Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ALMOST FAMILY INC | form8-k.htm |

Forward Looking Statements

This presentation contains, and answers given to questions that may be asked today may constitute, forward-looking

statements that are subject to a number of risks and uncertainties, many of which are outside our control. All

statements regarding our strategy, future operations, financial position, estimated revenues or losses, projected costs,

prospects, plans and objectives, other than statements of historical fact included in our prospectus, are forward-looking

statements. When used in this presentation or in answers given to questions asked today, the words “may,” “will,”

“could,” “would,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “project,” “potential,” “continue,” and similar

expressions are intended to identify forward-looking statements, although not all forward-looking statements contain

these identifying words. You should not place undue reliance on forward-looking statements. While we believe that we

have a reasonable basis for each forward-looking statement that we make, we caution you that these statements are

based on a combination of facts and factors currently known by us and projections of future events or conditions, about

which we cannot be certain. For a more complete discussion regarding these and other factors which could affect the

Company's financial performance, refer to the Company's various filings with the Securities and Exchange

Commission, including its filing on Form 10-K for the year ended December 31, 2010 and subsequently filed Forms 10-

Q, in particular information under the headings "Special Caution Regarding Forward-Looking Statements" and “Risk

Factors.” These cautionary statements qualify all of the forward-looking statements. In addition, market and industry

statistics contained in this presentation are based on information available to us that we believe is accurate. This

information is generally based on publications that are not produced for purposes of securities offerings or economic

analysis.

statements that are subject to a number of risks and uncertainties, many of which are outside our control. All

statements regarding our strategy, future operations, financial position, estimated revenues or losses, projected costs,

prospects, plans and objectives, other than statements of historical fact included in our prospectus, are forward-looking

statements. When used in this presentation or in answers given to questions asked today, the words “may,” “will,”

“could,” “would,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “project,” “potential,” “continue,” and similar

expressions are intended to identify forward-looking statements, although not all forward-looking statements contain

these identifying words. You should not place undue reliance on forward-looking statements. While we believe that we

have a reasonable basis for each forward-looking statement that we make, we caution you that these statements are

based on a combination of facts and factors currently known by us and projections of future events or conditions, about

which we cannot be certain. For a more complete discussion regarding these and other factors which could affect the

Company's financial performance, refer to the Company's various filings with the Securities and Exchange

Commission, including its filing on Form 10-K for the year ended December 31, 2010 and subsequently filed Forms 10-

Q, in particular information under the headings "Special Caution Regarding Forward-Looking Statements" and “Risk

Factors.” These cautionary statements qualify all of the forward-looking statements. In addition, market and industry

statistics contained in this presentation are based on information available to us that we believe is accurate. This

information is generally based on publications that are not produced for purposes of securities offerings or economic

analysis.

All forward-looking statements speak only as of the date of this presentation. Except as required by law, we assume

no obligation to update these forward-looking statements publicly or to update the factors that could cause actual

results to differ materially, even if new information becomes available in the future.

no obligation to update these forward-looking statements publicly or to update the factors that could cause actual

results to differ materially, even if new information becomes available in the future.

2

Almost Family

Overview

Overview

Almost Family

Founded in Louisville KY - 1976

Two Home Health Segments:

- Visiting Nurse, Medicare-certified

(~85% of Revenue)

- Personal Care, primarily Medicaid-Waiver

(~15% of Revenue)

Revenue Run Rate of approximately

$340 Million

$340 Million

4

Almost Family

Northeast Cluster

Southeast Cluster

Midwest Cluster

5

Our Mission - “We Are Senior Advocates”

One Common Goal - allow

Seniors to “Age in Place”

at home

Seniors to “Age in Place”

at home

Advocates on behalf of the

sick & elderly

sick & elderly

Make lives of elderly &

chronically ill better

chronically ill better

Backbone of who we are &

how we run our business

6

Our Mission - “We Are Senior Advocates”

How do we do this?

- Focus on being Patient-centric

- Build Caregiver Culture

- Improve & create Senior programs

- Credentialing clinicians as

Geriatric Specialists

Geriatric Specialists

- Consistent delivery of highest

quality patient care

quality patient care

7

Almost Family Caregiver

Almost Family is driven by

Highly Skilled Professional

Caregivers, including:

- Skilled & Experienced Nurses

- Physical Therapists

- Occupational Therapists

- Medical Social Workers

- Home Aides

8

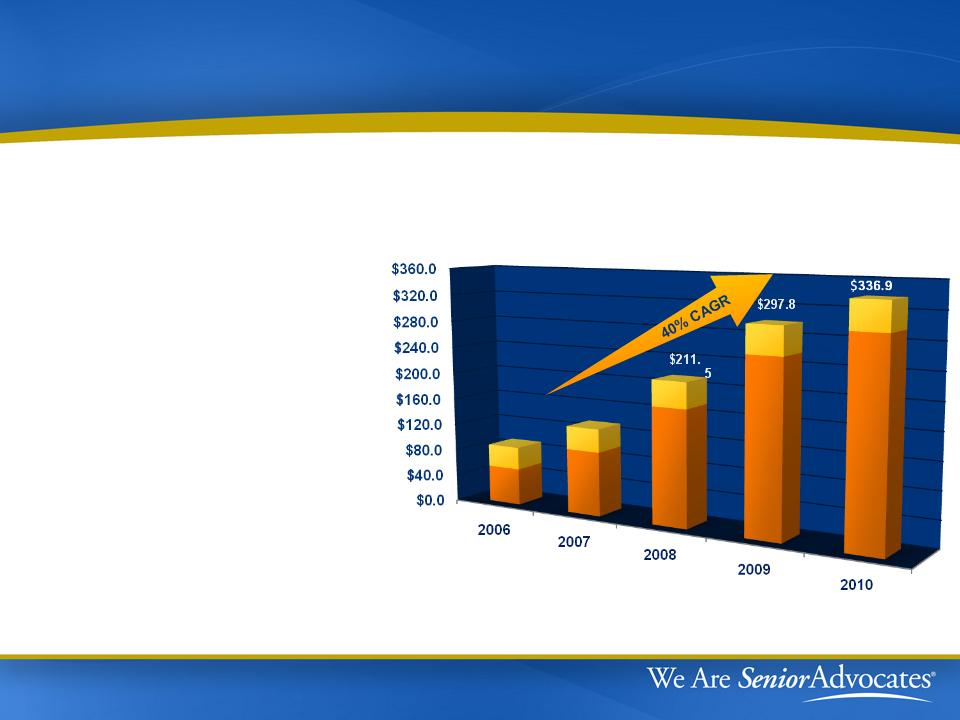

Almost Family

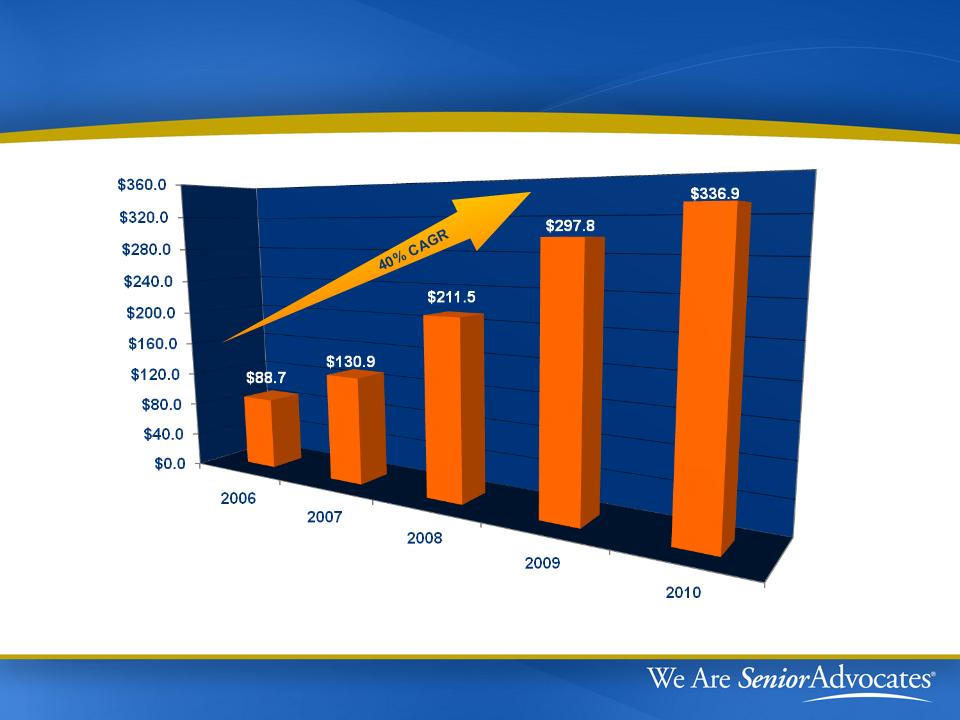

($Millions)

$88.7

Revenue

Track Record of

Strong Performance

- 4 Yr CAGR Revenue

40%

40%

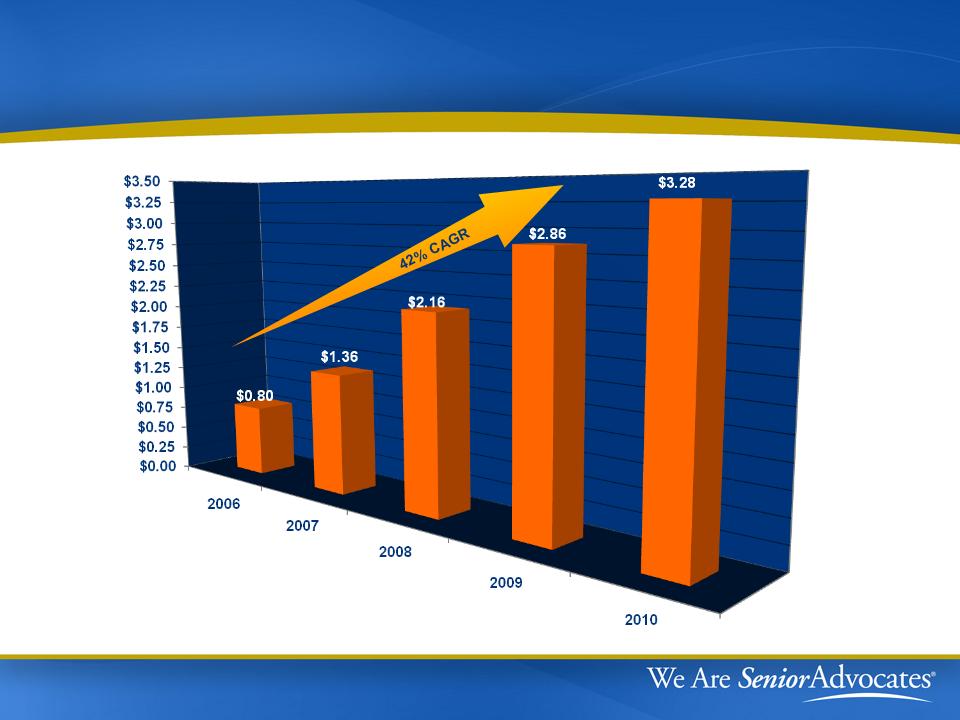

- 4 Yr CAGR EPS 42%

- Last 36 months:

- 49% Organic Growth

- Acquired $112 Million

in Revenue

$130.9

9

What is Home Health Care?

Home Health Industry

Aging Population is growing -

Prefer to stay at home

Home Health Care -

Bends the Cost Curve

of caring for the elderly

Industry is Fragmented -

Pipeline for Consolidation

11

Who Receives Home Health Care?

Over 3.5 million Americans

rely on home health care to stay

in their homes.

- 80+ year old, sick patients

- Chronic conditions, sickest of the sick

- Want to “Age in Place”, out of

hospitals & nursing homes

- Want to restore their ability to care

for themselves

12

Characteristics of Medicare Population

Source: Kaiser Family Foundation Medicare Primer 2009

45 million beneficiaries

- Limited Resources - 1 out of 2 have income of less than

$21,000 (near poverty level)

- 1 out of 3 - have 3 or more chronic health conditions

- 1 out of 3 - have cognitive or mental impairment

- 1 out of 3 - are in poor health

- 1 out of 5 - have significant limitations in activities

of daily living

- 1 out of 8 - is over 85 years old

- 1 out of 20 - lives in a nursing home

13

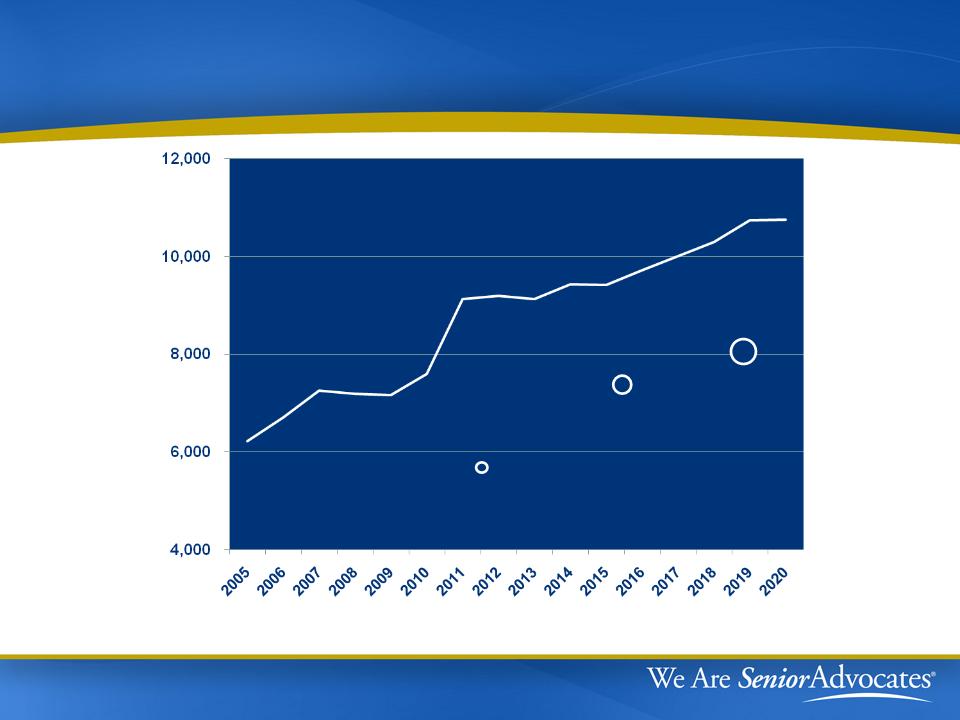

Number of New 65 Year Olds Per Day

14

2010

40.2 mil

2016

48.3 mil

2020

54.8 mil

65+ Population

The Benefits of Home Health Care

Bending the Cost Curve

- Lower cost per day vs.

hospital & nursing homes

hospital & nursing homes

- Lower costs to Medicare

Program

Program

- Prevents mild exacerbations

from escalating into critical

situations

from escalating into critical

situations

Cost per day

15

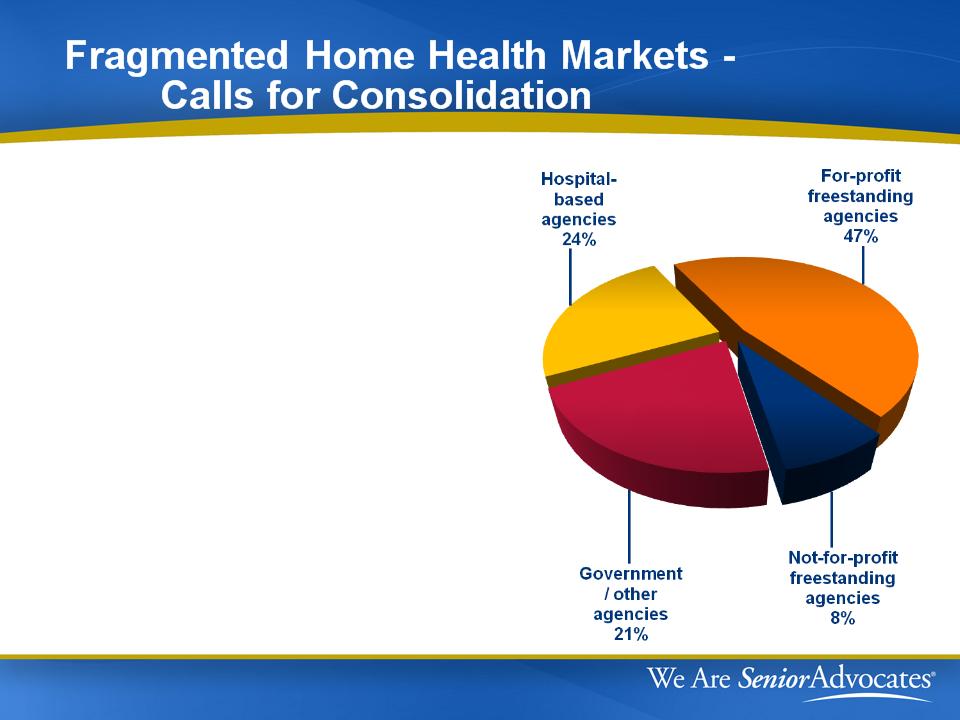

~10,000 Medicare-certified home

health agencies in U.S.

~7,000 agencies are independently-

owned operated

owned operated

$19B Annual Medicare Spend

Almost Family’s acquisition criteria

- Geography

- Multi-site, free-standing

agencies or hospital-based

agencies

agencies or hospital-based

agencies

16

Our Development

Strategy

Strategy

Our Development Strategy

Senior Advocacy

Senior Advocacy Mission

Seasoned Management Staff

Local Market Emphasis

Densification/Acquisitions

Strong Organic Growth

18

Our Experienced Management Team

Core Team Averages Over 20 Years at AFAM

William Yarmuth - CEO Todd Lyles - SVP Administration

- 29 yrs as AFAM CEO - 13 yrs as AFAM SVP

Steve Guenthner - SVP & CFO Anne Liechty - SVP VN Operations, North

- 18 yrs as AFAM CFO - 24 yrs at AFAM

Next Level Management Rich in Home Health Experience

o Average of 15 Years Experience in Home Health

19

Local Market Emphasis

Managing Successfully by:

Placing Senior Management

closer to local markets

Local “Course Knowledge”

hometown business

hometown business

Growing locally based sales &

marketing staff

marketing staff

Standard local office operating model,

with local office flexibility in

marketing & clinical programs

with local office flexibility in

marketing & clinical programs

20

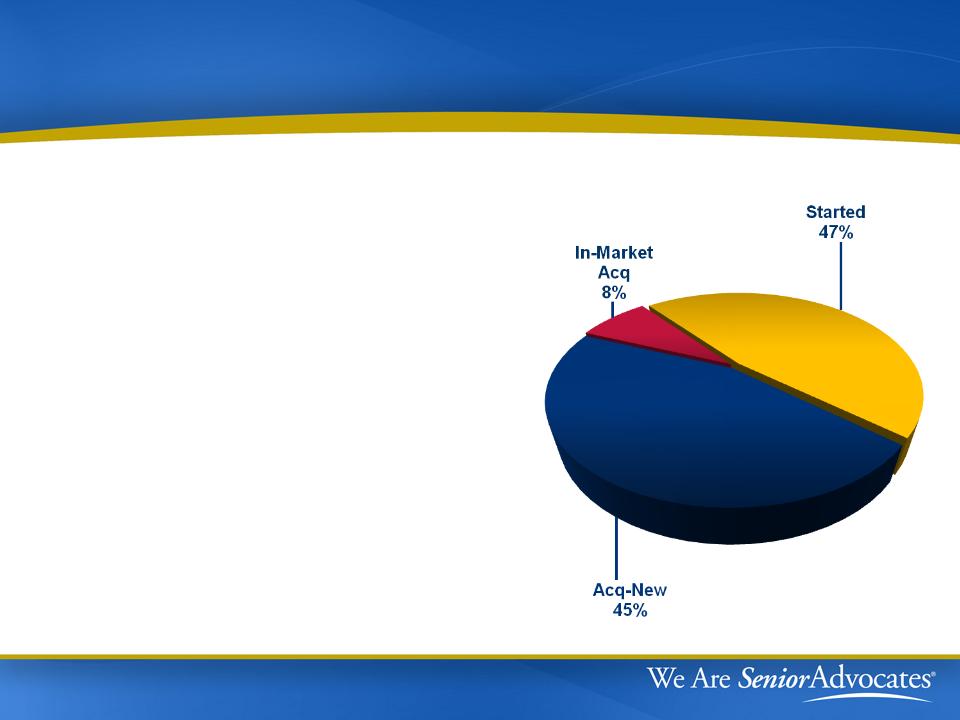

Densification/Acquisitions

Branch Development

Last 5 Years

Increase density of existing

geographic clusters

geographic clusters

Make selected acquisitions to enter

states & markets contiguous to

existing operations

states & markets contiguous to

existing operations

Build on local brand with start-ups

- opened 14 start-ups in 2008

- opened 8 start-ups in 2009

- opened 7 start-ups in 2010

Optimize span of control

21

Densification Works

|

Clusters

|

# of VN Branches

|

Revenue Per Branch

(In millions)

|

||||

|

2005

|

2010

|

%

Change |

2005

|

2010

|

%

Change |

|

|

Midwest

|

13

|

36

|

177%

|

$1.4

|

$2.4

|

73%

|

|

Northeast

|

1

|

12

|

NM

|

$1.3

|

$6.2

|

391%

|

|

Southeast

|

13

|

42

|

223%

|

$1.6

|

$3.2

|

104%

|

|

Total

|

27

|

90

|

233%

|

$1.5

|

$3.3

|

123%

|

22

Regulatory Front

2011 Medicare Topics

|

Topic

|

Discussion

|

|

Reimbursement

Rate Cut |

~ 5.2% cut in national payment rate - will reduce

margins (also impacted Q4 2010) |

|

Physician Face-to-

Face Encounter |

Agencies must get documentation of encounter

90 days before or 30 days after admit |

|

Therapy

Reassessments |

April 1, 2011 must reassess therapy need visits

13 and 19 |

|

Med Pac

Recommendations |

December 2010 presentation suggests March

2011 may recommend PPS not based on therapy visits |

24

Financial Highlights

Financial Highlights

þ Long term EPS growth driven by organic volumes

þ Prudent management of capital structure with appropriate

leverage

leverage

þ Proven ability to access debt and equity

þ Scalable infrastructure keeps tight rein on operating

costs, generating strong cash flow

costs, generating strong cash flow

þ Strong track record of investing capital in accretive

acquisitions

acquisitions

26

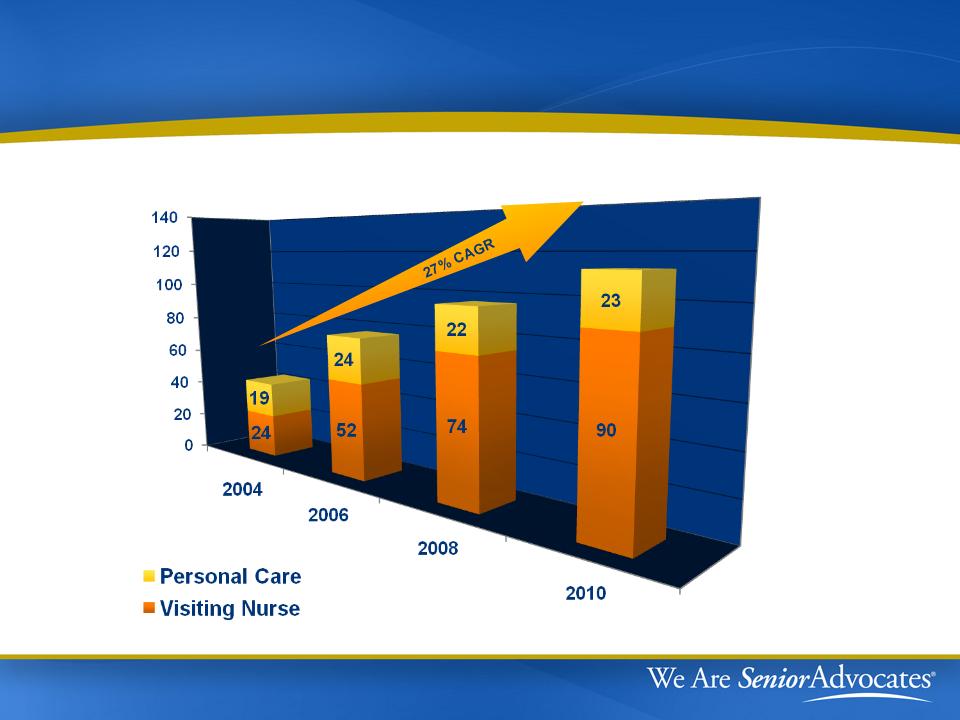

Track Record of Increasing Locations

# of Locations

76

43

96

113

27

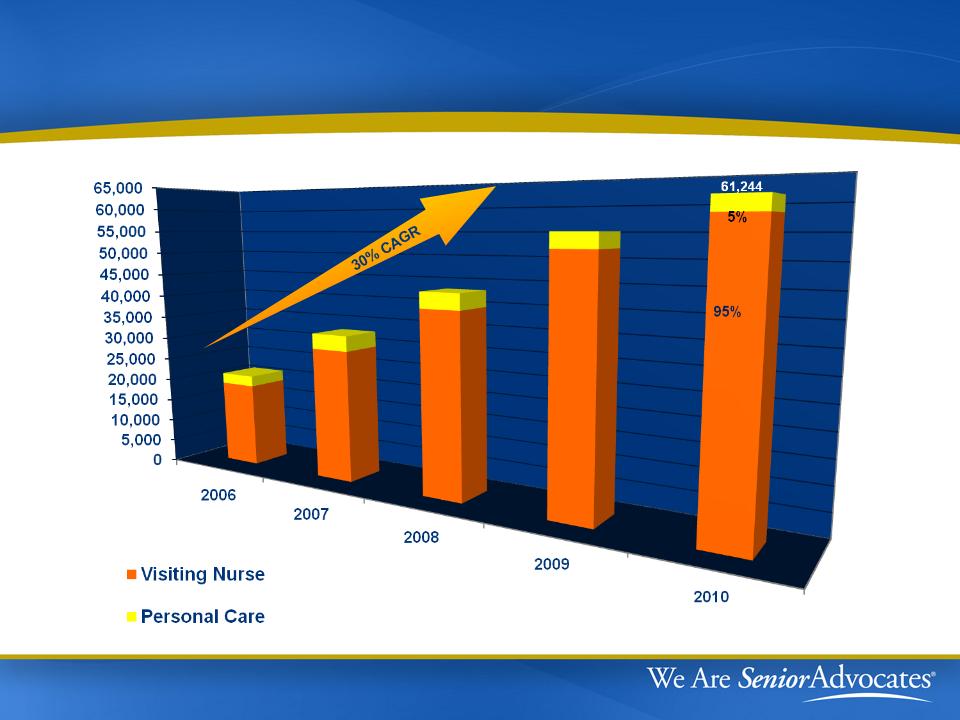

Growing Patient Admissions

21,258

55,248

32,745

43,148

Admissions

89%

90%

92%

11%

10%

8%

6%

94%

28

Proven Revenue Performance

New Service Revenue ($Millions)

29

Proven EPS Growth

Diluted EPS

30

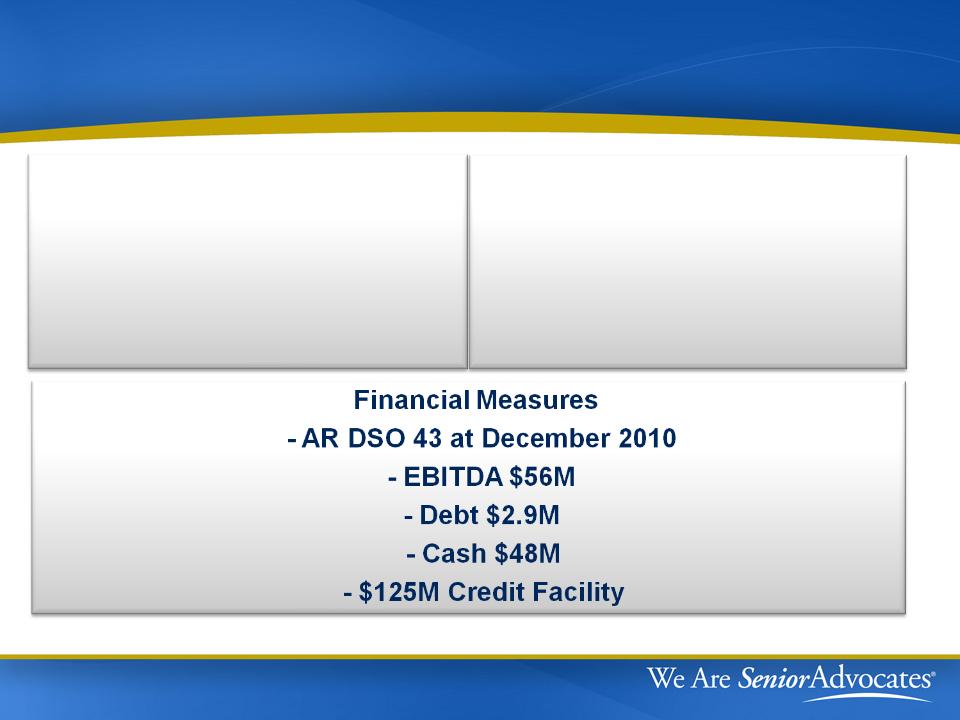

2010 Highlights

- Revenues +13%

- Diluted EPS +15%

- MCR Admissions +12%

- MCR Episodes +12%

31

Organic Medicare Growth

- Admissions +11%

- Episodes +12%

Healthcare Reform Legislation Impact

|

Topic

|

Impact

|

|

Market Basket

Updates |

Reduces updates by 1% in 2011, 2012 and 2013

|

|

Re-basing Rates

|

Begin 2014, phased in over 4 years with

adjustments limited to 3.5% per year |

|

Productivity

Adjustment |

Begin 2015

|

|

Rural Add-on

|

3% in 4/1/2010 - 2015

|

|

Outlier Cap

|

10% of revenue beginning 2011

(implemented by CMS in 2010)

|

32

Investment Thesis Remains - Long-Term EPS

Growth as Low Cost Provider

Growth as Low Cost Provider

Organic sales growth (including post-acquisition)

- 8%-12% organic volume growth

- Incremental margin 25%-30% on next dollar of same store

revenue (declining over future years with downward

margin pressure)

Favorable acquisition economics

- Agency EBITDA contribution 18%-22%, paying 4x-5x

- Incremental overhead 3%-4% of revenue

- Strong ROI, accretive investments

Follow-on startups enhance return

33

Investment Thesis Remains - Long-Term EPS

Growth as Low Cost Provider

Growth as Low Cost Provider

Earnings implications

•Volume-based incremental margin helps to offset rate cuts

•Continue emphasis on:

• Improved clinical outcomes

• Efficiency of operations

• Cash flow

•Conditions remain for long-term EPS growth as a

consolidator

consolidator

34

Investment Highlights

Annual Revenue run rate now over $340 million

Leading Regional Home Health Provider

- 40% four year revenue CAGR

- Decentralized operating model

Strong Capital Position

- $166 million immediately available

for future growth

Disciplined Approach to acquisitions driven

by Seasoned Management

Growing Force in consolidating home health care market

- 6 acquisitions in three years

- Three geographic clusters: Northeast, Southeast & Midwest

35

Contact Information

36

Non-GAAP Financial Measure

The information provided in the presentation used a non-GAAP financial measure as defined under Securities and Exchange

Commission (SEC) rules. In accordance with SEC rules, the Company has provided a reconciliation of that measure to the most

directly comparable GAAP measure.

Commission (SEC) rules. In accordance with SEC rules, the Company has provided a reconciliation of that measure to the most

directly comparable GAAP measure.

EBITDA: Earnings before interest, income tax, depreciation and amortization (EBITDA) is not a measure of financial performance

under accounting principles generally accepted in the United States of America (GAAP). It should not be considered in isolation or as

a substitute for net income, operating income, cash flows from operating, investing or financing activities, or any other measure

calculated in accordance with generally accepted accounting principles. The items excluded from EBITDA are significant components

in understanding and evaluating financial performance and liquidity. Management routinely calculates and communicates EBITDA and

believes that it is useful to investors because it is commonly used as an analytical indicator within our industry to evaluate

performance, measure leverage capacity and debt service ability, and to estimate current or prospective enterprise value. EBITDA is

also used in certain covenants contained in our credit agreement.

under accounting principles generally accepted in the United States of America (GAAP). It should not be considered in isolation or as

a substitute for net income, operating income, cash flows from operating, investing or financing activities, or any other measure

calculated in accordance with generally accepted accounting principles. The items excluded from EBITDA are significant components

in understanding and evaluating financial performance and liquidity. Management routinely calculates and communicates EBITDA and

believes that it is useful to investors because it is commonly used as an analytical indicator within our industry to evaluate

performance, measure leverage capacity and debt service ability, and to estimate current or prospective enterprise value. EBITDA is

also used in certain covenants contained in our credit agreement.

The following table sets forth a reconciliation of net income to EBITDA as of December 31, 2010 (in thousands):

37

|

Net income

|

$ 30,713

|

|

Add back:

|

|

|

Interest expense

|

266

|

|

Income tax expense

|

20,678

|

|

Depreciation and amortization

|

2,913

|

|

Amortization of stock-based compensation

|

1,505

|

|

EBITDA

|

$ 56,075

|