Attached files

| file | filename |

|---|---|

| EX-23.1 - Granto, Inc. | v212237_ex23-1.htm |

| EX-23.3 - Granto, Inc. | v212237_ex23-3.htm |

As filed with the Securities and Exchange Commission on February 23, 2011

Registration No. 333-166758

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PRE-EFFECTIVE AMENDMENT NO. 4 TO

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

RONGFU AQUACULTURE, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

0273

|

98-0655634

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer

Identification Number)

|

Dongdu Room 321, No. 475 Huanshidong Road, Guangzhou City, PRC 510075

011- 86-10-5170-9287

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Vcorp Services, LLC

20 Robert Pitt Drive, Suite 214

Monsey, New York 10952

(845)425-0077

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Darren Ofsink, Esq.

Guzov Ofsink, LLC

900 Third Avenue, 5th Floor

New York, New York 10022

(212) 371-8008

Approximate date of commencement of proposed sale to public: as soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o__________

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o_________

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering. o__________

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

¨

|

|

Accelerated filer

|

¨

|

|

Non-accelerated filer

(Do not check if a smaller reporting

company)

|

¨

|

Smaller reporting company

|

x

|

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

7,940,370 Shares of Common Stock

RONGFU AQUACULTURE, INC.

Common Stock

PROSPECTUS

__, 2011

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any state where the offer is not permitted.

SUBJECT TO COMPLETION, DATED FEBRUARY 23, 2011

PRELIMINARY PROSPECTUS

7,940,370 Shares

Rongfu Aquaculture, Inc.

Common Stock

This prospectus relates to the resale by the Selling Stockholders of up to 7,940,370 shares of our Common Stock, $.001 par value (“Common Stock”), including an aggregate of 1,044,081 shares issued to certain Selling Stockholders pursuant to or in connection with a Share Exchange Agreement dated as of March 29, 2010 (the “Share Exchange Agreement”) and an aggregate of 6,896,289 shares of our Common Stock issuable to the Selling Stockholders upon conversion of shares of our Series A Preferred Stock and exercise of warrants to purchase our Common Stock issued in a private placement (the “Private Placement”) pursuant to a Series A Preferred Stock Purchase Agreement dated as of March

29, 2010 (the “Purchase Agreement”).

All of the shares of Common Stock issued to the Selling Stockholders may be sold by the Selling Stockholders. It is anticipated that the Selling Stockholders will sell these shares of Common Stock from time to time in one or more transactions, in negotiated transactions or otherwise, at prevailing market prices or at prices otherwise negotiated (see “Plan of Distribution” beginning on page 76. We will not receive any proceeds from the sales by the Selling Stockholders. Under the terms of the warrants, cashless exercise is permitted in certain circumstances. We will not receive any proceeds from any cashless exercise of the warrants, but would receive the exercise price of warrants exercised on

a cash basis. We will pay all of the registration expenses incurred in connection with this offering, but the Selling Stockholders will pay any selling commissions, brokerage fees and related expenses.

There is a limited market in our Common Stock. The shares are being offered by the Selling Stockholders in anticipation of the continued development of a secondary trading market in our Common Stock. We cannot give you any assurance that an active trading market in our Common Stock will develop, or if an active market does develop, that it will continue.

Our Common Stock is listed on the OTC Bulletin Board and trades under the symbol RNFU.OB. On December 7, 2010, the date of the last reported trade of our Common Stock, the closing sale price of our Common Stock was $4.00 per share.

Investing in our Common Stock involves risks. See “Risk Factors” on page 9.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is ______, 2011

TABLE OF CONTENTS

|

Page

|

|

|

Prospectus Summary

|

3

|

|

Risk Factors

|

9

|

|

Special Note Regarding Forward-Looking Statements

|

22

|

|

Use of Proceeds

|

23

|

|

Market for Common Equity and Related Stockholder Matters

|

23

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

24

|

|

Organizational History of the Company and its Subsidiaries

|

37

|

|

Business

|

41

|

|

Description of Property

|

51

|

|

Directors, Executive Officers, Promoters and Control Persons

|

53

|

|

Transactions With Related Persons, Promoters and Control Persons; Corporate Governance

|

55

|

|

Security Ownership of Certain Beneficial Owners and Management

|

58

|

|

Selling Stockholders

|

60

|

|

Description of Securities

|

64

|

|

Shares Eligible for Future Sale

|

69

|

|

Material United States Federal Income Tax Considerations

|

70

|

|

Material PRC Income Tax Considerations

|

73

|

|

Plan of Distribution

|

76

|

|

Legal Matters

|

78

|

|

Experts

|

78

|

|

Changes in and Disagreements With Accountants

|

78

|

|

Where You Can Find More Information

|

78

|

|

Index to Consolidated Financial Statements

|

79

|

ABOUT THIS PROSPECTUS

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by or on behalf of us or to which we have referred you. We have not authorized anyone to provide you with information that is different. This document may only be used where it is legal to offer or sell these securities. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy these securities in any jurisdiction in which such offer or solicitation may not be legally made. If any other information or representation is given or made, such information or representation may not be relied upon as having

been authorized by us or the underwriter, and neither we nor the underwriter accepts any liability in relation thereto.

We obtained statistical data, market data and other industry data and forecasts used throughout, or incorporated by reference in, this prospectus from market research, publicly available information and industry publications. Industry publications generally state that they obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy and completeness of the information. Similarly, while we believe that the statistical data, industry data and forecasts and market research are reliable, we have not independently verified the data. We have not sought the consent of the sources to refer to their reports appearing or

incorporated by reference in this prospectus.

2

PROSPECTUS SUMMARY

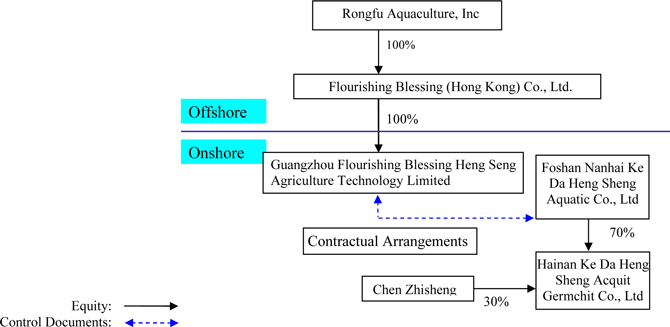

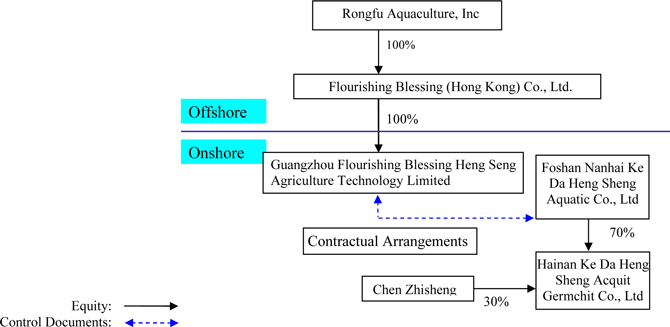

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, especially the “Risk Factors” section beginning on page 9 and our consolidated financial statements and the related notes appearing at the end of this prospectus, before making an investment decision. Unless the context otherwise requires, The "Company", "we," "us," and "our," refer to (i) Rongfu Aquaculture, Inc. (“Rongfu”), (iii) Flourishing Blessing (Hong Kong)

Co., Ltd. (“Flourishing HK”) and (iv) Guangzhou Flourishing Blessing Heng Seng Agriculture Technology Limited (the “WOFE” or “Guangzhou Flourishing”). Certain references to ownership and other rights of the Company in this prospectus include the rights of Foshan Nanhai Ke Da Heng Sheng Aquatic Co., Ltd. and Hainan Ke Da Heng Sheng Acquit Germchit Co., Ltd. which we are attributing to the Company by virtue of the Contractual Agreements described below. All information contained herein for the fiscal year ended December 31, 2010 and at December 31, 2010 is unaudited.

Our Business

Through our subsidiaries and the Contractual Agreements described below, we are engaged in commercial freshwater aquaculture in the People’s Republic of China (the “PRC”). Aquaculture is the cultivation or farming of fish under controlled conditions (as contrasted with the harvesting of fish in the wild). We cultivate fish in fresh water (not marine (salt water) or brackish environments), sell fish and fish fry (juvenile fish) and also act as a dealer of freshwater fish (generating trading profits from the purchase of fish from third party farmers and the immediate re-sale of such fish to wholesalers and processors).

During the fiscal year ended December 31, 2010 (“fiscal 2010”) we sold more than 38,000 tons of adult fish to frozen fish processors and wholesalers in Guangdong Province and Hainan Province, PRC and we sold approximately 370 million fry to distributors, which in turn sold such fry to other farmers to cultivate.

Our Industry

Aquaculture is the science, art, or practice of cultivating and harvesting aquatic organisms, including fish, mollusks, crustaceans, aquatic plants, and algae such as seaweed. Operating in marine, brackish, and freshwater environments, aquaculture provides food for people and in smaller amounts supplies fish for stocking lakes, bait for fishing, and live specimens for home aquariums. According to a recent study by the World Food and Agriculture Organization (“FAO”) published on March 2, 2009, world fisheries production reached a new high of 143.6 million metric tons in 2006, including farmed and ocean caught product. The contribution of

aquaculture to the world fisheries production in 2006 was 51.7 million tons of fish, which was 36 percent of world fisheries production in 2006, up from 3.6 percent in 1970. Global aquaculture accounted for 6 percent of the fish available for human consumption in 1970. In 2006 global aquaculture accounted for 47 percent of the fish available for human consumption according to the FAO. The FAO report also describes that over half of the global aquaculture in 2006 was freshwater finfish. Based on the FAO’s projections, it is estimated that in order to maintain the current level of per capita consumption, global aquaculture production will need to reach in excess of 80 million tons of fish by 2050.

Also according to the FAO, in 2006 China contributed approximately 67% of the total quantity and 49% of the total value of worldwide aquaculture production. In China, approximately 90% of fish production comes from aquaculture. China’s aquatic production for 2009 is forecast to have reached 49.5 metric tons (“MMT”), an increase of approximately two percent from the estimated 48.6 MMT of production in 2008.

Inland aquaculture is very important part of China fishery industry. Freshwater aquaculture is carried out in fish ponds, lakes, reservoirs, canals, pens, cages, and paddy fields. Freshwater aquaculture production is dominated by finfish, particularly silver, grass and other carps. Pond culture is the most important source of inland aquaculture, with an estimated share of 73.9% in 1996. More than 4.5 million Chinese farmers are engaged in aquaculture, more than the rest of the world combined.

3

In 2005, according to the American Tilapia Association (“ATA”), tilapia production worldwide was second in volume to carp, and it is projected by the ATA that tilapia will become the most important aquaculture crop in the 21st century. Commercial production of tilapia has become popular in many countries around the world. Touted as the “new white fish” to replace the depleted ocean stocks of cod, pollock, and hake, world tilapia production continues to rise and at least 100 countries currently raise tilapia, with the PRC being the largest producer. The American

Tilapia Association further reports that world production of tilapia products reached approximately 2.5 million metric tons in 2007, of which China produced the dominant share of 45.0 percent.

Our Principal Competitive Strengths

We believe we have the following principal competitive strengths:

|

|

•

|

Quality Products. We produce fish products and have developed a farming system that avoids the use of potentially toxic chemicals, drugs, pesticide residues, veterinary drug residues, heavy metals, pollutants and other substances. We believe that we fully comply with the Law of PRC on the Prevention and Control of Water Pollution. Our fish are raised in ponds of pure rain water collected for aquaculture. We use high quality fish food to comply with the safety rules and regulations in the PRC.

|

|

|

•

|

Vertically Integrated Operations. Vertical integration of our operations allows us to control and monitor quality, as well as reduce costs. Through our cooperative arrangements with local farmers, we train them to our production methods, while monitoring constantly the quality of production until harvest.

|

|

|

•

|

Environmental and Quality Assurances. We have adopted and implemented stringent quality control measures and procedures throughout the production process, in order to comply with the various environmental and quality standards. In order to supply to food processing companies, we have complied with the Food Safety Law of the PRC, which became effective on June 1, 2009. We use advanced technologies in our farming, feed formulation and processing operations. We have adopted modern and environmentally friendly and responsible technology in our growing process of fishes.

|

|

|

•

|

Strategic Location in Guangdong Province, PRC. Our processing facilities are geographically well-positioned in Guangdong Province to leverage favorable climatic conditions, abundant water supply, a pristine environment and a readily available source of labor for our processing plant. Furthermore, our logistics center is conveniently located near the farmers from whom we obtain our supply of fish and it is

also in close proximity to our new cooperative fish farms.

|

|

|

•

|

Competitive Cost Structure. We benefit from competitive cost structures due to the lower labor costs in China and the streamline of the supply chain transactions to increase the logistics efficiencies. We also believe that we are able to trim our operating costs by procurement of fry and fish food at relatively low cost and deployment of advanced methods for cultivation.

|

|

|

·

|

Experienced Management – The senior management has extensive experience in fish farming in Guangdong Province in China. Mr. Chen Zhisheng, our Chairman, has over 30 years experience in the field of aquaculture. He also serves as the Chairman of Foshan Nanhai Aquaculture Association and we believe that he has great influence in the development of the industry in Guangdong Province.

|

4

Our Growth Strategies

|

|

•

|

Domestic Sales and Marketing Efforts. The recent establishment of our sales office in Hangzhou on May 2010 will help us further roll out our products outside of Guangdong Province. Following the opening of our logistics center in May 2010, we can explore new sales networks for other regions to meet customer needs and thus advance our new branding and marketing initiative around our “Ke Da Heng Sheng” brand of our adult fish and fish fry products.

|

|

|

•

|

Strong Research and Development Team. We have an established and strong research and development team to enhance our growing technology and have close cooperation with leading research institutes with the aim to develop new strains of fish. We plan to add more breeding types of fish to meet the demand of farmers and to deliver “all-season” fry (fry that are raised and grown all year long) to smooth out our production cycle and enable us to minimize price fluctuations and generate more consistent revenue throughout the year.

|

|

|

•

|

Expansion of Cooperative Farming. We plan to expand our cooperative farming arrangements to increase the availability of our products to meet anticipated growth in demand.

|

|

|

•

|

Expansion of Production Facilities. We plan to expand our production facilities to satisfy the anticipated growing demand for our products.

|

Our Corporate Structure

Our current structure is set forth in the diagram below:

5

Company Information

Our principal executive offices are located at Dongdu Room 321, No. 475 Huanshidong Road, Guangzhou City, PRC 510075, and our telephone number is 011-86-20-8762-1778.

THE OFFERING

On March 29, 2010 the Company entered into and consummated the Share Exchange Agreement with certain of the Selling Stockholders. Pursuant to or in connection with the Share Exchange Agreement, the Company issued to certain of the Selling Stockholders an aggregate of 1,044,081 shares of common stock of Rongfu Aquaculture, Inc. On March 29, 2010 the Company also entered into and consummated the Purchase Agreement with certain of the Selling Stockholders, pursuant to which the Company issued to those Selling Stockholders in exchange for an aggregate cash payment of approximately $7,700,000 (a) an aggregate of 2,768,721 shares of its Series A Preferred Stock, (b)

five-year Series A Warrants to purchase an aggregate of 1,730,451 shares of its Common Stock for $3.47 per share and (c) five-year Series B Warrants to purchase an aggregate of 1,730,451 shares of its Common Stock for $4.17 per share. In connection with the consummation of the Purchase Agreement and the Share Exchange Agreement the Company also issued to certain of the Selling Stockholders (d) five-year Series C Warrants to purchase an aggregate of 333,333 shares of its Common Stock for $2.44 per share and (e) five-year Series D warrants to purchase an aggregate of 333,333 shares of its Common Stock for $2.93 per share.

This prospectus relates to the resale of the 7,940,370 shares of our Common Stock issued to the Selling Stockholders and issuable to the Selling Stockholders upon conversion of the Series A Preferred Stock and exercise of all of the warrants referred to in the preceding paragraph.

|

Issuer

|

Rongfu Aquaculture, Inc.

|

|

|

Common Stock outstanding prior to the Offering

|

21,286,789 shares

|

|

|

Common Stock offered by the Selling Stockholders

|

7,940,370 shares

|

|

|

Total shares of Common Stock to be outstanding after the Offering assuming conversion of all Series A Preferred Stock and exercise of all outstanding warrants

|

28,183,078 shares

|

|

|

Use of Proceeds

|

We will not receive any proceeds from the sale of the shares of Common Stock.

|

|

|

Our OTC Bulletin Board Trading Symbol

|

RNFU.OB

|

|

|

Risk Factors

|

You should read the “Risk Factors” section beginning on page 7 of this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our Common Stock.

|

The number of shares of our Common Stock to be outstanding after this offering is based on 21,286,789 shares of our Common Stock outstanding as of February 18, 2011 and gives effect to the issuance of an aggregate of 6,896,289 shares of Common Stock to the Selling Stockholders upon conversion of all of the Series A Preferred Stock and warrants to purchase our Common Stock held by them.

6

SUMMARY CONSOLIDATED FINANCIAL DATA

The following tables summarize our consolidated financial data for the periods presented. You should read these tables together with the consolidated financial statements and related notes appearing at the end of this prospectus, as well as “Capitalization,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the other financial information included elsewhere in this prospectus. We have derived the consolidated statement of operations data for the nine months ended September 30, 2010 and 2009 from our unaudited consolidated financial statements included in this prospectus. Our historical results are not necessarily

indicative of the results to be expected in any future period.

|

|

Nine months

ended September 30, 2010

|

Nine months

ended September 30, 2009

|

||||||

|

|

||||||||

|

Revenue

|

$ | 35,369,699 | $ | 21,731,927 | ||||

|

Cost of goods sold

|

23,576,353 | 13,323,764 | ||||||

|

Gross profit

|

11,793,346 | 8,408,163 | ||||||

|

Operating expenses:

|

||||||||

|

Selling expenses

|

1,299,046 | 491,112 | ||||||

|

General and administrative expenses

|

1,956,142 | 1,336,945 | ||||||

|

Research and development cost

|

104,255 | 56,437 | ||||||

|

Total operating expenses

|

3,359,443 | 1,884,494 | ||||||

|

Net income from operations

|

8,433,903 | 6,523,669 | ||||||

|

Other income (expenses):

|

||||||||

|

Loss on fair value of derivative liability

|

(6,251,254 | ) | - | |||||

|

Interest income

|

10,584 | 35,510 | ||||||

|

Interest expense

|

(35,678 | ) | (87,436 | ) | ||||

|

Total other income (expense)

|

(6,276,348 | ) | (51,926 | ) | ||||

|

Net income before income taxes

|

2,157,555 | 6,471,743 | ||||||

|

Income taxes

|

790,416 | 446,572 | ||||||

|

Net income

|

$ | 654,463 | $ | 5,021,462 | ||||

|

Deemed dividend from beneficial conversion feature of Series A preferred stock

|

(4,374,579 | ) | - | |||||

|

Dividends paid or declared

|

$ | (838,577 | ) | - | ||||

|

Net income (loss) available to common shareholders

|

$ | (3,846,017 | ) | $ | 6,025,171 | |||

|

Earnings per share – basic and diluted

|

$ | (0.19 | ) | $ | 0.31 | |||

|

Weighted average shares outstanding

|

20,756,854 | 19,623,889 | ||||||

|

Net income

|

$ | 1,367,139 | $ | 6,025,171 | ||||

|

Other comprehensive income

|

$ | 399,260 | $ | 18,092 | ||||

|

Comprehensive income

|

$ | 1,766,399 | $ | 6,043,263 | ||||

7

|

|

Year ended December 31, 2009

|

Year ended December

31, 2008

|

||||||

|

Revenue

|

$ | 43,842,407 | $ | 35,592,569 | ||||

|

Cost of goods sold

|

26,708,361 | 20,043,897 | ||||||

|

Gross profit

|

17,134,046 | 15,548,672 | ||||||

|

Operating expenses:

|

||||||||

|

General and administrative expenses

|

1,642,757 | 1,606,312 | ||||||

|

Selling expenses

|

871,279 | 1,023,444 | ||||||

|

Research and development cost

|

90,045 | 88,040 | ||||||

|

Total operating expenses

|

2,604,081 | 2,717,796 | ||||||

|

Net income from operations

|

14,529,965 | 12,830,876 | ||||||

|

Other income (expenses):

|

||||||||

|

Interest income

|

50,493 | 71,087 | ||||||

|

Interest expense

|

(107,827 | ) | (12,733 | ) | ||||

|

Other expenses

|

(415 | ) | (1,954 | ) | ||||

|

Total other income (expense)

|

(57,749 | ) | 56,400 | |||||

|

Net income before income taxes

|

14,472,216 | 12,887,276 | ||||||

|

Income taxes

|

1,396,028 | 1,027,781 | ||||||

|

Net income

|

$ | 13,076,188 | $ | 11,859,495 | ||||

|

Earnings per share – basic

|

$ | 0.67 | $ | 0.60 | ||||

|

Earnings per share – diluted

|

$ | 0.67 | $ | 0.60 | ||||

|

Weighted average shares outstanding –basic

|

19,623,889 | 19,623,889 | ||||||

|

Weighted average shares outstanding –diluted

|

19,623,889 | 19,623,889 | ||||||

|

Net income

|

$ | 13,076,188 | $ | 11,859,495 | ||||

|

Other comprehensive income

|

5,533 | 600,174 | ||||||

|

Comprehensive income

|

$ | 13,081,721 | 12,459,669 | |||||

8

Balance Sheet Data:

|

|

September 30, 2010

|

December 31, 2009

|

||||||

|

Cash

|

$ | 6,695,287 | $ | 3,194,248 | ||||

|

Accounts receivable

|

$ | 1,604,553 | $ | 236,374 | ||||

|

Inventories

|

$ | 10,905,977 | $ | 2,979,753 | ||||

|

Due from shareholders

|

$ | - | $ | 4,008,659 | ||||

|

Prepaid expenses

|

$ | 653,372 | $ | 230,247 | ||||

|

Fixed assets

|

$ | 868,448 | $ | 405,147 | ||||

|

Other receivables

|

$ | 1,321,356 | $ | 21,208 | ||||

|

Trade deposit

|

$ | - | $ | 121,224 | ||||

|

Biological assets

|

$ | 248,811 | $ | 432,808 | ||||

|

Total assets

|

$ | 22,297,804 | $ | 11,629,668 | ||||

|

Total liabilities

|

$ | 15,409,405 | $ | 9,254,732 | ||||

|

Temporary equity

|

$ | 7,700,00 | $ | - | ||||

|

Total stockholders' equity

|

$ | (811,601 | ) | $ | 2,374,936 | |||

|

Total liabilities and stockholders’ equity

|

$ | 22,297,804 | $ | 11,629,668 | ||||

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this prospectus, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS

We may not be able to effectively control and manage our growth, and a failure to do so could adversely affect our operations and financial condition.

We plan to expand our current production capacity. Planned expenditures for land, equipment, acquisition of companies and market expansion are approximately $20 million over the next two years. Even if we are able to secure the funds necessary to implement these expenditures (of which there is no assurance), we will face management, resource and other challenges in expanding our current facilities, integrating acquired assets or businesses with our own, and managing expanding product offerings. Failure to effectively deal with increased demands on our resources could interrupt or adversely affect our operations and cause production backlogs, longer product development time frames and administrative inefficiencies.

Other challenges involved with expansion, acquisitions and operation include:

|

●

|

unanticipated costs;

|

|

●

|

the diversion of management’s attention from other business concerns;

|

|

●

|

potential adverse effects on existing business relationships with suppliers and customers;

|

|

●

|

obtaining sufficient working capital to support expansion;

|

|

●

|

expanding our product offerings and maintaining the high quality of our products;

|

|

●

|

maintaining adequate control of our expenses and accounting systems;

|

|

●

|

successfully integrating any future acquisitions; and

|

9

|

●

|

anticipating and adapting to changing conditions in the aquaculture industry, whether from changes in government regulations, mergers and acquisitions involving our competitors, technological developments or other economic, competitive or market dynamics.

|

Even if we do obtain benefits of expansion in the form of increased sales, there may be a lag between the time when the expenses associated with an expansion or acquisition are incurred and the time when we recognize such benefits, which would affect our earnings.

The new cooperative model we are developing will require substantial investment and reliance upon independent farmers and there can be no assurance that the model will be successful.

We are developing a new cooperative business model which will rely more heavily on independent fish farmers to grow fish for us to purchase and re-sell. The new model will require substantial working capital from us because we intend to provide farmers fish fry to grow and not receive payment for the fry at the time we provide the fry. The cost of the fry provided to each farmer will be recorded as a receivable from such farmer on our books and recouped by us when we purchase adult fish from the farmer. A return on our investment will be dependent upon our success in training farmers in our techniques and insuring uniform quality. Currently, most of the independent

farmers lack the necessary expertise and management experience needed to economically produce healthy adult fish.

Any actual contamination of our products resulting from processing, packaging or transit of our products, or negative press from contamination experienced by other companies in our industry may adversely affect our operations or reduce our margins or profits.

We actively seek to control the quality of our products and avoid risk of contamination in the distribution of such products. However, no quality control program is guaranteed to be completely effective. We are dependent on others for the reliable processing, packaging and safe transportation of our products to the market place and the quality of our final product as experienced by the consumer may be impacted by disruptions in the processing, packaging and transit process beyond our control. In addition, if our competitors experience problems with contamination of their products, even if we do not concurrently suffer similar adverse events, publicity of such problems could negatively impact our reputation. Actual

contamination or reports of industry problems with contamination or poor quality may have a material adverse effect on our operations, including an increase in product liability claims, higher quality control and transport costs, reduced margins and decreased consumer interest in our products.

We may be adversely affected by the fluctuation in raw material prices and selling prices of our products.

Neither our products nor the raw materials we use have experienced any significant price fluctuations since we began operation, but there is no assurance that they will not be subject to future price fluctuations or pricing control. The products and raw materials we use may experience price volatility caused by events such as market fluctuations or changes in governmental programs. The market price of these raw materials may also experience significant upward adjustment, if, for instance, there is a material under-supply or over-demand in the market. These price changes may ultimately result in increases in the selling prices of our products, and may, in turn, adversely affect our sales volume, revenue and operating

profit.

We could be adversely affected by the occurrence of natural disasters in Guangdong and Hainan Provinces.

From time to time, both Guangdong and Hainan Provinces experience typhoons, particularly from June through September of any given year. Natural disasters could impede operations, damage infrastructure necessary to our operations or adversely affect the logistical services to and from such provinces. Even though we currently have insurance against damage caused by natural disasters, including typhoons, accidents or similar events, the occurrence of natural disasters in Hainan and Guangdong Provinces could adversely affect our business, the results of our operations, prospects and financial condition, through business disruptions and/or any losses in excess of our policy limits.

10

We do not presently maintain product liability insurance or business interruption insurance, and our property and equipment insurance does not cover the full value of our property and equipment, which leaves us with exposure in the event of loss or damage to our properties or claims filed against us.

We currently do not carry any product liability or other similar insurance or business interruption insurance. Unlike in the United States and many other countries, product liability claims and lawsuits in the PRC are rare. Product liability exposures and litigation, however, could become more commonplace in the PRC. Moreover, we could have more product liability exposure and liability as we expand our sales into international markets, like the United States, where product liability claims are more prevalent.

We may be required from time to time to recall products entirely or from specific co-packers, markets or batches. We do not maintain recall insurance. In the event we do experience product liability claims or a product recall, or suffer from natural or other unexpected disaster, business or government litigation, or any uncovered risks of operation our financial condition and business operations could be materially adversely affected.

We may not have adequate or effective internal accounting controls.

The PRC has not adopted a Western style of management and financial reporting concepts and practices. We may have difficulty in hiring and retaining a sufficient number of qualified employees to work in the PRC. As a result of these factors, we may experience difficulty in establishing accounting and financial controls, collecting financial data, budgeting, managing our funds and preparing financial statements, books of account and corporate records and instituting business practices that meet Western standards.

Rules adopted by the Securities and Exchange Commission (the “Commission”) pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 require annual assessment of our internal controls over financial reporting. The requirement that management perform an assessment of internal controls over financial reporting first applied to our Annual Report on Form 10-K for the fiscal year ended December 31, 2008. The standards that must be met for management to assess the internal controls over financial reporting as effective are relatively new and complex, and require significant documentation, testing and possible remediation to meet the detailed

standards.

Our lack of familiarity with Western practices generally and Section 404 specifically may unduly divert management’s time and resources, which could have a material adverse effect on our operating results. Further, if material weaknesses in our internal controls over financial reporting are identified or our external auditors are unable to attest that our management’s report is fairly stated or to express an opinion on the effectiveness of our internal controls, this could result in a loss of investor confidence in our financial reports, have an adverse effect on our stock price and/or subject us to sanctions or investigation by regulatory authorities.

During the preparation of our financial statements for the quarter ended September 30, 2010, we determined that there existed deficiencies in controls relating to the following and that it was necessary for the Company to restate its previously issued financial statements for the quarters ended March 31, 2009 and March 31, 2010 and June 30, 2009 and June 30, 2010 for the following reasons.

1. The weighted average common shares outstanding for the quarters ended March 31, 2009, June 30, 2009, March 31, 2010 and June 30, 2010 were overstated in such financial statements and earnings per share for the quarters ended March 31, 2009, June 30, 2009, March 31, 2010 and June 30, 2010 were understated in such financial statements.

11

2. The value attributed to shares of the Company’s common stock which were issued for prior services on March 29, 2010 should have been expensed in the Company’s income statements for the quarter ended March 31, 2010 and for the six months ended June 30, 2010.

3. $7,700,000 of Preferred Stock included under Stockholders’ Equity on the Company’s balance sheets as of March 31, 2010 and June 30, 2010 should be reclassified as Temporary Equity.

We have further concluded that such deficiencies represented material weaknesses. As a result, we concluded that the Company’s internal controls over financial reporting were not effective at September 30, 2010.

The Company is in the process of enhancing its financial reporting by implementation of stronger internal controls through the recruitment of high caliber personnel with strong financial reporting backgrounds and the establishment of effective checking and reviewing procedures. In 2011 we plan to enrich the accounting knowledge of all of our financial and accounting personnel by holding training to increase the awareness and use of controls and transparency by all staff and by redesigning document flows and establishing strong control points.

Our senior management lacks experience managing a public company and complying with laws applicable to operating as a U.S. public company.

Prior to the completion of this offering, subsidiaries of Rongfu have operated as private companies located in China. None of Rongfu’s senior management has experience managing a public company.

As a result of the reverse merger on March 29, 2010, our company became subject to laws, regulations and obligations that did not currently apply to it, and our senior management currently has limited experience in complying with such laws, regulations and obligations. Our senior management is currently experienced in operating the business of Rongfu in compliance with Chinese law. Similarly, by virtue of the reverse merger, Rongfu is required to file quarterly and annual reports and to comply with U.S. securities and other laws, which did not apply to subsidiaries of Rongfu prior to the merger. These obligations can be burdensome and complicated, and failure to comply with such obligations could have a material

adverse effect on Rongfu. In addition, we expect that the process of learning about such new obligations as a public company in the United States will require senior management to devote time and resources to such efforts that might otherwise be spent on the operation of the aquaculture business.

Further, because historically our operations have been in China, we have operated in accordance with China GAAP and have not previously been required to comply with U.S. GAAP. Our current CFO has experience with U.S. GAAP and our Financial manager has limited experience with U.S. GAAP. We are taking steps to increase our level of experience with U.S. accounting and SEC requirements, as well as to improve our internal accounting controls. Our annual financial statements are audited by our independent registered public accounting firm for compliance with GAAP standards. Yet, we cannot assure that our management has identified or fully remedied all material weaknesses in our

internal controls of financial reporting pursuant to US GAAP. If deficiencies go undetected or unremedied, our financial statements may not accurately reflect our financial condition as required by U.S. GAAP.

We may have violated Section 402 of the Sarbanes-Oxley Act of 2002 and Section 13(k) of the Exchange Act and may be subject to sanctions for such violations.

Section 13(k) of the Exchange Act provides that it is unlawful for a company such as ours, which has a class of securities registered under Section 12(g) of the Exchange Act, to directly or indirectly, including through any subsidiary, extend or maintain credit in the form of a personal loan to or for any director or executive officer of the company. Issuers violating Section 13(k) of the Exchange Act may be subject to civil sanctions, including injunctive remedies and monetary penalties, as well as criminal sanctions. The imposition of any of such sanctions on the Company may have a material adverse effect on our financial position, results of operations or cash flows.

12

On March 29, 2010 pursuant to a Share Exchange Agreement with the former stockholders of Rongfu Delaware we acquired 100% of the outstanding common stock of Rongfu Delaware. At the time, Chen Zhisheng, who became our Chairman on such date, was indebted on account of a previous loan of an aggregate of RMB 21,900,000 (approximately $3,220,588) made by Foshan Nanhai Ke Da Heng Sheng Aquatic Co., Ltd (“Nanhai Ke Da Heng Sheng”)., a PRC limited liability company with which one of Rongfu’s subsidiaries has certain Contractual Agreements described below.

The loan was repaid in full in on May 17, 2010. However, the existence of indebtedness of Mr. Chen to Nanhai Ke Da Heng Sheng Ltd. at the time the Company acquired Rongfu and the continuation of such indebtedness for a period of time thereafter may have constituted a violation of Section 13(k) of the Exchange Act (Section 402(a) of the Sarbanes-Oxley Act of 2002).

Partially in response to the matters set forth above, in October 2010, our board of directors adopted a policy regarding approval of related party transactions. Under the policy, any related party transaction involving an aggregate amount that is expected to exceed $50,000 must be approved by our board of directors or the audit committee of the Board once it is established, and no director may participate in any discussion or approval of a transaction that would be considered to be a related party transaction in which such person is interested. See the section of this prospectus entitled “Certain Relationships and Related Party

Transactions—Review, Approval or Ratification of Transactions with Related Persons.”

Our revenue will decrease if the aquaculture industry experiences a downturn.

We are subject to the general changes in economic conditions affecting many segments of the economy. Demand for fish is typically affected by a number of economic factors, including, but not limited to, fish supply, seasonal climates, government regulation and government guidance.

Competition in the aquaculture industry could adversely affect our results of operations.

We operate in local and regional markets in China, and many factors affect the competitive environments we face in any particular market. These factors include the number of competitors in the market, the pricing policies and financial strength of those competitors, the total production capacity serving the market, the barriers to enter the market and the proximity of natural resources, as well as general economic conditions and demand for construction materials within the market. There is no assurance that existing or new competitors may not receive contracts for which we compete by reason of events and factors beyond our control.

Our growth strategy is capital intensive; without additional capital on favorable terms we may not accomplish our strategic plan.

Our expansion plans are premised upon our raising sufficient capital. There can be no assurance that we will do so. Our inability to raise sufficient capital or inability to raise capital on acceptable terms to fund these new production plants would negatively impact our projected revenues and our projected growth.

Long-term collection of accounts receivable and potential bad debts may impose a threat to our operations and expansion.

At certain times we may have a large amount of accounts receivable, which account for over 2% of our total assets. A substantial majority of our outstanding trade receivables are not secured by any collateral or credit insurance. While we have procedures to monitor and limit exposure to credit risk on our trade and non-trade receivables, there is no assurance that such procedures will effectively limit our risks of bad debts and avoid losses, which could have a material adverse effect on our financial condition, operating results and business expansion.

13

We depend heavily on key personnel, and turnover of key employees and senior management could harm our business.

Our future business and results of operations depend in significant part upon the continued contributions of our key technical and senior management personnel, including Chen Zhisheng, our Chairman and Kelvin Chan, our Chief Executive Officer and President. They also depend in significant part upon our ability to attract and retain additional qualified management, technical, marketing and sales and support personnel for our operations. If we lose a key employee, or if we are not able to attract and retain skilled employees as needed, our business could suffer. We also depend on Professor Sifa Li and his team from Shanghai Fisheries University to help

us breed certain of our products. Significant turnover in our senior management could significantly deplete our institutional knowledge held by our existing senior management team. We depend on the skills and abilities of these key employees in managing the production, technical, marketing and sales aspects of our business, any part of which could be harmed by turnover in the future. We also depend on Professor Sifa Li and his team from Shanghai Fisheries University to help us breed certain of our products.

Approximately 62% of our sales revenues was derived from our ten largest customers in 2010 and any reduction in revenues from any of these customers would reduce our revenues and net income.

Based on unaudited information, in the fiscal year ended December 31, 2010 we derived approximately 62% of our revenue from our ten largest customers. In fiscal year 2009, we derived approximately 76% of our revenue from our ten largest customers. In fiscal year 2008, we derived approximately 75% from our ten largest customers. We believe we are favorably diversifying our customer base to put less reliance on any one customer; however, the loss of one of major customers could materially decrease our revenues and net income.

We may be unable to continue to take advantage of the seasonal pricing fluctuation in sales of our products, and we may be adversely affected by the seasonal fluctuation in the prices we earn for our products.

We have experienced seasonal fluctuation in the prices we earn for our products, generally in the range of 15 to 20%. Pricing fluctuation occurs during the winter season when fish farms in the northern part of the PRC suspend production due to cold weather conditions. These weather related disruptions in supply permit us to increase the sales prices of our tilapia products. However, there can be no assurance that such premium pricing, benefiting our profitability, can be maintained in the future. Other factors, such as an increase in the cost of feed, might also adversely impact on the cost of fish and lessen our margins and profitability.

Our continuing rapid expansion could significantly strain our resources, management and operational infrastructure which could impair our ability to meet increased demand for our products and hurt our business results.

To accommodate our anticipated growth and to build additional facilities, we will need to expend capital resources and dedicate personnel to implement and upgrade our accounting, operational and internal management systems and enhance our record keeping and contract tracking system. If we cannot successfully implement these measures efficiently and cost-effectively, we will be unable to satisfy the demand for our products, which will impair our revenue growth and hurt our overall financial performance.

14

Certain of our existing stockholders have substantial influence over our company, and their interests may not be aligned with the interests of our other stockholders.

Mr. Kelvin Chan is the owner of approximately 81.7% of our common stock. As more particularly described in footnote 3 to the table contained in “Security Ownership,” Mr. Chan has granted options to purchase an aggregate of 14,400,000 of his shares to certain persons, including 9,000,000 shares to Chen Zhisheng, our Chairman. As a result, Mr. Chan and Mr. Chen may have significant influence over our business, including decisions regarding mergers, consolidations and the sale of all or substantially all of our assets, election of directors and other significant corporate actions. This concentration of ownership may also have the effect of discouraging,

delaying or preventing a future change of control, which could deprive our stockholders of an opportunity to receive a premium for their shares as part of a sale of our company and might reduce the price of our shares.

Environmental claims or failure to comply with any present or future environmental regulations may require us to spend additional funds and may harm our results of operations.

Our business is subject to environmental, health and safety laws and regulations that affect our operations, facilities and products in each of the jurisdictions in which we operate. We believe that we are in compliance with all material environmental, health and safety laws and regulations related to our products, operations and business activities. Although we have not suffered material environmental claims in the past, the failure to comply with any present or future regulations could result in the assessment of damages or imposition of fines against us, suspension of production, cessation of our operations or even criminal sanctions. The enacting of new

regulations could also require us to acquire costly equipment or to incur other significant expenses.

Our holding company structure may limit the payment of dividends.

We have no direct business operations, other than our ownership of our subsidiaries. While we have no current intention of paying dividends, should we decide in the future to do so, as a holding company, our ability to pay dividends and meet other obligations depends upon the receipt of dividends or other payments from our operating subsidiaries and other holdings and investments. In addition, our operating subsidiaries, from time to time, may be subject to restrictions on their ability to make distributions to us, including as a result of restrictive covenants in loan agreements, restrictions on the conversion of local currency into U.S. dollars or other

hard currency and other regulatory restrictions as discussed below. If future dividends are paid in RMB, fluctuations in the exchange rate for the conversion of RMB into U.S. dollars may reduce the amount received by U.S. stockholders upon conversion of the dividend payment into U.S. dollars.

Chinese regulations currently permit the payment of dividends only out of accumulated profits as determined in accordance with Chinese accounting standards and regulations. Our subsidiaries in China are also required to set aside a portion of their after tax profits according to Chinese accounting standards and regulations to fund certain reserve funds. Currently, our subsidiaries in China are the only sources of revenues or investment holdings for the payment of dividends. If they do not accumulate sufficient profits under Chinese accounting standards and regulations to first fund certain reserve funds as required by Chinese accounting standards, we

will be unable to pay any dividends.

RISKS RELATED TO DOING BUSINESS IN CHINA

Risks Related to Doing Business in the PRC

The Company faces the risk that changes in the policies of the PRC government could have a significant impact upon the business that the Company may be able to conduct in the PRC and the profitability of such business.

The PRC economy is in a transition from a planned economy to a market oriented economy subject to five-year and annual plans adopted by the government that set national economic development goals. Policies of the PRC government can have significant effects on the economic conditions of the PRC. The PRC government has confirmed that economic development will follow the model of a market economy. Under this direction, the Company believes that the PRC will continue to strengthen its economic and trading relationships with foreign countries and business development in the PRC will follow market forces. While the Company believes that this trend will continue, there can be

no assurance that this will be the case. A change in policies by the PRC government could adversely affect the Company’s interests by, among other factors: changes in laws, regulations or the interpretation thereof, confiscatory taxation, restrictions on currency conversion, imports or sources of supplies, or the expropriation or nationalization of private enterprises. Although the PRC government has been pursuing economic reform policies for more than two decades, there is no assurance that the government will continue to pursue such policies or that such policies may not be significantly altered, especially in the event of a change in leadership, social or political disruption, or other circumstances affecting the PRC political, economic and social life.

15

The PRC laws and regulations governing the Company’s current business operations are sometimes vague and uncertain. Any changes in such PRC laws and regulations may have a material and adverse effect on the Company’s business.

There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations, including but not limited to the laws and regulations governing the Company’s business, or the enforcement and performance of the Company’s arrangements with customers in the event of the imposition of statutory liens, death, bankruptcy and criminal proceedings. The Company and any future subsidiaries are considered foreign persons or foreign funded enterprises under PRC laws, and as a result, the Company is required to comply with PRC laws and regulations. These laws and regulations are sometimes vague and may be subject to future changes, and

their official interpretation and enforcement may involve substantial uncertainty.

The effectiveness of newly enacted laws, regulations or amendments may be delayed, resulting in detrimental reliance by foreign investors. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively. The Company cannot predict what effect the interpretation of existing or new PRC laws or regulations may have on the Company’s businesses.

A slowdown or other adverse developments in the PRC economy may materially and adversely affect the Company’s customers, demand for the Company’s products and the Company’s business.

All of the Company’s operations are conducted in the PRC and all of its revenue is generated from sales in the PRC. Although the PRC economy has grown significantly in recent years, the Company cannot assure investors that such growth will continue. A slowdown in overall economic growth, an economic downturn or recession or other adverse economic developments in the PRC could materially reduce the demand for our products and materially and adversely affect the Company’s business.

Inflation in the PRC could negatively affect our profitability and growth.

In recent years, the Chinese economy has experienced periods of rapid expansion and highly fluctuating rates of inflation. During the past ten years, the rate of inflation in China has been as high as 20.7% and as low as -2.2%. These factors have led to the adoption by the Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. High inflation may in the future cause the Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China, reduce demand, materially increase our

costs, and thereby harm the market for our products and our Company.

Governmental control of currency conversion may affect the value of an investment in the Company and may limit our ability to receive and use our revenues effectively.

The Company receives all of its revenues in Renminbi, which is currently not a freely convertible currency. The PRC government imposes controls on the convertibility of Renminbi into foreign currencies and, in certain cases, the remittance of currency out of the PRC. Any future restrictions on currency exchanges may limit our ability to use revenue generated in Renminbi to fund any future business activities outside China or to make dividend or other payments in U.S. dollars. Although the Chinese government introduced regulations in 1996 to allow greater convertibility of the Renminbi for current account transactions, significant restrictions still remain,

including primarily the restriction that foreign-invested enterprises may only buy, sell or remit foreign currencies after providing valid commercial documents, at those banks in China authorized to conduct foreign exchange business. In addition, conversion of Renminbi for capital account items, including direct investment and loans, is subject to governmental approval in China, and companies are required to open and maintain separate foreign exchange accounts for capital account items. We cannot be certain that the Chinese regulatory authorities will not impose more stringent restrictions on the convertibility of the Renminbi.

16

The fluctuation of the Renminbi may materially and adversely affect investments in the Company and the value of our securities.

The value of the Renminbi against the U.S. dollar and other currencies may fluctuate and is affected by, among other things, changes in the PRC’s political and economic conditions. As the Company relies principally on revenues earned in the PRC, any significant revaluation of the Renminbi may materially and adversely affect the Company’s cash flows, revenues and financial condition, and the price of our common stock may be harmed. For example, to the extent that the Company needs to convert U.S. dollars it receives from an offering of its securities into Renminbi for the Company’s operations, appreciation of the Renminbi against the U.S. dollar could

have a material adverse effect on the Company’s business, financial condition and results of operations. Conversely, if the Company decides to convert its Renminbi into U.S. dollars for the purpose of making payments for dividends on its common stock or for other business purposes and the U.S. dollar appreciates against the Renminbi, the U.S. dollar equivalent of the Renminbi that the Company converts would be reduced. In addition, the depreciation of significant U.S. dollar denominated assets could result in a charge to the Company’s income statement and a reduction in the value of these assets.

PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may subject our PRC resident shareholders to penalties and limit our ability to inject capital into our PRC subsidiaries, limit our PRC subsidiaries’ ability to distribute profits to us, or otherwise adversely affect us.

On October 21, 2005, the PRC State Administration of Foreign Exchange, referred to as SAFE, issued the Notice on Issues Relating to the Administration of Foreign Exchange in Fund-raising and Reverse Investment Activities of Domestic Residents Conducted via Offshore Special Purpose Companies, or Notice 75, which became effective as of November 1, 2005. According to Notice 75, prior registration with the local SAFE branch is required for PRC residents to establish or to control an offshore company for the purposes of financing such offshore company with assets or equity interests in an onshore enterprise located in the PRC, or an offshore special purpose

company. An amendment to registration or filing with the local SAFE branch by such PRC resident is also required for the injection of equity interests or assets of an onshore enterprise in the offshore special purpose company or overseas funds raised by such offshore company, or any other material change involving a change in the capital of the offshore special purpose company. Moreover, Notice 75 applies retroactively. As a result, PRC residents who have established or acquired control of offshore special purpose companies that have made onshore investments in the PRC in the past are required to have completed the relevant registration procedures with the local SAFE branch by March 31, 2006. To further clarify the implementation of Circular 75, the SAFE issued Circular 106 on May 29, 2007. Under Circular 106, PRC subsidiaries of an offshore special purpose company are

required to coordinate and supervise the filing of SAFE registrations by the offshore holding company’s shareholders or beneficial owners who are PRC residents in a timely manner.

Our current shareholders and/or beneficial owners may fall within the ambit of the SAFE notice and be required to register with the local SAFE branch as required under the SAFE notice. If so required, and if such shareholders and/or beneficial owners fail to timely register their SAFE registrations pursuant to the SAFE notice, or if future shareholders and/or beneficial owners of our company who are PRC residents fail to comply with the registration procedures set forth in the SAFE notice, this may subject such shareholders, beneficial owners and/or our PRC subsidiaries to fines and legal sanctions and may also limit our ability to contribute additional capital

into our PRC subsidiaries, limit our PRC subsidiaries’ ability to distribute dividends to our company, or otherwise adversely affect our business.

17

We may be exposed to liabilities under the Foreign Corrupt Practices Act, and any determination that we violated the Foreign Corrupt Practices Act could hurt our business.

Although we are currently not subject to these regulations, we anticipate to become subject to the Foreign Corrupt Practices Act, or FCPA, and other laws that prohibit improper payments or offers of payments to foreign governments and their officials and political parties by U.S. persons and issuers as defined by the statute for the purpose of obtaining or retaining business. Our activities in China create the risk of unauthorized payments or offers of payments by one of the employees, consultants, sales agents or distributors of our Company, even though these parties are not always subject to our control. It is our policy to implement safeguards to discourage these

practices by our employees. However, our existing safeguards and any future improvements may prove to be less than effective, and the employees, consultants, sales agents or distributors of our Company may engage in conduct for which we might be held responsible. Violations of the FCPA may result in severe criminal or civil sanctions, and we may be subject to other liabilities, which could negatively affect our business, operating results and financial condition.

Because the Company’s principal assets are located outside of the United States and the Company’s officers and directors reside outside of the United States, it may be difficult for investors to enforce their rights in the U.S. based on U.S. federal securities laws against the Company and the Company’s officers and directors or to enforce U.S. court judgments against the Company or them in the PRC.

Rongfu Aquaculture, Inc. is located in the PRC and substantially all of its assets are located outside of the United States; it may therefore be difficult or impossible for investors in the United States to enforce their legal rights based on the civil liability provisions of the U.S. federal securities laws against the Company in the courts of either the U.S. or the PRC and, even if civil judgments are obtained in U.S. courts, to enforce such judgments in PRC courts. Further, it is unclear if extradition treaties now in effect between the United States and the PRC would permit effective enforcement against the Company or its officers and directors of

criminal penalties, under the U.S. federal securities laws or otherwise.

PRC regulations also involve complex procedures for acquisitions conducted by foreign investors that could make it more difficult for us to grow through acquisitions.

Pursuant to the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, effective as of September 8, 2006 and revised as of June 22, 2009, additional procedures and requirements were established that are expected to make merger and acquisition activities in China by foreign investors more time-consuming and complex, including requirements in some instances that the Ministry of Commerce of the PRC (“MOFCOM”) be notified in advance of any change-of-control transaction in which a foreign investor takes control of a PRC domestic enterprise, or that the approval from MOFCOM be obtained in circumstances where overseas companies

established or controlled by PRC enterprises or residents acquire affiliated domestic companies and special anti-monopoly submissions for parties meeting certain reporting thresholds. We may grow our business in part by acquiring other companies engaged in aquaculture in the PRC. Complying with the requirements of the new regulations to complete such transactions could be time-consuming, and any required approval processes, including approval from MOFCOM, may delay or inhibit our ability to complete such transactions, which could affect our ability to expand our business or maintain our market share.

18

There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations governing the validity and legality of call options to purchase of our Common Stock which are held by our Chairman and others and there can be no assurance that the call options held by such persons are not in breach of such laws and regulations.

Certain persons, including our Chairman, Chen Zhisheng, under certain call option agreements between Kelvin Chan, our President and Chief Executive Officer, have options to purchase an aggregate of 14,400,000 shares of our common stock held by Mr. Chan over the course of approximately three years in installments upon achievement of certain performance milestones by the Company. While we believe that this arrangement shall not be governed by PRC laws and regulations and therefore is not in breach of any PRC laws and regulations, there are substantial uncertainties regarding the interpretation and application of current or future PRC laws and regulations, including

regulations governing the validity and legality of such call options. Accordingly, we cannot assure you that PRC government authorities will not ultimately take a view contrary to our view. If such certain call option agreements are deemed to be governed by PRC laws and regulations, our Chairman and other PRC residents under such call option agreements may be required to register with the local SAFE branch for their overseas direct investment in the Company. Failure to make such SAFE registration may subject our Chairman and such PRC residents to fines and legal sanctions, and may also limit their ability to receive dividends from our PRC subsidiaries and remit their proceeds from their overseas investment into the PRC as a result of foreign exchange control under PRC laws and regulations.

We are subject to governmental regulations that may affect the use and development of our properties.

On March 19, 2009, Ministry of Land and Resource of PRC issued “Certain Opinions on the Promotion of the Steady Development of Agriculture and Constant Increase of Income of the Peasants and the Propelling of Coordinated Development of Rural and Urban Areas” to strictly regulate the procedures for the use of agricultural land in rural areas. These opinions provide that (a) for the use of agricultural land for permanent auxiliary facilities (buildings constructed for the purpose of management and residence, such as office

buildings, dormitories and canteens), the user thereof shall apply to planning administration, land and resource authorities and other relevant governmental authorities for the approval of conversion of agricultural use to construction use; and (b) for the use of agricultural land for simple auxiliary facilities constructed for the purpose of agricultural production (such as breeding pools and cultivation sheds), the user thereof shall apply to the government at the city level for approval and such approval shall be reported and registered with the provincial land and resource authorities.

We have constructed relevant auxiliary buildings and houses on the collectively-owned land in Wanqinyang. Such buildings are used as the headquarters of Nanhai Ke Da Heng Sheng However, we have not obtained the approval for conversion from agricultural use to construction use from competent authorities for the permanent buildings, such as the office building, dormitories and canteen we built. Neither have we applied for the approval and registration of the usage of agricultural land for simple auxiliary facilities for the purpose of production of our fish pond.

Without the said approval and registrations, we cannot obtain our property ownership licenses from the housing administration. Failing to obtain such approvals and registrations, we may be subject to sanctions, including fines, and could be required to restructure our operations or cease to provide certain services, which may have an adverse effect on our operations.

In addition, the change of existing land use rules and regulations that govern our development and use of our properties may restrict our ability to develop or use our properties in a desired manner and we may be subject to more severe penalties.

We rely on contractual arrangements with the two operating companies which conduct our operations in the PRC, which may not be as effective in providing control over such companies as direct ownership.

We have no equity ownership interest in Nanhai Ke Da Heng Sheng or Hainan Ke Da Heng Sheng Aquit Germchit Co., Ltd. (“Hainan Ke Da Heng Sheng”), and rely on contractual arrangements (“Contractual Agreements”) between our indirectly wholly owned subsidiary, Guangzhou Flourishing Blessing Heng Seng Agriculture Technology Limited (the “WOFE”), with Nanhai Ke Da Heng Sheng (which owns 70% of the equity interests in Hainan Ke Da Heng Sheng) and its sole shareholder, Chen Zhisheng (who is also our Chairman of the Board) to control and operate these companies. We describe these Contractual Agreements in more detail in the section

of this prospectus entitled “Organizational History of the Companies and its Subsidiaries.” Although we have received an opinion of Global Law Office, a lawfirm located in Beijing, PRC, that the Contractual Agreements are valid, lawful and enforceable under PRC laws and regulations and do not in any way contravene and violate any PRC laws and regulations, these Contractual Agreements may not be as effective in providing control over the operating companies as direct ownership would be. For example, the operating companies could fail to take actions required for our business despite the fact that the operations and management of the business of Nanhai Ke Da Heng Sheng has been contractually entrusted to the WOFE. If Nanhai Ke Da Heng Sheng, or its sole shareholder, Chen Zhisheng, fails to perform their respective obligations under agreements with us, we may have to

incur substantial costs and resources to enforce such agreements and may have to rely on legal remedies under PRC law, including seeking specific performance or injunctive relief, and claiming damages, which may not be effective. Our Contractual Agreements with Nanhai Ke Da Heng Sheng and Chen Zhisheng are governed by PRC law. Accordingly, these contracts would be interpreted in accordance with PRC law and any disputes would be resolved in accordance with PRC legal procedures. The legal environment in the PRC is not as developed as in the United States and uncertainties in the Chinese legal system could limit our ability to enforce these Contractual Agreements. In the event that we are unable to enforce the Contractual Agreements, our business, financial condition and results of operations could be materially and adversely affected.

19

Our Chairman of the Board may have a conflict of interest with regard to the enforcement of our contractual arrangements with the two operating companies which conduct our operations in the PRC.

Chen Zhisheng is the Chairman of the Company and has been granted an option to purchase 9,000,000 shares of our outstanding shares of Common Stock (approximately 42.3% of the outstanding shares of Common Stock) for a nominal price subject to the satisfaction of certain conditions (see “Security Ownership of Certain Beneficial Owners and Management”). Chen Zhisheng also owns 100% of the equity of Nanhai Ke Da Heng Sheng which entered into the Contractual Agreements with the Company’s indirect subsidiary, the WOFE, referred to in the immediately preceding Risk Factor. As a result of his position as Chairman of the Board of the Company and his potential

stock ownership of the Company, even though Chen Zhisheng is not the legal representative or an officer of the WOFE, by virtue of his power to cause the Company to remove existing management of the Company’s direct and indirect subsidiaries, he may be able to exert significant influence over actions taken by the WOFE with respect to the Contractual Agreements. These actions include deciding whether and when the WOFE shall exercise its option to acquire from Chen Zhisheng all of Nanhai Ke Da Heng Sheng’s equity as discussed in the next Risk Factor as well as negotiating the terms of the purchase, if the option is exercised. In addition, Chen Zhisheng may exert significant influence in determining whether the WOFE will vigorously enforce the terms of the other Contractual Agreements, including the extent to which the WOFE shall manage the operations of Nanhai Ke Da Heng Sheng

and Hainan Ke Da Heng Sheng and control the cash flow of such companies. In this regard, it is possible that despite being a director, officer and potentially significant stockholder of the Company, Chen Zsisheng’s interests may not be aligned with those of other stockholders of the Company since Chen Zsisheng also currently owns all of the equity of Nanhai Ke Da Heng Sheng.

The option we have to acquire Nanhai Ke Da Heng Sheng’s equity from Chen Zhisheng provides that the purchase price will be determined by the parties in the future; such arrangement leaves open the possibility that the parties will not be able to agree upon a price and that we may not be able to acquire such equity.