Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Argo Group International Holdings, Ltd. | d8k.htm |

Investor Presentation

Raymond James 32 Annual Institutional Investors Conference

March 8, 2011

nd

Exhibit 99.1 |

2.

Forward-Looking Statements

This

presentation

contains

“forward-looking

statements”

which

are

made

pursuant

to

the

safe

harbor provisions of the Private Securities Litigation Reform Act of 1995.

The forward-looking statements are based on the Company's current

expectations and beliefs concerning future developments and their potential

effects on the Company. There can be no assurance that actual developments

will be those anticipated by the Company. Actual results may differ materially from

those projected as a result of significant risks and uncertainties, including

non-receipt of the expected payments, changes in interest rates, effect

of the performance of financial markets on investment

income

and

fair

values

of

investments,

development

of

claims

and

the

effect

on

loss

reserves, accuracy in projecting loss reserves, the impact of competition and

pricing environments, changes in the demand for the Company's products, the

effect of general economic conditions, adverse state and federal

legislation, regulations and regulatory investigations into industry

practices, developments relating to existing agreements, heightened

competition, changes in pricing environments, and changes in asset

valuations. The Company undertakes no obligation to publicly update

any forward-looking statements as a result of events or developments

subsequent to the presentation. |

3.

The Argo Group Story

The Company

Argo Group is an international specialty underwriter of

property/casualty insurance and reinsurance focused in niche

markets.

The Objective

To maintain our profitable growth record while maximizing on the

opportunities afforded us through our international platform.

The Strategy

Apply our proven business model to deploy capital in attractive

niche markets that offer opportunities for maximum return.

|

4.

Argo Group Today

Major business segment locations

Bermuda Headquarters

Multinational specialty P&C underwriter of insurance and reinsurance

Headquarters: Bermuda

–

Operate internationally in all 50 states

–

1,300+ employees across six countries

Total capitalization of $2.0 billion

Operations conducted through four business segments

–

Excess

&

Surplus

Lines

–

U.S.

wholesale

distribution

–

Commercial

Specialty

–

U.S.

niche

retail

distribution

–

International

Specialty

–

Lloyd’s

syndicate

–

Reinsurance –

Event-driven businesses

A.M. Best Rating of A XII (excellent)

Brussels

London

Paris

Zurich |

5.

Our Strategy

Deploy capital in the international specialty market for maximum

return

Provide our clients with insurance solutions by continuously

focusing on new business development and organic growth

Strategically grow our platform and gain access to new markets

through acquisitions

Dedicated to attracting top tier talent to leverage our platform

Manage balance sheet risk by maintaining relatively low financial

leverage and a prudent investment portfolio

Maximize shareholder value through growth in book value per share

|

6.

A Recap of Our Successful Strategic Business Plan

1.

Target attractive

niche markets

2.

Develop leading,

differentiated

positions

3.

Expand position

–

organically

–

geographically

–

selective acquisitions

4.

Results: growth

in

premiums, earnings

and book value |

7.

ATTRACTIVE NICHE MARKETS

A Different Type of Approach

Key Criteria In Selecting Niche Markets

Higher margin and return

Market leadership in a reasonable time frame

Disciplined underwriting

Sustained, profitable organic growth |

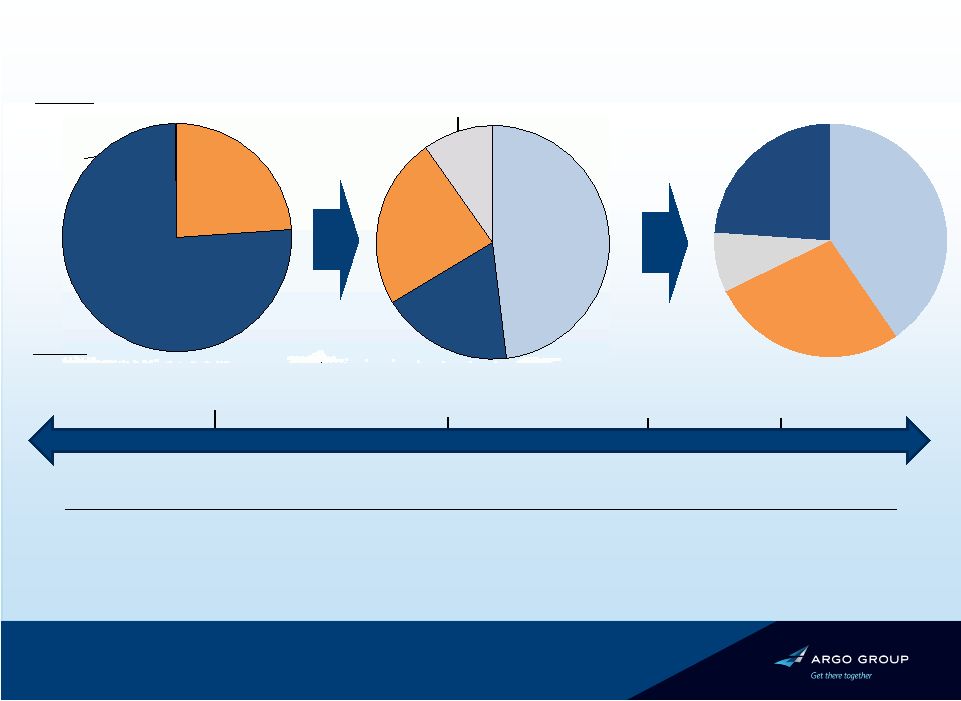

We

have successfully diversified our portfolio and become a global specialty

insurance underwriter 2004

2010

NEP Split

2000

2001 –

Acquires Colony and Rockwood.

Founds Trident

2007 –

Completes merger with PXRE;

Forms Argo Re

2008 –

Rebranded Argo Group; Acquired

Heritage and its Lloyd’s syndicate

2009 –

Introduces Casualty and

Professional Risks Division

Timeline

Notes

1 Book value per share share includes impact of the Series A Mandatory Convertible Preferred Stock on

an as if converted basis. Financial Highlights ($mm, except per share data)

2000

2004

(1)

2010

Book Value per Share

23.03

30.36

58.41

Total Capital

501.1

716.8

2,002.6

Excess and

Surplus Lines,

40.4%

Commercial

Specialty,

27.4%

Reinsurance,

8.3%

International

Specialty,

23.9%

8.

Excess & Suprlus

Lines, 48.1%

Risk Management,

18.3%

Specialty

Commercial, 23.8%

Public Entity, 9.7%

Specialty

Commercial,

23.9%

Specialty

Workers'

Compensation

, 75.9%

Public Entity,

0.2% |

9.

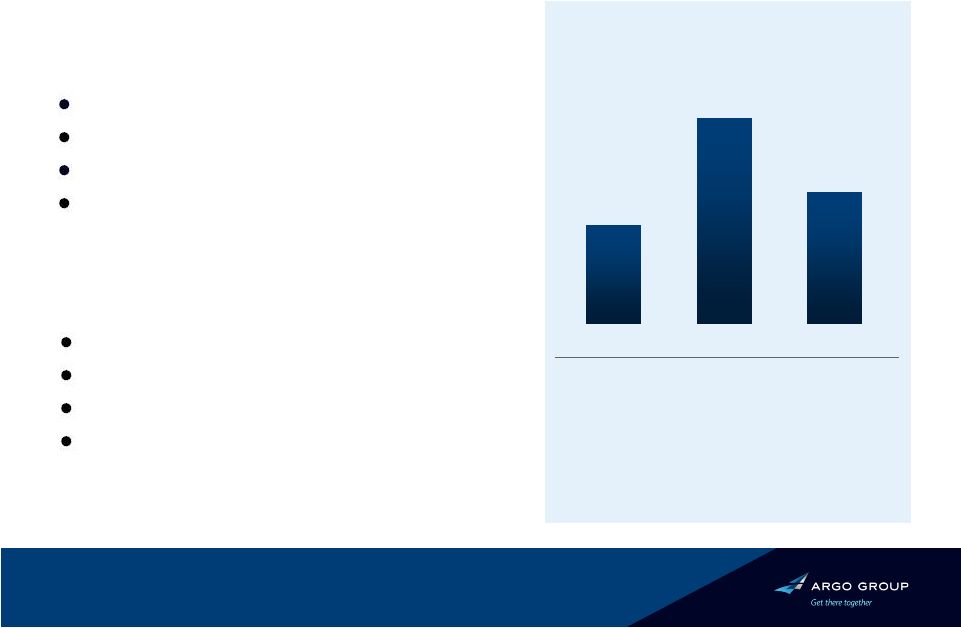

Earned Premiums

Gross Written Premiums

11.9%

CAGR

15.7%

CAGR

RESULTS: GROWTH

An Impressive Growth Record… |

10.

12.3%

CAGR

Net Income

Net Investment Income

51.3%

CAGR

RESULTS: GROWTH

Improved Bottom Line Results… |

11.

Growth of Book Value

BVPS Growth Since 2002

12.1%

CAGR

*

Book

value

per

common

share

-

outstanding,

includes

the

impact

of

the

Series

A

Mandatory

Convertible

Preferred

Stock on

an as if converted basis. Preferred stock had fully converted into common

shares as of Dec. 31, 2007. |

12.

Excess & Surplus

Lines

International

Specialty

•

2010 GWP $390M

•

Lloyd’s platform

•

2010 GWP $523M

Excess & Surplus

Lines

Reinsurance

•

2010 GWP $189M

•

Bermuda platform

•

Includes Casualty

& Professional

Risks Unit

Commercial

Specialty

•

2010 GWP $428M

Four Growth Platforms |

13.

EXCESS & SURPLUS LINES:

Largest and Most Profitable Segment

Status

Standard market expanding risk appetite

New entrants building market share

Argo maintaining underwriting discipline

Competitive advantages

Colony Specialty & Argo Pro

Excellent infrastructure –

broad

geography

Underwriting expertise

Broad product portfolio for small acct

U/Ws (restaurants, day care, contractors)

Controlled distribution

–

Wholesale agents

Benefits from a category XII ‘A’

(Excellent) rating by A.M. Best

Pre-Tax Operating Income

($M)

Combined ratio

* Includes $12.7M of losses from 2008 hurricanes.

88.9%

89.3%

93.3%

$102

$113

$98

$65

99.6%

$63

97.8%

2006

2007

2008*

2009

2010 |

14.

COMMERCIAL SPECIALITY:

Specialty Niche Segment

Status

Historical combined ratio in low 90%

range

Performing well given competition

Primarily admitted, retail-driven

Competitive advantages

Expertise in niche markets

–

grocery stores

–

mining operations

–

laundry & dry cleaners

–

small/medium-size public entities

Benefits from a category XII ‘A’

(Excellent) rating by A.M. Best

Pre-Tax Operating Income

($M)

Combined ratio

* Includes $2.8M of losses from 2008 hurricanes.

89.4%

88.7%

96.5%

$50

$61

$43

$46

95.6%

$29

99.0%

2006

2007

2008*

2009

2010 |

15.

$24

$50

Status

Underwriting on $1.2

billion of capital

Has achieved desired diversification

Event-driven businesses

Added Casualty and Professional Risks

business in 2009

Competitive advantages

Utilizes established infrastructure

Built diversified book of business

Proven record of leadership

Benefits from a category XII ‘A’

(Excellent) rating by A.M. Best

REINSURANCE:

Argo Re –

Well Established

Pre-Tax Operating Income

($M)

77.9%

52.3%

2008

2009

Combined ratio

*Includes $30.1M of catastrophe

losses (net of reinstatement premium).

2010*

$32

72.8% |

16.

Status

Acquired Heritage in 2008;

rebranded to Argo International

Carrier named head of U/W Jan 2011

Worldwide property

–

Direct and Facultative

–

North American and International

Binding Authority

Non-U.S. liability

–

Professional indemnity

–

General liability

Competitive advantages

Specialist knowledge

Carries the Lloyd’s market ratings of

‘A’

(Excellent) rating by A.M. Best, and

‘A+’

by S&P

INTERNATIONAL SPECIALTY:

Argo International (Lloyd’s)

Gross Written Premiums

($M)

$424

$706

$390

2008

2009

2010

Pre-tax Operating Income

2010: ($31.2M)*

2009: $24.1M

*Includes $24.8M of 2010

catastrophe losses. |

Combined Business Mix –

Established platform to write business worldwide and penetrate niche markets

Reinsurance

Quota share reinsurance

of business partners

Property reinsurance

62%

9%

29%

Based on 2010 gross written premiums

Worldwide property insurance

Non-US Liability

Excess casualty and professional liability

insurance

Excess & Surplus Lines

Commercial Specialty

Specialty

Insurance

17. |

18.

Diversified Business Model

Reinsurance

Insurance

91%

14%

As of Dec. 31, 2010

Note: Based on gross written premiums (GWP)

Casualty

~70%

~30%

Property

9% |

19.

Argo Group 2010 Results

2009

2010

Change

Gross Written Premium

23%

Net Earned Premium

14%

Total Revenue

11%

Net Operating Income Per Share

53%

Net Income Per Share

28%

** Impacted by $54.9M of losses (net of reinstatement premiums) from catastrophes

in 2010. Net Investment Income

8%

YTD Growth in Book Value Per Share

$ 2.0B

$ 1.4B

$ 1.5B

$

4.28

$

3.81

$ 146M

18.5%

$ 1.5B

$ 1.2B

$ 1.4B

$

2.00**

$

2.76

$ 134M

12.5% |

Dec

31, 2009 3,203

19.1%

1,996

1,615

6,897

$4,334

381

$52.36

Dec 31, 2008

2,997

24.1%

1,782

1,353

6,382

$3,995

429

$44.18

Strong Balance Sheet and Capital Base

Reserves

Total Leverage*

Total Capital

Shareholders’

Equity

Total Assets

Investment Portfolio

Indebtedness*

Book Value Per Share

In millions except for book value and leverage data

*Includes $311mm of Junior Subordinated Debentures

Dec 31, 2010

3,152

1,626

6,482

$4,215

$58.41

377

2,003

18.8%

20. |

Conservative Investment Portfolio

Fixed income (92%)

Equities (8%)

Total: $3.7bn

Total: $0.3bn

•

Internally and externally managed

•

Conservative focus on large cap

•

Average Rating of AA

•

Duration of 3.0 years

28%

18%

18%

27%

10%

Governments

State / Muni

Corporate

Structured

Short Term

Financials

Industrial & Other

6%

94%

Invested Assets

($mm)

$1,181

$1,553

$1,784

$2,173

$2,514

$3,556

$3,995

$4,334

$4,215

2002

2003

2004

2005

2006

2007

2008

2009

2010

21. |

22.

Capital Deployment Strategy

Support balance sheet, mainly loss reserves

Growth of core business

–

Deploy capital opportunistically across all four segments

–

Reduce reliance on third-party reinsurance

Pursue attractive market opportunities

–

Selective acquisitions that complement existing business lines

–

Books of business and companies

Repatriate capital depending on capital position and stock price

–

New $150M authorized stock repurchase program announced Feb. 2011

–

Repurchased $106.5M or 3.2M shares of common stock in 2010

–

Paid 48 cents per share in cash dividends in 2010 |

23.

Key Areas of Focus Today

Improve expense structure

–

Implementing shared services model for our back office, non-core

functions –

Evaluating outsourcing opportunities

Capital management

–

Constantly evaluating capital structure

–

Ensure we are adequately and efficiently capitalized

Investment portfolio

–

Analyzing risk-return threshold

–

Allocating investments accordingly to increase yield

New business development

–

Prudently evaluating new specialty products and new geographies that will be

accretive to ROE over time |

24.

I

N S

U

M

M

A

R

Y

Argo Group:

A Strong and Well-Positioned Specialty Underwriter

Powerful competitive force in specialty lines market

–

International platform with U.S., Bermuda and London advantages

–

Broadly diversified insurance and reinsurance businesses

–

Deep expertise in small-

to mid-size niche markets

–

Growth though geographic and product diversification

Proven and successful strategic business plan

–

Track record of growth and profitability through insurance cycle

–

Prudent risk management and controls

–

Strong, expanded and proven leadership team

Focus on profitable growth

–

Effective capital deployment + high-margin emphasis = ROE-driven

focus –

Achieved 12.1% CAGR since 2002 in book value per share

|

Thank you |