Attached files

| file | filename |

|---|---|

| EX-32.1 - Mobile Presence Technologies Inc. | v213100_ex32-1.htm |

| EX-31.2 - Mobile Presence Technologies Inc. | v213100_ex31-2.htm |

| EX-31.1 - Mobile Presence Technologies Inc. | v213100_ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark one)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010

Or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to_____

Commission File Number: 333-147666

CHINA SHANDONG INDUSTRIES, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

20-8545693

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

No. 2888 Qinghe Road

Development Zone Cao County

Shandong Province, China 274400

(Address of principal executive offices) (Zip Code)

Registrant’s Telephone Number, including area code: (86) 530-3431658

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

Title of Each Class

|

Name of Each Exchange on which Registered

|

|

None

|

Not Applicable

|

Securities registered pursuant to Section 12(g) of the Exchange Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer o Accelerated Filer o Non-Accelerated Filer o Smaller Reporting Company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of voting and non-voting stock held by non-affiliates of the registrant as of the last business day of the registrant’s most recently completed second fiscal quarter was $8,996,603

There were 8,611,697 shares of common stock outstanding as of February 25, 2011.

DOCUMENTS INCORPORATED BY REFERENCE

None

TABLE OF CONTENTS

|

PART I

|

3 | |||

|

ITEM 1. BUSINESS

|

6 | |||

|

ITEM 1A. RISK FACTORS

|

23 | |||

|

ITEM 1B. UNRESOLVED STAFF COMMENTS

|

42 | |||

|

ITEM 2. PROPERTIES

|

42 | |||

|

ITEM 3. LEGAL PROCEEDINGS

|

43 | |||

|

ITEM 4. (REMOVED AND RESERVED)

|

43 | |||

|

PART II

|

44 | |||

|

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

44 | |||

|

ITEM 6. SELECTED FINANCIAL DATA

|

44 | |||

|

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

44 | |||

|

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

53 | |||

|

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

53 | |||

|

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

53 | |||

|

ITEM 9A (T). CONTROLS AND PROCEDURES

|

54 | |||

|

ITEM 9B OTHER INFORMATION

|

56 | |||

|

PART III

|

56 | |||

|

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

56 | |||

|

ITEM 11. EXECUTIVE COMPENSATION

|

60 | |||

|

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

62 | |||

|

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE

|

63 | |||

|

ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES

|

63 | |||

|

PART IV

|

65 | |||

|

ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES

|

65 | |||

|

SIGNATURES

|

67 |

-2-

FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. These statements relate to future events or our future financial performance. We have attempted to identify forward-looking statements by terminology including “anticipates”, “believes”, “expects”, “can”, “continue”, “could”, “estimates”, “expects”, “intends”, “may”, “plans”, “potential”, “predict”, “should” or “will” or the negative of these terms or other comparable terminology. These statements are only predictions; uncertainties and other factors

may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels or activity, performance or achievements expressed or implied by these forward-looking statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Our expectations are as of the date this Form 10-K is filed, and we do not intend to update any of the forward-looking statements after the date this Annual Report on Form 10-K is filed to confirm these statements to actual results, unless required by law.

PART I

ITEM 1. BUSINESS.

In this Annual Report on Form 10-K, references to “dollars” and “$” are to United States Dollars and references to “RMB” and “renminbi” are to Chinese Renminbi (RMB).

Unless otherwise specified or required by context, references to “we,” “our” and “us” refer collectively to (i) China Shandong Industries, Inc., and our subsidiaries, Tianwei International Development Corporation, an Oregon corporation and Shandong Caopu Arts & Crafts Co., Ltd, a wholly foreign-owned enterprise organized under the laws of the PRC. Specific discussions or comments relating only to China Shandong Industries, Inc. will reference China Shandong Industries and those relating only to Shandong Caopu Arts & Crafts Co., Ltd will reference “Shandong.”

Overview

We are a designer and contract manufacturer of household furniture in the Peoples Republic of China (“PRC”). We produce a variety of indoor and outdoor residential furniture and wicker products that is sold and exported to more than 30 countries. Our products are sold through well known domestic and international retailers such as Trade Point A/S Direct Container (Denmark), Zara-Home, Habitat UK Ltd., ABM Group Inc. and US; Fuji Boeki Co. Ltd. The product depth and extensive style selections we offer we believe allows us to be a strong resource for global furniture, retail chains and retailers in the discounted price range.

Our subsidiary, Shandong, manufactures over 20,000 different products. We focus on providing high quality products at competitive prices. For the calendar year ended December 31, 2010, approximately 4.2% of our products were sold in the PRC and 95.8% of our products were sold to companies in countries and places such as Denmark, the United States, Germany, the United Kingdom, Spain, Italy, Sweden, Canada and Taiwan.

Because straw, wicker and handicraft products are relatively easy to produce and do not require a significant investment in technology or equipment, we do not produce such products in our manufacturing facilities. Instead, we employ local people to manufacture such products in their homes in Cao County, Shandong Province, PRC.

All of our four existing industrial parks are engaged in producing wood furniture. Our four industrial parks consist of 19 plants, which produce a full line of residential furniture products, including kitchen furniture, office furniture, living room furniture, outdoor furniture and general living furniture. In order to respond quickly to customer orders, we have designed our facilities and developed manufacturing practices that allow us to be highly flexible so that certain of our plants can be used to produce several types of furniture.

Corporate History and Organization

We were incorporated in February 2007 in Delaware under the name Mobile Presence Technologies, Inc. to develop and provide software and services to enhance the use of cellular phones and other hand held communication devices. Since our inception we had not generated any material revenues and determined to change our business. In November 2009, we acquired all of the issued and outstanding capital stock of Tianwei International Development Corporation, which we refer to as Tianwei, pursuant to a Stock Exchange and Reorganization Agreement. The transaction by which we acquired Tianwei is more fully described below. Tianwei was incorporated under the laws of Oregon on January 13, 2009 and is the owner of all of the issued and outstanding capital stock of

Shandong. Shandong was organized under the laws of the PRC in August 2000 under the name Heze Caopu Arts & Crafts Co., Ltd. In November 2000, it changed its name to Shandong Caopu Arts & Crafts., Ltd. In April 2008, Shandong has registered capital of $7.8 million, 96.79% of which was owned by Shandong Cao County Changsheng Arts & Crafts Co., Ltd. and the remaining 3.21% was owned by Japan Fit Co., Ltd. In January 2009, Tianwei acquired Japan Fit’s 3.21% interest and in July 2009, Tianwei acquired Shandong Cao County Changsheng Arts & Crafts Co., Ltd.’s 96.79% interest in Shandong. As a result, Tianwei became the sole owner of Shandong and we became the 100% owner of Tianwei. In addition, as a result of its new ownership structure, Shandong became what is known as a “Wholly Foreign Owned Enterprise” or “WFOE.” On December 3, 2009 we filed a certificate of

amendment to our Certificate of Incorporation changing our name to “China Shandong Industries, Inc.”, to better align our name with our business, increasing the authorized shares of our common stock to 100,000,000, increasing our authorized blank check preferred stock to 5,000,000 shares, and effectuating a 15 for 1 forward split of our common stock. On January 18, 2011, we effectuated a 1 for 1.5 reverse stock split of our shares of common stock.

-3-

Stock Exchange Agreement

On November 6, 2009, pursuant to a Stock Exchange and Reorganization Agreement (the “Exchange Agreement”), dated as of October 22, 2009, by and among us, Tianwei, CAOPU, London Financial Group Ltd., a company organized under the laws of the British Virgin Islands (“LFG”), Phoebus Vision Investment Developing Group, Ltd., a company organized under the laws of the British Virgin Islands (“Phoebus”), and Timothy Lightman (“TL”), we acquired all of the issued and outstanding capital stock of Tianwei. Pursuant to the Exchange Agreement, we issued an aggregate of 7,717,500 shares of our common stock to CAOPU, LFG and Phoebus in exchange for all of the issued and outstanding shares of Tianwei owned by each of CAOPU, LFG and Phoebus.

Pursuant to the terms of the Exchange Agreement, Mr. Lightman cancelled 4,375,000 shares of his total of 4,875,000 shares of our common stock. In addition, effective November 5, 2009, pursuant to a separate Assignment and Assumption Agreement by and between us and Mr. Lightman, Mr. Lightman acquired all our assets related to our prior business and assumed all our liabilities outstanding prior to our acquisition of Tianwei.

Effective as of the closing of our acquisition of Tianwei, our prior officers and directors resigned, and our current officers and directors were appointed.

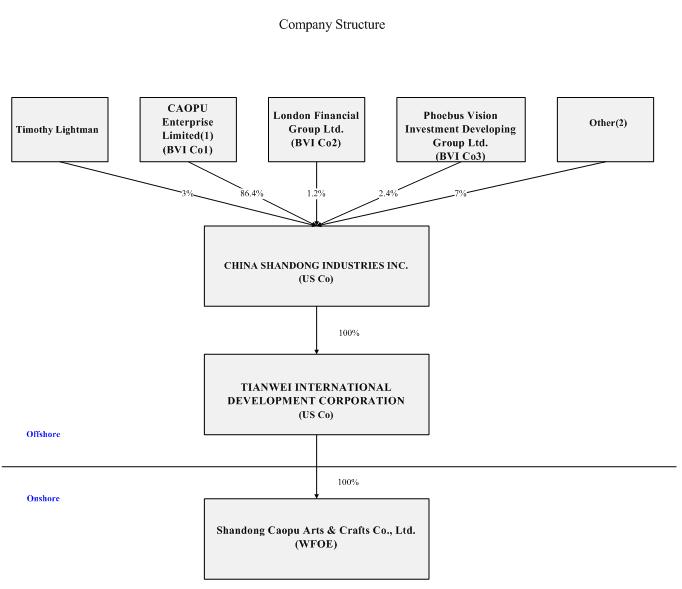

Company Structure

The following chart shows the ownership interests in our operating subsidiaries.

-4-

-5-

(1) CAOPU Enterprise Limited, a BVI entity (“CAOPU”), owns 86.4% of our issued and outstanding common stock. Mr. Jinliang Li, our Chairman, Chief Executive Officer and controlling stockholder, owns all of the issued and outstanding capital stock of CAOPU. CAOPU owns for the benefit and on behalf of (i) Mr. Jinliang Li, 51% of our issued and outstanding shares of our common stock, and (ii) nine (9) other stockholders, own 35.4% of our issued and outstanding shares of our common stock, which stockholders have agreed that CAOPU will hold their shares of our common stock for a period expiring 15 months from the date of the closing of a public offering of our securities. After such 15-month period, unless such 15-month period is extended by

the underwriter in the offering, each minority stockholder can publicly sell its respective shares of our common stock in accordance with the any lock-up agreement that may have been entered into by each such person with the underwriter. Although Mr. Li has no pecuniary interest in the shares of our common stock owned by such 9 minority stockholders but held by CAOPU, by reason of his sole ownership of CAOPU, Mr. Li has sole voting and dispositive power over such shares of our common stock.

(2) None of the remaining stockholders has more than 5% shares of our common stock.

ITEM 1. BUSINESS

Overview

We are a designer and contract manufacturer of household furniture in the Peoples Republic of China (“PRC”). We produce a variety of indoor and outdoor residential furniture and wicker products that is sold and exported to more than 30 countries. Our products are sold through well known domestic and international retailers such as Trade Point A/S Direct Container (Denmark), Zara-Home, Habitat UK Ltd., ABM Group Inc. and US; Fuji Boeki Co. Ltd. The product depth and extensive style selections we offer we believe allows us to be a strong resource for global furniture, retail chains and retailers in the discounted price range.

Our subsidiary, Shandong, manufactures over 20,000 different products. We focus on providing high quality products at competitive prices. For the calendar year ended December 31, 2010, approximately 4.2% of our products were sold in the PRC and 95.8% of our products were sold to companies in countries and places such as Denmark, the United States, Germany, the United Kingdom, Spain, Italy, Sweden, Canada and Taiwan.

Because straw, wicker and handicraft products are relatively easy to produce and do not require a significant investment in technology or equipment, we do not produce such products in our manufacturing facilities. Instead, we employ local people to manufacture such products in their homes in Cao County, Shandong Province, PRC.

All of our four existing industrial parks are engaged in producing wood furniture. Our four industrial parks consist of 19 plants, which produce a full line of residential furniture products, including kitchen furniture, office furniture, living room furniture, outdoor furniture and general living furniture. In order to respond quickly to customer orders, we have designed our facilities and developed manufacturing practices that allow us to be highly flexible so that certain of our plants can be used to produce several types of furniture.

Our products are divided into 3 categories based upon their features and producing methods, which are (i) furniture products, (ii) straw-wicker products, and (iii) wooden crafts products.

Our furniture products are primary indoor furniture products made of poplar and paulownia, including chairs, barstools, tables, bookcases, cabinets, lamps and similar items.

Following are pictures of our sample furniture products:

-6-

Our straw and wicker products are weaved and interlaced by hand into various products with different sizes and shapes, such as wicker basket, straw drawers. Straw and wicker products are cheaper to produce than wooden crafts products and furniture products because the price of the raw material used in such products is less expensive and more common in PRC households.

-7-

The following are the pictures of certain of our straw and wicker products:

Wooden crafts products mainly refers to decorations and accessories, “knick-knacks” and ornamental objects made of poplar wood in a semi-manual and semi-mechanical way. Such products include photo frames, gift boxes, bottle boxes, jewelry boxes, and bird nests, which can be used for decoration or as functional products in houses, offices and public places.

-8-

The following are pictures of certain of our wooden crafts products:

Because straw, wicker and handicraft products are relatively easy to produce, and do not require a significant investment in technology or equipment, we do not produce such products in our manufacturing facilities. Instead, we employ local people to manufacture such products in their homes in Cao County, Shandong Province, PRC.

All of our four existing industrial parks are engaged in producing wood furniture. Our four industrial parks consist of 19 plants, which produce a full line of residential furniture products, including kitchen furniture, office furniture, living room furniture, outdoor furniture and general living furniture. In order to respond quickly to customer orders, we have designed our facilities and developed manufacturing practices that allow us to be highly flexible so that certain of our plants can be used to produce several types of furniture.

Concentration on Furniture Industry

Based upon our experience as furniture markers and sellers both domestically and internationally as well as the Shandong Report, we believe that the demand for furniture has been growing steadily worldwide. We believe that historically western countries have accounted for the majority of world furniture production and consumption. However, we believe that the global furniture industry is undergoing a substantial transformation, where developing countries, such as China, are playing an increasingly important role in wood furniture production and consumption. As a result, although our straw, wicker and handicraft products have been and continue to be an integral part of our overall business, we intend to focus and devote substantial of our resources to expand our wood furniture

business.

Our Competitive Advantages

We believe that we are one of the large-scale producers and manufacturers of furniture and craft products in China because we have (i) over $7 million production facilities and equipments in 19 plants in a total area of 162,688.82 square meters, (ii) average revenue of $40 million in past 3 years, and (iii) over 20,000 products.

We believe we have the following advantages over our competitors:

|

•

|

We believe our brand name “CAOPU” is well-known among oversea retailers and wholesalers, such as Zara-Home, Habitat UK Ltd., ABM Group Inc., and IKEA;

|

-9-

|

|

•

|

We believe that we are becoming better known among overseas retailers and wholesalers for our poplar and paulownia wood products;

|

|

|

•

|

Our research and development (“R&D”) team has 24 employees, each of whom has over 4 years of experience in furniture and craft production;

|

|

|

•

|

We have what we believe to be a strong technological team in product improvement;

|

|

|

•

|

We have developed products based on traditional folk art in Cao County;

|

|

|

•

|

We believe that our raw materials costs are lower than our competitors because our production facility is located in an area that has an abundance of fast-growing trees that we use in manufacturing our products; and

|

|

|

•

|

Over the past ten years, we have developed long-term customer cooperative relationships with a number of well known companies, such as Zara-Home, Habitat UK Ltd., ABM Group Inc. and IKEA.

|

Our Strengths

Track record of growth

Our revenues and net income has increased substantially over the past 2 years. Specifically, we generated revenues of $89,934,050 and achieved net income of $14,157,889 during the twelve months ended December 31, 2010, as compared to $69,435,044 in revenues and $12,021,155 of net income for the comparable period in 2009. We generated revenues of $42,197,393 in revenues and $5,761,994 of net income for the comparable period in 2008. We plan, subject to available financing, to increase the aggregate annual production capacity for our existing products and to launch a higher end furniture line that we believe will have higher profit margins.

Flexibility to Meet Consumer Demands

We believe our production capability is customer-oriented in that we can change certain aspects of our production ability to accommodate customer orders and requirements. In this regard, we believe our production capabilities are very flexible in that we offer, manufacture and/or sell diversified products to meet diversified customers’ demands. With years of experience, we believe we have the ability to customize our products in accordance with customers’ ever-changing needs and requirements. To attempt to increase our flexibility to further meet our customer demands quickly and efficiently, we also have committed ourselves to (i) purchasing high technique manufacturing equipment and more investment in our own research and development and (ii) improving our

products’ variety, style and design based on market trends based upon our customers’ tastes and preferences based upon the information we receive in the domestic and international trade fairs we attend.

Strong Recognition from Domestic and International Customers

We believe the solid reputation that our management team has developed over the last number of years in the furniture industry in China and in other countries such as Denmark, the United States, Germany, the United Kingdom, Spain, Italy, Sweden, Canada and Taiwan, including an established track record for consistently providing quality products at competitive prices, has enabled us to develop a strong customer base which includes several reputable domestic and multinational retailers, including Zara-Home, Habitat UK Ltd. ABM Group Inc. and Fuji Boeki Co., Ltd.

Reliable Supplier Network for Low-Cost Raw Materials

We believe that many of our current suppliers with whom we have longstanding relationships prefer to sell raw materials to us as opposed to other purchasers, at competitive prices, due to our large order and track record for prompt payment. We believe these long-standing supplier relationships provide us with a competitive advantage in China. Since Cao County is a natural area for the raw materials required to make our products, the supply of raw materials is greater than we require. Thus, we are able to leverage our purchasing power to obtain favorable pricing and delivery terms. In addition, none of our current sources of raw materials supplies more than 5% of the raw materials we require.

-10-

Experienced Management and Operational Teams with Domestic PRC Market Knowledge

Our senior management team and key operating personnel have extensive management and operating experience and domestic PRC industry knowledge. In particular, Mr. Jinliang Li, our chairman and chief executive officer, has managed and operated businesses in the furniture industry in the PRC for approximately 25 years. Mr. Zhiqiang Zhong, the production manager of Shandong, has experience in the furniture industry in the PRC for approximately 22 years, Mr. Zhiyu Wang, chief financial officer of Shandong, has experience in furniture industry for approximately 24 years, Mr. Jiawei Li, our director and chief marketing manager of Shandong, has experience in marketing and furniture industry for approximately 4

years. We believe that our management team’s experience and in-depth knowledge of the furniture business will enable us to continue to successfully execute our expansion strategies. In addition, we believe our management team’s strong track record will enable us to continue to take advantage of market opportunities that may arise.

We Are Taking Advantage of Industry Trends

According to an article dated October 9, 2008, titled 2008 International Trade Development Tendency of China Furniture, the major furniture manufacturing provinces in China are Shandong (where we are located), Guangzhou and Jiangsu, and furniture manufactured in China is now exported to over 200 countries. We believe this shift to China in furniture manufacturing is attributable to the increasing labor, operational and manufacturing costs in more developed countries. Consequently, we believe retailers in developed countries are relying more on imported furniture products. Our strategy is to take advantage of this trend.

Our Weaknesses/Challenges

Need to increase our production capacity

Most of our current production equipment and facilities was purchased approximately 5 years ago, which we do not believe are sufficiently modern to optimally allow us to meet customer demand for our products, which we believe reduces our overall product output and revenues. In addition, due to the age of certain of our current machinery, we cannot produce certain products that new machines would allow us to produce. As a result, our production capacity limits our ability to accept certain overseas orders.

Lack of customer name brand to end customers

We are an original equipment manufacturer (“OEM”) for North American and European manufacturers. Currently, we receive orders and sell our products directly to retailers and wholesalers, who then resell our manufactured products to end users using the brand name of such retailers and wholesalers. We have not established our own name brand; as a result, end users do not recognize or “seek out” our products, which prevents us from selling them under our own brand name.

Absence of our own sales and distribution channels

We market and distribute our products mainly to retailers and wholesalers instead of consumers and we have not set up our own sales and distribution channels. Therefore, our sales are partially dependent on the sales, sales efforts and distribution channels of retailers and wholesalers who sell our products. Generally, this subjects our revenues to factors under the control of our retailers and wholesalers such as the quality of their showrooms, the quality and budget for marketing and advertising of such products and the availability of space in their showrooms and stores to show our products.

Our Proposed Growth Strategy

Based upon the historical growing demand for our wood furniture products and the changing dynamics of the wood furniture industry, we believe we have a unique opportunity to substantially increase our revenues, net income and gross margins by not only expanding the capacity of our existing wood furniture production business but also producing additional types of wood furniture products for which we believe there is a large and increasing international demand. We seek to increase our revenues by taking advantage of the increasing demand for wood furniture world-wide, as such we have developed a growth strategy that we believe will allow us to capitalize on this opportunity. Our growth strategy is focused on increasing our production capacity of wooden furniture and manufacturing new

products that we believe are in high demand internationally.

Develop new products

In order to produce higher end products we plan to develop a second new production line in 2011, subject to available financing. Based upon, among other items, our attendance at trade shows and discussions with our larger clients, we believe that we can substantially increase our revenues, gross margins and net income by producing an additional production line.

-11-

The cost to set up our second production line will be approximately $15 million. Although we currently do not have the funds to establish such production line, we intend in the future to attempt to obtain the required funding through a combination of the sale of our securities, working capital and/or retained earnings.

Increasing production capacity

We believe, based our managements’ experience, that our current production capacity for our existing wooden furniture products can only satisfy between 60% and 70% of the overseas requests for our products. Based on the profit margin the demands may bring, we currently select to place and satisfy the requests with higher profit margins (around 60% to 70%), and reject the requests with lower margins (around 30%-40%).

Our strategy to increase our capacity is multifaceted. In December 2006, we were granted by the PRC government a land-use permit to use approximately 98,435.32 square meters to establish our fifth industrial park to expand our current Caopu Industrial Park. In such industrial park, which also will be located in Caopu Industrial Park near our existing 4 industrial parks, we plan to build a new furniture production line with more state of the art manufacturing equipment and components in 2010 which we believe will enable us to fulfill a greater percentage of oversea requests for our products that we currently do not have the capacity to fulfill. We believe this plan will not only increase our production capacity but also increase

our gross margins and strengthen our market share in our product industry. The total estimated cost to build the new production line is approximately $20 million, which includes workshop construction cost as well as equipment and machinery cost.

Strengthening R&D

We believe product innovation and technology advancement are vital for our business expansion. In the past years, we mainly depended on in-house research. For fiscal years 2010 and 2009, we spent approximately $0.7 million and $0.5 million, respectively on R&D. We intend to build a new R&D center in the fifth industrial park in 2011. We believe our R&D initiatives will substantially shorten the time of both traditional and new product development. It is currently contemplated by us that the proposed new R&D center will include a 6,000 square meter building with an experiment workshop, office, training room and housing. The estimated cost of R&D center is an estimated approximately $1.4 million consisting of (i) $850,000 for

building costs and (ii) $550,000 for equipment costs. We intend to finance the cost of our proposed new R&D facility through either our own working capital and/or attempting to obtain additional financing, which will be decided by our Board of Directors at the appropriate time.

Strengthening our relationships with key customers and diversifying our customer base.

We intend to strengthen our relationships with key customers while further expanding our customer base. We plan to continue providing high-quality and cost-competitive products to our existing customers and to use our existing customer network and strong industry reputation to expand our product sales internationally. We also plan subject to available financing to improve our overseas sales networks by establishing retail stores to allow us to sell our products directly to the end users in the United States, Japan and Europe. We intend to continue to use customer feedback to improve the quality of our products and services and to strengthen our long-term base of domestic and international customers.

Seasonality

Our operating results and cash flows historically have not been subject to seasonal variations. Although we do not currently anticipate any changes, this pattern may change, however, as a result of new market opportunities or new product introductions.

Operations

We market our products under our brand name “CAOPU”, which we believe is recognized in certain western countries.

We have established a coordinated supply chain management system ranging from production to sale. Shandong’s factory is located on 162,688.82 square meters of land, and consists of 18 buildings with a total floor space of 71,708.4 square meters. In addition, Shandong’s factory is divided into four industry parks with 19 plants. We have over 1,500 employees in the Shandong factory.

-12-

Rigorous Quality Control Standards

Consistent with our continuing commitment to quality, we impose rigorous quality control standards at various stages of our production process. We strictly comply with various national quality standards, established by the General Administration of Quality Supervision, Inspection and Quarantine of China, with respect to the hardware and paint used in the manufacture of furniture, straw-wicker and handicraft products. We also strictly comply with various quality standards in accordance with the clients’ special quality requirements.

In order to improve the modern management level of enterprise and adapt to the demand of the international market, Shandong has obtained ISO 9001 International Quality Management System Certificate, ISO 14001 Environment Management System Certificate, OHSMS18001 Occupation Health & Safe Management System Certificate and CE Certificate (a certificate enabling our products to enter the Europe Union).

Products

Historically, our business has been primarily focused on straw-wicker, furniture and handicrafts products. We produce over 20,000 different products. We believe our wide variety of product categories, styles and finishes enable us to respond quickly to changing consumer preferences. We believe we offer retailers a comprehensive production line principally in the lower price range. Based on our sales and large client base, we believe our products represent good value, and that the style and quality of our furniture compares favorably with more premium-priced products.

In 2010, approximately 95.8% of our revenues resulted from sales of our products internationally, with the remaining approximately 4.2% resulting from sales in the PRC.

The following table lists our products by category and their respective contribution to our sales for the 12 months ended December 31, 2010. Among all the countries listed below, we believe that sales to Denmark, the United States, the United Kingdom, Spain, Japan, Germany and Sweden are material to our business.

|

Product

Category

|

Certain Products

|

Country where products were

delivered

|

Revenue

($ in Millions)

|

Revenue

Percentage

(%)

|

|

|

Furniture

|

Poplar & paulownia furniture including: folding screens, stools, 3-tier /5-tier bookshelves, coffee tables, bed cabinet

|

U.S.A., U.K., Germany, Japan, Italy, Spain

|

$

|

47.1

|

56.1%

|

|

Straw-wicker

|

Trunk, wash baskets, baskets, drawers, folder boxes, storage chests, fruit trays, bread baskets, vase covers

|

Spain, Germany, Italy, Holland, Greece, Poland, Portugal, Austria, UK, Japan, Malta, Malaysia, Australia, U.S.A.

|

$

|

35.4

|

42.2%

|

|

Wooden Crafts

|

Christmas gifts, photo frames, gift boxes, wood tubes, bottle boxes, decorative wooden plates, toys, pet supplies

|

U.S.A., Japan, Malta, Malaysia, European country

|

$

|

1.5

|

1.7%

|

Wood Furniture

We established our first wooden furniture production line in 2004 by producing furniture made from poplar and paulownia. Poplar and paulownia wood generally have distinctive characteristics of color, a smoother surface and lighter weight than certain other types of wood. In addition, Cao County is the natural base for the growth of both poplar and paulownia. The average time it takes poplar and paulownia trees to grow to maturity in Cao County is two to three years shorter than for other kinds of trees generally used for wood furniture in China. Over the past few years, revenues from wood furniture products have increased substantially and have become a substantial percentage of our overall product sales.

-13-

Japan and Europe are the primary target markets for sales of such wood furniture. For fiscal year 2010, sales and net income were approximately $47.1 million and $8.79 million, respectively, from our furniture products. Wood furniture products accounted for approximately 56.1% of our aggregate revenues.

Because of the growing demand, higher gross margins and changing dynamics of the international wood furniture industry, specifically, production moving away from countries such as the United States and Italy toward developing countries with cheaper labor, such as China and India, we have been and intend to focus substantial resources and efforts on our wood furniture production.

Straw-wicker products

Because straw-wicker are easy to produce, do not require a significant investment in technology or equipment, we do not produce such products in our manufacturing facilities. Instead, we employ local residents to manufacture such products in their homes in Cao County, Shandong Province, PRC. Although we have expanded our business to wood furniture manufacturing, straw-wicker products are continue to be an integral part of our overall business.

For fiscal year 2010, sales and net income for straw wicker products were approximately $35.4 million and $5.15 million, respectively. Straw wicker products accounted for approximately 42.2% of our aggregate revenues.

Handicraft Products

With the advantage of having poplar and paulownia resources in Cao Country, in 2000 we expanded our product mix to include wooden handicrafts. We are dedicated to producing a wide variety of novel-designed wooden handicrafts. We produce more than 800 kinds of wooden handicrafts varying from household articles, to office appliance and pet supplies.

For fiscal year 2010, sales and net income for handicraft products were approximately $1.5 million and $0.21 million, respectively. Handicraft products accounted for approximately 1.7% of our aggregate revenues.

Manufacturing

We operated approximately 162,688.82 square meters of manufacturing and supply plant capacity in Shandong Province for furniture and handicrafts production. These manufacturing and other facilities consist of 19 plants, which are located in our existing 4 industrial parks. In December 2006, we were granted an additional 98,435.32 square meters free land use right by the PRC Government, upon which we will build the fifth industrial park in 2010. As of December 31, 2010, we have the land use right for a total of 261,124.14 square meters. We consider the machinery and equipment at such location generally to be relatively up to date and well-maintained. The manufacturing equipment at those locations include band saws, cut-to-size saws, sanders, single-plate saws,

multi-plate saws, thickness, matchers, multiple-drillings, copying machines, engraving machines, routers, chilling presses, roll coaters, and leaching paint machines.

-14-

Following are photos of our manufacture plants:

|

Our domestic manufacturing strategy includes:

|

·

|

More frequent and cost-effective production runs,

|

|

·

|

Identification and recycling of product waste, and

|

|

·

|

Improvement of our relationships with suppliers by establishing primary suppliers.

|

Production Process

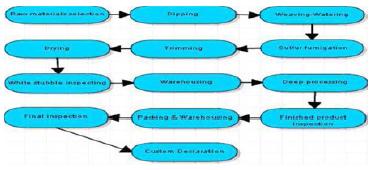

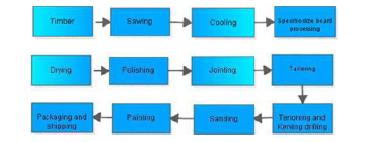

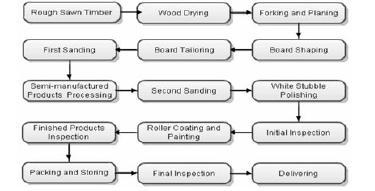

The manufacturing process of each of our products generally involves various steps. The following charts indicate the steps in manufacturing straw-wicker products, wooden craft products and furniture products.

1. Steps to manufacture straw-wicker products:

-15-

2. Steps to manufacture wooden craft products:

3. Steps to manufacture furniture products:

The technology and procedures used in the above processes vary depending on the different products that we manufacture and depend upon the product specifications prescribed by a particular customer.

Raw Materials

The principal materials used in manufacturing our wood furniture products include lumber, veneers, plywood, particle board, hardware, glue, finishing materials, glass products, laminates, fabrics and metals. We use a variety of species of lumber, including cherry, oak, ash, poplar, paulownia wood, pine and maple. The main raw materials for our straw-wicker products are thin grasses, seaweed, wheat straw and maize-leaf. The main raw material used in or handicrafts products are poplar and paulownia wood. We believe that our sources for raw materials are adequate and that we are not dependent on any one supplier. Our five

largest suppliers, (Qingping Wang, Xiaoyou Liu, Shandong Beier Chemical Co., Ltd, Cao County Shengcheng Carton Plant, and Cao County Minzu Carton Plant) accounted for an aggregate of approximately 20% of our raw materials for all of our furniture and handicrafts manufacturing operations during 2010. No single supplier accounted for more than 10% of our raw material purchases.

All of our operations are located in Cao County, PRC, the southwest of Shandong Province, which is at the junction of Anhui Province, Henan Province, Jiangsu and Shandong Province. We currently have four industrial plants located in such area. In and around Cao County, there are a substantial number of poplar and paulownia trees. The wood from such trees are used to make a variety of types of furniture, such as chairs, desks, cabinets, tables, stools, and dividers. Furniture made of poplar and paulownia has the following distinct characteristics: unique color, smooth surface, light weight (making it easy to carry and ship), and a low price. We believe that these characteristics have made it popular in Asia, Europe and the United

States. Cao County also has a large supply of readily available raw materials for our straw-and-wicker products.

-16-

Customers and Suppliers

We believe we have successfully established long-term, stable business relationships with over three hundred customers in over thirty countries. Our products are sold in stores operated by such well known retailers as Zara-Home, Habitat UK Ltd., ABM Group Inc., and Fuji Boeki Co. Ltd.

We receive most of our orders twice a year through attending the Chinese Export Commodities Fair (or Canton Fair) in May and October in Guangzhou City, China, respectively. In addition, we select which orders to fulfill from customers based upon the particular price and profit margin we receive from the products, and, as a result, our top ten customers change each year.

In fiscal 2010, our top 10 purchasers of our products were as follows:

Major Customers

|

Name

|

Amounts in USD

12 months ended

December 31, 2010 (’000s) |

Percentage of Overall Sales (%)

|

||||||

|

JYSK SP. Zoo, Gdansk. (Denmark)

|

$ | 12,829 | 15.28 | % | ||||

|

Trade Point A/S Direct Container (Denmark)

|

$ | 5,367 | 6.40 | % | ||||

|

ABM Group Inc. (USA)

|

$ | 4,912 | 5.85 | % | ||||

|

Zara-Home (Spain)

|

$ | 4,099 | 4.88 | % | ||||

|

Fuji Boeki Co., Ltd. (Japan)

|

$ | 2,513 | 2.99 | % | ||||

|

Axis Imex, Inc. (USA)

|

$ | 2,493 | 2.97 | % | ||||

|

WATSON TRADING COMPANY,INC. (USA)

|

$ | 2,471 | 2.94 | % | ||||

|

KWANTUM NEDERLAND B.V. (HOLLAND)

|

$ | 2,438 | 2.90 | % | ||||

|

Habitat UK Ltd. (England)

|

$ | 2,248 | 2.68 | % | ||||

|

TESCO (England)

|

$ | 1,984 | 2.36 | % | ||||

In fiscal 2010, our top 10 suppliers for raw materials used to manufacture our products were as follows:

Suppliers of Raw Materials

|

Name

|

Amount (USD)

12 months

ended December 31,

2010 (’000s)

|

Location

|

Percentage*

|

||||||

|

Qingping Wang

|

$ | 270.9 |

Cao County

|

7.42 | % | ||||

|

|

|

|

|

||||||

|

Xiaoyou Liu

|

$ | 252.8 |

Cao County

|

6.93 | % | ||||

|

Shandong Beier Chemical Co., Ltd.

|

$ | 919.5 |

Cao County

|

2.52 | % | ||||

|

Cao County Shengcheng Carton Plant

|

$ | 705.6 |

Cao County

|

1.93 | % | ||||

|

Cao County Minzu Carton Plant

|

$ | 411.3 |

Cao County

|

1.13 | % | ||||

|

|

|

|

|

||||||

|

Shengli Xie

|

$ | 379.6 |

Cao County

|

1.04 | % | ||||

|

|

|

|

|

||||||

|

Hongming Yu

|

$ | 358.3 |

Cao County

|

* | |||||

|

|

|

|

|

||||||

|

Hongqing Zhang

|

$ | 344.1 |

Cao County

|

* | |||||

|

|

|

|

|

||||||

|

Tengjian Wang

|

$ | 324.5 |

Cao County

|

* | |||||

|

|

|

|

|

||||||

|

Enzhu Zhang

|

$ | 304.2 |

Cao County

|

* | |||||

* less than 1%.

-17-

Quality Control

Consistent with our continuing commitment to quality, we impose rigorous quality control standards at various stages of our production process. We strictly comply with various national quality standards, established by the General Administration of Quality Supervision, Inspection and Quarantine of China, with respect to the hardware and paint used in the manufacture of furniture, straw-wicker and handicraft products. We also strictly comply with various quality standards based on the clients’ special quality requirements.

Marketing and Sales

We have developed a broad domestic and international network with our independent third party retailers and wholesalers who sell our products to their customers after purchasing them directly from us. We believe this broad network helps reduce exposure to regional recessions, and allows us to capitalize on emerging channels of distribution.

We believe general marketing practice followed in the furniture industry is to exhibit products at international and regional furniture markets. In the spring and fall of each year, a seven-day furniture market is held in High Point, North Carolina, which is attended by most buyers and is regarded by the industry as the international market. Generally, we follow the general marketing practice followed by furniture manufacturers in the furniture industry by exhibiting our products at international and regional furniture markets attended by buyers for furniture retailers. We market our products by participating in tradeshows and exhibitions in both the PRC and abroad. We believe that we have built up a solid business reputation among numerous well-known

retailers. We sell our furniture through over 300 retailers and wholesalers of residential home furnishings, who are broadly dispersed internationally, including: Trade Point A/S Direct Container, Zara-Home, Bettenwelt Gmbh & Co. KG, JYSK SP Zoo Gdansk, and Habitat UK Ltd. in Europe; ABM Group Inc. and Axis Imex, Inc., in the US; Fuji Boeki Co. Ltd. in Japan.

-18-

We believe no significant part of our business is dependent upon a single customer, however, the loss of our larger customers could have a material impact on our business. Approximately 95.2% of our net sales during fiscal year ended 2010 were to international customers.

Generally, we sell our finished products directly to third party retailers and wholesalers without any commission. We believe our broad network of 3rd party retailers and wholesalers reduces our exposure to regional recessions and allows us to capitalize on emerging trends in channels of distribution.

Warehousing, Inventory and Supply Chain Management

We distribute furniture to retailers and wholesalers from our distribution centers and warehouses in Caopu Industrial Park. We ship containers of finished products directly from our manufacturing facilities to the port of Qingdao to third-party retailers and wholesalers.

There is no backlog of unshipped orders for any of our products as of December 31, 2010. We believe, based on our managements’ experience, our current production capacity for our existing wooden furniture products can only satisfy an estimated approximately between 60% and 70% of our overseas demands. As a result, we are planning to expand our current production facility in order to meet all the demands we received or would received from oversea clients.

Competition

Competitive Environment

The furniture industry is highly competitive and includes a large number of foreign and domestic manufacturers and importers, none of which dominates the market. Currently, the arts and crafts industry is a concentrated industry in China. The majority of arts and crafts producers are located in southern and eastern China. While the markets in which we compete include a large number of relatively small and medium-sized manufacturers, certain competitors have substantially greater sales volumes and financial resources than we do.

With regard to the production scale and products categories, our main competitors are as follows:

Existing Competitors for our wood furniture products:

Puyang Hongda Wooden Products Co., Ltd, a company specialized in wooden furniture and wooden handicrafts production, focuses its business on producing paulownia products, mixed hard wood products, and mahogany products. Depending on technological advantages and advanced craftsmanship, we believe the company is attempting to expand into the United States market, keeping Japan and Europe as its main export countries.

Existing Competitors for straw-and-wicker and handicrafts manufacturers:

Nanjing Artall Light Industry Co., Ltd, a subsidiary of Jiangsu Holly Corporation, a public company on the Shanghai Stock Exchange. It is a manufacturing and trading corporation located in Jiangsu Province with annual export value exceeding RMB200 million, Artall is primarily engaged in producing gift products, handicrafts, kitchen applicants, travel products, outdoor products, toys, pet supplies, and willow products.

Shandong Jiaxiang Jinyi Arts & Crafts Co., Ltd, a company established in 1986, has a diversified product line featuring straw and wicker products, ranging from stone handicrafts, copper handicrafts, and iron handicrafts to Lu Brocade and Straw/Reed/Kenaf products.

Intellectual Property

As of December 31, 2010, we have the following intellectual property rights:

Patents

On June 20, 2010, we applied for 10 new design patents for furniture products with the appropriate PRC governmental authorities, in the name of Shandong Caopu Arts & Crafts Co., Ltd. We have received the patent authorization written notice for such application from the appropriate PRC governmental authorities in August 2010, and we believe we will receive the patent certificates in 2011.

-19-

Pursuant to an Exclusive Patent License Agreement dated as of July 2, 2010 (the “Agreement”), Mr. Li, our majority stockholder, Chairman and Chief Executive Officer, and the owner of the following listed seven (7) patents authorized us to use such patents exclusively on a royalty free base. Since such patents do not reflect current design trend in our industry and are easy to be imitated, we do not believe it is economically beneficial to keep them valid by paying annual fee with appropriate PRC governmental authorities. All such 7 patents expired in August 2010.

Trademarks and Domain Names

We have registered five trademarks:

|

Trademark

|

Certificate No.

|

Category

|

Registrant

|

Valid Term

|

||||

(1) (1) |

3722006

|

28

|

Shandong

|

June 7, 2006 to June 6, 2016

|

||||

(1) (1) |

3722025

|

20

|

Shandong

|

February 14, 2006 to February 13, 2016

|

(1) (1) |

3722007

|

20

|

Shandong

|

February 14, 2006 to February 13, 2016

|

||||

(2) (2) |

4900955

|

20

|

Shandong

|

Registered in Japan

|

||||

(3) (3) |

904344

|

20, 28

|

Shandong

|

January, 2007 to January, 2017

|

(1) Registered with the PRC Trademark Bureau under the State of Administration for Industry & Commerce.

(2) Registered in Japan.

(3) Registered with World Intellectual Property Organization.

We have registered the following domain names:

|

Domain Name

|

Owner

|

Registration Date

|

Expiration Date

|

|||

|

www.caopu.cn

|

Shandong

|

June 15, 2006

|

June 15, 2011

|

|||

|

www.cpgy.com

|

Shandong

|

April 27, 2002

|

April 27, 2012

|

|||

|

www.caopu.cc

|

Shandong

|

June 15, 2006

|

June 15, 2016

|

Employees

As of December 31, 2010, we had approximately 1,500 employees. In 2010, our average compensation per employee per month was RMB 1,152 or approximately US$175. We also paid social security insurance fees for employees who required such insurance under PRC law.

We have a human resource performance review system and series of incentive policies that allow personnel reviews to be carried out monthly or bi-monthly, depending on the length of employees’ service for Shandong.

The following table shows a breakdown of our employees by function as of December 31, 2010:

-20-

|

Functions

|

Number

of

employees

|

% of

total

|

||||||

|

Manufacturing

|

1,379

|

89

|

%

|

|||||

|

Sales and Marketing

|

45

|

2.9

|

%

|

|||||

|

General Administration, Purchasing and Logistics

|

60

|

3.9

|

%

|

|||||

|

Quality Control, Technology and Research & Development

|

66

|

4.2

|

%

|

|||||

|

Total

|

1,550

|

100

|

%

|

|||||

From time to time, we also employ third-party auditors to issue Capital Verification Reports once a year. We have not experienced any significant labor disputes and consider our relationship with our employees to be good.

Government Regulations

Insurance Plans

We are subject to a wide range of regulation covering our business. We are required to provide to our employees the following state-mandated insurance plans:

|

|

·

|

Retirement insurance: we withhold a portion of each employee’s average monthly salary from the prior year, as determined by the provincial government, generally 8%, and contribute an additional amount determined by law, up to approximately 20% of such average monthly salary

|

|

|

·

|

Medical insurance: we withhold approximately 2% of each employee’s average monthly salary from the prior year and contribute an additional amount totaling approximately 6% of such average monthly salary.

|

|

|

·

|

Unemployment insurance: we withhold approximately 1% of each employee’s average monthly salary from the prior year, and contribute an additional amount totaling approximately 2% of such average monthly salary.

|

|

|

·

|

Industrial injury insurance: we contribute an amount totaling approximately 1.1% of each employee’s average monthly salary from the prior year.

|

Circular 75 Compliance and Approval

SAFE issued the Notice on Issues Relating to the Administration of Foreign Exchange in Fund-raising and Reverse Investment Activities of Domestic Residents Conducted via Offshore Special Purpose Companies, or “Notice 75,” on October 21, 2005, which became effective as of November 1, 2005 and the operating procedures in May 2007, collectively the SAFE Rules. According to the SAFE Rules, prior registration with the local SAFE branch is required for PRC residents to establish or to control an offshore company for the purposes of financing that offshore company with assets or equity interests in an onshore enterprise located in the PRC. An amendment to registration or filing with the local SAFE branch by such PRC resident is also required for the injection of equity interests or assets of an

onshore enterprise in the offshore company or overseas funds raised by such offshore company, or any other material change involving a change in the capital of the offshore company. The SAFE rules define “PRC residents” to include both legal persons and natural persons who either hold legal PRC identification documents, or who habitually reside in China due to economic interests or needs. If any PRC resident fails to file its SAFE registration for an existing offshore enterprise, any dividends remitted by the onshore enterprise to its overseas parent after October 21, 2005 will be considered to be an evasion of foreign exchange purchase rules, and the payment of the dividend will be illegal. As a result, both the onshore enterprise and its actual controlling persons can be fined. In addition, failure to comply with the registration procedures may result in restrictions on the relevant onshore enterprise, including prohibitions on the payment of

dividends and other distributions to its offshore parent or affiliate and capital inflow from the offshore enterprise. The PRC resident stockholders of the offshore enterprise may also be subject to penalties under Chinese foreign exchange administration regulations.

-21-

We have requested our stockholders and beneficial owners who may be subject to SAFE Rules to make the necessary applications, filings and amendments as required under SAFE Rules. We have advised these stockholders and beneficial owners to comply with the relevant requirements. It is our understanding that these stockholders are in the process of making the required filings. However, we cannot provide any assurance that all of our stockholders and beneficial owners who may be PRC residents will comply with our request to make or obtain any applicable registrations or comply with other requirements required by SAFE Rules. The failure or inability of our PRC resident stockholders or beneficial owners to make any required registrations or comply with other

requirements may subject such stockholders or beneficial owners to fines and legal sanctions and may also limit our ability to contribute additional capital into or provide loans to our PRC subsidiaries, limit the ability of our PRC subsidiaries to pay dividends or otherwise distribute profits to us, or otherwise adversely affect us.

Approvals, Licenses and Certificates

We require a number of approvals, licenses and certificates in order to operate our business. Our principal approvals, licenses and certificates are set forth below:

|

|

·

|

Business License (No.371700400000825) issued on August 14, 2009 by Heze Administration for Industry and Commerce;

|

|

|

·

|

Organization Code Certificate issued by Heze Administration of Quality and Technology Supervision (code No. 724299773, and registration No. Zu Dai Guan 371700-000137-2), the valid period of which is from June 2007 to June 2011;

|

|

|

·

|

Taxation Registration Certificate (Lu He Shui Zi No. 372922724299773) issued by the Cao County National Taxation Bureau and Caopu County Local Taxation Bureau in September 2009; and

|

|

|

·

|

Registration Form for Operators of Foreign Trading (the code No (2009)0809) issued by People’s Government of Shandong Province on August 12, 2009.

|

Properties

There is no private land ownership in PRC. Land in the PRC is owned by the government and cannot be sold to any individual or entity. Instead, the government grants or allocates landholders a “land use right,” which is sometimes referred to informally as land ownership. Land use rights are granted for specific purposes and for limited periods. Each period may be renewed at the expiration of the initial and any subsequent terms. Granted land use rights are transferable and may be used as security for borrowings and other obligations. Generally speaking, there are four primary ways of obtaining land use rights in the PRC:

|

|

·

|

Grant of the right to use land;

|

|

|

·

|

Assignment of the right to use land;

|

|

|

·

|

Lease of the right to use land; and

|

|

|

·

|

Allocated land use rights.

|

Our executive offices and manufacturing facilities are located in Shandong, China, on approximately 130,000 square meters. We have been issued a Land Use Right Certificate for such property until 2056 by the municipal government of Shandong, which may be renewed upon our application and the municipal governments’ approval. We currently have land use rights for 18 buildings on such property as listed below. We believe that our existing facilities are well maintained and in good operating condition.

Our land use rights are set forth below:

Land Use Rights through Grants from Land Management Authority

|

Land Use Right

Certificate No.

|

Address

|

Area

|

Usage

|

Land Nature

|

Expiration

Date

|

|

Cao Count, China (2006) No.176

|

Zhongkou Village, Pulianji Town, Cao County

|

68,329.32 ㎡

|

Industrial Land

|

Allocated State-owned land

|

October 2056

|

|

Cao Count, China (2003) No.80

|

Zhongkou Village, Pulianji Town

|

41,572.46㎡

|

Industrial land

|

Allocated State-owned land

|

June 2053

|

|

Cao Count, China (2006) No.189

|

Zhongkou Village, Pulianji Town ,Cao County

|

98,435.32㎡

|

Industrial land

|

Allocated State-owned land

|

December 2056

|

|

Cao Count, China (2001) No.0106

|

Longhuadian Village, Pulianji Town, Cao County

|

13,150㎡

|

Industrial land

|

Allocated State-owned land

|

July 2053

|

|

Cao Count, China (2001) No. 0105

|

ZhaocaiyuanVillage, Pulianji Town, Cao County

|

39,637.04㎡

|

Industrial land

|

Allocated State-owned land

|

March 2051

|

-22-

All land use rights currently owned by us are land use rights relating to allocated land. The local governmental authorities have granted such land use rights to us for free use given our contribution to the development of the local economy. However, pursuant to the Catalogue on Allocated Land issued by the Ministry of Land Resources of the PRC, the land use rights for allocated land may only be granted to those specific projects which are in compliance with the Catalogue, subject to the approval of the competent governmental authorities. We, as a privately owned furniture manufacturer, may not be qualified to be granted with such land use rights for allocated land according to the Catalogue. Consequently, our use

of such land may be subject to challenges in the future, and the legal consequences could include the confiscation of such land by the governmental authorities or the request on us to pay a market price for purchasing the land use rights for such land and converting the allocated land use right to granted land use right.

Although we intend to pay the relevant grant fees (which we believe are at a favorable price specially offered to us by the local government, approximately $3,824 per mu (1 mu equals 666.67 square meters), or $1,497,800.4 for our current total land use right of 261,124.1 square meters). We started the application process to convert the allocated land into granted land in July 2010 and are currently awaiting the final consent from Shandong Provincial Government. As a result, we do not yet know whether our use of such land will be subject to challenges before we convert the allocated land into granted land.

Premises

Our operating facilities consist of 19 plants located in our existing four industrial parks in Cao County, Shandong Province, PRC. The existing industrial parks have a total area of 162,688.82 square meters, of which 71,708.4 square meters consists of buildings that house our production lines, warehouses, executive offices and related business items.

Insurance

We maintain various insurance policies to safeguard against risks and unexpected events. We provide social security insurance, including pension insurance, unemployment insurance, work related injury insurance, maternity insurance and medical insurance to in accordance with PRC regulations (see “Government Regulations”). We also maintain insurance for our plants, machinery, equipment, inventories and motor vehicles. However, we do not maintain product liability insurance for our products.

ITEM 1A. RISK FACTORS.

An investment in our common stock involves significant risks. You should carefully consider the following risks and all other information set forth in this Annual Report before deciding to invest in our common stock. If any of the events or developments described below occurs, our business, financial condition and results of operations may suffer. In that case, the value of our common stock may decline and you could lose all or part of your investment.

-23-

Our current business operations are conducted in the PRC. Because China’s economy and its laws, regulations and policies are different from those typically found in the West and are continually changing, we face certain risks, which are summarized below.

Risks Related to Our Business and Industry

The current economic and credit environment could have an adverse effect on demand for certain of our products and services, which would in turn have a negative impact on our results of operations, our cash flows, our financial condition, our ability to borrow and our stock price.

Since at least 2008, global market and economic conditions have been disrupted and volatile. Concerns over increased energy costs, geopolitical issues, the availability and cost of credit, the U.S. mortgage market and a declining residential real estate market in the U.S. have contributed to this increased volatility and diminished expectations for the economy and the markets going forward. These factors, combined with volatile oil prices, declining business and consumer confidence and increased unemployment, have precipitated a global recession. It is difficult to predict how long the current economic conditions will persist, whether they will deteriorate further, and which of our products, if not all of them, will be adversely affected. These conditions, if they

continue, could cause a material decrease in our sales, net income and an increase in the prices we pay for raw materials used in producing our furniture products and, thus, materially affect our operating results and financial condition.

We may be unable to maintain an effective system of internal control over financial reporting, and as a result we may be unable to accurately report our financial results.

Our reporting obligations as a public company place a significant strain on our management, operational and financial resources and systems. If we fail to maintain an effective system of internal control over financial reporting, we could experience delays or inaccuracies in our reporting of financial information, or non-compliance with the SEC, reporting and other regulatory requirements. This could subject us to regulatory scrutiny and result in a loss of public confidence in our management, which could, among other things, cause our stock price to drop.

We issued financial statements that we were required to restate in that they were not to be relied upon as a result of ineffective disclosure controls and procedures.

On June 17, 2010, our management concluded that our audited consolidated financial statements for the fiscal year ended December 31, 2009 (the “2009 Year”), and our unaudited consolidated financial statements for the quarter ended March 31, 2010 (the “2010 1st Quarter”), could no longer be relied upon. We filed a Current Report on Form 8-K with the SEC disclosing that the financial statements could not be relied upon on June 23, 2010. During the course of our review, we determined that our revenues were understated by approximately $10 million for the 2009 Year and overstated by approximately $55,000 for the 2010 1st Quarter. We further determined that our net income will increase by approximately $2 million for the 2009 Year, and decrease by approximately

$24,000 for the 2010 1st Quarter. As a result, we restated our financial statements for the 2009 Year as well as for the 2010 1st Quarter.

The reason for the discrepancy in our financial statements was that we recognized revenue on the date that we physically received clearance papers from the Chinese customs department (“Customs”). These clearance papers permit us to ship our products to their purchasers. However, there is a time lag between the date that we receive physical delivery of the clearance papers from Customs and the date that Customs actually approves the shipment of our products. On June 17, 2010, we concluded that the date that Customs actually approves the shipment of our products is the more appropriate and accurate date on which to recognize revenue.

While both the initial and subsequent means of recognizing revenue are consistent with GAAP, we believe that our presentation to our auditors of a policy that our management later concluded was less appropriate than the policy that we presently have in place resulted from inadequate internal communications. We further believe that such internal communications may indicate that our disclosure controls and procedures were ineffective as of the end of December 31, 2009 and March 31, 2010 since the information necessary to adopt the most appropriate policy was not communicated in a sufficiently timely manner. However, we believe that this was a relatively minor, isolated incident that is not representative of such disclosure controls and procedures taken as a whole. In addition, we

have since the occurrence of this incident taken certain corrective steps, such as hiring a full-time chief financial officer whom we believe has enhanced the effectiveness of our disclosure controls and procedures.

-24-

Although we believe that these corrective steps will enable management to conclude that our disclosure controls and procedures are effective, we cannot assure you that this will be sufficient. If we should in the future conclude that our disclosure controls and procedures are ineffective we will be required to expend additional resources to improve such disclosure controls and procedures. Any additional instances of ineffective disclosure controls and procedures, among other items, could cause our future financial statements to be incorrect, which, if material, could require a restatement. If such further restatements are required, there could be a material adverse affect on our stockholders’ confidence that our financial statements fairly present our financial condition and

results of operations, which in turn could materially and adversely affect the market price of our common stock.

Because we will require additional financing to expand our operation in accordance with our growing strategy, our failure to obtain necessary financing will impair our growth strategy.

As of December 31, 2010, we had working capital of $20,609,780. Our capital requirements in connection with our planned development and growth of our business are significant.

We believe we can substantially increase our revenue, net income and gross margins by implementing a growth strategy that focuses on (i) selling new wood furniture products and (ii) increasing our existing manufacturing capacity. To implement our growth strategy, we intend to expand our current Caopu Industrial Park by (i) constructing our 5th industrial park, located in such area, which we hope will include 2 new production facilities and an R&D center (ii) upgrading our existing facilities to further attempt to maximize our existing production lines, and (iii) setting up new facilities that will produce products used in the production of our new and existing furniture lines. We also intend to open retail stores overseas to sell our products directly to end users.

The estimated costs for this and other projects that are part of our growth strategy in the future will cost us an estimated $74.8 million in aggregate and will be undertaken in phases over a period of 3 to 5 years depending on the funds available to us, including internal capital and external capital. The 2 production lines are anticipated to cost approximately $20 million. We currently estimate that the first of our 2 proposed production lines will be in production approximately 3 to 6 months after our receipt of the requisite financing, if we are able to obtain such financing. However, we will need an additional approximately $54.8 million to accomplish our longer term objectives, including but not limited to the second proposed product line

To accomplish the objectives discussed above and to execute our business strategy, we need access to capital on appropriate terms. We currently have no commitments with any third party to obtain such additional financing and we cannot assure you that we will be able to obtain the requisite additional financing on any terms, and, if we are able to raise additional funds, it may be necessary for us to sell our securities at a price which is at a significant discount to the market price and on other terms which may be disadvantageous to us. In connection with any such financing, we may be required to provide registration rights to the investors and pay damages to the investors in the event that the registration statement is not filed or declared effective by specified dates. The

price and terms of any financing which would be available to us could result in both the issuance of a significant number of shares and significant downward pressure on our stock price. We cannot assure you that our business objectives, particularly over the longer term, will be met on a timely basis, if at all. Consequently, we may be unable to meet fixed obligations and expenses that will be generated in the operation of our business, whether as presently in existence or as proposed. Any failure to obtain requisite financing on acceptable terms could have material and adverse effect on our business, financial condition and future prospects.

Failure to produce and/or sell our new products may have an adverse effect on us.

As part of our growth strategy we intend to construct 2 new production lines which will manufacture products that we perceive global demand for. The failure by us to successfully manufacture such new products on a cost effective and timely basis and/or sell such products in sufficient amounts would result in us having expended substantial fund and time without producing corresponding revenues and net income, which could, among other negative items, weaken our cash position and further reduce our operating results.

An increase in the cost of raw materials, or our failure to obtain enough raw materials will adversely affect sales and revenues.

Raw materials required for the crafts and furniture industry include poplar, paulownia and other natural sources. Any increase in the prices of these raw materials in the future will affect the price at which we can sell our products. In addition, as we expand our business, we may encounter the problem of a shortage of raw materials. If we are not able to raise our prices to pass on increased costs or if we cannot obtain enough raw materials to meet the expansion of our business, we would be unable to maintain our margins, which would adversely affect our financial condition.

-25-

Because our funds are held in banks which do not provide insurance, the failure of any bank in which we deposit our funds could affect our ability to continue in business.