Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - EPIQ SYSTEMS INC | a2202203zex-23_1.htm |

| EX-21.1 - EX-21.1 - EPIQ SYSTEMS INC | a2202203zex-21_1.htm |

| EX-12.1 - EX-12.1 - EPIQ SYSTEMS INC | a2202203zex-12_1.htm |

| EX-32.1 - EX-32.1 - EPIQ SYSTEMS INC | a2202203zex-32_1.htm |

| EX-31.2 - EX-31.2 - EPIQ SYSTEMS INC | a2202203zex-31_2.htm |

| EX-31.1 - EX-31.1 - EPIQ SYSTEMS INC | a2202203zex-31_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 10-K

| (Mark One) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2010 |

||

or |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission File Number 0-22081

EPIQ SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

| Missouri | 48-1056429 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

501 Kansas Avenue, Kansas City, Kansas |

66105-1300 |

|

| (Address of principal executive offices) | (Zip Code) |

913-621-9500

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act

| Title of each class | Name of exchange on which registered | |

|---|---|---|

| Common Stock, $0.01 par value | The NASDAQ Stock Market, LLC |

Securities

registered pursuant to Section 12(g) of the Act

None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

The aggregate market value of voting common stock held by non-affiliates of the registrant (based upon the last reported sale price on the NASDAQ Global Market), as of the last business day of the registrant's most recently completed second fiscal quarter (June 30, 2010) was approximately $460,000,000.

There were 35,200,972 shares of common stock of the registrant outstanding as of February 11, 2011.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of Form 10-K is incorporated herein by reference to the registrant's definitive Proxy Statement relating to its 2011 Annual Meeting of Shareholders, which will be filed with the Commission within 120 days after the end of the registrant's fiscal year.

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

In this report, in other filings with the Securities and Exchange Commission (the "SEC") and in press releases and other public statements by our officers throughout the year, Epiq Systems, Inc. makes or will make statements that plan for or anticipate the future. These forward-looking statements include but are not limited to any projection or expectation of earnings, revenue or other financial items; the plans, strategies and objectives of management for future operations; factors that may affect our operating results; new products or services; the demand for our products or services; our ability to consummate acquisitions and successfully integrate them into our operations; future capital expenditures; effects of current or future economic conditions or performance; industry trends and other matters that do not relate strictly to historical facts or statements of assumptions underlying any of the foregoing. These forward-looking statements are based on our current expectations which may not prove to be accurate. Many of these statements are found in the "Business" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" sections of this report.

Forward-looking statements may be identified by words or phrases such as "believe," "expect," "anticipate," "should," "planned," "may," "estimated," "goal," "objective," "seeks," and "potential," and variations of these words and similar expressions or negatives of these words. Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended, provide a "safe harbor" for forward-looking statements. In order to comply with the terms of the safe harbor, and because forward-looking statements involve future risks and uncertainties, Item 1A, "Risk Factors" of this report lists a variety of factors that could cause actual results and experience to differ materially from the anticipated results or other expectations expressed in our forward-looking statements. We undertake no obligation to update publicly or revise any forward-looking statements contained in this report or in future communications to reflect future events or developments, except as required by law.

General Development of Business

Epiq Systems, Inc. is a provider of integrated technology solutions for the legal profession. References below to "the company," "we," "us" and "our" may refer to Epiq Systems, Inc. exclusively or to one or more of our subsidiaries. Our solutions streamline the administration of bankruptcy, litigation, financial transactions and regulatory compliance matters. We offer innovative technology solutions for e-discovery, document review, legal notification, claims administration and controlled disbursement of funds. Our clients include leading law firms, corporate legal departments, bankruptcy trustees, government agencies, mortgage processors, financial institutions, and other professional advisors who require innovative technology, responsive service and deep subject-matter expertise.

We were incorporated in the State of Missouri on July 13, 1988, and on July 15, 1988 acquired all of the assets of an unrelated predecessor corporation.

As a part of our business strategy, we have made several acquisitions over the past five years. During 2010, we acquired Jupiter eSources LLC, including their proprietary software product, AACER® (Automated Access to Court Electronic Records), that assists creditors including banks, mortgage processors, and their administrative services professionals to streamline processing of their portfolios of loans in bankruptcy cases. During 2008, we acquired all of the equity of Uberdevelopments Limited and its wholly-owned operating subsidiary Pinpoint Global Limited (collectively, "Pinpoint"), an e-discovery business with operations in the United Kingdom, to expand our market in the United Kingdom. During 2006, we acquired the net assets of Gazes LLC (now Epiq Preference Solutions) to supplement our ability to provide claims preference services for our bankruptcy segment clients.

Our trademarks, service marks, and registered marks include AACER®, Epiq™, EpiqSM, Epiq Systems™, Epiq SystemsSM,Bankruptcy Link®, CasePower®, CasePower 13®, ClaimsMatrix®, ClassMatrix™, ClassMatrixSM, CreditorMatrix™, CreditorMatrixSM, DebtorMatrix®, DocuMatrix®, DMX™, DMXSM, DMX Mobile™, DMX MobileSM, Documatrix Mobile™, Documatrix MobileSM, eDataMatrix®, eDiscovery IQ Review™, eDiscovery IQ ReviewSM, Epiq IQ Review™, Epiq IQ ReviewSM, IQ Review™, IQ ReviewSM, LegalMatrix™, LoanMatrixSM, TCMS®, TCMSWeb®, and XFrame™. The trademarks and service marks (denoted by ™ and SM) have been filed but are not yet registered; the registered marks (denoted by ®) have durations ranging from 2011 through 2020.

Financial Information About Segments

Our business is organized into three reporting segments: eDiscovery, bankruptcy, and settlement administration. Segment information related to revenues, a performance measure of profit or loss, capital expenditures, and total assets is contained in Note 14 of the Notes to Consolidated Financial Statements.

Narrative Description of Business

eDiscovery Segment

Our eDiscovery segment provides collections and forensics, processing, search and review, and document review services to companies and the litigation departments of law firms. Our eDataMatrix® software analyzes, filters, deduplicates and produces documents for review. Produced documents are made available primarily through a hosted environment, and our DocuMatrix™ software allows for efficient attorney review and data requests. Our customers are typically large corporations that use our

1

products and services cooperatively with their legal counsel to manage the e-discovery process for litigation and regulatory matters.

The substantial amount of electronic documents and other data used by businesses has changed the dynamics of how attorneys support discovery in complex litigation matters. Due to the complexity of cases, the volume of data that are maintained electronically, and the volume of documents that are produced in all types of litigation, law firms have become increasingly reliant on electronic evidence management systems to organize and manage the litigation discovery process.

Following is a description of the significant sources of revenue in our eDiscovery business.

- •

- Consulting, forensics and collection service fees based on the number of hours services are provided.

- •

- Fees related to the conversion of data into an organized, searchable electronic database. The amount earned varies

primarily on the number of documents.

- •

- Hosting fees based on the amount of data stored.

- •

- Document review fees based on the number of hours spent reviewing documents, the number of pages reviewed, or the amount of data reviewed.

In 2009, we opened new offices in Brussels and Hong Kong, established global reach for our offices and data centers in the U.S., Europe and Asia, and expanded our offerings to include data forensics and collections services, as well as document review services. In 2009, we also launched IQ Review™, a revolutionary combination of new intelligent technology and expert services which incorporates new prioritization technology into DocuMatrix™, our flagship document management platform. Increased case activity levels and an uptake of new service offerings launched in 2009 contributed to revenue grown in 2010, and is expected to continue into 2011.

Bankruptcy Segment

Bankruptcy is an integral part of the United States' economy. As reported by the Administrative Office of the U.S. Courts for the fiscal years ended December 31, 2010, 2009, and 2008, there were approximately 1.59 million, 1.47 million, and 1.12 million new bankruptcy filings, respectively. Bankruptcy filings for the twelve-month period ended December 31, 2010 increased 8% versus the twelve-month period ended December 31, 2009. During this period, Chapter 7 filings increased 8%, Chapter 11 filings fell 10%, and Chapter 13 filings increased 8%.

Our bankruptcy business provides solutions that address the needs of Chapter 7, Chapter 11, and Chapter 13 bankruptcy trustees to administer bankruptcy proceedings and of debtor corporations that file a plan of reorganization.

- •

- Chapter 7 is a liquidation bankruptcy for individuals or businesses that, as measured by the number of new cases

filed in the twelve-month period ended December 31, 2010, accounted for approximately 71% of all bankruptcy filings. In a Chapter 7 case, the debtor's assets are liquidated and the

resulting cash proceeds are used by the Chapter 7 bankruptcy trustee to pay creditors. Chapter 7 cases typically last several years.

- •

- Chapter 11 is a reorganization model of bankruptcy for corporations that, as measured by the number of new cases filed in the twelve-month period ended December 31, 2010, accounted for approximately 1% of all bankruptcy filings. Chapter 11 generally allows a company, often referred to as the debtor-in-possession, to continue operating under a plan of reorganization to restructure its business and to modify payment terms of both secured and unsecured obligations. Chapter 11 cases generally last several years.

2

- •

- Chapter 13 is a reorganization model of bankruptcy for individuals that, as measured by the number of new cases filed in the twelve-month period ended December 31, 2010, accounted for approximately 28% of all bankruptcy filings. In a Chapter 13 case, debtors make periodic cash payments into a reorganization plan and a Chapter 13 bankruptcy trustee uses these cash payments to make monthly distributions to creditors. Chapter 13 cases typically last between three and five years.

The application of Chapter 7 bankruptcy regulations has the practical effect of discouraging trustee customers from incurring direct administrative costs for computer system expenses. As a result, we provide our Chapter 7 products and services to our trustee customers at no direct charge, and they maintain deposit accounts for bankruptcy cases under their administration at a designated banking institution. We have arrangements with various banks under which we provide the bankruptcy trustee case management software and related services, and the bank provides the bankruptcy trustee with deposit-related banking services. During the years ended December 31, 2010 and 2009, a majority of our Chapter 7 trustee clients' deposits were maintained at Bank of America.

Chapter 11 bankruptcy engagements are generally long-term, multi-year assignments that provide revenue visibility into future periods. For the Chapter 7 trustee services component of the bankruptcy segment, the increase in filings is expected to translate into growth in client deposit balances related to asset liquidations. Our trustee services deposit portfolio exceeded $2.0 billion throughout 2010, while pricing continued at floor pricing levels under our agreements due to the low short-term interest rate environment.

The key participants in a bankruptcy proceeding include the debtor-in-possession, the debtor's legal counsel, the creditors, the creditors' legal counsel, and the bankruptcy judge. Chapter 7 and Chapter 13 cases also include a professional bankruptcy trustee, who is responsible for administering the bankruptcy case. The end-user customers of our Chapter 7, Chapter 11, and Chapter 13 bankruptcy businesses are debtor corporations that file a plan of reorganization and professional bankruptcy trustees. The Executive Office for United States Trustees, a division of the U.S. Department of Justice, appoints all bankruptcy trustees. A United States Trustee is appointed in most federal court districts and generally has responsibility for overseeing the integrity of the bankruptcy system. The bankruptcy trustee's primary responsibilities include liquidating the debtor's assets or collecting funds from the debtor, distributing the collected funds to creditors pursuant to the orders of the bankruptcy court and preparing regular status reports for the Executive Office for United States Trustees and for the bankruptcy court. Trustees manage an entire caseload of bankruptcy cases simultaneously.

On October 1, 2010, we completed the acquisition of Jupiter eSources LLC. The purchase price was comprised of $60.0 million of cash, $8.4 million of which was withheld for any claims for indemnification, and purchase price adjustments. In addition, there is contingent consideration related to an earn-out opportunity based on future revenue growth. The potential undiscounted amount of all future payments that we could be required to make under the earn-out opportunity is between $0 and $20 million over a four year period. The transaction was funded from our credit facility. See Note 13 of the Notes to Consolidated Financial Statements for further detail.

Through this purchase, we acquired a proprietary software product, AACER® (Automated Access to Court Electronic Records), that assists creditors including banks, mortgage processors, and their administrative services professionals to streamline processing of their portfolios of loans in bankruptcy cases. The AACER® product electronically monitors developments in all U.S. bankruptcy courts and applies sophisticated algorithms to classify docket filings automatically in each case to facilitate the management of large bankruptcy claims operations. By implementing the AACER® solution, clients achieve greater accuracy in faster timeframes, with a significant cost savings compared to manual attorney review of each case in the portfolio.

3

Following is a description of the significant sources of revenue in our bankruptcy business.

- •

- Data hosting fees and volume-based fees.

- •

- Case management professional service fees and other support service fees related to the administration of cases, including

data conversion, claims processing, claims reconciliation, professional services, and disbursement services.

- •

- Deposit-based fees, earned primarily on a percentage of Chapter 7 total liquidated assets placed on deposit with a

designated financial institution by our trustee clients, to whom we provide, at no charge, software licenses, limited hardware and hardware maintenance, and postcontract customer support services. The

fees we earn based on total liquidated assets placed on deposit by our trustee clients may vary based on fluctuations in short-term interest rates.

- •

- Legal noticing services to parties of interest in bankruptcy matters, including direct notification and media campaign and

advertising management in which we coordinate notification, primarily through print media outlets, to potential parties of interest for a particular client engagement.

- •

- Reimbursement for costs incurred, primarily related to postage on mailing services.

- •

- Monitoring and noticing fees earned based on monthly or on-demand requests for information provided through our AACER® software product.

Settlement Administration Segment

Our settlement administration segment provides managed services, including legal notification, claims administration, project administration and controlled disbursement.

The customers of our settlement administration segment are companies that require the administration of a settlement, resolution of a class action matter, or administration of a project. We sell our services directly to these customers and other interested parties, including legal counsel, which often provide access to these customers. During the years ended December 31, 2010, 2009 and 2008, less than 1%, 12%, and 22%, respectively, of our consolidated revenue was derived from a large contract with IBM in support of the federal government's analog to digital conversion program. The contract began in the fourth quarter of 2007 and, as expected, wound-down in 2009.

Following is a description of the significant sources of revenue in our settlement administration business.

- •

- Fees contingent upon the month-to-month delivery of case management services such as claims

processing, claims reconciliation, project management, professional services, call center support, website development and administration, and controlled disbursements. The amount we earn varies

primarily on the size and complexity of the engagement.

- •

- Legal noticing services to parties of interest in class action matters; including media campaign and advertising

management, in which we coordinate notification through various media outlets, such as print, radio and television, to potential parties of interest for a particular client engagement.

- •

- Reimbursement for costs incurred related to postage on mailing services.

Key participants in this marketplace include law firms that specialize in representing class action and mass tort plaintiffs and other law firms that specialize in representing defendants. Class action and mass tort refers to litigation in which class representatives bring a lawsuit against a defendant company or other persons on behalf of a large group of similarly affected persons. Mass tort refers to class action cases that are particularly large or prominent. Class action and mass tort litigation is often complex and the cases, including administration of any settlement, may last several years.

4

Competition

eDiscovery

The e-discovery market is highly fragmented, intensely competitive and rapidly evolving. Competitors include Electronic Evidence Discovery, Inc., Fios, Inc., Kroll Ontrack (Altegrity Inc.), Attenex (FTI Consulting, Inc.), Autonomy ZANTAZ, Inc., Stratify, Inc. (Iron Mountain Incorporated), and Clearwell Systems, Inc. Competition is primarily based on the quality of service, technology innovations, and price.

Bankruptcy

Our bankruptcy segment competes in a more mature market. We are one of two primary providers in the Chapter 7 bankruptcy market, along with Bankruptcy Management Solutions, Inc.; and in the Chapter 11 bankruptcy market competitors include Kurtzman Carson Consultants LLC and The Garden City Group, Inc. In both the Chapter 7 and Chapter 11 markets there are also several smaller competitors. Competition is primarily based on quality of service and technology innovations. Competitors for our AACER® product include American InfoSource and LexisNexis® Banko® Solutions.

Settlement Administration

The primary competitors with our settlement administration segment are The Garden City Group, Inc., Rust Consulting, Inc., and Gilardi & Co LLC, as well as several smaller competitors. Competition is primarily based on the quality of service, technology innovations, and price.

In addition to the competitors mentioned above, certain law firms, accounting firms, management consultant firms, turnaround specialists and crisis management firms offer products and services that compete with our products and services in each of our segments.

Key competitive factors and the relative strength of our products and services versus our competitors are directly and indirectly affected by our technology innovations, the quality of our services, price, ease of use of our technology solutions, quality of our technical support, reliability, and our domain expertise. Our ability to continually innovate and differentiate our product offerings has enabled us to achieve and maintain leadership positions in the various markets that we serve.

Sales and Marketing

Our sales executives market our products and services directly to prospective customers and referral law firms through on-site sales calls and longstanding relationships. We focus on attracting and retaining customers by providing superior integrated technology solutions and exceptional customer service. Our client support specialists are responsible for providing ongoing support services for existing customers. Additionally, we maintain a website that clients and potential clients may access to obtain additional information related to solutions we offer, we attend industry trade shows, we publish articles, and we conduct direct mail campaigns and advertise in trade journals.

Government Regulation

Our products and services are not directly regulated by the government. However, our bankruptcy segment customers are subject to significant regulation under the United States Bankruptcy Code, the Federal Rules of Bankruptcy Procedure and local rules and procedures established by bankruptcy courts. Additionally, the Executive Office for United States Trustees, a division of the United States Department of Justice, oversees the federal bankruptcy system and establishes administrative rules governing our clients' activities. Furthermore, class action and mass tort cases, as well as e-discovery

5

requirements related to litigation, are subject to various federal and state laws, as well as rules of evidence and rules of procedure established by the courts.

In April 2006, the United States Supreme Court approved certain amendments to the Federal Rules of Civil Procedure regarding the discovery in litigation of certain electronically stored information. These amendments became effective on December 1, 2006. Among other things, these amendments (i) require early attention by parties in litigation to meet and confer regarding discovery issues and to develop a discovery plan that identifies and addresses the parties' electronically stored information, (ii) expand the reach of federal court subpoenas to include electronically stored information, (iii) allow for parties to object to production of electronically stored information that is not reasonably accessible due to the undue burden or cost associated with such retrieval, and (iv) provide a "safe harbor" to parties unable to provide electronically stored information lost or destroyed as a result of the routine, good-faith operation of an electronic information system. While these federal rules do not apply in state court proceedings, the civil procedure rules of many states have been closely modeled on these provisions. We anticipate the federal and state court discovery rules relating to electronic documents and information will continue to evolve and affect the way we develop and implement technology and service solutions to those changing discovery rules.

Employees

As of December 31, 2010, we employed approximately 550 full-time employees, none of whom is covered by a collective bargaining agreement. We believe the relationship with our employees is good.

Financial Information About Geographic Areas

For the years ended December 31, 2010, 2009 and 2008, approximately 93%, 96%, and 96%, respectively, of our consolidated revenues were generated from services provided within the United States. For both the years ended December 31, 2010 and 2009, approximately 94% of our long-lived assets were located within the United States.

Available Information

Our company internet address is www.epiqsystems.com. We make a variety of information available, free of charge, at our Investor Relations website, www.epiqsystems.com/investors.php, including our annual report on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K, and any amendments to those reports as soon as reasonably practicable after we electronically file those reports with or furnish them to the SEC, as well as our code of ethics and other governance documents.

The public may read and copy materials filed by us with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC at www.sec.gov. The contents of these websites are not incorporated into this report. Further, our references to the URLs for these websites are intended to be inactive textual references only.

6

This report, other reports to be filed by us with the SEC, press releases made by us and other public statements by our officers, oral and written, contain or will contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended, including those relating to the possible or assumed future results of operations and financial condition. Because those statements are subject to a number of uncertainties and risks, actual results may differ materially from those expressed or implied by the forward-looking statements. Listed below are risks associated with an investment in our securities that could cause actual results to differ from those expressed or implied. If any of the following risks occurs, our business, financial condition, results of operations and prospects could be materially adversely affected.

We compete with other third party providers on the basis of the technological features, capabilities and price of our products and services, and we could lose existing customers and fail to attract new business if we do not keep pace with technological changes and offer competitive pricing for our products and services.

The markets for our products and services are competitive, continually evolving and subject to technological change. We believe that key competitive factors in the markets we serve include the breadth and quality of system and software solution offerings, the stability of the information systems provider, the features and capabilities of the product and service offerings, the pricing of our products and services, and the potential for future product and service enhancements. Our success depends upon our ability to keep pace with technological change and to introduce, on a timely and cost-effective basis, new and enhanced software solutions and services that satisfy changing client requirements. If we do not keep pace with technological changes, we could lose existing customers and fail to attract new business. Likewise, technology products and services can become more price sensitive over time, and if we are not able to maintain price competitive products and services we could lose existing customers and fail to attract new customers. The impact of not keeping pace with technological changes or maintaining competitive pricing could adversely affect our results of operations.

Security problems with our software products, systems or services, including the improper disclosure of personal data, could cause increased service costs, harm our reputation, and result in liability and increased expense for litigation and diversion of management time.

We store and process large amounts of personally identifiable information. Our software products also enable our customers to store and process personal data. We have included security features in our products and processes that are intended to protect the privacy and integrity of data, including confidential client or consumer data. Security for our products and processes is critical given the confidential nature of the information contained in our systems. It is possible that our security controls, our selection and training of employees, and other practices we follow may not prevent the improper disclosure of personally identifiable information. Such disclosure could harm our reputation and subject us to liability in regulatory proceedings and private litigation under laws that protect personal data, resulting in increased costs or loss of revenue. Improper disclosure of personal data could result in lawsuits or regulatory proceedings alleging damages, and perceptions that our products and services do not adequately protect the privacy of personal information could inhibit sales of our products and services. Defending these types of claims could result in increased expenses for litigation and claims settlement and a significant diversion of our management's attention. Additionally, our software products, the systems on which the products are used, and our processes may not be impervious to intentional break-ins ("hacking") or other disruptive disclosures or problems, whether as a result of inadvertent third party action, employee action, malfeasance, or otherwise. Hacking or other disruptive problems could result in the diversion of our development resources, damage to our reputation, increased service costs and impaired market acceptance of our products, any of which could result in higher expenses or lower revenues.

7

Errors or fraud related to our business processes could cause increased expense for litigation and diversion of management attention.

We administer claims, disburse funds, generate and distribute legal notices and provide professional services for third parties. Errors or fraud could occur, for example, in the payment of settlement claims in a case we are administering for a customer. Errors or fraud related to the processing or payment of these claims or errors related to the delivery of professional services could result in the diversion of management resources, damage to our reputation, increased service costs or impaired market acceptance of our services, any of which could result in higher expenses and lower revenues. Additionally, these types of errors or fraud could result in lawsuits alleging damages. Defending these types of claims could result in increased expenses for litigation and claims settlement and a significant diversion of our management's attention.

Interruptions or delays in service at the data centers we utilize could impair the delivery of our service and harm our business.

We provide certain of our services through computer hardware that is located in data centers operated by unrelated third parties. We do not control the operation of these facilities, which increases our vulnerability to problems with the services they provide, and they are subject to damage or interruption from earthquakes, floods, fires, power loss, terrorist attacks, telecommunications failures and similar events. They are also subject to break-ins, sabotage, intentional acts of vandalism and similar misconduct. The occurrence of any of these events, a decision to close a facility without adequate notice, or other unanticipated problems at a facility could result in interruptions in certain of our services. In addition, the failure by our vendor to provide our required data communications capacity could result in interruptions in our service. Any damage to, or failure of, our systems or services could reduce our revenue, cause us to issue credits or pay penalties, cause customers to terminate their agreements with us and adversely affect our ability to secure business in the future. Our business will be harmed if our customers and potential customers believe our services are unreliable.

Releases of new software products or upgrades to our existing software products may have undetected errors, or may not achieve our customer's desired objectives, which could cause litigation claims against us, damage to our reputation, or loss of business.

Certain of our services utilize software solutions developed by us for the needs of our customers. We issue new releases of our software products to our customers periodically. Complex software products, such as those we offer, can contain undetected errors when first introduced or as new versions are released, or may fail to achieve the customer's desired objectives. Any introduction of new software products or upgrade to existing software products has a risk of undetected errors. These undetected errors may be discovered only after a product has been installed and used either in our internal processing or by our customers. Likewise, the software products we acquire in business acquisitions have a risk of undetected errors.

Any undetected errors, difficulties in installing and maintaining our software products or upgrade releases, difficulties training customers and their staffs on the utilization of new software products or upgrade releases, or the failure to achieve the customer's desired objectives, may result in a delay or loss of revenue, diversion of development resources, damage to our reputation, the loss of that customer, loss of future business, increased service costs, potential litigation claims against us, or impaired market acceptance of our products.

8

We rely on third-party hardware and software, which could cause errors or failures of our software or services.

We rely on hardware purchased or leased and software licensed from third parties for our service offerings. The hardware is typically standardized hardware from national vendors. The software licenses are generally standardized, commercial software licenses from national software vendors. We are generally able to select from a number of competing hardware and software applications, and, from time to time, we have changed the hardware and software technologies incorporated into our software products and solutions. Any errors or defects in third party hardware or software incorporated into our products could result in a failure of our service or errors in our software, which in turn could adversely affect our customer relationships and result in the loss of customers, the loss of future business, potential litigation claims against us, and damage to our reputation.

Revenue in our segments can be driven from key business arrangements with third parties including law firms, financial institutions, technology consultancies or other third parties where we serve the same ultimate consumers. The modification of business terms, the projected conclusion, or termination of any of those arrangements could cause uncertainty and adversely affect our future revenue and earnings.

We have various key arrangements in our businesses with law firms, technology consultancies and other third parties where we serve the same ultimate consumers. For example, as reported in this Form 10-K, we had an arrangement with IBM in support of the federal government's analog to digital conversion program which represented less than 1%, 12% and 22% of our consolidated revenue in the years ended December 31, 2010, 2009 and 2008, respectively. This specific arrangement concluded, as expected, in the second half of 2009. The modification of business terms, the intended conclusion, or the unpredicted termination of key business arrangements could cause uncertainty and adversely affect our future revenue or earnings.

We depend upon our key personnel, and we may not be able to retain them or to attract, assimilate and retain highly qualified employees in the future.

Our future success may depend upon the continued service of our senior management and certain of our key technical personnel and our continuing ability to attract, assimilate and retain highly qualified technical, managerial, and sales and marketing personnel. We do not have employment agreements with our Chief Executive Officer, President, or Chief Financial Officer. We maintain key-man life insurance policies on our Chief Executive Officer and our President. The loss of the services of any of these senior executives or other key personnel, including key sales professionals, or the inability to hire or retain qualified personnel in the future could have a material adverse impact on our results of operations.

The integration of acquired businesses is time consuming, may distract our management from our other operations, and can be expensive, all of which could reduce or eliminate our expected earnings.

We have acquired businesses in the past and we may consider opportunities in the future to acquire other companies, assets or product lines that complement or expand our business. If we are unsuccessful in integrating these companies or product lines with our existing operations, or if integration is more difficult than anticipated, we may experience disruptions to our operations. A difficult or unsuccessful integration of an acquired business could have an adverse effect on our results of operations.

Some of the risks that may affect our ability to integrate or realize any anticipated benefits from companies or businesses we acquire include those associated with:

- •

- unexpected losses of key employees or customers of the acquired business;

9

- •

- conforming standards, processes, procedures and controls of the acquired business with our operations;

- •

- increasing the scope, geographic diversity and complexity of our operations;

- •

- difficulties in transferring processes and know-how;

- •

- difficulties in the assimilation of acquired operations, technologies or products;

- •

- diversion of management's attention from other business concerns to the acquired business; and

- •

- adverse effects on existing business relationships with customers.

We continue to expand our business internationally, which subjects us to additional risks associated with these international operations.

We have expanded our business internationally with offices in London, Brussels and Hong Kong, primarily related to our eDiscovery business. We could expand other businesses internationally and we could enter other world markets. It requires significant management attention and financial resources to develop successful global markets. In addition, new operations in geographies we may enter may not be immune from possible government monitoring or intrusion.

Global operations are subject to additional inherent risks, including certain risks that are not present with our domestic operations, and our future results could be adversely affected by a variety of uncontrollable and changing factors. These include:

- •

- difficulties and costs in recruiting effective management for international operations;

- •

- foreign certification, licensing and regulatory requirements, which may be substantially more complex or burdensome than

our domestic requirements;

- •

- unexpected changes in foreign regulatory requirements;

- •

- risk associated with selecting or terminating partners for foreign expansions, including marketing agents, distributors or

other strategic partners for particular markets;

- •

- changes to or reduced protection of intellectual property rights in some countries;

- •

- risk associated with fluctuations in currency exchange rates;

- •

- consequences from changes in applicable international tax laws;

- •

- risk associated with local ownership and/or investment requirements, as well as difficulties in obtaining financing in

foreign countries for local operations;

- •

- political and economic instability, national calamities, war, and terrorism;

- •

- reduced protection of confidential consumer information in some countries; and

- •

- different or additional functionality requirements for our software and services.

Our intellectual property is not protected through patents or formal copyright registration. Therefore, we do not have the full benefit of patent or copyright laws to prevent others from replicating our software.

Our intellectual property rights are not protected through patents or formal copyright registration. We may not be able to protect our trade secrets or prevent others from independently developing substantially equivalent proprietary information and techniques or from otherwise gaining access to our trade secrets. Moreover, litigation may be necessary to enforce our intellectual property rights, to protect our trade secrets, to determine the validity and scope of the proprietary rights of others or to defend against claims of infringements. Litigation of this nature could result in substantial expense for

10

us and diversion of management and other resources, which could result in a loss of revenue and profits.

We may be sued by third parties for alleged infringement of their proprietary rights.

The software and internet industries are characterized by the existence of a large number of patents, trademarks, and copyrights and by frequent litigation based on allegations of infringement or other violations of intellectual property rights. We have received in the past, and may receive in the future, communications from third parties claiming that we have infringed on the intellectual property rights of others. Our technologies may not be able to withstand any third party claims or rights against their use. Any intellectual property claims, with or without merit, could be time-consuming and expensive to resolve, could divert management attention from executing our business plan, and could require us to pay monetary damages or enter into royalty or licensing agreements. In addition, certain customer agreements require us to indemnify our customers for third-party intellectual property infringement claims, which would increase the cost to us of an adverse ruling on such a claim. An adverse determination could also prevent us from offering our service to others, which could result in a loss of revenues and profits.

Future government legislation or changes in court rules could adversely affect one or more of our business segments.

Our products and services are not directly regulated by the government. Each of our three reporting segments and the customers served by those businesses are, however, directly or indirectly affected by federal and state laws and regulations and court rules. For example, bankruptcy reform legislation, class action and tort reform legislation and amendments to the Federal Rules of Civil Procedure regarding discovery of "electronically stored information" have all affected our customers, and indirectly, our business segments. Future federal or state legislation or court rules, or court interpretations of those laws and rules, could adversely affect the businesses we serve and thus could have an adverse impact on our revenues and results of operations.

Goodwill comprises a significant portion of our total assets. We assess goodwill for impairment at least annually, which could result in a material, non-cash write-down and could have a material adverse effect on our results of operations and financial condition.

The carrying value of our goodwill was approximately $294.8 million, or approximately 62% of our total assets, as of December 31, 2010. We assess goodwill for impairment on an annual basis at a reporting unit level. Goodwill is assessed between annual tests if an event occurs or circumstances change that would more likely than not reduce the fair value of a reporting unit below its carrying value. Our impairment reviews require extensive use of accounting judgment and financial estimates. Application of alternative assumptions and definitions, such as reviewing goodwill for impairment at a different organization level, could produce significantly different results. We may be required to recognize impairment of goodwill based on future economic factors such as unfavorable changes in our stock price and market capitalization or unfavorable changes in the estimated future discounted cash flows of our reporting units. Impairment of goodwill could result in material charges that could, in the future, result in a material, non-cash write-down of goodwill, which could have a material adverse effect on our results of operations and financial condition.

Due to the current economic environment and the uncertainties regarding the impact that future economic consequences will have on our reporting units, there can be no assurances that our estimates and assumptions regarding the duration of the economic recession, or the period or strength of recovery, made for purposes of our annual goodwill impairment test, will prove to be accurate predictions of the future. If our assumptions regarding forecasted revenues or margins of certain of our reporting units are not achieved, we may be required to record goodwill impairment losses in future

11

periods. It is not possible at this time to determine if any such future impairment loss would occur, and if it does occur, whether such charge would be material.

As of July 31, 2010, which is the date of our most recent impairment test, the fair value of the bankruptcy trustee management reporting unit had approximately $74.9 million of goodwill allocated to it, and the fair value of this reporting unit exceeded its carrying value by approximately 14%; the fair value of each of our other reporting units was substantially in excess of the carrying value of the reporting unit. The discount rate used in the income approach for determining the fair value of the trustee management reporting unit, evaluated at July 31, 2010, was 12.3%. An increase to the discount rate of 1% would have lowered the fair value determined under the income approach for this reporting unit by approximately $12.0 million, or 12%, which, with all other variables remaining the same, would result in the fair value of this reporting unit exceeding its carrying value by 1%.

In connection with the acquisition of Jupiter eSources LLC in the fourth quarter of 2010, we recognized $30.7 million of goodwill. See Note 13 of the Notes to Consolidated Financial Statements for further detail.

Our quarterly results have fluctuated in the past and may fluctuate in the future. If they do, our operating results may not meet the expectations of securities analysts or investors. This could cause fluctuations in the market price of our common stock.

Our quarterly results have fluctuated in the past and may fluctuate in the future. Our quarterly revenues and operating results can be difficult to forecast. Our business will continue to be affected by a number of factors, any one of which could substantially affect our results of operations for a particular fiscal quarter. Specifically, our quarterly results from operations can vary due to:

- •

- the initiation or termination of a large engagement;

- •

- the timing, size, cancellation or rescheduling of customer orders;

- •

- fluctuations in short-term interest rates or bankruptcy trustees' deposit balances;

- •

- unanticipated expenses related to software maintenance or customer service; and

- •

- unexpected legal or regulatory expenses.

It is possible that our future quarterly results from operations from time to time will not meet the expectations of securities analysts or investors. This could cause a material decrease in the market price of our common stock.

The market price of our common stock may be volatile even if our quarterly results do not fluctuate significantly.

Even if we report stable or increased earnings, the market price of our common stock may be volatile. There are a number of factors, beyond earnings fluctuations, that can affect the market price of our common stock, including the following:

- •

- a decrease in market demand for our stock;

- •

- downward revisions in securities analysts' estimates;

- •

- announcements of technological innovations or new products developed by us or our competitors;

- •

- legal proceedings;

- •

- the degree of customer acceptance of new products or enhancements offered by us; and

- •

- general market conditions and other economic factors.

12

In addition, the stock market has experienced significant price and volume fluctuations that have often been unrelated to the operating performance of particular companies. The market price of our common stock has been volatile and this is likely to continue.

We may not pay cash dividends on our common stock in the future and our common stock may not appreciate in value or even maintain the price at which it was purchased.

Although we historically did not pay cash dividends on our common stock, we initiated our first cash dividend on our common stock during fiscal year 2010. There is no assurance that we will continue to pay cash dividends on our common stock in the future. Certain provisions in our credit facility may restrict our ability to pay dividends in the future. Subject to any financial covenants in current or future financing agreements that directly or indirectly restrict the payment of dividends, the payment of dividends is within the discretion of our board of directors and will depend upon our future earnings and cash flow from operations, our capital requirements, our financial condition and any other factors that the board of directors may consider. Unless we continue to pay cash dividends on our common stock in the future, the success of an investment in our common stock will depend entirely upon its future appreciation. Our common stock may not appreciate in value or even maintain the price at which it was purchased.

Future sales of equity or debt securities could dilute existing shares.

We are authorized to issue up to 100,000,000 shares of common stock and 2,000,000 shares of preferred stock. The issuance of additional common stock and/or preferred stock in the future will reduce the proportionate ownership and voting power of our common stock held by existing stockholders. As of February 11, 2011, there were 35,200,972 shares of common stock outstanding and no shares of preferred stock outstanding. Any future issuances of our common stock would similarly dilute the relative ownership interest of our current stockholders, and could also cause the trading price of our common stock to decline.

Our articles of incorporation and Missouri law contain provisions that could be used by us to discourage or prevent a takeover of our company.

Some provisions of our articles of incorporation could make it more difficult for a third party to acquire control of our company, even if the change of control would be beneficial to certain shareholders. For example, our articles of incorporation include "blank check" preferred stock provisions, which permit our board of directors to issue one or more series of preferred stock without shareholder approval. In conjunction with the issuance of a series of preferred stock, the board is authorized to fix the rights of that series, including voting rights, liquidation preferences, conversion rights and redemption privileges. The board could issue a series of preferred stock to a friendly investor and use one or more of these features of the preferred stock to discourage or prevent a takeover of the company. Additionally, our articles of incorporation do not permit cumulative voting in the election of directors. Cumulative voting, if available, would enable minority shareholders to elect one or more representatives to the board in certain circumstances, which could be used by third parties to facilitate a takeover of our company that was opposed by our board or management.

In addition, the General and Business Corporation Law of Missouri, under which we are incorporated, provides that any merger involving the company must be approved by the holders of not less than two-thirds of the outstanding shares of capital stock entitled to vote on the merger. Presently, our only outstanding voting securities are our shares of common stock. Accordingly, shareholders with voting power over as little as one-third of our outstanding common stock could block a merger proposal, even if that merger proposal were supported by our board of directors or shareholders holding a majority of our then outstanding shares of common stock.

13

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

Our corporate headquarters are located in a 49,000-square-foot facility in Kansas City, Kansas. This owned property serves as collateral under our credit facility. We also have significant leased offices in New York City and in metropolitan Portland, Oregon, and maintain smaller leased offices in Chicago, Miami, Washington, D.C., Los Angeles, Hartford, Wilmington, Oklahoma City, London, Brussels, and Hong Kong.

Purported Derivative Shareholder Complaint

On July 29, 2008, the Alaska Electrical Pension Fund filed a putative shareholder derivative action on behalf of Epiq Systems, Inc. in the U.S. District Court for the District of Kansas (the "Court") (Civil Action No. 08-CV-2344 CM/JPO), alleging, among other things, improper conduct by each of our current directors and certain current and former executive officers and directors regarding stock option grants. We have stated consistently that the claims made in the action are meritless.

Also as previously reported, on April 27, 2010, on the determination of our board of directors, we entered into a Stipulation of Settlement (the "Settlement Agreement") with plaintiff and defendants relating to the settlement of this litigation and mutual release of claims, and we and our insurance carrier agreed to pay plaintiff's counsel's fees and expenses, which totaled $3.5 million. On June 22, 2010, the Court entered an order which, among other things, preliminarily approved the Settlement Agreement and scheduled a final hearing. On August 25, 2010, the Court entered a final order, dated August 24, 2010, approving the Settlement Agreement and dismissing with prejudice the lawsuit and all claims contained therein (the "Final Order"). During the third quarter of 2010, the settlement amount, which had been fully accrued for in prior periods, was paid by us and our insurance company. On or about September 24, 2010, the Final Order became final and non-appealable because no appeal was filed prior to such date.

14

ITEM 5. MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Our common stock is traded under the symbol "EPIQ" on the NASDAQ Global Market. The following table shows the reported high and low sales prices for our common stock for the calendar quarters of 2010 and 2009 as reported by NASDAQ.

| |

2010 | 2009 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

High | Low | High | Low | |||||||||

First Quarter |

$ | 14.03 | $ | 11.62 | $ | 18.30 | $ | 14.41 | |||||

Second Quarter |

13.24 | 11.38 | 18.43 | 13.39 | |||||||||

Third Quarter |

13.44 | 12.06 | 16.31 | 14.50 | |||||||||

Fourth Quarter |

13.96 | 11.43 | 15.23 | 12.37 | |||||||||

Holders

As of February 11, 2011, there were approximately 42 owners of record of our common stock and approximately 4,300 beneficial owners of our common stock.

Dividends

For the first time in our history, we declared and paid cash dividends in fiscal 2010. On June 23, 2010 our board of directors declared our first cash dividend of $0.035 per share, payable on August 12, 2010 to shareholders of record at the close of business on July 15, 2010. On September 21, 2010, our board of directors declared another cash dividend of $0.035 per share, payable on November 18, 2010 to shareholders of record at the close of business on October 28, 2010. Total dividends declared and paid in 2010 totaled $1.6 million, or $0.07 per outstanding common share.

On January 17, 2011, our board of directors declared a cash dividend of $0.035 per outstanding common share, which was paid on February 17, 2011 to shareholders of record on January 27, 2011.

We do not have a formal dividend policy. We will determine if we will pay cash dividends on a quarterly basis and dividends may be declared at the discretion of our board of directors. There is no assurance that we will continue to pay cash dividends on our common stock in the future, or that any such dividends will be comparable to those previously declared. Any future declarations of dividends and the establishment of future record and payment dates are subject to the final determination of our board of directors.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

During 2010 our board of directors approved programs for us to repurchase up to $70.0 million of our common stock. Through December 31, 2010, we purchased 3.4 million shares of common stock for $43.2 million, at a weighted average cost of approximately $12.80 per share. Repurchases may be made from time to time at prevailing market prices in the open market or in privately negotiated purchases, or both. We may utilize one or more plans with its brokers or banks for pre-authorized purchases within defined limits pursuant to SEC Rule 10b5-1 to effect all or a portion of the repurchases.

Our stock repurchase authorization does not have an expiration date and the pace of our repurchase activity will depend on factors such as our working capital needs, our cash requirements for acquisitions and dividend payments, our debt repayment obligations or repurchases of our debt, our stock price, and economic and market conditions. Our stock repurchase program may be accelerated, suspended, delayed or discontinued at any time and without notice.

15

The following table presents the total number of shares purchased during the three months ended December 31, 2010, the average price paid per share, the number of shares that were purchased as part of a publicly announced repurchase program, and the maximum number (or approximate dollar value) of shares that may yet be purchased under a share repurchase program. In addition to the shares purchased under our share repurchase programs; we also have a policy that requires shares to be repurchased by the company to satisfy tax withholding obligations upon the vesting of restricted stock awards.

Period

|

Total Number of Shares Purchased |

Average Price Paid per Share(1) |

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

Maximum Number (or Approximate Dollar Value) of Shares that May Yet Be Purchased Under the Plans or Programs(1)(2) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

October 1 - October 31 |

— | — | — | $ | 35,000,000 | ||||||||

November 1 - November 30 |

801,077 | $ | 12.4112 | 801,077 | $ | 25,068,178 | |||||||

December 1 - December 31 |

251,923 | $ | 13.3771 | 251,923 | $ | 21,712,373 | |||||||

Total Activity for the Three Months Ended December 31, 2010 |

1,053,000 | $ | 12.7432 | 1,053,000 | $ | 21,712,373 | |||||||

- (1)

- Includes

brokerage commissions paid by the company.

- (2)

- On October 26, 2010, we announced that our board of directors authorized $35.0 million for share repurchases. This program has no stated expiration date.

Recent Sales of Unregistered Securities

None.

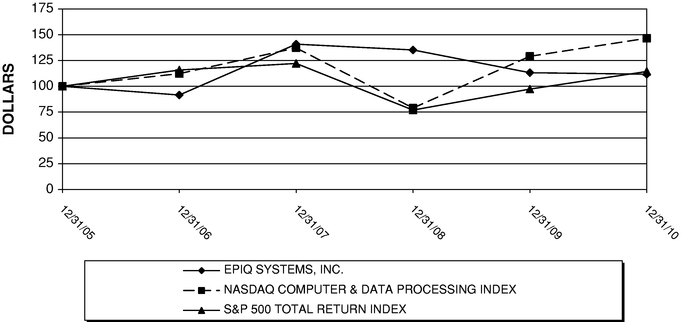

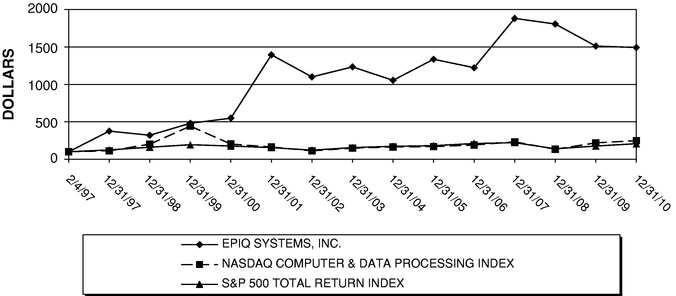

Performance Graph

The following Performance Graphs and related information shall not be deemed "soliciting material" or to be "filed" with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or Securities Exchange Act of 1934, each as amended, except to the extent that we specifically incorporate it by reference into such a filing.

The following graphs show the total shareholder return of an investment of $100 in cash for (i) Epiq's common stock, (ii) the NASDAQ Stock Market Computer & Data Processing Index (the "NASDAQ Computer Index"), and (iii) the Standard & Poor's 500 Total Return Index (the "S&P 500 Index") for our last five fiscal years (December 31, 2005 through December 31, 2010) and for the period beginning on the date of our initial public offering through the end of the last fiscal year (February 4, 1997 through December 31, 2010). All values assume reinvestment of the full amount of any dividends. The NASDAQ Computer Index and the S&P 500 Index are calculated by Standard & Poor's Institutional Market Services.

The five-year graph assumes that $100.00 was invested in our common stock on December 31, 2005, at the price of $12.29 per share, the closing sales price on that date. The second graph assumes that $100.00 was invested in our common stock on February 4, 1997, the date of our initial public offering, at the price of $0.93 per share, the closing sales price on that date (after giving effect to the stock splits and stock dividends paid by Epiq). The closing sales prices were used for each index on December 31, 2005 or February 4, 1997, as applicable, and all dividends were reinvested. Shareholder returns over the indicated period should not be considered indicative of future shareholder returns.

16

Five-Year Performance Graph

COMPARISON OF CUMULATIVE TOTAL RETURN

AMONG EPIQ SYSTEMS, INC., S&P 500 TOTAL RETURN INDEX

AND NASDAQ COMPUTER & DATA PROCESSING INDEX

ASSUMES $100 INVESTED ON DEC. 31, 2005

ASSUMES DIVIDEND REINVESTED

FISCAL YEAR ENDING DEC. 31, 2010

Performance Graph Since Initial Public Offering

COMPARISON OF CUMULATIVE TOTAL RETURN

AMONG EPIQ SYSTEMS, INC., S&P 500 TOTAL RETURN INDEX

AND NASDAQ COMPUTER & DATA PROCESSING INDEX

ASSUMES $100 INVESTED ON FEB. 4, 1997

ASSUMES DIVIDEND REINVESTED

FISCAL YEAR ENDING DEC. 31, 2010

17

ITEM 6. SELECTED FINANCIAL DATA

The following table presents selected historical financial data for the years ended December 31, 2010, 2009, 2008, 2007, and 2006.

| |

Year Ended December 31, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2009 | 2008 | 2007 | 2006 | |||||||||||

| |

(in thousands, except per share data) |

|||||||||||||||

Income Statement Data: |

||||||||||||||||

Total revenue |

$ | 247,166 | $ | 239,071 | $ | 236,118 | $ | 174,413 | $ | 224,170 | ||||||

Income from operations |

28,469 | 28,211 | 25,821 | 22,876 | 71,225 | |||||||||||

Net income |

13,929 | 14,595 | 13,836 | 6,929 | 35,131 | |||||||||||

Diluted net income per share |

0.36 | 0.38 | 0.36 | 0.21 | 1.05 | |||||||||||

Cash dividends declared per common share |

0.07 | — | — | — | — | |||||||||||

Balance Sheet Data: |

||||||||||||||||

Total assets |

$ | 478,218 | $ | 437,941 | $ | 418,946 | $ | 392,794 | $ | 382,220 | ||||||

Long-term obligations |

86,860 | 4,654 | 55,310 | 58,266 | 83,873 | |||||||||||

In October 2003 we entered into a three-year arrangement related to our Chapter 7 bankruptcy trustee business that included various elements which had previously been provided on a standalone basis. As a result, for the final quarter of 2003 and for the years ended December 31, 2004 and 2005 we deferred substantially all of our Chapter 7 bankruptcy trustee revenue. The $59.7 million of revenue deferred during these periods related to this arrangement was recognized during the year ended December 31, 2006.

In November 2007, we completed a registered offering of 5,000,000 shares of common stock and received net proceeds of approximately $78.6 million.

All per share amounts have been adjusted to reflect the 3-for-2 stock split, effected as 50% stock dividend, paid on June 7, 2007 to holders of record as of May 24, 2007.

18

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our consolidated results of operations and financial condition should be read in conjunction with the "Cautionary Statement Concerning Forward-Looking Statements," our "Risk Factors," "Selected Financial Data," and "Financial Statements and Supplementary Data" included in this Form 10-K.

Management's Overview

eDiscovery

Our eDiscovery segment provides collections and forensics, processing, search and review, and document review services to companies and the litigation departments of law firms. Our eDataMatrix® software analyzes, filters, deduplicates and produces documents for review. Produced documents are made available primarily through a hosted environment, and our DocuMatrix™ software allows for efficient attorney review and data requests. Our customers are typically large corporations that use our products and services cooperatively with their legal counsel to manage the e-discovery process for litigation and regulatory matters.

The substantial amount of electronic documents and other data used by businesses has changed the dynamics of how attorneys support discovery in complex litigation matters. Due to the complexity of cases, the volume of data that are maintained electronically, and the volume of documents that are produced in all types of litigation, law firms have become increasingly reliant on electronic evidence management systems to organize and manage the litigation discovery process.

Following is a description of the significant sources of revenue in our eDiscovery business.

- •

- Consulting, forensics and collection service fees based on the number of hours services are provided.

- •

- Fees related to the conversion of data into an organized, searchable electronic database. The amount earned varies

primarily on the number of documents.

- •

- Hosting fees based on the amount of data stored.

- •

- Document review fees based on the number of hours spent reviewing documents, the number of pages reviewed, or the amount of data reviewed.

In 2009 we opened new offices in Brussels and Hong Kong, established global reach for our offices and data centers in the U.S., Europe and Asia, and expanded our offerings to include data forensics and collections services, as well as document review services. In 2009 we also launched IQ Review™, a revolutionary combination of new intelligent technology and expert services which incorporates new prioritization technology into DocuMatrix™, our flagship document management platform. Increased case activity levels and an uptake of new service offerings launched in 2009 contributed to revenue grown in 2010, and is expected to continue into 2011.

Operating revenue exclusive of revenue originating from reimbursed direct costs in our eDiscovery segment was $81.1 million in 2010, which represented 37% of our consolidated total.

Bankruptcy Segment

Bankruptcy is an integral part of the United States' economy. As reported by the Administrative Office of the U.S. Courts for the fiscal years ended December 31, 2010, 2009, and 2008, there were approximately 1.59 million, 1.47 million, and 1.12 million new bankruptcy filings, respectively. Bankruptcy filings for the twelve-month period ended December 31, 2010 increased 8% versus the

19

twelve-month period ended December 31, 2009. During this period, Chapter 7 filings increased 8%, Chapter 11 filings fell 10%, and Chapter 13 filings increased 8%.

Our bankruptcy business provides solutions that address the needs of Chapter 7, Chapter 11, and Chapter 13 bankruptcy trustees to administer bankruptcy proceedings and of debtor corporations that file a plan of reorganization.

- •

- Chapter 7 is a liquidation bankruptcy for individuals or businesses that, as measured by the number of new cases

filed in the twelve-month period ended December 31, 2010, accounted for approximately 71% of all bankruptcy filings. In a Chapter 7 case, the debtor's assets are liquidated and the

resulting cash proceeds are used by the Chapter 7 bankruptcy trustee to pay creditors. Chapter 7 cases typically last several years.

- •

- Chapter 11 is a reorganization model of bankruptcy for corporations that, as measured by the number of new cases

filed in the twelve-month period ended December 31, 2010, accounted for approximately 1% of all bankruptcy filings. Chapter 11 generally allows a company, often referred to as the

debtor-in-possession, to continue operating under a plan of reorganization to restructure its business and to modify payment terms of both secured and unsecured obligations.

Chapter 11 cases generally last several years.

- •

- Chapter 13 is a reorganization model of bankruptcy for individuals that, as measured by the number of new cases filed in the twelve-month period ended December 31, 2010, accounted for approximately 28% of all bankruptcy filings. In a Chapter 13 case, debtors make periodic cash payments into a reorganization plan and a Chapter 13 bankruptcy trustee uses these cash payments to make monthly distributions to creditors. Chapter 13 cases typically last between three and five years.

The application of Chapter 7 bankruptcy regulations has the practical effect of discouraging trustee customers from incurring direct administrative costs for computer system expenses. As a result, we provide our Chapter 7 products and services to our trustee customers at no direct charge, and they maintain deposit accounts for bankruptcy cases under their administration at a designated banking institution. We have arrangements with various banks under which we provide the bankruptcy trustee case management software and related services, and the bank provides the bankruptcy trustee with deposit-related banking services. During the years ended December 31, 2010 and 2009, a majority of our Chapter 7 trustee clients' deposits were maintained at Bank of America.

Chapter 11 bankruptcy engagements are generally long-term, multi-year assignments that provide revenue visibility into future periods. For the Chapter 7 trustee services component of the bankruptcy segment, the increase in filings is expected to translate into growth in client deposit balances related to asset liquidations. Our trustee services deposit portfolio exceeded $2.0 billion throughout 2010, while pricing continued at floor pricing levels under our agreements due to the low short-term interest rate environment.

The key participants in a bankruptcy proceeding include the debtor-in-possession, the debtor's legal counsel, the creditors, the creditors' legal counsel, and the bankruptcy judge. Chapter 7 and Chapter 13 cases also include a professional bankruptcy trustee, who is responsible for administering the bankruptcy case. The end-user customers of our Chapter 7, Chapter 11, and Chapter 13 bankruptcy businesses are debtor corporations that file a plan of reorganization and professional bankruptcy trustees. The Executive Office for United States Trustees, a division of the U.S. Department of Justice, appoints all bankruptcy trustees. A United States Trustee is appointed in most federal court districts and generally has responsibility for overseeing the integrity of the bankruptcy system. The bankruptcy trustee's primary responsibilities include liquidating the debtor's assets or collecting funds from the debtor, distributing the collected funds to creditors pursuant to the orders of the bankruptcy court and

20

preparing regular status reports for the Executive Office for United States Trustees and for the bankruptcy court. Trustees manage an entire caseload of bankruptcy cases simultaneously.

On October 1, 2010, we completed the acquisition of Jupiter eSources LLC. The purchase price was comprised of $60.0 million of cash, $8.4 million of which was withheld for any claims for indemnification, and purchase price adjustments. In addition, there is contingent consideration related to an earn-out opportunity based on future revenue growth. The potential undiscounted amount of all future payments that we could be required to make under the earn-out opportunity is between $0 and $20 million over a four year period. The transaction was funded from our credit facility. See Note 13 of the Notes to Consolidated Financial Statements for further detail.

Through this purchase, we acquired a proprietary software product, AACER® (Automated Access to Court Electronic Records), that assists creditors including banks, mortgage processors, and their administrative services professionals to streamline processing of their portfolios of loans in bankruptcy cases. The AACER® product electronically monitors developments in all U.S. bankruptcy courts and applies sophisticated algorithms to classify docket filings automatically in each case to facilitate the management of large bankruptcy claims operations. By implementing the AACER® solution, clients achieve greater accuracy in faster timeframes, with a significant cost savings compared to manual attorney review of each case in the portfolio.

Following is a description of the significant sources of revenue in our bankruptcy business.

- •

- Data hosting fees and volume-based fees.

- •

- Case management professional service fees and other support service fees related to the administration of cases, including

data conversion, claims processing, claims reconciliation, professional services, and disbursement services.

- •

- Deposit-based fees, earned primarily on a percentage of Chapter 7 total liquidated assets placed on deposit with a

designated financial institution by our trustee clients, to whom we provide, at no charge, software licenses, limited hardware and hardware maintenance, and postcontract customer support services. The

fees we earn based on total liquidated assets placed on deposit by our trustee clients may vary based on fluctuations in short-term interest rates.

- •

- Legal noticing services to parties of interest in bankruptcy matters, including direct notification and media campaign and

advertising management in which we coordinate notification, primarily through print media outlets, to potential parties of interest for a particular client engagement.

- •

- Reimbursement for costs incurred, primarily related to postage on mailing services.

- •

- Monitoring and noticing fees earned based on monthly or on-demand requests for information provided through our AACER® software product.