Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - General Moly, Inc | a11-2322_1ex32d1.htm |

| EX-31.2 - EX-31.2 - General Moly, Inc | a11-2322_1ex31d2.htm |

| EX-32.2 - EX-32.2 - General Moly, Inc | a11-2322_1ex32d2.htm |

| EX-23.1 - EX-23.1 - General Moly, Inc | a11-2322_1ex23d1.htm |

| EX-31.1 - EX-31.1 - General Moly, Inc | a11-2322_1ex31d1.htm |

| EX-21.1 - EX-21.1 - General Moly, Inc | a11-2322_1ex21d1.htm |

| EX-10.60 - EX-10.60 - General Moly, Inc | a11-2322_1ex10d60.htm |

| EX-10.61 - EX-10.61 - General Moly, Inc | a11-2322_1ex10d61.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

|

For the fiscal year ended December 31, 2010 | |

|

|

|

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-32986

GENERAL MOLY, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware |

|

91-0232000 |

|

(State or Other Jurisdiction of Incorporation or |

|

(I.R.S. Employer Identification No.) |

|

1726 Cole Blvd., Suite 115 Lakewood, CO |

|

80401 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (303) 928-8599

Securities registered pursuant to Section 12(b) of the Act:

|

Common Stock, par value $0.001 per share |

|

NYSE Amex and Toronto Stock Exchange |

|

(Title of Each Class) |

|

(Name of each Exchange on Which Registered) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o |

|

Accelerated filer x |

|

|

|

|

|

Non-accelerated filer o |

|

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of June 30, 2010, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $163,728,125 based on the closing price as reported on the NYSE Amex.

As of February 28, 2011, 90,590,011 shares of the registrant’s common stock, par value of $0.001 per share, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain portions of the registrant’s definitive proxy statement to be used in connection with its Annual Meeting of Stockholders and to be filed within 120 days of December 31, 2010 are incorporated by reference into Part III, Items 10-14, of this report on Form 10-K.

ITEMS 1 & 2. BUSINESS AND PROPERTIES

The Company

References made in this Annual Report on Form 10-K to “we”, “our”, “us”, “GMI” and the “Company” refer to General Moly, Inc. and its consolidated subsidiary Eureka Moly, LLC.

We are a development stage company in the business of the exploration, development and mining of properties primarily containing molybdenum. Our primary asset is an 80% interest in the Mt. Hope Project (“Mt. Hope Project”), a primary molybdenum property, located in Eureka County, Nevada. The Mt. Hope Project has contained proven and probable molybdenum reserves totaling 1.3 billion pounds (1.1 billion pounds owned by GMI) of which 1.1 billion pounds (0.9 billion pounds owned by GMI) are estimated to be recoverable. In 2006, we acquired a second significant molybdenum project, the Liberty Property (“Liberty Property”), located in Nye County, Nevada which we own 100%. The Liberty Property is anticipated to become our second molybdenum operation, after completion of the Mt. Hope Project, with initial production dependent on market conditions.

Mt. Hope Project. In August, 2007, we completed a Bankable Feasibility Study (“Bankable Feasibility Study” or “BFS”) that provided data on the viability, expected economics, and production and cost estimates of the project. Since publication of the BFS, we have revised several estimates, based primarily on engineering progress, which is currently 60% complete. Our current estimates for the Mt. Hope Project capital cost requirements are referred to as the “Project Capital Estimate” and our current estimates for the Mt. Hope Project operating costs are referred to as the “Project Operating Cost Estimate”.

Estimated costs for construction, equipment, owners cost, pre-stripping and contingency are $1,039.3 million. Additionally, financial assurance and pre-paid items are estimated at $114.6 million, resulting in a total Project Capital Estimate of $1,153.9 million. These amounts do not include financing costs or amounts necessary to fund operating working capital. Through December 31, 2010, we have made deposits of $68.4 million on $116.2 million in equipment orders, have spent approximately $90.2 million for the development of the Mt. Hope Project and have pre-paid $12.0 million into an escrow arrangement for electricity transmission services.

Our Project Operating Cost Estimate projects (on a 100% basis) molybdenum production of approximately 40 million pounds per year for the first five years of operations at projected average direct operating costs of $5.29 per pound, based on $80 per barrel oil equivalent energy prices. The Costs Applicable to Sales (“CAS”) per pound, including anticipated royalties calculated at a market price of $15 per pound molybdenum, are anticipated to average $6.00 per pound. We currently estimate that, for each $10 per barrel change in oil-equivalent energy costs, the Mt. Hope Project’s direct operating costs will change by approximately $0.10 per pound.

Processed ore grades are expected to average 0.103% over the first five years. The mine is anticipated to have a 44-year life with 32 years of open pit mining and processing operations followed by 12 years of processing lower grade stockpiled ore.

The Company continues to operate under a cash conservation plan implemented in March 2009 designed to reduce expenditures and conserve cash in order to maximize financial flexibility. With our December 31, 2010 cash balance of $53.6 million and early 2011 receipt of $19.1 million in warrant exercise proceeds, we have the capacity to continue our current level of permitting efforts and secure and hold critical long lead equipment for the ultimate construction of the Mt. Hope Project through the end of 2011 without accessing new sources of financing while maintaining the current cash conservation strategy.

We anticipate that the Draft Environmental Impact Statement (“DEIS”) will be released for publication during the second quarter of 2011, followed by publication in the Federal Register in the third quarter, and receipt of the Record of Decision (“ROD”) six to nine months after publication. We plan to restart procurement and engineering efforts during 2011 as key milestones in the permitting process are reached and do not expect to generate revenues from operations before production of molybdenum begins at the Mt. Hope Project. Once financing is obtained and the major operating permits and the ROD from the United States Bureau of Land Management (“BLM”) are effective, it is expected that Mt. Hope can be constructed and in production within 20 months.

From October 2005 to January 2008, we owned the rights to 100% of the Mt. Hope Project. Effective as of January 1, 2008, we contributed all of our interest in the assets related to the Mt. Hope Project, including our lease of the Mt. Hope Project into a newly formed entity, Eureka Moly, LLC, a Delaware limited liability company (“LLC”), and in February 2008 (“Closing Date”) entered into an agreement (“LLC Agreement”) for the development and operation of the Mt. Hope Project with POS-Minerals Corporation (“POS-Minerals”) an affiliate of POSCO, a large Korean steel company. Under the LLC Agreement, POS-Minerals owns a 20% interest in the LLC and General Moly, through a wholly-owned subsidiary, owns an 80% interest. These ownership interests and/or required contributions under the LLC Agreement can change as discussed below.

Pursuant to the terms of the LLC Agreement, POS-Minerals made its first and second cash contributions to the LLC totaling $100.0 million during the year ended December 31, 2008 (“Initial Contributions”). Additional amounts will be due from POS-Minerals within 15 days after the date (“ROD Contribution Date”) that specified conditions (“ROD Contribution Conditions”) have been satisfied. The ROD Contribution Conditions are the receipt of major operating permits for the project, that the ROD from the BLM for the Mt. Hope Project has become effective, and any administrative or judicial appeals with respect thereto are final. We are currently targeting the effectiveness of the ROD and the satisfaction of the other ROD Contribution Conditions to occur six to nine months after publication of the DEIS, but circumstances beyond our control, including delays by reviewing agencies and requests for additional information and studies, and requests for review or appeals of the BLM decision, could cause the effectiveness of the ROD and/or the satisfaction of the other ROD Contribution Conditions to be delayed.

To maintain its 20% interest in the LLC, POS-Minerals will be required to make an additional $56.0 million contribution plus its 20% share of all Mt. Hope Project costs incurred from the Closing Date to the ROD Contribution Date within 15 days after the ROD Contribution Date. If POS-Minerals does not make its additional $56.0 million contribution when due after the ROD Contribution Date, its interest will be reduced to 10%.

In addition, as commercial production at the Mt. Hope Project will not occur by December 31, 2011, the LLC may be required to return to POS-Minerals $36.0 million of its contributions to the LLC, with no corresponding reduction in POS-Minerals’ ownership percentage. Based on our current plan and assuming POS-Minerals has made its additional $56.0 million contribution, a payment to POS-Minerals of $36.0 million will be due 20 days after the commencement of commercial production, as defined by the LLC Agreement. If POS-Minerals does not make its additional $56.0 million contribution when due, no return of contribution is required by us. Our wholly-owned subsidiary and 80% owner of the LLC, Nevada Moly, LLC (“Nevada Moly”), is obligated under the terms of the LLC Agreement to make capital contributions to fund the return of contributions to POS-Minerals, if required. If Nevada Moly does not make these capital contributions, POS-Minerals has an election to either make a secured loan to the LLC to fund the return of contributions, or receive an additional interest in the LLC of approximately 5%. In the latter case, our interest in the LLC is subject to dilution by a percentage equal to the ratio of 1.5 times the amount of the unpaid contributions over the aggregate amount of deemed capital contributions (as determined under the LLC Agreement) of both parties to the LLC (“Dilution Formula”). At December 31, 2010, the aggregate amount of deemed capital contributions of both parties was $880.0 million.

Furthermore, the LLC Agreement permits POS-Minerals to put its interest in the LLC to Nevada Moly after a change of control of Nevada Moly or the Company, as defined in the LLC Agreement, followed by a failure to use standard mining industry practice in connection with development and operation of the Mt. Hope Project as contemplated by the parties for a period of twelve consecutive months. If POS-Minerals puts its interest, Nevada Moly or the transferee or surviving entity would be required to purchase the interest for 120% of POS-Minerals’ contributions to the LLC plus 10% interest per annum.

The Initial Contributions of $100.0 million that were made by POS-Minerals during 2008 were expended by the second quarter of 2009 in accordance with the program and budget requirements of the Mt. Hope Project. Nevada Moly is required, pursuant to the terms of the LLC Agreement, to advance funds required to pay costs for the development of the Mt. Hope Project that exceed the Initial Contributions until the ROD Contribution Date, at which point the contributions described above to be made by POS-Minerals will be applied to reimburse us for POS-Minerals’ share of such development costs. All costs incurred after the ROD Contribution Date will be allocated and funded pro rata based on each party’s ownership interest. The interest of a party in the LLC that does not make its pro rata capital contributions to fund costs incurred after the ROD Contribution Date is subject to dilution based on the Dilution Formula.

Securities Purchase Agreement with Hanlong (USA) Mining Investment Inc.

On March 4, 2010, we signed a Securities Purchase Agreement (the “Purchase Agreement”) with Hanlong (USA) Mining Investment, Inc. (“Hanlong”), an affiliate of Sichuan Hanlong Group, a large privately held Chinese company. The

Purchase Agreement and the related agreements described below form the basis of a significant investment by Hanlong in the Company that is intended to provide the Company with adequate capital to develop the Mt. Hope Project. The Purchase Agreement provides for the sale to Hanlong of shares of our common stock in two tranches that will aggregate 25% of our outstanding stock on a fully diluted basis. The average price per share, based on the anticipated number of shares to be issued, is $2.88 for an aggregate price of $80.0 million. The Company’s stock closed at a price of $2.60 per share on the NYSE Amex on the day the agreement was signed. The share issuance is part of a larger transaction that includes the commitment by Hanlong to use its commercially reasonable efforts to procure a $665.0 million bank loan for the Company (the “Term Loan”) from a prime Chinese bank that will be guaranteed by an affiliate of Hanlong, a $20.0 million bridge loan (the “Bridge Loan”) from Hanlong to the Company, and a long-term molybdenum supply off-take agreement pursuant to which a Hanlong affiliate will agree to purchase a substantial part of the molybdenum production from the Mt. Hope Project at specified prices.

The Purchase Agreement

Stock Purchase. The Purchase Agreement provides, subject to terms and conditions of the Purchase Agreement, for the purchase by Hanlong for an aggregate price of $80.0 million, of approximately 27.6 million shares of our common stock which will equal 25% of our outstanding common stock on a fully-diluted basis following the purchase, or approximately 38.3% of our outstanding common stock at the time the transaction was announced. Fully diluted is defined as all of our outstanding common stock plus all outstanding options and warrants, whether or not currently exercisable.

On July 30, 2010, the Company and Hanlong executed an amendment to the Purchase Agreement extending the deadline for obtaining Chinese government approvals by two months to October 13, 2010, as well as extending the Company’s deadline for publishing its Draft Environmental Impact Statement (“DEIS”) and receiving its ROD to February 28, 2011 and November 30, 2011, respectively. Hanlong received Chinese government approvals for equity investment from the National Development and Reform Commission and the Ministry of Commerce (“MOFCOM”) on October 8, 2010 and October 12, 2010, respectively. Hanlong filed the MOFCOM approval with the State Administration of Foreign Exchange on October 12, 2010, fulfilling Hanlong’s Chinese government approval obligations.

On October 26, 2010, the Company and Hanlong executed a second amendment to the Purchase Agreement setting the closing of Hanlong’s purchase of the first tranche of equity in the Company on December 20, 2010. The parties agreed that the publication of the Mt. Hope Project’s DEIS was no longer a condition precedent to Hanlong’s first tranche equity investment. Timely publication of the DEIS does, however, remain a requirement of the entire agreement, and, in conjunction with this amendment, the required date for DEIS publication has been extended to May 31, 2011 from February 28, 2011. See “Break Fees” below for additional discussion on the potential penalties incurred if DEIS publication occurs after May 31, 2011.

On December 20, 2010, Hanlong completed the purchase of 12.5% of our fully-diluted shares, or approximately 11.8 million shares (“Tranche 1”) for $40.0 million, or approximately $3.38 per share, following satisfaction of certain conditions, including receipt of stockholder approval of the equity issuances in connection with the transaction, receipt of necessary Chinese government approvals for certain portions of the transaction, assurances from Hanlong as to the availability of the Term Loan, approval of the shares for listing on the NYSE Amex and absence of certain defaults.

The second tranche (“Tranche 2”), which is anticipated to involve the purchase of approximately 15.8 million additional shares, will be for a purchase price of an additional $40.0 million, or approximately $2.53 per share. The actual number of shares and price per share will be adjusted for any change in the number of fully diluted shares before the closing of Tranche 2. Significant conditions to the closing of Tranche 2 include issuance of the ROD for the Mt. Hope Project by the BLM, approval of the plan of operations for the Mt. Hope Project (the “POO”) by the BLM, and the completion of documentation for and satisfaction of conditions precedent to lending under the Term Loan, described below. The Purchase Agreement may be terminated by either party (provided the terminating party is not in default) if the closing of Tranche 2 has not occurred by December 31, 2011, subject to extension under some circumstances to March 31, 2012.

Hanlong will have the right to purchase a portion of any additional shares of common stock that we issue so that it can maintain its percentage ownership unless its ownership is at the time below 5%. It may also acquire additional shares so that it maintains a 20% indirect interest in the Mt. Hope Project if our interest in the LLC is reduced below 80%. If we issue shares to fund our obligation to fund the Mt. Hope Project under certain circumstances, and on or before the date of commercial production, and Hanlong exercises its rights to maintain its percentage interest, we will be obligated to refund to Hanlong the cost of such shares over a three-year period up to an aggregate of $9.0 million.

Break Fees. A break fee is payable by both the Company and Hanlong if the Purchase Agreement terminates because of the failure of certain conditions. A break fee of $10.0 million is payable to the Company if the Purchase Agreement is terminated because Hanlong fails to obtain necessary Chinese government approvals or to give its assurances about the availability of the Term Loan. The Company has agreed to pay $5 million to Hanlong if the conditions concerning our stockholder approval, the publication of the DEIS or the ROD are not timely satisfied or waived and the Purchase Agreement is terminated. The Company break fees may be increased by $5.0 million if the Purchase Agreement is terminated and the Company has violated the “no-shop” provisions of the Purchase Agreement. The break fees may also be increased in other circumstances, not to exceed an additional $3.0 million if the Company requests and Hanlong grants certain extensions of deadlines concerning the DEIS, and up to an additional $2.0 million if the Company requests and Hanlong grants certain extensions concerning the ROD. Further to the break fees, the Company must pay a $2.0 million fee to Hanlong at the granting of an extension concerning the ROD, and such fee will be credited against the arrangement fee described below. The break fee payable by the Company to Hanlong may be paid in cash, or, in certain circumstances, in shares of our common stock at our option. If paid in shares, the price would be the volume weighted average of our common stock on the NYSE Amex for the five days ending six days after the announcement of the termination.

Chinese Bank Loan. Pursuant to the Purchase Agreement, Hanlong is obligated to use its commercially reasonable efforts to procure the Term Loan in an amount of at least $665.0 million with a term of at least 14 years after commercial production begins at the Mt. Hope Project. The Term Loan will bear interest at a rate of LIBOR plus a spread of between 2% and 4% per annum. The Purchase Agreement provides that the Term Loan will have customary covenants and conditions; however, the terms of the Term Loan have not been negotiated with the lender and we have no assurance as to the final terms of the Term Loan. Hanlong or an affiliate is obligated to guarantee the Term Loan. When funds can be drawn by the Company under the Term Loan, the Company will pay a $15.0 million arrangement fee to Hanlong who will pay fees and expenses associated with the Term Loan before the Term Loan Closing, including those charged by the Chinese bank.

Bridge Loan

Hanlong has also agreed to provide a $20.0 million Bridge Loan to the Company which will be available in two equal $10.0 million tranches. On April 28, 2010, we drew down the first tranche in the amount of $10.0 million. The second loan tranche became available five business days after receipt of stockholder approval and is subject to the satisfaction of customary conditions. The first tranche of the Bridge Loan bears interest at LIBOR plus 2% per annum. The second tranche of the Bridge Loan will bear interest at 10% per annum and remains undrawn by the Company as of December 31, 2010. The Bridge Loan will be repaid from the proceeds of the Term Loan. If Hanlong agrees, the second tranche may also be repaid, at the Company’s election, in shares of the Company’s common stock. If paid in shares, the price would be the volume weighted average of the Company’s shares on the NYSE Amex for a five-day period after public announcement of the event that required repayment. The Company may offset its right to receive the break fee against its obligations to repay borrowings under the Bridge Loan. If not sooner repaid, the Bridge Loan will mature on the earliest of 120 days after the issuance of the ROD, the date on which the Purchase Agreement terminates, or March 31, 2012. The Bridge Loan and our obligation to pay a break fee to Hanlong under the Purchase Agreement are secured by a pledge by us of a 10% interest in the LLC.

Stockholder Agreement

In connection with the Tranche 1 closing, Hanlong signed a Stockholder Agreement with the Company that limits Hanlong’s future acquisitions of our common stock, provides for designation of up to two directors to our Board, and places some restrictions on Hanlong’s voting and disposition of our shares.

After the Tranche 1 closing, Hanlong became entitled to nominate one director to our Board, which right will remain in place so long as it maintains at least a 10% fully diluted interest in the Company. Hanlong nominated Hui (Steven) Xiao to serve on our Board, and he was appointed as a director in February 2011. After the Tranche 2 closing, and so long as Hanlong retains fully-diluted stock ownership of at least 20%, Hanlong will be entitled to nominate a second director. The Company has agreed to assure that each Hanlong nominee is included in the Board’s slate of nominees submitted to our stockholders, subject to the Board’s fiduciary obligations and compliance by the nominee with applicable law and Company requirements concerning disclosure of information. The Hanlong nominees may also serve on committees for which they are eligible. Following the Term Loan closing and until its guaranty has expired or otherwise been terminated, Hanlong will have the right to appoint one representative to the management committee of the LLC.

Hanlong has also agreed not to purchase additional shares, except as permitted by the Purchase Agreement, without the Company’s prior consent following the Tranche 1 closing, and has agreed that it will not solicit proxies, join a group with respect to our equity securities, solicit or encourage an offer from another person for the Company, call a meeting of the

Company’s stockholders or make a proposal to the Company’s stockholders, except to the Board. If our Board receives an offer for the Company, for its assets or a merger that the Board determines is in the best interests of the Company’s stockholders, Hanlong is required to vote in favor of such a transaction or tender its shares unless it proposes an alternative transaction that our Board determines is more favorable to our stockholders than the offer received.

Under the Stockholder Agreement, Hanlong may not, without the prior written consent of the Board, transfer ownership in the securities if the recipient would acquire beneficial ownership of more than 5% of our common stock as of the date of such transfer. The restrictions on Hanlong’s share ownership, voting, disposition and drag-along rights will terminate on the earlier of the time that Hanlong owns less than 12% of our Common Stock, the date that commercial production begins at the Mt. Hope Project, and June 30, 2014.

The equity issuance of the Company’s common stock to Hanlong was subject to stockholder approval and was voted on and approved in connection with the Company’s annual meeting of stockholders in May 2010.

ArcelorMittal Participation

The Company’s November 2007 private placement of 8.257 million shares with ArcelorMittal, the world’s largest steel company, included certain anti-dilution rights. Pursuant to those rights, ArcelorMittal had an option to participate in the Tranche 1 and Tranche 2 equity issuances. On April 16, 2010, the Company and ArcelorMittal entered into a Consent and Waiver Agreement (the “Agreement”) whereby ArcelorMittal waived its anti-dilution rights with respect to the Company’s proposed issuance of stock under the Hanlong investment. ArcelorMittal will retain anti-dilution rights for future issuances of Company stock outside of shares sold under the Hanlong investment. According to public filings, on January 25, 2011, the boards of directors of ArcelorMittal S.A. and APERAM each approved the transfer of the assets comprising ArcelorMittal’s stainless and specialty steels businesses from its carbon steel mining businesses to APERAM, a separate entity incorporated in the Grand Duchy of Luxembourg. This transfer included the off-take agreement the Company had in place with ArcelorMittal and the shares of the Company’s common stock previously owned by ArcelorMittal.

Liberty Property

In March 2006, we purchased the Liberty Property in Nye County, Nevada, including water rights, mineral and surface rights, buildings and certain equipment, from High Desert Winds LLC. The Liberty Property includes the former Hall molybdenum and copper deposit that was mined by open pit methods between 1982 and 1985 by the Anaconda Minerals Company (“Anaconda”) and, between 1988 and 1991, by Cyprus Metals Company (“Cyprus”). In addition, Equatorial Tonopah, Inc. mined copper from 1999 to 2000 on this property, although their operations were in a separate open pit. Much of the molybdenum deposit was drilled but not developed or mined by these previous owners.

In January 2007, we purchased the corporation that owned a 12% net smelter royalty on the Liberty Property, effectively eliminating all third party royalties on the property. Additionally in 2007, we purchased all outstanding mineral claims associated with this property that were not previously owned by us, thus giving us control over all mineral rights within the boundary of the Liberty Property.

Since purchasing the Liberty Property, we completed two drilling programs that, combined with previous evaluation work performed by former owners, identified mineralization totaling 433 million tons with an ore grade averaging 0.071% molybdenum and 0.07% copper. In April 2008 we completed a pre-feasibility study outlining project viability, expected economics, and production and cost estimates. In January 2011, the Company announced plans to re-start its evaluation program at the Liberty Property focusing on collecting baseline data for the Nevada State-issued permits, hydro-geological groundwater characterization of the open pit, infill drilling, and logging and assaying prior drill core to improve and update the existing geologic model. The Company anticipates an update to the pre-feasibility study by the end of 2011, including an evaluation of full feasibility study options. These activities will be financed using funds received in early 2011 from the exercise of outstanding warrants.

Other Properties

We also have mining claims and land purchased prior to 2006 which consist in part of (a) approximately 107 acres of fee simple land in the Little Pine Creek area of Shoshone County, Idaho, (b) six patented mining claims known as the Chicago-London group, located near the town of Murray in Shoshone County, Idaho, (c) 265 acres of private land with three unpatented claims in Josephine County, Oregon, known as the Turner Gold project, and (d) an undivided 50% interest in the

reserved mineral rights known as the Margaret Property and 105 unpatented mining claims comprising the Red Bonanza Property, situated in the St. Helens Mining District, Skamania County, Washington.

Corporate Information

The Company was initially incorporated in Idaho under the name “General Mines Corporation” in 1925. We have gone through several name changes and on October 5, 2007, we reincorporated the Company in the State of Delaware (“Reincorporation”) through a merger of Idaho General Mines, Inc. with and into General Moly, Inc., a Delaware corporation that was a wholly owned subsidiary of Idaho General Mines, Inc. with General Moly being the surviving entity. In connection with the Reincorporation, all of the outstanding securities of Idaho General Mines, Inc. were converted into securities of General Moly on a one-for-one basis. For purposes of the Company’s reporting status with the U.S. Securities and Exchange Commission (“SEC”), General Moly is deemed a successor to Idaho General Mines, Inc. Our common stock is traded on the NYSE Amex under the symbol “GMO” and, in February 2008, the Company began trading on the Toronto Stock Exchange (“TSX”) under the same symbol. Our registered and principal executive office is located at 1726 Cole Blvd., Suite 115, Lakewood, Colorado 80401 and the phone number for that office is (303) 928-8599.

We maintain a website at www.generalmoly.com, on which we will post free of charge our annual reports on Form 10-K, quarterly reports on Form 10-Q, and any amendments to these reports under the heading “Investors” as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. We also routinely post important information about the Company on our website under the heading “Investors.” We do not incorporate the information on our website into this document and you should not consider any information on, or that can be accessed through, our website as part of this document. You may read and copy any materials we file with the SEC at the Securities and Exchange Commission Public Reference Room at 100 F Street NE Washington, DC 20549. The SEC also maintains a website that contains our reports and other information at www.sec.gov.

Corporate Strategy and Objective

Our corporate strategy is to acquire and develop highly profitable advanced stage mineral deposits. Our near-term corporate objective is to profitably develop and operate the Mt. Hope Project and to complete our evaluation and commence development of the Liberty Property. In the short-term, we are focused on receiving permits required to complete the development of the Mt. Hope Project based on our current schedule, while at the same time conserving our cash resources until such permits are received.

We believe we have the following business strengths that will enable us to achieve our objectives:

· A strong, proven management team with experience in mine development, project financing, and operations.

· The Mt. Hope Project, of which we own 80%, currently in the permitting and development stage, is anticipated to be one of largest and lowest cost primary molybdenum projects in the world, driven, in part, by high ore grades that will be processed early in the mine life.

· Our Liberty Property has the potential to become a second, significant, molybdenum operation and is wholly-owned by the Company and royalty-free.

· The Mt. Hope Project and the Liberty Property are located in Nevada, which has a long and ongoing history of large-scale, open pit mining operations.

· Both the Mt. Hope Project and the Liberty Property have near-by infrastructure for power, access roads, and water and have an environmentally friendly design.

· We have strong international support from the steel industry.

· We anticipate favorable long-term market fundamentals for molybdenum.

Products

We do not currently produce any products. When the Mt. Hope Project is developed, we expect production (on a 100% basis) of 40 million pounds of molybdenum per year over the first five years on average and approximately 1.1 billion pounds of molybdenum over the expected 44-year life of the project. The Mt. Hope Project will primarily focus on producing Technical Grade Molybdenum Oxide (“TMO”), which is widely utilized by the steel industry. In the future, we may also consider producing FerroMolybdenum (“FeMo”), and have designed the Mt. Hope Project plant to accommodate this process, which is also used by the steel industry and would make the Company a more complete supplier to the steelmaking industry. We may also ultimately produce Ammonium Dimolybdate (“ADM”), which is a chemical used in the manufacture of desulfurizing catalysts for use in petroleum refining.

Molybdenum is a refractory metal with very unique properties. Approximately 70% to 80% of molybdenum applications are in steel making. Molybdenum, when added to plain carbon and low alloy steels, increases strength, corrosion resistance and high temperature properties of the alloy. The major applications of molybdenum containing plain and low alloy steels are automotive body panels, construction steel and oil and gas pipelines. When added to stainless steels, molybdenum imparts specialized corrosion resistance in severe corrosive environments while improving strength. The major applications of stainless steels are in industrial chemical process plants, desalinization plants, nuclear reactor cooling systems and environmental pollution abatement. When added to super alloy steels, molybdenum dramatically improves high temperature strength, thermal expansion and contraction resistance and resistance to oxidation in such applications as advanced aerospace engine components. The effects of molybdenum additions to steels are not readily duplicated by other elements and as such are not significantly impacted by substitution of other materials.

Other significant molybdenum applications include lubrication, catalytic sulfur reduction in petrochemicals, lighting, LCD activation screens, x-ray generation, high temperature heat dissipation and high temperature conductivity. These areas represent the highest technical and value-added applications of molybdenum, but are also the most readily replaceable in times of technical or economic downturns.

Competitive Conditions

The molybdenum exploration, development and production business is a competitive business. We anticipate competing with numerous producing companies once the Mt. Hope Project achieves production.

The supply of molybdenum comes from both primary molybdenum mines, such as our proposed Mt. Hope Project, and as a byproduct of porphyry copper production. Each source of supply represents approximately 50% of the global 455 million pounds of molybdenum produced annually. Although many companies produce molybdenum, many of which also mine other minerals, approximately two-thirds of global production is concentrated among ten companies.

After we commence production at both our Mt. Hope Project and Liberty Property, our competitive position will be based on the quality and grade of our ore bodies and our ability to manage costs compared with other producers. Our costs are driven by the grade and nature of our ore bodies as well as input costs, including energy, labor and equipment. Our ability to have a competitive position over the long-term will be based on, among other things, our ability to receive necessary permits, successfully finance and develop the Mt. Hope Project and Liberty Property, acquire additional quality deposits, hire and retain a skilled workforce, and manage our costs.

Employees

The Company had a total of 37 employees, including 32 exempt and 5 hourly employees, as of December 31, 2010.

Description of the Mt. Hope Project

Overview

Effective as of January 1, 2008, we contributed all of our interest in the assets related to the Mt. Hope Project, including our lease of the Mt. Hope Project into the LLC, and on the Closing Date entered into the LLC Agreement for the development and operation of the Mt. Hope Project with POS-Minerals. Under the LLC Agreement, POS-Minerals owns a 20% interest in the LLC and General Moly, through a wholly-owned subsidiary, owns an 80% interest. The discussion in this section “Description of the Mt. Hope Project” is based on the entire project, of which we own an 80% interest.

The LLC is proceeding with the permitting and development of the Mt. Hope Project. The Project will include the development of an open pit mine, construction of a concentrator and a roaster, and construction of all related infrastructure to produce TMO, the most widely marketed molybdenum product.

From November 2004 through August 2007 we conducted numerous exploration, drilling and evaluation studies, culminating in the BFS for the Mt. Hope Project. In 2005, we initiated the baseline studies necessary for development of an Environmental Impact Statement (“EIS”). We completed an initial POO which the BLM accepted in September 2006. In December 2006, the BLM selected an environmental firm to complete the EIS for the Mt. Hope Project. Since that time, the Company has been working with the environmental firm to complete the EIS. The current schedule for the development of the Mt. Hope Project estimates that the DEIS will be released for publication during the second quarter of 2011, followed by publication in the Federal Register in the third quarter, and receipt of the ROD six to nine months after publication.

In addition to working to complete the EIS, the LLC is working to finalize the transfer of water rights to mining use. In October of 2008, we completed a water rights hearing in Carson City, Nevada and in March 2009 were granted our water rights in a ruling by the State Engineer. An appeal of that ruling was granted in April 2010 by a Nevada District Court, overturning the original ruling and remanding the matter for another hearing by the State Engineer. In December 2010, we completed a second water rights hearing in Carson City, Nevada and currently anticipate a ruling by the State Engineer late in the first quarter or during the second quarter of 2011 (see “Permitting-Mt. Hope Permitting Requirements-Water Appropriation Permits-Nevada Division of Water Resources” below).

On August 19, 2010, the LLC entered into an agreement with the Eureka Producers’ Cooperative (the “EPC”) whereby Eureka Moly will fund a Sustainability Trust (the “Trust”) in exchange for the cooperation of the EPC with respect to Eureka Moly’s water rights and permitting of the Mt. Hope Project. The Trust will be tasked with developing and implementing programs that will serve to enhance the sustainability and well-being of the agricultural economy in the Diamond Valley Hydrographic Basin through reduced water consumption, which may include the Trust purchasing and relinquishing water rights in Diamond Valley to help bring the Diamond Valley basin into a more sustainable water balance. The Trust’s activities will be governed by a five member Board including one Eureka Moly representative.

The Trust may be funded by Eureka Moly in the amount of $4.0 million, contributed to the Trust over several years, contingent on the achievement of certain milestones. The achievement of these milestones is considered to be probable as of December 31, 2010. As such, the $4.0 million has been accrued in the Company’s December 31, 2010 financial statements. At least 50% of the contributions would be provided upon receipt of all permits, full financing and the Company’s Board of Directors’ decision to proceed with construction. The remaining payments would be split evenly with one payment due no later than 150 days from the commencement of commercial production at the Mt. Hope Project and the remaining payment due one year thereafter.

In addition to the ROD and the water rights, three state-issued permits are viewed as major environmental permits. These are the Water Pollution Control (“WPC”) Permit, the Air Quality Permit and the Reclamation Permit. The LLC continues to develop the applications and supporting information for these permits. These permits are anticipated to be received on or before the date that the ROD is received (see “Permitting- Mt Hope Permitting Requirements” below).

Once financing has become available and the major operating permits and the ROD from the BLM are effective, it is expected that the Mt. Hope Project can be constructed and in production within 20 months.

The Mt. Hope Project — the LLC

The Mt. Hope Project is owned and will be operated by the LLC under the LLC Agreement. The LLC currently has a 30-year renewable lease with Mount Hope Mines, Inc. (“MHMI”) for the Mt. Hope Project (“Mt. Hope Lease”). Located in Eureka County, Nevada, the Mt. Hope Project consists of 13 patented lode claims and one millsite claim, which are owned by MHMI and leased to the LLC, and 1,521 unpatented lode claims, including 109 unpatented lode claims owned by MHMI and leased to the LLC and 1,412 unpatented lode claims owned by the LLC.

The Mt. Hope Lease is subject to the payment of certain royalties. See “Business—Description of the Mt. Hope Project—Royalties, Agreement and Encumbrances” below. In addition to the royalty payments, the LLC is obligated to maintain the property and its associated water rights, including the payment of all property taxes and claim maintenance fees. The LLC must also indemnify MHMI against any and all losses incurred as a result of any breach or failure to satisfy any of the terms of the Mt. Hope Lease or any activities or operations on the Mt. Hope property.

The LLC is not permitted to assign or otherwise convey its obligations under the Mt. Hope Lease to a third party without the prior written consent of MHMI, which consent may be withheld in its sole discretion. If, however, the assignment takes the form of a pledge of our interest in the Mt. Hope Project for the purpose of obtaining financing, MHMI’s consent may not be unreasonably withheld. The Mt. Hope Lease further requires the LLC to keep the property free and clear of all liens, encumbrances, claims, charges and burdens on production except as allowed for a project financing.

The Mt. Hope Lease requires that the terms of any project financing must provide that: (i) any principal amount of debt can only be repaid after payment of the periodic payments as set out in the Mt. Hope Lease; (ii) the lenders may not prohibit or interfere with any advance royalty payments due to MHMI under the Mt. Hope Lease; and (iii) no cash sweeps or payments of excess cash flow may be made to the lenders in priority of such advance royalty payments.

The Mt. Hope Lease also contains an after acquired property clause, which requires that any property acquired by the LLC within two miles of the boundary of the Mt. Hope Project be conveyed to MHMI if requested within a certain time period following notification of such acquisition. MHMI has requested that we maintain ownership of all new claims filed by the LLC, which now includes 1,412 unpatented lode claims.

The Mt. Hope Lease may be terminated upon the expiration of its 30-year term, earlier at the election of the LLC, or upon a material breach and failure to cure such breach. If the LLC terminates the lease, the termination is effective 30 days after receipt by MHMI of written notice to terminate the Mt. Hope Lease. If MHMI terminates the lease, termination is effective upon receipt of a notice of termination of a material breach, representation, warranty, covenant or term contained in the Mt. Hope Lease and followed by failure to cure such breach within 90 days of receipt of a notice of default. MHMI may also elect to terminate the Mt. Hope Lease if the LLC has not cured the non-payment of obligations under the lease within 10 days of receipt of a notice of default. The term of the lease can be extended beyond 30 years if the Mt. Hope Project is in production or intends to resume production (and has provided notice accordingly).

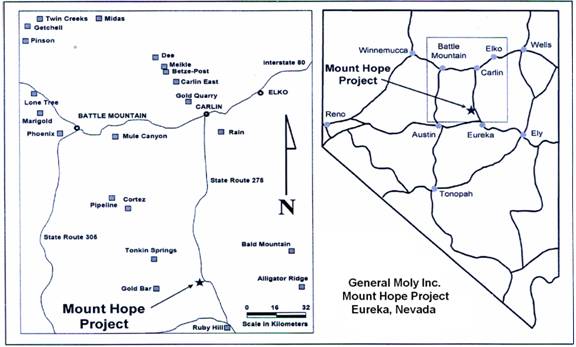

Property Description and Location

The Mt. Hope Project is located on the eastern flank of Mt. Hope approximately 21 miles north of Eureka, Nevada. The Mt. Hope Project is located at the southern end of the northwest-trending Battle Mountain-Eureka mineral belt. Mt. Hope is approximately 2.6 miles due west of State Route 278, and the Mt. Hope Project centers in sections 1 and 12, T22N-R51E and sections 12 and 13, T22N-R51½E.

Nature and Extent of the LLC’s Title

The land package for the Mt. Hope Project contains 13 patented lode claims, one patented mill site, and 1,521 unpatented lode claims. The total surface area covered by the Mt. Hope Project land package is 18,066 acres. MHMI

owns all of the patented claims and 109 of the unpatented lode claims. These claims are the subject of the Mt. Hope Lease. The LLC owns the remaining 1,412 unpatented lode claims. The patented claims and unpatented claims comprising the Mt. Hope Project are listed by number and ownership in the BFS. Patented claims are owned real property and unpatented claims are held subject to the paramount title of the United States and remain valid for as long as the claim contains a discovery of valuable minerals as defined by law and the holder pays the applicable fees.

Royalties, Agreements and Encumbrances

Advance Royalty

The Mt. Hope Lease may be terminated upon the expiration of its 30-year term, earlier at the election of the LLC, or upon a material breach of the agreement and failure to cure such breach. If the LLC terminates the lease, termination is effective 30 days after receipt by MHMI of written notice to terminate the Mt. Hope Lease and no further payments would be due to MHMI. In order to maintain the lease, the LLC must pay certain deferral fees, advance royalties and production royalties as discussed below.

The Mt. Hope Lease Agreement requires a royalty advance (“Construction Royalty Advance”) of 3% of certain construction capital costs, as defined in the Mt. Hope Lease. The LLC is obligated to pay a portion of the Construction Royalty Advance each time capital is raised for the Mt. Hope Project based on 3% of the expected capital to be used for those certain construction capital costs defined in the lease. Through December 31, 2010, we have paid $4.2 million of the total Construction Royalty Advance. We paid an additional $0.6 million in early 2011 as a result of the exercise of outstanding warrants. Based on our Project Capital Estimate we estimate that $17.9 million remains unpaid related to the Construction Royalty Advance. Based on the current estimate of raising capital and developing and operating the mine, we believe that 50%, or $9.0 million, of the LLC’s remaining Construction Royalty Advance will be paid on October 19, 2011. The remaining 50% must be paid on or before October 19, 2012.

Once the Construction Royalty Advance has been paid in full, the LLC is obligated to pay an advance royalty (“Annual Advance Royalty”) each October 19 thereafter in the amount of $500,000 per year. The Construction Royalty Advance and the Annual Advance Royalty are collectively referred to as the “Advance Royalties.” All Advance Royalties are credited against the MHMI Production Royalties (as hereinafter defined) once the mine has achieved commercial production. After the mine begins production, the LLC estimates that the Production Royalties will be in excess of the Annual Advance Royalties for the life of the project and, further, the Construction Royalty Advance will be fully recovered (credited against MHMI Production Royalties) by the end of 2015.

Production Royalty

Following commencement of commercial production, the LLC will be required to pay a production royalty to MHMI and Exxon Corporation (“Exxon”) as follows:

(a) MHMI Production Royalty

After commencement of commercial production at the Mt. Hope Project, the LLC will be required to pay to MHMI a production royalty equal to the greater of: (i) $0.25 per pound of molybdenum metal (or the equivalent of some other product) sold or deemed to be sold from the Mt. Hope Project; or (ii) 3.5% of net returns (“Base Percentage”), if the average gross value of products sold is equal or lower than $12.00 per pound, or the Base Percentage plus 1% of net returns if the average gross value of products sold is higher than $12.00 per pound but equal or lower than $15.00 per pound, or the Base Percentage plus 1.5% of net returns if the average gross value of products sold is higher than $15.00 per pound (“MHMI Production Royalties”). As used in this paragraph, the term “products” refers to ores, concentrates, minerals or other material removed and sold (or deemed to be sold) from the Mt. Hope Project; the term “gross value” refers generally to proceeds received by us or our affiliates for the products sold (or deemed to be sold); and the term “net returns” refers to the gross value of all products, less certain direct out of pocket costs, charges and expenses actually paid or incurred by us in producing the products.

(b) Exxon Production Royalty

Exxon will receive a perpetual 1% royalty interest in and to all ores, metals, minerals and metallic substances mineable or recoverable from the Mt. Hope Project in kind at the mine or may elect to receive cash payment equal to 1% of the total amount of gross payments received from the purchaser of ores mined/removed/sold from property net of certain deductions.

Environmental Regulations and Permits

The Mt. Hope Project is subject to numerous state and federal environmental regulations and permitting processes. See “Applicable Mining Laws” and “Permitting” below for a detailed description of these requirements.

Accessibility, Climate, Local Resources, Infrastructure and Physiography

Access

The Mt. Hope Project has year-round access from Nevada State Route 278. The land package includes the land between the project site and State Route 278 making the project accessible from existing roads.

Climate

Climate in the area is moderate, with average highs in July of about 86 degrees Fahrenheit and lows in January of about 17 degrees Fahrenheit. Precipitation in the area is relatively low with annual precipitation averages of about 12 inches. Operations at the site are planned to continue year-round.

Local Resources and Infrastructure

The town of Eureka, Nevada is approximately 21 miles to the south of the Mt. Hope Project, via State Route 278. The infrastructure requirements to support the mine and concentrator consist of bringing power and water to the property, commensurate with the operational requirements, including developing a water well field within the Kobeh Valley, constructing site access roads, and constructing maintenance shops for the mine and plant administrative offices. A 230kV power line is expected to be developed from the Machacek substation near the town of Eureka to the mine site.

Water Rights and Surface Rights

Planned water wells, located approximately 6 miles to the south-west of the planned operating facilities, are anticipated to supply approximately 7,000 gallons per minute (“gpm”) to the Mt. Hope Project. Exploration for water is sufficiently advanced to identify the source of water that will be used for all project water needs, with final fresh water development to occur during the construction of the project. (See “Permitting — Mt. Hope Permitting Requirements — Water Appropriation Permits-Nevada Division of Water Resources” below for a discussion of the current status of our applications for water rights for use in the Mt. Hope Project.)

Surface rights on the Mt. Hope Project include BLM open range grazing rights and stock water rights. Two power line easements cross within the property boundaries. An existing easement for a 345 kV transmission line runs north-south on the western edge of the property and the other existing easement is a medium-voltage power line that runs from the old mill facilities east along the main existing access road that connects to State Route 278 to the eastern property boundary.

Physiography

The Mt. Hope area lies within an area of north-south trending mountains separated by alluvial valleys. The primary mountain ranges in the Mt. Hope area include the Roberts Mountains, Sulphur Spring Range, Diamond Mountains, Simpson Park Range and the Cortez Mountains. Elevations of the mountains range from over 10,000 feet for the Roberts Mountains to approximately 6,800 feet for the crests of the Sulphur Spring range.

The major valleys in the Mt. Hope region are Diamond Valley to the east, Pine Valley to the north, and Kobeh Valley to the west. Diamond and Pine Valleys are elongated in a north-south direction. Kobeh Valley is located to the west and southwest of Mt. Hope.

The upper portions of the valleys are similar in nature and are characterized by slightly incised stream channels with no significant associated floodplain. The uplands and mountains have slopes ranging from moderate to steep (over 30 percent) with shallow to deep, moderately alkaline to medium acidic soils. Bedrock is often within 0.5 meters of the surface, particularly on the steep upland slopes.

Lake sediments make up the largest areas in the valleys. The slopes range from smooth to rolling (0 to 15 percent), and the soils vary from shallow to deep and mildly to strongly alkaline. The surface textures range from silty clay loams to gravelly sandy loams and local sand. The permeability of these soils ranges from slow to rapid.

The natural vegetation of the region consists of pinion juniper and sagebrush with grass. The pinion juniper occupies the higher elevations of the mountain slopes, with the lower areas in the valley covered predominantly with sagebrush and shrubs with perennial bunchgrasses.

Mt. Hope, located in the lower foothills of the southeast flank of the Roberts Mountains, stands approximately 8,400 feet in elevation. Areas to the east and southeast slope gently to elevations from 6,400 to 7,900 feet. Diamond Valley, situated to the south and east, is approximately 6,000 feet in elevation.

History

Prior Ownership and Results of Exploration Work

Lead-zinc ores were discovered at Mt. Hope in 1870, and small scale mining was carried out sporadically until the 1970s. Zinc and adjacent copper mineralization were the focus of drilling activities by Phillips Petroleum in the early 1970s and by ASARCO and Gulf (“ASARCO”) in the mid-1970s which outlined further zinc mineralization. The last drill hole of this series encountered significant molybdenum mineralization at depth west of the zinc deposits. The significance of this mineralization was first recognized by ASARCO in 1976, but ASARCO did not reach an agreement with MHMI to test this potential.

Exxon recognized molybdenum potential at Mt. Hope in 1978 and acquired an option on the property from MHMI. By 1982, Exxon had completed 69 holes, which partially defined a major molybdenum deposit underlying the east flank of the Mt. Hope property. Exxon conducted a +/-25% feasibility study of the Mt. Hope project in 1982. A draft EIS was completed on the project and public hearings were held in early 1985. Exxon drilled an additional 60 holes on the property between 1983 and 1988 but did not update their deposit block model with data from the post 1982 holes. Cyprus drilled four holes on the property in 1989-90 under an agreement with Exxon but did not pursue the project.

We established an agreement with MHMI in 2004 pursuant to which we obtained access to the work completed by previous companies that had evaluated the property, including drill core and drill data. We used this data as the basis for developing an evaluation of the Mt. Hope deposit. The evaluation provided the basic engineering, plant design and other aspects of analysis of the Mt. Hope Project and outlined a positive operating process, waste disposal, mine design and plan, preliminary EA, permitting plan, operating and capital cost estimates, and the corresponding estimates of mineralized material.

Geology

Mt. Hope is located in north-central Nevada on the eastern edge of a mineral belt linking ore deposits of diverse ages. The Battle Mountain-Eureka mineral belt, a northwest-southeast trending corridor about 250 miles long, has localized major deposits of gold, silver, copper, and molybdenum.

The Mt. Hope molybdenum ore deposit occurs in an area of about two square miles of elevated igneous rocks. The mineralized complex includes a variety of igneous rocks derived from a common volcanic source. Quartz porphyry, the primary molybdenum host rock, is commonly veined with molybdenite. Subordinate molybdenum mineralization also occurs in hornfels. The known orebody occurs in two zones of the quartz porphyry stock and hornfels wallrocks.

The ore deposit is a molybdenum porphyry, which is classified as a “Climax —type” deposit. This type of deposit has well zoned molybdenum mineralization. The molybdenum mineral content, termed grade zoning, surrounds the central area of the deposit and forms geometries that are circular in plan and arch shaped in section. The mineral zones or “shells” consist of quartz porphyry and hornfels cross-cut by quartz stockwork veining containing molybdenite. Drilling has proven strong ore grades near the surface and indications of deeper ore grade zones.

Mineralization

The main form of molybdenum mineralization that occurs within the orebody is molybdenite (MoS2 - molybdenum disulfide). Much of the known molybdenite is distributed around two lobes and apophyses of the main quartz porphyry

stock and within two separate mineralized zones. A concentration of higher grade mineralization, averaging 0.15% molybdenum, is present between the eastern and western mineral zones. Referred to as the Mt. Hope Fault Zone, this area is approximately 1,300 feet in diameter and varies from 325 to 985 feet deep. This zone is the target of open pit mining in the first 32 years. Lower grade ore will also be mined and stockpiled during the first 32 years and will be processed in the succeeding 12 years.

Exploration

Since acquiring access to the Mt. Hope Project, we have completed additional exploration drilling for molybdenum for the purposes of supporting our BFS and obtaining engineering information for items such as geotechnical design, hydrology, and condemnation for waste dumps and tailing ponds as well as infill drilling for ore calculation purposes.

The Mt. Hope property has been extensively drilled and all core and assay results are available to the Company. Accordingly, this data has been used to analyze and quantify the mineral resource based on an extensive high quality database. The drilling at the Mt. Hope Project has been predominately performed by utilizing diamond core methods, and some reverse circulation (“RC”) in areas of condemnation and water well drilling. To date, 311 holes have been drilled into the property for a total of 357,177 feet of drilling; 234,402 feet of which is core, the remaining 122,775 feet is RC.

Ore to Be Mined

The table below summarizes the ore grades we expect to be milled under our BFS mine plans for Mt. Hope.

Mill Feed Ore Statistics

|

|

|

|

|

Average |

|

|

|

|

|

|

|

|

Grade |

|

Mo |

|

|

Category |

|

Ktons |

|

Mo% |

|

Recovery % |

|

|

Ore in Years 1-5 |

|

110,346 |

|

0.103 |

|

87.7 |

|

|

Ore in Years 1-10 |

|

220,737 |

|

0.094 |

|

87.3 |

|

|

Ore in Years 1-20 |

|

439,195 |

|

0.086 |

|

86.2 |

|

The modeled pit, including the above mineralized material and waste, contains an estimated 2.7 billion tons of total material. Based on these estimates, from the inception of production through year 32, the mill will process 702,953 thousand tons of ore at an average ore grade of 0.078%. During this time period low grade ore totaling 262,973 thousand tons with an average ore grade of 0.042% will be stockpiled for later feed into the mill from years 32 through 44. Waste material totaling 1,741,815 thousand tons will also be mined and disposed of on site. The total production is based on estimated life of mine and has a 0.034% Mo cutoff grade.

Mining

The Mt. Hope Project is planned for production by conventional large-scale, hard-rock, open-pit mining methods. The current mine plan provides for primary loading with an initial fleet of four hydraulic shovels followed by two electric cable shovels and two front-end loaders. The mine fleet is expected to include 24 240-ton trucks by the end of the first full year of production. The Company anticipates engaging a contractor to perform approximately 10 months of pre-production stripping concurrent with the initial phases of construction at Mt. Hope.

Ore will be hauled directly to the crusher at the southeast side of the pit. Waste will be delivered to one of four waste sites located around the mine. One low grade stockpile will be located to the east of the pit. The low grade material will be re-handled and processed through the plant following the initial 32 years of mining. The planned storage of low-grade ores is 263 million tons at a grade of 0.042% Mo.

Process Overview

The process circuit will include:

· Primary Crusher & Coarse Ore Stockpile—The primary crusher (60x89 superior gyratory) will be located adjacent to the pit and crushed ore will be fed to a 70,000 ton live capacity stockpile.

· Semi-Autogenous Grinding (“SAG”) & Ball Mill Circuit—Ore will be reclaimed from the stockpile from one of four feeders and fed by conveyor to the SAG mill. The design will allow for the addition of a pebble crusher. Following the SAG mill, the ore will be ground to 80% passing 150 microns in the two ball mills at an average daily processing rate of 60,625 tons.

· Flotation Circuit—Following the grinding circuit, the ore will be processed in a conventional flotation plant. The molybdenum ore will be treated through two banks of rougher/scavenger flotation, one stage of first cleaners followed by regrind, and four additional stages of cleaner flotation. Some molybdenum concentrates with higher levels of contaminant metals will be treated through a concentrate leach facility to produce the final molybdenum concentrate. Metallurgical results indicated that an estimated mill recovery of approximately 85.8% is achievable across grades ranging from 0.04% through 0.1% Mo with final concentrate grades of approximately 54% to 56% Mo. The initial 32 years of higher-grade ores will achieve recoveries of about 87%.

· Roaster Circuit—Molybdenum concentrate will be further processed in two multi-hearth roasters to produce technical grade molybdenum trioxide product. The roasting facility will provide a fully integrated process.

Tailing Facility

The proposed mining and processing operation is expected to produce approximately 22 million tons of tailing (including SO2 scrubber residue) per year. Approximately 966 million tons of tailing will be produced under the current mine plan. The Tailing Storage Facility layout provides for the construction of one tailing impoundment that will contain the first 30 plus years of operations. A second facility is planned for the remaining years of the mine life. The tailing impoundments will be constructed with HDPE plastic liners for groundwater protection.

Bankable Feasibility Study

On August 30, 2007, we completed the BFS which established proven reserves totaling 189,675 thousand tons of ore at an average grade of 0.083% molybdenum sulfide and probable reserves totaling 776,251 thousand tons of ore at an average grade of 0.065% molybdenum sulfide summarized as follows.

Statement of Reserves and Mineralized Material

Units = Short Tons

Reserves

|

|

|

|

|

Proven Reserves |

|

Probable Reserves |

|

Proven+Probable Reserves |

| |||||||

|

Cutoff Grade |

|

|

|

Sulfide |

|

|

|

Sulfide |

|

|

|

Sulfide |

| |||

|

K$Net/hr |

|

%Mo Sulfide |

|

Ktons |

|

Grade% |

|

Ktons |

|

Grade% |

|

Ktons |

|

Mo Grade% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

$ |

3.000 |

|

0.034 |

% |

189,675 |

|

0.083 |

|

776,251 |

|

0.065 |

|

965,926 |

|

0.068 |

|

Additional Mineralized Material

|

|

|

|

|

Measured |

|

Indicated |

|

Measured+Indicated |

| |||||||

|

Cutoff Grade |

|

|

|

Sulfide |

|

|

|

Sulfide |

|

|

|

Sulfide |

| |||

|

K$Net/hr |

|

%Mo Sulfide |

|

Ktons |

|

Grade% |

|

Ktons |

|

Grade% |

|

Ktons |

|

Mo Grade% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

$ |

0.001 |

|

0.024 |

% |

11,089 |

|

0.029 |

|

98,552 |

|

0.030 |

|

109,641 |

|

0.030 |

|

Footnotes to Statements of Reserves and Mineralized Material

The cutoff grades are determined by optimizing the net present value based on process costs combined with throughput estimates of recoverable molybdenum included in each phase of the mining and milling processes. The derived income, based on assumed molybdenum prices, net of processing costs is calculated on a per ton basis and on a per hour milled basis and is expressed in units of thousands of dollars (“K$Net/hr”).

Mineralized material is tabulated at the cutoff grade of 0.024% Mo. Breakeven cutoff covers the cost to mine and process the material. The Moly cutoff grades in sulfide form are close approximations to K$Net/hr.

The final reserve pit design was based on a molybdenum price of $10/lb molybdenum in the saleable form of moly tri-oxide. The base case financial analysis for the Mt. Hope Feasibility Study utilized molybdenum prices that ranged from $13.50/lb to $28.00/lb.

As of December 31, 2010, the approximate three year backward average price for molybdenum was $18.31/lb. The spot price for molybdenum on the same date was approximately $16.40/lb. The pit design price and the financial analysis price assumptions are both conservative relative to the 3 year backward average and below recent prices.

The reserve at Mt. Hope is based on a block model that utilized the statistical process of Ordinary Linear Kriging constrained by appropriate rock type and grade boundaries. Base metal models that utilize these common techniques generally account for mining dilution and recovery so that additional factors are not required to be applied to the block model.

The metallurgical recovery applied to the determination of reserves was 90% in the flotation mill and 99.2% in the molybdenum roaster. More detailed process testing and design work later in the feasibility study resulted in a revised average flotation recovery estimate of 85.8%. This recovery difference is not material because the final open pit design is a practical plan with access roads and mine equipment working room. The final design is consequently a conservative representation of the mathematical economic pit that was guided by the initial estimates.

Capital Cost Estimates

Our current estimate of the initial capital is $1,039.3 million. In addition to the $1,039.3 million in initial capital required, approximately $114.6 million in cash financial assurance requirements and pre-paid items are estimated, resulting in a total of $1,153.9 million. Ongoing replacement and sustaining mine equipment and process plant capital over the expected 44-year operating life plus the three-year reclamation period is currently estimated to be approximately $642.0 million. These amounts do not include financing costs or amounts necessary to fund operating working capital. These cost estimates are based on 2009 constant dollars and will be subject to cost inflation or deflation. We expect that these cost estimates will continue to evolve over time based on changes in the industry-wide cost structure as well as changes in our operating strategies and initiatives for the project. The Mt. Hope Project’s anticipated capital requirements are broken down in the following table.

|

Estimated Capital Costs |

|

$ Millions |

| |

|

Mining Equipment |

|

$ |

134.1 |

|

|

Milling Equipment |

|

$ |

175.5 |

|

|

Construction |

|

$ |

347.2 |

|

|

Owners Costs, Pre-Stripping |

|

$ |

169.5 |

|

|

Taxes, freight, spares |

|

$ |

67.9 |

|

|

Engineering, Procurement, and Construction Management |

|

$ |

58.7 |

|

|

Contingency |

|

$ |

86.4 |

|

|

Total Capital |

|

$ |

1,039.3 |

|

|

Financial Assurance and pre-paid items |

|

$ |

114.6 |

|

|

Total Capital Requirement |

|

$ |

1,153.9 |

|

|

Sustaining Capital (40+ years) |

|

$ |

642.0 |

|

Pricing

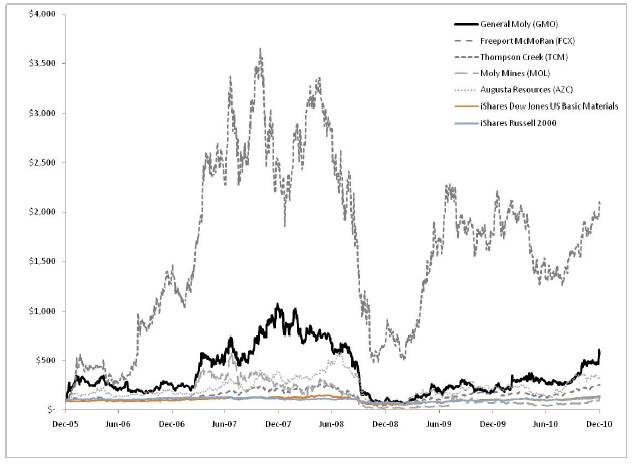

The worldwide molybdenum price has fluctuated between $5.33 per pound in 2003 to over $40.00 per pound in 2005 and traded in the mid-$30s per pound prior to October 2008, when prices fell from approximately $33.50 per pound to $7.70 per pound in April 2009 as a result of the global economic collapse. In 2009, prices slowly increased to finish the year at $12.00 per pound and continued to increase in 2010, finishing the year at $16.40 per pound. In 2010, molybdenum prices averaged $15.81 per pound. Price fluctuations are primarily related to global steel markets. Price declines in 2008 and 2009 were primarily caused by the global economic collapse when global steel output decreased by 30%. During 2010, global steel production generally recovered to pre-collapse levels, led by strong demand growth from China.

In our feasibility study and for a portion of our financial evaluations, we use molybdenum prices prepared by an independent commodities research company, CPM Group. Their research is a comprehensive look at both the supply and demand side of the molybdenum market. Through their research, they forecast global growth rates for molybdenum for both supply and demand. CPM Group continues to forecast substantially higher prices in the future. In October 2010, CPM Group forecast that molybdenum prices would average $21.75 in 2011, $28.50 in 2012; $25.00 in 2013; $18.25 in 2014; $13.75 in 2015; $14.50 in 2016, $16.00 in 2017 and $16.85 thereafter.

Production

Production over the life of the project is estimated to be 1.1 billion pounds of saleable molybdenum. Production over the first full five years is estimated to average approximately 40 million pounds of molybdenum. Direct operating costs for the Mt. Hope Project over the first full five years of operation are anticipated to average $5.29 per pound, using $80 per barrel oil equivalent energy costs, and CAS per pound over the first full five years of operation, including anticipated royalties calculated at $15 per pound molybdenum, are anticipated to average $6.00 per pound. For each $10 change in per barrel oil costs, Mt. Hope’s anticipated direct operating cost changes approximately $0.10 per pound. Life of mine CAS are estimated to be approximately $7.94 per pound of molybdenum at $80 per barrel oil, inclusive of anticipated royalty payments calculated at $15 per pound molybdenum.

Reconciliation between CAS, a measure based on accounting principles generally accepted in the United States of America (“GAAP”), and Direct Operating Costs, a non-GAAP measure, is provided in the table below.

|

Description |

|

First Five Years |

|

Life of Mine |

| ||

|

Direct Operating Costs |

|

$ |

5.29 |

|

$ |

7.13 |

|

|

Royalty payments (1) |

|

.71 |

|

.81 |

| ||

|

Total |

|

$ |

6.00 |

|

$ |

7.94 |

|

(1) Royalty payments are a function of assumed molybdenum prices realized.

Description of the Liberty Property

On March 17, 2006, we purchased the Liberty Property, an approximately ten square mile property in Nye County, Nevada, including water rights, mineral and surface rights, buildings and certain equipment from High Desert Winds LLC (“High Desert”). The property includes the former Hall molybdenum and copper deposit that was mined for molybdenum by open pit methods between 1982 and 1985 by Anaconda and between 1988 and 1991 by Cyprus. Equatorial Tonopah, Inc. mined copper from 1999 to 2000 on this property, although their operations were in a separate open pit also located on the property. Much of the molybdenum deposit was drilled but not developed or mined by these previous owners. At closing, we paid High Desert a cash payment of $4.5 million for a portion of the property, and in November 2006, made an additional payment of $1.0 million for the remainder of the property.

On January 30, 2007, we purchased Equatorial Mining North America, Inc. and its two subsidiaries, which owned a 12% net smelter returns royalty on the Liberty Property, from Equatorial Mining Pty. Limited, which effectively eliminated all third party royalties on the property. The consideration paid for the Equatorial acquisition was $4.8 million with an additional deferred payment of $6.0 million due upon commencement of commercial operation of the property. In connection with the transaction, we acquired $1.2 million in cash accounts and assumed certain environmental liabilities on the reclaimed site. Additionally in 2007, we purchased all outstanding mineral claims associated with this property that were not previously owned by us thus giving the Company 100% control over all mineral rights within the boundary of the property, as well as claims on BLM property adjacent to the patented grounds.

Since purchasing the Liberty Property, we have completed two drilling programs that, together with historical drilling, identified mineralization totaling 433 million tons averaging 0.071% molybdenum and 0.07% copper.