Attached files

| file | filename |

|---|---|

| EX-5 - OPINION OF COUNSEL - Apple Green Holding, Inc. | ex_5-1.txt |

| EX-23 - CONSENT OF ACCOUNTANTS - Apple Green Holding, Inc. | ex_23-1.txt |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 1

FORM S-1/A

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Blue Sun Media, Inc.

--------------------

(Exact name of registrant as specified in its charter)

Nevada

------

(State or other jurisdiction of incorporation or organization)

7372

----

(Primary Standard Industrial Classification Code Number)

27-3436055

----------

(I.R.S. Employer Identification Number)

Elise Travertini

349 W. Pine Street, Suite 4D, Central Point, OR 97502

541-499-1637

-----------------------------------------------------

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices)

As soon as practicable after the effective date of this registration statement

------------------------------------------------------------------------------

(Approximate date of commencement of proposed sale to the public)

This is the initial public offering of the Company's common stock.

If any of the securities being registered on this Form are to be offered on a

delayed or continuous basis pursuant to Rule 415 under the Securities Act of

1933 check the following box: [X]

If this Form is filed to register additional securities for an offering pursuant

to Rule 462(b) under the Securities Act, please check the following box and list

the Securities Act registration statement number of the earlier effective

registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under

the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement

for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under

the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement

for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting Company. See

the definitions of "large accelerated filer," "accelerated filer" and "smaller

reporting Company" in Rule 12b-2 of the Exchange Act. (Check one)

Large accelerated filer [ ] Accelerated filer [ ]

Non-accelerated filer [ ] Smaller reporting Company [X]

(Do not check if a smaller reporting Company)

CALCULATION OF REGISTRATION FEE

Title of Each Proposed Proposed

Class of Amount Maximum Maximum Amount of

Securities to to be Offering Price Aggregate Registration

be Registered Registered(1) Per Unit(2) Offering Price Fee(3)

------------- ------------- -------------- -------------- ------------

Common Stock

by Company 3,000,000 $0.01 $30,000 $3.48

(1) The Company may not sell all of the shares, in fact it may not sell any of

the shares. For example, if only 50% of the shares are sold, there will be

1,500,000 shares sold and the gross proceeds will be $15,000.

(2) The offering price has been arbitrarily determined by the Company and bears

no relationship to assets, earnings, or any other valuation criteria. No

assurance can be given that the shares offered hereby will have a market value

or that they may be sold at this, or at any price.

(3) Estimated solely for the purpose of calculating the registration fee based

on Rule 457(o).

The registrant hereby amends this registration statement on such date or dates

as may be necessary to delay its effective date until the Registrant shall file

a further amendment which specifically states that this Registration Statement

shall thereafter become effective in accordance with Section 8(a) of the

Securities Act of 1933 or until the registration statement shall become

effective on such date as the Commission, acting pursuant to said Section 8(a),

may determine.

ii

PROSPECTUS

----------

3,000,000 SHARES OF COMMON STOCK

BLUE SUN MEDIA, INC.

$0.01 PER SHARE

This registration statement constitutes the initial public offering of Blue Sun

Media, Inc. (the "Company", "us", or "BSM") common stock. BSM is registering

3,000,000 shares of common stock at an offering price of $0.01 per share for a

total amount of $30,000. The Company will sell the securities in $500

increments. There are no underwritings or broker dealers involved with the

offering.

The Company will offer the securities on a best efforts basis and there will be

no minimum amount required to close the transaction. The Company's sole officer

and director, Ms. Elise Travertini, will be responsible to market and sell these

securities.

Currently, Ms. Travertini owns 100% of the Company's common stock. After the

offering, Ms. Travertini will retain a sufficient number of shares to continue

to control the operations of the Company.

If all the shares are not sold, there is the possibility that the amount raised

may be minimal and might not even cover the costs of the offering which the

Company estimates at $5,000. The proceeds from the sale of the securities will

be placed directly into the Company's account and there will not be an escrow

account. Since there is no escrow account, any investor who purchases shares

will have no assurance that any monies besides themselves will be subscribed to

the prospectus. All proceeds from the sale of the securities are non-refundable,

except as may be required by applicable laws. The Company will pay all expenses

incurred in this offering. There has been no public trading market for the

common stock of BSM.

The offering shall terminate on the earlier of (i) the date when the sale of all

3,000,000 shares is completed or (ii) ninety (90) days from the date of this

prospectus becomes effective. The Company will not extend the offering period

beyond the ninety (90) days from the effective date of this prospectus.

This investment involves a high degree of risk. You should purchase shares only

if you can afford the complete loss of your investment. See the section titled

"Risk Factors" herein.

THESE SECURITIES ARE SPECULATIVE AND INVOLVE A HIGH DEGREE OF RISK AND SHOULD BE

CONSIDERED ONLY BY PERSONS WHO CAN AFFORD THE LOSS OF THEIR ENTIRE INVESTMENT.

PLEASE REFER TO "RISK FACTORS" BEGINNING ON PAGE 5.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES

COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE

ADEQUACY OR ACCURACY OF THE PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A

CRIMINAL OFFENSE.

The information in this prospectus is not complete and may be changed. The

Company may not sell these securities until the registration statement filed

with the U.S. Securities and Exchange Commission is deemed "effective". This

prospectus is not an offer to sell these securities and it is not soliciting an

offer to buy these securities in any state where the offer or sale is not

permitted.

The date of this prospectus is ____________, 2011

TABLE OF CONTENTS

Page No.

--------

Part I

------

SUMMARY OF OUR OFFERING................................................. 3

SUMMARY OF OUR COMPANY.................................................. 4

SUMMARY OF FINANCIAL DATA............................................... 4

DESCRIPTION OF PROPERTY................................................. 5

RISK FACTORS............................................................ 5

USE OF PROCEEDS......................................................... 13

DETERMINATION OF OFFERING PRICE......................................... 14

DILUTION OF THE PRICE YOU PAY FOR YOUR SHARES........................... 15

THE OFFERING BY THE COMPANY............................................. 15

PLAN OF DISTRIBUTION.................................................... 16

LEGAL PROCEEDINGS....................................................... 18

BUSINESS................................................................ 18

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND PLAN OF

OPERATION............................................................. 25

CODE OF BUSINESS CONDUCT AND ETHICS..................................... 30

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS............ 30

DIRECTOR AND OFFICER COMPENSATION....................................... 31

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT.......... 32

DESCRIPTION OF SECURITIES............................................... 32

REPORTING............................................................... 34

STOCK TRANSFER AGENT.................................................... 34

STOCK OPTION PLAN....................................................... 34

LITIGATION.............................................................. 34

LEGAL MATTERS........................................................... 34

EXPERTS................................................................. 34

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND CORPORATE GOVERNANCE. 34

INDEMNIFICATION FOR SECURITIES ACT LIABILITIES.......................... 35

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS................ 36

CHANGES AND DISAGREEMENTS WITH ACCOUNTANTS AND FINANCIAL DISCLOSURE..... 37

WHERE TO FIND ADDITIONAL INFORMATION.................................... 37

FINANCIAL STATEMENTS.................................................... F-1

Part II

-------

ITEM 13. OTHER EXPENSES OF ISSUANCE AND DISTRIBUTION ................... II-1

ITEM 14. INDEMNIFICATION OF DIRECTORS AND OFFICERS ..................... II-1

ITEM 15. RECENT SALES OF UNREGISTERED SECURITIES ....................... II-1

ITEM 16. EXHIBITS ...................................................... II-2

ITEM 17. UNDERTAKINGS .................................................. II-3

SIGNATURES ............................................................. II-5

2

SUMMARY OF OUR OFFERING

The following summary is not complete and does not contain all of the

information that may be important to you. You should read the entire prospectus

before making an investment decision to purchase our Common Stock.

THE ISSUER: Blue Sun Media, Inc. a Nevada corporation (BSM)

SECURITIES BEING OFFERED: 3,000,000 shares of our Common Stock, par value

$0.0001 per share.

OFFERING PRICE: $0.01 per share.

MINIMUM NUMBER OF SHARES TO None

BE SOLD IN THIS OFFERING:

COMPANY CAPITALIZATION: Common Stock: 500,000,000 shares authorized;

9,000,000 shares outstanding as of the date of

this prospectus.

Preferred Stock: 20,000,000 shares authorized; no

shares outstanding and no series of preferred

stock designated.

COMMON STOCK OUTSTANDING 9,000,000 Shares of our Common Stock are issued

BEFORE AND AFTER THE and outstanding as of the date of this prospectus.

OFFERING: Upon the completion of this offering, 12,000,000

shares will be issued and outstanding assuming all

of the shares offered are sold.

TERMINATION OF THE The offering will conclude at the earlier of when

OFFERING: all 3,000,000 shares of common stock have been

sold or 90 days after this registration statement

is declared effective by the Securities and

Exchange Commission.

USE OF PROCEEDS: We intend to use the proceeds to further develop

and continue our business operations and other

general working capital and expenses incurred

relating to this registration statement. See "Use

of Proceeds" section for more information.

RISK FACTORS: See "Risk Factors" and the other information in

this prospectus for a discussion of the factors

you should consider before deciding to invest in

shares of our Common Stock. An investment in our

Company should be considered high risk, and an

investment suitable only for those who can afford

to lose the entirety of their investment.

You should rely only upon the information contained in this prospectus. BSM has

not authorized anyone to provide you with information different from that which

is contained in this prospectus. BSM is offering to sell shares of common stock

and seeking offers to buy shares of common stock only in jurisdictions where

offers and sales are permitted. The information contained in this prospectus is

accurate only as of the date of this prospectus, regardless of the time of

delivery of this prospectus, or of any sale of the common stock.

3

SUMMARY INFORMATION ABOUT BLUE SUN MEDIA

Blue Sun Media, Inc. was founded in November 2010 to provide software solutions

to help simplify the management and control of the under age 17 group that is

using the online market and social network available to them on the Internet.

Blue Sun Media will provide these audience solutions that allow them to play,

transact and socialize in an arena that is supervised and guided by their

parents. This age group and their usage of the social media are growing rapidly.

Due to the growth in this market and social media content, parents need to

monitor and protect their children.

Blue Sun Media plans to provide products that will allow parents to be alerted

when their child visits a website with mature content, attempts to download

files, or conducts transactions online. This alert will come via email or text

and inform the parent as to the specific action their child is attempting. The

parents will be notified real time and provided the ability to approve or block

the event. These product offerings will provide parents the ability to allow

their child the freedom to play, transact and socialize in a secure environment.

The Company believes this is a fragmented market with no established leader, and

therefore represents a significant opportunity for Blue Sun Media.

Blue Sun Media, Inc. is in the early stage of developing its business plan. The

Company does not have any products, customers and has not generated any

revenues. The Company must complete the business plan, develop the product and

attract customers before it can start generating revenues.

The proceeds from this offering will be used to complete the Company's business

plan. The Company will need to secure additional financing to develop the

product, attract customers, and start generating revenues. There are no

assurances that the Company will be successful with any subsequent financings.

Our business and registered office is located at 349 W. Pine Street, Suite 4D,

Central Point, OR, 97502. Our contact number is 541-499-1637.

As of December 31, 2010, BSM has $9,000 of cash on hand in the corporate bank

account. The Company currently has incurred liabilities of $5,343. The Company

anticipates incurring costs associated with this offering totaling approximately

$5,000. As of the date of this prospectus, we have not generated any revenue

from our business operations. The following financial information summarizes the

more complete historical financial information found in the audited financial

statements of the Company filed with this prospectus.

SUMMARY FINANCIAL DATA

The following summary financial data should be read together with our financial

statements and the related notes and "Management's Discussion and Analysis or

Plan of Operation" appearing elsewhere in this prospectus. The summary financial

data is not intended to replace our financial statements and the related notes.

Our historical results are not necessarily indication of the results to be

expected for any future period.

BALANCE SHEET AS OF DECEMBER 31, 2010

------------- -----------------------

Total Assets .................................. $ 9,000

Total Liabilities ............................. $ 5,343

Total Shareholder's Equity .................... $ 3,657

OPERATING DATA NOVEMBER 15, 2010 THROUGH DECEMBER 31, 2010

-------------- -------------------------------------------

Revenue ............................ $ 0

Net Loss ........................... $ 5,343

Net Loss Per Share * ............... $ 0

4

* Diluted loss per share is identical to basic loss per share as the Company has

no potentially dilutive securities outstanding.

As indicated in the financial statements accompanying this prospectus, BSM has

had no revenue to date and has incurred only losses since inception. The Company

has had no operations and has been issued a "going concern" opinion from their

auditors, based upon the Company's reliance upon the sale of our common stock as

the sole source of funds for our future operations.

AVAILABLE INFORMATION

Upon the effectiveness of the Company's registration statement on Form S-1, of

which this prospectus is a part, with the Securities and Exchange Commission

("SEC"), the Company will be subject to the reporting and information

requirements of the Securities Exchange Act of 1934, as amended (the "Exchange

Act"), and will therefore be required to file annual and quarterly reports and

other reports and statements with the SEC. Such reports and statements will be

available free of charge on the SEC's website, www.sec.gov.

DIVIDEND POLICY

We have never paid or declared dividends on our securities. The payment of cash

dividends, if any, in the future is within the discretion of our Board and will

depend upon our earnings, our capital requirements, financial condition and

other relevant factors. We intend, for the foreseeable future, to retain future

earnings for use in our business.

DESCRIPTION OF PROPERTY

The company's office is located at 349 W. Pine Street, Suite 4D, Central Point,

OR 97502. The business office is located at the office of Elise Travertini, the

sole officer and director of the company at no charge.

RISK FACTORS

An investment in our Common Stock involves a high degree of risk. In addition to

the other information in this prospectus, you should carefully consider the

following risk factors in evaluating the Company and our business before

purchasing the shares of Common Stock offered hereby. This prospectus contains,

in addition to historical information, forward-looking statements that involve

risks and uncertainties. Our actual results could differ materially. Factors

that could cause or contribute to such differences include, but are not limited

to, those discussed below, as well as those discussed elsewhere in this

prospectus, including the documents incorporated by reference.

RISKS RELATED TO OUR BUSINESS

-----------------------------

ALTHOUGH WE PLAN TO OFFER THE SECURITIES FROM THIS OFFERING, THERE IS NO

GUARANTEE THAT WE WILL COMMENCE THE OFFERING AND IF WE DO, THE PROCEEDS MAY BE

INSUFFICIENT TO FUND OPERATIONS.

The Company plans to offer the securities from this offering, however there is

no guarantee that the Company will be able to sell the securities. There is

no-minimum amount required to be raised by the Company. Even if we fail to raise

enough proceeds to fund operations, the Company is not obligated to return any

of the raised proceeds to the investors. And even if the Company does offer the

securities, there are no guarantees that the proceeds from the offering will be

sufficient to fund our planned operations.

5

WE ARE NOT CURRENTLY PROFITABLE AND MAY NOT BECOME PROFITABLE.

At December 31, 2010, we had $9,000 cash on-hand and our stockholder's equity

was $3,657 and there is substantial doubt as to our ability to continue as a

going concern. We have incurred operating losses since our formation and expect

to incur losses and negative operating cash flows for the foreseeable future,

and we may not achieve profitability. We expect to incur substantial losses for

the foreseeable future and may never become profitable. We also expect to

experience negative cash flow for the foreseeable future as we fund our

operating losses and capital expenditures. As a result, we will need to generate

significant revenues in order to achieve and maintain profitability. We may not

be able to generate these revenues or achieve profitability in the future. Our

failure to achieve or maintain profitability could negatively impact the value

of our business.

THE COMPANY IS SUBJECT TO THE 15(D) REPORTING REQUIREMENTS UNDER THE SECURITIES

EXCHANGE ACT OF 1934 WHICH DOES NOT REQUIRE A COMPANY TO FILE ALL THE SAME

REPORTS AND INFORMATION AS A FULLY REPORTING COMPANY.

The Company is subject to the 15(d) reporting requirements according to the

Securities Exchange Act of 1934. The Company is required to file the necessary

reports in the fiscal year that the registration statement is declared effective

and after the registration statement is declared effective during that same

fiscal year. After that fiscal year and provided the Company has less than 300

shareholders, the Company is not required to file these reports. If the reports

are not filed, the investors will have reduced visibility as to the Company and

its financial condition. In addition, as a filer subject to Section 15(d) of the

Exchange Act, the Company is not required to prepare proxy or information

statements; our common stock will not be subject to the protection of the going

private regulations; the company will be subject to only limited portions of the

tender offer rules; our officers, directors, and more than ten (10%) percent

shareholders are not required to file beneficial ownership reports about their

holdings in our company; that these persons will not be subject to the

short-swing profit recovery provisions of the Exchange Act; and that more than

five percent (5%) holders of classes of your equity securities will not be

required to report information about their ownership positions in the

securities.

WE ARE DEPENDENT UPON THE PROCEEDS OF THIS OFFERING TO FUND OUR BUSINESS. IF WE

DO NOT SELL ENOUGH SHARES IN THIS OFFERING TO CONTINUE OPERATIONS, OUR SOLE

OFFICER AND DIRECTOR HAS VERBALLY AGREED TO FUND OUR OPERATIONS, WHICH COULD END

AT ANY TIME, WHICH COULD HAVE A NEGATIVE EFFECT ON YOUR COMMON STOCK.

As of December 31, 2010, Blue Sun Media, Inc. had $9,000 in assets and limited

capital resources. In order to continue operating through 2011, we must raise

approximately $30,000 in gross proceeds from this offering. To date, our

operations have been funded by our sole officer and director pursuant to a

verbal, non-binding agreement. Ms. Elise Travertini has agreed to personally

fund the Company's overhead expenses, including legal, accounting, and

operational expenses until the Company can achieve revenues sufficient to

sustain its operational and regulatory requirements. The Company does not

currently owe Ms. Elise Travertini any money as of the date of this registration

statement, as Ms. Elise Travertini' monetary funding to the Company as of the

date hereof has not been categorized as loans made to the Company, but as

contributions for which she has received founders stock. Future contributions by

Ms. Elise Travertini to the Company, pursuant to the verbal and non-binding

agreement, will be reflected on the financial statements of the Company as

liabilities.

The Company has approximately $5,000 in offering costs associated with this

financing. If the Company sells all the shares, there will be $25,000 in net

proceeds to the Company ($30,000 gross - $5,000 in expenses = $25,000). The

offering proceeds may not cover these costs and if this is the case, the Company

will be in a worse financial condition prior to the offering.

6

Unless the Company begins to generate sufficient revenues to finance operations

as a going concern, the Company may experience liquidity and solvency problems.

Such liquidity and solvency problems may force us to cease operations if

additional financing is not available.

In the event our Company does not have adequate proceeds from this offering, our

sole Officer and Director, Ms. Elise Travertini, has verbally agreed to fund the

Company for an indefinite period of time. The funding of the Company by Ms.

Elise Travertini will create a further liability of the Company to be reflected

on the Company's financial statements. Ms. Elise Travertini' commitment to

personally fund the Company is not contractual and could cease at any moment in

her sole and absolute discretion.

Also, as a public company, we will incur professional and other fees in

connection with our quarterly and annual reports and other periodic filings the

SEC. Such costs can be substantial and we must generate enough revenue or raise

money from offerings of securities or loans in order to meet these costs and our

SEC filing requirements.

ACCORDING TO YPULSE YOUTH ADVISORY BOARD, THE MOBILE PAYMENT SYSTEMS FOR TWEENS,

TEENS, AND CHILD PROTECTION IS A VERY FRAGMENTED MARKET WITH NO ESTABLISHED

LEADERS. IF THE COMPANY IS NOT ABLE TO ESTABLISH A FIRST TO MARKET POSITION, THE

COMPANY WILL RISK NOT GAINING CUSTOMERS AND WILL NOT GENERATE THE REVENUE TO

BECOME PROFITABLE. IF THE COMPANY DOESN'T GAIN THIS MARKET POSITION, WE FACE A

HIGH RISK OF BUSINESS FAILURE.

According to Chase Straight from the YPulse Advisory Board, the mobile payment

market for tweens/teens is fragmented with several players like Zong, Boku, and

Surfpin. The Company expects that attracting, building and managing a customer

base is difficult to accomplish, especially considering the Internet software

market is very competitive in nature. In particular, the software market to help

parents protect and monitor their children's action is emerging with no

established leader. In order to become successful, the Company must build and

maintain a customer base quickly and establish a reputation in the market. If

the Company does not attract customers and establish itself in the market, the

Company will not be able to generate sales and operating results will be

negatively impacted and our business could fail.

BLUE SUN MEDIA MAY BE UNABLE TO MANAGE ITS FUTURE GROWTH. IF THE COMPANY CAN NOT

SUCCESSFULLY MANAGE THE GROWTH, THE COMPANY MAY RUN OUT OF MONEY AND FAIL.

Any extraordinary growth may place a significant strain on management, finance,

operating and technical resources. Failure to manage this growth effectively

could have a materially adverse effect on the Company's financial condition or

the results of its operations.

AS OUR BUSINESS GROWS, WE WILL NEED TO ATTRACT ADDITIONAL MANAGERIAL EMPLOYEES

WHICH WE MIGHT NOT BE ABLE TO DO.

We have one officer and director, Ms. Elise Travertini, the President and sole

director. In order to grow and implement our business plan, we would need to add

managerial talent to support our business plan. There is no guarantee that we

will be successful in adding such managerial talent.

THE COMPANY'S SOLE OFFICER AND DIRECTOR MAY NOT BE IN A POSITION TO DEVOTE A

MAJORITY OF HER TIME TO THE COMPANY, WHICH MAY RESULT IN PERIODIC INTERRUPTIONS

AND EVEN BUSINESS FAILURE.

Ms. Elise Travertini, our sole officer and director, has other business

interests and currently devotes approximately 30-35 hours per week to our

operations. She currently works at Kids Health Connection, a family counseling

service provider for children under eighteen. In addition, the Company is

entirely dependent on the efforts of its sole officer and director, therefore

7

her departure could have a materially adverse effect on the business. Her

industry and technical expertise are critical to the success of the business.

The loss of this resource would have a significant impact on our business. The

Company does not maintain key person life insurance on its sole officer and

director.

SINCE OUR SOLE OFFICER AND DIRECTOR CURRENTLY OWNS 100% OF THE OUTSTANDING

COMMON STOCK, INVESTORS MAY FEEL THAT HER DECISIONS ARE CONTRARY TO THEIR

INTERESTS

The Company's sole officer and director, Ms. Elise Travertini, owns 100% of the

outstanding shares and will own no less than 75% after this offering is

completed. For example, if 50% of the offering is sold, Ms. Travertini will

retain 85.7% of the shares outstanding. As a result, she will maintain control

of the Company and be able to choose all of our directors. Her interests may

differ from those of other stockholders. Factors that could cause her interests

to differ from the other stockholders include the impact of corporate

transactions on the timing of business operations and her ability to continue to

manage the business given the amount of time she is able to devote to the

Company.

In addition, Ms. Travertini is involved in other business activities that may

present a conflict of interest with the Company. If such conflict arises, Ms.

Travertini will be forced to make a decision which may not be in the best

interests of the Company's shareholders. If such decision is made, this may

materially impact the Company and the value of your investment.

IF, AFTER DEMONSTRATING PROOF-OF-CONCEPT, WE ARE UNABLE TO ESTABLISH PROFITABLE

RELATIONSHIPS WITH CUSTOMERS AND GENERATE REVENUES, THE BUSINESS WILL FAIL.

Because there may be a substantial delay between the completion of this

offering, and creating a proof-of-concept we can use to attract customers, it

may take us longer to generate revenues. If the Company's efforts are

unsuccessful or take longer than anticipated, the Company may run out of capital

and if Ms. Elise Travertini does not fund the Company, the business will fail.

WE WILL RELY ON STRATEGIC RELATIONSHIPS TO PROMOTE OUR PRODUCTS SERVICES AND IF

WE FAIL TO DEVELOP, MAINTAIN OR ENHANCE THESE RELATIONSHIPS, OUR ABILITY TO

SERVE OUR CUSTOMERS AND DEVELOP NEW SERVICES AND APPLICATIONS COULD BE HARMED.

Our ability to provide our products to consumers depends significantly on our

ability to develop, maintain or enhance our strategic relationships with

distribution partners to access these potential customers. In the beginning of

operations, there will be a marketing challenge for BSM. The Company and

identity will be newly formed; therefore, the Company will be relatively unknown

in the marketplace. Therefore, BSM won't benefit from immediate name

recognition.

THE COMPANY MAY RETAIN INDEPENDENT CONTRACTORS OR CONSULTANTS DUE TO CAPITAL

CONSTRAINTS TO HELP GROW THE BUSINESS. IF THESE RESOURCES DO NOT PERFORM, THE

COMPANY MAY HAVE TO CEASE OPERATIONS AND YOU MAY LOOSE YOUR INVESTMENT.

The company's management may decide due to economic reasons to retain

independent contractors to provide services to the company. Those independent

individuals have no fiduciary duty to the shareholders of the Company and may

not perform as expected.

WE MAY NOT BE ABLE TO COMPETE SUCCESSFULLY WITH CURRENT AND FUTURE COMPETITORS.

8

Blue Sun Media, Inc. has many potential competitors in the technology industry

like Zong, Boku, and Surfpin according to Charlie Straight with YPulse Advisory

Board. In addition, the Company expects other companies like Facebook and Google

to offer competing services. Google owns the Android platform which is available

on mobile phones and the Company believes it's only a matter of time before they

offer a payment solution on the mobile phone, even though they do not target

consumers under 18 years old at this time. We will compete, in our current and

proposed businesses, with other companies, some of which have far greater

marketing and financial resources and experience than we do. We cannot guarantee

that we will be able to penetrate our intended market and be able to compete

profitably, if at all.

In addition to established competitors, there is ease of market entry for other

companies that choose to compete with us. Competition could result in price

reductions, reduced margins or have other negative implications, any of which

could adversely affect our business and chances for success. Competition is

likely to increase significantly as new companies enter the market and current

competitors expand their services. Many of these potential competitors are

likely to enjoy substantial competitive advantages, including: larger staffs,

greater name recognition, larger customer bases and substantially greater

financial, marketing, technical and other resources. To be competitive, we must

respond promptly and effectively to the challenges of financial change, evolving

standards and competitors' innovations by continuing to enhance our services and

sales and marketing channels. Any pricing pressures, reduced margins or loss of

market share resulting from increased competition, or our failure to compete

effectively, could fatally damage our business and chances for success.

AUDITOR'S GOING CONCERN - SUBSTANTIAL UNCERTAINTY ABOUT THE ABILITY OF BLUE SUN

MEDIA, INC. TO CONTINUE ITS OPERATIONS AS A GOING CONCERN

In their audit report for the period ending December 31, 2010 and dated January

20, 2011; our auditors have expressed an opinion that substantial doubt exists

as to whether we can continue as an ongoing business. Because our sole officer

may be unwilling or unable to loan or advance any additional capital to Blue Sun

Media, Inc. we believe that if we do not raise additional capital within 12

months of the effective date of this registration statement, we may be required

to suspend or cease the implementation of our business plans. Due to the fact

that there is no minimum investment and no refunds on sold shares, you may be

investing in a Company that will not have the funds necessary to develop its

business strategies. As such we may have to cease operations and you could lose

your entire investment. See the December 31, 2011 Audited Financial Statements -

Auditors' Report". Because the Company has been issued an opinion by its

auditors that substantial doubt exists as to whether it can continue as a going

concern it may be more difficult to attract investors.

RISKS RELATED TO THIS OFFERING

------------------------------

BECAUSE THERE IS NO PUBLIC TRADING MARKET FOR OUR COMMON STOCK, YOU MAY NOT BE

ABLE TO SELL YOUR STOCK

There is currently no public trading market for our common stock. Therefore,

there is no central place, such as a stock exchange or electronic trading

system, to resell your shares. If you do want to resell your shares, you will

have to locate a buyer and negotiate your own sale. The offering price and other

terms and conditions relative to the Company's shares have been arbitrarily

determined by the Company and do not bear any relationship to assets, earnings,

book value or any other objective criteria of value. Additionally, as the

Company was formed recently and has only a limited operating history and no

earnings, the price of the offered shares is not based on its past earnings and

no investment banker, appraiser or other independent third party has been

consulted concerning the offering price for the shares or the fairness of the

offering price used for the shares.

9

THE COMPANY SHARES MAY NEVER BE QUOTED ON THE OTCBB AND EVEN IF WE OBTAIN AN

OTCBB MARKET MAKER, THERE IS NO ASSURANCE OUR APPLICATION WILL BE ACCEPTED. IF

THE SHARES ARE NOT QUOTED, THE INVESTOR WILL NOT BE ABLE TO SELL THEM ON THE

OTCBB.

The Company has not identified an OTCBB market maker to apply for our shares to

be quoted on the OTCBB. Even if we are able to obtain an OTCBB market maker,

there are no assurances that our application will be accepted. If the Company's

shares are not quoted on the OTCBB, you will not be able to sell your shares on

the OTCBB.

The Company has only been recently formed and has only a limited operating

history and no earnings, therefore, the price of the offered shares is not based

on any data. The offering price and other terms and conditions regarding the

Company's shares have been arbitrarily determined and do not bear any

relationship to assets, earnings, book value or any other objective criteria of

value. No investment banker, appraiser or other independent third party has been

consulted concerning the offering price for the shares or the fairness of the

offering price used for the shares.

The offering price of $0.01 per common share as determined herein is

substantially higher than the net tangible book value per share of the Company's

common stock. BSM's assets do not substantiate a share price of $0.01. This

premium in share price applies to the terms of this offering and does not

attempt to reflect any forward looking share price subsequent to the Company

obtaining a listing on any exchange, or becoming quoted on the OTC Bulletin

Board.

THERE IS NO MINIMUM AMOUNT REQUIRED TO BE RAISED IN THIS OFFERING, AND IF WE

CANNOT GENERATE SUFFICIENT FUNDS FROM THIS OFFERING, THE BUSINESS WILL FAIL.

There is not a minimum amount of shares that need to be sold in this Offering

for the Company to access the funds. Therefore, the proceeds of this Offering

will be immediately available for use by us and we don't have to wait until a

minimum number of Shares have been sold to keep the proceeds from any sales. We

can't assure you that subscriptions for the entire Offering will be obtained. We

have the right to terminate the offering of the Shares at any time, regardless

of the number of Shares we have sold since there is no minimum subscription

requirement. Our ability to meet our financial obligations, cash needs, and to

achieve our objectives, could be adversely affected if the entire offering of

Shares is not fully subscribed for.

BECAUSE THE COMPANY HAS 500,000,000 AUTHORIZED SHARES, MANAGEMENT COULD ISSUE

ADDITIONAL SHARES, DILUTING THE CURRENT SHAREHOLDERS' EQUITY

The Company has 500,000,000 authorized shares, of which only 9,000,000 common

are currently issued and outstanding and an up to a maximum amount of 12,000,000

will be issued and outstanding after this offering terminates if the full

offering is subscribed. The Company has 20,000,000 authorized as preferred

stock, none are issued or outstanding. The Company's management could, without

the consent of the existing shareholders, issue substantially more common

shares, causing a large dilution in the equity position of the Company's current

shareholders. In addition, the Company could issue preferred stock that could

have more favorable terms and conditions that could adversely affect the common

shareholders. Lastly, large share issuances would generally have a negative

impact on the Company's share price. It is possible that, due to additional

share issuance, you could lose a substantial amount, or all, of your investment.

THE COMPANY DOES NOT ANTICIPATE PAYING DIVIDENDS IN THE FORESEEABLE FUTURE

We do not anticipate paying dividends on our common stock in the foreseeable

future, but plan rather to retain earnings, if any, for the operation growth and

expansion of our business. Therefore, the only way to liquidate your investment

is to sell your stock. And since the Company does not plan on paying dividends,

the only way for an investor to obtain a return on their shares is for them to

sell their shares at a higher price than what they initially paid for them.

10

THE FAILURE TO COMPLY WITH THE INTERNAL CONTROL EVALUATION AND CERTIFICATION

REQUIREMENTS OF SECTION 404 OF SARBANES-OXLEY ACT COULD HARM OUR OPERATIONS AND

OUR ABILITY TO COMPLY WITH OUR PERIODIC REPORTING OBLIGATIONS.

Our Company is subject to the reporting requirements of the Securities Exchange

Act of 1934, as amended, or the Exchange Act. We are also required to comply

with the internal control evaluation and certification requirements of Section

404 of the Sarbanes-Oxley Act of 2002. We are not subject to paragraph (a) of

Item 308 of Regulation S-K until we file an annual report pursuant to section

13(a) or 15(d) of the Exchange Act for the prior fiscal year or filed an annual

report with the Commission for the prior fiscal year. In addition, we are not

subject to paragraph (b) of Item 308 of Regulation S-K until we are an

accelerated or large accelerated filer.

We are in the process of determining whether our existing internal controls over

financial reporting systems are compliant with Section 404. This process may

divert internal resources and will take a significant amount of time, effort and

expense to complete. If it is determined that we are not in compliance with

Section 404, we may be required to implement new internal control procedures and

reevaluate our financial reporting. If we are unable to implement these changes

effectively or efficiently, it could harm our operations, financial reporting or

financial results and could result in our being unable to obtain an unqualified

report on internal controls from our independent auditors, which could adversely

affect our ability to comply with our periodic reporting obligations under the

Exchange Act and the rules of the NASDAQ Global Market.

AS WE DO NOT HAVE AN ESCROW OR TRUST ACCOUNT WITH SUBSCRIPTIONS FOR INVESTORS,

IF WE FILE FOR OR ARE FORCED INTO BANKRUPTCY PROTECTION, THEY WILL LOSE THE

ENTIRE INVESTMENT

Invested funds for this offering will not be placed in an escrow or trust

account and if we file for bankruptcy protection or a petition for involuntary

bankruptcy is filed by creditors against us, your funds will become part of the

bankruptcy estate and administered according to the bankruptcy laws. As such,

you will lose your investment and your funds will be used to pay creditors.

BLUE SKY LAWS MAY LIMIT YOUR ABILITY TO SELL YOUR SHARES. IF THE STATE LAWS ARE

NOT FOLLOWED, YOU WILL NOT BE ABLE TO SELL YOUR SHARES

State Blue Sky laws may limit resale of the Shares. The holders of our shares of

common stock and persons who desire to purchase them in any trading market that

might develop in the future should be aware that there may be significant state

law restrictions upon the ability of investors to resell our shares.

Accordingly, even if we are successful in having the Shares available for

quoting on the OTCBB, investors should consider any secondary market for the

Company's securities to be limited. We intend to seek coverage and publication

of information regarding the Company in an accepted publication which permits a

"manual exemption". This manual exemption permits a security to be distributed

in a particular state without being registered if the company issuing the

security has a listing for that security in a securities manual recognized by

the state. However, it is not enough for the security to be listed in a

recognized manual. The listing entry must contain (1) the names of issuers,

officers, and directors, (2) an issuer's balance sheet, and (3) a profit and

loss statement for either the fiscal year preceding the balance sheet or for the

most recent fiscal year of operations. Furthermore, the manual exemption is a

non issuer exemption restricted to secondary trading transactions, making it

unavailable for issuers selling newly issued securities. Most of the accepted

manuals are those published in Standard and Poor's, Moody's Investor Service,

Fitch's Investment Service, and Best's Insurance Reports, and many states

expressly recognize these manuals. A smaller number of states declare that they

recognize securities manuals' but do not specify the recognized manuals. The

following states do not have any provisions and therefore do not expressly

recognize the manual exemption: Alabama, Georgia, Illinois, Kentucky, Louisiana,

Montana, South Dakota, Tennessee, Vermont and Wisconsin.

11

OUR COMMON STOCK WILL BE SUBJECT TO THE "PENNY STOCK" RULES OF THE SEC AND THE

TRADING MARKET IN OUR SECURITIES IS LIMITED, WHICH MAKES TRANSACTIONS IN OUR

STOCK CUMBERSOME AND MAY REDUCE THE VALUE OF AN INVESTMENT IN OUR STOCK.

The Securities and Exchange Commission has adopted Rule 15g-9 which establishes

the definition of a "penny stock," for the purposes relevant to us, as any

equity security that has a market price of less than $5.00 per share or with an

exercise price of less than $5.00 per share, subject to certain exceptions. For

any transaction involving a penny stock, unless exempt, the rules require:

o that a broker or dealer approve a person's account for transactions in

penny stocks; and

o the broker or dealer receives from the investor a written agreement to the

transaction, setting forth the identity and quantity of the penny stock to

be purchased.

In order to approve a person's account for transactions in penny stocks, the

broker or dealer must:

o obtain financial information and investment experience objectives of the

person; and

o make a reasonable determination that the transactions in penny stocks are

suitable for that person and the person has sufficient knowledge and

experience in financial matters to be capable of evaluating the risks of

transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny

stock, a disclosure schedule prescribed by the Commission relating to the penny

stock market, which, in highlight form:

o sets forth the basis on which the broker or dealer made the suitability

determination; and

o that the broker or dealer received a signed, written agreement from the

investor prior to the transaction.

Generally, brokers may be less willing to execute transactions in securities

subject to the "penny stock" rules. This may make it more difficult for

investors to dispose of our Common Stock and cause a decline in the market value

of our stock. Disclosure also has to be made about the risks of investing in

penny stocks in both public offerings and in secondary trading and about the

commissions payable to both the broker-dealer and the registered representative,

current quotations for the securities and the rights and remedies available to

an investor in cases of fraud in penny stock transactions. Finally, monthly

statements have to be sent disclosing recent price information for the penny

stock held in the account and information on the limited market in penny stocks.

THE PRICE OF OUR SHARES OF COMMON STOCK IN THE FUTURE MAY BE VOLATILE.

If a market develops for our Common Stock, of which no assurances can be given,

the market price of our Common Stock will likely be volatile and could fluctuate

widely in price in response to various factors, many of which are beyond our

control, including, but not limited to: additions or departures of key

personnel; sales of our Common Stock; new technology, products and services; our

ability to execute our business plan; operating results below expectations; loss

of any strategic relationship; economic and quarter to quarter fluctuations in

our financial results. Because we have a very limited operating history with

limited to no revenues to date, you may consider any one of these factors to be

material.

12

FORWARD-LOOKING STATEMENTS

This prospectus contains certain forward-looking statements regarding

management's plans and objectives for future operations, including plans and

objectives relating to our planned entry into our service business. The

forward-looking statements and associated risks set forth in this prospectus

include or relate to, among other things, (a) our projected profitability, (b)

our growth strategies, (c) anticipated trends in our industry, (d) our ability

to obtain and retain sufficient capital for future operations, and (e) our

anticipated needs for working capital. These statements may be found under

"Management's Discussion and Analysis or Plan of Operation" and "Description of

Business," as well as in this prospectus generally. Actual events or results may

differ materially from those discussed in these forward-looking statements as a

result of various factors, including, without limitation, the risks outlined

under "Risk Factors" and matters described in this prospectus generally. In

light of these risks and uncertainties, the forward-looking statements contained

in this prospectus may not in fact occur.

The forward-looking statements herein are based on current expectations that

involve a number of risks and uncertainties. Such forward-looking statements are

based on the assumptions that we will be able to continue our business

strategies on a timely basis, that we will attract customers, that there will be

no materially adverse competitive conditions under which our business operates,

that our sole officer and director will remain employed as such, and that our

forecasts accurately anticipate market demand. The foregoing assumptions are

based on judgments with respect to, among other things, future economic,

competitive and market conditions, and future business decisions, all of which

are difficult or impossible to predict accurately and many of which are beyond

our control. Accordingly, although we believe that the assumptions underlying

the forward-looking statements are reasonable, any such assumption could prove

to be inaccurate and therefore there can be no assurance that the results

contemplated in forward-looking statements will be realized. In addition, as

disclosed elsewhere in this "Risk Factors" section of this prospectus, there are

a number of other risks inherent in our business and operations, which could

cause our operating results to vary markedly and adversely from prior results or

the results contemplated by the forward-looking statements. Increases in the

cost of our services, or in our general or administrative expenses, or the

occurrence of extraordinary events, could cause actual results to vary

materially from the results contemplated by these forward-looking statements.

Management decisions, including budgeting, are subjective in many respects and

subject to periodic revisions in order to reflect actual business conditions and

developments. The impact of such conditions and developments could lead us to

alter our marketing, capital investment or other expenditures and may adversely

affect the results of our operations. In light of the significant uncertainties

inherent in the forward-looking information included in this prospectus, the

inclusion of such information should not be regarded as a representation by us

or any other person that our objectives or plans will be achieved.

USE OF PROCEEDS

Our offering is being made on a self-underwritten basis: no minimum number of

shares must be sold in order for the offering to proceed. The offering price per

share is $0.01. The following table sets forth the potential net proceeds and

the uses of proceeds assuming the sale of 25%, 50%, 75% and 100%, respectively,

of the securities offered for sale by the Company.

13

IF 25% OF IF 50% OF IF 75% OF IF 100% OF

SHARES SOLD SHARES SOLD SHARES SOLD SHARES SOLD

----------- ----------- ----------- -----------

NET PROCEEDS FROM

THIS OFFERING $2,500 $10,000 $17,500 $25,000

Our offering is being made on a self-underwritten basis: no minimum number of

shares must be sold in order for the offering to proceed. The offering price per

share is $0.01. The net proceeds in the table above assume $5,000 in costs

associated with this offering.

The funds raised through this offering will be used to complete the business and

financial plan. The specific components and associated costs of the business

plan are the market analysis ($4,000), marketing plan ($9,000), competitive

analysis ($3,000), and detailed financial plan include proformas ($9,000). If

less than the maximum offering funds are raised, the proceeds will be used in

the following order: marketing plan, market analysis, financial plan, and

competitive analysis. If any of the foregoing tasks are not completed due to the

lack of funds from the offering, Ms. Travertini will complete these tasks.

The above tables represent our intended uses of proceeds based on our ability to

raise certain amounts of the contemplated offering. To the extent that we cannot

raise the entire amount contemplated by this offering, our sole Officer and

Director, Elise Travertini, has verbally agreed to fund the Company for an

indefinite period of time. The funding of the Company by Ms. Elise Travertini

will create a further liability to the Company to be reflected on the Company's

financial statements. Ms. Elise Travertini' commitment to personally fund the

Company is not contractual and could cease at any moment in her sole and

absolute discretion.

To date, our operations have been funded by our sole officer and director

pursuant to a verbal, non-binding agreement. Ms. Elise Travertini has agreed to

personally fund the Company's overhead expenses, including legal, accounting,

and operational expenses until the Company can achieve revenues sufficient to

sustain its operational and regulatory requirements. The Company does not

currently owe Ms. Elise Travertini any money as of the date of this registration

statement, as Ms. Elise Travertini' monetary funding to the Company as of the

date hereof has not been categorized as loans made to the Company, but as

contributions for which she has received founders stock. Future contributions by

Ms. Elise Travertini to the Company, pursuant to the verbal and non-binding

agreement, will be reflected on the financial statements of the Company as

liabilities.

DETERMINATION OF OFFERING PRICE

As there is no established public market for our shares, the offering price and

other terms and conditions relative to our shares have been arbitrarily

determined by BSM and do not bear any relationship to assets, earnings, book

value, or any other objective criteria of value. In addition, no investment

banker, appraiser, or other independent third party has been consulted

concerning the offering price for the shares or the fairness of the offering

price used for the shares.

The price of the current offering is fixed at $0.01 per share. This price is

significantly greater than the price paid by the company's sole officer and

director for common equity since the company's inception on November 15, 2010.

The company's sole officer and director paid $0.0001 per share, a difference of

$0.0099 per share lower than the share price in this offering.

14

DILUTION OF THE PRICE YOU PAY FOR YOUR SHARES

Dilution represents the difference between the offering price and the net

tangible book value per share immediately after completion of this offering. Net

tangible book value is the amount that results from subtracting total

liabilities and intangible assets from total assets. Dilution arises mainly as a

result of our arbitrary determination of the offering price of the shares being

offered. Dilution of the value of the shares you purchase is also a result of

the lower book value of the shares held by our existing stockholders. The

following tables compare the differences of your investment in our shares with

the investment of our existing stockholders.

This table represents a comparison of the prices paid by purchasers of the

Common Stock in this offering and the individual who received shares in BSM

Tech, Inc. previously:

If 25% of If 50% of If 75% of If 100% of

Shares Sold Shares Sold Shares Sold Shares Sold

----------- ----------- ----------- -----------

Book value per share before offering ..... $ 0.0007 $ 0.0007 $ 0.0007 $ 0.0007

Book value per share after offering ...... $ 0.0009 $ 0.0015 $ 0.0021 $ 0.0026

Net increase to original shareholders .... $ 0.0002 $ 0.0009 $ 0.0014 $ 0.0019

Decrease in investment to new shareholders $ 0.0091 $ 0.0085 $ 0.0079 $ 0.0074

Dilution to new shareholders ............. 8.7% 15.2% 20.9% 25.8%

THE OFFERING BY THE COMPANY

BSM is registering 3,000,000 shares of its common stock for offer and sale.

There is currently no active trading market for our common stock, and such a

market may not develop or be sustained. If and when we become effective with the

SEC, we plan to apply to the OTCBB for quotation. In order to do so, we have to

retain an authorized OTC Bulletin Board market maker. If we are successful in

securing a market maker, they will file Form 211 with FINRA (Financial Industry

Regulatory Authority). If FINRA approves the Company's 211, our stock will be

quoted on the OTCBB.

There can be no assurances that we will be able to retain an authorized OTCBB

market maker and furthermore, there are no assurances that we will be approved

by FINRA. At the date hereof, we are not aware that any market maker has any

such intention.

All of the shares registered herein will become effective for sale to investors.

The Company will not offer the shares through a broker-dealer or anyone

affiliated with a broker-dealer.

NOTE: As of the date of this prospectus, our sole officer and director, Ms.

Elise Travertini, owns 9,000,000 common shares, which are subject to Rule 144

restrictions. There is currently one (1) shareholder of our common stock.

The company is hereby registering 3,000,000 common shares. The price per share

is $0.01.

15

In the event the company receives payment for the sale of their shares, BSM will

receive all of the proceeds from such sales. BSM is bearing all expenses in

connection with the registration of the shares of the company.

PLAN OF DISTRIBUTION

We are offering the shares on a "self-underwritten" basis directly through Ms.

Travertini our executive officer and director named herein, who will not receive

any commissions or other remuneration of any kind for selling shares in this

offering, except for the reimbursement of actual out-of-pocket expenses incurred

in connection with the sale of the common stock. The offering will conclude at

the earlier of (i) when all 3,000,000 shares of common stock have been sold, or

(ii) 90 days after this registration statement becomes effective with the

Securities and Exchange Commission.

This offering is a self-underwritten offering, which means that it does not

involve the participation of an underwriter to market, distribute or sell the

shares offered under this prospectus. We will sell shares on a continuous basis.

We reasonably expect the amount of securities registered pursuant to this

offering to be offered and sold within ninety (90) days from this initial

effective date of this registration.

In connection with her selling efforts in the offering, Ms. Travertini will not

register as broker-dealer pursuant to Section 15 of the Exchange Act, but rather

will rely upon the "safe harbor" provisions of Rule 3a4-1 under the Exchange

Act. Generally speaking, Rule 3a4-1 provides an exemption from the broker-dealer

registration requirements of the Exchange Act for persons associated with an

issuer that participate in an offering of the issuer's securities. Edward

Travertini is not subject to any statutory disqualification, as that term is

defined in Section 3(a)(39) of the Exchange Act. Elise Travertini will not be

compensated in connection with her participation in the offering by the payment

of commissions or other remuneration based either directly or indirectly on

transactions in our securities. Ms. Travertini is not and has not been within

the past 12 months, a broker or dealer, and is not within the past 12 months, an

associated person of a broker or dealer. At the end of the offering, Ms.

Travertini will continue to primarily perform substantial duties for us or on

our behalf. Ms. Travertini has not participated in selling an offering of

securities for any issuer more than once every 12 months other than in reliance

on Exchange Act Rule 3a4-1(a)(4)(i) or (iii).

9,000,000 common shares are issued and outstanding as of the date of this

prospectus. The Company is registering an additional 3,000,000 shares of its

common stock at the price of $0.01 per share.

BSM will receive all proceeds from the sale of the shares by the company. The

price per share is $0.01. However, BSM common stock may never be quoted on the

OTCBB or listed on any exchange.

Penny Stock Rules

The Securities and Exchange Commission has adopted rules that regulate

broker-dealer practices in connection with transactions in penny stocks. Penny

stocks are generally equity securities with a price of less than $5.00 (other

than securities registered on certain national securities exchanges or quoted on

the Nasdaq system, provided that current price and volume information with

respect to transactions in such securities is provided by the exchange or

system).

16

A purchaser is purchasing penny stock which limits the ability to sell the

stock. The shares offered by this prospectus constitute penny stock under the

Securities and Exchange Act. The shares will remain penny stocks for the

foreseeable future. The classification of penny stock makes it more difficult

for a broker-dealer to sell the stock into a secondary market, which makes it

more difficult for a purchaser to liquidate her/her investment. Any

broker-dealer engaged by the purchaser for the purpose of selling her or her

shares in us will be subject to Rules 15g-1 through 15g-10 of the Securities and

Exchange Act. Rather than creating a need to comply with those rules, some

broker-dealers will refuse to attempt to sell penny stock.

The penny stock rules require a broker-dealer, prior to a transaction in a penny

stock not otherwise exempt from those rules, to deliver a standardized risk

disclosure document, which:

- Contains a description of the nature and level of risk in the market for

penny stock in both Public offerings and secondary trading;

- Contains a description of the broker's or dealer's duties to the customer

and of the rights and remedies available to the customer with respect to a

violation of such duties or other requirements of the Securities Act of

1934, as amended;

- Contains a brief, clear, narrative description of a dealer market,

including "bid" and "ask" price for the penny stock and the significance

of the spread between the bid and ask price;

- Contains a toll-free number for inquiries on disciplinary actions;

- Defines significant terms in the disclosure document or in the conduct of

trading penny stocks; and

- Contains such other information and is in such form (including language,

type, size and format) as the Securities and Exchange Commission shall

require by rule or regulation.

The broker-dealer also must provide, prior to effecting any transaction in a

penny stock, to the customer:

- The bid and offer quotations for the penny stock;

- The compensation of the broker-dealer and its salesperson in the

transaction;

- The number of shares to which such bid and ask prices apply, or other

comparable information relating to the depth and liquidity of the market

for such stock; and

- Monthly account statements showing the market value of each penny stock

held in the customer's account.

In addition, the penny stock rules require that prior to a transaction in a

penny stock not otherwise exempt from those rules; the broker-dealer must make a

special written determination that the penny stock is a suitable investment for

the purchaser and receive the purchaser's written acknowledgement of the receipt

of a risk disclosure statement, a written agreement to transactions involving

penny stocks, and a signed and dated copy of a written suitability statement.

These disclosure requirements will have the effect of reducing the trading

activity in the secondary market for our stock because it will be subject to

these penny stock rules. Therefore, stockholders may have difficulty selling

their securities.

17

The company's shares may be sold to purchasers from time to time directly by,

and subject to, the discretion of the company. Further, the company will not

offer their shares for sale through underwriters, dealers, or agents or anyone

who may receive compensation in the form of underwriting discounts, concessions

or commissions from the company and/or the purchasers of the shares for whom

they may act as agents. The shares sold by the company may be sold occasionally

in one or more transactions, at an offering price that is fixed at $0.01.

The shares may not be offered or sold in certain jurisdictions unless they are

registered or otherwise comply with the applicable securities laws of such

jurisdictions by exemption, qualification or otherwise. We intend to sell the

shares only in the states in which this offering has been qualified or an

exemption from the registration requirements is available, and purchases of

shares may be made only in those states.

In addition and without limiting the foregoing, the company will be subject to

applicable provisions, rules and regulations under the Exchange Act with regard

to security transactions during the period of time when this Registration

Statement is effective.

BSM will pay all expenses incidental to the registration of the shares

(including registration pursuant to the securities laws of certain states).

LEGAL PROCEEDINGS

We are not a party to any material legal proceedings and to our knowledge; no

such proceedings are threatened or contemplated by any party.

BUSINESS

COMPANY SUMMARY

Blue Sun Media Inc. is in business to develop internet applications which allow

children to play, interact and transact in a secure manner by providing their

parents complete control over their online activities. The Company plans to

develop their technology to enable online business to function in a manner

consistent with COPPA - CHILDREN ONLINE PRIVACY PROTECTION ACT. COPPA which was

implemented by the US Federal Trade Commission (FTC) in April 2000 includes

rules for website operators who target children under the age of 13.

MARKET OVERVIEW

The rapid growth in the social market as it relates to mobile and internet

devices has been driven by a couple of forces. First, the migration of users to

social networks as places where they spend significant amounts of time

interacting with friends, consuming content and being entertained. Facebook,

mySpace, and Twitter are just a few of the growing places users spend time. This

trend has influenced developers to build new products, which continue to attract

this age group to increase their play, interact and purchase more goods and

services either on line or from their mobile device. Blue Sun Media's solutions

will focus on the parent segment, and address the need to monitor and authorize

their children's time on the Internet in a safe and enjoyable manner.

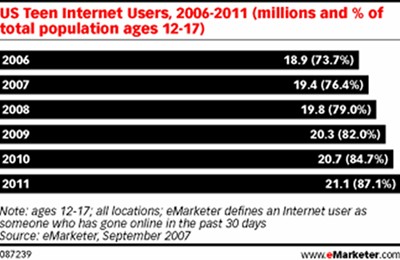

According to eMarketer, tweens/teens have and continue to increase their

Internet usage with over 75% using the Internet monthly and projected to

increase over 87% in 2011.

18

US mobile phone owners age 13-17 send and receive an average of 3,705 texts per month according to The Nielsen Company. This is more than double the next-highest average number of texts sent and received in average month, 1,707, performed by 18-to-24-year-olds. Younger mobile phone users are the most active group. The only other group averaging more than 1000 texts per month is the 0-12-year-olds (1,178). Text usage starts early and is the dominant communication channel among the users under 18.

One example of Internet usage among the teen market is virtual worlds. In 2007,

according to eMarketer 24% of the 34 million under 18 market visited a virtual

world on a monthly basis. In 2011, eMarketer expects 53% of them will go

"virtual."

19

US online ad spending will increase from $25.8 billion in 2010 to over $40 billion in 2014, an increase of over 42% according to eMarketer. In 2010, online advertising will surpass newspaper advertising, and will be second only to television.

TNS Infratest has identified the following factors as important in the growth of

the E-Commerce market: (1) E-Commerce allows for higher price transparency and

lower distribution costs (2) today's customers have higher price sensitivity (3)

E-Commerce facilitates customer participation in the development and design of

products and services ("Social Shopping").

The online market for ecommerce has developed and grown dramatically over the

last five years. According to market research firm, Forrester, US online

shopping is expected to grow between 7-8% annually to $229 billion in 2013.

20

MARKET OPPORTUNITY / PRODUCT POSITIONING

Addressing the problem of unsupervised child internet access has become a major

challenge for parents. As Internet access has become much faster, an increasing

proportion of leisure time is now spent online rather than in front of the TV.

Online shops have flourished and new applications such as online games and

virtual worlds have emerged which are becoming more and more popular -

especially with children. Many of these applications are not free of charge.

Advertisers have developed special online campaigns targeting children who are

spending increasing amounts online.

The Children Online Privacy Protection Act (COPPA) was enacted by the US

Congress in 1998. The US Federal Trade Commission (FTC) issued the COPPA rule

enforcing the Act in April 2000. COPPA sets rules for online providers who

target and collect information on children under 13. Several advocacy groups in

the US have urged the FTC to introduce an amendment to COPPA in order to cover

new forms of online entertainment such as online games and virtual worlds, and

also extend the guidelines to 13-17 year old children. We expect this legal

framework to strongly support the Company's business development in the near

future.

There have been many instances of the U18 age group not being protected enough

by the new places/internet sites for them to play, transact and socialize. Blue

Sun Media intends to answer these concerns and attack this market with a simple,

convenient way to monitor and protect your children.

PRODUCT OVERVIEW

The Company plans to start product development after the business plan is

completed and the Company is able to secure the additional financing required

for the product development. Provided that the capital is secured, the Company

plans up to twelve (12) months to complete the products (SiteView, SiteTransact,

and SiteSocial - see below) and then will start selling its products to generate

revenues. At this time, the Company has not developed any products.

21

The Company has plans to develop the following products:

SiteView - provides the parents capabilities to monitor and report on the

various websites their children visit. The parent has the option to setup a

profile for their child that allows access to certain websites. In addition, if

the child visits a website that is new or unknown, the parent will be notified

real time and upon approval the child will be able to access that site. For

example, if a child attempts to visit a horse betting site, the access will be

denied.

SiteTransact - provides parents the ability to setup, monitor, control, and

allow their children to conduct transactions on the Internet. The parent will be

notified of any potential transaction the child attempts and is given real time

control to either allow or deny the transaction. For example, if a child visits

Amazon.com and wants to purchase a children's book for $8.99, the parent will be

notified and with the push of a button, allow the transaction to complete. In

addition, if the child attempts to purchase a rap music CD with explicit

language, the parent will be notified and will not be able to complete the

transaction.

SiteSocial - social sites like Facebook, MySpace, Twitter are gaining tremendous

amount of interest from Internet users and retailers. Due to the overwhelming

popularity of these types, parents have to allow access to these sites.

Otherwise, their children will circumvent those restrictions. The parent can set

up the profile for their children which allows them to control the sharing of

personal information. For example, if they don't want to share any personal data

like address, phone, etc., the program will block this information from the

site. This way the parent is assured that all personal data is kept

confidential. In addition, the software will monitor and track communication

with other users. Parents will be allowed to set up rules that only allow their

children to communicate with other similar aged children, children within a

certain mile radius, etc. This provides parental controls that protect the

children's identity, yet allows social interaction with other users.

In addition, the Company plans to provide the essential tools for effective

management for mobile devices. Leveraging unique data discovery and tracking

capabilities, the Company's products will feature:

o Automated messaging and alerts of web surfing;

o Automated messaging and alerts of mobile network surfing;

o Automated messaging and alerts of mobile network purchases;

o Automated messaging and alerts of mobile network downloads;

o Automated messaging and alerts of internet purchases;

o Automated messaging and alerts of internet downloads;

o Extensive query and reporting capabilities;

o Customizable user-defined enhancements and features; and

o Simple installation and ease of use.

The Company plans to provide all of the above mobile capabilities on

smartphones. The targeted smartphones will be the iPhone, Blackberry, and

Android phones.

22

SALES & DISTRIBUTION

BSM will not market products directly to consumers. The Company plans to market

the products and services through indirect channels consisting of value added

resellers, IT consulting firms, OEMs, and online application stores like

Blackberry World, App World, etc. The Company will also seek a partner program,

targeted at key resellers and system integrators. This program will include

special pricing, training and dedicated technical support for partners who

achieve and maintain certain minimum sales volumes.

BSM will also target fortune 500 companies directly that focus directly on

online sales like retailers and carriers. Large organizations must differentiate

themselves in the marketplace and parent control solutions are an attractive

differentiation for the businesses. For example, WalMart could private label the

products and use them to market to parents.

COMPETITION