Attached files

| file | filename |

|---|---|

| 8-K - China Internet Cafe Holdings Group, Inc. | v211884_8k.htm |

| EX-3.1 - China Internet Cafe Holdings Group, Inc. | v211884_ex3-1.htm |

| EX-3.2 - China Internet Cafe Holdings Group, Inc. | v211884_ex3-2.htm |

| EX-10.4 - China Internet Cafe Holdings Group, Inc. | v211884_ex10-4.htm |

| EX-99.1 - China Internet Cafe Holdings Group, Inc. | v211884_ex99-1.htm |

| EX-10.5 - China Internet Cafe Holdings Group, Inc. | v211884_ex10-5.htm |

| EX-10.1 - China Internet Cafe Holdings Group, Inc. | v211884_ex10-1.htm |

| EX-10.3 - China Internet Cafe Holdings Group, Inc. | v211884_ex10-3.htm |

| EX-10.6 - China Internet Cafe Holdings Group, Inc. | v211884_ex10-6.htm |

| EX-10.2 - China Internet Cafe Holdings Group, Inc. | v211884_ex10-2.htm |

Investor Presentation

China Unitech Group, Inc.(OTCBB:CUI G)

January 2011

Safe Harbor

Page 2

Private and Confidential

This presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of

1933, as amended (the “Act”) and Section 21E of the Securities Act of 1934, as amended

(the “Exchange Act”). In

particular, the words "believes," "expects," "intends," "plans," "anticipates," or "may," and similar conditional

expressions are intended to identify forward-looking statements and are subject to the safe harbor created

by these

Acts. Any statements made in this presentation about an action, event or development, are forward-looking

statements. Such statements are based upon assumptions that in the future may prove not to have been accurate

and are subject to significant

risks and uncertainties. Although the Company believes that the expectations reflected

in the forward-looking statements are reasonable, it can give no assurance that its forward-looking statements will

prove to be correct.

Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the

control of the Company. Statements regarding future drilling and production are subject to all

of the risks and

uncertainties normally incident to the exploration and development of oil and gas. These risks include, but are not

limited to, completion risk, dry hole risk, price volatility, reserve estimation risk, regulatory risk, potential inability

to

secure oilfield service risk as well as general economic risks and uncertainties, as disclosed in the Company’s SEC

filings. Investors are cautioned that any forward-looking statements are not guarantees of future performance and

actual

results or developments may differ materially from those projected. The forward-looking statements in this

presentation are made as of the date hereof. The Company takes no obligation to update or correct its own forward-

looking statements or those

prepared by third parties that are not paid by the Company, except as required by law.

The Company’s complete SEC filings are available at http://www.sec.gov.

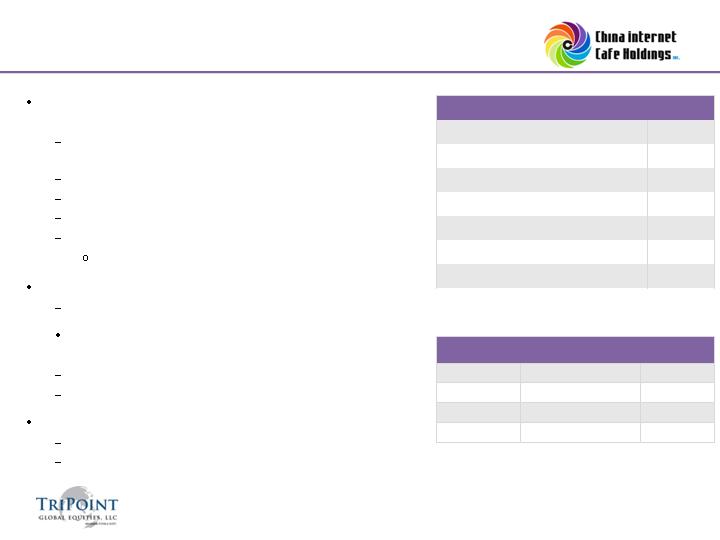

Executive Summary

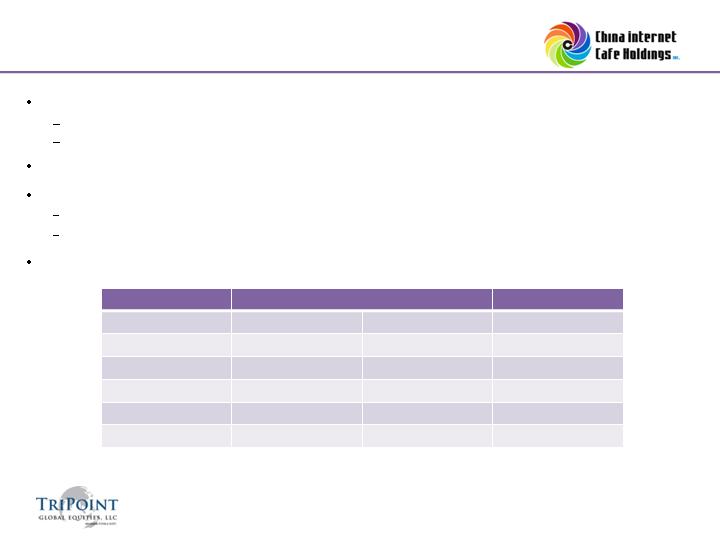

Capitalization

Shares

%

Insiders

19,000,000

94

Public

1,200,000

6

Total

20,200,000

100%

Key Financials

Ticker

CUIG

2009 Annual Revenue (12/31/09)

$14.04M

2009 Net Income (12/31/09)

$4.34M

2010 YTD Revenue (9/30/10)

$14.14M

2010 YTD Net Income (9/30/10)

$4.21M

Deal Price

$1.35

Market Capitalization

$27.3M

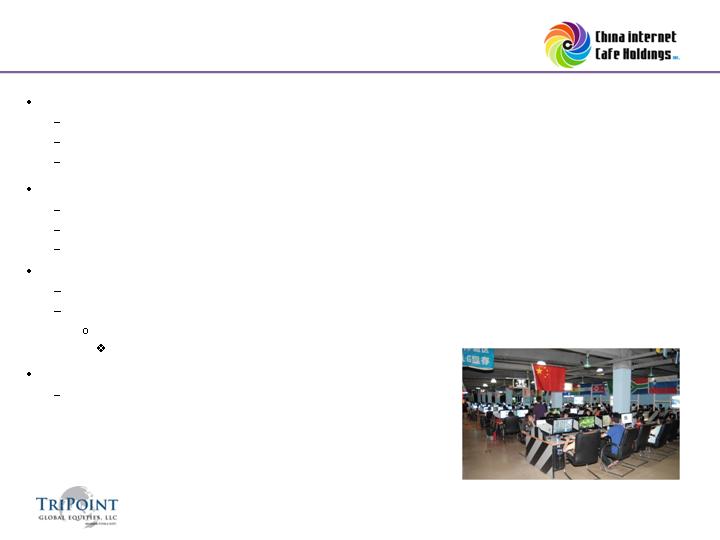

China Unitech Group owns and operates 44 internet

cafés in Southern China

Doing business as Shenzhen Junlong Culture

Communication (Junlong)

Headquarters in Shenzhen, China

Employees: 510

Opened first café in 2006

Public via RTO in July 2010

First public company in the industry

Junlong brand of internet cafés

Translation: Dragon Surf

Affordable online entertainment for low income

customers

95% of revenue generated by internet usage fees

Over 10,500 computers

Well defined growth strategy

Obtain national internet café chain license

Balanced organic growth and regional expansion through

acquisition

Page 3

Private and Confidential

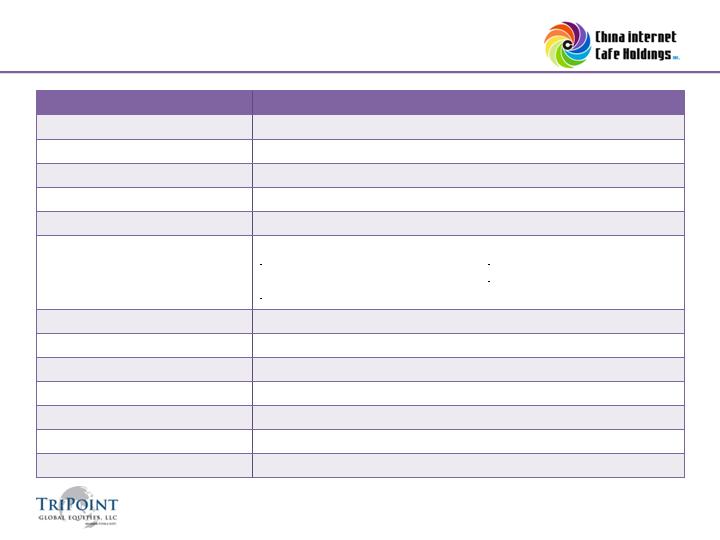

Transaction Summary

Issuer (Ticker):

China Unitech Group, Inc. (OTCBB:CUIG)

Headquarters:

Shenzhen, Guangdong, China

Industry:

Specialty retail – Chinese internet cafés

Type of Offering:

PIPE

Capital Raise:

$10 million

Unit Price:

$13.50

Securities Offered:

Stock:

9 shares 5% Series A Preferred

(converts 1:1)

1 share common

3 year warrants:

2 Class A: $2.00 strike

2 Class B: $3.00 strike

Expected Pricing:

February, 2011

Issuer’s China Counsel:

China Commercial Law Firm

Issuer’s US Counsel:

Sichenzia Ross Friedman Ference

Issuer’s Auditor:

EFP Rotenberg

Placement Agent:

TriPoint Global Equities

Placement Agent Counsel:

Leser, Hunter, Taubman & Taubman

Investor Counsel:

Anslow & Jaclin

Page 4

Private and Confidential

Investment Highlights

Pre-money valuation

2010 P/E multiple: 4.66x

2011 P/E multiple: 2.7x

28.3% NI margin

Make good provision

2011 net income target: $10M

1M shares in escrow

Proven company execution

Profitable business since inception

2 year NI CAGR 38.7%

$6M YTD cash flow from operations (as of 9/30/10)

Strong café performance

Average monthly revenue per café (of cafés open more than 1 year)

2009: $44,000

2010: $49,000

Same store sales: 11.9%

Average payback period: 14-24 months

Page 5

Private and Confidential

Use of Proceeds

Items

Cost

Guizhou province JV - 51% interest

$4M

Build out new wholly-owned cafés in Shenzhen

4M

Working capital

2M

Total

$10M

Page 6

Private and Confidential

Business Description and Café Pricing

Diversified entertainment and media access platforms

Movies, surfing, voice over IP service, online chatting, online gaming, snacks and drinks

Preloaded games and videos

Target customers: migrant workers, college students and low income residents

Customers purchase reloadable stored value integrated circuit (IC) cards

IC cards are inserted into the card slot on the computer

Funds deducted per 6 minutes of usage time

Hourly pricing ranges from $0.15 to $0.76

Configuration

Member

Non-member

Off Peak

Peak

Video chatting

$0.15

$0.30

$0.45

LCD screens

0.23

0.38

0.53

World of Warcraft

0.30

0.45

0.61

High end gaming

0.45

0.53

0.68

Private booth

0.45

0.61

0.76

*Exchange rate:6.69

Page 7

Private and Confidential

Core Competencies

Café locations

Early mover advantage in Shenzhen

Access to prime sites near new factories

Highly populated and dense locations such as universities, industrial zones and business centers

Connectivity

Preferential rates on high bandwidth connections from telecom provider

Proprietary Saflash software for stability

Fast and reliable

Compliance with safety regulations and usage requirements

Frequent internal inspections

Seasoned management works closely with regulatory agencies

CEO is executive president of Shenzhen Longgang District Internet Industry Association

Affiliated with the Ministry of Culture (MoC)

Superior management system

Known for quality and service

Page 8

Private and Confidential

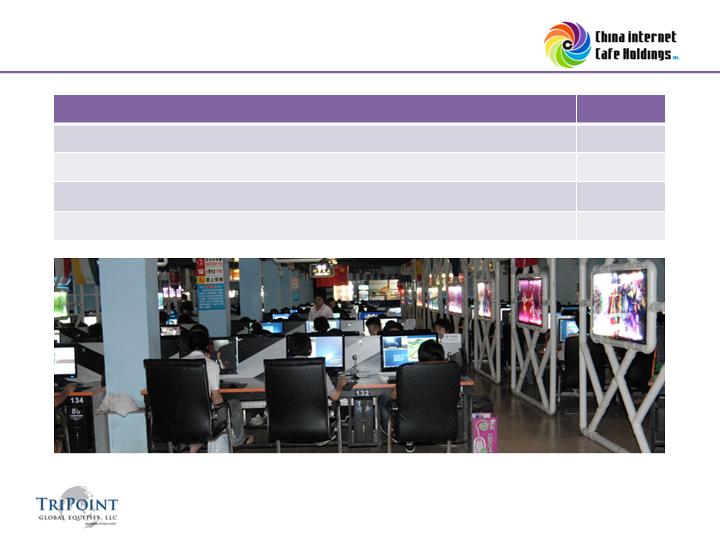

Strong Cafe Portfolio

Junlong granted internet chain license by Ministry of Culture (MoC) in 2005

Page 9

Private and Confidential

Existing café portfolio

44 locations in Shenzhen manufacturing zone

Limited entertainment options in this area

Areas of operation: Longgang, Pingshan, Baoan, Yangtian

High traffic areas near live/work communities

Café Portfolio Factsheet

Average number of computers

245

Average size

875m²

Average occupancy

11.3 hrs/day

Revenue per square meter/year

$618.4

Revenue contribution/year/cafe

$500k

Average cafe cost

$350k

High end café cost

$500k-600k

Payback period

14-24 months

Busiest hours

6PM-12AM

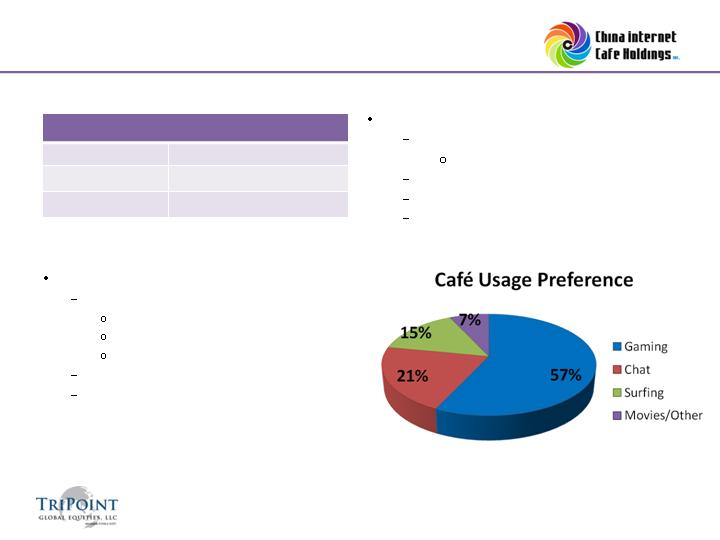

Company Owned Cafés

Customer Base

1M registered users in January 2011

Customer activity:

80% active within last year

65% within 1 month

50% within 1 week

Average length of visit: 3 hours

Average number of visits/month: 1.5 times

Page 10

Private and Confidential

Demographics

Age

82.3% are 18-25

Gender

78% are male

Salary

$220-450/month

Junlong caters to gaming customers

57% of users

vs. 30% industry average

Longer play times

Higher revenue configurations

Ancillary revenue from game card sales

Quality & Superior Service

Junlong uses management oversight to create

a favorable customer experience and comply with regulations

Page 11

Private and Confidential

Quality control – centralized and standardized operations management

Routine corporate inspections

At least bi-monthly at random

Cleanliness and appearance, fire safety, game and software updates, uniforms, staff training

Incentivize café managers for revenue performance

$1,800 available annual bonus pool per cafe

Penalize cafe managers for infractions

$30-$45 per infraction

Better service in a customer friendly environment

High speed

100Mbit/sec Fast Ethernet VS 10 -25Mbit/sec Ethernet at competition

Consistent store presentation and employee attitude

Clean environment with air conditioning

Up to date equipment and software

Customer focused innovation

Internet café industry facility requirements

Stringent safety regulations and content restrictions

Monitored by 4 regulators

Technology Differentiation

Fast computers and reliable internet connections are important to Junlong’s customers

according to 2010 internal survey:

53.2% attend for service and equipment quality

26.5% attend for internet speed and stability of connection

Page 12

Private and Confidential

Junlong cafés are designed to run at 100% capacity

Innovation improves customer experience

Saflash proprietary network control software

Team gaming area

Fast game updates

Host local movie/TV content

Limits outside bandwidth usage

Ensure faster connections

Updated daily

Phone call service can be charged on the

prepaid IC card

Prevents connection disruptions

Lower package drop rate

Stable gaming

Throughput maximization

Microsoft Windows development platform

Automatic flow control

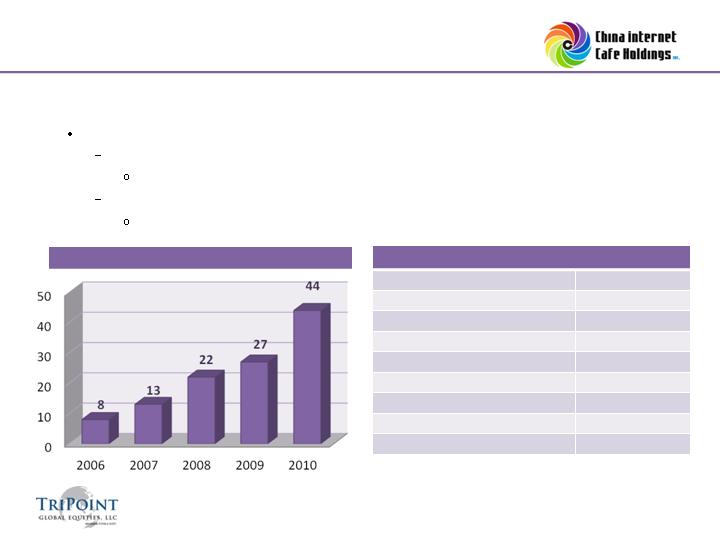

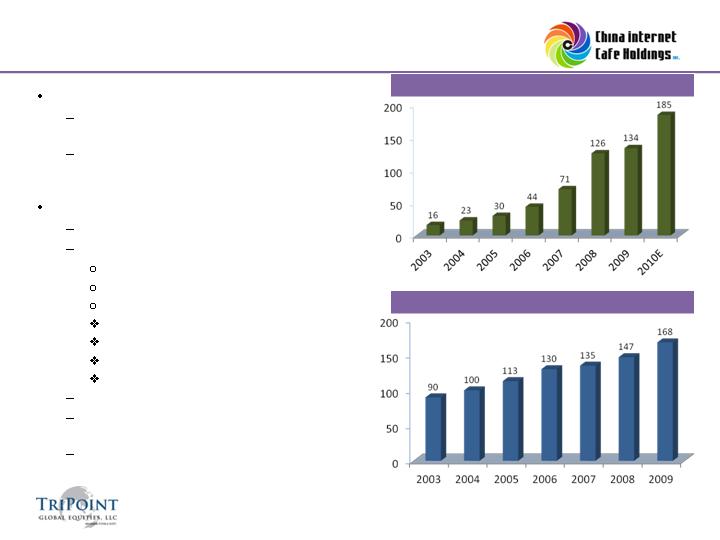

Steady Growth of Internet Café Usage

Internet café industry

Approximately $13B in revenue in 2009

according to the MoC

Poised for continued expansion and a wave

of consolidation amongst the less

established players

Social benefits for low income population

Safe and easy access to information

Affordable costs:

Average user: 6 hrs/month= $3.18

Frequent user: 50 hrs/month= $26.50

VS purchase a computer

~$450 for a basic PC

~$1,200 for a gaming PC

~$15/month for 512k ADSL service

$450=one month’s salary

Low home computer/console ownership

Social: customers prefer café atmosphere

and team play without supervision

Quality: unreliable home internet

connections

Page 13

Private and Confidential

Source: www.enfodesk.com

Source: www.iresearch.com

Chinese Internet Cafés (Thousands)

Chinese Internet Café Users (Millions)

Increased MoC Regulation of Internet Café Market

Policy: Safety through Consolidation

In 2009, the MoC cracked down on illegal operators

Underage users

Internet addiction

Unsafe conditions

Banned content

Encourage larger, better regulated nationally licensed chains

Junlong will meet national license requirements after expansion into two additional provinces

Expected in early 2012

Page 14

Private and Confidential

National license requirements:

Benefits of national license:

$7.5 million registered capital

30 wholly owned cafés in 3 provinces

No fines in past year

Priority application for entry in tier two cities

Marketing benefits

Brand awareness

Attract franchisees

National Internet Café License

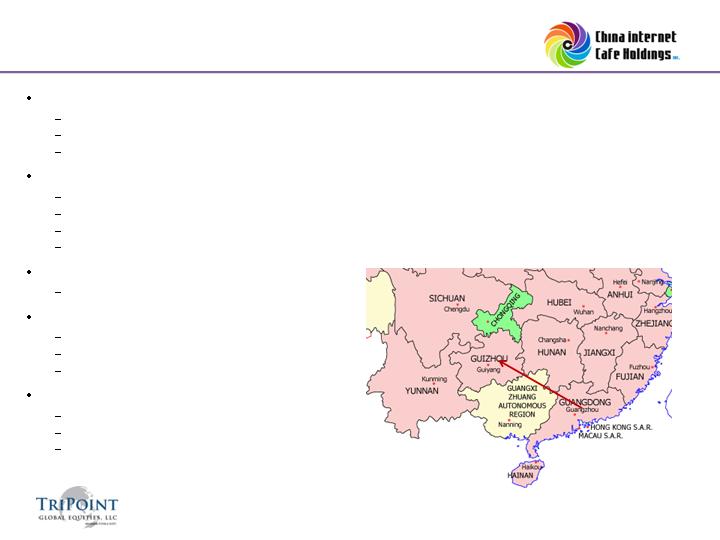

2-Pronged Growth Plan

Focused Approach to Expansion

1.

Existing cafe acquisitions

Joint venture operations in new provinces

Provide financial and operational support to less established regional operators

Targeted regions include Guizhou, Yunnan, Sichuan and Chongqing

Qualify for national internet café chain license

2.

Organic growth

Company owned cafés in Shenzhen manufacturing zone

Company owned high-end cafés in up-scale residential locations

JV owned cafés based around newly acquired cafe operations

Page 15

Private and Confidential

Acquisition Strategy

Location

Timeframe

Regional characteristics

Guizhou

2Q11

Densely populated locations such as colleges & universities,

entertainment areas and residential areas

Internet cafe trend directed towards high end environment

Yunnan

4Q11

Focused on Kunming

Developing tier 2 city with lower rates of computer ownership

Chongqing

2012

Concentrated in Jiangbei, Yuzhong, Jiulongpo and Shapingba districts

Focused on lively streets, downtown areas and small districts

Sichuan

2012

Located adjacent to universities and train stations

Average occupancy rate is 65% compared to 40% industry average

Targeted markets offer attractive returns

Average hourly bill rate in undeveloped regions is 6RMB ($0.90) compared to 5RMB ($0.75) in

Shenzhen

Minimize development risks by partnering with quality regional operators

Page 16

Private and Confidential

Proposed Acquisition- Guizhou Province

Target company under LOI: Langren Internet Technology Culture Development Co.

32 internet cafés with 5800 PCs

Junlong brings in modernized management with strong assets

Change name to Junlong Langren

Rationale

National license

Market leader

Strong synergies: quality brand and attractive café appearance, lacking internal controls

Integration: bring Junlong’s advanced management system to increase margins

2010 estimated financials

Rev: $7.6M, NI: $2M, NI growth rate: 20%

Consideration for JV: $6.9M

CUIG ownership: 51%

50% stock, 50% cash

Stock price: $ 1.35 (deal price or higher)

Valuation

6.8x estimated 2010 NI

Third party independent validation

2.9M RMB ($440K) per café

Page 17

Private and Confidential

Organic Growth Strategy

30 new cafés in 2011

12 large cafés with 300 or more computers focusing

on movies, high-end games and entertainment

15 medium cafés with 150 to 300 computers and a

few movie suites focusing on high-end games

3 small cafés with 100 to 150 computers

Move up market with high-end cafés

Private rooms

Surround sound equipped movie screening areas

Team gaming and tournament play areas

LCD screens for spectator viewing

Optimizing resources and improve operations

Increase demographic requirements for choice of

new locations

Upgrade café format, signage and layout

CapEx management by controlling equipment costs

Page 18

Private and Confidential

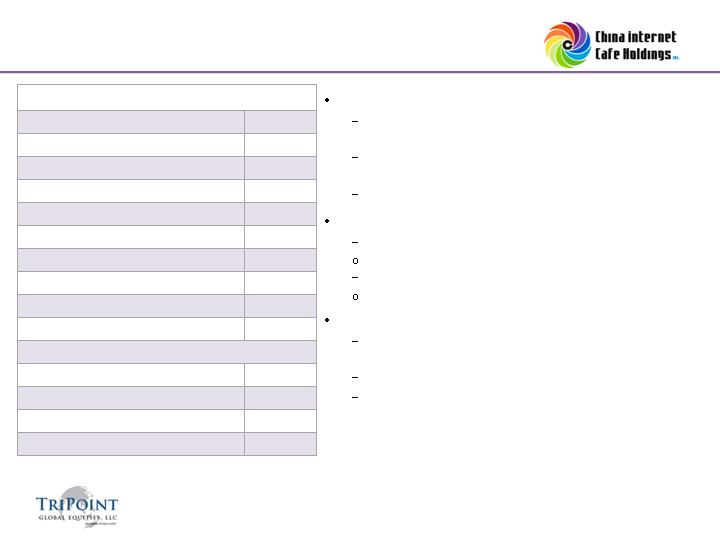

Estimated Mid-Tier Café Expenditures

250 Computers

$160,000

Furnishings & Decoration

56,000

Equipment

56,000

Permits

30,000

Leasehold improvement

19,500

Prepaid rent

9,000

Signage

7,500

Drinks & Snacks

3,000

Others

11,500

Total

$352,500

PC Configuration

First class

8%

High end

20%

Middle

40%

Low end

32%

Expenditures increase for computers, furniture and decorations

in high-end cafés

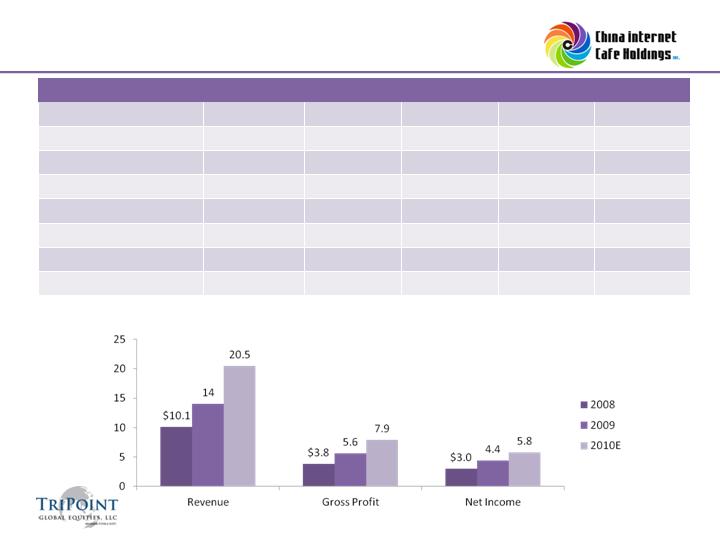

Key Financials

Fiscal Year ended Dec 31

($ in thousands)

2008A

2009A

2010E

2011E

2012E

Revenue

$10,107

$14,038

$20,460

$37,446

$59,952

Gross Profit

3,772

5,629

8,637

16,072

25,144

Gross Margin

37.3%

40.1%

42.21%

42.9%

41.9%

Operating Income

3,665

5,463

7,573

13,436

20,886

Operating Margin

36.3%

38.9%

37.01%

35.9%

34.8%

Net Income

3,014

4,388

5,747

10,031

14,759

Net Income Margin

29.8%

31.3%

28.09%

26.8%

24.6%

Page 19

Private and Confidential

*Projections include two acquisitions in 2011. 2012E are from organic growth. Other potential acquisitions are not included

$ in millions

Experienced Management

Guo Dishan: CEO

Bachelors degree in Business Administration from Management Administration Institute in Guangdong

Executive president of the Internet Industry Association in Long Gang District Shenzhen, Guangdong

Member of the Guangdong Chamber of Commerce of High-tech Industries

Li Jingwei: VP of Corporate Finance

CPA

Masters degree in Professional Accounting from Monash University in Victoria, Australia

Served as a senior accountant at Bentleys MRI, Melbourne, Australia

Li Zhenfan: Engineering Manager

Bachelors degree in Public Administration from Hunan Teacher-Training University

Responsible for Junlong Saflash system software R&D

Served in Shenzhen Altai Technology Co. Ltd. as the Chief Technology Officer/Chief Information Officer

Guo Zhenquan: Sales Manager

Five years experience as sales manager in internet cafés industry

Strong strategic planning capacity and management decision-making ability

Huo Kai: Marketing Manager

Masters degree in Computer Management from Grafton College in Dublin, Ireland

Five years marketing experience

Page 20

Private and Confidential

Investment Summary

Strong demand

Driven by the increasing internet café user base in China

$13B industry revenue

37% Y/Y café user growth in 2010

Well defined growth strategy

Balanced organic growth and expansion through acquisition

Proven business model

Sustainable and profitable business

28% NI margin

Commitment to customer service and quality

Cafés are designed to run at 100% performance capacity

Seasoned management team

Extensive experience with the internet cafe business

Company website: www.chinainternetcafe.com

Page 21

Private and Confidential

Contact Us

17 State Street, 20th Floor

New York, New York 10004

Tel: (917) 512-0822

sales@tpglobal.com

Page 22

Private and Confidential

Appendix I

Page 23

Private and Confidential

Regulation

Restriction

Regulator

Provincial office of national authority

Age restriction

At least 18 years old

Ministry of Culture

Content control

Internet operations license

PRC approved content only

Unmonitored internet communication

Monitoring software required

Ministry of Culture

Local

Internet security safety

Public safety

Fire Safety

1 computer per 3 m2

Extinguishers

Clear aisles and exits

Emergency management system

Police & Fire

Internet cafés are subject to numerous national, provincial and local regulations

Appendix II: Corporate Structure

China Unitech Group, Inc. OTCBB:CUIG

(Nevada)

Classic Bond Development Limited

(BVI)

Shenzhen Zhonghefangda Network Technology Co., Ltd.

(PRC)

Shenzhen Junlong Culture Communication Co., Ltd.

(PRC)

100%

100%

Contractual agreements*

*Contractual agreements consisting of a management and consulting service agreement, an equity pledge

agreement, option agreement and proxy agreement

Page 24

Private and Confidential