Attached files

| file | filename |

|---|---|

| 8-K - CHINA NORTH EAST PETROLEUM HOLDINGS LTD | m361108k.htm |

INVESTOR RELATIONS

PRESENTATION

PRESENTATION

Rodman & Renshaw Conference

March 2011

This presentation contains forward-looking statements as defined by the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements include statements concerning plans, objectives, goals,

strategies, future events, performance and results of operations, and

underlying assumptions and other statements that are other than

statements of historical facts. These statements are subject to uncertainties

and risks including, but not limited to, product and service demand and

acceptance, changes in technology, economic conditions, the impact of

competition and pricing, government regulation, and other risks contained

in statements filed from time to time with the Securities and Exchange

Commission. All such forward-looking statements, whether written or oral,

and whether made by or on behalf of the company, are expressly qualified

by the cautionary statements and any other cautionary statements which

may accompany the forward-looking statements. In addition, the company

disclaims any obligation to update any forward-looking statements to

reflect events or circumstances after the date hereof.

Private Securities Litigation Reform Act of 1995. Forward-looking

statements include statements concerning plans, objectives, goals,

strategies, future events, performance and results of operations, and

underlying assumptions and other statements that are other than

statements of historical facts. These statements are subject to uncertainties

and risks including, but not limited to, product and service demand and

acceptance, changes in technology, economic conditions, the impact of

competition and pricing, government regulation, and other risks contained

in statements filed from time to time with the Securities and Exchange

Commission. All such forward-looking statements, whether written or oral,

and whether made by or on behalf of the company, are expressly qualified

by the cautionary statements and any other cautionary statements which

may accompany the forward-looking statements. In addition, the company

disclaims any obligation to update any forward-looking statements to

reflect events or circumstances after the date hereof.

SAFE HARBOR STATEMENT

2

COMPANY OVERVIEW

• China North East Petroleum (NYSE Amex: NEP)

• NEP is an independent oil company that engages in oil

drilling project management and the extraction of crude

oil in proven oilfields in Northern China.

drilling project management and the extraction of crude

oil in proven oilfields in Northern China.

• A Pioneer in China’s Private Oil Exploration, Production

& Services Industry

& Services Industry

• First Chinese non-state-owned oil company trading on

the NYSE Amex

the NYSE Amex

• NEP operates over 295 producing oil wells within 4

proven oilfields in Northern China (as of 12/31/10)

proven oilfields in Northern China (as of 12/31/10)

|

Stock Summary

|

|

|

Current Price (March, 1)

|

$5.07

|

|

52 week Range

|

$4.75 - $10.09

|

|

Average Volume (3mths)

|

453,387

|

|

Shares Outstanding

|

32.5MM

|

|

Market Cap

|

$165MM

|

|

Fiscal Year End

|

31-Dec

|

|

Financial Overview

($ in million)

|

|

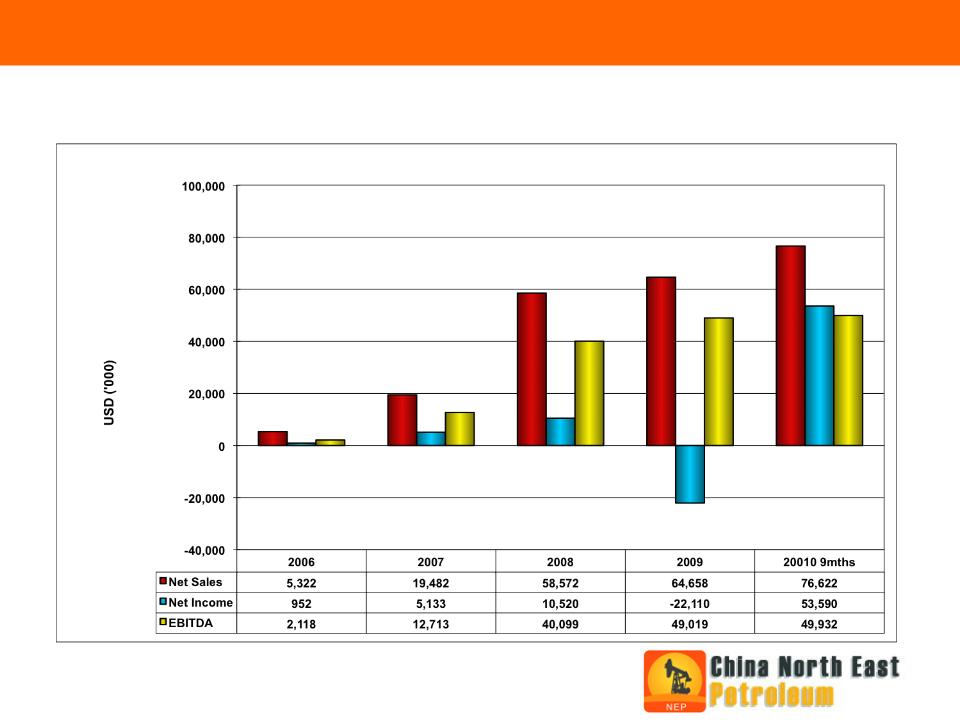

Q1-Q3: 2010

§ Revenue US$ 76.6

§ Net Income US$ 53.6

2009

§ Revenue US$ 64.7

§ Net Income US$ (22.1)*

* Loss due to the non-cash costs, including:

impairment of oil properties,

change in fair value of warrants,

and loss on extinguishment of debt

|

3

3

• Uniquely positioned to benefit from China’s increasing domestic energy demands

• Vertically integrated operator with oil drilling and oilfield services platform

• Exclusive 20 year oil lease and extraction contract with PetroChina (PTR) to operate four

oilfields in Jilin Oilfield

oilfields in Jilin Oilfield

• Acquisition of Durimu oilfield significantly expands market presence & establishes strong

drilling platform for foreseeable future

drilling platform for foreseeable future

• No marketing costs: Guaranteed sales arrangement all produced crude oil

• Highly scalable operations

• Convenient and cost-effective to develop future oil wells

• Strong cash flow to help fuel continuous growth cycle

• Operations consistently >60% of revenues

INVESTMENT HIGHLIGHTS

4

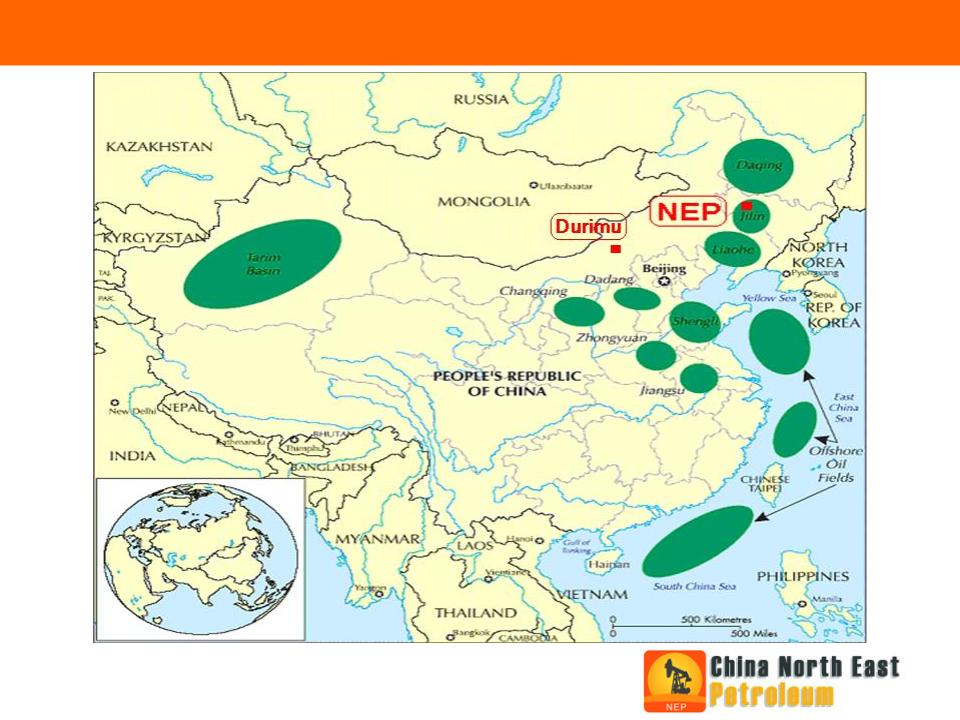

CHINA OILFIELDS MAP (Includes NEP’s Oilfield)

5

CURRENT OIL PRODUCTION: JILIN OILFIELD

NEP granted 20-years lease and

extraction contract from Petro China

(PTR)

extraction contract from Petro China

(PTR)

• First 10 years, PTR receives 20%

of oil produced by NEP as

royalty

of oil produced by NEP as

royalty

• Second 10 years, PTR receives

40% of oil produced as royalty

40% of oil produced as royalty

NEP hires outside drilling contractors

NEP extracts oil and places oil into

storage tanks

storage tanks

NEP delivers oil, via truck (about 5 miles),

to PTR

to PTR

NEP agrees to sell all of its extracted oil to

PTR

PTR

All the financial and production numbers

are reported NET of royalties to PTR.

are reported NET of royalties to PTR.

6

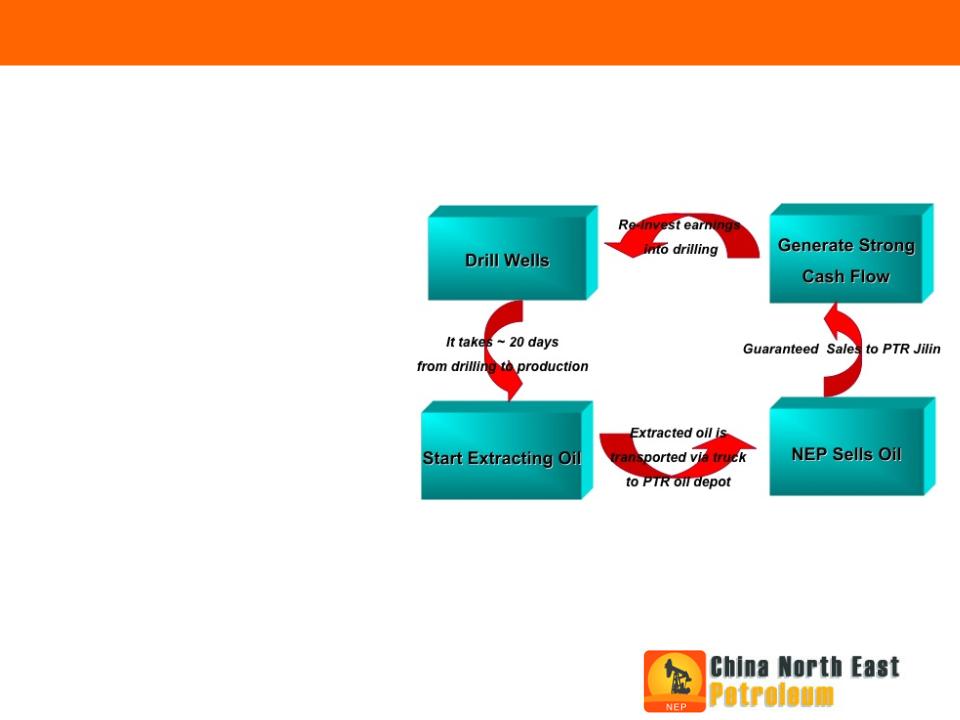

• STRONG CASH FLOW

• Cash flow from operations consistently

>60% of revenues

>60% of revenues

• HIGHLY SCALABLE

• ~20 days from commencement of drilling to

initial production

initial production

• LOW RESERVE RISKS

• Exploration was conducted by PTR to verify

oil reserves

oil reserves

• 100% success rate to date (applying latest

3D seismic imaging technology)

3D seismic imaging technology)

• NO MARKETING COST

• PTR guarantees to purchase all oil NEP

produced

produced

• MINIMAL ACCOUNTS RECEIVABLE RISK

• PTR has never defaulted on payment to

NEP

NEP

7

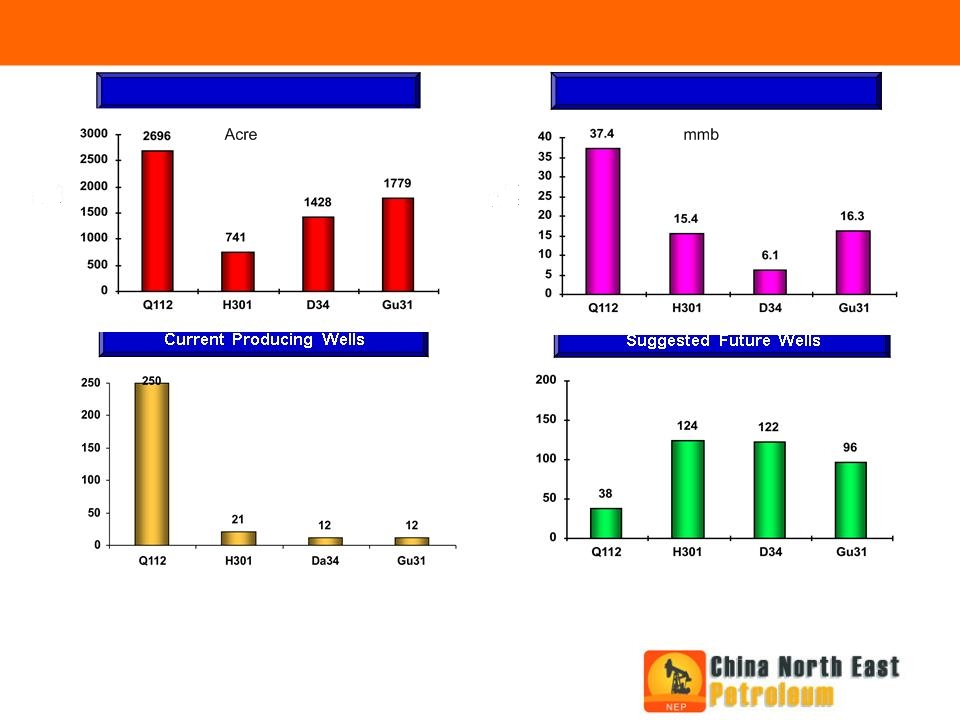

DRILLING OPPORTUNITY WITHIN NEP’s FOUR JILIN OILFIELDS

As of the end of 2010, total number of current Producing wells is 295

The total number of suggested future wells is 380; total of 675 wells

Proved Oil Bearing Area

Geological Reserves

8

NEP acquired oil drilling and services company, Song Yuan Tiancheng Drilling

Engineering Co. Ltd. ("Tiancheng") in late 2009

Engineering Co. Ltd. ("Tiancheng") in late 2009

• Acquisition transformed NEP into a more diversified and integrated operator

• Tiancheng is the largest of four PetroChina- licensed private drilling operators in NE China

region

region

• Vertical expansion enhances opportunities to secure new oilfield leases at more favorable

terms, accelerate our drilling schedule and lower operating costs

terms, accelerate our drilling schedule and lower operating costs

• Reduces company’s exposure to oil price volatility

• Tiancheng has consistently generated solid financial results

• Operating margins in mid-40% range

• Net margin in mid-30% range

• 251 wells drilled since acquisition

• Contributed $58 million in revenue since acquisition

TIANCHENG OIL DRILLING & SERVICES BUSINESS

9

• 8 rigs: Two 13,000 foot rig

Three 9,800 foot rig

Three 6,500 foot rig

• Capacity to drill 200 wells annually

• Current customers are PetroChina and other

private oil producers

private oil producers

• Typical contract depth of well drilling: 3,000

feet to 8,200 feet

feet to 8,200 feet

• Avg. # of days to drill new well*: 7-9 days

• Avg. revenue per well drilled*: ~$230,000

• 320 employees

*based on a contract drilling depth of 5,900 feet

TIANCHENG OIL DRILLING & SERVICES BUSINESS

10

January 2011: NEP announced acquisition of Shengyuan, an independent operator with exclusive

oilfield exploration and drilling rights to the 175 sq. km Durimu oilfield in Inner Mongolia.

oilfield exploration and drilling rights to the 175 sq. km Durimu oilfield in Inner Mongolia.

Deal Terms:

• Total consideration of US$43.4 million consisting of approximately USD$10.6 million in cash and 5.8

million shares of NEP restricted common stock in exchange for 100% ownership of Shengyuan.

million shares of NEP restricted common stock in exchange for 100% ownership of Shengyuan.

• 25 year exclusive exploration agreement (24 years remaining) with state-owned enterprise of the local

government to drill in the Durimu oilfield

government to drill in the Durimu oilfield

Assets:

• Three exploration wells

• 24 years of exclusive drilling and exploration rights to a 175 square kilometer oilfield, called Durimu

Reserves:

• The proven oil reserve within this oilfield currently is approximately 1.55MM barrels, based on the 3

exploration wells*

exploration wells*

• Based on geologist study conducted by PetroChina, the Durimu oilfield has a geological reserve of

approximately 77.5MM tons (approximately 573.5MM barrels); the recoverable reserve is approximately

25%, or 19.4MM tons (approximately 143.4MM barrels). This same survey estimated that the number of

wells drilled in this oilfield could exceed 2,000.

approximately 77.5MM tons (approximately 573.5MM barrels); the recoverable reserve is approximately

25%, or 19.4MM tons (approximately 143.4MM barrels). This same survey estimated that the number of

wells drilled in this oilfield could exceed 2,000.

OILFIELD ACQUISITION

11

*Based on study conducted by independent worldwide petroleum consultant, Ralph E. Davis in

accordance with generally accepted petroleum engineering and evaluation principles in conformity with

SEC definitions and guidelines.

accordance with generally accepted petroleum engineering and evaluation principles in conformity with

SEC definitions and guidelines.

Financing:

• The Company expects to finance the cash portion of the purchase price agreements from cash on

balance sheet

Timing:

• The Company expects to close the intended acquisition by the end of its 2011 first quarter.

Operational plan upon closing:

• Conduct further seismic tests in the oilfield to gather more geo-data, and begin drilling additional

exploration wells to test productivity within the oilfield.

• Company to utilize 2-3 in-house drilling rigs to conduct initial work; initial stage expected to last

approximately 12-18 months.

• Upon completion of first stage of testing, NEP to aggressively drill in Durimu and increase overall

production.

• Drilling in Durimu will be done while maintaining current production levels within four existing Jilin

oilfields.

oilfields.

OILFIELD ACQUISITION (cont’d)

12

13

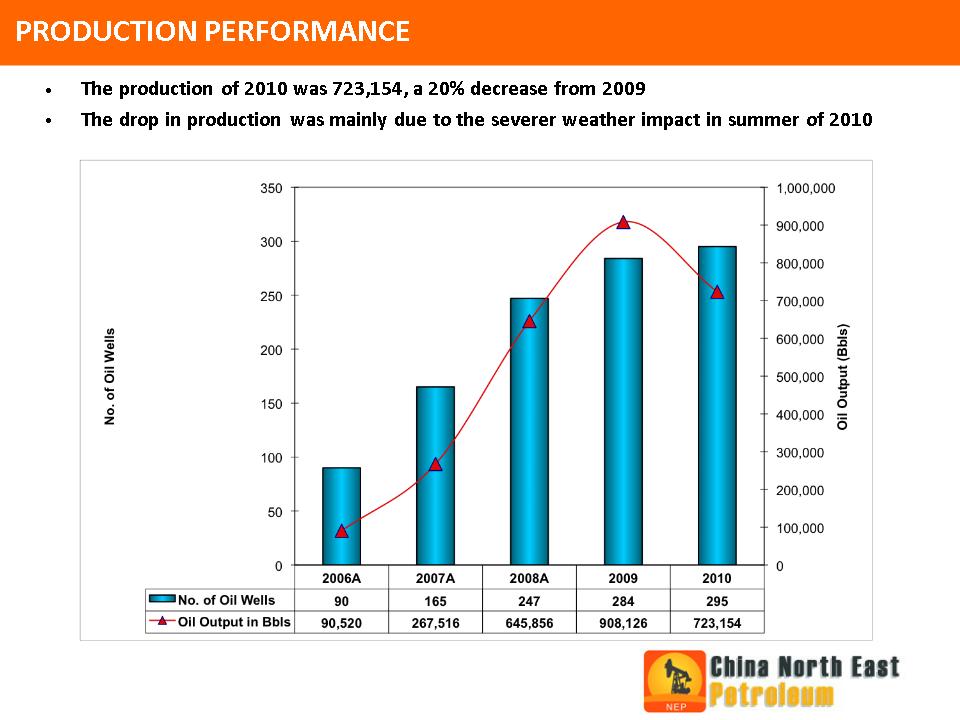

Operational Performance

14

STRONG FINANCIAL PERFORMANCE

15

• Fiscal year 2010 earnings expects to report on March 15

• A earnings conference call will be held on the same date

• Li Jingfu - CEO

40 Years Experience in Oil Industry

Strong Knowledge and First-hand Experience in Oil Production and Operation

• Chen Shaohui - CFO

MBA, University of California

Strong knowledge and experience in U.S. Capital Markets

Experienced in US GAAP and Financial Reporting

• Jiang Chao - Senior Vice President, Corporate Finance

Master in Business and Finance, Surrey University UK

Strong knowledge and experience in U.S. Capital Markets

Experienced in Financial Reporting, Capital Raising and Investor Relations

• Zhang Xiang - Chief Geological Engineer

Over 20 years experience for PetroChina in geological exploration studies

Specializes in researching and implementing the latest E&P technologies to oilfields

One of most senior and respected geological engineers in Jilin oilfield

• Liu Xiaoyu - Senior Geological Engineer

Over 20 years oilfield technical and production management experience for PTR

Specializes in geological data analysis and production planning

MANAGEMENT TEAM

16

• Rule Edward - Chairman of the Board

Strong Financial Knowledge and Experience

Director of Hong Kong and Australian Companies

Decades Experiences in China as Diplomat and Banker

Business Savvy in Asian Culture

• Tang Yau-Sing - Chairman of Audit Committee

Formal Auditor Background

Strong Financial Knowledge and Experience

Fellow of Association of Chartered Certified Accountants in the U.K. and the Hong Kong

Institute of Certified Public Accountants

Institute of Certified Public Accountants

Member of the Institute of Chartered Accountants in England and Wales and the Taxation

Institute of Hong Kong.

Institute of Hong Kong.

• Hu Ruishi - Director

30 Years Experience in Oil Industry

Strong Knowledge and First-hand Experience in Oil Production and Operation

Director of multiple PetroChina Joint Venture Companies

INDEPENDENT DIRECTORS

17

• Uniquely positioned to benefit from China’s increasing domestic energy demands

• Vertically integrated operator with oil drilling and oilfield services platform

• Exclusive 20 year oil lease and extraction contract with PetroChina (PTR) to operate four

oilfields in Jilin Oilfield

oilfields in Jilin Oilfield

• Acquisition of Durimu oilfield significantly expands market presence & establishes strong

drilling platform for foreseeable future

drilling platform for foreseeable future

• No marketing costs: Guaranteed sales arrangement all produced crude oil

• Highly scalable operations

• Convenient and cost-effective to develop future oil wells

• Strong cash flow to help fuel continuous growth cycle

• Operations consistently >60% of revenues

INVESTMENT HIGHLIGHTS

18

For Further Information

IR Department

(909) 610 2212 | info@cnepetroleum.com

Bill Zima

ICR Inc.

(203) 682 8200 | bill.zima@icrinc.com