Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - NetSpend Holdings, Inc. | a2202337zex-23_1.htm |

| EX-31.2 - EX-31.2 - NetSpend Holdings, Inc. | a2202337zex-31_2.htm |

| EX-31.1 - EX-31.1 - NetSpend Holdings, Inc. | a2202337zex-31_1.htm |

| EX-32.2 - EX-32.2 - NetSpend Holdings, Inc. | a2202337zex-32_2.htm |

| EX-32.1 - EX-32.1 - NetSpend Holdings, Inc. | a2202337zex-32_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010

Commission file number: 001-34915

NetSpend Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

20-2306550 (I.R.S. Employer Identification No.) |

|

701 Brazos Street Suite 1300 Austin, Texas (Address of principal executive offices) |

78701-2582 (Zip Code) |

Registrant's telephone number, including area code:

(512) 532-8200

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered | |

|---|---|---|

| Common Stock, $.001 par value | The NASDAQ Stock Market LLC (Nasdaq Global Select Market) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

The registrant was not a public company as of the last business day of its most recently completed second fiscal quarter and, therefore cannot calculate the aggregate market value of its common equity held by non-affiliates as of such date.

The number of shares of the registrant's common stock outstanding on February 25, 2011 was 88,880,518.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this report, to the extent not set forth herein, is incorporated by reference from the registrant's proxy statement relating to the annual meeting of stockholders in 2011. Such proxy statement will be filed with the Securities and Exchange Commission not later than 120 days after the end of the fiscal year to which this report relates.

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K and the documents incorporated into this Annual Report on Form 10-K by reference contain forward-looking statements. These forward-looking statements include statements with respect to our financial condition, results of operations and business. The words "assumes," "believes," "expects," "budgets," "may," "will," "should," "projects," "contemplates," "anticipates," "forecasts," "intends" or similar terminology identify forward-looking statements. These forward-looking statements reflect our current expectations regarding future events, results or outcomes. These expectations may not be realized. Some of these expectations may be based upon assumptions or judgments that prove to be incorrect. In addition, our business and operations involve numerous risks and uncertainties, many of which are beyond our control, which could result in our expectations not being realized, cause actual results to differ materially from our forward-looking statements and/or otherwise materially affect our financial condition, results of operations and cash flows. Please see the section below entitled "Risk Factors" for a discussion of examples of risks, uncertainties and events that may cause our actual results to differ materially from the expectations we describe in our forward-looking statements. You should carefully review the risks described herein and in other documents we file from time to time with the Securities and Exchange Commission, including Quarterly Reports on Form 10-Q to be filed in 2011. We caution readers not to place undue reliance on any forward-looking statements, which only speak as of the date hereof. Except as provided by law, we undertake no obligation to update any forward-looking statement based on changing circumstances or otherwise.

1

NetSpend is a leading provider of general-purpose reloadable prepaid debit cards, or GPR cards, and related alternative financial services to underbanked consumers in the U.S. We believe we are one of the largest dedicated providers of GPR cards in the U.S., with approximately 2.1 million active cards as of December 31, 2010 and a gross dollar volume of debit transactions and cash withdrawals of $9.8 billion for the twelve months ended December 31, 2010. We primarily focus on the estimated 60 million underbanked consumers in the U.S. who do not have a traditional bank deposit account or who rely on alternative financial services.

Our GPR cards are tied to FDIC-insured depository accounts and can be used to make purchase transactions at any merchant that participates in the MasterCard, Visa or PULSE networks and to withdraw funds at participating automated teller machines, or ATMs. The additional features we offer to our cardholders include direct deposit, interest-bearing savings accounts, bill pay and card-to-card transfer functionality, personal financial management tools and online and mobile phone card account access. We market our cards through multiple distribution channels, including contractual relationships with retail distributors, direct-to-consumer and online marketing programs, and contractual relationships with corporate employers. As of December 31, 2010, we marketed our GPR cards through approximately 750 retail distributors at approximately 39,000 locations and offered our cardholders the ability to reload funds onto their cards at over 100,000 locations.

Market Opportunity

Prepaid Cards

The prepaid card market is one of the fastest growing segments of the payments industry in the U.S. This market has experienced significant growth in recent years due to consumers and merchants embracing improved technology, greater convenience, more product choices and greater flexibility. Within the prepaid card market, which includes branded and private label gift cards, GPR cards, payroll cards, travel cards, college campus cards and teen spending cards, one of the fastest growing segments is GPR cards. A GPR card, typically branded with the MasterCard or Visa logo, is an "open-loop" prepaid debit card that provides cardholders the ability to load and reload funds onto their cards and make purchase transactions at any merchant that participates in the MasterCard, Visa or PULSE network, as well as to withdraw funds from participating ATMs. GPR cards such as NetSpend's have the same functionality as bank debit cards, serving as access devices to an FDIC-insured depository account with a bank. NetSpend is one of the most established providers of GPR cards, having marketed GPR cards since our inception.

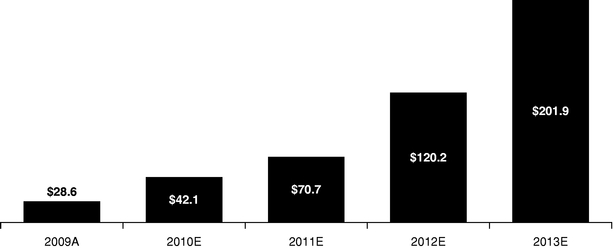

Mercator Advisory Group estimates the total loads on open-loop prepaid debit cards in 2010 to be $165.3 billion, and forecasts total loads to grow at a compound annual growth rate of 35.6% from 2009-2013. Mercator estimates that of those loads in 2010, $42.1 billion was loaded on GPR cards and that total loads on GPR cards will grow at a compound annual growth rate of 63.0% from 2009-2013, reaching an estimated $201.9 billion in load volume in 2013.

2

GPR Card Load Volumes 2009-2013 (U.S. $ billions)

Underbanked Consumers

Prepaid debit cards have proven an attractive alternative to traditional bank accounts for certain segments of the population, particularly underbanked consumers. A December 2009 study by the FDIC concluded that at least 25.6% of U.S. households, comprising approximately 60 million adults, are unbanked or underbanked, which we refer to collectively as underbanked. This includes 7.7% of U.S. households that are "unbanked"—those without a checking or savings account, and another 17.9% that are "underbanked"—those reliant on alternative financial services such as non-bank money orders, check cashing, rent-to-own agreements and payday loans. Although this consumer segment represents an attractive market segment for financial services products given the large amounts of payments they receive, underbanked consumers often remain underserved by traditional financial services providers. We believe many underbanked consumers are dissatisfied with the traditional banking sector due to expensive fee structures, including minimum balance fees and overdraft charges, denial of access to credit products due to a lack of credit history or poor credit, or a distrust in non-cash financial instruments. In addition, many traditional financial services providers are not open during hours or located in areas that are convenient for underbanked consumers.

As a result of their lack of access to traditional bank services, many underbanked consumers have historically used cash as their primary payment vehicle. However, the reliance on cash inherently limits these consumers' purchasing power and flexibility. For this large portion of the population, prepaid debit cards have emerged as an attractive alternative to cash, allowing a cardholder to participate in mainstream financial transactions by other means. Our GPR cards provide the cardholder with the convenience, security and freedom associated with access to universal electronic payment capabilities and product innovations such as direct deposit, interest-bearing savings accounts, complimentary insurance coverage, bill pay and card-to-card transfer functionality, personal finance management tools and online and mobile phone card account access.

3

We believe that our competitive strengths include the following:

Extensive Knowledge of Underbanked Consumers

Since 2001, we have served more than seven million underbanked consumers and have developed a database of more than 34 million consumers who we believe are underbanked. The experience we have gained and the data we have gathered have allowed us to develop extensive knowledge regarding the attitudes, characteristics and purchasing behavior of underbanked consumers. We have utilized this knowledge to develop a robust portfolio of products and services that we believe not only attracts underbanked consumers as new cardholders, but also drives longer cardholder retention.

Valuable and Loyal Customer Base

We believe we have achieved one of the highest average cardholder lifetimes among GPR card providers. Our promotion of direct deposit and our product suite provide consumers a consistent and affordable financial services solution and increase the lifetime value of the customer relationship.

Extensive and Diverse Distribution and Reload Network

We have built an extensive distribution and reload network throughout the U.S. comprised of diverse categories of retailers, our own direct-to-consumer and online marketing programs and corporate employers, which allows us to reach a large number of underbanked consumers and reduce our dependency on any single channel or distributor.

End-to-End, Scalable and Proprietary Technology Platform

We believe that the full integration of our program management and transaction processing operations into a single end-to-end operational and technology platform is unique among the leading GPR card providers. This platform provides us with a competitive advantage derived from attractive economies of scale, flexible product development capabilities and speed to market with differentiated product offerings. Further, by processing transactions on our own platform, we gain unique and extensive insight into the attitudes, characteristics and purchasing behavior of underbanked consumers, which allows us to better tailor our products and services to this consumer segment.

Strong Regulatory Compliance

As a provider of prepaid debit cards targeting underbanked consumers since 2001, we have acquired extensive knowledge about the unique characteristics of prepaid debit card programs for underbanked consumers. We have incorporated that knowledge into our proprietary regulatory and risk management systems. Working closely with our issuing banks and distributors, we have developed systems and processes designed to comply with rigorous federal regulatory standards for anti-money laundering and consumer protection in a manner adapted to the unique characteristics of our programs.

Proven and Experienced Management Team

We have assembled an executive team with substantial public company experience in financial services, payment systems, retail program management, direct marketing and technology. We believe that the strength and experience of our management team has helped us attract and retain our cardholders and distributors and create a differentiated product offering, contributing to our significant growth.

4

We aim to be the leading provider of GPR cards and related alternative financial services to underbanked consumers. To achieve this goal, we have developed a multi-pronged growth strategy that leverages our core capabilities to address expanding market opportunities for our services.

Increase Cardholder Usage and Retention

We plan to increase cardholder usage and retention by increasing the number of our cardholders who direct deposit their wages, government benefits or tax refunds onto their cards, as well as through marketing programs, product development, customer support and joint marketing efforts with our distributors. We plan to continue to provide competitive pricing while adding functionality and complementary products and services that will encourage underbanked consumers to use our cards as the equivalent of a traditional bank account over a longer period of time.

Increase Penetration of the Underbanked Consumer Market

We plan to focus on further penetrating the existing underbanked consumer market and attracting new categories of consumers who are dissatisfied with the traditional banking system by:

- •

- increasing our retail card sales by providing superior product offerings and pricing for underbanked consumers seeking

cash or bank alternatives;

- •

- developing new distribution relationships with leading national retailers and corporate employers;

- •

- continuing to grow and diversify our reload network; and

- •

- improving the effectiveness and efficiency of our direct-to-consumer and online marketing programs.

Leverage Our Technology Platform to Increase Profitability

Our end-to-end, proprietary technology platform provides us with attractive economies of scale, flexible product development capabilities and speed to market with differentiated product offerings. In addition, we continue to drive new efficiencies in our business, such as the continued integration of Skylight's infrastructure with our operational and technology platform. As we continue to increase our number of active cards and the volume of transactions we process, we believe we will be able to increase our profitability.

GPR Cards

The GPR card is our core product. As of December 31, 2010, we had approximately 2.1 million active cards and our GPR cards were responsible for approximately 97.7% of our total revenues for the year ended December 31, 2010. We consider a GPR card to be "active" if a personal identification number, or PIN, or signature-based purchase transaction, a load transaction at a retailer location, or an ATM withdrawal has been made with respect to such card within the previous 90 days. Marketed and processed by us and issued by our issuing banks, our GPR card is a prepaid debit card tied to an FDIC-insured depository account maintained by us, with the funds held at an issuing bank on behalf of the cardholder. Our GPR card represents the equivalent of a bank account for underbanked consumers and is marketed through our network of retail distributors, our direct-to-consumer and online marketing programs and corporate employers as an alternative method of wage payment rather than through bank branches. Our GPR cards can be used to make purchase transactions at any merchant

5

that participates in the MasterCard, Visa or PULSE network and withdraw funds at participating ATMs.

Funds may be loaded onto the GPR cards we market through our retail distributors and our direct-to-consumer and online marketing programs by:

- •

- a cardholder reloading his or her GPR card at a retail location within our distribution and reload network;

- •

- direct deposit of wages, government benefits or tax refunds;

- •

- a cardholder from his or her bank debit card through our online banking portal; or

- •

- electronic transfer by a third party.

The GPR cards we market through corporate employers are promoted to their employees as an alternative method of wage payment and are designed to be compliant with state wage and hour laws governing payroll cards. Similar to the GPR cards we market through our retail distributors, cardholders may load their wages onto our employer-marketed GPR cards through direct deposit. Although our employer-marketed GPR cards currently may not be reloaded through our reload network, they may be reloaded at all MoneyGram agent locations.

Additional Products and Services

We provide a feature rich suite of products and services to our cardholders, including direct deposit, overdraft protection through our issuing banks, complimentary insurance coverage, and a variety of bill payment options. Our cardholders also have the ability to transfer funds to other cardholders and deposit a portion of their funds into an interest-bearing savings account linked to their GPR cards. We also provide certain cardholders with a "cushion" which allows them to overdraw their card accounts without a fee. Our website allows our cardholders to access their account information and effectively manage their budgets through our personal finance management tools. Our interactive voice response systems also provide account information and allow cardholders to activate their accounts and perform a range of transaction activities such as card-to-card transfers of funds. We also provide our cardholders with a text message service that automatically sends balance and transaction information to enrolled cardholders' mobile phones, and also allows them to interact with their account by sending text messages to NetSpend. We believe we were the first prepaid debit card provider to provide text message services to cardholders.

In addition to GPR cards, we were also a provider of gift cards. Beginning in 2008, we decided to focus primarily on our GPR cards, and ceased marketing gift cards entirely as of August 21, 2010.

We have built distribution and reload network throughout the U.S. comprised of diverse categories of retailers, corporate employers and our own direct-to-consumer and online marketing programs.

Retail Distribution

As of December 31, 2010, we marketed our GPR cards through approximately 750 retail distributors at over 39,000 locations in the U.S. The majority of our agreements with our retail distributors require our retail distributors to exclusively market our GPR cards for a period of three to five years. Our long-term relationships include leading alternative financial services providers, such as ACE Cash Express, Advance America, Cash America International, Community Financial Service Center and Check City, leading grocery and convenience stores, such as H-E-B, Speedway, Murphy Oil and Winn-Dixie, and leading tax preparation service providers, such as Liberty Tax Service. Our largest retail distributor is ACE Cash Express Inc., or ACE, with whom we have an exclusive distribution

6

agreement through March 31, 2016. GPR cards distributed through ACE accounted for approximately 37.5% of our total revenues in 2010.

Corporate Employer Distribution

As of December 31, 2010, we marketed our GPR cards through approximately 800 corporate employers. These employers promote our GPR card to their underbanked employees as an alternative method of wage payment, allowing their employees to receive their wages on their GPR cards through direct deposit rather than a paper check and allowing the employers to avoid the costs associated with distributing paper checks. The corporate employers through which we market our GPR cards include Kohl's, Macy's, TravelCenters of America, Church's Chicken, Starwood Hotels & Resorts Worldwide and Hospital Corporation of America.

Direct Distribution

We also market our cards directly to consumers through direct-to-consumer and online marketing programs. We have developed proprietary systems for optimizing the placement of information regarding our products on the Internet through affiliate marketing and search optimization, and for identifying consumers likely to be receptive to offers to apply for our GPR cards.

Reload Network

As of December 31, 2010, we offered reload services through approximately 500 retailers at over 100,000 locations in the U.S. Our reload network is designed to provide convenient ways for our cardholders to add more funds to their cards, to provide our retail distributors with additional opportunities to earn revenue by providing services to our cardholders and to supplement our core GPR card revenues. Retailers typically collect a fee in connection with the reload of our GPR cards and we are entitled to a portion of such fee only with respect to some of such retailers. We do not process reloads of other providers and therefore none of our revenues are derived from reloads of cards offered by other prepaid debit card companies. Our reload network is comprised of all of the alternative financial services provider locations and traditional retail locations that market our GPR cards, as well as all MoneyGram and Western Union agent locations and all Safeway grocery stores. In addition, we have entered into a contractual relationships with Interactive Communications International, or InComm, to offer reload services through certain InComm agents.

Our sales force is comprised of business development and key account management professionals responsible for developing and maintaining our relationships with our retail distributors, online marketers and corporate employers. Our marketing staff is comprised of product, channel and functional marketing professionals focused on cardholder acquisitions, deepening usage and retention for us and our retail distributors and corporate employers. We principally market our cards under the NetSpend and Skylight brands and in many cases have co-branding relationships with our retail distributors. Our marketing programs focus principally on direct deposit enrollment and cardholder lifetime value optimization.

The NetSpend Platform

We fully integrate our program management and transaction processing operations into a single proprietary platform. Our end-to-end operational and technology platform encompasses the critical functions required for us to acquire cardholders, process transactions, maintain account-level balance data, communicate with cardholders, manage risk and ensure regulatory compliance and communicate

7

with our issuing banks and distributors. These integrated capabilities allow us to customize our products and services for different markets, distribution channels and customer segments.

Program Management

Customer Acquisition and Account Activation. Customers that acquire cards through our retail distributors and corporate employers are typically issued a temporary "Instant Issue" card with funds immediately available at reduced load and transaction limits. Card applications are typically submitted by these customers through the retail distributor or corporate employer, as applicable. A customer may activate a temporary card either online or by telephone. Upon the approval of the application, the account is established and a permanent card embossed and personalized with the customer's name is sent to the customer within ten business days. Customers that acquire a card through our direct-to-consumer or online marketing campaigns submit a card application to us directly, either online or by telephone, and upon approval of the application the card is activated and, if not included in the original solicitation, a permanent card is sent to the customer. We accept or decline card applications based on a review of the personal data included in each customer's application against our own and third party databases, in accordance with compliance procedures designed to comply with applicable law.

Customer Service and Support. We provide a comprehensive set of services to cardholders for account and balance information, budgeting tools, person-to-person payment, query resolution, bill payment and similar services. Customer support is provided through a combination of live service agents, as well as 24 hours a day, seven days a week access to our interactive voice response systems, our websites and other online and mobile phone based services. Our customer service includes employees at our Austin, Texas and Atlanta, Georgia facilities and outsourced services through facilities in Mexico and the Philippines. We provide certain of our large distributors with private-labeled customer support interfaces incorporating their brands.

Risk Management and Regulatory Compliance. We maintain substantially all aspects of portfolio and customer risk management, fraud exposure, chargeback recovery and transaction and distributor monitoring on behalf of our issuing banks. We also support many aspects of regulatory compliance monitoring and management within the risk area.

Marketing and Promotion. Our marketing and promotional efforts are targeted at consumers as well as our retail distributors and corporate employers. We are able to leverage our experience and the data we gather from our cardholders to design marketing and promotional programs that we believe more effectively drive customer acquisition, usage and retention. Because our marketing and promotional efforts are maintained by us as part of our end-to-end platform, we are able to quickly customize and change our programs to match changes in the market, consumer purchasing trends and technology improvements.

Distributor Relationship Management. We believe that our prepaid debit card programs are an integral part of many of our retail distributors' businesses. We work with our distributors to create a prepaid debit card program and strategy tailored to their respective businesses. We do this through a combination of marketing, information technology, risk management and regulatory compliance and sales and customer support.

8

Transaction Processing

Processing and Authorization. A transaction begins with an electronic message from a merchant requesting funds from a cardholder's account followed by a response from us authorizing or denying the transaction. In the case of an authorization, the cardholder's account is updated to reduce the funds available in the cardholder's account. We electronically receive and respond to an authorization request through the MasterCard, Visa or PULSE networks. The transaction is completed when a subsequent settlement transaction indicating the final purchase amount is received by us, upon which we debit the funds from the cardholder's account.

Network and Telecommunications. We maintain our own networking systems designed to provide secure and reliable connections to our distributors, issuing banks, cardholders and third parties, such as the card associations and other processors on whom we rely to provide services that are integrated into our platform.

Customer Statements and Account Information. Cardholders can access their account status and recent transactions through our customer service agents, through voice activation responses or by text messages to their mobile phones. Full account statements can be accessed online and printed statements are available to the cardholder upon request.

Clearing and Settlement Process. We have agreements with our issuing banks to undertake funds management and settlement processes through the card associations and network organizations. All cardholder funds are held by our issuing banks in FDIC-insured custodial depository accounts. Members of our distribution and reload network collect our cardholders' funds and remit them by electronic transfer to our issuing banks for deposit in the card accounts. Loads made through direct deposit are routed from the originating depository financial institutions through the Federal Reserve to our issuing banks for deposit in the card accounts. We provide a series of daily reports and instructions to our issuing banks regarding the movement of cardholder funds.

Our issuing banks provide us with critical products and services, including the FDIC-insured depository accounts tied to our GPR cards, access to the ATM networks, membership in the card associations and network organizations and other banking functions. All cardholder funds are held by our issuing banks. Our cardholders are charged fees by our issuing banks in connection with the products and services we provide. Further, interchange fees are remitted by merchants to our issuing banks when cardholders make purchase transactions using our prepaid debit cards. Our issuing banks compensate us for our services based on these service fees and interchange fees. The revenues earned by our issuing banks in connection with our prepaid debit cards consist primarily of returns earned on our cardholders' funds, as well as fees from additional products and services of our issuing banks marketed with our GPR cards, such as overdraft protection.

MetaBank, which has been one of our issuing banks since 2005, is a federal savings bank that is a leading issuer of prepaid debit cards. In January 2010, we amended our agreement with MetaBank pursuant to which we agreed to promote MetaBank as a preferred issuing bank and MetaBank agreed to promote us as a preferred program manager. In order to further align our strategic interests with MetaBank, we also acquired approximately 4.9% of the outstanding equity interests in Meta Financial Group, Inc., MetaBank's holding company.

On October 12, 2010, MetaBank publicly disclosed that the Office of Thrift Supervision, or OTS, issued a Supervisory Directive on October 6, 2010, which clarified and supplemented an initial Supervisory Directive issued to MetaBank on August 31, 2010 (collectively, the "OTS Directives"). The OTS Directives require MetaBank to discontinue offering its iAdvance product, based on a determination by OTS that MetaBank engaged in unfair or deceptive acts or practices in connection

9

with its operation of the iAdvance program. In addition, MetaBank announced that the OTS Directives will require MetaBank to obtain prior written approval of OTS to, among other things, enter into any new third party relationship agreements concerning any credit or deposit product (including prepaid access), or materially amend any such existing agreements or publicly announce any new third party relationship agreements or material amendments to existing agreements. MetaBank further indicated that it cannot predict whether OTS will address other compliance and supervisory matters, or the effect on MetaBank's results of operations or financial condition of any such OTS actions, although OTS has informed MetaBank that it will address in the future OTS's expectations with respect to reimbursement of borrowers under the iAdvance program. Future actions by OTS could seek to address other concerns that MetaBank indicated were factors leading to the OTS Directives, including MetaBank's third-party relationship risk, enterprise risk management and rapid growth. We are not in communication with OTS on these matters, and our information is limited to the information that is publicly disclosed and provided to us by MetaBank.

Based on further communications between MetaBank and OTS, we understand that the OTS Directives will require MetaBank to obtain OTS approval prior to MetaBank executing new third party agency agreements with new distributor relationships established by existing program managers such as NetSpend. This means that we will not, without MetaBank obtaining the prior written approval of OTS, be able to enter into new agreements with distributors that are also parties to a third party agency relationship with MetaBank (or amend any such existing three-party agency agreements), which would include any distributors that have the capability to issue cards and accept cash deposits on those cards. Our distributors that do not accept cash deposits, such as our direct-to-consumer and non-standard auto insurance distributors do not enter into third party agency relationship agreements with our issuing banks. Similarly, as a general matter extensions or renewals of our existing distributor agreements do not require execution of new or amended agency agreements with our issuing banks, including MetaBank. Therefore, MetaBank expects to be able to continue to service its existing third party relationship agreements, which would include our card program management agreement and the existing agency agreements it has entered into with our distributors, consistent with their terms and the OTS Directives.

In September 2010, we amended our agreement with Inter National Bank, one of our other issuing banks. Pursuant to the amendment, we will transition our cards issued by Inter National Bank to another bank on or prior to July 2011, at which time Inter National Bank will cease serving as one our issuing banks.

We are pursuing a bank diversification strategy pursuant to which we intend to diversify our cards among at least three issuing banks. We are focused on doing so in a manner that balances our diversification strategy with the protection of existing cardholder and direct deposit relationships and other operational considerations. In furtherance of this strategy, in January 2011 we entered into an agreement with The Bancorp Bank, pursuant to which The Bancorp Bank will serve as a new issuing bank for our new and existing card programs. We expect to begin marketing cards issued by The Bancorp Bank in April 2011. We have also continued our discussions with other prospective issuing banks. For a discussion of the risks associated with changing issuing banks, see "Risk Factors—Risks Relating to Our Business—The loss of, or change to, our relationships with MetaBank or our other issuing banks could adversely affect our business, results of operations and financial position."

We develop and maintain all critical operations systems in-house. Our integrated end-to-end operational and technology platform supports a wide variety of core processing, client servicing and operational functions. Our proprietary systems include an account hosting database infrastructure, an integrated layer of banking, cardholder acquisition, cardholder relationship management and transactions processing applications, a range and variety of third-party client interfaces and a real-time

10

reporting infrastructure. In addition to our core systems, we have also developed a number of ancillary systems that support a variety of customized operational needs, including risk management, customer servicing and financial reconciliation and reporting.

We rely on a combination of patent, copyright, trademark and trade secret laws, employee and third-party nondisclosure agreements and other methods to protect our intellectual property and other proprietary rights. In addition, we license technology from third parties.

We have one registered patent and four patent applications pending with the United States Patent and Trademark Office. Most of our services and products are based on proprietary software and related payments systems solutions. Protecting our rights to our proprietary software and the patents, copyrights and trade secrets related to them is critical, as it enhances our ability to offer distinctive services and products to our cardholders, distributors and issuing banks, which differentiates us from our competitors. We have U.S. federal trademark registrations for the marks "NetSpend", "Skylight" and "All-Access" and several other marks, as well as registrations in a variety of foreign jurisdictions.

The financial services industry, including the prepaid card market, is subject to intense and increasing competition. We directly compete with a number of companies that market open-loop prepaid debit cards through retail and online distribution, including Green Dot Corporation, Account Now, Inc. and Blackhawk Network Inc. Many transaction processors, such as First Data Corporation, Total System Services, Inc., Fidelity National Information Services and Galileo Processing, Inc., have prepaid platform capability and are increasingly in direct competition with us for prepaid program management opportunities with large distributors. We compete against large retailers such as Wal-Mart seeking to integrate more profitable financial services into their product offerings. We also anticipate increased competition from alternative financial services providers who are often well-positioned to service the underbanked and who may wish to develop their own prepaid debit card programs. In the past year, two of our prior retail distributors Pay-O-Matic, Inc. and Checksmart Financial Company began to distribute their own GPR cards through their stores. While the increased desire of banks, retailers and alternative financial services providers to develop successful prepaid debit card programs frequently creates new business opportunities for us, it could also have an adverse effect on our business, including increased price competition and loss of distributor relationships.

We, and the products and services that we market and provide processing services for, are subject to a variety of federal and state laws and regulations, including, but not limited to:

- •

- Banking laws and regulations;

- •

- Money transmitter and payment instrument laws and regulations;

- •

- State wage payment laws and regulations;

- •

- Anti-money laundering laws;

- •

- Privacy and data security laws and regulations;

- •

- Consumer protection laws and regulations;

- •

- Unclaimed property laws; and

- •

- Card association and network organization rules.

11

As the laws applicable to our business, and those of our distributors and issuing banks, change frequently, are often unclear and may differ or conflict between jurisdictions, ensuring compliance has become more difficult and costly. Failure by us, our issuing banks or distributors to comply with all applicable statutes and regulations could result in fines, penalties, regulatory enforcement actions, civil liability, criminal liability, and/or limitations on our ability to operate our business, each of which could significantly harm our reputation and have a material adverse impact on our business, results of operations and financial condition. For additional discussion of the laws to which we are subject, proposed changes to such laws, the related impact that such changes may have on our business or financial position, and potential penalties associated with failure to comply with such laws, see "Risk Factors—Risks Relating to our Business—We, are subject to extensive and complex federal and state regulation and new regulations and/or changes to existing regulations could adversely affect our business."

Banking Laws and Regulations

The products we market and process are the products of MetaBank, Inter National Bank, The Bancorp Bank, SunTrust Bank and U.S. Bank, or collectively our issuing banks, and are subject to various federal and state laws and regulations, including those discussed below. MetaBank is a federal savings banks primarily regulated by the Office of Thrift Supervision, or the OTS. Inter National Bank and U.S. Bank N.A. are each national banks primarily regulated by the Office of the Comptroller of the Currency, or the OCC, and their respective holding companies are primarily regulated by the Board of Governors of the Federal Reserve System, or the FRB. The Bancorp Bank is a Delaware state-chartered bank principally regulated by the Delaware Office of the State Bank Commissioner, or the DOSBC, and the FRB, and its holding company is also principally regulated by the FRB. SunTrust Bank is a Georgia state-chartered bank principally regulated by the Georgia Department of Banking and Finance, or the GDBF, and the FRB, and its holding company is also principally regulated by the FRB. As the deposits of each of our issuing banks are insured by the Federal Deposit Insurance Corporation, or the FDIC, up to the applicable limit, the FDIC also serves as the secondary federal regulator for each of our issuing banks. As an agent of, and third-party service provider to, our issuing banks, we are subject to indirect regulation and direct audit and examination by the OTS, OCC, FRB, DOSBC, GDBF and FDIC.

The GPR cards we market through corporate employers as payroll cards are subject to certain portions of the FRB's Regulation E, which implements the Electronic Fund Transfers Act, or the EFTA. Additionally, while our other GPR cards are not expressly subject to the provisions of the EFTA and Regulation E, with the exception of those provisions comprising the CARD Act described below, we, and our issuing banks, treat our GPR cards as being subject to certain provisions of the EFTA and Regulation E, such as those related to disclosure requirements, periodic reporting, error resolution procedures and liability limitations.

On March 23, 2010, the FRB issued a final rule implementing Title IV of the Credit Card Accountability, Responsibility, and Disclosure Act of 2009, or CARD Act, which imposes requirements relating to disclosures, fees and expiration dates that are generally applicable to gift certificates, store gift cards and general-use prepaid cards. We believe that our GPR cards, and the maintenance fees charged on our GPR cards, are exempt from the requirements under this rule, as they fall within an express exclusion for cards which are reloadable and not marketed or labeled as a gift card or gift certificate. However, this exclusion is not available if the issuer, the retailer selling the card to a consumer or the program manager promotes, even if occasionally, the use of the card as a gift card or gift certificate. As a result, we provide retailers with instructions and policies regarding the display and promotion of our GPR cards so that retailers do not place our GPR cards on a display that does not separate or otherwise distinguish our GPR cards from gift cards. See "Risk Factors—Risks Relating to Our Business—Our card programs are subject to strict regulation under federal law regarding

12

anti-money laundering and anti-terrorist financing. Failure to comply with such laws, or abuse of our card programs for purposes of money laundering or terrorist financing, could have a material adverse impact on our business."

Money Transmitter and Payment Instrument Laws and Regulations

Most states regulate the business of money transmitters. While a large number of states expressly exempt banks and their agents from such regulation, others purport to regulate the money transmittal business of banks and their agents to the extent not conducted through bank branches. We have historically taken the position that state money transmitter statutes do not apply to our business for a number of reasons, including that we do not believe that our activities related to our prepaid debit cards are of the type which are regulated by the state money transmitter statutes, in that we do not receive or handle any consumer funds related to our prepaid debit cards at any time. Instead, our distributors collect all consumer funds related to the sale or load of our prepaid debit cards and remit them by electronic transfer directly to our issuing banks. We, in turn, are compensated directly by each issuing bank for our provision of program management and processing services related to our prepaid cards. We have obtained confirming opinions in support of our exemption from state regulation from regulators in a number of the states where our products and services are offered, and periodically update our analysis of such issues and communications with the relevant regulatory authorities. In each of the remaining states, we provide all services related to our prepaid debit cards either as a licensed money transmitter or on behalf of, and as the agent of, MetaBank, Inter National Bank or The Bancorp Bank, and therefore are exempt from regulation as the agent of an exempt entity. We currently are licensed in Ohio, Virginia, Florida, Texas, Michigan and Wyoming, and are in the process of applying for licenses in Alaska and North Carolina. In those states where we are licensed as a money transmitter, we are subject to direct supervision and regulation by the relevant state banking departments or similar agencies charged with enforcement of the money transmitter statutes, and must comply with various requirements, such as those related to the maintenance of a certain level of net worth, surety bonding, selection and oversight of our authorized agents, permissible investments in an amount equal to our outstanding payment obligations, recordkeeping and reporting, and disclosures to consumers. We are also subject to periodic examinations by the relevant licensing authorities, which may include reviews of our compliance practices, policies and procedures, financial position and related records, various agreements that we have with our issuing banks, distributors and other third parties, privacy and data security policies and procedures, and other matters related to our business.

We understand that state banking departments, which are charged with regulating the business of money transmission, have traditionally taken the position that the offering of payroll cards does not constitute money transmission, such that we would not be required to obtain a state money transmission license in order to engage in such activity. We believe that our marketing, distribution and servicing of GPR cards through corporate employers as a program manager and third-party service provider to our issuing banks is not subject to regulation under state money transmitter statutes as we do not handle any related consumer funds at any time.

State Wage Payment Laws and Regulations

The GPR cards we market through corporate employers are designed to comply with applicable state wage and hour laws governing payroll cards. The use of payroll cards as a means for an employer to remit wages or other compensation to its employees or independent contractors is governed by state labor laws related to wage payments. Most states do permit the use of payroll cards as a method of paying wages to employees, either through statutory provisions allowing such use, or, in the absence of specific statutory guidance, the adoption by state labor departments of formal or informal policies allowing for the use of such cards. There are a few states, specifically Georgia, New Mexico and Rhode Island, which do not have statutes and regulations that specifically provide for the use of payroll cards,

13

and have taken the position, through the state labor department, that state law prohibits the use of payroll cards for the purpose of remitting wages or other compensation. Nearly every state allowing payroll cards places certain requirements and/or restrictions on their use as a wage payment method, the most common of which involve obtaining the prior written consent of the relevant employee, limitations on payroll card fees, and disclosure requirements. There is a risk that one or more states or state labor departments that currently permit the use of payroll cards as a wage payment method will take a contrary position, either through revised legislation, regulation or policies, as applicable, or will impose additional requirements on the provision and use of such cards, each of which could have an adverse impact on our business.

Anti-Money Laundering Laws and Regulations

At certain times in our history we have been registered with the Financial Crimes Enforcement Network of the U.S. Department of the Treasury, or FinCEN, as a "money services business," and therefore have been subject to certain anti-money laundering compliance obligations arising under the Bank Secrecy Act and its implementing regulations. However, we subsequently concluded that we were not required to be registered as a money services business, did not renew our registration, and requested a formal, written opinion from FinCEN to confirm our conclusion. Accordingly, while we do have certain anti-money laundering compliance obligations, these obligations arise contractually under the agreements that we have with each of our issuing banks. It is possible that we may at some future date be required to re-register as a money services business, whether due to a notification from FinCEN that we are required to register under the current requirements or new regulatory requirements or otherwise. Furthermore, in the event that FinCEN's recent Notice of Proposed Rulemaking is adopted in its current form, it is likely that we will be required to register as a money services business. See "Risk Factors—Risks Relating to Our Business—Our card programs are subject to strict regulation under federal law regarding anti-money laundering and anti-terrorist financing. Failure to comply with such laws, or abuse of our card programs for purposes of money laundering or terrorist financing, could have a material adverse impact on our business."

Privacy and Data Security Laws and Regulations

We collect and store personally identifiable information about our cardholders, including names, addresses, social security numbers, driver's license numbers and account numbers, and maintain a database of cardholder data relating to specific transactions, including account numbers, in order to process transactions and prevent fraud. As a result, we are required to comply with the privacy provisions of the Gramm-Leach-Bliley Act and its implementing regulations, or GLBA, various other federal and state privacy statutes and regulations, and the Payment Card Industry Data Security Standard, each of which is subject to change at any time. In order to comply with our obligations under GLBA and applicable state laws, and our agreements with our issuing banks, we are required to safeguard and protect the privacy of such personally identifiable information, make disclosures to our cardholders regarding the applicable privacy and information sharing policies, and give our cardholders the opportunity to prevent us and our issuing banks from releasing information about them to unaffiliated third parties for marketing and other purposes. The privacy laws of certain states, including California, impose more stringent limitations on access and use of personal information than GLBA, requiring our cardholders to affirmatively opt-in to certain categories of disclosures. We continue to work with our issuing banks to implement and maintain appropriate policies and programs as well as adapt our business practices in order to comply with applicable privacy laws and regulations.

Consumer Protection Laws and Regulations

We are subject to various federal and state consumer protection laws, including those related to unfair and deceptive trade practices. We continue to implement and maintain policies and procedures

14

to assist us in our compliance with such laws, which are subject to frequent change due to the increased focus on this area by federal and state legislatures, regulatory authorities and consumer protection groups.

Card Association and Payment Network Operating Rules

In providing certain of our services to our issuing banks, we are required to comply with the operating rules promulgated by various card associations and network organizations, including certain data security standards, with such obligations arising either under our agreements with each issuing bank or as a condition to access or otherwise participate in the relevant card association or network organization. Each card association and network organization audits us from time to time to ensure our compliance with these standards, and our failure to comply could subject us to a variety of fines or penalties, including the termination of our ability to process transactions routed through these networks. We continue to work with our issuing banks to implement and maintain appropriate policies and programs as well as adapt our business practices in order to comply with all applicable rules and standards.

Other Laws and Regulations

As we develop new services and new products, we may become subject to additional federal and state regulations. These additional regulations could substantially restrict the nature of the business in which we may engage and the nature of the businesses in which we may invest. In addition, changes in current laws or regulations and future laws or regulations may restrict our ability to continue our current methods or operations or expand our operations and may have a material adverse effect on our business, results of operations and financial condition.

As of December 31, 2010, we had 507 employees. We are not subject to any collective bargaining agreement and have never been subject to a work stoppage. We believe that we have maintained good relationships with our employees.

Our website address is www.netspend.com. Through a link on the Investor Relations section of our website, we make available the following filings as soon as reasonably practicable after they are electronically filed with or furnished to the SEC: our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act. All such filings are available free of charge.

15

Risks Relating to Our Business

The market for prepaid debit cards and alternative financial services is highly competitive, and competition is increasing as more companies, many that are larger and have greater resources than we do, endeavor to address the needs of underbanked consumers.

The market for prepaid debit cards and related alternative financial services is highly competitive. We directly compete with a number of companies that market and serve as program managers for open-loop prepaid debit cards through retail and online distribution, such as Green Dot Corporation, AccountNow, Inc. and Blackhawk Network Inc. Open-loop prepaid debit cards are those that can be used for transactions at any merchant participating in the relevant card association, such as MasterCard or Visa, or network organization, such as PULSE, as opposed to a single merchant. Many of the arrangements that our competitors have with large distributors are long-term and exclusive, which would prevent these distributors from offering our GPR cards during the terms of the arrangements. Many transaction processors, such as First Data Corporation, Total System Services, Inc., and Galileo Processing, Inc., have prepaid platform capability and increasingly compete directly with us for prepaid program management and processing opportunities with large distributors. We also compete with traditional providers of financial services, such as banks that offer demand deposit accounts and card issuers. Similarly, we anticipate increased competition from large retailers seeking to integrate more profitable financial services into their product offerings. For example, Wal-Mart currently offers a prepaid debit card and related services through its stores with our direct competitors Green Dot and Total System Services as the program manager and the processor, respectively. We also anticipate increased competition from alternative financial services providers, who are often well-positioned to service the underbanked and who may wish to develop and manage their own prepaid debit card programs. For example, in the past year, two of our prior retail distributors Pay-O-Matic and Checksmart introduced their own GPR cards through their stores. While the increased desire of banks, retailers and alternative financial services providers to develop prepaid debit card programs frequently creates new business opportunities for us, it could also have an adverse effect on our business, including through increased price competition and loss of distributor relationships.

Our ability to grow our business is dependent on our ability to compete effectively against other providers of GPR cards and alternative financial services. Many existing and potential competitors have longer operating histories and greater name recognition than we do. In addition, many of our existing and potential competitors are substantially larger than we are and may already have or could develop substantially greater financial and other resources than we have. We may also face price competition that results in decreases in the purchase and use of our products and services. To stay competitive, we may have to increase the incentives that we offer to our retail distributors and decrease the prices of our products and services, which could adversely affect our operating results.

The majority of our revenues result from GPR cards marketed pursuant to agreements we have entered into with a small number of retail distributors. If we are unable to maintain relationships with our retail distributors on terms that are favorable to us, our business, financial condition and operating results may be materially adversely affected.

Our business model substantially depends on establishing agreements with our retail distributors, which primarily consist of alternative financial services providers, as well as grocery and convenience stores and other traditional retailers. While we continually seek to diversify the sources of our revenues and card distribution, the majority of our revenue streams have historically depended on cards distributed through these retail distributors. In 2010, GPR cards distributed through our largest retail distributor, ACE, accounted for approximately 37.5% of our revenues. In June 2010, during the course

16

of negotiations with ACE regarding possible modifications to our distribution agreement, ACE initiated arbitration against us alleging breach of our agreement based on certain activities of our direct-to-consumer and online marketing programs and seeking, among other things, termination of our agreement. We filed a response setting forth the reasons we believed the claims to be without merit, as well as a counterclaim. We have resolved the dispute and entered into a mutual agreement to release and dismiss with prejudice all claims in the arbitration, and reached an agreement on the terms of certain modifications to our existing distribution agreement. In September 2010, we entered into an amendment to our distribution agreement to reflect these modifications, which we do not expect to have a material impact on our business, financial condition or operating results. However, ACE, or other of our retail distributors, may in the future object to competition from our direct-to-consumer and online marketing programs, and may seek modifications to our agreements or make claims against us, which could have a material adverse effect on our business, financial condition and operating results.

The success of our business depends substantially on our ability to attract and retain retailers with a large number of locations that are convenient for our cardholders to purchase and reload our GPR cards. In the future, some of our retail distributors may endeavor to internally develop their own prepaid debit card programs or enter into exclusive relationships with our competitors to distribute their products. The loss of, or a substantial decrease in revenues from, one or more of our top retail distributors could have a material adverse effect on our business and operating results. Most of our retail distribution agreements have terms ranging from three to five years and are typically renewable automatically for subsequent terms of at least one year unless we or the distributor affirmatively elect to discontinue the agreement within the required notice period. If we want to continue a contractual relationship with a retail distributor after the expiration of the agreement, we are typically required to renegotiate the terms of the agreement upon its expiration, and in some circumstances we may be forced to modify the terms of the agreement before it expires. Our negotiations to renew some distribution agreements have resulted in, and in the future may result in, financial and other terms that are less favorable to us than the terms of the prior agreements, such as terms that permit the distributors to market prepaid debit cards that compete with our GPR cards. We may not succeed in renewing these agreements when they expire, which would result in a complete loss of revenue from these distributors. If we are required to pay higher revenue-sharing amounts or agree to other less favorable terms to retain our retail distributors, or we are not able to renew our relationships with our retail distributors upon the expiration of our agreements, our business, financial condition and operating results would be harmed.

We depend on our distributors' sale and promotion of our products and services, but their interests and operational decisions might not always align with our interests.

A significant portion of our operating revenues are derived from our products and services sold at the stores of our retail distributors. Our reliance on these retail distributors means that we do not have direct control over the sales of our cards and, as a result, our future growth is inherently unpredictable. Because we often compete with many other providers of consumer and financial products for placement and promotion of products in the stores of our retail distributors, our success depends on our retail distributors and their willingness to promote our products and services successfully. In general, our contracts with these third parties allow them to exercise significant discretion over the placement and promotion of our products in their stores, and they could give higher priority to the products and services of other prepaid debit card providers. In many instances, our retail distributors have greater incentives to promote other products or services to consumers. If our retailers do not actively and effectively promote the sale of our cards, our growth will be limited and our operating results will suffer.

17

We are subject to extensive and complex federal and state regulation and new regulations and/or changes to existing regulations could adversely affect our business.

As an agent of, and third-party service provider to, our issuing banks, we are subject to indirect regulation and direct audit and examination by the Office of Thrift Supervision, or the OTS, the Office of the Comptroller of the Currency, or the OCC, the Board of Governors of the Federal Reserve System, or the FRB, the Georgia Department of Banking and Finance, or the GDBF, and the Federal Deposit Insurance Corporation, or the FDIC. We are also subject to direct regulation by those states in which we are licensed as a money transmitter.

We have historically taken the position that state money transmitter statutes do not apply to our business for a number of reasons. We discuss this in greater detail under "Business—Regulation—Money Transmitter and Payment Instrument Laws and Regulations." In the event that a state regulatory authority were to disagree with our position that we are not required to be licensed in any of the states in which we are not currently licensed, it is possible that we, our distributors or our issuing banks could become subject to regulatory enforcement or other proceedings, which could in turn have a significant adverse impact on our business, even if we were to ultimately prevail in such proceedings. In such event, we may have additional arguments available to us that we should not be subject to the licensing requirements under the relevant state money transmitter statutes, and may utilize one or more of these arguments at such time. However, it is possible that we could be unsuccessful in making a persuasive argument that we should not be subject to such licensing requirements, and could be deemed to be in violation of one or more of the state money transmitter statutes. Such failure to comply could result in the imposition of fines, the suspension of our ability to offer some or all of our prepaid debit cards in the relevant jurisdiction, civil liability and criminal liability, each of which would likely have material adverse impact on our revenues.

On March 23, 2010, the FRB issued a final rule implementing Title IV of the Credit Card Accountability, Responsibility, and Disclosure Act of 2009, or CARD Act, which imposes requirements relating to disclosures, fees and expiration dates that are generally applicable to gift certificates, store gift cards and general-use prepaid cards. We believe that our GPR cards, and the maintenance fees charged on our GPR cards, are exempt from the requirements under this rule, as they fall within an express exclusion for cards which are reloadable and not marketed or labeled as a gift card or gift certificate. However, this exclusion is not available if the issuer, the retailer selling the card to a consumer or the program manager promotes, even if occasionally, the use of the card as a gift card or gift certificate. As a result, we provide retailers with instructions and policies regarding the display and promotion of our GPR cards. It is possible, however, that despite our instructions and policies to the contrary, a retailer engaged in offering our GPR cards to consumers could take an action with respect to one or more of the cards that would cause each similar card to be viewed as being marketed or labeled as a gift card, such as by placing our GPR cards on a display which prominently features the availability of gift cards and does not separate or otherwise distinguish our GPR cards from the gift cards. In such event, it is possible that such GPR cards would lose their eligibility for such exclusion to the CARD Act and the rule's requirements, and therefore could be deemed to be in violation of the CARD Act and the rule, which could result in the imposition of fines, the suspension of our ability to offer our GPR cards, civil liability, criminal liability, and the inability of our issuing banks to apply certain fees to our GPR cards, each of which would likely have a material adverse impact on our revenues.

As the laws applicable to our business, and those of our distributors and issuing banks, change frequently, are often unclear and may differ or conflict between jurisdictions, ensuring compliance has become more difficult and costly. Any failure, or perceived failure, by us, our issuing banks or our distributors to comply with all applicable statutes and regulations could result in fines, penalties, regulatory enforcement actions, civil liability, criminal liability, and/or limitations on our ability to

18

operate our business, each of which could significantly harm our reputation and have a material adverse impact on our business, results of operations and financial condition.

Our retail distributors are subject to extensive and complex federal and state regulations and new regulations and/or changes to existing regulations could adversely affect our ability to offer our GPR cards through their locations, which in turn could have an adverse impact on our business.

As each of our retail distributors offering prepaid cards and related services conducts such activity either as an agent of our issuing banks or, where applicable, of NetSpend in its capacity as a licensed money transmitter, we do not believe that our distributors would be required to become licensed as money transmitters in order to engage in such activity. However, there is a risk that a federal or state regulator will take a contrary position and initiate enforcement or other proceedings against a distributor, us or our issuing banks, which in turn could have an adverse impact on our business, even if the relevant party were to ultimately prevail in such proceedings. In such event, the relevant party may have additional arguments available to it that the retail distributor should not be subject to the licensing requirements under the relevant state money transmitter statutes, and may utilize one or more of these arguments at such time. However, it is possible that the relevant party could be unsuccessful in making a persuasive argument that the retail distributor should not be subject to such licensing requirements, and therefore could be deemed to be in violation of one or more of the state money transmitter statutes. Such failure to comply could result in the imposition of fines, the suspension of the distributor's ability to offer some or all of our GPR cards and related services in the relevant jurisdiction, civil liability and criminal liability, each of which would likely have a material adverse impact on our revenues.

Our retail distributors include a large number of companies in industries that are highly regulated, such as alternative financial services providers. It is possible that changes in the legal regime governing such businesses could limit the ability of some of our retail distributors to distribute our products or adversely impact their business, and thereby have an indirect adverse impact on our business. For example, a large number of states have either prohibited, or imposed substantial restrictions upon, the offering of "payday loans," and this activity continues to draw substantial scrutiny from federal and state legislatures, regulatory authorities and various consumer groups. Furthermore, the federal financial reform legislation enacted in July 2010 grants supervisory authority over entities engaged in this activity to a new Consumer Financial Protection Bureau, which is directed to promulgate regulations which may significantly impact the operations and/or viability of various entities, including those engaged in the business of offering payday loans. As a number of our retail distributors, including our largest distributor, ACE Cash Express, are engaged in offering payday loans, further legislative and regulatory restrictions which negatively impact their ability to continue their operations could have a corresponding negative impact on our ability to offer our GPR cards through their locations, potentially resulting in a significant decline in our revenue. In addition, various states have statutes that limit the ability of check cashers to charge a fee for cashing government-issued checks.

We are subject to extensive and complex federal and state regulation relating to the distribution of our GPR cards through corporate employers and new regulations and/or changes to existing regulations could adversely affect our business.

We understand that state banking departments, which are charged with regulating the business of money transmission, have traditionally taken the position that the offering of payroll cards does not constitute money transmission, such that we would not be required to obtain a state money transmission license in order to engage in such activity. We believe that our marketing, distribution and servicing of GPR cards through corporate employers as a program manager and third-party service provider to our issuing banks is not subject to regulation under state money transmitter statutes as we do not handle any related consumer funds at any time. However, there is a risk that a federal or state

19

regulator will take a contrary position and initiate enforcement or other proceedings against us or our issuing banks, which in turn could have an adverse impact on our business, even if we were to ultimately prevail in such proceedings. In such event, we may have arguments other than those described above that we should not be subject to the licensing requirements under the relevant state money transmitter statutes, and may utilize one or more of these arguments at such time. However, it is possible that we could be unsuccessful in making a persuasive argument that we should not be subject to such licensing requirements, and could be deemed to be in violation of one or more of the state money transmitter statutes. Such failure to comply could result in the imposition of fines, the suspension of our ability to offer our GPR cards through corporate employers in the relevant jurisdiction, civil liability and criminal liability, each of which would likely have a material adverse impact on our revenues.

The use of payroll cards as a means for an employer to remit wages or other compensation to its employees or independent contractors is also governed by state labor laws related to wage payments. Most states permit the use of payroll cards as a method of paying wages to employees, either through statutory provisions allowing such use, or, in the absence of specific statutory guidance, the adoption by state labor departments of formal or informal policies allowing for the use of such cards. There are a few states, specifically Georgia, New Mexico and Rhode Island, which do not have statutes and regulations that specifically provide for the use of payroll cards, and have taken the position, through the state labor department, that state law prohibits the use of payroll cards for the purpose of remitting wages or other compensation. Nearly every state allowing payroll cards places certain requirements and/or restrictions on their use as a wage payment method, the most common of which involve obtaining the prior written consent of the relevant employee, limitations on payroll card fees, and disclosure requirements. There is a risk that one or more states or state labor departments that currently permit the use of payroll cards as a wage payment method will take a contrary position, either through revised legislation, regulation or policies, as applicable, or will impose additional requirements on the provision and use of such cards, each of which could have an adverse impact on our business.

Limitations on the amount of interchange fees that may be charged to merchants which are fixed by the card associations and network organizations could decrease our revenues and negatively impact our business and financial performance.

A material portion of our operating revenues is derived from our share of the fees charged to merchants for services provided in settling transactions routed through the networks of the card associations and network organizations, commonly known as "interchange fees." For the year ended December 31, 2010, revenues from interchange fees represented approximately 21.6% of our total operating revenues, and we expect interchange revenues to continue to represent a material percentage of our total operating revenues in the near term. The amounts of these interchange fees are currently fixed by the card associations and network organizations in their sole discretion.

In July 2010, the U.S. Congress adopted legislation which requires the amount of interchange fees charged to merchants in connection with transactions utilizing traditional debit cards and certain prepaid cards issued by financial institutions that, together with their affiliates, have assets of $10 billion or more, to be reasonable and proportionate to the costs of the underlying transactions. The new legislation also generally gave the FRB the power to regulate the amount of such interchange fees and required FRB to promulgate regulations establishing standards for determining when interchange fees are reasonable and proportionate to the costs of the underlying transactions. The FRB published proposed regulations in December 2010. The final regulations are scheduled to be published in April 2011 and become effective in July 2011. The proposed regulations prescribe limits on interchange fees that are below the current rates set by the card associations and network organizations. While we believe that the exemption of GPR cards and small issuing banks, such as MetaBank, Inter National Bank and The Bancorp Bank, from the legislation will apply to our GPR card programs, it remains

20