Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AVON PRODUCTS INC | d8k.htm |

Exhibit 99.1 |

Andrea Jung

Chairman and

Chief Executive Officer |

This presentation

contains forward-looking statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Words such as “estimate,” “project,” “forecast,”

“plan,” “believe,” “may,” “expect,” “anticipate,”

“intend,” “planned,” “potential,” “can,”

“expectation,” and similar expressions, or the negative of those expressions, may identify

forward-looking statements. Such forward-looking statements are based on

management’s reasonable current assumptions and expectations. Such forward-looking

statements involve risks, uncertainties and other factors, which may cause the actual results,

levels of activity, performance or achievement of Avon to be materially different from any

future results expressed or implied by such forward-looking statements, and there can be no

assurance that actual results will not differ materially from management’s expectations.

Please see our “Risk Factors” in Part I, Item 1A, and “Management’s

Discussion and Analysis of Financial Conditions and Results of Operations” in Part II,

Item 7, of Avon’s Annual Report on Form 10-K for the fiscal year ended December 31,

2010. We undertake no obligation to update any forward-looking statements, whether as

a result of new information, future events or otherwise.

Please see the Appendix to this slide presentation which is posted on

www.avoninvestor.com

for an explanation and/or reconciliation of certain Non-GAAP financial measures included

in this presentation.

|

Investor materials, including today’s slides,

can be found at:

http://www.avoninvestor.com |

Key

Messages •

We are committed to delivering sustainable

growth,

with

mid-teen

operating margins by 2013

•

We have restructured

the management team

to

strengthen execution rigor

•

In 2011, we are squarely focused on top and

bottom-line recovery

in the second half

•

We remain committed to sustained strategic

investment

in

2011

and

beyond

•

We have redesigned short and long-term

executive

compensation

to tightly align with

operating margin expansion |

Underlying these messages is our intent

to reinforce management accountability

and provide better

visibility

into

our financial objectives |

1

2

3

4

5

Management Reorganization

A Look at 2013

More Detail on 2011

Executive Compensation

2011 Priorities

Agenda |

1

Management

Reorganization |

Implementing a Comprehensive Management

Realignment to Sharpen our Operational Focus

•

Represents most significant

reorganization since 2005

•

Entirely new CBU leadership team

–

Five new regional heads

–

New leadership in U.S. and Russia

•

New Developed and Developing Market Group leaders

increases operational oversight

•

Strengthens management depth

and bench |

Developed

Markets

Charles Cramb

Developing

Markets

Charles Herington

Chairman & CEO

Andrea Jung

•

Latin America

•

CEE

•

Asia Pacific & China

•

North America

•

WEMEA

•

Silpada

& Liz Earle

•

Corporate Strategy |

Leveraging Seasoned Internal Talent with

Strategic Hires to Strengthen Execution Rigor

•

Highly experienced

CBU leadership team

–

Seasoned direct selling operators

–

General management experience spanning all regions

–

Cross-functional experience in Marketing and global

Direct Selling

•

External searches

underway for CFO and

Latin America CBU leader |

2

2011 Priorities |

Our

2011 Priorities are Clear •

Restore growth in Brazil and Russia

•

Stabilize North America

•

Reignite Skincare

•

Deliver meaningful operating margin expansion |

•

Organic sales growth of mid-single digit (C$)

–

Low-single-digit growth continues in 1H

–

Reaccelerate to mid-single digit growth in 2H

•

FY

adjusted

operating

margin

expansion

of

50-70

bps

–

Lower in 1H

–

Significant improvement in 2H

–

Costing to lower end of mid-single digit sales growth

More Visibility on Goals for 2011 |

In

Brazil, We are Expecting Revenue to Improve Throughout the Year

•

Return Service levels to

historical norms

•

Sustain healthy Avon Field

fundamentals and consumer

demand

•

Hold or grow Beauty

market share in 2H

How We Would Define Success in 2011 |

Aggressive Recovery Programs are Underway

in Brazil

•

Short-term, end-to-end

micro-management

of

service recovery

•

Mid to long-term investments in

service

infrastructure

•

Stepped

up

RVP

investment

to address Representative

annoyance factor and retention |

In

Russia, We are Focusing on Strengthening Sales Growth in the Second Half

•

Regain mid-single digit

Active Representative

growth by year-end

•

Return Skincare and Color to

at-market growth by year-end

•

Strengthen Field fundamentals

for share gains in 2012 and

beyond

How We Would Define Success in 2011 |

In

Russia, Growth Initiatives are Targeted Against Field and Category

Activation •

New Sales Leadership

compensation plan that

increases earning potential

for first year leaders by 25%

•

Strengthened Skincare

pipeline, expected to pay

dividends in 2H

•

Higher focus on promotional

activity in Color |

In

North America, our Near-Term Goal is to Stabilize the Top-Line

•

Stem Active Representative

declines during the

second half

•

Stabilize average order by

year-end

•

Maintain steady annual

progress toward double-digit

operating margin

How We Would Define Success in 2011 |

Initiatives are Underway in the U.S. to Stabilize

Field and Average Order Growth in the Near-Term

•

$20 million investment to

improve Sales Leadership

earnings

–

“Believe in Your Success”

program steps up recruiting

and development bonuses

•

Re-energized Holiday

offers and giftables

•

New Mom

&

Baby

business in 2H |

We

are Also Evaluating Significant Changes to our Sales Leadership Model

•

More leadership titles and levels

•

Increased compensation at all levels of Leadership

•

Higher % of variable vs. fixed sales expense

•

Even greater focus on Sales Leadership as a

growth driver

Opportunities Under Evaluation |

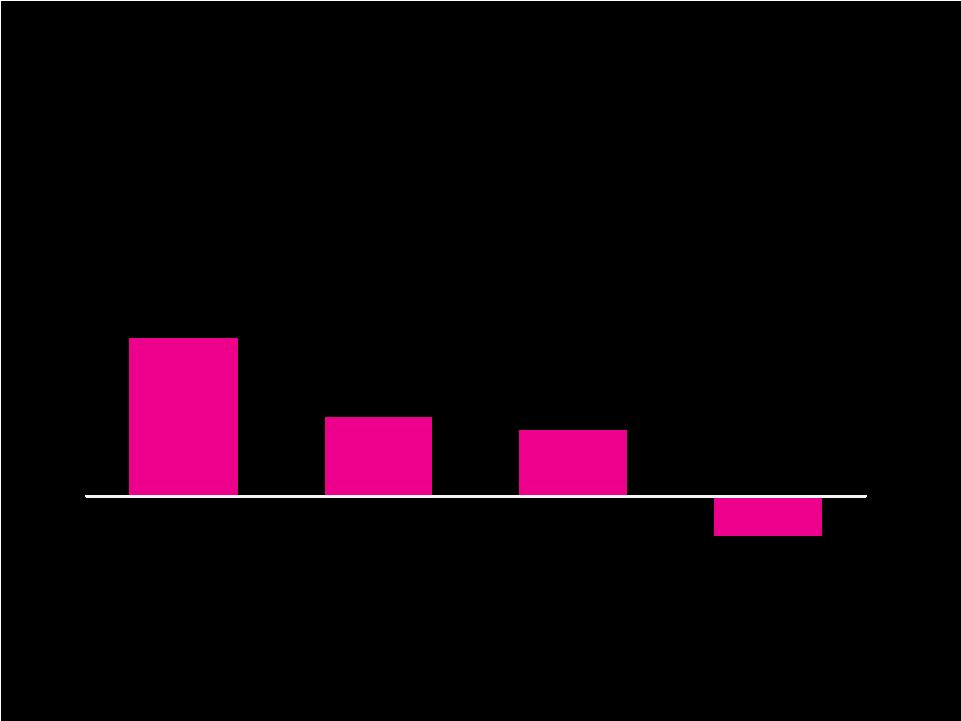

Turning to our Global Beauty Business,

Reigniting Skincare Growth is Critical in 2011

Avon Net Sales Growth, 2010 vs. 2009 (C$)

12%

6%

5%

-3%

Fragrance

Color

Personal Care

Skincare |

We are Strengthening

our Skincare

Portfolio with a Compelling

Product Offer

Across Price Tiers

|

In

the Value Tier, We are Launching a New Global Brand, Avon

Care Value-priced skin

and body

line for Developing

markets |

Avon Care Video |

In

Mass, We are Revitalizing Avon Solutions

Revamped

formula, brand and packaging launching Q2 |

In

Masstige, We are Defending Anew with

Technology

First-to-Market

Sun Care

Innovation

Q4

Anti-Aging

Breakthrough |

First-to-Market Sun Innovation Reverses 50% of

Sun Damage in 24 Hours |

In

Q4, We Will Continue to Build our Flagship Anew Brand with an Anti-Aging

Breakthrough •

Based on 10 years of

groundbreaking

cell

biology research

•

Uncovers

a

genetic

link

between longevity and

youthful skin |

Fountain of Youth Teaser Video |

In

sum, our execution focus against the

top-line is clear –

restore growth in Brazil

and Russia,

stabilize the U.S.

and reignite Skincare

|

On the bottom-line, we are focused on

delivering

50-70

bps of margin

expansion… |

…without compromising strategic investments

against Avon’s

long-term health |

Our

Investment Philosophy is Fully Aligned With Growth Objectives as We Drive the

Bottom-Line •

On average, grow

advertising

and

RVP

in line

with sales

•

Continuously

optimize

mix

based on paybacks

•

Defend

share

in

priority

markets and categories |

In

2011, We are Rebalancing Investment From Advertising to RVP to Support Field

Recovery A strong Field is a pre-requisite for

effective advertising investment

>10% increase

>10% decline

2011 vs. 2010 Investment Growth

RVP

Advertising |

Despite Reduced Overall Advertising Spend,

We Will Maintain Strong Support in Key Markets

2%

5%

Largest, Most

Competitive

Markets

1

All Other

Avon Markets

2011E Advertising Spend as % Beauty Sales

1

Includes: Brazil, Russia, US, Mexico, Turkey, Colombia

|

50

100

And We Will Focus on Core Beauty Categories

With the Highest Near-Term Paybacks

Core Skincare,

Fragrance, Color

Hair Care

"White Space"

2010 Advertising Payback Index –

Large Market Example

Reducing spend in "white space" categories while

sustaining focus on core Beauty

Source: Brazil 2010 Marketing Mix Model |

We

Also Remain Committed to our Long-Term Strategic Growth Agenda

Innovate our

Channel

to drive Representative

productivity

+

Innovate our

Market Basket

to enhance

average order |

We

are Launching New Advertising to Reinforce Direct Selling Channel Equity

•

Designed to promote the benefits of Direct Selling

•

TV commercial tested significantly above industry

norms

•

Airing in the U.S. and U.K. |

Channel Ad |

We

are Continuing to e-Enable Representatives... •

Doubling geographic coverage

of e-tools

in 2011

•

Aggressively focusing on activation,

leveraging

pilot market learnings

•

Actively

monitoring

and

measuring

performance

Avon Leadership Manager

e-Brochure

Intelligent Ordering |

...And Early Pilot Market Results are Positive

Intelligent Ordering Example

•

90%

of Representatives in

Russia, Poland and Ukraine

say

they

are

using

the tool

•

In Brazil, Representatives

who used Intelligent Ordering

increased

their

units

per

order

•

In

8

markets today, rolling out

to

22

by year end |

Service Model Transformation Remains a

Key Focus

•

Redefine core processes

that make up Service

•

Define required business

requirements

and

capabilities

•

Redesign and standardize

OMS

Supported by a 60 person

global, cross-functional team

Objectives

Scope

•

Order Submission

•

Product Availability

•

Segmented Service

•

Fulfillment and Delivery

•

Settlement/Collections

•

Returns

•

Customer Service |

To

Enhance our Market Basket, We are Launching Mom and Baby...

Expanding

Avon Baby

in Developing markets

Launching

Tiny Tillia,

starting in the U.S. |

...And We are Extending our Focus on

Higher-Tier Direct Selling

Liz Earle

to begin global

expansion in 2012

Silpada

primarily focused in

North America, now in U.K. |

In

sum,

we

will

continue

to

invest

in our

brand and channel for the long-term as

we deliver

operating margin

expansion |

3

Executive

Compensation |

From

50%

Operating Profit

50% Revenue Growth

To

60%

Operating Margin

40% Revenue Growth

Business

Objectives

2011 Annual Incentive Plan is Tied to:

•

Mid-single digit sales growth

•

12% adjusted operating margin

Annual Incentive Plan Shifts Focus From

Operating Profit to Operating Margin |

New

Long-Term Incentive Plan Drives Alignment with Operating Margin Goals

•

Significant margin expansion

is

required

over the

three year period to trigger payout

•

Achievement of both

Cumulative Economic Profit and

Revenue Growth determine payout percentage

–

Use of a payout “matrix”

ensures tradeoffs

between

revenue growth

and

profitability/margin

are

considered |

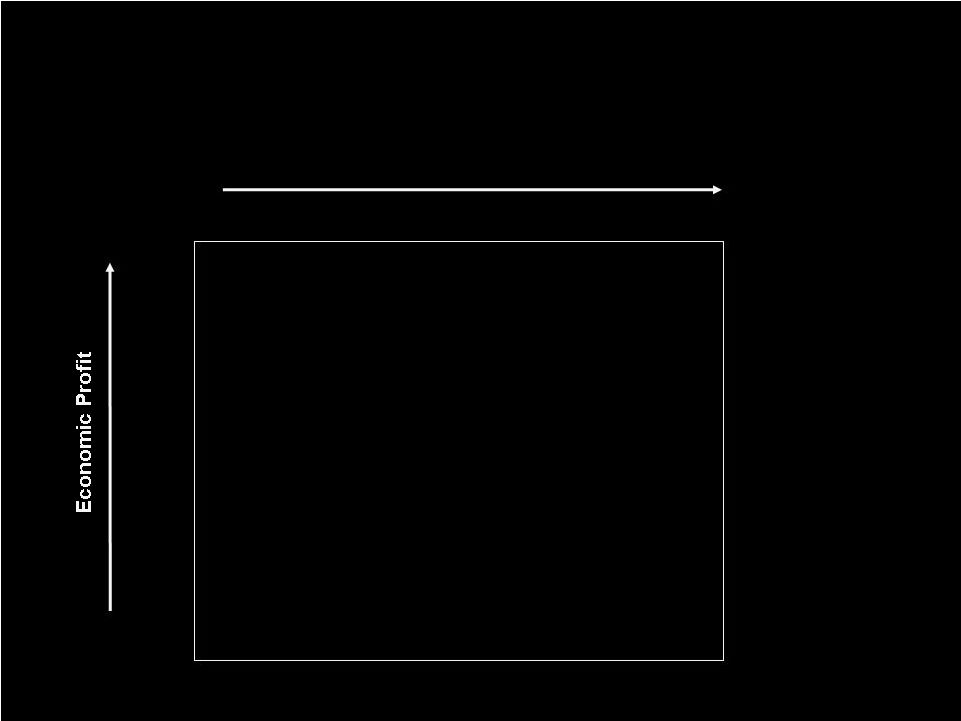

Economic Profit is a Key Component of the Plan

•

Rewards management for both profitability

and

efficient asset management

Economic

Profit

Capital Charge

X

Assets

Employed

Revenue

X

Operating

Margin |

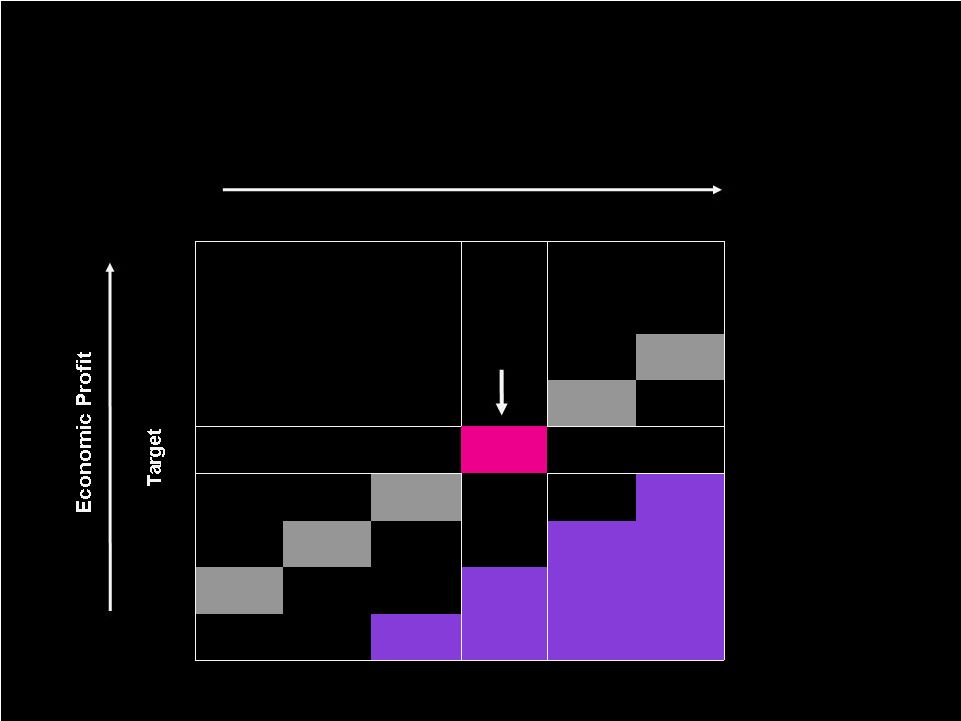

Long-Term Incentive Plan Payout is Based on

a Matrix

Revenue Growth

Low

High

14% Margin |

Payout is Tied to 14% Operating Margin

by 2013

Revenue Growth

Target

(MSD)

Low

High

14%

14%

14%

14%

14%

100%

payout

14%

14% Margin |

Payout Can Exceed 100% Only If We Deliver

Operating Margin Above 14% in 2013

Revenue Growth

Target

(MSD)

Low

High

14%

14%

14%

14%

14%

100%

payout

14%

14% Margin |

There

is No Payout if Operating Margin is Less Than 13.5% and Economic Profit is

Below Target Revenue Growth

Target

(MSD)

Low

14%

14%

14%

14%

14%

Margins too

Low –

0%

Payout

100%

payout

14%

High |

New

Incentive Programs – Summary

•

Tightly aligned to 2013 14% operating

margin •

Annual

and

Long

Term

Plan

work

in

tandem

to:

–

Realize both revenue growth

and margin expansion

–

Effectively manage cash

and capital

•

100%

of senior management long-term incentive

compensation is at risk

–

70% Performance RSUs

–

30% Performance cash |

4

More Detail

on 2011 |

Chuck Cramb

Vice Chairman,

Chief Finance and Strategy Officer

56 |

4

More Detail

on 2011 |

A

Look at 2011 Revenue Growth •

We are costing to the lower end of mid-single digit

sales growth |

A

Look at 2011 Revenue Growth •

We are costing to the lower end of mid-single digit

sales growth

•

First-half organic sales likely to be in low-single digit

range

–

Need to regain momentum

–

1Q expected to be similar to 4Q 2010

–

Some improvement in 2Q |

A

Look at 2011 Revenue Growth •

We are costing to the lower end of mid-single digit

sales growth

•

First-half organic sales likely to be in low-single digit

range

–

Need to regain momentum

–

1Q expected to be similar to 4Q 2010

–

Some improvement in 2Q

•

Acquisitions expected to add approximately 2pts to

1H growth |

A

Look at 2011 Revenue Growth •

We are costing to the lower end of mid-single digit

sales growth

•

First-half organic sales likely to be in low-single digit

range

–

Need to regain momentum

–

1Q expected to be similar to 4Q 2010

–

Some improvement in 2Q

•

Acquisitions expected to add approximately 2pts to

1H growth

•

Expect return to mid-single digit range in second half

–

Minimal impact from acquisitions |

A

Look at 2011 Revenue Growth •

Gradual recovery in Brazil

–

Shorts should return to historical norms

–

Representative annoyance dissipates |

A

Look at 2011 Revenue Growth •

Gradual recovery in Brazil

–

Shorts should return to historical norms

–

Representative annoyance dissipates

•

Gradual recovery in Russia

–

New compensation scheme takes hold

–

Macro and competitive pressures remain |

A

Look at 2011 Revenue Growth •

Gradual recovery in Brazil

–

Shorts should return to historical norms

–

Representative annoyance dissipates

•

Gradual recovery in Russia

–

New compensation scheme takes hold

–

Macro and competitive pressures remain

•

North America remains in transition

–

Rolling out changes to redesigned Sales Leadership

model

–

Expect signs of stabilization by year-end |

A

Look at 2011 Revenue Growth •

Gradual recovery in Brazil

–

Shorts should return to historical norms

–

Representative annoyance dissipates

•

Gradual recovery in Russia

–

New compensation scheme takes hold

–

Macro and competitive pressures remain

•

North America remains in transition

–

Rolling out changes to redesigned Sales Leadership

model

–

Expect signs of stabilization by year-end

Mid-single

digit

revenue

growth |

A

Look at 2011 Operating Margin •

Key elements of our plan

–

Overall mid-single digit sales growth

–

Significant gross margin improvement

–

RVP and advertising grow roughly in line with sales, with a shift

more towards RVP

–

Recalibrate the pace of incremental strategic investments

–

Duplicate distribution costs to taper off in second half

–

Overhead to grow slower than sales |

A

Look at 2011 Operating Margin •

Key elements of our plan

–

Overall mid-single digit sales growth

–

Significant gross margin improvement

–

RVP and advertising grow roughly in line with sales, with a shift

more towards RVP

–

Recalibrate the pace of incremental strategic investments

–

Duplicate distribution costs to taper off in second half

–

Overhead to grow slower than sales

•

Recognize potential headwinds

–

Significant commodity cost increases

–

Timing of major market recoveries and stabilizations

–

Venezuela uncertainties |

A

Look at 2011 Operating Margin •

Key elements of our plan

–

Overall mid-single digit sales growth

–

Significant gross margin improvement

–

RVP and advertising grow roughly in line with sales, with a shift

more towards RVP

–

Recalibrate the pace of incremental strategic investments

–

Duplicate distribution costs to taper off in second half

–

Overhead to grow slower than sales

•

Recognize potential headwinds

–

Significant commodity cost increases

–

Timing of major market recoveries and stabilizations

–

Venezuela uncertainties

Lower margins in 1H and improvement in 2H |

A

Look at 2011 Operating Margin •

Key elements of our plan

–

Overall mid-single digit sales growth

–

Significant gross margin improvement

–

RVP and advertising grow roughly in line with sales, with a shift

more towards RVP

–

Recalibrate the pace of incremental strategic investments

–

Duplicate distribution costs to taper off in second half

–

Overhead to grow slower than sales

•

Recognize potential headwinds

–

Significant commodity cost increases

–

Timing of major market recoveries and stabilizations

–

Venezuela uncertainties

Leads to a 50-70bps margin improvement |

2011

Cash Flow Expected to be Similar to Prior Year |

2011

Cash Flow Expected to be Similar to Prior Year

•

Key Assumptions

–

Mid-single digit revenue growth

–

Achieve margin target for compensation

–

Restructuring of $0.09 (~$65MM)

–

No major Venezuela disruption |

Key

Swing Factors to 2011 Cash Flow •

Higher net income

–

Mid-single digit revenue growth and target margins

–

Lower restructuring |

Key

Swing Factors to 2011 Cash Flow •

Higher net income

–

Mid-single digit revenue growth and target margins

–

Lower restructuring

•

Offset by lower non-cash items

–

2010 impacted by Venezuela $60MM

–

Lower obsolescence and bad debt provisions |

Key

Swing Factors to 2011 Cash Flow •

Higher net income

–

Mid-single digit revenue growth and target margins

–

Lower restructuring

•

Offset by lower non-cash items

–

2010 impacted by Venezuela $60MM

–

Lower obsolescence and bad debt provisions

•

Results in higher cash-related earnings |

Key

Swing Factors to 2011 Cash Flow •

Cash flow will further benefit from

–

Inventory improvements of 3 to 5 days

–

Lower income and other taxes

•

Primarily $60MM unfavorable 2010 timing |

Key

Swing Factors to 2011 Cash Flow •

Cash flow will further benefit from

–

Inventory improvements of 3 to 5 days

–

Lower income and other taxes

•

Primarily $60MM unfavorable 2010 timing

•

These gains offset by

–

Higher accounts receivable (follows revenue increases)

–

Lower A/P and Accruals

•

Unfavorable CTI mismatch of $40MM in 2011 vs. $30MM

favorable mismatch in 2010

•

Payout of 3 year Long-term Incentive cash plan

•

Incremental pension contribution of $75MM |

Key

Swing Factors to 2011 Cash Flow •

Cash flow will further benefit from

–

Inventory improvements of 3 to 5 days

–

Lower income and other taxes

•

Primarily $60MM unfavorable 2010 timing

•

These gains offset by

–

Higher accounts receivable (follows revenue increases)

–

Lower A/P and Accruals

•

Unfavorable CTI mismatch of $40MM in 2011 vs. $30MM

favorable mismatch in 2010

•

Payout of 3 year Long-term Incentive cash plan

•

Incremental pension contribution of $75MM

•

Net result operating cash flow roughly equal to 2010 |

2011

Capital Expenditures Expected to Be in $300-315MM Range

•

Shifting from Supply Chain to higher IT investments

(US$ Millions)

2008A

2009A

2010A

2011E

$377

$296

$331

$300-315

IT

Supply Chain

Other |

2011

Free Cash Flow Expected to Cover Dividends

Free Cash Flow

>

$395

MM

Current Dividend

~ $395

MM |

5

A Look at

2013 |

$135

$200

$300

$40

$120

$230

$270

$300

$350

$390

$430

$430

$15

$80

$120

$150

$200

$300+

$300+

$300+

$15

$200+

$200+

$200+

$200+

2007

2008

2009

2010

2011

2012

2013+

SSI

PLS

2005 Program

2009 Program

We Have and Expect to Continue to Deliver on

our Restructuring and Strategic Initiatives

Projected Savings and Benefits ($MM)

$1,130MM+

+$80

+$70

+$50

$930MM+ |

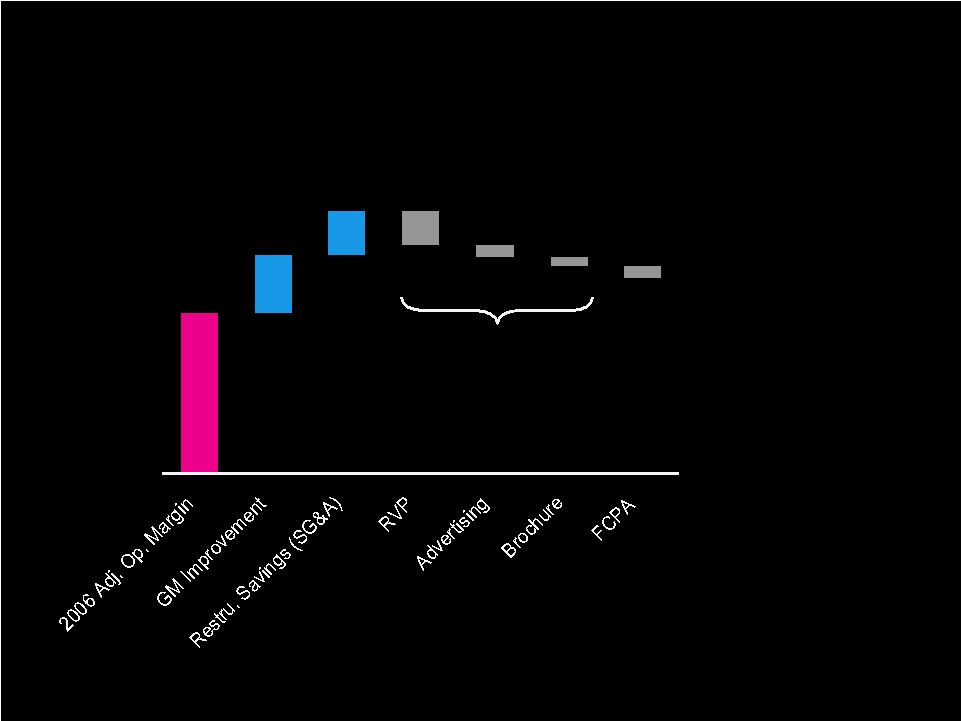

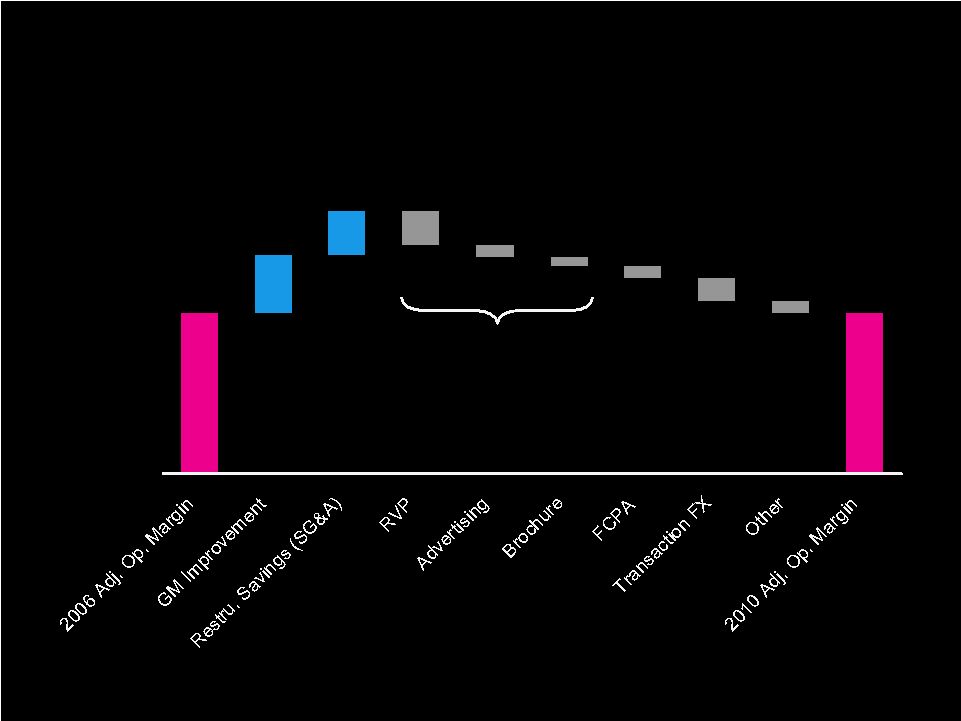

However, Savings and Benefits Have Been More than

Offset by Planned Investments and Unanticipated Costs |

11.4%

However, Savings and Benefits Have Been More than

Offset by Planned Investments and Unanticipated Costs |

11.4%

4.2%

However, Savings and Benefits Have Been More than

Offset by Planned Investments and Unanticipated Costs |

11.4%

4.2%

3.1%

However, Savings and Benefits Have Been More than

Offset by Planned Investments and Unanticipated Costs |

11.4%

-0.6%

-0.9%

-2.4%

3.1%

4.2%

However, Savings and Benefits Have Been More than

Offset by Planned Investments and Unanticipated Costs

-3.9% |

11.4%

-0.9%

-0.6%

-0.9%

-2.4%

3.1%

4.2%

However, Savings and Benefits Have Been More than

Offset by Planned Investments and Unanticipated Costs

-3.9% |

11.4%

-1.6%

-0.9%

-0.6%

-0.9%

-2.4%

3.1%

4.2%

However, Savings and Benefits Have Been More than

Offset by Planned Investments and Unanticipated Costs

-3.9% |

11.4%

-0.9%

-1.6%

-0.9%

-0.6%

-0.9%

-2.4%

3.1%

4.2%

However, Savings and Benefits Have Been More than

Offset by Planned Investments and Unanticipated Costs

-3.9%

•

Freight

•

Bad Debt |

11.4%

11.4%

-0.9%

-1.6%

-0.9%

-0.6%

-0.9%

-2.4%

3.1%

4.2%

However, Savings and Benefits Have Been More than

Offset by Planned Investments and Unanticipated Costs

-3.9% |

As

Promised, We Reinvested for Future Growth… $430MM

Restructuring

Savings

Advertising

$265MM

Strategic

Investments

$23MM

RVP

$400MM

Incremental Investments 2005 vs. 2010 |

A

Look at 2013 Margin •

Revenue growth

•

Gross margin improvement

•

SG&A savings |

A

Look at 2013 Margin Revenue Growth |

Our

Business Fundamentals Should Drive Mid-Single Digit Growth

•

Beauty market is growing

•

Direct-selling channel remains strong

•

68% of business in emerging and developing markets |

64%

56%

17%

15%

14%

13%

11%

10%

10%

South

Africa

India

Central

America

Turkey

Ukraine

Italy

Argentina

Colombia

Philippines

Don’t Underestimate Growth Potential of Some of

the Smaller Markets

2010 Revenue Growth (C$)

2010 Revenue

~20%

of

Sales from

DD Growers |

Geographic Mix Will be Beneficial

•

Key market recovery

–

Brazil and Russia

•

Stabilization and then return to growth

–

U.S. and China

•

Growth from emerging and developing markets

–

Higher margin businesses |

A

Look at 2013 Margin Gross Margin Improvement |

Continue Improvement in Gross Margin

2010 Gross Margin

63.5%

•

Pricing

+

•

Product Mix

+

•

Supply Chain Productivity

+

•

Continued Restructuring Savings

+

•

Commodity Increases

-

2013

Gross Margin

++ |

As

Skincare Returns to Growth, We Expect to Benefit From its Strong Margins

Skincare

Color

Fragrance

Jewelry

Personal Care

Hair Care

Home

1.3x |

3-4% Annual Supply Chain Productivity Savings

by Focusing on…

•

Strategic sourcing

–

Directs: raw materials and components

–

Indirects: maintenance & repair, and logistics

•

Distribution

–

New facilities come online (Brazil and Colombia)

–

Automation and efficiency improvements of old facilities

•

Greater leverage of our global manufacturing footprint

–

Closure of Springdale and Germany factories (2012)

•

Consolidating production into remaining facilities

–

Increasing Beauty outsourcing from 10-15% to 30-35%

|

…with the Goal of Offsetting Some Inflationary

and Commodity Pressures

•

Inflationary labor costs, mainly in LATAM & CEE

•

Pricing pressure on our oil based derivatives

–

Resins

–

Chemicals

–

Transportation

•

As well as impact of cotton prices on our Non-Beauty

business |

And

our Highest Margin Markets Should Lead the Growth

2010 Adjusted Operating Margin

~60%

of our

portfolio

19%

15%

12%

12%

9%

-5%

CEE

LATAM

WEMEA

AP

NA

China |

A

Look at 2013 Margin SG&A Savings |

SG&A Savings

Overhead to grow slower than sales

-

Restructuring savings

-

ZOG philosophy

Advertising and RVP together, to

grow in line with sales

New facilities

Higher Average Order size

Advertising

RVP

Distribution

Overhead |

Impact of Actions on 2013 Operating Margin

2010 Operating Margin

11.4%

•

GM Improvement

++

•

Advertising & RVP

=

•

Distribution Costs

+

•

Overhead Leverage

+

•

Geographic Mix

+

2013 Operating Margin

Mid-Teens |

There Will Still be Some Mismatch Between

Net Income and Cash Flow

2011

•

LTI

•

Pension

•

Restructuring

$40M

mismatch

2012

•

Closing 2

Factories

•

Restructuring

$50M

mismatch

2013

•

No mismatch |

Other Cash Flow Drivers

•

Capital Expenditures to remain in $300-350MM range

•

Target 3-5 day annual reduction in Inventory

•

Continue to improve Accounts Payable terms

•

Remain committed to competitive dividend |

We

Expect Continued Improvement in Cash Flow…

•

Driven by net income growth

•

Benefit from working capital improvements

•

End of restructuring programs

Will Improve to $1B+ Annual

Cash Flow from Operations |

Closing Remarks… |

In

Summary… •

We

have

reorganized

to

strengthen

operational

oversight

and

execution

rigor

•

We

have

redesigned

short

and

long-term

executive

compensation

to tightly align with operating margin

expansion

•

We

remain

squarely

focused

against

:

–

Restore sustainable top-line growth

–

Deliver mid-teen operating margins by 2013

two priorities |

|

Appendix |

Non-GAAP Financial

Measures •

To supplement our financial results presented in accordance with US GAAP, we disclose operating

results that have been adjusted to exclude the impact of changes due to the translation of foreign

currencies into U.S. dollars. We refer to these adjusted growth rates as Constant $ growth,

which is a non-GAAP financial measure. We believe this measure provides investors an

additional perspective on trends. To exclude the impact of changes due to the translation

of foreign currencies into U.S. dollars, we calculate current year results and prior year

results at a constant exchange rate. Currency impact is determined as the difference between

actual growth rates and constant currency growth rates.

•

We present gross margin and operating margin on a non-GAAP basis. The discussion of our

segments presents operating margin on a non-GAAP basis. We have provided a

quantitative reconciliation of the difference between the non-GAAP financial measure and

the financial measure calculated and reported in accordance with GAAP. These non-GAAP

measures should not be considered in isolation, or as a substitute for, or superior to,

financial measures calculated in accordance with GAAP. The Company uses non-GAAP

financial measures to evaluate its operating performance and believes that it is meaningful for

investors to be made aware of, on a period to period basis, the impacts of 1) costs to

implement (“CTI”) restructuring initiatives and 2) costs and charges related to

Venezuela being designated as a highly inflationary economy and the subsequent devaluation of

its currency in January 2010 (“Venezuelan special items”). The Venezuelan special

items include the impact on the Statement of Income caused by the devaluation of the Venezuelan

currency on monetary assets and liabilities, such as cash, receivables and payables; deferred tax

assets and liabilities; and nonmonetary assets, such as inventory and prepaid expenses.

For nonmonetary assets, the Venezuelan special items include the earnings impact caused by the

difference between the historical cost of the assets at the previous official exchange rate of

2.15 and the revised exchange rate of 4.30. |

AVON PRODUCTS,

INC. SUPPLEMENTAL SCHEDULE

NON-GAAP FINANCIAL MEASURES

(Unaudited)

Reported

(GAAP)

CTI

restructuring

initiatives

Venezuelan

special items

Rounding

Adjusted

(Non-GAAP)

62.8%

0.1

0.6

63.5%

13.2%

0.4

1.8

15.4%

6.9%

1.8

0.0

0.1

8.8%

18.8%

0.3

0.0

19.1%

12.1%

0.1

0.0

12.2%

12.4%

0.0

0.0

12.4%

(4.7)%

0.0

0.0

(0.1)

(4.8)%

0.0%

0.0

0.0

0.0%

Total

9.9%

0.7

0.7

0.1

11.4%

Asia Pacific

China

Global and other

Latin America

North America

Central & Eastern Europe

Western Europe, Middle East & Africa

SEGMENT OPERATING MARGIN

Gross margin

$ in Millions (except per share data)

TWELVE MONTHS ENDED 12/31/10 |

GAAP

and C$ Growth Rates 10%

15%

Philippines

10%

25%

Colombia

11%

6%

Argentina

Fragrance

11%

12%

Color

7%

6%

Personal Care

5%

5%

Skincare

-3%

-3%

South Africa

82%

64%

India

65%

56%

Central America

16%

17%

Turkey

17%

15%

Ukraine

12%

14%

Italy

7%

13%

GAAP

Constant $ |