Attached files

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year ended December 31, 2010

Commission file number 1-12284

GOLDEN STAR RESOURCES LTD.

(Exact Name of Registrant as Specified in Its Charter)

| Canada | 98-0101955 | |

| (State or other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

| 10901 West Toller Drive, Suite 300 Littleton, Colorado |

80127-6312 | |

| (Address of Principal Executive Office) | (Zip Code) | |

Registrant’s telephone number, including area code (303) 830-9000

Securities registered or to be registered pursuant to Section 12 (b) of the Act:

| Title of Each Class |

Name of each exchange on which registered | |

| Common Shares | NYSE Amex |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 (the “Act”) during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. (See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act). (Check one):

| Large accelerated filer: | x | Accelerated filer: | ¨ | |||

| Non-accelerated filer: | ¨ | Smaller reporting company: | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant was approximately $1,126.1 million as of June 30, 2010, based on the closing price of the shares on the NYSE Amex as of that date of $4.38 per share.

Number of Common Shares outstanding as at February 22, 2011: 258,559,486

DOCUMENTS INCORPORATED BY REFERENCE

Portions of our Definitive Proxy Statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14A in connection with the 2011 Annual Meeting of Shareholders are incorporated by reference to Part III of this Annual Report on Form 10-K.

REPORTING CURRENCY, FINANCIAL AND OTHER INFORMATION

All amounts in this report are expressed in United States (“US”) dollars, unless otherwise indicated. Canadian currency is denoted as “Cdn$.”

Financial information is presented in accordance with accounting principles generally accepted in Canada (“Cdn GAAP” or “Canadian GAAP”). Differences between accounting principles generally accepted in the U.S. (“U.S. GAAP”) and Canadian GAAP, as applicable to Golden Star Resources Ltd., are explained in Note 27 to the Consolidated Financial Statements.

References to “Golden Star,” the “Company,” “we,” “our,” and “us” mean Golden Star Resources Ltd., its predecessors and consolidated subsidiaries, or any one or more of them, as the context requires.

NON-GAAP FINANCIAL MEASURES

In this Form 10-K, we use the terms “total cash cost per ounce” and “cash operating cost per ounce” which are considered non-GAAP financial measures as defined in Securities and Exchange Commission (“SEC”) Regulation S-K Item 10 and applicable Canadian securities law and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with Cdn GAAP or U.S. GAAP. See Item 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations for a definition of these measures as used in this Form 10-K.

STATEMENTS REGARDING FORWARD-LOOKING INFORMATION

This Form 10-K contains “forward-looking statements”, within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended, and within the meaning of applicable Canadian securities law. Words such as “anticipates,” “expects,” “intends,” “forecasts,” “plans,” “believes,” “seeks,” “estimates,” “may,” “will,” and similar expressions (including negative and grammatical variations) tend to identify forward-looking statements.

Although we believe that our plans, intentions and expectations reflected in these forward-looking statements are reasonable, we cannot be certain that these plans, intentions or expectations will be achieved. Actual results, performance or achievements could differ materially from those contemplated, expressed or implied by the forward-looking statements contained in this Form 10-K.

These statements include comments regarding: production and cash operating cost estimates for 2011; anticipated commencement dates of mining and production at Prestea South and Pampe; development of the Dumasi pit; completion of the Bogoso tailings processing project; production capacity, production rates, and production costs; cash operating costs generally; gold sales; mining operations and recovery rates; ore delivery; ore processing; potential mine life; permitting; establishment and estimates of Mineral Reserves and Resources; geological, environmental, community and engineering studies; expectations of the resettlement of communities; exploration efforts and activities; availability, cost and efficiency of mining equipment; ore grades; reclamation work; expected reclamation expenditures over the next five years; expected PFIC (as defined below) status in 2011 and in the future; our anticipated investing and exploration spending in 2011; identification of acquisition and growth opportunities; power costs; the ability to meet total power requirements; retention of earnings from our operations; our objectives for 2011; and sources of and adequacy of liquidity to meet capital and other needs in 2011.

Forward statements are subject to risk, uncertainties, and other factors which could cause actual results to differ materially from future results expressed, projected, or implied by the forward-looking statements. Such risks include, but are not limited to, the following:

| • | significant increases or decreases in gold prices; |

| • | losses or gains in Mineral Reserves from changes in operating costs and/or gold prices; |

| • | failure of exploration efforts to expand Mineral Reserves around our existing mines; |

| • | unexpected changes in business and economic conditions; |

| • | variances in Mineral Reserves and non-reserves estimates; |

| • | changes in interest and currency exchange rates; |

| • | timing and amount of gold production; |

| • | unanticipated variations in ore grade, tonnes mined and crushed or milled; |

| • | unanticipated recovery or production problems; |

2

| • | effects of illegal mining on our properties; |

| • | changes in mining and processing costs, including changes to costs of raw materials, supplies, services and personnel; |

| • | changes in metallurgy and processing; |

| • | availability of skilled personnel, contractors, materials, equipment, supplies, power and water; |

| • | changes in project parameters or mine plans; |

| • | costs and timing of development of new Mineral Reserves; |

| • | weather, including drought or excessive rainfall in West Africa; |

| • | changes in regulatory frameworks based upon perceived climate trends; |

| • | results of current and future exploration activities; |

| • | results of pending and future feasibility studies; |

| • | acquisitions and joint venture relationships; |

| • | political or economic instability, either globally or in the countries in which we operate; |

| • | changes in regulations affecting our operations, particularly in Ghana, where our principal producing properties are located; |

| • | local and community impacts and issues, including resettlement; |

| • | availability and cost of replacing Mineral Reserves; |

| • | timing of receipt and maintenance of government approvals and permits; |

| • | unanticipated transportation costs and shipping incidents and losses; |

| • | accidents, labor disputes and other operational hazards; |

| • | environmental liabilities, costs and risks; |

| • | unanticipated title issues; |

| • | competitive factors, including competition for property acquisitions; |

| • | possible litigation; and |

| • | availability of capital at reasonable rates or at all. |

These factors are not intended to represent a complete list of the general or specific factors that could affect us. More detailed information regarding these factors is provided in the other risk factors disclosed and discussed in Item 1A below. We undertake no obligation to update forward-looking statements except as may be required by applicable laws.

CONVERSION FACTORS AND ABBREVIATIONS

All units in this report are stated in metric measurements unless otherwise noted.

For ease of reference, the following conversion factors are provided:

| 1 acre | = 0.4047 hectare | 1 mile | = 1.6093 kilometers | |||

| 1 foot | = 0.3048 meter | 1 troy ounce | = 31.1035 grams | |||

| 1 gram per metric tonne | = 0.0292 troy ounce/short ton | 1 square mile | = 2.59 square kilometers | |||

| 1 short ton (2000 pounds) | = 0.9072 tonne | 1 square kilometer | = 100 hectares | |||

| 1 tonne | = 1,000 kg or 2,204.6 lbs | 1 kilogram | = 2.204 pounds or 32.151 troy oz | |||

| 1 hectare | = 10,000 square meters | 1 hectare | = 2.471 acres | |||

| The following abbreviations may be used herein: | ||||||

| m | = meter | T or t | = tonne | |||

| g | = gram | oz | = troy ounce | |||

| g/t | = grams per tonne | km 2 | = square kilometers | |||

| ha | = hectare | kg | = kilogram | |||

| km | = kilometer | |||||

3

GLOSSARY OF TERMS

We report our Mineral Reserves to two separate standards to meet the requirements for reporting in both Canada and the United States. Canadian reporting requirements for disclosure of mineral properties are governed by National Instrument 43-101 (“NI 43-101”). The definitions in NI 43-101 are adopted from those given by the Canadian Institute of Mining, Metallurgy and Petroleum. U.S. reporting requirements for disclosure of mineral properties are governed by the SEC Industry Guide 7. These reporting standards have similar goals in terms of conveying an appropriate level of confidence in the disclosures being reported, but embody differing approaches and definitions.

We estimate and report our Mineral Resources and Mineral Reserves according to the definitions set forth in NI 43-101 and modify them as appropriate to conform to SEC Industry Guide 7 for reporting in the U.S. The definitions for each reporting standard are presented below with supplementary explanation and descriptions of the similarities and differences.

NI 43-101 DEFINITIONS

| Mineral Reserve | The term “Mineral Reserve” refers to the economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a preliminary feasibility study. The study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined. | |

| Proven Mineral Reserve | The term “Proven Mineral Reserve” refers to the economically mineable part of a Measured Mineral Resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified. | |

| Probable Mineral Reserve | The term “Probable Mineral Reserve” refers to the economically mineable part of an Indicated, and in some circumstances, a Measured Mineral Resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified. | |

| Mineral Resource | The term “Mineral Resource” refers to a concentration or occurrence of diamonds, natural solid inorganic material, or natural solid fossilized organic material including base and precious metals, coal, and industrial minerals in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge. | |

| Measured Mineral Resource | The term “Measured Mineral Resource” refers to that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity. | |

| Indicated Mineral Resource | The term “Indicated Mineral Resource” refers to that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed. | |

4

| Inferred Mineral Resource | The term “Inferred Mineral Resource” refers to that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. | |

| Qualified Person (1) | The term “qualified person” refers to an individual who is an engineer or geoscientist with at least five years of experience in mineral exploration, mine development or operation or mineral project assessment, or any combination of these, has experience relevant to the subject matter of the mineral project and the technical report and is a member in good standing of a professional association. | |

| SEC INDUSTRY GUIDE 7 DEFINITIONS | ||

| reserve | The term “reserve” refers to that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Reserves must be supported by a feasibility study(2) done to bankable standards that demonstrates the economic extraction. (“bankable standards” implies that the confidence attached to the costs and achievements developed in the study is sufficient for the project to be eligible for external debt financing.) A reserve includes adjustments to the in-situ tonnes and grade to include diluting materials and allowances for losses that might occur when the material is mined. | |

| proven reserve | The term “proven reserve” refers to reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape depth and mineral content of reserves are well-established. | |

| probable reserve | The term “probable reserve” refers to reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation. | |

| mineralized material (3) | The term “mineralized material” refers to material that is not included in the reserve as it does not meet all of the criteria for adequate demonstration for economic or legal extraction. | |

| non-reserves | The term “non-reserves” refers to mineralized material that is not included in the reserve as it does not meet all of the criteria for adequate demonstration for economic or legal extraction. | |

| exploration stage | An “exploration stage” prospect is one which is not in either the development or production stage. | |

| development stage | A “development stage” project is one which is undergoing preparation of an established commercially mineable deposit for its extraction but which is not yet in production. This stage occurs after completion of a feasibility study. | |

| production stage | A “production stage” project is actively engaged in the process of extraction and beneficiation of Mineral Reserves to produce a marketable metal or mineral product. | |

| (1) | Industry Guide 7 does not require designation of a qualified person. |

| (2) | For Industry Guide 7 purposes the feasibility study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified. |

| (3) | This category is substantially equivalent to the combined categories of Measured Mineral Resource and Indicated Mineral Resource specified in NI 43-101. |

ADDITIONAL DEFINITIONS

assay —a measure of the valuable mineral content

bio-oxidation— a processing method that uses bacteria to oxidize refractory sulfide ore to make it amenable to normal oxide ore processing techniques such as carbon-in-leach

5

Birimian— a thick and extensive sequence of Proterozoic age metamorphosed sediments and volcanics first identified in the Birim region of southern Ghana

CIL or carbon-in-leach—an ore processing method involving the use of cyanide where activated carbon, which has been added to the leach tanks, is used to absorb gold as it is leached by cyanide

craton— a stable relatively immobile area of the earth’s crust

cut-off grade—when determining economically viable Mineral Reserves, the lowest grade of mineralized material that qualifies as ore, i.e. that can be mined and processed at a profit

cyanidation— the process of introducing cyanide to ore to recover gold

diamond drilling—rotary drilling using diamond-set or diamond-impregnated bits, to produce a solid continuous core of rock sample

dip —the angle that a structural surface, a bedding or fault plane, makes with the horizontal, measured perpendicular to the strike of the structure

doré— unrefined gold bullion bars containing various impurities such as silver, copper and mercury, which will be further refined to near pure gold

fault —a surface or zone of rock fracture along which there has been displacement

feasibility study—a comprehensive study of a mineral deposit in which all geological, engineering, legal, operating, economic, social, environmental and other relevant factors are considered in sufficient detail that it could reasonably serve as the basis for a final decision by a financial institution to finance the development of the deposit for mineral production

formation —a distinct layer of sedimentary rock of similar composition

geochemical — the distribution and amounts of the chemical elements in minerals, ores, rocks, solids, water, and the atmosphere

geophysical — the mechanical, electrical, gravitational and magnetic properties of the earth’s crust

geophysical surveys—a survey method used primarily in the mining industry as an exploration tool, applying the methods of physics and engineering to the earth’s surface

grade— quantity of metal per unit weight of host rock

greenstone —a sequence of usually metamorphosed volcanic-sedimentary rock assemblages

heap leach—a mineral processing method involving the crushing and stacking of an ore on an impermeable liner upon which solutions are sprayed to dissolve metals i.e. gold, copper etc.; the solutions containing the metals are then collected and treated to recover the metals

host rock—the rock in which a mineral or an ore body may be contained

hydrothermal —the products of the actions of heated water, such as a mineral deposit precipitated from a hot solution

in-situ —in its natural position

life-of-mine —a term commonly used to refer to the likely term of a mining operation and normally determined by dividing the tonnes of Mineral Reserve by the annual rate of mining and processing

mineral —a naturally occurring inorganic crystalline material having a definite chemical composition

mineralization —a natural accumulation or concentration in rocks or soil of one or more potentially economic minerals, also the process by which minerals are introduced or concentrated in a rock

National Instrument 43-101 or NI 43-101—standards of disclosure for mineral projects prescribed by the Canadian Securities Administration

non-refractory— ore containing gold that can be satisfactorily recovered by basic gravity concentration or simple cyanidation

6

open pit—surface mining in which the ore is extracted from a pit or quarry, the geometry of the pit may vary with the characteristics of the ore body

ore —mineral bearing rock that can be mined and treated profitably under current or immediately foreseeable economic conditions

ore body—a mostly solid and fairly continuous mass of mineralization estimated to be economically mineable

ore grade—the average weight of the valuable metal or mineral contained in a specific weight of ore i.e. grams per tonne of ore

oxide —gold bearing ore which results from the oxidation of near surface sulfide ore

Precambrian —period of geologic time, prior to 700 million years ago

preliminary assessment—a study that includes an economic analysis of the potential viability of Mineral Resources taken at an early stage of the project prior to the completion of a preliminary feasibility study

preliminary feasibility study and pre-feasibility study—each mean a comprehensive study of the viability of a mineral project that has advanced to a stage where the mining method, in the case of underground mining, or the pit configuration in the case of an open pit, has been established and an effective method of mineral processing has been determined, and includes a financial analysis based on reasonable assumptions of technical, engineering, legal, operating, economic, social, and environmental factors and the evaluation of other relevant factors which are sufficient for a qualified person, acting reasonably, to determine if all or part of the Mineral Resource may be classified as a Mineral Reserve

Proterozoic —the more recent time division of the Precambrian; rocks aged between 2,500 million and 550 million years old

put —a financial instrument that provides the right, but not the obligation, to sell a specified number of ounces of gold at a specified price

QA/QC —Quality Assurance/Quality Control is the process of controlling and assuring data quality for assays and other exploration and mining data

RC (reverse circulation) drilling—a drilling method using a tri-cone bit, during which rock cuttings are pushed from the bottom of the drill hole to the surface through an outer tube, by liquid and/or air pressure moving through an inner tube

refractory— ore containing gold that cannot be satisfactorily recovered by basic gravity concentration or simple cyanidation

resettlement – the relocation or resettlement of a community or part of a community

rock —indurated naturally occurring mineral matter of various compositions

sampling and analytical variance/precision—an estimate of the total error induced by sampling, sample preparation and analysis

shield —a large area of exposed basement rocks often surrounded by younger rocks, e.g. Guiana Shield

strike —the direction or trend that a structural surface, e.g. a bedding or fault plane, takes as it intersects the horizontal

strip —to remove overburden in order to expose ore

sulfide— a mineral including sulfur (S) and iron (Fe) as well as other elements; metallic sulfur-bearing mineral often associated with gold mineralization

tailings —fine ground wet waste material produced from ore after economically recoverable metals or minerals have been extracted

Tarkwaian— a group of sedimentary rocks of Proterozoic age named after the town of Tarkwa in southern Ghana where they were found to be gold bearing

tectonic— relating to the forces that produce movement and deformation of the Earth’s crust

transition ore—is an ore zone lying between the oxide ore and the sulfide ore; ore material that is partially weathered and oxidized

vein —a thin, sheet-like crosscutting body of hydrothermal mineralization, principally quartz

VTEM –a proprietary airborne geophysical survey systems that identifies electrical conductivity of rock units

7

PART I

ITEM 1. BUSINESS

OVERVIEW OF GOLDEN STAR

We are a Canadian federally–incorporated, international gold mining and exploration company producing gold in Ghana, West Africa. We also conduct gold exploration in other countries in West Africa and in South America. Golden Star Resources Ltd. was established under the Canada Business Corporations Act on May 15, 1992 as a result of the amalgamation of South American Goldfields Inc., a corporation incorporated under the federal laws of Canada, and Golden Star Resources Ltd., a corporation originally incorporated under the provisions of the Alberta Business Corporations Act on March 7, 1984 as Southern Star Resources Ltd. Our principal office is located at 10901 West Toller Drive, Suite 300, Littleton, Colorado 80127, and our registered and records offices are located at 333 Bay Street, Bay Adelaide Centre, Box 20, Toronto, Ontario M5H 2T6.

We own controlling interests in several gold properties in southwest Ghana:

| • | Through a 90% owned subsidiary, Golden Star (Bogoso/Prestea) Limited (“GSBPL”), we own and operate the Bogoso/Prestea gold mining and processing operations (“Bogoso/Prestea”) located near the town of Bogoso, Ghana. GSBPL operates a gold ore processing facility at Bogoso/Prestea with a capacity of up to 3.5 million tonnes of ore per annum, which uses bio-oxidation technology to treat refractory sulfide ore (“Bogoso sulfide plant”). In addition, GSBPL has a carbon-in-leach (“CIL”) processing facility located next to the sulfide plant, which is suitable for treating oxide gold ores (“Bogoso oxide plant”) at a rate up to 1.5 million tonnes per annum. Bogoso/Prestea produced and sold 170,973 ounces of gold in 2010 and 186,054 ounces of gold in 2009. |

| • | Through another 90% owned subsidiary, Golden Star (Wassa) Limited (“GSWL”), we own and operate the Wassa open-pit gold mine and carbon-in-leach processing plant (“Wassa”), located approximately 35 km east of Bogoso/Prestea. The design capacity of the carbon-in-leach processing plant at Wassa (“Wassa plant”) is nominally 3.0 million tonnes per annum but varies depending on the ratio of hard to soft ore. GSWL also owns the Hwini-Butre and Benso concessions (the “HBB properties”) in southwest Ghana. The HBB properties send their ore to Wassa for processing. The Hwini-Butre and Benso concessions are located approximately 80km and 50km, respectively, by road south of Wassa. Wassa/HBB produced and sold 183,931ounces of gold in 2010 and 223,848 ounces of gold in 2009. |

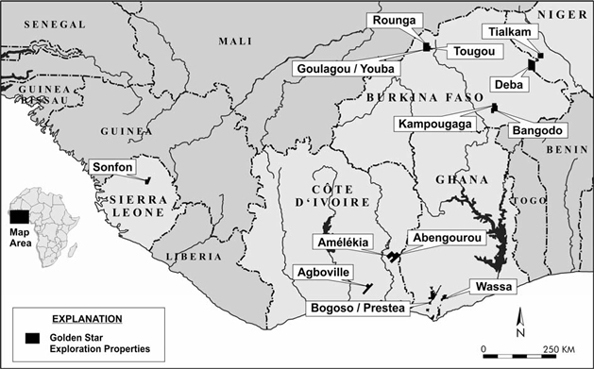

We also hold interests in several gold exploration projects in Ghana and elsewhere in West Africa including Sierra Leone, Burkina Faso, Niger and Côte d’Ivoire, and in South America where we hold exploration properties in Brazil.

All our operations, with the exception of certain exploration projects, transact business in U.S. dollars and keep financial records in U.S. dollars. Our accounting records are kept in accordance with Cdn GAAP. Our fiscal year ends December 31. We are a reporting issuer or the equivalent in all provinces of Canada, in Ghana and in the United States and file disclosure documents with securities regulatory authorities in Canada and Ghana, and with the United States Securities and Exchange Commission.

Note that gold productions Mineral Reserves and Mineral Resources are shown on a 100% basis in this Form 10-K, which represents our current beneficial interest. While the Government of Ghana owns a 10% carried interest in GSBPL and in GSWL, the Government’s interest is limited to 10% of any dividends distributed from GSBPL and GSWL but only after their outstanding loans and interest have been repaid to Golden Star. The Mineral Resources at Prestea Underground, which are owned by GSBPL, are also subject to the Government of Ghana’s 10% minority interest, resulting in an effective 81% interest.

GOLD SALES AND PRODUCTION

Ghana has been a significant gold producing country for over 100 years with AngloGold Ashanti’s Obuasi mine and our inactive underground mine at Prestea historically being the two major producers. Several other areas in Ghana have also produced large amounts of gold. Ghana produced just under 3 million ounces of gold in 2009.

Currently, all our gold production is shipped to a South African gold refinery in accordance with a long-term gold sales contract. Our gold is sold in the form of doré bars that average approximately 90% gold by weight with the remaining portion being silver and other metals. The sales price is based on the London P.M. fix on the day of shipment to the refinery.

GOLD PRICE HISTORY

The price of gold is volatile and is affected by numerous factors all of which are beyond our control such as the sale or purchase of gold by various central banks and financial institutions, inflation, recession, fluctuation in the relative values of the U.S. dollar and foreign currencies, changes in global and regional gold demand, and the political and economic conditions of major gold-producing countries throughout the world.

The following table presents the high, low and average London P.M. fixed prices for gold per ounce on the London Bullion Market over the past ten years.

8

| Year |

High | Low | Average | Average Price Received by Golden Star |

||||||||||||

| 2001 |

293 | 256 | 271 | 271 | ||||||||||||

| 2002 |

349 | 278 | 310 | 311 | ||||||||||||

| 2003 |

416 | 320 | 363 | 364 | ||||||||||||

| 2004 |

454 | 375 | 410 | 410 | ||||||||||||

| 2005 |

537 | 411 | 445 | 446 | ||||||||||||

| 2006 |

725 | 525 | 603 | 607 | ||||||||||||

| 2007 |

841 | 608 | 695 | 713 | ||||||||||||

| 2008 |

1,011 | 713 | 872 | 870 | ||||||||||||

| 2009 |

1,213 | 810 | 972 | 978 | ||||||||||||

| 2010 |

1,421 | 1,058 | 1,225 | 1,219 | ||||||||||||

| To February 22, 2011 |

1,403 | 1,319 | 1,358 | NA | ||||||||||||

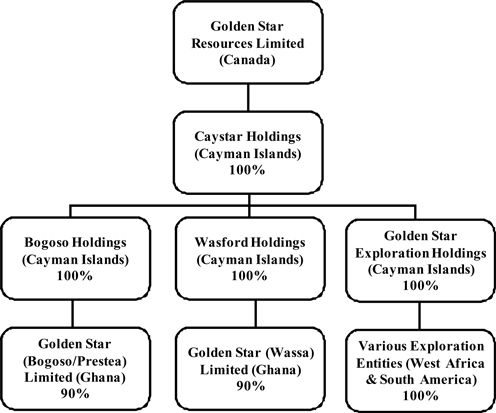

The following diagram depicts the organizational structure of Golden Star and its significant subsidiaries:

BUSINESS STRATEGY AND DEVELOPMENT

Our business and development strategy has been focused primarily on the acquisition of producing and development-stage gold properties in Ghana and on the exploration, development and operation of these properties. We have also pursued exploration activities in South America and other countries in West Africa.

We acquired Bogoso in 1999 and have operated the Bogoso oxide plant most of the time since then to process oxide and other non-refractory ores. In 2001, we acquired the Prestea property located adjacent to our Bogoso property and mined surface deposits at Prestea from late 2001 to late 2006. In late 2002, we acquired Wassa, and constructed the Wassa plant, which began commercial operation in April 2005. In July 2007, we completed construction and development of the Bogoso sulfide plant.

9

In late 2005, we acquired the HBB properties consisting of the Benso and Hwini-Butre properties. Benso development activities started in late 2007, and in 2008 we began trucking ore from the Benso mine to the Wassa plant for processing. Hwini-Butre development was initiated in the fourth quarter of 2008, and in May 2009 the Hwini-Butre mine began shipping ore to the Wassa plant for processing.

Our overall objective is to grow our business to become a mid-tier gold producer. We continue to evaluate potential acquisition and merger opportunities that could further increase our annual gold production. However, we presently have no agreement or understanding with respect to any specific potential transaction.

In addition to our gold mining and development activities, we actively explore for gold in West Africa and South America, investing approximately $9.0 million on such activities during 2009 and approximately $20 million during 2010. We are conducting regional reconnaissance projects in Ghana, Cote d’Ivoire and Brazil, and have drilled more advanced targets in Ghana, Niger, Sierra Leone, Burkina Faso and Brazil. See Item 2 – “Description of Properties” for additional details on our assets.

GOLD PRODUCTION AND UNIT COSTS

The following table shows historical and projected gold production and cash operating costs.

| Production and Cost Per Ounce(1) |

2008 | 2009 | 2010 | 2011 Projected | ||||||||||||

| BOGOSO/PRESTEA |

||||||||||||||||

| Gold Sales (thousands of ounces) |

170.5 | 186.1 | 171.7 | 160.0 – 180.0 | ||||||||||||

| Cash Operating Cost ($/oz) |

837 | 705 | 863 | 950 – 1,050 | ||||||||||||

| WASSA/HBB |

||||||||||||||||

| Gold Sales (thousands of ounces) |

125.4 | 223.8 | 183.9 | 170.0 – 180.0 | ||||||||||||

| Cash Operating Cost ($/oz) |

554 | 447 | 677 | 650 – 700 | ||||||||||||

| CONSOLIDATED |

||||||||||||||||

| Consolidated Total Sales (thousands of ounces) |

295.9 | 409.9 | 354.9 | 330.0 – 360.0 | ||||||||||||

| Consolidated Cash Operating Cost ($/oz) |

717 | 564 | 766 | 800 – 870 | ||||||||||||

| (1) | See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for a definition of cash operating cost per ounce. |

MINERAL RESERVES

Our Proven and Probable Mineral Reserves are estimated in conformance with definitions set out in NI 43-101. We have filed Technical Reports regarding the initial disclosure of Mineral Reserves and Mineral Resources for Bogoso/Prestea and Wassa/HBB as required by NI 43-101. The Proven and Probable Mineral Reserves are those ore tonnages contained within economically optimized pits, configured using current and predicted mining and processing methods and related operating costs and performance parameters. We believe that our Mineral Reserves are estimated on a basis consistent with the definition of proven and probable reserves prescribed for use in the U.S. by the U.S. Securities and Exchange Commission and set forth in SEC Industry Guide 7. See our “Glossary of Terms.”

In estimating Mineral Reserves, we first design an economically optimized pit based on all operating costs, including the costs to mine. Since all material lying within the optimized pit will be mined, the cut-off grade used in determining our Mineral Reserves is estimated based on the material that, having been mined, is economic to transport and process without regard to primary mining costs (i.e. mining costs that were appropriately applied at the economic optimization stage).

10

The QA/QC controls program used in connection with the estimation of our Mineral Reserves consists of regular insertion and analysis of blanks and standards to monitor laboratory performance. Blanks are used to check for contamination. Standards are used to check for grade-dependence biases.

The following table summarizes our estimated Proven and Probable Mineral Reserves as of December 31, 2010 and December 31, 2009:

PROVEN AND PROBABLE MINERAL RESERVES

| As at December 31, 2010 | As at December 31, 2009 | |||||||||||||||||||||||

| Property Mineral Reserve Category |

Tonnes (millions) |

Gold Grade (g/t) |

Ounces (millions) |

Tonnes (millions) |

Gold Grade (g/t) |

Ounces (millions) |

||||||||||||||||||

| Bogoso/Prestea (1) |

||||||||||||||||||||||||

| Proven Mineral Reserves |

||||||||||||||||||||||||

| Non-refractory |

1.3 | 1.58 | 0.06 | 1.1 | 1.60 | 0.06 | ||||||||||||||||||

| Refractory |

12.0 | 2.79 | 1.07 | 9.7 | 3.08 | 0.96 | ||||||||||||||||||

| Total Proven |

13.2 | 2.67 | 1.14 | 10.8 | 2.92 | 1.01 | ||||||||||||||||||

| Probable Mineral Reserves |

||||||||||||||||||||||||

| Non-refractory |

7.0 | 2.31 | 0.52 | 5.0 | 2.60 | 0.42 | ||||||||||||||||||

| Refractory |

26.9 | 2.45 | 2.13 | 15.5 | 2.65 | 1.32 | ||||||||||||||||||

| Total Probable |

34.0 | 2.42 | 2.65 | 20.5 | 2.64 | 1.73 | ||||||||||||||||||

| Total Proven and Probable |

||||||||||||||||||||||||

| Non-refractory |

8.3 | 2.20 | 0.59 | 6.1 | 2.42 | 0.47 | ||||||||||||||||||

| Refractory |

38.9 | 2.56 | 3.20 | 25.1 | 2.81 | 2.27 | ||||||||||||||||||

| Total Bogoso/Prestea Proven and Probable |

47.2 | 2.49 | 3.78 | 31.2 | 2.74 | 2.75 | ||||||||||||||||||

| Wassa (2) |

||||||||||||||||||||||||

| Proven Mineral Reserves |

||||||||||||||||||||||||

| Non-refractory |

0.6 | 1.14 | 0.02 | 0.8 | 1.91 | 0.05 | ||||||||||||||||||

| Probable Mineral Reserves |

||||||||||||||||||||||||

| Non-refractory |

17.5 | 1.44 | 0.81 | 16.3 | 1.79 | 0.94 | ||||||||||||||||||

| Total Wassa Proven & Probable |

18.1 | 1.43 | 0.83 | 17.1 | 1.79 | 0.99 | ||||||||||||||||||

| Totals |

||||||||||||||||||||||||

| Proven Mineral Reserves |

||||||||||||||||||||||||

| Non-refractory |

1.9 | 1.43 | 0.09 | 1.9 | 1.73 | 0.11 | ||||||||||||||||||

| Refractory |

12.0 | 2.79 | 1.07 | 9.7 | 3.08 | 0.96 | ||||||||||||||||||

| Total Proven |

13.9 | 2.60 | 1.16 | 11.6 | 2.86 | 1.06 | ||||||||||||||||||

| Probable Mineral Reserves |

||||||||||||||||||||||||

| Non-refractory |

24.5 | 1.69 | 1.33 | 21.3 | 1.98 | 1.35 | ||||||||||||||||||

| Refractory |

26.9 | 2.45 | 2.13 | 15.5 | 2.65 | 1.32 | ||||||||||||||||||

| Total Probable |

51.5 | 2.09 | 3.46 | 36.8 | 2.26 | 2.67 | ||||||||||||||||||

| Total Proven and Probable |

||||||||||||||||||||||||

| Non-refractory |

26.4 | 1.67 | 1.42 | 23.2 | 1.96 | 1.46 | ||||||||||||||||||

| Refractory |

38.9 | 2.56 | 3.20 | 25.1 | 2.81 | 2.27 | ||||||||||||||||||

| Total Proven and Probable (8) |

65.3 | 2.20 | 4.62 | 48.3 | 2.40 | 3.73 | ||||||||||||||||||

Notes to the Mineral Reserve Statement:

| (1) | The stated Mineral Reserve for Bogoso/Prestea includes Prestea South, Pampe and Mampon. |

| (2) | The stated Mineral Reserve for Wassa includes the Hwini-Butre and Benso properties. |

| (3) | The stated Mineral Reserves have been prepared in accordance with Canada’s National Instrument 43-101 Standards of Disclosure for Mineral Projects and are classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum’s “CIM Definition Standards – For Mineral Resources and Mineral Reserves”. Mineral Reserves are equivalent to “proven” and “probable reserves” as defined by the SEC Industry Guide 7. Mineral Reserve estimates reflect the Company’s reasonable expectation that all necessary permits and approvals will be obtained and maintained. Mining dilution and mining recovery vary by deposit and have been applied in estimating the Mineral Reserves. |

11

| (4) | The 2010 and 2009 Mineral Reserves were prepared under the supervision of Mr. Karl Smith, Vice President Technical Services for the Company. Mr. Smith is a “Qualified Person” as defined by Canada’s National Instrument 43-101. |

| (5) | The Mineral Reserves at December 31, 2010, were estimated using a gold price of $1,025 per ounce, which is approximately equal to the three-year average gold price. At December 31, 2009, Mineral Reserves were estimated using a gold price of $850 per ounce. |

| (6) | The terms “non-refractory” and “refractory” refer to the metallurgical characteristics of the ore and are defined in the Glossary of Terms. We plan to process the refractory ore in our sulfide bio-oxidation plant at Bogoso and to process the non-refractory ore using our more traditional gravity, flotation and/or cyanidation techniques. |

| (7) | The slope angles of all pit designs are based on geotechnical criteria as established by external consultants. The size and shape of the pit designs are guided by consideration of the results from a pit optimization program which incorporates historical and projected operating costs at Bogoso/Prestea, Wassa and Hwini-Butre and Benso. Metallurgical recoveries are based on historical performance or estimated from test work and typically range from 80% to 95% for non-refractory ores and from 70% to 85% for refractory ores. A government royalty of 5% of gold revenues is allowed as are other applicable royalties. |

| (8) | Numbers may not add due to rounding. |

12

STOCKPILED ORES

Stockpiled ores are included in the Mineral Reserves for both Bogoso/Prestea and Wassa. Details of the Proven and Probable stockpiles included in the Mineral Reserves at year-end 2010 and 2009 are summarized in the table below.

PROVEN AND PROBABLE STOCKPILES INCLUDED IN MINERAL RESERVES

| As at December 31, 2010 | As at December 31, 2009 | |||||||||||||||||||||||

| Property Mineral Reserve Category |

Tonnes (millions) |

Gold Grade (g/t) |

Ounces (millions) |

Tonnes (millions) |

Gold Grade (g/t) |

Ounces (millions) |

||||||||||||||||||

| Bogoso/Prestea |

||||||||||||||||||||||||

| Proven Stockpiles |

||||||||||||||||||||||||

| Non-refractory |

0.0 | 2.56 | 0.00 | 0.0 | 2.32 | 0.00 | ||||||||||||||||||

| Refractory |

0.0 | 2.10 | 0.00 | 0.1 | 2.67 | 0.01 | ||||||||||||||||||

| Total Proven Stockpiles |

0.1 | 2.42 | 0.00 | 0.1 | 2.57 | 0.01 | ||||||||||||||||||

| Probable Stockpiles |

||||||||||||||||||||||||

| Non-refractory |

— | — | — | — | — | — | ||||||||||||||||||

| Refractory |

0.2 | 2.31 | 0.02 | 0.7 | 2.34 | 0.05 | ||||||||||||||||||

| Total Probable Stockpiles |

0.2 | 2.31 | 0.02 | 0.7 | 2.34 | 0.05 | ||||||||||||||||||

| Total Proven and Probable |

||||||||||||||||||||||||

| Non-refractory |

0.0 | 2.56 | 0.00 | 0.0 | 2.32 | 0.00 | ||||||||||||||||||

| Refractory |

0.2 | 2.30 | 0.02 | 0.7 | 2.37 | 0.06 | ||||||||||||||||||

| Total Bogoso/Prestea Proven and Probable |

0.3 | 2.33 | 0.02 | 0.8 | 2.37 | 0.06 | ||||||||||||||||||

| Wassa |

||||||||||||||||||||||||

| Proven Stockpiles |

||||||||||||||||||||||||

| Non-refractory |

0.3 | 0.78 | 0.01 | 0.3 | 1.08 | 0.01 | ||||||||||||||||||

| Probable Stockpiles |

||||||||||||||||||||||||

| Non-refractory |

2.6 | 0.52 | 0.04 | 2.7 | 0.52 | 0.05 | ||||||||||||||||||

| Total Wassa Proven & Probable Stockpiles |

2.8 | 0.55 | 0.05 | 3.0 | 0.57 | 0.06 | ||||||||||||||||||

| Totals |

||||||||||||||||||||||||

| Proven Stockpiles |

||||||||||||||||||||||||

| Non-refractory |

0.3 | 0.98 | 0.01 | 0.3 | 1.20 | 0.01 | ||||||||||||||||||

| Refractory |

0.0 | 2.10 | 0.00 | 0.1 | 2.67 | 0.01 | ||||||||||||||||||

| Total Proven Stockpiles |

0.3 | 1.03 | 0.01 | 0.4 | 1.49 | 0.02 | ||||||||||||||||||

| Probable Stockpiles |

||||||||||||||||||||||||

| Non-refractory |

2.6 | 0.52 | 0.04 | 2.7 | 0.52 | 0.05 | ||||||||||||||||||

| Refractory |

0.2 | 2.31 | 0.02 | 0.7 | 2.34 | 0.05 | ||||||||||||||||||

| Total Probable Stockpiles |

2.8 | 0.67 | 0.06 | 3.4 | 0.87 | 0.10 | ||||||||||||||||||

| Total Proven and Probable Stockpiles |

||||||||||||||||||||||||

| Non-refractory |

2.9 | 0.57 | 0.06 | 3.0 | 0.59 | 0.06 | ||||||||||||||||||

| Refractory |

0.2 | 2.30 | 0.02 | 0.7 | 2.37 | 0.06 | ||||||||||||||||||

| Total Proven and Probable Stockpiles |

3.1 | 0.70 | 0.07 | 3.8 | 0.93 | 0.11 | ||||||||||||||||||

RECONCILIATION OF MINERAL RESERVES AS SHOWN UNDER NI 43-101 AND UNDER SEC INDUSTRY GUIDE 7

Since we report our Mineral Reserves to both NI 43-101 and SEC Industry Guide 7 standards, it is possible for our Mineral Reserve figures to vary between the two. Where such a variance occurs it will arise from the differing requirements for reporting Mineral Reserves. For example, NI 43-101 has a minimum requirement that Mineral Reserves be supported by a pre-feasibility study, whereas SEC Industry Guide 7 requires support from a detailed feasibility study that demonstrates that economic extraction is justified.

13

For the Mineral Reserves at December 31, 2010, and 2009, there is no difference between the Mineral Reserves as disclosed under NI 43-101 and those disclosed under SEC Industry Guide 7, and therefore no reconciliation is provided.

RECONCILIATION OF PROVEN AND PROBABLE MINERAL RESERVES—DECEMBER 31, 2009 TO DECEMBER 31, 2010

| Tonnes (millions) |

Contained Ounces (millions) |

Tonnes (% of Opening) |

Ounces (% of Opening) |

|||||||||||||

| Mineral Reserves at December 31, 2009 |

48.3 | 3.73 | 100 | 100 | ||||||||||||

| Gold Price Increase (1 and 6) |

15.5 | 0.74 | 32 | 20 | ||||||||||||

| Exploration Changes (2 and 7) |

4.3 | 0.51 | 9 | 14 | ||||||||||||

| Mining Depletion (3) |

(4.3 | ) | (0.46 | ) | (9 | ) | (12 | ) | ||||||||

| Engineering (4) |

1.5 | 0.10 | 3 | 3 | ||||||||||||

| Mineral Reserves at December 31, 2010 (5) |

65.3 | 4.62 | 135 | 124 | ||||||||||||

Notes to the reconciliation of Mineral Reserves:

| (1) | Gold Price Increase represents changes resulting from an increase in gold price used in the Mineral Reserve estimates from $850 per ounce in 2009 to $1,025 per ounce in 2010. |

| (2) | Exploration Changes include changes due to geological modeling, data interpretation and resource block modeling methodology as well as exploration discovery of new mineralization. |

| (3) | Mining Depletion represents the 2009 Mineral Reserve within the volume mined in 2010 with adjustments to account for stockpile addition and depletions during 2010 and therefore does not correspond with 2010 actual gold production. |

| (4) | Engineering includes changes as a result of engineering facts such as changes in operating costs, mining dilution and recovery assumptions, metallurgical recoveries, pit slope angles and other mine design and permitting considerations. |

| (5) | Numbers may not add due to rounding. |

| (6) | Pit design changes that are primarily due to a higher gold price are included here. |

| (7) | Pit design changes that are primarily due to exploration discoveries are included here. |

NON-RESERVES—MEASURED AND INDICATED MINERAL RESOURCES

Cautionary Note to U.S. Investors Concerning Estimates of Measured and Indicated Mineral Resources

This section uses the terms “Measured Mineral Resources” and “Indicated Mineral Resources.” We advise U.S. investors that while those terms are recognized and required by Canadian regulations, the U.S. Securities and Exchange Commission does not recognize them. US investors are cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into Mineral Reserves.

Our Measured and Indicated Mineral Resources, which are reported in this Form 10-K, do not include that part of our Mineral Resources that have been converted to Proven and Probable Mineral Reserves as shown above, and have been estimated in compliance with definitions set out in NI 43-101. Golden Star Resources has filed Technical Reports regarding the initial disclosure of Mineral Reserves and Mineral Resources for Bogoso/Prestea, Wassa and the HBB properties as required by NI 43-101 regulations. See our “Glossary of Terms.”

Except as otherwise provided, the total Measured and Indicated Mineral Resources for all properties have been estimated at an economic cut-off grade based on a gold price of $1,300 per ounce for December 31, 2010, and $1,000 per ounce for December 31, 2009, and on economic parameters deemed realistic. The economic cut-off grades for Mineral Resources are lower than those for Mineral Reserves and are indicative of the fact that the Mineral Resource estimates include material that may become economic under more favorable conditions including increases in gold price.

14

The following table summarizes our estimated non-reserves—Measured and Indicated Mineral Resources as of December 31, 2010, as compared to the totals for December 31, 2009:

| Measured | Indicated | Measured & Indicated | ||||||||||||||||||||||

| Property |

Tonnes (millions) |

Gold Grade (g/t) |

Tonnes (millions) |

Gold Grade (g/t) |

Tonnes (millions) |

Gold Grade (g/t) |

||||||||||||||||||

| Bogoso/Prestea (1) |

8.5 | 1.94 | 19.3 | 2.00 | 27.8 | 1.98 | ||||||||||||||||||

| Prestea Underground |

— | — | 1.1 | 15.80 | 1.1 | 15.80 | ||||||||||||||||||

| Wassa |

0.1 | 0.88 | 20.3 | 1.07 | 20.4 | 1.07 | ||||||||||||||||||

| Benso |

— | — | 0.8 | 2.53 | 0.8 | 2.53 | ||||||||||||||||||

| Chichiwelli Manso |

— | — | 0.9 | 1.80 | 0.9 | 1.80 | ||||||||||||||||||

| Hwini-Butre |

— | — | 0.5 | 2.07 | 0.5 | 2.07 | ||||||||||||||||||

| Father Brown Underground (8) |

— | — | 0.8 | 6.68 | 0.8 | 6.68 | ||||||||||||||||||

| Goulagou (7) |

— | — | 2.7 | 1.75 | 2.7 | 1.75 | ||||||||||||||||||

| Total 2010 (6) |

8.6 | 1.93 | 46.4 | 2.00 | 54.9 | 1.99 | ||||||||||||||||||

| Total 2009 |

4.8 | 1.87 | 21.8 | 2.66 | 26.6 | 2.52 | ||||||||||||||||||

Notes to Non-Reserves—Measured and Indicated Mineral Resources Table:

| (1) | The Mineral Resources for Bogoso/Prestea include Pampe and Mampon. |

| (2) | The Mineral Resources were estimated in accordance with the definitions and requirements of Canada’s National Instrument 43-101. The Mineral Resources are equivalent to Mineralized Material as defined by the SEC Industry Guide 7. |

| (3) | The Mineral Resources, other than for Goulagou (see Note 8), were estimated using optimized pit shells at a gold price of $1,300 per ounce from which the Mineral Reserves have been subtracted. Other than gold price, the same optimized pit shell parameters and modifying factors used to determine the Mineral Reserves were used to determine the Mineral Resources. The Prestea Underground resource was estimated using a $1,300 per ounce gold price and operating cost estimates. In 2009, we used a gold price of $1,000 per ounce for the optimized shell. |

| (4) | The Mineral Resources are not included in and are in addition to the Mineral Reserves described above. |

| (5) | The Qualified Person for the estimation of the Mineral Resources is S. Mitchel Wasel, Golden Star Resources Vice President of Exploration. |

| (6) | Numbers may not add due to rounding. |

| (7) | The Mineral Resources for Goulagou were estimated using optimized pit shells at a gold price of $560. Pit optimization parameters for the Goulagou Mineral Resources were estimated based on feasibility studies on other similar gold deposits in Burkina Faso, Golden Star’s experience in West Africa, and from limited metallurgical test work on the Goulagou ores. Heap leach processing was the assumed processing option for this deposit. Goulagou is 10% owned by an unrelated party. |

| (8) | The Father Brown Underground resource has been estimated below the $1,300 pit shell down to the 700 m elevation using an economic gold grade cut off of 4.5 g/t. |

NON-RESERVES—INFERRED MINERAL RESOURCES

Cautionary Note to U.S. Investors Concerning Estimates of Inferred Mineral Resources

This section uses the term “Inferred Mineral Resources.” We advise U.S. investors that while this term is recognized and required by NI 43-101, the U.S. Securities and Exchange Commission does not recognize it. “Inferred Mineral Resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of Inferred Mineral Resources will ever be upgraded to a higher category. In accordance with Canadian rules, estimates of Inferred Mineral Resources cannot form the basis of feasibility or other economic studies. U.S. investors are cautioned not to assume that part or all of the Inferred Mineral Resource exists, or is economically or legally mineable.

Our Inferred Mineral Resources have been estimated in compliance with definitions defined by NI 43-101. Golden Star Resources has filed Technical Reports regarding the initial disclosure of Mineral Reserves and Mineral Resources for Bogoso/Prestea, Wassa and the HBB properties as required by NI 43-101. See our “Glossary of Terms.”

15

The total Inferred Mineral Resources for all of our open pit deposits are those ore tonnages contained within economically optimized pits, configured using current and predicted mining and processing methods and related operating costs and performance parameters. Except as otherwise indicated, the Inferred Mineral Resources for all properties have been estimated at economic cut-off grades based on gold prices of $1,300 per ounce and $1,000 per ounce as of December 31, 2010, and December 31, 2009, respectively, and economic parameters deemed realistic.

The following table summarizes estimated non-reserves – Inferred Mineral Resources as of December 31, 2010, as compared to the total for December 31, 2009:

| Property |

Tonnes (millions) |

Gold Grade (g/t) |

||||||

| Bogoso/Prestea (1) |

10.6 | 2.11 | ||||||

| Prestea Underground |

4.1 | 8.20 | ||||||

| Wassa |

0.1 | 2.27 | ||||||

| Benso |

0.1 | 3.56 | ||||||

| Hwini-Butre |

0.7 | 1.71 | ||||||

| Chichiwelli Manso |

0.1 | 2.23 | ||||||

| Father Brown Underground (8) |

0.4 | 5.97 | ||||||

| Goulagou (7) |

0.5 | 1.00 | ||||||

| Total 2010 |

16.5 | 3.66 | ||||||

| Total 2009 |

11.0 | 4.62 | ||||||

Notes to Non-Reserves—Inferred Mineral Resources Table

| (1) | The Inferred Mineral Resources for Bogoso/Prestea incorporates Pampe and Mampon. |

| (2) | The Inferred Mineral Resources were estimated in accordance with the definitions and requirements of Canada’s National Instrument 43-101. Inferred Mineral Resources are not recognized by the United States Securities and Exchange Commission. |

| (3) | The Inferred Mineral Resources, other than for Goulagou, were estimated using an optimized pit shell at a gold price of $1,300 per ounce from which the Mineral Reserves have been subtracted. Other than gold price, the same optimized pit shell parameters and modifying factors used to determine the Mineral Reserves were used to determine the Mineral Resources. For Goulagou optimized pit shell at a gold price of $560 was used. The Prestea Underground resource was estimated using an $1,300 per ounce gold price and operating cost estimates. |

| (4) | The Inferred Mineral Resources are not included in and are in addition to the Mineral Reserves described above. |

| (5) | The Qualified Person for the estimation of the Inferred Mineral Resources is S. Mitchel Wasel, Golden Star Resources Vice President of Exploration. |

| (6) | Numbers may not add due to rounding. |

| (7) | Pit optimization parameters for the Goulagou Inferred Mineral Resources were estimated based on feasibility studies on other similar gold deposits in Burkina Faso, Golden Star’s experience in West Africa, and from limited metallurgical test work on the Goulagou ores. Heap leach processing was the assumed processing option for this deposit. |

| (8) | The Father Brown Underground resource has been estimated below the $1,300 pit shell down to the 700 m elevation using an economic gold grade cut off of 4.5 g/t. |

EMPLOYEES

As of December 31, 2010, Golden Star, including our majority-owned subsidiaries, had approximately 2,120 full time employees and approximately 370 contract employees, for a total of 2,490, a 13% increase from the approximately 2,200 full time and contract employees at the end of 2009. The 2010 total includes 20 employees at our principal office in Littleton, Colorado and 4 exploration personnel in South America.

16

CUSTOMERS

Currently all of our gold production is shipped to a South African gold refinery in accordance with a gold sales contract. The refinery arranges for sale of the gold on the day it is shipped from the mine site and we receive payment for gold sold approximately two working days after the gold leaves the mine site. The global gold market is competitive with numerous banks and refineries willing to buy gold on short notice. Therefore, we believe that the loss of our current customer would not materially delay or disrupt revenues.

COMPETITION

Our competitive position depends upon our ability to successfully and economically explore, acquire and develop new and existing gold properties. Factors that allow gold producers to remain competitive in the market over the long term include the quality and size of ore bodies, cost of operation, and the acquisition and retention of qualified employees. We compete with other mining companies in the acquisition, exploration, financing and development of new mineral properties. Many of these companies are larger and better capitalized than we are. There is significant competition for a limited number of gold acquisition and exploration opportunities. We also compete with other mining companies for skilled mining engineers, mine and processing plant operators and mechanics, mining equipment, geologists, geophysicists and other experienced technical personnel.

SEASONALITY

All of our operations are in tropical climates that experience annual rainy seasons. Ore output from our surface mining operations can be reduced during wet periods. While mine plans anticipate periods of high rain fall each year, in the third and fourth quarters of 2010 unusually heavy rainfall disrupted operations at both Bogoso/Prestea and Wassa/HBB for extended periods. Exploration activities are generally timed to avoid the rainy periods to ease transportation logistics associated with wet roads and swollen rivers.

AVAILABLE INFORMATION

We make available, free of charge, on or through our Internet website, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Our Internet address is www.gsr.com. Our Internet website and the information contained therein or connected thereto are not intended to be, and are not incorporated into this Annual Report on Form 10-K.

ITEM 1A. RISK FACTORS

You should consider the following discussion of risks in addition to the other information contained in or included by reference in this Form 10-K. In addition to historical information, the information in this Form 10-K contains “forward-looking statements” about our future business and performance. Our actual operating results and financial performance may be very different from what we expect as of the date of this Form 10-K. The risks below address material factors that may affect our future operating results and financial performance.

General Risks

A substantial or prolonged decline in gold prices would have a material adverse effect on us.

The price of our common shares, our financial results and our exploration, development and mining activities have previously been, and would in the future be significantly adversely affected by a substantial or prolonged decline in the price of gold. The price of gold is volatile and is affected by numerous factors beyond our control such as the sale or purchase of gold by various central banks and financial institutions, inflation or deflation, fluctuation in the value of the United States dollar and foreign currencies, global and regional demand, and the political and economic conditions of major gold-producing countries throughout the world. Any drop in the price of gold adversely impacts our revenues, profits and cash flows. In particular, a sustained low gold price could:

| • | cause suspension of our mining operations at Bogoso/Prestea and Wassa/HBB if these operations become uneconomic at the then-prevailing gold price, thus further reducing revenues; |

| • | cause us to be unable to fulfill our obligations under agreements with our partners or under our permits and licenses which could cause us to lose our interests in, or be forced to sell, some of our properties; |

| • | cause us to be unable to fulfill our debt payment obligations; |

17

| • | halt or delay the development of new projects; and |

| • | reduce funds available for exploration, with the result that depleted mineral reserves are not replaced. |

Furthermore, the need to reassess the feasibility of any of our projects because of declining gold prices could cause substantial delays or could interrupt operations until a reassessment could be completed. Mineral reserve estimations and life-of-mine plans using significantly lower gold prices could result in reduced estimates of mineral reserves and non-reserve mineral resources and in material write-downs of our investment in mining properties and increased amortization, reclamation and closure charges.

We have incurred and may in the future incur substantial losses that could make financing our operations and business strategy more difficult and that may affect our ability to service our debts as they become due.

While we had net income of $16.5 million in 2009, we experienced net losses of $8.3 million, $119.3 million and $35.3 million in 2010, 2008 and 2007, respectively, and have experienced net losses in other prior fiscal years. In recent years, increasing operating costs, natural variation in ore grades and gold recovery rates within the pits mined, and impairment write-offs of mine property and exploration property costs have been the primary factors contributing to such losses. In the future, these factors, as well as declining gold prices, could cause us to continue to be unprofitable. Future operating losses could adversely affect our ability to raise additional capital if needed, and could materially and adversely affect our operating results and financial condition. In addition, continuing operating losses could affect our ability to meet our debt payment obligations.

Our obligations could strain our financial position and impede our business strategy.

We had total consolidated debt and liabilities as of December 31, 2010, of $282.3 million, including $15.7 million in equipment financing loans; $108.8 million ($125.0 million including the loan’s equity portion) pursuant to the convertible debentures; $88.5 million of current trade payables, accrued current and other liabilities; $21.6 million of current and future taxes; $2.7 million payable under capital leases and a $45.0 million accrual for environmental rehabilitation liabilities. Our indebtedness and other liabilities may increase as a result of general corporate activities. These liabilities could have important consequences, including the following:

| • | increasing our vulnerability to general adverse economic and industry conditions; |

| • | limiting our ability to obtain additional financing to fund future working capital, capital expenditures, exploration costs and other general corporate requirements; |

| • | requiring us to dedicate a significant portion of our cash flow from operations to make debt service payments, which would reduce our ability to fund working capital, capital expenditures, exploration and other general corporate requirements; |

| • | limiting our flexibility in planning for, or reacting to, changes in our business and the industry; and |

| • | placing us at a disadvantage when compared to our competitors that have less debt relative to their market capitalization. |

Our estimates of Mineral Reserves and non-reserves could be inaccurate, which could cause actual production and costs to differ from estimates.

There are numerous uncertainties inherent in estimating Proven and Probable Mineral Reserves and non-reserve Measured, Indicated and Inferred Mineral Resources, including many factors beyond our control. The accuracy of estimates of Mineral Reserves and non-reserves is a function of the quantity and quality of available data and of the assumptions made and judgments used in engineering and geological interpretation, which could prove to be unreliable. These estimates of Mineral Reserves and non-reserves may not be accurate, and Mineral Reserves and non-reserves may not be able to be mined or processed profitably.

Fluctuation in gold prices, results of drilling, metallurgical testing, changes in operating costs, production, and the evaluation of mine plans subsequent to the date of any estimate could require revision of the estimates. The volume and grade of Mineral Reserves mined and processed and recovery rates might not be the same as currently anticipated. Any material reductions in estimates of our Mineral Reserves and non-reserves, or of our ability to extract these Mineral Reserves and non-reserves, could have a material adverse effect on our results of operations and financial condition.

We currently have only two sources of operational cash flows, which could be insufficient by themselves to fund our continuing exploration and development activities.

While we have received significant infusions of cash from sales of equity and debt securities, our only current significant internal sources of funds are operational cash flows from Bogoso/Prestea and Wassa/HBB. The anticipated continuing exploration and development of our properties are expected to require significant expenditures over the next several years. Although we expect sufficient internal cash flow to cover all of these projects, such expenditures may exceed free cash flows generated by Bogoso/Prestea and Wassa/HBB in future years, and therefore, we may require additional external debt or equity financing. Our ability to raise significant new capital will be a function of macroeconomic conditions, future gold prices, our operational performance and our then

18

current cash flow and debt position, among other factors. In light of the current limited global availability of credit, we may not be able to obtain adequate financing on acceptable terms or at all, which could cause us to delay or indefinitely postpone further exploration and development of our properties. As a result, we could lose our interest in, or could be forced to sell, some of our properties.

We are subject to fluctuations in currency exchange rates, which could materially adversely affect our financial position.

Our revenues are in United States dollars, and we maintain most of our working capital in United States dollars or United States dollar-denominated securities. We convert our United States funds to foreign currencies as certain payment obligations become due. Accordingly, we are subject to fluctuations in the rates of currency exchange between the United States dollar and these foreign currencies, and these fluctuations could materially affect our financial position and results of operations. A significant portion of the operating costs at Bogoso/Prestea and Wassa/HBB is based on the Ghanaian currency, the Cedi. We are required by the Government of Ghana to convert into Cedis 20% of the foreign exchange proceeds that we receive from selling gold, but the Government could require us to convert a higher percentage of gold sales proceeds into Cedis in the future. We obtain construction and other services and materials and supplies from providers in South Africa and other countries. The costs of goods and services could increase or decrease due to changes in the value of the United States dollar or the Cedi, the Euro, the South African Rand or other currencies. Consequently, operation and development of our properties could be more costly than anticipated.

Our hedging activities might be unsuccessful and incur losses.

During the second quarter of 2010, we entered into contracts with respect to 32,000 ounces of gold to address potential gold price volatility. All of these contracts expired by the end of the second quarter of 2010. As of December 31, 2010, we had no outstanding hedge contracts. While we may enter into additional hedging arrangements in the future, further hedging activities might not protect adequately against declines in the price of gold. In addition, although a hedging program could protect us from a decline in the price of gold, it might also prevent us from benefiting fully from price increases. For example, as part of a hedging program, we could be obligated to sell gold at a price lower than the then-current market price.

Risks inherent in acquisitions that we might undertake could adversely affect our current business and financial condition and our growth.

We plan to continue to pursue the acquisition of producing, development and advanced stage exploration properties and companies. The search for attractive acquisition opportunities and the completion of suitable transactions are time consuming and expensive, divert management attention from our existing business and may be unsuccessful. Success in our acquisition activities depends on our ability to complete acquisitions on acceptable terms and integrate the acquired operations successfully with our operations. Any acquisition would be accompanied by risks. For example, there may be a significant change in commodity prices after we have committed to complete a transaction and established the purchase price or exchange ratio, a material ore body may prove to be below expectations or the acquired business or assets may have unknown liabilities which may be significant. We may lose the services of our key employees or the key employees of any business we acquire or have difficulty integrating operations and personnel. The integration of an acquired business or assets may disrupt our ongoing business and our relationships with employees, suppliers and contractors. Any one or more of these factors or other risks could cause us not to realize the anticipated benefits of an acquisition of properties or companies, and could have a material adverse effect on our current business and financial condition and on our ability to grow.

We are subject to litigation risks.

All industries, including the mining industry, are subject to legal claims, with and without merit. As such, we are involved in various routine legal proceedings incidental to our business. Defense and settlement costs can be substantial, even with respect to claims that have no merit. Due to the inherent uncertainty of the litigation process, the resolution of any particular legal proceeding could have a material effect on our future financial position and results of operations.

We are subject to a number of operational hazards that can delay production or result in liability to us.

Our activities are subject to a number of risks and hazards including:

| • | power shortages; |

| • | mechanical and electrical equipment failures; |

| • | parts availability; |

19

| • | unexpected changes in ore grades; |

| • | unexpected changes in ore chemistry and gold recoverability; |

| • | environmental hazards; |

| • | discharge of pollutants or hazardous chemicals; |

| • | industrial accidents; |

| • | labor disputes and shortages; |

| • | supply and shipping problems and delays; |

| • | shortage of equipment and contractor availability; |

| • | unusual or unexpected geological or operating conditions; |

| • | cave-ins of underground workings; |

| • | slope failures and failure of pit walls or dams; |

| • | fire; |

| • | marine and transit damage and/or loss; |

| • | changes in the regulatory environment, including in the area of climate change; |

| • | delayed or restricted access to ore due to community interventions; and |

| • | natural phenomena such as inclement weather conditions, floods, droughts and earthquakes. |

These or other occurrences could result in damage to, or destruction of, mineral properties or production facilities, personal injury or death, environmental damage, delays in mining, delayed production, monetary losses and possible legal liability. Satisfying such liabilities could be very costly and could have a material adverse effect on our financial position and results of operations.

Our mining operations are subject to numerous environmental laws, regulations and permitting requirements and bonding requirements that can delay production and adversely affect operating and development costs.

Compliance with existing regulations governing the discharge of materials into the environment, or otherwise relating to environmental protection, in the jurisdictions where we have projects may have a material adverse effect on our exploration activities, results of operations and competitive position. New or expanded regulations, if adopted, could affect the exploration, development, or operation of our projects or otherwise have a material adverse effect on our operations.

Portions of our Wassa property, as well as some of our exploration properties in Ghana, including Dunkwa, are located within forest reserve areas. Although Dunkwa and Wassa have been identified by the Government of Ghana as eligible for mining permits, subject to normal procedures and a site inspection, permits for projects in forest reserve areas may not be issued in a timely fashion, or at all, and such permits may contain special requirements with which it is burdensome or uneconomic to comply.

Mining and processing gold from our future development projects in Ghana will require mining, environmental, and other permits and approvals from the Government of Ghana. These permits and approvals may not be issued on a timely basis or at all, and such permits and approvals, when issued, may be subject to requirements or conditions with which it is burdensome or uneconomic to comply. For example, although we received mining permits for Prestea South in 2008, we are still awaiting the environmental permit from the Government of Ghana. Such permitting issues could adversely affect our projected production commencement dates, production amounts and costs.

Developing our pit at Dumasi will require us to implement a resettlement action plan and reach agreements both with the residents that live close to the pit and other stakeholders. These negotiations could be difficult or unsuccessful and may materially affect our ability to access these mineral reserves and mineral resources.

Due to an increased level of non-governmental organization activity targeting the mining industry in Ghana, the potential for the Government of Ghana to delay the issuance of permits or impose new requirements or conditions upon mining operations in Ghana may increase. Any changes in the Government of Ghana’s policies, or their application, may be costly to comply with and may delay mining operations. The exact nature of other environmental control problems, if any, which we may encounter in the future, cannot be predicted primarily because of the changing character of environmental requirements that may be enacted within the various jurisdictions where we operate.