Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - Mellanox Technologies, Ltd. | a2202377zex-32_1.htm |

| EX-23.1 - EX-23.1 - Mellanox Technologies, Ltd. | a2202377zex-23_1.htm |

| EX-31.2 - EX-31.2 - Mellanox Technologies, Ltd. | a2202377zex-31_2.htm |

| EX-32.2 - EX-32.2 - Mellanox Technologies, Ltd. | a2202377zex-32_2.htm |

| EX-10.4 - EX-10.4 - Mellanox Technologies, Ltd. | a2202377zex-10_4.htm |

| EX-21.1 - EX-21.1 - Mellanox Technologies, Ltd. | a2202377zex-21_1.htm |

| EX-31.1 - EX-31.1 - Mellanox Technologies, Ltd. | a2202377zex-31_1.htm |

| EX-10.17 - EX-10.17 - Mellanox Technologies, Ltd. | a2202377zex-10_17.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the Fiscal Year Ended: December 31, 2010 |

||

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission File Number 001-33299

MELLANOX TECHNOLOGIES, LTD.

(Exact name of registrant as specified in its charter)

| Israel (State or other jurisdiction of incorporation or organization) |

98-0233400 (I.R.S. Employer Identification Number) |

Mellanox Technologies, Ltd.

Hermon Building, Yokneam, Israel 20692

(Address of principal executive offices, including zip code)

+972-4-909-7200

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class: | Name of Each Exchange on Which Registered: | |

|---|---|---|

| Ordinary shares, nominal value NIS 0.0175 per share | The NASDAQ Stock Market, Inc. |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes o No ý

The aggregate market value of the registrant's ordinary shares, nominal value NIS 0.0175 per share, held by non-affiliates of the registrant on June 30, 2010, the last business day of the registrant's most recently completed second fiscal quarter, was approximately $550.9 million (based on the closing sales price of the registrant's ordinary shares on that date). Ordinary shares held by each director and executive officer of the registrant, as well as shares held by each holder of more than 10% of the ordinary shares known to the registrant, have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not a determination for other purposes.

The total number of shares outstanding of the registrant's ordinary shares, nominal value NIS 0.0175 per share, as of February 28, 2011, was 34,693,219.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's Definitive Proxy Statement, to be filed with the Securities and Exchange Commission pursuant to Regulation 14A in connection with the 2011 Annual General Meeting of Shareholders of Mellanox Technologies, Ltd. (hereinafter referred to as the "Proxy Statement") are incorporated by reference in Part III of this report. Such Proxy Statement will be filed with the Securities and Exchange Commission not later than 120 days after the conclusion of the registrant's fiscal year ended December 31, 2010.

2

PART I

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report includes forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends affecting the financial condition of our business. Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by which, such performance or results will be achieved. Forward-looking statements are based on information available at the time those statements are made and/or management's good faith belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to:

- •

- levels of capital spending in the semiconductor industry, in general, and in the market for high-performance

interconnect products;

- •

- our ability to achieve new design wins;

- •

- our ability to successfully introduce new products;

- •

- competition and competitive factors;

- •

- our dependence on a relatively small number of customers;

- •

- our ability to expand our presence with existing customers;

- •

- our ability to protect our intellectual property;

- •

- future costs and expenses; and

- •

- other risk factors included under "Risk Factors" in this report.

In addition, in this report, the words "believe," "may," "will," "estimate," "continue," "anticipate," "intend," "expect," "predict," "potential" and similar expressions, as they relate to us, our business and our management, are intended to identify forward-looking statements. In light of these risks and uncertainties, the forward-looking events and circumstances discussed in this report may not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements.

You should not put undue reliance on any forward-looking statements. We assume no obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information, except to the extent required by applicable laws. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

Overview

Mellanox Technologies, Ltd. ("Mellanox" or the "Company") is a leading fabless semiconductor company that produces and supplies high-performance connectivity products which facilitate efficient data transmission between servers, communications infrastructure equipment and storage systems. We design, develop and market adapter, gateway and switch ICs (integrated circuits), all of which are silicon devices that provide high performance connectivity. We also offer a complete line of adapter cards that incorporate our adapter ICs, switch and gateway system product lines. Our end-to-end products, including adapter, gateway and switch ICs, adapter cards, switch systems, gateway systems and cables are an integral part of a total networking solution focused on computing, storage and communication applications used in enterprise data centers or EDCs, high-performance computing or

3

HPC and embedded systems. We are one of the pioneers of InfiniBand; an industry-standard architecture that provides specifications for high-performance interconnects. We believe we are the leading supplier of field-proven InfiniBand-compliant semiconductor products that deliver industry-leading performance and capabilities, which is demonstrated by the performance, efficiency and scalability of clustered computing and storage systems that incorporate our products. In addition to supporting InfiniBand, our products also support the industry standard Ethernet interconnect specification and provide unique product differentiation and connectivity flexibility.

Our adapter products provide bandwidth up to 10Gb/s (Single Data Rate or SDR) Ethernet or InfiniBand, 20Gb/s (Double Data Rate or DDR) InfiniBand and 40Gb/s (Quad Data Rate or QDR) Ethernet or InfiniBand, and our switch ICs provide bandwidth up to 120Gb/s per interface. Our switch systems based on our switch ICs range in port size and density from top-of-rack 36-port switches through director-class 648-port switches.

We have been shipping our InfiniBand products since 2001 and our Ethernet products since 2007. During 2008 we introduced Virtual Protocol Interconnect, or VPI, into our adapter ICs and cards. VPI provides the ability for an adapter to automatically sense whether a communications port is connected to an Ethernet fabric or an InfiniBand fabric. Data centers which use VPI adapters in their servers have the ability to dynamically select the connectivity protocol for use by those servers. In addition to reselling our adapter cards, one of our major OEM customers has begun to embed our ConnectX VPI Ethernet and InfiniBand silicon devices directly on motherboards of a number of server and server blade products. This will increase the proliferation of our IB and Ethernet solutions in the market. Over time, we expect other major OEMs will similarly embed our high-speed interconnect products due to the market demand for higher I/O throughput and performance.

We have established significant expertise with high-performance interconnect solutions from successfully developing and implementing multiple generations of our products. Our expertise enables us to develop and deliver products that serve as building blocks for creating reliable and scalable InfiniBand and Ethernet solutions with leading performance.

As the leading merchant supplier of InfiniBand ICs, we play a significant role in enabling the providers of computing, storage and communications applications to deliver high-performance interconnect solutions. We have developed strong relationships with our customers, many of which are leaders in their respective markets. Our products are included in servers from the five largest server vendors, Hewlett-Packard, IBM, Dell, Oracle and Fujitsu-Siemens, which collectively shipped the majority of servers in 2010, according to the industry research firm IDC. We also supply leading storage and communications infrastructure equipment vendors such as LSI/Engenio Corporation, Oracle, NetApp, Isilon/EMC, Data Direct Networks and Xyratex. Additionally, our products are used as embedded solutions by GE Fanuc, Toshiba Medical, SeaChange International and others.

In order to accelerate adoption of our high-performance interconnect solutions and our products, we work with leading vendors across related industries, including:

- •

- processor vendors such as Intel, AMD, IBM and Oracle;

- •

- operating system vendors such as Microsoft, Novell and Red Hat; and

- •

- software applications vendors such as Oracle, IBM and VMware.

We are a Steering Committee member of the InfiniBand Trade Association, or IBTA, and the OpenFabrics Alliance, or OFA, both of which are industry trade organizations that maintain and promote InfiniBand technology. Additionally, OFA supports and promotes Ethernet solutions. We are also a participating member of the Institute of Electrical and Electronic Engineers, or IEEE, an organization which facilitates the advancement of the Ethernet standard, Ethernet Alliance and other industry organizations advancing various networking and storage related standards.

4

Our business headquarters are in Sunnyvale, California, and our engineering headquarters are in Yokneam, Israel. Our total assets for the years ended December 31, 2008, 2009 and 2010 were approximately $244.8 million, $275.4 million, and $315.8 million respectively. During the years ended December 31, 2008, 2009 and 2010, we generated approximately $107.7 million, $116.0 million, and $154.6 million in revenues, respectively, and approximately $22.4 million, $12.9 million, and $13.5 million in net income, respectively.

We measure our business based on one reportable segment: the development, manufacturing, marketing and sales of inter-connect semiconductor products. Additional information required by this item is incorporated herein by reference to Note 10, "Segment Information," of the Notes to Consolidated Financial Statements, included in Part IV, Item 15 of this report

Industry Background

High-Performance Interconnect Market Overview

Computing and storage systems such as servers, supercomputers and storage arrays handling large volumes of data require high-performance interconnect solutions which enable fast transfer of data and efficient sharing of resources. Interconnect solutions are based on ICs that handle data transfer and associated processing which are added to server, storage, communications infrastructure equipment and embedded systems by either integrating the ICs on circuit boards or by inserting adapter cards containing these ICs into slots on the circuit board.

Interconnect solution requirements, such as high-bandwidth, low-latency (response time), reliability, scalability and price/performance, generally depend on the systems and the applications they support. High-performance interconnect solutions are used in the following markets:

- •

- Enterprise Data Center or EDC. EDCs are facilities that

house both virtualized and non-virtualized servers, storage and communication infrastructure equipment and embedded systems that enable deployment of commercial applications, such as

customer relationship management, financial trading and risk management applications, enterprise resource planning, E-commerce and web service applications. EDCs typically provide multiple

data processing and storage resources to one or many organizations and are capable of supporting several applications at the same time.

- •

- High-Performance Computing or HPC. HPC

encompasses applications that utilize the computing power of advanced parallel processing over multiple servers, commonly called a supercomputer. The expanding list of HPC applications includes

financial modeling, government research, computer automated engineering, geosciences and bioscience research and digital content creation. HPC systems typically focus data processing and storage

resources on one application at a time.

- •

- Embedded. Embedded applications encompass computing, storage and communication functions that use interconnect solutions contained in a chassis which has been optimized for a particular environment. Examples of embedded applications include storage and data acquisition equipment, military operations, industrial and medical equipment and telecommunications and data communications infrastructure equipment.

A number of semiconductor-based interconnect solutions have been developed to address different applications. These solutions include proprietary technologies as well as standard technologies, including Fibre Channel, Ethernet and most recently InfiniBand, which was specifically created for high-performance computing, storage and embedded applications.

5

Trends Affecting High-Performance Interconnect

Demand for computing power and data storage capacity is rising, fueled by the increasing reliance on enterprises on information technology, or IT, for everyday operations. The increase in compute resources for virtual product design, the increase in online banking and electronic medical records for healthcare and government regulations requiring digital records retention require increased IT capacity. Due to greater amounts of information to be processed, stored and retrieved, data centers rely on high-performance computing and high-capacity storage systems to optimize price/performance, minimize total cost of ownership, utilize power efficiently and simplify management. We believe that several IT trends impact the demand for interconnect solutions and the performance required from these solutions. These trends include:

- •

- Transition to blade systems, clustered computing and storage using connections among multiple standard

components. Historically, enterprises addressed the requirements for high-end computing and storage using monolithic

systems, which are based on proprietary components. These systems typically require significant upfront capital expenditures as well as high ongoing operating and maintenance expense. More recently,

enterprises have deployed systems with multiple off-the-shelf standardized servers and storage systems linked by high-speed interconnects, also known as clusters.

Clustering enables significant improvements in performance, reliability, scalability, cost and power savings. The need for better utilization of floor space and power consumption has driven the

adoption of compact form factor (size and shape) blade servers.

- •

- Transition to multiple and multi-core processors in

servers. In order to increase processing capabilities, processor vendors have integrated multiple computing cores into a single

processor device. In addition, server original equipment manufacturers, or OEMs, are incorporating several multi-core processors into a single server. While this significantly increases

the computing capabilities of an individual server, the total performance of a cluster of these servers is impacted by the total input/output, or I/O, bandwidth. Inadequate cluster I/O bandwidth

results in processor underutilization, thereby reducing the overall capability and performance of the cluster.

- •

- Data center infrastructure consolidation. IT managers are

increasingly faced with the need to optimize total cost of ownership associated with the data centers they manage. As the demand for I/O to servers increases, so does the need for a unified I/O

interconnect. In the past the solution was to add more I/O adapters and cables to each server, which resulted in increased costs, power consumption and management complexity. This has led to a

widespread trend of consolidating network infrastructures to reduce costs and generate a higher return on investments.

- •

- Increasing deployment of virtualized computing

resources. Enterprises are turning to virtualization software, which allows multiple applications to run on a single server, thereby

improving resource utilization and requiring increased I/O bandwidth in the EDC.

- •

- Cloud computing. Cloud computing is a convergence of two

interdependent IT trends—IT efficiency (converting IT costs from capital expenses to operating expenses) and business agility. The recent emergence of massive network bandwidth and

virtualization technologies has enabled this transformation to a new services-oriented infrastructure. Cloud computing enables IT organizations to increase their hardware utilization and to scale up

to massive capacities in an instant without having to invest in new infrastructure or license new software. With increased I/O bandwidth and lower latency, cloud providers can perform system

provisioning, workload migrations and support multiple users' requests faster and in the most efficient way.

- •

- Increasing deployments of mission-critical, latency sensitive applications. There is an increasing number of applications that require extremely fast response times in order to deliver an optimal

6

- •

- Virtual product design. A significant reduction in cost

and turn-around time of product design can be accomplished by carrying out the design activities using simulation and optimization tools and reducing the number of prototypes and physical

testing. To accomplish this, a detailed representation of the product's physical properties, high capability simulations software tools and an intensive compute environment are required. Such

environments mandate high-speed networking to become effective and carry the compute intensive simulations.

- •

- Green computing. With the growth in IT capacity, data centers have become major consumers of electrical energy. Furthermore, data center networks have increased in size and managing a growing multi-infrastructure has become a daunting task. Enterprise data centers currently use three different networks—Storage Area Networks using Fibre Channel transport for storage access, Local Area Networks using Ethernet transport for standard network access and System Area Networks using InfiniBand transport for inter-process communication and high-performance clustering. In order to reduce energy, real estate, management and infrastructure costs of modern data centers, a new field of data center architecture was defined—the green data center. The new architecture leverages from I/O virtualization and consolidation to enable green, simple-managed, highly-utilized modern data centers. The ability to consolidate data center I/O mandates the use of high-throughput networks to deliver the needed bandwidth equal or greater than the sum of the separate networks.

result or user experience. Reducing latency, the absolute time it takes for information to be sent from one resource to another over a high-performance interconnect, is critical to enhancing application performance in clustered environments. Some examples of applications that benefit from low-latency interconnect include financial trading, clustered databases and parallel processing solutions used in HPC.

Challenges Faced by High-Performance Interconnect

The trends described above indicate that high-performance interconnect solutions will play an increasingly important role in IT infrastructures and will drive strong growth in unit demand. Performance requirements for interconnect solutions, however, continue to evolve and lead to high demand for solutions that are capable of resolving the following challenges to facilitate broad adoption:

- •

- Performance limitations. In clustered computing, cloud

computing and storage environments, high bandwidth and low latency are key requirements to capture the full performance capabilities of a cluster. With the usage of multiple multi-core

processors in server, storage and embedded systems, I/O bandwidth has not been able to keep pace with processor advances, creating performance bottlenecks. Fast data access has become a critical

requirement to accommodate microprocessors' increased compute power. In addition, interconnect latency has become a limiting factor in a cluster's overall performance.

- •

- Increasing complexity. The increasing usage of clustered

servers and storage systems as a critical IT tool has led to an increase in complexity of interconnect configurations. The number of configurations and connections have also proliferated in EDCs,

making them increasingly complicated to manage and expensive to operate. Additionally, managing multiple software applications utilizing disparate interconnect infrastructures has become increasingly

complex.

- •

- Interconnect inefficiency. The deployment of clustered computing and storage has created additional interconnect implementation challenges. As additional computing and storage systems, or nodes, are added to a cluster, the interconnect must be able to scale in order to provide the expected increase in cluster performance. Additionally, government attention on data center energy efficiency is causing IT managers to look for ways to adopt more energy-efficient implementations.

7

- •

- Limited reliability and stability of connections. Most

interconnect solutions are not designed to provide reliable connections when utilized in a large clustered environment, which can cause data transmission interruption. As more applications in EDCs

share the same interconnect, advanced traffic management and application partitioning become necessary to maintain stability and reduce system down time. Such capabilities are not offered by most

interconnect solutions.

- •

- Poor price/performance economics. In order to provide the required system bandwidth and efficiency, most high-performance interconnects are implemented with complex, multi-chip semiconductor solutions. These implementations have traditionally been extremely expensive.

In addition to InfiniBand, proprietary and other standards-based, high-performance interconnect solutions, including Fibre Channel and Ethernet, are currently used in EDC, HPC and embedded markets. Performance and usage requirements, however, continue to evolve and are now challenging the capabilities of these interconnect solutions:

- •

- Proprietary interconnect solutions have been designed for use in supercomputer applications by supporting low latency and

increased reliability. These solutions are only supported by a single vendor for product and software support, and there is no standard organization maintaining and facilitating improvements and

changes to the technology. The number of supercomputers that use proprietary interconnect solutions has been declining largely due to the availability of industry standards-based interconnects that

offer superior price/performance, a lack of compatible storage systems, and the required use of proprietary software solutions.

- •

- Fibre Channel is an industry standard interconnect solution limited to storage applications. The majority of Fibre Channel

deployments support 2, 4 and 8Gb/s. Fibre Channel lacks a standard software interface, does not provide server cluster capabilities and remains more expensive relative to other standards-based

interconnects. There have been industry efforts to support the Fibre Channel data transmission protocol over interconnect technologies including Ethernet (Fibre Channel over Ethernet) and InfiniBand

(Fibre Channel over InfiniBand).

- •

- Ethernet is an industry-standard interconnect solution that was initially designed to enable basic connectivity between a local area network of computers or over a wide area network, where latency, connection reliability and performance limitations due to communication processing are non-critical. While Ethernet has a broad installed base at 1Gb/s and lower data rates, its overall efficiency, scalability and reliability have been less optimal than certain alternative interconnect solutions in high-performance computing, storage and communication applications. An increase to 10Gb/s, a significant reduction in application latency and more efficient software solutions have improved Ethernet's capabilities to address specific high-performance applications that do not demand the highest scalability. There are also ongoing efforts to standardize additional features within the Ethernet specification to improve its reliability and scalability in EDCs. These enhancements are in the definition and standardization process as part of the IEEE 802.1 Working Group and are generally referred to as Data Center Bridging.

In the HPC, EDC and embedded markets, the predominant interconnects today are 1Gb/s Ethernet and 4Gb/s Fibre Channel. Based on our knowledge of the industry, we believe there is significant demand for interconnect products that provide higher bandwidth and better overall performance in these markets.

Overview of the InfiniBand Standard

InfiniBand is an industry standard, high-performance interconnect architecture that effectively addresses the challenges faced by the IT industry by enabling cost-effective, high-speed data communications. We believe that InfiniBand has significant advantages compared to alternative interconnect technologies. InfiniBand defines specifications for designing host channel adapters, or HCAs, that fit into standard, off-the-shelf servers and storage systems, and switch solutions that

8

connect all the systems together. The physical connection of multiple HCAs and switches is commonly known as an InfiniBand fabric.

The InfiniBand standard was developed under the auspices of the IBTA, which was founded in 1999 and is composed of leading IT vendors and hardware and software solution providers including Mellanox, Fujitsu, Hitachi, IBM, Intel, LSI Corporation, NEC, QLogic Corporation and Oracle. The IBTA tests and certifies vendor products and solutions for interoperability and compliance. Our products meet the specifications of the InfiniBand standard and have been tested and certified by the IBTA.

Advantages of InfiniBand

We believe that InfiniBand-based solutions have advantages compared to solutions based on alternative interconnect architectures. InfiniBand addresses the significant challenges within IT infrastructures created by more demanding requirements of the high-performance interconnect market. More specifically, we believe that InfiniBand has the following advantages:

- •

- Superior performance. In comparison to other interconnect technologies that were architected to have a heavy reliance on communication processing, InfiniBand was designed for implementation in an IC that relieves the central processing unit, or CPU, of communication processing functions. InfiniBand is able to provide superior bandwidth and latency relative to other existing interconnect technologies and has maintained this advantage with each successive generation of products. For example, our current InfiniBand adapters provide bandwidth up to 40Gb/s, and our current switch ICs support bandwidth up to 120Gb/s, which is significantly higher than the 10Gb/s or less supported by competing technologies. The InfiniBand specification supports the design of interconnect products with up to 120Gb/s bandwidth, which is the highest performance industry-standard interconnect specification. In addition, InfiniBand fully leverages the I/O capabilities of PCI Express, a high-speed system bus interface standard. We have announced our plans to support the IBTA's FDR (Fourteen Data Rate) 56Gb/s InfiniBand specification, with adapter, switch, cables and software products expected to be released into the market in 2011.

The following table provides a bandwidth comparison of the various high performance interconnect solutions.

| |

Proprietary | Fibre Channel | Ethernet | InfiniBand | ||||

|---|---|---|---|---|---|---|---|---|

Supported bandwidth of available solutions |

2Gb/s - 10Gb/s | 2Gb/s - 8Gb/s | 1Gb/s - 40Gb/s | 10Gb/s - 40Gb/s server-to-server 10Gb/s - 120Gb/s switch-to-switch |

Performance in terms of latency varies depending on system configurations and applications. According to independent benchmark reports, latency of InfiniBand solutions was less than half of that of tested 10Gb/s Ethernet and proprietary solutions. Fibre Channel, which is used only as a storage interconnect, is typically not benchmarked on latency performance. HPC typically demands low latency interconnect solutions. In addition, there are increasing numbers of latency-sensitive applications in the EDC and embedded markets, and, therefore, there is a trend towards using industry-standard InfiniBand and 10Gb/s Ethernet solutions that deliver lower latency than Gigabit Ethernet, which is predominantly used today.

- •

- Reduced complexity. While other interconnects require use of individual cables to connect servers, storage and communications infrastructure equipment, InfiniBand allows for the consolidation of multiple I/Os on a single cable or backplane interconnect, which is critical for

9

- •

- Highest interconnect efficiency. InfiniBand was developed

to provide efficient scalability of multiple systems. InfiniBand provides communication processing functions in hardware, relieving the CPU of this task, and enables the full resource utilization of

each node added to the cluster.

- •

- Reliable and stable connections. InfiniBand is the only

industry standard high-performance interconnect solution which provides reliable end-to-end data connections. In addition, InfiniBand facilitates the deployment of

virtualization solutions, which allow multiple applications to run on the same interconnect with dedicated application partitions. As a result, multiple applications run concurrently over stable

connections, thereby minimizing down time.

- •

- Superior price/performance economics. In addition to providing superior performance and capabilities, standards-based InfiniBand solutions are generally available at a lower cost than other high-performance interconnects.

blade servers and embedded systems. InfiniBand also consolidates the transmission of clustering, communications and storage and management data types over a single connection.

Our InfiniBand Solution

We provide comprehensive solutions based on InfiniBand, including HCA, switch and gateway ICs, adapter cards, switch and gateway systems, cables and software. InfiniBand enables us to provide products that we believe offer superior performance and meet the needs of the most demanding applications, while also offering significant improvements in total cost of ownership compared to alternative interconnect technologies. As part of our comprehensive solution, we perform validation and interoperability testing from the physical interface to the applications software. Our expertise in performing validation and testing reduces time to market for our customers and improves the reliability of the fabric solution.

Data provided in the most recent list of the World's Fastest Supercomputers published by TOP500.org in November 2010 illustrates the benefits of our solutions. TOP500.org is an independent organization that was founded in 1993 to provide a reliable basis for reporting trends in high-performance computing by publishing a list of the most powerful computers twice a year. The number of listed InfiniBand-based supercomputers has grown from 182 as of November 2009 to 215 as of November 2010, which represents an 18% increase. InfiniBand-based clusters represented four of the top 10 and 61% of the top 100. The November 2010 TOP500 list also illustrates that InfiniBand interconnects have continued to replace proprietary interconnects in supercomputers. Proprietary cluster interconnects have declined significantly since the November 2007 list, and represent less than 2% of the latest list. We believe that the majority of these InfiniBand-based supercomputers incorporate our HCA products and switch silicon products. Additionally, we believe the current cluster implementations that incorporate both our HCA and switch silicon products in the November 2010 TOP500 list of the World's Fastest Supercomputers compare favorably to clusters based on other interconnect technologies.

Our Ethernet Solution

Advances in server virtualization, network storage and compute clusters have driven the need for faster network throughput to address application latency and availability problems in the Enterprise. To service this need, we provide competitive, high bandwidth 10 and 40 Gigabit Ethernet adapters for use in Enterprise Data Centers, High-Performance Computing and Embedded environments. These adapters remove I/O bottlenecks in mainstream servers that are limiting application performance and support hardware-based I/O virtualization, providing dedicated adapter resources and guaranteed isolation and protection for virtual machines within the server.

10

VPI: Providing Connectivity to InfiniBand and Ethernet

In addition to supporting InfiniBand, our latest generation adapter products also support the industry standard Ethernet interconnect specification at 1Gb/s, 10Gb/s and 40Gb/s. In developing this dual interconnect support, we created VPI. VPI enables us to offer fabric-flexible products that concurrently support both Ethernet and InfiniBand with network ports having the ability to auto sense the type of switch to which it is connected and then take on the characteristics of that fabric. In addition, these products extend certain InfiniBand advantages to Ethernet fabrics, such as reduced complexity and superior price/performance, by utilizing existing, field-proven InfiniBand software solutions.

Our Strengths

We apply our strengths to enhance our position as a leading supplier of semiconductor-based, high-performance interconnect products. We consider our key strengths to include the following:

- •

- We have expertise in developing high-performance interconnect

solutions. We were founded by a team with an extensive background in designing and marketing semiconductor solutions. Since our

founding, we have been focused on high-performance interconnect and have successfully launched several generations of InfiniBand products in addition to launching our first Ethernet

products. We believe we have developed strong competencies in integrating mixed-signal design and developing complex ICs. We have used these competencies along with our knowledge of InfiniBand to

design our innovative, next generation, high-performance products that also support the Ethernet interconnect standard. We also consider our software development capability as a key

strength, and we believe that our software allows us to offer complete solutions. We have developed a significant portfolio of intellectual property, or IP, and have 33 issued patents. We believe our

experience, competencies and IP will enable us to remain a leading supplier of high-performance interconnect solutions.

- •

- We believe we are the leading merchant supplier of InfiniBand ICs with a multi-year competitive

advantage. We have gained in-depth knowledge of the InfiniBand standard through active participation in its development. We

were first to market with InfiniBand products (in 2001) and InfiniBand products that support the standard PCI Express interface (in 2004) and PCI Express 2.0 interface (in 2007). We have

sustained our leadership position through the introduction of several generations of products. Because of our market leadership, vendors have developed and continue to optimize their software products

based on our semiconductor solutions. We believe that this places us in an advantageous position to benefit from continuing market adoption of our products.

- •

- We have a comprehensive set of technical capabilities to deliver innovative and reliable

products. In addition to designing our ICs, we design standard adapter card products and custom adapter card and switch products,

providing us a deep understanding of the associated circuitry and component characteristics. We believe this knowledge enables us to develop solutions that are innovative and can be efficiently

implemented in target applications. We have devoted significant resources to develop our in-house test development capabilities, which enables us to rapidly finalize our mass production

test programs, thus reducing time to market. We have synchronized our test platform with our outsourced testing provider and are able to conduct quality control tests with minimal disruption. We

believe that because our capabilities extend from product definition, through IC design, and ultimately management of our high-volume manufacturing partners, we have better control over

our production cycle and are able to improve the quality, availability and reliability of our products.

- •

- We have extensive relationships with our key OEM customers and many end users. Since our inception we have worked closely with major OEMs, including leading server, storage,

11

communications infrastructure equipment and embedded systems vendors, to develop products that accelerate market adoption of InfiniBand. During this process we have obtained valuable insight into the challenges and objectives of our customers, and gained visibility into their product development plans. We also have established end-user relationships with influential IT executives who allow us access to firsthand information about evolving EDC, HPC and embedded market trends. We believe that our OEM customer and end-user relationships allow us to stay at the forefront of developments and improve our ability to provide compelling solutions to address their needs.

Our Strategy

Our goal is to be the leading supplier of end-to-end connectivity solutions for servers and storage that optimize data center performance for computing, storage and communications applications. To accomplish this goal, we intend to:

- •

- Continue to develop leading, high-performance interconnect

products. We will continue to expand our technical expertise and customer relationships to develop leading interconnect products. We are

focused on extending our leadership position in high-performance interconnect technology and pursuing a product development plan that addresses emerging customer and end-user

demands and industry standards. In order to expand our market opportunity, we have added products that are compatible with the Ethernet interconnect standard in addition to InfiniBand. These products

will allow our customers to capture certain advantages of InfiniBand while providing connectivity to Ethernet-based infrastructure equipment. Our unified software strategy is to use a single software

stack to support connectivity to InfiniBand and Ethernet with the same VPI enabled hardware adapter device.

- •

- Facilitate and increase the continued adoption of

InfiniBand. We will facilitate and increase the continued adoption of InfiniBand in the high-performance interconnect

marketplace by expanding our partnerships with key vendors that drive high-performance interconnect adoption, such as suppliers of processors, operating systems and other associated

software. In conjunction with our OEM customers, we will expand our efforts to promote the benefits of InfiniBand and VPI directly to end users to increase demand for high performance interconnect

solutions.

- •

- Expand our presence with existing server OEM customers. We

believe the leading server vendors are influential drivers of high-performance interconnect technologies to end users. We plan to continue working with and expanding our relationships with

server OEMs to increase our presence in their current and future product platforms.

- •

- Broaden our customer base with storage, communications infrastructure and embedded systems

OEMs. We believe there is a significant opportunity to expand our global customer base with storage, communications infrastructure and

embedded systems OEMs. In storage solutions specifically, we believe our products are well suited to replace existing technologies such as Fibre Channel. We believe our products are the basis of

superior interconnect fabrics for unifying disparate storage interconnects, including back-end, clustering and front-end connections, primarily due to their ability to be a

unified fabric and superior price/performance economics.

- •

- Leverage our fabless business model to deliver strong financial performance. We intend to continue operating as a fabless semiconductor company and consider outsourced manufacturing of our ICs, adapter cards and switches to be a key element of our strategy. Our fabless business model offers flexibility to meet market demand and allows us to focus on delivering innovative solutions to our customers. We plan to continue to leverage the flexibility and efficiency offered by our business.

12

Our Products

We provide complete solutions which are based on and meet the specifications of the InfiniBand standard in addition to products that also support the Ethernet standard. Our InfiniBand products include adapter ICs and cards (InfiniHost® product family) and switch ICs (InfiniScale® product family) and systems, gateway ICs (BridgeX® product family) and gateway systems, software and cables. Our latest 4th and 5th generation adapters and cards (ConnectX® and ConnectX-2 product families) also support the Ethernet interconnect standard in addition to InfiniBand. Our gateway devices support bridging capabilities from InfiniBand to Ethernet and Fibre Channel, and from Ethernet to Fibre Channel.

We have registered "Mellanox," "BridgeX," "ConnectX," "InfiniBlast," "InfiniBridge," "InfiniHost," "InfiniPCI," "InfiniRISC," "PhyX," "InfiniScale," and "Virtual Protocol Interconnect" as trademarks in the United States. We have a trademark application pending to register "FabricIT" and "CORE-Direct."

We provide adapters to server, storage, communications infrastructure and embedded systems OEMs as ICs or standard card form factors with PCI-X or PCI Express interfaces. Adapter ICs or cards are incorporated into OEM server and storage systems to provide InfiniBand and/or Ethernet connectivity. All of our adapter products interoperate with standard programming interfaces and are compatible with previous generations, providing broad industry support. We also support server operating systems including Linux, Windows, AIX, HPUX, Solaris and VxWorks.

We also provide our InfiniBand switch ICs to server, storage, communications infrastructure and embedded systems OEMs to create switching equipment that is at the core of InfiniBand fabrics. To deploy an InfiniBand fabric, any number of server or storage systems that contain an HCA can be connected to an InfiniBand-based communications infrastructure system such as an InfiniBand switch. Our 4th generation switch IC (InfiniScale IV) supports up to 120Gb/s InfiniBand throughput. We have also introduced our 40Gb/s InfiniBand switch systems that include 8-port, 18-port, 36-port, 108-port, 216-portm, 324-port and 648-port.

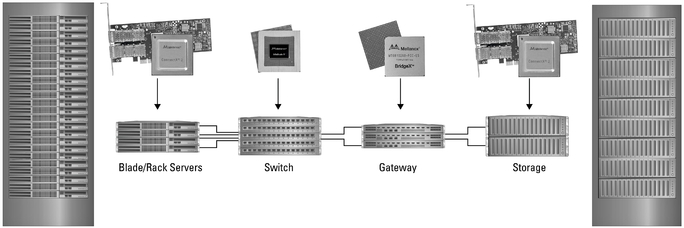

The figure below illustrates the components of servers and storage equipment clustered with a high-performance interconnect and how our products are incorporated into the total solution.

Our products generally vary by the number and performance of InfiniBand and/or Ethernet ports supported.

We also offer custom products that incorporate our ICs to select server and storage OEMs that meet their special system requirements. Through these custom product engagements we gain insight into the OEMs' technologies and product strategies.

13

We also provide our OEM customers software and tools that facilitate the use and management of our products. Developed in conjunction with the OFA, our Linux- and Windows-based software enables applications to efficiently utilize the features of the interconnect. We have expertise in optimizing the performance of software that spans the entire range of upper layer protocols down through the lower level drivers that interface to our products. We provide a suite of software tools and a comprehensive management software solution, FabricIT, for managing, optimizing, testing and verifying the operation of InfiniBand switch fabrics. We also provide gateway management software, FabricIT BridgeX Manager, which runs on top of our BridgeX gateway systems to manage I/O consolidation from an InfiniBand network to Ethernet and Fibre Channel for cluster, cloud and virtual environments.

We provide an extensive selection of passive and optical cabling and modules to enable InfiniBand and Ethernet connectivity.

Technology

We have technological core competencies in the design of high-performance interconnect ICs that enable us to provide a high level of integration, efficiency, flexibility and performance for our adapter and switch ICs. Our products integrate multiple complex components onto a single IC, including high-performance mixed-signal design, specialized communication processing functions and advanced interfaces.

High-performance mixed-signal design

One of the key technology differentiators of our ICs is our mixed-signal data transmission SerDes technology. SerDes I/O directly drives the interconnect interface, which provides signaling and transmission of data over copper interconnects and cables or fiber optic interfaces for longer distance connections. We are the only company that has shipped field-proven integrated controller ICs that operate with a 5Gb/s SerDes over a ten meter InfiniBand copper cable (up to 60Gb/s connections with 12 SerDes working in parallel on our switch IC). Additionally, we are able to integrate several of these high-performance SerDes onto a single, low-power IC, enabling us to provide the highest bandwidth, merchant switch ICs based on an industry-standard specification. We have developed a 10Gb/s SerDes I/O that is used in our 4th generation ConnectX adapter that supports both InfiniBand and Ethernet, as well as our 4th generation InfiniScale IV switch IC that supports InfiniBand. Our 10Gb/s SerDes enables our ConnectX adapters to support 40Gb/s bandwidth (4 10Gb/s SerDes operating in parallel) in addition to providing a direct 10Gb/s connection to standard XFP and SFP+ fiber modules to provide long range Ethernet connectivity without the requirement of additional components, which saves power, cost and board space. In addition, our 10Gb/s SerDes supports 40Gb/s (4 10Gb/s SerDes operating in parallel) as well as 120Gb/s (12 10Gb/s SerDes operating in parallel) port bandwidth on our InfiniScale IV switch IC.

Specialized communication processing and switching functions

We also specialize in high-performance, low-latency design architectures that incorporate significant memory and logic areas requiring proficient synthesis and verification. Our adapter ICs are specifically designed to perform communication processing, effectively offloading this very intensive task from server and storage processors in a cost-effective manner. Our switch ICs are specifically designed to switch cluster interconnect data transmissions from one port to another with high bandwidth and low latency, and we have developed a packet switching engine and non-blocking crossbar switch fabric to address this.

We have developed a custom embedded Reduced Instruction Set Computer processor called InfiniRISC® that specializes in offloading network processing from the host server or storage system and adds flexibility, product differentiation and customization. We integrate a different number of these

14

processors in a device depending on the application and feature targets of the particular product. Integration of these processors also shortens development cycles as additional features can be added by providing new programming packages after the ICs are manufactured, and even after they are deployed in the field.

Advanced interfaces

In addition to InfiniBand and Ethernet interfaces, we also provide other industry-standard, high-performance advanced interfaces such as PCI Express and PCI Express 2.0 which also utilize our mixed-signal 2.5Gb/s and 5Gb/s SerDes I/O technology. PCI Express is a high-speed chip-to-chip interface which provides a high-performance interface between the adapter and processor in server and storage systems. PCI Express and our high-performance interconnect interfaces are complementary technologies that facilitate optimal bandwidth for data transmissions along the entire connection starting from a processor of one system in the cluster to another processor in a different system. We were among the first to market with an IC solution that integrates the PCI Express interface (in 2004) and PCI Express 2.0 interface (in 2007), and we believe this provides an example of the technical proficiency of our development team.

System hardware technology

In addition to silicon technology, we also provide system hardware technology that enables us to build high-density high-performance network adapters and switch systems. Our technology delivers end-to-end solutions that maximize data throughput through a given media at minimal hardware or power cost at very low Bit Error Rate (BER).

Software technology

In addition to hardware products, we develop and provide software stacks to expose standard IO interfaces to the consumer applications on the host and to network management applications within the network. We also provide advanced interfaces and capabilities to enable efficient resource management and utilization in cloud data center, factoring cost, power and performance into the efficiency equation.

Customers

EDC, HPC and embedded end-user markets for systems utilizing our products are mainly served by leading server, storage and communications infrastructure OEMs. In addition, our customer base includes leading embedded systems OEMs that integrate computing, storage and communication functions that use high-performance interconnect solutions contained in a chassis which has been optimized for a particular environment.

Representative OEM customers in these areas include:

| Server | Storage | Communications Infrastructure Equipment |

Embedded Systems | |||

|---|---|---|---|---|---|---|

| Dell | HP | Oracle | GE Fanuc | |||

| HP | LSI/Engenio Corporation | Xsigo | Toshiba Medical | |||

| IBM | Network Appliance | Seachange International | ||||

| Oracle | Isilon/EMC |

We sold products to more than 197 customers worldwide in the year ended December 31, 2010.

A small number of customers account for a significant portion of our revenues. In the year ended December 31, 2010, sales to Hewlett-Packard accounted for 15% of our total revenues and sales to Dell accounted for 12% of our total revenues. In the year ended December 31, 2009, sales to Hewlett-Packard accounted for 15% of our total revenues, sales to IBM accounted for 11% of our total

15

revenues and sales to Supermicro Computer Inc. accounted for 10% of our total revenues. In the year ended December 31, 2008, sales to Hewlett-Packard accounted for 19% of our total revenues, sales to Sun Microsystems accounted for 17% of our total revenues, and sales to QLogic Corporation accounted for 11% of our total revenues.

Sales and Marketing

We sell our products worldwide through multiple channels, including our direct sales force, our network of domestic and international sales representatives and independent distributors. We have strategically located sales personnel in the United States, Europe, China, Japan, India and Taiwan. Our sales directors focus their efforts on leading OEMs and target key decision makers. We are also in frequent communication with our customers' and partners' sales organizations to jointly promote our products and partner solutions into end-user markets. We have expanded our business development team which engages directly with end users promoting the benefits of our products which we believe creates additional demand for our customers' products that incorporate our products.

Our sales support organization is responsible for supporting our sales channels and managing the logistics from order entry to delivery of products to our customers. In addition, our sales support organization is responsible for customer and revenue forecasts, customer agreements and program management for our large, multi-national customers. Customers within North America are supported by our staff in California and customers outside of North America are supported by our staff in Israel.

To accelerate design and qualification of our products into our OEM customers' systems, and ultimately the deployment of our technology by our customers to end users, we have a field applications engineering, or FAE, team and an internal support engineering team that provide direct technical support. In certain situations, our OEM customers will also utilize our expertise to support their end-user customers jointly. Our technical support personnel have expertise in hardware and software, and have access to our development team to ensure proper service and support for our OEM customers. Our FAE team provides OEM customers with design and review capabilities of their systems in addition to technical training on the technology we have implemented in our products.

Our marketing team is responsible for product strategy and management, future product plans and positioning, pricing, product introductions and transitions, competitive analysis, marketing communications and raising the overall visibility of our company. The marketing team works closely with both the sales and research and development organizations to properly align development programs and product launches with market demands.

Our marketing team leads our efforts to promote our interconnect technology and our products to the entire industry by:

- •

- assuming leadership roles within IBTA, OFA and other industry trade organizations;

- •

- participating in tradeshows, press and analyst briefings, conference presentations and seminars for end-user

education; and

- •

- building and maintaining active partnerships with industry leaders whose products are important in driving InfiniBand and Ethernet adoption, including vendors of processors, operating systems and software applications.

Research and Development

Our research and development team is composed of experienced semiconductor designers, software developers and system designers. Our semiconductor design team has extensive experience in all phases of complex, high-volume design, including product definition and architecture specification, hardware code development, mixed-signal and analog design and verification. Our software team has

16

extensive experience in development, verification, interoperability testing and performance optimization of software for use in computing and storage applications. Our systems design team has extensive experience in all phases of high-volume adapter card and custom switch designs including product definition and architectural specification, product design, design verification and transfer to production.

We design our products with careful attention to quality, reliability, cost and performance requirements. We utilize a methodology called Customer Owned Tooling, or COT, where we control and manage a significant portion of timing, layout design and verification in-house, before sending the semiconductor design to our third-party manufacturer. Although COT requires a significant up-front investment in tools and personnel, it provides us with greater control over the quality and reliability of our IC products as opposed to relying on third-party verification services, as well as better time to market.

We choose first tier technology vendors for our design tools and continue to maintain long-term relationships with our vendors to ensure timely support and updates. We also select a mainstream silicon manufacturing process only after it has proven its production worthiness. We verify that actual silicon characterization and performance measurements strongly correlate to models that were used to simulate the device while in design, and that our products meet frequency, power and thermal targets with good margins. Furthermore, we insert Design-for-Test circuitry into our IC products which increases product quality, provides expanded debugging capabilities and ultimately enhances system-level testing and characterization capabilities once the device is integrated into our customers' products.

Frequent interaction between our silicon, software and systems design teams gives us a comprehensive view of the requirements necessary to deliver quality, high-performance products to our OEM customers. Our research and development expense was $56.8 million in 2010, $42.2 million in 2009 and $39.5 million in 2008.

Manufacturing

We depend on third-party vendors to manufacture, package and production test our products as we do not own or operate a semiconductor fabrication, packaging or production testing facility. By outsourcing manufacturing, we are able to avoid the high cost associated with owning and operating our own facilities. This allows us to focus our efforts on the design and marketing of our products.

Manufacturing and Testing. We use Taiwan Semiconductor Manufacturing Company, or TSMC, to manufacture and Advanced Semiconductor Engineering, or ASE, to assemble, package and production test our IC products. We use Flextronics International Ltd. to manufacture our standard and custom adapter card products and switch systems. In addition, we also use Comtel Systems Technology, Inc. to manufacture some of our switch systems. We maintain close relationships with our suppliers, which improves the efficiency of our supply chain. We focus on mainstream processes, materials, packaging and testing platforms, and have a continuous technology assessment program in place to choose the appropriate technologies to use for future products. We provide all of our suppliers a 12-month rolling forecast, and generally receive their confirmation that they are able to accommodate our needs on a monthly basis. We have access to on-line production reports that provide up-to-date status information of our products as they flow through the manufacturing process. On a quarterly basis, we generally review lead-time, yield enhancements and pricing with all of our suppliers to obtain the optimal cost for our products.

Quality Assurance. We maintain an ongoing review of product manufacturing and testing processes. Our IC products are subjected to extensive testing to assess whether their performance exceeds the design specifications. We own an in-house Teradyne Tiger IC tester which provides us with immediate test data and the ability to generate characterization reports that are made available to our customers. Our adapter cards and custom switch system products are subject to similar levels of testing and characterization, and are additionally tested for regulatory agency certifications such as Safety and

17

EMC (radiation test) which are made available to our customers. We only use components on these products that are qualified to be on our approved vendor list.

Requirements Associated with the OCS. Israeli law requires that we manufacture our products developed with government grants in Israel unless we otherwise obtain approval from the Office of the Chief Scientist of Israel's Ministry of Industry Trade and Labor, or the OCS. This approval, if provided, is generally conditioned on an increase in the total amount to be repaid to the OCS, ranging from 120% to 300% of the amount of funds granted. The specific increase would depend on the extent of the manufacturing to be conducted outside of Israel. The restriction on manufacturing outside of Israel does not apply to the extent that we disclosed our plans to manufacture outside of Israel when we filed the application for funding (and provided the application was approved based on the information disclosed in the application). We have indicated our intent to manufacture outside of Israel on some of our grant applications, and the OCS has approved the manufacture of our IC products outside of Israel, subject to our undertaking to pay the OCS royalties from the sales of these products up to 120% of the amount of OCS funds granted. The manufacturing of our IC products outside of Israel, including those products manufactured by TSMC and ASE, is in compliance with the terms of our grant applications and applicable provisions of Israeli law. Under applicable Israeli law, Israeli government consent is required to transfer technologies developed under projects funded by the government to third parties outside of Israel. Transfer of OCS-funded technologies outside of Israel is permitted with the approval of the OCS and in accordance with the restrictions and payment obligations set forth under Israeli law. Israeli law further specifies that both the transfer of know-how as well as the transfer of IP rights in such know-how are subject to the same restrictions. These restrictions do not apply to exports from Israel or the sale of products developed with these technologies.

Employees

As of December 31, 2010, we had 460 full-time employees and 48 part-time employees, including 360 in research and development, 80 in sales and marketing, 39 in general and administrative and 29 in operations. Of our 460 full-time employees, 379 are located in Israel.

Certain provisions of the collective bargaining agreements between the Histadrut (General Federation of Labor in Israel) and the Coordination Bureau of Economic Organizations (including the Industrialists' Associations) are applicable to our employees in Israel by order of the Israeli Ministry of Industry, Trade and Labor. These provisions primarily concern the length of the workday and pension fund benefits for all employees. We generally provide our employees with benefits and working conditions above the required minimums.

We have never experienced any employment-related work stoppages and believe our relationship with our employees is good.

Intellectual Property

One of the key values and drivers for future growth of our high-performance interconnect IC, system hardware and software products is the IP we develop and use to improve them. We believe that the main value proposition of our high-performance interconnect products and success of our future growth will depend on our ability to protect our IP. We rely on a combination of patent, copyright, trademark, mask work, trade secret and other IP laws, both in the United States and internationally, as well as confidentiality, non-disclosure and inventions assignment agreements with our employees, customers, partners, suppliers and consultants to protect and otherwise seek to control access to, and distribution of, our proprietary information and processes. In addition, we have developed technical knowledge, which, although not patented, we consider to be significant in enabling us to compete. The proprietary nature of such knowledge, however, may be difficult to protect and we may be exposed to

18

competitors who independently develop the same or similar technology or gain access to our knowledge.

The semiconductor industry is characterized by frequent claims of infringement and litigation regarding patent and other IP rights. We, like other companies in the semiconductor industry, believe it is important to aggressively protect and pursue our IP rights. Accordingly, to protect our rights, we may file suit against parties whom we believe are infringing or misappropriating our IP rights. These measures may not be adequate to protect our technology from third party infringement or misappropriation, and may be costly and may divert management's attention away from day-to-day operations. We may not prevail in these lawsuits. If any party infringes or misappropriates our IP rights, this infringement or misappropriation could materially adversely affect our business and competitive position.

As of December 31, 2010, we had 23 issued patents and 35 patent applications pending in the United States, five issued patents in Taiwan, five issued patents in Israel and one patent application pending in China, each of which covers aspects of the technology in our products. The term of any issued patent in the United States is 20 years from its filing date and if our applications are pending for a long time period, we may have a correspondingly shorter term for any patent that may be issued. Our present and future patents may provide only limited protection for our technology and may not be sufficient to provide competitive advantages to us. Furthermore, we cannot assure you that any patents will be issued to us as a result of our patent applications.

The risks associated with patents and intellectual property are more fully discussed under the section entitled "Risk Factors" under Item 1A of this report.

Competition

The markets in which we compete are highly competitive and are characterized by rapid technological change, evolving industry standards and new demands on features and performance of interconnect solutions. We compete primarily on the basis of:

- •

- price/performance;

- •

- time to market;

- •

- features and capabilities;

- •

- wide availability of complementary software solutions;

- •

- reliability;

- •

- power consumption;

- •

- customer and application support;

- •

- product roadmap;

- •

- intellectual property; and

- •

- reputation.

We believe that we compete favorably with respect to each of these criteria. Many of our current and potential competitors, however, have longer operating histories, significantly greater resources, greater economies of scale, stronger name recognition and a larger base of customers than we do. This may allow them to respond more quickly than we are able to respond to new or emerging technologies or changes in customer requirements. Many of our competitors also have significant influence in the semiconductor industry. They may be able to introduce new technologies or devote greater resources to the development, marketing and sales of their products than we can. Furthermore, in the event of a manufacturing capacity shortage, these competitors may be able to manufacture products when we are unable to do so.

19

We compete with other providers of semiconductor-based high performance interconnect products based on InfiniBand, Ethernet, Fibre Channel and proprietary technologies. With respect to InfiniBand products, we compete with QLogic Corporation. In EDCs, products based on the InfiniBand standard primarily compete with two different industry-standard interconnect technologies, namely Ethernet and Fibre Channel. For Ethernet technology, the leading IC vendors include Intel and Broadcom Corporation. The leading IC vendors that provide Ethernet and Fibre Channel products to the market include Marvell Technology Group, Emulex Corporation and QLogic Corporation. In HPC, products based on the InfiniBand standard primarily compete with the industry-standard Ethernet and Fibre Channel interconnect technologies. In embedded markets, we typically compete with interconnect technologies that are developed in-house by system OEM vendors and created for specific applications.

We acquired Voltaire Ltd. in February, 2011

In February, 2011, we acquired Voltaire Ltd ("Voltaire"). Voltaire designs and develops scale-out computing fabrics for data centers, high performance computing and cloud computing environments. Voltaire's family of scale-out fabric switches, application acceleration software and advanced fabric management software improves the performance of mission-critical applications, increases efficiency and reduces costs through infrastructure consolidation, and lower power consumption.

Scale-out computing is the ability to build large data centers that scale horizontally to thousands of servers while:

- •

- leveraging industry standard servers, storage and networks;

- •

- delivering highly dense and power efficient infrastructure;

- •

- enabling virtual infrastructure and application mobility; and

- •

- providing linear scalability of applications and resources.

The term scale-out computing includes the following:

- •

- Cluster computing. Clusters run applications in a

distributed way on a number of servers ranging from two servers to thousands of servers. The servers are tightly linked and are typically located in a single data center at the same physical location.

- •

- Grid computing. Grids run applications in a distributed

fashion on dozens to thousands of servers in a similar manner to clusters. However, grids typically run many applications in parallel and applications are more loosely linked. Grids may be deployed

across several geographical locations.

- •

- Cloud computing. Cloud computing is based on grid

computing concepts with service level models describing expected performance applied to them. There are two main types of clouds:

- •

- Private clouds. These are owned by enterprises for running

their internal information technology (IT) services. The internal IT department offers services to different business units, dynamically re-provisioning resources based on the requirements of those

units.

- •

- Public clouds. Companies completely outsource their IT infrastructure, or a particular application, to cloud service providers. The enterprises' applications run on the service provider's infrastructure and can be accessed over the Internet.

Voltaire's principal executive offices are located in Ra'anana, Israel. Voltaire also has offices in North America, Europe and Asia-Pacific.

20

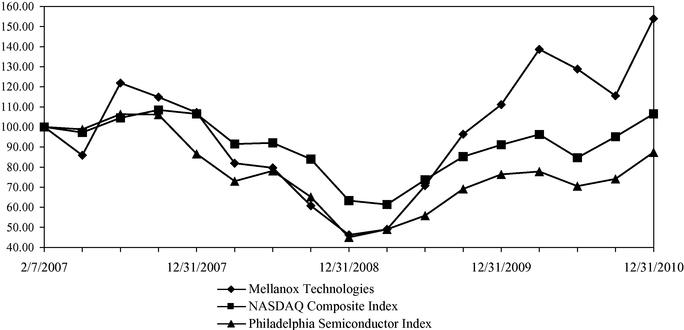

Additional Information

We were incorporated under the laws of Israel in March 1999. Our ordinary shares began trading on the NASDAQ Global Market as of February 8, 2007 under the symbol "MLNX" and on the Tel-Aviv Share Exchange as of July 9, 2007 under the symbol "MLNX." Prior to February 8, 2007, our ordinary shares were not traded on any public exchange.

Our principal executive offices in the United States are located at 350 Oakmead Parkway, Suite 100, Sunnyvale, California 94085, and our principal executive offices in Israel are located at Hermon Building, Yokneam, Israel 20692. The majority of our assets are located in the United States. Our telephone number in Sunnyvale, California is (408) 970-3400, and our telephone number in Yokneam, Israel is +972-4-909-7200. Michael Gray is our agent for service of process in the United States, and is located at our principal executive offices in the United States. Our website address is www.mellanox.com. Information contained on our website is not a part of this report and the inclusion of our website address in this report is an inactive textual reference only.

Available Information

We file reports with the Securities and Exchange Commission, or SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any other filings required by the SEC. We post on the Investor Relations pages of our website, ir.mellanox.com, a link to our filings with the SEC, our Code of Business Conduct and Ethics, our Complaint and Investigation Procedures for Accounting, Internal Accounting Controls, Fraud or Auditing Matters and the charters of our Audit, Compensation and Nominating and Corporate Governance Committees of our board of directors and the charter of our Disclosure Committee. Our filings with the SEC, including our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any other filings required by the SEC, are posted on our website as soon as reasonably practical after they are electronically filed with, or furnished to, the SEC. You can also obtain copies of these documents, without charge to you, by writing to us at: Investor Relations, c/o Mellanox Technologies, Inc., 350 Oakmead Parkway, Suite 100 Sunnyvale, California 94085 or by emailing us at: ir@mellanox.com. All these documents and filings are available free of charge. Please note that information contained on our website is not incorporated by reference in, or considered to be a part of, this report. Further, a copy of this report on Form 10-K is located at the SEC's Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Information on the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements and other information regarding our filings at www.sec.gov.

Investing in our ordinary shares involves a high degree of risk. You should carefully consider the following risk factors, in addition to the other information set forth in this report, before purchasing our ordinary shares. Each of these risk factors could harm our business, financial condition or operating results, as well as decrease the value of an investment in our ordinary shares.

Risks Related to Our Business

The semiconductor industry may be adversely impacted by worldwide economic uncertainties which may cause our revenues and profitability to decline.

We operate primarily in the semiconductor industry, which is cyclical and subject to rapid change and evolving industry standards. From time to time, the semiconductor industry has experienced significant downturns characterized by decreases in product demand and excess customer inventories. Economic volatility can cause extreme difficulties for our customers and vendors to accurately forecast and plan future business activities. This unpredictability could cause our customers to reduce spending

21

on our products and services, which would delay and lengthen sales cycles. Furthermore, during challenging economic times our customers and vendors may face issues gaining timely access to sufficient credit, which could affect their ability to make timely payments to us. As a result, we may experience growth patterns that are different than the end demand for products, particularly during periods of high volatility.