Attached files

| file | filename |

|---|---|

| EX-21.1 - EX-21.1 - Macquarie Infrastructure Corp | d27893_ex21-1.htm |

| EX-23.1 - EX-23.1 - Macquarie Infrastructure Corp | d27893_ex23-1.htm |

| EX-32.1 - EX-32.1 - Macquarie Infrastructure Corp | d27893_ex32-1.htm |

| EX-32.2 - EX-32.2 - Macquarie Infrastructure Corp | d27893_ex32-2.htm |

| EX-99.(1) - EX-99.(1) - Macquarie Infrastructure Corp | d27893_ex99-1.htm |

| EX-31.2 - EX-31.2 - Macquarie Infrastructure Corp | d27893_ex31-2.htm |

| EX-23.2 - EX-23.2 - Macquarie Infrastructure Corp | d27893_ex23-2.htm |

| EX-31.1 - EX-31.1 - Macquarie Infrastructure Corp | d27893_ex31-1.htm |

| EX-10.28 - EX-10.28 - Macquarie Infrastructure Corp | d27893_ex10-28.htm |

| EX-10.27 - EX-10.27 - Macquarie Infrastructure Corp | d27893_ex10-27.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2010

OR

OR

[ ] |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________________ to _________________

Commission File Number: 001-32384

MACQUARIE INFRASTRUCTURE COMPANY LLC

(Exact Name of Registrant as Specified in Its Charter)

(Exact Name of Registrant as Specified in Its Charter)

Delaware |

43-2052503 |

||||||

(Jurisdiction

of Incorporation or Organization) |

(IRS Employer Identification No.) |

||||||

125 West 55th Street New York, New York 10019 (Address of Principal Executive Offices) (Zip Code) Registrant’s Telephone Number, Including Area Code: (212) 231-1000 Securities registered pursuant to Section 12(b) of the Act: |

|||||||

Title of

Each Class: |

Name of Exchange on Which Registered: |

|||||

Limited

Liability Company Interests of Macquarie Infrastructure Company LLC (“LLC Interests”) |

New York Stock Exchange |

|||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark

if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Yes [ ] No [X]

Indicate by check mark if the

registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [X]

Yes [ ] No [X]

Indicate by check mark whether the

registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past

90 days. Yes [X] No [ ]

Indicate by check mark if disclosure of

delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrants’

knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form

10-K. [ ]

Indicate by check mark whether the

registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted

pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit and post such files). Yes [ ] No [ ]

Indicate by check mark whether the

registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of

“large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange

Act.

Large Accelerated Filer

[ ] Accelerated Filer [X] Non-Accelerated Filer [ ] Smaller Reporting Company [ ]

Indicate by check mark whether the

registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

The aggregate market value of the

outstanding shares of stock held by non-affiliates of Macquarie Infrastructure Company LLC at June 30, 2010 was $531,493,528 based on the closing price

on the New York Stock Exchange on that date. This calculation does not reflect a determination that persons are affiliates for any other

purposes.

There were 45,715,448 shares of stock

without par value outstanding at February 23, 2011.

DOCUMENTS INCORPORATED BY REFERENCE

The definitive proxy statement relating

to Macquarie Infrastructure Company LLC’s Annual Meeting of Shareholders for fiscal year ended December 31, 2010, to be held June 2, 2011, is

incorporated by reference in Part III to the extent described therein.

MACQUARIE INFRASTRUCTURE COMPANY LLC

TABLE OF CONTENTS

| Page |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| PART I |

||||||||||||

Item

1. |

Business

|

3 | ||||||||||

Item

1A. |

Risk Factors

|

23 | ||||||||||

Item

1B. |

Unresolved Staff

Comments |

39 | ||||||||||

Item

2. |

Properties

|

39 | ||||||||||

Item

3. |

Legal Proceedings

|

41 | ||||||||||

Item

4. |

[Removed and

Reserved] |

41 | ||||||||||

PART II |

||||||||||||

Item

5. |

Market for

Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

42 | ||||||||||

Item

6. |

Selected

Financial Data |

43 | ||||||||||

Item

7. |

Management’s

Discussion and Analysis of Financial Condition and Results of Operations |

46 | ||||||||||

Item

7A. |

Quantitative and

Qualitative Disclosures About Market Risk |

99 | ||||||||||

Item

8. |

Financial

Statements and Supplementary Data |

102 | ||||||||||

Item

9. |

Changes in and

Disagreements With Accountants on Accounting and Financial Disclosure |

151 | ||||||||||

Item

9A. |

Controls and

Procedures |

151 | ||||||||||

Item

9B. |

Other Information

|

153 | ||||||||||

PART III |

||||||||||||

Item

10. |

Directors and

Executive Officers of the Registrant |

153 | ||||||||||

Item

11. |

Executive

Compensation |

153 | ||||||||||

Item

12. |

Security

Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

153 | ||||||||||

Item

13. |

Certain

Relationships and Related Transactions |

154 | ||||||||||

Item

14. |

Principal

Accountant Fees and Services |

154 | ||||||||||

PART IV |

||||||||||||

Item

15. |

Exhibits,

Financial Statement Schedules |

154 | ||||||||||

i

FORWARD-LOOKING STATEMENTS

We have included or incorporated by

reference into this report, and from time to time may make in our public filings, press releases or other public statements, certain statements that

may constitute forward-looking statements. These include without limitation those under “Risk Factors” in Part I, Item 1A, “Legal

Proceedings” in Part I, Item 3, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II,

Item 7, and “Quantitative and Qualitative Disclosures about Market Risk” in Part II, Item 7A. In addition, our management may make

forward-looking statements to analysts, investors, representatives of the media and others. These forward-looking statements are not historical facts

and represent only our beliefs regarding future events, many of which, by their nature, are inherently uncertain and beyond our control. We may, in

some cases, use words such as “project,” “believe,” “anticipate,” “plan,” “expect,”

“estimate,” “intend,” “should,” “would,” “could,” “potentially,” “may” or other

words that convey uncertainty of future events or outcomes to identify these forward-looking statements.

In connection with the “safe

harbor” provisions of the Private Securities Litigation Reform Act of 1995, we are identifying important factors that, individually or in the

aggregate, could cause actual results to differ materially from those contained in any forward-looking statements made by us. Any such forward-looking

statements are qualified by reference to the following cautionary statements.

Forward-looking statements in this

report are subject to a number of risks and uncertainties, some of which are beyond our control, including, among other things:

• |

changes in general economic, business or demographic conditions or trends in the United States or changes in the political environment, level of travel or construction or transportation costs where we operate, including changes in interest rates and price levels; |

• |

changes in patterns of commercial or general aviation air travel, including variations in customer demand for our business; |

• |

our Manager’s affiliation with the Macquarie Group, which may affect the market price of our LLC interests; |

• |

our limited ability to remove our Manager for underperformance and our Manager’s right to resign; |

• |

our holding company structure, which may limit our ability to pay or increase a dividend; |

• |

our ability to service, comply with the terms of and refinance at maturity our substantial indebtedness; |

• |

our ability to make, finance and integrate acquisitions; |

• |

our ability to implement our operating and internal growth strategies; |

• |

the regulatory environment, including U.S. energy policy, in which our businesses and the businesses in which we hold investments operate and our ability to estimate compliance costs, comply with any changes thereto, rates implemented by regulators of our businesses and the businesses in which we hold investments, and our relationships and rights under and contracts with governmental agencies and authorities; |

• |

technological innovations leading to a change in energy consumption patterns; |

• |

changes in electricity or other energy costs; |

• |

the competitive environment for attractive acquisition opportunities facing our businesses and the businesses in which we hold investments; |

• |

environmental risks, including the impact of climate change and weather conditions, pertaining to our businesses and the businesses in which we hold investments; |

• |

work interruptions or other labor stoppages at our businesses or the businesses in which we hold investments; |

1

• |

changes in the current treatment of qualified dividend income and long-term capital gains under current U.S. federal income tax law and the qualification of our income and gains for such treatment; |

• |

disruptions or other extraordinary or force majeure events affecting the facilities or operations of our businesses and the businesses in which we hold investments and our ability to insure against any losses resulting from such events or disruptions; |

• |

fluctuations in fuel costs, or the costs of supplies upon which our gas production and distribution business is dependent, and our ability to recover increases in these costs from customers; |

• |

our ability to make alternate arrangements to account for any disruptions or shutdowns that may affect the facilities of the suppliers or the operation of the barges upon which our gas production and distribution business is dependent; and |

• |

changes in U.S. domestic demand for chemical, petroleum and vegetable and animal oil products, the relative availability of tank storage capacity and the extent to which such products are imported. |

Our actual results, performance,

prospects or opportunities could differ materially from those expressed in or implied by the forward-looking statements. A description of risks that

could cause our actual results to differ appears under the caption “Risk Factors” in Part I, Item 1A and elsewhere in this report. It is not

possible to predict or identify all risk factors and you should not consider that description to be a complete discussion of all potential risks or

uncertainties that could cause our actual results to differ.

In light of these risks, uncertainties

and assumptions, you should not place undue reliance on any forward-looking statements. The forward-looking events discussed in this report may not

occur. These forward-looking statements are made as of the date of this report. We undertake no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information, future events or otherwise. You should, however, consult further disclosures we may

make in future filings with the Securities and Exchange Commission, or the SEC.

Macquarie Infrastructure Company LLC

is not an authorized deposit-taking institution for the purposes of the Banking Act 1959 (Commonwealth of Australia) and its obligations do not

represent deposits or other liabilities of Macquarie Bank Limited ABN 46 008 583 542 (MBL). MBL does not guarantee or otherwise provide assurance in

respect of the obligations of Macquarie Infrastructure Company LLC.

2

PART I

ITEM 1. BUSINESS

Macquarie Infrastructure Company, LLC,

a Delaware limited liability company, was formed on April 13, 2004. Except as otherwise specified, “Macquarie Infrastructure Company”,

“MIC,” “the Company”, “we,” “us,” and “our” refer to Macquarie Infrastructure Company LLC and its

subsidiaries together. References to our “shareholders” herein means holders of LLC interests. The holders of LLC interests are also the

members of our company. Macquarie Infrastructure Management (USA) Inc., the company that we refer to as our Manager, is part of the Macquarie Group of

companies. References to the Macquarie Group means Macquarie Group Limited and its respective subsidiaries and affiliates worldwide.

General

We own, operate and invest in a

diversified group of infrastructure businesses in the United States. We believe our infrastructure businesses, which provide basic services, have a

sustainable and stable cash flow profile and offer the potential for capital growth. We offer investors an opportunity to participate directly in the

ownership of infrastructure businesses, which traditionally have been owned by governments or private investors, or have formed part of vertically

integrated companies.

The Company’s four operating

segments are classified into either energy-related businesses or aviation-related business, Atlantic Aviation. The energy-related businesses consist of

three operating segments: The Gas Company, District Energy and an investment in IMTT, which is accounted for under the equity method. All of the

business segments are managed separately and management has chosen to organize the Company around the distinct products and services

offered.

The Energy-Related Businesses:

• |

a 50% interest in a bulk liquid storage terminal business (“International Matex Tank Terminals” or “IMTT”), which provides bulk liquid storage and handling services at ten marine terminals in the United States and two in Canada and is one of the largest participants in this industry in the U.S., based on storage capacity; |

• |

a gas production and distribution business (“The Gas Company”), which is a full-service gas energy company, making gas products and services available in Hawaii; and |

• |

a 50.01% controlling interest in a district energy business (“District Energy”), which operates the largest district cooling system in the U.S., serving various customers in Chicago, Illinois and Las Vegas, Nevada. |

Atlantic Aviation — an airport services

business providing products and services, including fuel and aircraft hangaring/parking, to owners and operators of private jets at 66 airports and one

heliport in the U.S.

On June 2, 2010, we concluded the sale

in bankruptcy of an airport parking business (“Parking Company of America Airports” or “PCAA”), resulting in a pre-tax gain of

$130.3 million, of which $76.5 million related to the forgiveness of debt, and the elimination of $201.0 million of current debt from liabilities from

our consolidated balance sheet. The results of operations from this business and the gain from the bankruptcy sale are separately reported as a

discontinued operations in the Company’s consolidated financial statements. This business is no longer a reportable segment. As a part of the

bankruptcy sale process, substantially all of the cash proceeds were used to pay the creditors of this business and were not paid to us. We received

$602,000 from the PCAA bankruptcy estate for expenses paid on behalf of PCAA during its operations. See Note 4, “Discontinued Operations”, in

our consolidated financial statements in “Financial Statements and Supplementary Data” in Part II, Item 8, of this Form 10-K for financial

information and further discussions.

We have elected to treat MIC as a

corporation for federal tax purposes. As a result, all investor tax reporting with respect to distributions made is based on our being a corporation

for U.S. federal tax purposes and such reporting will be provided on Form 1099.

3

Our Manager

Our Manager is a member of the

Macquarie Group, a diversified international provider of financial, advisory and investment services. The Macquarie Group is headquartered in Sydney,

Australia and is a global leader in management of infrastructure investment vehicles on behalf of third-party investors and advising on the

acquisition, disposition and financing of infrastructure assets.

We have entered into a management

services agreement with our Manager. Our Manager is responsible for our day-to-day operations and affairs and oversees the management teams of our

operating businesses. The Company neither has, nor will have, any employees. Our Manager has assigned, or seconded, to the Company, on a permanent and

wholly dedicated basis, two of its employees to assume the offices of chief executive officer and chief financial officer and seconds or makes other

personnel available as required. The services performed for the Company are provided at our Manager’s expense, and includes the compensation of

our seconded personnel.

We pay our Manager a quarterly base

management fee based primarily on our market capitalization. Our Manager can also earn a performance fee if the quarterly total return to shareholders

(capital appreciation plus dividends) exceeds the quarterly total return of a U.S. utilities index. The performance fee is equal to 20% of the

difference between the benchmark return and the return for our shareholders. To be eligible for the performance fee, our Manager must deliver quarterly

total returns that are positive and in excess of any prior underperformance. Please see the management services agreement filed as an exhibit to this

Annual Report on Form 10-K for the full terms of this agreement.

We believe that Macquarie Group’s

demonstrated expertise and experience in the management, acquisition and funding of infrastructure businesses will provide us with a significant

advantage in pursuing our strategy. Our Manager is part of the Macquarie Funds Group, the asset management division of Macquarie globally.

Macquarie-managed entities own, operate and/or invest in a global portfolio of approximately 100 businesses including toll roads, airports and

airport-related infrastructure, ports, communications, media, electricity and gas distribution networks, water utilities, renewable energy generation,

aged care, rail and ferry assets across 24 countries.

Industry

Infrastructure businesses, in general,

tend to generate sustainable and growing cash flows resulting from relatively inelastic customer demand and strong competitive positions of the

businesses. Characteristics of infrastructure businesses include:

• |

ownership of long-lived, high-value physical assets that are difficult to replicate or substitute around; |

• |

predictable maintenance capital expenditure requirements; |

• |

consistent, relatively inelastic demand for their services, such as those provided by our energy-related businesses; |

• |

strong competitive positions, largely due to high barriers to entry, including: |

• |

high initial development and construction costs; |

• |

difficulty in obtaining suitable land; |

• |

long-term, exclusive concessions or leases and customer contracts; and |

• |

lack of cost-effective alternatives to customers in the foreseeable future; |

• |

scalability, such that relatively small amounts of growth can generate significant increases in earnings before interest, taxes, depreciation and amortization, or EBITDA; and |

• |

the provision of basic, often essential services. |

4

In addition to the benefits related to

these characteristics, the revenues generated by our infrastructure businesses generally can be expected to keep pace with inflation. The price

escalators built into customer contracts, and the inflation and cost pass-through adjustments typically a part of pricing terms in user pays businesses

or provided for by the regulatory process to regulated businesses, serve to insulate infrastructure businesses to a significant degree from the

negative effects of inflation and commodity price risk. We also employ interest rate swaps in connection with our businesses’ floating rate debt

to effectively fix our interest expense and hedge variability from interest rate change.

We focus on the ownership and operation

of infrastructure businesses in the following categories:

• |

“contracted,” such as IMTT, the revenues of which are derived from per-use or rental charges in medium-term contracts, and District Energy, a majority of the revenues of which are derived from long-term contracts with businesses and governments; |

• |

“regulated,” such as the utility operations of The Gas Company; and |

• |

“user pays,” such as Atlantic Aviation, the revenues of which are based on patronage. |

Strategy

There are three components to our

strategy:

• |

programs to improve the operating performance of each of our businesses; |

• |

a sustainable balance between distributions to our shareholders of available cash and investment in the growth of new or existing businesses; and |

• |

continued debt reduction at Atlantic Aviation to levels at which it is again prudent to distribute cash from the business to MIC. |

Our Businesses and Investments

We provide below information about our

businesses and investments, including key financial information for each business. We are disclosing earnings before interest, taxes, depreciation and

amortization (EBITDA) excluding non-cash items as defined by us. We believe EBITDA excluding non-cash items provides additional insight into the

performance of our operating businesses relative to each other and similar businesses without regard to their capital structure, and their ability to

service or reduce debt, fund capital expenditures and/or support distributions to the holding company. Additionally, EBITDA excluding non-cash items is

a key performance metric relied on by management in evaluating the performance of the Company and our operating segments. Therefore, this Annual Report

on Form 10-K discloses EBITDA excluding non-cash items in addition to the other financial information provided in accordance with GAAP. See

“Management’s Discussion and Analysis of Financial Conditions and Results of Operations — Results of Operations” in Part II, Item 7

for a reconciliation of net income (loss) to EBITDA excluding non-cash items for the Company and its operating segments.

Energy-Related Businesses

IMTT

Business Overview

We own 50% of International-Matex Tank

Terminals, or IMTT. The 50% we do not own is owned by members of the founding family. IMTT stores and handles petroleum products, various chemicals,

renewable fuels and vegetable and animal oils. IMTT is one of the largest independent providers of bulk liquid storage terminal services in the U.S.,

based on capacity.

For the year ended December 31, 2010,

IMTT generated approximately 42% of its terminal revenue and approximately 40% of its terminal gross profit at its Bayonne, New Jersey facility in New

York Harbor.

5

Energy-Related

Businesses: IMTT – (continued)

Approximately 42% of IMTT’s total terminal revenue and approximately 50% of its terminal gross profit was generated by its St. Rose, Gretna, Avondale and Geismar facilities, which together service the lower Mississippi River region (with St. Rose as the largest contributor).

IMTT also owns Oil Mop, an

environmental response and spill clean-up business. Oil Mop has a network of facilities along the U.S. Gulf Coast between Houston and New Orleans.

These facilities service predominantly the Gulf region, but also respond to spill events as needed throughout the United States and

internationally.

The table below summarizes the

proportion of the terminal revenue generated from the commodities stored at IMTT’s U.S. terminals for the year ended December 31,

2010:

| Proportion of Terminal Revenue from Major

Commodities Stored |

||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Petroleum/Asphalt |

Chemical |

Renewable/Vegetable & Animal Oil |

Other |

|||||||||||||

60% |

27% |

9% |

4% |

|||||||||||||

Financial information for 100% of this

business is as follows ($ in millions):

| As of, and for the Year Ended, December 31, |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2010 |

2009 |

2008 |

|||||||||||||

Revenue

|

$ | 557.2 | $ | 346.2 | $ | 352.6 | |||||||||

EBITDA

excluding non-cash items |

236.8 | 147.7 | 136.6 | ||||||||||||

Total assets

|

1,221.9 | 1,064.8 | 1,006.3 | ||||||||||||

Industry Overview

Bulk liquid storage terminals provide

an essential link in the supply chain for liquid commodities such as crude oil, refined petroleum products and basic and specialized chemicals. In

addition to renting storage tanks, bulk liquid storage terminals generate revenues by offering ancillary services including product transfer

(throughput), heating and blending. Pricing for storage and other services typically reflects local supply and demand as well as the specific

attributes of each terminal including access to deepwater berths and connections to land-based infrastructure such as roads, pipelines and

rail.

Both domestic and international factors

influence demand for bulk liquid storage in the United States. Demand for storage rises and falls according to local and regional consumption, which

largely reflects the underlying economic activity over the medium term. In addition to these domestic forces, import and export activity also accounts

for a material portion of the business. Shippers require storage for the staging, aggregation and/or distribution of products before and after

shipment. The extent of import/export activity depends on macroeconomic trends such as currency fluctuations as well as industry-specific conditions,

such as supply and demand balances in different geographic regions. The medium-term length of storage contracts tends to offset short-term fluctuations

in demand for storage in both the domestic and import/export markets.

Potential entrants into the bulk liquid

storage terminal business face several substantial barriers. Strict environmental regulations, limited availability of waterfront land with the

necessary access to land-based infrastructure, local community resistance to new fuel/chemical sites, and high initial investment costs impede the

construction of new bulk liquid storage facilities. These deterrents are most formidable around New York Harbor and other waterways near major urban

centers. As a consequence, new supply is generally created by the addition of tankage to existing terminals where existing infrastructure can be

leveraged, resulting in higher returns on invested capital. However, restrictions on land use, difficulties in securing environmental permits, and the

potential for operational bottlenecks due to infrastructure constraints may limit the ability of existing terminals to expand the storage capacity of

their facilities.

6

Energy-Related

Businesses: IMTT – (continued)

Strategy

The key components of IMTT’s

strategy are to drive growth in revenue and cash flows by attracting and retaining customers who place a premium on flexibility, speed and efficiency

in bulk liquid storage and to invest, where prudent, in additional storage capacity. IMTT believes that the successful execution of this strategy will

be aided by its size, technology and service capability.

Flexibility: Operational flexibility is essential to making IMTT an attractive supplier of bulk liquid storage

services in its key markets. Its facilities operate 24/7 providing shippers, refiners, manufacturers, traders and distributors with prompt access to a

wide range of storage services. In each of its two key markets, IMTT’s scale ensures availability of sophisticated product handling and storage

capabilities along with ancillary services such as heating and blending. IMTT continues to improve its facilities’ speed and flexibility of

operations by investing in upgrades of its docks, pipelines and pumping infrastructure and facility management systems.

Investment in

Growth: IMTT seeks to increase its available storage capacity, especially in New York Harbor and the lower Mississippi

River, by building new tankage at existing facilities when supported by customer demand.

Locations

The following table summarizes the

location of each IMTT facility and the corresponding millions of barrels of storage capacity in service and ship and barge docks available for product

transfer. This information is as of December 31, 2010 and does not include tanks used in packaging, recovery tanks, and/or other storage capacity not

typically available for rent.

| Facility |

Land |

Aggregate Capacity of Storage Tanks in Service |

Number of Ship & Barge Berths in Service |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (Millions of Barrels) | ||||||||||||||

Facilities

in the United States: |

||||||||||||||

Bayonne, NJ

|

Owned |

16.0 | 20 | |||||||||||

St. Rose, LA*

|

Owned |

14.7 | 16 | |||||||||||

Gretna, LA*

|

Owned |

2.0 | 5 | |||||||||||

Avondale, LA*

|

Owned |

1.1 | 4 | |||||||||||

Geismar, LA*

|

Owned |

0.9 | 3 | |||||||||||

Lemont, IL

|

Owned/Leased |

1.0 | 1 | |||||||||||

Joliet, IL

|

Owned |

0.9 | 3 | |||||||||||

Richmond, CA

|

Owned |

0.7 | 2 | |||||||||||

Chesapeake, VA

|

Owned |

1.0 | 1 | |||||||||||

Richmond, VA

|

Owned |

0.4 | 1 | |||||||||||

Facilities

in Canada: |

||||||||||||||

Quebec City,

Quebec(1) |

Leased |

2.0 | 2 | |||||||||||

Placentia Bay,

Newfoundland(2) |

Leased |

3.0 | 2 | |||||||||||

Total

|

43.7 | 60 | ||||||||||||

* |

Collectively the “Louisiana” facilities. |

(1) |

Indirectly 66.7% owned and managed by IMTT. |

(2) |

Indirectly 20.1% owned and managed by IMTT. |

7

Energy-Related

Businesses: IMTT – (continued)

All facilities have marine access, road

access and, except for Richmond, Virginia and Placentia Bay, Newfoundland, all sites have rail access.

Bayonne, New Jersey

The 16.0 million barrel storage

terminal at Bayonne, New Jersey has the most storage capacity of any IMTT site. Located on the Kill Van Kull between New Jersey and Staten Island, the

terminal occupies a strategically advantageous position in New York Harbor, or NYH. As the largest independent bulk liquid storage facility in NYH,

IMTT-Bayonne has substantial market share for third-party storage of refined petroleum products and chemicals.

NYH serves as the main petroleum

trading hub in the northeast United States and the physical delivery point for the gasoline and heating oil futures contracts traded on New York

Mercantile Exchange (NYMEX). In addition to waterborne shipments, products reach NYH through petroleum product pipelines from the U.S. Gulf region and

elsewhere. NYH also serves as the starting point for refined product pipelines linked to inland markets and as a key port for refined petroleum product

imports. IMTT-Bayonne has connections to the Colonial, Buckeye and Harbor refined petroleum product pipelines as well as rail and road connections. As

a result, IMTT-Bayonne provides its customers with substantial logistical flexibility.

IMTT-Bayonne has the capability to

quickly load and unload the largest bulk liquid transport ships entering NYH. The U.S. Army Corp of Engineers (USACE) has dredged the Kill Van Kull

channel passing the IMTT-Bayonne docks to 45 feet (IMTT has dredged some but not all of its docks to that depth). Most competitors in NYH have

facilities located on the southern portion of the Arthur Kill (water depth of approximately 35 feet) and force large ships to transfer product through

lightering (transferring cargo to barges at anchorage) before docking. This technique substantially increases the cost of loading and unloading

vessels. This competitive advantage for Bayonne may improve as the USACE is in the process of dredging the Kill Van Kull to 50 feet (with no planned

increase in the depth of the southern portion of the Arthur Kill). Demand for third-party bulk liquid storage in NYH has remained strong during the

past several years.

St. Rose/Gretna/Avondale/Geismar

On the lower Mississippi River, IMTT

currently operates four terminals (St. Rose, Gretna, Avondale and Geismar). With combined storage capacity of 18.7 million barrels, the four sites give

IMTT substantial market share in storage for black oil, bulk liquid chemicals, and vegetable oils on the lower Mississippi River.

The Louisiana facilities give IMTT a

substantial presence in a key domestic transport hub. The lower Mississippi River serves as a major transshipment point between the central United

States and the rest of the world for exported agricultural products (such as vegetable oils) and imported commodity chemicals (such as methanol). The

region also has substantial domestic traffic related to the petroleum industry. Gulf Coast refiners send their products to other regions of the U.S.

and overseas and require storage capacity and ancillary services to facilitate distribution. IMTT’s Louisiana facilities, with their deep water

ship and barge docks as well as access to rail, road and pipeline infrastructure, are highly capable of performing these functions. Demand for

third-party bulk liquid storage on the lower Mississippi River has remained strong during the past several years.

Competition

The competitive environment in which

IMTT operates varies by terminal location. The principal competition for each of IMTT’s facilities comes from other bulk liquid storage facilities

located in the same regional market. Kinder Morgan, which owns three bulk liquid storage facilities in New Jersey and Staten Island, New York,

represents IMTT’s major competitor in the NYH market. Kinder Morgan also owns facilities along the lower Mississippi River near New Orleans. In

both the NYH and lower Mississippi River markets, IMTT operates the largest terminal by capacity which, combined with the capabilities of IMTT’s

facilities, provides IMTT with a strong competitive position in both of these key bulk liquid storage markets.

8

Energy-Related

Businesses: IMTT – (continued)

IMTT’s minor facilities in

Illinois, California and Virginia represent only a small proportion of available bulk liquid storage capacity in their respective markets and have

numerous competitors with facilities of similar or larger size and with similar capabilities.

Secondary competition for IMTT’s

facilities comes from bulk liquid storage facilities located in the same broad geographic region as IMTT’s terminals. For example, bulk liquid

storage facilities located on the Houston Ship Channel provide indirect competition for IMTT’s Louisiana facilities.

Customers

IMTT provides bulk liquid storage

services principally to vertically integrated petroleum product producers and refiners, chemical manufacturers, food processors and traders of bulk

liquid petroleum, chemical and agricultural products. BP represented more than 10% of IMTT’s consolidated revenues and accounts receivable for the

year ended and at December 31, 2010, primarily due to the non-recurring oil spill response activity in the Gulf of Mexico.

Customer Contracts

IMTT generally rents storage tanks to

customers under contracts with terms of three to five years. Pursuant to these contracts, customers generally pay for the tank storage whether they use

it or not. The contracts generally have no early termination provisions. Customers generally pay rental charges monthly at rates stated in terms of

cents per barrel of storage capacity per month. Tank rental rates vary by commodity stored and by location. IMTT’s standard form of customer

contract generally permits a certain number of free product movements into and out of the storage tank with charges for throughput exceeding the

prescribed levels. In cases where stored liquids require heating to keep viscosity at acceptable levels, IMTT generally charges the customer for the

heating with such charges essentially reflecting a pass-through of IMTT’s cost. Heating charges principally cover the cost of fuel used to produce

steam. Pursuant to IMTT’s standard form of customer contract, tank rental rates, throughput rates and the rates for other services generally

increase based on annual inflation indices. Customers retain title to products stored in the tanks and have responsibility for securing insurance

against loss. As a result, IMTT has no commodity price risk related to the liquids stored in its tanks and has limited liability from product loss.

IMTT is responsible for ensuring appropriate care of products stored at its facilities and maintains adequate insurance with respect to its

exposure.

Regulation

The rates that IMTT charges for its

services are not subject to regulation. However, a number of regulatory bodies oversee IMTT’s operations. IMTT must comply with numerous federal,

state and local environmental, occupational health and safety, security, tax and planning statutes and regulations. These regulations require IMTT to

obtain and maintain permits to operate its facilities and impose standards that govern the way IMTT operates its business. If IMTT does not comply with

the relevant regulations, it could lose its operating permits and/or incur fines and increased liability. As a result, IMTT has developed environmental

and health and safety compliance functions which are overseen by the terminal managers at the terminal level, IMTT’s Director of Environmental,

Health and Safety, Chief Operating Officer and Chief Executive Officer. While changes in environmental, health and safety regulations pose a risk to

IMTT’s operations, such changes are generally phased in over time to manage the impact on industry.

The Bayonne terminal was acquired and

expanded over a 27 year period. It has significant remediation requirements that were partially assumed at the time of purchase from the various former

owners. One former owner retained environmental remediation responsibilities for a purchased site as well as sharing other remediation costs.

Remediation efforts entail removal of the free product, groundwater control and treatment, soil treatment, repair/replacement of sewer systems, and the

implementation of containment and monitoring systems. These remediation activities are expected to continue for ten to twenty years.

9

Energy-Related

Businesses: IMTT – (continued)

The Lemont terminal has entered into a

consent order with the State of Illinois to remediate contamination at the site that pre-dated IMTT’s ownership. This remediation effort,

including the implementation of extraction and monitoring wells and soil treatment, is estimated to continue for ten to twenty years.

See “Management’s Discussion

and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources” in Part II, Item 7 for discussion of the

expected future capitalized cost of environmental remediation.

Management

The day-to-day operations of

IMTT’s terminals are overseen by individual terminal managers who are responsible for all aspects of the operations at their respective sites.

IMTT’s terminal managers have on average 28 years experience in the bulk liquid storage industry and 17 years of service with

IMTT.

The IMTT head office in New Orleans

provides the business with central management, performs support functions such as accounting, tax, finance, human resources, insurance, information

technology and legal services and provides support for functions that have been partially de-centralized to the terminal level such as engineering and

environmental and occupational health and safety regulatory compliance. IMTT’s senior management team, other than the terminal managers, have on

average 36 years experience in the bulk liquid storage industry and 29 years service with IMTT.

The Board of IMTT Holdings consists of

six members with three appointees each from Macquarie Terminal Holdings, LLC, our wholly owned subsidiary, and our co-investor. All decisions of the

Board require majority approval, including the approval of at least one member appointed by Macquarie Terminal Holdings, LLC and one member appointed

by our co-investor. The Shareholders’ Agreement to which we became a party at the time of our investment in IMTT contains a customary list of

items that must be referred to the Board for approval. The Shareholders’ Agreement is included as an exhibit to this Annual Report on Form

10-K.

Distribution of funds to the Company

from IMTT is governed by the Shareholders’ Agreement between the Company and the co-investor that owns the remaining 50% stake. The co-investor

has refused to vote in favor of distributing these funds, and the Company believes that such a refusal violates the Shareholders’

Agreement.

As a result, the Company has formally

initiated the dispute resolution process in the Shareholders’ Agreement, and intends to proceed to arbitration with the co-investor if a

satisfactory resolution cannot be reached within the timeframe prescribed in the Shareholders’ Agreement.

Employees

As of December 31, 2010, IMTT

(excluding non-consolidated sites) had a total of 1,024 employees, including 135 employed by Oil Mop. At the Bayonne terminal, 138 employees are

unionized, 52 of the employees are unionized at the Lemont and Joliet terminals and 35 employees are unionized at the Quebec terminal. We believe

employee relations at IMTT are good.

The Gas Company

Business Overview

The Gas Company is Hawaii’s only

government franchised full-service gas company, manufacturing and distributing gas products and services in Hawaii. The market includes Hawaii’s

approximately 1.4 million residents and approximately 7.0 million visitors in 2010. The Gas Company manufactures synthetic natural gas, or SNG, for its

utility customers on Oahu, and distributes Liquefied Petroleum Gas, or LPG, to utility and non-utility customers throughout the state’s six

primary islands.

10

Energy-Related Businesses: The Gas

Company – (continued)

The Gas Company has two primary

businesses, utility (or regulated) and non-utility (or unregulated):

• |

The utility business serves approximately 35,300 customers through localized pipeline distribution systems located on the islands of Oahu, Hawaii, Maui, Kauai, Molokai and Lanai. The utility business includes the manufacture, distribution and sale of SNG on the island of Oahu and distribution and sale of LPG. Utility revenue consists principally of sales of SNG and LPG. The operating costs for the utility business include the cost of locally purchased feedstock, the cost of manufacturing SNG from the feedstock, LPG purchase costs and the cost of distributing SNG and LPG to customers. Utility sales comprised approximately 43% of The Gas Company’s total contribution margin in 2010. |

• |

The non-utility business sells and distributes LPG to approximately 33,300 customers. LPG is delivered by truck to individual tanks located on customer sites on Oahu, Hawaii, Maui, Kauai, Molokai and Lanai. Non-utility revenue is generated primarily from the sale of LPG delivered to customers. The operating costs for the non-utility business include the cost of purchased LPG and the cost of distributing the LPG to customers. Non-utility sales comprised approximately 57% of The Gas Company’s total contribution margin in 2010. |

The Gas Company’s two products,

SNG and LPG, are relatively clean-burning fuels that produce lower levels of carbon emissions than other hydrocarbon fuels such as coal or oil. This is

particularly important in Hawaii where heightened public awareness of environmental impact makes lower emission products attractive to

customers.

SNG and LPG have a wide number of

commercial and residential applications including water heating, drying, cooking, emergency power generation and tiki torches. LPG is also used as a

fuel for specialty vehicles such as forklifts. Gas customers include residential customers and a wide variety of commercial, hospitality, military,

public sector and wholesale customers.

Financial information for this business

is as follows ($ in millions):

| As of, and for the Year Ended, December 31, |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2010 |

2009 |

2008 |

|||||||||||||

Revenue |

$ | 210.6 | $ | 175.4 | $ | 213.0 | |||||||||

EBITDA

excluding non-cash items |

44.4 | 37.6 | 27.9 | ||||||||||||

Total

assets |

350.4 | 344.9 | 330.2 | ||||||||||||

% of our

consolidated revenue |

25.0 | % | 24.7 | % | 21.8 | % | |||||||||

Strategy

The Gas Company’s long-term

strategy is to increase and diversify its customer base. The business intends to increase penetration of the residential, the expanding government

(primarily military) and the tourism-related markets. The business also intends to invest in and promote the value of The Gas Company’s products

and services and its attractiveness as a cleaner alternative to other energy sources in Hawaii.

As a second component of its strategy,

The Gas Company intends to diversify its sources of feedstock and LPG to ensure reliable supply and to mitigate any potential cost increases to its

customers. The Gas Company is exploring other clean and renewable energy alternatives that may be distributed using its existing

infrastructure.

The Gas Company also recognizes the

important role it plays in the local community and, as a component of its strategy, will focus on maintaining good relationships with regulators,

governments and the communities it serves.

11

Energy-Related Businesses: The Gas

Company – (continued)

Products

While the mainland U.S. obtains natural

gas from wells drilled into underground reservoirs of porous rock, Hawaii relies solely on manufactured and imported alternatives. Hawaii has no

natural gas reserves.

Synthetic Natural

Gas. The business converts a light hydrocarbon feedstock (currently naphtha) to SNG. The product is chemically similar in

most respects to natural gas and has a similar heating value on a per cubic foot basis. The Gas Company has the only SNG manufacturing capability in

Hawaii at its plant located on the island of Oahu. SNG is delivered by underground piping systems to customers on Oahu.

Liquefied Petroleum

Gas. LPG is a generic name for a mixture of hydrocarbon gases, typically propane and butane. LPG liquefies at a relatively

low pressure under normal temperature conditions. As a result, LPG can be stored or transported more easily than natural or synthetic natural gas. LPG

is typically transported in cylinders or tanks. Domestic and commercial applications of LPG are similar to those of natural gas and synthetic natural

gas.

Utility Regulation

The Gas Company’s utility business

is regulated by the Hawaii Public Utilities Commission, or HPUC, while the business’ non-utility business is not. The HPUC exercises broad

regulatory oversight and investigative authority over all public utility companies in the state of Hawaii.

Rate

Regulation. The HPUC establishes the rates that The Gas Company can charge its utility customers via cost of service

regulation. The rate approval process is intended to ensure that a public utility has a reasonable opportunity to recover costs that are prudently

incurred and earn a fair return on its investments, while protecting consumer interests.

Although the HPUC sets the base rate

for the SNG and LPG sold by The Gas Company’s utility business, the business is permitted to pass through changes in its raw materials cost by

means of a monthly fuel adjustment charge, or FAC. The adjustment protects the business’ earnings from volatility in feedstock commodity

costs.

The business’ utility rates are

established by the HPUC in periodic rate cases typically initiated by The Gas Company. The business initiates a rate case by submitting a request to

the HPUC for an increase in rates based, for example, upon materially higher costs related to providing the service. Following initiation of the rate

increase request by The Gas Company and submission by the Division of Consumer Advocacy and other intervening parties of their positions on the rate

request, and potentially an evidentiary hearing, the HPUC issues a decision establishing the revenue requirements and the resulting rates that The Gas

Company will be allowed to charge.

Other

Regulations. The HPUC regulates all franchised or certificated public service companies operating in Hawaii; prescribes

rates, tariffs, charges and fees; determines the allowable rate of earnings in establishing rates; issues guidelines concerning the general management

of franchised or certificated utility businesses; and acts on requests for the acquisition, sale, disposition or other exchange of utility properties,

including mergers and consolidations. When we acquired The Gas Company, we agreed to 14 regulatory conditions with the HPUC that address a variety of

matters including: a requirement that the ratio of consolidated debt to total capital for The Gas Company, LLC and HGC Holdings LLC, or HGC, does not

exceed 65%; and a requirement to maintain $20.0 million in readily-available cash resources at The Gas Company, HGC or MIC.

Competition

Depending upon the end-use, the

business competes with electricity, diesel, solar energy, geo-thermal, wind, other gas providers and alternative energy sources. Hawaii’s

electricity is generated by four electric utilities and various non-utility generators.

12

Energy-Related Businesses: The Gas

Company – (continued)

Utility

Business. The Gas Company holds the only government franchise for regulated gas services in Hawaii. This enables it to

utilize public easements for its pipeline distribution systems. This franchise also provides protection from competition within the same gas-energy

sector since the business has developed and owns extensive below-ground distribution infrastructure. The costs associated with developing distribution

infrastructure are significant. However, in most instances, the business’ utility customers also have the ability to use non-utility gas supplied

by The Gas Company or its competitors by using LPG tanks.

Non-Utility

Business. The Gas Company also sells LPG in an unregulated market on the six primary islands of Hawaii. There are two other

wholesale companies and several small retail distributors that share the LPG market. The Gas Company believes it has a competitive advantage because of

its established customer base, storage facilities, distribution network and reputation for reliable service.

Fuel Supply, SNG Plant and Distribution

System

Fuel Supply

The business obtains its LPG from

foreign sources and each of the Chevron and Tesoro oil refineries located on Oahu. The Gas Company has LPG supply agreements with each refinery. The

business purchases its LPG from foreign sources under foreign supply agreements and through spot-market purchases, if needed.

In 2010, Chevron considered converting

its Hawaii refinery to a storage terminal. Chevron concluded that it would continue operating as a refinery in Hawaii; however, Chevron has publicly

stated that it is considering other alternatives for this facility. Chevron’s Hawaii refinery supplied The Gas Company with approximately

one-third of its total LPG purchases in 2010. The refinery also supplies the business’ principal competitor in the non-utility

market.

Any decision by Chevron regarding its

operations in Hawaii could affect the business’ cost of LPG and may adversely impact its non-utility contribution margin and profitability. In an

effort to mitigate the risk of supply disruption and/or a potential increase in costs, the business has been evaluating a number of alternatives,

including additional shipments of foreign sourced product and additional storage.

The business also obtains its feedstock

and fuel for SNG production, naphtha, from the Tesoro refinery on Oahu. The Gas Company has an agreement with Tesoro that expires August 31, 2011. The

agreement was effective as of September 1, 2010 and remains subject to final HPUC approval expected by mid-2011. Under the rate structures in place in

Hawaii, The Gas Company expects its utility business will have the ability to pass fluctuations in the cost of feedstock through to its

customers.

SNG Plant and Distribution System (Utility

Business)

The Gas Company manufactures SNG at its

plant located west of the Honolulu business district. The SNG plant has an estimated remaining economic life of approximately 20 years. The economic

life of the plant may be extended with additional capital investment.

A 22-mile transmission pipeline links

the SNG plant to a distribution system that ends at Pier 38 in south Oahu. From Pier 38 a pipeline distribution system consisting of approximately 900

miles of distribution and service pipelines takes the gas to customers. Additionally, LPG is trucked to holding tanks on Oahu and shipped by barge to

the neighboring islands where it is distributed via pipelines to utility customers that are not connected to the Oahu SNG pipeline system.

Approximately 90% of the business’ pipeline system is on Oahu.

Distribution System (Non-Utility

Business)

The non-utility business provides gas

on all six primary islands to customers that are not connected to the business’ utility pipeline system. The majority of The Gas Company’s

non-utility customers are on the neighboring islands. LPG is distributed to the neighboring islands by direct deliveries from overseas

suppliers

13

Energy-Related Businesses: The Gas

Company – (continued)

and by barge delivery. The business also owns the infrastructure to distribute LPG to its customers, such as harbor pipelines, trucks, several holding facilities and storage base-yards on Kauai, Maui and Hawaii.

Employees and Management

As of December 31, 2010, The Gas

Company had 315 employees, of which 213 are unionized. The unionized employees are subject to a collective bargaining agreement that expires on April

30, 2013. The business believes it has a good relationship with the union and there have been no major disruptions in operations due to labor matters

for over 30 years. Management of the business is headquartered in Honolulu, Oahu with branch office management at operating locations.

Environmental Matters

Environmental

Permits: Gas manufacturing requires environmental operating permits. The most significant are air and wastewater permits

that are required for the SNG plant. The Gas Company is in compliance in all material respects with all applicable provisions of these

permits.

Environmental

Compliance: The business believes that it is in compliance in all material respects with applicable state and federal

environmental laws and regulations. Under normal operating conditions, its facilities do not generate hazardous waste. Hazardous waste, when produced,

poses little ongoing risk to the facilities from a regulatory standpoint because SNG and LPG dissipates quickly if released.

District Energy

Business Overview

Through December 22, 2009, District

Energy consisted of a 100% ownership of Thermal Chicago and a 75% interest in Northwind Aladdin and all of the senior debt of Northwind Aladdin. The

remaining 25% equity interest in Northwind Aladdin is owned by Nevada Electric Investment Company, or NEICO, an indirect subsidiary of NV Energy, Inc.

On December 23, 2009, we sold 49.99% of our membership interests in District Energy to John Hancock Life Insurance Company and John Hancock Life

Insurance Company (U.S.A.) (collectively “John Hancock”) for $29.5 million. The financial results discussed below reflect 100% of District

Energy’s full year performance.

District Energy operates the largest

district cooling system in the United States. The system currently serves approximately 100 customers in downtown Chicago under long-term contracts and

one customer outside the downtown area. District Energy produces chilled water at five plants located in downtown Chicago and distributes it through a

closed loop of underground piping for use in the air conditioning systems of large commercial, retail and residential buildings in the central business

district. The first of the plants became operational in 1995, and the most recent came on line in June 2002. With modifications made in 2009, the

downtown system has the capacity to produce approximately 92,000 tons of chilled water, although it has approximately 103,000 tons of cooling under

contract. The business is able to sell continuous service capacity in excess of the total system capacity because not all customers use their full

capacity at the same time.

District Energy also owns a

site-specific heating and cooling plant that serves a single customer in Chicago outside the downtown area. This plant has the capacity to produce

4,900 tons of cooling and 58 million British Thermal Units, or BTUs, of heating per hour.

District Energy’s Las Vegas

operation owns and operates a stand-alone facility that provides cold and hot water (for chilling and heating, respectively) to three customers in Las

Vegas, Nevada. These customers consist of a resort and casino, a condominium that began receiving full service in February 2010 and a shopping complex.

The three customers represent approximately 48%, 45% and 7% of the Las Vegas operation’s cash flows, respectively. All three Las Vegas contracts

expire in February 2020. The Las Vegas operation represented approximately 25% of the cash flows of District Energy in 2010.

14

Energy-Related Businesses: District

Energy – (continued)

Financial information for 100% of this

business is as follows ($ in millions):

| As of, and for the Year Ended, December 31, |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2010 |

2009 |

2008 |

|||||||||||||

Revenue

|

$ | 56.8 | $ | 48.6 | $ | 48.0 | |||||||||

EBITDA

excluding non-cash items |

22.8 | 20.8 | 21.1 | ||||||||||||

Total assets

|

228.5 | 234.8 | 227.1 | ||||||||||||

% of our

consolidated revenue |

6.8 | % | 6.8 | % | 4.9 | % | |||||||||

Industry Overview

District energy systems provide chilled

water, steam and/or hot water from a centralized plant through underground piping for cooling and heating purposes. A typical district energy customer

is the owner/manager of a large office or residential building or facilities such as hospitals, universities or municipal buildings. District energy

systems exist in many major North American and European cities and some have been in operation for over 100 years.

Strategy

District Energy’s strategy is to

position the business in the market as the most effective and value-added method of providing building chilled water such that it attracts and connects

new customers to the system and can invest in further expansion. We believe that District Energy will continue to generate consistent revenue and

stable cash flows as a result of the long-term contractual relationships with its customers and the management team’s proven ability to improve

the operating performance of the business.

Growth: This business intends to grow revenue and profits by marketing its services to developers in the

downtown Chicago market. Its value proposition is centered on high reliability, ease of operation and maintenance. The management team develops and

maintains relationships with property developers, engineers, architects and city planners as a means of keeping District Energy and these attributes

“top of mind” when they select among building cooling systems and services.

Business

Management: The business focuses on minimizing the cost of electricity consumed per unit of chilled water produced by its

plants. District Energy is able to maintain and potentially increase its competitive advantage over self cooling by consuming electricity efficiently.

District Energy has the ability to create ice during off-peak hours when electricity costs are typically lower. District Energy uses the cold energy in

the ice to produce chilled water during the day when electricity prices are typically higher. The resulting cost savings are passed through to its

customers.

System

Expansion: Since our acquisition in 2004, system modifications and expansion at the business’ plants have increased

total cooling capacity by approximately 15,000 tons or 15%. Projects currently under development will further expand the system capability and

accommodate an expected increase in demand for district cooling in Chicago.

Operations

Maintenance is typically performed by

qualified contract personnel and off-season maintenance is performed by a combination of plant staff and contract personnel. The majority of preventive

maintenance is conducted off-season.

15

Energy-Related Businesses: District

Energy – (continued)

Customers

District Energy currently serves

approximately 100 customers in downtown Chicago and one outside the downtown area. Its customer base is diverse and consists of retail stores, office

buildings, residential buildings, theaters and government facilities. Office and commercial buildings constitute approximately 70% of its customer

base. No one customer accounts for more than 10% of total contracted capacity at December 31, 2010.

The business typically enters into

contracts with the owners of the buildings to which the chilled water service is provided. The weighted average life of customer contracts as of

December 31, 2010 is approximately 9 years. The majority require a termination payment if a customer wishes to terminate a contract early or if the

business terminates the contract for customer default. The termination payment allows the business to recover the remaining capital that it invested to

provide service to the customer.

Customers pay two charges to receive

chilled water services: a fixed capacity charge and a variable consumption charge. The capacity charge is a fixed monthly amount based on the maximum

number of tons of chilled water that the business has contracted to make available to the customer at any point in time whether they use it or not. The

consumption charge is a variable amount based on the volume of chilled water actually used during a billing period.

Contractual adjustments to the capacity

charge and consumption charge occur periodically, typically annually. Capacity charges generally increase at a fixed rate or are indexed to the

Consumer Price Index, or CPI, as a broad measure of inflation. Consumption payments generally increase in line with a number of indices that reflect

the cost of electricity, labor and other input costs relevant to the operations of the business. The largest and most variable direct expense of the

operation is electricity. District Energy passes through to its customers changes in electricity costs. The business focuses on minimizing the cost of

electricity consumed per unit of chilled water produced by operating its plants to maximize efficient use of electricity.

Seasonality

Consumption revenue is higher in the

summer months when the demand for chilled water is at its highest. Approximately 80% of consumption revenue is received in the second and third

quarters combined each year.

Competition

District Energy is not subject to

substantial competitive pressures. Customers are generally not allowed to cool their premises by means other than the chilled water service the

business provides. In addition, the primary alternative available to building owners is the installation of a stand-alone water chilling system

(self-cooling). While competition from self-cooling exists, the business expects that the vast majority of its current contracts will be renewed at

maturity. Installation of a water chilling system can require significant building reconfiguration as well as space for reconfiguration, and capital

expenditure, whereas District Energy has the advantage of economies of scale in terms of efficiency, staff and electricity

procurement.

District Energy believes competition

from an alternative district energy system in the Chicago downtown market is unlikely. There are significant barriers to entry including the

considerable capital investment required, the need to obtain City of Chicago consent and the difficulty in obtaining sufficient customers given the

number of buildings in downtown Chicago already committed under long-term contracts to use its system.

City of Chicago Use Agreement

The business is not subject to specific

government regulation, but its downtown Chicago system operates under the terms of a Use Agreement with the City of Chicago. The Use Agreement

establishes the rights and obligations of District Energy and the City of Chicago with respect to its use of the public ways. Under the Use Agreement,

the business has a non-exclusive right to construct, install, repair, operate and maintain the

16

Energy-Related Businesses: District

Energy – (continued)

plants, facilities and piping essential in providing district cooling chilled water service to customers. During 2008, the Chicago City Council extended the term of the Use Agreement for an additional 20 years until December 31, 2040. Any proposed renewal, extension or modification of the Use Agreement will be subject to the approval by the City Council of Chicago.

Management

The day-to-day operations of District

Energy are managed by a team located in Chicago, Illinois. The management team has a broad range of experience that includes engineering, construction

and project management, business development, operations and maintenance, project consulting, energy performance contracting and retail electricity

sales. The team also has significant financial and accounting experience.

The business is governed by a board of

directors on which we have three representatives and our co-shareholder has two. Although we control decisions that require a simple majority, certain

issues require super majority approval including sale or other disposal of all or substantially all of the business’ property or assets, entry

into a new line of business, modifications of constituent or governing documents and pursuit of an initial public offering of any membership

interests.

Employees

As of December 31, 2010, District

Energy had 40 full-time employees and one part-time employee. In Chicago, 27 plant staff members are employed under a three-year collective bargaining

agreement expiring on January 14, 2012. In Las Vegas, 6 plant staff members are employed under a four-year labor agreement expiring on March 31, 2013.

We believe employee relations at District Energy are good.

Aviation-Related Business

Atlantic Aviation

Business Overview

The business, Atlantic Aviation,

operates fixed-based operations, or FBOs, at 66 airports and one heliport throughout the United States. Atlantic Aviation’s FBOs provide fueling

and fuel-related services, aircraft parking and hangar services to owners/operators of jet aircraft, primarily in the general aviation sector of the

air transportation industry, but also commercial, military, freight and government aviation customers.

Financial information for this business

is as follows ($ in millions):

| As of, and for the Year Ended, December 31, |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2010 |

2009 |

2008 |

|||||||||||||

Revenue

|

$ | 573.4 | $ | 486.1 | $ | 716.3 | |||||||||

EBITDA

excluding non-cash items |

117.5 | 106.5 | 137.1 | ||||||||||||

Total assets

|

1,410.1 | 1,473.2 | 1,660.8 | ||||||||||||

% of our

consolidated revenue |

68.2 | % | 68.5 | % | 73.3 | % | |||||||||

Industry Overview

FBOs predominantly service the general

aviation segment of the air transportation industry. General aviation includes corporate and leisure flying and does not include commercial air

carriers or military operations. Local airport authorities, the owners of the airport property, grant FBO operators the right to provide fueling and

other services pursuant to a long-term ground lease. Fuel sales provide the majority of an FBO’s revenue and gross profit.

17

Aviation-Related Business: Atlantic

Aviation – (continued)

FBOs generally operate in environments

with high barriers to entry. Airports often have limited physical space for additional FBOs. Airport authorities generally do not have an incentive to

add additional FBOs unless there is a significant demand for additional capacity, as profit-making FBOs are more likely to reinvest in the airport and

provide a broad range of services, thus attracting increased airport traffic. The increased traffic tends to generate additional revenue for the

airport authority in the form of landing and fuel flowage fees. Government approvals and design and construction of a new FBO can also take significant

time.

Demand for FBO services is driven by

the level of general aviation aircraft activity. General aviation activity level can be measured by the number of take-offs and landings in a given

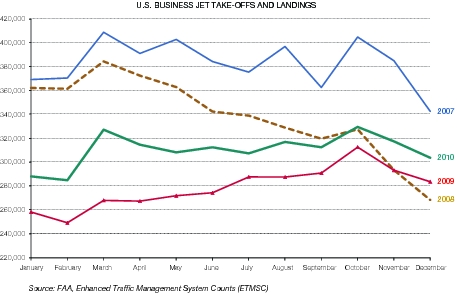

period. General aviation business jet take-offs and landings increased in 2010. According to flight data reported by the Federal Aviation

Administration, or “FAA”, take-offs and landings increased 6.9% and 11.3% in the fourth quarter and the year ended December 31, 2010,

respectively, as compared to the prior comparable periods. However, as stated by the FAA on their website, the data has several limitations and

challenges. Nonetheless, the business believes it is a useful directional tool to assess trends in the general aviation sector. The business believes

business jet traffic will continue to expand if economic activity continues to recover.

Strategy

Atlantic Aviation is pursuing a

strategy that has five principal components. The first component encompasses an overarching commitment to provide superior service and safety to its

customers. The second component is to continue to reduce debt. The third component addresses organic growth of the business and focuses on leveraging

the size of the Atlantic Aviation network and its information technology capabilities to identify marketing leads and implement cross-selling

initiatives. The fourth is to aggressively manage the business so as to minimize, to the extent possible, its operating expenses. The fifth is to

optimize the portfolio through selective site acquisition and divestitures. These components are discussed in greater detail in the Operations

and Marketing sections below.

18

Aviation-Related Business: Atlantic

Aviation – (continued)

Operations

The business has high-quality

facilities and focuses on attracting customers who desire a high level of personal service. Fuel and fuel-related services generated 79% of Atlantic

Aviation’s revenue and accounted for 65% of Atlantic Aviation’s gross profit in 2010. Other services, including de-icing, aircraft parking,

hangar rental and catering, provided the balance. Fuel is stored in fuel tank farms and each FBO operates refueling vehicles owned or leased by the

FBO. The FBO either owns or has access to the fuel storage tanks to support its fueling activities. At some of Atlantic Aviation’s locations,

services are also provided to commercial carriers. These may include refueling from the carrier’s own fuel supplies stored in the carrier’s

fuel farm, de-icing and/or ground and ramp handling services.

Atlantic Aviation buys fuel at a

wholesale price and sells fuel to customers at a contracted price, or at a price negotiated at the point of purchase. While fuel costs can be volatile,

Atlantic Aviation generally passes fuel cost changes through to customers and attempts to maintain and, when possible, grow a dollar-based margin per

gallon of fuel sold. Atlantic Aviation also fuels aircraft with fuel owned by other parties and charges customers a service fee.

Atlantic Aviation has limited exposure

to commodity price risk as it generally carries a limited inventory of jet fuel on its books and passes fluctuations in the wholesale cost of fuel

through to its customers.

Atlantic Aviation is particularly

focused on managing costs effectively. In light of the recent slowdown in general aviation activity, initiatives have been implemented that have

reduced operating costs by more than $30.0 million per year. These cost savings did not impair Atlantic’s ability to continue to deliver superior

customer service. Atlantic Aviation will continue to evaluate opportunities to reduce expenses through, for example, business reengineering, more

efficient purchasing and capturing synergies resulting from acquisitions.

Atlantic Aviation has recently

completed a strategic review of its portfolio of FBOs. During this process, the business concluded that several of its sites did not have sufficient

scale or serve a market with sufficiently strong growth prospects to warrant continued operations at these sites. As a result, Atlantic Aviation has

undertaken to exit certain markets and redeploy resources that may be made available in the process into markets which it views as having better growth

profiles. Consistent with this, Atlantic Aviation anticipates opening a new FBO that is currently under construction at Will Rogers Airport in Oklahoma