Attached files

| file | filename |

|---|---|

| EX-21.1 - Duff & Phelps Corp | v212153_ex21-1.htm |

| EX-32.2 - Duff & Phelps Corp | v212153_ex32-2.htm |

| EX-31.1 - Duff & Phelps Corp | v212153_ex31-1.htm |

| EX-31.2 - Duff & Phelps Corp | v212153_ex31-2.htm |

| EX-32.1 - Duff & Phelps Corp | v212153_ex32-1.htm |

| EX-23.1 - Duff & Phelps Corp | v212153_ex23-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the year ended December 31, 2010

|

|

|

or

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the transition period from _______ to ________.

|

Commission File No. 001-33693

DUFF & PHELPS CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware

|

20-8893559

|

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

(I.R.S. Employer

Identification No.)

|

55 East 52nd Street, 31st Floor

New York, New York 10055

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (212) 871-2000

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

|

Class A Common Stock, $0.01 par value

|

New York Stock Exchange

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of the registrant’s knowledge, in the definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ¨ Accelerated Filer x Non-Accelerated Filer ¨ Smaller Reporting Company ¨

Indicate by check whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the registrant’s Class A common stock held by non-affiliates was $381.9 million as of June 30, 2010, based on the closing price of the registrant’s Class A common stock reported on the New York Stock Exchange on such date of $12.63 per share, assuming the conversion of all shares of Class B common stock into shares of Class A common stock and exclusion of common equity held by affiliates.

The number of shares outstanding of the registrant’s Class A common stock, par value $0.01 per share, was 30,168,386 as of January 31, 2011. The number of shares outstanding of the registrant’s Class B common stock, par value $0.0001 per share, was 11,150,997 as of January 31, 2011.

Documents Incorporated by Reference

Portions of the registrant’s consolidated financial statements are incorporated by reference into Part I and Part II of this Form 10-K. Portions of the registrant’s Proxy Statement for its 2011 Annual Meeting of Stockholders are incorporated by reference into Part III of this Form 10-K.

DUFF & PHELPS CORPORATION

FORM 10-K

TABLE OF CONTENTS

|

Page

|

||

|

PART I

|

||

|

Item 1.

|

Business

|

1

|

|

Item 1A.

|

Risk Factors

|

11

|

|

Item 1B.

|

Unresolved Staff Comments

|

21

|

|

Item 2.

|

Properties

|

21

|

|

Item 3.

|

Legal Proceedings

|

21

|

|

Item 4.

|

(Removed and Reserved)

|

21

|

|

PART II

|

||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

22

|

|

Item 6.

|

Selected Financial Data

|

25

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

29

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

63

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

63

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

63

|

|

Item 9A.

|

Controls and Procedures

|

64

|

|

Item 9B.

|

Other Information

|

65

|

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance.

|

65

|

|

Item 11.

|

Executive Compensation

|

65

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

65 |

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

65

|

|

Item 14.

|

Principal Accountant Fees and Services

|

65

|

|

PART IV

|

||

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

66

|

|

Signatures

|

67

|

Forward-Looking Statements

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”), which reflect the Company’s current views with respect to, among other things, future events and financial performance. The Company generally identifies forward looking statements by terminology such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “could,” “should,” “seeks,” “approximately,” “predicts,” “intends,”

“plans,” “estimates,” “anticipates” or the negative version of those words or other comparable words. Any forward-looking statements contained in this discussion are based upon our historical performance and on our current plans, estimates and expectations. The inclusion of this forward-looking information should not be regarded as a representation by us, or any other person that the future plans, estimates or expectations contemplated by us will be achieved. Such forward-looking statements are subject to various risks and uncertainties and assumptions relating to our operations, financial results, financial condition, business prospects, growth strategy and liquidity. If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, our actual

results may vary materially from those indicated in these statements. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements and the risk factors section that are included in this Annual Report on Form 10-K and any subsequent filings of our Quarterly Reports on Form 10-Q. The forward-looking statements included in this Annual Report on Form 10-K are made only as of the date of this filing with the Securities and Exchange Commission. The Company does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

In this report, references to the “Company,” “we,” “us,” “our” and “Successor” refer to Duff & Phelps Corporation and its consolidated subsidiaries during the period subsequent to October 3, 2007, the date we consummated our initial public offering (“IPO”) and related transactions. Prior to the IPO, Duff & Phelps Acquisitions, LLC and its subsidiaries (“D&P Acquisitions” or “Predecessor”) was comprised of certain consolidated entities under the common ownership of D&P Acquisitions. References to “revenue” or “revenues” refer to revenue

excluding client reimbursable expenses. Amounts are reported in thousands, except for per share amounts, rate-per-hour, headcount or where the context requires otherwise.

Part I

Item 1. Business.

Overview

We are a leading provider of independent financial advisory and investment banking services. Our mission is to help our clients protect, maximize and recover value by providing independent advice on issues involving highly technical and complex assessments in the areas of valuation, transactions, financial restructuring, disputes and taxation. We believe that the Duff & Phelps brand is associated with experienced professionals who give trusted guidance in a responsive manner. We serve a global client base through offices in 24 cities, comprised of offices in 17 U.S. cities, including New York, Chicago, Dallas and Los Angeles, and seven international offices located in Amsterdam,

London, Munich, Paris, Shanghai, Tokyo and Toronto.

We provide our services globally to a wide variety of companies that are in need of industry-leading, customized financial advice. Our clients include publicly-traded and privately-held companies, government entities, and investment firms such as private equity firms and hedge funds. Additionally, we maintain extensive relationships with law, accounting and investment banking firms from which we receive referral business.

Our collaborative, team-based culture promotes the cross-selling of new business opportunities across practice groups and enables us to deliver the most appropriate Duff & Phelps professionals to meet a client's needs. In addition, our integrated, multi-disciplinary approach enables us to cross-staff our professionals across multiple service lines to better manage the utilization of our professionals. We believe that our Company’s culture, global scale, broad service offering and strong brand name, provides an appealing career platform that allows us to attract and retain highly qualified professionals.

Our History

The original Duff & Phelps business was founded in 1932 to provide high quality investment research services focused on the utility industry. Over several decades, it evolved into a diversified financial services firm providing investment banking, credit rating and investment management services. In 1994, the credit rating business of Duff & Phelps was spun off into a separate public company that was eventually purchased by Fitch Ratings, Ltd. In 2000, Duff & Phelps, LLC, the company that operated the investment banking practice of the Duff & Phelps business, was acquired by Webster Financial Corporation (“Webster”). In 2004, Duff & Phelps,

LLC was acquired from Webster by its management and an investor group led by Lovell Minnick Partners LLC (“Lovell Minnick”).

In 2005, Duff & Phelps, LLC teamed with Lovell Minnick and Vestar Capital Partners (“Vestar”), another leading private equity firm, to acquire the Corporate Value Consulting business (“CVC”) from the Standard & Poor's division of The McGraw-Hill Companies, Inc. (“McGraw-Hill”). CVC was formed in the 1970s, initially as part of the financial advisory service groups of Price Waterhouse and Coopers & Lybrand. These practices were combined in 1998 when Price Waterhouse merged with Coopers & Lybrand to form PricewaterhouseCoopers (“PwC”) and were subsequently acquired by McGraw-Hill in 2001, thereby establishing independence from the

audit practice of PwC. In connection with the acquisition of CVC, D&P Acquisitions, LLC (“D&P Acquisitions”) was formed and Duff & Phelps, LLC became a wholly-owned subsidiary of D&P Acquisitions. In October 2006, D&P Acquisitions acquired Chanin Capital Partners, LLC (“Chanin”), an independent specialty investment bank providing restructuring advisory services.

The Company was incorporated on April 23, 2007 and consummated its initial public offering (“IPO”) on October 3, 2007. Since our IPO, we have acquired eight additional businesses to continue the build out of our business and the services we offer.

1

2010 Developments

General developments during 2010 included the following:

|

|

§

|

Over the past several years, our business has been impacted by the economic downturn in general and slowdown of merger and acquisition (“M&A”) activity in particular. During 2010, we began to see modest improvements in certain areas of our business, particularly in the latter part of the year in certain areas relating to M&A activity. Many areas of our business, including M&A Advisory, Transaction Opinions and Due Diligence, demonstrated growth as a result of the improvement in overall M&A transaction volume. We believe these businesses, as well as Valuation Advisory, should generally react favorably to the extent that the overall increase in transaction volume continues. Our Global Restructuring Advisory business grew modestly as a

result of continued economic volatility, although such growth may be tempered if we enter a more robust period of economic recovery. Certain other areas of our business which we believe have historically been less correlated to M&A volumes, such as Portfolio Valuation and Financial Engineering, have experienced lower growth in recent quarters as a result of the current economic environment. Overall, we believe that revenue and earnings for the year demonstrate the resiliency of our balanced portfolio of services and diversified client base, whose demand for complex financial advisory and valuation services continues.

|

|

|

§

|

Our client service headcount decreased to 785 client service professionals at December 31, 2010, compared to 878 client service professionals at December 31, 2009. We had 157 client service managing directors at December 31, 2010, compared to 163 at December 31, 2009.

|

|

|

§

|

We had $113,328 of cash and cash equivalents and no debt at December 31, 2010.

|

|

|

§

|

We made targeted acquisitions to strengthen the depth of our offerings in key markets and service areas:

|

|

Effective

|

||||

|

Date

|

Acquisition

|

Description

|

||

|

6/15/10

|

Cole Valuation Partners

|

Toronto-based independent financial advisory firm. Specializing in financial litigation support, business valuation, corporate finance advisory and forensic and investigative accounting. Cole added 20 client service professionals and became part of our Dispute & Legal Management Consulting business unit.

|

||

|

12/15/10

|

Dynamic Credit Partners (U.S. Advisory Business)

|

New York-based provider of valuation services for complex financial instruments. Dynamic added 8 client service professionals and became part of our Financial Engineering business unit.

|

||

|

12/15/10

|

June Consulting Group

|

Houston-based advisor to corporate legal departments on technical and operational issues. June added 12 client service professionals and became part of our Dispute & Legal Management Consulting business unit.

|

|

|

§

|

We paid quarterly cash dividends of $0.05 per share of our Class A common stock to holders of record on March 16, 2010 and $0.06 per share on May 18, 2010, August 17, 2010 and November 23, 2010. Concurrent with the payment of per share dividends on our Class A common stock, the Company distributed an equal amount per unit to holders of vested ownership units of D&P Acquisitions (“New Class A Units”).

|

|

|

§

|

In 2010 the Company announced that its Board of Directors had approved a stock repurchase program, authorizing the Company to repurchase in the aggregate up to $50,000 of its outstanding common stock. As part of this program, the Company repurchased 451 shares of Class A common stock to date at an average price of $13.54 per share through the filing date of this Annual Report on Form 10-K.

|

2

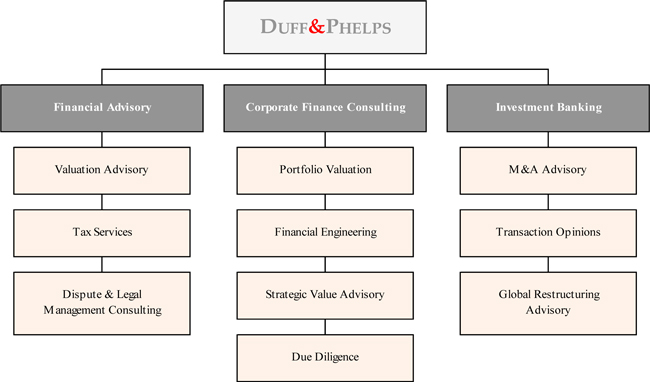

Overview of Our Services

We generate revenues from Financial Advisory, Corporate Finance Consulting and Investment Banking services. We typically enter into these engagements on a time-and-materials basis, a fixed-fee basis or a contingent-fee basis. Revenue trends in our Financial Advisory and Investment Banking segments, and to a lesser extent the Corporate Finance Consulting segment, generally are correlated to the volume of M&A activity and restructurings. However, deviations from this trend can occur in any given year for a number of reasons. For example, changes in our market share or the ability of our clients to close certain large transactions can cause our revenue results to diverge

from the level of overall M&A or restructuring activity. In addition, because many businesses do not routinely engage in M&A and restructuring activity, our fee paying engagements with many clients are not likely to be predictable and high levels of revenue in one quarter are not necessarily predictive of continued high levels of revenue in future periods. Further, we have lines of business that are not correlated to the volume of M&A activity and restructurings, but rather to bankruptcy filings, litigation or regulatory trends.

Revenues and operating income by segment are reported in the Notes to the Consolidated Financial Statements. Segment revenues as a percentage of total revenues excluding reimbursable expenses are summarized as follows:

|

Year Ended December 31,

|

||||||||||||

|

2010

|

2009

|

2008

|

||||||||||

|

Financial Advisory

|

60 | % | 63 | % | 66 | % | ||||||

|

Corporate Finance Consulting

|

15 | % | 17 | % | 15 | % | ||||||

|

Investment Banking

|

25 | % | 20 | % | 19 | % | ||||||

| 100 | % | 100 | % | 100 | % | |||||||

Our Financial Advisory segment provides clients with services through our Valuation Advisory, Tax Services and Dispute & Legal Management Consulting business units. Our Corporate Finance Consulting segment provides services related to Portfolio Valuation, Financial Engineering, Strategic Value Advisory and Due Diligence. We believe our services provided through these two segments help our clients effectively navigate through increasingly complex financial valuations as well as accounting, tax, regulatory and legal issues. Our Investment Banking segment includes our Global Restructuring Advisory, Transaction Opinions and M&A Advisory business units. Through this

segment we provide independent advice to our clients in order to assist them in making critical decisions in a variety of strategic situations.

3

Our segments serve a broad base of clients and work collaboratively to identify and capture new business opportunities. The services we offer within these segments are often complementary, which present opportunities for us to cross-sell related services and, we believe, increase our relevance to our clients. In addition, our client service professionals possess core financial and valuation skill sets that are portable within operating segments, facilitating the sharing of resources across the organization.

Financial Advisory

The foundation of our Financial Advisory segment is our core competency in making highly technical and complex assessments of value. We believe we are one of the leading independent valuation services firms in the world. Services are delivered by client service professionals who possess highly specialized skills in finance, valuation, accounting and tax. We typically price these services based on our assessment of the hours required to deliver the work and the billing rates of the client service professionals assigned to the project. In addition, certain of our property tax engagements are contingency-based.

Valuation Advisory

Financial Reporting. We believe we are a leading independent provider of valuation services for financial reporting. We provide objective and independent valuation advice that allows our clients to meet important regulatory, market and fiduciary requirements. Our corporate finance expertise and extensive working knowledge of the relevant accounting requirements, combined with our use and development of industry-specific sophisticated valuation methodologies, fulfill even the most complex financial reporting requirements. Examples of the financial reporting services we offer in the context of both U.S. Generally Accepted

Accounting Principles (“GAAP”) and International Financial Reporting Standards (“IFRS”) include valuations for business combinations (purchase price allocations) pursuant to Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 805, Business Combinations and IFRS 3, Business Combinations; periodic impairment testing of goodwill and other intangibles pursuant to FASB ASC 350, Intangibles–Goodwill and Other; periodic impairment testing of long-lived fixed assets pursuant to FASB ASC 360, Property, Plant, and Equipment; periodic impairment testing of assets, including

goodwill, pursuant to International Accounting Standards (“IAS”) IAS 36, Impairment of Assets; valuations related to stock compensation pursuant to FASB ASC 718, Compensation–Stock Compensation and IFRS 2, Share-Based Payment; “cheap stock” valuation; and fresh start accounting for companies emerging from Chapter 11 bankruptcy. The acute sensitivity of our clients at the highest levels of the organization to the quality and transparency of the financial information they present to their investors results in strong customer loyalty, which often leads to repeat client engagements and creates an established entry point for the delivery of additional services.

Fixed Asset/Real Estate Valuation. We provide integrated fixed asset and real estate valuations, with specialized expertise in machinery and equipment valuation, fixed asset reconciliation, cost segregation, real estate valuation and real estate consulting. Our services are used for a variety of purposes, including valuation of machinery and equipment for financial and tax reporting and loan/lease structuring; satisfying Sarbanes-Oxley Act Section 404 requirements for fixed asset internal controls; optimizing tax depreciation benefits; assisting corporate clients in reviewing their real estate occupancy strategy in an effort to reduce costs,

increase operating efficiencies and raise capital; and various real estate appraisal purposes. Our geographic scale enables us to compete effectively and win large client assignments involving multiple asset sites on a national and global basis.

Tax Valuation. We specialize in tax valuations and related advisory services when tax laws and regulations stipulate that a valuation is required or when assistance is needed to implement a client's tax strategies. We offer tax valuation and advisory services for a variety of transaction-related, compliance and planning purposes, including taxable reorganizations; purchase price allocations; inventory, fixed asset, intangible asset and goodwill valuations; net operating loss and built-in gains analyses; and estate and gift taxes. We have the technical expertise and testimony experience to defend our work and our clients' valuation

positions in regulatory inquiries.

Tax Services

State & Local Tax Services. We provide tax valuation and consulting services for a variety of transaction-related, compliance, planning and dispute purposes.

|

|

§

|

Property tax services – Property taxes are a significant recurring expense paid by companies, but one of the least understood due to the complexity of the applicable tax regulations. We assist companies in identifying opportunities for property tax savings by reviewing their property tax assessments and liabilities. Our services include negotiating assessment appeals, providing property tax due diligence for acquisitions, preparing studies to remove non-taxable embedded costs, obtaining property tax exemptions and providing general property tax consulting and compliance services.

|

4

|

|

§

|

Business incentives advisory – State and local governments often offer valuable tax incentives in return for investments in their jurisdictions. Whether the planned investment will create new facilities, expand or relocate operations, penetrate new markets, result in hiring additional or replacement employees, or initiate research and development activities, business incentives in the form of tax exemptions, tax credits, project grants and other tax benefits may be available at the state and local levels to offset some of these costs. Our strategic geographic network of business incentives experts provides us with specialized, local knowledge of the potential business incentives available to our clients.

|

|

|

§

|

Unclaimed property and tax risk advisory – Our professionals combine their extensive experience and technical resources to help our clients manage their unclaimed property responsibilities. We offer services to help clients effectively manage the reporting of unclaimed property, such as audit representation and negotiation, transaction planning and M&A assistance, and outsourcing of the unclaimed property compliance process.

|

Transfer Pricing. Transfer pricing is a significant international tax issue facing multi-national companies. Most tax authorities require comprehensive transfer pricing documentation, have other compliance requirements and impose severe penalties for failure to comply. Furthermore, transfer pricing presents significant tax optimization opportunities for multi-national companies. We provide a full scope of transfer pricing services to ensure that inter-company transactions comply with required arm's-length standards as well as create the contemporaneous documentation to support global compliance requirements.

Dispute & Legal Management Consulting

Dispute Consulting. We offer a broad array of dispute consulting services to corporate clients in a variety of industries. Our professionals provide comprehensive support throughout all stages of a dispute including early case assessment, electronic discovery services, complex data management, forensic accounting and damages testimony. Our experts have provided testimony in a variety of subject matters including bankruptcy and retrospective solvency, business insurance consulting, intellectual property disputes, commercial and shareholder litigation, forensic accounting and investigative services and purchase price

disputes. Our clients include corporations and attorneys from many of the largest and most prominent corporations and law firms in the country. Our professionals have provided testimony in arbitrations, mediations, federal and state courts and on behalf of clients involved in governmental inquiries. In addition to the industry and forensic accounting experts which are a part of our practice, we also maintain an external network of affiliates with specialized skills whom we work with on an as-needed basis in order to provide our clients with comprehensive support.

Legal Management Consulting. We provide various services designed to enable chief legal officers, chief compliance officers and law firm leaders to develop organizational strategy, streamline operations, improve compliance programs, optimize technology systems and make informed risk management decisions. Legal management consulting services are matched to the specific needs of the client, and have encompassed organizational planning and design, operations improvement, and technology and infrastructure planning. In addition, we assist clients in the development and implementation of a wide variety of records and information management

programs, including the creation of records retention and privacy programs.

Global Electronic Discovery and Investigations. Our electronic discovery and investigations practice supports the efforts of both the dispute consulting and legal management consulting practices. Our services include computer forensic investigations and expert testimony, litigation readiness and electronic discovery cost containment consulting, complex data management and electronic discovery collection, preservation, processing, analysis, review and production of a wide variety of digital evidence types.

Corporate Finance Consulting

Our Corporate Finance Consulting segment provides consulting services in connection with the valuation of difficult-to-value investments, advice regarding transactions and business growth strategies and consulting regarding business performance measurement and improvement. This segment primarily serves clients who invest in alternative assets. Its foundation is our expertise in the valuation of these assets, especially for securities and positions for which there are no “active market” quotations available. Given the significant rise in the number and value of illiquid securities held by hedge funds, private equity funds, pension funds, endowments and corporations, we

believe the scrutiny and attention by investors and regulators to fair value reporting standards has increased substantially.

5

Portfolio Valuation

Our portfolio valuation client service professionals specialize in assisting the alternative asset management community with investment and reporting issues, including portfolio valuations, “best practices” consulting, general partnership valuations, secondary market transaction valuations and operational risk due diligence. Our portfolio valuation clients include investors in illiquid and restricted securities, including private equity firms and hedge funds. The majority of our clients’ illiquid portfolios are comprised of secured and unsecured loans and other debt instruments, privately held preferred equity and common equity, convertible securities, warrants and options,

structured products, OTC and other derivative securities. Similar to our corporate clients, our alternative asset community clients are under intense scrutiny regarding their fiduciary duties to their investors/constituents, which has prompted many of these firms to obtain outside assurances on the valuations of the investment portfolios for which they are responsible. Conflict of interest considerations typically prevent any accounting firm that has an audit relationship with a portfolio company from rendering valuation advisory services on the entire portfolio. As a result, we typically do not compete with large accounting firms, such as the four largest international accounting firms (i.e., the “Big Four”), in providing these services. We typically deliver these services on a recurring

basis. We believe we are a market leader in portfolio valuations, which provides us with an attractive opportunity to increase our revenues in this practice group and increase our brand equity and recognition within the alternative asset community.

Financial Engineering

New financial processes and sophisticated quantitative models are transforming the way investors analyze and manage risk, price financial instruments and evaluate business strategies. Our financial engineering practice provides the valuation advice investors use, including valuation of alternative and derivative instruments (including structured products, mortgage-backed securities and other complex instruments), to enhance their ability to identify, control, diversify, mitigate and exploit risk. Financial engineering analyses and valuations can be used to support financial reporting, tax planning, risk management, securities design and investment decision making. We draw upon the

latest developments in finance theory, mathematics and computer science to design and evaluate financial instruments that help achieve investors' goals. Financial engineering services include auction rate securities valuation; derivatives valuations pursuant to FASB ASC 815, Derivatives and Hedging; alternative assets valuations pursuant to FASB ASC 820, Fair Value Measurements and Disclosures; and valuations for employee stock options and incentives pursuant to FASB ASC 718, Compensation–Stock Compensation.

Due Diligence

We provide buy-side and sell-side transaction advisory services to private equity and strategic buyers. Our professionals assist with the accounting, financial, commercial, operational, tax and information technology aspects of the due diligence process by developing and executing a due diligence plan that focuses on the key value drivers and risks that are critical to our clients' investment or divestiture decisions. Our independence allows us to provide a broader and deeper array of services to our clients than their audit firms. Our ability to collaborate across D&P practices also creates a more efficient and cost effective process. We have expanded our

services to include interim financial management (CFO, controller, etc.), working capital and cash flow analysis/forecasts, performance analysis and benchmarking, lender analyses, covenant reviews, IPO related assistance (helping prepare management’s discussion and analysis, pro-forma financial statements and footnote disclosures) and operations analysis. These services enable our clients to obtain further transparency into their investment portfolios and enhance their ability to proactively make investment lifecycle decisions.

Strategic Value Advisory

Our strategic value advisory practice helps clients improve ongoing performance, optimize their transaction and investment strategies, and enhance fundamental company value. Whether a company is contemplating a transaction, allocating capital, addressing profitability or liquidity issues, or weighing alternative growth strategies, we provide advice and management tools based on a rigorous valuation-oriented perspective. We advise management and boards of directors of companies that are evaluating strategic alternatives, looking to raise capital or considering mergers, acquisitions, joint ventures or divestitures. We also help companies address profitability and operational issues,

value contingencies and allocate limited capital.

Investment Banking

Our Investment Banking segment focuses on providing services to corporate and investor clients through our M&A Advisory, Transaction Opinions and Global Restructuring Advisory business units. A significant portion of revenues in this segment are generated from success-based fees that are paid when a transaction closes and are generally tied to the value of the transaction. As a result, revenues in this segment can be less predictable and more event-driven than revenues in our Financial Advisory and Corporate Finance Consulting segments. However, projects in this segment have the potential to generate higher revenue per client service professional, thereby resulting in higher

margins.

M&A Advisory

We provide objective valuation, structuring and negotiation services tailored to help our clients achieve their strategic goals on the best possible terms. We have developed our expertise through hundreds of sell-side, buy-side, divestiture and capital raising assignments across a wide range of industries. We provide our services primarily to middle-market clients, including the portfolio companies of our private equity clients, focusing primarily on transaction values ranging from $20 million to $1 billion (actual dollars).

6

Transaction Opinions

Our independent fairness opinions, solvency opinions and commercially reasonable debt opinions help provide boards of directors, lenders, trustees and other corporate fiduciaries with a legally defensible basis to support important corporate decisions. Our ability to offer financial opinions that satisfy all constituencies, including regulators and shareholders, has been developed through extensive research, detailed financial analyses and a commitment to stay current on key governance and regulatory issues. In recent years, we believe our fairness opinion practice has benefited from an increase in the perceived standard of diligence required by boards of directors to adequately satisfy their

fiduciary duties, particularly when faced with financial advisors who may have conflicts arising from the receipt of success-based transaction advisory or financing fees in conjunction with sell-side advisory assignments. Finally, we believe we are one of the leading financial advisors in transactions involving retirement benefit plans, including employee stock ownership plans (“ESOPs”) and other ERISA plans. We have a strong background in resolving the unique financial, valuation, tax and structural issues involving employee benefit plans under the Employee Retirement Income Security Act of 1974 (“ERISA”), and also provide recurring ERISA/ESOP valuation services for our clients on a periodic basis.

Global Restructuring Advisory

Our global restructuring practice provides financial restructuring advice to all constituencies in the business reorganization process, including debtors, senior and junior lenders, existing and potential equity investors and other interested parties for clients domestically and internationally. Our services include strategy, plan development and implementation, working capital forecasting and management, exchange offers and consent solicitations, out-of-court workouts, Chapter 11 restructurings and debtor-in-possession and exit financing advisory services.

Our Global Reach

Increasing our global presence remains a key strategy. Revenues excluding reimbursable expenses attributable to geographic area are summarized as follows:

|

Year Ended December 31,

|

||||||||||||

|

2010

|

2009

|

2008

|

||||||||||

|

North America

|

89 | % | 90 | % | 90 | % | ||||||

|

Europe

|

10 | % | 9 | % | 9 | % | ||||||

|

Asia

|

1 | % | 1 | % | 1 | % | ||||||

|

Total revenues

|

100 | % | 100 | % | 100 | % | ||||||

Our Clients

We have a client base that includes Fortune 1000 and smaller companies, prominent law firms and leading private equity and hedge funds. Our clients operate in a broad array of industries. The following table summarizes our global client base and the number of engagements we performed for each client:

|

Approximate

|

Approximate

|

|||||||

|

Number of

|

Number of

|

|||||||

|

Clients

|

Engagements

|

|||||||

|

2010

|

2,100 | 4,500 | ||||||

|

2009

|

2,200 | 4,500 | ||||||

|

2008

|

2,300 | 4,900 | ||||||

In addition, our client base includes over one third of S&P 500 companies. Our top ten clients represented approximately 11.8%, 15.9% and 8.5% of revenues excluding reimbursable expenses in 2010, 2009 and 2008, respectively. No single client accounted for more than 1.7% of total revenues in 2010, 2009 or 2008, except for one client that accounted for 2.4% and 8.1% of revenues in 2010 and 2009, respectively. This client resulted from an engagement to serve as a financial advisor to the court appointed examiner of a large financial services company under bankruptcy protection. This engagement wound down during the first half of 2010.

7

Our Professionals

We believe our core asset is our professional staff, their intellectual capital, their professional relationships and their dedication to providing the highest quality services to our clients. We seek talented, motivated and detail-oriented individuals with a desire to grow in a challenging, professional and diversified work environment. We believe individuals are attracted to us as an employer because we combine the stability, professionalism and client relationships of a large firm with the collaborative culture and conflict-free environment of a smaller, high growth firm, which enables our personnel to maximize their commercial potential and career development opportunities.

At December 31, 2010, we had 1,039 globally-based personnel, consisting of 785 experienced and credentialed client service professionals, 158 internal support personnel and 96 administrative staff. Of our 785 client service professionals, 157 were managing directors and 628 were directors, vice-presidents, senior associates and analysts. Of the 785 client service professionals, 83% were based domestically and 17% internationally. Most of our client service professionals have backgrounds in accounting, finance or economics. The common elements of these skill sets enables us to transfer staff between service lines to better manage the utilization and career development of

our client service professionals. We source these client service professionals from top undergraduate and graduate schools, and from a variety of our competitors, including the Big Four, independent specialty consulting firms, middle market investment banks and larger, diversified investment banks.

We consistently monitor the performance of our personnel through an annual performance management process that is designed to align performance with our business strategy, assess competency against appropriately set benchmarks and identify development needs in the context of short and long-term career aspirations. To reward performance we have implemented a reward program that aims to aggressively differentiate compensation based on performance. Our reward program includes base pay, an incentive bonus and a variety of benefits. We also aim to align our interests with those of our personnel through equity ownership programs. Many of our senior client service professionals

are subject to restrictive covenants that, in most cases, prohibit the individual from soliciting our clients for a period of up to two years following termination of the person's employment with us and from soliciting our personnel for a period of two years after termination of the person's employment.

We have comprehensive training programs in place to further enhance the development of our personnel. We provide ongoing professional development through the D&P University (our annual multi-week national training event) for new client service professionals and internal courses on both technical and non-technical subjects, and we support personnel in their career progression through training and development programs designed to help new and recently promoted personnel to quickly become effective in their new roles.

Business Development and Marketing

Our goal is to build a well-recognized brand globally that is synonymous with a top-tier financial advisory and investment banking services firm. We generate new business opportunities primarily based on the professional relationships of our managing directors, our reputation in the marketplace and referrals from third party advisors, including law, accounting and investment banking firms and our corporate investor clients. Our managing directors are respected within their chosen fields and are instrumental to our business development activities. Many of our managing directors are recognized as leaders in their fields and are members of national trade boards and committees of trade

associations.

Our client service professionals are encouraged to generate new business from both existing and new clients, and are rewarded with increased compensation and promotions for obtaining new business. Many of our client service professionals have published articles in industry, business opportunities, economic and legal journals and have made speeches and presentations at industry conferences and seminars, which serve as a means of attracting new business and enhancing their reputations. In pursuing new business, our client service professionals emphasize Duff & Phelps' institutional reputation and experience while also promoting the expertise of the particular individuals who will work on the matter.

We augment the business development activities of our managing directors and other client service professionals with centralized brand support through advertising in business and industry media, select sports marketing avenues, the production of marketing materials and the organization and sponsorship of seminars, trade conferences and other events.

Competition

Our competition varies by segment. Within our Financial Advisory and Corporate Finance Consulting segments, we compete primarily with the consulting practices of major accounting firms, such as the Big Four, and regional and global consulting companies. Within our Investment Banking segment, we compete with both boutique M&A and restructuring advisory firms as well as large, diversified investment banks. We believe the principal competitive factors in all segments include the reputation of the firm and its professionals, technical expertise and experience, the ability to rapidly deploy large teams for client engagements, geographic presence, and to a lesser extent,

price.

8

Regulation

As a participant in the financial services industry, we are subject to extensive regulation in the U.S., the United Kingdom and elsewhere. As a matter of public policy, regulatory bodies in the U.S. and foreign jurisdictions are charged with safeguarding the integrity of the securities and other financial markets and with protecting the interests of customers participating in those markets. In the United States, the Securities and Exchange Commission (“SEC”) is the federal agency responsible for the administration of the federal securities laws. Duff & Phelps Securities, LLC, our subsidiary through which we provide our M&A advisory services in the United States,

is registered as a broker-dealer with the SEC and is a member firm of the Financial Industry Regulatory Authority, Inc. (“FINRA”). Accordingly, the conduct and activities of Duff & Phelps Securities, LLC are subject to the rules and regulations of the SEC and FINRA. As Duff & Phelps Securities, LLC is also registered to conduct business in all U.S. states, the District of Columbia and Puerto Rico, state securities regulators also have regulatory authority over Duff & Phelps Securities, LLC.

Our business is also subject to regulation by non-U.S. governmental and regulatory bodies and self-regulatory authorities in other jurisdictions in which we operate. Duff & Phelps Securities, Ltd. is authorized and regulated by the Financial Services Authority. The Financial Services Authority is an independent non-governmental body located in the United Kingdom. In addition to conducting business in the United Kingdom, Duff & Phelps Securities, Ltd. has also received passports into 29 European Economic Area (“EEA”) territories. Under the Markets in Financial Instruments Directive (“MiFID”), Duff & Phelps Securities, Ltd. may engage in

certain regulated activities on a cross border basis. Duff & Phelps Securities, Ltd. is allowed to conduct certain regulated services in those countries without receiving direct authorization from the host EEA state (i.e., the EEA country where the Company is doing business). The Financial Services Authority is wholly responsible for the Company’s business conducted in the United Kingdom and all prudential regulation. The host state is responsible for regulating the conduct of that business. Therefore, although Duff & Phelps Securities, Ltd. is not required to obtain direct authorization from the host state, it must comply with local regulatory requirements. Duff & Phelps Securities, Ltd. also received permission from the Financial Services Authority and the

Bundesanstalt für Finanzdienstleistungsaufsicht (“BaFin”) to establish a branch office in Munich, Germany. Duff & Phelps SAS is regulated by the Autorité des marchés financiers (“AMF”). The AMF is an independent public body located in France. Duff & Phelps SAS is permitted to conduct certain regulated activities in France as a result of this authorization.

Broker-dealers are subject to regulations that cover all aspects of the securities business, including sales methods, trade practices among broker-dealers, use and safekeeping of customers' funds and securities, capital structure, record-keeping, the financing of customers' purchases and the conduct and qualifications of directors, officers and employees. In particular, as a registered broker-dealer and member of various self-regulatory organizations, Duff & Phelps Securities, LLC is subject to the SEC's uniform net capital rule, Rule 15c3-1. Rule 15c3-1 specifies the minimum level of net capital a broker-dealer must maintain and also requires that a significant part of a broker-dealer's

assets be kept in relatively liquid form. The SEC and various self-regulatory organizations impose rules that require notification when net capital falls below certain predefined criteria, limit the ratio of subordinated debt to equity in the regulatory capital composition of a broker-dealer and constrain the ability of a broker-dealer to expand its business under certain circumstances. Additionally, the SEC's uniform net capital rule imposes certain requirements that may have the effect of prohibiting a broker-dealer from distributing or withdrawing capital and requiring prior notice to the SEC for certain withdrawals of capital. Certain of our businesses are subject to compliance with laws and regulations of U.S. federal and state governments, non-U.S. governments, their respective agencies and/or various self-regulatory organizations or exchanges

relating to the privacy of client information, and any failure to comply with these regulations could expose us to liability and/or reputational damage.

Additional legislation, changes in rules promulgated by the SEC and self-regulatory organizations or changes in the interpretation or enforcement of existing laws and rules, either in the United States or elsewhere, may directly affect the mode of our operation and profitability.

The U.S. and non-U.S. government agencies and self-regulatory organizations, as well as state securities commissions in the United States, are empowered to conduct administrative proceedings that can result in censure, fine, the issuance of cease-and-desist orders or the suspension or expulsion of a broker-dealer or its directors, officers or employees.

Intellectual Property

Our success has resulted in part from our methodologies and other proprietary intellectual property rights. We rely upon a combination of nondisclosure and other contractual arrangements, trade secret, copyright and trademark laws to protect our proprietary rights and rights of third parties from whom we license intellectual property. We also enter into confidentiality and intellectual property agreements with our personnel that limit the distribution of proprietary information. We have only a limited ability to protect our important intellectual property rights. Pursuant to a name use agreement between the Company and Phoenix Duff & Phelps Corporation, a subsidiary of

Virtus Investment Partners, Inc., we have the perpetual exclusive right to use the Duff & Phelps name in connection with capital raising, M&A advisory services, corporate valuation, fairness opinions, strategic financial consulting, capital adequacy opinions and certain other investment banking businesses.

9

Available Information

Our website address is www.duffandphelps.com. We make available free of charge on the Investor Relations section of our website (http://ir.duffandphelps.com) our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports as soon as reasonably practicable after such material is electronically filed or furnished with the SEC pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934. We also make available through our website other reports filed with or furnished to the SEC under the

Exchange Act, including our Proxy Statements and reports filed by our officers and directors under Section 16(a) of that Act. Our Corporate Governance Guidelines, Code of Business Conduct and Ethics, Whistleblower Policy and Committee Charters are also available on our website. We do not intend for information contained in our website to be part of this Annual Report on Form 10-K.

Any materials we file with the SEC may be read and copied at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, DC 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

10

Item 1A. Risk Factors.

Risks Related to Our Business

A continued or renewed economic downturn, decline in global financial markets and/or other conditions beyond our control may materially and adversely affect our business, results of operations, financial condition, access to funding and the market price of our Class A common stock

A continued or renewed economic downturn, decline in global financial markets and/or other conditions beyond our control may continue to adversely affect employment rates, commercial and consumer spending, commercial and consumer indebtedness, availability of credit, asset values, investments and liquidity, which in turn may continue to negatively impact certain of our customers and have resulted and may continue to result in decreased demand or pricing levels for our services.

As a financial advisory, corporate finance consulting and investment banking firm, our business segments are materially affected by conditions in the global financial markets and economic conditions throughout the world. For example, revenue generated by our M&A advisory, transaction opinions and purchase price allocation engagements is directly related to the volume and size of the M&A transactions for which we provide services. During periods of unfavorable market or economic conditions, the volume and size of M&A transactions may decrease, thereby reducing the demand for our services and increasing price competition among financial advisory firms seeking such

engagements. Our results of operations would be adversely affected by any such reduction in the volume or value of M&A transactions. We have seen a reduction in demand for these services in recent periods and may continue to see a reduction in demand for these or other services in future periods. Our profitability could also be adversely affected by our fixed costs and the possibility that we would be unable to scale back other costs within a time frame sufficient to match any decreases in revenue relating to changes in market and economic conditions.

The future market and economic climate may deteriorate because of many factors beyond our control, and any one of these factors may cause a substantial decline in the global financial services markets, which could result in reduced demand for our services. These factors include, among other things, economic and political conditions in the United States and elsewhere in the world, wavering corporate/consumer confidence levels, the availability of cash for investment by mutual funds and other institutional as well as retail investors, and legislative and regulatory changes. Beginning in July 2007, there was a significant disruption in world financial markets, particularly in the credit markets,

which negatively impacted M&A activity, particularly among private equity buyers. If the ongoing effects of this downturn continue or renew, our results of operations, demand for our services or pricing levels could be adversely affected in future periods.

Our liquidity, financial position and profitability could be adversely affected by deterioration in U.S. and international credit markets and economic conditions

Recent deterioration in the global capital markets has caused financial institutions to seek additional capital, merge with larger financial institutions and in some cases fail. These conditions have led to concerns by market participants about the stability of financial markets generally and the strength of counterparties, resulting in a contraction of available credit, even for the most credit-worthy borrowers. Due to recent market events, our liquidity and our ability to obtain financing may be negatively impacted if the lender under our revolving credit facility, or another financial institution, suffers liquidity issues. In such an event, we may not be able to draw on all, or a

substantial portion, of our revolving credit facility. Also, if we attempt to obtain future financing in addition to, or replacement of, our existing credit facility to finance our continued growth through acquisitions or otherwise, the credit market turmoil could negatively impact our ability to obtain such financing.

Our clients may be unable to pay us for our services

Our clients include some companies that may from time to time encounter financial difficulties, especially in light of the current economic environment and the recent turmoil in the credit markets. If a client's financial difficulties become severe, the client may be unwilling or unable to pay our invoices in the ordinary course of business, which could adversely affect collections of our accounts receivable and unbilled services. On occasion, some of our clients have entered bankruptcy, which has prevented us from collecting amounts owed to us. The bankruptcy of a client with a substantial account receivable could have a material adverse effect on our financial condition and results

of operations. In addition, if a client declares bankruptcy after paying us certain invoices, a court may determine that we are not properly entitled to that payment and may require repayment of some or all of the amount we received, which could adversely affect our financial condition and results of operations.

11

Our business operates in a highly competitive environment where typically there are no long-term contracted sources of revenue and clients can terminate engagements with us at any time

Our business operates in a highly competitive environment where typically there are no long-term contracted sources of revenue. Typically, each revenue-generating engagement is separately solicited, awarded and negotiated. In addition, many businesses do not routinely engage in transactions requiring our services. As a consequence, our fee-paying engagements with many clients are not likely to be predictable, and high levels of revenue in one period are not necessarily predictive of continued high levels of revenue in future periods. We also lose clients each year as a result of the sale or merger of a client, a change in a client's senior management, competition from

other firms and other causes. As a result, our revenue could decline materially due to such changes in the volume, nature and scope of our engagements.

Further, many of our engagements depend upon transactions, disputes or proceedings that involve our clients. Our clients may decide at any time to abandon the transaction, resolve the dispute or proceeding or file for bankruptcy. Our engagements can therefore terminate suddenly and without advance notice to us. If an engagement is terminated unexpectedly, our client service professionals working on the engagement could be underutilized until we assign them to other projects. In addition, because much of our work is project-based rather than recurring in nature, our client service professionals' utilization depends on our ability to secure engagements on a continual

basis. Accordingly, the termination or significant reduction in the scope of a single large engagement could have an immediate adverse impact on our revenues and results of operations.

A high percentage of our revenue is derived from a small number of clients and the reduction of services provided to clients or termination of any one of our engagements could reduce our revenues and harm our operating results

Our clients operate in a broad array of industries and include Fortune 1000 companies, smaller companies, prominent law firms and leading private equity and hedge funds. Our top ten clients represented approximately 11.8%, 15.9% and 8.5% of revenues excluding reimbursable expenses in 2010, 2009 and 2008, respectively. The composition of the group of clients comprising these percentages can vary significantly each year, and a relatively small number of clients may account for a significant portion of our revenues. The loss or decrease of revenue from even one client or the failure of us to consummate a success-fee based engagement could adversely affect our revenues and results of

operations.

No single client accounted for more than 1.7% of total revenues in 2010, 2009 or 2008, except for one client that accounted for 2.4% and 8.1% of revenues in 2010 and 2009, respectively. This client resulted from an engagement to serve as a financial advisor to the court appointed examiner of a large financial services company under bankruptcy protection. This engagement wound down during the first half of 2010. The inability to replace revenue from this or certain other of our clients that represent a significant percentage of our revenues could adversely affect our revenues and results of operations in the future.

The financial advisory, corporate finance consulting and investment banking industries are highly competitive, and we may not be able to compete effectively

The financial advisory and corporate finance consulting industries are extremely competitive, highly fragmented and subject to rapid change and we expect it to remain so in the future. The industries include a large number of participants with a variety of skills and industry expertise, including the consulting practices of major accounting, financial consulting, technical and economic advisory, general management consulting firms and regional and specialty consulting firms as well as the internal professional resources of organizations. Our competitors vary depending on the particular practice group. In addition, we also expect to continue to face competition from new entrants

because the barriers to entry into financial advisory services and corporate finance consulting are relatively low. The principal competitive factors in the financial advisory and corporate finance consulting markets include firm and professional reputations, client and referral source relationships, the ability to attract and retain top professionals, the ability to manage engagements effectively and the ability to be responsive and provide high quality services. There is also competition on price. Many of our competitors have greater national and international presences, as well as significantly greater personnel, financial, technical and marketing resources. In addition, these competitors may generate greater revenues and have greater name recognition than we do. If we are unable to compete successfully with our existing

competitors or with any new competitors, our financial results will be adversely affected.

The investment banking industry is extremely competitive and we expect it to remain so in the future. Most of our competitors in the investment banking industry have a wider range of products and services, greater financial and marketing resources, larger customer bases, greater name recognition, more managing directors to serve their clients' needs, greater global reach and more established relationships with their customers than we have. These larger and better capitalized competitors may be better able to respond to changes in the investment banking market, to compete for skilled professionals, to finance acquisitions, to fund internal growth and to compete for market share

generally. In particular, the ability to provide financing as well as advisory services has become an important advantage for some of our larger competitors, and because we are unable to provide such financing we may be unable to compete for advisory clients in a significant part of the investment banking market.

12

Our inability to hire and retain talented people in an industry where there is great competition for talent could have a serious negative effect on our prospects and results of operations

Our business involves the delivery of professional services and is highly labor-intensive. Our performance is largely dependent on the talents and efforts of highly skilled individuals. Competition for qualified professionals in the financial advisory and investment banking industries is intense. Our continued ability to compete effectively in our business depends on our ability to attract new professionals and to retain and motivate our existing professionals. The unexpected or unplanned loss of a significant number of our professionals or the inability to attract, hire, develop, train and retain additional skilled personnel could have a serious negative effect on us,

including our ability to manage, staff and successfully complete our existing engagements and obtain new engagements. Increasing competition for these individuals may also significantly increase our labor costs, which could negatively affect our margins and results of operations.

Our inability to retain our senior management team and other key personnel would be detrimental to our business

We rely heavily on our senior management team and other key personnel, and our ability to retain them is particularly important to our business. Given the highly specialized nature of our services, these people must have a thorough understanding of our service offerings as well as the skills and experience necessary to manage an organization consisting of a diverse group of professionals. In addition, we rely on our senior management team and other key personnel to generate and market our business. Many of our key personnel do not have employment contracts with us. Any of our key personnel, including those with written employment contracts, may voluntarily terminate his or

her employment with us. If one or more members of our senior management team or our other managing directors leave and we cannot replace them with a suitable candidate quickly, we could experience difficulty in securing and successfully completing engagements and managing our business properly, which could harm our business prospects and results of operations. In addition, the loss of these personnel could jeopardize our relationships with clients and result in the loss of client engagements.

Revenues from our success-based engagements are difficult to predict, and the timing and extent of recovery of our costs is uncertain

From time to time, primarily in our Investment Banking segment and in certain of our Tax Services businesses, we enter into engagement agreements under which our fees include a significant success-based component. Success-based fees are contingent on the achievement of certain goals, such as the successful completion of a transaction or restructuring. In many cases we are not paid for advisory engagements that do not result in the successful consummation of a transaction or restructuring, other than the reimbursement of certain out-of-pocket expenses and, in some cases, a modest retainer. The achievement of these contractually-defined goals is often impacted by factors outside of our control,

such as market conditions and the decisions and actions of our clients and interested third parties. For example, a client could delay or terminate an acquisition transaction because of a failure to agree upon final terms with the counterparty, failure to obtain necessary regulatory consents or board or shareholder approvals, failure to secure necessary financing, adverse market conditions or because the target's business is experiencing unexpected financial problems. Anticipated bidders for assets of a client during a restructuring transaction may not materialize or our client may not be able to restructure its operations or indebtedness due to a failure to reach agreement with its principal creditors. Because success-based fees are contingent, revenues on such engagements, which are recognized when all revenue recognition criteria are met, are not certain and the

timing of receipt is difficult to predict and may not occur evenly throughout the year. In the current economic environment, completing transactions is a challenge, and many have failed or been delayed, making our ability to predict revenues increasingly difficult, even late into any fiscal period. We intend to continue to enter into success-based fee arrangements and these engagements could impact our revenues to a greater extent in the future. Should success-based fee arrangements represent a greater percentage of our business in the future, we may experience increased volatility in our working capital requirements and greater variations in our quarter-to-quarter results, which could affect the price of our Class A common stock.

Our financial results could suffer if we are unable to achieve or maintain adequate utilization and suitable billing rates for our client service professionals

Our profitability depends to a large extent on the utilization and billing rates of our client service professionals in our Financial Advisory and Corporate Finance Consulting segments. Utilization of our client service professionals is affected by a number of factors, including, among other things, the number and size of client engagements, the timing of the commencement, completion and termination of engagements, which in many cases is unpredictable, our ability to transition our client service professionals efficiently from completed engagements to new engagements, the hiring of additional client service professionals (because there is generally a transition period for new client service professionals

that may result in a temporary drop in our utilization rate, which may be the result of restrictions imposed by non-compete or other similar agreements with the professional's former employer), unanticipated changes in the scope of client engagements, our ability to forecast demand for our services and thereby maintain an appropriate level of client service professionals, and conditions affecting the industries in which we practice as well as general economic conditions.

13

The billing rates of our client service professionals in our Financial Advisory and Corporate Finance Consulting segments are also affected by a number of factors, including, among other things, our clients' perception of our ability to add value through our services, the market demand for the services we provide, introduction of new services by us or our competitors, the pricing policies of our competitors and general economic conditions. If we are unable to achieve and maintain adequate overall utilization as well as maintain or increase the billing rates for our professionals, our financial results could materially suffer.

The profitability of our fixed-fee engagements with clients may not meet our expectations if we underestimate the cost of these engagements

When making proposals for fixed-fee engagements, we estimate the costs and timing for completing the engagements. These estimates reflect our best judgment regarding the efficiencies of our methodologies and client service professionals as we plan to deploy them on engagements. Any increased or unexpected costs or unanticipated delays in connection with the performance of fixed-fee engagements, including delays caused by factors outside our control, could make these contracts less profitable or unprofitable, which would have an adverse effect on our profit margin.

Fees earned in connection with assignments in the bankruptcy context may be subject to challenge and reduction

From time to time we advise debtors, creditors, examiners or other stakeholders of companies which are involved in bankruptcy proceedings in the United States Bankruptcy Courts. Under the applicable rules of those courts, our fees are subject to approval by the court and other interested parties have the ability to challenge the payment of those fees. Fees earned and reflected in our revenues may be subject to successful challenges, which could result in a reduction of revenues and affect our stock price adversely.

Fluctuations in our quarterly revenues and results of operations could depress the market price of our common stock

We may experience significant fluctuations in our revenues and results of operations from one quarter to the next. If our revenues or net income in a quarter fall below the expectations of securities analysts or investors, the market price of our Class A common stock could fall significantly. Our results of operations in any quarter can fluctuate for many reasons, including the number, scope, and timing of ongoing client engagements; when we receive success-based fees; the extent to which we can reassign our client service professionals efficiently from one engagement to the next; the extent to which our client service professionals take holiday, vacation, and sick time; hiring; the extent of

fee discounting or cost overruns and other factors affecting productivity and collectability of receivables and unbilled work in process.

Because we generate a substantial portion of our revenues from advisory services that we provide on a time-and-materials basis, our revenues in any period are directly related to the number of our client service professionals, their billing rates, and the number of billable hours they work in that period. We have a limited ability to increase any of these factors in the short term. Accordingly, if we underutilize our client service professionals during one part of a fiscal period, we may be unable to compensate by augmenting revenues during another part of that period. In addition, we are occasionally unable to fully utilize any additional client service professionals that we hire,

particularly in the quarter in which we hire them. Moreover, a significant majority of our operating expenses, primarily office rent and salaries, are fixed in the short term. As a result, if our revenues fail to meet our expectations in any quarter, the shortfall could have a disproportionate adverse effect on our net income. For these reasons, we believe our historical results of operations are not necessarily indicative of our future performance.

Potential conflicts of interest may preclude us from accepting some engagements

We provide our services primarily in connection with significant or complex transactions, disputes, or other matters that usually involve sensitive client information or are adversarial. Our engagement by a client may preclude us from accepting engagements with the client's competitors or adversaries because of conflicts, or perceived conflicts, between their business interests or positions on disputed issues or other reasons. Accordingly, the nature of our business limits the number of both potential clients and potential engagements. Moreover, in many industries in which we provide services, there has been a continuing trend toward business consolidations and strategic

alliances. These consolidations and alliances reduce the number of potential clients for our services and increase the chances that we will be unable to continue some of our ongoing engagements or accept new engagements as a result of actual or perceived conflicts of interest.

14

Our ability to maintain and attract new business depends upon our reputation, the professional reputation of our client service professionals and the quality of our services

As a professional services firm, our ability to secure new engagements depends heavily upon our reputation and the individual reputations of our client service professionals. Any factor that diminishes our reputation or that of our client service professionals, including not meeting client expectations or misconduct by our client service professionals, could make it substantially more difficult for us to attract new engagements and clients. Similarly, because we obtain many of our new engagements from former or current clients or from referrals by those clients or by law, accounting or investment banking firms with whom we have worked in the past, any client that questions the quality of our

work or that of our client service professionals could impair our ability to secure additional new engagements and clients.

Our intellectual property rights in our Duff & Phelps name are important, and any inability to use that name could negatively impact our ability to build brand identity