Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended October 31, 2010 |

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 000-52038

Verigy Ltd.

(Exact name of registrant as specified in its charter)

| SINGAPORE | N/A | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| NO. 1 YISHUN AVE 7 SINGAPORE 768923 |

N/A | |

| (Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s telephone number, including area code (+65) 6755-2033

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Ordinary Shares, no par value | The NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the registrant’s voting and non-voting common equity held by non-affiliates as of April 30, 2010, the last business day of the registrant’s most recently completed second fiscal quarter, was $705 million based upon the closing sale price of our ordinary shares on The NASDAQ Global Select Market.

As of December 8, 2010, there were 60,522,738 outstanding ordinary shares of Verigy Ltd.

DOCUMENTS INCORPORATED BY REFERENCE

None.

EXPLANATORY NOTE

This Annual Report on Form 10-K/A is being filed as Amendment No. 1 to the Registrant’s Annual Report on Form 10-K for the fiscal year ended October 31, 2010 (the “Annual Report”), for the purposes of including information that was to be incorporated by reference from the Registrant’s definitive proxy statement pursuant to Regulation 14A of the Securities and Exchange Act of 1934. The Registrant will not file its proxy statement within 120 days of its fiscal year ended October 31, 2010, and is therefore amending the Annual Report as set forth below to include such information.

PART III

| Item 10: | Directors and Executive Officers and Corporate Governance |

Board of Directors

The names of the directors of Verigy Ltd. (“us,” “we,” or the “Company”) and certain information about them as of October 31, 2010 are set forth below.

C. Scott Gibson (age 58)—Scott Gibson has served as a member of Verigy’s board of directors and of the Audit and Compensation Committees and as the chairperson of the Nominating and Governance Committee since June 2006. Mr. Gibson also served as chairperson of the Compensation Committee from June 2006 to September 2008. Mr. Gibson has served as Verigy’s Lead Independent Director since July 2007. He has served as a director of RadiSys Corporation, a global supplier of embedded computing solutions for automation, telecommunications and other industries, and as a member of its audit committee since June 1993 and as chairperson of its board of directors since October 2002. From January 1983 through March 1992, Mr. Gibson co-founded Sequent Computer Systems, Inc. (“Sequent”), a computer systems company, and served as president from January 1988 to March 1992. Before co-founding Sequent, Mr. Gibson served as General Manager, Memory Components Operation, at Intel Corporation. Mr. Gibson also serves on the boards of directors of several other public companies, including TriQuint Semiconductor, Inc., where he has served on the audit committee since 2006, Pixelworks, Inc., where he also serves on the audit committee and Northwest Natural Gas Company. Mr. Gibson holds a BSEE degree and an MBA in finance from the University of Illinois.

Mr. Gibson brings to Verigy’s board of directors his semiconductor expertise and experience in the high-technology industry which provide him with a deep understanding of Verigy’s business. In addition, Mr. Gibson’s experience as a director of other public companies provides him with a current working knowledge of business and economic trends that affect Verigy’s industry. Mr. Gibson’s prior experience co-founding and leading Sequent, along with other senior management positions he has held, provide him with insight into a range of issues Verigy faces.

Ernest L. Godshalk (age 65)—Ernest Godshalk has served as a member of Verigy’s board of directors, as chairperson of the Audit Committee and as a member of the Nominating and Governance Committee since June 2006. Since 1993, Mr. Godshalk has served as Managing Director of ELGIN Management Group, a private investment company. From February 2001 until he retired in December 2004, Mr. Godshalk served as President, Chief Operating Officer and a director of Varian Semiconductor Equipment Associates, Inc. (“Varian Semiconductor”), a supplier of semiconductor manufacturing equipment. From April 1999 until February 2001, Mr. Godshalk served as Varian Semiconductor’s Vice President and Chief Financial Officer. From November 1998 until April 1999, Mr. Godshalk was Vice President, Finance of the semiconductor equipment business of Varian Associates, Inc. Mr. Godshalk serves on the boards of directors as well as the audit committees of both GT Solar International Inc. and Hittite Microwave Corporation. He holds a BA degree from Yale University and an MBA degree from Harvard Business School.

Mr. Godshalk brings to Verigy’s board of directors his extensive knowledge of the industry gained through his service as the president, chief operating officer and chief financial officer of a company engaged in a business similar to Verigy’s. In addition, his educational background in management, accounting and finance as well as his experience serving on other boards and audit committees provide him with a wealth of experience that is relevant to Verigy’s business.

Edward C. Grady (age 63)—Edward Grady has served as a member of Verigy’s board of directors since July 2007, of the Compensation Committee since December 2007, including as Compensation Committee chairperson since September 2008, and of the Nominating and Governance Committee since December 2008. Mr. Grady was the President and Chief Executive Officer at Brooks Automation Inc. (“Brooks”), a provider of factory automation equipment for

semiconductor manufacturing, until October 1, 2007 when he retired. Prior to joining Brooks in 2003, he ran several divisions at KLA-Tencor, served as President and Chief Executive Officer of Hoya Micro Mask and was Vice President of Worldwide Sales for the EPI division of Monsanto/MEMC, where he started his career. Mr. Grady also serves on the boards of directors of Evergreen Solar Inc., Advanced Energy Industries, Inc. and Electro Scientific Industries, Inc. He holds a BS degree in engineering from Southern Illinois University and an MBA degree from the University of Houston, Clear Lake City.

Mr. Grady brings to Verigy’s board of directors his knowledge and experience in the semiconductor capital equipment industry. He provides the insight and understanding that he has developed from his executive leadership at several companies, including in the areas of product strategy and development, service and organizational development. In addition, Mr. Grady’s significant experience serving on other public company boards provides him with insight into business and economic trends.

Keith L. Barnes (age 59)—Keith Barnes has served as Verigy’s Chief Executive Officer since July 2010,1 as its President and Chief Executive Officer from May 2006 to July 2010, as a member of the board of directors since June 2006, and as Chairman of the board of directors since July 2007. From October 2003 through April 2006, Mr. Barnes was Chairman and Chief Executive Officer of Electroglas, Inc., an integrated circuit probe manufacturer. From August 2002 to October 2003, Mr. Barnes was Vice Chairman of the Board of Directors of Oregon Growth Account and a management consultant. He served as Chief Executive Officer of Integrated Measurement Systems, Inc. (“IMS”), a manufacturer of engineering test stations and test software, from 1995 until 2001, and also as Chairman of the board of directors of IMS from 1998 through 2001 when it was acquired by Credence Systems Corporation. Prior to becoming Chief Executive Officer of IMS, Mr. Barnes was a Division President at Valid Logic Systems and later Cadence Design Systems. Mr. Barnes served on the board of directors of Cascade Microtech, Inc., a provider of advanced wafer probing solutions for semiconductor testing from February 2004 to December 2010. Mr. Barnes earned his BSES degree from California State University, San Jose.

Mr. Barnes’ significant knowledge and understanding of Verigy and its businesses together with his extensive experience in the semiconductor industry provide the board of directors with significant insight into Verigy’s businesses and operations. In addition, he brings to the board of directors significant industry-specific knowledge and operational experience with large and small public and private companies.

Steven W. Berglund (age 59)—Steven Berglund has served as a member of Verigy’s board of directors and of the Audit Committee since January 2008. Mr. Berglund has been President and Chief Executive Officer of Trimble Navigation since March 1999, and has diverse industry experience, including engineering, manufacturing, finance and global operations. Prior to joining Trimble Navigation, he was President of Spectra Precision, a unit of Spectra-Physics AB, and a pioneer in the development of laser systems. Mr. Berglund spent a number of years at Varian Associates in Palo Alto, California, where he held roles in planning and manufacturing. He began his career as a process engineer at Eastman Kodak in Rochester, New York. Mr. Berglund is a member of the Trimble Navigation board of directors. He attended the University of Oslo and the University of Minnesota, where he received a BS in chemical engineering. Mr. Berglund also received an MBA from the University of Rochester.

Mr. Berglund brings to the board of directors deep knowledge of engineering, manufacturing, finance and global operations, each of which are significant issues in Verigy’s business. Mr. Berglund’s engineering background, as well as his role as chief executive officer of a growing technology company, provides the board of directors with useful guidance and insights into Verigy’s products and business development and growth opportunities.

Bobby Cheng (age 61)—Bobby Cheng Hoo Wah has served as a member of Verigy’s board of directors since September 2008 and as a member of the Nominating and Governance Committee since September 2010. Since June 2007, Mr. Cheng has served as the non-executive chairperson of IVCG Corporation, an investment holding company he founded with other partners in 2006. He began his career as Asia Regional Marketing Director with Texas Instruments, Inc., and over subsequent years held regional leadership roles in Asia-Pacific with computer systems and related companies, including Digital Equipment Corp., Computervision, Inc., International Computer Limited and Autodesk, Inc. In 1993, he founded his own IC tooling and supply chain company. Since selling his company in 1998, he has consulted on business strategies in Asia for clients such as Jabil Circuit, Inc. and World Bank-IFC. He has served on the board of governors for the Singapore Institute of Management and a committee for the Singapore Stock Exchange. He holds a BA degree in computer science from the University of London.

| 1 | Mr. Barnes resigned as our Chief Executive Officer effective December 31, 2010. He continues to serve as Chairman of the board of directors. |

Mr. Cheng provides the board of directors with significant experience in the financial markets resulting from his leadership role in an investment holding company. His extensive experience and leadership roles with various technology companies provide the board of directors with strategic and business planning expertise.

Eric Meurice (age 54)—Eric Meurice has served as a member of Verigy’s board of directors since November 2006 and as a member of the Compensation Committee since September 2010. Mr. Meurice has served as the President and Chief Executive Officer of ASML Holding, a manufacturer of lithography equipment and supplier to the semiconductor industry, since October 2004. From March 2001 until he joined ASML, Mr. Meurice was Executive Vice President of Thomson Television Worldwide. Between 1995 and 2001, Mr. Meurice served as Vice President of Dell Computer, where he ran the Western and Eastern Europe regions and Dell’s emerging markets business within Europe, the Middle East and Africa. Mr. Meurice holds a Master’s degree in applied economics from the Sorbonne University, Paris, a Master’s degree in mechanics and energy generation from the École Centrale de Paris, and an MBA from Stanford University.

Mr. Meurice brings to the board of directors active experience as the chief executive officer of a semiconductor equipment company. In addition, Mr. Meurice has extensive experience with European and Asian technology business operations which is relevant to a significant aspect of Verigy’s business as an international company. Mr. Meurice’s experiences in mergers and acquisitions as well as his role as a chief executive officer provide the board of directors with significant expertise in areas of business and product development as well as strategy.

Claudine Simson (age 57)2—Dr. Claudine Simson has served as a member of Verigy’s board of directors and of the Compensation Committee since November 2006. She served as a member of the Audit Committee from November 2006 to January 2009. Since December 2010, Dr. Simson serves as Global Business Development Executive at International Business Machines Corporation. From March 2007 to January 2009, Dr. Simson served as Executive Vice President and Chief Technology Officer of LSI Corporation, a developer of semiconductor and storage systems. Dr. Simson served as Corporate Vice President and Chief Technology Officer of Motorola Inc., a provider of technologies, products and services for mobile communications, and its semiconductor product spin-off, Freescale Semiconductor, from April 2003 to April 2006. Prior to joining Motorola, from September 2002 to March 2003, Dr. Simson served as Chief Technology Officer at IPVALUE Management Inc., an emerging company specializing in the commercialization of corporate intellectual property. Prior to joining IPVALUE, Dr. Simson was with Nortel Networks for 23 years, holding senior executive positions including General Manager of Nortel’s Semiconductor Business, and Vice President of Global Technology Research and Intellectual Property. She is currently retired from corporate life and is transitioning to part-time consulting and additional board work. Dr. Simson received a Bachelor’s degree in electrical engineering and a Ph.D. in semiconductor physics from l’Institut National des Sciences Appliquées in Toulouse, France.

Dr. Simson brings to the board of directors 30 years of senior leader experience in the semiconductor industry. With experience that spans research and development, strategy, process and design technology, product prototyping and manufacturing, she brings to Verigy deep and broad knowledge of the semiconductor business. In addition, having led multi-functional groups of over 2,500 engineers/scientists across North America, Europe and Asia Pacific, she has significant expertise in issues ranging from compensation planning to evaluating strategic alternatives and partnerships and growth opportunities to risk assessment and risk management.

| 2 | Dr. Simson resigned from the board of directors effective January 13, 2011. On January 14, 2011, the board of directors appointed Jorge Titinger as a member of the board of directors. |

Executive Officers

The names, ages, position and a brief account of the business experience of our executive officers as October 31, 2010 are as follows:

| Name |

Age | Position | ||||

| Keith L. Barnes3 |

59 | Chairman and Chief Executive Officer | ||||

| Robert J. Nikl |

55 | Chief Financial Officer | ||||

| Gayn Erickson |

46 | Vice President, Memory Test | ||||

| Pascal Rondé |

48 | Vice President, Sales, Service and Support | ||||

| Margo M. Smith |

38 | Vice President and General Counsel | ||||

| Jorge Titinger4 |

49 | President and Chief Operating Officer | ||||

| Hans-Jürgen Wagner |

50 | Vice President, SOC Test | ||||

Keith L. Barnes has served as Verigy’s Chief Executive Officer since July 2010, as Verigy’s President and Chief Executive Officer from May 2006 to July 2010, as a member of the board of directors since June 2006, and as Chairman of the board of directors since July 2007. From October 2003 through April 2006, Mr. Barnes was Chairman and Chief Executive Officer of Electroglas, Inc., an integrated circuit probe manufacturer. From August 2002 to October 2003, Mr. Barnes was Vice Chairman of the board of directors of Oregon Growth Account and a management consultant. He served as Chief Executive Officer of Integrated Measurement Systems, Inc. (“IMS”), a manufacturer of engineering test stations and test software, from 1995 until 2001, and also as Chairman of the board of directors of IMS from 1998 through 2001 when it was acquired by Credence Systems Corporation. Prior to becoming Chief Executive Officer of IMS, Mr. Barnes was a Division President at Valid Logic Systems and later Cadence Design Systems. Mr. Barnes also serves on the board of directors of Cascade Microtech, Inc., a provider of advanced wafer probing solutions for semiconductor testing. Mr. Barnes earned his BSES degree from California State University, San Jose.

Robert J. Nikl has served as Verigy’s Chief Financial Officer since June 2006. From September 2004 through May 2006, he served as Senior Vice President, Finance and Chief Financial Officer of Asyst Technologies, Inc., an integrated automated semiconductor solutions company. Prior to joining Asyst, Mr. Nikl held several positions from 1994 to 2003 in finance, operations management and administration with Solectron Corporation, a provider of electronics manufacturing and integrated supply chain services, most recently as Corporate Vice President, Finance of Global Operations from 1999 to November 2003. Prior to joining Solectron in 1994, Mr. Nikl held a number of senior financial management positions for Xerox Corporation, including Vice President, Finance for Xerox Engineering Systems. Mr. Nikl is a certified public accountant with active licenses in the states of California and New York. He holds a BBA from Pace University and an MBA from the University of Connecticut.

Gayn Erickson has served as Verigy’s Vice President, Memory Test since February 2006. Prior to Verigy’s separation from Agilent, Mr. Erickson served as Vice President of the Memory Test Business within the Automated Test Group of Agilent Technologies, Inc., a provider of electronic measurement solutions and Verigy’s predecessor company, beginning in May 2005. Prior to assuming that position, Mr. Erickson served as Vice President, Sales and Marketing of Agilent’s Memory Test Business from August 2004 to May 2005. He served as Senior Marketing Manager of Agilent’s Memory Test Business from 2000 to 2004. Mr. Erickson holds a BS degree in Electrical Engineering from Arizona State University.

Pascal Rondé has served as Verigy’s Vice President, Sales, Service and Support since February 2006. From October 2000 until he joined Verigy, Mr. Rondé served as the Vice President of Sales, Service and Support for the Automated Test Group of Agilent Technologies, Inc., a provider of electronic measurement solutions and Verigy’s predecessor company. Mr. Rondé holds a Masters degree in Electronics Engineering from the Institut National des Sciences Appliquées in Lyon, France.

Margo M. Smith has served as Verigy’s Vice President and General Counsel since February 2010. From May 2006 until February 2010, she served as our Deputy General Counsel and Chief Privacy Officer. Prior to joining Verigy, Ms. Smith was an attorney at Wilson Sonsini Goodrich & Rosati, a national law firm. Ms. Smith holds a JD degree from Columbia University School of Law and a BA degree from the University of Washington.

Hans-Jürgen Wagner has served as Verigy’s Vice President, SOC Test since February 2006. Mr. Wagner served as Vice President, SOC Test, of the Semiconductor Test Solutions business of Agilent Technologies, Inc., a provider of electronic measurement solutions and Verigy’s predecessor company, from September 2005 to January 2006. Prior to

| 3 | Mr. Barnes resigned as our Chief Executive Officer effective December 31, 2010. |

| 4 | Mr. Titinger was promoted to serve as our Chief Executive Officer effective January 1, 2011 and no longer serves as Chief Operating Officer. |

assuming that position, Mr. Wagner served as Vice President, Memory Test, of the Automated Test Group of Agilent from November 2004 to September 2005. He served as Vice President, Computer Test at Agilent from 2003 to 2004. Mr. Wagner was a Research and Development Manager in the Automated Test Group at Agilent from 1998 to 2003. Mr. Wagner holds a Masters degree in engineering from the Technical University in Stuttgart, Germany.

Jorge Titinger has served as Verigy’s President and Chief Operating Officer since July 2010. Prior to his promotion to President and Chief Operating Officer in July 2010, Mr. Titinger served as our Chief Operations Officer beginning June 2008. Prior to assuming that position, from November 2007 to June 2008, Mr. Titinger served as Senior Vice President of the Product Business Groups at FormFactor, Inc., a provider of semiconductor wafer probe cards. He previously held several executive leadership positions at KLA-Tencor Corporation, a leading supplier of process control and yield management solutions for semiconductor and related microelectronics industries. His roles during his tenure at KLA-Tencor from 2002 to 2007 included Executive Vice President of Global Operations and Chief Manufacturing Officer, Chief Administrative Officer, Senior Vice President and General Manager of KLA-Tencor’s Global Support Services and Field Operations Group. Before joining KLA-Tencor, Mr. Titinger held several executive positions at Applied Materials from 1997 to 2002. Mr. Titinger holds a BS and MS in Electrical Engineering and an MS in Engineering Management from Stanford University.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors and executive officers, and persons who own more than 10% of our ordinary shares to file initial reports of ownership and reports of changes in ownership with the SEC. Such persons are required by SEC regulations to furnish us with copies of all Section 16(a) forms that they file. We generally assist our directors and executive officers in making filings required by Section 16(a) of the Securities Exchange Act of 1934, as amended. Based solely on our review of copies of reports filed by reporting persons pursuant to Section 16(a) of the Exchange Act, or written representations from reporting persons that no Form 5 filing was required for such persons, we believe that during fiscal 2010 all filings required to be made by Verigy reporting persons were timely made under Section 16(a).

Audit Committee Information

The Audit Committee of our board of directors is currently composed of Ernest Godshalk, the chairperson of the committee, Scott Gibson and Steven Berglund, each of whom the board of directors has determined to be an independent director and to meet the financial experience requirements under both the rules of the SEC and NASDAQ. Our board of directors determined that each of Messrs. Godshalk, Berglund and Gibson is an “audit committee financial expert” within the meaning of the rules of the SEC and is “financially sophisticated” within the meaning of NASDAQ rules. In making these determinations, our board of directors considered and discussed the respective experience, skills and expertise of each of Messrs. Godshalk, Berglund and Gibson. In the case of Mr. Godshalk, the board of directors considered his experience in his roles as President, as Chief Financial Officer, as Chief Operating Officer and as Vice President of Finance at Varian Semiconductor from November 1998 to December 2004, his seven years of combined service as Chief Financial Officer at three other public companies, his current service on the audit committees of GT Solar International, Inc. and Hittite Microwave Corporation, and his educational background, including an MBA with a concentration in finance. In determining that Steven Berglund is an “audit committee financial expert” and is “financially sophisticated,” the board of directors considered Mr. Berglund’s experience in his current role as Chief Executive Officer of Trimble Navigation and his prior role as President of Spectra Precision, as well as Mr. Berglund’s educational background. In the case of Scott Gibson, the board of directors determined that Mr. Gibson qualifies as an “audit committee financial expert” and is “financially sophisticated” by virtue of his years of service on the audit committees of numerous public companies, including currently TriQuint Semiconductor, RadiSys Corporation and Pixelworks, Inc., his experience as the chairperson of the finance and audit committee of the Oregon Health and Science University Governing Board from 2000-2009, his experience as Chief Financial Officer and Senior Vice President of Operations and, later, as President at Sequent Computer Systems, and his educational background, including an MBA in Finance.

| Item 11: | Executive Compensation |

Compensation Discussion and Analysis

This Compensation Discussion and Analysis describes Verigy’s executive compensation program for fiscal 2010 and certain elements of the fiscal 2011 program for Verigy’s Chief Executive Officer, Chief Financial Officer and each of its three most highly compensated executive officers during fiscal 2010 (referred to collectively as the named executive officers). Verigy’s named executive officers for fiscal 2010 are:

| • | Keith L. Barnes, our Chief Executive Officer through December 31, 2010; |

| • | Robert J. Nikl, our Chief Financial Officer; |

| • | Jorge Titinger, our President and Chief Operating Officer during fiscal 2010 and through December 31, 2010 and President and Chief Executive Officer beginning January 1, 2011; |

| • | Pascal Rondé, our Vice President, Sales, Service and Support; and |

| • | Hans-Jürgen Wagner, our Vice President, SOC Test. |

For a complete understanding of Verigy’s executive compensation program, this Compensation Discussion and Analysis should be read in conjunction with the “Summary Compensation Table” and other compensation disclosures included in this Annual Report.

Compensation Philosophy and Objectives

Verigy believes that the quality, experience, skills, engagement and leadership of its executive officers are critical factors affecting our performance and our ability to drive the long-term success of the Company and shareholder value. To attract and retain the executives critical to our success, we seek to:

| • | establish compensation at competitive levels to attract, motivate and retain the superior executive talent necessary to achieve our business objectives; |

| • | pay for performance by providing variable cash incentive awards based on Verigy’s satisfaction of designated financial and non-financial objectives; and |

| • | align the financial interests of executive officers with those of the shareholders by providing appropriate long-term, equity-based incentives and retention awards. |

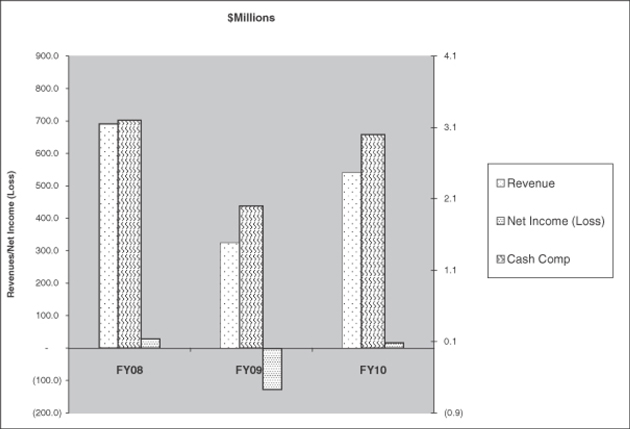

The core of Verigy’s executive compensation philosophy remains to pay for performance. When our business is strong, executive compensation is higher, and when our business results are weak, executive compensation is lower. The following graph illustrates the close link between our results, measured by our annual revenue and net income (loss), and cash compensation of the officers who were our named executive officers in each of the last three fiscal years.

Impact of Fiscal 2010 Business Results on Executive Compensation

Fiscal 2010 was a year of solid improvement from the economic challenges of fiscal 2009. Total annual revenue increased to $539 million, a year-over-year increase of 67% from $323 million in fiscal 2009. Net income increased in fiscal 2010 to $16 million, or $0.26 per share, from a loss of $127 million, or $2.17 per share in fiscal 2009. The improved business environment affected executive compensation in the following ways in fiscal 2010:

| • | base salaries remained frozen at 2008 levels, but the 10% temporary reduction of the base pay of all employees that began in the second quarter of fiscal 2009 was terminated effective February 1, 2010; and |

| • | variable pay in the form of semi-annual bonuses were paid as a result of achieving targets under our Pay for Results Bonus Program. |

For more information about our fiscal 2010 business results, please see the section of the Annual Report entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Determining Compensation

We regularly monitor trends, conduct benchmarking studies and generally strive to position our executives’ overall compensation at the median of compensation levels of our peer group. However, we do not adhere to specific formulas, internal pay multiples or market positioning when determining any individual executive’s compensation.

The Compensation Committee establishes a total direct compensation opportunity for each of our executive officers, consisting of base salary, annual target cash bonus and long-term incentives. In determining each component of the direct compensation opportunity, the Compensation Committee uses the executive’s current level of compensation as the starting point. The Compensation Committee bases any adjustments to those levels primarily on benchmarking to peer companies and the individual’s performance. In the process of determining the executive compensation program, the Compensation Committee relies on support from our Chief Executive Officer, other members of management and the committee’s outside independent consulting firm.

Role of Management. Our Chief Executive Officer annually reviews the performance of each executive officer (other than himself). Our Chief Executive Officer’s performance is reviewed by the Compensation Committee, relative to the annual performance goals established for the year. See “Assessment of Individual Performance” below. He then presents his compensation recommendations based on these reviews, including with respect to items such as salary

adjustments and incentive award amounts, to the Compensation Committee. The Compensation Committee can and does exercise discretion in modifying any compensation recommendations relating to executive officers that were made by our Chief Executive Officer and is responsible for approving all compensation decisions for our executive officers. During fiscal 2010, the Compensation Committee also received support from members of the Human Resources department and the Vice President and General Counsel.

Role of External Advisors. Since fiscal year 2006, Frederic W. Cook & Co., or FWC, has served as the Compensation Committee’s independent compensation consultant. FWC provides analysis and recommendations regarding base salary, cash incentives, long term incentives, perquisites and other related executive compensation practices. In addition, they advise our Compensation Committee regarding overall equity practices. The Compensation Committee relied extensively on a benchmarking study prepared by FWC in determining the 2010 program. FWC attended many of the Compensation Committee meetings, and met in executive session without the presence of management at most of these meetings. No other consultants or advisors were retained by either management or the Compensation Committee in connection with determining the fiscal 2010 executive compensation program.

Benchmarking. To assist the Compensation Committee in its review of executive compensation, FWC provides compensation data compiled from executive compensation surveys as well as data gathered from annual reports and proxy statements from a peer group of companies. Peer companies were selected by FWC on the basis of objective industry classifications (Global Industrial Classification codes) and financial size criteria (market capitalization, operating income, number of employees and revenue). The Compensation Committee reviewed and approved the following group of peer companies selected by FWC:

17 Semiconductor Equipment Companies

| Advanced Energy Industries, Inc. | Cohu, Inc. | FormFactor, Inc. | Novellus Systems, Inc. | |||

| Amkor Technology, Inc. | Cymer, Inc. | Kulicke & Soffa Industries, Inc. | Teradyne, Inc. | |||

| ATMI, Inc. | ||||||

| Brooks Automation, Inc. | Entegris, Inc. | LTX-Credence | Tessera Technologies, Inc. | |||

| Cabot Microelectronics Corporation | FEI Company | MKS Instruments, Inc. | Varian Semiconductor Equipment Associates, Inc. | |||

| 15 Semiconductor Companies

| ||||||

| Atheros Communications, Inc. | Hittite Microwave Corporation | Power Integrations, Inc. | Skyworks Solutions, Inc. | |||

| Atmel Corporation | Microsemi Corporation | RF Micro Devices, Inc. | TriQuint Semiconductor, Inc. | |||

| Cypress Semiconductor Corporation | ON Semiconductor Corporation | Semtech Corporation | Zoran Corporation | |||

| Diodes Incorporated | PMC-Sierra, Inc. | Silicon Laboratories, Inc. | ||||

We made the following changes to our peer group from fiscal 2009 to fiscal 2010: KLA-Tencor Corporation and Lam Research Corporation were removed from the semiconductor equipment group and Cohu, Inc., Kulicke & Soffa Industries, Inc. and LTX-Credence were added; and Cree, Inc. was removed from the semiconductor companies group and Zoran Corporation was added.

Peer group data for the Chief Executive Officer is publicly available, thus, the Chief Executive Officer was compared only to the peer companies noted above. For the Chief Financial Officer and other named executive officers, in addition to the peer group data, the Compensation Committee also reviewed a Radford Executive Compensation Report of more than 70 semiconductor equipment and related industry companies to supplement market references for the Chief Financial Officer because his role is not industry specific and for other named executive officers because information for all peer group executive officer positions is not publicly available. The Compensation Committee also reviewed additional Radford reports based on executive location: Northern California, France and Germany.

Assessment of Company Performance. For fiscal 2010, the Compensation Committee reviewed our operating results against internal budgets and also evaluated Verigy’s total shareholder return relative to the 2010 semiconductor equipment peers, plus Advantest, which was not part of the fiscal 2010 peer group. Advantest is also a semiconductor equipment company, and as such, was included in the 2010 semiconductor equipment peer group when evaluating relative total shareholder return. However, Advantest is a Japanese-based company that does not publicly report executive compensation. As such, Advantest was not included in the evaluation of individual executive compensation, which is an assessment of competitive compensation practices for executives in similar industry and size companies. The Compensation Committee determined that it was appropriate that the 2010 semiconductor equipment peer group plus Advantest be used as the group for comparative purposes with respect to total shareholder return in order to have a consistent group of companies considered for the entirety of fiscal 2010.

Assessment of Individual Performance. The Compensation Committee reviews the performance of individual executives as a factor in determining compensation levels. As mentioned above, the Compensation Committee relies on our Chief Executive Officer to evaluate the performance of the other executive officers annually, and to make recommendations regarding all compensation components. The performance summary of each executive officer reflects achievement in three areas: (i) delivering business results; (ii) setting direction and strategy; and (iii) building organizational capability. In addition, each executive officer’s potential is assessed. Finally, a performance ranking between 1 and 3 is assigned, with Rank 1 being the highest performance. The board of directors completes a similar survey on the performance of the Chief Executive Officer.

The Compensation Committee is responsible for the annual performance review of our Chief Executive Officer. The Chief Executive Officer’s performance is measured against a broad set of financial and strategic measures set by the Compensation Committee at the beginning of the fiscal year. For fiscal 2010, the performance review process of the Chief Executive Officer included:

| • | a performance assessment survey completed by all members of the board of directors; |

| • | discussions during executive sessions of both the Compensation Committee and board of directors meetings; |

| • | discussions between Scott Gibson, our Lead Independent Director, and a number of the direct reports of the Chief Executive Officer; and |

| • | a self-assessment by the Chief Executive Officer. |

Components of Total Compensation for Fiscal 2010

The principal components of our fiscal 2010 executive compensation program, our target competitive position for each component and the purpose of each component are presented in the table below.

Target Competitive Position

| Compensation |

(in aggregate for all positions) |

Purpose | ||

| Base Salary | Equal to the peer group median; adjustments made based on individual performance. | Fixed component of pay intended to compensate the executive officer fairly for the responsibility level of the position held. Key recruitment and retention tool. | ||

| Annual Cash Incentive Awards | Target opportunities are set at or near the peer group median; actual payouts may exceed or be less than market median based upon actual financial and individual performance. | Variable component of pay intended to provide short-term incentive compensation based upon, and link the total cash compensation for executive officers directly to, operating profit goals and relative shareholder return. | ||

| Long-Term Equity Incentives | Equity award levels are set by reference to the peer group median; actual award levels may exceed or be less than market median, based on individual performance and the ultimate value of the awards will depend upon our share price. | Variable component of pay intended to motivate and align executive officers with the long-term value to shareholders. | ||

| Benefits and Perquisites | Generally consistent with benefits offered to non- executive employees and competitive with industry norms. | Primarily provides security through health and welfare, retirement and paid time off benefits. | ||

| Severance (Change in Control) Compensation | Terms are based on commitments made to executives at the time of our separation from Agilent in May 2006 and are believed to be consistent with reasonable market practices. | Intended to provide continuity of management through a change in control transaction and to provide temporary income following an executive’s termination in connection with a change in control transaction. | ||

2010 Compensation Decisions

Base Salary. The Compensation Committee reviewed each named executive officer’s base compensation and competitive positions against the peer group of semiconductor and semiconductor equipment companies, listed above under “Benchmarking.” In setting base salary, we also consider the impact of any changes to base salary on other components of compensation, such as short-term incentive opportunities, certain benefits and potential severance payments.

In fiscal 2010, to help the Company recover from the severe economic downturn in 2009, the Compensation Committee determined that all executive base salaries would remain at fiscal 2009 levels and in the second quarter of fiscal 2010, a 10% salary reduction that had taken effect as of February 15, 2009, for U.S.-based named executive officers and March 1, 2009, for other named executive officers, was terminated effective February 1, 2010.

Short-Term Incentives. The Compensation Committee assigns each named executive officer an annual target bonus opportunity under the Company’s Pay for Results Program, expressed as a percentage of full base salary, based on recommendations by the Chief Executive Officer with respect to the non-Chief Executive Officer officers and by the board of directors for the Chief Executive Officer, incentive compensation levels in our peer group and advice from the Compensation Committee’s independent compensation consultant, FWC. The Compensation Committee determined that the 2009 annual incentive targets remained competitive with the market median practices and did not change the individual 2010 incentive targets for the named executive officers.

The following table contains the fiscal 2010 performance metrics and the associated target and final payouts expressed as a percentage of base salary for each of the named executive officers. These weightings were effective for both the first and second halves of fiscal 2010.

| Mid- Cycle Operating Profit Margin |

Semi- Annual Operating Profit Margin |

Product Family Financial Results (Operating Profit Margin) |

Relative Total Shareholder Return Results |

Total Target Payout (% of base salary) |

Maximum Target Payout (2x Target) |

Actual Payout |

||||||||||||||||||||||

| Keith L. Barnes |

15 | % | 50 | % | — | 35 | % | 100 | % | $ | 1,164,816 | $ | 605,766 | |||||||||||||||

| Jorge Titinger |

15 | % | 35 | % | — | 30 | % | 80 | % | $ | 600,000 | $ | 282,628 | |||||||||||||||

| Robert J. Nikl |

15 | % | 35 | % | — | 30 | % | 80 | % | $ | 536,120 | $ | 251,047 | |||||||||||||||

| Hans-Jürgen Wagner |

15 | % | — | 25 | % | 20 | % | 60 | % | $ | 339,520 | $ | 127,701 | |||||||||||||||

| Pascal Rondé |

15 | % | 25 | % | — | 20 | % | 60 | % | $ | 410,564 | $ | 200,941 | |||||||||||||||

The Compensation Committee determines bonus metrics and goals at the beginning of each six-month performance period and they are not adjusted during the period. The Compensation Committee uses six-month performance periods because of the difficulty of setting annual goals (or longer) within a volatile and rapidly-changing environment. The Compensation Committee and management have determined that operating profit is the most effective performance metric to support long-term profitability and to align our executive officers with shareholder interests. The Compensation Committee established the goals, other than relative total shareholder return, based on Verigy’s internal operating plan. In establishing the thresholds and maximums for performance, the Compensation Committee took into consideration industry dynamics for the prospective period and other competitive intelligence. The bonuses are paid if the minimum performance threshold (described below) is met or exceeded in the fiscal half performance period; however, a positive result in any one metric may trigger a payout even though other metric targets are not met. The maximum bonus represents 200% of the target bonus if the maximum target level is met or exceeded. The Compensation Committee believes the performance parameters and overall mechanics for payment are consistent with competitive practices.

For fiscal 2010, the Compensation Committee defined and measured performance for each fiscal half year based on achievement of goals in the following four categories:

| • mid-cycle non-GAAP operating profit margins; |

• relative total shareholder return compared to the peer group; and | |

| • semi-annual non-GAAP operating profit margins; |

• SOC Test Financial Results (referred to as “Product Family Financial Results” in the above table) | |

Operating Profit Margins. Operating profit margin goals and results exclude restructuring related costs as well as acquisition costs and incremental operating expenses associated with Touchdown Technologies. The operating profit goals were intended to be very challenging and required close management of all aspects of the business in order to be achieved.

The Mid-Cycle Non-GAAP Operating Profit Margin goal intends to set a long-term profitability goal based on the middle of a multiple-year period reflecting the various up and down cycles within the semiconductor industry. The Semi-Annual Non-GAAP Operating Profit Margin goal helps drive management to meet the annual business plan, and as such, is based on recent and forecast financial performance.

In addition, the payout to the Mid-Cycle Non-GAAP Operating Profit Margin goal minimum is at 2% of salary, which is 13% of the target 15% of salary for this bonus component, whereas the payout to the minimum threshold for the Semi-Annual Non-GAAP Operating Profit Margin goal is 25% of target for that respective bonus component (that varies as a percentage of salary according to the target bonus level assigned to each executive).

Non-GAAP operating profit excludes the effects of charges for restructuring actions, impairment of assets, merger transaction cost, gains and losses on the sale of investment and other non-recurring costs.

Relative Total Shareholder Return. Relative total shareholder return was measured by using the average closing price of our ordinary shares for the last 20 trading days of each six-month performance period, compared to the average closing price in the same period of the prior year. Verigy’s shareholder return is compared to the group of semiconductor equipment peers listed above under “Benchmarking,” plus Advantest Corporation. As noted above, Advantest is a direct product competitor with Verigy, and as such, is included in the semiconductor equipment peer group when evaluating relative total shareholder return. Verigy’s total shareholder return ranking must be at least at the 25th percentile of the peer group to fund 25% of this portion of the bonus. Achieving total shareholder return at the median of the peer group results in 100% funding of this portion of the bonus. If Verigy is ranked number 1 in total shareholder return, this portion of the bonus is funded at 200%. If our corporate operating profit and total shareholder return are negative, there is no funding of this portion of the bonus. The relative ranking of Verigy’s total shareholder return did not meet the minimum performance threshold for either performance period during the fiscal year.

SOC Test Financial Results. Goals related to SOC Test financial results only applied directly to Hans-Jürgen Wagner, our Vice President, SOC Test, and measured short-term non-GAAP operating profit for the SOC Test product family against budgeted goals for each six-month period. The Compensation Committee designed those goals to help drive the growth and strategic objectives for our SOC business and promote the achievement of Verigy’s operating profit margin goals. The other named executive officers are in corporate roles, and therefore, are not assigned specific division or business unit goals. The SOC Test goals are set based on historical performance results and forecast plans, where the target goal represents a reasonable stretch goal, the minimum threshold requires a minimum performance level no lower than break-even profitability and a maximum that reflects an unlikely but possible outcome. We have not disclosed the specific SOC Test goals or results because disclosure could place us at a disadvantage with customers, vendors, suppliers and competitors. However, the Compensation Committee believed the achievement at the target levels or above was very difficult during the unprecedented global economic downturn, and, if achieved, would contribute significantly to the overall success of Verigy.

The following table sets forth the minimum, target and maximum performance thresholds, as well as actual results, for each of the categories, other than SOC Test financial results:

| Pay For Results Measures |

Minimum Threshold |

Target Threshold |

Maximum Threshold |

Actual Result |

||||||||||||

| Mid-Cycle Non-GAAP Operating Profit Margin |

||||||||||||||||

| First half 2010 |

5 | 15.5 | 23 | 4.85 | ||||||||||||

| Second half 2010 |

5 | 15.5 | 23 | 14.8 | ||||||||||||

| Semi-Annual Non-GAAP Operating Profit Margin |

||||||||||||||||

| First half 2010 |

0 | 2 | 5 | 4.85 | ||||||||||||

| Second half 2010 |

9 | 11.9 | 15 | 14.8 | ||||||||||||

| Relative Total Shareholder Return (TSR) |

TSR

at 25th percentile |

TSR

at 50th percentile |

TSR

at 100th percentile |

|||||||||||||

| First half 2010 |

39 | 50 | 684 | 31 | ||||||||||||

| Second half 2010 |

(14 | ) | 0 | 29 | (20 | ) | ||||||||||

As noted in the above table, the target for the Mid-Cycle Non-GAAP Operating Profit Margin goal was not met for first half 2010, but was met for second half 2010. The target for the Semi-Annual Non-GAAP Operating Profit Margin was met for both first half and second half 2010. The Relative TSR goals were not met for either fiscal halves. Bonuses were paid to named executive officers for fiscal 2010 under the Pay for Results Program as follows: Mr. Barnes, $605,766; Mr. Titinger, $282,628; Mr. Nikl, $251,047; Mr. Wagner, $127,701; and Mr. Rondé, $200,941. In addition, the Compensation Committee exercised its discretion and approved a discretionary bonus for Mr. Wagner in the amount of $20,000 in light of superior SOC Test financial results.

Long-Term Incentives. Long-term incentives help us to compete for and retain executive talent within a highly competitive market, while also aligning executive officers with the long-term value to shareholders. Our named executive officers are awarded a mix of a fixed number of share options and a fixed number of restricted share units, or RSUs, each representing approximately half of the total target grant date value. The equal weighting of equity value on options and restricted share units provides a balance between aligning executives with shareholder interests and retaining executives within a volatile industry. This approach also helps to more efficiently utilize available shares, thereby keeping overall equity dilution to competitive norms. The number of share options and restricted share units granted to each named executive officer is based on a target economic value. Share options are intended to directly link executive officer compensation to shareholder value creation over a multi-year period, and RSUs establish significant, unvested equity positions and are intended to help retain our executives’ services during difficult periods which are inevitable in our industry.

In fiscal 2010, the Compensation Committee determined that the median long-term incentive practice of our peer group for comparable positions was appropriate to help retain the Chief Executive Officer and other named executive officers. However, in specific cases, we set the target economic value of the equity award higher or lower where appropriate based on factors such as Verigy’s prior year performance, individual executive officer performance, the existing holdings of the executive officer and any recent grants made in connection with new employment or promotion. The fiscal 2010 equity awards to our named executive officers were comparable to the market median given the factors noted above.

The Compensation Committee adopted an approach to granting options, which we refer to as our “four-tranche option approach,” in 2006 in recognition of the volatility of our industry. The purpose of the four-tranche option approach is to provide cost-averaging of the exercise prices of an award over a period of several future quarters rather than establish a single exercise price applicable to the entire award. By linking the automatic pricing mechanism to future announcements of financial results, the exercise prices of the second, third and fourth tranches are established at times when our insider trading window would generally be open and at times when the market has current information about our recent financial results and outlook. In the event of a termination of an executive officer’s employment for

any reason, the price of any previously un-priced tranche is fixed as of the last trading day preceding the date of termination. In the event a change in control is announced, the price of any previously un-priced tranche is fixed as of the last trading day preceding the day of the announcement of the change in control transaction. However, our four-tranche option approach, in effect, automates a quarterly grant approach by allowing a single award to be priced as if it had been awarded in four separate actions.

Annual grant levels for fiscal 2010 were finalized and approved on December 1, 2009. The Compensation Committee approved a mix of restricted share units and options as part of the fiscal 2010 executive officer compensation. The restricted share units vest and are paid out quarterly over a four-year period from the grant date. As of the end of fiscal 2009, there were approximately 2,500,000 shares available for grant under our 2006 EIP and we sought approval of an amendment to increase the number of shares authorized under the plan. In order to conserve shares under the 2006 EIP until shareholders either approved or did not approve amendment, the Compensation Committee determined to make a portion (25%) of the annual option awards contingent on the shareholders approving the addition of shares to the 2006 EIP at the 2010 Annual General Meeting of Shareholders. Accordingly, the Compensation Committee granted each executive officer a non-contingent award representing 75% of their annual share option award, referred to as a Non-Contingent Award, and a contingent award representing 25% of their annual share option award, referred to as a Contingent Award. The following is a summary of the material terms of the Non-Contingent Awards and Contingent Awards.

Non-Contingent Awards. Similar to our four-tranche option approach used in the past:

| • | the exercise price of the 1st tranche (1/3rd of the shares) of the Non-Contingent Award was set as the closing price of our ordinary shares on the grant date of the award, and the first tranche vests in 16 equal quarterly installments with the first installment vesting on March 13, 2010, subject to continued service through the applicable vesting date; |

| • | the exercise price of the 2nd tranche (1/3rd of the shares) of the Non-Contingent Award automatically was set as the closing price of our ordinary shares on the 3 rd business day following the announcement of our financial results for the quarter ending January 31, 2010, and vests in 15 equal quarterly installments with the first installment vesting on June 13, 2010, subject to continued service through the applicable vesting date; and |

| • | the exercise price of the 3rd tranche (1/3rd of the shares) of the Non-Contingent Award automatically was set as the closing price of our ordinary shares on 3rd business day following the announcement of our financial results for the quarter ending April 30, 2010, and vests in 14 equal quarterly installments with the first installment vesting on September 13, 2010, subject to continued service through the applicable vesting date. |

In the case of Mr. Rondé, the first tranche of his Non-Contingent Award was priced on December 7, 2009, in accordance with applicable French regulations regarding tax qualifications for option grants. Each of the remaining two tranches was priced at the earliest date allowable subsequent to the release of our financial results for the quarters ending January 31, 2010, and April 30, 2010, in accordance with applicable French regulations regarding tax qualification for option grants. Generally, the pricing of each tranche of Mr. Rondé’s Non-Contingent Award occurred on the 11th business day following the public announcement of our financial results, or on the 11th business day following a material announcement that occurs within that 11-day period. The option price for Mr. Rondé’s awards is the greater of (A) the fair market value (closing price) of our ordinary shares on the pricing date; or (B) 80% of the average of the fair market values (closing prices) for the 20 trading days preceding the pricing date.

Contingent Awards. Shareholders approved the amendment of the 2006 EIP; and, accordingly, the exercise price of the Contingent Awards automatically was set as the closing price of our ordinary shares on the 3rd trading day following the announcement of our financial results for the quarter ending July 31, 2010. In the case of Mr. Rondé, the Contingent Award was priced on the 11th business day following the public announcement of our financial results for the quarter ending July 31, 2011. The Contingent Awards vest in 13 equal quarterly installments, with the first installment vesting on December 13, 2010.

Restricted Share Units. The RSUs are scheduled to vest and be paid out quarterly over a four-year period from the grant date, which provides the Company with retention incentives and encourages our named executive officers to drive performance over this multi-year period. Similarly, the options are scheduled to vest quarterly over a total of 16

quarters on the four year anniversary of the grant date. Vesting generally is subject to the award holder’s continued service to the Company, subject to acceleration of vesting under certain circumstances. Please see “Grants of Plan Based Awards” for further details regarding the equity award grants to the named executive officers.

The total equity value of awards granted to our named executive officers for fiscal 2009 and 2010 is shown in the following table:

| Fiscal 2010 Total Equity Grant Date Value ($) |

Fiscal 2009 Total Equity Grant Date Value ($) |

Year-Over- Year Change in Total Equity Awards (%) |

||||||||||

| Keith L. Barnes |

2,507,829 | 2,727,971 | (8 | ) | ||||||||

| Jorge Titinger(1) |

933,995 | 715,516 | 30 | |||||||||

| Robert J. Nikl |

895,057 | 800,744 | 12 | |||||||||

| Hans-Jürgen Wagner |

616,783 | 535,616 | 15 | |||||||||

| Pascal Rondé |

677,144 | 602,794 | 12 | |||||||||

| (1) | On July 1, 2010, in connection with Jorge Titinger’s appointment to serve as our President and Chief Operating Officer, he received a grant of options covering 60,000 ordinary shares and an award of 30,000 RSUs. The Compensation Committee reviewed competitive practices and determined an appropriate equity award level given Mr. Titinger’s increased responsibilities. |

Benefits & Perquisites

Our executive compensation program includes limited executive perquisites and other benefits, described below, which we believe are important to allow us to compete for employee talent. We believe that the limited perquisites and other benefits that we provide the executive officers are consistent with the executive compensation programs of many of the companies with which we compete for executive talent.

Health, Welfare and Retirement Benefits. The named executive officers receive the same health, welfare and retirement benefits as are available to other full-time employees in the particular country in which the executive is resident.

Financial Counseling. Reimbursement of tax preparation and financial counseling services were available to the named executive officers and payments ranging between $1,100 and $16,645 were made by Verigy for these services in fiscal 2010. This is a common executive perquisite, which helps the executive focus on business requirements. Amounts paid are included in the officer’s income, and the officer bears any income tax payable with respect to the benefit.

Temporary Living Allowances / Relocation Benefits. During fiscal 2010, we paid our then-current Chief Executive Officer, Keith Barnes, a temporary living expense allowance of $12,000 per month and our Chief Financial Officer, Robert Nikl, a temporary living expense allowance of $32,247. In November 2009, we entered into a Relocation Agreement with Mr. Nikl pursuant to which Verigy paid Mr. Nikl a lump sum gross amount of $180,000, less applicable tax withholding, to cover costs associated with his relocation to a residence closer to the Cupertino, California office of Verigy’s principal U.S. subsidiary. Verigy paid the relocation benefit promptly after receipt of appropriate documents confirming Mr. Nikl’s purchase of a new residence in the local area in early 2010. We believe that living allowances and relocation benefits are commonly offered by global companies to executive officers that are asked to relocate and therefore were appropriate benefits to offer to Messrs. Barnes and Nikl. A more detailed description of the living allowances for Mr. Barnes and Mr. Nikl and the relocation benefit for Mr. Nikl is set forth set forth below under “Executive Compensation” in the sections entitled “Agreements with Our Chief Executive Officer” and “Agreements with Our Chief Financial Officer.”

Severance Payments in Connection With Termination or a Change in Control

As described more fully below under “Potential Payments in Connection With Termination or a Change in Control,” we have entered into agreements with each of the named executive officers, except for Pascal Rondé and Hans-Jürgen Wagner, that provide for cash severance, health-care benefits continuation and acceleration of unvested equity if they are terminated either before or in connection with a change in control under certain circumstances. These agreements also require us to pay gross-up payments to the named executive officers if the officer is subject to a “golden parachute” excise tax in connection with the change in control benefits. However, if the golden parachute excise taxes can be avoided by reducing the payments to the executive officer, we may reduce the payments up to a total reduction not to exceed $25,000.

We have also entered into agreements with Messrs. Rondé and Wagner that provide for acceleration of unvested equity if they are terminated in connection with a change in control. Messrs. Rondé and Wagner would also be eligible for certain payments after termination in connection with a change in control as provided under French and German law, respectively.

The change in control severance terms were offered to certain executive officers by Agilent Technologies, Inc., prior to our separation from Agilent in 2006. Our Compensation Committee approved the change in control severance agreements in 2006 and the amended agreements in 2008. In approving the terms of the severance arrangements, the Compensation Committee recognized that providing certain benefits upon an executive’s termination of employment in certain instances provides the executive with enhanced financial security and incentive and encouragement to remain with the Company. We felt that such considerations were critical to retaining our executive officers. Further, from time to time we may consider or may be presented with the need to consider the possibility of an acquisition by another company or other change in control of Verigy. We recognize that such considerations can be a distraction to executive officers and can cause executive officers to consider alternative employment opportunities or to be influenced by the impact of a possible change in control on their personal circumstances in evaluating such possibilities. We also recognize that our executive officers might not be retained in comparable positions by a large acquirer, and so the benefit of the cash and equity incentive compensation provided to them might otherwise be forfeited upon a termination of employment by such acquirer. As a result, we believe that it is important to provide such individuals with severance benefits upon their termination of employment in connection with a change in control to secure their continued dedication and objectivity, notwithstanding the possibility, threat or occurrence of a change in control, as well as to provide them with enhanced financial security.

The Compensation Committee considers the impact of the potential benefits under the agreements when considering changes in base salary and short-term incentive opportunities.

Executive Share Ownership Guidelines; Recoupment Policy; Hedging Prohibition

As noted above, a core element of our compensation philosophy is to align the interests of executive officers with those of shareholders by providing appropriate long-term incentives. To further align the interests of executive officers and shareholders, in January 2010, the board of directors adopted guidelines regarding minimum ownership of shares by Verigy’s executive officers and directors. The ownership guidelines call for the Chief Executive Officer to own 50,000 ordinary shares, for each other executive officer to own 15,000 ordinary shares and for our non-employee directors to own 10,000 ordinary shares. Executive officers and non-employee directors are encouraged to reach this goal within five years of the date the board of directors approved the guidelines or the date of their initial election to our board of directors or promotion or hire date as an executive officer, whichever is later, and to hold at least such minimum number of shares for as long as he or she is an executive officer or non-employee director. In the event that an individual has not achieved at least 50% of their target holdings at the end of the third year of the five year transition period, then it is recommended that the individual retain 50% of any net ordinary shares acquired or vested or, if less, the number of ordinary shares necessary to attain 100% of the applicable share ownership level. For purposes of the ownership guidelines, share holdings include ordinary shares and vested and unvested restricted share units held by the individual, family trust and immediate family members.

Another part of our compensation philosophy is pay for performance, meaning that executive officers should earn variable cash incentives based on the achievement of financial and non-financial objectives. Following the Nominating and Governance Committee’s recommendation, in January 2010, the board of directors adopted a recoupment policy that applies if there is a restatement of Verigy’s financial statements caused by fraud or willful misconduct by an executive officer. The policy provides for, in discretion of our independent directors, the following as to any executive officer whose fraud or misconduct caused the restatement of our financial statements:

| • | recouping incentive cash compensation in excess of the amount by which incentive compensation based on financial statements that required restating exceeds the amounts that would have been paid based on the accurate, restated numbers; |

| • | cancelling outstanding equity awards; and |

| • | recouping after-tax gains on sales of securities sold between the filing of the financial statements that required restating and the filing of the accurate, restated numbers. |

Our Insider Trading Policy prohibits our executives from margining Verigy securities or trading in derivative securities related to our securities.

Fiscal 2011 Executive Compensation

The board of directors and the Compensation Committee made several decisions with respect to succession planning and executive compensation for fiscal 2011 as described below.

Appointment of New Chief Executive Officer. The board of directors made the following decisions with respect to certain of our named executive officers: Jorge Titinger, our President and then-Chief Operating Officer was promoted to serve as our President and Chief Executive Officer, effective January 1, 2011. Keith Barnes serves as Chairman of the board of directors. For a discussion of compensation arrangements with Mr. Titinger, see “Compensation of Jorge Titinger and Robert Nikl” below.

Executive Compensation Decision Made in Connection with the Merger. Contingent upon the completion of the proposed merger between the Company and LTX-Credence Corporation, which we refer to as the merger, Jorge Titinger and David Tacelli, LTX-Credence’s current President and Chief Executive Officer, will serve as Co-Chief Executive Officers of the combined company, and Robert Nikl, our current Chief Financial Officer, will serve as Chief Financial Officer of the combined company. In addition, contingent upon the completion of the merger, Keith Barnes will serve as Chairman of the board of directors of the combined company.

In connection with the merger and Mr. Barnes’ transition, we entered into a non-competition agreement with Mr. Barnes dated November 17, 2010, which we refer to as the Non-Competition Agreement, in order to (i) provide incentive for Mr. Barnes to lead Verigy through the merger, (ii) preserve the value and goodwill of the business being acquired by the combined company after the merger and (iii) protect the trade secrets of Verigy. Although Mr. Barnes continues to be eligible to receive benefits under his severance agreement with Verigy, which we refer to as the Barnes Severance Agreement, the Non-Competition Agreement amends the Barnes Severance Agreement as described below.

Under the Non-Competition Agreement, Mr. Barnes receives the following benefits, subject to his not breaching his obligations thereunder, which are described below, or under the Barnes Severance Agreement:

| • | If Mr. Barnes had died prior to his resignation date of December 31, 2010, the severance pay and benefits that otherwise would have been payable to Mr. Barnes, pursuant to the existing Barnes Severance Agreement, upon a termination of employment unrelated to a “change of control” (as defined in the Barnes Severance Agreement) without “cause” (as defined in the Barnes Severance Agreement) or for “good reason” (as defined in the Barnes Severance Agreement) would have been payable to Mr. Barnes’ estate in a lump sum within 30 days after his death; |

| • | Cash payments of (a) $146,000, less applicable withholdings, paid in 24 equal monthly payments commencing January 1, 2011, subject to any delay required by Section 409A of the Internal Revenue Code, as amended (the “Code”) and (b) $125,000, less applicable withholdings, in a lump sum within 5 days after the completion of the merger; |

| • | On his resignation date, Mr. Barnes’ then-outstanding stock options became exercisable until the maximum expiration date of each applicable stock option; and |

| • | The Barnes Severance Agreement provides that Mr. Barnes is eligible for increased severance benefits if his qualifying termination occurs within a specified period before or after a change of control. The period prior to a change of control in which Mr. Barnes is eligible for these increased change of control-related benefits if he experiences a qualifying termination of employment has been increased to 12 months from 3 months, pursuant to the Non-Competition Agreement. |

As a condition to receiving the benefits under the Non-Competition Agreement, Mr. Barnes agreed to be bound by a non-competition period commencing on November 17, 2010 and continuing through December 31, 2012. During that time, Mr. Barnes has agreed not to directly or indirectly (i) engage in any business that is competitive with Verigy or its affiliates, (ii) become an employee, director, shareholder, owner or consultant of or hold certain other service provider positions with, such a competing business, (iii) acquire or hold an interest in, or participate in or facilitate the financing, operation, management or control of, any person, entity or business that engages in any such competitive business or (iv) contact, solicit or communicate with customers of Verigy in connection with a competitive business. In addition, as a condition to receiving the cash payment and exercise period extension benefits under the Non-Competition Agreement, Mr. Barnes has agreed to a 2-year non-solicitation provision commencing on the date the merger closes during which time Mr. Barnes can neither personally solicit any employee of Verigy (or its successor) or any of their subsidiaries nor personally induce any employee of Verigy (or its successor) or any of their subsidiaries to engage in any such competitive business.

Compensation of Jorge Titinger and Robert Nikl. On November 17, 2010, we entered into a promotion letter agreement with Jorge Titinger and a compensation letter agreement with Robert Nikl, collectively referred to as the Letters. Mr. Nikl’s compensation letter was amended on January 18, 2011. The compensation and benefits provided under the Letter for Mr. Titinger are effective as of January 1, 2011, and as of February 1, 2011 for Mr. Nikl. Under the Letters, Mr. Titinger and Mr. Nikl receive the compensation and benefits described below.

| • | Base Salary: (i) Mr. Titinger’s annual base salary was increased from $400,000 to $575,000 and (ii) Mr. Nikl’s annual base salary will be increased from $335,076 to $360,000. |

| • | Target Variable Pay: Mr. Titinger and Mr. Nikl will each be eligible for a target variable pay opportunity equal to 80% of their respective annual base salary under Verigy’s pay for results bonus program. |

| • | Stock Options: On January 1, 2011, Mr. Titinger was granted a nonqualified share option grant for 18,100 combined company ordinary shares. On February 1, 2011, Mr. Nikl will be granted a non-qualified share option grant for 13,700 combined company ordinary shares. In each case, such grants are made pursuant to and subject to the terms of 2006 Plan and our four-tranche option approach. |

| • | Restricted Share Units: On January 1, 2011, Mr. Titinger was granted an RSU award covering 7,300 ordinary shares. On February 1, 2011, Mr. Nikl was granted an RSU award covering 5,500 ordinary shares. In each case, such grants are subject to the 2006 Plan. The restricted share units will vest quarterly over the subsequent four years. |

Under Mr. Titinger’s Letter, the “good reason” definition set forth in his severance agreement with Verigy, referred to as the Titinger Severance Agreement, has been amended to add provisions such that: (i) Mr. Titinger’s resignation at the request of 2/3 of the board of directors qualifies as a “good reason” resignation and (ii) the appointment of any person other than Mr. Titinger to the role of sole Chief Executive Officer of the combined company, or a change to Mr. Titinger’s position which results in him no longer reporting directly to the board of directors, in each case, constitute “good reason” grounds for his resignation.

The Letter for Mr. Titinger also amends the Titinger Severance Agreement to provide for 100% acceleration of vesting for Mr. Titinger’s stock options, stock appreciation rights, restricted shares and restricted share units in the event that he is involuntarily terminated by the combined company without “cause” or he resigns for “good reason” and the change of control-related severance benefits under the Titinger Severance Agreement otherwise do not apply. In addition, upon such a termination or resignation, Mr. Titinger’s outstanding stock options and stock appreciation rights would remain exercisable for up to 15 months post termination or resignation. On November 17, 2010, the Verigy Compensation Committee approved the grant of stock options and restricted share units on the terms described above.