Attached files

| file | filename |

|---|---|

| EX-32 - MICROMET, INC. | v212586_ex32.htm |

| EX-21.1 - MICROMET, INC. | v212586_ex21x1.htm |

| EX-31.1 - MICROMET, INC. | v212586_ex31x1.htm |

| EX-31.2 - MICROMET, INC. | v212586_ex31x2.htm |

| 10-K - MICROMET, INC. | v212586_10k.htm |

Exhibit 10.48

OFFICE LEASE AGREEMENT

THIS OFFICE LEASE AGREEMENT (this “Lease”) dated for references purposes only is made between PS BUSINESS PARKS, L.P., a California limited partnership (“Landlord”), and MICROMET, INC., a Delaware corporation (“Tenant”), as of December 23, 2010 (the “date of this Lease”).

BASIC LEASE INFORMATION

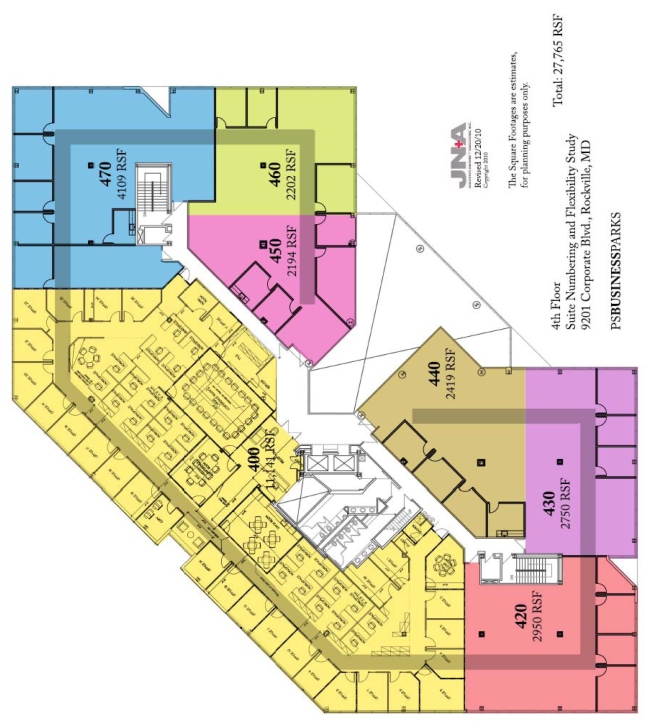

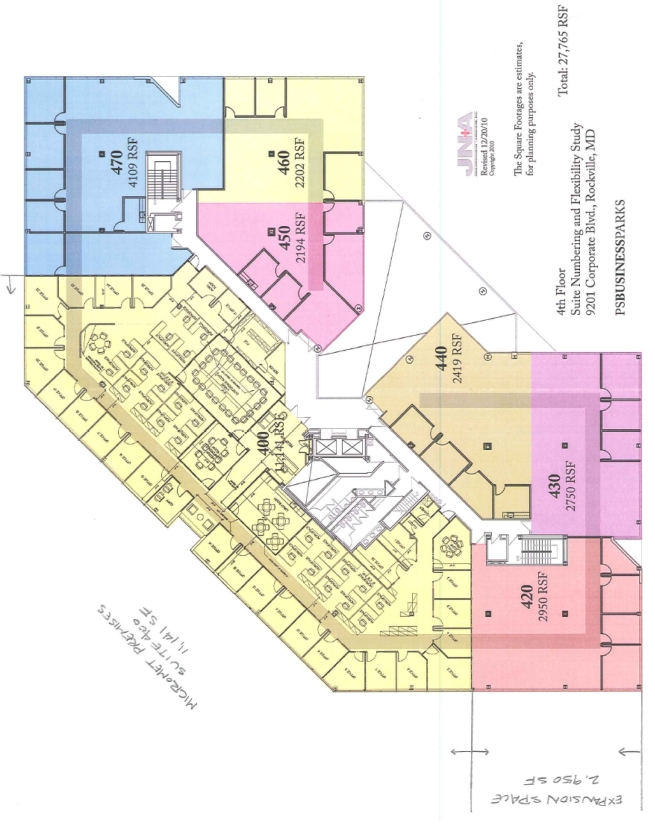

PREMISES: Approximately Eleven Thousand One Hundred Forty-One (11,141) rentable square feet commonly known as Suite 400, 9201 Corporate Boulevard, Rockville, Maryland, as depicted on Exhibit A-1. The number of rentable square feet in the Premises shall be certified by Landlord’s architect and shall be calculated in accordance with the Standard Method for Measuring Floor Area in Office Buildings, ANSI Z65.1-1996, as promulgated by the Building Owners and Managers Association (“BOMA”) International.

BUILDING & PROJECT: Approximately One Hundred Five Thousand Three Hundred Eighteen (105,318) rentable square feet located at 9201 Corporate Boulevard, Rockville, Maryland, as depicted on Exhibit A-2. The Building is a part of the Project commonly referred to as Shady Grove Executive Center, as depicted on Exhibit A-2.

PERMITTED USE: General office use, including permitted uses reasonably ancillary thereto, including shipping of pumps and other materials used in clinical trials

|

TERM:

|

The Lease shall commence on the date on which the Tenant Improvements (defined in Exhibit B attached hereto) are Substantially Complete (defined in Exhibit B attached hereto) (the “Commencement Date”), and shall end on the last day of the eighty-fourth (84th) full calendar month thereafter (the “Termination Date”), unless earlier terminated.

|

BASE RENT:

|

Period of Term

(in full calendar months)

|

Monthly Base Rent

|

|||

|

Commencement Date – last day of

the 12th full calendar month thereafter

|

$ | 25,067.00 | ||

|

13 – 24

|

$ | 25,819.00 | ||

|

25 – 36

|

$ | 26,594.00 | ||

|

37 – 48

|

$ | 27,392.00 | ||

|

49 – 60

|

$ | 28,214.00 | ||

|

61 – 72

|

$ | 29,060.00 | ||

|

73 – 84

|

$ | 29,932.00 | ||

BASE YEAR: The calendar year 2011, subject to Exhibit D

SECURITY DEPOSIT: NONE

LETTER OF CREDIT: $300,807.00 in the form of an unconditional and irrevocable letter of credit as more full described in Section 28.02 below.

TENANT'S PROPORTIONATE SHARE OF BUILDING: 10.58%

|

PARKING DENSITY:

|

3.0 unreserved spaces per 1,000 square feet of the Premises, which spaces shall be in common with other tenants of the Project and shall be free of charge throughout the Term of the Lease, as the same may be extended or renewed.

|

LANDLORD’S BROKER: None TENANT’S BROKER: Jones Lang LaSalle

TENANT’S SIC CODE: 8731

|

ADDRESSES FOR NOTICES:

|

After occupancy to Tenant at:

Micromet, Inc.

9201 Corporate Boulevard

Suite 400

Rockville, MD 20850

Attn: Matthias Alder, Senior VP,

General Counsel and Secretary

FAX:

Prior to Occupancy to Tenant at:

Micromet, Inc.

6707 Democracy Boulevard

Suite 505

Bethesda, Maryland 20817

Attn: Matthias Alder, Senior VP,

General Counsel and Secretary

|

To: Landlord

PS Business Parks, L.P.

7529 Standish Place, Suite 115

Rockville, Maryland 20855

Attn: William A. McFaul

FAX: (301) 340-8503

|

TENANT’S BILLING ADDRESS [If different from Notice Address]:

LANDLORD’S REMITTANCE ADDRESS: Rent Checks shall be made payable to PS Business Parks, L.P. and sent to PS Business Parks, Inc., P. O. Box 535011, Atlanta, GA 30353-5011.

1

BUILDING BUSINESS HOURS: 8:00 a.m. to 6:00 p.m. weekdays and 9:00 a.m. to 1:00 p.m. Saturdays, except holidays observed by the federal government.

This Lease consists of the foregoing Basic Lease Information, the following Lease provisions consisting of Sections 1 through 28 and Exhibits A-1, A-2, A-3, B, C, D, E, and F all of which are incorporated herein by this reference. Defined terms used in this Lease and included in the Basic Lease Information shall have the mea

nings given them in the Basic Lease Information.

1. Lease of Premises; Compliance with Laws; Surrender.

1.01 Landlord leases to Tenant, and Tenant leases from Landlord, the Premises, upon the terms of this Lease. The Premises are leased “AS IS” except only for the Tenant Improvements which are to be constructed by Landlord pursuant to Exhibit B. All of the HVAC systems, mechanical systems, utilities and plumbing serving the Building and the Premises shall be delivered in good working order. Tenant acknowledges that neither Landlord nor any agent of Landlord has made any representation or warranty regarding the Premises unless expressly stated in this Lease. By taking possession of the Premises, Tenant agrees that the Premises are in good order and satisfactory condition, subject to the provisions

of Exhibit B including but not limited to Landlord’s obligation to construct the Tenant Improvements in accordance with Laws as well as providing the Construction Warranty (defined in Exhibit B). The square footages set forth in this Lease are approximate and agreed, subject to Landlord’s obligation to provide Tenant with a certificate from Landlord’s architect concerning the rentable square footage of the Premises measured in accordance with BOMA. For purposes of this Lease, the term “Property” means the Building (as defined above in the Basic Lease Information), the Project (as defined above in the Basic Lease Information), and the parcel(s) of land on which they are located and the parking facilities and other improvements, if any, serving the Building, Project and/or the parcel(s) of land on which they are located. If the Project is

part of a larger complex of structures, the term “Property” may include the entire complex, where appropriate in Landlord’s reasonable discretion.

1.02 If for any reason Landlord cannot deliver possession of the Premises on the Commencement Date, Landlord will not be subject to any liability nor will the validity of this Lease be affected in any manner other than as specifically set forth below. Rather, the actual Commencement Date shall be delayed until delivery of possession in which event the Termination Date shall be extended to include the same number of full calendar months as set forth in the Basic Lease Information (plus any partial first month); provided, in the event delivery of possession is delayed by a Tenant Delay (defined in Exhibit B), then the Premises shall be deemed to have been delivered (and the actual Commencement Date shall occur) on the earlier of the actual date of delivery or the date delivery would ha

ve occurred absent the number of days of such Tenant Delay and the Term (as defined above in the Basic Lease Information) shall then be for such number of full calendar months (plus any partial first month). Within a reasonable period of time following the Commencement Date, Landlord shall prepare and Tenant shall execute and deliver to Landlord a commencement letter setting forth the actual Commencement Date, the date upon which the Term shall expire, and such other matters regarding the commencement of this Lease as Landlord shall reasonably request. Tenant’s failure to execute and return the commencement letter, or to provide written objection to the statements contained in the commencement letter, within 15 business days after the date of the commencement letter is received by Tenant shall be deemed an approval by Tenant of the statements contained therein.

Notwithstanding the foregoing, provided the Lease has been executed and delivered by Tenant to Landlord on or before December 31, 2010 (together with the first month’s Rent, the Letter of Credit (defined in Section 28.02 below) and any other items due from Tenant upon Tenant’s execution of the Lease), then if the Commencement Date has not occurred on or before the Outside Date (defined below) subject to Tenant Delays and Force Majeure, as set forth below, Tenant, as its sole remedy, may terminate this Lease by giving Landlord written notice of termination on or before the earlier to occur of: (i) 10 business days after the Outside Date; and (ii) the Commencement Date. If such a termination notice is so given to Landlord, Landlord shall promptly refund any prepaid rent and return the Letter of Cre

dit previously deposited by Tenant under this Lease and this Lease shall be null and void and the parties hereto shall have no further responsibilities or obligations to each other with respect to this Lease except with respect to any obligations which survive a termination of this Lease. The “Outside Date” shall mean May 1, 2011. Landlord and Tenant acknowledge and agree that the Outside Date shall be postponed by the number of days the Commencement Date is delayed due to Tenant Delays (defined in Exhibit B), events of Force Majeure as provided in Article 26 and/or long-lead items necessary for the completion of the Tenant Improvements of which Tenant has been given written notice. Notwithstanding anything to the contrary contained in this Lease, if the Term of the Lease has not commenced within twenty-one (21) years after the date of this Lease, this L

ease shall automatically terminate on the twenty-first (21st) anniversary of such date. The sole purpose of this provision is to avoid any interpretation of this Lease as a violation of the Rule Against Perpetuities, or any other rule of law or equity concerning restraints on alienation.

1.03 Provided that Tenant does not interfere with or delay the completion by Landlord or its agents or contractors of the construction of any tenant improvements, Tenant shall have the right to enter the Premises up to thirty (30) days prior to the anticipated Commencement Date only for the purpose of installing furniture, trade fixtures, equipment, wiring and cabling, telecommunications equipment and similar items. Tenant shall be liable for any damages or delays caused by Tenant's activities at the Premises. Such occupancy shall be subject to all provisions of this Lease, provided, however; that so long as Tenant has not begun operating its business from the Premises, the foregoing activity shall not constitute the delivery of possession of the Premises to Tenant and neither the Te

rm of the Lease nor Tenant’s obligation to pay Base Rent hereunder shall commence as a result of said activities. Prior to entering the Premises, Tenant shall obtain all insurance it is required to obtain by the Lease and shall provide certificates of said insurance to Landlord. Tenant shall coordinate such entry with Landlord's building manager, and such entry shall be made in compliance with all terms and conditions of this Lease and the Rules and Regulations attached hereto. In the event Tenant occupies the Premises prior to the Commencement Date for any other purpose, other than as expressly provided herein, such occupancy shall not change the termination date, but Tenant shall pay Base Rent and all other charges provided for in this Lease during the period of such occupancy.

2

1.04 Subject to Section 1.05 and 1.06 below, Tenant, at its sole expense, agrees to comply with all federal, state and local laws, codes, ordinances, statutes, rules, regulations and other legal requirements (including covenants and restrictions) applicable to the Premises (collectively, “Laws”), and to cause the Premises to comply with all Laws, including by making any changes to the Premises necessitated by any Tenant activity, including but not limited to changes required by (a) any Tenant Alterations (as defined below), or (b) any use of the Premises or Property by Tenant or any Tenant Entity, provided that if any activity of Tenant or any Tenant Entity necessitates changes to the Project other than the Premises, then Landl

ord shall elect that Landlord accomplish the same at Tenant’s expense or that Tenant accomplish the same at its own expense.

1.05 Following the Commencement Date, and subject to Section 1.06 below, in the event that as a result of Tenant’s specific use (or intended specific use) of the Premises (other than for general office use), including any Tenant Alterations made to the Premises by or on behalf of Tenant, any Law, including without limitation, the Americans With Disabilities Act, requires modifications or the construction or installation of improvements in or to the Premises, Building, Project and/or common areas of the Property (as the same are identified from time to time by Landlord for common use) (the “Common Areas”), the parties agree that such modifications, construction or improvements shall be made at Tenant’s exp

ense. Landlord or such other person(s) as Landlord may appoint shall have the exclusive control and management of the Common Areas. Landlord shall have the right, in Landlord’s sole discretion, from time to time, (i) to make changes to the Common Areas, including, without limitation, changes in the location, size, shape and number of the lobbies, windows, stairways, air shafts, elevators, escalators, restrooms, driveways, entrances, parking spaces, parking areas, loading and unloading areas, ingress, egress, direction of traffic, landscaped areas, walkways and utility raceways, (ii) to close temporarily any of the Common Areas for maintenance purposes so long as reasonable access to the Premises remains available, (iii) to add additional buildings and improvements to the Common Areas, and (iv) and to do and perform such other acts and make such other changes in, to or with respect to the Common Areas and Property as Landlord may, in the exercise of sound business judgment, deem to

be appropriate so long as Landlord's actions in connection with such rights set forth in clauses (i) through (iv) above do not unreasonably interfere with Tenant's use of or access to the Premises.

1.06 The Tenant Improvements to be constructed by Landlord pursuant to Exhibit B shall be made in compliance with all Laws in effect as of the Commencement Date. Notwithstanding anything to the contrary contained herein, Landlord shall be responsible for correcting any violations of Laws with respect to the Premises or the Common Areas of the Building, or the Property; provided that Landlord's obligation with respect to the Premises shall be limited to violations that arise out of the Tenant Improvements (defined in Exhibit B) performed by Landlord only and/or the condition of the Premises at the execution of this Lease and prior to the installation of any furniture, equipm

ent and other personal property of Tenant; and provided further that Tenant, not Landlord, shall be responsible for the correction of any violations of Law that arise out of or in connection with the specific nature of Tenant's business in the Premises, the acts or omissions of Tenant or any Tenant Entity, the arrangement of any furniture, equipment or other property in the Premises, any repairs or Tenant Alterations performed by or on behalf of Tenant (other than the Tenant Improvements performed by Landlord), requirements of any employees of Tenant (subject to Landlord’s obligation to comply with applicable Laws with respect to the Common Areas and the Tenant Improvements), and any design or configuration of the Premises specifically requested by Tenant (other than the Tenant Improvements). Landlord shall have the right to contest any alleged violation in good faith, including, without limitation, the right to apply for and obtain a waiver or deferment of compliance, the right to assert an

y and all defenses allowed by law and the right to appeal any decisions, judgments or rulings to the fullest extent permitted by law. The cost of any such compliance by Landlord shall constitute an Operating Expense hereunder; provided, however, in the event the Law was in effect as of the Commencement Date and the violation existed as of the Commencement Date, then the cost of any such compliance shall be at Landlord's sole cost and expense.

1.07 Upon expiration or termination of this Lease, Tenant agrees to remove all of Tenant’s personal property from the Premises and return the Premises to Landlord in the same condition as received by Tenant (excepting normal wear and tear, and damage by casualty (which repair obligation shall be controlled by Section 15)) with all removal, repair, and restoration duties of Tenant, including without limitation pursuant to Section 9.04, being fully performed to Landlord’s reasonable satisfaction. Notwithstanding any other provision of this Lease to the contrary, Tenant shall remove at its expense in compliance with the National Electric Code or other applicable Law, at or prior to the expiration or termination of this Lease, all wiring and cabling installed at or about the

Premises which shall have been installed by or on behalf of Tenant. Such wiring and cabling shall include but not be limited to (a) wiring and cabling above the ceiling panels, behind or within walls, and under or within floors, and (b) wiring and cabling for voice, data, security or other purposes. If Tenant abandons, vacates, or surrenders the Premises, or is dispossessed by process of Law, or otherwise, any personal property belonging to Tenant left in or about the Premises will, at the option of Landlord, be deemed abandoned and may be disposed of by Landlord at the expense and risk of Tenant.

1.08 Subject to Section 8.04 below, Landlord has no duty to provide security for any portion of the Property. To the extent Landlord elects to provide any security, Landlord is not warranting the effectiveness of any security personnel, services, procedures or equipment and Tenant shall not rely on any such personnel, services, procedures or equipment. Landlord shall not be liable for failure of any such security personnel, services, procedures or equipment to prevent or control, or to apprehend anyone suspected of, personal injury or property damage in, on or around the Property.

2. Base Rent. Subject to Section 28.01 below, on or before the first day of each calendar month of the Term, Tenant will pay to Landlord the Base Rent for such month. Base Rent and Additional Rent (defined below) for any first partial month and for the first full calendar month of the Term, together with the Letter of Credit, are due and payable upon execution of this Lease. Monthly rent for any partial calendar month will be prorated based on the number of days in the calendar month involved. All sums and other charges payable by Tenant to Landlord hereunder shall be deemed rent. Base Rent and all other amounts required to be paid by Tenant hereunder shall be pa

id without deduction or offset and without prior notice or demand. All such amounts shall be paid in lawful money of the United States of America and shall be paid to Landlord at the address stated herein or to such other persons or to such other places as Landlord may designate in writing from time to time. Amounts payable hereunder shall be deemed paid when actually received by Landlord.

3. Additional Rent. Unless otherwise specifically stated in this Lease, any charge payable by Tenant under this Lease other than Base Rent is called “Additional Rent.” The term “rent” whenever used in this Lease means Base Rent, Additional Rent and/or any other charge, fee or monies payable by Tenant under the terms of this Lease. Tenant shall pay Tenant’s Proportionate Share of Operating Expenses in accordance with Exhibit D of this Lease.

3

4. Late Charges. If any sum payable by Tenant to Landlord is not received by Landlord on the date due, Tenant shall pay a late charge equal to the greater of (a) $50.00, or (b) 10% or the highest per annum rate of interest permitted from time to time under applicable Law (whichever is less) of the then delinquent amount; provided, however, that the foregoing late charge shall not apply to the first such late payment in any 12 month period of the Term of this Lease or any extension thereto until following written notice to Tenant and the expiration of 5 days thereafter without cure. A $50.00 handling fee will be paid to Landlord by Tenant for each bank returned check. Following a monet

ary Default, Tenant, at Landlord’s election, shall make all future payments to Landlord by wire or electronic transfer, by cashier’s check or by an automatic payment from Tenant’s bank account to Landlord’s account, in each case without cost to Landlord. The acceptance of late charges and returned check charges by Landlord will not constitute a waiver of any Tenant default nor any other rights or remedies of Landlord.

5. [Intentionally omitted]

6. Use of Premises.

6.01 The Premises will be used and occupied only for the Permitted Use. Tenant will, at its sole expense, comply with all conditions and covenants of this Lease, and, subject to Landlord’s obligations pursuant to Section 1.04 above, all Laws in any way relating to Premises or Tenant’s use and occupancy thereof. Tenant will not use or permit the use of the Premises, the Property or any part thereof by any party claiming by, through or under Tenant, in a manner that is unlawful or in violation of any Law, conflicts with or is prohibited by the terms and conditions of this Lease or the Rules and Regulations (as defined in Section 27.08 below), diminishes the appearance or aesthetic quality of any part of the Property, creates waste or a nuisance, or causes damage

to the Property. Tenant shall not permit any objectionable or unpleasant odors, smoke, dust, gas, noise or vibrations to emanate from the Premises nor take or permit any other action in the Premises that would endanger, annoy, or interfere with the operations of, Landlord or any other tenant of the Property. Subject to Landlord’s obligations pursuant to Exhibit B, including without limitation, obtaining the final building approval from Montgomery County, Maryland, necessary for Tenant to initially legally occupy the Premises following the completion of the Tenant Improvements, Tenant shall obtain, at its sole expense, any permit or other governmental authorization required for Tenant to legally operate its business from the Premises. Any animals, excepting guide dogs, on or about the Property or any part thereof are expressly prohibited.

6.02 In the event of any excessive trash in or outside the Premises caused by Tenant or any Tenant Entity, as determined by Landlord in its reasonable discretion, Landlord will have the right to remove such excess trash, charge all costs and expenses attributable to its removal to Tenant and impose fines in the event Tenant fails to remedy the situation. Tenant will not cause, maintain or permit any outside storage on or about the Property. In the event of any unauthorized outside storage by Tenant or any Tenant Entity, Landlord will have the right, without notice, in addition to such other rights and remedies it may have, to remove any such storage at Tenant’s expense.

7. Parking. All parking will comply with the terms and conditions of this Lease and applicable Rules and Regulations (as defined in Exhibit C hereto). Tenant will have a non-exclusive privilege on a "first-come, first-served" basis to use Tenant’s Proportionate Share of those parking spaces designated by Landlord for public parking free of charge during the Term hereof, as the same may be extended or renewed. The parking privileges granted to Tenant are personal to Tenant and Tenant’s Permitted Transferees (or as otherwise expressly agreed by Landlord in writing); Tenant shall not assign or sublet parking privileges s

eparate and apart from this Lease.

8. Utilities and Services.

8.01 Landlord agrees to furnish to the Premises during Building Business Hours (specified in the Basic Lease Information) on generally recognized business days (but exclusive in any event of Sundays and holidays observed by the federal government), the following services and utilities subject to the Rules and Regulations: (a) water for use in the base Building lavatories; (b) customary heat and air conditioning (“HVAC”) required in Landlord’s judgment for the use and occupation of the Premises during Building Business Hours, although Tenant shall have the right to receive HVAC service during hours other than Building Business Hours by paying Landlord’s then standard charge for additional HVAC service and

providing such prior notice as reasonably specified by Landlord; (c) standard janitorial service (after normal business hours for services within the Premises) and otherwise in accordance with Exhibit E attached hereto; (d) elevator service by non-attended automatic elevators; and (e) electricity in accordance with the terms and conditions in this Section 8.01; and (g) such other services as Landlord reasonably determines are necessary or appropriate for the Property. As of the date hereof, and subject to future increases, the standard charge for after hours HVAC service is Seventy-Five Dollars ($75.00) per hour. Electricity and/or any other services or utilities used by Tenant in the Premises shall, at Landlord’s option, be paid for by Tenant either: (i) through inclusion in Operating Expenses (except as provided for excess usage); (ii) by a separate charge payable by Tenant to Landlord; or (iii) by separate charg

e billed by the applicable utility company and payable directly by Tenant. Without the consent of Landlord, Tenant’s use of electrical service shall not exceed, either in voltage, rated capacity, use beyond Building Business Hours or overall load, that which Landlord reasonably deems to be standard for the Building. Landlord shall have the right to measure electrical usage by commonly accepted methods, including the installation of measuring devices such as submeters and check meters. If it is determined that Tenant is using excess electricity, Tenant shall pay Landlord, as Additional Rent, the cost of such excess electrical usage and for the cost of purchasing and installing the measuring device(s).

8.02 Landlord will not be liable or deemed in default, nor will there be any abatement of rent, breach of any covenant of quiet enjoyment, partial or constructive eviction or right to terminate this Lease, for (a) any interruption or reduction of utilities, utility services or telecommunication services, (b) any telecommunications or other company failing to provide such utilities or services or providing the same defectively, and/or (c) any utility interruption in the nature of blackouts, brownouts, rolling interruptions, hurricanes, tropical storms or other natural disasters. Tenant agrees to comply with any energy conservation programs required by Law or implemented by Landlord. Landlord reserves the right, in its sole discretion, to designate, at any time, the utility

and service providers (e.g., janitorial service providers but specifically excluding service providers for non-Building related services such as Tenant’s shredder or courier services and the like) for Tenant’s use within the Property; no such designation shall impose liability upon Landlord. Tenant has satisfied itself as to the adequacy of any Landlord owned utility equipment and the quantity of telephone lines and other service connections to the “Building’s Point of Demarcation” available for Tenant’s use. If the Premises, or a material portion of the Premises, are made untenantable for a period in excess of 5 consecutive days as a result of any failure to furnish, or any interruption, diminishment or termination of services due to the application of Laws, the failure of any equipment, the performance of repairs, improvements or alterations, utility interruptions or the occurrence of an event of Force Majeure (collectively, a “Service Failure”) that is reasonably within the control of Landlord to correct, then Tenant, as its sole remedy, shall be entitled to receive an abatement of Base Rent and Tenant’s Proportionate Share of Operating Expenses payable hereunder during the period beginning on the 6th consecutive day of the Service Failure and ending on the day the service has been restored. If the entire Premises have not been rendered untenantable by the Service Failure, the amount of abatement shall be equitably prorated.

4

8.03 Subject to the other terms and conditions of the Lease, Landlord shall provide Tenant with reasonable access to the Common Areas of the Building and the Project, including the parking area, and to the Premises, including the use of at least one (1) elevator, twenty-four (24) hours a day, three hundred sixty-five (365) days per year. Notwithstanding the foregoing, Tenant acknowledges and agrees that repairs, hazardous conditions and other circumstances beyond Landlord's reasonable control may prevent access to the Common Areas of the Building and to the Premises from time to time.

8.04 Landlord shall maintain during the Term of the Lease (as the same may be extended) the level of security, including a keycard access system securing the perimeter of the Building, existing at the Project as of the date hereof. Thirty-five (35) card keys for the perimeter access control system for the Building shall be provided to Tenant at no cost. All additional card keys shall be provided at Tenant’s expense.

9. Tenant Improvements; Tenant Alterations; Mechanic’s Liens.

9.01 The Tenant Improvements to be constructed by Landlord pursuant to Exhibit B are referred to throughout this Lease as “Tenant Improvements.” All Tenant Improvements will be performed by Landlord in accordance with the terms and conditions outlined in Exhibit B.

9.02 The following provisions apply to “Tenant Alterations” which means and includes (a) any alterations, additions or improvements to the Premises undertaken by or on behalf of Tenant (other than the Tenant Improvements), (b) any utility installations at the Premises undertaken by Tenant, and (c) any repair, restoration, replacement, or maintenance work at the Premises undertaken by or on behalf of Tenant (other than the Construction Warranty work if any and the completion of any punchlist items in connection with the Tenant Improvements as required by Exhibit B). Tenant shall not commence any Tenant Alteration without first obtaining the prior written consent of Landlord in each instance, which may be given or withheld i

n Landlord’s sole discretion; provided, however; Landlord’s consent shall not be unreasonably withheld with respect to alterations which (i) are not structural in nature, (ii) are not visible from the exterior of the Building, and (iii) do not affect or require modification of the Building’s electrical, mechanical, plumbing, HVAC or other systems. Tenant shall submit such information regarding the intended Tenant Alteration as Landlord may reasonably require, and no request for consent shall be deemed complete until such information is so delivered. The following provisions apply to all Tenant Alterations: (i) Tenant shall hire a licensed general contractor approved by Landlord who, in turn, shall hire only licensed subcontractors; (ii) Tenant shall obtain all required permits and deliver a copy of the same to Landlord. Tenant shall install all Tenant Alterations in strict compliance with all Laws, permits, any plans approved by Landlord, and all

conditions to Landlord’s approval; (iii) unless Landlord elects otherwise, Tenant shall remove each Tenant Alteration at the end of this Lease or Tenant’s right of possession and restore the Premises to its prior condition, all at Tenant’s sole expense; and (iv) Tenant shall deliver to Landlord, within ten (10) days following installation of each Tenant Alteration, (A) accurate, reproducible as-built plans, (B) proof of final inspection and approval by all governmental authorities, (C) complete lien waivers acceptable to Landlord for all costs of the Tenant Alteration, and (D) a copy of a recorded notice of completion. Landlord’s approval of any Tenant Alterations and/or Landlord’s approval or designation of any general contractor, subcontractor, supplier or other project participant will not create any liability whatsoever on the part of Landlord. Except in connection with the Tenant Improvements and any Permitted Alteration not requiring Landlord’s

consent, Tenant shall pay to Landlord a fee equal to 7% of total hard costs of the Tenant Alteration to compensate Landlord for review of plans, inspection of work, and other activities regarding any Tenant Alterations.

9.03 Tenant shall pay all costs of Tenant Alterations as and when due. Tenant shall not allow any lien to be filed. Tenant shall obtain lien waivers from all contractors, subcontractors, suppliers, and others providing equipment, labor, materials, or services, in the form required by Landlord. If any lien is filed, Tenant shall within 10 days after written notice thereof remove such lien. In addition, if any such lien is filed, then, without waiver of any other right or remedy, Landlord shall have the right to cause such lien to be removed by any means allowed by Law. All sums expended by Landlord in connection with such lien and/or its removal, including attorney fees, shall be immediately due from Tenant to Landlord, together with interest at t

he rate of 10% or the highest per annum rate of interest permitted from time to time under applicable Law (whichever is less).

9.04 All Tenant Improvements and Tenant Alterations are part of the realty and belong to Landlord. Tenant shall be solely responsible for all taxes applicable to any Tenant Alterations, to insure all Tenant Alterations and to restore the same following any casualty. Except as expressly provided hereinafter, at the expiration or earlier termination of this Lease, Landlord may require, upon written notice to Tenant, that Tenant remove all, or any part of the Tenant Alterations at its sole cost and expense and repair any damage caused by such removal. In no event shall Tenant be required to remove any of the Tenant Improvements installed in the Premises by Landlord pursuant to Exhibit B attached to this Lease. If Tenant fails to perform its obligations in a ti

mely manner, Landlord may perform such work at Tenant’s expense. Notwithstanding anything to the contrary contained herein, so long as Tenant’s written request for consent for a proposed Tenant Alteration contains the following statement in large, bold and capped font “PURSUANT TO ARTICLE 9 OF THE LEASE, IF LANDLORD CONSENTS TO THE SUBJECT ALTERATION, LANDLORD SHALL NOTIFY TENANT IN WRITING WHETHER OR NOT LANDLORD WILL REQUIRE SUCH ALTERATION TO BE REMOVED AT THE EXPIRATION OR EARLIER TERMINATION OF THE LEASE.”, at the time Landlord gives its consent for any Tenant Alterations, if it so does, Tenant shall also be notified in Landlord’s consent whether or not Landlord will require that such Tenant Alterations be removed upon the expiration or earlier termination of this Lease. Notwithstanding anything to the contrary contained in this Lease, at the expiration or earlier termination of this Lease and oth

erwise in accordance with the terms and conditions of this Lease, Tenant shall be required to remove all Tenant Alterations made to the Premises except for any such Tenant Alterations which Landlord expressly indicates or is deemed to have indicated shall not be required to be removed from the Premises by Tenant. If Tenant’s written request strictly complies with the foregoing and if Landlord fails to so notify Tenant at the time of Landlord’s consent whether Tenant shall be required to remove the subject Tenant Alterations at the expiration or earlier termination of this Lease, it shall be deemed that Landlord shall not require the removal of the subject Tenant Alterations. The provisions of this Article 9 shall survive the expiration or any earlier termination of this Lease.

5

9.05 Tenant shall have the right to make non-structural Alterations to the Premises without obtaining Landlord's prior written consent, provided that (i) such Alterations do not exceed Fifty Thousand Dollars ($50,000) in cost in the aggregate in any twelve (12) month period; (ii) Tenant provides Landlord with prior written notice of its intention to make such Alterations together with the plans and specifications for the same; (iii) except in the event of an emergency, Tenant provides Landlord seven (7) business days to review Tenant's plan of Alteration; (iv) any such Alteration to the Premises does not affect any of the structural portions of the Building or the base building systems in the Building; (v) such Alterations are not visible from the Common Areas, (vi) Tenant adheres to all applicable g

overnment regulations, including the Americans with Disabilities Act, and obtains any necessary permits in making such Alterations; (vii) such Alterations are designed in conformance with the Building design criteria; (viii) such Alterations do not reduce the value or utility of the Building, and (ix) all work is performed in a good and workmanlike manner and shall otherwise comply with the provisions of this Article 9. Any such Alterations meeting the conditions described in this Section 9.05 shall be known as “Permitted Alterations”. Regardless of whether Landlord’s consent is required for an Alteration, it shall be deemed reasonable for Landlord: (x) to require Tenant to perform Alterations during non-business hours if such Alterations will create unreasonable noise, noxious fumes or otherwise interfere with the quiet enjoyment of the other tenants in the Building, and (y) to require Tenant to perform Alterations in accordance with a reasonable schedule approved by

the manager of the Building.

10. Repairs.

10.01 Tenant shall periodically inspect the Premises to identify any conditions that are dangerous or in need of maintenance or repair. Tenant shall promptly provide Landlord with notice of any such conditions. Tenant shall, at its sole cost and expense, perform all maintenance and repairs to the Premises that are not Landlord’s express responsibility under this Lease, and keep the Premises in good condition and repair, reasonable wear and tear excepted. Tenant’s repair and maintenance obligations include, without limitation, repairs to: (a) floor coverings; (b) interior partitions; (c) doors (including, without limitation, overhead and roll up doors); (d) the interior side of demising walls; (e) electronic, fiber, phone and data cabling and related equipment that is installed by or for th

e exclusive benefit of Tenant; (f) supplemental air conditioning units, kitchens, including hot water heaters, plumbing, and similar facilities exclusively serving the Premises; and (g) except as set forth in Exhibit B, Tenant Improvements and Tenant Alterations. The standard for comparison of condition will be the condition of the Premises as of the original date of Landlord’s delivery of the Premises and failure to meet such standard shall create the need to repair, ordinary wear and tear excepted. If Tenant does not perform required maintenance or repairs after ten (10) days’ written notice from Landlord (or such lesser period given the emergency), Landlord shall have the right but not the obligation, without waiver of Default or of any other right or remedy, to perform such obligations of Tenant on Tenant’s behalf, and Tenant will reimburse Landlord for any costs incurred, together with an administrative charge in an amount equal to 7% of the cost of the repairs, i

mmediately upon demand

10.02 Subject to the provisions of Section 1.04, Section 10.01, Article 15 (Damage or Destruction) and Article 19 (Condemnation), Landlord at all times during the Lease Term and subsequent renewal periods shall maintain and promptly and expeditiously undertake and manage all necessary or customary repairs to, and the maintenance of (a) the structural elements of the Building; (b) the mechanical, electrical, plumbing and fire/life safety systems serving the Building and the Premises in general (but not serving the Premises solely); (c) the Common Areas, including but not limited to the stairwells and the parking areas; (d) the roof of the Building; (e) the exterior windows and the atrium windows of the Building; and (f) the elevators serving the Building. Any damage caused by or repairs necessitated by

any negligence or act of Tenant or any Tenant Entity may be repaired by Landlord at Landlord’s option and Tenant’s expense, subject to the provisions of Section 11.09. Landlord’s liability with respect to any defects, repairs, or maintenance for which Landlord is responsible under any of the provisions of this Lease shall be limited to the cost of such repairs or maintenance, and there shall be no abatement of rent and no liability of Landlord by reason of any injury to or interference with Tenant’s business arising from the making of repairs, alterations or improvements in or to any portion of the Premises, the Building or the Common Areas or to fixtures, appurtenances or equipment in the Building or the Common Areas, except as provided in Section 8.02 and Article 15. Tenant expressly waives the benefit of any statute or other legal right now or hereafter in effect which would otherwise afford Tenant the right to make repairs at Landlord’s expense, whethe

r by deduction of rent or otherwise, or to terminate this Lease because of Landlord’s failure to keep the Property, or any part thereof in good order, condition and repair.

11. Insurance.

11.01 Tenant will not do or permit anything to be done within or about the Premises or the Property by a Tenant Entity which will increase the existing rate of any insurance on any portion of the Property or cause the cancellation of any insurance policy covering any portion of the Property (including, without limitation, any liability coverage). Tenant will, at its sole cost and expense, comply with any requirements of any insurer of Landlord. Tenant agrees to maintain policies of insurance described in this Article. Landlord reserves the right, from time to time, to require additional coverage (including, flood insurance, if the Premises is located in a flood hazard zone), and/or to require higher amounts of coverage.

11.02 Tenant shall maintain the following insurance (“Tenant’s Insurance”):

|

|

(a)

|

Commercial General Liability Insurance applicable to the Premises and its appurtenances providing, on an occurrence basis, a minimum of $1,000,000.00, and not less than $2,000,000.00 in the annual aggregate, covering third-party bodily injury, property damage, personal injury and advertising injury, product/completed operations as applicable, medical expenses and contractual liability. Defense costs will be in addition to the limit of liability. A combination of a General Liability policy and an umbrella policy or excess liability policy may be used to satisfy this limit;

|

6

|

|

(b)

|

Property/Business Interruption Insurance written on an All Risk or Special Cause of Loss Form at replacement cost value and with a replacement cost endorsement covering all of Tenant’s business and trade fixtures, equipment, movable partitions, furniture, merchandise and other personal property within the Premises, including for which Tenant has repair obligations and any Tenant Improvements and Tenant Alterations performed by or for the benefit of Tenant. No coinsurance provision will apply;

|

|

|

(c)

|

Excess Liability in the amount of $2,000,000.00;

|

|

|

(d)

|

Workers’ Compensation Insurance in amounts not less than the amounts required by Law;

|

|

|

(e)

|

Employers Liability Coverage of at least $500,000.00 (each accident, disease – each employee, disease – policy limit);

|

|

|

(f)

|

Automobile Liability coverage of not less than $1,000,000.00 combined single limit including property damage covering Tenant’s owned, and hired vehicles; and

|

|

|

(g)

|

If Tenant uses any part of the Premises or Property to store or to perform work on vehicles, Tenant shall maintain garage liability insurance in such form and amount as Landlord may require from time to time, but not less than $2,000,000.00.

|

11.03 No insurance policy of Tenant shall have a self insured retention or deductible greater than $5,000.00, excluding flood and earthquake insurance which will have deductibles of $25,000.00.

11.04 Any company writing Tenant’s Insurance shall be licensed to do business in the state in which the Premises is located and shall have an A.M. Best rating of not less than A-VIII.

11.05 Tenant will deliver to Landlord (and, at Landlord’s request, to any Mortgagee (as defined in Article 25 below) or to any other third party), simultaneously with its execution of this Lease certificates acceptable to Landlord of insurance evidencing, at a minimum, the coverage specified in this Article 11. Thereafter, Tenant shall, at least ten (10) days after the expiration of such policies, furnish Landlord with certificates of insurance evidencing renewals thereof. All such certificates shall be in form and substance satisfactory to Landlord, shall affirmatively demonstrate all coverage and requirements set forth in this Lease, shall contain no disclaimers of coverage, and shall include that the insurer will endeavor to give the certificate holder 30 days’ written notice prior to c

ancellation or change in any coverage. In addition, Tenant will give Landlord at least 30 days’ prior written notice prior to cancellation or change in any coverage.

11.06 Tenant hereby assigns to Landlord all its rights to receive any proceeds of such insurance policies attributable to any Tenant Improvements and Tenant Alterations if this Lease is terminated due to damage or destruction. Landlord and the Landlord Related Parties shall be named additional insureds on Tenant’s insurance policies (excluding Workers’ Compensation Insurance); provided, however, that with respect to property insurance covering any Tenant Improvements and Tenant Alterations, Landlord and the Landlord Related Parties shall be loss payee thereunder (and the foregoing designations shall be evidenced on the insurance certificates delivered to Landlord as required hereby). All insurance to be carried by Tenant will be primary to, and non-contributory with, Landlord

217;s insurance, and there will be no exclusion for cross-liability endorsements and will in addition to the above coverage specifically insure Landlord against any damage or loss that may result either directly or indirectly from any default of Tenant under Article 13 (Hazardous Materials) herein. Any similar insurance carried by Landlord will be non-contributory and considered excess insurance only.

11.07 Tenant will name Landlord (and, at Landlord’s request, any Mortgagee (as defined in Article 25 below), Landlord’s agents, and/or any other parties designated by Landlord) as additional insureds on all insurance policies required of Tenant under this Lease, other than Worker’s Compensation, Employer’s Liability, and Fire and Extended coverage (except on Tenant Improvements or Tenant Alterations to the Premises for which Landlord shall be named loss payee) insuring Landlord and such other additional insureds regardless of any defenses the insurer may have against Tenant and regardless of whether the subject claim is also made against Tenant. All insurance policies carried by Tenant will permit the insured, prior to any loss, to agree with a third party to waive any claim it

might have against said third party without invalidating the coverage under the insurance policy, and will release Landlord and the Landlord Related Parties (as defined in Article 24 below), from any claims for damage to any person, to the Property of which the Premises are a part, any existing improvements, Tenant Improvements and Tenant Alterations to the Premises, and to any furniture, fixtures, equipment, installations and any other personal property of Tenant caused by or resulting from, risks which are to be insured against by Tenant under this Lease, regardless of cause. The foregoing shall be evidenced in Tenant’s certificate of insurance.

11.08 Landlord shall at all times during the term of this Lease, maintain in effect a policy or policies of insurance covering the Building and Landlord’s personal property located therein (excluding property required to be insured by Tenant) in an amount not less than the full replacement cost of such Building (less foundations and footings) and property, as the same may exist from time to time, providing protection against loss or damage by fire, and other casualties normally covered under a standard fire and extended coverage insurance policy with any necessary endorsements to also provide insurance against loss by explosion or other hazards and contingencies together with insurance against sprinkler damage, vandalism and malicious mischief, and such other risks as Landlord may from time to time determi

ne and with any such reasonable deductibles as may be customary for landlords of buildings similar to the Building and located in the same geographic area as the Building. Landlord shall at all times during the term of this Lease maintain general public liability insurance against claims for personal injury or death and property damage occurring upon, in or about the Building, the Common Areas and the Project (except for in the Premises and for such other losses required to be covered by Tenant hereinabove) in such commercially reasonable amounts determined by Landlord insuring Landlord against liability arising out of the ownership, operation and management of the Project. All insurance to be carried by Tenant will be primary to, and non-contributory with, Landlord’s insurance. The premiums for such coverage are “Insurance Premiums” under Exhibit D to this Lease.

7

11.09 Landlord and Tenant hereby waive and shall cause their respective insurance carriers to waive any and all rights of recovery, claims, actions or causes of action against the other for any loss or damage with respect to Tenant’s personal property, fixtures and equipment, any Tenant Improvements or Tenant Alterations, the Building, the Premises, the Common Areas, the Project or any contents thereof, including rights, claims, actions and causes of action based on negligence, which loss or damage is (or would have been, had the insurance required by this Lease been carried) covered by insurance. For the purposes of this waiver, any deductible with respect to a party’s insurance shall be deemed covered by and recoverable by such party under valid and collectable policies of insurance.

0; For purposes of this Section 11.09, “Landlord” shall include the Landlord Related Parties.

11.10 Whenever Tenant shall undertake any alterations, additions or improvements in, to or about the Premises, including, without limitation, any Tenant Alterations (“Work”) the aforesaid insurance protection must extend to and include injuries to persons and damage to property arising in connection with such Work, without limitation including liability under any applicable structural work act, and such other insurance as Landlord shall require; and the policies of or certificates evidencing such insurance must be delivered to Landlord prior to the commencement of any such Work.

11.11 So long as the coverage afforded Landlord, the other additional insureds and any designees of Landlord shall not be reduced or otherwise adversely affected, all or part of Tenant’s insurance may be carried under a blanket policy covering the Premises and any other of Tenant’s locations, or by means of a so called “Umbrella” policy and/ or by an Excess Liability policy so long as the total required coverage amounts are met by Tenant's cumulative insurance coverage, be it by Tenant's insurance policy, Excess Liability coverage and/or a combination thereof.

12. Waiver of Claims; Indemnification.

12.01 Tenant waives all claims against Landlord and the Landlord Related Parties for any damage to any property in or about the Property, for any loss of business or income, and for injury to or death of any persons, regardless of the cause of any such loss or event (excluding the gross negligence or willful misconduct of Landlord or the Landlord Related Parties) or time of occurrence.

12.02 Tenant will indemnify, protect, defend and hold harmless Landlord and the Landlord Related Parties from and against any and all claims, liabilities, losses, costs, damages, injuries, or expenses, including reasonable attorneys’ and consultants’ fees and court costs, demands, causes of action, or judgments, to the extent arising out of Tenant’s occupancy of the Premises, the conduct of Tenant’s business, any Default by Tenant, and/or any act, omission or neglect (including violations of Law) of Tenant or its agents, contractors, employees, suppliers, licensees or invitees, successors or assigns, subject to the provisions of Section 11.09 (each a “Tenant Entity” and collectively, the “Tenant Entities”) in the Premises, except to the extent arising out of or relating to the negligence or willful misconduct of Landlord.

12.03 Landlord shall indemnify, protect, defend and hold Tenant harmless from and against any and all claims, liabilities, losses, costs, damages, injuries or expenses, including reasonable attorneys’ and consultants’ fees and court costs, demands, causes of action, or judgments, to the extent arising out of or relating to the negligence or willful misconduct of Landlord or the Landlord Related Parties (subject to the provisions of Section 11.09). However, notwithstanding anything to the contrary contained herein, Landlord shall in no event be liable for (i) injury to Tenant’s business or any loss of income or profit therefrom or for consequential damages or events of Force Majeure (as defined in Article 26), or (ii) sums up to the amount of insurance proceeds received by Tenant (or

which would have been received by Tenant under any insurance coverage required to be maintained by Tenant hereunder) for any loss. The foregoing indemnity by Landlord shall also not be applicable to claims to the extent arising from the negligence or willful misconduct of Tenant or any Tenant Entity.

12.04 Each party’s agreement to indemnify and hold the other harmless set forth above is not intended to, and shall not relieve any insurance carrier of its obligations under policies required to be carried by Landlord or Tenant pursuant to the provisions of the Lease to the extent that such policies cover the results of such acts or conduct. The provisions of this Article 12 shall survive the expiration or earlier termination of this Lease.

13. Hazardous Materials.

13.01 “Hazardous Materials” will mean any substance commonly referred to, or defined in any Law, as a hazardous material or hazardous substance (or other similar term), including but not be limited to, chemicals, solvents, petroleum products, flammable materials, explosives, asbestos, urea formaldehyde, PCB’s, chlorofluorocarbons, freon or radioactive materials. Tenant will not cause or permit any Hazardous Materials to be brought upon, kept, stored, discharged, released or used in, under or about any portion of the Property by Tenant, or its agents without the prior written consent of Landlord, which consent may be withheld or conditioned in Landlord’s sole discretion; provided, Tenant may bring into the Premises small am

ounts of Hazardous Materials (such as cleaning products and copy toner) which are readily available to Tenant by unregulated retail purchase if the same are necessary in Tenant’s normal business operations. Other than small amounts of Hazardous Materials (such as cleaning products and copy toner) which are readily available to Tenant by unregulated retail purchase if the same are necessary in Tenant’s normal business operations, if Tenant or any Tenant Entity brings any Hazardous Materials to the Premises or Property, with or without the prior written consent of Landlord (without waiver of the requirement of prior written consent), and in executing this Lease Tenant acknowledges and agrees that by its direct or indirect involvement in the introduction of any Hazardous Materials to the Premises or Property, with or without the consent of the Landlord, that Tenant accepts full and complete responsibility for such Hazardous Materials and henceforth on will be considered the Responsible Pa

rty as defined by any applicable governmental authority and/or Law. Further, Tenant shall: (a) use such Hazardous Material only as is reasonably necessary to Tenant’s business, in small, properly labeled quantities; (b) handle, use, keep, store, and dispose of such Hazardous Material using the highest accepted industry standards and in compliance with all applicable Laws; (c) maintain at all times with Landlord a copy of the most current MSDS sheet for each such Hazardous Material; and (d) comply with such other rules and requirements Landlord may from time to time reasonably impose, or with any definition of Hazardous Waste or Law as it may be implemented or modified during or after the term of this Lease. Upon expiration or earlier termination of this Lease, Tenant will, at Tenant’s sole cost and expense, cause all Hazardous Materials brought to the Premises or the Property by Tenant or any Tenant Entity, to be removed from the Property in compliance with any and all applicable Laws.

8

13.02 If Tenant or any Tenant Entity violates the provisions of this Article 13, or perform any act or omission which contaminates or expands the scope of contamination of the Premises, the Property, or any part thereof, the underlying groundwater, or any property adjacent to the Property, or violates or allegedly violates any applicable Law, then Tenant will promptly, at Tenant’s expense, take all investigatory and/or remedial action (collectively called “Remediation”), as directed or required by any governmental authority that is necessary to fully clean up, remove and dispose of such Hazardous Materials and any contamination so caused and shall do so in compliance with any applicable Laws. Tenant will also repair any damage t

o the Premises and any other affected portion(s) of the Property caused by such contamination and Remediation.

13.03 Tenant shall immediately provide to Landlord written notice of any investigation or claim arising out of the use by Tenant or any Tenant Entity of Hazardous Materials at the Property or the violation of any provision of this Article 13, or alleged violation of any Law and shall keep Landlord fully advised regarding the same. Tenant shall provide to Landlord all reports regarding the use of Hazardous Materials by Tenant or any Tenant Entity at the Property and any incidents regarding the same, regardless of whether any such documentation is considered by Tenant to be confidential. Landlord retains the right to participate in any Remediation and/or legal actions affecting the Property involving Hazardous Materials arising from Tenant’s actual or alleged violation of any provision

of this Article 13 or Law.

13.04 Tenant will indemnify, protect, defend and forever hold Landlord, its lenders and ground lessor if any, the Landlord Related Parties, the Premises, the Property, or any portion thereof, harmless from any and all damages, causes of action, fines, losses, liabilities, judgments, penalties, claims, and other costs, including, but not limited to, any Landlord Related Parties’ costs incurred during its participation in any Remediation and/or legal actions as specified in 13.03, arising out of any failure of Tenant or Tenant Entity to observe any covenants of this Article 13. Tenant shall have no liability arising from the existence or disposal of Hazardous Material brought into the Premises or the Property by anyone other than Tenant or a Tenant Entity. All provisions of this Article 13 shall s

urvive the expiration of this Lease and any termination of this Lease or of Tenant’s right of possession.

13.05 Landlord represents and warrants that to the best of its knowledge and belief there is no Hazardous Material on, in or under the Premises, Project or Property in violation of any applicable Law.

14. Landlord’s Access. Landlord, its agents, contractors, consultants and employees, will have the right to enter the Premises at any time without notice in the case of an emergency, and otherwise at reasonable times upon at least twenty-four (24) hours telephonic notice (except for access in connection with providing Building standard janitorial services to the Premises after normal business hours which shall not require any such notice) to examine the Premises, perform work in or clean the Premises, inspect any Tenant Alterations and/or any Tenant Improvements, show the Premises (provided, however, so long as Tenant is not in Default under the Lease, Landlord shall only show the Premises to prospective tenants

during the last six (6) months of the Term), exercise any right or remedy, or for any other reasonable purpose. For each of these purposes, Landlord will at all times have and retain any necessary keys. Tenant will not alter any lock or install new or additional locks or bolts on any door in or about the Premises without obtaining Landlord’s prior written approval and will, in each event, furnish Landlord with a new key. Access by Landlord will not give Tenant the right to terminate this Lease, and will be without abatement of rent or liability on the part of Landlord or any Landlord Related Parties; provided, however, Landlord shall use reasonable efforts to minimize interference with Tenant's use and occupancy of the Premises during Landlord's actions in connection with this provision. Subject to the other terms and conditions of the Lease, Landlord shall provide Tenant with reasonable access to the Premises and the Common Areas of the Building twenty-four

(24) hours a day, three hundred sixty-five (365) days per year. Notwithstanding the foregoing, Tenant acknowledges and agrees that repairs, hazardous conditions and other circumstances beyond Landlord's control may prevent access to the Common Areas of the Building and to the Premises from time to time.

15. Damage or Destruction.

15.01 If all or a portion of the Premises is damaged or destroyed by fire or other casualty, Tenant will immediately give written notice to Landlord of the casualty. Landlord shall, within sixty (60) days after the discovery of such casualty, notify Tenant in writing if the damage cannot be repaired within one hundred eighty (180) days from the date restoration commences.

15.02 Landlord will have the right to terminate this Lease following a casualty if any of the following occur: (a)insurance proceeds actually paid to Landlord and available for use are not sufficient to pay the full cost to fully repair the damage (so long as Landlord carried the insurance required of Landlord pursuant to this Lease); (b) Landlord determines that the Premises or the Building cannot be repaired within 180 days from the date restoration commences; (b) the Premises are damaged or destroyed within the last 6 months of the Term; (d) Tenant is in Default of this Lease after the expiration of any applicable notice and cure period at the time of the casualty; or (e) the Property, or the Building in which the Premises is located, is damaged such that the cost of repair of the same would e

xceed 50% of the replacement cost of the same. If Landlord elects to terminate this Lease, Landlord will be entitled to retain all Tenant insurance proceeds applicable to the Tenant Improvements and any other improvements paid for by Landlord or located within the Premises as of the date of this Lease and Tenant shall assign or endorse over to Landlord (or to any party designated by Landlord) all property insurance proceeds related thereto payable to Tenant under Tenant's insurance, excepting those attributable to Tenant’s Alterations paid for by Tenant, furniture, fixtures, equipment, and any other personal property. If the Lease is not terminated pursuant to this Section 15.01 or pursuant to Section 15.03 below, Landlord shall proceed promptly and diligently to adjust the loss with applicable insurers, to secure all required governmental permits and approvals, and to repair or restore the Premises or the portion of the Building necessary for Tenant’s occupancy.

This Lease shall remain in full force and effect, subject to Tenant’s right to receive a rent abatement for that portion of the Premises rendered unusable for the normal conduct of Tenant’s business pursuant to Section 15.02 below.

9

15.03 If this Lease is not terminated pursuant to Section 15.01, Landlord will repair the Premises and this Lease shall continue. The repair obligation of Landlord shall be limited to repair of the Premises excluding any Tenant Improvements, Tenant Alterations, and any personal property and trade fixtures of Tenant. During the period of repair, rent will be abated or reduced in proportion to the degree to which Tenant’s use of the Premises is impaired, as reasonably determined by Landlord. However, rent will not be abated if the casualty was caused by the gross negligence or willful misconduct of Tenant or any of its agents.

15.04 In addition to Landlord's right to terminate as provided herein, Tenant shall have the right to terminate this Lease if all or substantial portion of the Premises or reasonable access thereto has been damaged by fire or other casualty rendering the Premises unusable and (a) the Landlord has notified Tenant that such damage cannot be fully repaired within 180 days from the date restoration commences; or (b) the Premises are damaged or destroyed within the last six (6) months of the then-applicable Term. Tenant shall have a period of fifteen (15) days following the date of Landlord’s notice pursuant to Section 15.01 within which Tenant may elect to terminate this Lease, upon thirty (30) days’ advance written notice to Landlord. Tenant's termination right desc

ribed in the preceding sentence shall not apply if the damage was caused by the gross negligence or willful misconduct of Tenant or any Tenant Entity.

16. Assignment and Subletting.

16.01 Except as specifically set forth herein, Tenant will not, voluntarily or by operation of law, assign, sell, convey, sublet or otherwise transfer all or any part of Tenant’s right or interest in this Lease, or allow any other person or entity to occupy or use all or any part of the Premises (collectively called “Transfer”) without first obtaining the written consent of Landlord, which consent shall not be unreasonably withheld, conditioned or delayed. Landlord shall respond to Tenant's written request for consent hereunder within twenty (20) days after Landlord's receipt of the written request from Tenant. Tenant's written request for Landlord's consent shall include, and Landlord's twenty (20) day response perio

d referred to above shall not commence, unless and until Landlord has received from Tenant, all of the information related to the Transfer and reasonably required by Landlord to make an informed decision regarding Tenant’s request to Transfer. Any Transfer without the prior written consent of Landlord shall be void. Without limiting the generality of the definition of “Transfer,” and subject to Section 16.06, it is agreed that each of the following shall be deemed a “Transfer” for purposes of this Article 16: (a) an entity other than Tenant becoming the tenant hereunder by merger, consolidation, or other reorganization; and (b) a transfer of any ownership interest in Tenant (unless Tenant is an entity whose stock is publicly traded). Tenant shall provide to Landlord all information requested by Landlord concerning a Transfer. In no event shall Tenant mortgage, encumber, pledge or assign for security purposes all or any part of its

interest in this Lease. Regardless of whether consent by Landlord is granted in connection with any Transfer, no Transfer shall release Tenant from any obligation or liability hereunder; Tenant shall remain primarily liable to pay all rent and other sums due hereunder to Landlord and to perform all other obligations hereunder. Similarly, no Transfer, with or without the consent of Landlord, shall release any guarantor from its obligations under its guaranty. Upon any assignment or sublease, any rights, options or opportunities granted to Tenant hereunder to extend or renew the Term, to shorten the Term, or to lease additional space shall be null and void.

Notwithstanding any other provision hereof and subject to Section 16.06,, it shall be considered reasonable for Landlord to withhold its consent to any Transfer of this Lease or sublease of any portion of the Premises if at the time of Tenant’s notice of the proposed Transfer, there shall exist any uncured Default of Tenant, or if the proposed assignee or sublessee is an entity: (a) with which Landlord is already in negotiation; (b) is already an occupant of the Building or the Project if Landlord is marketing space in the Project at the time of Tenant’s request; (c) is a governmental agency; (d) is incompatible with the character of occupancy of the Building or the Project; (e) the proposed assignee has a net worth or creditworthiness unacceptable to Landlord in its reasonable discretion, or (f) would subject t

he Premises to a use which would: (i) involve a materially increase in personnel or wear upon the Building or the Project; (ii) violate any exclusive right granted to another tenant of the Building or the Project; (iii) require any addition to or modification of the Premises, Building or the Project in order to comply with building code or other governmental requirements; or, (iv) involve the handling or presence of any Hazardous Materials. Tenant expressly agrees that for the purposes of any statutory or other requirement of reasonableness on the part of Landlord, Landlord’s refusal to consent to any Transfer for any of the reasons described in this Section 16.05, shall be conclusively deemed to be reasonable. Notwithstanding anything to the contrary contained herein, even in the event Landlord is marketing comparable space in the Project at the time of Tenant's request, the fact that Tenant has agreed to sublease space in the Premises at a base rent less th

an the prevailing rental rate in the Building at the time of Tenant’s request to such Transfer, shall not in itself be a reason for Landlord to withhold its consent to a Transfer requested by Tenant so long as Tenant has not advertised or marketed the Premises at a base rent which is significantly less than the prevailing rental rate in the Building at the time of Tenant’s request.

16.02 In the event Landlord consents to a Transfer, the Transfer will not be effective until Landlord receives a fully executed agreement regarding the Transfer, in a form and of substance acceptable to Landlord, any documents or information required by such agreement (including any estoppel certificate and any subordination agreement required by any lender of Landlord), an amount equal to all attorneys’ fees incurred by Landlord (regardless of whether such consent is granted and regardless of whether the Transfer is consummated) and other expenses of Landlord incurred in connection with the Transfer, and a Transfer fee in an amount determined by Landlord (a minimum fee of $250.00), the total amount of such attorneys’ fees and other expenses, including the Transfer fee, not to collectively exceed Two

Thousand Five Hundred and 00/100 Dollars ($2,500.00) per Transfer or request to Transfer.

16.03 Fifty percent (50%) of any consideration paid to Tenant for assignment of this Lease, less any reasonable brokerage commission, marketing expenses, tenant improvement costs, and attorneys’ fees actually paid by Tenant with respect to such assignment, shall be immediately paid to Landlord. In the event of a sublease of all or a portion of the Premises, fifty percent (50%) of all rents payable by the subtenant in excess of rents payable hereunder (allocated on a per square foot basis in the event of a partial sublease) shall be immediately due and payable to Landlord; provided, excess rental shall be calculated taking into account straight-line amortization, without interest, of any reasonable brokerage commission, marketing expenses, tenant improvement costs, and attorneys’ fees actua

lly paid by Tenant in connection with the subject sublease transaction. The provisions of this Section 16.03 shall not apply with respect to a Permitted Transfer (defined in Section 16.06 below).

16.04 [Intentionally omitted]

10

16.05 Upon the occurrence of a Default, if the Premises or any portion thereof are sublet, Landlord may, at its option and in addition and without prejudice to any other remedies herein provided or provided by Law, collect directly from the sublessee(s) all rentals becoming due Tenant and apply such rentals against other sums due hereunder to Landlord.

16.06 Notwithstanding anything to the contrary provided in Section 16.01, a Transfer to an Affiliate (defined below) in accordance with the following provisions of this Article 16 shall constitute a “Permitted Transfer” hereunder. An “Affiliate” means any entity that (i) controls, is controlled by, or is under common control with Tenant, (ii) results from the transfer of all or substantially all of Tenant’s assets or stock, including by way of a merger, consolidation or reorganization, or (iii) results from the merger or consolidation of Tenant with another entity. “Control”

means the direct or indirect ownership of more than 50% of the voting securities of an entity or possession of the right to vote more than 50% of the voting interest in the ordinary direction of the entity’s affairs. Notwithstanding anything to the contrary contained in this Lease, Landlord’s consent is not required for any assignment of this Lease or sublease of all or a portion of the Premises to an Affiliate so long as the following conditions are met: (A) as soon as reasonably practicable, but in any event no later than five (5) business days after any such assignment or sublease, Landlord receives written notice of such assignment or sublease (as well as any documents or information reasonably requested by Landlord regarding the proposed Transfer and the transferee); (B) Tenant is not in default under this Lease; (C) if the Transfer is an assignment or any other Transfer to an Affiliate other than a sublease, the intended assignee assumes in writing all

of Tenant’s obligations under this Lease relating to the Premises in form satisfactory to Landlord or, if the Transfer is a sublease, the intended sublessee accepts the sublease in form satisfactory to Landlord; (D) the intended transferee has a tangible net worth, as evidenced by financial statements delivered to Landlord and certified by an independent certified public accountant in accordance with generally accepted accounting principles that are consistently applied, at least equal to Tenant’s net worth at the date of this Lease; (E) the Premises shall continue to be operated solely for the Permitted Use; and (F) Tenant shall pay to Landlord the fee in accordance with Section 16.02 below for approving assignments and subleases. No Transfer to an Affiliate in accordance with this subparagraph shall relieve the Tenant named herein of any obligation under this Lease or alter the primary liability of Tenant named herein for the payment of rent or for the performance of a

ny other obligation to be performed by Tenant, including the obligations of any guarantor.

16.07 Tenant shall also be permitted to allow customers, vendors, licensees, partners or Affiliates (collectively, “Business Affiliates”) to use offices within or other portions of the Premises on a temporary or flexible basis by license, so-called “desk-sharing” or similar agreements (i.e., so long as Tenant does not enter into an assignment or sublease with any such Business Affiliates), without any such action constituting any assignment, sublease or other transfer of this Lease and without separate prior written consent of the Landlord, provided that Tenant delivers prior written notice to Landlord of the occupancy by the Business Affiliates and the identity of the Business Affiliates, and further provided that (a) Tenant do

es not separately demise the space used by the Business Affiliates and the Business Affiliates shall utilize with Tenant one common entryway to the Premises as well as certain shared central services, such as reception, photocopying and the like; (b) the Business Affiliates shall not occupy, in the aggregate, more than 10% of the rentable area in the Premises; (c) the Business Affiliates operate their business in the Premises for the Permitted Use and for no other purpose; and (d) the business of the Business Affiliates is suitable for the Project considering the business of other tenants and the Project’s prestige. If any Business Affiliates occupy any portion of the Premises as described herein, it is agreed that (i) the Business Affiliates must comply with all provisions of this Lease, and a default by any Business Affiliates shall be deemed a default by Tenant under this Lease; (ii) all notices required of Landlord under this Lease shall be sent only to Tenant in

accordance with the terms of this Lease, and in no event shall Landlord be required to send any notices to any Business Affiliates; (iii) in no event shall any such occupancy or use by the Business Affiliates release or relieve Tenant from any of its obligations under this Lease; (iv) the Business Affiliates and their employees, contractors and invitees visiting or occupying space in the Premises shall be deemed contractors of Tenant for purposes of Tenant’s indemnification obligations in Article 12; and (v) if the Business Affiliates pay rent for the Premises directly to Landlord, Landlord, at its option, may accept the rent and the rent shall be considered to be for the account of Tenant and applied against the rent owed by Tenant as deemed appropriate by Landlord. Neither the occupancy of any portion of the Premises by the Business Affiliates, nor the payment of any rent directly by the Business Affiliates shall be deemed to create a landlord and tenant relationship betwee