Attached files

EXHIBIT 10.3

STOCK PURCHASE AGREEMENT

By and Among

ECLIPSE ELECTRONIC SYSTEMS, INC.

ITS SHAREHOLDERS

AND

ESTERLINE TECHNOLOGIES CORPORATION

Dated as of December 28, 2010

TABLE OF CONTENTS

| SECTION 1. DEFINITIONS AND INTERPRETATION |

1 | |||||||

| 1.1. |

Certain Definitions | 1 | ||||||

| 1.2. |

Other Defined Terms | 8 | ||||||

| 1.3. |

Interpretation | 10 | ||||||

| SECTION 2. SALE AND PURCHASE; CLOSING; NET ASSETS ADJUSTMENT |

11 | |||||||

| 2.1. |

Sale and Purchase; Purchase Price | 11 | ||||||

| 2.2. |

Closing | 11 | ||||||

| 2.3. |

Closing Deliverables | 11 | ||||||

| 2.4. |

Net Assets Adjustment | 13 | ||||||

| 2.5. |

Part 12 Holdback | 16 | ||||||

| 2.6. |

The Seller Representative | 18 | ||||||

| 2.7. |

Escrow Amount | 19 | ||||||

| 2.8. |

Tax Withholding | 20 | ||||||

| SECTION 3. REPRESENTATIONS AND WARRANTIES OF THE SELLERS |

20 | |||||||

| 3.1. |

Power and Authority; Authorization and Execution; Enforceability | 20 | ||||||

| 3.2. |

Noncontravention | 20 | ||||||

| 3.3. |

Ownership of Shares; Transfer | 20 | ||||||

| 3.4. |

Brokers’ or Finders’ Fees | 21 | ||||||

| SECTION 4. REPRESENTATIONS AND WARRANTIES OF THE COMPANY |

21 | |||||||

| 4.1. |

Formation, Existence and Good Standing | 21 | ||||||

| 4.2. |

Power and Authority; Authorization and Execution; Enforceability | 21 | ||||||

| 4.3. |

Governmental Consents | 21 | ||||||

| 4.4. |

No Conflicts | 21 | ||||||

| 4.5. |

Qualification as a Foreign Corporation | 22 | ||||||

| 4.6. |

Organizational Documents; Minute Books | 22 | ||||||

| 4.7. |

Capitalization | 22 | ||||||

| 4.8. |

No Subsidiaries | 23 | ||||||

| 4.9. |

Financial Statements | 23 | ||||||

| 4.10. |

No Undisclosed Liabilities | 23 | ||||||

| 4.11. |

Changes Since Interim Balance Sheet Date | 23 | ||||||

| 4.12. |

Real and Personal Property | 25 | ||||||

| 4.13. |

Contracts | 26 | ||||||

| 4.14. |

Litigation and Orders | 27 | ||||||

| 4.15. |

Taxes | 28 | ||||||

| 4.16. |

Intellectual Property | 30 | ||||||

| 4.17. |

Employee Benefit Plans | 31 | ||||||

| 4.18. |

Employee Matters | 34 | ||||||

| 4.19. |

Environmental Laws and Regulations | 34 | ||||||

| 4.20. |

Governmental Authorizations | 36 | ||||||

| 4.21. |

Compliance with Laws | 36 | ||||||

| 4.22. |

Insurance | 36 | ||||||

| 4.23. |

Material Customers | 36 | ||||||

| 4.24. |

Material Suppliers | 36 | ||||||

| 4.25. |

Bank Accounts | 37 | ||||||

| 4.26. |

Accounts Receivable | 37 | ||||||

| 4.27. |

Inventory | 37 | ||||||

| 4.28. |

Government Contractor Status | 37 | ||||||

| 4.29. |

Absence of Questionable Payments | 38 | ||||||

| 4.30. |

Affiliate Transactions | 38 | ||||||

| 4.31. |

Products | 38 | ||||||

| 4.32. |

Certain Proceedings | 39 | ||||||

| 4.33. |

Broker’s or Finder’s Fees | 39 | ||||||

| SECTION 5. REPRESENTATIONS AND WARRANTIES OF THE BUYER |

39 | |||||||

| 5.1. |

Organization, Existence and Good Standing; Organizational Documents | 39 | ||||||

| 5.2. |

Power and Authority; Authorization and Execution; Enforceability | 39 | ||||||

| 5.3. |

Governmental Consents | 39 | ||||||

| 5.4. |

No Conflicts | 40 | ||||||

| 5.5. |

Certain Proceedings | 40 | ||||||

| 5.6. |

Financing | 40 | ||||||

| 5.7. |

Investment Status | 40 | ||||||

| 5.8. |

Broker’s or Finder’s Fees | 40 | ||||||

| SECTION 6. COVENANTS OF THE COMPANY AND SELLERS PRIOR TO CLOSING |

40 | |||||||

| 6.1. |

Access | 40 | ||||||

| 6.2. |

Conduct of Business | 41 | ||||||

| 6.3. |

Commercially Reasonable Efforts | 42 | ||||||

| 6.4. |

Assistance with Permits and Filings | 42 | ||||||

| 6.5. |

Exclusive Dealing | 42 | ||||||

| 6.6. |

Regulatory Approvals; Other Actions | 42 | ||||||

| 6.7. |

Adoption of Certain Plans | 43 | ||||||

| SECTION 7. COVENANTS OF THE BUYER PRIOR TO CLOSING |

43 | |||||||

| 7.1. |

Commercially Reasonable Efforts | 43 | ||||||

| 7.2. |

Assistance with Permits and Filings | 43 | ||||||

| 7.3. |

Regulatory Approvals; Other Actions | 43 | ||||||

| SECTION 8. CONDITIONS PRECEDENT TO SELLERS’ OBLIGATION TO CLOSE |

44 | |||||||

| 8.1. |

Accuracy of Representations and Warranties | 44 | ||||||

| 8.2. |

Performance | 44 | ||||||

| 8.3. |

Buyer Closing Certificate | 45 | ||||||

| 8.4. |

Buyer Closing Documents | 45 | ||||||

| 8.5. |

Consents | 45 | ||||||

| 8.6. |

No Prohibition | 45 | ||||||

| 8.7. |

HSR Act Matters | 45 | ||||||

| 8.8. |

Sander’s Loan | 45 | ||||||

| SECTION 9. CONDITIONS PRECEDENT TO THE BUYER’S OBLIGATION TO CLOSE |

45 | |||||||

| 9.1. |

Accuracy of Representations and Warranties | 45 | ||||||

| 9.2. |

Performance | 46 | ||||||

| 9.3. |

Company Closing Certificate | 46 | ||||||

| 9.4. |

Other Closing Documents | 46 | ||||||

| 9.5. |

Consents | 46 | ||||||

| 9.6. |

No Prohibition | 46 | ||||||

| 9.7. |

HSR Act Matters | 46 | ||||||

| 9.8. |

New Facility | 46 | ||||||

| 9.9. |

Sander’s Loan | 46 | ||||||

| 9.10. |

Audited Financials | |||||||

| SECTION 10. TERMINATION |

46 | |||||||

| 10.1. |

Termination Events | 46 | ||||||

| 10.2. |

Right to Cure | 47 | ||||||

| 10.3. |

Effect of Termination | 48 | ||||||

| SECTION 11. INDEMNIFICATION; REMEDIES |

48 | |||||||

| 11.1. |

Survival | 48 | ||||||

| 11.2. |

Indemnification by the Sellers | 49 | ||||||

| 11.3. |

Indemnification by the Buyer | 50 | ||||||

| 11.4. |

Limitations | 50 | ||||||

| 11.5. |

Third Party Claims | 52 | ||||||

| 11.6. |

Procedure for Indemnification – Other Claims | 53 | ||||||

| 11.7. |

Escrow | 53 | ||||||

| 11.8. |

Mitigation | 54 | ||||||

| 11.9. |

Subrogation | 54 | ||||||

| 11.10. |

Exclusivity of Remedies | 54 | ||||||

| SECTION 12. TAX MATTERS |

54 | |||||||

| 12.1. |

Proration of Taxes | 54 | ||||||

| 12.2. |

Tax Returns | 54 | ||||||

| 12.3. |

Refunds and Tax Benefits | 55 | ||||||

| 12.4. |

Inter-period Adjustments | 56 | ||||||

| 12.5. |

Cooperation on Tax Matters | 56 | ||||||

| 12.6. |

Tax Proceedings | 56 | ||||||

| 12.7. |

Transfer Taxes | 57 | ||||||

| 12.8. |

Termination of Tax Sharing Agreements | 57 | ||||||

| 12.9. |

Noncompetition | 58 | ||||||

| SECTION 13. OTHER POST-CLOSING COVENANTS |

58 | |||||||

| 13.1. |

Transaction Costs | 58 | ||||||

| 13.2. |

Confidentiality | 58 | ||||||

| 13.3. |

Further Assurances | 58 | ||||||

| 13.4. |

Public Announcements | 58 | ||||||

| 13.5. |

Employees and Employee Matters | 59 | ||||||

| 13.6. | Noncompetition | 59 | ||||||

| 13.7. | Records Retention and Access | 60 | ||||||

| 13.8. | Company 401(k) Plans | 61 | ||||||

| SECTION 14. MISCELLANEOUS PROVISIONS |

61 | |||||||

| 14.1. | Notices | 61 | ||||||

| 14.2. | Waiver | 62 | ||||||

| 14.3. | Entire Agreement | 63 | ||||||

| 14.4. | Amendments | 63 | ||||||

| 14.5. | Assignment; Binding Effect | 63 | ||||||

| 14.6. | No Third-Party Beneficiaries | 63 | ||||||

| 14.7. | Specific Performance | 63 | ||||||

| 14.8. | Attorney’s Fees and Expenses | 64 | ||||||

| 14.9. | Disclosure Schedules | 64 | ||||||

| 14.10. | Severability | 65 | ||||||

| 14.11. | Governing Law | 65 | ||||||

| 14.12. | Venue | 65 | ||||||

| 14.13. | Counterparts | 65 | ||||||

| 14.14. | Waiver of Jury Trial | 65 | ||||||

| 14.15. | Negotiation and Drafting | 65 | ||||||

LIST OF EXHIBITS

| Exhibit A | Capitalization Table | |

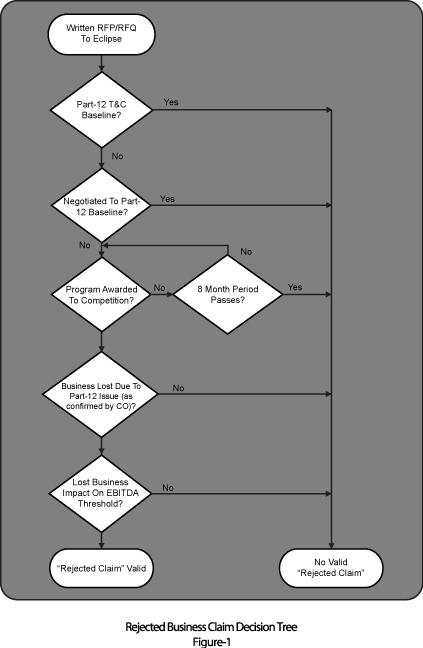

| Exhibit B | Rejection Claim Decision Tree | |

| LIST OF SCHEDULES | ||

| Schedule 4.1 | Formation, Existence and Good Standing | |

| Schedule 4.2 | Power and Authority; Authorization and Execution; Enforceability | |

| Schedule 4.3 | Governmental Consents | |

| Schedule 4.4 | No Conflicts | |

| Schedule 4.5 | Qualification as a Foreign Corporation | |

| Schedule 4.6 | Organization Documents; Minute Books | |

| Schedule 4.7 | Capitalization | |

| Schedule 4.8 | No Subsidiaries | |

| Schedule 4.9 | Financial Statements | |

| Schedule 4.10 | No Undisclosed Liabilities | |

| Schedule 4.11 | Changes Since Interim Balance Sheet | |

| Schedule 4.12 | Real and Personal Property | |

| Schedule 4.13 | Contracts | |

| Schedule 4.14 | Litigation and Orders | |

| Schedule 4.15 | Taxes | |

| Schedule 4.16 | Intellectual Property | |

| Schedule 4.17 | Employee Benefit Plans | |

| Schedule 4.18 | Employee Matters | |

| Schedule 4.19 | Environmental Laws and Regulations | |

| Schedule 4.20 | Governmental Authorizations | |

| Schedule 4.21 | Compliance with Laws | |

| Schedule 4.22 | Insurance | |

| Schedule 4.23 | Material Customers | |

| Schedule 4.24 | Material Suppliers | |

| Schedule 4.25 | Bank Accounts | |

| Schedule 4.26 | Accounts Receivable | |

| Schedule 4.27 | Certain Proceedings | |

| Schedule 4.28 | Broker’s or Finder’s Fees | |

| Schedule 8.5 | Company Consents | |

| Schedule 9.5 | Buyer Consents | |

STOCK PURCHASE AGREEMENT

This Stock Purchase Agreement (the “Agreement”) is made and entered into as of December, 2010, by and among Eclipse Electronic Systems, Inc., a Texas corporation (the “Company”), all of the holders of the common stock, no par value (the “Common Stock”), of the Company (each, individually, a “Seller” and, collectively, the “Sellers”) and Esterline Technologies Corporation, a Delaware corporation (the “Buyer”). The Company, the Sellers and the Buyer are sometimes referred to herein individually as a “Party” and collectively as the “Parties.”

RECITALS

The Company designs and manufactures embedded communications intercept receivers for Signals Intelligence applications (the “Business”).

The Sellers collectively own all of the Company’s issued and outstanding Common Stock (the “Shares”) with each owning the Shares as set forth on Exhibit A hereto.

On the terms and subject to the conditions set forth in this Agreement, the Sellers desire to sell all of the issued and outstanding Shares to the Buyer, and the Buyer desires to purchase such Shares from the Sellers.

NOW, THEREFORE, in consideration of the premises and the terms and provisions of this Agreement, the Parties agree as follows:

SECTION 1. DEFINITIONS AND INTERPRETATION

1.1. Certain Definitions. As used in this Agreement, the terms below have the following meanings:

“Affiliate” means, when used with respect to any Person, any other Person directly or indirectly controlling, controlled by or under common control with, such first Person; provided, however, that for purposes of this definition, “control” (including, with correlative meanings, the terms “controlled by” and “under common control with”), as used with respect to any Person, means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of such Person, whether through the ownership of voting or other equity securities, by contract or otherwise.

“Antitrust Laws” means the Sherman Antitrust Act of 1980, as amended, the Clayton Antitrust Act of 1914, as amended, the HSR Act, the Federal Trade Commission Act, as amended, and all other laws, rules and regulations and other legal requirements that are designed or intended to prohibit, restrict or regulate actions having the purpose or effect of monopolization or restraint of trade.

- 1 -

“Benefit Plan” means any employment, consulting, severance, termination, retirement, profit sharing, bonus, incentive or deferred compensation, retention bonus or change in control agreement, pension, stock option, restricted stock or other equity-based benefit, profit sharing, savings, life, health, disability, accident, medical, insurance, vacation, paid time off, long-term care, executive or other employee allowance program, other welfare fringe benefit or other employee compensation or benefit plan, program, arrangement, agreement, fund or commitment, including any “employee benefit plan” as defined in ERISA Section 3(3) and any program to which IRC Section 6039D applies.

“Buyer Closing Documents” means (a) the Buyer Closing Certificate executed and delivered by the Buyer as contemplated by Section 8.3 and (b) the agreements and documents executed and delivered by the Buyer at the Closing pursuant to Section 2.3(c).

“Buyer Disclosure Schedule” means the disclosure schedule delivered to the Seller by the Buyer pursuant to Section 5 setting forth disclosures supplementing, modifying or qualifying the representations and warranties in Section 5.

“Buyer Plan” means any Benefit Plan of the Buyer.

“Buyer Specified Representations” means the representations and warranties of the Buyer contained in Section 5.1, Section 5.2 and Section 5.8.

“Closing Documents” means the Buyer Closing Documents and the Company Closing Documents.

“Confidentiality Agreement” means the Confidentiality and Nondisclosure Agreement dated as of June 29, 2010, by and between PBW, on behalf of the Company, and the Buyer.

“Consent” means any approval, consent, ratification, waiver or other authorization (including any Governmental Authorization).

“Contemplated Transactions” means all of the transactions contemplated by this Agreement, including:

(a) the transactions described or referred to in Section 2.1; and

(b) the performance by the Parties of their respective covenants and agreements contained in this Agreement.

“Contract” means any agreement, contract, promise or undertaking (whether written or oral) that is legally binding.

“Company Closing Documents” means (a) the Company Closing Certificate executed and delivered by the Company as contemplated by Section 9.3, and (b) the

- 2 -

agreements and documents executed and delivered by the Company at the Closing pursuant to Section 2.3(b).

“Company Disclosure Schedule” means the disclosure schedule delivered to the Buyer by the Company pursuant to Section 4 setting forth disclosures supplementing, modifying or qualifying the representations and warranties in Section 4.

“Company Plan” means each Benefit Plan sponsored by the Company or to which the Company has (or could have) a contribution obligation or any other Liability, whether fixed or contingent, including an obligation to make a payment of withdrawal liability under ERISA Section 4201, or with respect to which an agreement under ERISA Section 4204 is effective.

“Company Specified Representations” means the representations and warranties of the Company contained in Section 4.1, Section 4.2 and Section 4.7 and Section 4.33.

“Disclosure Schedules” means the Buyer Disclosure Schedule and the Company Disclosure Schedule.

“DOL” means the United States Department of Labor.

“Environment” means soil, land surface or subsurface strata, surface waters (including navigable waters, ocean waters, streams, ponds, drainage basins and wetlands), groundwater, drinking water supply, stream sediments, ambient air (including indoor air), plant and animal life and any other environmental medium or natural resource.

“Environmental Claims” means any and all demands, claims, liens, notices of noncompliance or violation, formal requests for information by a Governmental Body, investigations or Proceedings relating in any way to any Environmental Law or any Governmental Authorization issued under any Environmental Law (for purposes of this definition, “Claims”), including (a) any and all Claims by any Governmental Body for enforcement, cleanup, removal, response, remedial or other actions or Losses pursuant to any applicable Environmental Law and (b) any and all Claims by any Person seeking Losses, contribution, indemnification, cost recovery, compensation or injunctive relief resulting from Hazardous Materials or arising from alleged injury or threat of injury to the Environment.

“Environmental Law” means any Legal Requirement imposing liability or standards of conduct concerning, or otherwise relating to, pollution or protection of the Environment, including Legal Requirements relating to emissions, discharges or releases of pollutants, contaminants, chemicals, noises, odors or toxic, industrial or hazardous substances, materials or wastes into the Environment or otherwise relating to the manufacture, processing, generation, distribution, use, treatment, storage,

- 3 -

disposal, cleanup, transport or handling of pollutants, contaminants, chemicals or industrial, toxic or hazardous substances or wastes.

“Environmental Reports” means any written site assessment reports, audits, studies and related documents that describe, analyze or evaluate the past or present state of compliance of any applicable real property with any Environmental Law or the presence or absence of Hazardous Materials on such real property.

“ERISA” means the Employee Retirement Income Security Act of 1974.

“Escrow Agent” means Wells Fargo Bank, National Association, Corporate Trust Services, 1300 SW Fifth Avenue, 11th Floor, Portland, Oregon 97201.

“GAAP” means United States generally accepted accounting principles.

“Governmental Authorization” means any approval, consent, license, permit, waiver or other authorization issued, granted, given or otherwise made available by or under the authority of any Governmental Body.

“Governmental Body” means any:

(a) nation, state, county, city, town, village, district or other jurisdiction of any nature;

(b) federal, state, county, local, municipal, foreign or other government;

(c) governmental or quasi-governmental body of any nature (including any governmental agency, branch, department, official or entity and any court); or

(d) body exercising any administrative, executive, judicial, legislative, police, regulatory or taxing authority or power.

“Hazardous Materials” means (a) any petroleum or petroleum products, radioactive materials, asbestos, asbestos containing materials, chlorofluorocarbons or other ozone deleting substances or polychlorinated biphenyls and (b) any chemical, material or substance defined as or included in the definition of “hazardous substance,” “hazardous waste,” “hazardous material,” “extremely hazardous substance,” “restricted hazardous waste,” “dangerous waste,” “toxic substance,” “toxic pollutant,” “toxic waste,” “regulated substance” or any similar term under any Environmental Law or the presence of which requires investigation or remediation under any Environmental Law.

“HSR Act” means the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, and the rules and regulations promulgated thereunder, as amended.

“Indemnified Party” means, with respect to any matter, the Party entitled to seek indemnification with respect to such matter pursuant to Section 11.

- 4 -

“Indemnifying Party” means, with respect to any matter, the Party obligated to provide indemnification with respect to such matter pursuant to Section 11.

“Interim Balance Sheet Date” means July 31, 2010.

“Inventory” means all inventory of the Company, including raw materials, work-in-process, finished goods and related supplies, whether (a) located at the Company, (b) in transit from the Company’s suppliers, (c) held for delivery by the Company’s suppliers or (d) held on consignment for the Company by third parties.

“IRC” means the Internal Revenue Code of 1986.

“IRS” means the United States Internal Revenue Service or any successor agency, and, to the extent relevant, the United States Department of the Treasury.

“Knowledge” means the actual knowledge that the following individuals, as applicable, currently have or would have upon completion of a reasonably comprehensive investigation regarding the accuracy of the representation or warranty with respect to which the term “Knowledge” is used: (a) when the term “Knowledge” is used with respect to the Company, Jeffery C. Sanders, Conrad Romberg, Thomas Bradley, John Reeves, Dana Rogers (as to Sections 4.17 and 4.18 only), John Payne, Bill Broyles and Ken Maples, and (b) when the term “Knowledge” is used with respect to the Buyer, its officers.

“Legal Requirement” means any federal, state or local Order, constitution, law, code, ordinance, principle of common law, regulation, rule or statute, in each case as in effect on the date of the applicable representation, warranty, covenant, or other provision in which such term is used.

“Liability” means any direct or indirect debt, obligation or liability of any nature, whether known or unknown, absolute or contingent, accrued or unaccrued, disputed or undisputed, liquidated or unliquidated, secured or unsecured, joint or several, due or to become due, vested or unvested, executory, determined, determinable or otherwise, and whether or not the same is required to be accrued on the financial statements of any Person.

“Lien” means any mortgage, deed of trust, lien, security interest, easement, right of way, restriction or encumbrance.

“Losses” means, subject to any applicable limitation set forth in this Agreement, any loss, damage, liability, judgment or reasonable expense, including reasonable attorney’s fees and disbursements.

“Material Adverse Effect” means any event, change, condition, circumstance, state of facts or effect that has had a material adverse effect on the business, properties, assets, results of operations or financial condition of the Company; provided, however, that in no event shall any of the following (or the effects or consequences

- 5 -

thereof) constitute a “Material Adverse Effect” or be considered in determining whether a “Material Adverse Effect” has occurred or will occur: (a) the negotiation (including activities relating to due diligence), execution, delivery or public announcement or the pendency of this Agreement or the Contemplated Transactions or any actions taken in compliance herewith or otherwise with the consent of the Buyer, including the impact thereof on the relationships of the Company with customers, suppliers, distributors, consultants, employees, independent contractors or other third parties with whom the Company has any relationship, (b) any event, change, condition, circumstance, state of facts or effect, including a diminution in value, related to the Company or any of its respective businesses, properties, assets, results of operations or financial condition, that is described in the Company Disclosure Schedule or the Sellers Disclosure Schedule in sufficient detail to put the Buyer on notice of the potential adverse effect, (c) any change in any Legal Requirement or any interpretation thereof applicable or potentially applicable to any of the products or services provided by or operations of the Company, (d) changes generally affecting the United States aerospace industry or the markets in which the Company operates, provided that the Company is not disproportionately impacted, (e) changes in economic, market or political conditions in the United States, in any region thereof, or in any non-U.S. or global economy, provided that the Company is not disproportionately impacted, (f) acts of war (whether or not declared), sabotage or terrorism, military actions or the escalation thereof occurring on or after the date hereof, provided that the Company is not disproportionately impacted, and (g) changes in accounting principles, or GAAP (or any interpretation thereof; provided that such changes are not a result of Company’s election or voluntary changes in policies or procedures).

“Order” means any award, decision, injunction, judgment, order, ruling, subpoena or verdict entered, issued, made or rendered by any Governmental Body or arbitrator.

“Ordinary Course of Business” means, with respect to an action taken or obligation incurred by a Person, such action or obligation is consistent in nature with the past practices of such Person and is taken in the ordinary course of the normal, day-to-day operations of such Person, and shall be deemed to include any actions taken and obligations incurred (including any Transaction Costs) in connection with the Contemplated Transactions and the Closing.

“Organizational Documents” means (a) with respect to a corporation, the articles of incorporation and the bylaws of such corporation, and any amendment to any of the foregoing.

“New Facility Agreement” means that certain North Texas Commercial Association of Realtors Commercial Contract of Sale between F G Synergy Park Inc. and Eclipse Electronic Systems, Inc. and/or assigns effective as of August 11, 2010, and all addenda, exhibits, modifications and amendments thereto.

“PBW” means Philpott, Ball & Werner.

- 6 -

“Permitted Liens” means (a) Liens for Taxes not yet due and payable or being contested in good faith, (b) inchoate Liens in the nature of zoning restrictions, and easements, rights or restrictions of record on the use of real property, none of which interferes in any material respect with the present use of such real property, (c) inchoate Liens to secure landlords, lessors or others who enter into leases or rental agreements, (d) deposits or pledges made in connection with, or to secure payment of, worker’s compensation, unemployment insurance or old age pension programs mandated under applicable Legal Requirements, and (e) Liens in favor of carriers, warehousemen, mechanics and materialmen, to secure amounts not yet due and payable.

“Person” means any individual, corporation (including any non-profit corporation), general or limited partnership, limited liability company, limited liability partnership, joint venture, estate, trust (including a business trust), association, Governmental Body or other entity.

“Post-Closing Tax Period” means any Tax period beginning after the Closing Date and the portion of any Straddle Period after the Closing Date.

“Pre-Closing Tax Period” means any Tax period ending on or before the Closing Date and the portion of any Straddle Period through the Closing Date.

“Proceeding” means any action, arbitration, suit or proceeding (whether civil, criminal or administrative) commenced, brought, conducted or heard by or before any Governmental Body or arbitrator.

“Representative” means, when used with respect to any Person, any stockholder, member, partner, owner, director, trustee, manager, officer, employee, agent, consultant, advisor or other representative of such Person, including legal counsel, accountants and financial advisors.

“Sellers Specified Representations” means the representation and warranties of the Sellers contained in Section 3.1, Section 3.3, and Section 3.4.

“Straddle Period” mean any Tax period that begins on or before the Closing Date and ends after the Closing Date.

“Tax” or “Taxes” means any federal, state, local or foreign taxes, including income, gross receipts, premiums, profits, capital, franchise, withholding, payroll, employment, social security, workers compensation, unemployment, disability, real property, real property gains, personal property, windfall profit, ad valorem, stamp, excise, registration, occupation, service, sales, use, license, lease, transfer, import, export, customs, value added, severance, environmental, alternative or add-on minimum, estimated or other similar tax (including any fee, assessment, levy, tariff, charge or duty in the nature of or in lieu of any tax) imposed by any Governmental Body, and any interest, penalties, additions or additional amounts in respect of the foregoing, whether disputed or not. The term “Tax” includes, with respect to any

- 7 -

Person, such Person’s liability for Taxes imposed on any consolidated or combined basis.

“Tax Proceeding” means any Proceeding relating to the determination of any Taxes of the Company.

“Tax Return” means any return (including any information return), declaration, report, claim for refund, statement, schedule, notice, form or other document or information or amendment thereof, filed with or submitted to, or required to be filed with or submitted to, any Governmental Body in connection with the determination, assessment, collection or payment of any Tax.

“Transaction Costs” means, when used with respect to any Person, all out-of-pocket legal, accounting, consultant and other fees, costs and expenses incurred or paid by such Person in connection with (a) the negotiation of the Contemplated Transactions, (b) providing documents and information to any other Person or its Representatives in connection with the Contemplated Transactions, (c) any due diligence investigation conducted by such Person in connection with or for the purpose of evaluating the Contemplated Transactions, (d) the negotiation, preparation, execution or delivery of this Agreement or any agreement or document negotiated or delivered pursuant hereto or thereto, (e) complying with obligations required to be performed or conditions required to be satisfied at or prior to the Closing pursuant to the terms of this Agreement or any agreement or document referred to in clause (d) of this sentence, or (f) the consummation of the Closing; provided, however, that the term “Transaction Costs” does not include any transfer Tax or other Taxes, fees, charges and amounts described in Section 12.7.

“Treasury Regulations” means the federal income Tax regulations promulgated under the IRC, as such Treasury Regulations may be amended from time to time, and shall also include proposed and temporary federal income Tax regulations and proposed amendments to Treasury Regulations, as they shall exist from time to time. All references herein to specific sections of the Treasury Regulations shall be deemed also to refer to any corresponding provisions of predecessor or successor Treasury Regulations.

“Welfare Plan” means any Welfare Plan (as defined in ERISA Section 3(1)).

1.2. Other Defined Terms. The following is a list of additional terms used in this Agreement and a reference to the Section in which such term is defined:

| Term |

Section | |

| Accounting Firm |

Section 2.4 | |

| Agreement |

Preamble | |

| Base Net Assets |

Section 2.4 | |

| Business |

Recitals | |

- 8 -

| Business Records |

Section 13.7(a) | |

| Buyer |

Preamble | |

| Buyer Closing Certificate |

Section 8.3 | |

| Cap Amount |

Section 11.4(b) | |

| Closing |

Section 2.2 | |

| Closing Date |

Section 2.2 | |

| Closing Date Cash Consideration |

Section 2.1(b) | |

| Closing Date Net Assets |

Section 2.4 | |

| Closing Date Net Assets Calculation |

Section 2.4 | |

| COBRA |

Section 4.17(b)(i) | |

| Common Stock |

Preamble | |

| Company |

Preamble | |

| Company Closing Certificate |

Section 9.3 | |

| Continued Employees |

Section 13.5 | |

| Controlled Group Plans |

Section 4.17(b)(ix) | |

| Deductible |

Section 11.4(a) | |

| Deficiency |

Section 10.2 | |

| DFVC |

Section 13.8 | |

| DOJ |

Section 6.6 | |

| Effective Time |

Section 2.2 | |

| EPCRS |

Section 13.8 | |

| Escrow Amount |

Section 2.1(b) | |

| Estimated Net Assets |

Section 2.4 | |

| Financial Statements |

Section 4.9(a) | |

| FTC |

Section 6.6 | |

| Intellectual Property |

Section 4.16(b) | |

| Interim Balance Sheet |

Section 4.9(a)(iii) | |

| Leased Real Property |

Section 4.12(b) | |

| Material Customers |

Section 4.23 | |

| Material Suppliers |

Section 4.24 | |

| Net Assets |

Section 2.4 | |

| Net Assets Adjustment Payment |

Section 2.4 | |

| Net Assets Holdback |

Section 2.4 | |

| Part 15 Claim |

Section 2.5(b) | |

| Parties |

Preamble | |

| Party |

Preamble | |

| Patents and Trademarks |

Section 4.16(b) | |

| Purchase Price |

Section 2.1(b) | |

| RFP |

Section 2.5(e) | |

| RFQ |

Section 2.5(e) | |

| Rejection Claim |

Section 2.5(b) | |

| Restriction Period |

Section 13.6 | |

| Seller |

Preamble | |

| Seller Property and Casualty Insurance Policies |

Section 4.22 | |

| Seller Representative |

Section 2.6(a) | |

- 9 -

| Sellers |

Preamble | |

| Shares |

Recitals | |

| Successor Seller Representative |

Section 2.6(g) | |

| Survival Date |

Section 11.1 | |

| Tax Benefit |

Section 12.3 | |

| Tax Records |

Section 13.7(a) | |

| Third Party Claim |

Section 11.5(a) | |

| VFCP |

Section 13.8 | |

1.3. Interpretation. Unless otherwise specified herein or unless the context hereof otherwise requires, the following rules of interpretation apply:

(a) when used in this Agreement, the words “hereof,” “herein,” “hereunder” and “herewith” and words of similar import refer to this Agreement as a whole and not to any particular provision of this Agreement;

(b) all headings and captions contained in this Agreement are for convenience of reference only, do not constitute a part of this Agreement, and shall not affect in any way the meaning or interpretation of this Agreement;

(c) references herein to a “Section,” “Exhibit,” or “Schedule” are to the designated Section of the main body of this Agreement, or to the designated Exhibit or Schedule attached to this Agreement;

(d) whenever the words “include,” “includes” or “including” are used in this Agreement, they shall be deemed to be followed by the words “without limitation”;

(e) any singular term in this Agreement shall be deemed to include the plural, and any plural term the singular;

(f) words in this Agreement denoting any gender include the other gender;

(g) a defined term herein has its defined meaning throughout this Agreement and in each Exhibit, Schedule and Disclosure Schedule, regardless of whether such defined term appears before or after the place where it is defined;

(h) a reference herein to any, legislation or to any provision of any legislation shall include any amendment, modification or re-enactment thereof, any legislative provision substituted therefor and all regulations issued thereunder or pursuant thereto;

(i) references herein to “$” or “dollars” refer to U.S. dollars; and

- 10 -

(j) to the extent this Agreement refers to information or documents having been delivered, furnished, provided or made available to the Buyer, the Sellers shall be deemed to have satisfied such obligation if the Company, any Seller, any Affiliate of the Company or any Seller or any Representative of the Company or any Seller has delivered or provided such information or document (or made such information or document available by posting such information or document in the Shadow Document Room hosted by Firmex) to the Buyer or any Representative of the Buyer.

SECTION 2. SALE AND PURCHASE; CLOSING; NET ASSETS ADJUSTMENT

2.1. Sale and Purchase; Purchase Price.

(a) Sale and Purchase of Shares. On the terms and subject to the conditions set forth in this Agreement, at the Closing, each Seller will sell, assign, transfer and convey to the Buyer, and the Buyer will purchase and accept from such Seller, all of the Shares owned by such Seller (which number of Shares is set forth opposite such Seller’s name under the heading “Number of Shares Owned” on Exhibit A hereto).

(b) Purchase Price. The aggregate purchase price to be paid by the Buyer to the Sellers for the Shares (the “Purchase Price”) is (i) Ninety Eight Million Dollars ($98,000,000) (the “Closing Date Cash Consideration”), (ii) plus Six Million Dollars ($6,000,000) (the “Escrow Amount”), (iii) plus Fourteen Million Dollars ($14,000,000) (the “Part 12 Holdback”), (iv) plus the Net Assets Adjustment Payment, if any, that the Buyer is required to pay to the Seller Representative, on behalf of the Sellers, pursuant to Section 2.4(e), (v) plus Two Million Dollars ($2,000,000) (the “Net Assets Holdback”), and (iv) minus the Net Assets Adjustment Payment, if any, that the Seller Representative is required to instruct the Escrow Agent to release to the Buyer pursuant to Section 2.4(e).

2.2. Closing. The closing of the Contemplated Transactions (the “Closing”) shall take place (a) at 10:00 a.m. Central Time at the offices of Strasburger & Price, L.L.P., 901 Main Street, Suite 4400, Dallas, Texas, on the second business day after the first day on which all of the conditions set forth in Section 8 and Section 9 have been fulfilled or waived (other than any conditions that are not capable of being satisfied until the Closing, but subject to the satisfaction or waiver of those conditions), or (b) at such other date, time and place as the Company and the Buyer mutually agree upon in writing (the date on which the Closing actually occurs, the “Closing Date”). The Closing shall be deemed to have occurred and to be effective as of 12:01 a.m., Central Time on the Closing Date (the “Effective Time”).

2.3. Closing Deliverables.

(a) At the Closing, each Seller shall deliver to the Buyer the following:

- 11 -

(i) Either (A) the original certificates representing all of the Shares owned by such Seller, duly endorsed in blank by such Seller or accompanied by transfer powers duly endorsed in blank by such Seller, or (B) an affidavit of loss duly executed by such Seller, reasonably satisfactory in form to the Buyer; and

(ii) a certificate of non-foreign status duly executed by such Seller which meets the requirements of Treasury Regulations Section 1.14452(b)(2).

(b) At the Closing, the Company shall deliver to the Buyer:

(i) a certificate, in form and substance reasonably satisfactory to the Company and the Buyer, duly executed on behalf of the Company by an officer of the Company and certifying (A) the resolutions adopted by the Board of Directors of the Company approving the Contemplated Transactions, (B) the Company Organizational Documents and (C) the incumbency and specimen signature of each officer of the Company executing this Agreement and the Company Closing Documents;

(ii) duly executed resignations pursuant to which each officer of the Company resigns from all of his or her officer positions with the Company effective immediately after consummation of the Closing on the Closing Date;

(iii) duly executed resignations pursuant to which each member of the Company’s Board of Directors resigns his or her position on the Company’s Board of Directors effective immediately after consummation of the Closing on the Closing Date;

(iv) the corporate minute book of the Company;

(v) evidence, reasonably acceptable to the Buyer, of the pay off and termination of any credit facility to which the Company is a party;

(vi) executed copies of employment agreements between the Buyer and each of the following: Conrad Romberg (through March 31, 2011), Jeffery C. Sanders (through the 2nd anniversary of Closing) and John Payne (through the first anniversary of Closing);

(vii) executed copies of consulting agreements, in form and substance acceptable to the Buyer, between the Buyer and each of the following: John Reeves (for two years following Closing), and Conrad Romberg and Jeffery C. Sanders (commencing following the expiration of their employment term and continuing for an additional two years);

(viii) evidence, reasonably acceptable to the Buyer that the persons involved with the development of any Company Intellectual Property

- 12 -

have assigned any rights and interest in such Intellectual Property to the Company;

(c) At the Closing, the Buyer shall:

(i) deliver to the Sellers the Closing Date Cash Consideration, by wire transfer of immediately available funds to an account or accounts designated in writing by the Seller Representative to the Buyer;

(ii) deliver to the Escrow Agent (A) the Escrow Amount, and (B) the Net Assets Holdback, in each case by wire transfer of immediately available funds to an account or accounts designated in writing by the Escrow Agent to the Buyer;

(iii) deliver to the Seller Representative a certificate, in form and substance reasonably satisfactory to the Seller Representative and the Buyer, duly executed on behalf of the Buyer by an officer of the Buyer and certifying (A) the resolutions adopted by the Board of Directors of the Buyer approving the Contemplated Transactions, (B) the Organizational Documents of the Buyer and (C) the incumbency and specimen signature of each officer of the Buyer executing this Agreement and the Buyer Closing Documents;

(iv) deliver to the Seller Representative and the Escrow Agent the Escrow Agreement, duly executed by the Buyer;

(v) executed copies of employment agreements between the Buyer and each of the following: Conrad Romberg (through March 31, 2011), Jeffery C. Sanders (through the 2nd anniversary of Closing) and John Payne (through the first anniversary of Closing);

(vi) executed copies of consulting agreements, in form and substance acceptable to the Buyer, between the Buyer and each of the following: John Reeves (for two years following Closing), and Conrad Romberg and Jeffery C. Sanders (commencing following the expiration of their employment term and continuing for an additional two years).

(d) At the Closing, the Seller Representative shall deliver to the Buyer and the Escrow Agent the Escrow Agreement duly executed by the Seller Representative.

2.4. Net Assets Adjustment.

(a) As used herein, (i) the term “Net Assets” means the amount determined by subtracting the liabilities of the Company from the assets of the Company (and excluding from such calculation any deferred Tax assets or liabilities reflecting temporary differences between book and Tax income) and (ii) the term “Base Net Assets” means, he Net Assets of the Company as of

- 13 -

July 31, 2010, which was Sixteen Million Seven Thousand Fifteen Dollars ($16,007,015).

(b) At least five days prior to the Closing, the Seller Representative shall deliver to Buyer a written determination of the Net Assets as of 11:59 p.m. Central Time on November 30, 2010 (“Estimated Net Assets”), which written determination shall contain reasonable detail and supporting documents showing the computation of such determination and the components of assets and liabilities included therein. The principles, specifications and methodologies for determining Estimated Net Assets, including the components of the assets and the components of the liabilities to be included therein, shall be as specified in Schedule 2.4 and shall be consistent with the calculation of the Base Net Assets and GAAP. If Estimated Net Assets exceed Base Net Assets, the difference shall be added to the Closing Date Cash Consideration. If Estimated Net Assets are less than Base Net Assets, the Closing Date Cash Consideration shall be reduced by the difference.

(c) Within 60 days after the Effective Time, the Buyer shall deliver to the Seller Representative a written determination of the Net Assets as of 11:59 p.m. Central Time on the day before the Closing Date (“Closing Date Net Assets”), which written determination shall contain reasonable detail and supporting documents showing the computation of such determination and the components of assets and liabilities included therein. The principles, specifications and methodologies for determining Closing Date Net Assets, including the components of the assets and the components of the liabilities to be included therein, shall be as specified in Schedule 2.4. Each Party shall have reasonable access to the relevant financial books and records of the Company to confirm or audit Closing Date Net Assets computations. If the Seller Representative disagrees with the Buyer’s determination of Closing Date Net Assets, the Seller Representative shall notify the Buyer in writing within 20 days after the Buyer’s delivery of its determination of Closing Date Net Assets and state in reasonable detail the basis for such disagreement. Failure of the Seller Representative to deliver such a notice of disagreement within such 20 day period shall constitute the Sellers’ acceptance of the Buyer’s determination of Closing Date Net Assets as delivered to the Seller Representative under this Section 2.4. If the Seller Representative and the Buyer fail to agree within 30 days after the Seller Representative’s delivery of notice of disagreement on the amount of Closing Date Net Assets, such disagreement shall be resolved in accordance with the procedures set forth in Section 2.4(d), which shall be the sole and exclusive remedy for resolving disputes relative to the determination of the amount of Closing Date Net Assets under this Section 2.4.

(d) In the event that the Seller Representative and the Buyer are not able to agree on the Closing Date Net Assets within 30 days after the Seller Representative’s delivery of notice of disagreement pursuant to Section 2.4(c), the Seller Representative and the Buyer shall each have the right to require that

- 14 -

such disputed determination be submitted to BDO Seidman, or if BDO Seidman is not available for any reason or does not maintain its independent status, Grant Thornton, LLP or such other independent certified public accounting firm as the Seller Representative and Buyer may then promptly mutually agree upon in writing (the “Accounting Firm”) for computation or verification in accordance with the provisions of this Agreement. The Accounting Firm shall review the matters in dispute and, acting as arbitrator, shall promptly decide the proper amounts of such disputed entries (which decision shall also include a final calculation of Closing Date Net Assets). The submission of the disputed matter to the Accounting Firm shall be the exclusive remedy for resolving disputes relative to the determination of Closing Date Net Assets under this Section 2.4. If issues are submitted to the Accounting Firm for resolution, (i) each Seller, the Company and the Buyer shall furnish or cause to be furnished to the Accounting Firm such work papers and other documents and information relating to the disputed issues as the Accounting Firm may request and are available to that Party or its agents, and the Seller Representative and the Buyer shall be afforded the opportunity to present to the Accounting Firm any material relating to the disputed issues and to discuss the issues with the Accounting Firm; (ii) the determination by the Accounting Firm, as set forth in a notice to be delivered to both the Seller Representative and the Buyer within 60 days of the submission to the Accounting Firm, of the issues remaining in dispute, shall be final, binding and conclusive on the Parties and shall be used in the calculation of Closing Date Net Assets; and (iii) one-half of the Accounting Firm’s fees and expenses shall be paid by the Sellers, and one-half of such fees and expenses shall be paid by the Buyer. The final calculation of Closing Date Net Assets pursuant to this Section 2.4, as determined pursuant to this Section 2.4, is referred to herein as the “Closing Date Net Assets Calculation.”

(e) If the Closing Date Net Assets Calculation as finally agreed upon or determined pursuant to this Section 2.4 equals or exceeds the Estimated Net Assets, the Buyer shall direct the Escrow Agent to pay the Seller Representative, on behalf of the Sellers the Net Assets Holdback. In addition, if the Closing Date Net Assets Calculation exceeds the Estimated Net Assets, then the Buyer shall pay to the Seller Representative, on behalf of the Sellers, an amount equal to such excess with interest. If the Estimated Net Assets exceed the Closing Date Net Assets Calculation as finally agreed upon or determined pursuant to this Section 2.4, the Seller Representative shall direct the Escrow Agent to pay the Buyer out of the Net Assets Holdback an amount equal to such excess with interest. If the difference between the Estimated Net Assets and the Closing Date Net Assets Calculation exceeds the Net Assets Holdback, then the Sellers (on a several basis) will pay the amount of such excess to the Buyer. Any payment required to be made pursuant to this Section 2.4(e), is referred to as the “Net Assets Adjustment Payment.” The Net Assets Adjustment Payment, together with interest thereon from the Closing Date until the date of payment at the rate of interest published as the “Prime Rate” in the “Money Rates” column of

- 15 -

the Southwest Edition of The Wall Street Journal (or the average of such rates if more than one rate is indicated) on the Closing Date, shall be paid by the Escrow Agent and, if applicable, the Buyer to the Seller Representative, by the Escrow Agent to the Buyer or by the Sellers to the Buyer, as the case may be, by wire transfer of immediately available funds to an account designated in writing by the Party that is to receive the Net Assets Adjustment Payment, not later than five days after the amount of the Net Assets Adjustment Payment is finally agreed upon or determined pursuant to this Section 2.4. After payment of the Net Assets Adjustment Payment or if no Net Assets Adjustment Payment is required, any amount of the Net Assets Holdback and any interest thereon remaining on deposit with the Escrow Agent, if any, shall be paid to the Seller Representative, on behalf of the Sellers.

2.5. Part 12 Holdback.

(a) Holdback Generally. The $14,000,000 Part 12 Holdback will be held in a separate escrow account and will be released to the Sellers incrementally over three years ($5,000,000 thirty days after the first anniversary of the Closing, $5,000,000 thirty days after the second anniversary and the balance thirty days after the third anniversary, subject to actual and pending claims). The Part 12 Holdback account shall bear interest at money market interest rates for the benefit of the party ultimately receiving such funds.

(b) Types of Claims. The Part 12 Holdback will be paid to the Sellers unless the Company has been unsuccessful in defending a challenge to Federal Acquisition Regulations Part 12 classification. The defense of a Part 12 classification challenge will be considered unsuccessful for purposes of the Part 12 Holdback, if and only if, one of the following events occurs: (i) a challenged commercial catalog product is sold on a Part 15 basis (a “Part 15 Claim”), or (ii) a contract is rejected because the purchaser will only buy a commercial catalog product on a Part 15 basis and the Company refuses to sell the product on that basis, as defined by the decision tree shown in Exhibit B “Rejection Business Claim Decision Tree” (a “Rejection Claim”).

(c) EBITDA Thresholds. Notwithstanding the foregoing, no claim against the Part 12 Holdback shall be paid for a Rejection Claim incurred during a particular year if the Company’s actual EBITDA meets or exceeds the forecasted EBITDA for the relevant year. For purposes of the payment of the Part 12 Holdback, the forecasted EBITDA for each year during the Part 12 Holdback period is:

Jan-Dec 2011: $14,548,000

Jan-Dec 2012: $15,994,000

- 16 -

Jan-Dec 2013: $18,733,000

For purposes of this Agreement, EBITDA will be understood to mean the earnings of the Company before adjustments for interest, taxes, depreciation and amortization, all calculated on a GAAP basis from the Company’s regularly prepared financial statements.

(d) Determination of Claim Amount.

(i) For Part 15 Claims, the amount of the Buyer’s claim will be calculated by deducting the net present value (using a 5% discount rate) of the stream of payments anticipated to be received under the accepted contract from the net present value (using a 5% discount rate) of the same stream of payments if the purchaser had paid the gross commercial catalog sales price for the products. The anticipated ship dates in the supply agreement or purchase order will be used as the anticipated payment dates for purposes of the net present value calculation. The Buyer will assert claims against the Part 12 Holdback promptly after the Company’s acceptance of the supply agreement or purchase order, but in any event, prior to the final distribution of the Part 12 Holdback.

(ii) For Rejection Claims, the amount of the claim will be 31% of the then-current gross commercial catalog sales price for products identified on a refused contract. Rejection Claims will be asserted by the Buyer within 30 days following the final determination of EBITDA for the period relating to the claim. For example, if 10 units were to have been delivered in March 2011 and 20 units in September 2011, the Buyer will submit a Rejection Claim, if applicable, with respect to the 30 units in January 2012. If the rejected contract included shipments after the third anniversary of the Closing, the claim related to those shipments will be discounted (at a 5% discount rate) back to the third anniversary of the Closing Date. Such Rejection Claims with respect to shipments scheduled following the third anniversary will be permitted only if the applicable EBITDA threshold was not met for the final period of the Part 12 Holdback period.

(e) Other Part 12 Holdback Procedures. If a Request for Proposal (“RFP”) or Request for Quotation (“RFQ”) has not been finally accepted or rejected but an annual distribution to the Sellers is upcoming, the Buyer may submit a notice to the Escrow Agent causing that such distribution shall be delayed until after it is determined if either a Part 15 Claim or a Rejection Claim may be asserted with respect to the subject contract. Any challenge to Part 12 classification arising with respect to proposals or solicitations first submitted after the third anniversary of the Closing will not result in any claim against the sellers or adjustment to the purchase price. In no event shall the total Part 12 indemnification claims exceed the Part 12 Holdback. On a given distribution date, if there are no pending claims, the Escrow Agent will distribute to the Sellers, pro rata in accordance with their Share ownership, (i) the amount to be distributed on such date pursuant to Section 2.5(a), minus (ii) the amount of any

- 17 -

Part 15 Claim and Rejection Claim payments made to the Buyer during such annual period, plus (iii) the amount of interest earned on the amount to be distributed to the Sellers. If a claim is currently pending at the time of the distribution of the holdback, only the potential amount of such claim shall be held back and the distribution of that potential claim shall be made within five business days of the resolution of the last of the pending claims.

2.6. The Seller Representative.

(a) Each Seller hereby constitutes and appoints Jeffery C. Sanders as its representative and true and lawful agent and attorney-in-fact (in such capacity, the “Seller Representative”) with full power and authority in each of their names and on behalf of each of them:

(i) to act on behalf of each of them in the absolute discretion of the Seller Representative, but only with respect to the following provisions of this Agreement, with the power to: (A) designate the account for payment of any payments to be made to such Seller pursuant to this Agreement; (B) act pursuant to Section 2.4 with respect to the Estimated Net Assets and Closing Date Net Assets Calculation determinations and all other determinations related thereto; (C) execute and deliver any waiver, consent or amendment under or pursuant to this Agreement; (D) act, with specific direction from the Sellers, as applicable, in connection with any matter as to which the Sellers have or are alleged to have indemnity obligations, or as to which any Seller is or claims to be an Indemnified Party under Section 11; (E) act, give and receive notices pursuant to any provision of this Agreement; (F) execute, with specific direction from the Sellers, waivers on behalf of the Sellers as contemplated by Section 14.2; and (G) receive and accept such notices or correspondence, execute such other documents, and take such other actions as are provided herein to be received, accepted, executed or taken by the Seller Representative; and

(ii) in general, to do all things and to perform all acts, including executing and delivering all agreements, certificates, receipts, instructions and other instruments contemplated by or deemed advisable, to effectuate the provisions of this Section 2.4(e).

(b) The foregoing appointment and grant of power and authority is coupled with an interest and is in consideration of the mutual covenants made herein and is irrevocable and shall not be terminated by any act of any Seller or by operation of Law or by the occurrence of any other event. By execution of the “Acceptance and Agreement of Seller Representative” attached hereto, Jeffery C. Sanders accepts such appointment and grant.

(c) Each Seller consents to the taking by the Seller Representative of any and all actions and the making by the Seller Representative of any decisions required or permitted to be taken or made by the Seller Representative pursuant

- 18 -

to this Section 2.4(e), and agrees that each such action or decision shall bind such Seller.

(d) Each Seller agrees that the Seller Representative shall have no obligation or liability to any Person for any action or omission taken or omitted by the Seller Representative in good faith hereunder.

(e) The Buyer shall be entitled to conclusively rely, without any independent verification or inquiry, upon any document or notice delivered by the Seller Representative or upon any other action taken by the Seller Representative as (i) genuine and correct and (ii) having been duly signed or sent or taken by the Seller Representative.

(f) Payments made to or as directed by the Seller Representative under Section 2.3(c), Section 2.6 or any other provision of this Agreement are sufficient and binding to the same extent as though such payments were made directly to the appropriate Seller. The Buyer shall not have any responsibility or liability for any further delivery or application of any such payment, it being agreed by the Sellers that, on the terms set forth herein, (i) any payment the Buyer is required to make hereunder to any Seller may be made to or as directed by the Seller Representative on behalf of such Seller, as the case may be, (ii) the Sellers shall determine among themselves the amount due to each Seller from each payment made to or as directed by the Seller Representative hereunder, and (iii) each Seller shall look solely to the Seller Representative for such Seller’s respective share of any payment made to or as directed by the Seller Representative hereunder.

(g) The Seller Representative or any successor thereto may appoint a successor Seller Representative (the “Successor Seller Representative”). To be effective, such appointment must be (i) written, (ii) signed by the outgoing Seller Representative or outgoing Successor Seller Representative as the Seller Representative hereunder, (iii) indicate such appointment, (iv) signed by the Successor Seller Representative to indicate its acceptance of such appointment and its agreement to be bound by the terms hereof pertaining to the Seller Representative, and (v) delivered to the Buyer. Upon such an appointment of a Successor Seller Representative under this Agreement, such Successor Seller Representative will succeed to and become vested with all of the rights, powers, privileges and duties of the Seller Representative, and the predecessor Seller Representative shall be discharged from such predecessor Seller Representative’s duties and obligations under this Agreement.

2.7. Escrow Amount. The Escrow Amount will be available to satisfy indemnity claims made by the Buyer pursuant to Section 11, and any amount remaining available after 18 months from the Closing (not subject to a pending claim) will be released to the Seller Representative for distribution to the Sellers, all as provided for in more detail in the Escrow Agreement.

- 19 -

2.8. Tax Withholding. If Buyer determines that the withholding of any amount from the consideration payable to Sellers pursuant to this Agreement is required under any applicable Legal Requirements, Buyer will give reasonable advance written notice to Seller of such withholding obligation. Buyer will be entitled to deduct and withhold from any such payments such amounts as Buyer reasonably determines are required to be deducted and withheld with respect to the making of such payment under applicable Legal Requirements. To the extent that amounts are so withheld and are paid over for Sellers’ account according to applicable Legal Requirements, such amounts will be treated for all purposes of this Agreement as having been paid to Sellers as provided in the Agreement. If Buyer’s obligation to withhold with respect to a payment to Sellers can be reduced or eliminated through the provision of a certification or applicable form, Buyer shall provide Sellers with a reasonable opportunity to provide such certification or form.

SECTION 3. REPRESENTATIONS AND WARRANTIES OF THE SELLERS

Each Seller, severally and not jointly, represents and warrants to the Buyer as follows:

3.1. Power and Authority; Authorization and Execution; Enforceability. Such Seller has full capacity and power to execute and deliver this Agreement and to perform such Seller’s obligations hereunder. This Agreement has been duly executed and delivered by such Seller and, subject to due execution by the other Sellers, the Company and the Buyer, constitutes the legal, valid and binding obligations of such Seller, enforceable against such Seller in accordance with its respective terms, subject to applicable reorganization, insolvency, moratorium and other laws affecting creditors’ rights generally and general equitable remedies.

3.2. Noncontravention. Such Seller’s execution, delivery and performance and the consummation of the transactions contemplated by this Agreement will not violate in any material respect any Legal Requirement, judgment, award or decree or any material agreement or other instrument to which such Seller is a party, or by which such Seller or such Seller’s properties or assets are bound, or result in a breach of or constitute a material default under any such agreement or other instrument.

3.3. Ownership of Shares; Transfer. Such Seller is the record and beneficial owner of the Shares shown as owned by such Seller on Exhibit A, free and clear of any and all Liens and such Seller does not own any other equity, phantom or quasi-equity interest in the Company or any instrument convertible into or exchangeable for an equity or quasi-equity interest in the Company. Such Seller has not granted and is not a party to any agreement granting purchase rights, preemptive rights, rights of first refusal or any similar or comparable rights with respect to the Shares owned by such Seller. At Closing, the delivery by such Seller of the Certificates evidencing the Shares owned by such Seller, duly endorsed for transfer or accompanied by transfer powers duly endorsed in blank, to the Buyer, will transfer ownership of such Shares free and clear of any and all Liens.

- 20 -

3.4. Brokers’ or Finders’ Fees. All negotiations relative to this Agreement and the transactions contemplated hereby have been carried out by such Seller directly with the Buyer, without the intervention of any Person on behalf of such Seller in such manner as to give rise to any valid claim by any Person against the Buyer for a finder’s fee, brokerage commission or similar payment, other than the claim of PBW.

SECTION 4. REPRESENTATIONS AND WARRANTIES OF THE COMPANY

The Company represents and warrants to the Buyer as follows:

4.1. Formation, Existence and Good Standing. The Company is a corporation duly organized, validly existing and in good standing under the laws of the State of Texas.

4.2. Power and Authority; Authorization and Execution; Enforceability. The Company has all requisite corporate power and authority to execute and deliver and perform its obligations under, this Agreement and the Company Closing Documents. The execution, delivery and performance by the Company of this Agreement and the Company Closing Documents have been duly authorized by all necessary corporate action on the part of the Company. This Agreement has been, and the Company Closing Documents will have been when delivered by the Company, duly executed and delivered by the Company and constitute or will constitute (when so delivered) legal, valid and binding obligations of the Company, enforceable in accordance with their respective terms except as such enforceability may be limited by (a) applicable bankruptcy, reorganization, insolvency, moratorium and similar Legal Requirements affecting the enforcement of creditors’ rights generally and (b) general equitable principles (regardless of whether enforceability is considered in a Proceeding at law or in equity).

4.3. Governmental Consents. The execution, delivery and performance of this Agreement by the Company will not require any Consent of, or filing by the Company with or notification by the Company to, any Governmental Body, except (a) as set forth in Section 4.3 of the Company Disclosure Schedule and (b) where the failure to obtain such Consents, or to make such filings or notifications, would not (i) prevent or materially delay the consummation of the Closing, (ii) otherwise prevent or materially delay performance by the Company of any of its material obligations under this Agreement, or (iii) reasonably be expected to materially affect the Company.

4.4. No Conflicts. The execution, delivery and performance of this Agreement by the Company will not (a) conflict with or violate any provision of the Organizational Documents of the Company, (b) assuming that all Consents described in Section 4.3, or in Section 4.4 of the Company Disclosure Schedule, will have been obtained at or prior to the Closing and all filings and notifications described in Section 4.3 will have been made at or prior to the Closing, be in material conflict with, constitute a material; default under or materially violate any Legal Requirement applicable to the Company, or (c) except as shown in Section 4.4 of the Company Disclosure Schedule, require

- 21 -

any Consent under, result in any breach of or any loss of any benefit under, or constitute a default (or an event which with notice or lapse of time or both would become a default) under, or give to others any right of termination, vesting, amendment, acceleration or cancellation of, or result in the creation of a Lien on any property or asset of the Company pursuant to, any material Contract to which the Company is a party or by which any of its properties or assets are bound.

4.5. Qualification as a Foreign Corporation. Section 4.5 of the Company Disclosure Schedule sets forth a complete and accurate list of the jurisdictions in which the Company is qualified to do business as a foreign corporation. There are no other jurisdictions in which the Company is required to qualify to do business as a foreign entity, except where failure to do so would not reasonably be expected to have a Material Adverse Effect.

4.6. Organizational Documents; Minute Books. The Company has delivered or made available to the Buyer complete and accurate copies of the Company’s Organizational Documents. Except as set forth in Section 4.6 of the Company Disclosure Schedule, the minutes of meetings and consents in lieu of meetings contained in such minute books of the Company, all of which have been made available to the Buyer, accurately reflect in all material respects all actions, by way of vote or resolution, taken by the Shareholders and Board of Directors of the Company.

4.7. Capitalization.

(a) The authorized capital stock of the Company consists solely of 100,000 shares of Common Stock, of which 1,500 shares are issued and outstanding and held of record as shown on Exhibit A. All of the issued and outstanding shares of the Company are owned of record legally by the Sellers in the amounts as set forth on Exhibit A.

(b) No Person owns or has any rights to any shares of the Company or to acquire any shares of the Company that is not set forth on Exhibit A. There are no Contracts relating to the issuance, sale or transfer of any equity securities or other securities of the Company, nor are there outstanding any securities or obligations that are convertible into or exchangeable for any shares of capital stock of the Company. Each of the Shares is duly authorized, validly issued and outstanding, fully paid and non-assessable, and were offered and sold in compliance with all applicable state and Federal securities laws, rules and regulations. None of the Shares are subject to any right of first refusal in favor of any Person. The Company has not granted and is not a party to any agreement granting control of the Company or preemptive rights, rights of first refusal or comparable rights with respect to the shares of the Company. There are no stock appreciation rights, phantom stock or similar rights in existence with respect to the Company. There are no voting trusts, proxies, or other

- 22 -

agreements or understandings with respect to the voting of any capital stock of the Company.

4.8. No Subsidiaries. The Company does not have any subsidiaries, own any shares of stock or any equity interest in any partnership, limited liability company or other entity.

4.9. Financial Statements.

(a) The Company has delivered to the Buyer the following financial statements (the “Financial Statements”):

(i) an audited balance sheet of the Company as at July 31, 2009, and the related audited statement of earnings and statement of cash flows of the Company for the fiscal year then ended;

(ii) an audited balance sheet of the Company as at July 31, 2008, and reviewed statements of earnings and combined statement of cash flows of the Company for the fiscal year then ended; and

(iii) an audited balance sheet of the Company as at the Interim Balance Sheet Date (the “Interim Balance Sheet”), and the related audited statement of earnings and combined statement of cash flows of the Company for the fiscal year then ended.

(b) Except as set forth in Section 4.9 of the Company Disclosure Schedule, (i) the Financial Statements fairly present in all material respects the financial position of the Company as at the indicated dates, and the operating results and cash flows of the Company for the indicated periods and (ii) the Financial Statements have been prepared in accordance with GAAP (subject to the absence of footnote disclosure and other presentation items and to changes resulting from normal period-end adjustments) applied on a consistent basis throughout the periods covered.

4.10. No Undisclosed Liabilities. Except as set forth in Section 4.10 of the Company Disclosure Schedule, the Company has no material Liabilities except for (a) Liabilities reflected on the Interim Balance Sheet, (b) Liabilities incurred after the Interim Balance Sheet Date in the Ordinary Course of Business, and (c) Liabilities of a type that would not be required to be set forth on a balance sheet of the Company prepared in conformity with GAAP.

4.11. Changes Since Interim Balance Sheet Date. Since the Interim Balance Sheet Date, except as otherwise required or permitted by this Agreement or as set forth in Section 4.11 of the Company Disclosure Schedule, the Company has not:

(a) amended its Organizational Documents;

- 23 -

(b) made any sale or other transfer of any material asset, except sales of Inventory in the Ordinary Course of Business;

(c) entered into, amended or terminated any Contract, or effected any other transaction affecting its business, operations, assets or Liabilities, except (i) in the Ordinary Course of Business, or (ii) to the extent any such Contract or transaction requires aggregate payments to or from the Company after the Interim Balance Sheet Date not in excess of $75,000 per year;

(d) permitted any increase in its aggregate obligations under any operating lease to which it is a party involving personal property having a fair market value in excess of $75,000 in respect of any single operating lease or which, when added to all other such increases made by the Company after the Interim Balance Sheet Date, exceeds $150,000 in the aggregate for the Company;

(e) made any single capital expenditure in excess of $75,000, or made capital expenditures which, when added to all other such capital expenditures made by the Company after the Interim Balance Sheet Date, exceed $150,000 in the aggregate for the Company;

(f) waived, cancelled or compromised any right to receive any material payment or other material benefit owing to it, other than in the Ordinary Course of Business;

(g) settled or compromised any claim or Proceeding, other than monetary settlements the uninsured portion of which does not exceed $75,000, individually, or which, when added to the uninsured portion of all other such settlements or compromises entered into by the Company after the Interim Balance Sheet Date, does not exceed $150,000 in the aggregate for the Company;

(h) created, incurred, assumed, guaranteed, endorsed, refinanced, modified, extended, renewed or otherwise become liable for any indebtedness for borrowed money in excess of $75,000, except for borrowings in the Ordinary Course of Business pursuant to existing credit facilities disclosed pursuant to Section 4.13(a);

(i) entered into any employment agreement with, or granted any increase in the rate of wages, salaries, bonuses, benefits, severance or other remuneration of, any of its officers or employees, except for increases in salaries or wages in the Ordinary Course of Business;

(j) terminated the employment of any of its officers or any other member of its senior management;

- 24 -

(k) made any material bonus, pension, retirement or profit sharing distribution or payment of any kind, except in the Ordinary Course of Business;

(l) increased the benefits under, or established, amended or terminated, any bonus, insurance, severance, termination pay, deferred compensation, pension, retirement, profit sharing, option or other plan (including any Benefit Plan), except for amendments required by applicable Legal Requirements or increases in salaries or wages in the Ordinary Course of Business;

(m) made any material change to any of its financial reporting or accounting practices or policies;

(n) changed or rescinded any material Tax election, filed any amended Tax Return, executed any written waiver or extension of the statute of limitations in respect of material Taxes for which the Company may be liable, settled or compromised any material Tax liability, or surrendered any right or claim for a Tax refund;

(o) made any revaluation of any of its material assets, including the writing down or off of any material accounts receivable and the writing down of the value of any material portion of its Inventory, other than in the Ordinary Course of Business;

(p) agreed to do any of the foregoing;

(q) experienced any damage, destruction or casualty loss affecting any asset or property used in its business, the uninsured amount of which damage or destruction exceeds $75,000 in respect of any single asset or which, when added to the uninsured portion of all other such damages or destructions experienced by the Company after the Interim Balance Sheet Date, exceeds $150,000 in the aggregate; or

(r) experienced any Material Adverse Effect.

4.12. Real and Personal Property.

(a) The Company does not own any real property.

(b) Section 4.12(b) of the Disclosure Schedule lists all real property leased or subleased to the Company (the “Leased Real Property”). The Company has good and valid leasehold or use rights with respect to such parcel of leased real property, free and clear of any Liens except for Permitted Liens. To the Knowledge of the Company, each lease and sublease listed in Section 4.12(b) of the Company Disclosure Schedule is legal, valid, binding and enforceable and is in full force and effect, except where the illegality, invalidity, nonbinding nature, unenforceability or ineffectiveness would not have a Material

- 25 -

Adverse Effect. The Company has not received any written notice from any lessor under such leases asserting the existence of a default under any such lease or that the lessor has taken action, or, to the Knowledge of the Company, threatened, to terminate the lease prior to the expiration date specified in the lease.

(c) Except as set forth in Section 4.12(c) of the Company Disclosure Schedule and except for Permitted Liens, (a) the Company has valid title to, or in the case of leased tangible personal property, valid leasehold interests in, all of the tangible personal property owned or leased by it and used or held for use in its business, and (b) to the Knowledge of the Company, no material defects exist with respect to the condition of such tangible personal property that would reasonably be expected to interfere in any material respect with the continued use and operation thereof as the same is currently used and operated by the Company.

4.13. Contracts.