Attached files

| file | filename |

|---|---|

| EX-24 - EXHIBIT (24) - EASTGROUP PROPERTIES INC | exhibit24.htm |

| EX-21 - EXHIBIT (21) - EASTGROUP PROPERTIES INC | exhibit21.htm |

| EX-23 - EXHIBIT (23) - EASTGROUP PROPERTIES INC | exhibit23.htm |

| EX-31.A - EXHIBIT 31(A) - EASTGROUP PROPERTIES INC | exhibit31a.htm |

| EX-32.B - EXHIBIT 32(B) - EASTGROUP PROPERTIES INC | exhibit32b.htm |

| EX-31.B - EXHIBIT 31(B) - EASTGROUP PROPERTIES INC | exhibit31b.htm |

| EX-10.O - FIRST AMENDMENT TO SECOND AMENDED AND RESTATED CREDIT AGREEMENT - EASTGROUP PROPERTIES INC | exhibit10o.htm |

| EX-32.A - EXHIBIT 32(A) - EASTGROUP PROPERTIES INC | exhibit32a.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2010 COMMISSION FILE NUMBER 1-07094

EASTGROUP PROPERTIES, INC.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

|

MARYLAND

|

13-2711135

|

|||

|

(State or other jurisdiction

|

(I.R.S. Employer

|

|||

|

of incorporation or organization)

|

Identification No.)

|

|||

|

190 EAST CAPITOL STREET

|

||||

|

SUITE 400

|

||||

|

JACKSON, MISSISSIPPI

|

39201

|

|||

|

(Address of principal executive offices)

|

(Zip code)

|

|||

|

Registrant’s telephone number: (601) 354-3555

|

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

SHARES OF COMMON STOCK, $.0001 PAR VALUE,

NEW YORK STOCK EXCHANGE

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: NONE

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES (x) NO ( )

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

YES ( ) NO (x)

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES (x) NO ( )

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES (x) NO ( )

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. (x)

1

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer (x) Accelerated Filer ( ) Non-accelerated Filer ( ) Smaller Reporting Company ( )

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ( ) NO (x)

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of June 30, 2010, the last business day of the Registrant's most recently completed second fiscal quarter: $923,034,000.

The number of shares of common stock, $.0001 par value, outstanding as of February 24, 2011 was 26,972,262.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement for the 2011 Annual Meeting of Stockholders are incorporated by reference into Part III.

2

PART I

ITEM 1. BUSINESS.

Organization

EastGroup Properties, Inc. (the Company or EastGroup) is an equity real estate investment trust (REIT) organized in 1969. The Company has elected to be taxed and intends to continue to qualify as a REIT under Sections 856-860 of the Internal Revenue Code (the Code), as amended.

Available Information

The Company maintains a website at www.eastgroup.net. The Company posts its annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after it electronically files or furnishes such materials to the Securities and Exchange Commission (SEC). In addition, the Company's website includes items related to corporate governance matters, including, among other things, the Company's corporate governance guidelines, charters of various committees of the Board of Directors, and the Company's code of business conduct and ethics applicable to all employees, officers and directors. The Company intends to disclose on its website any amendment to, or waiver of, any provision of this code of business conduct and ethics applicable to the Company's directors and executive officers that would otherwise be required to be disclosed under the rules of the SEC or the New York Stock Exchange. Copies of these reports and corporate governance documents may be obtained, free of charge, from the Company's website. Any shareholder also may obtain copies of these documents, free of charge, by sending a request in writing to: Investor Relations, EastGroup Properties, Inc., 190 East Capitol Street, Suite 400, Jackson, MS 39201-2152.

Administration

EastGroup maintains its principal executive office and headquarters in Jackson, Mississippi. The Company also has regional offices in Orlando, Houston and Phoenix and an asset management office in Charlotte. EastGroup has property management offices in Jacksonville, Tampa, Fort Lauderdale and San Antonio. Offices at these locations allow the Company to provide property management services to all of its Florida (except Fort Myers), Arizona, Mississippi, North Carolina, and Houston and San Antonio, Texas properties, which together account for 69% of the Company’s total portfolio on a square foot basis. In addition, the Company currently provides property administration (accounting of operations) for its entire portfolio. The regional offices in Florida, Texas and Arizona also provide development capability and oversight in those states. As of February 24, 2011, EastGroup had 64 full-time employees and one part-time employee.

Operations

EastGroup is focused on the acquisition, development and operation of industrial properties in major Sunbelt markets throughout the United States with an emphasis in the states of Florida, Texas, Arizona and California. The Company’s goal is to maximize shareholder value by being a leading provider of functional, flexible, and quality business distribution space for location sensitive tenants primarily in the 5,000 to 50,000 square foot range. EastGroup’s strategy for growth is based on the ownership of premier distribution facilities generally clustered near major transportation features in supply constrained submarkets. Over 99% of the Company’s revenue is generated from renting real estate.

During 2010, EastGroup increased its ownership in real estate properties through its acquisition and development programs. The Company purchased three business distribution complexes with a total of six buildings (499,000 square feet) and 2.1 acres of land for a combined cost of $23.9 million. Also during 2010, EastGroup transferred five properties (426,000 square feet) with aggregate costs of $30.5 million at the date of transfer from development to real estate properties.

EastGroup incurs short-term floating rate bank debt in connection with the acquisition and development of real estate and, as market conditions permit, replaces floating rate debt with equity, including preferred equity, and/or fixed-rate term loans. EastGroup also may, in appropriate circumstances, acquire one or more properties in exchange for EastGroup securities.

EastGroup holds its properties as long-term investments, but may determine to sell certain properties that no longer meet its investment criteria. The Company may provide financing in connection with such sales of property if market conditions require. In addition, the Company may provide financing to a partner or co-owner in connection with an acquisition of real estate in certain situations.

Subject to the requirements necessary to maintain our qualifications as a REIT, EastGroup may acquire securities of entities engaged in real estate activities or securities of other issuers, including for the purpose of exercising control over those entities.

The Company intends to continue to qualify as a REIT under the Code. To maintain its status as a REIT, the Company is required to distribute at least 90% of its ordinary taxable income to its stockholders. The Company has the option of (i) reinvesting the sales price of properties sold through tax-deferred exchanges, allowing for a deferral of capital gains on the sale, (ii) paying out capital gains to the stockholders with no tax to the Company, or (iii) treating the capital gains as having been distributed to the stockholders, paying the tax on the gain deemed distributed and allocating the tax paid as a credit to the stockholders.

3

EastGroup has no present intention of acting as an underwriter of offerings of securities of other issuers. The strategies and policies set forth above were determined and are subject to review by EastGroup's Board of Directors, which may change such strategies or policies based upon its evaluation of the state of the real estate market, the performance of EastGroup's assets, capital and credit market conditions, and other relevant factors. EastGroup provides annual reports to its stockholders, which contain financial statements audited by the Company’s independent registered public accounting firm.

Environmental Matters

Under various federal, state and local laws, ordinances and regulations, an owner of real estate may be liable for the costs of removal or remediation of certain hazardous or toxic substances on or in such property. Many such laws impose liability without regard to whether the owner knows of, or was responsible for, the presence of such hazardous or toxic substances. The presence of such substances, or the failure to properly remediate such substances, may adversely affect the owner’s ability to sell or rent such property or to use such property as collateral in its borrowings. EastGroup’s properties have been subjected to Phase I Environmental Site Assessments (ESAs) by independent environmental consultants. These reports have not revealed any potential significant environmental liability. Management of EastGroup is not aware of any environmental liability that would have a material adverse effect on EastGroup’s business, assets, financial position or results of operations.

ITEM 1A. RISK FACTORS.

In addition to the other information contained or incorporated by reference in this document, readers should carefully consider the following risk factors. Any of these risks or the occurrence of any one or more of the uncertainties described below could have a material adverse effect on the Company's financial condition and the performance of its business. The Company refers to itself as "we" or "our" in the following risk factors.

Real Estate Industry Risks

We face risks associated with local real estate conditions in areas where we own properties. We may be adversely affected by general economic conditions and local real estate conditions. For example, an oversupply of industrial properties in a local area or a decline in the attractiveness of our properties to tenants would have a negative effect on us. Other factors that may affect general economic conditions or local real estate conditions include:

|

·

|

population and demographic trends;

|

|

·

|

employment and personal income trends;

|

|

·

|

income tax laws;

|

|

·

|

changes in interest rates and availability and costs of financing;

|

|

·

|

increased operating costs, including insurance premiums, utilities and real estate taxes, due to inflation and other factors which may not necessarily be offset by increased rents; and

|

|

·

|

construction costs.

|

We may be unable to compete for properties and tenants. The real estate business is highly competitive. We compete for interests in properties with other real estate investors and purchasers, some of whom have greater financial resources, revenues, and geographical diversity than we have. Furthermore, we compete for tenants with other property owners. All of our industrial properties are subject to significant local competition. We also compete with a wide variety of institutions and other investors for capital funds necessary to support our investment activities and asset growth.

We are subject to significant regulation that inhibits our activities. Local zoning and land use laws, environmental statutes and other governmental requirements restrict our expansion, rehabilitation and reconstruction activities. These regulations may prevent us from taking advantage of economic opportunities. Legislation such as the Americans with Disabilities Act may require us to modify our properties, and noncompliance could result in the imposition of fines or an award of damages to private litigants. Future legislation may impose additional requirements. We cannot predict what requirements may be enacted or what changes may be implemented to existing legislation.

Risks Associated with Our Properties

We may be unable to lease space. When a lease expires, a tenant may elect not to renew it. We may not be able to re-lease the property on similar terms, if we are able to re-lease the property at all. The terms of renewal or re-lease (including the cost of required renovations and/or concessions to tenants) may be less favorable to us than the prior lease. We also develop some properties with no pre-leasing. If we are unable to lease all or a substantial portion of our properties, or if the rental rates upon such leasing are significantly lower than expected rates, our cash generated before debt repayments and capital expenditures and our ability to make expected distributions to stockholders may be adversely affected.

4

We have been and may continue to be affected negatively by tenant bankruptcies and leasing delays. At any time, a tenant may experience a downturn in its business that may weaken its financial condition. Similarly, a general decline in the economy may result in a decline in the demand for space at our industrial properties. As a result, our tenants may delay lease commencement, fail to make rental payments when due, or declare bankruptcy. Any such event could result in the termination of that tenant’s lease and losses to us, and distributions to investors may decrease. We receive a substantial portion of our income as rents under long-term leases. If tenants are unable to comply with the terms of their leases because of rising costs or falling sales, we may deem it advisable to modify lease terms to allow tenants to pay a lower rent or a smaller share of taxes, insurance and other operating costs. If a tenant becomes insolvent or bankrupt, we cannot be sure that we could recover the premises from the tenant promptly or from a trustee or debtor-in-possession in any bankruptcy proceeding relating to the tenant. We also cannot be sure that we would receive rent in the proceeding sufficient to cover our expenses with respect to the premises. If a tenant becomes bankrupt, the federal bankruptcy code will apply and, in some instances, may restrict the amount and recoverability of our claims against the tenant. A tenant’s default on its obligations to us could adversely affect our financial condition and the cash we have available for distribution.

We face risks associated with our property development. We intend to continue to develop properties where market conditions warrant such investment. Once made, our investments may not produce results in accordance with our expectations. Risks associated with our current and future development and construction activities include:

|

·

|

the availability of favorable financing alternatives;

|

|

·

|

the risk that we may not be able to obtain land on which to develop or that due to the increased cost of land, our activities may not be as profitable;

|

|

·

|

construction costs exceeding original estimates due to rising interest rates and increases in the costs of materials and labor;

|

|

·

|

construction and lease-up delays resulting in increased debt service, fixed expenses and construction costs;

|

|

·

|

expenditure of funds and devotion of management's time to projects that we do not complete;

|

|

·

|

fluctuations of occupancy rates and rents at newly completed properties, which depend on a number of factors, including market and economic conditions, resulting in lower than projected rental rates and a corresponding lower return on our investment; and

|

|

·

|

complications (including building moratoriums and anti-growth legislation) in obtaining necessary zoning, occupancy and other governmental permits.

|

We face risks associated with property acquisitions. We acquire individual properties and portfolios of properties and intend to continue to do so. Our acquisition activities and their success are subject to the following risks:

|

·

|

when we are able to locate a desired property, competition from other real estate investors may significantly increase the purchase price;

|

|

·

|

acquired properties may fail to perform as expected;

|

|

·

|

the actual costs of repositioning or redeveloping acquired properties may be higher than our estimates;

|

|

·

|

acquired properties may be located in new markets where we face risks associated with an incomplete knowledge or understanding of the local market, a limited number of established business relationships in the area and a relative unfamiliarity with local governmental and permitting procedures;

|

|

·

|

we may be unable to quickly and efficiently integrate new acquisitions, particularly acquisitions of portfolios of properties, into our existing operations, and as a result, our results of operations and financial condition could be adversely affected; and

|

|

·

|

we may acquire properties subject to liabilities and without any recourse, or with only limited recourse, to the transferor with respect to unknown liabilities. As a result, if a claim were asserted against us based upon ownership of those properties, we might have to pay substantial sums to settle it, which could adversely affect our cash flow.

|

Coverage under our existing insurance policies may be inadequate to cover losses. We generally maintain insurance policies related to our business, including casualty, general liability and other policies, covering our business operations, employees and assets as appropriate for the markets where our properties and business operations are located. However, we would be required to bear all losses that are not adequately covered by insurance. In addition, there may be certain losses that are not generally insured against or that are not generally fully insured against because it is not deemed economically feasible or prudent to do so, including losses due to floods, wind, earthquakes, acts of war, acts of terrorism or riots. If an uninsured loss or a loss in excess of insured limits occurs with respect to one or more of our properties, then we could lose the capital we invested in the properties, as well as the anticipated future revenue from the properties. In addition, if the damaged properties are subject to recourse indebtedness, we would continue to be liable for the indebtedness, even if these properties were irreparably damaged.

We face risks due to lack of geographic and real estate sector diversity. Substantially all of our properties are located in the Sunbelt region of the United States with an emphasis in the states of Florida, Texas, Arizona and California. A downturn in general economic conditions and local real estate conditions in these geographic regions, as a result of oversupply of or reduced demand for industrial properties, local business climate, business layoffs and changing demographics, would have a particularly strong adverse effect on us. Our investments in real estate assets are concentrated in the industrial distribution sector. This concentration may expose us to the risk of economic downturns in this sector to a greater extent than if our business activities included other sectors of the real estate industry.

5

We face risks due to the illiquidity of real estate which may limit our ability to vary our portfolio. Real estate investments are relatively illiquid. Our ability to vary our portfolio in response to changes in economic and other conditions will therefore be limited. In addition, because of our status as a REIT, the Internal Revenue Code limits our ability to sell our properties. If we must sell an investment, we cannot ensure that we will be able to dispose of the investment on terms favorable to the Company.

We are subject to environmental laws and regulations. Current and previous real estate owners and operators may be required under various federal, state and local laws, ordinances and regulations to investigate and clean up hazardous substances released at the properties they own or operate. They may also be liable to the government or to third parties for substantial property or natural resource damage, investigation costs and cleanup costs. Such laws often impose liability without regard to whether the owner or operator knew of, or was responsible for, the release or presence of such hazardous substances. In addition, some environmental laws create a lien on the contaminated site in favor of the government for damages and costs the government incurs in connection with the contamination. Contamination may adversely affect the owner’s ability to use, sell or lease real estate or to borrow using the real estate as collateral. We have no way of determining at this time the magnitude of any potential liability to which we may be subject arising out of environmental conditions or violations with respect to the properties we currently or formerly owned. Environmental laws today can impose liability on a previous owner or operator of a property that owned or operated the property at a time when hazardous or toxic substances were disposed of, released from, or present at the property. A conveyance of the property, therefore, may not relieve the owner or operator from liability. Although ESAs have been conducted at our properties to identify potential sources of contamination at the properties, such ESAs do not reveal all environmental liabilities or compliance concerns that could arise from the properties. Moreover, material environmental liabilities or compliance concerns may exist, of which we are currently unaware, that in the future may have a material adverse effect on our business, assets or results of operations.

Compliance with new laws or regulations related to climate change, including compliance with “green” building codes, may require us to make improvements to our existing properties. Proposed legislation could also increase the costs of energy and utilities. The cost of the proposed legislation may adversely affect our financial position, results of operations and cash flows. We may be adversely affected by floods, hurricanes and other climate related events.

Financing Risks

We face risks associated with the use of debt to fund acquisitions and developments, including refinancing risk. We are subject to the risks normally associated with debt financing, including the risk that our cash flow will be insufficient to meet required payments of principal and interest. In addition, certain of our mortgages will have significant outstanding principal balances on their maturity dates, commonly known as “balloon payments.” Therefore, we will likely need to refinance at least a portion of our outstanding debt as it matures. There is a risk that we may not be able to refinance existing debt or that the terms of any refinancing will not be as favorable as the terms of the existing debt.

We face risks associated with our dependence on external sources of capital. In order to qualify as a REIT, we are required each year to distribute to our stockholders at least 90% of our ordinary taxable income, and we are subject to tax on our income to the extent it is not distributed. Because of this distribution requirement, we may not be able to fund all future capital needs from cash retained from operations. As a result, to fund capital needs, we rely on third-party sources of capital, which we may not be able to obtain on favorable terms, if at all. Our access to third-party sources of capital depends upon a number of factors, including (i) general market conditions; (ii) the market’s perception of our growth potential; (iii) our current and potential future earnings and cash distributions; and (iv) the market price of our capital stock. Additional debt financing may substantially increase our debt-to-total capitalization ratio. Additional equity financing may dilute the holdings of our current stockholders.

Covenants in our credit agreements could limit our flexibility and adversely affect our financial condition. The terms of our various credit agreements and other indebtedness require us to comply with a number of customary financial and other covenants, such as maintaining debt service coverage and leverage ratios and maintaining insurance coverage. These covenants may limit our flexibility in our operations, and breaches of these covenants could result in defaults under the instruments governing the applicable indebtedness even if we had satisfied our payment obligations. If we are unable to refinance our indebtedness at maturity or meet our payment obligations, the amount of our distributable cash flow and our financial condition would be adversely affected.

Fluctuations in interest rates may adversely affect our operations and value of our stock. As of December 31, 2010, we had approximately $91 million of variable interest rate debt. As of December 31, 2010, the weighted average interest rate on our variable rate debt was 1.12%. We may incur additional indebtedness in the future that bears interest at a variable rate or we may be required to refinance our existing debt at higher rates. Accordingly, increases in interest rates could adversely affect our financial condition, our ability to pay expected distributions to stockholders and the value of our stock.

A lack of any limitation on our debt could result in our becoming more highly leveraged. Our governing documents do not limit the amount of indebtedness we may incur. Accordingly, our Board of Directors may incur additional debt and would do so, for example, if it were necessary to maintain our status as a REIT. We might become more highly leveraged as a result, and our financial condition and cash available for distribution to stockholders might be negatively affected and the risk of default on our indebtedness could increase.

6

Other Risks

The market value of our common stock could decrease based on our performance and market perception and conditions. The market value of our common stock may be based primarily upon the market’s perception of our growth potential and current and future cash dividends and may be secondarily based upon the real estate market value of our underlying assets. The market price of our common stock is influenced by the dividend on our common stock relative to market interest rates. Rising interest rates may lead potential buyers of our common stock to expect a higher dividend rate, which would adversely affect the market price of our common stock. In addition, rising interest rates would result in increased expense, thereby adversely affecting cash flow and our ability to service our indebtedness and pay dividends.

The current economic situation may adversely affect our operating results and financial condition. The continuation or intensification of the turmoil in the global financial markets may have an adverse impact on the availability of credit to businesses generally and could lead to a further weakening of the U.S. and global economies. Currently these conditions have not impaired our ability to access credit markets and finance our operations. However, our ability to access the capital markets may be restricted at a time when we would like, or need, to raise financing, which could have an impact on our flexibility to react to changing economic and business conditions. Furthermore, deteriorating economic conditions including business layoffs, downsizing, industry slowdowns and other similar factors that affect our customers could continue to negatively impact commercial real estate fundamentals and result in lower occupancy, lower rental rates and declining values in our real estate portfolio and in the collateral securing any loan investments we may make. Additionally, the economic situation could have an impact on our lenders or customers, causing them to fail to meet their obligations to us. No assurances can be given that the effects of the current economic situation will not have a material adverse effect on our business, financial condition and results of operations.

We may fail to qualify as a REIT. If we fail to qualify as a REIT, we will not be allowed to deduct distributions to stockholders in computing our taxable income and will be subject to federal income tax, including any applicable alternative minimum tax, at regular corporate rates. In addition, we may be barred from qualification as a REIT for the four years following disqualification. The additional tax incurred at regular corporate rates would significantly reduce the cash flow available for distribution to stockholders and for debt service. Furthermore, we would no longer be required by the Internal Revenue Code to make any distributions to our stockholders as a condition of REIT qualification. Any distributions to stockholders would be taxable as ordinary income to the extent of our current and accumulated earnings and profits, although such dividend distributions would be subject to a top federal tax rate of 15% through 2012. Corporate distributees, however, may be eligible for the dividends received deduction on the distributions, subject to limitations under the Internal Revenue Code. To qualify as a REIT, we must comply with certain highly technical and complex requirements. We cannot be certain we have complied with these requirements because there are few judicial and administrative interpretations of these provisions. In addition, facts and circumstances that may be beyond our control may affect our ability to qualify as a REIT. We cannot assure you that new legislation, regulations, administrative interpretations or court decisions will not change the tax laws significantly with respect to our qualification as a REIT or with respect to the federal income tax consequences of qualification. We cannot assure you that we will remain qualified as a REIT.

There is a risk of changes in the tax law applicable to real estate investment trusts. Since the Internal Revenue Service, the United States Treasury Department and Congress frequently review federal income tax legislation, we cannot predict whether, when or to what extent new federal tax laws, regulations, interpretations or rulings will be adopted. Any of such legislative action may prospectively or retroactively modify our tax treatment and, therefore, may adversely affect taxation of us and/or our investors.

We face possible adverse changes in tax laws. From time to time, changes in state and local tax laws or regulations are enacted which may result in an increase in our tax liability. A shortfall in tax revenues for states and municipalities in which we operate may lead to an increase in the frequency and size of such changes. If such changes occur, we may be required to pay additional taxes on our assets or income. These increased tax costs could adversely affect our financial condition, results of operations, and the amount of cash available for the payment of dividends.

Our Charter contains provisions that may adversely affect the value of EastGroup stock. Our charter prohibits any holder from acquiring more than 9.8% (in value or in number, whichever is more restrictive) of our outstanding equity stock (defined as all of our classes of capital stock, except our excess stock (of which there is none outstanding)) unless our Board of Directors grants a waiver. The ownership limit may limit the opportunity for stockholders to receive a premium for their shares of common stock that might otherwise exist if an investor were attempting to assemble a block of shares in excess of 9.8% of the outstanding shares of equity stock or otherwise effect a change in control. Also, the request of the holders of a majority or more of our common stock is necessary for stockholders to call a special meeting. We also require advance notice by stockholders for the nomination of directors or the proposal of business to be considered at a meeting of stockholders.

7

The Company faces risks in attracting and retaining key personnel. Many of our senior executives have strong industry reputations, which aid us in identifying acquisition and development opportunities and negotiating with tenants and sellers of properties. The loss of the services of these key personnel could affect our operations because of diminished relationships with existing and prospective tenants, property sellers and industry personnel. In addition, attracting new or replacement personnel may be difficult in a competitive market.

We have severance and change in control agreements with certain of our officers that may deter changes in control of the Company. If, within a certain time period (as set in the officer’s agreement) following a change in control, we terminate the officer's employment other than for cause, or if the officer elects to terminate his or her employment with us for reasons specified in the agreement, we will make a severance payment equal to the officer's average annual compensation times an amount specified in the officer's agreement, together with the officer's base salary and vacation pay that have accrued but are unpaid through the date of termination. These agreements may deter a change in control because of the increased cost for a third party to acquire control of us.

Our Board of Directors may authorize and issue securities without stockholder approval. Under our Charter, the Board has the power to classify and reclassify any of our unissued shares of capital stock into shares of capital stock with such preferences, rights, powers and restrictions as the Board of Directors may determine. The authorization and issuance of a new class of capital stock could have the effect of delaying or preventing someone from taking control of us, even if a change in control were in our stockholders' best interests.

Maryland business statutes may limit the ability of a third party to acquire control of us. Maryland law provides protection for Maryland corporations against unsolicited takeovers by limiting, among other things, the duties of the directors in unsolicited takeover situations. The duties of directors of Maryland corporations do not require them to (a) accept, recommend or respond to any proposal by a person seeking to acquire control of the corporation, (b) authorize the corporation to redeem any rights under, or modify or render inapplicable, any stockholders rights plan, (c) make a determination under the Maryland Business Combination Act or the Maryland Control Share Acquisition Act, or (d) act or fail to act solely because of the effect of the act or failure to act may have on an acquisition or potential acquisition of control of the corporation or the amount or type of consideration that may be offered or paid to the stockholders in an acquisition. Moreover, under Maryland law the act of a director of a Maryland corporation relating to or affecting an acquisition or potential acquisition of control is not subject to any higher duty or greater scrutiny than is applied to any other act of a director. Maryland law also contains a statutory presumption that an act of a director of a Maryland corporation satisfies the applicable standards of conduct for directors under Maryland law.

The Maryland Business Combination Act provides that unless exempted, a Maryland corporation may not engage in business combinations, including mergers, dispositions of 10 percent or more of its assets, certain issuances of shares of stock and other specified transactions, with an "interested stockholder" or an affiliate of an interested stockholder for five years after the most recent date on which the interested stockholder became an interested stockholder, and thereafter unless specified criteria are met. An interested stockholder is generally a person owning or controlling, directly or indirectly, 10 percent or more of the voting power of the outstanding stock of the Maryland corporation.

The Maryland Control Share Acquisition Act provides that "control shares" of a corporation acquired in a "control share acquisition" shall have no voting rights except to the extent approved by a vote of two-thirds of the votes eligible to cast on the matter. "Control Shares" means shares of stock that, if aggregated with all other shares of stock previously acquired by the acquirer, would entitle the acquirer to exercise voting power in electing directors within one of the following ranges of the voting power: one-tenth or more but less than one-third, one-third or more but less than a majority or a majority or more of all voting power. A "control share acquisition" means the acquisition of control shares, subject to certain exceptions.

If voting rights of control shares acquired in a control share acquisition are not approved at a stockholders' meeting, then subject to certain conditions and limitations, the issuer may redeem any or all of the control shares for fair value. If voting rights of such control shares are approved at a stockholders' meeting and the acquirer becomes entitled to vote a majority of the shares of stock entitled to vote, all other stockholders may exercise appraisal rights.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

None.

8

ITEM 2. PROPERTIES.

EastGroup owned 247 industrial properties and one office building at December 31, 2010. These properties are located primarily in the Sunbelt states of Florida, Texas, Arizona and California, and the majority are clustered around major transportation features in supply constrained submarkets. As of February 24, 2011, EastGroup’s portfolio was 90.9% leased and 89.7% occupied. The Company has developed approximately 32% of its total portfolio, including real estate properties and development properties in lease-up and under construction. The Company’s focus is the ownership of business distribution space (76% of the total portfolio) with the remainder in bulk distribution space (19%) and business service space (5%). Business distribution space properties are typically multi-tenant buildings with a building depth of 200 feet or less, clear height of 20-24 feet, office finish of 10-25% and truck courts with a depth of 100-120 feet. See Consolidated Financial Statement Schedule III – Real Estate Properties and Accumulated Depreciation for a detailed listing of the Company’s properties.

At December 31, 2010, EastGroup did not own any single property that was 10% or more of total book value or 10% or more of total gross revenues.

ITEM 3. LEGAL PROCEEDINGS.

The Company is not presently involved in any material litigation nor, to its knowledge, is any material litigation threatened against the Company or its properties, other than routine litigation arising in the ordinary course of business or which is expected to be covered by the Company’s liability insurance.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

None.

PART II. OTHER INFORMATION

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

The Company’s shares of common stock are listed for trading on the New York Stock Exchange under the symbol “EGP.” The following table shows the high and low share prices for each quarter reported by the New York Stock Exchange during the past two years and the per share distributions paid for each quarter.

Shares of Common Stock Market Prices and Dividends

|

Calendar Year 2010

|

Calendar Year 2009

|

|||||||||||||||||||||||

|

Quarter

|

High

|

Low

|

Distributions

|

High

|

Low

|

Distributions

|

||||||||||||||||||

|

First

|

$ | 39.09 | 33.65 | $ | .52 | $ | 34.93 | 21.14 | $ | .52 | ||||||||||||||

|

Second

|

42.02 | 35.44 | .52 | 36.26 | 27.70 | .52 | ||||||||||||||||||

|

Third

|

37.97 | 33.39 | .52 | 40.59 | 31.85 | .52 | ||||||||||||||||||

|

Fourth

|

43.05 | 37.50 | .52 | 40.54 | 35.45 | .52 | ||||||||||||||||||

| $ | 2.08 | $ | 2.08 | |||||||||||||||||||||

As of February 24, 2011, there were 701 holders of record of the Company’s 26,972,262 outstanding shares of common stock. The Company distributed all of its 2010 and 2009 taxable income to its stockholders. Accordingly, no provision for income taxes was necessary. The following table summarizes the federal income tax treatment for all distributions by the Company for the years 2010 and 2009.

Federal Income Tax Treatment of Share Distributions

|

Years Ended December 31,

|

||||||||

|

2010

|

2009

|

|||||||

|

Common Share Distributions:

|

||||||||

|

Ordinary income

|

$ | 1.4775 | 1.7534 | |||||

|

Return of capital

|

.6025 | .3266 | ||||||

|

Total Common Distributions

|

$ | 2.0800 | 2.0800 | |||||

Securities Authorized For Issuance Under Equity Compensation Plans

See Item 12 of this Annual Report on Form 10-K, “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters,” for certain information regarding the Company’s equity compensation plans.

9

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

|

Period

|

Total Number

of Shares Purchased

|

Average Price Paid Per Share

|

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs

|

Maximum Number of Shares That May Yet Be Purchased Under the Plans or Programs

|

||||||||||||

|

10/01/10 thru 10/31/10

|

– | $ | – | – | 672,300 | |||||||||||

|

11/01/10 thru 11/30/10

|

– | – | – | 672,300 | ||||||||||||

|

12/01/10 thru 12/31/10

|

10,174 | (1) | 42.59 | – | 672,300 | (2) | ||||||||||

|

Total

|

10,174 | $ | 42.59 | – | ||||||||||||

|

(1)

|

As permitted under the Company's equity compensation plans, these shares were withheld by the Company to satisfy the tax withholding obligations for those employees who elected this option in connection with the vesting of shares of restricted stock. Shares withheld for tax withholding obligations do not affect the total number of remaining shares available for repurchase under the Company’s common stock repurchase plan.

|

|

(2)

|

EastGroup's Board of Directors has authorized the repurchase of up to 1,500,000 shares of its outstanding common stock. The shares may be purchased from time to time in the open market or in privately negotiated transactions. Under the common stock repurchase plan, the Company has purchased a total of 827,700 shares for $14,170,000 (an average of $17.12 per share) with 672,300 shares still authorized for repurchase. The Company has not repurchased any shares under this plan since 2000.

|

10

Performance Graph

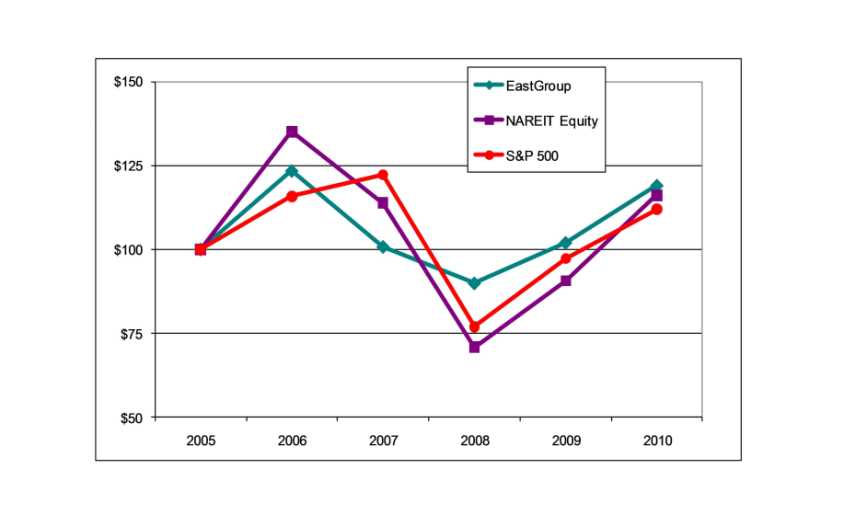

The following graph compares, over the five years ended December 31, 2010, the cumulative total shareholder return on EastGroup’s common stock with the cumulative total return of the Standard & Poor’s 500 Index (S&P 500) and the Equity REIT index prepared by the National Association of Real Estate Investment Trusts (NAREIT Equity).

The performance graph and related information shall not be deemed “soliciting material” or be deemed to be “filed” with the SEC, nor shall such information be incorporated by reference into any future filing, except to the extent that the Company specifically incorporates it by reference into such filing.

|

Fiscal years ended December 31,

|

||||||||||||||||||||||||

|

2005

|

2006

|

2007

|

2008

|

2009

|

2010

|

|||||||||||||||||||

|

EastGroup

|

$ | 100.00 | 123.39 | 100.76 | 89.90 | 101.97 | 119.01 | |||||||||||||||||

|

NAREIT Equity

|

100.00 | 135.06 | 113.87 | 70.91 | 90.76 | 116.13 | ||||||||||||||||||

|

S&P 500

|

100.00 | 115.79 | 122.15 | 76.95 | 97.31 | 111.96 | ||||||||||||||||||

The information above assumes that the value of the investment in shares of EastGroup’s common stock and each index was $100 on December 31, 2005, and that all dividends were reinvested.

11

ITEM 6. SELECTED FINANCIAL DATA.

The following table sets forth selected consolidated financial data for the Company derived from the audited consolidated financial statements and should be read in conjunction with the consolidated financial statements and notes thereto included elsewhere in this report.

|

Years Ended December 31,

|

||||||||||||||||||||

|

2010

|

2009

|

2008

|

2007

|

2006

|

||||||||||||||||

|

OPERATING DATA

|

(In thousands, except per share data)

|

|||||||||||||||||||

|

Revenues

|

||||||||||||||||||||

|

Income from real estate operations

|

$ | 173,002 | 172,273 | 168,255 | 150,038 | 132,394 | ||||||||||||||

|

Other income

|

124 | 81 | 248 | 92 | 182 | |||||||||||||||

| 173,126 | 172,354 | 168,503 | 150,130 | 132,576 | ||||||||||||||||

|

Expenses

|

||||||||||||||||||||

|

Expenses from real estate operations

|

51,142 | 50,259 | 47,259 | 40,837 | 36,909 | |||||||||||||||

|

Depreciation and amortization

|

58,350 | 53,953 | 51,144 | 47,644 | 41,108 | |||||||||||||||

|

General and administrative

|

10,332 | 9,071 | 8,547 | 8,295 | 7,401 | |||||||||||||||

| 119,824 | 113,283 | 106,950 | 96,776 | 85,418 | ||||||||||||||||

|

Operating income

|

53,302 | 59,071 | 61,553 | 53,354 | 47,158 | |||||||||||||||

|

Other income (expense)

|

||||||||||||||||||||

|

Equity in earnings of unconsolidated investment

|

335 | 320 | 316 | 285 | 287 | |||||||||||||||

|

Gain on sales of non-operating real estate

|

37 | 31 | 321 | 2,602 | 123 | |||||||||||||||

|

Gain on sales of securities

|

– | – | 435 | – | – | |||||||||||||||

|

Other expense

|

(84 | ) | – | – | – | – | ||||||||||||||

|

Interest income

|

336 | 302 | 293 | 306 | 142 | |||||||||||||||

|

Interest expense

|

(35,171 | ) | (32,520 | ) | (30,192 | ) | (27,314 | ) | (24,616 | ) | ||||||||||

|

Income from continuing operations

|

18,755 | 27,204 | 32,726 | 29,233 | 23,094 | |||||||||||||||

|

Discontinued operations

|

||||||||||||||||||||

|

Income (loss) from real estate operations

|

– | (139 | ) | 10 | 150 | 1,013 | ||||||||||||||

|

Gain on sales of real estate investments

|

– | 29 | 2,032 | 960 | 5,727 | |||||||||||||||

|

Income (loss) from discontinued operations

|

– | (110 | ) | 2,042 | 1,110 | 6,740 | ||||||||||||||

|

Net income

|

18,755 | 27,094 | 34,768 | 30,343 | 29,834 | |||||||||||||||

|

Net income attributable to noncontrolling interest

in joint ventures

|

(430 | ) | (435 | ) | (626 | ) | (609 | ) | (600 | ) | ||||||||||

|

Net income attributable to EastGroup Properties, Inc.

|

18,325 | 26,659 | 34,142 | 29,734 | 29,234 | |||||||||||||||

|

Dividends on Series D preferred shares

|

– | – | 1,326 | 2,624 | 2,624 | |||||||||||||||

|

Costs on redemption of Series D preferred shares

|

– | – | 682 | – | – | |||||||||||||||

|

Net income available to EastGroup Properties, Inc.

common stockholders

|

$ | 18,325 | 26,659 | 32,134 | 27,110 | 26,610 | ||||||||||||||

|

BASIC PER COMMON SHARE DATA FOR INCOME AVAILABLE TO EASTGROUP PROPERTIES, INC. COMMON STOCKHOLDERS

|

||||||||||||||||||||

|

Income from continuing operations

|

$ | .68 | 1.04 | 1.23 | 1.10 | .89 | ||||||||||||||

|

Income (loss) from discontinued operations

|

.00 | .00 | .08 | .05 | .30 | |||||||||||||||

|

Net income available to common stockholders

|

$ | .68 | 1.04 | 1.31 | 1.15 | 1.19 | ||||||||||||||

|

Weighted average shares outstanding

|

26,752 | 25,590 | 24,503 | 23,562 | 22,372 | |||||||||||||||

|

DILUTED PER COMMON SHARE DATA FOR INCOME AVAILABLE TO EASTGROUP PROPERTIES, INC. COMMON STOCKHOLDERS

|

||||||||||||||||||||

|

Income from continuing operations

|

$ | .68 | 1.04 | 1.22 | 1.09 | .87 | ||||||||||||||

|

Income (loss) from discontinued operations

|

.00 | .00 | .08 | .05 | .30 | |||||||||||||||

|

Net income available to common stockholders

|

$ | .68 | 1.04 | 1.30 | 1.14 | 1.17 | ||||||||||||||

|

Weighted average shares outstanding

|

26,824 | 25,690 | 24,653 | 23,781 | 22,692 | |||||||||||||||

|

AMOUNTS AVAILABLE TO EASTGROUP PROPERTIES, INC. COMMON STOCKHOLDERS

|

||||||||||||||||||||

|

Income from continuing operations

|

$ | 18,325 | 26,769 | 30,092 | 26,000 | 19,870 | ||||||||||||||

|

Income (loss) from discontinued operations

|

– | (110 | ) | 2,042 | 1,110 | 6,740 | ||||||||||||||

|

Net income available to common stockholders

|

$ | 18,325 | 26,659 | 32,134 | 27,110 | 26,610 | ||||||||||||||

|

OTHER PER SHARE DATA

|

||||||||||||||||||||

|

Book value, at end of year

|

$ | 15.16 | 16.57 | 16.39 | 15.51 | 16.28 | ||||||||||||||

|

Common distributions declared

|

2.08 | 2.08 | 2.08 | 2.00 | 1.96 | |||||||||||||||

|

Common distributions paid

|

2.08 | 2.08 | 2.08 | 2.00 | 1.96 | |||||||||||||||

|

BALANCE SHEET DATA (AT END OF YEAR)

|

||||||||||||||||||||

|

Real estate investments, at cost(1)

|

$ | 1,528,048 | 1,475,062 | 1,409,476 | 1,270,691 | 1,091,653 | ||||||||||||||

|

Real estate investments, net of accumulated depreciation(1)

|

1,124,861 | 1,120,317 | 1,099,125 | 1,001,559 | 860,547 | |||||||||||||||

|

Total assets

|

1,183,276 | 1,178,518 | 1,156,205 | 1,055,833 | 911,787 | |||||||||||||||

|

Mortgage and bank loans payable

|

735,718 | 692,105 | 695,692 | 600,804 | 446,506 | |||||||||||||||

|

Total liabilities

|

771,770 | 731,422 | 742,829 | 651,136 | 490,842 | |||||||||||||||

|

Noncontrolling interest in joint ventures

|

2,650 | 2,577 | 2,536 | 2,312 | 2,148 | |||||||||||||||

|

Total stockholders’ equity

|

408,856 | 444,519 | 410,840 | 402,385 | 418,797 | |||||||||||||||

|

(1) Includes mortgage loans receivable. See Notes 4 and 5 in the Notes to Consolidated Financial Statements.

|

||||||||||||||||||||

12

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

OVERVIEW

EastGroup’s goal is to maximize shareholder value by being a leading provider in its markets of functional, flexible, and quality business distribution space for location sensitive tenants primarily in the 5,000 to 50,000 square foot range. The Company acquires, develops and operates distribution facilities, the majority of which are clustered around major transportation features in supply constrained submarkets in major Sunbelt regions with an emphasis in the states of Florida, Texas, Arizona and California.

The Company believes the slowdown in the economy has affected and will continue to affect its operations. The Company has experienced decreases in occupancy and rental rates. The current economic situation is also impacting lenders, making it more difficult to obtain financing. Loan proceeds as a percentage of property values have decreased, and property values have decreased. The Company believes its current lines of credit provide the capacity to fund the operations of the Company for 2011 and 2012. The Company also believes it can issue common and/or preferred equity and obtain mortgage financing from insurance companies and financial institutions as evidenced by the closing of a $74 million, non-recourse mortgage loan in December 2010, which is described in Liquidity and Capital Resources.

The Company’s primary revenue is rental income; as such, EastGroup’s greatest challenge is leasing space. During 2010, leases expired on 5,733,000 square feet (20.4%) of EastGroup’s total square footage of 28,085,000, and the Company was successful in renewing or re-leasing 77% of the expiring square feet. In addition, EastGroup leased 2,706,000 square feet of other vacant space during the year. During 2010, average rental rates on new and renewal leases decreased by 12.3%. Property net operating income (PNOI) from same properties decreased 4.2% for 2010 as compared to 2009.

EastGroup’s total leased percentage was 90.8% at December 31, 2010 compared to 90.0% at December 31, 2009. Leases scheduled to expire in 2011 were 12.6% of the portfolio on a square foot basis at December 31, 2010. As of February 24, 2011, leases scheduled to expire in 2011 were 9.6% of the portfolio on a square foot basis.

The Company generates new sources of leasing revenue through its acquisition and development programs. During 2010, EastGroup purchased three business distribution complexes with a total of six buildings (499,000 square feet) and 2.1 acres of land for a total of $23.9 million. The operating properties are located in San Diego (274,000 square feet), Charlotte (193,000 square feet), and Phoenix (32,000 square feet). The small tract of land is located adjacent to an existing property in Tucson and provides additional parking and trailer storage for the property.

EastGroup continues to see targeted development as a contributor to the Company’s long-term growth. The Company mitigates risks associated with development through a Board-approved maximum level of land held for development and by adjusting development start dates according to leasing activity. EastGroup’s development activity has slowed considerably as a result of current market conditions. The Company had two development starts in 2010: a 20,000 square foot pre-leased expansion project in San Antonio and a 44,000 square foot partially pre-leased service center in Houston. During 2010, the Company transferred five properties (426,000 square feet) with aggregate costs of $30.5 million at the date of transfer from development to real estate properties. These properties, which were collectively 66.3% leased as of February 24, 2011, are located in Tucson, Arizona; Houston, Texas; and Tampa and West Palm Beach, Florida.

During 2010, the Company funded its acquisition and development programs through its $225 million lines of credit (as discussed in Liquidity and Capital Resources). As market conditions permit, EastGroup issues equity, including preferred equity, and/or employs fixed-rate debt to replace short-term bank borrowings.

EastGroup has one reportable segment – industrial properties. These properties are primarily located in major Sunbelt regions of the United States, have similar economic characteristics and also meet the other criteria that permit the properties to be aggregated into one reportable segment. The Company’s chief decision makers use two primary measures of operating results in making decisions: (1) property net operating income (PNOI), defined as income from real estate operations less property operating expenses (before interest expense and depreciation and amortization), and (2) funds from operations available to common stockholders (FFO), defined as net income (loss) attributable to common stockholders computed in accordance with U.S. generally accepted accounting principles (GAAP), excluding gains or losses from sales of depreciable real estate property, plus real estate related depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. The Company calculates FFO based on the National Association of Real Estate Investment Trusts’ (NAREIT) definition.

13

PNOI is a supplemental industry reporting measurement used to evaluate the performance of the Company’s real estate investments. The Company believes the exclusion of depreciation and amortization in the industry’s calculation of PNOI provides a supplemental indicator of the properties’ performance since real estate values have historically risen or fallen with market conditions. PNOI as calculated by the Company may not be comparable to similarly titled but differently calculated measures for other real estate investment trusts (REITs). The major factors influencing PNOI are occupancy levels, acquisitions and sales, development properties that achieve stabilized operations, rental rate increases or decreases, and the recoverability of operating expenses. The Company’s success depends largely upon its ability to lease space and to recover from tenants the operating costs associated with those leases.

PNOI is comprised of Income from real estate operations, less Expenses from real estate operations. PNOI was calculated as follows for the three fiscal years ended December 31, 2010, 2009 and 2008.

|

Years Ended December 31,

|

||||||||||||

|

2010

|

2009

|

2008

|

||||||||||

|

(In thousands)

|

||||||||||||

|

Income from real estate operations

|

$ | 173,002 | 172,273 | 168,255 | ||||||||

|

Expenses from real estate operations

|

(51,142 | ) | (50,259 | ) | (47,259 | ) | ||||||

|

PROPERTY NET OPERATING INCOME

|

$ | 121,860 | 122,014 | 120,996 | ||||||||

Income from real estate operations is comprised of rental income, pass-through income and other real estate income including lease termination fees. Expenses from real estate operations are comprised of property taxes, insurance, utilities, repair and maintenance expenses, management fees, other operating costs and bad debt expense. Generally, the Company’s most significant operating expenses are property taxes and insurance. Tenant leases may be net leases in which the total operating expenses are recoverable, modified gross leases in which some of the operating expenses are recoverable, or gross leases in which no expenses are recoverable (gross leases represent only a small portion of the Company’s total leases). Increases in property operating expenses are fully recoverable under net leases and recoverable to a high degree under modified gross leases. Modified gross leases often include base year amounts and expense increases over these amounts are recoverable. The Company’s exposure to property operating expenses is primarily due to vacancies and leases for occupied space that limit the amount of expenses that can be recovered.

The following table presents reconciliations of Net Income to PNOI for the three fiscal years ended December 31, 2010, 2009 and 2008.

|

Years Ended December 31,

|

||||||||||||

|

2010

|

2009

|

2008

|

||||||||||

|

(In thousands)

|

||||||||||||

|

NET INCOME

|

$ | 18,755 | 27,094 | 34,768 | ||||||||

|

Equity in earnings of unconsolidated investment

|

(335 | ) | (320 | ) | (316 | ) | ||||||

|

Interest income

|

(336 | ) | (302 | ) | (293 | ) | ||||||

|

Other income

|

(124 | ) | (81 | ) | (248 | ) | ||||||

|

Gain on sales of securities

|

– | – | (435 | ) | ||||||||

|

Gain on sales of non-operating real estate

|

(37 | ) | (31 | ) | (321 | ) | ||||||

|

(Income) loss from discontinued operations

|

– | 110 | (2,042 | ) | ||||||||

|

Depreciation and amortization from continuing operations

|

58,350 | 53,953 | 51,144 | |||||||||

|

Interest expense

|

35,171 | 32,520 | 30,192 | |||||||||

|

General and administrative expense

|

10,332 | 9,071 | 8,547 | |||||||||

|

Other expense

|

84 | – | – | |||||||||

|

PROPERTY NET OPERATING INCOME

|

$ | 121,860 | 122,014 | 120,996 | ||||||||

The Company believes FFO is a meaningful supplemental measure of operating performance for equity REITs. The Company believes that excluding depreciation and amortization in the calculation of FFO is appropriate since real estate values have historically increased or decreased based on market conditions. FFO is not considered as an alternative to net income (determined in accordance with GAAP) as an indication of the Company’s financial performance, nor is it a measure of the Company’s liquidity or indicative of funds available to provide for the Company’s cash needs, including its ability to make distributions. In addition, FFO, as reported by the Company, may not be comparable to FFO by other REITs that do not define the term in accordance with the current NAREIT definition. The Company’s key drivers affecting FFO are changes in PNOI (as discussed above), interest rates, the amount of leverage the Company employs and general and administrative expense. The following table presents reconciliations of Net Income Available to EastGroup Properties, Inc. Common Stockholders to FFO for the three fiscal years ended December 31, 2010, 2009 and 2008.

14

|

Years Ended December 31,

|

||||||||||||

|

2010

|

2009

|

2008

|

||||||||||

|

(In thousands, except per share data)

|

||||||||||||

|

NET INCOME AVAILABLE TO EASTGROUP PROPERTIES, INC.

COMMON STOCKHOLDERS

|

$ | 18,325 | 26,659 | 32,134 | ||||||||

|

Depreciation and amortization from continuing operations

|

58,350 | 53,953 | 51,144 | |||||||||

|

Depreciation and amortization from discontinued operations

|

– | 51 | 148 | |||||||||

|

Depreciation from unconsolidated investment

|

132 | 132 | 132 | |||||||||

|

Noncontrolling interest depreciation and amortization

|

(210 | ) | (206 | ) | (201 | ) | ||||||

|

Gain on sales of depreciable real estate investments

|

– | (29 | ) | (2,032 | ) | |||||||

|

FUNDS FROM OPERATIONS (FFO) AVAILABLE TO

COMMON STOCKHOLDERS

|

$ | 76,597 | 80,560 | 81,325 | ||||||||

|

Net income available to common stockholders per diluted share

|

$ | .68 | 1.04 | 1.30 | ||||||||

|

Funds from operations available to common stockholders per diluted share

|

2.86 | 3.14 | 3.30 | |||||||||

|

Diluted shares for earnings per share and funds from operations

|

26,824 | 25,690 | 24,653 | |||||||||

The Company analyzes the following performance trends in evaluating the progress of the Company:

|

·

|

The FFO change per share represents the increase or decrease in FFO per share from the same quarter in the current year compared to the prior year. FFO per share for the fourth quarter of 2010 was $.71 per share compared with $.75 per share for the same period of 2009, a decrease of 5.3% per share. For the year 2010, FFO was $2.86 per share compared with $3.14 per share for 2009, a decrease of 8.9% per share.

|

FFO per share for both periods decreased primarily due to a decrease in same property operations and decreases in capitalized interest and capitalized development costs due to a slowdown in the Company’s development program. These decreases were partially offset by lower bad debt expense for the fourth quarter and the year. In addition, for the year, the Company’s termination fee income was higher in 2010 than in 2009.

|

·

|

Same property net operating income change represents the PNOI increase or decrease for the same operating properties owned during the entire current period and prior year reporting period. PNOI from same properties decreased 2.0% for the three months ended December 31, 2010. For the year 2010, PNOI from same properties decreased 4.2%.

|

|

·

|

Occupancy is the percentage of leased square footage for which the lease term has commenced as compared to the total leasable square footage as of the close of the reporting period. Occupancy at December 31, 2010 was 89.8%. Quarter-end occupancy ranged from 86.2% to 89.8% over the period from December 31, 2009 to December 31, 2010.

|

|

·

|

Rental rate change represents the rental rate increase or decrease on new and renewal leases compared to the prior leases on the same space. Rental rate decreases on new and renewal leases (5.6% of total square footage) averaged 15.7% for the fourth quarter of 2010. For the year, rental rate decreases on new and renewal leases (25.2% of total square footage) averaged 12.3%.

|

|

·

|

Termination fee income for the three months ended December 31, 2010, was $37,000 compared to $208,000 for the same period of 2009. For the year 2010, termination fee income was $2,853,000 compared to $963,000 for 2009. Bad debt expense for the three months ended December 31, 2010, was $202,000 compared to $473,000 for the same period of 2009. For the year 2010, bad debt expense was $1,035,000 compared to $2,101,000 for the same period last year.

|

15

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

The Company’s management considers the following accounting policies and estimates to be critical to the reported operations of the Company.

Real Estate Properties

The Company allocates the purchase price of acquired properties to net tangible and identified intangible assets based on their respective fair values. Goodwill is recorded when the purchase price exceeds the fair value of the assets and liabilities acquired. Factors considered by management in allocating the cost of the properties acquired include an estimate of carrying costs during the expected lease-up periods considering current market conditions and costs to execute similar leases. The allocation to tangible assets (land, building and improvements) is based upon management’s determination of the value of the property as if it were vacant using discounted cash flow models. The purchase price is also allocated among the following categories of intangible assets: the above or below market component of in-place leases, the value of in-place leases, and the value of customer relationships. The value allocable to the above or below market component of an acquired in-place lease is determined based upon the present value (using a discount rate which reflects the risks associated with the acquired leases) of the difference between (i) the contractual amounts to be paid pursuant to the lease over its remaining term and (ii) management’s estimate of the amounts that would be paid using fair market rates over the remaining term of the lease. The amounts allocated to above and below market leases are included in Other Assets and Other Liabilities, respectively, on the Consolidated Balance Sheets and are amortized to rental income over the remaining terms of the respective leases. The total amount of intangible assets is further allocated to in-place lease values and customer relationship values based upon management’s assessment of their respective values. These intangible assets are included in Other Assets on the Consolidated Balance Sheets and are amortized over the remaining term of the existing lease, or the anticipated life of the customer relationship, as applicable.

During the period in which a property is under development, costs associated with development (i.e., land, construction costs, interest expense, property taxes and other direct and indirect costs associated with development) are aggregated into the total capitalized costs of the property. Included in these costs are management’s estimates for the portions of internal costs (primarily personnel costs) that are deemed directly or indirectly related to such development activities.

The Company reviews its real estate investments for impairment of value whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. If any real estate investment is considered permanently impaired, a loss is recorded to reduce the carrying value of the property to its estimated fair value. Real estate assets to be sold are reported at the lower of the carrying amount or fair value less selling costs. The evaluation of real estate investments involves many subjective assumptions dependent upon future economic events that affect the ultimate value of the property. Currently, the Company’s management is not aware of any impairment issues nor has it experienced any significant impairment issues in recent years. EastGroup currently has the intent and ability to hold its real estate investments and to hold its land inventory for future development. In the event of impairment, the property’s basis would be reduced, and the impairment would be recognized as a current period charge on the Consolidated Statements of Income.

Valuation of Receivables

The Company is subject to tenant defaults and bankruptcies that could affect the collection of outstanding receivables. In order to mitigate these risks, the Company performs credit reviews and analyses on prospective tenants before significant leases are executed. On a quarterly basis, the Company evaluates outstanding receivables and estimates the allowance for doubtful accounts. Management specifically analyzes aged receivables, customer credit-worthiness, historical bad debts and current economic trends when evaluating the adequacy of the allowance for doubtful accounts. The Company believes its allowance for doubtful accounts is adequate for its outstanding receivables for the periods presented. In the event the allowance for doubtful accounts is insufficient for an account that is subsequently written off, additional bad debt expense would be recognized as a current period charge on the Consolidated Statements of Income.

Tax Status

EastGroup, a Maryland corporation, has qualified as a real estate investment trust under Sections 856-860 of the Internal Revenue Code and intends to continue to qualify as such. To maintain its status as a REIT, the Company is required to distribute at least 90% of its ordinary taxable income to its stockholders. The Company has the option of (i) reinvesting the sales price of properties sold through tax-deferred exchanges, allowing for a deferral of capital gains on the sale, (ii) paying out capital gains to the stockholders with no tax to the Company, or (iii) treating the capital gains as having been distributed to the stockholders, paying the tax on the gain deemed distributed and allocating the tax paid as a credit to the stockholders. The Company distributed all of its 2010, 2009 and 2008 taxable income to its stockholders. Accordingly, no provision for income taxes was necessary.

16

FINANCIAL CONDITION

EastGroup’s assets were $1,183,276,000 at December 31, 2010, an increase of $4,758,000 from December 31, 2009. Liabilities increased $40,348,000 to $771,770,000 and equity decreased $35,590,000 to $411,506,000 during the same period. The paragraphs that follow explain these changes in detail.

Assets

Real Estate Properties

Real estate properties increased $76,867,000 during the year ended December 31, 2010, primarily due to the purchase of the operating properties detailed below and the transfer of five properties from development, as detailed under Development below.

|

REAL ESTATE PROPERTIES ACQUIRED IN 2010

|

Location

|

Size

|

Date

Acquired

|

Cost (1)

|

|||||||

|

(Square feet)

|

(In thousands)

|

||||||||||

|

Commerce Park 2 & 3

|

Charlotte, NC

|

193,000 |

01/12/10

|

$ | 4,722 | ||||||

|

Ocean View Corporate Center

|

San Diego, CA

|

274,000 |

01/28/10

|

13,681 | |||||||

|

East University Distribution Center III

|

Phoenix, AZ

|

32,000 |

06/01/10

|

1,142 | |||||||

|

Total Acquisitions

|

499,000 | $ | 19,545 | ||||||||

|

(1)

|

Total cost of the properties acquired was $23,555,000, of which $19,545,000 was allocated to real estate properties as indicated above. Intangibles associated with the purchases of real estate were allocated as follows: $3,118,000 to in-place lease intangibles, $923,000 to above market leases (both included in Other Assets on the Consolidated Balance Sheets) and $31,000 to below market leases (included in Other Liabilities on the Consolidated Balance Sheets). All of these costs are amortized over the remaining lives of the associated leases in place at the time of acquisition. During 2010, the Company expensed acquisition-related costs of $72,000 in connection with the Commerce Park, Ocean View, and East University III acquisitions. During the fourth quarter of 2009, the Company expensed acquisition-related costs of $62,000 in connection with the Commerce Park and Ocean View acquisitions. These costs are included in General and Administrative Expenses on the Consolidated Statements of Income.

|

EastGroup also acquired 2.1 acres of land adjacent to its Country Club buildings in Tucson, Arizona, for $351,000. This land provides additional parking and trailer storage for the existing buildings.

The Company made capital improvements of $23,953,000 on existing and acquired properties (included in the Capital Expenditures table under Results of Operations). Also, the Company incurred costs of $2,563,000 on development properties subsequent to transfer to Real Estate Properties; the Company records these expenditures as development costs on the Consolidated Statements of Cash Flows during the 12-month period following transfer.

Development

EastGroup’s investment in development at December 31, 2010 consisted of properties under construction of $2,462,000 and prospective development (primarily land) of $71,260,000. The Company’s total investment in development at December 31, 2010 was $73,722,000 compared to $97,594,000 at December 31, 2009. Total capital invested for development during 2010 was $9,145,000, which consisted of costs of $6,081,000 and $501,000 as detailed in the development activity table below and costs of $2,563,000 on developments transferred to Real Estate Properties during the 12-month period following transfer.

17

The Company transferred five developments to Real Estate Properties during 2010 with a total investment of $30,454,000 as of the date of transfer.

|

Costs Incurred

|

||||||||||||||||||||

|

DEVELOPMENT

|

Size

|

Costs Transferred in 2010(1)

|

For the

Year Ended 12/31/10

|

Cumulative as of 12/31/10

|

Estimated

Total Costs(2)

|

|||||||||||||||

|

(Square feet)

|

(In thousands)

|

|||||||||||||||||||

|

UNDER CONSTRUCTION

|

||||||||||||||||||||

|

Arion 8 Expansion, San Antonio, TX

|

20,000 | $ | – | 1,356 | 1,407 | 1,900 | ||||||||||||||

|

World Houston 31, Houston, TX

|

44,000 | 973 | 82 | 1,055 | 4,600 | |||||||||||||||

|

Total Under Construction

|

64,000 | 973 | 1,438 | 2,462 | 6,500 | |||||||||||||||

|

PROSPECTIVE DEVELOPMENT (PRIMARILY LAND)

|

||||||||||||||||||||

|

Tucson, AZ

|