Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT ON FORM 8-K - Simulations Plus, Inc. | simulations_8k-021811.htm |

| EX-3.1 - CERTIFICATE OF AMENDMENT - Simulations Plus, Inc. | simulations_8k-ex301.htm |

Exhibit 99.1

Annual Shareholders Meeting

February 18, 2011

Simulations Plus, Inc.

• Welcome and Introductions

• Discussion of Voting Issues

• Chairman’s Remarks

• Questions & Answers

• Adjournment of Official Meeting

Agenda

Management & Directors

• Board of Directors:

– Walter S. Woltosz, M.S., M.A.S., Chairman & CEO.

• Co-founder, Words+, Inc. and Simulations Plus, Inc.

– David Z. D’Argenio, Ph.D., Director

• Professor, Biomedical Engineering, USC

• Director, Co-Director, Biological Simulation Resource Center, USC since 1985

– Richard R. Weiss, Ph.D., Director

• Formerly, Deputy Director, Launch Systems, U.S. Department of Defense

• Formerly, Director, Propulsion, USAF Philips Laboratory

– H. Wayne Rosenberger, Director

• Sr. Regional VP of American Security Bank

– Virginia E. Woltosz, B.S., M.B.A., Director and Secretary

• Co-founder, Words+, Inc. and Simulations Plus, Inc.

• Senior Management Team

– Momoko A. Beran, B.S., M.B.A., Chief Financial Officer, CPA qualified

– Michael B. Bolger, Ph.D., Chief Scientist

– Robert Clark, Ph.D., Director, Life Sciences

– John DiBella, M.S., Director, Business Development, Marketing, and Sales

– Jeffrey A. Dahlen, B.S.E.E., President, Words+, Inc. subsidiary

• Registered Independent Auditors

• Rose, Snyder & Jacobs, Encino, CA

• Tax Specialists

• Rabbani, Inc., Los Angeles, CA

• Legal Counsel

• Luce, Forward, Hamilton & Scripps, San Diego, CA

Outside Counsels

Candidates for Board of Directors remain unchanged:

• David Z. D’Argenio, Ph.D.

• Richard R. Weiss, Ph.D.

• H. Wayne Rosenberger

• Virginia E. Woltosz, MBA

• Walter S. Woltosz, MS, MAS

• Outside auditor:

• Rose, Snyder, Jacobs

• Expansion of Board of Directors to minimum of 5 and maximum of 9 members

• There are no other voting issues

• Votes already received by proxy have resulted in all items being passed

overwhelmingly with over ___ % of the number of votes outstanding having

reported, therefore, a vote at this meeting would serve no purpose. All measures

have been approved.

overwhelmingly with over ___ % of the number of votes outstanding having

reported, therefore, a vote at this meeting would serve no purpose. All measures

have been approved.

Discussion of Voting Issues

• Company Overview

• Financial Performance

• Words+, Inc.

• Simulations Plus, Inc.

Chairman’s Remarks

With the exception of historical information, the matters discussed in this

presentation are forward looking statements that involve a number of risks

and uncertainties. The actual results of the Company could differ

significantly from those statements. Factors that could cause or contribute

to such differences include, but are not limited to: continuing demand for

the Company’s products, competitive factors, the Company’s ability to

finance future growth, the Company’s ability to produce and market new

products in a timely fashion, the Company’s ability to continue to attract

and retain skilled personnel, and the Company’s ability to sustain or

improve current levels of productivity. Further information on the

Company’s risk factors is contained in the Company’s quarterly and

annual reports and filed with the Securities and Exchange Commission.

presentation are forward looking statements that involve a number of risks

and uncertainties. The actual results of the Company could differ

significantly from those statements. Factors that could cause or contribute

to such differences include, but are not limited to: continuing demand for

the Company’s products, competitive factors, the Company’s ability to

finance future growth, the Company’s ability to produce and market new

products in a timely fashion, the Company’s ability to continue to attract

and retain skilled personnel, and the Company’s ability to sustain or

improve current levels of productivity. Further information on the

Company’s risk factors is contained in the Company’s quarterly and

annual reports and filed with the Securities and Exchange Commission.

Safe Harbor Statement Under the

Private Securities Litigation Act 1995

Private Securities Litigation Act 1995

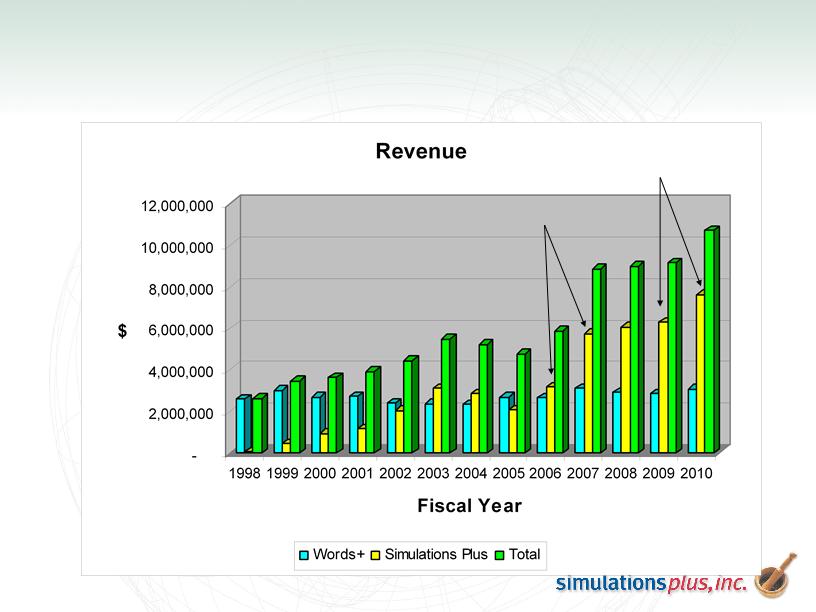

Historical Consolidated Revenue

21%

81%

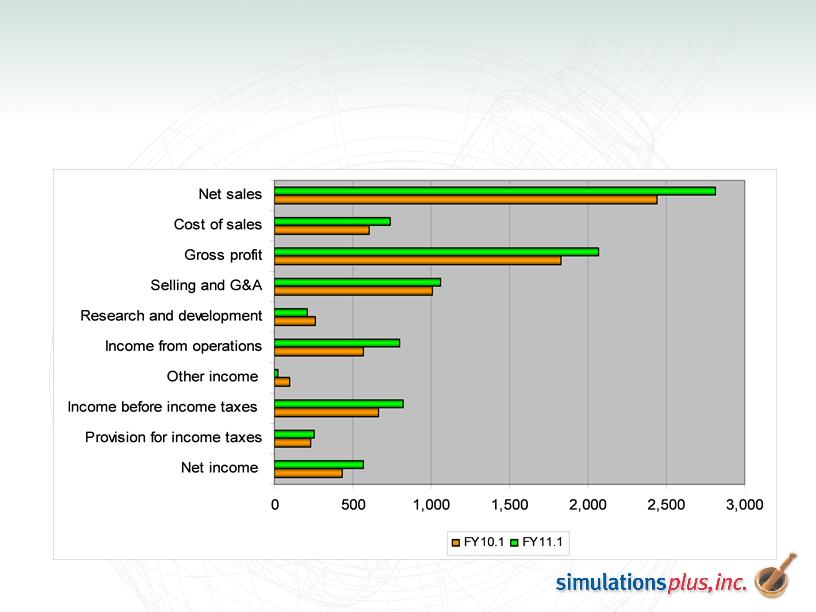

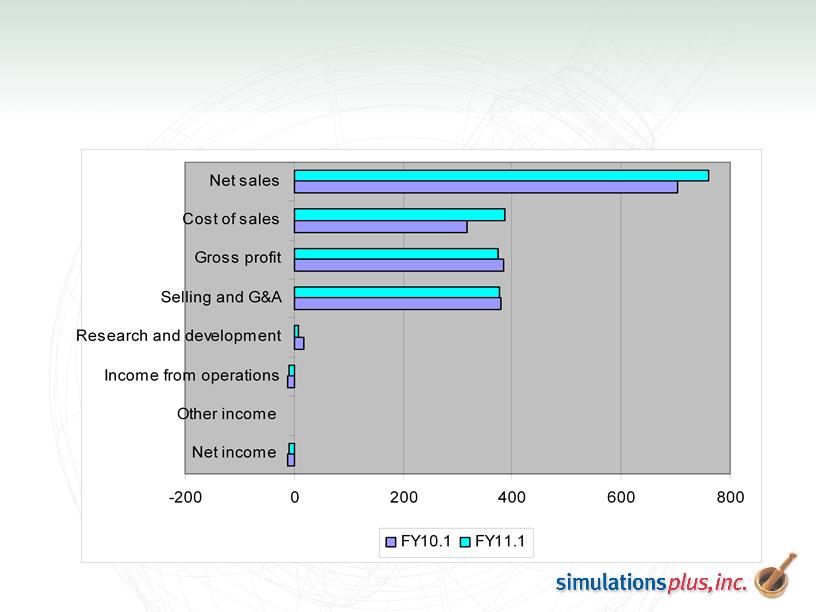

Consolidated Income Statement (3M)

FY11.1 vs. FY10.1

FY11.1 vs. FY10.1

+31.9%

+11.3%

+24.7%

+41.4%

+5.9%

+13.1%

+22.1%

+15.3%

+20.3%

+74.0%

Simulations Plus Income Statement (3M)

FY11.1 vs. FY10.1

FY11.1 vs. FY10.1

+18.2%

+30.3%

+11.3%

+23.8%

+40.0%

-16.9%

+9.8%

+17.4%

+22.5%

-74.7%

Words+ Income Statement (3M)

FY11.1 vs. FY10.1

FY11.1 vs. FY10.1

+8.3%

-25.0%

+21.7%

-2.9%

-0.5%

-63.2%

-23.1%

+0.0%

• Symbol: NASDAQ: SLP

• Market Capitalization: $51.91 million*

• Recent Price: $3.35*

• Average Daily Volume last 3 mo = 42,313*, last 10 days = 72,067*

• Shares outstanding: 15.5 million* (9.5% held by institutions)*

• Public float: 4.81 million*

• 12 Month Price Range: $ 1.62 - 3.74*

• Trailing twelve months revenues (11/30/10): $11.09 million*

• Quarterly revenue growth (yoy) 15.4%*

• Quarterly earnings growth (yoy) = 32.0%*

• Diluted EPS (trailing twelve months): $0.13*

• Return on Assets = 14.44%*

• Return on Equity = 19.69%*

*Yahoo! Data as of 2/17/11

Market Profile

Share Repurchase Program

• Board of directors authorized a second share repurchase

program for up to one million shares from February 15, 2010

through February 14, 2011

program for up to one million shares from February 15, 2010

through February 14, 2011

– Purchased 996,248 shares out of authorized 1 MM at average price of

$2.8341 including commissions (Total cost of $2,823,795).

$2.8341 including commissions (Total cost of $2,823,795).

• Just over 1,000,000 shares were bought back last year at

average price per share of about $1.30

average price per share of about $1.30

• Total share repurchases over both phases were about 2 million

shares at an average price of about $2.06/share

shares at an average price of about $2.06/share

• Board of directors may consider another repurchase program

at any time

at any time

12-Month Stock Prices

• Words+, Inc.

– Global business founded 1981 - pioneer business

– Assistive technology products for disabled

• Hardware

• Software

• Support products

– Technology leader and innovator since inception

– Provides some synergies and overhead cost-sharing

with pharmaceutical/biotech business

with pharmaceutical/biotech business

• Windows operating system programming issues

• Multi-national issues

• Accounting, Facilities and Human Relations

Words+ Overview

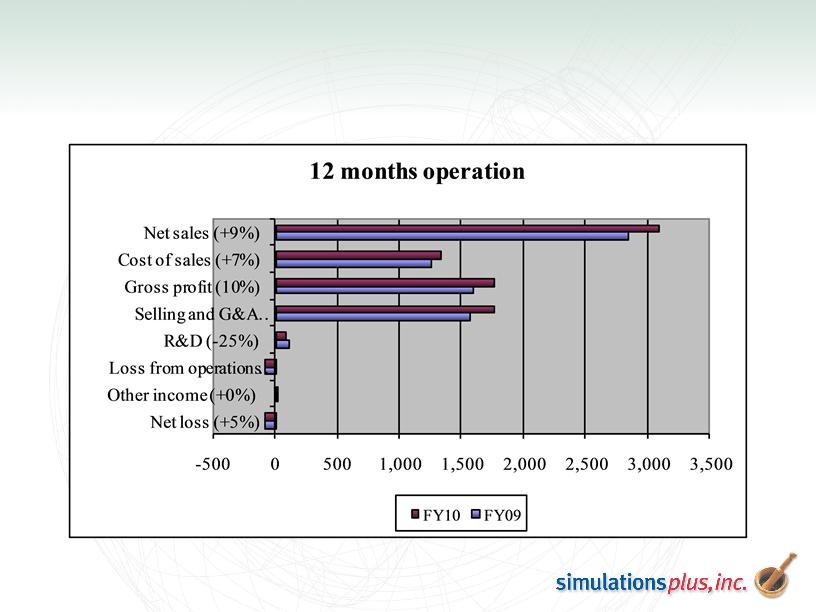

Words+ Financial Performance

FY 2010 vs FY2009

FY 2010 vs FY2009

Factors Affecting Words+ Financials

• Positive

• EyePro sales have helped since its introduction last year

• New product developments (not yet announced for competitive

reasons)

reasons)

• Funding software package has improved accounts receivable

collection cycle

collection cycle

• Negative

– Cost of Sales higher on products that are selling this year

– State budgets are very tight, may affect Medicaid orders

– Supplier of sound chips for MessageMate suddenly discontinued

product

product

• Limited supply remaining

• New design in progress with different circuitry

– iPhone and iPad solutions are becoming popular

• Inexpensive software offerings for simple voice output, but . . .

– Built-in speakers are not adequate for many environments

– Ruggedness is an issue

• May be a “flash in the pan” that loses its luster when practicality is not there

EyePro

• Introduced in May 2010

• Contributed to very profitable 4th quarter for Words+

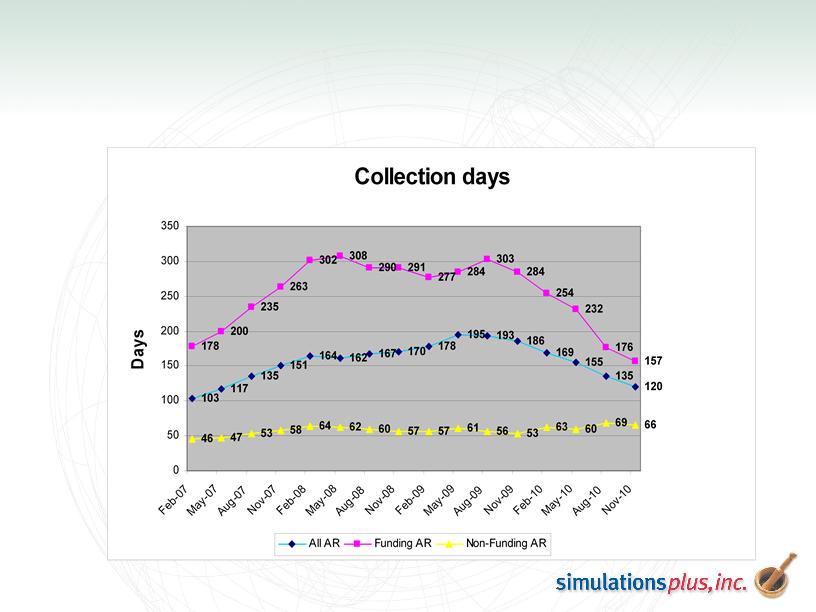

Words+ AR Aging is Improving

*

* PacWare software started in Oct-09.

Words+ Growth Strategies

• Expand Product Offerings

– Focus product development on market needs

– Form alliances with other assistive technology companies

• Increase product awareness

– Workshops, conferences, webinars, web store

– Alliances with key clinicians and educators

• Increase dealer effectiveness

– Expansion of dealer/representative network

– Incorporation of remote video interaction with clients

• Simulations Plus, Inc.

– Software for pharmaceutical research

• Simulation technologies

• GastroPlus™

• DDDPlus™

• ADMET Predictor™

• MedChem Studio™

Simulations Plus (Life Sciences)

Overview

Overview

• The industry’s Gold Standard - most advanced and widely used

simulation of oral absorption/pharmacokinetics/pharmacodynamics

simulation of oral absorption/pharmacokinetics/pharmacodynamics

• Version 7.0 release in August 2010:

– Drug-drug Interaction Module released - new extra-cost module

– Additional Dosing Routes Module released - new extra-cost module

– Improved methods for dealing with in vivo solubilities

• Strategy going forward:

• Continue to enhance program in response to customer requests

• Continue to expand capabilities for dosing routes (transdermal,

intramuscular, intraperitoneal)

intramuscular, intraperitoneal)

GastroPlusTM

• First and only simulation tool for in vitro dissolution experiments

• Industry is learning how to use this unique tool and sales continue to grow

• Strategy going forward:

– Continue advancing state-of-the-art for this one-of-a-kind tool

– Continue aggressive marketing and sales activities

• Educate formulation scientists on how to use simulation in their work

• Emphasize compatibility with GastroPlus for formulation studies

DDDPlusTM

• Predicts properties of molecules from just their structures, including physicochemical properties,

pharmacokinetic properties, metabolism properties, and numerous toxicities

pharmacokinetic properties, metabolism properties, and numerous toxicities

• Consistently top-ranked in accuracy in published independent comparison studies

• Version 5.0 released in FY2010

• New atomic and molecular descriptors enhance all models - all models retrained

• New property predictions

• Improved model-building capabilities of ADMET Modeler™ subprogram

• Strategy going forward:

– Continue to expand- new toxicity and metabolism models coming shortly in version 5.5

– Further improve prediction accuracy through better molecular and atomic descriptors

– Further enhanced graphical outputs and reporting features

ADMET PredictorTM

• Integrated with ADMET Predictor - provides complete modeling/prediction

capability - used to build all models in ADMET Predictor except for a few

simple calculations

capability - used to build all models in ADMET Predictor except for a few

simple calculations

• Speed and model quality unsurpassed - contract studies have shown ability to

find useful models from user data (including activity) when others have failed

find useful models from user data (including activity) when others have failed

• Strategy going forward:

– Continue to advance state-of-the-art in machine learning methods

– Further improve user interface and convenience features

– May develop stand-alone product for general modeling use

ADMET ModelerTM

• Formerly ClassPharmer™. renamed it MedChem Studio last year

• Classifies molecules by “maximum common substructures” using proprietary algorithms (red

parts of molecules above)

parts of molecules above)

• Helps chemists identify what it is about molecular structures that cause good or bad properties

• Generates new molecules using proprietary algorithms

• Tight integration with ADMET Predictor to eliminate “losers” based on property predictions

• Strategy going forward:

– Molecule design now area of emphasis - MedChem Designer™ integrated into MedChem Studio to

further enhance our design capabilities

further enhance our design capabilities

MedChem StudioTM

• Exciting new product launched on February 17, 2011! Provided free

• Exciting combination of innovative molecule drawing capabilities that integrates tightly with

ADMET Predictor

ADMET Predictor

• Provides chemist with never-before-available information about how each change to a

molecule affects up to almost 130 different properties.

molecule affects up to almost 130 different properties.

• Strategy going forward:

– Molecule design now area of strategic emphasis

– MedChem Designer™ is integrated into MedChem Studio to further enhance our design capabilities

– Free ADMET Predictor predictions are a teaser - expected to promote additional ADMET Predictor

sales so chemists can see the other 120+ properties

sales so chemists can see the other 120+ properties

MedChem DesignerTM

Consulting Contracts

• Growing part of business

– Simulation studies

• Troubleshooting problem compounds

• Virtual bioequivalence trials

• Assist with design of new oral dosage formulations

• Generates leads for software licenses

• Identifies unmet needs for software improvements

• Increases our knowledge base and expertise

– Exposure to unusual compound behaviors

• Builds rapport and confidence not only with

customers’ scientists, but also with their management

customers’ scientists, but also with their management

Some of Our International

Pharma Customers

Pharma Customers

|

|

– Growing team of exceptional scientists and engineers

• Chemistry, biochemistry, molecular biology

• Chemical engineering, biomedical engineering

• Computer science

• Augmentative communication (Words+ subsidiary)

– Recognized world-class expertise in oral drug delivery,

pharmacokinetics, pharmacodynamics

pharmacokinetics, pharmacodynamics

– Large scale system simulations

– Applied numerical simulation/optimization methods to

multidimensional nonlinear problems

multidimensional nonlinear problems

– High quality, rapid structure-property modeling

– Marketing and sales to a highly technical global market

– Strong relationships with pharmaceutical scientists in industry,

government, and academia

government, and academia

Core Capabilities and Strengths

Strategic Considerations

• Aggressive marketing and sales activities have paid off,

and will continue

and will continue

• Development of new technologies via in-house funding

– Continue to develop new products such as our new MedChem

Designer™ software announced yesterday

Designer™ software announced yesterday

– Maintain our industry-leading position with GastroPlus™

– Continue to refine our existing products

• Cash position remains very strong

– We will use it to continue to hire selected staff and grow

organically, for accretive acquisitions, and for outsourcing of

specific activities to augment internal efforts

organically, for accretive acquisitions, and for outsourcing of

specific activities to augment internal efforts

– Board of Directors may consider additional share repurchases

• World-class and growing scientific team

• Experienced professional management team and board

• Continuously growing and profitable through global

economic crisis

economic crisis

• High margins: earnings growth > revenues growth

• Approximately $8.9 MM in cash and no debt

• Emerging, high-growth market

• Proprietary multi-platform software

• Recurring revenue business model

• Acquisition remains a major strategic goal

Investment Highlights

Increasing shareholder

value by providing

competitive advantages to

our customers in the

pharmaceutical, biotech,

and disability industries

value by providing

competitive advantages to

our customers in the

pharmaceutical, biotech,

and disability industries

Simulations Plus, Inc.

Questions and Answers

Opportunity for shareholders to ask questions about the

company.

company.

Please understand that we cannot provide any information

that would be considered “insider information” - information

that would provide those attending this meeting with

knowledge about company operations that would give them

an advantage in deciding to buy or sell shares in the public

markets. However, we will endeavor to answer every

question in as much detail as possible without violating SEC

rules.

that would be considered “insider information” - information

that would provide those attending this meeting with

knowledge about company operations that would give them

an advantage in deciding to buy or sell shares in the public

markets. However, we will endeavor to answer every

question in as much detail as possible without violating SEC

rules.