Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2010

Commission File No. 001-34061

HSN, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 26-2590893 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 1 HSN Drive, St. Petersburg, Florida | 33729 | |

| (Address of principal executive offices) | (Zip Code) | |

(727) 872-1000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of exchange on which registered | |

| Common Stock, par value $0.01 Series A Junior Participating Preferred Stock Purchase Rights |

The NASDAQ Stock Market LLC The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, an Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registration was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company as defined in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | x | Accelerated filer | ¨ | |||||

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the registrant’s outstanding common stock held by non-affiliates as of June 30, 2010 (the registrant’s most recently completed second fiscal quarter), was $928,377,528 (based on a closing price of $24.00 per share for the registrant’s common stock on the NASDAQ Global Select Market).

As of February 1, 2011, the registrant had 58,024,353 shares of common stock, $0.01 par value per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement for the 2011 Annual Meeting of Shareholders to be filed with the U.S. Securities and Exchange Commission no later than 120 days after the end of the registrant’s 2010 fiscal year end are incorporated by reference into Items 10, 11, 12, 13 and 14 of Part III of this Form 10-K.

Table of Contents

| Page | ||||||

| PART I | ||||||

| ITEM 1. | 2 | |||||

| ITEM 1A. | 9 | |||||

| ITEM 1B. | 16 | |||||

| ITEM 2. | 16 | |||||

| ITEM 3. | 16 | |||||

| ITEM 4. | 16 | |||||

| PART II | ||||||

| ITEM 5. | 17 | |||||

| ITEM 6. | 19 | |||||

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

20 | ||||

| ITEM 7A. | 33 | |||||

| ITEM 8. | 34 | |||||

| ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

70 | ||||

| ITEM 9A. | 70 | |||||

| ITEM 9B. | 73 | |||||

| PART III | ||||||

| ITEM 10. | 73 | |||||

| ITEM 11. | 73 | |||||

| ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED SHAREHOLDER MATTERS |

73 | ||||

| ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE |

73 | ||||

| ITEM 14. | 73 | |||||

| PART IV | ||||||

| ITEM 15. | 74 | |||||

Table of Contents

FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K contains certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”), which are based on management’s exercise of business judgment, as well as assumptions made by and information currently available to management. When used in this document, the words “may,” “will,” “anticipate,” “believe,” “estimate,” “expect,” “intend” and words of similar import, are intended to identify any forward-looking statements. These forward-looking statements include, among other things, statements relating to the following: HSNi’s future financial performance, HSNi’s business prospects and strategy, anticipated trends and prospects in the various markets in which HSNi’s businesses operate and other similar matters. These forward-looking statements relate to expectations concerning matters that are not historical fact and are based on management’s current expectations and assumptions about future events, which are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict. Although we believe our expectations are based on reasonable estimates and assumptions, they are not guarantees of performance.

Should one or more of these uncertainties, risks or changes in circumstances materialize, or should underlying assumptions prove incorrect, our actual results could differ materially from those anticipated in these forward-looking statements. Factors that could cause or contribute to such differences include but are not limited to those described under “Risk Factors,” and the following: the continued impact of the current macroeconomic environment on consumer confidence and spending levels; whether national economic stimulus initiatives and measures will be successful in achieving their objectives within the expected timeframes; other changes in political, business and economic conditions, particularly those that affect consumer confidence, consumer spending or internet growth; changes in our relationships with pay television operators, vendors, manufacturers and other third parties; changes in product delivery costs particularly if we are unable to offset them; our ability to offer new or alternative products and services in a cost effective manner and consumer acceptance of these products and services; any technological or regulatory developments that could negatively impact the way we do business, including regulations regarding state and local sales and use taxes; HSNi’s business prospects and strategy, including whether HSNi’s initiatives will be effective; and the loss of any key member of our senior management team. Other unknown or unpredictable factors that could also adversely affect HSNi’s business, financial condition and results of operations may arise from time to time.

You should not place undue reliance on these forward-looking statements. Such forward-looking statements speak only to the date such statements are made and we do not undertake to update, revise or otherwise publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date hereof, or to reflect the occurrence of any unanticipated events. Although we believe that our expectations are based on reasonable assumptions, we can give no assurance that our expectations will materialize. Historical results should not be considered an indication of future performance.

1

Table of Contents

PART I

| ITEM 1. | BUSINESS |

Unless otherwise indicated in this Annual Report or the context otherwise requires, all references in this Annual Report to “HSNi,” the “Company,” “us,” “our” or “we” are to HSN, Inc. and/or its subsidiaries and affiliates.

Business Overview

HSNi is an interactive multi-channel retailer offering retail experiences through various platforms including television, online, mobile, in catalogs and in retail and outlet stores through its two operating segments, HSN and Cornerstone. HSN is a retailer and interactive lifestyle network offering a broad assortment of products primarily through television home shopping programming on the HSN television networks and through its business-to-consumer internet commerce site HSN.com. HSN strives to transform the shopping experience by incorporating experts, entertainment, inspiration, solutions, tips and ideas in connection with the sale of products. Cornerstone comprises home and lifestyle brands, including Frontgate, Ballard Designs, Garnet Hill, Smith+Noble, The Territory Ahead, TravelSmith and Improvements. Cornerstone distributes more than 275 million catalogs annually, operates seven separate internet sites and operates 20 retail and outlet stores.

Our principal offices are located at 1 HSN Drive, St. Petersburg, Florida 33729 and our main telephone number is 727-872-1000.

History

HSNi’s predecessor company began broadcasting television home shopping programming from its studios in St. Petersburg, Florida in 1981 and, by 1985, was broadcasting this programming through a national network of cable and local television stations 24 hours a day, seven days a week. The company continued to broaden its national distribution network through a combination of cable, satellite and broadcast systems and, as of December 31, 2010, the HSN television networks reached approximately 95.9 million residential homes in the United States.

The company began conducting business online in 1994 and formally launched HSN.com, the online shopping portal for the HSN television network, in 1999.

The company acquired Improvements, a catalog featuring thousands of innovative home, patio and outdoor products, in June 2001, and significantly grew its catalogs business through the acquisition of Cornerstone Brands, Inc., with its portfolio of leading print catalogs and related websites, in April 2005.

HSNi was incorporated in Delaware in May 2008 in connection with the spin-off of several businesses previously owned by IAC/InterActiveCorp, or IAC. HSNi was generally formed to hold HSN and Cornerstone, the businesses that previously comprised most of IAC’s retailing segment and are referred to herein as the “HSNi Businesses.” The spin-off from IAC occurred on August 20, 2008 concurrent with the spin-offs from IAC of Interval Leisure Group, Inc., Ticketmaster Entertainment, Inc., and Tree.com, Inc. In this Annual Report, we refer to the separation transaction as the “spin-off” and each of these companies as “Spincos.” In connection with the Spin-off, HSNi’s shares began trading on the NASDAQ Global Select Market under the symbol “HSNI.”

What We Do

HSNi markets and sells a wide range of third party and private label merchandise directly to consumers through HSN, which includes the HSN television networks and its related website, HSN.com, as well as through Cornerstone’s portfolio of catalogs and related websites.

2

Table of Contents

HSNi is committed to providing an evolving variety and mix of quality products at reasonable prices and from brands that resonate with its customers. Products offered through HSN include jewelry, fashion (apparel & accessories), beauty & wellness, and home & other (including housewares, home fashions, electronics, fitness and other). Featured products include proprietary label products and third party-branded products, some of which are produced exclusively for HSN, as well as merchandise generally available through other retailers. Cornerstone primarily offers home and outdoor furnishings and casual and leisure apparel with the majority produced exclusively for Cornerstone.

HSN

Overview

HSN includes the HSN television networks; its related website, HSN.com; and a limited number of outlet stores. The HSN television network broadcasts live, customer interactive television home shopping programming 24 hours a day, seven days a week. This programming is intended to promote sales and customer loyalty through a combination of product quality, value and selection, coupled with product information and entertainment. Programming is divided into separately televised segments, each of which has a host who presents and conveys information regarding featured products, sometimes with the assistance of a representative from the product vendor or someone that we retain to aid in the sale of the goods. HSN.com is a business-to-consumer internet commerce site that sells all of the merchandise offered on the HSN television networks, together with complementary products and select merchandise sold exclusively on HSN.com. The HSN strategy continues to focus on defining a clear and differentiated brand and creating an identity for itself as a lifestyle, editorial, programmed commerce network that provides great products with innovative and engaging presentations.

Reach

HSN produces live programming for the HSN television network from its studios in St. Petersburg, Florida, and distributes this programming by means of satellite uplink facilities, which it owns and operates, to two transponders (one for the high definition feed and the other for the standard definition feed) on the same satellite. HSN2, a network that primarily distributes taped programming on a limited distribution basis, debuted in August, 2010. The satellite transponders are leased on a full-time basis; one satellite transponder is leased through January 2012 and the other is leased through May 2019. Each satellite transponder lease provides for continued carriage of the HSN television networks on a replacement transponder and/or replacement satellite, as applicable, in the event of a failure of the transponder and/or satellite. HSN has also designed business continuity and disaster recovery plans to ensure its continued satellite transmission capability on a temporary basis in the event of inclement weather or a natural or other disaster.

As of December 31, 2010 and 2009, the HSN television networks reached approximately 95.9 million and 94.4 million homes, respectively, of the approximately 115.9 million and 114.9 million homes, respectively, in the United States with a television set. Television households reached by the HSN television networks as of December 31, 2010 and 2009 primarily include approximately 65.5 million and 64.6 million households capable of receiving cable and/or broadcast transmissions, respectively, and approximately 30.4 million and 29.8 million direct broadcast satellite system, or DBS, households, respectively.

Pay Television Distribution

HSN has entered into multi-year distribution and affiliation agreements with cable television and DBS operators, collectively referred to in this document as pay television operators, in the United States to carry the HSN television networks, as well as to promote the networks by carrying related commercials and distributing related marketing materials to their respective subscriber bases. HSN currently has contracts with many local and national pay television operators to distribute HSN television programming. Some of HSN’s larger pay television operators include Comcast, DirecTV, Echostar/DISH and Time Warner. HSN television network sales from customers residing in households that subscribed to these larger pay television operators accounted for approximately 27% of HSNi’s annual revenue in 2010.

3

Table of Contents

In exchange for this carriage and related promotional and other efforts, HSN generally pays these pay television operators a fee consisting of a per subscriber fee and some of which also receive commissions based on a percentage of the net merchandise sales to their subscriber bases. In some cases, pay television operators receive additional compensation in the form of advertising insertion time on the HSN television network, commission guarantees in exchange for their commitments to deliver a specified number of subscribers and channel placement incentives.

HSN typically negotiates multi-year agreements that require HSN to pay monthly or annual fees. The weighted average overall length of the terms of all distribution and affiliation agreements in effect as of December 31, 2010 is 2.6 years. Distribution and affiliation agreements with pay television operators expire from time to time and renewal and negotiation processes may be lengthy. At any given time in the ordinary course of business HSN is likely to be engaged in renewal and/or negotiation processes with one or more pay television operators. In some cases, renewals are not agreed upon prior to the expiration of a given agreement and the HSN television network continues to be carried by the relevant pay television operator without an effective affiliation agreement in place. This is currently the situation with a major cable pay television operator with which an agreement expired in 2005. The ongoing extension of this agreement is on economic terms that are substantially similar to the agreement that expired in 2005. HSN expects that, as in the past, any extension of the agreement that expired in 2005 as well as the other agreements that have expired will be on terms that, when taken as a whole, are commercially reasonable to HSN and competitive with the economics of other pay television operators.

Broadcast Television Distribution

As of December 31, 2010, HSN also had affiliation agreements with 30 low power broadcast television stations for leased carriage of the HSN television network with terms ranging from several weeks to several years. In exchange for this carriage, HSN pays the broadcast television stations hourly or monthly fixed rates. HSNi’s subsidiary, Ventana Television, Inc. (“Ventana”) also owns 27 low power broadcast television stations that carry the HSN network on a full-time basis.

Digital Distribution

In 2010, HSN expanded its digital reach by launching applications for the iPhone, Android and Windows 7 phones as well as an application for the iPad. These applications are highly video-centric, customized experiences that allow users to order merchandise, stream live video from HSN and watch previously-aired content from the network’s video library while simultaneously browsing related products. Among other things, these applications also allow customers to create their own personalized channels, select their favorite brands or categories of merchandise and compile videos focused on these preferences.

HSN.com

HSN also includes HSN.com, a transactional internet site that sells merchandise offered on the HSN television networks, as well as select merchandise sold exclusively on HSN.com. HSN.com provides customers with additional content to support and enhance HSN television programming. For example, HSN.com provides users with an online program guide, value-added video of product demonstrations, live streaming video of the HSN television network, customer-generated product reviews and additional information about HSN show hosts and guest personalities. According to Internet Retailer, HSN.com ranks in the top 25 of “The Top 500” business-to-consumer retailers in the U.S. and Canada. HSN.com features more than 16,000 product videos.

Cornerstone

Cornerstone consists of a number of branded catalogs and related websites, the primary of which are Frontgate, Ballard Designs, Garnet Hill, Smith+Noble, The Territory Ahead, TravelSmith and Improvements, and 20 retail and outlet stores.

4

Table of Contents

Frontgate features premium, high quality bed, bath and kitchen accessories, as well as outdoor, patio, garden and pool furnishings and accessories. Ballard Designs features European-inspired bed, bath, dining and office furnishings and accessories, as well as rugs, shelving and architectural accents for the home. Garnet Hill offers bed and bath furnishings and soft goods, as well as apparel and accessories for women and children, and Smith+Noble offers custom home furnishings and window treatments. The Territory Ahead offers casual apparel for men and women and TravelSmith offers travel wear for men and women and related accessories. Improvements features thousands of innovative home, patio and outdoor products.

The various brands within Cornerstone generally incorporate on-site photography and real-life settings, coupled with related editorial content describing the merchandise and depicting situations in which it may be used. Branded catalogs are designed and produced in-house, which enables each individual brand to control the production process and reduces the amount of lead time required to produce a given catalog.

New editions of full-color catalogs are mailed to customers several times each year, with a total annual circulation in 2010 of more than 275 million catalogs. The timing and frequency of catalog circulation varies by brand and depends upon a number of factors, including the timing of the introduction of new products, marketing campaigns and promotions and inventory levels, among other factors.

Cornerstone also operates Frontgate.com, BallardDesigns.com, GarnetHill.com, SmithandNoble.com, TerritoryAhead.com, TravelSmith.com and Improvementscatalog.com, among other branded websites. These websites serve as additional, alternative storefronts for products featured in related print catalogs, as well as provide customers with additional content to support and enhance their shopping experience. Additional content provided by these websites, which differs across the various websites, includes decorating tips, measuring and installation information, online design centers, gift registries and travel centers, as well as a feature that allows customers to browse the related catalog online.

Supply

HSN and Cornerstone purchase products by way of short- and long-term contracts and purchase orders, including products made to their respective specifications, as well as name brand merchandise and lines from third party partners, typically under certain exclusive rights. The terms of these contracts and purchase orders vary depending upon the underlying products, the retail channel in which the products will ultimately be sold and the method of sale. In some cases, these contracts provide for the payment of additional amounts to partners in the form of commissions, the amount of which is based upon the achievement of agreed upon sales targets, among other milestones. In addition, in the case of some purchases, HSNi may have certain return, extended payment and/or termination rights. The mix and source of products generally depends upon a variety of factors, including price and availability, and HSNi manages inventory levels through periodic, ongoing analyses of anticipated and current sales. No single vendor accounted for more than 10% of HSNi’s consolidated net sales in 2010, 2009 or 2008.

Marketing and Merchandising

HSN continuously works to bring customers a broad assortment of new and existing products in a compelling, informative and entertaining format. For example, HSN frequently collaborates with experts in a variety of fields to present special events on the HSN television network featuring HSN products and relevant expert content. In most cases, these events are staged at HSN’s television studios and, to a lesser extent, staged at venues associated with featured products. Online versions of certain special events are also featured on HSN.com for a limited period of time following their broadcast on the HSN television network. Also featured on HSN.com are over 16,000 video demonstrations of products available for sale.

In an effort to promote its own differentiated brand, HSN seeks to provide its customers with unique products that can only be purchased through HSN. HSN frequently partners with leading personalities and brands to develop product lines exclusive to HSN and believes that these affiliations enhance the awareness of the HSN

5

Table of Contents

brand among consumers generally, as well as increase the extent to which HSN and/or products sold through HSN are featured in the media. In some cases, vendors have agreed to market their HSN affiliation to their existing customers (e.g., notifying customers when their products will be featured on the HSN television network).

HSN engages in co-promotional partnerships with major media companies to secure print advertising in national fashion, style and/or lifestyle publications to market HSN to prospective customers in its target demographic. HSN also engages in search engine marketing and targeted offline advertising around the holidays and other key promotional periods. In 2010, HSN initiated joint marketing and promotional partnerships with two major motion picture companies as well as with several well-known recording artists. These promotions are designed to not only generate additional revenue but to also provide unique experiences for our customers in our continued effort to drive customer engagement.

The Cornerstone brands differentiate themselves by offering customers an assortment of innovative proprietary and branded apparel and home products. In many cases, Cornerstone seeks to secure exclusive distribution rights for certain products. Cornerstone also employs in-house designers or partners with leading manufacturers to develop exclusive new technology, such as wrinkle free fabrics. The Cornerstone brands use their respective websites to promote special sales events and e-mail marketing to promote special offers, including cross-promotions for other Cornerstone brands. In addition, Cornerstone partners with third parties to offer promotional events such as sweepstakes and/or other advertising agreements. HSNi believes that these affiliations enhance the awareness of the Cornerstone brands among consumers as well as strengthen its various brands overall.

Order Entry, Fulfillment and Customer Service

HSNi provides customers with convenient options in connection with the purchase, payment and shipment of merchandise, some of which vary by brand, business or product. Merchandise may be purchased online or ordered using toll free phone numbers through live sales and service agents. HSN also offers the convenience of an automated attendant system and, in limited markets, remote control ordering capabilities through pay television set-top boxes. Cornerstone’s catalog orders can also be made via traditional catalog sales order form submissions.

In addition to traditional payment options, such as credit and debit cards, payment options include private label credit cards, Paypal and, in the case of HSN, Flexpay. By utilizing Flexpay customers may pay for select merchandise in two to six interest-free, monthly credit or debit card payments. HSN also offers its customers the convenience of ordering products under its Autoship program, pursuant to which customers may arrange to have products automatically shipped and billed at scheduled intervals. Standard and express shipping options are available and customers may generally return most merchandise for a full refund or exchange in accordance with applicable return policies (which vary by brand and business). Returns generally must be received within specified time periods after purchase, ranging from a minimum of thirty days to a maximum of one year, depending upon the applicable policy.

HSNi seeks to fulfill customer orders and process returns quickly and accurately from a network of fulfillment centers. For HSN, these centers are located in Tennessee, California and Virginia, and for Cornerstone, the fulfillment centers are located in Ohio. HSNi contracts with several third party carriers and other fulfillment partners to ensure the reliable and timely delivery of products to its customers and processing of returns.

Through HSN.com and the various websites operated by Cornerstone or through HSNi’s common carriers, customers can also generally track the status of their orders, confirm information regarding shipping and, in some cases, confirm the availability of inventory and establish and manage personal accounts. Customers may communicate directly with customer service via e-mail or by telephone with call center representatives available seven days a week.

6

Table of Contents

Government Regulation

We market and offer a broad range of merchandise through television, online, catalogs and other channels. The manner in which we promote and sell merchandise, including claims and representations made in connection with these efforts, is regulated by a wide variety of federal, state and local laws, regulations, rules, policies and procedures. Some examples of these that affect the manner in which we sell and promote merchandise or otherwise operate our businesses include, but are not limited to, the following:

| • | The Federal Trade Commission’s regulations related to the sale of products and/or commercial contacts with our customers or potential customers, such as the Telemarketing Sales Rule and Do Not Call; |

| • | The Food and Drug Administration’s regulations regarding marketing claims that can be made about cosmetic beauty products and over-the-counter drugs, which include products for treating acne or medical products, and claims that can be made about food products; and |

| • | Regulations related to product safety issues and product recalls including, but not limited to, the Consumer Product Safety Act, the Consumer Product Safety Improvement Act of 2008, the Federal Hazardous Substance Act, the Flammable Fabrics Act and regulations promulgated pursuant to these acts. |

These laws, regulations, rules, policies and procedures are subject to change at any time. Unfavorable changes applicable to us could decrease demand for merchandise offered by us, increase costs which we may not be able to offset, subject us to additional liabilities and/or otherwise adversely affect our businesses.

Since October 1996, HSN has been subject to a consent order issued by the Federal Trade Commission, or FTC, which terminates on the later of April 15, 2019, or 20 years from the most recent date that the United States or the FTC files a complaint in federal court alleging any violation thereunder. Pursuant to this consent order, we are prohibited from making claims for specified categories of products, including claims that a given product can cure, treat or prevent any disease or have an effect on the structure or function of the human body, unless we have competent and reliable scientific evidence to substantiate such claims. Violation of this consent order may result in the imposition of significant civil penalties for non-compliance and related redress to consumers and/or the issuance of an injunction enjoining us from engaging in prohibited activities. The FTC periodically investigates our business and operations on an ongoing basis for purposes of determining our compliance with the consent order.

Online sales must comply with a variety of existing and new federal and state laws dealing with privacy, intellectual property, taxation, the provision of online payment services and electronic contracts. While U.S. Supreme Court decisions generally restrict the imposition of obligations to collect state and local sales and use taxes with respect to sales made over the internet in states in which internet retailers have no nexus, a number of states have adopted or are considering initiatives that would impose sales and use tax collection obligations arising from internet-based transactions. The imposition by the federal or state and local governments of various taxes and related obligations upon internet commerce could create administrative burdens for our businesses, could put our businesses at a competitive disadvantage to the extent that similar obligations are not imposed upon our competitors and could decrease future sales.

While we believe that the practices of our businesses have been structured in a manner to ensure compliance with these laws and regulations; federal, state or local regulatory authorities may take a contrary position. Our failure to comply with these laws and regulations could result in proceedings against us, fines and penalties and/or a diminution of our reputation, each of which could adversely affect our financial condition, results of operations and businesses.

Intellectual Property

We regard our intellectual property rights, including patents, service marks, trademarks, domain names, copyrights and trade secrets, as critical to our success. Our businesses also rely heavily upon software codes,

7

Table of Contents

informational databases and other systemic components that are necessary to manage and support our operations. We rely on a combination of laws and contractual restrictions with employees, customers, suppliers, licensees, affiliates and other third parties to establish and protect these proprietary rights. Despite these precautions, it may be possible for a third party to copy or otherwise obtain and use trade secrets or copyrighted intellectual property without authorization which, if discovered, might require legal action to correct. In addition, third parties may independently and lawfully develop substantially similar intellectual properties.

We have generally registered and continue to apply to register, or secure by contract when appropriate, our trademarks and service marks as they are developed and used, and reserve and register domain names as we deem appropriate. We consider the protection of our trademarks to be important for purposes of brand maintenance and reputation. While we vigorously protect our trademarks, service marks and domain names, effective trademark protection may not be available or may not be sought in every country in which products and services are made available, and contractual disputes may affect the use of marks governed by private contract. Similarly, not every variation of a domain name may be available or be registered, even if available. Our failure to protect our intellectual property rights in a meaningful manner or challenges to related contractual rights could result in dilution of brand names and/or limit our ability to control marketing on or through the internet using our various domain names either of which could adversely affect our business, financial condition and results of operations.

Some of our businesses have been granted patents and/or have patent applications pending with the United States Patent and Trademark Office and/or foreign patent authorities for various proprietary technologies and other inventions. We consider applying for patents or for other appropriate statutory protection when we develop valuable new or identify improved proprietary technologies or inventions, and will continue to consider the appropriateness of filing for patents to protect future proprietary technologies and inventions as circumstances may warrant. The issuance or assessment of the validity of any patent involves complex legal and factual questions, and the breadth of claims allowed is uncertain. Accordingly, any patent application filed may not result in a patent being issued or existing or future patents may not be adjudicated valid by a court or be afforded adequate protection against competitors with similar technology. In addition, third parties may create new products or methods that achieve similar results without infringing upon patents that we own. Likewise, the issuance of a patent to us does not mean that our processes or inventions will not be found to infringe upon patents or other rights previously issued to third parties.

From time to time, we are subject to legal proceedings and claims in the ordinary course of business, including claims of alleged infringement of the trademarks, copyrights, patents and other intellectual property rights of third parties. In addition, litigation may be necessary in the future to enforce our intellectual property rights, protect trade secrets or determine the validity and scope of proprietary rights claimed by others. Any litigation of this nature, regardless of outcome or merit, could result in substantial costs and diversion of management and technical resources, any of which could adversely affect our business, financial condition and results of operations. Patent litigation tends to be particularly protracted and expensive.

Competition

HSNi brands and businesses operate in a highly competitive environment. These brands and businesses are in direct competition for consumers with traditional offline and online retailers (both television and internet retailers), ranging from large department stores to specialty shops, electronic retailers, direct marketing retailers, mail order and catalog companies, infomercial retailers, wholesale clubs and discount retailers. In addition, the HSN television networks compete for access to customers and audience share with other conventional forms of entertainment and content. The price and availability of programming for pay television systems affect the availability of distribution for HSN television programming. Both the compensation that must be paid to pay television operators for related carriage and competition for channel capacity and placement continues to increase. Principal competitive factors for HSNi brands and businesses include: (i) brand recognition, (ii) value, quality and selection of merchandise, (iii) customer experience, including customer service and reliability of fulfillment and delivery services and (iv) convenience and accessibility of sales channels.

8

Table of Contents

Employees

As of February 1, 2011, HSNi employed approximately 5,000 full-time employees and 800 part-time employees. No HSNi employees are represented by unions or other similar organizations and HSNi considers its relations with its employees to be good.

Available Information

Our website is located at http://www.hsni.com. We make available free of charge, on or through the website, our annual, quarterly and current reports, and any amendments to those reports, as soon as reasonably practicable after electronically filing such reports with the SEC.

Information relating to corporate governance, including our Code of Business Conduct and Ethics and our Corporate Governance Guidelines, is also available on our website at http://www.hsni.com/governance.cfm. The code of conduct complies with Item 406 of SEC Regulation S-K and the rules of the NASDAQ Global Select Market. Any changes to the code of conduct that affect the provisions required by Item 406 of Regulation S-K, and any waivers of the code of conduct for our executive officers, directors or senior financial officers, will also be disclosed on our website.

The content of our website is not a part of this Annual Report or any other report filed with the SEC.

| ITEM 1A. | RISK FACTORS |

The risks and uncertainties described below are not the only risks that may have a material adverse effect on HSNi. There exist additional risks and uncertainties that could adversely affect our business and our results. If any of the following risks actually occur, our business, financial condition or results of operations could be negatively affected, and the market price for our shares could decline. Further, to the extent that any of the information contained in this Annual Report on Form 10-K constitutes forward-looking statements, the risk factors set forth below also are cautionary statements identifying important factors that could cause the actual results of HSNi to differ materially from those expressed in any forward-looking statements made by or on behalf of HSNi.

Risks Related to Our Business

Macroeconomic conditions have negatively impacted our business and may continue to have additional negative impacts in the future.

Retailers generally are particularly sensitive to adverse economic and business conditions, in particular to the extent they result in a loss of consumer confidence, rising unemployment and decreases in consumer spending, particularly discretionary spending. Beginning in 2008 and through 2010, we experienced weakness across both business segments in connection with the deteriorating macroeconomic conditions. We are not able to predict the timing of any recovery. If macroeconomic conditions do not improve or worsen, our business could be adversely affected.

We depend on relationships with pay television operators and adverse changes in these relationships could result in an interruption, material decrease or even the cessation of carriage of the HSN television networks.

We are dependent upon the pay television operators with whom we enter into distribution and affiliation agreements to carry the HSN television networks. We currently have contracts with many local and national pay television operators to distribute HSN television programming. Some of HSN’s larger pay television operators include Comcast, DirecTV, Echostar/DISH and Time Warner. The two largest pay television operators each represent over 20% of our subscribers. The cessation of carriage of the HSN television networks by a major pay

9

Table of Contents

television operator or a significant number of smaller pay television operators for a prolonged period of time could adversely affect our business, financial condition and results of operations. While we believe that we will be able to continue to successfully manage the distribution process in the future, certain changes in distribution levels, as well as increases in commission rates and/or other fees payable for carriage, could occur notwithstanding these efforts.

We typically seek to enter into long-term distribution and affiliation agreements with these major pay television operators; however, in some cases, renewals are not agreed upon prior to the expiration of a given agreement and the HSN television networks continue to be carried by the relevant pay television operator without an effective agreement in place. We currently provide service to approximately 35.1% of our total subscribers pursuant to month-to-month contracts or contracts that have expired. In addition, another 21.3% of our subscribers are represented by contracts that expire within one year. Renewal and negotiation processes with pay television operators are typically lengthy. No assurance can be given that we will be successful in negotiating renewals with all these operators or that the financial and other terms of renewal will be on acceptable terms. The failure to successfully renew or negotiate new distribution and affiliation agreements covering a material portion of these existing cable and satellite households on acceptable terms could adversely affect our growth, sales revenue and earnings.

We depend on relationships with vendors, manufacturers and other third parties; any adverse changes in these relationships could result in a failure to meet customer expectations which could result in lost sales.

We purchase merchandise from a wide variety of third party vendors, manufacturers and other sources pursuant to short- and long-term contracts and purchase orders. Our ability to identify and establish relationships with these parties, as well as access quality merchandise in a timely and efficient manner on acceptable terms and at acceptable costs, can be challenging. In particular, we purchase a significant amount of merchandise from vendors and manufacturers abroad and have experienced (and expect to continue to experience) increased costs for goods sourced in these markets. We depend on the ability of vendors and manufacturers in the U.S. and abroad to produce and deliver goods that meet applicable quality standards, which is impacted by a number of factors not within the control of these parties, such as political or financial instability, trade restrictions, tariffs, currency exchange rates and transport capacity and costs, among others. In particular, Cornerstone is dependent, in significant part, upon independent, third party manufacturers to produce private label merchandise.

Our failure to identify new vendors and manufacturers, maintain relationships with a significant number of existing vendors and manufacturers and/or access quality merchandise in a timely and efficient manner could cause us to miss customer delivery dates or delay scheduled promotions, which would result in the failure to meet customer expectations and could cause customers to cancel orders or cause us to be unable to source merchandise in sufficient quantities, which could result in lost sales.

The unanticipated loss of certain larger vendors could negatively impact our sales and profitability on a short term basis.

It is possible that one or more of our larger vendors could experience financial difficulties, including bankruptcy, or otherwise could elect to cease doing business with us. While we have periodically experienced the loss of a major vendor, if a number of our current larger vendors ceased doing business with us, this could materially and adversely impact our sales and profitability on a short term basis.

The failure to secure suitable channel placement for the HSN television network programming would adversely affect our ability to attract and retain television viewers and could result in a decrease in revenue.

We are dependent upon the continued ability of HSN to compete for television viewers. Effectively competing for television viewers is dependent, in substantial part, on the ability of HSN to secure suitable placement of the HSN television networks within a suitable programming tier at a low channel position. The

10

Table of Contents

advent of digital compression technologies and the adoption of digital cable has resulted in increased channel capacity, which together with other changing laws, rules and regulations regarding cable television ownership, impacts the ability of HSN to secure suitable channel placement. While increased channel capacity could provide a means through which the HSN television networks could be more widely distributed, it could also adversely affect our ability to attract television viewers to the television networks and a reduction in our growth rate to the extent it results in:

| • | higher channel position placement for the HSN television networks; |

| • | placement of the HSN television networks in digital programming tiers, which generally have lower levels of television viewer penetration than basic or expanded basic programming tiers; |

| • | more competitors entering the marketplace; or |

| • | more programming options being available to the viewing public in the form of new television networks and time-shifted viewing (e.g., personal video recorders, video-on-demand, interactive television and streaming video over broadband internet connections). |

If the HSN television networks are carried exclusively in a system on a digital programming tier, HSN will experience a reduction in revenue to the extent that the digital programming tier has less television viewer penetration than the basic or expanded basic programming tier. In addition, HSN may experience a further reduction in revenue due to increased television viewing audience fragmentation and to the extent that not all television sets within a digital cable home are equipped to receive television programming in a digital format. Our future success will also depend, in part, on the ability of HSN to anticipate and adapt to technological changes and to offer elements of the HSN television networks via new technologies in a cost-effective manner that meet customer demands and evolving industry standards.

The continued or permanent inability to broadcast the HSN television networks would result in lost customers and lost sales.

Our success is dependent upon the continued ability of HSN to transmit the HSN television networks to broadcast and pay television operators from its satellite uplink facilities, which transmission is subject to the Federal Communications Commission (“FCC”) compliance. HSN has entered into two satellite transponder leases to provide for continued carriage of the HSN television networks on a replacement transponder and/or replacement satellite, as applicable, in the event of a failure of the transponder and/or satellite. Although we believe that every reasonable measure is being taken to ensure continued satellite transmission capability, termination or interruption of satellite transmissions may occur.

HSN is affiliated with a number of low power broadcast television station licensees (the “Low Power Licensees”) that broadcast programming pursuant to licenses from the FCC. These Low Power Licensees are subject to regulation by the FCC under the Communications Act of 1934, as amended, which prohibits the operation of broadcast television stations except in accordance with a license issued by the FCC and empowers the FCC to issue, revoke, modify and renew broadcast television licenses, approve the transfer of control of any entity holding such licenses, determine the location of stations, regulate the equipment used by stations, adopt necessary regulations and impose penalties for related violations. The failure of the Low Power Licensees to comply with the terms of the broadcast licenses could result in the inability to broadcast the HSN television networks on over-the-air facilities, as well as penalties. The prolonged or permanent interruption of satellite transmission capability or other inability to transmit the HSN television networks for any reason, as well as related costs incurred, would result in lost sales and could result in lost customers.

System interruption and the lack of integration and redundancy in these systems and infrastructures may adversely affect our ability to operate websites, process and fulfill transactions, respond to customer inquiries and generally maintain cost-efficient operations.

Our success depends, in part, on our ability to maintain the integrity of our systems and infrastructures, including websites, information and related systems, call centers and fulfillment facilities. We may experience

11

Table of Contents

occasional system interruptions that make some or all systems or data unavailable or prevent our businesses from efficiently providing services or fulfilling orders. We also rely on affiliate and third-party computer systems, broadband and other communications systems and service providers in connection with the provision of services generally, as well as to facilitate, process and fulfill transactions. Any interruptions, outages or delays in our systems and infrastructures, our businesses, our affiliates and/or third parties, or deterioration in the performance of these systems and infrastructures, could impair our ability to provide services, fulfill orders and/or process transactions. Fire, flood, power loss, telecommunications failure, hurricanes, tornadoes, earthquakes, acts of war or terrorism, acts of God and similar events or disruptions may damage or interrupt computer, broadband or other communications systems and infrastructures at any time. Any of these events could cause system interruption, delays and loss of critical data, and could prevent us from providing services, fulfilling orders and/or processing transactions. While we have backup systems for certain aspects of our operations, these systems are not fully redundant and disaster recovery planning is not sufficient for all eventualities. In addition, we may not have adequate insurance coverage to compensate for losses from a major interruption.

Increased delivery costs could adversely impact our profits, particularly if we are unable to offset them by increasing prices without a detrimental effect on customer demand.

We are impacted by increases in shipping rates charged by various shipping vendors relating to the procurement of merchandise from vendors and manufacturers, the shipment of merchandise to customers and the mailing of catalogs, which over the past few years have experienced volatility in comparison to historical levels. We currently expect that shipping and postal rates will continue to increase. In the case of deliveries to customers, we have negotiated favorable shipping rates, which increase at agreed upon levels over time, with one independent, third party shipping company pursuant to a long-term contract. If this relationship were to terminate or if the shipping company was unable to fulfill its obligations under the contract for any reason, we would have to work with other shipping companies to deliver merchandise to customers, which could be at less favorable rates and could cause a disruption in our business. Any increase in shipping rates and related fuel and other surcharges passed on to us by this or any other shipping company may adversely impact profits, given that we may not be able to pass these increased costs directly to customers or offset them by increasing prices without a detrimental effect on customer demand.

Our long-term success depends, in large part, on our continued ability to attract new and retain existing customers in a cost-effective manner.

In an effort to attract and retain customers, we engage in various marketing and merchandising initiatives, which involve the expenditure of considerable money and resources, particularly in the case of the production and distribution of HSN television programming and Cornerstone catalogs and, to a lesser but increasing extent, online advertising. We have spent, and expect to continue to spend, increasing amounts of money on, and devote greater resources to, certain of these initiatives, particularly in connection with the growth and maintenance of our brands generally, as well as in the continuing efforts of our businesses to increasingly engage customers through online channels. These initiatives, however, may not resonate with existing customers or consumers generally or may not be cost-effective. In addition, we believe that costs associated with the production and distribution of HSN television programming, paper and printing costs for Cornerstone catalogs and costs associated with online marketing, including search engine marketing (primarily the purchase of relevant keywords) are likely to increase in the foreseeable future and, if significant, could have an adverse effect on our business, financial condition and results of operations to the extent that they do not result in corresponding increases in sales.

We may not be able to accurately predict and/or respond in a timely manner to evolving customer preferences and trends and industry standards, which could result in excess inventory, related markdowns and lost sales.

Our success depends, in significant part, on our ability to accurately predict, and respond in a timely manner to, changes in customer preferences and fashion, lifestyle and other trends and industry standards. While product

12

Table of Contents

mix and price points are continuously monitored and adjusted in an attempt to satisfy consumer demand and respond to changing economic and business conditions, we may not be successful in these efforts, and any sustained failure could result in excess inventory and related markdowns.

In addition, the internet industry is characterized by evolving industry standards, frequent new service and product introductions and enhancements, as well as changing customer demands. If we are not able to adapt quickly enough and/or in a cost-effective manner to these changes it could result in lost sales.

We could be subject to additional sales tax liability, including liability for past sales.

U.S. Supreme Court decisions generally restrict the imposition of obligations to collect state and local sales and use taxes with respect to sales made over the internet. However, a number of states, as well as the U.S. Congress, have adopted or are considering initiatives that would impose sales and use tax collection obligations arising from internet-based transactions. If these initiatives are successful, we could be required to collect sales and use taxes in additional states. The imposition by state and local governments of various taxes upon internet commerce could create administrative burdens for us, put us at a competitive disadvantage if they do not impose similar obligations on all online competitors and decrease our future sales.

In addition, certain states and local jurisdictions have attempted to collect sales and use tax from businesses without an obvious physical presence in that state. The successful assertion by one or more states that we should collect sales, use or other taxes on sales in states for which we do not currently collect taxes could raise substantial tax liabilities, decrease our ability to compete and otherwise harm our business.

Failure to comply with existing laws, rules and regulations, or to obtain and maintain required licenses and rights could subject us to additional liabilities.

We market and provide a broad range of merchandise through television, online catalogs and other channels. As a result, we are subject to a wide variety of statutes, rules, regulations, policies and procedures in various jurisdictions which are subject to change at any time, including laws regarding product safety, consumer protection, privacy, the regulation of retailers generally, the importation, sale and promotion of merchandise and the operation of retail stores and warehouse facilities, as well as laws and regulations applicable to the internet and businesses engaged in online commerce, such as those regulating the sending of unsolicited, commercial electronic mail. Our failure to comply with these laws and regulations could result in fines and/or proceedings against us by governmental agencies and/or consumers, which could adversely affect our business, financial condition and results of operations. Moreover, unfavorable changes in the laws, rules and regulations applicable to us could decrease demand for merchandise offered by us, increase costs, subject us to additional liabilities and/or otherwise adversely affect our businesses. Finally, certain of these regulations impact the marketing efforts of our businesses and brands.

We are currently the subject of a consent order issued by the FTC and violation of this consent order could result in significant civil penalties and/or an injunction enjoining HSN from engaging in prohibited activities, among other penalties or remedies.

In October 1996, HSN became subject to a consent order issued by the FTC which terminates on the later of April 15, 2019, or 20 years from the most recent date that the United States or the FTC files a complaint in federal court alleging any violation thereunder. Pursuant to this consent order, HSNi (including its subsidiaries and affiliates) is prohibited from making claims for specified categories of products, including claims that a given product can cure, treat or prevent any disease or have an effect on the structure or function of the human body, unless it has competent and reliable scientific evidence to substantiate such claims. Violation of this consent order may result in the imposition of significant civil penalties for non-compliance and related redress to consumers and/or the issuance of an injunction enjoining us from engaging in prohibited activities. The FTC periodically investigates our business and operations on an ongoing basis for purposes of determining its compliance with the consent order.

13

Table of Contents

We may be subject to claims for representations made in connection with the sale and promotion of merchandise or for harm experienced by customers who purchase merchandise from us.

The manner in which we sell and promote merchandise and related claims and representations made in connection with these efforts is regulated by federal, state and local law. We may be exposed to potential liability from claims by purchasers or from federal, state and local regulators and law enforcement agencies, including, but not limited to, for personal injury, product safety, wrongful death and damage to personal property relating to merchandise sold and misrepresentation of merchandise features and benefits. In certain instances, we have the right to seek indemnification for related liabilities from our vendors and may require such vendors to carry minimum levels of product liability and errors and omissions insurance. These vendors, however, may be unable to obtain suitable coverage or maintain this coverage on acceptable terms, or this insurance may provide inadequate coverage against all potential claims or may not even be available with respect to a particular claim.

The processing, storage, use and disclosure of personal data could give rise to liabilities as a result of governmental regulation, conflicting legal requirements or differing views of personal privacy rights.

In the processing of consumer transactions, we receive, transmit and store a large volume of personally identifiable information and other user data. The sharing, use, disclosure and protection of this information are governed by the privacy and data security policies maintained by us. Moreover, there are federal, state and international laws regarding privacy and the storing, sharing, use, disclosure and protection of personally identifiable information and user data. Specifically, personally identifiable information is increasingly subject to legislation and regulations in numerous jurisdictions around the world, the intent of which is to protect the privacy of personal information that is collected, processed and transmitted in or from the governing jurisdiction. We could be adversely affected if legislation or regulations are expanded to require changes in business practices or privacy policies, or if governing jurisdictions interpret or implement their legislation or regulations in ways that negatively affect our business, financial condition and results of operations.

We are subject to online security risks, including security breaches and identity theft.

To succeed, we must be able to provide for secure transmission of confidential information over public networks. Our failure, and/or the failure by the various third party vendors and service providers with which we do business, to comply with applicable privacy policies or federal, state or similar international laws and regulations or any compromise of security that results in the unauthorized release of personally identifiable information or other user data could damage the reputation of our businesses, discourage potential users from trying our products and services and/or result in fines and/or proceedings by governmental agencies and/or consumers, one or all of which could adversely affect our business, financial condition and results of operations. Any penetration of network security or other misappropriation or misuse of personal consumer information could cause interruptions in the operations of our businesses and subject us to increased costs, litigation and other liabilities. Security breaches could also significantly damage our reputation with consumers and third parties with whom we do business. We may be required to expend significant capital and other resources to protect against and remedy any potential or existing security breaches and their consequences. We also face risks associated with security breaches affecting third parties with which we are affiliated or otherwise conduct business online.

Failure to effectively manage our Flexpay program could result in unplanned losses.

HSN offers Flexpay, pursuant to which customers may pay for certain merchandise in two to six interest-free, monthly credit or debit card payments. We maintain allowances for estimated losses resulting from the inability of customers to make required payments. While actual losses due to the inability of customers to make required payments have historically been within estimates, we may not continue to experience these losses at the same rate as we have historically or our actual losses in any given period may exceed related estimates. As Flexpay usage grows, we may experience these losses at greater rates, which will require us to maintain greater allowances for doubtful accounts of estimated losses than we have historically.

14

Table of Contents

We may fail to protect our intellectual property rights within the full scope and manner available to us under applicable law or statute or may be accused of infringing upon the intellectual property rights of third parties.

We regard our intellectual property rights, including patents, service marks, trademarks and domain names, copyrights and trade secrets, as critical to our success. We rely heavily upon software codes, informational databases and other systemic components that are necessary to manage and support our business operations.

From time to time, we are subject to legal proceedings and claims in the ordinary course of business, including claims of alleged infringement of the trademarks, copyrights, patents and other intellectual property rights of third parties. In addition, litigation may be necessary in the future to enforce our intellectual property rights, protect trade secrets or to determine the validity and scope of proprietary rights claimed by others. Any litigation of this nature, regardless of outcome or merit, could result in substantial costs and diversion of management and technical resources, any of which could adversely affect our business, financial condition and results of operations. Patent litigation tends to be particularly protracted and expensive. Our failure to protect our intellectual property rights in a meaningful manner or challenges to related contractual rights could result in erosion of brand names and limit our ability to control marketing on or through the internet using our various domain names or otherwise, which could adversely affect our business, financial condition and results of operations.

Restrictive covenants in our debt instruments could limit our flexibility in responding to current market conditions or otherwise restrict our business activities.

The existence of, and limitations on the availability of our debt could have important consequences. The existence of debt could, among other things:

| • | require a substantial portion of our cash flow from operations to be dedicated to the payment of principal and interest on our indebtedness; |

| • | limit our ability to use cash flow or obtain additional financing for future working capital, capital expenditures or other general corporate purposes; |

| • | increase our vulnerability to general economic and industry conditions; or |

| • | expose us to the risk of increased interest rates because certain of our borrowings, including borrowings under our credit facilities, are at variable interest rates. |

Limitations imposed as a part of the debt, such as the availability of credit and the existence of restrictive covenants may, among other things, make it difficult for us to satisfy our financial obligations; and/or limit our ability to respond to business opportunities. The credit agreement relating to our credit facility and indenture with respect to the senior notes do include restrictive covenants, financial and non-financial.

Risks Related to Our Common Stock

The shareholders’ rights plan adopted by the Board of Directors in December 2008 may inhibit takeovers that would otherwise be beneficial to shareholders.

In the fourth quarter of 2008, our Board of Directors approved the creation of a Series A Junior Participating Preferred Stock, adopted a shareholders’ rights plan and declared a dividend of one right for each outstanding share of common stock held by our shareholders. Initially, these rights, which trade with the shares of our common stock, are not exercisable. Under the rights plan, these rights will be exercisable if a person or group acquires or commences a tender or exchange offer for 15% or more of our common stock (except for certain grandfathered persons to which higher thresholds apply). If the rights become exercisable, each right will permit the holder, other than the “acquiring person,” to purchase from us shares of common stock at a 50% discount to the then prevailing market price. As a result, the rights will cause substantial dilution to a person or group that becomes an “acquiring person” on terms not approved by our Board of Directors. The existence of these rights may prevent, discourage or delay an acquisition of us, even if such acquisition would be beneficial to our shareholders.

15

Table of Contents

The market price and trading volume of our common stock may be volatile and may face negative pressure.

Our stock price has experienced, and could continue to experience in the future, substantial volatility as a result of many factors, including persistent adverse macroeconomic conditions, broad market fluctuations and public perception of the prospects for the retail industry. Our failure to meet market expectations would also likely result in a decline in the market price of our stock. These and other factors may result in short-term or long-term negative pressure on the value of our common stock.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

Not applicable.

| ITEM 2. | PROPERTIES |

HSNi owns its corporate headquarters in St. Petersburg, Florida, which consist of approximately 600,000 square feet of office space and include executive offices, television studios, showrooms, broadcast facilities and administrative offices for HSN. HSN leases the HSN fulfillment centers in Piney Flats, Tennessee; Fontana, California and Roanoke, Virginia, as well as four outlet stores and other properties in various locations in the United States for administrative offices and data centers pursuant to leases that expire in 2012 through 2020. Cornerstone owns an office and storage facility in Franconia, New Hampshire. Otherwise, Cornerstone leases its properties, consisting of administrative offices, retail outlets and fulfillment centers in West Chester, Ohio, as well as 20 retail stores and outlets in various locations throughout the United States, all pursuant to leases with expiration dates ranging from 2011 to 2020.

HSNi believes that the duration of each lease is adequate and does not anticipate any future problems renewing or obtaining suitable leases for its principal properties. HSNi believes that its principal properties, whether owned or leased, are currently adequate for the purposes for which they are used and are suitably maintained for these purposes. From time to time HSNi considers various alternatives related to its long term facilities needs. While HSNi management believes existing facilities are adequate to meet its short term needs, it may become necessary to lease or acquire additional or alternative space to accommodate future growth.

| ITEM 3. | LEGAL PROCEEDINGS |

In the ordinary course of business, we are involved in various legal matters arising out of our operations. These matters may relate to claims involving property, personal injury, contract, intellectual property (including patent infringement), sales tax, regulatory compliance and other claims. As of the date of this filing, we are not a party to any legal proceedings that are reasonably expected to have a material adverse effect on our business, results of operations, financial condition or cash flows; however, litigation matters are subject to inherent uncertainties and the results of these matters cannot be predicted with certainty. An unfavorable resolution of one or more of these matters could have a material adverse effect on our business, results of operations, financial condition or cash flows. Moreover, any claims or regulatory actions against us, whether meritorious or not, could be time consuming, result in costly litigation, require significant amounts of management time and results in the diversion of significant operational resources.

See Note 14—Commitments and Contigencies in Part II, Item 8 for additional information regarding legal matters in which we are involved.

| ITEM 4. | REMOVED AND RESERVED |

16

Table of Contents

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED SHAREHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information

Our common stock trades on the NASDAQ Global Select Market under the symbol HSNI. The table below sets forth the high and low per share sales prices of our common stock for the periods indicated, as reported by the NASDAQ Global Select Market.

| Sales Price | ||||||||

| Fiscal 2010 |

High | Low | ||||||

| Fourth Quarter |

$ | 31.99 | $ | 25.50 | ||||

| Third Quarter |

$ | 31.49 | $ | 23.40 | ||||

| Second Quarter |

$ | 34.66 | $ | 22.03 | ||||

| First Quarter |

$ | 30.99 | $ | 17.93 | ||||

| Fiscal 2009 |

||||||||

| Fourth Quarter |

$ | 20.90 | $ | 13.99 | ||||

| Third Quarter |

$ | 16.60 | $ | 8.25 | ||||

| Second Quarter |

$ | 12.09 | $ | 4.83 | ||||

| First Quarter |

$ | 7.55 | $ | 3.33 | ||||

Holders

As of February 1, 2011, there were 1,970 shareholders of record of our common stock. Because many of our shares of common stock are held by brokers and other institutions on behalf of shareholders, we are not able to estimate the total number of beneficial shareholders represented by these record holders.

Dividends

We have never paid any cash dividends nor do we currently plan to institute a cash dividend. Instead we currently intend to retain any future earnings for reinvestment. Our credit agreement and indenture limit the amount of and our ability to pay cash dividends. Any determination to pay cash dividends will be at the discretion of our Board of Directors and will depend upon our operating results, financial condition and capital requirements, general business conditions and such other factors that the Board of Directors considers relevant.

Issuer Purchases of Equity Security

We did not purchase any shares of our common stock during the quarter ended December 31, 2010.

17

Table of Contents

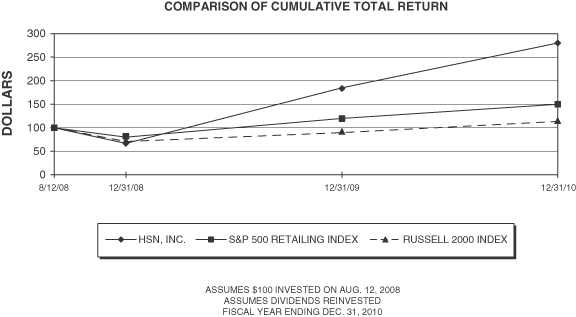

Performance Graph

The graph depicted below compares the performance of our common stock with the cumulative total return on the S&P 500 Retailing Index and the Russell 2000 Index from August 12, 2008, the first day of trading of the Company’s common stock on the NASDAQ Global Select Market after the spin-off through December 31, 2010, the last day of our fiscal year.

| 8/12/2008 | 12/31/2008 | 12/31/2009 | 12/31/2010 | |||||||||||||

| HSN, Inc. |

100.00 | 66.70 | 185.23 | 281.19 | ||||||||||||

| S&P 500 Retailing Index |

100.00 | 80.07 | 119.94 | 150.35 | ||||||||||||

| Russell 2000 Index |

100.00 | 70.45 | 89.60 | 113.66 | ||||||||||||

18

Table of Contents

| ITEM 6. | SELECTED FINANCIAL DATA |

The following table presents selected consolidated financial data for HSNi. The information in this table is not necessarily indicative of future performance and should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our audited consolidated financial statements and related notes included herein. Our consolidated financial statements present our results of operations, financial position, shareholders’ equity and comprehensive income and cash flows on a combined basis up through the spin-off on August 20, 2008, and on a consolidated basis thereafter. However, this financial information does not necessarily reflect what the historical financial position and results of operations of HSNi would have been had HSNi been a stand-alone company during the periods presented prior to the spin-off.

For information about the shares used in computing earnings per share, see Note 10 of Notes to Consolidated Financial Statements.

| Year Ended December 31, | ||||||||||||||||||||

| 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||

| (In thousands, except per share data) | ||||||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||

| Net sales |

$ | 2,996,780 | $ | 2,749,609 | $ | 2,823,593 | $ | 2,908,242 | $ | 2,877,954 | ||||||||||

| Asset impairments (1) |

— | — | 3,186,650 | — | — | |||||||||||||||

| Operating income (loss) |

196,087 | 155,654 | (3,102,311 | ) | 169,791 | 213,196 | ||||||||||||||

| Income (loss) from continuing operations |

98,562 | 72,578 | (2,387,478 | ) | 105,233 | 133,532 | ||||||||||||||

| Net income (loss) (2) |

98,523 | 72,488 | (2,390,888 | ) | 164,804 | 122,817 | ||||||||||||||

| Income (loss) from continuing operations per share: |

||||||||||||||||||||

| Basic |

$ | 1.72 | $ | 1.29 | $ | (42.48 | ) | $ | 1.87 | $ | 2.38 | |||||||||

| Diluted |

$ | 1.66 | $ | 1.27 | $ | (42.48 | ) | $ | 1.86 | $ | 2.36 | |||||||||

| Net income (loss) per share: |

||||||||||||||||||||

| Basic |

$ | 1.72 | $ | 1.29 | $ | (42.54 | ) | $ | 2.93 | $ | 2.19 | |||||||||

| Diluted |

$ | 1.65 | $ | 1.26 | $ | (42.54 | ) | $ | 2.91 | $ | 2.17 | |||||||||

| Shares used in computing earnings per share: |

||||||||||||||||||||

| Basic |

57,414 | 56,383 | 56,208 | 56,206 | 56,206 | |||||||||||||||

| Diluted |

59,546 | 57,330 | 56,208 | 56,649 | 56,649 | |||||||||||||||

| Dividends per common share |

— | — | — | — | — | |||||||||||||||

| Balance Sheet Data (end of period): |

||||||||||||||||||||

| Working capital |

$ | 451,406 | $ | 332,964 | $ | 306,354 | $ | 147,185 | $ | 340,592 | ||||||||||

| Total assets |

1,345,743 | 1,218,650 | 1,152,457 | 4,220,631 | 4,458,167 | |||||||||||||||

| Total debt, including current maturities |