Attached files

| file | filename |

|---|---|

| 8-K - Midway Gold Corp | midway8k_022511.htm |

| EX-99.1 - PRESS RELEASE DATED FEBRUARY 18,2011 - Midway Gold Corp | ex99_1.htm |

EXHIBIT 99.2

| February 24, 2011 |

TSX Venture Exchange Symbol: MDW

NYSE Amex Symbol: MDW

Website: www.midwaygold.com

|

Midway Gold Adds 1.8 km of Potential Strike Length at Spring Valley Project, Nevada

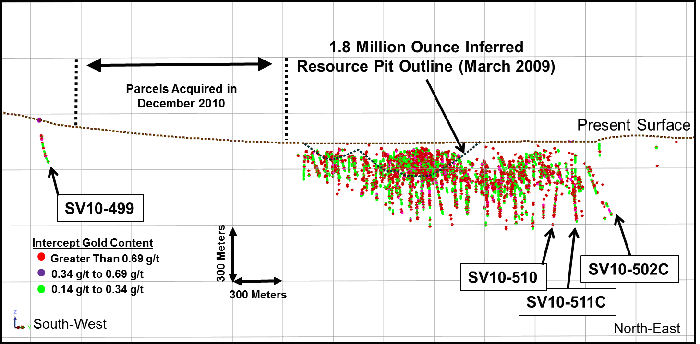

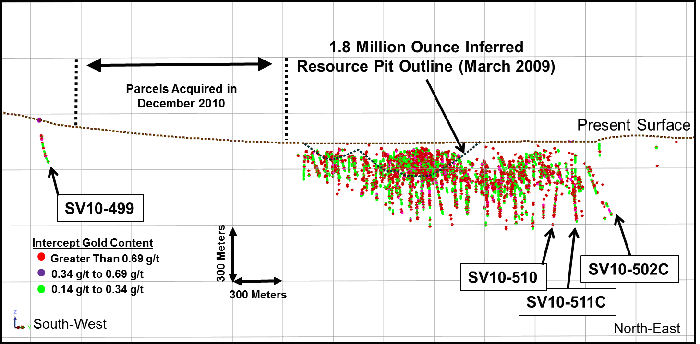

Denver, Colorado – Midway Gold Corp. (the “Company”) reports that exploration drilling conducted in the fourth quarter of 2010 has resulted in an extension of the mineralized strike length by about1.8 km to the south-southwest of the previously known gold resourceat Spring Valley. Thestep out in reverse circulation drill hole SV10-499 intersected 12.2 m of 1.2 gram per tonne (g/t) Au including 1.5 m of 7.8 g/t Au mineralization, showing strong, relatively shallow Spring Valley-type mineralization in similar structures and host rocks to the existing gold resource. The drill hole is south of the property acquired late last year and described in the press release dated December 8, 2010 (see illustration below). The gold resourceremainsopen to the northwest, to the south, and to depth.

Highlights of fourth quarter drill results reported to the Company by Barrick Gold Exploration Inc. (“Barrick”)includes several high grade intercepts (further described in the tablebelow):

|

·

|

Hole SV-511C with 62.5 m of 2.2 g/t Au including 1.5 m of 22.4 g/t Au, 1.5 m of 305.0 g/t Au, and 1.5 m of 21.1 g/t Au; and 42.7 m of 0.9 g/t Au including 1.5 m of 12.5 g/t Au.

|

|

·

|

Hole SV-502C with 3.3 m of 3.0 g/t Au including 0.8 m of 17.8 g/t Au, and 10.5 m of 1.6 g/t Au including 1.0 m of 28.0 g/t Au.

|

|

·

|

Hole SV-510 with 25.9 m of 0.8 g/t Au including 1.5 m of 4.6 g/t Au, and 12.2 m of 3.6 g/t Au including 1.5 m of 96.0 g/t Au.

|

These holes intersected mineralization below the rim of the north edge of the conceptual pit and to depth and could therefore expand the length and width of the resource as well as at depth.

“Midway believes that these results are strong evidence that the new, untested parcels acquired last year could potentially contain significant resources at relatively shallow depths,” said Ken Brunk, President and COO. “It will be exciting to watch the development of this potentially world-class gold system.”

Barrick has informed Midway that it intends to conduct and fund the minimum requiredprogram of US$7 million in 2011 fora cumulative amount of US$16 million by December 31, 2011. Drilling in 2011 is expected to focus on expanding the resource and evaluatingsatellite targets, particularly within the recently acquired land south of the existing resource.Under the terms of the March 9th, 2009 agreement between Midway and Barrick, Barrickwillearn a 60% interest in the project by completing work expenditures of US$30 million before December 31, 2013.

Midway has commissioned an independently prepared NI43-101 compliant resource update to estimate how much the resource may have expanded due toBarrick’s drill programs since 2009.As of March, 2009, the Inferred Resource was 1.8 million ounces of gold contained within 80 million tonnesgrading 0.72 g/t gold. See the Midway press release dated March 2, 2009 and the subsequent NI 43-101 technical report filed on SEDAR March 30, 2009 for more details. The open pit outlineshown below is based upon a $715 gold price pit from the 1.8 million ounce InferredResource.

Long Section, Spring Valley Project, Nevada

(looking northwest)

Significant Recent FireAssay Drill Intercepts, Spring Valley Project, Nevada

(as reported to Midway by Barrick)

|

Hole ID

|

From (m)

|

To (m)

|

Interval (m)

|

Gold (g/t)

|

|

SV10-497C

|

||||

|

108.2

|

112.8

|

4.6

|

1.1

|

|

|

129.5

|

132.6

|

3.0

|

1.3

|

|

|

395.8

|

398.8

|

3.0

|

2.1

|

|

|

SV10-498

|

||||

|

152.4

|

157.0

|

4.6

|

0.6

|

|

|

169.2

|

173.7

|

4.6

|

0.7

|

|

|

SV10-499

|

||||

|

33.5

|

36.6

|

3.0

|

0.6

|

|

|

102.1

|

106.7

|

4.6

|

0.5

|

|

|

118.9

|

125.0

|

6.1

|

0.6

|

|

|

149.4

|

161.5

|

12.2

|

1.2

|

|

|

including

|

149.4

|

150.9

|

1.5

|

7.8

|

2

|

Hole ID

|

From (m)

|

To (m)

|

Interval (m)

|

Gold (g/t)

|

|

SV10-497C

|

||||

|

108.2

|

112.8

|

4.6

|

1.1

|

|

|

129.5

|

132.6

|

3.0

|

1.3

|

|

|

395.8

|

398.8

|

3.0

|

2.1

|

|

|

SV10-498

|

||||

|

152.4

|

157.0

|

4.6

|

0.6

|

|

|

169.2

|

173.7

|

4.6

|

0.7

|

|

|

SV10-499

|

||||

|

33.5

|

36.6

|

3.0

|

0.6

|

|

|

102.1

|

106.7

|

4.6

|

0.5

|

|

|

118.9

|

125.0

|

6.1

|

0.6

|

|

|

149.4

|

161.5

|

12.2

|

1.2

|

|

|

including

|

149.4

|

150.9

|

1.5

|

7.8

|

|

234.7

|

242.3

|

7.6

|

0.4

|

|

|

248.4

|

257.6

|

9.1

|

0.9

|

|

|

297.2

|

301.8

|

4.6

|

0.7

|

|

|

SV10-500C

|

||||

|

321.9

|

328.0

|

6.1

|

0.9

|

|

|

SV10-501C

|

||||

|

326.1

|

332.1

|

6.0

|

0.4

|

|

|

SV10-502C

|

||||

|

182.9

|

187.8

|

4.9

|

1.8

|

|

|

396.6

|

408.1

|

11.4

|

1.1

|

|

|

412.8

|

416.1

|

3.3

|

3.0

|

|

|

including

|

414.0

|

414.8

|

0.8

|

17.8

|

|

444.7

|

461.8

|

17.1

|

1.4

|

|

|

including

|

452.9

|

454.8

|

1.8

|

6.0

|

|

520.3

|

530.7

|

10.3

|

1.4

|

|

|

including

|

523.5

|

525.0

|

1.5

|

6.7

|

|

539.0

|

549.6

|

10.5

|

1.6

|

|

|

including

|

542.5

|

543.5

|

1.0

|

28.0

|

|

613.0

|

621.6

|

8.6

|

0.8

|

|

|

630.8

|

642.6

|

11.9

|

1.3

|

|

|

including

|

635.7

|

637.2

|

1.5

|

5.4

|

|

649.7

|

665.7

|

16.1

|

0.6

|

|

|

692.2

|

697.0

|

4.8

|

0.7

|

|

|

SV10-505C

|

||||

|

358.7

|

366.7

|

7.9

|

1.2

|

|

|

367.3

|

378.6

|

11.3

|

0.7

|

|

|

393.5

|

396.8

|

3.3

|

0.6

|

|

|

393.5

|

396.8

|

3.3

|

0.9

|

|

|

SV10-506C

|

||||

|

389.9

|

393.4

|

3.5

|

0.6

|

|

|

416.1

|

437.7

|

21.6

|

0.7

|

|

|

SV10-507C

|

||||

|

73.2

|

86.9

|

13.7

|

1.4

|

|

|

including

|

77.7

|

79.2

|

1.5

|

6.3

|

|

SV10-508

|

||||

|

210.3

|

214.9

|

4.6

|

8.4

|

|

|

SV10-510

|

||||

|

120.4

|

126.5

|

6.1

|

0.5

|

|

|

161.5

|

164.6

|

3.0

|

1.2

|

|

3

| Hole ID | From (m) | To (m) | Interval (m) | Gold (g/t) |

|

233.2

|

236.2

|

3.0

|

1.3

|

|

|

256.0

|

265.2

|

9.1

|

1.3

|

|

|

272.8

|

275.8

|

3.0

|

6.6

|

|

|

291.1

|

301.8

|

10.7

|

0.5

|

|

|

310.9

|

336.8

|

25.9

|

2.7

|

|

|

344.4

|

358.1

|

13.7

|

0.6

|

|

|

368.8

|

394.7

|

25.9

|

0.8

|

|

|

including

|

378.0

|

379.5

|

1.5

|

4.6

|

|

405.4

|

417.6

|

12.2

|

3.6

|

|

|

including

|

411.5

|

413.0

|

1.5

|

96.0

|

|

SV10-511C

|

||||

|

269.7

|

332.2

|

62.5

|

2.2

|

|

|

including

|

275.8

|

277.4

|

1.5

|

22.4

|

|

including

|

300.2

|

301.8

|

1.5

|

305.0

|

|

including

|

304.8

|

306.3

|

1.5

|

21.1

|

|

338.3

|

341.4

|

3.0

|

2.0

|

|

|

350.5

|

358.1

|

7.6

|

0.6

|

|

|

370.3

|

384.0

|

13.7

|

0.6

|

|

|

390.1

|

403.9

|

13.7

|

0.4

|

|

|

410.0

|

452.6

|

42.7

|

0.9

|

|

|

including

|

417.6

|

419.1

|

1.5

|

12.5

|

Assays received in the fourth quarter for seven additional holes produced no significant intercepts. Reverse circulation drilling was conducted by Hard Rock Drilling of Elko, Nevada. Core drilling was conducted by TonaTec Exploration of Mapleton, Utah. Drill hole numbers ending with a "C" indicate core holes. Samples were assayed by ALS-Chemex Labs, in Sparks, Nevada using30 gram fire assay methods (FA). Results reported represent thickness along the trace of the drill hole and do not necessarily represent true thickness. Intervals may not match to the nearest tenth due to arithmetic rounding.

Data reported to Midway by Barrick and disclosed in this press release have been reviewed for Midway by Richard D. Moritz, (B.Sc., MBA), a "Qualified Person" as that term is defined in National Instrument 43-101.

ON BEHALF OF THE BOARD

"Ken Brunk"

Ken Brunk, Director, President and COO

About Midway Gold Corp.

Midway Gold Corp. is a precious metals company with a vision to explore, design, build and operate mines in a manner accountable to all stakeholders while producing an acceptable return to its shareholders. For more information about Midway, please visit our website at www.midwaygold.com or contact R.J. Smith, Manager of Corporate Administration, at (877) 475-3642 (toll-free).

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release contains forward-looking statements about the Company and its business. Forward looking statements are statements that are not historical facts and include resource estimates. The forward-looking statements in this press release are

3

subject to various risks, uncertainties and other factors that could cause the Company's actual results or achievements to differ materially from those expressed in or implied by forward looking statements. These risks, uncertainties and other factors include, without limitation risks related to fluctuations in gold prices; uncertainties related to raising sufficient financing to fund the planned work in a timely manner and on acceptable terms; changes in planned work resulting from weather, logistical, technical or other factors; the possibility that results of work will not fulfill expectations and realize the perceived potential of the Company's properties; uncertainties involved in the interpretation of drilling results and other tests and the estimation of gold resources; the possibility that required permits may not be obtained on a timely manner or at all; the possibility that capital and operating costs may be higher than currently estimated and may preclude commercial development or render operations uneconomic; the possibility that the estimated recovery rates may not be achieved; risk of accidents, equipment breakdowns and labor disputes or other unanticipated difficulties or interruptions; the possibility of cost overruns or unanticipated expenses in the work program; and other factors identified in the Company's SEC filings and its filings with Canadian securities regulatory authorities. Forward-looking statements are based on the beliefs, opinions and expectations of the Company's management at the time they are made, and other than as required by applicable securities laws, the Company does not assume any obligation to update its forward-looking statements if those beliefs, opinions or expectations, or other circumstances, should change.

This press release uses the terms "Measured resources", "Indicated resources" and "Inferred resources", which are calculated in accordance with the Canadian National Instrument 43-101 and the Canadian Institute of Mining and Metallurgy Classification system. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. We advise investors that while those terms are recognized and required by Canadian regulations, the U.S. Securities and Exchange Commission does not recognize them. U.S. investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. In addition, "Inferred resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. U.S. investors are cautioned not to assume that part or all of an inferred resource exists, or is economically or legally minable.

4