UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

February 23, 2011

(Date of earliest event reported)

LABORATORY CORPORATION OF

AMERICA HOLDINGS

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

1-11353

|

13-3757370

|

||

|

(State or other jurisdiction of Incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

|

358 South Main Street,

|

||||

|

Burlington, North Carolina

|

27215

|

336-229-1127

|

||

|

(Address of principal executive offices)

|

(Zip Code)

|

(Registrant’s telephone number including area code)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

[ ]

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 7.01

|

Regulation FD Disclosure

|

Summary information of the Company in connection with non-deal related meetings at Barclays Capital in New York, NY on February 24, 2011.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

LABORATORY CORPORATION OF AMERICA HOLDINGS

Registrant

|

By:

|

/s/ F. SAMUEL EBERTS III

|

|

|

F. Samuel Eberts III

|

||

|

Chief Legal Officer and Secretary

|

February 23, 2011

February 24, 2011

New York, NY

Barclays Capital

NDR

2

This slide presentation contains forward-looking

statements which are subject to change based

on various important factors, including without

limitation, competitive actions in the marketplace

and adverse actions of governmental and other

third-party payors.

statements which are subject to change based

on various important factors, including without

limitation, competitive actions in the marketplace

and adverse actions of governmental and other

third-party payors.

Actual results could differ materially from those

suggested by these forward-looking statements.

Further information on potential factors that

could affect the Company’s financial results is

included in the Company’s Form 10-K for the

year ended December 31, 2009, and

subsequent SEC filings, and will be available in

the Company’s Form 10-K for year ended

December 31, 2010, when filed.

suggested by these forward-looking statements.

Further information on potential factors that

could affect the Company’s financial results is

included in the Company’s Form 10-K for the

year ended December 31, 2009, and

subsequent SEC filings, and will be available in

the Company’s Form 10-K for year ended

December 31, 2010, when filed.

Forward Looking Statement

Introduction

3

Leading National

Lab Provider

• Fastest growing national lab

• $55 billion market

• Clinical, Anatomic and Genomic Testing

• Serving clients in all 50 states and Canada

• Foremost clinical trials testing business

Introduction

4

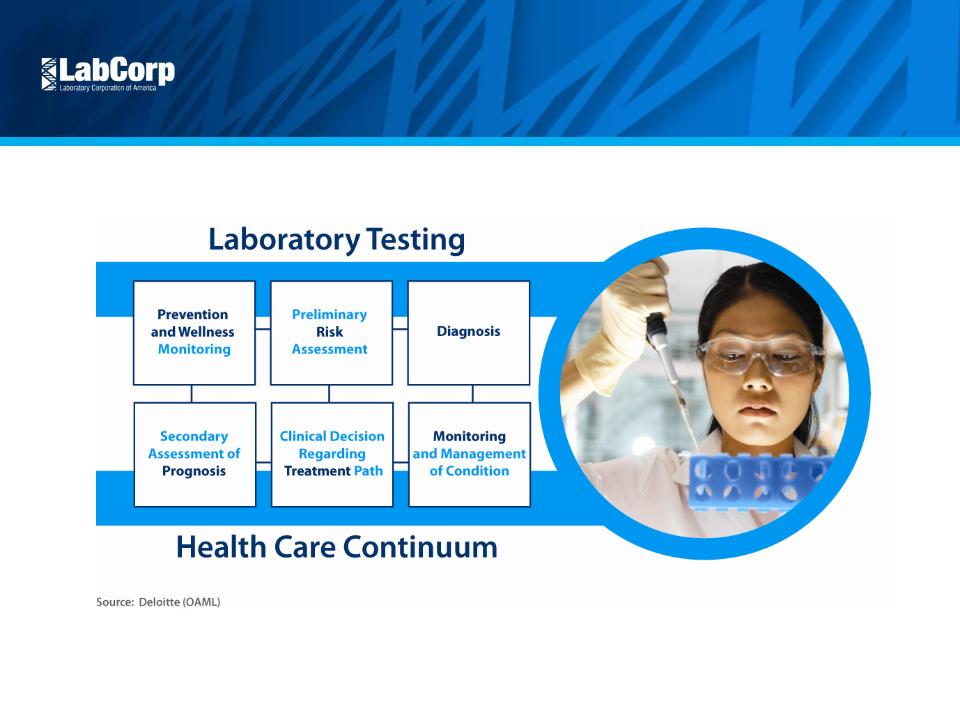

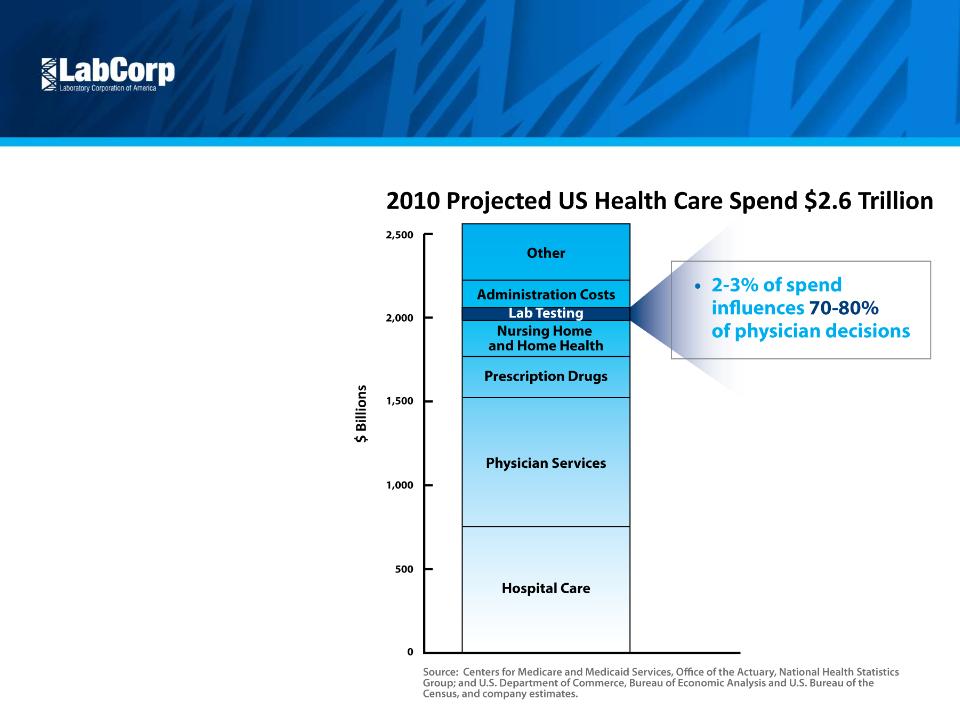

Valuable Service

• Small component of total cost

influences large percentage

of clinical decisions

• Screening, early detection,

and monitoring reduce

downstream costs

• Companion diagnostics

improve drug efficacy and

reduce adverse drug effects

Attractive Market

5

Attractive Market

6

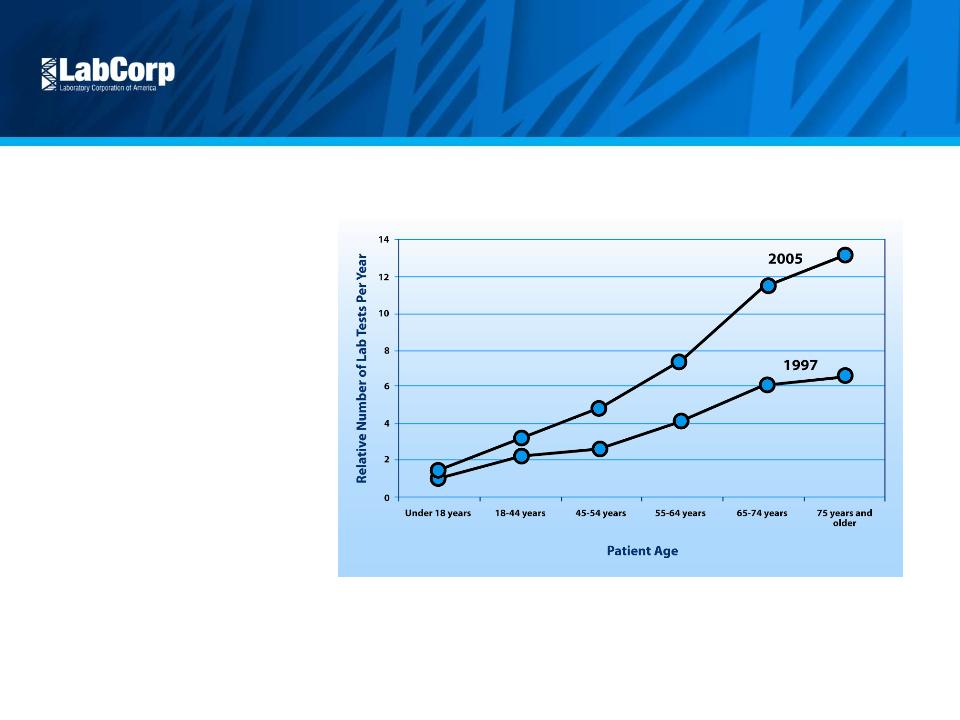

Growth Drivers

• Aging population

• Industry consolidation

• Advances in genomics

• Pharmacogenomics /

companion diagnostics

• Cost pressures

Source: CDC National Ambulatory Medical Care Survey and Company Estimates

Attractive Market

7

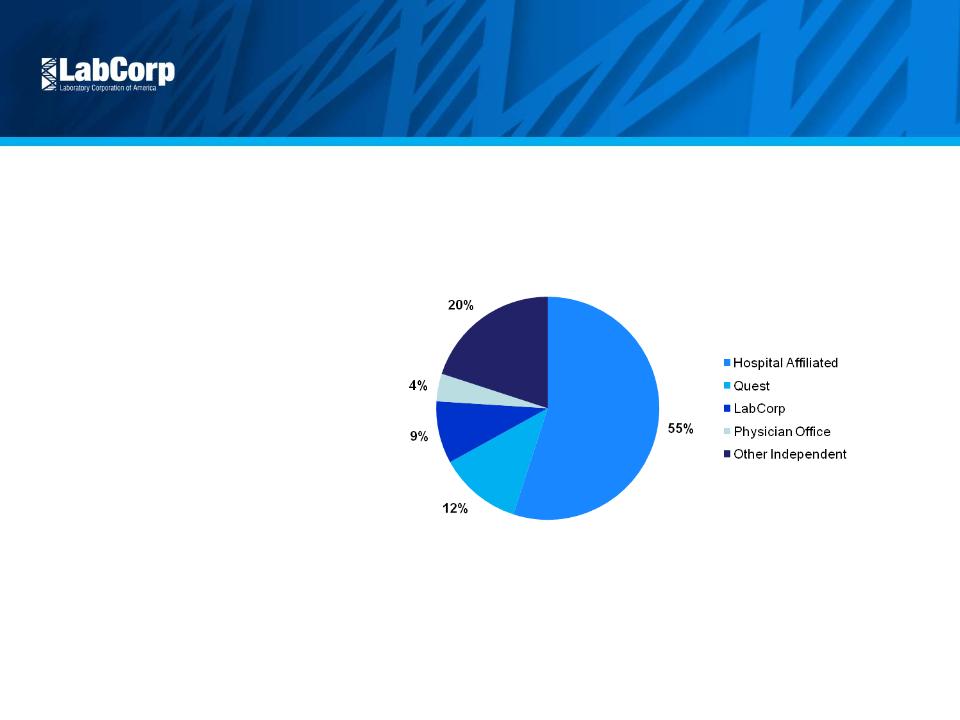

Opportunity to

Take Share

• Approximately 5,000

independent labs

• Less efficient, higher cost

competitors

Source: Washington G-2 Reports and Company estimates

$55 Billion US Lab Market

Attractive Market

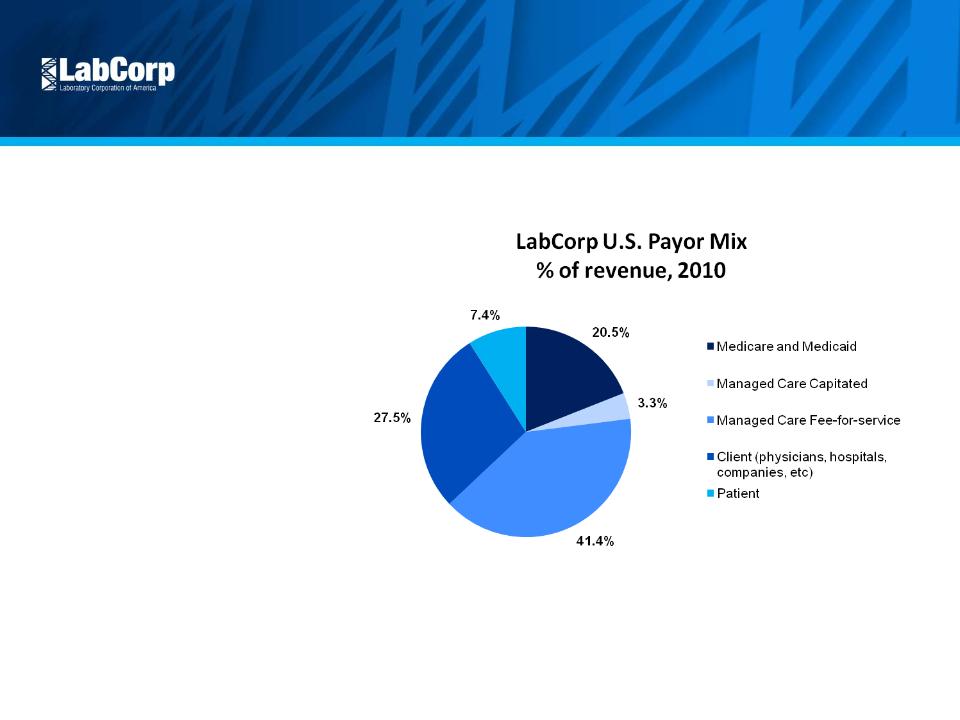

Diversified Payor Mix

• No customer > 9% of revenue

• Limited government exposure

8

Attractive Market

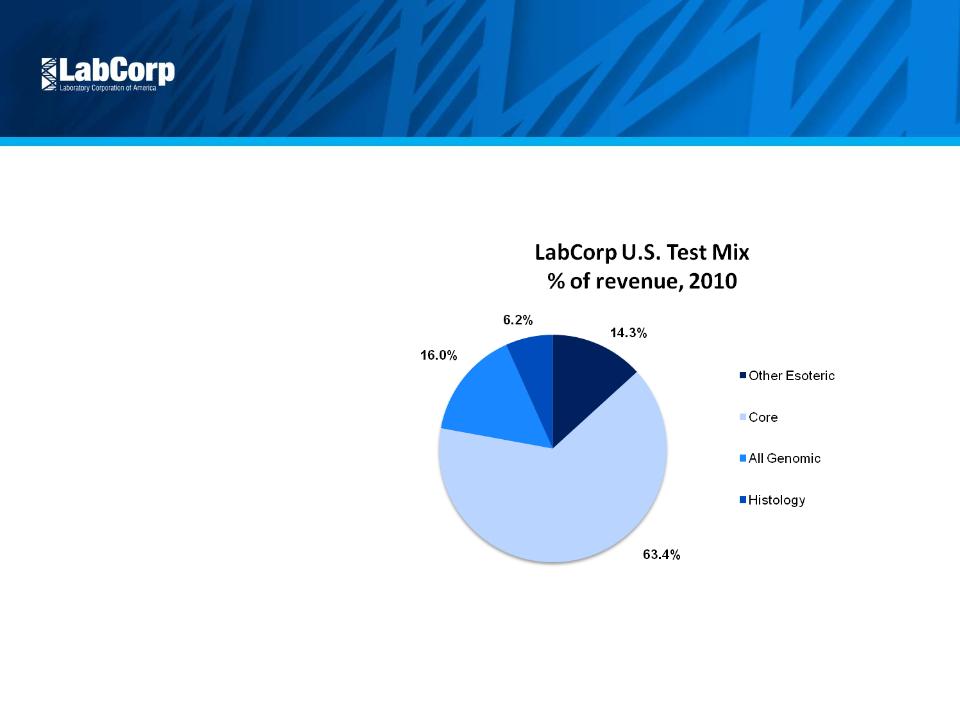

Diversified Test Mix

With Genzyme GeneticsSM*

acquisition, esoteric testing

comprises approximately

40% of revenue

9

*GENZYME GENETICSSM and its logo are trademarks of Genzyme Corporation and used by Esoterix Genetic Laboratories,

LLC, a wholly-owned subsidiary of LabCorp, under license. Esoterix Genetic Laboratories and LabCorp are operated

independently from Genzyme Corporation.

LLC, a wholly-owned subsidiary of LabCorp, under license. Esoterix Genetic Laboratories and LabCorp are operated

independently from Genzyme Corporation.

Competitive Position

Scale and Scope

• National infrastructure

• Broad test offering

• Managed care contracts

• Economies of scale

10

Primary LabCorp Testing Locations*

Esoteric Lab Locations

(CET, CMBP, Dianon, Esoterix, Monogram Biosciences, NGI, OTS, US Labs, Viromed)

Patient Service Centers*

Competitive Position

11

Managed Care Relationships

• Exclusive national laboratory for UnitedHealthcare

• Sole national strategic partner for WellPoint

• Significant national plans recently renewed or

extended on a multi-year basis, including

WellPoint, Cigna and Humana

• Contracted with numerous local and

regional anchor plans

Scientific

Leadership

• Introduction of new tests

• Acquisitions and licensing

• Collaborations with leading

companies and academic

institutions

Competitive Position

12

|

Partner

|

Clinical Area

|

|

ARCA biopharma

|

Companion Diagnostics (Cardiovascular Disease)

|

|

BG Medicine

|

Cardiovascular Disease

|

|

Celera Diagnostics

|

Breast Cancer

|

|

Duke University

|

Joint Venture in biomarker development

|

|

Duke University

|

Lung Cancer

|

|

Exact Sciences

|

Colon Cancer

|

|

Intema Ltd.

|

Prenatal Testing

|

|

Johns Hopkins

|

Melanoma

|

|

MDxHealth

|

Companion Diagnostics (Oncology)

|

|

Medco Health Solutions

|

Companion Diagnostics (Research)

|

|

Merck

|

Companion Diagnostics (Infectious Disease)

|

|

On-Q-ity

|

Circulating tumor cells

|

|

University of Minnesota

|

Lupus

|

|

Veridex

|

Prostate Cancer

|

|

Yale University

|

Ovarian Cancer (exclusive)

|

Competitive Position

13

Most Efficient and

Lowest Cost Provider

Lowest Cost Provider

• Standardized lab and billing IT systems

• Automation of pre-analytics

• Supply chain optimization

• Sysmex fully automated hematology

operations

• Gross margin improvement

• Bad debt reduction of 50bp in 2010

2010 Accomplishments

14

Our Results

• Profitable revenue growth

• Empire contract

• Esoteric growth

• Acquisitions

• Improved IT and client connectivity

• LabCorp Beacon

• Enhanced experience

for physicians and patients

• Continued scientific leadership

• Clearstone collaboration

• IL-28B

• New Monogram assays

• Maintained price

• Managed care stability

• Strong 2010 results

2011 Priorities

15

Our Focus

• Operating objectives

• Genzyme Genetics integration

• LabCorp Beacon rollout

• Continue scientific leadership

• Financial objectives

• Profitable revenue growth

• Maintain price

• Control costs

2011 Priorities - Genzyme Genetics Integration

16

Acquisition Rationale

• Creates the premier genetics and

oncology business in the industry

• Builds on our strategy of leadership in

personalized medicine

• Generates revenue opportunities

• Selling LabCorp’s test menu to

Genzyme Genetics accounts

• Selling Genzyme Genetics’ test menu to

LabCorp accounts

• Genzyme Genetics customer access to

LabCorp’s convenient PSC network

• Expanded use of genetic counselors

• Creates cost synergies

• Logistics

• Specimen collection

• G&A

• Facility overlap

2011 Priorities - Genzyme Genetics Integration

Increasing Importance

of Genetics

• Preconception

• Pre - and post - natal

• Identification of disease carriers

• Identification of disease predisposition

• Diagnosis of genetically caused or

influenced conditions (e.g., developmental delay)

• Disease prognosis and treatment

(especially cancer)

17

2011 Priorities - Genzyme Genetics Integration

Increasing Importance

of Oncology

• More sophisticated methods of cancer

testing complement traditional biopsies

• Value of diagnostics for disease prognosis,

and monitoring of progression

and recurrence

• Critical role of testing in therapy

selection

18

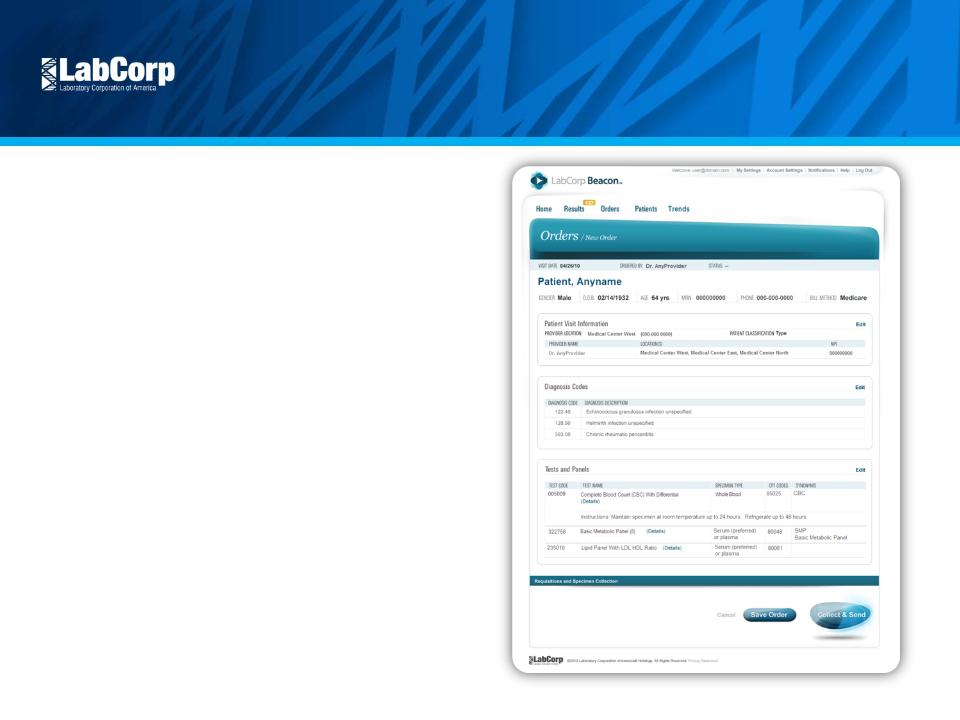

2011 Priorities - Beacon Rollout

19

Intuitive Order Entry

•Streamlined Ordering

Provider, Diagnosis, Test and

Collection information are all displayed

in a single screen

Provider, Diagnosis, Test and

Collection information are all displayed

in a single screen

•Requisition and Account Logic

Automatically generates requisitions

with appropriate account numbers

Automatically generates requisitions

with appropriate account numbers

•Key Time-saving Features

• Send to PSC

• Standing orders

• Electronic add-on testing

• User-defined pick lists

2011 Priorities - Beacon Rollout

20

AccuDraw Integration

•Reduce Errors

•Reduce Training Time

•Proven Results

Success in LabCorp Patient Service

Centers will be extended to

customers

Success in LabCorp Patient Service

Centers will be extended to

customers

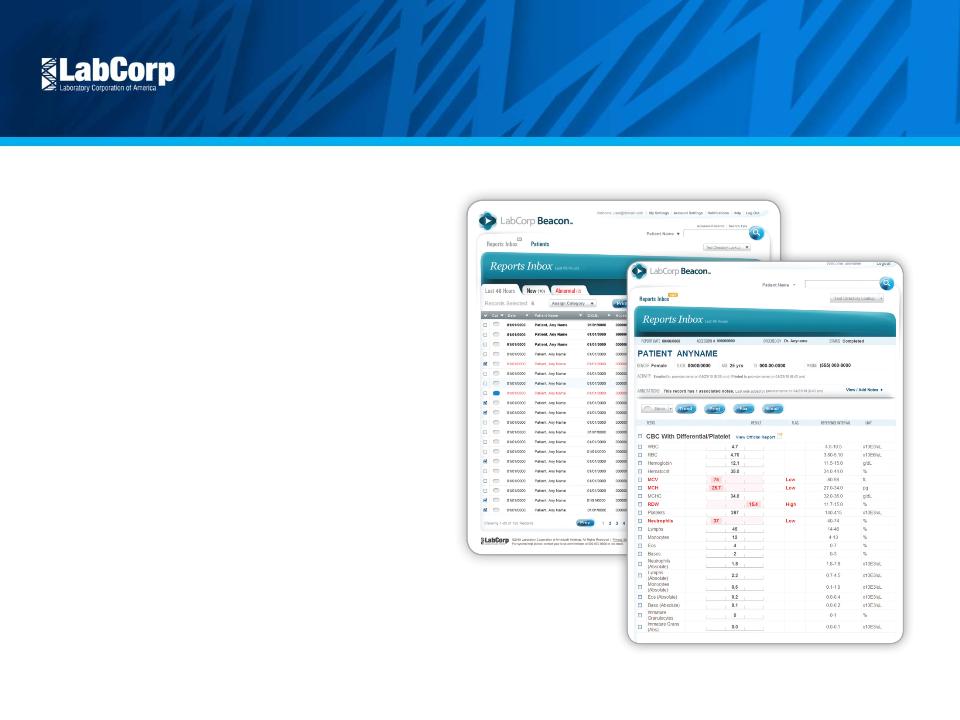

2011 Priorities - Beacon Rollout

21

Unified Results

•Centralizes Lab Connectivity

View lab reports from DIANON

Systems, Esoterix, LabCorp,

Litholink, USLabs, and CMBP

View lab reports from DIANON

Systems, Esoterix, LabCorp,

Litholink, USLabs, and CMBP

•Share Results

Email, fax, print and annotations

make it easy to share critical

information

Email, fax, print and annotations

make it easy to share critical

information

•Visual Cues

Supports physician decision making,

enhances the timeliness of patient

care and facilitates follow-up with

abnormal results in red and unread

reports in bold

Supports physician decision making,

enhances the timeliness of patient

care and facilitates follow-up with

abnormal results in red and unread

reports in bold

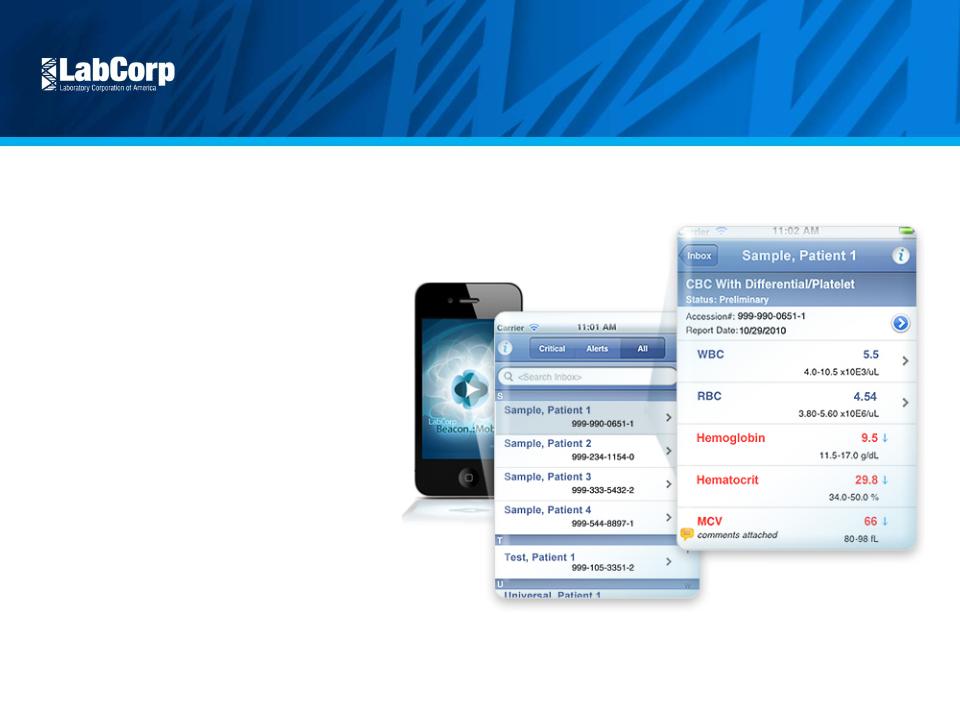

2011 Priorities - Beacon Rollout

22

Results on the Go

•Clear, Concise Reports

Physicians and staff can quickly

access results via iPhone® or

iPad™ including alerts for abnormal

or critical lab results

Physicians and staff can quickly

access results via iPhone® or

iPad™ including alerts for abnormal

or critical lab results

•Connect to Patients

Access patient demographics

directly from the results for phone or

email follow up

Access patient demographics

directly from the results for phone or

email follow up

2011 Priorities - Beacon Rollout

23

Trends & Analytics

•One-Click Trending

Physicians and staff can quickly view

a single test or analyte for one

patient and the trended history for

that patient

Physicians and staff can quickly view

a single test or analyte for one

patient and the trended history for

that patient

•Sort and Filter Results

Providers can filter their entire

patient population on

demographics and test results to

identify trends and patients at risk

Providers can filter their entire

patient population on

demographics and test results to

identify trends and patients at risk

•View Lab History

2011 Priorities - Scientific Leadership

24

“K-RAS testing should be routinely conducted in

all colorectal cancer patients immediately after

diagnosis to ensure the best treatment strategies

for the individual Patient”

all colorectal cancer patients immediately after

diagnosis to ensure the best treatment strategies

for the individual Patient”

- Dr. Eric Van Cutsem, presenter at the June 2008 American

Society of Clinical Oncology meeting

FDA recommends genetic screening prior to

treatment with Abacavir

treatment with Abacavir

ROCKVILLE, Md -- July 24, 2008 -- The US Food and Drug Administration (FDA) has

issued an alert regarding serious, and sometimes fatal, hypersensitivity reactions (HSRs)

caused by abacavir (Ziagen) therapy in patients with a particular human leukocyte antigen

(HLA) allele, HLA-B* 5701.

issued an alert regarding serious, and sometimes fatal, hypersensitivity reactions (HSRs)

caused by abacavir (Ziagen) therapy in patients with a particular human leukocyte antigen

(HLA) allele, HLA-B* 5701.

Genetic tests for HLA-B*5701 are already available, and all patients should be screened for

the HLA-B*5701 allele before starting or restarting treatment with abacavir or abacavir-

containing medications.

the HLA-B*5701 allele before starting or restarting treatment with abacavir or abacavir-

containing medications.

“FDA has approved the expanded use of

Selzentry… to include adult patients with CCR5-

tropic HIV-1 virus who are starting treatment for

the first time.”

Selzentry… to include adult patients with CCR5-

tropic HIV-1 virus who are starting treatment for

the first time.”

- ViiV Healthcare Press Release, November 20th, 2009

Continue Scientific

Leadership

• Recent offerings in companion

diagnostics and personalized medicine

• IL-28B

• K-RAS

• HLA-B* 5701

• BRAF Gene Mutation Detection

• EGFR Mutation Analysis

• CYP 450 2C19

• Trofile® (CCR5 Tropism)

• PhenoSense®, PhenoSense GT®

• HERmark®

• Outcome Improvement Programs

• CKD program

• Litholink kidney stone program

• Clearstone collaboration

• Global clinical trials capability

• Presence in China

Excellent Performance

25

Revenue and

EPS Growth

• 6-year revenue CAGR of

approximately 8.4%

• 6-year Adjusted EPS CAGR

of approximately 14.6%

Revenue and Adjusted EPS Growth: 2004 - 2010 (1) (2)

(1) Excluding the $0.09 per diluted share impact in 2005 of restructuring and other special charges, and a

non-recurring investment loss; excluding the $0.06 per diluted share impact in 2006 of restructuring

and other special charges; excluding the $0.25 per diluted share impact in 2007 of restructuring and

other special charges; excluding the $0.44 per diluted share impact in 2008 of restructuring and other

special charges; excluding the ($0.09) per diluted share impact in 2009 of restructuring and other

special charges; excluding the ($0.17) per diluted share impact in 2010 of restructuring and other

special charges.

non-recurring investment loss; excluding the $0.06 per diluted share impact in 2006 of restructuring

and other special charges; excluding the $0.25 per diluted share impact in 2007 of restructuring and

other special charges; excluding the $0.44 per diluted share impact in 2008 of restructuring and other

special charges; excluding the ($0.09) per diluted share impact in 2009 of restructuring and other

special charges; excluding the ($0.17) per diluted share impact in 2010 of restructuring and other

special charges.

(2) EPS, as presented represents adjusted, non-GAAP financial measures. Diluted EPS, as reported in

the Company’s Annual Report were: $2.45 in 2004; $2.71 in 2005; $3.24 in 2006; $3.93 in 2007; $4.26

in 2008; $4.98 in 2009; and $5.29 in 2010

the Company’s Annual Report were: $2.45 in 2004; $2.71 in 2005; $3.24 in 2006; $3.93 in 2007; $4.26

in 2008; $4.98 in 2009; and $5.29 in 2010

Excellent Performance

26

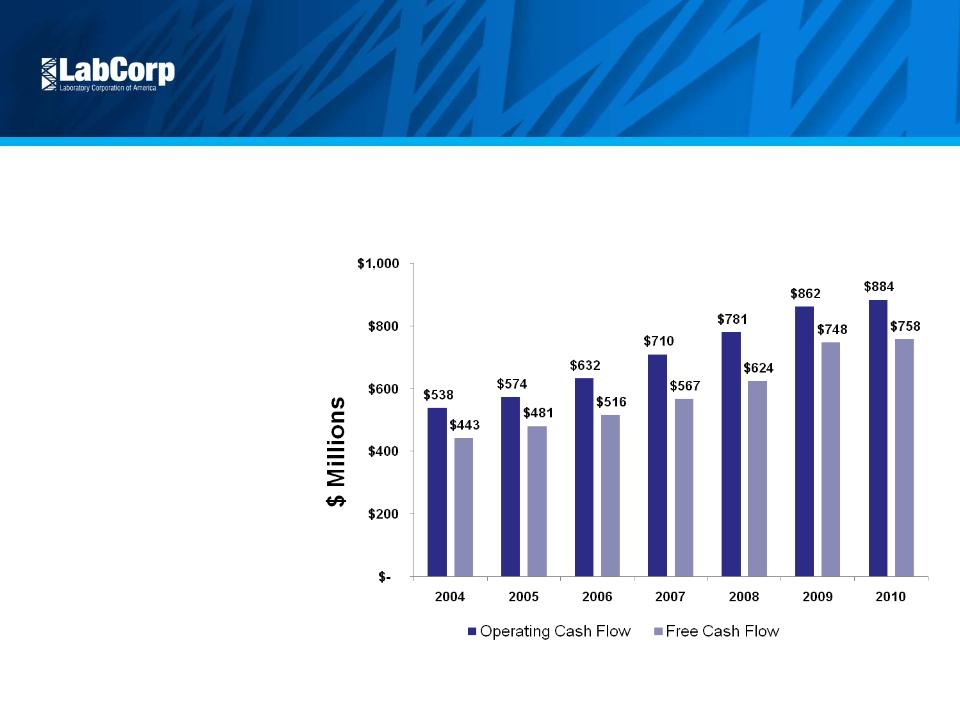

Cash Flow

• 6-year FCF CAGR of 9.4%

• Strategic acquisitions

• $2.0 B+ share repurchase

over last three years

Note: $ in millions and Free Cash Flow is a non-GAAP metric

Excellent Performance

27

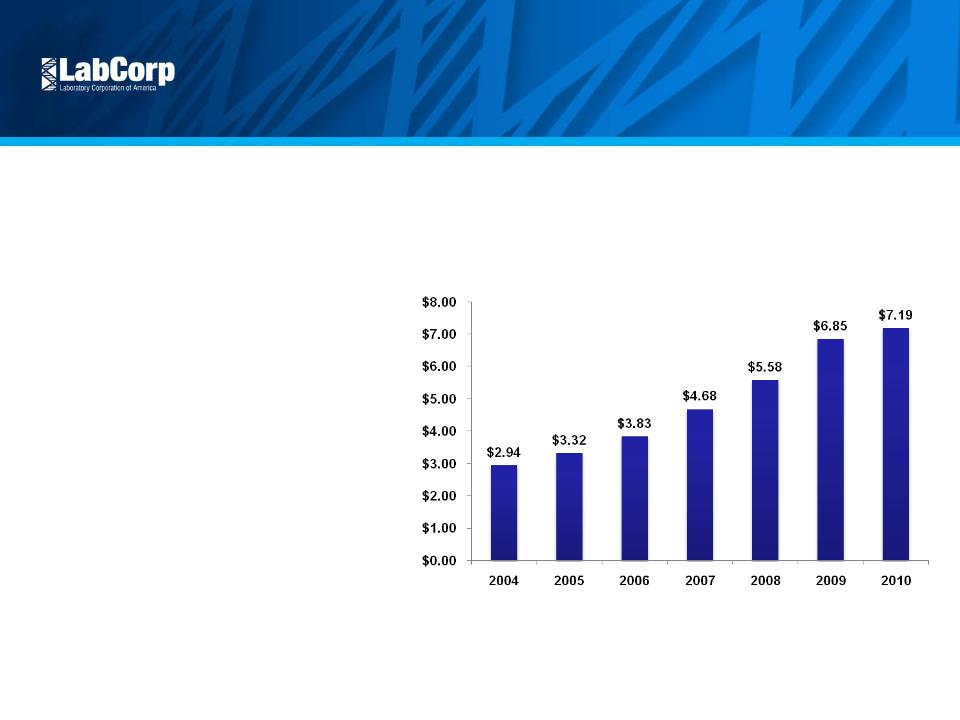

Free Cash Flow Per Share

• 6-year FCF Per Share CAGR of 16.1%

• FCF Yield ranged from approximately

8% to 10% in 2010

Note: Free Cash Flow Per Share and Free Cash Flow Yield are non-GAAP metrics

FCF Yield range noted above was calculated using trailing twelve month Free Cash Flow, weighted average diluted share counts and

closing stock prices during 2010

Fourth Quarter and Full Year 2010 Results

28

(1) During the first quarter of 2010 inclement weather reduced revenue by an estimated $23 million and EPS by approximately eight cents

|

|

Three Months Ended

Dec 31, |

|

|

|

|

|

Twelve Months Ended

Dec 31, |

|

|

|

|

||||

|

|

2010

|

|

2009

|

|

+/(-)

|

|

|

|

2010

|

|

2009

|

|

+/(-)

|

|

|

|

Revenue

|

$1,295.40

|

|

$1,165.10

|

|

11.2%

|

|

|

|

$5,003.90

|

|

$4,694.70

|

|

6.6%

|

|

|

|

Adjusted Operating Income (1)

|

$252.40

|

|

$221.90

|

|

13.7%

|

|

|

|

$1,016.50

|

|

$954.90

|

|

6.5%

|

|

|

|

Adjusted Operating Income

Margin (1) |

19.5%

|

|

19.0%

|

|

50 |

bp

|

|

20.3%

|

|

20.3%

|

|

- |

bp

|

||

|

Adjusted EPS (1)

|

$1.34

|

|

$1.16

|

|

15.5%

|

|

|

|

$5.55

|

|

$4.89

|

|

13.5%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Cash Flow

|

$259.20

|

|

$224.70

|

|

15.4%

|

|

|

|

$883.60

|

|

$862.40

|

|

2.5%

|

|

|

|

Less: Capital Expenditures

|

($32.80)

|

|

($37.60)

|

|

-12.8%

|

|

|

|

($126.10)

|

|

($114.70)

|

|

9.9%

|

|

|

|

Free Cash Flow

|

$226.40

|

|

$187.10

|

|

21.0%

|

|

|

|

$757.50

|

|

$747.70

|

|

1.3%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Key Points

• Critical position in health care delivery system

• Attractive market

• Strong competitive position - well positioned to gain share

• Leadership in personalized medicine

• Excellent cash flow

• Strong balance sheet

Conclusion

29

30

Reconciliation of non-GAAP

Financial Measures

|

Reconciliation of non-GAAP Financial Measures

|

|||||

|

(In millions, except per share data)

|

|||||

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended Dec 31,

|

||

|

Adjusted Operating Income

|

|

2010

|

|

2009

|

|

|

|

Operating income

|

|

$ 238.8

|

|

$ 215.8

|

|

|

Restructuring and other special charges (1) (2)

|

|

13.6

|

|

6.1

|

|

|

Adjusted operating income

|

|

$ 252.4

|

|

$ 221.9

|

|

|

|

|

|

|

|

|

Adjusted EPS

|

|

|

|

|

|

|

|

Diluted earnings per common share

|

|

$ 1.26

|

|

$ 1.33

|

|

|

Impact of restructuring and other special charges (1) (2)

|

|

0.08

|

|

(0.17)

|

|

|

Adjusted EPS

|

|

$ 1.34

|

|

$ 1.16

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) During the fourth quarter of 2010, the Company recorded restructuring and other special charges of $13.6 million, consisting of $14.8 million in professional fees and expenses associated with

recent acquisitions, which were offset by a net restructuring credit of $1.2 million resulting from the reversal of unused severance and facility closure liabilities. The after tax impact of these charges decreased net earnings for the three months ended December 31, 2010, by $8.3 million and diluted earnings per share by $0.08 ($8.3 million divided by 104.5 million shares). |

|||||

|

(2) During the fourth quarter of 2009, the Company recorded net charges of $3.3 million ($2.0 million after tax) relating to severance payments for the reduction of certain management positions and

the closing of redundant and underutilized facilities. The Company also adopted amendments to its employee pension plans, effective January 1, 2010, resulting in the recognition of a one-time net curtailment charge of $2.8 million ($1.7 million after tax). In addition, the Company recorded favorable adjustments of $21.5 million to its fourth quarter tax provision relating to the resolution of certain state tax issues under audit, as well as the realization of foreign tax credits. Combined, these net after tax adjustments increased net earnings for the quarter ended December 31, 2009 by $17.8 million and increased diluted earnings per share for the quarter by $0.17 ($17.8 million divided by 107.5 million shares). |

|||||

31

Reconciliation of non-GAAP

Financial Measures

|

Reconciliation of non-GAAP Financial Measures

|

|||||

|

(In millions, except per share data)

|

|||||

|

|

|

|

|

|

|

|

|

|

|

Year Ended Dec 31,

|

||

|

Adjusted Operating Income

|

|

2010

|

|

2009

|

|

|

|

Operating income

|

|

$ 978.8

|

|

$ 935.9

|

|

|

Restructuring and other special charges (1) (2)

|

|

37.7

|

|

19.0

|

|

|

Adjusted operating income

|

|

$ 1,016.5

|

|

$ 954.9

|

|

|

|

|

|

|

|

|

Adjusted EPS

|

|

|

|

|

|

|

|

Diluted earnings per common share

|

|

$ 5.29

|

|

$ 4.98

|

|

|

Impact of restructuring and other special charges (1) (2) (3) (4)

|

|

0.26

|

|

(0.09)

|

|

|

Adjusted EPS

|

|

$ 5.55

|

|

$ 4.89

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) 2010 includes net restructuring and other special charges of $44.7 million ($27.4 million after tax), consisting of $25.7 million in professional fees and expenses associated with recent acquisitions;

$7.0 million in bridge financing fees; and $12.0 million in severance related liabilities associated with workforce reduction initiatives. |

|||||

|

(2) 2009 includes net restructuring charges of $13.5 million ($8.1 million after tax), a one-time charge of $2.8 million ($1.7 million after tax) for curtailment of employee pension plans, and $2.7 million

($1.6 million after tax) transaction fees and expenses associated with the acquisition of Monogram Biosciences. |

|||||

|

(3) In 2009, the Company recorded favorable adjustments of $21.5 million to its fourth quarter tax provision relating to the resolution of certain state tax issues under audit, as well as the realization of

foreign tax credits. In 2008, the Company recorded a $7.1 million reduction to its fourth quarter tax provision as a result of tax treaty amendments with Canada. These adjustments had no impact on operating income, but did increase net earnings by $21.5 million and $7.1 million, respectively. |

|||||

|

(4) 2010: $27.4 million divided by 105.4 million shares

|

|||||

|

2009: $10.1 million divided by 109.1 million shares

|

|||||

Supplemental Financial Information

32

|

Laboratory Corporation of America

|

||||||||||||||||

|

Other Financial Information

|

||||||||||||||||

|

FY 2009 and FY 2010

|

||||||||||||||||

|

($ in millions)

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q1 09

|

|

Q2 09

|

|

Q3 09

|

|

Q4 09

|

|

Q1 10

|

|

Q2 10

|

|

Q3 10

|

|

Q4 10

|

|

Bad debt as a percentage of sales

|

|

5.30%

|

|

5.30%

|

|

5.30%

|

|

5.30%

|

|

5.05%

|

|

4.80%

|

|

4.80%

|

|

4.70%

|

|

Days sales outstanding

|

|

52

|

|

50

|

|

48

|

|

44

|

|

46

|

|

45

|

|

44

|

|

43

|

©2010 LabCorp. All rights reserved. 8026-0210