Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Bancorp, Inc. | d8k.htm |

Follow-On Offering of Common Stock

NASDAQ: TBBK

February / March 2011

Exhibit 99.1 |

1

Forward Looking Statements

Safe Harbor Regarding Forward-Looking Statements

This presentation may contain forward-looking information about The Bancorp,

Inc. (“the Company”) that is intended to be covered by

the

safe

harbor

for

forward-looking

statements

provided

by

the

Private

Securities

Litigation

Reform

Act

of

1995.

Actual

results

and trends could differ materially from those set forth in such statements due to

various risks, uncertainties and other factors. Such risks,

uncertainties and other factors that could cause actual results and experience to differ from those projected include, but are

not limited to, the following: ineffectiveness of the Company’s business

strategy due to changes in current or future market conditions;

the

effects

of

competition,

and

of

changes

in

laws

and

regulations,

including

industry

consolidation

and

development

of

competing financial products and services; interest rate movements; changes in

credit quality; volatilities in the securities markets; and deteriorating

economic conditions, and other risks and uncertainties, including those detailed in the Company’s filings with the

Securities and Exchange Commission. The statements are valid only as of the

date hereof and the Company disclaims any obligation to update this

information except as may be required by applicable law. Free Writing

Prospectus Statement The Company has filed a registration statement

(including a prospectus and a related prospectus supplement) with the SEC (File

No. 333-170613) for the offering to which this communication relates.

Before you invest, you should read the prospectus and the prospectus

supplement in that registration statement, the preliminary prospectus supplement and other documents that the

Company has filed with the SEC for more complete information about the Company and

the offering. You may obtain these documents

without

charge

by

visiting

EDGAR

on

the

SEC

website

at

www.sec.gov.

Alternatively,

copies

of

the

preliminary

prospectus supplement and the prospectus relating to the offering may be obtained

from UBS Securities LLC, 299 Park Avenue, New York, NY 10171, Attention:

Prospectus Department, (888) 827-7275, or Sandler O'Neill + Partners, L.P., 919 Third Avenue, 6th

Floor, New York, NY 10022, (866) 805-4128. |

2

Offering Summary

Issuer:

The Bancorp, Inc. (“The Bancorp”

or the "Company")

Ticker/Exchange:

TBBK / NASDAQ Global Select Market

Offering:

Follow-on Public Offering

Type of Security:

Common Stock

Transaction Size:

Approximately $50 million

Over-Allotment Option:

15%

Use of Proceeds:

General corporate purposes

Joint Book-Running Managers:

UBS Securities LLC

Sandler O’Neill + Partners, L.P.

Co-Manager:

Sterne, Agee & Leach, Inc. |

Offering Rationale:

–

Increase

tangible

common

equity

(TCE/TA¹

to

9.7%)

and

regulatory

capital

ratios

(TRBC¹

to

16.0%)

to

further

enable

balance sheet

growth and profitability enhancement through continued business line expansion and

organic growth opportunities Strategic Goal:

–

Create and grow a stable, profitable institution with the optimum reliance on

capital, risk management and technology, and manage it with knowledgeable

and experienced management and senior officers Tactical Approach:

–

Deposits –

Utilize a branchless banking network to gather scalable deposits through strong

contractual relationships at costs significantly below peers

–

Assets –

Focus on asset classes, including loans and securities, appropriate to our

expertise to deliver the requisite risk-adjusted returns to achieve

above-peer net interest margins –

Non-Interest

Income

–

Generate

non-interest

income,

through

our

deposit

and

asset

approaches,

sufficient

to

offset

non-interest

expenses

3

Planning for Growth with Safety and Soundness

(1) Assumes (i) net proceeds received in the offering of $47.0 million and (ii) new

assets risk-weighted at 20%; please reference non-GAAP reconciliation on page

25 for TCE/TA reconciliation |

4

Unprecedented Market Opportunity for Growth

The Bancorp is uniquely positioned to take advantage of recent industry trends,

regulatory changes, and competitor dislocation, all of which will enable

strong growth for The Bancorp and create a compelling use of capital in the

near and longer term Industry trends are from "paper to plastic",

"credit to debit", and "manual to electronic", all of which support The

Bancorp's continued strong growth and are unique strengths of The Bancorp's unique

market positioning Through The Bancorp's affinity relationships, the company

will continue to provide fee based services and aggregate low-cost

deposit bases as more financial services firms turn to partners with scale, strong regulatory

standing and compliance records, and niche experience

The Bancorp’s ability to leverage large affinity relationships for the

distribution of its products and services provides outsized forward growth

opportunity Recent

legislative

changes

will

push

larger

companies

to

partner

with

firms

like

The

Bancorp

to

protect

current

revenue

Because of these strong growth trends and favorable industry dynamics, The

Bancorp's competitive position has improved dramatically over the last

several years through enhanced scale, reputation, personnel and

capabilities |

5

Investment Highlights

Experienced senior management team with significant inside ownership of more than

13% and a track record of performance and shareholder returns at previous

institutions The Company has experienced considerable growth through

strategic initiatives and targeted acquisitions and is well-positioned

to further leverage its existing infrastructure to capitalize on

opportunities in its markets of operation

–

In 2010, The Bancorp’s deposits grew 22%

–

Low-cost, stable funding base through multi-channel deposit gathering

strategy in niche products Weighted

average

cost

of

deposits

of

0.58%

for

the

quarter

ended

December

31,

2010

Asset quality compares favorably to peers due to disciplined underwriting and

long-standing relationships with a significant percentage of the

Company's borrowers –

Community bank assets originated by experienced lenders in relatively stable

markets –

Non-accrual

loans

represent

0.94%

of

total

loans

at

12/31/2010,

compared

to

2.04%

for

regional

peers

(1)

Solid capital position and asset quality permits the Company to be on the offensive

and forward-thinking at a time when many competitors are forced to

operate in a reactionary manner (1) Publicly-traded Mid-Atlantic

commercial banks with assets between $1 billion and $4 billion as of December 31, 2010

Source: SNL Financial |

6

DEPOSITS

•

Private-Label Banking: stable, lower-cost core deposits

Healthcare

Merchant Processing

Prepaid Cards

Wealth Management

•

Community Bank

Net Interest Margin

INCOME

Non-Interest Income:

Stored value, leasing and

merchant processing

Business Model: A Distinct Business

Strategy A commercial bank founded in 2000 headquartered in Wilmington,

Delaware with approximately $2.4 billion in assets, $1.6 billion in

outstanding loan balances and $2.0 billion of deposits at 12/31/2010

Employs a primarily branchless deposit strategy that delivers a full array of

commercial and consumer banking services both locally and nationally through

private label banking products ASSETS

•

Above-peer credit quality, well-collateralized loans

to businesses and individuals in the Philadelphia/Wilmington

market area:

Commercial lending, commercial & residential

real estate, construction lending

•

Automobile Fleet Leasing

•

Wealth Management Lending:

Securities backed loans

•

SBA Guaranteed Lending Program for National Franchises

•

Securities Portfolio:

Primarily highly rated government obligations |

7

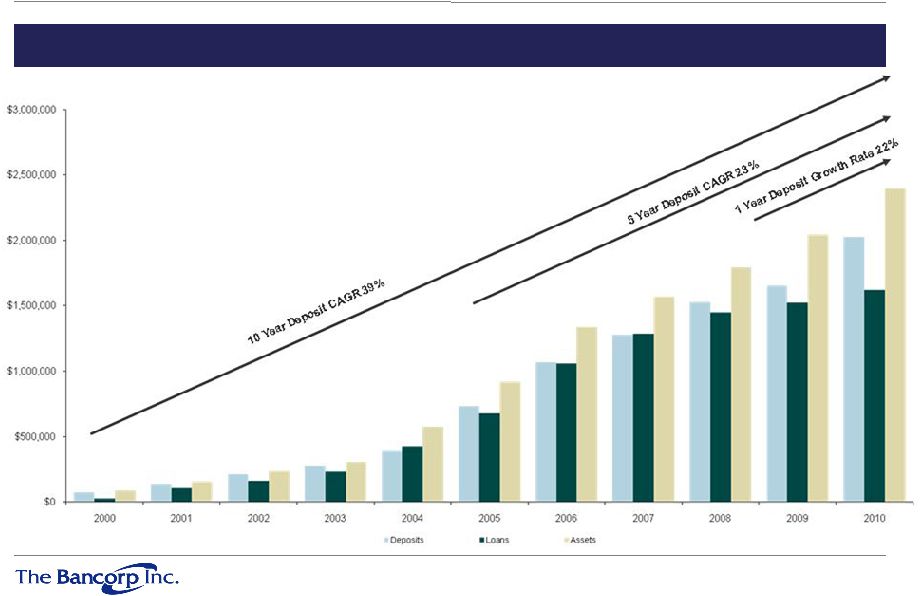

Track Record of Significant Growth Since Inception

Since 2005, The Bancorp has grown total assets at a compound annual growth rate of

over 20% |

8

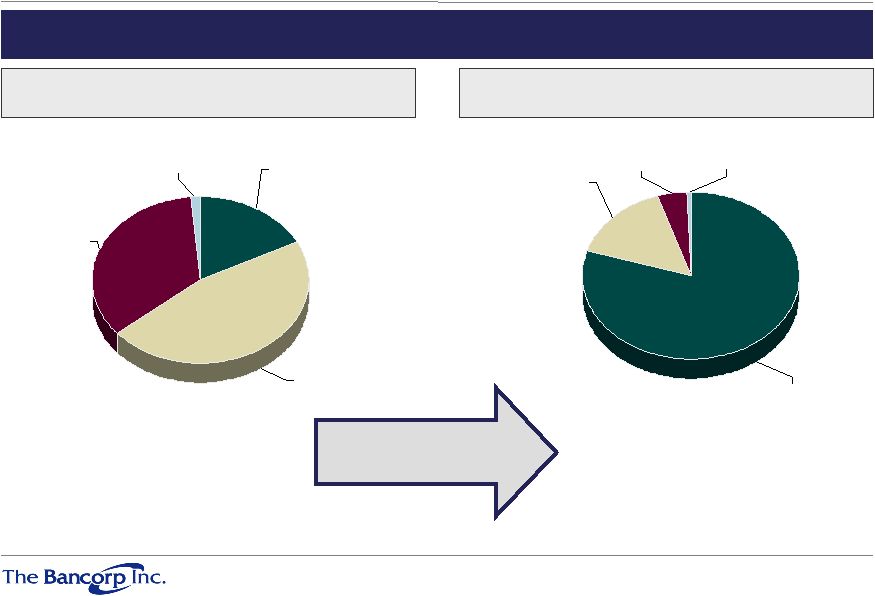

The

Bancorp

has

leveraged

its

private

label

partnerships

to

grow

core

deposits

meaningfully

in

recent

periods and expects that business to continue to grow through increased market

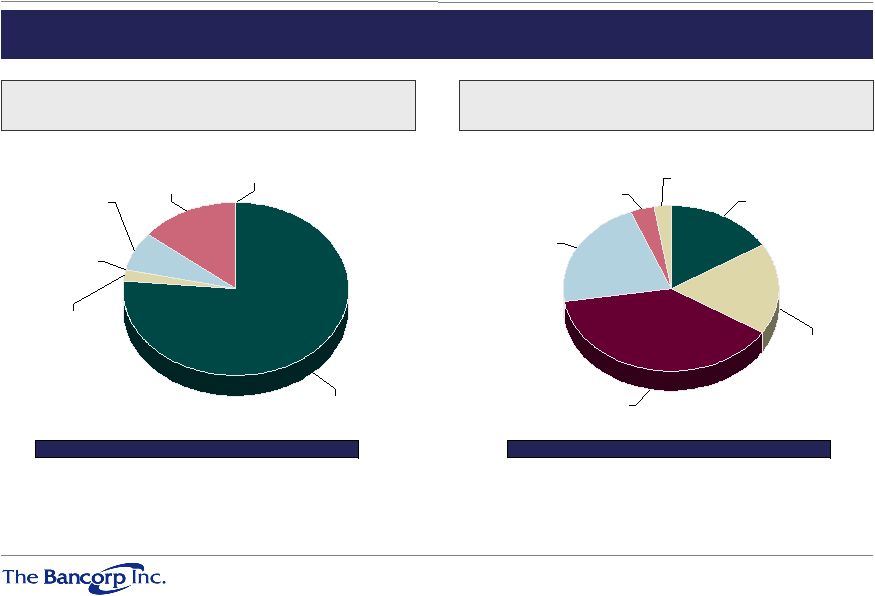

penetration December 31, 2005

December 31, 2010

Transaction

17.6%

MMDA &

Savings

46.3%

CDs < $100k

34.8%

CDs > $100k

1.3%

Transaction

79.7%

MMDA &

Savings

15.2%

CDs < $100k

4.5%

CDs > $100k

0.6%

Total Deposits: $0.732bn

YTD Average Cost: 2.43%

Peer¹

Average Cost: 1.67%

Total Deposits: $2.0bn

YTD Average Cost: 0.67%

Peer¹

Average Cost: 0.79%

34% CAGR of non-CD deposits

Significant reduction in average

cost of deposits

Growth Engine: Strong Growth in Deposit

Business Lines at Low Cost (1) Publicly-traded Mid-Atlantic

commercial banks with assets between $1 billion and $4 billion at December 31, 2010

Source: SNL Financial |

9

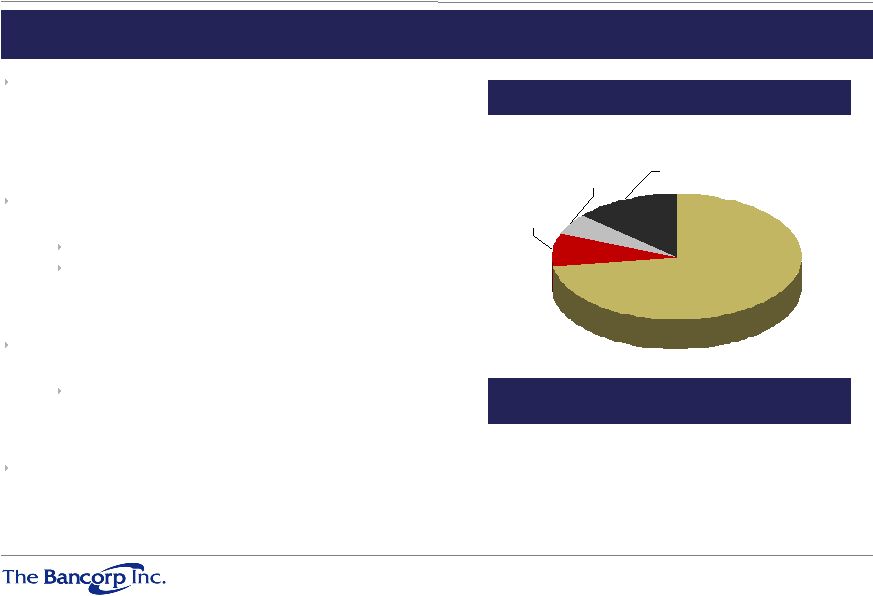

Significant growth in stored value, health care and other deposit business lines

support decreasing average cost of deposits

1031 Exchange,

0.0%

Community Bank,

76.4%

Stored Value,

0.0%

Wealth

Management,

7.1%

Health Care, 2.3%

Merchant

Processing,

14.2%

Growth Engine: Strong Growth in Deposit

Business Lines at Low Cost Stored Value

38.6%

Health Care

17.8%

Community

Bank

16.1%

1031

Exchange

2.5%

Merchant

Processing

3.7%

Wealth

Management

21.3%

December 31, 2005

December 31, 2010

Category

Balance

Average Cost

Community Bank

$559mm

2.32%

Merchant Processing

$104mm

2.29%

Wealth Management

$52mm

3.70%

Health Care

$17mm

2.21%

Stored Value

$0mm

NA

10/31 Exchange

$0mm

NA

Category

Balance

Average Cost

Stored Value

$781mm

0.11%

Wealth Management

$431mm

0.73%

Health Care

$360mm

1.12%

Community Bank

$327mm

0.58%

Merchant Processing

$75mm

0.41%

10/31 Exchange

$50mm

1.21% |

10

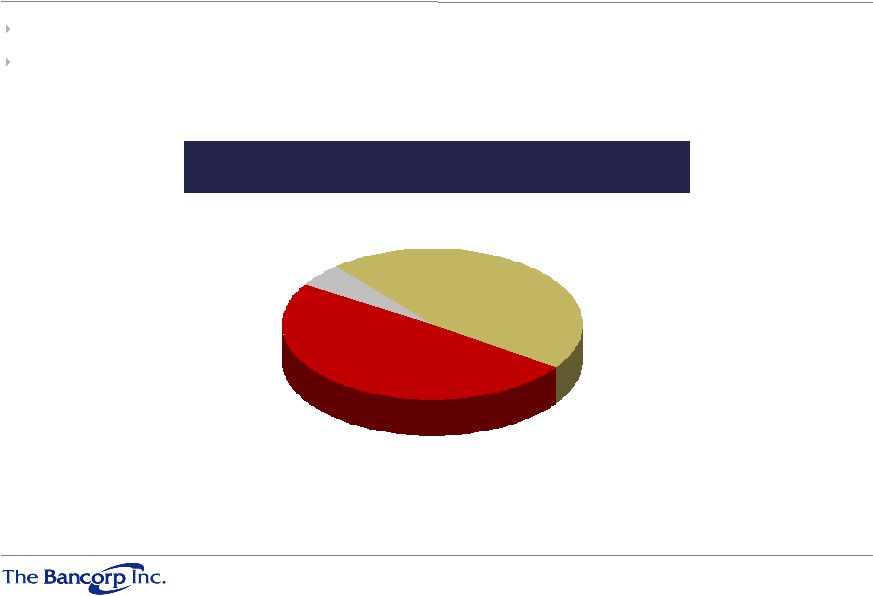

Deposit-Generating Strategies: Sticky

and Long-Term

3 < > 5

years

5%

1 < > 3

years

49%

< 1 year

46%

The Bancorp has long-term, often exclusive agreements in place with its

private-label banking partners We have retained 99% of maturing

contracts Private Label Agreements by Remaining Contractual Term

|

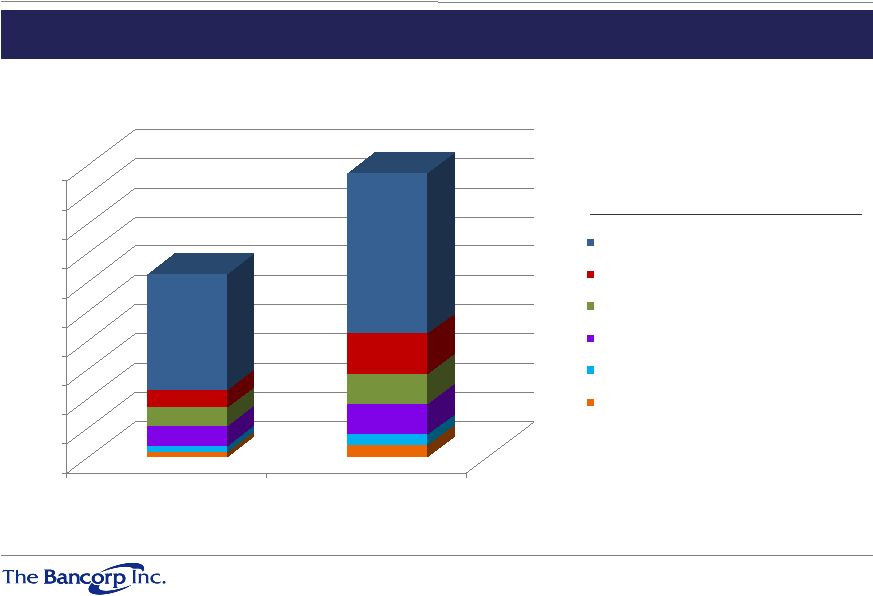

$0.0

$2.0

$4.0

$6.0

$8.0

$10.0

$12.0

$14.0

$16.0

$18.0

$20.0

2009

2010

Stored value income: 38%

Leasing income: 133%

Merchant income: 65%

Deposit Service fees: 56%

Debit card income: 48%

Other: 153%

11

Non-Interest Income-Generating Strategies: Growth and Sustainability

Continued

growth

in

non-interest

income

(1)

from

all

business

segments

(1)

Excludes

a

gain

of

$1.1

million

on

sale

of

investments

and

$2.2

million

of

securities

impairments

in

2009

and

a

$1.2

million

gain

on

sale

of

investments

and

$0.135 million of securities impairments in 2010

Year-over-Year Percentage Growth

Dollars in millions |

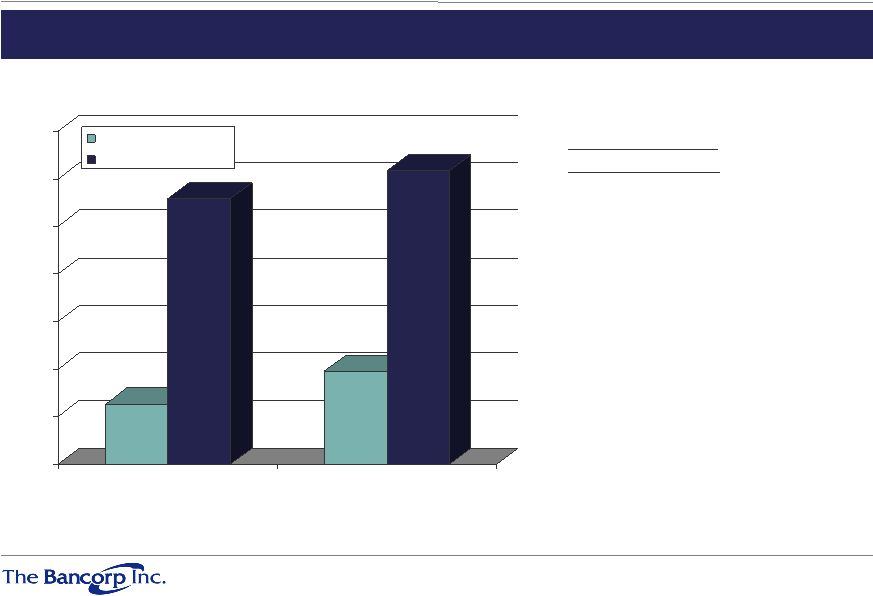

12

Non-Interest Income-Generating Strategies: Growth and Sustainability

Continued growth in non-interest income

(1)

relative to non-interest expense

$0.0

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

$70.0

2009

2010

Non-interest Income

Non-interest Expense

Non-interest Income /

Non-interest Expense

2009:

23%

2010:

32%

Dollars in millions

(1) Excludes a gain of $1.1 million on sale of investments and $2.2 million of

securities impairments in 2009 and a $1.2 million gain on sale of

investments and $0.135 million of securities impairments in 2010

|

13

Primary Asset-Generating Strategies:

Business Line Overview

Category

Balance

(in thousands)

Avg. Yield

Community Bank

$ 1,358,349

4.92%

Wealth Management

$ 157,471

3.36%

Leasing Portfolio

$ 103,289

8.93%

Investment Securities

$ 252,529

4.30%

Community

Bank

Lending

72.6%

Wealth

Management

Lending

8.4%

Leasing

Portfolio

5.5%

Investment

Securities

13.5%

December 31, 2010

Community Bank

–

Offers traditional community banking products and

services

targeting the highly fragmented Philadelphia/Wilmington

banking market

Leasing Portfolio

–

Well-collateralized automobile fleet leasing

Primarily Eastern United States

Average transaction: 8-15 automobiles, $350,000

–

50% of portfolio leased by state and federal agencies

Wealth Management

–

16 partners, managing $200 billion in assets

SEI Investments, Legg Mason

–

Generates securities-backed loans and other loans

Securities

–

High credit quality tax-exempt municipal obligations

–

U.S. Government agency securities

As with funding, The Bancorp employs a multi-channel growth strategy for loan

origination, with the primary driver being its regional commercial banking

operations |

14

Well-Positioned in Attractive, Stable Markets

Home Prices 3Q2007 to 3Q2010

Home Prices 3Q2009 to 3Q2010

United States

(1)

-24.7%

-1.5%

Philadelphia, PA

(1)

-8.4%

-1.0%

1st

Quarter 2010

US

NJ

DE

PA

% of Homes with Negative

Equity

(2)

22.5%

15.2%

13.3%

7.4%

Commercial lending is substantially all in greater Philadelphia/Wilmington

metropolitan area –

Consists of the 12 counties surrounding Philadelphia and Wilmington, including

Philadelphia, Delaware, Chester, Montgomery, Bucks and Lehigh Counties in

Pennsylvania; New Castle County in Delaware; and Mercer, Burlington, Camden, Ocean and

Cape May Counties in New Jersey

Philadelphia/Wilmington and the surrounding markets encompass a large population,

stable economic activity and attractive demographics

Throughout the current down cycle and in prior cycles, the Philadelphia region has

exhibited relative stability, which is reflected in a lesser reduction in

housing prices and negative equity compared to the rest of the nation, as

shown below (1) Fiserv, Inc., February 2011

(2) CoreLogic |

15

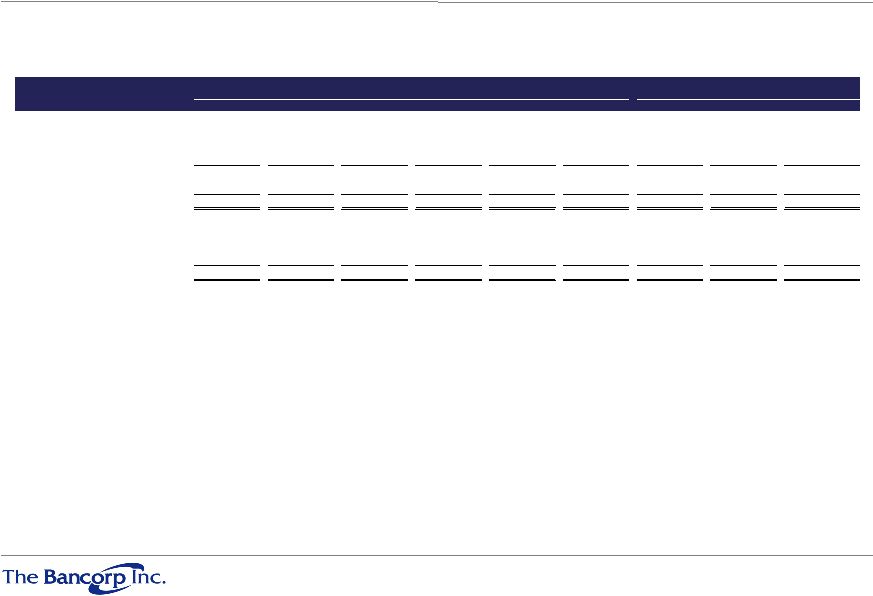

Historical Loan Portfolio Overview

Proven track record of originating high quality loans

–

Loan

/

Deposit

ratio

stands

at

approximately

80%

at

December

31,

2010

–

Non-accrual / Loans of 0.94% at December 31, 2010

(1) Loans balances exclude deferred loan costs

(2) Prior to December 31, 2007, construction loans were not broken out by category

Robust growth through strong community relationships, while maintaining

conservative underwriting standards

110,930

107,096

142,171

140,129

Construction: Commercial, Acquisition and

Development

26.1%

194,320

178,608

157,446

144,882

108,374

61,017

Security-Backed Loans and Other

29.9%

441,799

402,232

353,219

325,166

199,397

119,654

Commercial & Industrial

(Dollar Values in Thousands)

2005

2006

2007

2008

2009

2010

CAGR

Commercial Mortgage

190,153

327,639

369,124

488,986

569,434

580,780

25.0%

Construction

168,149

275,079

307,614

305,889

207,184

203,120

3.9%

Direct Financing Leases, Net

81,162

92,947

89,519

85,092

78,802

103,289

4.9%

Residential Mortgage

62,378

62,413

50,193

57,636

85,759

93,004

8.3%

Total Loans

(1)

682,513

1,065,849

1,286,498

1,448,268

1,522,019

1,616,312

18.8%

Supplemental loan data

(2)

Construction: 1-4 Family

167,485

163,718

100,088

92,190

Total Construction

307,614

305,889

207,184

203,120 |

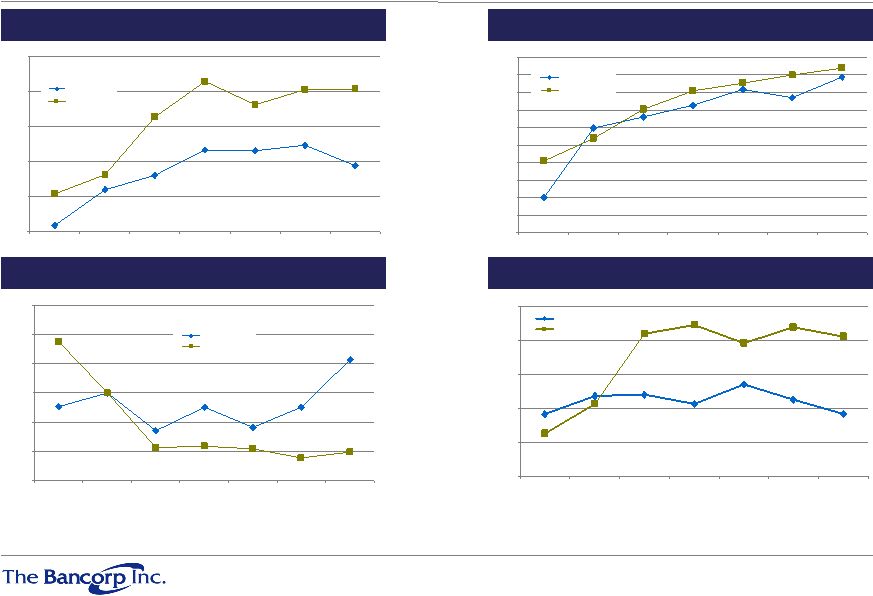

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

2007

2008

2009

Mar-10

Jun-10

Sep-10

Dec-10

TBBK

Regional Peers

0.60%

0.70%

0.80%

0.90%

1.00%

1.10%

1.20%

1.30%

1.40%

1.50%

1.60%

2007

2008

2009

Mar-10

Jun-10

Sep-10

Dec-10

TBBK

Regional Peers

40%

60%

80%

100%

120%

140%

160%

2007

2008

2009

Mar-10

Jun-10

Sep-10

Dec-10

TBBK

Regional Peers

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

2007

2008

2009

Mar-10

Jun-10

Sep-10

Dec-10

TBBK

Regional Peers

16

Asset Quality Review

Non-accrual Loans / Total Loans

(1)

Reserves / Gross Loans

(1)

Reserves / NPAs

(1)(2)

(1) Regional peers include publicly traded Mid-Atlantic commercial banks with

assets between $1 billion and $4 billion as of December 31, 2010; graphs represent median values

(2) NPAs

include non-accrual loans, loans 90+days past due, restructured loans and

OREO (3)

Texas

Ratio

=

(Non-accrual

Loans

+

Restructured

Loans

+

Loans

90+PD

+

OREO)

/

(Loan

Loss

Reserves

+

Tangible

Common

Equity)

Source: SNL Financial

Texas Ratio

(1)(3) |

17

Investment Highlights

Experienced senior management team with significant inside ownership of more than

13% and a track record of performance and shareholder returns at previous

institutions The Company has experienced considerable growth through

strategic initiatives and targeted acquisitions and is well-positioned

to further leverage its existing infrastructure to capitalize on

opportunities in its markets of operation

–

In 2010, The Bancorp’s deposits grew 22%

–

Low-cost, stable funding base through multi-channel deposit gathering

strategy in niche products Weighted

average

cost

of

deposits

of

0.58%

for

the

quarter

ended

December

31,

2010

Asset quality compares favorably to peers due to disciplined underwriting and

long-standing relationships with a significant percentage of the

Company's borrowers –

Community bank assets originated by experienced lenders in relatively stable

markets –

Non-accrual

loans

represent

0.94%

of

total

loans

at

12/31/2010,

compared

to

2.04%

for

regional

peers

(1)

Solid capital position and asset quality permits the Company to be on the offensive

and forward-thinking at a time when many competitors are forced to

operate in a reactionary manner (1) Publicly-traded Mid-Atlantic

commercial banks with assets between $1 billion and $4 billion as of December 31, 2010

Source: SNL Financial |

| Appendix

*

*

*

*

* |

19

Strong Senior Management Team with a Wealth of Experience

Highly experienced senior management team with an aggregate of over 140 years of

experience providing middle market banking services

–

Management

has

a

significant

history

together

as

most

are

former

executives

of

a

prior

bank

which

was

sold

in

November

1999

Inside ownership over 13% (fully diluted)

Executive

Title

Banking Experience

Betsy Z. Cohen (6% Ownership)

Chief Executive Officer, Chairman of Bancorp Bank

36 Years

Frank M. Mastrangelo

President & Chief Operating Officer

18 Years

Paul Frenkiel

Executive Vice President & Chief Financial Officer

20 Years

Donald F. McGraw, Jr

Executive Vice President & Chief Credit Officer

33 Years

Arthur M. Birenbaum

Executive Vice President, Commercial Lending

30 Years

Scott R. Megargee

Executive Vice President, Consumer Lending

26 Years

Peter Chiccino

Chief Information Officer

16 Years

Jeremy Kuiper

Managing Director (Stored Value Solutions)

16 Years |

20

Historical Financial Performance

12/31/2005

12/31/2006

12/31/2007

12/31/2008

12/31/2009

12/31/2010

6/30/2010

9/30/2010

12/31/2010

Balance Sheet ($000)

Total Assets

917,471

1,334,838

1,568,382

1,792,375

2,043,534

2,395,723

2,123,870

2,659,676

2,395,723

Total Net Loans

676,069

1,056,419

1,276,556

1,431,988

1,504,599

1,595,132

1,554,189

1,568,709

1,595,132

Total Deposits

732,588

1,069,255

1,278,317

1,525,362

1,654,509

2,024,097

1,881,607

2,422,387

2,024,097

Total Equity

134,947

148,908

176,259

180,403

245,203

198,906

203,778

201,432

198,906

Profitability (%)’

Net Income ($000)

7,447

12,500

14,340

(42,380)

4,102

5,222

407

588

2,041

ROAA

1.02

1.19

1.04

(2.49)

0.22

0.23

0.07

0.10

0.34

ROAE

5.69

8.90

9.15

(23.64)

1.99

2.45

0.76

1.15

4.01

Net Interest Margin

4.57

4.32

3.90

3.44

3.74

3.28

3.44

3.26

3.37

Efficiency Ratio

62.37

51.72

51.77

68.17

70.94

70.39

71.95

72.86

69.37

Balance Sheet Ratios/ Capital (%)’

Loans/ Deposits

92.93

99.59

100.66

95.36

92.10

80.00

83.79

65.66

80.00

Tangible Common Equity/ Tangible Assets

14.19

10.80

7.50

7.26

9.63

7.96

9.19

7.25

7.96

Tier 1 Ratio

17.94

13.50

10.15

11.72

15.81

11.99

12.82

12.25

11.99

Risk-based Capital Ratio

18.69

14.28

10.95

12.87

17.06

13.24

14.07

13.51

13.24

Leverage Ratio (Bank, BHC Only)

15.90

12.28

9.18

10.10

12.68

8.37

9.76

8.67

8.37

Asset Quality (%)’

Non-accrual Loans + Restructured Loans + OREO/ Assets

0.00

0.00

0.07

0.73

0.62

0.73

0.88

0.75

0.73

Loan Loss Reserves/ Gross Loans

0.81

0.79

0.80

1.20

1.26

1.49

1.42

1.37

1.49

Reserves/ Non-accrual Loans + OREO

NM

NM

875.28

130.25

150.23

138.19

119.75

109.73

138.19

For the Year Ended

For the Quarter Ended |

21

Current Loan Portfolio and Asset Quality Overview at 12/31/2010

(185)

12

332

-

0.06%

960

12%

194,320

Securities backed loans and other

25

285

100

-

0.14%

2,280

27%

441,799

Commercial & Industrial

Category

Balance

(in

thousands)

% of Total

Loans

Nonaccrual

Loans

(in

thousands)

Nonaccrual/

Total Loans

OREO

(in

thousands)

30-89 Days

Delinquent

(in

thousands)

90+ Days

Delinquent

(in

thousands)

Quarter

Charge-offs

(net in

thousands)

Commercial mortgage

$580,780

36%

$1,650

0.10%

$1,890

$774

$824

$(1,229)

Construction

203,120

13%

4,881

0.30%

-

391

-

-

Direct financing leases (auto leases)

103,289

6%

-

0.00%

-

1,008

49

(3)

Residential mortgage

93,004

6%

5,526

0.34%

225

-

1,050

(493)

Total

$1,616,312

100%

$15,297

0.94%

$2,115

$2,605

$2,220

$(1,885) |

22

Asset Quality Trends

30 - 89 Days

90+ Days

Delinquent

Non-Accrual

Total 90+ PD,

(Dollar Values in Thousands)

Past Due

Past Due

Loans

Loans

OREO

NA Loans & OREO

December 31, 2008

23,883

4,054

27,937

8,729

4,600

17,383

December 31, 2009

9,463

12,995

22,458

12,270

459

25,724

December 31, 2010

2,605

2,220

4,825

15,297

2,115

19,632

(Dollar Values in Thousands)

30 - 89 Days Past Due

90 Days+ Past Due

Non-Accrual Loans

Category

12/31/07

12/31/08

12/31/09

12/31/10

12/31/07

12/31/08

12/31/09

12/31/10

12/31/07

12/31/08

12/31/09

12/31/10

Commercial

97

500

0

100

0

0

1,161

285

1,169

373

3,765

2,280

Commercial Mortgage

1,530

11,769

1,649

774

168

2,493

5,980

824

0

1,719

2,310

1,650

Construction

0

7,357

2,970

391

0

499

2,612

0

0

4,841

4,521

4,881

Direct Financing Leases, Net

1,421

3,618

2,358

1,008

506

541

47

49

0

0

0

0

Residential Mortgae

592

0

2,486

332

6,400

0

0

12

0

1,796

149

960

Security-Backed Loans and Other

2,923

639

0

0

1,599

521

3,195

1,050

0

0

1,525

5,526

Total Loans

$6,563

$23,883

$9,463

$2,605

$8,673

$4,054

$12,995

$2,220

$1,169

$8,729

$12,270

$15,297 |

23

Deposit-Generating Strategies: Grow

Market Share in Expanding Markets Healthcare Affinity

Relationships As of January 10, 2010 we were the 6th largest financial

institution in the Health Savings Account (HSA) space based on

total deposits

(1)

We service insurance carriers, third-party administrators and

large brokerage firms for distribution of HSAs

and related

accounts

Dynamics of the healthcare insurance industry are generating

rapid growth in the HSA market:

–

For the year ended January 10 ,2010, there was a 24%

increase

in

HSA

balances

nationally

(1)

–

During that same period, HSA custodians and administrators

reported

that

the

number

of

HSAs

grew

by

26%

(1)

–

Since 2003, the number of Americans with HSAs

and High

Deductible Health Plans (HDHPs) has grown to over 8

million,

from

a

base

of

3

million

(2)

–

Growth trends are projected to continue with banks holding

$25

billion

in

assets

by

2015

(1)

Prepaid Card Affinity Relationships

We are a market leader in a rapidly growing market for open loop

prepaid debit cards:

–

5th

largest

prepaid

bank

card

issuer

(3)

–

17th largest overall Visa and Mastercard

commercial card

issuer

in

the

U.S.

(3)

Prepaid card growth rates have been in excess of 31% annually,

with some segments growing significantly more:

–

Open-Loop products are projected to have $549.7 billion

loaded in 2012 compared to $124.64 billion loaded in 2009,

or

an

annual

growth

rate

of

64%

(4)

–

The Open-Loop Gift Card market grew by 31% in 2009 and

we believe will continue that trajectory

We

are

the

industry’s

largest

Agent

Bank

gift

card

issuer

(5)

We serve clients such as Western Union, Intuit, Deluxe Check

Printers, Digital, Incomm

and Univision

(1) Consumer Health Savings Update 2010 ,Consumer Driven Market Report

Industry Data (2) AHIP’s

Center for Policy and Research, January 2009 census HSA/High-Deductible Health

Plans (3) Nilson

Report, June 2010

(4) Mercator Advisory Group

(5) There is no independent survey of which we are aware, this conclusion is based

on our knowledge of the industry |

24

Deposit-Gathering Strategies: Grow

Market Share in Expanding Markets Wealth Management Affinity

Relationships Wealth management deposit and lending services to wealth

management platforms and firms –

including limited-purpose

trust companies, broker/dealers and TPAs/record keepers:

Wealth Management Bank Affinities:

–

Currently 16 relationships with firms having approximately

$200 billion in assets under management

–

Over 7,000 investment advisors serving more than 280,000

clients

–

SEI, Legg Mason, Commonfund

Master Demand Account (MDA) –

DTC/NSCC-traded ERISA-

qualified bank deposit account:

–

Trades on the DTC/NSCC like Money Market Mutual Funds

–

FDIC insurance passed through to 401(k) participant

–

Schwab, Matrix, SunGard, Ascensus, Great-West

–

Growth potential due to growing demographics of retirement

market

Safe Harbor IRA Rollovers:

–

Rollover Systems, WMSI

Merchant Processing Relationships

Top

20

Acquiring

Bank

for

credit

and

debit

card

processing

(1)

Top

50

Originating

Bank

for

ACH

processing

(2)

Combined

annual

processing

volume

of

$25

billion

(3)

Numerous third-party channels, including: Fiserv, FIS, TSYS,

BankServ, Heartland, Planet Payment and HealthEquity

(1)

Management

believes,

based

upon

increased

volume

in

2010

and

independent

rankings

for

2009,

that

The

Bancorp

would

rank

in

the

top

20

nationally

of

acquiring banks

(2)

NACHA

–

The

Electronics

Payments

Association,

The

Top

50

Originators,

2010

(3) The Nilson

Report, March 2010 |

25

Non-GAAP Reconciliation

Dollars in thousands

2005

2006

2007

2008

2009

2010

6/30/2010

9/30/2010

12/31/2010

Shareholders' Equity

$134,947

$148,908

$176,259

$180,403

$245,203

$198,906

$203,778

$201,432

$198,906

Goodwill

(3,951)

(3,951)

(50,173)

0

0

0

0

0

0

Intangible Assets

0

0

(12,006)

(11,005)

(10,005)

(9,005)

(9,505)

(9,255)

(9,005)

Tangible Equity

130,996

144,957

114,080

169,398

235,198

189,901

194,273

192,177

189,901

Preferred Equity

(1,330)

(1,186)

(1,116)

(40,109)

(39,411)

0

0

0

0

Tangible Common Equity

$129,666

$143,771

$112,964

$129,289

$195,787

$189,901

$194,273

$192,177

$189,901

Total Assets

$917,471

$1,334,838

$1,568,382

$1,792,375

$2,043,534

$2,395,723

$2,123,870

$2,659,676

$2,395,723

Goodwill

(3,951)

(3,951)

(50,173)

0

0

0

0

0

0

Intangible Assets

0

0

(12,006)

(11,005)

(10,005)

(9,005)

(9,505)

(9,255)

(9,005)

Tangible Assets

$913,520

$1,330,887

$1,506,203

$1,781,370

$2,033,529

$2,386,718

$2,114,365

$2,650,421

$2,386,718

Tangible Common Equity / Tangible Assets

14.19%

10.80%

7.50%

7.26%

9.63%

7.96%

9.19%

7.25%

7.96%

For the Year Ended December 31,

For the Quarter Ended |