that reconcile the non-GAAP financial

measures included in the following presentation to the most directly comparable financial measures

calculated and presented in accordance with Generally Accepted Accounting Principles in the United

States. Our Form 8-K, dated March 8, 2011, to which the following supplemental slides are attached as

Exhibit 99.1, provides further explanation and disclosure regarding our use of non-GAAP financial measures

and should be read in conjunction with these supplemental slides.

The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G

under the Securities Exchange Act of 1934. Schedules are attached that reconcile the non-GAAP financial

measures included in the following presentation to the most directly comparable financial measures

calculated and presented in accordance with Generally Accepted Accounting Principles in the United

States. Our Form 8-K, dated March 8, 2011, to which the following supplemental slides are attached as

Exhibit 99.1, provides further explanation and disclosure regarding our use of non-GAAP financial measures

and should be read in conjunction with these supplemental slides.

Forward-Looking Statements

2

Exhibit 99.1

|

Inpatient Rehabilitation Hospitals (“IRF”)

|

|

|

Outpatient Rehabilitation Satellite Clinics

|

|

|

Long-Term Acute Care Hospitals (“LTCH”)

|

|

|

Hospital-Based Home Health Agencies

|

|

|

Employees

|

|

|

Revenue in 2010

|

|

|

Inpatient Discharges in 2010

|

|

|

Outpatient Visits in 2010

|

|

|

Number of States

|

|

|

Exchange (Symbol)

|

|

3

Largest Provider of Inpatient Rehabilitative Healthcare Services in the U.S.

Our Company

|

Marketshare

|

|

~ 8% of IRFs

~ 17% of Licensed Beds ~ 22% of Patients Served |

Exhibit 99.1

Our Hospitals

Major Services

• Rehabilitation Physicians: manage and treat medical needs of patients

• Rehabilitation Nurses: oversee treatment programs of patients

• Physical Therapists: address physical function, mobility, safety

• Occupational Therapists: promote independence and re-integration

• Speech-Language Therapists: treat communication & swallowing disorders

• Case Managers: coordinate care plan with physician, caregivers and family

• Post-discharge services: outpatient therapy and home health

4

Exhibit 99.1

Our Patients

5

Most Common Conditions (2010)

1. Stroke 17.2%

2. Neurological 15.2%

3. Debility 11.3%

4. Fracture of the lower extremity 11.0%

5. Knee/Hip replacement 9.5%

6. Other orthopedic conditions 9.5%

7. Brain injury 7.4%

8. Cardiac conditions 4.3%

9. Spinal cord injury 3.6%

10. All other 11.0%

Referral Sources

94% Acute Care Hospitals

5% Physician Offices

1% Skilled Nursing Facilities

Admission to an IRF

• Physicians and acute care

hospital case managers are key

decision-makers.

hospital case managers are key

decision-makers.

• All IRF patients must meet

reasonable and necessary criteria

and must be admitted by a

physician.

reasonable and necessary criteria

and must be admitted by a

physician.

• All IRF patients must be medically

stable and have potential to

tolerate three hours of therapy per

day (minimum).

stable and have potential to

tolerate three hours of therapy per

day (minimum).

• IRF patients receive 24-hour, 7

days a week nursing care.

days a week nursing care.

• Average length of stay (ALOS) =

14.1 days

14.1 days

Exhibit 99.1

Our Quality

FIM Gain

Change in

Functional

Independence

Measurement

(based on an 18

point assessment)

from admission to

discharge

Functional

Independence

Measurement

(based on an 18

point assessment)

from admission to

discharge

6

(1) Average = Expected, Risk-adjusted

• Inpatient rehabilitation hospitals evaluate all patients at admission and upon

discharge to determine their functional status.

discharge to determine their functional status.

− The Functional Independence Measurement (“FIM”) patient assessment

instrument is used for these evaluations.

instrument is used for these evaluations.

• The difference between the FIM scores at admission and upon discharge is called

the “FIM Gain.”

the “FIM Gain.”

− The greater the FIM Gain, the greater the patient’s level of independence, the

better the patient outcome.

better the patient outcome.

Exhibit 99.1

(1) The 1,171 total and the 91 for HLS do not include HealthSouth Rehabilitation Hospital of Northern Virginia; Rehabilitation Hospital of Southwest Virginia;

Rehabilitation Hospital of Mesa, AZ; and Rehabilitation Hospital of Fredericksburg, VA. that were opened after the data collection. Desert Canyon

Rehabilitation Hospital and HealthSouth Sugar Land Rehabilitation Hospital, currently owned by HLS, were included in the 139 non-HLS freestanding.

Rehabilitation Hospital of Mesa, AZ; and Rehabilitation Hospital of Fredericksburg, VA. that were opened after the data collection. Desert Canyon

Rehabilitation Hospital and HealthSouth Sugar Land Rehabilitation Hospital, currently owned by HLS, were included in the 139 non-HLS freestanding.

(2) In 2009, HealthSouth averaged 1,177 total Medicare and non-Medicare discharges in its 90 consolidated hospitals and 6 long-term acute care hospitals.

Sources: FY 2011 CMS Rate Setting File - see slide 28

7

Total Inpatient Rehabilitation Facilities (IRFs): 1,171 (1)

Our Cost-Effectiveness

HealthSouth

differentiates

itself by

providing

superior quality

care at a

differentiates

itself by

providing

superior quality

care at a

lower cost.

Exhibit 99.1

Our Payors (2010)

Prospective Payment System (“PPS”)

• Payments based on Case Mix Groups

(“CMGs”)

(“CMGs”)

– Diagnosis of patient’s illness

• Fixed payment per CMG adjusted for:

– Acuity/severity

– Regional wage differential

• Per diems for “short stays”

Per Diem or CMG

• Negotiated rate

• Some are “tiered” for acuity/severity

Variety of methodologies

Varies by state

Variety of methodologies

Medicare

Managed Care

• Includes managed

Medicare

Medicare

Other Third-Party Payors

Medicaid

Workers’ Comp./

Patients/Other

Patients/Other

Payment Methodology

Payor Source

8

70.5%

21.5%

2.3%

4.0%

1.7%

Exhibit 99.1

Our Track Record

(1)Reconciliation to GAAP provided on slides 29 and 31-35.

9

Exhibit 99.1

Historical Performance

10

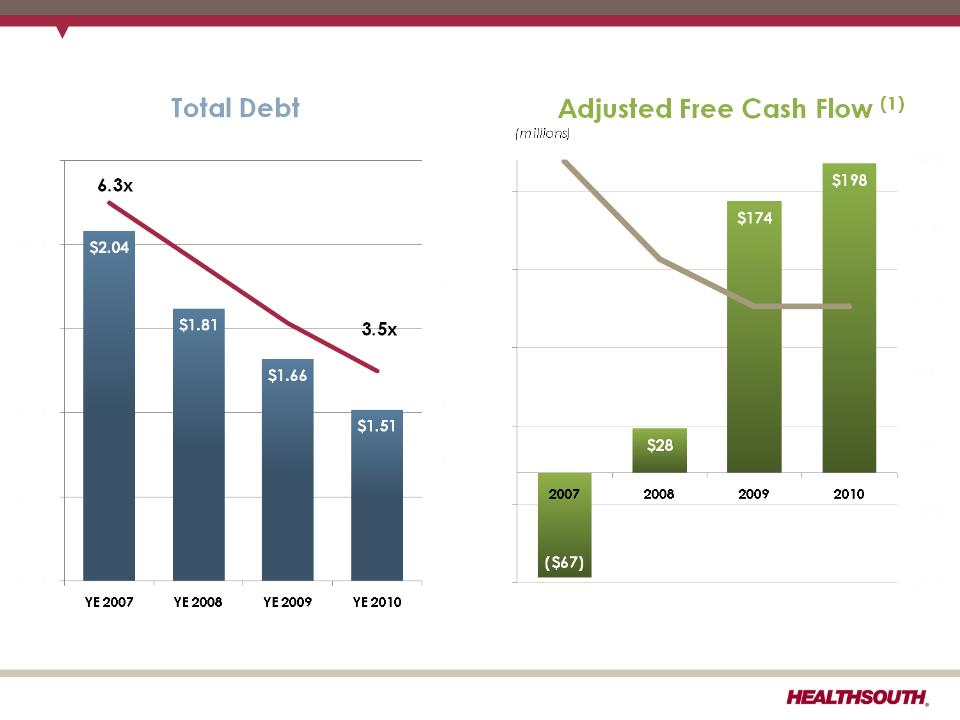

Leverage Ratio(1)

(billions)

(1) Reconciliation to GAAP provided on slides 29-35.

Interest Expense

$229

$126

Exhibit 99.1

Business Outlook: 2011 to 2013

Business Model

• Adjusted EBITDA CAGR: 5-8% (1)

• Adjusted Free Cash Flow CAGR: 12-17% (1)

Strategy

2010

2011

2012

2013

Deleveraging(2)

Goal: < 4.0x

debt to EBITDA

debt to EBITDA

Longer-Term Goal: ~ 3.0x

debt to EBITDA (3.5x goal achieved at year-end 2010)

debt to EBITDA (3.5x goal achieved at year-end 2010)

Growth

Organic growth (includes capacity expansions)

De novos (~ 2-3/year)

IRF acquisitions (~ 2-3/year)

Opportunistic, disciplined acquisitions

of complementary post-acute services

of complementary post-acute services

Key Operational

Initiatives

Initiatives

• Beacon (Management Reporting Software) = Labor / outcomes / quality optimization

• TeamWorks = Care Management

• “CPR” (Comfort, Professionalism, Respect) Initiative

(1) Reconciliation to GAAP provided on slides 29-35.

(2) Exclusive of any E&Y recovery.

11

Exhibit 99.1

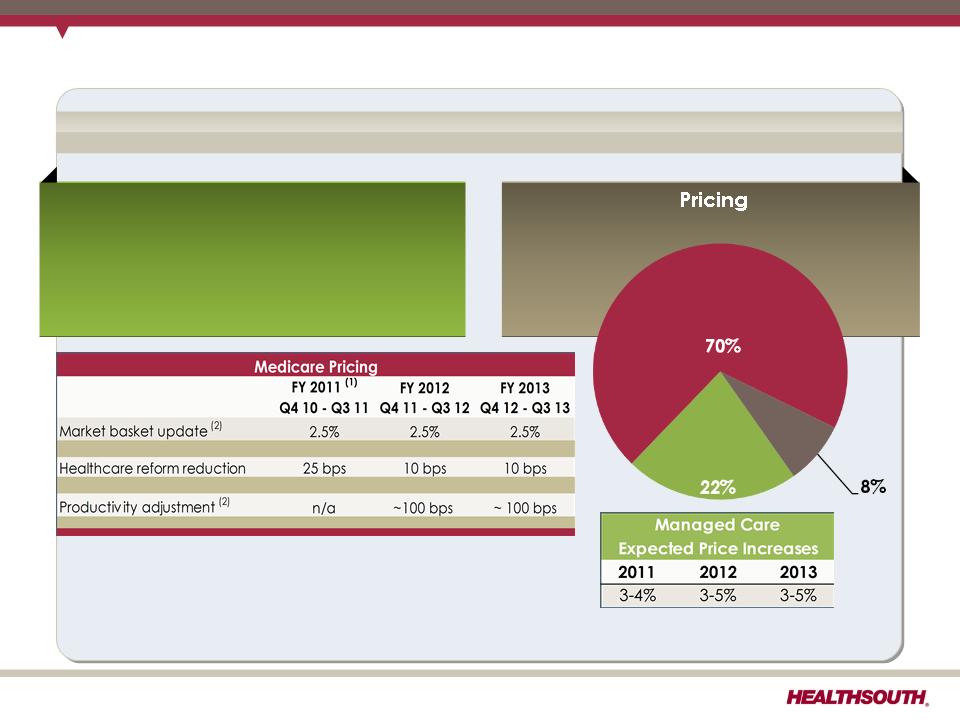

Business Outlook: Revenue Assumptions

12

Revenue

Volume

•2.5% to 3.5% annual growth (excludes

acquisitions)

acquisitions)

•Includes bed expansions, de novos

and unit consolidations

and unit consolidations

Medicare

Managed

Care

Care

Other

(1) We believe based on the 2011 Medicare rule for IRFs, HealthSouth should realize an increase of approximately 2.1% annually.

(2) Management estimates

Exhibit 99.1

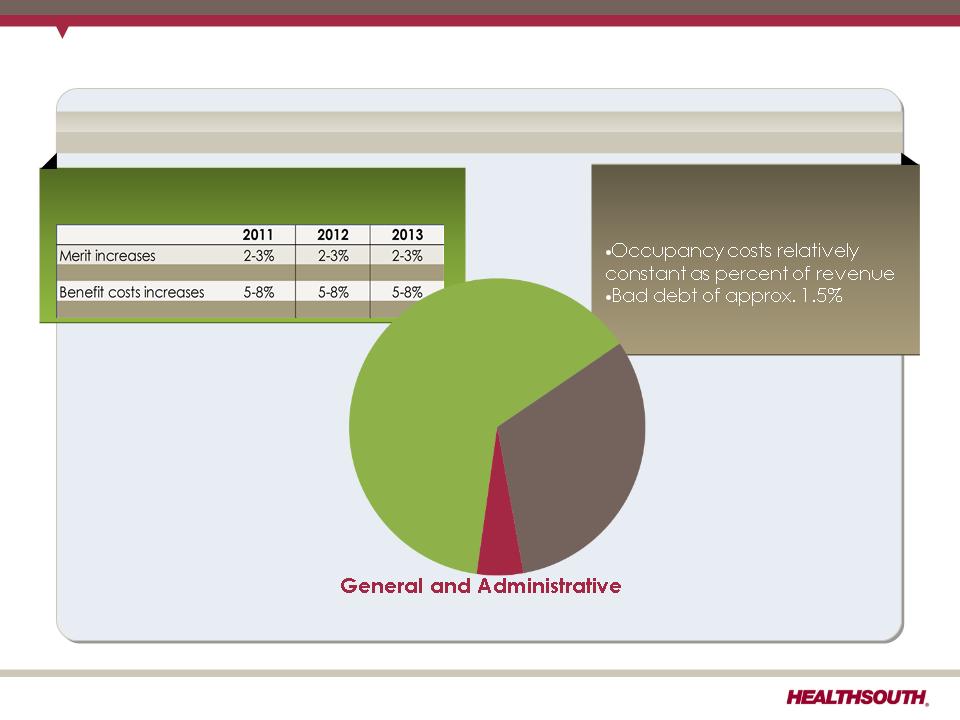

Business Outlook: Expense Assumptions

Expense

Salaries & Benefits (1)

Hospital Expenses

• Other operating and supplies

tracking with inflation

tracking with inflation

4.5% of revenue

(excludes stock-based compensation)

Salaries

& Benefits

Hospital

Expenses

Expenses

(1) Salaries, Wages and Benefits: 85% Salaries and Wages; 15% Benefits

13

Exhibit 99.1

Adjusted Free Cash Flow (1) Assumptions

(1) Reconciliation to GAAP provided on slide 30.

• Items that will affect Adjusted Free Cash Flow in 2011:

+ Cash settlements for interest rate swaps will be $33.8 million lower in 2011.

− Interest expense will be approximately $4 million per quarter higher in 2011 than 2010,

prior to any repayment/refinancing of the 10.75% senior notes.

prior to any repayment/refinancing of the 10.75% senior notes.

+ Interest expense will be reduced with any repayment/refinancing of 10.75% senior notes

callable in June 2011.

callable in June 2011.

– Maintenance capital expenditures are estimated to be approximately $20 million higher

in 2011 than 2010.

in 2011 than 2010.

• 2010 working capital benefited from a shift in timing of interest payments related to the

refinancing in Q4 2010, offset by the $6.9 million unwind fee related to the termination of

the two forward-starting interest rate swaps.

refinancing in Q4 2010, offset by the $6.9 million unwind fee related to the termination of

the two forward-starting interest rate swaps.

HealthSouth’s GAAP income statement will be affected by a

number of items that will not affect cash flow from operating

activities or adjusted free cash flow:

number of items that will not affect cash flow from operating

activities or adjusted free cash flow:

•Normalized GAAP tax rate resulting from the valuation

allowance reversal in Q4 2010.

allowance reversal in Q4 2010.

•Loss on early extinguishment of debt

Multi-Year Adjusted Free Cash Flow 12% to 17% CAGR

14

Exhibit 99.1

Free Cash Flow Reinvestment

15

• $500 million of 10.75% notes callable June 2011

• Growth in core business

• Bed expansions

• Hospital acquisitions

• Acute care IRF unit acquisition/consolidation

• De novo hospitals

• Lower capital cost

• Share repurchase

• Offset shares underlying convertible preferred

shares

shares

• Offset shares issued in settlement of securities

litigation

litigation

Adjusted free cash flow CAGR: 12-17%

• Acquisitions of complementary business

Exhibit 99.1

2011 Guidance - Adjusted EBITDA

Adjusted EBITDA (1)

$440 million to $450 million

(1) Reconciliation to GAAP provided on slides 29 and 31-35.

Considerations:

ü2010 bad debt expense was 0.9% of revenue; expect 2011 bad debt expense to

be approximately 1.5% of revenue, in line with historical average

be approximately 1.5% of revenue, in line with historical average

üMedicare pricing in Q4 2011 will be reduced by a TBD productivity adjustment,

which we estimate to be 100 basis points.

which we estimate to be 100 basis points.

üOutpatient revenues subject to approximately $1.4 million reduction related to

the 25% rate reduction for reimbursement of therapy expenses for multiple therapy

services (Medicare physician fee schedule for calendar year 2011CMS).

the 25% rate reduction for reimbursement of therapy expenses for multiple therapy

services (Medicare physician fee schedule for calendar year 2011CMS).

Reflects:

• 2.9% to 5.3% growth over 2010

• 7.2% to 8.4% CAGR over 2009

16

Exhibit 99.1

Income Tax Considerations

|

GAAP Considerations:

•Valuation allowance reduced at YE 2010 by approximately $825 million resulting in a

$736.6 million benefit to 2010 income tax provision. •As of 12/31/10, the Company had a remaining valuation allowance of approximately

$113 million, primarily related to state NOLs. Future Cash Tax Payments:

•Expects to pay approximately $6-8 million per year of income tax.

•Does not expect to pay significant federal income taxes for up to 10 years.

•HealthSouth is not currently subject to an annual use limitation (“AUL”) under Internal

Revenue Code Section 382 (“Section 382”). A “change of ownership,” as defined by Section 382, would subject us to an AUL, which is equal to the market capitalization of the Company at the time of the “change of ownership” multiplied by the long-term tax exempt rate. |

17

Exhibit 99.1

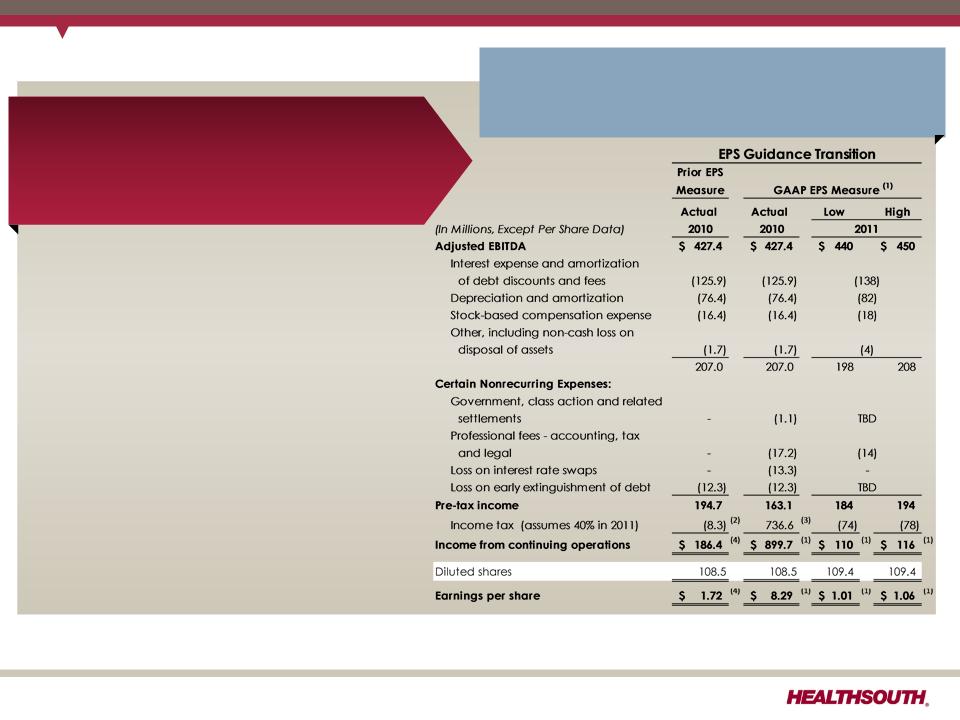

2011 Guidance - EPS

Diluted Earnings per Share from

Continuing Operations Attributable

to HealthSouth (1)

Continuing Operations Attributable

to HealthSouth (1)

$1.01 to $1.06

Considerations:

ü Assumes provision for income tax of 40%;

cash taxes expected to be $6-$8 million.

cash taxes expected to be $6-$8 million.

ü Guidance does not include any

repayment/refinancing of the 10.75%

repayment/refinancing of the 10.75%

senior notes callable in June 2011, which

would affect the following items:

• Interest expense which is currently

forecasted to be approximately $4

million per quarter higher in Q1, Q2, and

Q3 2011 vs. prior periods in 2010.

forecasted to be approximately $4

million per quarter higher in Q1, Q2, and

Q3 2011 vs. prior periods in 2010.

• Does not include “loss on early

extinguishment of debt” (non-cash)

extinguishment of debt” (non-cash)

• Depreciation is estimated to be higher

as a result of capital expenditures in

prior periods.

as a result of capital expenditures in

prior periods.

HealthSouth is transitioning EPS guidance to a

GAAP measure.

GAAP measure.

(1) Income from continuing operations attributable to HealthSouth

(2) Current period amounts in income tax provision; see slides 31 and 35

(3) Total income tax provision for full-year 2010, including the reversal of a substantial portion of the Company's valuation allowance against deferred tax assets.

(4) Adjusted income from continuing operations; see slides 31 and 35

18

Exhibit 99.1

• Volume:

– January and February 2011 exhibited strong discharge growth against easy comps from

Q1 2010.

Q1 2010.

– Full-year 2011 on track for 2.5% to 3.5 % discharge growth (comps become tougher as

the year progresses).

the year progresses).

• Pricing:

– Includes net Medicare price increase of approximately 2% effective Oct. 1, 2010.

– Comps will be impacted by the April 1, 2010, reduction (25 bps) of Medicare pricing

resulting from PPACA implementation.

resulting from PPACA implementation.

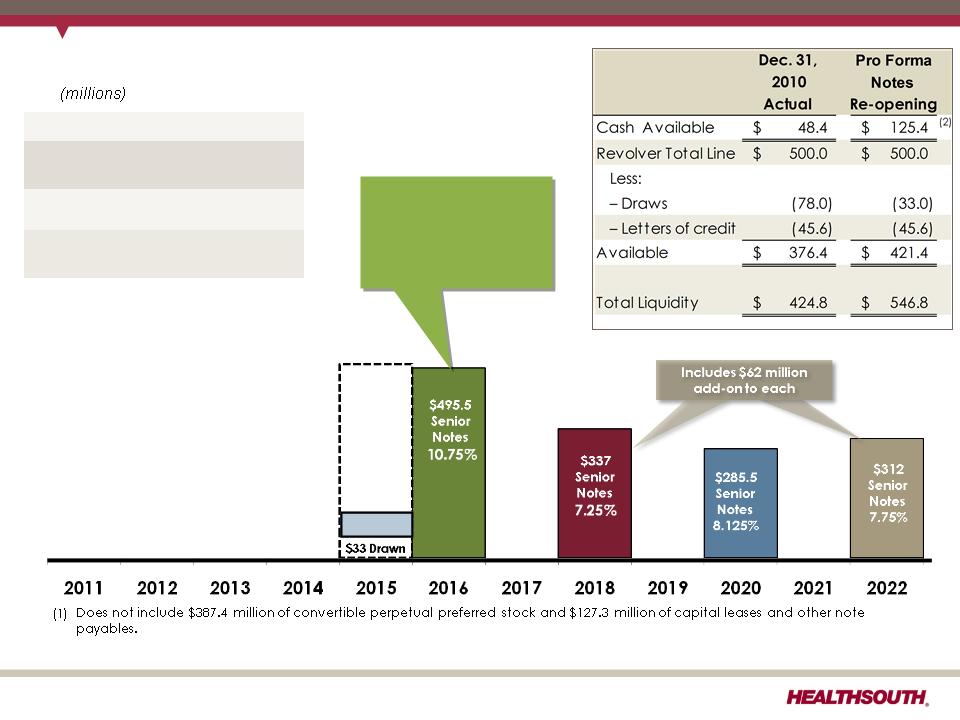

• Senior Notes Offering:

– HealthSouth completed a $120 million senior notes offering through a reopening of its

7.25% senior notes due 2018 and its 7.75% senior notes due 2022.

7.25% senior notes due 2018 and its 7.75% senior notes due 2022.

– Issued at a premium to par

– Net proceeds from the offering were $122.0 million.

§ $45 million of the net proceeds were utilized to pay down the revolving credit facility.

We intend to use the balance to redeem a portion of the 10.75% senior notes.

We intend to use the balance to redeem a portion of the 10.75% senior notes.

− Blended yield of add-on is approximately 7.0%

§ The impact on Q1 2011 interest expense is an increase of $0.5 million.

Q1 2011 Observations

19

Exhibit 99.1

(1) Reconciliation to GAAP provided on slides 29-35.

The HealthSouth Value Proposition

Poised for Growth

Financial Strength/Strong

Cash Flow Generation

Cash Flow Generation

Industry Leading Position

Attractive Healthcare Sector

20

Exhibit 99.1

Appendix

21

Exhibit 99.1

(2) Includes $77.0 million of the net proceeds from the notes reopening. We intend to use this portion of the net proceeds to redeem a

portion of the 10.75% senior notes.

portion of the 10.75% senior notes.

Debt Maturity Profile (1)

22

|

|

S&P

|

Moodys

|

|

Corporate

Rating |

B+

|

B1

|

|

Revolver Rating

|

BB

|

Ba1

|

|

Senior Notes

Rating |

B+

|

B2

|

Call schedule:

June 15, 2011 (price 105.375);

June 15, 2012 (price 103.583);

June 15, 2013 (price 101.792);

June 15, 2014 and thereafter

(price 100.000)

(price 100.000)

Pro Forma for Notes Re-opening

$46 LC

$500

Revolver

L+350

Exhibit 99.1

|

Sources

|

$ Million (1)

|

Assumed

Call Price (3) |

Annual

Cash Savings

|

|

Cash on hand

|

$100.0

|

105.375

|

$10.2

|

|

|

|

|

|

|

Revolving credit facility (LIBOR + 350 bps)(2)

|

$100.0

|

105.375

|

$6.4

|

|

|

|

|

|

|

New senior notes (assumed yield of 7.00%)

|

$100.0

|

105.375

|

$3.2

|

|

Accounting effect for early repayment/ refinancing :

|

|||

|

“Loss on early extinguishment of debt” = ~$8 million per $100 million of the 10.75% senior notes.

|

|||

|

|

|||

Options for Addressing the 10.75% Senior Notes

(millions)

(1) Illustrative only

(2) Assumes 3M LIBOR of 0.302%

(3) Call schedule: June 15, 2011 (price 105.375); June 15, 2012 (price 103.583); June 15, 2013 (price 101.792); June 15, 2014 and

thereafter (price 100.000)

thereafter (price 100.000)

We can utilize a number of sources to repay/refinance the 10.75% notes.

Illustration of Potential Interest Expense Reduction by Funding Source

23

Exhibit 99.1

Debt Schedule and Interest Expense

(1) The annualized interest expense does not reflect any anticipated pay down of the 10.75% or the impact of the re-opening of the

7.25% and the 7.75% senior notes.

7.25% and the 7.75% senior notes.

(2) On March 7, 2011, the Company closed on a public offering of $60 million in aggregate principal amount of its 7.25% senior

notes due 2018 at a public offering price of 103.25% of the principal amount and $60 million in aggregate principal amount of its

7.75% senior notes due 2022 at a public offering price of 103.50%.

notes due 2018 at a public offering price of 103.25% of the principal amount and $60 million in aggregate principal amount of its

7.75% senior notes due 2022 at a public offering price of 103.50%.

(3) Based on 2010 and 2009 Adjusted EBITDA of $427.4 million and $383.0 million, respectively; reconciliation to GAAP provided on

slides 29 and 31-35.

slides 29 and 31-35.

(4) Based on debt balances as of December 31, 2010 and assumes 3 month LIBOR of 0.302%.

24

Exhibit 99.1

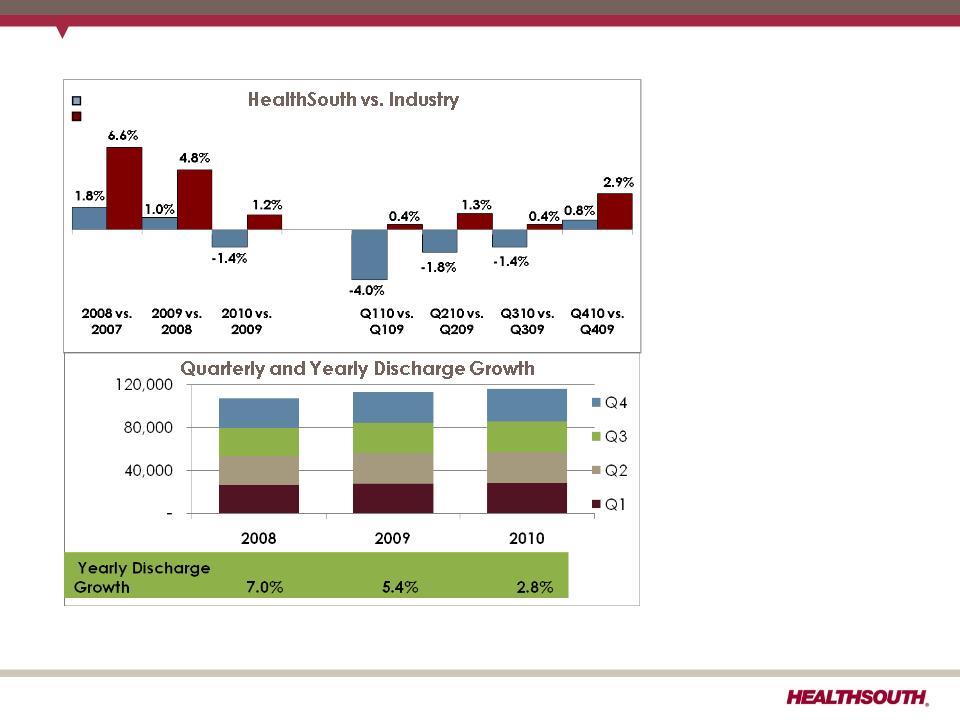

(1) Data provided by UDSMR, a data gathering and analysis organization for the rehabilitation industry; represents ~ 65-70% of industry,

including HealthSouth sites.

including HealthSouth sites.

(2) Includes consolidated HealthSouth inpatient rehabilitation hospitals and long-term acute care hospitals classified as same store during

that time period.

that time period.

Historic Discharge Growth vs. Industry

• HealthSouth’s

volume growth has

outpaced

competitors’.

volume growth has

outpaced

competitors’.

• TeamWorks =

standardized and

enhanced sales &

marketing

standardized and

enhanced sales &

marketing

• Bed additions will

help facilitate

continued organic

growth.

help facilitate

continued organic

growth.

UDS Industry Sites (1)

HLS Same Store (2)

10.7%

9.4%

5.6%

2.6%

4.6%

5.5%

5.8%

5.8%

5.3%

2.5%

2.2%

1.1%

25

Exhibit 99.1

Note: These numbers are program spending only and do not include beneficiary copayments.

Source: Centers for Medicare and Medicaid Services, Office of the Actuary (MedPAC June 2010 Data Book - Page 130), 2009 and 2010

Medicare Trustees Report

Medicare Trustees Report

Medicare Spending on Post-Acute Services

Skilled nursing

facilities 18.1%

facilities 18.1%

Home health

agencies 17.7%

agencies 17.7%

Inpatient

rehabilitation

hospitals 8.4%

Long-term acute

care hospitals 5.7%

26

2009

Medicare

Margin

Medicare

Margin

Post-Acute Settings

Inpatient rehabilitation

spending (% of total

Medicare spending)

spending (% of total

Medicare spending)

Exhibit 99.1

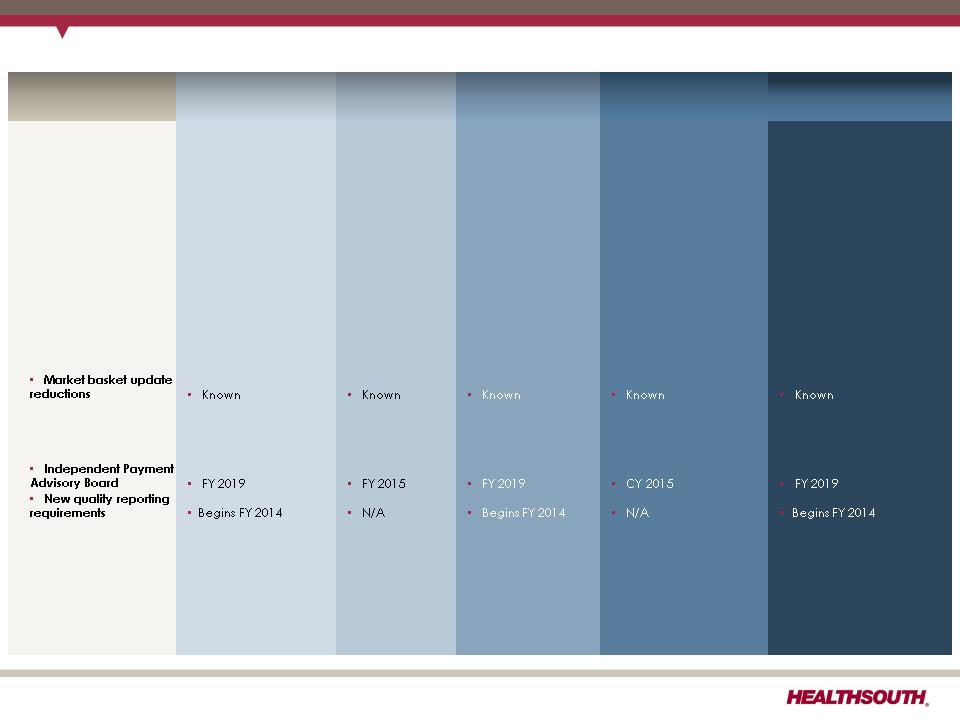

|

Future Regulatory Risk

|

Inpatient Rehabilitation

Facility |

Skilled Nursing

Facility |

Long-Term Acute

Care Hospital |

Home Health

|

Hospice

|

|

1. Re-basing payment

system |

No

|

Yes; RUGS IV and

MDS 3.0 implemented October 1, 2010 |

No

|

Yes; would be required

as part of PPACA starting in 2014 |

Yes: Required by PPACA

beginning in 2013; Modified wage index system being phased in over 7-year period beginning in FY 2010 |

|

2. Major outlier payment

adjustments |

No

|

No

|

Yes; will occur when

MMSEA relief expires (short stay outliers) |

Yes; 10% cap per agency;

2.5% taken out of outlier

pool (per PPACA) |

No

|

|

3. Upcoding adjustments

|

No

|

No

|

Yes; occurring in FY

2011 |

Yes; occurring in CY 2011 (

-3.79%), and potential further reduction 2012 |

No

|

|

4. Patient criteria

|

No; 60% Rule

already in place

|

No

|

Study dictated as

part of MMSEA; Industry developing criteria |

PPACA requires a patient -

physician “face-to-face” encounter; new therapy coverage

|

No

|

|

5. Healthcare Reform

|

|

|

|

|

|

|

• Productivity

adjustments |

• Begins FY 2012

|

• Begins FY 2012

|

• Begins FY 2012

|

• Begins 2015

|

• Begins 2013

|

|

• Bundling pilot

established |

• By 2013

|

• By 2013

|

• By 2013

|

• By 2013

|

• N/A

|

|

• Value based

purchasing |

• Pilot begins 2016

|

• Post 2012

|

• Pilot begins 2016

|

• Post 2012

|

• Pilot begins 2016

|

|

•Hospital Acquired

Infections |

• Post 2012

|

• Post 2012

|

• Post 2012

|

• N/A

|

•N/A

|

|

6. Other

|

N/A

|

Forecast error

being implemented in FY 2011 |

25% Rule regulatory

relief expires in 2012/2013; prohibition on new LTCHs through 2012 |

Limits on transfer

of ownership |

MedPac recommending

overhaul of payment system methodology in FY 2013 |

Post-Acute Regulatory Risks

Sources: Healthcare Reform Bill (PPACA, HERA),CMS Regulatory published rules and MMSEA

27

Exhibit 99.1

CMS Fiscal Year 2011 IRF Rate Setting File Analysis

Notes:

(1) All data provided was filtered and compiled from the Centers for Medicare and

Medicaid Services (CMS) Fiscal Year 2011 IRF rate setting Final Rule file found at

http://www.cms.hhs.gov/InpatientRehabFacPPS/07_DataFiles.asp#TopOfPage. The

data presented was developed entirely by CMS and is based on its definitions

which are different in form and substance from the criteria HealthSouth uses for

external reporting purposes. Because CMS does not provide its detailed

methodology, HealthSouth is not able to reconstruct the CMS projections or the

calculation.

Medicaid Services (CMS) Fiscal Year 2011 IRF rate setting Final Rule file found at

http://www.cms.hhs.gov/InpatientRehabFacPPS/07_DataFiles.asp#TopOfPage. The

data presented was developed entirely by CMS and is based on its definitions

which are different in form and substance from the criteria HealthSouth uses for

external reporting purposes. Because CMS does not provide its detailed

methodology, HealthSouth is not able to reconstruct the CMS projections or the

calculation.

(2) The CMS file contains data for each of the 1,171 inpatient rehabilitation facilities

used to estimate the policy updates for the FY 2011 IRF-PPS Final Rule. Most of the

data represents historical information from the CMS fiscal year 2009 period and

does not reflect the same HealthSouth hospitals in operation today. The data

presented was separated into three categories: Freestanding, Units, and

HealthSouth. HealthSouth is a subset of Freestanding and the Total.

used to estimate the policy updates for the FY 2011 IRF-PPS Final Rule. Most of the

data represents historical information from the CMS fiscal year 2009 period and

does not reflect the same HealthSouth hospitals in operation today. The data

presented was separated into three categories: Freestanding, Units, and

HealthSouth. HealthSouth is a subset of Freestanding and the Total.

28

Exhibit 99.1

(1) Notes on page 35.

Net Cash Provided by Operating Activities

29

Exhibit 99.1

Adjusted Free Cash Flow

(1) Q4 2010 and full-year 2010 working capital benefited from a shift in timing of interest payments related to the refinancing in Q4 2010.

(2) Q4 2010 and full-year 2010 were negatively affected by the $6.9 million unwind fee related to the termination of two forward-starting

interest rate swaps, which is included in cash provided by operating activities and not included in the net settlements on interest rate

swaps.

interest rate swaps, which is included in cash provided by operating activities and not included in the net settlements on interest rate

swaps.

30

Exhibit 99.1

Reconciliation of Net Income to Adjusted Income from Continuing Operations and

Adjusted EBITDA (1) (3) (4)

Adjusted EBITDA (1) (3) (4)

(1) (2) (3) (4) - Notes on page 35.

31

Exhibit 99.1

(1) (2) (3) (4) - Notes on page 35.

32

Exhibit 99.1

(1) (2) (3) (4) - Notes on page 35.

33

Exhibit 99.1

34

(1) (2) (3) (4) - Notes on page 35.

Exhibit 99.1

Reconciliation Notes

1. Adjusted income from continuing operations and Adjusted EBITDA are non-GAAP

financial measures. The Company’s leverage ratio (total consolidated debt to

Adjusted EBITDA for the trailing four quarters) is, likewise, a non-GAAP financial

measure. Management and some members of the investment community utilize

adjusted income from continuing operations as a financial measure and Adjusted

EBITDA and the leverage ratio as liquidity measures on an ongoing basis. These

measures are not recognized in accordance with GAAP and should not be viewed as

an alternative to GAAP measures of performance or liquidity. In evaluating these

adjusted measures, the reader should be aware that in the future HealthSouth may

incur expenses similar to the adjustments set forth above.

financial measures. The Company’s leverage ratio (total consolidated debt to

Adjusted EBITDA for the trailing four quarters) is, likewise, a non-GAAP financial

measure. Management and some members of the investment community utilize

adjusted income from continuing operations as a financial measure and Adjusted

EBITDA and the leverage ratio as liquidity measures on an ongoing basis. These

measures are not recognized in accordance with GAAP and should not be viewed as

an alternative to GAAP measures of performance or liquidity. In evaluating these

adjusted measures, the reader should be aware that in the future HealthSouth may

incur expenses similar to the adjustments set forth above.

2. Per share amounts for each period presented are based on basic weighted average

common shares outstanding for all amounts except adjusted income from continuing

operations per diluted share, which is based on diluted weighted average shares

outstanding. The difference in shares between the basic and diluted shares

outstanding is primarily related to our convertible perpetual preferred stock.

common shares outstanding for all amounts except adjusted income from continuing

operations per diluted share, which is based on diluted weighted average shares

outstanding. The difference in shares between the basic and diluted shares

outstanding is primarily related to our convertible perpetual preferred stock.

3. Adjusted income from continuing operations per diluted share and Adjusted EBITDA

are two components of our historical guidance.

are two components of our historical guidance.

4. The Company’s credit agreement allows certain other items to be added to arrive at

Adjusted EBITDA, and there may be certain other deductions required.

Adjusted EBITDA, and there may be certain other deductions required.

35

Exhibit 99.1