Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - People's United Financial, Inc. | d8k.htm |

KBW

Boston Bank Conference March 1, 2011

*

*

*

*

*

Exhibit 99.1

*

*

*

*

*

*

*

*

* |

1

Forward Looking Statement

Certain comments made in the course of this presentation by

People’s United Financial are forward-looking in nature

These include all statements about People’s United

Financial’s operating results or financial position for periods

ending or on dates occurring after December 31, 2010 and usually use

words such as “expect”, “anticipate”,

“believe”, and similar expressions. These

comments represent management’s current beliefs, based upon

information available to it at the time the statements are made, with

regard to the matters addressed. All forward-looking statements are subject to risks and

uncertainties that could cause People’s United Financial’s

actual results or financial condition to differ materially from those

expressed in or implied by such statements. Factors of

particular importance to People’s United Financial include, but are not limited to: (1) failure of People’s

United Financial and Danvers Bancorp to satisfy the closing conditions

in the merger agreement in a timely manner or at all; (2)

failure of the shareholders of Danvers Bancorp to approve the merger agreement; (3) failure to obtain

governmental approvals for the merger; (4) disruptions to the

parties’ businesses as a result of the announcement and

pendency of the merger; (5) costs or difficulties related to the

integration of the businesses following the merger with Danvers

Bancorp and recent acquisitions; (6) changes in general, national or regional economic conditions; (7) the

risk that the anticipated benefits, cost savings and any other savings

from the merger may not be fully realized or may take longer

than expected to realize (8) changes in loan default and charge-off rates; (9) reductions in deposit

levels necessitating increased borrowings to fund loans and

investments; (10) changes in interest rates or credit

availability; (11) possible changes in regulation resulting from or

relating to the recently enacted financial reform legislation;

(12) changes in levels of income and expense in noninterest income and expense related activities; (13)

competition and its effect on pricing, spending, third-party

relationships and revenues. |

2

Corporate Overview

Snapshot, as of December 31, 2010

1842

Founded:

518

ATMs:

339

Branches:

$17.9 billion

Deposits:

$17.5 billion

Loans:

$25.0 billion

Assets:

$4.7 billion

Market Capitalization (2/25/11)

NASDAQ (PBCT)

People’s United Financial, Inc. |

3

Primary Objectives

Optimize the existing business

+

Deploy capital in high risk-adjusted return initiatives

Return the franchise to >1.25% ROAA |

4

Strengthening the Leadership Team

Executive Management Committee Changes

Name

Position

As of:

Years in

Banking

Professional

Experience

Kirk Walters

SEVP &

CFO, Director

Mar. 2011

25

Sovereign, Chittenden,

Northeast Financial

Jeff Tengel

SEVP & Head of

Commercial Banking

Jan. 2011

30+

People’s United Bank,

NationalCity

Jack Barnes *

President & CEO,

Director

July 2010

30+

People’s United Bank (SEVP,

CAO), Chittenden Bank, FDIC

Dave Norton

SEVP &

Chief HR Officer

Oct. 2009

1

New York Times, Starwood,

PepsiCo

Chantal Simon

SEVP &

Chief Risk Officer

May 2009

20+

Merrill Lynch US Bank Entities

Prospective Additions to Board of Directors

Name

Position

As of:

Years in

Banking

Professional

Experience

Kirk Walters

SEVP &

CFO, Director

Mar. 2011

25

Sovereign, Chittenden,

Northeast Financial

Kevin Bottomley

Director

Upon

completion of

merger

30+

Danvers Bancorp, Boston

Private, 1

st

National Bank of

Boston, Banker’s Trust

* Became interim President & CEO in April 2010 |

5

Deepening Presence in NYC Metro and Boston MSA |

6

Strong Pro Forma Deposit Market Position

Deposits of $20.2BN

#1 in Fairfield County, CT, 64 branches, $5.4BN, 17.8% market share

#2 in Essex County, MA, 24 branches, $2.0BN, 12.3% market share

Source: SNL Financial |

7

7

Low Cost of Deposits

Publicly Traded Banks, $5BN < Assets <$100BN

Source: SNL Financial

Total

Cost of

Assets ($BN)

Deposits (%)

Company Name

City

State

2010Q4

2010Q4

1

M&T Bank Corporation

Buffalo

NY

68.0

0.35

2

First Niagara Financial Group, Inc.

Buffalo

NY

21.1

0.51

3

People's United Financial, Inc.

Bridgeport

CT

25.0

0.64

4

NBT Bancorp Inc.

Norwich

NY

5.3

0.64

5

Boston Private Financial Holdings, Inc.

Boston

MA

6.2

0.69

6

Community Bank System, Inc.

De Witt

NY

5.4

0.70

7

Webster Financial Corporation

Waterbury

CT

18.0

0.70

8

Valley National Bancorp

Wayne

NJ

14.1

0.72

9

New York Community Bancorp, Inc.

Westbury

NY

41.2

0.84

10

Provident Financial Services, Inc.

Jersey City

NJ

6.8

0.85

11

National Penn Bancshares, Inc.

Boyertown

PA

8.8

0.85

12

Fulton Financial Corporation

Lancaster

PA

16.3

0.86

13

First Commonwealth Financial Corporation

Indiana

PA

5.8

0.93

14

NewAlliance Bancshares, Inc.

New Haven

CT

9.0

0.94

15

Signature Bank

New York

NY

11.7

0.95

16

Susquehanna Bancshares, Inc.

Lititz

PA

14.0

1.02

17

Northwest Bancshares, Inc.

Warren

PA

8.1

1.18

18

Investors Bancorp, Inc. (MHC)

Short Hills

NJ

9.6

1.38

19

Hudson City Bancorp, Inc.

Paramus

NJ

61.2

1.38

20

Astoria Financial Corporation

Lake Success

NY

18.1

1.41

21

F.N.B. Corporation

Hermitage

PA

9.0

NA |

8

Net Interest Margin

8

3.19%

3.47%

3.68%

3.73%

3.85%

Q4 2009

Q1 2010

Q2 2010

Q3 2010

Q4 2010 |

9

2006-2010

0.28

0.57

1.74

2.10

-0.50

0.00

0.50

1.00

1.50

2.00

2.50

3.00

Q1

2006

Q2

2006

Q3

2006

Q4

2006

Q1

2007

Q2

2007

Q3

2007

Q4

2007

Q1

2008

Q2

2008

Q3

2008

Q4

2008

Q1

2009

Q2

2009

Q3

2009

Q4

2009

Q1

2010

Q2

2010

Q3

2010

Q4

2010

PBCT

Peer Group Mean

Top 50 Banks

Asset Quality

Net Charge-Offs / Avg. Loans (%)

Source: SNL Financial and Company filings |

10

2006-2010

2.07

2.18

4.86

4.72

0.00

1.00

2.00

3.00

4.00

5.00

6.00

Q2

2006

Q3

2006

Q4

2006

Q1

2007

Q2

2007

Q3

2007

Q4

2007

Q1

2008

Q2

2008

Q3

2008

Q4

2008

Q1

2009

Q2

2009

Q3

2009

Q4

2009

Q1

2010

Q2

2010

Q3

2010

Q4

2010

PBCT

Peer Group Mean

Top 50 Banks by Assets

Asset Quality

NPAs / Loans & REO* (%)

Source: SNL Financial and Company filings

*

Non-performing assets (excluding acquired non-performing loans) as a percentage of

originated loans plus all REO and repossessed assets; acquired non-performing

loans excluded as risk of loss has been considered by virtue of our estimate of acquisition-date fair value and/or the

existence of an FDIC loss sharing agreement

|

11

Focused on Revenue Synergies Throughout the Franchise

By Pursuing Best Practices in All Markets

Northern New England

Retail Banking and Brokerage

Enhance our industry leading loyalty by initiating a New Customer Experience

program – on-boarding and retention focused

Invest in securities and life insurance licensing, product and sales training in

retail bank Introduced People’s Securities brokerage model

Objective is to increase cross-selling to 4.6 products and services per

customer (the current level in Southern NE franchise) from 3.6 products and

services (the current level in Northern NE franchise)

Upper Middle-Market Commercial Banking

Larger corporate lending capabilities >$25MM per loan

Insurance brokerage capability

Southern New England

Build out small business capabilities

Market

business

services:

payroll

processing,

merchant

services,

business

credit

card,

401k administration

Emphasize private banking and wealth management |

12

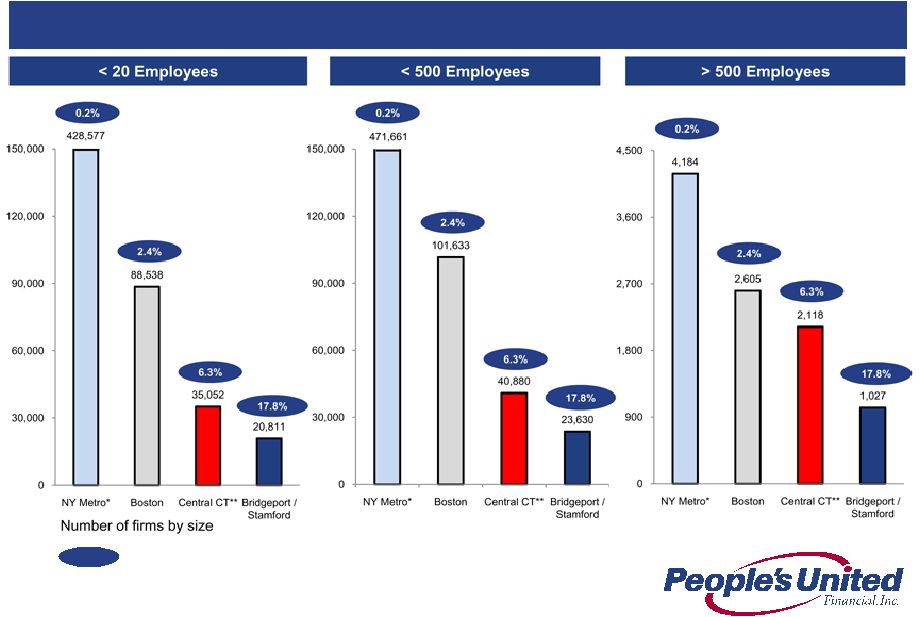

Commercial Market Opportunity by MSA

Source: SBA firms and employment by MSA 2007

* NY Metro area includes New York, Northern New Jersey, and Long

Island MSA

** Central Connecticut includes New Haven and Hartford MSAs

Pro Forma Deposit Market Share

People’s United is growing in NYC Metro and Boston Metro,

areas rich with potential commercial, non-commodity relationships

|

13

New Markets

Boston

~75% of economic activity within New England takes place inside the Rt. 128

loop. Boston MSA has a population of ~4.5MM

In just two months our two de novo branches have gathered $33MM in deposits

70% are non-CDs

23% are commercial deposits

Expanded commercial lending efforts are progressing well

$78MM in loan balances targeted by year end 2011

1Q11 balances will likely total >$50MM

Recent commitments average ~$10MM

Borrower industries include: food distribution and healthcare

Pipeline is strong |

14

New Markets

Boston / Danvers Bancorp

Danvers -

An excellent platform for commercial loan growth

Boston

is

the

second

largest

MSA

within

our

footprint

behind

New

York

City MSA

49% of Danverbank’s loans are C&I loans

Adds

23

commercial

lenders

to

the

10

we

now

have

based

in

Boston

MSA

Asset-based lending unit can be expanded significantly

Complements our existing Massachusetts and New Hampshire footprint

Danvers Timing Update

Transaction expected to close late 2Q10 |

15

New Markets

Long Island

If

Long

Island

were

a

state

it

would

rank

12

th

in

population

(~7.5MM)

and

1

st

in population density

Since our acquisition closed, core deposits have grown 4% or $60MM

(excluding municipal deposits and CDARS)

C&I Lending is progressing well

Expect >$20MM in loans outstanding by end of first quarter

Regional manager in place, recently hired an experienced in-market

C&I lender and 2 experienced in-market small business lenders

Actively meeting with companies and professionals in the business

community

Deepening our understanding of the existing CRE portfolio

Significant investor and related party interest in legacy Smithtown non-

performers |

16

Capital Deployment

Acquisition activity is focused on New England and the Mid-Atlantic

Building

relationships

with

banks

$1BN

-

$20BN

in

asset

size

Maintaining price discipline in light of challenging industry conditions

Effectively

deploying

capital

via

organic

loan

growth

-

“new

markets

and

new products”

Repurchased $191MM of stock in 2010 at a weighted average price of $13.35

In

January

2011,

Board

authorized

a

new

share

repurchase

program

for

another 5% of shares outstanding

Volume of repurchases constrained by SEC regulations due to stock

issuance in Danvers Bancorp deal –

expected to close in late 2Q11

Our dividend yield is ~4.7% |

17

Acquisition Discipline

Geographic and/or product/service fit with existing franchise

Potential for significant revenue synergies

Preference for relationship-based, commercially oriented franchises

Valuation models are based on:

Thorough due diligence including detailed loan file review

Conservative credit marks, cost savings and profitability

assumptions

Valuation models do not include revenue synergies

Financial Hurdles:

IRR must exceed 15%

Cash on cash returns of ~10% or greater

Deal-specific TBV dilution earn back period of less than 10 years

|

18

Loans

Deposits

Growing Future Earnings Per Share

Loans and Deposits per Share

* Pro forma for FIF acquisition

* *Pro forma for SMTB & LSBX acquisitions

** *Pro

forma

for DNBK acquisition |

19

Summary

Premium brand built over 169 years

High quality Northeast footprint characterized by wealth, density and commercial

activity

Strengthened leadership team

Low cost of deposits

Strong net interest margin

Superior asset quality

Focus on non-commodity/relationship based lending

Growing

loans

and

deposits

within

footprint

-

in

two

of

the

largest

MSAs

in the

country (New York City, #1 and Boston, #10)

Efficiently growing loans and deposits per share

Significantly more asset sensitive than peers

Pro forma tangible common equity ratio of 12.0%

Sustainable Competitive Advantage |

| Q & A

*

*

*

*

*

*

*

*

*

*

*

*

* |

| APPENDIX

*

*

*

*

*

*

*

*

*

*

*

* |

22

Completed

October 2009

Loans

$263M

Deposits

$415M

Danvers Bancorp -

Overview

ROAA

0.71

ROAE

6.7

Net Interest Margin

3.53

Efficiency Ratio

67.0

TCE / TA

8.94

NPA / (Loans + OREO)

0.83

LLR / Loans

1.00

LTM NCO / Avg. Loans

0.12

Select Balance Sheet Ratios (%)

Profitability (%)

Source: SNL Financial

Financial data as of 12/31/2010

Headquarters

Danvers, MA

Established

March 1850

Branches

28

Conversion Date

12/13/2007

Overview

Recent Acquisition: Beverly National Bank

Chairman, President & CEO

Kevin T. Bottomley

EVP & COO

James J. McCarthy

EVP & Chief Lending Officer

John O’Neill

Executive VP & CFO

L. Mark Panella

Executive Management

Assets

$2,853

Net Loans

1,768

Deposits

2,100

Tangible Common Equity

252

Balance Sheet ($MM) |

23

Danvers Bancorp -

Exceptional Asset Quality

Source: SNL Financial

Note: PBCT Non-performing assets (excluding acquired non-performing loans) as a

percentage of originated loans plus all REO and repossessed assets; acquired non-performing

loans excluded as risk of loss has been considered by virtue of our estimate of acquisition-date fair value

and/or the existence of an FDIC loss sharing agreement

|

24

People’s United / Danvers Bancorp -

Pro Forma Impact

* PBCT financials as of 12/31/2010; DNBK financials as of 12/31/2010

** Balance sheet figures do not include the impact of purchase accounting

adjustments ^ Pro forma levels at estimated close of transaction

PBCT*

DNBK*

Pro Forma**

Assets ($Bn)

25.0

2.9

27.9

Loans ($Bn)

17.5

1.8

19.3

Deposits ($Bn)

17.9

2.1

20.0

Branches

341

28

369

Tangible common equity ratio

14.1%

~12.0%

Tangible book value per share

$9.30

~$8.67

2012 operating EPS accretion

~$0.08

TBV dilution value earn back period

~7 years

Internal rate of return

>15%

^

^ |

25

We

expect

that

interest

rates

will

not

rise

in

2011.

However,

we

do

expect

rates

to

rise in 2012 and beyond

Given short term interest rates are so low and are expected to remain low this

year, we have again added to our securities portfolio

For Q3 2010 we were 3.0x as asset sensitive as our peers

For every 100bps increase in the Fed Funds rate, our net interest income will

increase by ~$40MM on an annualized basis

Notes:

1.

Analysis is as of 9/30/10 filings

2.

Data as of 9/30/10 SEC filings, where exact +100bps shock up scenario data was not

provided PBCT interpolated based on data disclosed 3.

Data as of 9/30/10 filings, where exact +200bps shock up scenario data was

not provided PBCT interpolated based on data disclosed People’s United

- Current Asset Sensitivity

Net Interest Income at Risk

1

Analysis involves PBCT estimates, see notes below

Lowest Amongst

Highest Amongst

Core

PBCT Multiple to

Scenario

Our Peers

Our Peers

Peer Median

PBCT

Peer Median

Shock Up 100bps 2

-0.6%

4.8%

2.0%

6.0%

3.0x

Shock Up 200bps

3

0.4%

9.6%

4.4%

13.3%

3.0x

Change in Net Interest Income |

26

Peer Group

Company Name

Ticker

State

1

Associated Banc-Corp

ASBC

WI

2

Astoria Financial Corporation

AF

NY

3

BOK Financial Corporation

BOKF

OK

4

City National Corporation

CYN

CA

5

Comerica Incorporated

CMA

TX

6

Commerce Bancshares, Inc.

CBSH

MO

7

Cullen/Frost Bankers, Inc.

CFR

TX

8

First Horizon National Corporation

FHN

TN

9

Flagstar Bancorp, Inc.

FBC

MI

10

Fulton Financial Corporation

FULT

PA

11

Hudson City Bancorp, Inc.

HCBK

NJ

12

M&T Bank Corporation

MTB

NY

13

Marshall & Ilsley Corporation

MI

WI

14

New York Community Bancorp, Inc.

NYB

NY

15

Synovus Financial Corp.

SNV

GA

16

TCF Financial Corporation

TCB

MN

17

Valley National Bancorp

VLY

NJ

18

Webster Financial Corporation

WBS

CT

19

Zions Bancorporation

ZION

UT |

For

more information, investors may contact: Peter Goulding, CFA

203-338-6799

peter.goulding@peoples.com

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

* |