Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: December 26, 2010

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 1-9824

The McClatchy Company

(Exact name of registrant as specified in its charter)

| Delaware | 52-2080478 | |

| State or other jurisdiction of incorporation or organization | I.R.S. Employer Identification No. | |

| 2100 “Q” Street, Sacramento, CA | 95816 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: 916-321-1846

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Class A Common Stock, par value $.01 per share | New York Stock Exchange |

Securities registered pursuant to section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨ (Do not check if a smaller reporting company) Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

Based on the closing price of the Company’s Class A Common Stock on the New York Stock Exchange on June 25, 2010 the last business day of the Company’s second fiscal quarter, the aggregate market value of the voting and non-voting common equity held by non-affiliates was approximately $257.1 million. For purposes of the foregoing calculation only, as required by Form 10-K, the Registrant has included in the shares owned by affiliates, the beneficial ownership of Common Stock of officers and directors of the Registrant and members of their families, and such inclusion shall not be construed as an admission that any such person is an affiliate for any purpose.

Shares outstanding as of February 25, 2011:

Class A Common Stock 60,221,538

Class B Common Stock 24,800,962

DOCUMENTS INCORPORATED BY REFERENCE

Definitive Proxy Statement for the Company’s May 18, 2011 Annual Meeting of Shareholders to be filed pursuant to Regulation 14A under the Securities Exchange Act of 1934 (incorporated in Part II and Part III to the extent provided in Items 10, 11, 12, 13 and 14 hereof).

Table of Contents

INDEX TO THE McCLATCHY COMPANY

2010 FORM 10-K

| Item No. |

Page |

|||||

| PART I | ||||||

| 1. |

2 | |||||

| 1A. |

8 | |||||

| 1B. |

13 | |||||

| 2. |

13 | |||||

| 3. |

14 | |||||

| 4. |

14 | |||||

| PART II | ||||||

| 5. |

15 | |||||

| 6. |

17 | |||||

| 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

18 | ||||

| 7A. |

38 | |||||

| 8. |

39 | |||||

| 9. |

Changes In and Disagreements With Accountants on Accounting and Financial Disclosure |

80 | ||||

| 9A. |

80 | |||||

| 9B. |

80 | |||||

| PART III | ||||||

| 10. |

81 | |||||

| 11. |

81 | |||||

| 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

81 | ||||

| 13. |

Certain Relationships and Related Transactions, and Director Independence |

82 | ||||

| 14. |

82 | |||||

| PART IV | ||||||

| 15. |

83 | |||||

Table of Contents

Forward-Looking Information:

This report on Form 10-K contains forward-looking statements regarding the Company’s actual and expected financial performance and operations. These statements are based upon our current expectations and knowledge of factors impacting our business, including, without limitation, statements about our ability to consummate contemplated sales transactions for our assets or investments, and the ability of those sales to enable debt reduction on anticipated terms, our customers and the markets in which we operate, advertising revenues, the effect of revenues on the fair value of our reporting units, our impairment analyses and our evaluation of the factors pertinent thereto, the economy, our pension plans, including our assumptions regarding return on pension plan assets and assumed discount rates and future contributions to our qualified pension plan, newsprint costs, our restructuring plans, including projected costs and savings, amortization expense, stock option expenses, prepayment of debt, capital expenditures, litigation, sufficiency of capital resources, possible acquisitions and investments, and our future financial performance. Such statements are subject to risks, trends and uncertainties. Forward-looking statements are generally preceded by, followed by or are a part of sentences that include the words “believes,” “expects,” “anticipates,” “estimates,” or similar expressions. For all of those statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

You should understand that the following important factors, in addition to those discussed elsewhere in this document, particularly in the section entitled “Risk Factors” and in the documents which we incorporate by reference, could affect the future results of McClatchy and could cause those future results to differ materially from those expressed in our forward-looking statements: the duration and depth of economic recessions and strength of subsequent recoveries; McClatchy might not generate cash from operations, or otherwise, necessary to reduce debt or meet debt covenants as expected; McClatchy might not consummate contemplated transactions to enable debt reduction on anticipated terms or at all; McClatchy might not achieve its expense reduction targets or might do harm to its operations in attempting to achieve such targets; McClatchy’s operations have been, and will likely continue to be, adversely affected by competition, including competition from internet publishing and advertising platforms; increases in the cost of newsprint; bankruptcies or financial strain of its major advertising customers; litigation or any potential litigation; geo-political uncertainties including the risk of war; changes in printing and distribution costs from anticipated levels; changes in interest rates; changes in pension assets and liabilities; increased consolidation among major retailers in our markets or other events depressing the level of advertising; our inability to negotiate and obtain favorable terms under collective bargaining agreements with unions; competitive action by other companies; decreased circulation and diminished revenues from retail, classified and national advertising; and other factors, many of which are beyond our control.

1

Table of Contents

| ITEM 1. | BUSINESS |

Available Information

The McClatchy Company (McClatchy or the Company) maintains a website which includes an investor relations section available to all interested parties at www.mcclatchy.com. All filings with the United States Securities and Exchange Commission, along with any amendments thereto, are available free of charge on our website in the Investor Relations section. The Company’s corporate governance guidelines; charters for the following committees of the board of directors: audit committee, committee on the board, pension and savings plans committee, compensation and nominating committees; and the Company’s codes of business conduct and ethics and senior officers code of ethics may also be found on this website. In addition, paper copies of any such filings and corporate governance documents are available free of charge by contacting us at the address listed on the cover page of this filing. The contents of this website are not incorporated into this filing. Further, our reference to the URL for this website is intended to be an inactive textual reference only.

Overview

The Company is a hybrid print and digital, news and advertising company committed to a three-pronged strategy:

| • | First, to operate high-quality newspapers in growth markets; |

| • | Second, to operate the leading local digital business in each of its daily newspaper markets, including websites, email products, mobile services and other electronic media; and |

| • | Third, to extend these franchises by supplementing the mass reach of the newspaper with direct marketing and direct mail products so that advertisers can capture both mass and targeted audiences with one-stop shopping. |

By virtue of its strategy, the Company is the leading local media company in its premium growth markets. The Company has more than a century and a half of experience in mass and targeted media with its origins in the California Gold Rush era of 1857. Originally incorporated in California as McClatchy Newspapers, Inc., the Company’s three original California newspapers—The Sacramento Bee, The Fresno Bee and The Modesto Bee—were the core of the Company until 1979 when the Company began to diversify geographically outside of California. At that time, it purchased two newspapers in the Northwest, the Anchorage Daily News and the Tri-City Herald in southeastern Washington. In 1986, the Company purchased The (Tacoma) News Tribune and in 1987, the Company reincorporated in Delaware. The Company expanded into the Carolinas when it purchased newspapers in South Carolina in 1990 and The News and Observer Publishing Company in North Carolina in 1995.

On June 27, 2006, the Company acquired Knight-Ridder, Inc. (the Acquisition), retaining 20 former Knight-Ridder, Inc. (Knight Ridder) owned daily papers that are in strong markets, and significant digital assets.

The Company is the third largest newspaper publisher by circulation in the United States, with 30 daily newspapers, approximately 43 non-dailies and direct marketing and direct mail operations located in 29 markets across the country. The Company’s newspapers range from large dailies serving metropolitan areas to non-daily newspapers serving small communities. For the fiscal year 2010, the Company had an average paid daily circulation of 2.1 million and Sunday circulation of 2.8 million. McClatchy also operates local websites in each of its markets that complement its newspapers and extend its audience reach. McClatchy-owned newspapers include, among others, The Miami Herald, The Sacramento Bee, the Fort Worth Star-Telegram, The Kansas City Star, The Charlotte Observer, and The (Raleigh) News & Observer.

2

Table of Contents

McClatchy also owns a portfolio of premium digital assets, including 14.4% of CareerBuilder LLC, which operates the nation’s largest online job site CareerBuilder.com, 25.6% of Classified Ventures LLC, a company that offers two of the nation’s premier classified websites: the auto website Cars.com and the rental site Apartments.com and 33.3% of HomeFinder LLC, which operates the real estate website HomeFinder.com.

McClatchy is listed on the New York Stock Exchange under the symbol MNI.

Strategic Emphasis

The Company’s local media businesses have undergone a period of tremendous structural and cyclical change. The Company’s strategy of being the leading local media company in each of its markets is furthered by focusing on five major operational imperatives:

| • | Increasing advertising revenues; |

| • | Expanding its digital advertising business; |

| • | Maintaining its commitment to public service journalism; |

| • | Broadening audience in its local markets; and |

| • | Focusing on cost controls. |

Increasing Advertising Revenues

Advertising revenues make up the vast majority of the Company’s revenues, making the quality of its sales function of utmost importance. Advertising revenues were approximately 76% of consolidated net revenues in fiscal 2010 and 78% in fiscal 2009. Circulation revenues approximated 20% of consolidated net revenues in fiscal 2010 and 19% in fiscal 2009.

The Company has a local sales force in each of its markets and believes that these sales forces are generally larger than those of other local media outlets and websites in those markets. The Company’s sales forces are responsible for delivering to advertisers the broad array of its advertising products, including print, digital and direct marketing products. The Company’s advertisers range from large national retail chains to local automobile dealerships to small businesses and classified advertisers. Increasingly, the Company’s emphasis has been on growing the breadth of products offered to advertisers, particularly its digital products, while expanding its relationships with smaller advertisers. To reach national advertisers, the Company’s newspapers work with national advertising representation firms and the Company’s corporate advertising department to develop relationships and make it easier for those large advertisers to place orders.

Expanding McClatchy’s Digital Advertising Business

The Company’s advertising revenues from digital advertising have been growing even as the Company has faced structural and cyclical change. McClatchy continues to be an industry leader in digital advertising revenue from newspaper websites as a percent of total advertising with 18.1% of advertising coming from digital products in fiscal 2010, compared to 16.2% in fiscal 2009. For fiscal 2010, 45.2% of the Company’s digital advertising revenues came from advertisements placed only online; that is, they were not tied to a joint print buy. Management believes this independent revenue stream bodes well for the future of the Company’s digital business and is evidence of its importance as a resource for advertisers.

The Company’s websites offer classified digital advertising products provided by companies in which we hold non-majority equity interests, including CareerBuilder for employment, Cars.com for autos and Apartments.com in the rental category.

3

Table of Contents

The Company is a member, along with other newspaper companies, in a broad-based partnership with Yahoo, Inc. (Yahoo). The Company’s local sales force is able to sell Yahoo advertising inventory and share in the revenue from the sales.

Maintaining Commitment to Public Service Journalism

The Company believes that high-quality news content is the foundation of the mass reach necessary for the press to play its role in a democratic society. It is also the underpinning of the Company’s success in the marketplace. McClatchy newspapers continually receive national and regional awards among their peers for high-quality journalism.

Today, the Company delivers breaking news as its websites compete with television and radio broadcasters for news headlines that can subsequently be expanded in its newspapers. The Company’s news organizations can provide both targeted information and in-depth coverage as needed through newspapers, websites, mobile delivery and other developing technologies.

Management believes its newspapers and websites are well-equipped to discover, produce and distribute premium quality content in ways that leverage the Company’s size and tap technology to find efficiencies in newsgathering and distribution.

Broadening Newspaper’s Audiences in Their Local Markets

Each of the Company’s daily newspapers has the largest circulation of any newspaper serving its particular community, and coupled with a local website, reaches a broad audience in each market. The Company believes that its broad reach in each market is of primary importance in attracting advertising, the principal source of revenues for the Company.

While daily newspaper paid circulation was down 6.9% and Sunday circulation was down 6.3% in fiscal 2010 compared with fiscal 2009, a portion of the decline in print circulation reflected initiatives the Company began in 2009, including aggressive price increases at most newspapers and reductions in distribution by the Company to eliminate unprofitable circulation not valued by advertisers. Circulation volumes improved steadily during the course of 2010 as the Company’s newspapers cycled over these 2009 initiatives, from down 10.0% daily and 8.2% Sunday in the first fiscal quarter of 2010 to down 4.5% daily and 4.2% Sunday in the fourth quarter of fiscal 2010, in each case as compared to the corresponding periods in the prior year. In addition, the Company’s digital audience continues to show growth, with average local daily unique visitors at McClatchy newspapers’ websites in 2010 up 17.3% from 2009. In addition, all McClatchy websites now offer mobile-friendly versions for smartphones, and many are available on e-readers, tablets and other mobile devices.

The Audit Bureau of Circulations (ABC) now certifies audience reach where surveys are available— generally in larger markets. Based on September 2010 ABC data the Company’s newspapers deliver unduplicated reach of print and online readers of 60.7% in its 14 measured McClatchy markets.

To remain the leading local media company and a must-buy for advertisers, McClatchy is focused on maintaining a broad reach of print and digital audiences in each market it serves. McClatchy will continue to refine and strengthen its print platform, but its growth increasingly comes from its digital products and the beneficial impact those products have on the total audience the Company delivers for its advertisers.

Focusing on Cost Controls

The ongoing structural and cyclical change in the current economy demands that the Company respond by reengineering and restructuring its operations to achieve an efficient and sustainable cost structure. Compensation expense is the largest component of the Company’s cash operating expenses. Technology increasingly is giving the Company the ability to operate more efficiently and reduce staff and related

4

Table of Contents

compensation expense. The Company looks actively for opportunities to realize efficiencies by outsourcing and/or centralizing certain functions such as production, circulation, finance, information systems, customer call centers, and advertising operations. For instance, nine of the Company’s newspapers are now produced by others in outsourcing arrangements. The Company also believes using technology is an important component of its restructuring plans.

The Company’s newspaper operations have emphasized restructuring moves that are preferred or acceptable to our audiences and advertisers, such as reducing the width of newspapers or reducing unprofitable circulation that reaches areas outside of a newspaper’s core market. The Company is focusing its efforts on quality content production, effective sales efforts and growth in digital operations.

During the last three years the Company announced strategic restructuring programs that resulted in significant reduction of staffing and announced the freezing of the Company’s pension plans and other cost saving measures. See further discussion in, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operation.”

Other Operational Information

Each of the Company’s newspapers is largely autonomous in its local advertising and editorial operations in order to meet most effectively the needs of the communities it serves.

The Company has two operating segments. Each segment consists primarily of a group of newspapers and related businesses reporting to a segment manager that are aggregated into a single reportable segment. Publishers and editors of each of the newspapers make the day-to-day decisions and report to one of two vice presidents of operations (segment managers). The segment managers are responsible for implementing the operating and financial plans at each of the newspapers within their respective operating segment. The corporate managers, including executive officers, set the basic business, accounting, financial and reporting policies.

Publishers also work together to consolidate functions and share resources regionally and across the Company in operational areas that lend themselves to such efficiencies, such as certain regional or national sales efforts, accounting functions, digital publishing systems and products, information technology functions and others. A corporate advertising department was formed in 2008 and is headed by a vice president of advertising who works with the Company’s largest advertisers in placing advertising across the Company in newspapers and online websites. These efforts are often coordinated through the segment managers and corporate personnel.

The Company’s newspaper business is somewhat seasonal, with peak revenues and profits generally occurring in the second and fourth quarters of each year reflecting the spring and Thanksgiving and Christmas holidays, respectively. The first quarter, when holidays are not prevalent, is historically the slowest quarter for revenues and profits.

5

Table of Contents

The following table summarizes the circulation of each of the Company’s daily newspapers. These circulation figures are reported on the Company’s fiscal year basis and are not meant to reflect Audit Bureau of Circulations (ABC) reported figures.

| 2010 |

2009 |

|||||||||||||||

| Circulation by Newspaper |

Daily |

Sunday |

Daily |

Sunday |

||||||||||||

| The Sacramento Bee |

211,745 | 263,340 | 226,329 | 272,738 | ||||||||||||

| The Kansas City (Missouri) Star |

210,891 | 299,091 | 222,415 | 316,390 | ||||||||||||

| The Charlotte Observer |

163,120 | 216,173 | 175,565 | 231,243 | ||||||||||||

| Fort Worth Star-Telegram |

160,627 | 235,000 | 174,991 | 259,011 | ||||||||||||

| The Miami Herald |

155,818 | 220,308 | 167,998 | 245,849 | ||||||||||||

| The (Raleigh) News & Observer |

133,944 | 185,106 | 144,356 | 194,924 | ||||||||||||

| The Fresno Bee |

114,549 | 139,616 | 129,542 | 153,251 | ||||||||||||

| Lexington Herald-Leader |

94,509 | 112,136 | 101,229 | 117,219 | ||||||||||||

| The (Tacoma) News Tribune |

83,839 | 95,769 | 91,545 | 104,974 | ||||||||||||

| The (Columbia, SC) State |

77,654 | 99,221 | 87,633 | 111,587 | ||||||||||||

| The Wichita Eagle |

72,677 | 108,549 | 76,024 | 116,944 | ||||||||||||

| The Modesto Bee |

63,537 | 72,007 | 68,102 | 74,903 | ||||||||||||

| El Nuevo Herald |

57,134 | 73,592 | 61,261 | 81,634 | ||||||||||||

| Idaho Statesman (Boise) |

50,842 | 72,933 | 53,913 | 73,121 | ||||||||||||

| Belleville (Illinois) News-Democrat |

50,155 | 54,324 | 50,167 | 57,127 | ||||||||||||

| The (Macon, GA) Telegraph |

48,726 | 65,107 | 49,133 | 64,578 | ||||||||||||

| Anchorage Daily News |

46,883 | 52,432 | 51,749 | 57,641 | ||||||||||||

| The (Myrtle Beach, SC) Sun News |

38,441 | 51,687 | 42,892 | 54,889 | ||||||||||||

| (Biloxi) Sun Herald |

38,437 | 42,504 | 39,665 | 45,032 | ||||||||||||

| The Bradenton (Florida) Herald |

35,589 | 45,290 | 39,134 | 45,925 | ||||||||||||

| Tri-City (Washington) Herald |

34,209 | 38,531 | 37,073 | 39,961 | ||||||||||||

| The (San Luis Obispo, CA) Tribune |

33,863 | 38,978 | 34,579 | 39,717 | ||||||||||||

| (Columbus, GA) Ledger-Enquirer |

33,835 | 42,197 | 35,483 | 43,933 | ||||||||||||

| The Olympian (Washington) |

25,107 | 30,041 | 27,530 | 33,271 | ||||||||||||

| The (Rock Hill, SC) Herald |

23,185 | 26,765 | 24,993 | 27,947 | ||||||||||||

| (Pennsylvania) Centre Daily Times |

20,592 | 27,026 | 22,024 | 28,352 | ||||||||||||

| The Island Packet (Hilton Head, SC) |

18,475 | 20,882 | 18,417 | 19,724 | ||||||||||||

| The Bellingham (Washington) Herald |

17,730 | 22,295 | 19,496 | 24,342 | ||||||||||||

| Merced (California) Sun-Star |

13,848 | — | 14,702 | — | ||||||||||||

| The Beaufort (South Carolina) Gazette |

10,108 | 10,298 | 10,694 | 10,171 | ||||||||||||

The Company’s newspapers are generally delivered by independent contractors, and subscription revenues are recorded net of direct delivery costs.

Other Operations

The Company owns 14.4% of CareerBuilder LLC, which operates the nation’s largest online job site CareerBuilder.com, and 25.6% of Classified Ventures LLC, a company that offers classified websites such as Cars.com and Apartments.com. The Company owns 33.3% of HomeFinder LLC, which operates the real estate website HomeFinder.com. The Company also owns a 15.0% interest in TKG Internet Holdings, which owns 75.0% of Topix.net (Topix), a general interest website focused on local communities, for an effective ownership of 11.3%.

McClatchy-Tribune Information Service (MCT), a joint venture of McClatchy and Tribune Company (Tribune), offers stories, graphics, illustrations, photos and paginated pages for print publishers and web-ready

6

Table of Contents

content for online publishers. All the Company’s newspapers, Washington D.C. staff and foreign bureaus produce MCT editorial material. Content is also supplied by Tribune newspapers and a number of other newspapers.

The Company owns 49.5% of the voting stock and 70.6% of the nonvoting stock of The Seattle Times Company. The Seattle Times Company owns The Seattle Times newspaper and weekly newspapers in Puget Sound and daily newspapers located in Walla Walla and Yakima, Washington.

In addition, the Company owns a 27.0% interest in Ponderay Newsprint Company (Ponderay), a general partnership, which owns and operates a newsprint mill in the state of Washington. The Company is required to purchase up to 56,800 metric tons of newsprint annually from Ponderay on a “take-if-tendered” basis at prevailing market prices.

The Company and affiliates of Cox Enterprises, Inc. and Media General Inc. each owned a 33.3% interest in SP Newsprint Co. (SP), a newsprint manufacturing company that was sold to a third party in 2008. The Company has an annual purchase commitment that extended for six years from the date of the sale. The Company’s purchase commitment for 2011 is for up to 109,730 metric tons of newsprint from SP.

The Company uses the equity method of accounting for a majority of its investments in unconsolidated companies.

Raw Materials

During fiscal 2010, the Company consumed approximately 183,000 metric tons of newsprint compared to 218,000 metric tons in fiscal 2009 for its continuing operations. The decrease in tons consumed was primarily due to lower advertising sales and circulation volumes, and to a reduction of web widths at certain newspapers. The Company currently obtains a majority of its supply of newsprint from Ponderay and SP, as well as a number of other suppliers, primarily under long-term contracts.

The Company’s earnings are sensitive to changes in newsprint prices. Newsprint expense accounted for 9.2% of total operating expenses in fiscal 2010 and 10.7% in fiscal 2009. However, because the Company has an ownership interest in Ponderay, an increase in newsprint prices, while negatively affecting the Company’s operating expenses, would increase the earnings from its share of this investment, therefore partially offsetting the increase in the Company’s newsprint expense. A decline in newsprint prices would have the opposite effect. Ponderay is also impacted by fluctuations in the cost of energy and fiber used in the paper-making process. The Company estimates that it will use approximately 175,000 metric tons of newsprint in fiscal 2011, depending on the level of print advertising, circulation volumes and other business considerations.

The Company purchased 149,545 metric tons of newsprint from Ponderay and SP in 2010. See the discussion above; Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operation”; and the financial statements and accompanying notes for further discussion of the impact of these investments on the Company’s business.

McClatchy fully supports recycling efforts. In 2010, 99.4% of the newsprint used by McClatchy newspapers was made up of some recycled fiber; the average content was 69.8% recycled fiber. This translates into an overall recycled newsprint average of 69.4%. During 2010, all of McClatchy’s newspapers collected and recycled press waste, newspaper returns and printing plates.

Competition

The Company’s newspapers, direct marketing programs and internet sites compete for advertising revenues and readers’ time with television, radio, other internet sites, direct mail companies, free shoppers, suburban

7

Table of Contents

neighborhood and national newspapers and other publications, and billboard companies, among others. In some of its markets, the Company’s newspapers also compete with other newspapers published in nearby cities and towns. Competition for advertising is generally based upon print readership levels and demographics, advertising rates, internet usage and advertiser results, while competition for circulation and readership is generally based upon the content, journalistic quality, service and the price of the newspaper.

The Company’s major daily newspapers are the primary general circulation newspaper in each of their respective markets. Its newspaper internet sites are generally the leading local sites in each of the Company’s major daily newspaper markets, based upon research conducted by the Company and various independent sources. Nonetheless, the Company has noted changes in readership trends, including a shift of readers to the internet and mobile devices, and has experienced greater shift of advertising in the classified categories to digital advertising. The Company faces greater competition, particularly in the areas of employment, automotive and real estate advertising, from online competitors. To address the structural shift to digital media, the Company’s newspapers provide editorial content on a wide variety of platforms and formats—from its daily newspaper to leading local websites; on social network sites such as Facebook and Twitter; on smartphones and on e-readers; on blogs and in niche publications and websites; in e-mail newsletters and RSS feeds. In addition its websites offer leading digital classified products such as CareerBuilder.com, Cars.com and Apartments.com and the Company continues to expand its partnerships with technology companies such as its affiliation with Yahoo on retail efforts.

Employees—Labor

As of December 26, 2010, the Company had approximately 8,473 full and part-time employees (equating to approximately 7,773 full-time equivalent employees), of whom approximately 6% were represented by unions. Most of the Company’s union-represented employees are currently working under labor agreements expiring in 2012. Twenty of the Company’s 30 daily papers have no unions.

While the Company’s newspapers have not had a strike for decades and the Company does not currently anticipate a strike occurring, the Company cannot preclude the possibility that a strike may occur at one or more of its newspapers when future negotiations occur. The Company believes that, in the event of a newspaper strike, it would be able to continue to publish and deliver to subscribers, a capability which is critical to retaining revenues from advertising and circulation, although there can be no assurance of this.

Compliance with Environmental Laws

The Company uses appropriate waste disposal techniques for items such as ink and other toxic fluids. The Company has a $1 million letter of credit shared among various state environmental agencies and the US Environmental Protection Agency to provide collateral related to existing or previously disposed oil drums. However, the Company does not have any significant environmental issues and has no significant expenses or capital expenditures related to environmental control facilities.

| ITEM 1A. | RISK FACTORS |

The Company has significant competition in the market for news and advertising, which may reduce its advertising and circulation revenues in the future.

The Company’s primary source of revenues is advertising, followed by circulation. In recent years, the advertising industry generally has experienced a secular shift toward internet advertising and away from other traditional media. In addition, the Company’s circulation has declined, reflecting general trends in the newspaper industry including consumer migration toward the internet and other media for news and information. The Company faces increasing competition from other digital sources for both advertising and circulation revenues. This competition has intensified as a result of the continued developments of digital media technologies.

8

Table of Contents

Distribution of news, entertainment and other information over the internet, as well as through mobile phones and other devices, continues to increase in popularity. These technological developments are increasing the number of media choices available to advertisers and audiences. As media audiences fragment, the Company expects advertisers to allocate larger portions of their advertising budgets to digital media. This increased competition has had and is expected to continue to have an adverse effect on the Company’s business and financial results, including negatively impacting revenues and operating income.

Weak general economic and business conditions subject the Company to risks of declines in advertising revenues.

Despite some signs of recovery, the United States economy continues to be in a period of economic uncertainty. Certain aspects of the economy, including real estate, employment and consumer confidence, remain distressed. The economies in California and Florida, where approximately a third of the Company’s advertising revenues are generated, have been particularly hard hit and are recovering more slowly than the national economy. These economic conditions have had and are expected to continue to have an adverse effect on the Company’s advertising revenues. To the extent these economic conditions continue or worsen, the Company’s business and advertising revenues will be adversely affected, which could negatively impact the Company’s operations and cash flows and the Company’s ability to meet the covenants in its senior secured credit agreement. In addition, seasonal variations in consumer spending cause our quarterly advertising revenues to fluctuate. Second and fourth quarter advertising revenues are typically higher than first and third quarter advertising revenues, reflecting the slower economic activity in the winter and summer and the stronger fourth quarter holiday season. If general economic conditions and other factors cause a decline in revenues, particularly during the second or fourth quarters, we may not be able to grow or maintain our revenues for the year, which would have an adverse effect on the Company’s business and financial results.

If management is unable to execute cost-control measures successfully, total operating costs may be greater than expected, which may adversely affect the Company’s profitability.

As a result of recent adverse general economic and business conditions and the Company’s operating results, the Company has taken steps to lower operating costs by reducing workforce and implementing general cost-control measures. If the Company does not achieve its expected savings from these initiatives, or if operating costs increase as a result of these initiatives, total operating costs may be greater than anticipated. Although management believes that appropriate steps have been taken and are being taken to implement cost-control efforts, such efforts may affect the Company’s business and its ability to generate future revenue. Portions of the Company’s expenses are fixed costs that neither increase nor decrease proportionately with revenues. As a result, management is limited in its ability to reduce costs in the short term. If these cost-control efforts do not reduce costs sufficiently, income from continuing operations may decline.

An economic downturn and the decline in the price of the Company’s publicly-traded stock may result in goodwill and masthead impairment charges.

The Company recorded masthead impairment charges of $59.6 million in 2008 and $3.0 billion of goodwill and masthead impairment charges in 2007 reflecting the economic downturn and the decline in the price of the Company’s publicly-traded common stock. Further erosion of general economic, market or business conditions could have a negative impact on the Company’s stock price, which may require the Company to record additional impairment charges in the future.

The Company owns excess real property whose carrying value may be subject to impairment given the protracted downturn in commercial real estate in recent years.

The Company has excess real property that is classified as a “Level 3” classification under applicable accounting rules with respect to fair value guidance. Level 3 classifications are used in cases in which there is

9

Table of Contents

limited or no market activity to determine the value of an asset or liability, thereby requiring the reporting entity to make estimates and assumptions related to the pricing of the asset or liability. The Company recorded a write-down of $21.4 million in 2010 and $26.3 million in 2009 on the carrying value of land that was formerly under contract to be sold in Miami, Florida, based on its analysis of an independent appraisal of the property, including the economic downturn and the decline in the fair value of the commercial real estate in Miami. The Company may need to record additional write-downs of excess property if its analysis indicates that its carrying value no longer reflects the fair value of any of the property. Any such write-downs could have a material adverse effect on the Company’s financial position.

The Company has $1.8 billion in total consolidated debt, which subjects the Company to significant financial risk.

As of December 26, 2010, the Company had approximately $1.8 billion in total principal indebtedness outstanding. This level of debt increases the Company’s vulnerability to general adverse economic and industry conditions. Higher leverage ratios could affect the Company’s future ability to refinance maturing debt or the ultimate structure of such refinancing. In addition, the Company’s credit ratings could affect its ability to refinance its debt.

Covenants in the indenture governing the Company’s 11.50% Senior Secured Notes due 2017 (the “2017 Notes”) and its senior secured credit facility restrict the Company’s operations in many ways.

The indenture governing the 2017 Notes and the senior secured credit facility contain various covenants that limit, subject to certain exceptions, the Company’s ability and/or its restricted subsidiaries’ ability to, among other things:

| • | incur liens or additional debt or provide guarantees; |

| • | issue redeemable stock and preferred stock; |

| • | pay dividends or make distributions on capital stock or repurchase capital stock or repurchase outstanding notes or debentures prior to their stated maturity; |

| • | make loans, investments or acquisitions; |

| • | enter into agreements that restrict distributions from its subsidiaries; |

| • | create or permit restrictions on the ability of its subsidiaries to pay dividends or distributions or guarantee debt or create liens; |

| • | sell assets and capital stock of its subsidiaries; |

| • | enter into certain transactions with its affiliates; and |

| • | dissolve, liquidate, consolidate or merge with or into, or sell substantially all its assets to another person. |

The restrictions contained in the indenture for the 2017 Notes and the senior secured credit facility could adversely affect the Company’s ability to:

| • | finance its operations; |

| • | make needed capital expenditures; |

| • | make strategic acquisitions or investments or enter into alliances; |

| • | withstand a future downturn in its business or the economy in general; |

| • | engage in business activities, including future opportunities, that may be in its interest; and |

| • | plan for or react to market conditions or otherwise execute our business strategies. |

10

Table of Contents

The Company’s ability to comply with covenants contained in the indenture for the 2017 Notes and the senior secured credit facility may be affected by events beyond its control, including prevailing economic, financial and industry conditions. Even if the Company is able to comply with all of the applicable covenants, the restrictions on its ability to manage its business could adversely affect its business by, among other things, limiting its ability to take advantage of financings, mergers, acquisitions and other corporate opportunities that the Company believes would be beneficial to it.

Potential disruptions in the credit markets could adversely affect the availability and cost of short-term funds for liquidity requirements and could adversely affect the Company’s access to capital or to obtain financing at reasonable rates and its ability to refinance existing debt at reasonable rates or at all.

If internal funds are insufficient to fund the Company’s operations, the Company may be required to rely on the banking and credit markets to meet its financial commitments and short-term liquidity needs. Disruptions in the capital and credit markets, as were experienced during 2008 and 2009, could adversely affect the Company’s ability to access additional funds in the capital markets or draw on its senior secured credit facility. There can be no assurance that continued or increased volatility and disruption in the capital and credit markets will not impair the Company’s liquidity in future periods. If this should happen, any alternative credit arrangements may not be put in place without a potentially significant increase in the Company’s cost of borrowing.

As of December 26, 2010, the Company had approximately $1.8 billion in total principal indebtedness, consisting of $875 million of publicly-traded senior secured notes and unsecured publicly-traded notes maturing in 2011, 2014, 2017, 2027 and 2029. The near-term 2011 notes totaled $18.1 million and the 2014 notes totaled $168.9 million. While cash flow should permit the Company to lower the amount of this debt before it matures, a significant portion of this debt will probably need to be refinanced in the future. Access to the capital markets for longer-term financing may be restricted if disruptions in the capital and credit markets as were experienced during 2008 and 2009 occur again.

The Company requires newsprint for operations and, therefore, its operating results may be adversely affected if the price of newsprint increases.

Newsprint is the major component of the Company’s cost of raw materials. Newsprint accounted for 9.2% of McClatchy’s operating expenses for fiscal 2010. Accordingly, earnings are sensitive to changes in newsprint prices. The price of newsprint has historically been volatile and may increase as a result of various factors, including:

| • | declining newsprint supply from mill closures; |

| • | reduction in newsprint suppliers because of consolidation in the newsprint industry; |

| • | paper mills reducing their newsprint supply because of switching their production to other paper grades; and |

| • | a decline in the financial situation of newsprint suppliers. |

The Company has not attempted to hedge fluctuations in the normal purchases of newsprint or enter into contracts with embedded derivatives for the purchase of newsprint. If the price of newsprint increases materially, operating results could be adversely affected. If newsprint suppliers experience labor unrest, transportation difficulties or other supply disruptions, the Company’s ability to produce and deliver newspapers could be impaired and/or the cost of the newsprint could increase, both of which would negatively affect its operating results.

11

Table of Contents

A portion of the Company’s employees are members of unions and if the Company experiences labor unrest, its ability to produce and deliver newspapers could be impaired.

If McClatchy experiences labor unrest, its ability to produce and deliver newspapers could be impaired in some locations. The results of future labor negotiations could harm the Company’s operating results. The Company’s newspapers have not endured a labor strike for decades. However, management cannot ensure that a strike will not occur at one or more of the Company’s newspapers in the future. As of December 26, 2010, approximately 6.0% of full-time and part-time employees were represented by unions. Most of the Company’s union-represented employees are currently working under labor agreements, which expire in 2012. McClatchy faces collective bargaining upon the expirations of these labor agreements. Even if its newspapers do not suffer a labor strike, the Company’s operating results could be harmed if the results of labor negotiations restrict its ability to maximize the efficiency of its newspaper operations.

Under the Pension Protection Act, the Company will be required to make greater contributions to its defined benefit pension plans in the next several years than previously required, placing greater liquidity needs upon its operations.

The poor capital markets of 2008 had a significantly negative impact on the investment funds in the Company’s pension plan, which was partially offset by strong returns in the capital markets in 2009 and 2010. However, as a result of the plan’s lower assets, the projected benefit obligations of the Company’s qualified pension plan exceeded plan assets by $479.1 million as of December 26, 2010. The Company made an $8.2 million contribution to its retirement plan in the third quarter of fiscal 2010. In January 2011, McClatchy contributed company-owned real property valued at $49.6 million to its retirement plan that is expected to meet substantially all of the Company’s 2011 funding requirements.

Nonetheless, the excess of benefit obligations over pension assets is expected to give rise to an increase in required pension contributions over the next several years. The Pension Relief Act of 2010 (PRA) provides relief in the funding requirements of the qualified defined benefit pension plan, and the Company has elected an option that allows the funding related to its 2009 plan year required contributions to be paid over 15 years (15-year-deferral relief option). Under the PRA, the Company may elect a 15-year-deferral relief option on one additional plan year in the future. However, even with the relief provided by the PRA, management expects future contributions to be substantially higher than the 2010 amounts. In addition, poor capital market performance and/or lower long-term interest rates may result in greater annual contributions.

The Company has invested in certain internet ventures, but such ventures may not be as successful as expected, which could adversely affect the results of operations of the Company.

The Company continues to evaluate its business and make strategic investments in digital ventures, either alone or with partners, to further its growth in its digital businesses. There can be no assurances that these investments or partnerships will result in advertising growth or will produce equity income or capital gains in future years.

If the Company is not successful in growing its digital businesses, its business, financial condition and prospects will be adversely affected.

The Company’s future growth depends to a significant degree upon the development of its digital businesses. The growth and success of its digital businesses over the long term depends on various factors, including, among other things the ability to:

| • | continue to increase digital audiences; |

| • | attract advertisers to its websites; |

| • | maintain or increase the advertising rates on its websites; |

12

Table of Contents

| • | exploit new and existing technologies to distinguish its products and services from those of its competitors and develop new content, products and services; and |

| • | invest funds and resources in digital opportunities. |

If the Company is not successful in growing its digital businesses, its business, financial condition and prospects will be adversely affected.

Circulation declines could adversely affect the Company’s circulation and advertising revenues.

Advertising and circulation revenues are affected by circulation and readership levels of the Company’s newspapers. In recent years, newspapers have experienced difficulty maintaining or increasing print circulation levels because of a number of factors, including:

| • | increased competition from other publications and other forms of media technologies available in various markets, including the internet and other new media formats that are often free for users; |

| • | continued fragmentation of media audiences; |

| • | a growing preference among some consumers to receive all or a portion of their news other than from a newspaper; |

| • | increases in subscription and newsstand rates; and |

| • | declining discretionary spending by consumers affected by negative economic conditions. |

These factors could also affect the Company’s newspapers’ ability to institute circulation price increases for print products. A prolonged reduction in circulation would have a material adverse effect on advertising revenues. To maintain the Company’s circulation base, it may be required to incur additional costs which it may not be able to recover through circulation and advertising revenues.

Adverse results from litigation or governmental investigations can impact the Company’s business practices and operating results.

From time to time, the Company and its subsidiaries are parties to litigation and regulatory, environmental and other proceedings with governmental authorities and administrative agencies. Adverse outcomes in lawsuits or investigations could result in significant monetary damages or injunctive relief that could adversely affect our operating results or financial condition as well as our ability to conduct our businesses as they are presently being conducted.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2. | PROPERTIES |

The corporate headquarters of the Company are located at 2100 “Q” Street, Sacramento, California. At December 26, 2010, the Company had newspaper production facilities in 29 markets situated in 15 states. The Company’s facilities vary in size and in total occupy about 7.9 million square feet. Approximately 1.3 million of the total square footage is leased from others, while the remaining square footage is property owned by the Company. The Company owns substantially all of its production equipment, although certain office equipment is leased.

Beginning on January 14, 2011, a total of 0.9 million of Company-owned square footage of property was contributed to the Company’s qualified defined benefit pension plan and leased back by the Company. This transaction is discussed in greater detail in Item. 8, Note 13 to the Consolidated Financial Statements.

13

Table of Contents

The Company maintains its properties in good condition and believes that its current facilities are adequate to meet the present needs of its newspapers.

| ITEM 3. | LEGAL PROCEEDINGS |

The Company becomes involved from time to time in claims and lawsuits incidental to the ordinary course of its business, including such matters as libel, invasion of privacy, intellectual property infringement, wrongful termination actions, wage and hour violations and complaints alleging discrimination. In addition, the Company is involved from time to time in governmental and administrative proceedings concerning employment, labor, environmental and other claims. Historically, such claims and proceedings have not had a material adverse effect upon the Company’s consolidated results of operations or financial condition.

| ITEM 4. | REMOVED AND RESERVED |

14

Table of Contents

| ITEM 5. | MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information: The Company’s Class A Common Stock is listed on the New York Stock Exchange (NYSE symbol—MNI). A small amount of Class A Common Stock is also traded on other exchanges. The Company’s Class B Stock is not publicly traded. The following table lists per share dividends paid on both classes of Common Stock and the high and low prices of the Company’s Class A Common Stock as reported by the NYSE for each fiscal quarter of 2010 and 2009:

| PRICES |

||||||||||||

| HIGH |

LOW |

DIVIDENDS |

||||||||||

| Year Ended December 26, 2010: |

||||||||||||

| First quarter |

$ | 6.28 | $ | 3.23 | $ | 0.00 | ||||||

| Second quarter |

$ | 7.16 | $ | 3.76 | $ | 0.00 | ||||||

| Third quarter |

$ | 4.26 | $ | 2.60 | $ | 0.00 | ||||||

| Fourth quarter |

$ | 5.13 | $ | 2.63 | $ | 0.00 | ||||||

| Year Ended December 27, 2009: |

||||||||||||

| First quarter |

$ | 1.87 | $ | 0.35 | $ | 0.09 | ||||||

| Second quarter |

$ | 1.33 | $ | 0.46 | $ | 0.00 | ||||||

| Third quarter |

$ | 2.88 | $ | 0.39 | $ | 0.00 | ||||||

| Fourth quarter |

$ | 4.04 | $ | 2.13 | $ | 0.00 | ||||||

Holders:

The number of record holders of Class A and Class B Common Stock at February 25, 2011 was 5,652 and 22, respectively.

Dividends:

The payment and amount of future dividends remain within the discretion of the Board of Directors and will depend upon the Company’s future earnings, financial condition and requirements, and other factors considered relevant by the Board. The Company suspended its quarterly dividend after the payment of the first quarter dividend in fiscal 2009. Also, the amount of future dividends is governed by reaching certain leverage levels of earnings before interest, taxes, depreciation and amortization (EBITDA) under its senior secured credit agreement.

Sales of Unregistered Securities:

None

Purchases of Equity Securities:

None

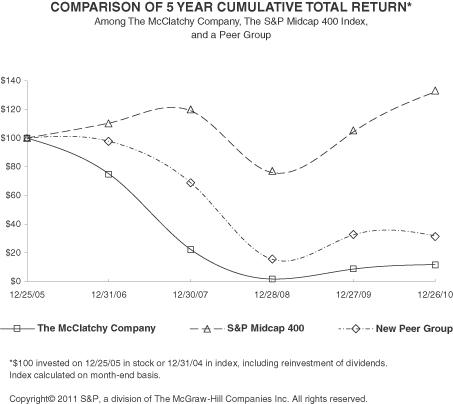

The following graph compares the cumulative five-year total return attained by shareholders on The McClatchy Company’s common stock versus the cumulative total returns of the S&P Midcap 400 index and a customized peer group composed of nine companies. The Company selected its peer group based on the fact that McClatchy is a pure-play newspaper publishing and digital media company with no other media business beyond its newspaper and online business.

15

Table of Contents

| 12/25/05 |

12/31/06 |

12/30/07 |

12/28/08 |

12/27/09 |

12/26/10 |

|||||||||||||||||||

| The McClatchy Company |

100.00 | 75.38 | 22.77 | 1.63 | 8.66 | 11.72 | ||||||||||||||||||

| S&P Midcap 400 |

100.00 | 110.32 | 119.12 | 75.96 | 104.36 | 132.16 | ||||||||||||||||||

| Peer Group |

100.00 | 97.80 | 69.24 | 15.46 | 32.55 | 31.73 | ||||||||||||||||||

The Company’s current customized peer group includes nine companies which are publicly traded with a majority of their revenues from newspaper publishing. This peer group includes: A H Belo Corp., E W Scripps Company, Gannett Inc., Gatehouse Media Inc., Journal Communications Inc., Lee Enterprises Inc., Media General Inc., New York Times Company and Sun-Times Media Group Inc.

16

Table of Contents

| ITEM 6. | SELECTED FINANCIAL DATA |

The following selected financial data should be read in conjunction with the Consolidated Financial Statements and related notes, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and other financial information appearing elsewhere in this Annual Report on Form 10-K. The information set forth below is not necessarily indicative of the Company’s future financial condition or results of operations.

SELECTED FINANCIAL DATA (1)(2)

(in thousands, except per share amounts)

| December 26, 2010 |

December 27, 2009 |

December 28, 2008 |

December 30, 2007 (1) |

December 31, 2006 (2) |

||||||||||||||||

| REVENUES—NET: |

||||||||||||||||||||

| Advertising |

$ | 1,049,964 | $ | 1,143,129 | $ | 1,568,766 | $ | 1,911,722 | $ | 1,432,913 | ||||||||||

| Circulation |

272,776 | 278,256 | 265,584 | 275,658 | 194,940 | |||||||||||||||

| Other |

52,492 | 50,199 | 66,106 | 72,983 | 47,337 | |||||||||||||||

| 1,375,232 | 1,471,584 | 1,900,456 | 2,260,363 | 1,675,190 | ||||||||||||||||

| OPERATING EXPENSES: |

||||||||||||||||||||

| Depreciation and amortization |

133,404 | 142,889 | 142,948 | 148,559 | 98,865 | |||||||||||||||

| Other operating expenses |

1,002,945 | 1,130,183 | 1,536,343 | 1,685,710 | 1,229,417 | |||||||||||||||

| Goodwill and masthead impairment |

— | — | 59,563 | 2,992,046 | — | |||||||||||||||

| 1,136,349 | 1,273,072 | 1,738,854 | 4,826,315 | 1,328,282 | ||||||||||||||||

| OPERATING INCOME (LOSS) |

238,883 | 198,512 | 161,602 | (2,565,952 | ) | 346,908 | ||||||||||||||

| NON-OPERATING (EXPENSES) INCOME: |

||||||||||||||||||||

| Interest expense |

(177,641 | ) | (127,276 | ) | (157,385 | ) | (197,997 | ) | (93,664 | ) | ||||||||||

| Interest income |

550 | 47 | 1,429 | 243 | 3,562 | |||||||||||||||

| Equity income (loss) in unconsolidated |

11,752 | 2,130 | (14,021 | ) | (36,899 | ) | 4,951 | |||||||||||||

| Write-down of investments and land |

(24,297 | ) | (28,322 | ) | (26,462 | ) | (84,568 | ) | — | |||||||||||

| Gain (loss) on non-operating items and other—net |

(10,396 | ) | 44,320 | 56,922 | 1,982 | 9,128 | ||||||||||||||

| (200,032 | ) | (109,101 | ) | (139,517 | ) | (317,239 | ) | (76,023 | ) | |||||||||||

| INCOME (LOSS) FROM CONTINUING OPERATIONS BEFORE INCOME TAXES |

38,851 | 89,411 | 22,085 | (2,883,191 | ) | 270,885 | ||||||||||||||

| INCOME TAX PROVISION (BENEFIT) |

5,661 | 29,147 | 19,278 | (156,582 | ) | 87,390 | ||||||||||||||

| INCOME (LOSS) FROM CONTINUING OPERATIONS |

33,190 | 60,264 | 2,807 | (2,726,609 | ) | 183,495 | ||||||||||||||

| INCOME (LOSS) FROM DISCONTINUED OPERATIONS, NET OF INCOME TAXES |

3,083 | (6,174 | ) | (6,758 | ) | (9,404 | ) | (339,072 | ) | |||||||||||

| NET INCOME (LOSS) |

$ | 36,273 | $ | 54,090 | $ | (3,951 | ) | $ | (2,736,013 | ) | $ | (155,577 | ) | |||||||

| NET INCOME (LOSS) PER COMMON SHARE: |

||||||||||||||||||||

| Basic: |

||||||||||||||||||||

| Income (loss) from continuing operations |

$ | 0.39 | $ | 0.72 | $ | 0.03 | $ | (33.26 | ) | $ | 2.85 | |||||||||

| Income (loss) from discontinued operations |

0.04 | (0.07 | ) | (0.08 | ) | (0.11 | ) | (5.27 | ) | |||||||||||

| Net income (loss) per share |

$ | 0.43 | $ | 0.65 | $ | (0.05 | ) | $ | (33.37 | ) | $ | (2.42 | ) | |||||||

| Diluted: |

||||||||||||||||||||

| Income (loss) from continuing operations |

$ | 0.39 | $ | 0.72 | $ | 0.03 | $ | (33.26 | ) | $ | 2.84 | |||||||||

| Income (loss) from discontinued operations |

0.04 | (0.07 | ) | (0.08 | ) | (0.11 | ) | (5.25 | ) | |||||||||||

| Net income (loss) per share |

$ | 0.43 | $ | 0.65 | $ | (0.05 | ) | $ | (33.37 | ) | $ | (2.41 | ) | |||||||

| DIVIDENDS PER COMMON SHARE |

$ | — | $ | 0.09 | $ | 0.54 | $ | 0.72 | $ | 0.72 | ||||||||||

| CONSOLIDATED BALANCE SHEET DATA: |

||||||||||||||||||||

| Total assets |

$ | 3,136,359 | $ | 3,302,899 | $ | 3,522,206 | $ | 4,137,919 | $ | 8,054,710 | ||||||||||

| Long-term debt (3) |

1,703,339 | 1,896,436 | 2,037,776 | 2,471,827 | 2,746,669 | |||||||||||||||

| Stockholders’ equity |

219,345 | 170,189 | 52,429 | 425,540 | 3,103,624 | |||||||||||||||

| (1) | On March 5, 2007, the Company sold the (Minneapolis) Star Tribune newspaper of Minneapolis, MN. Results of the (Minneapolis) Star Tribune newspaper are included in discontinued operations for all periods presented. |

| (2) | On June 27, 2006 the Company purchased Knight-Ridder, Inc. Information as of and for the year ended December 31, 2006, includes the newspapers and other operations from the acquisition since the beginning of the third quarter of fiscal 2006. |

| (3) | Excludes $530.0 million classified in current liabilities as of December 31, 2006, as such debt was repaid with proceeds from the disposition of the (Minneapolis) Star Tribune newspaper. |

17

Table of Contents

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION |

Overview

The McClatchy Company is the third largest newspaper publisher by circulation in the United States, with 30 daily newspapers, approximately 43 non-dailies, and direct marketing and direct mail operations. McClatchy also operates leading local websites in each of its markets which extend its audience reach. The websites offer users information, comprehensive news, advertising, e-commerce and other services. Together with its newspapers and direct marketing products, these interactive operations make McClatchy the leading local media company in each of its premium high growth markets. McClatchy-owned newspapers include The Miami Herald, The Sacramento Bee, the Fort Worth Star-Telegram, The Kansas City Star, The Charlotte Observer, and The News & Observer (Raleigh).

McClatchy also owns a portfolio of premium digital assets, including 14.4% of CareerBuilder LLC, which operates the nation’s largest online job site CareerBuilder.com, 25.6% of Classified Ventures LLC, a company that offers classified websites such as the auto website Cars.com and the rental site Apartments.com, and 33.3% of HomeFinder LLC, which operates the online real estate website HomeFinder.com.

The Company’s primary source of revenue is print and digital advertising, which accounted for 76.3% of the Company’s revenue for fiscal 2010. Print and digital advertising revenues are derived from retail, national and classified advertising. Print and preprinted insert advertising are sold in the daily newspaper, but are also sold in direct marketing and other advertising products. While percentages vary from year to year and from newspaper to newspaper, classified advertising has, over time, generally decreased as a percentage of total advertising revenues. Classified advertising as a percentage of total advertising revenues was 26.7% in 2010 compared to 26.9% in fiscal 2009 and 31.3% in fiscal 2008. The decrease in classified advertising as a percentage of total advertising from 2008 to recent periods was primarily as a result of the economic slowdown affecting classified advertising and the secular shift in advertising demand to digital products.

While revenues from retail advertising carried as a part of newspapers (run-of-press or ROP advertising) or in advertising inserts placed in newspapers (preprint advertising) has decreased year over year, retail advertising has, over time, generally increased as a percentage of total advertising. For 2010 retail advertising was 52.5% of total advertising compared to 53.4% in fiscal 2009 and 50.1% in fiscal 2008. This is partially a reflection of retail advertising declining at a slower rate than classified advertising during the economic downturn, thus increasing as a percentage of total advertising.

National advertising as a percentage of total advertising revenue remained relatively similar year-over-year and contributed 9.2% of total advertising revenue in fiscal 2010. Direct marketing and other advertising made up the remainder of the Company’s advertising revenues in fiscal 2010.

While included in the revenues described above, all categories of digital advertising are performing better than print advertising. The Company, along with a number of other newspaper companies, is a partner in a broad-based partnership with Yahoo, Inc. (Yahoo). The Company’s local sales force is able to sell Yahoo advertising inventory and share in the revenue from the sales.

In total, revenues from digital advertising increased 2.4% in fiscal 2010 compared to fiscal 2009 while print advertising revenues declined 10.2% over the same periods. Also, digital advertising revenues represented 18.1% of total advertising revenues in fiscal 2010, up from 16.2% of total advertising revenues in fiscal 2009 and 11.6% of total advertising in fiscal 2008.

Circulation revenues increased to 19.8% of the Company’s newspaper revenues in fiscal 2010 from 18.9% in fiscal 2009 and 14.0% in fiscal 2008. Most of the Company’s newspapers are delivered by independent contractors. Circulation revenues are recorded net of direct delivery costs.

18

Table of Contents

See the following “Results of Operations” for a discussion of the Company’s revenue performance and contribution by category for fiscal 2010, 2009 and 2008.

Recent Events and Trends

Advertising Revenues:

Advertising revenues declined in fiscal 2009 and fiscal 2008, but the declines moderated in 2010 as the economy began to recover. Management believes the declines are primarily attributable to the weaknesses in the United States economy and the general shift in advertising to the internet, particularly in the classified area, where the Company’s newspapers face increased competition.

During 2010 certain advertising revenue categories, including digital and direct marketing advertising grew year-over-year from 2009. The digital and direct marketing categories also gained strength in their rates of growth in the last half of 2010 and management expects this trend to continue in 2011.

See the revenue discussions in management’s review of the Company’s “Results of Operations.”

Purchase of Debt Securities:

In February 2011 the Company purchased $28.4 million aggregate principal amount of its outstanding debt securities for $28.4 million in cash generated by operations and partially obtained from its Credit Agreement. The Company purchased outstanding principal amount of debt securities as follows: $0.4 million of the 15.75% senior notes maturing in 2014, $8.0 million of unsecured notes maturing in 2014, $10.0 million of unsecured notes maturing in 2017 and $10.0 million of its secured notes maturing in 2017.

Contribution of Company-Owned Real Property to Pension Plan:

In January 2011 the Company contributed certain of its real property appraised at $49.6 million to its qualified defined benefit pension plan. The Company is leasing back the property from its pension plan for 10 years at an annual rent of approximately $4.0 million. The property will be managed by an independent fiduciary and the appraisals and lease payments have been determined by that fiduciary.

McClatchy expects its required pension contribution under ERISA to be approximately $51.2 million in 2011, and the contribution of real property is expected to satisfy most of the required pension contribution in 2011. The remaining required contribution for 2011, if any, will be made in cash. See Note 13 to the Consolidated Financial Statements for a greater description of this transaction and the “Liquidity and Capital Resources” section below for a discussion of potential future pension contributions.

Restructuring Plans and Other Expense Activity:

In 2008, the Company announced plans to reduce its workforce as the Company streamlined its operations and staff size. The Company’s workforce in 2008 was reduced by approximately 2,550 positions. In March 2009, the Company announced additional restructuring efforts, which included reducing the Company’s workforce by 15%, or 1,650 positions, the freezing of the Company’s pension plans and a temporary suspension of the Company matching contribution to the 401(k) plan as of March 31, 2009. The Company’s restructuring plan also involved wage reductions across the Company for additional savings. The Company’s chairman and chief executive officer (CEO) declined his 2008 and 2009 bonuses and other executive officers did not receive bonuses for 2008. In addition, effective March 30, 2009, the CEO’s base salary was reduced by 15%, other executive officers’ salaries were reduced by 10%, and no bonuses were paid to any employee in 2009. The Company also reduced the cash compensation, including retainers and meeting fees, paid to its directors by approximately 13%, and the directors declined any stock awards for 2008 and 2009. The costs related to these plans, including related

19

Table of Contents

severance, were largely paid in the years the plans were implemented. Much of the expense reductions from the plans are permanent in nature, however, the impact of the savings were mostly realized in fiscal years 2008 and 2009 and through the first fiscal quarter of 2010.

Newsprint:

Newsprint prices are volatile and are largely dependent on global demand and supply for newsprint. Supply and demand are largely in balance as the result of higher export demand and reductions in capacity. As a result, producers have been able to increase prices in the second half of 2009 and in fiscal 2010.

Significant changes in newsprint prices can increase or decrease the Company’s operating expenses, and therefore, directly affect the Company’s operating results. However, because the Company has ownership interests in newsprint producer Ponderay, an increase in newsprint prices, while negatively affecting the Company’s operating expenses, would increase its share of earnings from this investment. A decline in newsprint prices would have the opposite effect. Ponderay is also impacted by the higher cost of energy and fiber used in the paper-making process. The impact of newsprint price increases on the Company’s financial results is discussed under “Results of Operations” below.

Debt Refinancing:

February 11, 2010: The Company was a party to a credit agreement, dated as of June 27, 2006 (as amended through May 20, 2009, the “original credit agreement”), which provided for a five-year revolving credit facility and term loans. On January 26, 2010, the Company entered into an amendment and restatement of the original credit agreement that became effective on February 11, 2010 (the “Amended and Restated Credit Agreement”), immediately prior to the closing of an offering of $875.0 million of senior secured notes. The Amended and Restated Credit Agreement required a substantial reduction in bank debt and allowed for the early retirement of other bond debt using the proceeds of the secured notes offering. The Company was in compliance with all covenants of the credit agreement at the time of the refinancing.

Upon closing of the refinancing transaction on February 11, 2010, the Amended and Restated Credit Agreement provided for a $262.0 million term loan and a $249.3 million revolving credit facility, including a $100.0 million letter of credit sub-facility, and extended the term of certain of the credit commitments to July 1, 2013. In connection with the Amended and Restated Credit Agreement, certain of the lenders did not extend the maturity of their commitments from the original maturity date of June 27, 2011. See discussion of the December 16, 2010, amendment below for additional details on the Amended and Restated Credit Agreement.

In connection with the Amended and Restated Credit Agreement, the Company issued new 11.50% Senior Secured Notes due 2017 (the “2017 Notes”) totaling $875.0 million. In addition, the Company completed tender offers for its 7.125% notes due in 2011 (the “2011 Notes”) and 15.75% senior notes due in 2014 (the “2014 Senior Notes”), paying $187.3 million in cash for aggregate principal amounts of $148.0 million of 2011 Notes and $23.9 million of 2014 Notes.

December 16, 2010, Amendment: The Company paid down the principal amount of its term loans outstanding under the Amended and Restated Credit Agreement throughout 2010 using its cash from operations. On December 16, 2010 the Company entered into an amendment of the Amended and Restated Credit Agreement (the Credit Agreement) to, among other things, remove certain restrictions on the ability to repurchase its publicly-traded bonds, to repay the remaining $41.0 million of bank term loans and to reduce the lenders’ revolving loan commitments under the Amended and Restated Credit Agreement. The remaining term loans were repaid on December 20, 2010.

The Credit Agreement provides for a $150.8 million revolving credit facility, including a $100.0 million letter of credit sub-facility. Revolving commitments of $25.8 million will terminate on June 27, 2011 and the remaining revolving loan commitments of $125.0 million will terminate on July 1, 2013.

20

Table of Contents

Debt Exchange Offers: On June 26, 2009, the Company completed a private debt exchange offer for all of its outstanding debt securities for a combination of cash and its 2014 Senior Notes. The 2014 Senior Notes were senior unsecured obligations and were guaranteed by McClatchy’s existing and future material domestic subsidiaries. The Company exchanged $3.4 million in cash and $24.2 million of 2014 Senior Notes in the exchange offer. In exchange for the cash and 2014 Senior Notes the Company retired the following outstanding principal amount of debt securities maturing in the respective years: $3.8 million in 2011 notes, $11.1 million in 2014 notes, $53.4 million in 2017 notes, $10.8 million in 2027 debentures and $23.8 million in 2029 debentures. The Company recorded a pre-tax gain of approximately $44.1 million on the exchange in 2009. The gain was equal to the carrying amount of the exchanged securities less the total future cash payments of the 2014 Senior Notes, including both payments of interest and principal amount, and related expenses of the exchange. A total of $23.9 million of 2014 Senior Notes were repurchased in connection with the February 2010 tender-offer using the proceeds from the 2017 Notes discussed in “Debt Refinancing” section above. The remainder of the 2014 Senior Notes was repurchased in February 2011.

In the second fiscal quarter of 2008, the Company repurchased $300.0 million aggregate principal amount of its outstanding debt securities for $282.4 million in cash obtained from its original credit facility. In the second half of 2008, the Company purchased $19.0 million aggregate principal of its outstanding debt securities maturing in 2009 in the open market for $17.7 million in cash obtained from its original credit facility. The Company recorded gains totaling $21.0 million on the extinguishments of these notes which included the write-off of approximately $3.0 million of net unamortized premiums related to these securities.

See Note 5 to the Consolidated Financial Statements for an expanded discussion of these transactions.

Disposition Transactions:

On March 5, 2007, the Company sold the (Minneapolis) Star Tribune and other publications and websites related to the newspaper for $530.0 million. In 2008, the Company received a total income tax benefit of approximately $200.0 million related to the sale; $185.0 million of the income tax benefit was received as an income tax refund and approximately $15.0 million was recouped through reductions to income taxes payable.

On January 31, 2011, the contract to sell certain land in Miami terminated because the buyer did not consummate the transaction by the closing deadline in the contract. Management evaluated the value of this land on its balance sheet and, as a result of this evaluation, the Company wrote down the value of the land by $21.4 million in the fourth quarter of 2010. This transaction is discussed in greater detail in Note 3 to the Consolidated Financial Statements.

Recent Accounting Pronouncements:

See Note 1 to the Consolidated Financial Statements for a discussion of recent accounting pronouncements.

Critical Accounting Policies