Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark One) | ||

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the fiscal year ended December 31, 2010 | ||

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the transition period from __________ to __________ | ||

Commission File Number: 1-9293

PRE-PAID LEGAL SERVICES, INC.

(Exact name of registrant as specified in its charter)

(Exact name of registrant as specified in its charter)

| Oklahoma | 73-1016728 |

| (State or other jurisdiction of incorporation or | (I.R.S. Employer Identification No.) |

| organization) | |

| One Pre-Paid Way | |

| Ada, Oklahoma | 74820 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number including area code: (580) 436-1234

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of each class | Name of each exchange on which registered |

| Common Stock, $0.01 Par Value | New York Stock Exchange |

Securities registered under Section 12 (g) of the Exchange Act: None

Indicate by check mark if registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K 7. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer x | Non-accelerated filer o | Smaller reporting Company o | |

| (do not check if a smaller | ||||

| reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes o No x

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: As of February 11, 2011, there were 9,764,194shares of Common Stock, par value $.01 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE.

Portions of our definitive proxy statement for our 2011 annual meeting of shareholders are incorporated into Part III of this Form 10–K by reference.

PRE-PAID LEGAL SERVICES, INC.

FORM 10-K

For the Year Ended December 31, 2010

TABLE OF CONTENTS

FORM 10-K

For the Year Ended December 31, 2010

TABLE OF CONTENTS

| PART I | Page | |||

| MERGER ANNOUNCEMENT | 1 | |||

| ITEM 1. | BUSINESS | |||

| General | 2 | |||

| Industry Overview | 2 | |||

| Description of Memberships | 3 | |||

| Specialty Legal Service Plans | 7 | |||

| Provider Law Firms | 8 | |||

| Identity Theft Shield Provider | 12 | |||

| Marketing | 13 | |||

| Operations | 16 | |||

| Quality Control | 17 | |||

| Competition | 17 | |||

| Regulation | 17 | |||

| Employees | 20 | |||

| Foreign Operations | 20 | |||

| Availability of Information | 20 | |||

| ITEM 1A. | RISK FACTORS | 20 | ||

| ITEM 1B. | UNRESOLVED STAFF COMMENTS | 24 | ||

| ITEM 2. | PROPERTIES | 24 | ||

| ITEM 3. | LEGAL PROCEEDINGS | 25 | ||

| ITEM 4. | (Removed and Reserved) | 26 | ||

| PART II | ||||

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS | |||

| AND ISSUER PURCHASES OF EQUITY SECURITIES | ||||

| Market Price of and Dividends on the Common Stock | 27 | |||

| Recent Sales of Unregistered Securities | 27 | |||

| Issuer Purchases of Equity Securities | 28 | |||

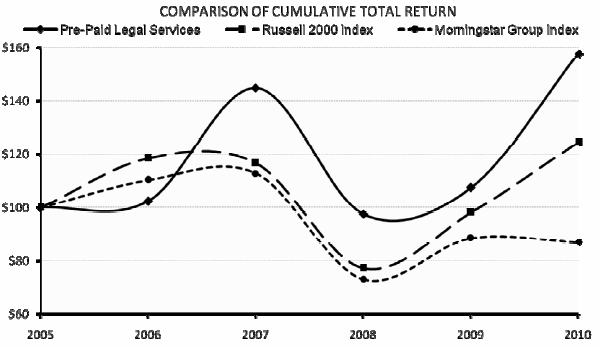

| Shareholder Return Performance Graph | 28 | |||

| ITEM 6. | SELECTED FINANCIAL DATA | 29 | ||

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND | |||

| RESULTS OF OPERATIONS | ||||

| Overview of our Financial Model | 31 | |||

| Critical Accounting Policies | 32 | |||

| Other General Matters | 38 | |||

| Measures of Member Retention | 39 | |||

| Results of Operations | ||||

| Comparison of 2010 to 2009 | 42 | |||

| Comparison of 2009 to 2008 | 43 | |||

| Liquidity and Capital Resources | 45 | |||

| Forward Looking Statements | 48 | |||

| ITEM 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 48 | ||

| ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 50 | ||

| ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND | |||

| FINANCIAL DISCLOSURE | 78 | |||

| ITEM 9A. | CONTROLS AND PROCEDURES | 78 | ||

| ITEM 9B. | OTHER INFORMATION | 78 | ||

| PART III | (Information required by Part III is incorporated by reference from our definitive | |||

| proxy statement for our 2011 annual meeting of shareholders.) | ||||

| PART IV | ||||

| ITEM 15. | EXHIBITS, FINANCIAL STATEMENT SCHEDULES | 79 | ||

| SIGNATURES | 80 | |||

PRE-PAID LEGAL SERVICES, INC.

FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2010

PART I

MERGER ANNOUNCEMENT

On January 30, 2011, Pre-Paid Legal Services, Inc. (“Pre-Paid” or the “Company”) entered into an Agreement and Plan of Merger (the “Merger Agreement”) with MidOcean PPL Holdings Corp., a Delaware corporation (“Parent”), and PPL Acquisition Corp., an Oklahoma corporation and a wholly owned subsidiary of Parent (“Merger Sub”), providing for the merger of Merger Sub with and into the Company (the “Merger”), with the Company surviving the Merger as a wholly owned subsidiary of Parent. Parent and Merger Sub are beneficially owned by MidOcean Partners III, L.P., and affiliated investment funds. The Merger Agreement was unanimously approved by the Company’s Board of Directors acting upon the unanimous recommendation of the special committee of the Board formed in September 2010 for the purpose of evaluating strategic alternatives for the Company.

At the effective time of the Merger, each share of Common Stock, par value $0.01 per share, of the Company (“Company Common Stock”) issued and outstanding immediately prior to the effective time (other than shares owned by (i) the Company or any of its subsidiaries, (ii) Parent or any of its subsidiaries or (iii) shareholders who have perfected and not withdrawn a demand for appraisal rights under Oklahoma law) will be automatically cancelled and converted into the right to receive $66.50 in cash without interest. The Merger is expected to close on or before July 31, 2011.

Consummation of the Merger is subject to customary conditions, including, without limitation, (i) the approval by the holders of a majority of the outstanding shares of Company Common Stock entitled to vote on the Merger, (ii) the expiration or early termination of the waiting period applicable to the consummation of the Merger under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, (iii) the absence of any law, injunction, judgment or ruling that restrains or prohibits the consummation of the Merger and (iv) the approval of Oklahoma and Florida insurance regulatory authorities.

Additional Information and Where to Find It

In connection with the merger, Pre-Paid prepared and filed a preliminary proxy statement with the Securities and Exchange Commission (the “SEC”). When completed, a definitive proxy statement and a form of proxy will be mailed to Pre-Paid's shareholders. BEFORE MAKING ANY VOTING DECISION, PRE-PAID'S SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT REGARDING THE MERGER CAREFULLY AND IN ITS ENTIRETY BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. Pre-Paid's shareholders will be able to obtain, without charge, a copy of the proxy statement (when available) and other relevant documents filed with the SEC from the SEC's website at www.sec.gov. Pre-Paid's shareholders will also be able to obtain, without charge, a copy of the proxy statement and other relevant documents (when available) by directing a request by mail or telephone to Pre-Paid, Attn: Randy Harp, One Pre-Paid Way, Ada, Oklahoma 74820-5813, telephone: (580) 436-1234, or from the investor relations section of the Company's website, http://www.prepaidlegal.com/newCorp2/investor/investor_home.html.

Participants in Solicitation

Pre-Paid and its directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from Pre-Paid's shareholders with respect to the special meeting of shareholders that will be held to consider the merger. Information about Pre-Paid's directors and executive officers and their ownership of the Company's common stock is set forth in the proxy statement related to the merger transaction, which was filed with the SEC on February 23, 2011. Shareholders may obtain additional information regarding the interests of the participants in the solicitation by reading the proxy statement and other relevant documents regarding the merger, when filed with the SEC.

1

ITEM 1. BUSINESS.

General

We were one of the first companies in the United States organized solely to design, underwrite and market legal expense plans. Our predecessor commenced business in 1972 and began offering legal expense reimbursement services as a “motor service club” under Oklahoma law. In 1976, we were formed and acquired our predecessor in a stock exchange. We began offering Memberships independent of the motor service club product by adding a legal consultation and advice service, and in 1979, we implemented a legal expense benefit that provided for partial payment of legal fees in connection with the defense of certain civil and criminal actions. Our life events legal plans (referred to as “Memberships”) currently provide for a variety of legal services. In most states and provinces, standard plan benefits include preventive legal services, motor vehicle legal defense services, trial defense services, IRS audit services and a 25% discount off legal services not specifically covered by the Membership for an average monthly Membership fee of approximately $21. Additionally, in 49 states, the District of Columbia (“D.C.”) and 4 Canadian provinces, the Legal Shield rider can be added to the standard plan for only $1 per month and provides members with 24-hour access to a toll-free number for attorney assistance if the member is arrested or detained. We also offer our Identity Theft Shield (“IDT”) to new and existing members at $9.95 per month if added to a legal service Membership (“add-on IDT”) or IDT may be purchased separately for $12.95 per month (“stand-alone IDT”). The identity theft related benefits include a credit report and related instructional guide, a credit score and related instructional guide, credit report monitoring with daily online and monthly offline notification of any changes in credit information and comprehensive identity theft restoration services. Also, benefits for minors are available for an additional $1 per month and monitoring from all three major credit repositories (tri-bureau monitoring) is available for an additional $3 per month.

Life events legal plan benefits are generally provided through a network of independent provider law firms, typically one firm per state or province and IDT plan benefits are provided by Kroll Background America, Inc., a subsidiary of Kroll Inc. (“Kroll”). Members have direct, toll-free access to Kroll or their provider law firm rather than having to call for a referral. At December 31, 2010, we had 1,473,237 Memberships in force with members in all 50 states, D.C. and the Canadian provinces of Ontario, British Columbia, Alberta and Manitoba. Approximately 90% of such Memberships were in 29 states and provinces.

Industry Overview

Legal service plans, while used in Europe for more than one hundred years and representing more than a $4 billion European industry, were first developed in the United States in the late 1960s. Since that time, there has been substantial growth in the number of Americans entitled to receive various forms of legal services through legal service plans. The National Resource Center for Consumers of Legal Services (“NRC”) previously provided market information for different types of legal service plans and estimates of number of users. However, the NRC is no longer in existence and we are unaware of any current comparable information sources. In the last NRC report in 2002, the NRC estimated there were 164 million Americans without any type of legal service plan. We believe the legal service plan industry continues to evolve and market acceptance of legal service plans, as indicated by the continuing growth in the number of individuals covered by plans, is increasing.

2

“Public Perceptions of Lawyers: Consumer Research Findings, April 2002” prepared on behalf of the American Bar Association concluded nearly seven in ten households had some occasion during the past year that might have led them to hire a lawyer. This report further suggested, “for the consumer, legal services are among the most difficult services to buy. The prospect of doing so is rife with uncertainty and potential risk,” and further concluded, “the challenge (and opportunity) for the legal profession is to make lawyers more accessible and less threatening to consumers who might need them.”

The American Bar Association’s web site also reflects the legal profession’s support of the legal service plan concept by saying “The ABA has long supported prepaid legal services plans as a way to increase access to the justice system for low- and middle-income Americans. These plans allow individuals and families to address legal issues before they become significant problems, reducing demands on already overburdened court systems and instilling confidence in our justice system. The ABA web site points out that:

- Group legal plans are important to maintaining confidence in our justice system and the rule of law.

- Group legal plans efficiently and inexpensively provide preventative legal services to low and middle income Americans.

- Group legal services help ease the burden on overtaxed government programs.

- Group legal plans enhance productivity by allowing employees to focus on their jobs, not their legal troubles.

Legal service plans are offered through various organizations and marketing methods and contain a wide variety of benefits. Free plans include those sponsored by labor unions, elder hotlines, the American Association of Retired Persons and the National Education Association and employee assistance plans that are also automatic enrollment plans without direct cost to participants designed to provide limited telephonic access to attorneys for members of employee groups. There are also employer paid plans pursuant to which more comprehensive benefits are offered by the employer as a fringe benefit. Finally, there are individual enrollment plans, other employment based plans, including voluntary payroll deduction plans, and miscellaneous plans. These plans typically have more comprehensive benefits, higher utilization, involve higher costs to participants, and are offered on an individual enrollment or voluntary basis. This is the market segment in which we compete.

According to the latest estimates of the census bureaus of the United States and Canada, the two geographic areas in which we operate, the number of households in the combined area exceeds 141 million. Since we have always disclosed our members in terms of Memberships and individuals covered by the Membership include the individual who purchases the Membership together with his or her spouse and never-married children living at home up to age 21 or up to age 23 if the children are full time college students, we believe that our market share should be viewed as a percentage of households. Historically, we have described and suggested to our independent sales associates that their primary market focus should be the “middle” eighty percent of such households rather than the upper and lower ten percent segments based on our belief that the upper ten percent may already have access to legal services and the lower ten percent may not be able to afford the cost of a legal service plan. As a percentage of this defined “middle” market of approximately 113 million households, we currently have an approximate 1.3% share of the estimated market based on our existing 1.5 million active Memberships and, over the last 30 years, an additional 7% of households have previously purchased, but no longer own, Memberships. We routinely remarket to previous members and reinstated approximately 90,000, 95,000 and 82,000 Memberships during 2010, 2009 and 2008, respectively.

Description of Memberships

The Memberships we sell generally allow members to access legal services through a network of independent law firms (“provider law firms”) under contract with us. Provider law firms are paid a monthly fixed fee on a capitated basis to render services to plan members residing within the state or province in which the provider law firm attorneys are licensed to practice. Because the fixed fee payments by us to benefit providers do not vary based on the type and amount of benefits utilized by the member, this capitated arrangement provides significant advantages to us in managing claims risk since we know the percentage of Membership fees that will be paid to the benefit providers to deliver the Membership benefits and the timing of such payments. At December 31, 2010, Memberships subject to the capitated provider law firm arrangement comprised more than 99% of our active Memberships. The remaining Memberships, less than 1%, were primarily sold prior to 1987 and allow members to locate their own lawyer (“open panel”) to provide legal services available under the Membership with the member’s lawyer being reimbursed for services rendered based on usual, reasonable and customary fees, or are in states where there is no provider law firm in place and our referral attorney network described below is utilized.

3

Membership benefits utilization

During 2010, our provider law firms processed more than 2.2 million requests for service, an average of 1.6 per Member. A request for service represents a member’s request for assistance on a specific legal matter. These requests usually include multiple telephone consultation(s) and often include document review(s), letter(s) written or telephone call(s) made to third parties on the members’ behalf, preparation of last will(s) and testament(s) and other legal assistance as described below. Although not all of our provider law firms maintain specific records of how often the legal engagement leads to additional fees being paid by members to the provider law firm, provider law firms representing approximately 99% of our Membership base reported that on average, less than 1% of these requests for service resulted in additional fees being paid by the member to the provider law firm.

During 2010, our provider law firms processed more than 2.2 million requests for service, an average of 1.6 per Member. A request for service represents a member’s request for assistance on a specific legal matter. These requests usually include multiple telephone consultation(s) and often include document review(s), letter(s) written or telephone call(s) made to third parties on the members’ behalf, preparation of last will(s) and testament(s) and other legal assistance as described below. Although not all of our provider law firms maintain specific records of how often the legal engagement leads to additional fees being paid by members to the provider law firm, provider law firms representing approximately 99% of our Membership base reported that on average, less than 1% of these requests for service resulted in additional fees being paid by the member to the provider law firm.

Family Legal Plan

The Family Legal Plan we currently market in most jurisdictions consists of five basic benefit groups that provide coverage for a broad range of preventive and litigation-related legal expenses. The Family Legal Plan accounted for approximately 74% and 72%, respectively, of our Membership fees in 2010 and 2009 not including the add-on identity theft shield benefit that is often added to the family legal plans. When combined, the family legal plans and the add-on identity theft shield benefit accounted for approximately 92% of our Membership fees in both years. In addition to the Family Legal Plan, we market other specialized legal services products specifically related to employment in certain professions described below.

The Family Legal Plan we currently market in most jurisdictions consists of five basic benefit groups that provide coverage for a broad range of preventive and litigation-related legal expenses. The Family Legal Plan accounted for approximately 74% and 72%, respectively, of our Membership fees in 2010 and 2009 not including the add-on identity theft shield benefit that is often added to the family legal plans. When combined, the family legal plans and the add-on identity theft shield benefit accounted for approximately 92% of our Membership fees in both years. In addition to the Family Legal Plan, we market other specialized legal services products specifically related to employment in certain professions described below.

In 11 states, certain of our plans are available in the Spanish language. For the Spanish language plans, the provider law firms have both bilingual staff and lawyers and we have bilingual staff for customer service, attorney resources and marketing service functions. We will continue to evaluate making our plans available in additional languages in markets where there is both sufficient demand and qualified staff and attorneys available.

In exchange for a fixed monthly, semi-annual or annual payment, members are entitled to specified legal services. Those individuals covered by the Membership include the individual who purchases the Membership along with his or her spouse and never married children living at home up to age 21 or up to age 23 if the children are full time college students. Also included are children up to age 18 for whom the member is legal guardian and any dependent child, regardless of age, who is mentally or physically disabled. Each Membership, other than the Business Owners’ Legal Solutions Plan, is guaranteed renewable, except in the case of fraud or nonpayment of Membership fees. Historically, we have not raised rates to existing members. If new benefits become available, existing members may choose the newer, more comprehensive plan at a higher rate or keep their existing Memberships. Memberships are automatically renewed at the end of each Membership period unless the member cancels prior to the renewal date or fails to make payment on a timely basis.

4

The basic legal service plan Membership is sold as a package consisting of five separate benefit groups. Memberships range in cost from $14.95 to $25.00 per month depending in part on the schedule of benefits, which may vary from state or province in compliance with regulatory requirements. Benefits for domestic matters, bankruptcy and drug and alcohol related matters are limited in most Memberships.

Preventive Legal Services. These benefits generally offer unlimited toll-free access to a member’s provider law firm for advice and consultation on any legal matter. These benefits also include letters and phone calls on the member’s behalf, review of personal contracts and documents, each up to 10 pages in length, last will and testament preparation for the member and annual will reviews at no additional cost. In almost every case, additional wills for spouse and other covered members may be prepared at a cost of $20 or less.

Motor Vehicle Legal Protection. These benefits offer legal assistance for matters resulting from the operation of a licensed motor vehicle. Members have assistance available to them at no additional cost for: (a) defense in the court of original jurisdiction of moving traffic violations deemed meritorious, (b) defense in the court of original jurisdiction of any charge of manslaughter, involuntary manslaughter, vehicular homicide or negligent homicide as the result of a licensed motor vehicle accident, (c) up to 2.5 hours of assistance per incident for collection of minor property damages (up to $2,000) sustained by the member’s licensed motor vehicle in an accident, (d) up to 2.5 hours of assistance per incident for collection of personal injury damages (up to $2,000) sustained by the member or covered family member while driving, riding or being struck as a pedestrian by a motor vehicle, and (e) up to 2.5 hours of assistance per incident in connection with an action, including an appeal, for the maintenance or reinstatement of a member’s driver’s license which has been canceled, suspended, or revoked. No coverage under this benefit of the basic legal service plan is offered to members for pre-existing conditions, drug or alcohol related matters, or for commercial vehicles over two axles or operation without a valid license.

Trial Defense. These benefits offer assistance to the member and the member’s spouse through an increasing schedule of benefits based on Membership year. Up to 60 hours are available for the defense of civil or job-related criminal charges by the provider law firm in the first Membership year. The criminal action must be within the scope and responsibility of employment activities of the member or spouse. Up to 2.5 hours of assistance are available prior to trial, and the balance is available for actual trial services. The schedule of benefits under this benefit area increases by 60 hours each Membership year to: 120 hours in the second Membership year, 3 hours of which are available for pre-trial services; 180 hours in the third Membership year, 3.5 hours of which are available for pre-trial services; 240 hours in the fourth Membership year, 4 hours of which are available for pre-trial services, to the maximum limit of 300 hours in the fifth Membership year, 4.5 hours of which are available for pre-trial services. This benefit excludes domestic matters, bankruptcy, deliberate criminal acts, alcohol or drug-related matters, business matters, and pre-existing conditions.

In addition to the pre-trial benefits of the basic legal plan described above, there are additional pre-trial hours available as an option, or add-on, to the basic plan. These optional benefits cost $9.00 per month and add 15 hours of pre-trial services during the first year of the Membership increasing 5 additional hours each Membership year to the maximum limit of 35 hours in the fifth Membership year and increases total pre-trial and trial defense hours available pursuant to the expanded Membership to 75 hours during the first Membership year to 335 hours in the fifth Membership year. These pre-trial hours are in addition to those hours already provided by the basic plan so that the member, in the first year of the Membership, has a combined total of 17.5 pre-trial hours available escalating to a combined total of 39.5 pre-trial hours in the fifth Membership year. There were approximately 438,000 subscribers of this benefit at December 31, 2010 compared to 479,000 at December 31, 2009.

5

IRS Audit Protection Services. This benefit offers up to 50 hours of legal assistance per year in the event the member, spouse or dependent children receive written notification of an Internal Revenue Service (“IRS”) audit or are summoned in writing to appear before the IRS concerning a tax return. The 50 hours of assistance are available in the following circumstances: (a) up to 1 hour for initial consultation, (b) up to 2.5 hours for representation in connection with the audit if settlement with the IRS is not reached within 30 days, and (c) the remaining 46.5 hours of actual trial time if settlement is not achieved prior to litigation. Coverage is limited to audit notification received regarding the tax return for years during which the Membership is effective. Representation for charges of fraud or income tax evasion, business and corporate tax returns and certain other matters are excluded from this benefit.

With pre-trial benefits limited to 2.5 hours to 4.5 hours based on the Membership year for trial defense (without the pre-trial option described) and 3.5 hours for the IRS audit benefit, these benefits do not ensure complete pre-trial coverage. In order to receive additional pre-trial IRS audit or trial defense benefits, a matter must actually proceed to trial. The costs of pre-trial preparation that exceed the benefits under the Membership are the responsibility of the member. Provider law firms under the closed panel Membership have agreed to provide to members any additional pre-trial services beyond those stipulated in the Membership at a 25% discount from the provider law firm’s customary and usual hourly rate. Retainer fees for these additional services may be required.

Preferred Member Discount for All Other Services. Provider law firms have agreed to provide to members any legal services beyond those stipulated in the Membership at a fee discounted 25% from the provider law firm’s customary and usual hourly rate. This “customary and usual hourly rate” is a fixed single hourly rate for each provider firm that is generally an average of the firm’s various hourly rates for its attorneys which typically vary based on experience and expertise.

Legal Shield Benefit

In 49 states, D.C. and four Canadian provinces, the Legal Shield plan can be added to the standard or expanded Family Legal Plan for $1 per month and provides members with 24-hour access to a toll-free number for provider law firm assistance if the member is arrested or detained. The Legal Shield member, if detained, can present their Legal Shield card to the officer that has detained them to make it clear that they have access to legal representation and that they are requesting to contact a lawyer immediately. The benefits of the Legal Shield plan are subject to conditions imposed by the detaining authority, which may not allow for the provider law firm to communicate with the member on an immediate basis. The Legal Shield benefit was introduced in 1999. There were approximately 1,059,000 Legal Shield subscribers at December 31, 2010 compared to approximately 1,110,000 at December 31, 2009.

In 49 states, D.C. and four Canadian provinces, the Legal Shield plan can be added to the standard or expanded Family Legal Plan for $1 per month and provides members with 24-hour access to a toll-free number for provider law firm assistance if the member is arrested or detained. The Legal Shield member, if detained, can present their Legal Shield card to the officer that has detained them to make it clear that they have access to legal representation and that they are requesting to contact a lawyer immediately. The benefits of the Legal Shield plan are subject to conditions imposed by the detaining authority, which may not allow for the provider law firm to communicate with the member on an immediate basis. The Legal Shield benefit was introduced in 1999. There were approximately 1,059,000 Legal Shield subscribers at December 31, 2010 compared to approximately 1,110,000 at December 31, 2009.

Identity Theft Shield Benefit

Through a joint marketing agreement with Kroll our independent sales associates market Kroll’s identity theft benefits in 50 states and four Canadian provinces. By adding the Identity Theft Shield to their existing family Membership, members have toll free access to the identity theft specialists at Kroll. This benefit can be added to a legal service Membership for $9.95 per month or purchased separately for $12.95 per month. Also, benefits for minors are available for an additional $1 per month and monitoring from all three major credit repositories (tri-bureau monitoring) is available for an additional $3 per month. The identity theft related benefits include a credit report provided through Experian and related instructional guide, a credit score calculated by an independent scoring service and related instructional guide, credit report monitoring through Experian with daily online and monthly offline notification of any changes in credit information and comprehensive identity theft restoration services. Beginning in the first quarter of 2009, our Identity Theft membership were offered as an on-line service where new members can authenticate their membership by logging on to the Internet and get an immediate credit report delivered via the web making the method of requesting and receiving the credit report more streamlined and efficient. There were approximately 760,000 and 804,000 subscribers at December 31, 2010 and 2009, respectively, comprised of 668,000 and 711,000 subscribers that have added the benefit to an underlying legal plan and 92,000 and 93,000 subscribers with a stand-alone identity theft plan.

Through a joint marketing agreement with Kroll our independent sales associates market Kroll’s identity theft benefits in 50 states and four Canadian provinces. By adding the Identity Theft Shield to their existing family Membership, members have toll free access to the identity theft specialists at Kroll. This benefit can be added to a legal service Membership for $9.95 per month or purchased separately for $12.95 per month. Also, benefits for minors are available for an additional $1 per month and monitoring from all three major credit repositories (tri-bureau monitoring) is available for an additional $3 per month. The identity theft related benefits include a credit report provided through Experian and related instructional guide, a credit score calculated by an independent scoring service and related instructional guide, credit report monitoring through Experian with daily online and monthly offline notification of any changes in credit information and comprehensive identity theft restoration services. Beginning in the first quarter of 2009, our Identity Theft membership were offered as an on-line service where new members can authenticate their membership by logging on to the Internet and get an immediate credit report delivered via the web making the method of requesting and receiving the credit report more streamlined and efficient. There were approximately 760,000 and 804,000 subscribers at December 31, 2010 and 2009, respectively, comprised of 668,000 and 711,000 subscribers that have added the benefit to an underlying legal plan and 92,000 and 93,000 subscribers with a stand-alone identity theft plan.

6

Canadian Family Plan

The Family Legal Plan is currently marketed in the Canadian provinces of Ontario, British Columbia, Alberta and Manitoba. We began operations in Ontario and British Columbia during 1999 and Alberta and Manitoba in 2001. Benefits of the Canadian plan include expanded preventive benefits including assistance with Canadian Government agencies, warranty assistance and small claims court assistance as well as the preferred member discount. Canadian Membership fees collected during 2010 were approximately $9.5 million (including foreign currency translation adjustments) in U.S. dollars compared to $7.9 million collected in 2009 and $8.2 million collected in 2008.

The Family Legal Plan is currently marketed in the Canadian provinces of Ontario, British Columbia, Alberta and Manitoba. We began operations in Ontario and British Columbia during 1999 and Alberta and Manitoba in 2001. Benefits of the Canadian plan include expanded preventive benefits including assistance with Canadian Government agencies, warranty assistance and small claims court assistance as well as the preferred member discount. Canadian Membership fees collected during 2010 were approximately $9.5 million (including foreign currency translation adjustments) in U.S. dollars compared to $7.9 million collected in 2009 and $8.2 million collected in 2008.

Specialty Legal Service Plans

In addition to the Family Legal Plan described above, we also offer other specialty or niche legal service plans. These specialty plans usually contain many of the Family Legal Plan benefits adjusted as necessary to meet specific industry or prospective member requirements. In addition to those specialty plans described below, we will continue to evaluate and develop other such plans as the need and market allow.

Business Owners’ Legal Solutions Plan

The Business Owners’ Legal Solutions plan was developed during 1995 and provides business oriented legal service benefits for small businesses with 99 or fewer employees. This plan was developed and test marketed in selected geographical areas and more widely marketed beginning in 1996 at a monthly rate of $69.00. This plan provides for-profit small businesses with legal consultation and correspondence benefits, contract and document reviews, debt collection assistance and reduced rates for any non-covered areas. During 1997, the coverage offered pursuant to this plan was expanded to include trial defense benefits and membership in GoSmallBiz.com, an unrelated Internet based service provider. Through GoSmallBiz.com, members may receive unlimited business consultations from business consultants and have access to timely small business articles, educational software, Internet tools and more. This expanded plan is currently marketed at a monthly rate ranging from $69 to $150 ($175 in Canada) depending on the number of employees and provides business oriented legal service benefits for any for-profit business with 99 or fewer employees. This plan is available in 44 states, D.C. and four Canadian provinces and represented approximately 5.0%, 5.2% and 5.4% of our Membership fees collected during 2010, 2009 and 2008, respectively.

The Business Owners’ Legal Solutions plan was developed during 1995 and provides business oriented legal service benefits for small businesses with 99 or fewer employees. This plan was developed and test marketed in selected geographical areas and more widely marketed beginning in 1996 at a monthly rate of $69.00. This plan provides for-profit small businesses with legal consultation and correspondence benefits, contract and document reviews, debt collection assistance and reduced rates for any non-covered areas. During 1997, the coverage offered pursuant to this plan was expanded to include trial defense benefits and membership in GoSmallBiz.com, an unrelated Internet based service provider. Through GoSmallBiz.com, members may receive unlimited business consultations from business consultants and have access to timely small business articles, educational software, Internet tools and more. This expanded plan is currently marketed at a monthly rate ranging from $69 to $150 ($175 in Canada) depending on the number of employees and provides business oriented legal service benefits for any for-profit business with 99 or fewer employees. This plan is available in 44 states, D.C. and four Canadian provinces and represented approximately 5.0%, 5.2% and 5.4% of our Membership fees collected during 2010, 2009 and 2008, respectively.

Commercial Driver Legal Plan

The Commercial Driver Legal Plan (“CDLP”) is designed specifically for the professional truck driver and offers a variety of driving-related benefits, including coverage for moving and non-moving violations. This plan provides coverage by a provider law firm for persons who drive a commercial vehicle. This legal service plan is currently offered in 44 states and D.C. In certain states, the Commercial Driver Legal Plan is underwritten by the Road America Motor Club, an unrelated motor service club. During 2010, this plan accounted for approximately 0.7% of Membership fees collected compared to approximately 0.7% and 0.8% of Membership fees during 2009 and 2008. The Plan underwritten by the Road America Motor Club is available at the monthly rate of $35.95 or at a group rate of $32.95. Basic plans underwritten by us are available at the monthly rate of $32.95 or at a group rate of $29.95. Benefits include the motor vehicle related benefits described above, defense of Department of Transportation violations and the 25% discounted rate for transportation related services beyond plan scope, such as defense of non-moving violations. The Road America Motor Club underwritten plan includes bail and arrest bonds and services for family vehicles. Also available is our Super CDLP plan which includes all the benefits of the basic CDLP plan together with some of the family plan benefits and discounts and is available at a monthly rate of $44.95, or a group rate of $39.95.

The Commercial Driver Legal Plan (“CDLP”) is designed specifically for the professional truck driver and offers a variety of driving-related benefits, including coverage for moving and non-moving violations. This plan provides coverage by a provider law firm for persons who drive a commercial vehicle. This legal service plan is currently offered in 44 states and D.C. In certain states, the Commercial Driver Legal Plan is underwritten by the Road America Motor Club, an unrelated motor service club. During 2010, this plan accounted for approximately 0.7% of Membership fees collected compared to approximately 0.7% and 0.8% of Membership fees during 2009 and 2008. The Plan underwritten by the Road America Motor Club is available at the monthly rate of $35.95 or at a group rate of $32.95. Basic plans underwritten by us are available at the monthly rate of $32.95 or at a group rate of $29.95. Benefits include the motor vehicle related benefits described above, defense of Department of Transportation violations and the 25% discounted rate for transportation related services beyond plan scope, such as defense of non-moving violations. The Road America Motor Club underwritten plan includes bail and arrest bonds and services for family vehicles. Also available is our Super CDLP plan which includes all the benefits of the basic CDLP plan together with some of the family plan benefits and discounts and is available at a monthly rate of $44.95, or a group rate of $39.95.

7

Home-Based Business Rider

The Home-Based Business plan was designed to provide small business owners access to commonly needed legal services. It can be added to the Expanded Family Legal Plan in approved states. To qualify, the business and residence address must be the same with three or fewer employees and be a for-profit business that is not publicly traded. Benefits under this plan include unlimited business telephone consultation, review of three business contracts per month, three business and debt collection letters per month and discounted trial defense rates. This plan also includes Membership in GoSmallBiz.com. This plan is available in 38 states, D.C. and three Canadian provinces and represented approximately 1.9% of our Membership fees collected during 2010, 2009 and 2008.

The Home-Based Business plan was designed to provide small business owners access to commonly needed legal services. It can be added to the Expanded Family Legal Plan in approved states. To qualify, the business and residence address must be the same with three or fewer employees and be a for-profit business that is not publicly traded. Benefits under this plan include unlimited business telephone consultation, review of three business contracts per month, three business and debt collection letters per month and discounted trial defense rates. This plan also includes Membership in GoSmallBiz.com. This plan is available in 38 states, D.C. and three Canadian provinces and represented approximately 1.9% of our Membership fees collected during 2010, 2009 and 2008.

Comprehensive Group Legal Services Plan

In late 1999, we introduced the Comprehensive Group plan, designed for the large group employee benefit market. This plan, available in 38 states and D.C., provides all the benefits of the Family Legal Plan as well as mortgage document preparation, assistance with uncontested legal situations such as adoptions, name changes, separations and divorces. Additional benefits include the preparation of health care power of attorney and living wills or directives to physicians. Although sales of this plan during the last three years (2,761 Memberships, 2,735 Memberships and 2,599 Memberships during 2010, 2009 and 2008, respectively) are not significant compared to our total Membership sales, we still believe this plan improves our competitive position in the large group market. We continue to emphasize group marketing to employee groups of less than 50 rather than larger groups where there is more competition, price negotiation and typically a longer sales cycle.

In late 1999, we introduced the Comprehensive Group plan, designed for the large group employee benefit market. This plan, available in 38 states and D.C., provides all the benefits of the Family Legal Plan as well as mortgage document preparation, assistance with uncontested legal situations such as adoptions, name changes, separations and divorces. Additional benefits include the preparation of health care power of attorney and living wills or directives to physicians. Although sales of this plan during the last three years (2,761 Memberships, 2,735 Memberships and 2,599 Memberships during 2010, 2009 and 2008, respectively) are not significant compared to our total Membership sales, we still believe this plan improves our competitive position in the large group market. We continue to emphasize group marketing to employee groups of less than 50 rather than larger groups where there is more competition, price negotiation and typically a longer sales cycle.

Other than additional benefits such as the Legal Shield and Identity Theft Shield benefits described above, the basic structure and design of the Membership benefits has not significantly changed over the last several years. The consistency in plan design and delivery provides us consistent, accurate data about plan utilization that enables us to manage our benefit costs through the capitated payment structure to provider firms. We frequently evaluate and consider other plan benefits that may include other services complimentary to the basic legal service plan.

Provider Law Firms

Our Memberships generally allow members to access legal services through a network of independent provider law firms under contract with us generally referred to as “provider law firms.” Provider law firms are paid a fixed fee on a per capita basis to render services to plan members residing within the state or province as provided by the contract. Because the fixed fee payments by us to provider law firms in connection with the Memberships do not vary based on the type and amount of benefits utilized by the member, this arrangement provides significant advantages to us in managing our cost of benefits. Pursuant to these provider law firm arrangements and due to the volume of revenue directed to these firms, we have the ability to more effectively monitor the customer service aspects of the legal services provided, the financial leverage to help ensure a customer friendly emphasis by the provider law firms and access to larger, more diversified law firms. Through our members, we are typically the largest client base of our provider law firms.

Provider law firms are selected to serve members based on a number of factors, including recommendations from provider law firms and other lawyers in the area in which the candidate provider law firm is located and in neighboring states, our investigation of bar association standing and client references, evaluation of the education, experience and areas of practice of lawyers within the firm, on-site evaluations by our management, and interviews with lawyers in the firm who would be responsible for providing services. Most importantly, these candidate law firms are evaluated on the firm’s customer service philosophy.

8

All of our provider law firms, representing more than 99% of our legal service members, are connected to us via high-speed digital links to our management information systems, thereby providing real-time monitoring capability. This online connection offers the provider law firm access to specially designed software developed by us for administration of legal services by the firm. These systems provide statistical reports of each law firm’s activity and performance and allow virtually all of the members served by provider law firms to be monitored on a near real-time basis. The online statistical reporting allows quality control monitoring of over 15 separate service delivery benchmarks. In addition, we regularly conduct extensive random surveys of members who have used the legal services of a provider law firm. We survey members in each state every 60 days, compile the results of such surveys and provide the provider law firms with copies of each survey and the overall summary of the results. If a member indicates on a survey the service did not meet their expectation, the member is contacted as soon as possible to resolve the issue.

Each month, provider law firms are presented with a comprehensive report of ratings related to our online monitoring, member assistance requests, member survey evaluations, telephone reports and other information developed in connection with member service monitoring. If a problem is detected, we recommend immediate remedial actions to the provider law firms to eliminate service deficiencies. In the event the deficiencies of a provider law firm are not eliminated through discussions and additional training with us, such deficiencies may result in the termination of the provider law firm. We are in constant communication with our provider law firms and meet with them frequently for additional training, to encourage increased communications with us and to share suggestions relating to the timely and effective delivery of services to our members.

Each attorney member of the provider law firm rendering services must have at least two years of experience as a lawyer, unless we waive this requirement due to special circumstances such as instances when the lawyer demonstrates significant legal experience acquired in an academic, judicial or similar capacity other than as a lawyer. Initially, we provide customer service training to the provider law firms and their support staff through on-site training that allows us to observe the individual lawyers of provider law firms as they directly assist the members. Additionally, we provide initial orientation and training for new staff and new attorneys joining the firm via weekly conference calls. We provide monthly “WOW, Service from the Heart Customer Service Training” on a continuous basis.

9

Agreements with provider law firms: (a) generally permit termination of the agreement by either party upon 60 days prior written notice, (b) permit us to terminate the Agreement for cause immediately upon written notice, (c) require the firm to maintain a minimum amount of malpractice insurance on each of its attorneys, in an amount not less than $100,000, (d) preclude us from interference with the lawyer-client relationship, (e) provide for periodic review of services provided, (f) provide for protection of our proprietary information and (g) require the firm to indemnify us against liabilities resulting from legal services rendered by the firm. We are precluded from contracting with other law firms to provide the same service in the same geographic area, except in situations where the designated law firm has a conflict of interest, we enroll a group of 500 or more members, or when the agreement is terminated by either party. Provider law firms are precluded from contracting with other prepaid legal service companies without our approval. Provider law firms receive a fixed monthly payment for each member who are residents in the service area and are responsible for providing the Membership benefits without additional remuneration. If a provider law firm delivers legal services to an open panel member, the law firm is reimbursed for services rendered according to the contract benefits of the open panel Membership. As of December 31, 2010, provider law firms averaged approximately 45 employees each and on average are relatively evenly split between support staff and lawyers.

The following table reflects the composition of our provider law firm network by state/province, together with each firm's Memberships and attorneys as of December 31, 2010 and year 2010 requests for service by state/province. As reflected in the table below, the average number of requests for service per member during 2010 was 1.6.

10

| Requests | ||||||||||

| Memberships | for | |||||||||

| State/Province | Provider Firm | Memberships | Attorneys | per attorney | Service | |||||

| Alabama | The Anderson Law Firm, LLC | 17,232 | 8 | 2,154 | 20,463 | |||||

| Alaska | No designated provider law firm - services | |||||||||

| provided by referral attorneys | 2 | |||||||||

| Alberta | Nickerson, Roberts, Holinski & Mercer | 4,595 | 12 | 383 | 4,651 | |||||

| Arizona | Davis Miles, PLLC | 38,189 | 42 | 909 | 74,367 | |||||

| Arkansas | Lisle Rutledge, P.A. | 13,743 | 7 | 1,963 | 19,629 | |||||

| British Columbia | Watson, Goepel & Maledy | 4,630 | 35 | 132 | 9,294 | |||||

| California | Parker Stanbury | 204,198 | 62 | 3,294 | 412,422 | |||||

| Colorado | Riggs, Abney, Neal, Turpen, Orbison & Lewis | 33,664 | 32 | 1,052 | 49,618 | |||||

| Connecticut | Willinger, Willinger & Bucci, P.C. | 7,957 | 12 | 663 | 12,809 | |||||

| Delaware | Mattleman, Weinroth & Miller | 4,181 | 4 | 1,045 | 5,859 | |||||

| Florida | DeBeaubien, Knight, Simmons, Mantzaris & Neal | 51,442 | 45 | 1,143 | 82,622 | |||||

| Florida | Glantz Law Firm | 38,675 | 30 | 1,289 | 77,985 | |||||

| Georgia | Deming, Parker, Hoffman, Campbell & Daly | 57,657 | 46 | 1,253 | 112,974 | |||||

| Hawaii | Bervar & Jones | 12,009 | 8 | 1,501 | 21,196 | |||||

| Idaho | The Huntley Law Firm, PLLC | 8,134 | 8 | 1,017 | 11,153 | |||||

| Illinois | Evans, Loewenstein, Shimanovsky & Moscardini, Ltd. | 40,746 | 22 | 1,852 | 76,866 | |||||

| Indiana | O'Koon Hintermeister, PLLC | 22,355 | 13 | 1,720 | 34,851 | |||||

| Iowa | McEnroe, Gotsdiner, Brewer, Steinbach & Henrichsen, P.C. | 5,521 | 5 | 1,104 | 4,657 | |||||

| Kansas | Riling, Burkhead & Nitcher | 13,210 | 12 | 1,101 | 14,686 | |||||

| Kentucky | O'Koon Hintermeister, PLLC | 9,106 | 6 | 1,518 | 13,133 | |||||

| Louisiana | Provosty, Sadler, deLaunay, Fiorenza & Sobel | 20,956 | 22 | 953 | 22,191 | |||||

| Maine | Robinson, Kriger & McCallum | 3,918 | 13 | 301 | 5,088 | |||||

| Manitoba | Tapper Cuddy | 1,760 | 27 | 65 | 2,574 | |||||

| Maryland/D.C. | Weinstock, Friedman & Friedman, P.A. | 40,088 | 39 | 1,028 | 67,034 | |||||

| Massachusetts | Framme Law Firm | 2,828 | 3 | 943 | 4,758 | |||||

| Michigan | Powers, Chapman, DeAgostino, Meyers & Milia | 40,521 | 21 | 1,930 | 69,722 | |||||

| Minnesota | Wagner, Falconer & Judd, LTD | 18,554 | 21 | 884 | 27,322 | |||||

| Mississippi | Nixon, Ray & Framme, PLLC | 9,640 | 4 | 2,410 | 12,169 | |||||

| Missouri | Dubail Judge | 21,981 | 16 | 1,374 | 26,757 | |||||

| Montana | Rimel & Mrkich, PLLP | 4,530 | 2 | 2,265 | 4,489 | |||||

| N. Carolina | Merritt, Flebotte, Wilson, Webb & Caruso | 55,928 | 25 | 2,237 | 86,148 | |||||

| N. Dakota | Wagner, Falconer & Judd, LTD | 482 | 1 | 482 | 545 | |||||

| Nebraska | Morrow, Poppe, Watermeier & Lonowski, P.C. | 2,511 | 7 | 359 | 3,228 | |||||

| Nevada | Dempsey, Roberts & Smith | 16,199 | 14 | 1,157 | 33,248 | |||||

| New Hampshire | Framme Law Firm | 3,220 | 3 | 1,073 | 5,318 | |||||

| New Jersey | Mattleman, Weinroth & Miller | 28,454 | 21 | 1,355 | 36,059 | |||||

| New Mexico | Davis Miles, PLLC | 17,533 | 9 | 1,948 | 25,541 | |||||

| New York | Feldman, Kramer & Monaco, P.C. | 46,356 | 46 | 1,008 | 69,753 | |||||

| Ohio | Maguire & Schneider, LLP | 39,403 | 26 | 1,516 | 63,157 | |||||

| Oklahoma | Riggs, Abney, Neal, Turpen, Orbison & Lewis | 39,530 | 76 | 520 | 37,032 | |||||

| Ontario | Mills & Mills | 17,584 | 25 | 703 | 27,885 | |||||

| Oregon | Kivel & Howard, LLP | 21,792 | 14 | 1,557 | 33,748 | |||||

| Pennsylvania | Welch, Gold & Siegel, P.C. | 31,813 | 20 | 1,591 | 47,301 | |||||

| Rhode Island | Framme Law Firm | 1,046 | 1 | 1,046 | 1,834 | |||||

| S. Carolina | Merritt, Flebotte, Wilson, Webb & Caruso | 20,463 | 13 | 1,574 | 33,734 | |||||

| S. Dakota | Demersseman Jensen | 2,358 | 6 | 393 | 1,740 | |||||

| Tennessee | Merritt, Flebotte, Wilson, Webb & Caruso | 22,242 | 12 | 1,854 | 29,725 | |||||

| Texas | Ross & Matthews, P.C. | 132,074 | 97 | 1,362 | 170,016 | |||||

| Utah | Smart, Schofield, Shorter & Lunceford | 13,328 | 14 | 952 | 21,831 | |||||

| Vermont | Framme Law Firm | 481 | 1 | 481 | 636 | |||||

| Virginia | Framme Law Firm | 37,135 | 17 | 2,184 | 49,517 | |||||

| W. Virginia | Caldwell & Riffee | 4,192 | 3 | 1,397 | 2,870 | |||||

| Washington | Lombino - Martino, PS | 42,501 | 28 | 1,518 | 81,180 | |||||

| Wisconsin | Wagner, Falconer & Judd, LTD | 10,812 | 19 | 569 | 18,368 | |||||

| Wyoming | Smart, Schofield, Shorter & Lunceford | 1,751 | 2 | 876 | 1,774 | |||||

| Total Closed Panel Memberships | 1,361,210 | 1,077 | 1,264 Avg. | 2,183,527 | ||||||

| “Stand-alone” IDT Memberships | 91,809 | |||||||||

| Open Panel Memberships | 9,425 | |||||||||

| Commercial Driver Legal Plan Memberships | 10,793 | |||||||||

| Total Memberships | 1,473,237 | |||||||||

11

We have had occasional disputes with provider law firms, some of which have resulted in litigation. The toll-free telephone lines utilized and paid for by the provider law firms are owned by us so that in the event of a termination, the members’ calls can be rerouted very quickly. Nonetheless, we believe that our relations with provider law firms are generally very good. At the end of 2010 and 2009, we had provider law firms representing 49 states and four provinces, compared to 47 states and four provinces at the end of 2008. During the last three calendar years, our relationship with one provider law firm was terminated by the provider law firm or us. As of December 31, 2010, provider law firms representing 35 states have been under contract with us for more than eight years with the average tenure of all provider law firms being approximately 12 years.

There are occasions when members need to be referred by the provider law firm or PPL to an attorney outside the provider law firm. These instances are for geographic reasons, expertise reasons or if the matter is a conflict of interest for the provider law firm. We have an extensive database of referral lawyers developed for PPL and the provider law firms to access when members need services to be coordinated outside the provider law firm. Lawyers with whom members have experienced verified service problems, or are otherwise inappropriate for the referral system, are removed from our database of referral lawyers.

We design our plans for the convenience of our member. The provider law firms primarily deliver consultation benefits via the telephone while document reviews and letters are primarily delivered by fax, email and mail, and thus, the member does not normally need to travel to any law firm to receive the majority of their benefits. They can utilize their benefits from the comfort of their home or office and not take time off from work.

The provider law firms provide and/or coordinate all benefits for our members. After the provider law firm has provided telephone consultation benefits and possible document review and letters, if appropriate, the provider law firm will provide further benefits or coordinate a referral to a local attorney if that is necessary. We have a database of referral attorneys covering North America should a member need a local attorney. The provider law firm coordinates these referrals based on the member's legal needs and the location of the courts.

Members’ benefits carry over to the local attorneys when referred, based on the specific legal matter being referred and the specific benefit applicable to the member. Some referrals are free to the member by way of the specific plan benefit and the referral attorney is paid by the provider law firm. Other referrals are provided under the 25% discount benefit of the plan, where the member pays the discounted fee to the local attorney.

Referrals are made on a case-by-case basis, depending on the specific legal matter and the applicable benefits. The majority of referrals are based on geography of where the member lives, in conjunction with the legal venue and/or the location of the court. Occasionally a member is referred because of expertise that is required on a particular issue.

Identity Theft Shield Benefits Provider

Kroll Inc. is the world’s leading risk consulting company. For more than 30 years, Kroll has helped companies, government agencies and individuals reduce their exposure to risk and capitalize on business opportunities. Kroll is an operating unit of Altegrity, Inc., the holding company for USIS, Kroll, HireRight and Explore Information Services. Headquartered in Falls Church, Va., Altegrity has approximately 11,000 employees in 30 countries. Kroll can scrutinize accounting practices and financial documents; gather and filter electronic evidence for attorneys; recover lost or damaged data from computers and servers; conduct in-depth investigations; protect individuals, and enhance security systems and procedures. Kroll’s clients include many of the world’s largest and most prestigious corporations, law firms, academic institutions, non-profit organizations, sovereign governments, government agencies, and high net-worth individuals, entertainers and celebrities. Kroll’s seasoned professionals were handpicked and recruited from leading management consulting companies, top law firms, international auditing companies, multinational corporations, special operations forces, law enforcement and intelligence agencies. Kroll also maintains a network of highly trained specialists in cities throughout the world who can respond to global needs 24 hours a day, seven days a week. Over the last four years, Kroll has developed a unique solution for victims of identity theft and this service is now available to our members through the Identity Theft Shield benefit. Similar to the provider law firms, Kroll is paid a fixed fee on a monthly per capita basis to render services to IDT members.

12

Marketing

Multi-Level Marketing

We market Memberships through a multi-level marketing program that encourages individuals to sell Memberships and allows individuals to recruit and develop their own sales organizations. Commissions are paid only when a Membership is sold. No commissions are paid based solely on recruitment. When a Membership is sold, commissions are paid to the associate making the sale, and to other associates (on average, eight others at December 31, 2010, 2009 and 2008) who are in the line of associates who directly or indirectly recruited the selling associate. We provide training materials, organize area-training meetings and designate personnel at the home office specially trained to answer questions and inquiries from associates. We offer various communication avenues to our sales associates to keep such associates informed of any changes in the marketing of our Memberships. The primary communication vehicles we utilize to keep our sales associates informed include extensive use of conference calls and e-mail, an interactive voice-mail service, The Connection monthly magazine, an interactive voice response system and our website, prepaidlegal.com.

Multi-level marketing is primarily used for marketing based on personal sales since it encourages individual or group face-to-face meetings with prospective members and has the potential of attracting a large number of sales personnel within a short period of time. Our marketing efforts towards individuals typically target the middle income family or individual and seek to educate potential members concerning the benefits of having ready access to legal counsel for a variety of everyday legal problems. Memberships with individuals or families sold by the multi-level sales force constituted 73% of our Memberships in force at December 31, 2010, compared to 73% at December 31, 2009 and 74% at December 31, 2008. Although other means of payment are available, approximately 73% of fees on Memberships purchased by individuals or families are paid on a monthly basis by means of automatic bank draft or credit card.

Group marketing

Our marketing efforts towards employee groups, principally on a payroll deduction payment basis, are designed to permit our sales associates to reach more potential members with each sales presentation and strive to capitalize on, among other things, what we perceive to be a growing interest among employers in the value of providing legal and identity theft service plans to their employees. Memberships sold through employee groups constituted approximately 27% of total Memberships in force at December 31, 2010 and 2009, compared to 26% at December 31, 2008. Most employee group Memberships are sold to school systems, governmental entities and businesses. We emphasize group marketing to employee groups of less than 50 rather than larger groups where there is more competition, price negotiation and typically a longer sales cycle. No group accounted for more than 1% of our consolidated revenues from Memberships during 2010, 2009 or 2008. Substantially all group Memberships are paid on a monthly basis. We are active in legislative lobbying efforts to enhance our ability to market to public employee groups and to encourage Congress to reenact legislation to permit legal service plans to qualify for pre-tax payments under tax qualified employee cafeteria plans.

Affirmative Defense Response System

We developed the Affirmative Defense Response System (“ADRS”) to provide businesses and their employees a way to minimize their risk in regard to identity theft by encouraging businesses to take proactive measures to protect non-public information. Once our sales associates meet the program requirements and have been through the required training, they can begin to offer businesses template forms they can work from to begin their security program. We encourage businesses to host mandatory employee meetings and training sessions on identity theft and privacy compliance including reviewing the employer’s privacy policy with employees. At such meetings, our associates will provide the employees of the business an opportunity to purchase our legal service and identity theft plans. Since our Identity Theft Shield provides identity restoration benefits and our legal plans provide help on related issues, we believe the majority of the time in restoring an employee’s identity is covered by our plan and therefore is not done on company time or at company expense. We believe our suite of services including our legal plan, the Legal Shield and the Identity Theft Shield provide employees assistance in every phase of identity theft – before, during and after the crime occurs. We developed ADRS to enhance our group marketing efforts and we intend to continue to utilize this program in 2011.

13

General

Sales associates are generally engaged as independent contractors, are provided with training materials and are given the opportunity to participate in our training programs. Sales associates are required to complete a specified training program prior to marketing our Memberships to employee groups. All advertising and solicitation materials used by sales associates must be approved by us prior to use. At December 31, 2010, we had 438,007 “vested” sales associates compared to 477,208 and 425,018 “vested” sales associates at December 31, 2009 and 2008, respectively. A sales associate is considered to be “vested” if he or she has met our vesting requirements. However, a substantial number of vested associates do not continue to market the Membership, as they are not required to do so in order to continue to be vested. In order to meet the vesting requirements and be eligible to receive commissions, sales associates must have an active Associate Agreement. In order to keep an active Agreement; sales associates must (1) maintain an active personal legal services membership or (2) make three personal membership sales per calendar quarter. If a sales associate fails to do either, his or her Associate Agreement will be placed in a pre-cancel status for one quarter (“quarterly vesting probationary period”). During this period, the Associate must either (1) reinstate their personal legal services membership or (2) make six personal membership sales. If these requirements are not met, the Associate will go into a dropped status at the end of the probationary period. Upon the date the Associate Agreement is dropped, the Associate loses all down line, level, counters and qualifications and forfeits any pending advanced commission, earnings and bonuses.

During 2010, we had 82,620 sales associates who personally sold at least one Membership, of which 46,117 (56%) made first time sales. During 2009 and 2008 we had 95,303 and 81,731 sales associates producing at least one Membership sale, respectively, of which 56,736 (59%) and 43,674 (53%), respectively, made first time sales. During 2010, we had 6,806 sales associates who personally sold more than ten Memberships compared to 7,448 and 6,996 in 2009 and 2008, respectively. A substantial number of our sales associates market our Memberships on a part-time basis only. For the year 2010, new sales associates enrolled decreased 26% to 138,442 with an average enrollment fee of $75 from the 186,064 enrolled in 2009 with an average enrollment fee of $87.

The following table recaps, on a quarterly basis for the last two fiscal years, total vested sales associates that made new Membership sales and those that did not as well as those that own a Membership and those that do not own a Membership, by their respective levels of sales:

| Assocs Without A Membership | (3) | |||||||||

| (1) | (2) | Assocs Selling | (4) | |||||||

| Assocs Selling | Assocs Selling | With a | Assocs Not | (5) | ||||||

| Qtr/Year | 3 or more | Less than 3 | Membership | Selling | Total Assocs | |||||

| Q1/09 | 60 | 179 | 22,805 | 389,135 | 412,179 | |||||

| Q2/09 | 85 | 227 | 23,676 | 377,062 | 401,050 | |||||

| Q3/09 | 158 | 678 | 38,615 | 408,733 | 448,184 | |||||

| Q4/09 | 273 | 1,012 | 38,097 | 437,826 | 477,208 | |||||

| Q1/10 | 153 | 380 | 29,833 | 443,254 | 473,620 | |||||

| Q2/10 | 139 | 314 | 28,897 | 429,535 | 458,885 | |||||

| Q3/10 | 164 | 275 | 27,575 | 425,789 | 453,803 | |||||

| Q4/10 | 166 | 280 | 24,854 | 412,707 | 438,007 | |||||

| (1) | Represents sales associates that do not own a Membership that have sold 3 or more new Memberships during the quarter indicated. | |

| (2) | Represents sales associates that do not own a Membership that have sold less than 3 new Memberships during the quarter indicated. | |

| (3) | Represents sales associates who owned a Membership and sold at least 1 new Membership during the quarter indicated. | |

| (4) | Represents sales associates who owned a Membership or were in their quarterly vesting probationary period but did not sell at least 1 new Membership during the quarter indicated. | |

| (5) | Represents the total vested associates (including those associates in their quarterly vesting probationary period) during the quarter indicated. | |

14

We derive revenues from our multi-level marketing sales force, including one-time enrollment fee from each new sales associate for which we provide initial marketing supplies and enrollment services to the associate. Amounts collected from sales associates are intended primarily to offset our costs incurred in recruiting and training and providing materials to sales associates and are not intended to generate profits from such activities. Other revenues from sales associates represent the sale of marketing supplies and promotional materials and include fees related to our eService program for associates. The eService program provides subscribers Internet based back office support such as reports, on-line documents, tools, a personal e-mail account and multiple personalized web sites with video presentations.

We continually review our compensation plan for the multi-level marketing force to assure that the various financial incentives in the plan encourage our desired goals. We offer various incentive programs from time to time and frequently adjust the program to maintain appropriate incentives and to improve Membership production and retention.

We hold our International Convention once a year, typically in the spring, and a Leadership Summit, typically in the fall, and routinely host more than 10,000 of our sales associates at these events. These events are intended to provide additional training, corporate updates, new announcements, motivation and associate recognition. Additionally, we offer the Player’s Club incentive program providing additional incentives to our associates as a reward for consistent, quality business. Associates can earn the right to attend an annual incentive trip by meeting certain qualification requirements and maintaining certain personal retention rates. Associates can also earn the right to receive additional monthly bonuses by meeting the monthly qualification requirements for twelve consecutive months and maintaining certain personal retention rates for the Memberships sold during that twelve-month period.

Regional Vice Presidents

Prior to January 1, 2007, we had a group of approximately 115 employees that served as Regional Vice Presidents (“RVPs”) and were responsible for associate activity in given geographic regions and had the ability to appoint independent contractors as Area Coordinators within the RVP’s region. Effective January 1, 2007, we dramatically revamped this program by reducing the number of RVPs from approximately 115 to 15; eliminated the employee relationship of the RVPs so that all are independent contractors; significantly increased both the size of their regions and the commission override percentages that can be earned by the RVPs; put in place additional bonus compensation available based on growth in their assigned regions; replaced the previous large number of Area Coordinators with substantially fewer Regional Managers appointed by the RVPs; created commission overrides than can be earned by the Regional Managers in their regions and created a new class of appointees, Certified Meeting Coordinators that are appointed by the Regional Managers. Additionally, we have significantly increased the frequency of communications between the RVPs and us and the frequency and the amount of reporting both from and to, the RVPs. At December 31, 2010, we had 35 RVPs assigned.

The RVP/Regional Manager/Certified Meeting Coordinator program provides a basis to effectively monitor current sales activity, further educate and motivate the sales force and otherwise enhance the relationships between the associates and us. New products, incentives and initiatives will be channeled through the RVPs.

15

Pre-Paid Legal Benefits Association

The PPL Benefits Association (“PPLBA”) was founded in 1999 with the intent of providing sales associates the opportunity to have access, at their own expense, to health insurance and life insurance benefits. Membership in the Association allows a sales associate to become eligible to enroll in numerous benefit programs, as well as take advantage of attractive affinity agreements. Membership in this Association is open to sales associates that reach a certain level within our marketing programs who also maintain an active personal legal services Membership. The PPLBA is a separate association not owned or controlled by us and is governed by an 8 member Board of Directors, including four officer positions. None of the officers or directors of the PPLBA serve in any such capacity with us. The PPLBA employs a Director of Associate Benefits paid by the Association. Affinity programs available to members of the PPLBA include credit cards, long-distance, wireless services, vehicle purchasing services, mortgage and real estate assistance and a travel club. As determined by its Board of Directors, some of the revenue generated by the PPLBA through commissions from vendors of the benefits and affinity programs or contributed to the Association by us may be used to make open-market purchases of our stock for use in stock bonus awards to Association members based on criteria established from time to time by the Board of Directors of the PPLBA. Since inception and through December 31, 2010, approximately 47,300 shares were purchased by the PPLBA for awards to its members, including approximately 1,400 and 1,900 shares of stock to Association members for 2009 and 2008. No share purchases were made for 2010.

Cooperative Marketing