Attached files

| file | filename |

|---|---|

| 8-K - U.S. CONCRETE, INC. 8-K - U.S. CONCRETE, INC. | usconcrete8k.htm |

Exhibit 99.1

Davenport Infrastructure & Basic Industries Conference March 3, 2011

Forward-Looking Statement Certain statements provided in this presentation, including those that express a belief, expectation or intention and those that are not of historical fact, are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements involve a number of risks and uncertainties and are intended to qualify for the safe harbors from liability established by the Private Securities Litigation Reform Act of 1995. These risks and uncertainties may cause actual results to differ materially from expected results and are described in detail in filings made by U.S. Concrete, Inc. (the “Company”) with the Securities and Exchange Commission, including the Company’s Annual Report on Form 10-K for the year ended December 31, 2009 and subsequent Quarterly Reports on Form 10-Q. The forward-looking statements speak only as of the date of this presentation. Investors are cautioned not to rely unduly on them. Many of these forward-looking statements are based on expectations and assumptions about future events that may prove to be inaccurate. The Company’s management considers these expectations and assumptions to be reasonable, but they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond the Company’s control. The Company undertakes no obligation to update these statements unless required by applicable securities laws.Also, this presentation will contain various financial measures not in conformity with generally accepted accounting principles (“GAAP”). A reconciliation to the most comparable GAAP financial measure can be found at the end of this presentation.

Company Overview

Company Overview Top 10 Producer of Ready Mixed Concrete in the U.S. Ready mixed concrete 3.8 million cubic yards in 2010 102 fixed concrete and 11 portable plants Leading market position in 4 regions Precast products Seven production facilities Serving 3 states Aggregate business 7 producing aggregate facilities 2 of 7 aggregate facilities leased to third parties

Revenue by Business Segment 2010 Revenue 2009 Revenue $57 $56 $428 Ready-Mix Precast $400

Note: Ready-Mix revenue net of intersegment sales

Broad Geographic Footprint FIXED READY-MIXED PRECAST AGGREGATES San Francisco San Jose Headquarters

Quality Asset Base113 ready mixed concrete plants producing 3.8 million cubic yards of concrete 7 aggregate quarries with 76 million tons of estimated reserves 7 pre-cast concrete plants generating $56 million in annual revenue 800+ ready-mixed concrete trucks 1,232 other vehicles $29 million book value of owned real estate

Annual Revenue and Mix Trend Ready-Mixed Only Consolidated Revenue Note: 2005 – 2007 includes Michigan revenue 2006 2008 2009 2007 2010 $ 685.4 $ 485.4 $ 455.7 2005 $900.0 $800.0 $700.0 $600.0 $500.0 $400.0 $300.0 $200.0 $100.0 $ 525.6 $ 728.5 $ 803.8 Commercial Residential Public Works 2005 45.9% 50.4% 3.7% 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 2006 50.5% 42.2% 7.3% 2007 49.1% 35.0% 16.0% 2008 54.7% 26.0% 19.3% 2009 54.7% 18.9% 26.4% 2010 53.0% 19.5% 27.5%

Industry Overview

Large, Fragmented Market Concrete Products Market Size Over $43.2 billion in annual revenue More than 2,300 independent ready-mixed concrete producers More than 3,500 precast concrete manufacturers Increasing vertical integration among cement, aggregates and concrete producers Source: National Ready-Mixed Concrete Association and National Precast Concrete Association ($ in billions) $60.0 $40.0 $20.0 $0.0 Pre-Cast Ready Mixed $24.7 $18.5

Route to Market Ready mixed concrete and concrete products are the principle route to market for CONCRETE PRODUCTS both cement and aggregates

CEMENTITIOUS ASPHALT + CONSTRUCTION SERVICES Merchants/DIY Local Authorities / Highway Agency Indicates amount of volume moved through each product

Civil Engineering Contractors General Contractors/ Self Builders Home Builders CUSTOMERS BITUMEN MORTAR READY MIX AGGREGATES

cement blended cement Fly-ash Slag Inland Agg. Marine Agg. 5% 75% 15% 5% 2% 22% 36% 15% 25%

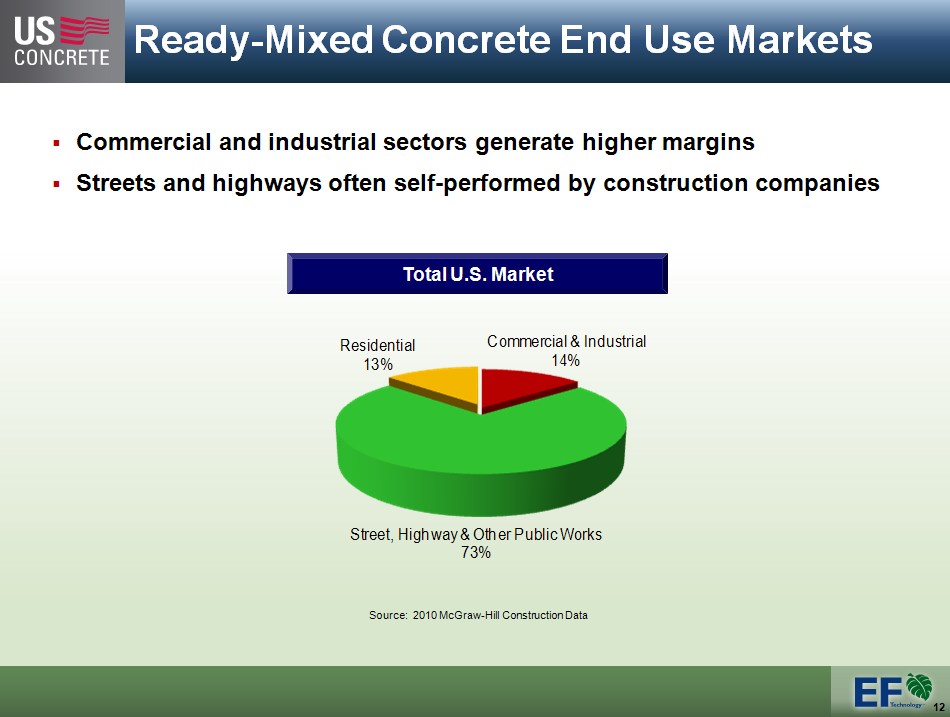

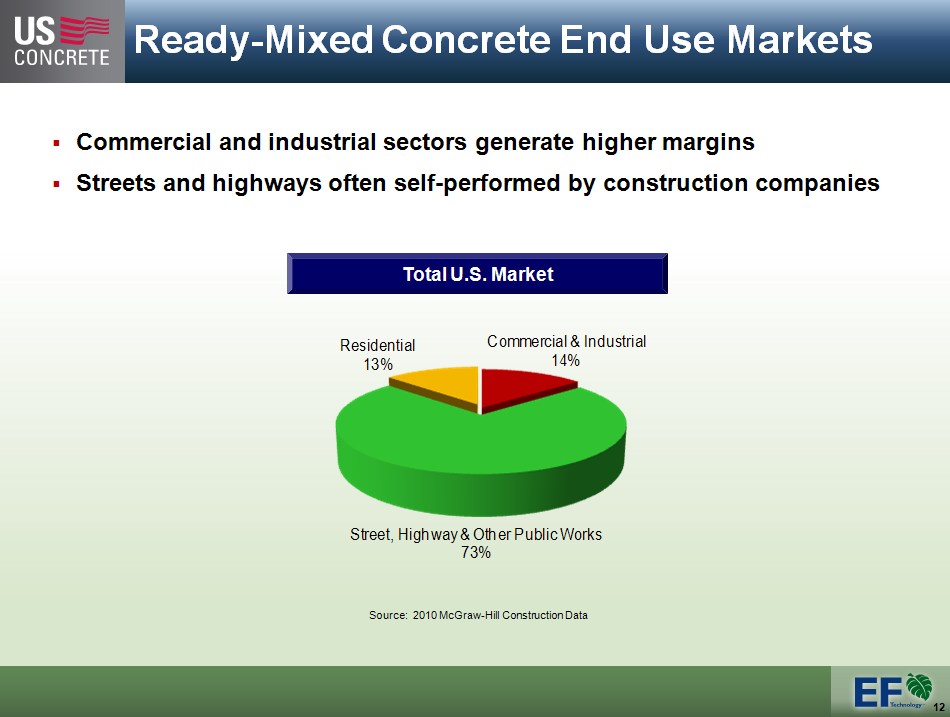

Ready-Mixed Concrete End Use Markets Commercial and industrial sectors generate higher margins Streets and highways often self-performed by construction companies

Total U.S. Market Residential 13% Commercial & Industrial 14% Street, Highway & Other Public Works 73% Source: 2010 McGraw-Hill Construction Data

Economic Conditions and Forecast

Construction Outlook The outlook for the US construction industry and consequent demand for concrete will be shaped by public policy action in the short-term.

The US construction industry is expected to produce year-over-year growth for the first time since 2006; total US construction starts are forecasted to

increase 3% in 2010 to a dollar value of $432.0 billion after declining approximately 25% in 2009.Although 2010 construction starts were projected to grow from their 2009 level, on a dollar value basis, they remain 37% below their 2006 peak of $689.0 billion. Total U.S. Construction Starts Growth (YOY % Growth) Total U.S. Construction Starts ($ in billions) Source: McGraw-Hill 2010 Construction Outlook 2005 13% 2006 3% 2007 -7% 2008 -13%

2009 -25% 2010 3% 2005 $670 2006 $690 2007 $641 2008 $555 2009 $419 2010 $432 15% 10% 0% -5% -10% -15% -20% -25% -30% 2005 2006 2007 2008 2009 2010 $800 $700 $600 $500 $400 $300 $200 $100 $0

Residential Demand Number of Starts 2005 1,719 354 2006 1,474 338 2007 1,038 306 2008 617 282 2009 440 113

2010 476 126 2011 492 155 2012 690 190 2013 945 240 2014 1,175 325 2015 1,236 355 2,500 2,000 1,500 1,000, 500 0 Single Family Multi-Family 6.3% (12.6%) (26.0%) (33.1%) (39.0%) 8.9% 7.5% 36.0% 34.7% 26.6% 6.1%

Note: PCA Fall 2010

Commercial Demand Metric Tons of Cement 2009 6,092 2010 4,503 2011 4,266 2012 4,372 2013 5,766 2014 8,863 2015 12,620 (26.1%)

(5.3%) 2.5% 31.9% 53.7% 42.4% 14,000 12,000 10,000 8,000 6,000 4,000 2,000 0 (000's) Note: PCA Fall 2010

Public Construction Demand Metric Tons of Cement 2009 35,770 2010 36,495 2011 36,590 2012 35,375 2013 39,230 2014 45,302 2015 50,277 2009 $35,770.0 2010 $36,495.0 2011 $36,590.0 2012 $35,375.0 2013 $39,230.0 2014 $45,302.0 2015 $50,277.0 (000's) 60,000 50,000 40,000 30,000 20,000 10,000 0

Company Strategy and Focus

Strategic Plan - Key Elements Market and Customer Segmentation Reposition existing customer and product mix Promote value-added products Change the “point-of-sale” Pursue sustainable construction market

Maximize Operational Excellence Be a low cost operator Provide outstanding customer service Eliminate waste and inefficiencies Exploit systems and technology advantage Evaluate Assets, Business Units and Opportunities

Long-term market demand conditions Customer mix versus market demand Vertically integrated competition ROI and capital requirements

Our Focus Today Continue to aggressively manage through current economic cycle Closely monitor liquidity Limit capital spending to internally generated cash flow Evaluate assets, business units and opportunities

Ensure assets are delivering appropriate returns Develop plan to improve underperforming operations Stick to our knitting Maximize value of our existing operations Focus on value-added products, customer service and operating efficiency Pursue Strategic Development Opportunities Look to businesses that enhance existing position, such as aggregates Utilize creative structures to limit capital investment required

Financial Summary

Performance Summary analysis Volume and Price Trend Revenue, EBITDA and Margin Trend Volume ASP 2008 5,674 $96.19 2009 3,948 $96.38 2010 3,805 $92.54

2008 $685.4 $41.1 6.0% 2009 $485.4 $16.7 3.4% 2010 $455.7 $12.5 2.7% 6,000 5,000 4,000 3,000 2,000 1,000 Down 32.9%

Down 3.8 % Down 33.5% Down 330 BP Down 69.6% $800.0 $700.0 $600.0 $500.0 $400.0 $300.0 $200.0 $100.0 $97.00 $96.00 $95.00 $94.00 $93.00 $92.00 $91.00 $90.00

Revenue EBITDA % margin 8.0% 7.0% 6.0% 5.0% 4.0% 3.0% 2.0% 1.0%

2010 Highlights Restructuring of balance sheet completed with long-term debt reduced by $243.0 million Ready-mixed and precast backlog increased significantly from 2009 yearend Relatively stable raw material spread 44.2% Average sales price appears to be stabilizing 4th quarter 2010 revenues up 3.3% over prior year on an 8.6% increase in ready-mixed volume

Condensed consolidated Balance sheet December 31, 2010 December 31, 2009 (in thousands) (unaudited) ASSETS Cash $5,290 $4,229

Other current assets 118,127 124,360 Property, plant and equipment, net 138,757 239,917 Goodwill and other assets 13,224 20,654 Total assets $275,398 $389,160 LIABILITY

Current liabilities $85,199 $94,108 Long-term debt, net of current maturities 52,370 288,669 Other long-term liabilities 12,165 16,574 Equity and noncontrolling interest 125,664 (10,191) Total liabilities and equity $275,398 $389,160

Liquidity Summary December 31, 2010 September 30, 2010 Remaining Revolver Capacity $30.6 $34.0 Cash 5.3 4.6 Note: Total liquidity expected to decline during 1Q2011.

Trend in Average Selling Prices % Change Versus Prior Year Comparable Period Pricing appears to be stabilizing Oct-09 2.0%

Nov-09 -1.7% Dec-09 -2.4% Jan-10 -7.5% Feb-10 -1.1% Mar-10 -5.5% Apr-10 -5.5% May-10 -2.7% Jun-10 -5.1% Jul-10 -5.6% Aug-10 -5.6% Sep-10 -2.9% Oct-10 -2.7% Nov-10 1.4% Dec-10 -1.0% Jan-11 0.8%

4.0% 2.0% 0.0% -2.0% -4.0% -6.0% -8.0%

Nov-09 -1.7% Dec-09 -2.4% Jan-10 -7.5% Feb-10 -1.1% Mar-10 -5.5% Apr-10 -5.5% May-10 -2.7% Jun-10 -5.1% Jul-10 -5.6% Aug-10 -5.6% Sep-10 -2.9% Oct-10 -2.7% Nov-10 1.4% Dec-10 -1.0% Jan-11 0.8%

4.0% 2.0% 0.0% -2.0% -4.0% -6.0% -8.0%

Percent Change in Backlog Versus Prior Year Period JAN -28.8% 40.0% 30.0% 20.0% 10.0% 0.0% -40.0% -30.0% -20.0% -10.0% FEB -23.7% MAR

-26.2% APR -30.0% MAY -21.6% JUN -15.5% JUL -20.2%AUG -20.6% SEP -23.4% OCT -23.5% NOV -21.2% DEC

-14.9% JAN -10.0% FEB -3.9% MAR 4.5% APR 28.8% MAY 15.2% JUN 10.3%JUL 10.8% AUG 9.7% SEP 11.8% OCT 15.3% NOV 21.2% DEC 27.6%

Percent Change in Backlog Versus Prior Year Period JUN -15.5% JUL -20.2%

AUG -20.6% SEP -23.4% OCT -23.5% NOV -21.2% DEC -14.9% JAN -10.0% FEB -3.9% MAR 4.5% APR 28.8% MAY 15.2%

JUN 10.3% JUL 10.8% AUG 9.7% SEP 11.8% OCT 15.3% NOV 21.2% DEC 27.6% 40.0% 30.0% 20.0% 10.0% 0.0% -10.0% -20.0% -30.0% -40.0%

Key Investment Highlights Poised to benefit from rebound in construction activity Experienced management team lead by industry veterans throughout the organization Solid financial condition with recapitalized balance sheet

High quality assets with significant market share located in attractive markets Strategic customer of vertically integrated cement producers due to volume

Disclosure of Non-GAAP Financial Measures U.S. CONCRETE, INC. ADDITIONAL STATISTICS (In thousands, unless otherwise noted; unaudited)

We report our financial results in accordance with generally accepted accounting principles in the United States (“GAAP”). However, our management believes that certain non-GAAP performance measures and ratios, which our management uses in managing our business, may provide users of this financial information additional meaningful comparisons between current results and results in prior operating periods. See the table below for presentations of our adjusted EBITDA and adjusted EBITDA margin for the years 2008, 2009, and 2010. We define adjusted EBITDA as our net income (loss) from continuing operations plus the provision (benefit) for income taxes, net interest expense, reorganization costs, noncash impairments, depreciation, depletion and amortization. We define adjusted EBITDA margin as the amount determined by dividing adjusted EBITDA by total sales. We have included adjusted EBITDA and adjusted EBITDA margin in the accompanying tables because they are often used by investors for valuation and for comparing our financial performance with the performance of other building material companies. We also use adjusted EBITDA to monitor and compare the financial performance of our operations. Adjusted EBITDA does not give effect to the cash we must use to service our debt or pay our income taxes and thus does not reflect the funds actually available for capital expenditures. In addition, our presentation of adjusted EBITDA may not be comparable to similarly titled measures other companies report. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, our reported operating results or cash flow from operations or any other measure of performance prepared in accordance with GAAP.

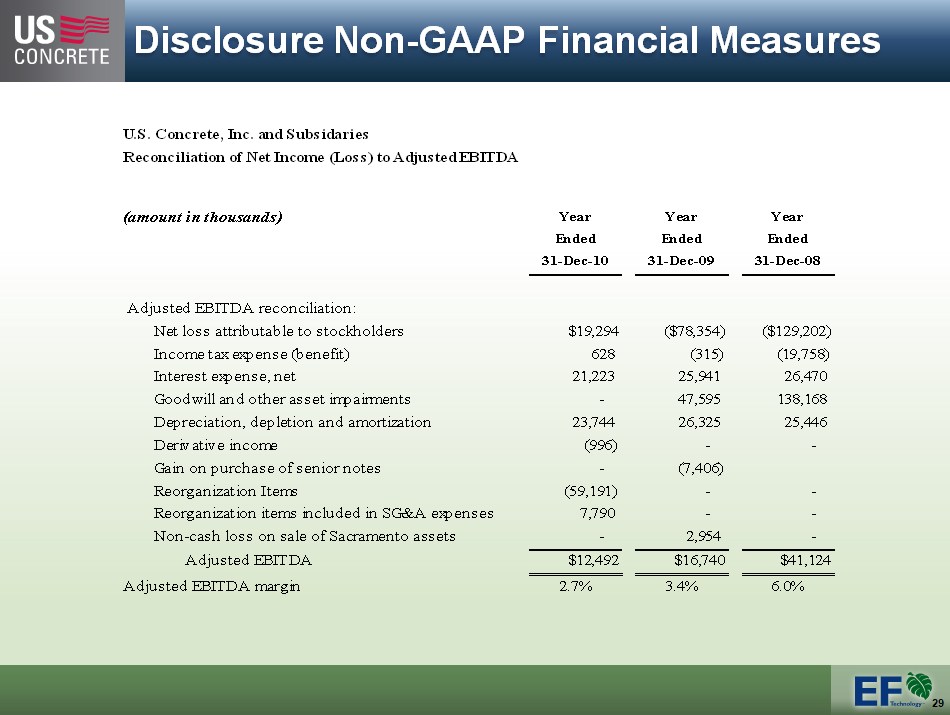

Disclosure Non-GAAP Financial Measures U.S. Concrete, Inc. and Subsidaries Reconciliation of Net Income (Loss) to Adjusted EBITDA

(amount in thousands) Year Year Year Ended Ended Ended 31-Dec-10 31-Dec-09 31-Dec-08

Adjusted EBITDA reconciliation: Net loss attributable to stockholders $19,294($78,354)($129,202) Income tax expense (benefit) 628 (315) (19,758) Interest expense, net 21,223 25,941 26,470 Goodwill and other asset impairments - 47,595 138,168 Depreciation, depletion and amortization 23,744 26,325 25,446

Derivative income (996) - - Gain on purchase of senior notes - (7,406) Reorganization Items (59,191) - -

Reorganization items included in SG&A expenses 7,790 - -

Non-cash loss on sale of Sacramento assets - 2,954 -

Adjusted EBITDA $12,492 $16,740$41,124

Adjusted EBITDA margin 2.7% 3.4% 6.0%

Davenport Infrastructure &

Basic Industries Conference

March 3, 2011