Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PNC FINANCIAL SERVICES GROUP, INC. | d8k.htm |

Exhibit 99.1

From the Chairman March 3, 2011

To Our Shareholders,

Two years after the greatest financial crisis since the Great Depression, PNC has emerged as one of the largest, strongest banks in America.

We are poised to compete successfully in a consolidating industry despite economic headwinds and significant regulatory change.

We see tremendous momentum for growth in 2011 with the goal of creating even greater value for our shareholders.

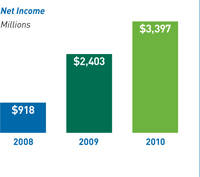

Outstanding Performance, Exceptional Achievements PNC delivered an outstanding performance in 2010, a year of exceptional achievements in a challenging environment. We produced record net income of $3.4 billion or $5.74 per diluted common share. We enhanced the quality of our capital throughout the year and reached a record Tier 1 common capital ratio of 9.8 percent at year end, providing PNC with significant flexibility for the future. We significantly increased the number of clients we serve and are well positioned for future growth.

We have a powerful banking franchise stretching across 14 states and the District of Columbia. Within that market resides one-third of the U.S. population and the corporate headquarters of half the Fortune 500. In addition, we have national capabilities to provide residential mortgages and credit to consumers. For our middle-market clients throughout the U.S., we offer credit, liquidity, and capital markets products and services.

We enhanced our scale through the successful conversion of National City, which we completed in 2010 ahead of our original schedule. It was one of the largest customer and branch integrations in banking history. We converted 1,300 branches and millions of customers and surpassed our initial customer retention goals. We also exceeded the original cost savings goal for the combined company by 50 percent, reaching $1.8 billion on an annualized basis by the end of 2010.

I am fond of saying that eventually all companies meet their balance sheet. In 2010 we continued to transition ours, and we are pleased with the results. We ended the year with $264 billion of assets. Common equity grew by $7.6 billion to $29.6 billion as of December 31, 2010. We originated loans and commitments of $149 billion during 2010, including $3.5 billion of small business loans. Our credit quality metrics improved during the year. With an improving economy, we expect greater loan demand in 2011.

Total deposits were $183 billion at December 31. We increased transaction deposits by $8.4 billion, or 7 percent, during 2010, a strong sign of our ability to grow our customer deposit franchise. At the same time we significantly reduced higher-cost retail certificates of deposit by $11.3 billion, or 23 percent, while retaining nearly 75 percent of our relationship accounts. These trends resulted in a loan-to-deposit ratio of 82 percent – a highly liquid balance sheet with a strong bank liquidity position to support growth.

We achieved these results by executing our proven business model. Our model is designed to produce diverse revenue streams through our commitment to a moderate risk philosophy, continuous improvement and a well-positioned balance sheet.

Our accomplishments brought PNC unprecedented international recognition. In December we were selected “Bank of the Year in the U.S.” by The Banker magazine in London, a publication of the Financial Times Group and the industry’s longest running trade journal.

An Industry Perspective If I think back to the fall of 2008, it was difficult to know when or how the financial crisis would end. As a company, we view change as an opportunity for growth and greater success. In the wake of significant uncertainty, we positioned the firm with a strong balance sheet and a proven management team which gave us the confidence to buy a bank larger than PNC. We had already developed innovative products, and we were focused on the needs of our customers, with thousands of dedicated employees ready to serve them.

Today, we believe we stand as one of the clear winners coming out of the financial crisis and are ready to exceed the expectations of our customers as their financial needs expand in an improving economy.

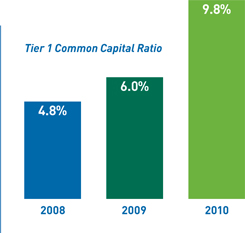

Delivering Value to Our Shareholders Given the economic uncertainty of the past two years, it has been prudent to build a larger level of capital. At December 31, 2008, our Tier 1 common capital ratio – a key current capital adequacy benchmark – was 4.8 percent. By raising capital, retaining earnings and selling a non-core business, at year end 2010, our Tier 1 common capital ratio had grown to 9.8 percent, one of the strongest levels in the industry. This should help us shift from a strategy of capital building to one of capital optimization.

We recently submitted to our regulators a capital plan as part of a second round of “stress tests.” The result of this regulatory assessment will, in part, determine whether and how much capital we may begin to return to shareholders.

With the economy now more stable, our board of directors views increasing the dividend as a key priority along with repurchasing stock. Subject to approval from our regulators, I am optimistic that we would be able to increase our dividend in 2011.

We would also consider mergers and acquisitions at the right prices that offer opportunities to expand or augment existing markets and businesses and to generate greater shareholder value.

A further factor in determining how much capital we hold will be new international banking requirements coming out of the Basel Committee on Banking Supervision. Given current assumptions based on the rules as we understand them today, we anticipate our capital levels will exceed the expected benchmark even before the new rules go into effect.

In the end, we believe our capital position, together with our earnings potential, gives us the flexibility to comply with new regulatory capital requirements when finalized while still returning capital to our shareholders.

The progress we made and our results in 2010 contributed to a 15 percent increase in PNC’s share price. Taking a longer view, we ranked third among our peers in total shareholder return on a five-year basis. For the same period, we outperformed the overall stock market index, the S&P 500 index, the S&P 500 bank index and our peer group average.*

Serving the Needs of Consumers and Small Business The combination of Retail Banking, Residential Mortgage Banking and our Asset Management Group accounted for nearly half of our 2010 revenue. We offer a broad array of products and services for individual consumers, small businesses, colleges and universities, and institutional clients.

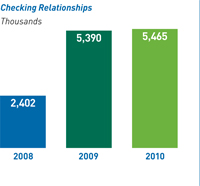

Retail Banking PNC has more than 5.4 million consumer and small business checking relationships, which we see as a cornerstone product in our client acquisition strategy. We increased these relationships by 75,000 and grew average transaction deposits by more than $3 billion in 2010.

While we attract the majority of our new customers through our 2,500 branches, 38 percent of our total account acquisition in 2010 came through alternative channels. These channels play an important role in our client acquisition success.

For example, through our University Banking program, we currently have relationships with more than 200 colleges and universities, an increase of nearly 75 percent from 2009. This program gives us the opportunity to market PNC’s retail products to more than 300,000 incoming freshmen and approximately 1.9 million students overall. Once we have these customers in the door, our wide branch network and innovative products provide us with long-term retention opportunities.

In my tenure at PNC, few changes have been as notable as the decline of paper checks. Customers have been moving away from checks and toward electronic payments at an accelerating pace. At the same time, we are seeing tremendous growth in mobile banking.

At PNC, we recognize that changes in customer preferences along with financial reform will affect Retail Banking. We know that many of our peers have announced increased fees and the elimination of free checking, which we believe will result in significant market disruption.

| * | PNC’s 2010 peer group consists of BB&T Corporation, Bank of America Corporation, Capital One Financial, Inc., Comerica Inc., Fifth Third Bancorp, JPMorgan Chase, KeyCorp, M&T Bank, Regions Financial Corporation, SunTrust Banks, Inc., U.S. Bancorp, and Wells Fargo & Co. |

Our response differs. We are seeking to increase customers and deepen our relationships with them. As a result, we are offering new, integrated payment products that connect checking, credit, debit and rewards, and that leverage our highly successful Virtual Wallet bank account offering.

This approach reflects our extensive research, indicating customers want choice, transparency and value from their bank. We believe this is consistent with our brand promise to customers and employees and is aligned to our shareholders’ expectations.

Asset Management Group Our Asset Management Group had an outstanding 2010, with full year earnings up 34 percent compared with 2009. Asset flows improved through the year, picking up speed in the second half. This sales momentum combined with a year-end lift in equity markets helped us reach $212 billion in assets under administration by year end. Assets under management totaled $108 billion.

Despite extreme market volatility in the last two years, Asset Management has consistently grown sales and acquired new clients. Referrals from other PNC business units, including Retail Banking and Corporate & Institutional Banking, enabled us to end 2010 with one of the strongest prospect pipelines we have ever had. In fact, total sales and referrals from PNC businesses increased 60 percent in comparison with 2009 and now make up 30 percent of overall sales. We believe these in-house referrals to be among the best in the industry, and we think we can do even better by spreading the practice to more PNC units.

A strong pipeline gives us the confidence to invest aggressively in Asset Management. Last year, we hired approximately 500 employees, placing many of them in higher-potential markets such as Chicago, Florida, Milwaukee and Washington, D.C. We are not finished. Over the next two years, we expect to add 400 more employees in this business.

We are investing in technology as well as people. Later this year, we will introduce a new tool specifically designed to give our high-net-worth clients a consolidated view of their assets in much the same way Virtual Wallet provides retail customers with a high-definition view of their money. This tool, called Wealth Insight, will provide our Asset Management customers with more information about their assets, and we believe it will give us a competitive advantage in the marketplace.

Residential Mortgage Banking Two years ago, PNC made the decision to return to the national residential mortgage business as it is a key consumer-banking product. We believe this strategy provides us with opportunities to deepen customer relationships while maintaining our focus on moderate risk.

Our mortgage business accomplished a great deal this year. We have enhanced technology and realigned the sales and servicing aspects of this business so it better reflects our moderate risk philosophy and our relationship-based business approach.

High unemployment throughout the year made it difficult for many Americans to remain current on their mortgages. We responded by increasing our mortgage servicing staff and working to modify mortgage loans of qualified borrowers both through the government’s Home Affordable Modification Program and our own proprietary programs.

PNC is working to address foreclosure concerns that arose across the industry in 2010. We have strengthened senior management in Residential Mortgage, reviewed our procedures, opened a second mortgage servicing facility and instituted new safeguards, including expanded training and additional supervision.

We have also increased our production staff in Residential Mortgage. In spite of the difficulties in this market, we have written many new mortgages consistent with PNC’s traditionally moderate approach to risk management. Our mortgage offices in 32 states last year originated more than $10.5 billion of new loans, including a new jumbo mortgage product.

Serving the Needs of Large Businesses and Institutions One third of PNC’s revenue in 2010 came from serving large business, government and not-for-profit clients through our Corporate & Institutional Banking (C&IB) business. We have a broad array of products and services and financing capabilities.

Corporate & Institutional Banking We had record client growth in 2010, adding more than 1,100 primary clients in commercial banking and corporate and asset-based lending last year. This provides significant momentum going into 2011. If we can cross sell to these new clients at the same rate as we do to our existing clients, we would see as much $300 million in additional annual revenue in 2011 and beyond.

We are a top provider of investment banking solutions to the middle market. Based on transactions closed in 2010, we ranked fourth in the following categories: middle-market client bookrunner, real estate bookrunner and asset-based lending bookrunner. We are a leader in middle-market loan syndications of $100 million or less, ranking second in 2010. Our Harris Williams business is one of the nation’s largest merger and acquisition advisory firms focused on the middle market.

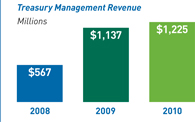

PNC Treasury Management is ranked among the top 10 nationally, with revenues increasing by 8 percent in 2010 compared to the previous year, a very favorable outcome given that industry growth was projected to be in the range of 1-2 percent for the year. The business produces an excellent source of low-cost deposits and is our entry into attractive sectors, including government agencies and health care. We are among the largest financial firms in the health care market thanks to our innovative suite of Healthcare Advantage products, which helps to improve the exchange of funds among insurers and providers. Sales of these products have had a compound average growth rate of 19 percent over the last five years.

Our goal is to deliver all of PNC to our C&IB clients. We want relationships, not isolated transactions with our customers. For them, that means having one bank to meet all their financial needs. For us, it means additional cross-selling opportunities.

Given our focus on revenue growth in the wake of changing consumer preferences and regulatory requirements, in 2010 I asked Senior Vice Chairman Bill Demchak to lead all of our businesses. Bill did an exceptional job delivering the full value of C&IB products and services to our customers. I look for him to apply that same leadership across our expanded franchise.

Employees Drive Our Success Our success last year was largely due to our more than 50,000 employees. We win when our employees are engaged in their jobs and committed to the company and our clients. Our 2010 employee engagement results show an increase across the board despite starting from a level that was already very good. The world outside has noticed. Last year, Retail Banking won its second “Gallup Great Workplace Award,” making PNC the only U.S. bank to be so honored.

PNC is committed to being a great place to work. Our benefits program for full-time employees includes health care, life insurance, disability coverage, retirement benefits – including a company-funded pension – and many work/life benefits. These offerings are one reason PNC is a nine-time recipient of Working Mother magazine’s “100 Best Companies” award.

In 2010, we launched PNC Living Well, which is focused on helping employees better manage their health, money and work/life balance. We also expanded our commitment to diversity and inclusion, launching training for employees. Each PNC line of business has developed a customized “Diversity Action” plan focused on enhancing the recruitment, retention, development and promotion of employees within the various businesses. We are on the right track. In 2010, the National Association for Female Executives named PNC one of its “Top 50 Companies for Executive Women” for the third year in a row.

Our Communities Matter PNC’s strength reflects the vitality of the communities where we do business, so we support important community development and philanthropic efforts. In 2010, PNC spent more than $50 million across 15 states and the District of Columbia to encourage home ownership and economic development and to partner with community-based organizations.

Our signature cause, PNC Grow Up Great, which prepares young children for success in school and life, enters its seventh year in 2011. Our employees have volunteered 170,000 hours to this effort. Building on our success, this year we will launch Financial Literacy for Preschool Children which focuses on the concept of sharing. Our partner in this program is Sesame Workshop, the nonprofit educational organization behind Sesame Street.

PNC advanced its leadership in green building in 2010 as well. The completion of our new Washington, D.C. regional headquarters, PNC Place, marked PNC’s 100th LEED certification from the U.S. Green Building Council and our first Platinum-level certification. To date, PNC has 116 certifications for leadership in energy and environmental design, and has more newly constructed, LEED-certified buildings than any company on Earth.

Building a Great Company At PNC, we strive for excellence, and we know that we must prove ourselves every day. Over the past two years, we believe that we have delivered exceptional performance. Thanks to the hard work of our management team and our employees, we now have more opportunities than ever before.

To be successful in the future, it will not be enough to recognize or respond to change; the leaders will be those companies that anticipate and embrace change and respond with innovative products and services. I believe the people of PNC have those qualities and capabilities, and I look forward to working for you as we continue to build a great company.

Sincerely,

James E. Rohr

Chairman and Chief Executive Officer

For more information regarding certain factors that could cause future results to differ, possibly materially, from historical performance or from those anticipated in forward-looking statements, see the Cautionary Statement in Item 7 of our 2010 Annual Report on Form 10-K, which accompanies this letter.