Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the Year Ended December 31, 2010

QEP RESOURCES, INC.

(Exact name of registrant as specified in its charter)

| STATE OF DELAWARE | 001-34778 | 87-0287750 | ||

| (State or other jurisdiction of incorporation) |

(Commission File No.) | (I.R.S. Employer Identification No.) |

1050 17th Street, Suite 500, Denver, Colorado 80265

(Address of principal executive offices)

Registrant’s telephone number, including area code: 303-672-6900

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common stock, $0.01 par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||

| Non-accelerated filer | x | (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | ||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. (June 30, 2010): $0.

At February 18, 2011, there were 176,305,256 shares of the registrant’s $0.01 par value common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III is incorporated by reference from the registrant’s Definitive Proxy Statement for its 2011 Annual Meeting of Stockholders to be filed, pursuant to Regulation 14A, no later than 120 days after the close of the registrant’s fiscal year.

Table of Contents

| Page No. | ||||||

| 4 | ||||||

| 4 | ||||||

| 5 | ||||||

| PART I | ||||||

| Item 1. | 8 | |||||

| 8 | ||||||

| 9 | ||||||

| 10 | ||||||

| 11 | ||||||

| 11 | ||||||

| 12 | ||||||

| Item 1A. | 13 | |||||

| Item 1B. | 20 | |||||

| Item 2. | 21 | |||||

| 21 | ||||||

| 24 | ||||||

| 24 | ||||||

| Item 3. | 25 | |||||

| Item 4. | 25 | |||||

| PART II | ||||||

| Item 5. | 26 | |||||

| Item 6. | 28 | |||||

| Item 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

|

30 |

| ||

| Item 7A. | 45 | |||||

| Item 8. | 47 | |||||

| Item 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

|

87 |

| ||

| Item 9A. | 87 | |||||

| Item 9B. | 89 | |||||

2

Table of Contents

| Page No. | ||||||

| PART III | ||||||

| Item 10. | 89 | |||||

| Item 11. | 89 | |||||

| Item 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

89 | ||||

| Item 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE |

89 | ||||

| Item 14. | 89 | |||||

| PART IV | ||||||

| Item 15. | 90 | |||||

| 94 | ||||||

3

Table of Contents

Where You Can Find More Information

QEP Resources, Inc. (QEP or the Company) files annual, quarterly, and current reports with the Securities and Exchange Commission (SEC). Prior to QEP’s Spin-off from Questar Corporation (described in more detail in the Explanatory Note in Item 1 of Part I of this Annual Report on Form 10-K), QEP’s predecessor, Questar Market Resources, Inc., filed annual, quarterly and current reports with the SEC. QEP also regularly files proxy statements and other documents with the SEC. These reports and other information can be read and copied at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549-0213. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the Public Reference Room. The SEC also maintains an internet site at http://www.sec.gov that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC, including QEP.

Investors can also access financial and other information via QEP’s website at www.qepres.com. QEP makes available, free of charge through the website copies of Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and any amendments to such reports and all reports filed by executive officers and directors under Section 16 of the Exchange Act reporting transactions in QEP securities. Access to these reports is provided as soon as reasonably practical after such reports are electronically filed with the SEC. Information contained on or connected to QEP’s website which is not directly incorporated by reference into the Company’s Annual Report on Form 10-K should not be considered part of this report or any other filing made with the SEC.

QEP’s website also contains copies of charters for various board committees, including the Audit Committee, Corporate Governance Guidelines and QEP’s Business Ethics and Compliance Policy.

Finally, you may request a copy of filings other than an exhibit to a filing unless that exhibit is specifically incorporated by reference into that filing, at no cost by writing or calling QEP, 1050 17th Street, Suite 500, Denver, CO 80265 (telephone number: 1-303-672-6900).

This Annual Report contains or incorporates by reference information that includes or is based upon “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements give expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. They use words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” and other words and terms of similar meaning in connection with a discussion of future operating or financial performance. Forward-looking statements include statements relating to, among other things:

| • | plans to drill or participate in wells; |

| • | expenses; |

| • | the outcome of contingencies such as legal proceedings; |

| • | trends in operations; |

| • | forecasted capital expenditures for 2011; |

| • | the importance of adjusted EBITDA as a measure of cash flow and liquidity; |

| • | the ability of QEP to use derivative instruments to manage commodity price risk; |

| • | acquisition plans; |

| • | growth strategy; |

| • | climate change; and |

| • | the impact of regulatory changes on exploration and development costs; |

4

Table of Contents

Any or all forward-looking statements may turn out to be incorrect. They can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. Many such factors will be important in determining actual future results. These statements are based on current expectations and the current economic environment. They involve a number of risks and uncertainties that are difficult to predict. These statements are not guarantees of future performance. Actual results could differ materially from those expressed or implied in the forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to the following:

| • | the risk factors discussed in Part I, Item 1A of this Annual Report; |

| • | general economic conditions, including the performance of financial markets and interest rates; |

| • | changes in industry trends; |

| • | changes in laws or regulations; and |

| • | other factors, most of which are beyond the Company’s control. |

QEP undertakes no obligation to publicly correct or update the forward-looking statements in this Annual Report, in other documents, or on the website to reflect future events or circumstances. All such statements are expressly qualified by this cautionary statement.

Glossary of Commonly Used Terms

B Billion.

bbl Barrel, which is equal to 42 U.S. gallons and is a common measure of volume of crude oil and other liquid hydrocarbons.

basis The difference between a reference or benchmark commodity price and the corresponding sales price at various regional sales points.

basis-only swap A derivative that “swaps” the basis (defined above) between two sales points from a floating price to a fixed price for a specified commodity volume over a specified time period. Typically used to fix the price relationship between a geographic sales point and a NYMEX reference price.

Btu One British thermal unit – a measure of the amount of energy required to raise the temperature of a one-pound mass of water one degree Fahrenheit at sea level.

cash flow hedge A derivative instrument that complies with Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) 815 and is used to reduce the exposure to variability in cash flows from the forecasted physical sale of gas and oil production whereby the gains (losses) on the derivative transaction are anticipated to offset the losses (gains) on the forecasted physical sale.

cf Cubic foot or feet is a common unit of gas measurement. One standard cubic foot equals the volume of gas in one cubic foot measured at standard conditions – a temperature of 60 degrees Fahrenheit and a pressure of 30 inches of mercury (approximately 14.7 pounds per square inch).

cfe Cubic foot or feet of natural gas equivalents.

developed reserves Reserves of any category that can be expected to be recovered through existing wells with existing equipment and operating methods or in which the cost of the required equipment is relatively minor compared to the cost of a new well. See 17 C.F.R. Section 4-10(a)(6).

development well A well drilled into a known producing formation in a previously discovered field.

5

Table of Contents

dry hole A well drilled and found to be incapable of producing hydrocarbons in sufficient quantities such that proceeds from the sale of production exceed expenses and taxes.

equity production Production at the wellhead attributed to QEP’s ownership.

exploratory well A well drilled into a previously untested geologic prospect to determine the presence of gas or oil.

frac spread The difference between the market value for natural gas liquids (NGL) extracted from the natural gas stream and the market value of the Btu-equivalent volume of natural gas required to replace the extracted liquids.

futures contract A contract to buy or sell a standard quantity and quality of a commodity at a specified future date and price.

gal U.S. gallon.

gas All references to “gas” in this report refer to natural gas.

gross “Gross” natural gas and oil wells or “gross” acres are the total number of wells or acres in which the Company has a working interest.

hedging The use of commodity and interest-rate derivative instruments to reduce financial exposure to commodity price and interest-rate volatility.

M Thousand.

MM Million.

natural gas equivalents Oil and NGL volumes are converted to natural gas equivalents using the ratio of one barrel of crude oil, condensate or NGL to 6,000 cubic feet of natural gas.

natural gas liquids (NGL) Liquid hydrocarbons that are extracted from the natural gas stream. NGL products include ethane, propane, butane, natural gasoline and heavier hydrocarbons.

net “Net” gas and oil wells or “net” acres are determined by the sum of the fractional ownership working interest the Company has in those gross wells or acres.

net revenue interest A share of production after all burdens, such as royalties and overriding royalties, have been deducted from the working interest. It is the percentage of production that each owner is entitled to receive.

NYMEX The New York Mercantile Exchange.

proved reserves Those quantities of natural gas, oil, condensate and NGL which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible from known reservoirs under existing economic conditions, operating methods and government regulations. See 17 C.F.R. Section 4-10(a)(22).

reserves Estimated remaining quantities of natural gas, oil and related substances anticipated to be economically producible by application of development projects to known accumulations. In addition, there must exist, or there must be a reasonable expectation that there will exist, the legal right to produce. See 17 C.F.R. Section 4-10(a)(26).

6

Table of Contents

reservoir A porous and permeable underground formation containing a natural accumulation of producible natural gas and/or oil that is confined by impermeable rock or water barriers and is individual and separate from other reservoirs.

royalty An interest in a gas and oil lease that gives the owner the right to receive a portion of the production from the leased acreage (or of the proceeds of the sale thereof), but generally does not require the owner to pay any portion of the costs of drilling or operating the wells on the leased acreage. Royalties may be either landowner’s royalties, which are reserved by the owner of the minerals at the time the lease is granted, or overriding royalties, which are usually reserved by an owner of the leasehold in connection with a transfer to a subsequent owner.

seismic data/survey An exploration method of sending energy waves or sound waves into the earth and recording the wave reflections to indicate the type, size, shape and depth of a subsurface rock formation. 2-D seismic provides two-dimensional information and 3-D seismic provides three-dimensional views.

T Trillion.

undeveloped reserves Reserves of any category that are expected to be recovered from new wells on undrilled acreage, or from existing wells where a relatively major expenditure is required for recompletion. See 17 C.F.R. Section 4-10(a)(31).

working interest An interest in a gas and oil lease that gives the owner the right to drill, produce and conduct operating activities on the leased acreage and receive a share of any production.

workover Operations on a producing well to restore or increase production.

7

Table of Contents

FORM 10-K

ANNUAL REPORT 2010

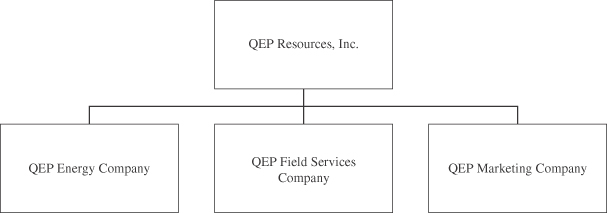

QEP Resources, Inc. (QEP or the Company), is an independent natural gas and oil exploration and production company. QEP is a holding company with three major lines of business – gas and oil exploration and production, midstream field services, and energy marketing – which are conducted through three principal subsidiaries:

| • | QEP Energy Company (QEP Energy) acquires, explores for, develops and produces natural gas, oil, and natural gas liquids (NGL); |

| • | QEP Field Services Company (QEP Field Services) provides midstream field services including natural gas gathering, processing and treating services for affiliates and third parties; and |

| • | QEP Marketing Company (QEP Marketing) markets equity and third-party natural gas and oil, provides risk-management services, and owns and operates an underground gas-storage reservoir. |

QEP operates in the Rocky Mountain and Midcontinent regions of the United States and is headquartered in Denver, Colorado. Principal offices are located in Denver, Colorado; Salt Lake City, Utah; Oklahoma City, Oklahoma; and Tulsa, Oklahoma.

The corporate-organization structure and principal subsidiaries are depicted below:

EXPLANATORY NOTE

Effective May 18, 2010, Questar Market Resources, Inc., (Market Resources) then a wholly-owned subsidiary of Questar Corporation (Questar), merged with and into a newly-formed, wholly-owned subsidiary, QEP Resources, Inc., a Delaware corporation in order to reincorporate in the State of Delaware (Reincorporation Merger). The Reincorporation Merger was effected pursuant to an Agreement and Plan of Merger entered into between Market Resources and QEP. The Reincorporation Merger was approved by the boards of directors of Market Resources and QEP and submitted to a vote of, and approved by, the Board of Directors of Questar, as sole shareholder of Market Resources, and by Market Resources, as sole shareholder of QEP on May 18, 2010.

On June 30, 2010, Questar distributed all of the shares of common stock of QEP held by Questar to Questar shareholders in a tax-free, pro rata dividend (the Spin-off). Each Questar shareholder received one share of QEP

8

Table of Contents

common stock for each one share of Questar common stock held (including fractional shares) at the close of business on the record date. In connection therewith, QEP distributed Wexpro Company (Wexpro), a wholly-owned subsidiary of QEP at the time, to Questar. In addition, Questar contributed $250.0 million of equity to QEP prior to the Spin-off.

In connection with the reorganization, QEP renamed its subsidiaries as follows:

| • | QEP Energy Company (formerly Questar Exploration and Production Company), |

| • | QEP Field Services Company (formerly Questar Gas Management Company), and |

| • | QEP Marketing Company (formerly Questar Energy Trading Company). |

The financial information presented in this Form 10-K presents QEP’s financial results as an independent company separate from Questar and reflects Wexpro’s financial condition and operating results as discontinued operations for all periods presented. A summary of discontinued operations can be found in Note 3 to the consolidated financial statements in Item 8 of this Annual Report on Form 10-K.

EXPLORATION AND PRODUCTION – QEP Energy Company

General: QEP’s exploration and production business is conducted through QEP Energy, which generated approximately 72% of the Company’s operating income in 2010. QEP Energy operates in two core regions – the Rocky Mountain region (including the states of Wyoming, Utah, Colorado, New Mexico and North Dakota) and the Midcontinent region (including the states of Oklahoma, Texas and Louisiana). QEP Energy reported production of 229.0 Bcfe compared to 189.5 Bcfe in 2009. The Midcontinent region contributed approximately 53% of 2010 production while the Rocky Mountain region contributed the remaining 47%. QEP Energy reported 3,030.7 Bcfe of estimated proved reserves as of December 31, 2010, of which approximately 61%, or 1,860.2 Bcfe, were located in the Rocky Mountain region, while the remaining 39%, or 1,170.5 Bcfe, were located in the Midcontinent region. Approximately 53% of the proved reserves reported by QEP Energy at year-end 2010 were developed, while 47% were categorized as proved undeveloped. Natural gas comprised about 86% of the total proved reserves at year-end 2010. The SEC amended its definitions of oil and natural gas reserves effective December 31, 2009. Key revisions impacting the Company include a change in the pricing used to determine estimated proved reserves from year-end prices to first-of-the-month prior 12-month average prices, changes in reserve category definitions, and the allowance of the application of reliable technologies in the determination of proved reserves. See Item 2 of Part I and Note 16 to the consolidated financial statements included in Item 8 of Part II of this Annual Report for more information on the Company’s proved reserves.

QEP Energy has a large inventory of identified development drilling locations, primarily on the Pinedale Anticline in western Wyoming, in northwestern Louisiana, in western Oklahoma and in western North Dakota. QEP Energy continues to conduct exploratory drilling to determine the commerciality of its inventory of undeveloped leaseholds. The Company seeks to acquire, develop and produce natural gas and oil from so-called “resource plays” in its core areas. Resource plays are characterized by continuous, aerially extensive hydrocarbon accumulations in tight sand, shale and coal reservoirs. Since the existence and distribution of hydrocarbons in resource plays is well understood, development of these accumulations has lower exploration risk than conventional discrete hydrocarbon accumulations. Resource plays typically require many wells, drilled at high density, to fully develop and produce the hydrocarbon accumulations. Development of QEP Energy’s resource play accumulations requires expertise in drilling large numbers of complex, highly deviated or horizontal wells to depths in excess of 13,000 feet and the application of advanced well completion techniques, including hydraulic fracture stimulation, to achieve economic production. QEP Energy seeks to maintain geographical and geological diversity with its two core regions. The Company has in the past and may in the future pursue acquisition of producing properties through the purchase of assets or corporate entities to expand its presence in its core areas or to create new core areas.

9

Table of Contents

Competition and Customers: QEP Energy faces competition in every part of its business, including the acquisition of producing properties and undeveloped leasehold, the marketing of natural gas and oil, and obtaining goods, services and labor. Its longer-term growth strategy depends, in part, on its ability to acquire reasonably-priced acreage containing reserves and identify and develop them in a low-cost and efficient manner.

QEP Energy, both directly and through QEP Marketing, sells natural gas production to a variety of customers, including gas-marketing firms, industrial users and local-distribution companies. QEP Energy regularly evaluates counterparty credit and may require financial guarantees or prepayments from parties that fail to meet its credit criteria.

Regulation: QEP Energy operations are subject to various government controls and regulation at the federal, state and local levels. QEP Energy must obtain permits to drill and produce wells; maintain required bonds to drill and operate wells; submit and implement spill-prevention plans; and file notices relating to the presence, use, and release of specified contaminants incidental to gas and oil drilling, completion and production. QEP Energy is also subject to various conservation matters, including the regulation of the size of drilling and spacing units, the number of wells that may be drilled in a unit and the unitization or pooling of gas and oil properties.

Most of QEP Energy’s leasehold acreage in the Rocky Mountain region is held under leases granted by the United States and administered by federal agencies, principally the Bureau of Land Management (BLM). Current federal regulations restrict activities during certain times of the year on significant portions of QEP Energy leasehold due to wildlife activity and/or habitat. QEP Energy has worked with federal and state officials in Wyoming to obtain authorization for limited winter-drilling activities on the Pinedale Anticline and has developed measures, such as drilling multiple wells from a single pad location, to minimize the impact of its activities on wildlife and wildlife habitat. Various wildlife species inhabit QEP Energy leaseholds at Pinedale and in other areas. The presence of wildlife or plants, including species and types that are protected under the federal Endangered Species Act, could limit access to leases held by QEP Energy on public lands.

In September 2008, the BLM issued a Record of Decision (ROD) on the Final Supplemental Environmental Impact Statement (FSEIS) for long-term development of natural gas resources in the Pinedale Anticline Project Area (PAPA). Under the ROD, QEP Energy is allowed to drill and complete wells year-round in one of five Concentrated Development Areas defined in the PAPA. The ROD contains additional requirements and restrictions on development of the PAPA.

MIDSTREAM FIELD SERVICES – QEP Field Services Company

General: QEP Field Services generated approximately 27% of the Company’s operating income in 2010. QEP Field Services owns various natural gas gathering, treating and processing facilities in the Rocky Mountain and Midcontinent regions as well as 78% of Rendezvous Gas Services, LLC, (RGS), a partnership that operates gas gathering facilities in western Wyoming. QEP Field Services also owns 38% of Uintah Basin Field Services, LLC (UBFS) and 50% of Three Rivers Gathering, LLC (Three Rivers). These partnerships operate natural gas gathering facilities in eastern Utah. The FERC-regulated Rendezvous Pipeline Co., LLC (Rendezvous Pipeline), a wholly owned subsidiary of QEP Field Services, operates a 21-mile, 20-inch-diameter pipeline between QEP Field Services’ Blacks Fork gas-processing plant and the Muddy Creek compressor station owned by Kern River Gas Transmission Co. (Kern River Pipeline). RGS gathers natural gas for Pinedale Anticline and Jonah Field producers for delivery to various interstate pipelines.

Fee-based gathering and processing revenues were 78% of QEP Field Services’ net operating revenues (revenues less plant shrink) during 2010. Approximately 36% of QEP Field Services’ 2010 net gas-processing revenues (processing revenues less plant shrink) were derived from fee-based processing agreements. The remaining revenues were derived from keep-whole processing agreements. A keep-whole contract exposes QEP Field Services to frac-spread risk while a fee-based contract eliminates commodity price exposure. To further reduce volatility associated with keep-whole contracts, QEP Field Services may enter into forward-sales contracts for NGL or hedge NGL prices and equivalent gas volumes with the intent to lock in a processing margin.

10

Table of Contents

Competition and Customers: QEP faces regional competition with varying competitive factors in each basin. QEP’s gathering and processing business competes with other midstream companies, interstate and intrastate pipelines, producers and independent gatherers and processors. Numerous factors impact a customer’s choice of a gathering or processing services provider, including rate, location, term, pressure obligations, timeliness of services, and contract structure. QEP Field Services provides natural gas gathering, processing and treating services to affiliates and third-party producers who own producing natural gas fields in the Rocky Mountain region and in northwest Louisiana. Most of QEP Field Services’ gas gathering, processing and treating services are provided under long-term agreements.

ENERGY MARKETING—QEP Marketing Company

General: QEP Marketing provides wholesale marketing and sales of affiliate and third-party natural gas, oil and NGL and generated approximately 1% of the Company’s operating income in 2010. As a wholesale marketing entity, QEP Marketing concentrates on markets in the Rocky Mountains, Pacific Northwest and Midcontinent that are either close to affiliate reserves and production or accessible by major pipelines. QEP Marketing contracts for firm-transportation capacity on pipelines and firm-storage capacity at Clay Basin, a large baseload-storage facility. QEP Marketing, through its subsidiary Clear Creek Storage Company, LLC, operates an underground gas-storage reservoir in southwestern Wyoming. QEP Marketing uses owned and leased storage capacity together with firm-transportation capacity to manage seasonal swings in prices in the Rocky Mountain region.

Competition and Customers: QEP Marketing competes directly with large independent energy marketers, marketing affiliates of regulated pipelines and utilities and natural gas producers. QEP Marketing also competes with brokerage houses, energy hedge funds and other energy-based companies offering similar services. QEP Marketing sells QEP Energy natural gas and volumes purchased from third parties to wholesale marketers, industrial end-users and utilities. QEP Marketing sells QEP Energy crude oil volume to refiners, remarketers and other companies, including some with pipeline facilities near company producing properties. In the event pipeline facilities are not available, QEP Marketing arranges transportation of crude oil by truck or rail to storage, refining or pipeline facilities. QEP Marketing uses derivative instruments to manage commodity price risk, primarily fixed-price swaps to secure a known price for a specific volume of production. QEP Marketing does not engage in speculative hedging transactions. See Item 7A and Notes 1 and 7 to the consolidated financial statements included in Item 8 of Part II of this Annual Report for additional information relating to hedging activities.

At December 31, 2010, QEP Resources, Inc. had 823 employees, including 603 in QEP Energy, 198 in QEP Field Services and 22 in QEP Marketing.

11

Table of Contents

Executive Officers of the Registrant

Primary Positions Held with the Company

and Affiliates, Other Business Experience

| Charles B. Stanley | 52 | President, Chief Executive Officer, QEP (2010 to present). Previous titles with Questar: Chief Operating Officer (2008 to 2010); Executive Vice President and Director (2003 to 2010); President, Chief Executive Officer and Director, Market Resources and Market Resources subsidiaries (2002 to 2010). | ||

| Richard J. Doleshek | 52 | Executive Vice President and Chief Financial Officer, QEP (2010 to present). Previous titles with Questar: Executive Vice President and Chief Financial Officer (2009 to 2010). Prior to joining Questar, Mr. Doleshek was Executive Vice President and Chief Financial Officer, Hilcorp Energy Company (2001 to 2009). | ||

| Jay B. Neese | 52 | Executive Vice President, QEP (2010 to present). Previous titles with Questar: Senior Vice President (2005 to 2010); Executive Vice President, Market Resources and Market Resources subsidiaries (2005 to 2010); Vice President, Market Resources and Market Resources subsidiaries (2003 to 2005); Assistant Vice President (2001 to 2003). | ||

| Perry H. Richards | 50 | Senior Vice President – Field Services (2010 to present). Previous title with Questar: Vice President, Questar Gas Management (2005 to 2010). | ||

| Eric L. Dady | 56 | Vice President and General Counsel, QEP (2010 to present). Previous title with Questar: General Counsel Market Resources (2005 to 2010). | ||

| Abigail L. Jones | 50 | Vice President, Compliance, Corporate Secretary and Assistant General Counsel, QEP (2010 to present). Previous titles with Questar: Vice President Compliance (2007 to 2010); Corporate Secretary (2005 to 2010); Assistant Secretary (2004 to 2005). | ||

There is no “family relationship” between any of the listed officers or between any of them and the Company’s directors. The executive officers serve at the pleasure of the Board of Directors. There is no arrangement or understanding under which the officers were selected.

12

Table of Contents

Investors should read carefully the following factors as well as the cautionary statements referred to in “Forward-Looking Statements” herein. If any of the risks and uncertainties described below or elsewhere in this Annual Report actually occur, the Company’s business, financial condition or results of operations could be materially adversely affected.

Risks Inherent in the Company’s Business

The future prices for natural gas, oil and NGL are volatile, and a decline in such prices could adversely affect QEP’s results, stock price and growth plans. Historically natural gas, oil and NGL prices have been volatile and will likely continue to be volatile in the future. U.S. natural gas prices in particular are significantly influenced by weather. Any significant or extended decline in commodity prices would impact the Company’s future financial condition, revenue, operating results, cash flow, return on invested capital, and rate of growth. In addition, significant and extended declines in commodity prices could limit QEP’s access to sources of capital or cause QEP to delay or postpone some of its capital projects. Because a significant portion of QEP Energy’s future production is natural gas, the Company’s financial results are substantially more sensitive to changes in natural gas prices than to changes in oil prices.

QEP cannot predict the future price of natural gas, oil and NGL because of factors beyond its control, including but not limited to:

| • | changes in domestic and foreign supply of natural gas, oil and NGL; |

| • | changes in local, regional, national and global demand for natural gas, oil, and NGL; |

| • | regional price differences resulting from available pipeline transportation capacity or local demand; |

| • | the level of imports of, and the price of, foreign natural gas, oil and NGL; domestic and global economic conditions; |

| • | the potential long-term impact of an abundance of natural gas from unconventional sources on the global gas supply; |

| • | domestic political developments; |

| • | weather conditions; |

| • | domestic government regulations and taxes; |

| • | technological advances affecting energy consumption and energy supply; |

| • | conservation efforts; |

| • | the price, availability and acceptance of alternative fuels; |

| • | storage levels of natural gas, oil, and NGL; and |

| • | the quality of natural gas and oil produced. |

In addition, lower commodity prices may result in asset impairment charges from reductions in the carrying values of QEP’s natural gas and oil properties.

The Company may not be able to economically find and develop new reserves. The Company’s profitability depends not only on prevailing prices for natural gas, oil and NGL, but also its ability to find, develop and acquire gas and oil reserves that are economically recoverable. Producing natural gas and oil reservoirs are generally characterized by declining production rates that vary depending on reservoir characteristics. Because of the initial high-rate production decline profile of several of the Company’s producing areas, substantial capital expenditures are required to find, develop and acquire gas and oil reserves to replace those depleted by production.

13

Table of Contents

Gas and oil reserve estimates are imprecise and subject to revision. QEP’s proved natural gas and oil reserve estimates are prepared annually by independent reservoir-engineering consultants. Gas and oil reserve estimates are subject to numerous uncertainties inherent in estimating quantities of proved reserves, projecting future rates of production and timing of development expenditures. The accuracy of these estimates depends on the quality of available data and on engineering and geological interpretation and judgment. Reserve estimates are imprecise and will change as additional information becomes available. Estimates of economically recoverable reserves and future net cash flows prepared by different engineers, or by the same engineers at different times, may vary significantly. Results of subsequent drilling, testing and production may cause either upward or downward revisions of previous estimates. In addition, the estimation process also involves economic assumptions relating to commodity prices, operating costs, severance and other taxes, capital expenditures and remediation costs. Actual results most likely will vary from the estimates. Any significant variance from these assumptions could affect the recoverable quantities of reserves attributable to any particular properties, the classifications of reserves, the estimated future net cash flows from proved reserves and the present value of those reserves.

Investors should not assume that QEP’s presentation of the Standardized Measure of Discounted Future Net Cash Flows Relating to Proved Reserves in this Annual Report is the current market value of the estimated natural gas and oil reserves. In accordance with SEC disclosure rules, the estimated discounted future net cash flows from QEP’s proved reserves are based on the first-of-the-month prior 12-month average prices and current costs on the date of the estimate, holding the prices and costs constant throughout the life of the properties and using a discount factor of 10 percent per year. Actual future prices and costs may differ materially from those used in the current estimate, and future determinations of the Standardized Measure of Discounted Future Net Cash Flows using similarly determined prices and costs may be significantly different from the current estimate.

Shortages of oilfield equipment, services and qualified personnel could impact results of operations. The demand for qualified and experienced field personnel to drill wells and conduct field operations, geologists, geophysicists, engineers and other professionals in the oil and gas industry can fluctuate significantly, often in correlation with natural gas and oil prices, causing periodic shortages. There have also been regional shortages of drilling rigs and other equipment, as demand for specialized rigs and equipment has increased along with the number of wells being drilled. These factors also cause increases in costs for equipment, services and personnel. These cost increases could impact profit margin, cash flow and operating results or restrict the ability to drill wells and conduct operations, especially during periods of lower natural gas and oil prices.

Operations involve numerous risks that might result in accidents and other operating risks and costs. Drilling of natural gas and oil wells is potentially a high-risk activity. Risks include:

| • | fire, explosions and blow-outs; |

| • | unexpected drilling conditions such as abnormally pressured formations; |

| • | pipe, cement or casing failures; |

| • | pipeline accidents and failures; and |

| • | environmental accidents such as oil spills, natural gas leaks, ruptures or discharges of toxic gases, brine water or well fluids (including groundwater contamination). |

The Company could incur substantial losses as a result of injury or loss of life; pollution or other environmental damage; damage to or destruction of property and equipment; regulatory investigation; fines or curtailment of operations; or attorney’s fees and other expenses incurred in the prosecution or defense of litigation. As a working interest owner in wells operated by other companies, the Company may also be exposed to the risks enumerated above that are not within its care, custody or control.

There are also inherent operating risks and hazards in the Company’s gas and oil production and gas gathering, processing and treating operations that could cause substantial financial losses. In addition, these risks could result in personal injury or loss of human life, significant damage to property, environmental pollution,

14

Table of Contents

impairment of operations and substantial losses. The location of pipelines near populated areas, including residential areas, commercial business centers and industrial sites could increase the level of damages resulting from these risks. Certain segments of the Company’s pipelines run through such areas. In spite of the Company’s precautions, an event could cause considerable harm to people or property, and could have a material adverse effect on the financial position and results of operations, particularly if the event is not fully covered by insurance. Accidents or other operating risks could further result in lost business activity. Such circumstances could adversely impact the Company’s ability to meet contractual obligations.

As is customary in the gas and oil industry, the Company maintains insurance against some, but not all, of these potential risks and losses. Although QEP believes the coverages and amounts of insurances that it carries are adequate and consistent with industry practice, QEP does not have insurance protection against all risks that it faces, because QEP chooses not to insure certain risks, insurance is not available at a level that balances the costs of insurance and QEP’s desired rates of return, or actual losses exceed coverage limits. Losses and liabilities arising from uninsured or underinsured events could have a material adverse effect on QEP’s financial condition, results of operations and cash flows.

Disruption of, capacity constraints in, or proximity to pipeline systems could impact results of operations. QEP transports natural gas, crude oil and NGL to market by utilizing pipelines owned by others. If pipelines do not exist near producing wells, if pipeline capacity is limited or if pipeline capacity is unexpectedly disrupted, sales could be reduced or shut in, reducing profitability. If pipeline quality requirements change, the company might be required to install additional treating or processing equipment which could increase costs.

QEP is dependent on its revolving credit facility and continued access to capital markets to successfully execute its operating strategies. If QEP is unable to obtain needed capital or financing on satisfactory terms, QEP may experience a decline in its natural gas and oil reserves. QEP is partially dependent on external capital sources to provide financing for certain projects. The availability and cost of these capital sources is cyclical, and these capital sources may not remain available, or the Company may not be able to obtain financing at a reasonable cost in the future. Over the last few years, conditions in the global capital markets have deteriorated, making terms for certain financings less attractive, and in certain cases, resulting in the unavailability of certain types of financing. If QEP’s revenues decline as a result of lower natural gas, oil and NGL prices, operating difficulties, declines in production or for any other reason, QEP may have limited ability to obtain the capital necessary to sustain its operations at current levels. The Company utilizes its revolving credit facility, provided by a group of financial institutions, to meet short-term funding needs. All of QEP’s debt under its revolving credit facility is floating-rate debt. From time to time, the Company may use interest-rate derivatives to fix the rate on a portion of its floating-rate debt. The interest rates on debt under the Company’s revolving credit facility are tied to QEP’s debt ratings which are published by Standard & Poor’s and Moody’s. Under QEP’s revolving credit agreement, a downgrade of credit ratings will increase the interest cost of borrowings under the revolving credit facility. In addition, a downgrade of credit ratings may make it more difficult or expensive to raise capital from financial institutions or other sources. QEP’s failure to obtain additional financing could result in a curtailment of its operations relating to exploration and development of its prospects, which in turn could lead to a possible reduction in QEP’s natural gas or oil reserves and its revenues, and could negatively impact its results of operations.

QEP is exposed to counterparty credit risk as a result of QEP’s receivables and commodity derivative transactions. QEP has significant credit exposure to outstanding accounts receivable from joint interest and working interest owners as well as customers in all segments of its business. Because QEP is the operator on a majority of its large joint venture development projects, QEP pays joint venture expenses and makes cash calls on its non-operating partners for their respective shares of joint venture costs. These projects are capital intensive and, in some cases, a non-operating partner may experience a delay in obtaining financing for its share of the joint venture costs. Counterparty liquidity problems could result in a delay in QEP receiving proceeds from commodity sales or reimbursement of joint venture costs. Credit enhancements, such as financial guarantees or prepayments, have been obtained from some but not all parties. Nonperformance by a trade creditor or joint

15

Table of Contents

venture partner could result in financial losses. In addition, QEP’s commodity derivative transactions expose it to risk of financial loss if a counterparty fails to perform under a contract. During periods of falling commodity prices, QEP’s hedge receivable positions increase, which increases its counterparty exposure.

Risks Related to Strategy

QEP’s use of derivative instruments to manage exposure to uncertain prices could result in financial losses or reduce its income. QEP uses commodity-price derivative arrangements to reduce, or hedge, exposure to volatile natural gas, oil, and NGL prices and to protect cash flow, returns on capital, net income and credit ratings from downward commodity price movements. To the extent the Company hedges commodity price exposure, it may forgo some or all of the benefits of commodity price increases. Additionally, there are proposed financial regulations which may change our reporting and margining requirements relating to such instruments.

QEP enters into commodity-price derivative arrangements with creditworthy counterparties (banks and energy-trading firms) that do not require collateral deposits. QEP is exposed to the risk of counterparties not performing. The amount of credit available may vary depending on the credit ratings assigned to the Company’s debt securities.

QEP faces significant competition and certain of its competitors have resources in excess of QEP’s available resources. QEP operates in the highly competitive areas of natural gas and oil exploration, exploitation, acquisition and production. QEP faces intense competition from:

| • | large multi-national, integrated oil companies; |

| • | US independent oil and gas companies; |

| • | service companies engaging in oil and gas exploration and production activities; and |

| • | private oil and gas equity funds. |

QEP faces competition in a number of areas such as:

| • | acquiring desirable producing properties or new leases for future exploration; |

| • | marketing its natural gas, oil and NGL production; |

| • | acquiring the equipment and expertise necessary to operate and develop properties; and |

| • | attracting and retaining employees with certain skills. |

Certain of QEP’s competitors have financial and other resources in excess of those available to QEP. Such companies may be able to pay more for seismic and lease rights on natural gas and oil properties and exploratory prospects and to define, evaluate, bid for and purchase a greater number of properties and prospects than QEP’s financial or human resources permit. This highly competitive environment could have an adverse impact on QEP’s business.

QEP may be subject to risks in connection with acquisitions and organizational changes. The acquisition of gas and oil properties requires the assessment of recoverable reserves; future gas and oil sales prices and basis differentials; operating costs; and potential environmental and other liabilities. The accuracy of these assessments is inherently uncertain. QEP may not be able to identify attractive acquisition opportunities. Even if QEP does identify attractive opportunities, it may not be able to complete the acquisitions due to capital constraints. If QEP acquires an additional business, QEP could have difficulty integrating the operations, systems, management and other personnel and technology of the acquired business with QEP’s own, or could assume unidentified or unforeseeable liabilities, resulting in a loss of value.

16

Table of Contents

Organizational modifications due to acquisitions, divestitures or other strategic changes can alter the risk and control environments, disrupt ongoing business, distract management and employees, increase expenses and adversely affect results of operations. Even if these challenges can be dealt with successfully, the anticipated benefits of any acquisition, divestiture or other strategic change may not be realized.

Failure of our controls and procedures to detect error or fraud could seriously harm our business and results of operations. Our management, including our Chief Executive Officer and Chief Financial Officer, does not expect that our internal controls and disclosure controls will prevent all possible error and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. In addition, the design of a control system must reflect the fact that there are resource constraints and the benefit of controls must be relative to their costs. Because of the inherent limitations in all control systems, no evaluation of our controls can provide absolute assurance that all control issues and instances of fraud, if any, in our Company have been detected. The design of any system of controls is based in part upon the likelihood of future events, and there can be no assurance that any design will succeed in achieving its intended goals under all potential future conditions. Over time, a control may become inadequate because of changes in conditions or the degree of compliance with its policies or procedures may deteriorate. Because of inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur without detection.

Risks Related to Regulation

QEP is subject to complex federal, state, local and other laws and regulations that could adversely affect its cost of doing business and recording of proved reserves. The Company is subject to federal, state and local tax, environmental, health and safety laws and regulations. Environmental laws and regulations are complex, change frequently and tend to become more onerous over time. In addition to the costs of compliance, substantial costs may be incurred to take corrective actions at both owned and previously-owned facilities. Accidental spills and leaks requiring cleanup may occur in the ordinary course of business. As standards change, the Company may incur significant costs in cases where past operations followed practices that were considered acceptable at the time but now require remedial work to meet current standards. Failure to comply with these laws and regulations may result in fines, significant costs for remedial activities, or injunctions.

QEP must comply with numerous and complex federal and state regulations governing activities on federal and state lands, notably the National Environmental Policy Act, the Endangered Species Act, the Clean Air Act, and the National Historic Preservation Act and similar state laws. The United States Fish and Wildlife Service may designate critical habitat areas for certain listed threatened or endangered species. A critical habitat designation could result in further material restrictions to federal land use and private land use and could delay or prohibit land access or development. The listing of certain species, such as the sage grouse, as threatened and endangered, could have a material impact on the Company’s operations in areas where such species are found. The Clean Water Act and similar state laws regulate discharges of storm water, wastewater, oil, and other pollutants to surface water bodies, such as lakes, rivers, wetlands, and streams. Failure to obtain permits for such discharges could result in civil and criminal penalties, orders to cease such discharges, and other costs and damages. These laws also require the preparation and implementation of Spill Prevention, Control, and Countermeasure Plans in connection with on-site storage of significant quantities of oil.

Federal and state regulatory agencies frequently impose conditions on the Company’s activities. These restrictions have become more stringent over time and can limit or prevent exploration and production on the Company’s leasehold. Certain environmental groups oppose drilling on some of QEP’s federal and state leases. These groups sometimes sue federal and state regulatory agencies for alleged procedural violations in an attempt to stop, limit or delay natural gas and oil development on public lands.

In addition, the Company is subject to federal and state hazard communications and community right-to-know statutes and regulations such as the Emergency Planning and Community Right-to-Know Act that require certain record keeping and reporting of the use and release of hazardous substances.

17

Table of Contents

Various federal agencies within the U.S. Department of the Interior, particularly the Bureau of Land Management and the Bureau of Indian Affairs, along with potentially each Native American tribe, promulgate and enforce regulations pertaining to gas and oil operations on Native American tribal lands. These regulations include such matters as lease provisions, drilling and production requirements, environmental standards and royalty considerations. In addition, under prevailing legal precedent each Native American tribe has limited attributes of sovereignty including the right to enforce laws and regulations independent from federal, state and local statutes and regulations so long as not inconsistent with federal law and regulation. These tribal laws and regulations include various taxes, fees, requirements to employ Native American tribal members and other conditions that apply to lessees, operators and contractors conducting operations on Native American tribal lands. Lessees and operators conducting operations on tribal lands may be subject to the Native American tribal court system. One or more of these factors may increase the Company’s costs of doing business on Native American tribal lands and have an impact on the viability of its gas and oil exploration, production, gathering, processing and transportation operations on such lands.

The Federal Energy Regulatory Commission (FERC) regulates interstate natural gas transportation and oversees natural gas marketing. FERC has issued a number of orders related to market transparency (e.g., price reporting indices, capacity release, standards of conduct, transportation capacity, general compliance) that extend FERC oversight to QEP. Since the enactment of the Energy Policy Act of 2005, granting FERC increased penalty authority for non compliance, FERC has targeted various issues in the natural gas industry for compliance audits and investigations. QEP owns three facilities that are directly regulated by FERC as either an interstate pipeline or a natural gas storage facility connected to interstate pipelines.

QEP may not be able to obtain the permits and approvals necessary to continue and expand its operations. Regulatory authorities exercise considerable discretion in the timing and scope of permit issuance. Requirements imposed by these authorities may be costly and time consuming and may result in delays in the commencement or continuation of the Company’s exploration and production and midstream field services operations. Further, the public may comment on and otherwise seek to influence the permitting process, including through intervention in the courts. Accordingly, needed permits may not be issued, or if issued, may not be issued in a timely fashion, or may involve requirements that restrict QEP’s ability to conduct its operations or to do so profitably.

QEP may incur more taxes if certain federal income tax deductions currently available with respect to natural gas and oil exploration and development are eliminated as a result of future legislation. Our activities are subject to regulation by various federal, state and local tax laws and regulations and government agencies, including the Internal Revenue Service. The need to comply with new or revised tax laws or regulations, or new or changed interpretations or enforcement of existing tax laws or regulations, may have a material adverse effect on our business and results of operations. Federal budget proposals could potentially increase and accelerate the payment of federal income taxes for independent producers of natural gas and oil. The repeal of expensing of intangible drilling costs, percentage of depletion allowance and increased amortization periods for geological and geophysical expenses are some of the proposals that would have a significant impact on us. If enacted, these changes will increase the cost of exploration and development of natural gas and oil resources.

Federal or state hydraulic fracturing legislation could increase QEP’s costs and restrict its access to natural gas and oil reserves. All wells drilled in tight gas sand and shale reservoirs require hydraulic fracture stimulation to achieve economic production rates and recoverable reserves. A significant portion of the Company’s current and future production and reserve potential is derived from reservoirs that require hydraulic fracture stimulation to be commercially viable. Hydraulic fracture stimulation involves pumping fluid at high pressure into tight sand or shale reservoirs to artificially induce fractures. The artificially induced fractures allow better connection between the wellbore and the surrounding reservoir rock, thereby enhancing productive capacity and ultimate hydrocarbon recovery of each well. The fracture stimulation fluid is typically comprised of over 99 percent water and sand, with the remaining constituents consisting of additives designed to optimize the fracture stimulation treatment and production from the reservoir. The Company does not use diesel fuel in any of its fracturing

18

Table of Contents

operations. QEP obtains water for fracture stimulations from a variety of sources including industrial water wells and surface sources. When technically and economically feasible, the Company recycles flow-back and produced water, which reduces water consumption from surface and groundwater sources. The Company believes that the employment of fracture stimulation technology does not present any unique risks other than the inherent risks associated with natural gas and oil drilling and production operations described above. Currently, all well construction activities, including hydraulic fracture stimulation, are regulated by state agencies that review and approve all aspects of gas and oil well design and operation. New environmental initiatives, proposed federal and state legislation and rulemaking pertaining to hydraulic fracture stimulation could include additional permitting, and reporting and disclosure requirements and potential restrictions on the use of hydraulic fracture stimulation that could materially affect the Company’s ability to develop and produce gas and oil reserves.

The adoption of greenhouse gas emission or other environmental legislation could result in increased operating costs, delays in obtaining air pollution permits for new or modified facilities, and reduced demand for the natural gas, oil and NGL that QEP produces. Federal and state courts and administrative agencies are considering the scope and scale of climate-change regulation under various laws pertaining to the environment, energy use and development, and greenhouse gas emissions. QEP’s ability to access and develop new natural gas reserves may be restricted by climate-change regulation. In recent legislative sessions bills have been pending in Congress that would regulate greenhouse gas emissions through a cap-and-trade system under which emitters would be required to buy allowances for offsets of emissions of greenhouse gases. The Environmental Protection Agency (EPA) has adopted final regulations for the measurement and reporting of greenhouse gases emitted from certain large facilities (25,000 tons/year of carbon dioxide (CO2) equivalent) beginning with operations in 2010. The first report is to be filed with the EPA by March 31, 2011. In addition, several of the states in which QEP operates are considering various greenhouse gas registration and reduction programs. Carbon dioxide regulation could increase the price of natural gas, restrict access to or the use of natural gas, and/or reduce natural gas demand. Federal, state and local governments may also pass laws mandating the use of alternative energy sources, such as wind power and solar energy, which may reduce demand for natural gas. While future climate-change regulation is possible, it is too early to predict how such regulation would affect QEP’s business, operations or financial results. It is uncertain whether QEP’s operations and properties, located in the Rocky Mountain and Midcontinent regions of the United States, are exposed to possible physical risks, such as severe weather patterns, due to climate change that may or may not be the result of man-made greenhouse gases. However, management does not believe such physical risks are reasonably likely to have a material effect on the company’s financial condition or results of operations.

Derivatives regulation could increase QEP’s liquidity risks by restricting its use of derivative instruments. The Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act), which was passed by Congress and signed into law in July 2010, contains significant derivatives regulation, including a requirement that certain derivative transactions be cleared on exchanges, a requirement to post cash collateral (commonly referred to as “margin”) for such derivative transactions, and strong business conduct standards. The Dodd-Frank Act provides for a potential exception from clearing and cash collateral requirements for commercial end-users. The availability of this “end-user exemption” depends on how the Commodities Futures and Trading Commission (CFTC) defines a number of terms that will be used in determining how this exception applies to particular derivative transactions and the parties to those transactions. The CFTC is in the process of proposing definitions to determine which entities will face additional requirements for clearing, trading and posting of margin.

Depending on the rules and definitions adopted by the CFTC, the Dodd-Frank Act could require that QEP post significant amounts of cash collateral with its dealer counterparties for QEP’s derivative transactions. A sudden, unexpected margin call triggered by rising commodity prices would have an immediate negative impact on QEP’s liquidity, forcing QEP to divert capital from exploration, development and production activities. Requirements to post cash collateral could not only cause significant liquidity issues by reducing the Company’s flexibility in using its cash and other sources of funds, such as its revolving credit facility, but could also cause QEP to incur additional debt. In addition, a requirement for QEP’s counterparties to post cash collateral would likely result in additional costs being passed on to QEP, thereby decreasing the effectiveness of its commodity

19

Table of Contents

derivatives and its profitability. If the costs of complying with the clearing and margin requirements and business conduct rules under the Dodd-Frank Act significantly increase the costs of entering into commodity derivative transactions, QEP may reduce its commodity derivative program, which could increase its exposure to fluctuating commodity prices.

Other Risks

General economic and other conditions impact QEP’s results. QEP’s results may also be negatively affected by: changes in global economic conditions; changes in regulation; availability and economic viability of gas and oil properties for sale or exploration; creditworthiness of counterparties; rate of inflation and interest rates; assumptions used in business combinations; weather and natural disasters; changes in customers’ credit ratings; competition from other forms of energy, other pipelines and storage facilities; effects of accounting policies issued periodically by accounting standard-setting bodies; terrorist attacks or acts of war; changes in business or financial condition; changes in credit ratings; and availability of financing for QEP.

The underfunded status of our pension plans may require large contributions which may divert funds from other uses. Approximately one-quarter of our employees participate in defined benefit pension plans, although effective January 1, 1997, we closed participation in the QEP Retirement Plan. Over time, periods of declines in interest rates and pension asset values may result in a reduction in the funded status of our pension plans. As of December 31, 2010, our pension plans were $47.1 million underfunded. The underfunded status of our pension plans may require us to make large contributions to such plans. We made cash contributions of $1.6 million in 2010 to our defined benefit pension plans and expect to make contributions of approximately $11.9 million to such plans in 2011. However, we cannot predict whether changing economic conditions, the future performance of assets in the plans or other factors will require us to make contributions in excess of our current expectations, diverting funds we would otherwise apply to other uses.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None

20

Table of Contents

Reserves – QEP Energy

QEP Energy’s reserve estimates are prepared by Ryder Scott Company, L.P., independent reservoir-engineering consultants. The estimates of proved reserves at December 31, 2010, were made in accordance with amended reserves definitions included in the SEC’s rules for the Modernization of Oil and Gas Reporting, that were adopted December 31, 2009. The most significant amendments affecting the Company include, allowing the use of reliable technologies to estimate and categorize reserves and using the arithmetic average of the price on the first day of each month within the 12-month period prior to the end of the reporting period (unless contractual arrangements designate the price) to be used to calculate economic producibility of reserves and the discounted cash flows reported as the Standardized Measure of Future Net Cash Flows Relating to Proved Reserves. Refer to Note 16 of the consolidated financial statements included in Item 8 of Part II of this Annual Report for additional information regarding estimates of proved reserves and the preparation of such estimates.

At December 31, 2010, approximately 88% of QEP Energy’s estimated proved reserves were Company operated. Proved developed reserves represented 53% of the Company’s total proved reserves at December 31, 2010 while the remaining 47% of reserves were proved undeveloped. All reported reserves are located in the United States. QEP Energy does not have any long-term supply contracts with foreign governments, reserves of equity investees or reserves of subsidiaries with a significant minority interest. QEP Energy’s estimated reserves are summarized as follows:

| December 31, 2010 | ||||||||||||

| Natural Gas |

Oil and NGL |

Natural Gas Equivalents(1) |

||||||||||

| (Bcf) | (MMbbl) | (Bcfe) | ||||||||||

| Proved developed reserves |

1,404.8 | 34.4 | 1,611.5 | |||||||||

| Proved undeveloped reserves |

1,208.1 | 35.2 | 1,419.2 | |||||||||

| Total proved reserves |

2,612.9 | 69.6 | 3,030.7 | |||||||||

| (1) | Oil and NGLs are converted to natural gas at the ratio of one bbl of oil or NGL to six Mcf of natural gas. |

QEP Energy’s reserve statistics for the years ended December 31, 2008 through 2010, are summarized below:

| Year | Year End Reserves (Bcfe) | Natural Gas and Oil Production (Bcfe) |

Reserve Life Index(1) (Years) | |||

| 2008 |

2,218.1 | 171.4 | 12.9 | |||

| 2009 |

2,746.9 | 189.5 | 14.5 | |||

| 2010 |

3,030.7 | 229.0 | 13.2 |

| (1) | Reserve life index is calculated by dividing year-end proved reserves by production for such year. |

QEP Energy’s proved reserves in major operating areas at December 31, 2010 and 2009 are summarized below:

| 2010 | 2009 | |||||||||||||||

| (Bcfe) | (% of total) | (Bcfe) | (% of total) | |||||||||||||

| Midcontinent |

1,170.5 | 39 | 1,100.5 | 40 | ||||||||||||

| Pinedale Anticline |

1,348.9 | 44 | 1,300.7 | 47 | ||||||||||||

| Uinta Basin |

212.8 | 7 | 197.7 | 7 | ||||||||||||

| Rockies Legacy |

298.5 | 10 | 148.0 | 6 | ||||||||||||

| Total QEP Energy |

3,030.7 | 100 | 2,746.9 | 100 | ||||||||||||

Estimates of proved gas and oil reserves have been completed in accordance with professional engineering standards and the Company’s established internal controls, which includes the compliance oversight of a multi-

21

Table of Contents

functional reserves review committee responsible to the Company’s board of directors. QEP Energy’s estimated proved reserves have been prepared by Ryder Scott Company, L.P., independent reservoir engineering consultants, in accordance with the SEC’s Regulation S-X and ASC 932 as amended. The individuals performing reserves estimates possess professional qualifications and demonstrate competency in reserves estimation and evaluation. Refer to Note 16 of the consolidated financial statements included in Item 8 of Part II of this Annual Report for additional information pertaining to QEP Energy’s proved reserves as of the end of each of the last three years.

In addition to this filing, QEP Energy will file reserves estimates as of December 31, 2010, with the Energy Information Administration of the Department of Energy on Form EIA-23. Although companies use the same technical and economic assumptions when they prepare the EIA-23, they are obligated to report reserves for all wells they operate, not for all wells in which they have an interest, and to include the reserves attributable to other owners in such wells.

Production

The following table sets forth the net production volumes, the average net realized prices per Mcf of natural gas, per bbl of oil and NGL produced, and the operating expenses per Mcfe for the years ended December 31, 2010, 2009 and 2008.

| Year Ended December 31, | ||||||||||||

| 2010 | 2009 | 2008 | ||||||||||

| QEP Energy |

||||||||||||

| Volumes produced and sold |

||||||||||||

| Natural gas (Bcf) |

203.8 | 168.7 | 151.9 | |||||||||

| Oil and NGL (MMbbl) |

4.2 | 3.5 | 3.3 | |||||||||

| Total production (Bcfe) |

229.0 | 189.5 | 171.4 | |||||||||

| Average net realized price, net to the well(1) |

||||||||||||

| Natural gas (per Bcf) |

$ | 4.74 | $ | 6.39 | $ | 7.56 | ||||||

| Oil and NGL (per bbl) |

56.80 | 45.91 | 72.96 | |||||||||

| Lifting costs (per Mcfe) |

||||||||||||

| Lease operating expense |

$ | 0.56 | $ | 0.67 | $ | 0.73 | ||||||

| Production taxes |

0.34 | 0.31 | 0.61 | |||||||||

| Total lifting costs |

$ | 0.90 | $ | 0.98 | $ | 1.34 | ||||||

| (1) | Includes the impact of all settled commodity price derivatives |

Productive Wells

The following table summarizes the Company’s productive wells as of December 31, 2010. All wells are located in the United States.

| Gas | Oil | Total | ||||||||||

| Gross |

4,844 | 2,121 | 6,965 | |||||||||

| Net |

2,224 | 436 | 2,660 | |||||||||

Although many wells produce both gas and oil, a well is categorized as either a gas or an oil well based upon the ratio of gas to oil produced. Each gross well completed in more than one producing zone is counted as a single well. At the end of 2010, the Company had 94 gross wells with multiple completions.

The Company also holds numerous overriding-royalty interests in gas and oil wells, a portion of which are convertible to working interests after recovery of certain costs by third parties. After converting to working interests, these wells with overriding-royalty interests will be included in the gross and net-well count.

22

Table of Contents

Leasehold Acreage

The following table summarizes developed and undeveloped-leasehold acreage in which the Company owns a working interest or mineral interest as of December 31, 2010. “Undeveloped Acreage” includes leasehold interests that already may have been classified as containing proved undeveloped reserves and unleased mineral-interest acreage owned by the Company. Excluded from the table is acreage in which the Company’s interest is limited to royalty, overriding-royalty and other similar interests. All leasehold acres are located in the United States.

| Developed Acres(1) | Undeveloped Acres(2) | Total Acres | ||||||||||||||||||||||

| Gross | Net | Gross | Net | Gross | Net | |||||||||||||||||||

| Arkansas |

32,642 | 9,260 | 5,498 | 3,594 | 38,140 | 12,854 | ||||||||||||||||||

| Colorado |

155,000 | 105,625 | 158,025 | 53,839 | 313,025 | 159,464 | ||||||||||||||||||

| Kansas |

29,822 | 12,922 | 52,459 | 17,245 | 82,281 | 30,167 | ||||||||||||||||||

| Louisiana |

55,812 | 45,215 | 24,106 | 22,975 | 79,918 | 68,190 | ||||||||||||||||||

| Montana |

15,094 | 7,706 | 307,134 | 53,027 | 322,228 | 60,733 | ||||||||||||||||||

| New Mexico |

96,969 | 70,756 | 32,939 | 12,618 | 129,908 | 83,374 | ||||||||||||||||||

| North Dakota |

12,068 | 3,681 | 237,877 | 96,121 | 249,945 | 99,802 | ||||||||||||||||||

| Oklahoma |

1,596,688 | 293,403 | 261,769 | 148,474 | 1,858,457 | 441,877 | ||||||||||||||||||

| South Dakota |

— | — | 204,398 | 107,151 | 204,398 | 107,151 | ||||||||||||||||||

| Texas |

133,409 | 46,424 | 56,416 | 50,959 | 189,825 | 97,383 | ||||||||||||||||||

| Utah |

162,820 | 130,788 | 273,359 | 184,458 | 436,179 | 315,246 | ||||||||||||||||||

| Wyoming |

289,270 | 181,211 | 383,248 | 276,154 | 672,518 | 457,365 | ||||||||||||||||||

| Other |

2,429 | 735 | 158,475 | 43,350 | 160,904 | 44,085 | ||||||||||||||||||

| Total |

2,582,023 | 907,726 | 2,155,703 | 1,069,965 | 4,737,726 | 1,977,691 | ||||||||||||||||||

| (1) | Developed acreage is acreage assigned to productive wells. |

| (2) | Undeveloped acreage is leased acreage on which wells have not been drilled or completed to a point that would permit the production of commercial quantities of natural gas and oil regardless of whether such acreage contains proved reserves. |

A portion of the leases summarized in the preceding table will expire at the end of their respective primary terms unless the existing leases are renewed or production has been established from the acreage subject to the lease prior to that date. Leases held by production remain in effect until production ceases. The following table sets forth the gross and net acres subject to leases summarized in the preceding table that will expire during the periods indicated:

Leaseholds Expiring

| Undeveloped Acres Expiring | ||||||||

| Gross | Net | |||||||

| 12 months ending December 31, |

||||||||

| 2011 |

125,647 | 80,786 | ||||||

| 2012 |

68,154 | 45,760 | ||||||

| 2013 |

140,959 | 77,445 | ||||||

| 2014 |

57,707 | 46,779 | ||||||

| 2015 and later |

241,770 | 220,340 | ||||||

23

Table of Contents

Drilling Activity

The following table summarizes the number of development and exploratory wells drilled on acreage owned by QEP during the years indicated.

| Year Ended December 31, | ||||||||||||||||||||||||

| Productive | Dry | |||||||||||||||||||||||

| 2010 | 2009 | 2008 | 2010 | 2009 | 2008 | |||||||||||||||||||

| Net Wells Completed |

||||||||||||||||||||||||

| Exploratory |

16.2 | 3.7 | 2.3 | 1.9 | — | 0.9 | ||||||||||||||||||

| Development |

170.5 | 154.5 | 219.2 | — | — | 6.3 | ||||||||||||||||||

| Gross Wells Completed |

||||||||||||||||||||||||

| Exploratory |

33 | 12 | 10 | 2 | — | 2 | ||||||||||||||||||

| Development |

516 | 273 | 456 | — | 1 | 13 | ||||||||||||||||||

MIDSTREAM FIELD SERVICES – QEP Field Services