Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ALLEGHENY ENERGY, INC | d8k.htm |

Exhibit 99.1

| 800 Cabin Hill Drive, Greensburg, PA 15601-1650 | ||||

| Media contact: | Investor contact: | |||

| David Neurohr | Max Kuniansky | |||

| Director, External Communications | Executive Director, Investor Relations and Corporate Communications | |||

| Phone: (724) 838-6020 | ||||

| Media Hotline: 1-888-233-3583 | Phone: (724) 838-6895 | |||

| E-mail: dneuroh@alleghenyenergy.com | E-mail: mkunian@alleghenyenergy.com | |||

FOR IMMEDIATE RELEASE

Allegheny Energy Reports Strong Financial Results for Year 2010

GREENSBURG, Pa., February 23, 2011 – Allegheny Energy, Inc. (NYSE: AYE) today reported financial results for the fourth quarter and full year 2010.

Consolidated Net Income Attributable to Allegheny Energy, Inc.

| $ millions | Per share | |||||||||||||||

| 2010 | 2009 | 2010 | 2009 | |||||||||||||

| Three Months Ended December 31 |

||||||||||||||||

| GAAP |

$ | 88.2 | $ | 109.3 | $ | 0.52 | $ | 0.64 | ||||||||

| Adjusted |

105.9 | 112.7 | 0.62 | 0.66 | ||||||||||||

| Twelve Months Ended December 31 |

||||||||||||||||

| GAAP |

$ | 411.7 | $ | 392.8 | $ | 2.42 | $ | 2.31 | ||||||||

| Adjusted |

430.6 | 396.6 | 2.53 | 2.33 | ||||||||||||

Adjusted net income for the fourth quarter of 2010 excludes $3.2 million of pre-tax expense related to the proposed merger with FirstEnergy Corp. and unrealized pre-tax losses of $25.4 million from economic hedges that do not qualify for hedge accounting. Adjusted net income for the fourth quarter of 2009 excludes $13.4 million of pre-tax interest expense related to a debt tender offer and unrealized pre-tax gains of $7.9 million from economic hedges.

Adjusted net income is a non-GAAP financial measure. For information on the calculation of adjusted net income for all periods, see the attached reconciliations of non-GAAP financial measures.

“2010 marks our seventh consecutive year of earnings growth,” said Paul J. Evanson, Chairman, President and Chief Executive Officer of Allegheny Energy. “During the year, we again held O&M costs flat, substantially completed our TrAIL transmission line in record time, and charted a new future for Allegheny with our pending merger with FirstEnergy. We look forward to the opportunities created by joining a larger and more diversified energy company.”

1

Fourth Quarter Consolidated Results

Adjusted net income for the fourth quarter of 2010 decreased by $6.8 million compared with the same period in 2009. Adjusted results for 2009 included a $10.5 million after-tax benefit associated with the purchase of hydro generation facilities. Key positive factors contributing to results for the fourth quarter of 2010 include increased revenue from transmission expansion, a base rate increase in West Virginia, increased industrial sales and favorable weather. These positive factors were offset by the effect of power hedges and the sale of the Virginia distribution business.

A reduction in tax provisions benefited adjusted net income from regulated operations by $18.8 million in the fourth quarter of 2010. In the fourth quarter of the prior year, changes in Pennsylvania tax law benefited adjusted net income from merchant generation by $18.1 million.

Adjusted EBITDA for the fourth quarter of 2010 was $304.2 million, a decrease of $8.2 million compared to the same quarter of the prior year. EBITDA and adjusted EBITDA are non-GAAP financial measures. Details on the calculation of EBITDA and adjusted EBITDA, as well as reconciliations of these financial measures to net income, are attached to this release.

Fourth Quarter Segment Results

Net Income Attributable to Allegheny Energy, Inc.

Three Months Ended December 31

($ millions)

| 2009 | 2010 | Increase (Decrease) |

||||||||||

| Regulated Operations: |

||||||||||||

| GAAP |

$ | 80.2 | $ | 34.8 | $ | 45.4 | ||||||

| Adjusted |

81.7 | 34.8 | 46.9 | |||||||||

| Merchant Generation: |

||||||||||||

| GAAP |

$ | 7.8 | $ | 74.3 | $ | (66.5 | ) | |||||

| Adjusted |

24.0 | 77.7 | (53.7 | ) | ||||||||

Adjusted net income for both segments for 2010 excludes merger-related costs. Adjusted net income for the Merchant Generation segment in both 2010 and 2009 excludes net unrealized gains and losses from economic hedges that do not qualify for hedge accounting. Adjusted net income in the Merchant Generation business for 2009 also excludes expenses related to a debt tender offer. There were no adjustments in the Regulated Operations segment in 2009.

2

Twelve-Month Consolidated Results

Adjusted net income for the twelve months ended December 31, 2010 increased by $34.0 million compared to the same period in 2009. Key factors contributing to the improved results include increased generation output, higher energy and capacity prices, increased revenue from transmission expansion, higher retail electricity sales, and a base rate increase in West Virginia, partially offset by higher fuel costs, the effect of power hedges, the sale of the Virginia distribution business, and increased interest and depreciation expense reflecting the operation of new scrubbers.

Adjusted EBITDA for the twelve-month period increased by $111.7 million compared to the same period of the prior year. Details on the calculation of EBITDA and adjusted EBITDA, as well as reconciliations of these financial measures to net income, are attached to this release.

Twelve-Month Segment Results

Net Income Attributable to Allegheny Energy, Inc.

Twelve Months Ended December 31

($ millions)

| 2009 | 2010 | Increase (Decrease) |

||||||||||

| Regulated Operations: |

||||||||||||

| GAAP |

$ | 247.7 | $ | 157.9 | $ | 89.8 | ||||||

| Adjusted |

236.1 | 157.9 | 78.2 | |||||||||

| Merchant Generation: |

||||||||||||

| GAAP |

$ | 163.1 | $ | 234.0 | $ | (70.9 | ) | |||||

| Adjusted |

193.6 | 237.8 | (44.2 | ) | ||||||||

Adjusted net income for both segments for 2010 excludes merger-related costs. Adjusted net income in the Regulated Operations segment for 2010 excludes a gain from the sale of the company’s Virginia distribution business. There were no adjustments in the Regulated Operations segment in 2009. Adjusted net income for the Merchant Generation segment for 2010 and 2009 excludes net unrealized gains and losses from economic hedges that do not qualify for hedge accounting, as well as interest expense related to debt tender offers.

3

Allegheny Energy: An Era of Accomplishments

“We’ve achieved a great deal since we refocused on our core business and began restoring the company’s financial health in 2003,” said Mr. Evanson. “Success would not have been possible without the dedication of our hard-working employees. Together, we’ve made great progress.”

Key accomplishments since 2003 include:

Restored Financial Condition

| • | Reduced debt |

| • | Returned to profitability from brink of bankruptcy |

| • | Restored investment grade credit ratings |

| • | Reinstated dividend |

Created a High-Performance Culture

| • | Achieved high customer satisfaction ratings; ranked #1 among northeastern US utilities for six consecutive years by TQS Research (large commercial and industrial customer survey) |

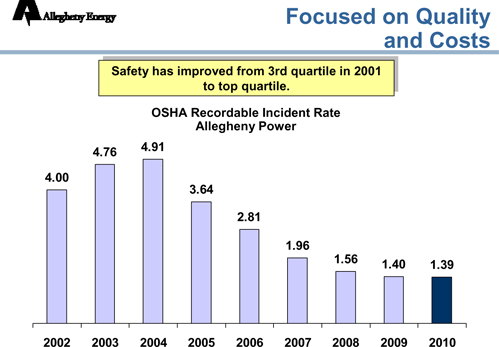

| • | Improved safety performance to record levels (see Exhibit 1) |

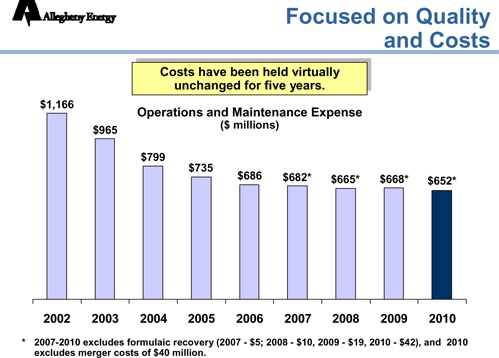

| • | Reduced operations and maintenance expense and held costs virtually unchanged for past five years (see Exhibit 2) |

Launched Transmission Expansion Business

| • | Nearly completed multi-state Trans-Allegheny Interstate Line (TrAIL) in unprecedented 5-year period |

Increased Profitability

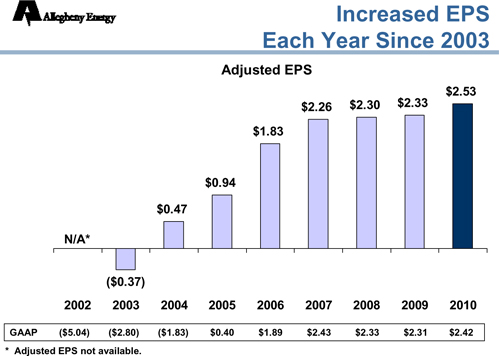

| • | Achieved growth in adjusted earnings per share each year since 2003 (see Exhibit 3) |

Committed to Environmental Stewardship

| • | Invested $1.3 billion to add scrubbers at two power plants |

| • | Completed scrubber projects on time, on budget |

“As we move forward, Allegheny will become part of FirstEnergy, a much larger company with a strong balance sheet, a diversified generation fleet including nuclear plants, solid regulated operations, and better access to capital markets,” Mr. Evanson said. “The new FirstEnergy will be positioned to prosper and grow well into the future.”

4

Merger Update

The companies have received approvals for their merger from the Virginia State Corporation Commission, the Public Service Commission of West Virginia, and the Maryland Public Service Commission, and have a comprehensive settlement with the majority of the parties to the merger application pending before the Pennsylvania Public Utility Commission. The merger has received approval from the Federal Energy Regulatory Commission and completed the U.S. Department of Justice review process. Shareholders of both FirstEnergy and Allegheny Energy overwhelmingly approved proposals related to the merger.

Investor Call Will Not Be Held

Due to the imminent merger with FirstEnergy, Allegheny Energy will not host an investor conference call to discuss its quarterly results. The companies expect to complete the merger in the first quarter of this year.

Reconciliation of Non-GAAP Financial Measures

This news release includes presentation of adjusted net income, EBITDA, adjusted EBITDA and other non-GAAP financial measures as defined in the Securities and Exchange Commission’s Regulation G.

Management believes that presenting these additional financial measures provide investors with a more complete understanding of the core results and underlying trends from which to consider past performance and prospects for the future. These financial measures should not be considered in isolation or viewed as a substitute for, or superior to, net income or other data prepared in accordance with GAAP as a measure of operating performance or liquidity.

Pursuant to the requirements of Regulation G, tables are attached that reconcile non-GAAP financial measures in this document to the most directly comparable GAAP measure. Additional reconciliations are available at www.alleghenyenergy.com.

Allegheny Energy

Headquartered in Greensburg, Pa., Allegheny Energy is an investor-owned electric utility with total annual revenues of over $3 billion and more than 4,000 employees. The company owns and operates generating facilities and delivers low-cost, reliable electric service to 1.5 million customers in Pennsylvania, West Virginia and Maryland. For more information, visit www.alleghenyenergy.com.

###

5

ALLEGHENY ENERGY, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

| Three Months Ended December 31, |

Twelve Months

Ended December 31 |

|||||||||||||||

| (In millions, except per share amounts) |

2010 | 2009 | 2010 | 2009 | ||||||||||||

| Operating revenues |

$ | 864.6 | $ | 861.1 | $ | 3,902.9 | $ | 3,426.8 | ||||||||

| Operating expenses: |

||||||||||||||||

| Fuel |

255.7 | 222.9 | 1,192.6 | 886.6 | ||||||||||||

| Purchased power and transmission |

113.2 | 121.7 | 502.9 | 502.0 | ||||||||||||

| Deferred energy costs, net |

10.0 | (25.5 | ) | 38.1 | (64.4 | ) | ||||||||||

| Gain on sale of Virginia distribution business |

0.5 | 0 | (44.6 | ) | 0 | |||||||||||

| Operations and maintenance |

159.5 | 168.2 | 732.9 | 687.1 | ||||||||||||

| Depreciation and amortization |

81.8 | 74.9 | 323.5 | 282.1 | ||||||||||||

| Taxes other than income taxes |

54.1 | 53.9 | 226.0 | 213.6 | ||||||||||||

| Total operating expenses |

674.8 | 616.1 | 2,971.4 | 2,507.0 | ||||||||||||

| Operating income |

189.8 | 245.0 | 931.5 | 919.8 | ||||||||||||

| Other income (expense), net |

3.5 | 0.9 | 13.3 | 7.0 | ||||||||||||

| Interest expense |

76.3 | 89.7 | 316.4 | 291.1 | ||||||||||||

| Income before income taxes |

117.0 | 156.2 | 628.4 | 635.7 | ||||||||||||

| Income tax expense |

28.8 | 46.4 | 216.7 | 241.6 | ||||||||||||

| Net income |

88.2 | 109.8 | 411.7 | 394.1 | ||||||||||||

| Net income attributable to noncontrolling interests |

0 | (0.5 | ) | 0 | (1.3 | ) | ||||||||||

| Net income attributable to Allegheny Energy, Inc. |

$ | 88.2 | $ | 109.3 | $ | 411.7 | $ | 392.8 | ||||||||

| Earnings per common share attributable to Allegheny Energy, Inc.: |

||||||||||||||||

| Basic |

$ | 0.52 | $ | 0.64 | $ | 2.42 | $ | 2.32 | ||||||||

| Diluted |

$ | 0.52 | $ | 0.64 | $ | 2.42 | $ | 2.31 | ||||||||

| Average common shares outstanding: |

||||||||||||||||

| Basic |

170.1 | 169.6 | 169.8 | 169.5 | ||||||||||||

| Diluted |

170.6 | 170.1 | 170.3 | 170.0 | ||||||||||||

6

ALLEGHENY ENERGY, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

| As of December 31, | ||||||||

| (In millions) |

2010 | 2009 | ||||||

| ASSETS |

||||||||

| Current Assets: |

||||||||

| Cash and cash equivalents |

$ | 490.2 | $ | 286.6 | ||||

| Accounts receivable: |

||||||||

| Customer |

245.9 | 188.2 | ||||||

| Unbilled utility revenue |

124.1 | 116.4 | ||||||

| Wholesale and other |

53.7 | 64.4 | ||||||

| Allowance for uncollectible accounts |

(15.7 | ) | (14.0 | ) | ||||

| Materials and supplies |

108.4 | 110.6 | ||||||

| Fuel |

151.3 | 206.4 | ||||||

| Deferred income taxes |

0 | 81.5 | ||||||

| Prepaid taxes |

48.9 | 48.4 | ||||||

| Collateral deposits |

30.7 | 20.8 | ||||||

| Derivative assets |

24.5 | 4.6 | ||||||

| Restricted funds |

46.9 | 25.9 | ||||||

| Regulatory assets |

177.5 | 132.7 | ||||||

| Assets held for sale |

0 | 32.4 | ||||||

| Other |

29.2 | 40.4 | ||||||

| Total current assets |

1,515.6 | 1,345.3 | ||||||

| Property, Plant and Equipment: |

||||||||

| Generation |

7,623.2 | 7,469.4 | ||||||

| Transmission |

1,421.1 | 1,313.2 | ||||||

| Distribution |

3,937.5 | 3,784.4 | ||||||

| Other |

515.0 | 440.7 | ||||||

| Accumulated depreciation |

(5,362.9 | ) | (5,104.9 | ) | ||||

| Subtotal |

8,133.9 | 7,902.8 | ||||||

| Construction work in progress |

1,168.0 | 800.6 | ||||||

| Property, plant and equipment held for sale, net |

0 | 253.7 | ||||||

| Total property, plant and equipment, net |

9,301.9 | 8,957.1 | ||||||

| Other Noncurrent Assets: |

||||||||

| Regulatory assets |

706.1 | 717.3 | ||||||

| Goodwill |

367.3 | 367.3 | ||||||

| Restricted funds |

29.4 | 60.2 | ||||||

| Investments in unconsolidated affiliates |

49.8 | 26.7 | ||||||

| Other |

105.7 | 115.2 | ||||||

| Total other noncurrent assets |

1,258.3 | 1,286.7 | ||||||

| Total Assets |

$ | 12,075.8 | $ | 11,589.1 | ||||

7

ALLEGHENY ENERGY, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS (Continued)

| As of December 31, | ||||||||

| (In millions, except share amounts) |

2010 | 2009 | ||||||

| LIABILITIES AND EQUITY |

||||||||

| Current Liabilities: |

||||||||

| Long-term debt due within one year |

$ | 15.5 | $ | 140.8 | ||||

| Accounts payable |

383.4 | 411.4 | ||||||

| Accrued taxes |

99.5 | 87.3 | ||||||

| Payable to PJM for FTRs, excluding portion netted against derivative assets |

0 | 31.7 | ||||||

| Derivative liabilities |

6.0 | 24.4 | ||||||

| Regulatory liabilities |

9.8 | 37.4 | ||||||

| Accrued interest |

72.2 | 68.3 | ||||||

| Security deposits |

55.6 | 51.0 | ||||||

| Liabilities associated with assets held for sale |

0 | 10.1 | ||||||

| Deferred income taxes |

26.1 | 0 | ||||||

| Other |

122.8 | 123.2 | ||||||

| Total current liabilities |

790.9 | 985.6 | ||||||

| Long-term Debt: |

||||||||

| Securitized debt-Environmental Control Bonds |

481.0 | 496.5 | ||||||

| Other long-term debt |

4,205.0 | 3,920.5 | ||||||

| Total long-term debt |

4,686.0 | 4,417.0 | ||||||

| Deferred Credits and Other Liabilities: |

||||||||

| Derivative liabilities |

7.4 | 6.7 | ||||||

| Income taxes payable |

43.4 | 85.7 | ||||||

| Investment tax credit |

58.3 | 61.6 | ||||||

| Deferred income taxes |

1,653.6 | 1,501.3 | ||||||

| Regulatory liabilities |

512.8 | 461.2 | ||||||

| Pension and other postretirement employee benefit plan liabilities |

596.8 | 597.4 | ||||||

| Adverse power purchase commitment |

96.3 | 114.4 | ||||||

| Liabilities associated with assets held for sale |

0 | 53.1 | ||||||

| Other |

188.6 | 177.0 | ||||||

| Total deferred credits and other liabilities |

3,157.2 | 3,058.4 | ||||||

| Equity: |

||||||||

| Common stock - $1.25 par value per share, 260,000,000 shares authorized and 170,028,499 and 169,620,917 shares issued at December 31, 2010 and 2009, respectively |

212.5 | 212.0 | ||||||

| Other paid-in capital |

1,987.8 | 1,970.2 | ||||||

| Retained earnings |

1,307.0 | 1,022.7 | ||||||

| Treasury stock at cost - 54,955 and 51,313 shares at December 31, 2010 and 2009, respectively |

(1.9 | ) | (1.8 | ) | ||||

| Accumulated other comprehensive loss |

(63.7 | ) | (89.9 | ) | ||||

| Total Allegheny Energy, Inc. common stockholders’ equity |

3,441.7 | 3,113.2 | ||||||

| Noncontrolling interest |

0 | 14.9 | ||||||

| Total equity |

3,441.7 | 3,128.1 | ||||||

| Total Liabilities and Equity |

$ | 12,075.8 | $ | 11,589.1 | ||||

8

ALLEGHENY ENERGY, INC. AND SUBSIDIARIES

SEGMENT STATEMENTS OF INCOME

THREE MONTHS ENDED DECEMBER 31, 2010 AND 2009

| (In millions) |

Merchant Generation |

Regulated Operations |

Eliminations | Total | ||||||||||||

| 2010 | ||||||||||||||||

| Operating revenues |

$ | 353.5 | $ | 806.0 | $ | (294.9 | ) | $ | 864.6 | |||||||

| Operating expenses: |

||||||||||||||||

| Fuel |

178.3 | 77.4 | 0 | 255.7 | ||||||||||||

| Purchased power and transmission |

10.7 | 396.2 | (293.7 | ) | 113.2 | |||||||||||

| Deferred energy costs, net |

0 | 10.0 | 0 | 10.0 | ||||||||||||

| Gain on sale of Virginia distribution business |

0 | 0.5 | 0 | 0.5 | ||||||||||||

| Operations and maintenance |

61.9 | 98.8 | (1.2 | ) | 159.5 | |||||||||||

| Depreciation and amortization |

32.6 | 49.6 | (0.4 | ) | 81.8 | |||||||||||

| Taxes other than income taxes |

12.8 | 41.3 | 0 | 54.1 | ||||||||||||

| Total operating expenses |

296.3 | 673.8 | (295.3 | ) | 674.8 | |||||||||||

| Operating income |

57.2 | 132.2 | 0.4 | 189.8 | ||||||||||||

| Other income (expense), net |

0.6 | 5.3 | (2.4 | ) | 3.5 | |||||||||||

| Interest expense |

32.8 | 43.9 | (0.4 | ) | 76.3 | |||||||||||

| Income before income taxes |

25.0 | 93.6 | (1.6 | ) | 117.0 | |||||||||||

| Income tax expense |

15.4 | 13.4 | 0 | 28.8 | ||||||||||||

| Net income |

9.6 | 80.2 | (1.6 | ) | 88.2 | |||||||||||

| Net income attributable to noncontrolling interests |

(1.8 | ) | 0 | 1.8 | 0 | |||||||||||

| Net income attributable to Allegheny Energy, Inc. |

$ | 7.8 | $ | 80.2 | $ | 0.2 | $ | 88.2 | ||||||||

| (In millions) |

Merchant Generation |

Regulated Operations |

Eliminations | Total | ||||||||||||

| 2009 |

||||||||||||||||

| Operating revenues |

$ | 420.6 | $ | 741.5 | $ | (301.0 | ) | $ | 861.1 | |||||||

| Operating expenses: |

||||||||||||||||

| Fuel |

185.4 | 37.5 | 0 | 222.9 | ||||||||||||

| Purchased power and transmission |

(0.9 | ) | 422.1 | (299.5 | ) | 121.7 | ||||||||||

| Deferred energy costs, net |

0 | (25.5 | ) | 0 | (25.5 | ) | ||||||||||

| Operations and maintenance |

46.0 | 123.7 | (1.5 | ) | 168.2 | |||||||||||

| Depreciation and amortization |

30.6 | 44.8 | (0.5 | ) | 74.9 | |||||||||||

| Taxes other than income taxes |

13.5 | 40.4 | 0 | 53.9 | ||||||||||||

| Total operating expenses |

274.6 | 643.0 | (301.5 | ) | 616.1 | |||||||||||

| Operating income |

146.0 | 98.5 | 0.5 | 245.0 | ||||||||||||

| Other income (expense), net |

(0.2 | ) | 4.0 | (2.9 | ) | 0.9 | ||||||||||

| Interest expense |

50.6 | 39.6 | (0.5 | ) | 89.7 | |||||||||||

| Income before income taxes |

95.2 | 62.9 | (1.9 | ) | 156.2 | |||||||||||

| Income tax expense |

18.8 | 27.6 | 0 | 46.4 | ||||||||||||

| Net income |

76.4 | 35.3 | (1.9 | ) | 109.8 | |||||||||||

| Net income attributable to noncontrolling interests |

(2.1 | ) | (0.5 | ) | 2.1 | (0.5 | ) | |||||||||

| Net income attributable to Allegheny Energy, Inc. |

$ | 74.3 | $ | 34.8 | $ | 0.2 | $ | 109.3 | ||||||||

9

ALLEGHENY ENERGY, INC. AND SUBSIDIARIES

SEGMENT STATEMENTS OF INCOME

YEAR ENDED DECEMBER 31, 2010 AND 2009

| (In millions) |

Merchant Generation |

Regulated Operations |

Eliminations | Total | ||||||||||||

| 2010 | ||||||||||||||||

| Operating revenues |

$ | 1,758.6 | $ | 3,440.3 | $ | (1,296.0 | ) | $ | 3,902.9 | |||||||

| Operating expenses: |

||||||||||||||||

| Fuel |

876.0 | 316.6 | 0 | 1,192.6 | ||||||||||||

| Purchased power and transmission |

38.4 | 1,755.2 | (1,290.7 | ) | 502.9 | |||||||||||

| Deferred energy costs, net |

0 | 38.1 | 0 | 38.1 | ||||||||||||

| Gain on sale of Virginia distribution business |

0 | (44.6 | ) | 0 | (44.6 | ) | ||||||||||

| Operations and maintenance |

250.7 | 487.5 | (5.3 | ) | 732.9 | |||||||||||

| Depreciation and amortization |

129.7 | 195.5 | (1.7 | ) | 323.5 | |||||||||||

| Taxes other than income taxes |

51.2 | 174.8 | 0 | 226.0 | ||||||||||||

| Total operating expenses |

1,346.0 | 2,923.1 | (1,297.7 | ) | 2,971.4 | |||||||||||

| Operating income |

412.6 | 517.2 | 1.7 | 931.5 | ||||||||||||

| Other income (expense), net |

3.6 | 22.2 | (12.5 | ) | 13.3 | |||||||||||

| Interest expense |

145.8 | 173.7 | (3.1 | ) | 316.4 | |||||||||||

| Income before income taxes |

270.4 | 365.7 | (7.7 | ) | 628.4 | |||||||||||

| Income tax expense |

98.7 | 118.0 | 0 | 216.7 | ||||||||||||

| Net income |

171.7 | 247.7 | (7.7 | ) | 411.7 | |||||||||||

| Net income attributable to noncontrolling interests |

(8.6 | ) | 0 | 8.6 | 0 | |||||||||||

| Net income attributable to Allegheny Energy, Inc. |

$ | 163.1 | $ | 247.7 | $ | 0.9 | $ | 411.7 | ||||||||

| (In millions) |

Merchant Generation |

Regulated Operations |

Eliminations | Total | ||||||||||||

| 2009 | ||||||||||||||||

| Operating revenues |

$ | 1,608.6 | $ | 3,051.2 | $ | (1,233.0 | ) | $ | 3,426.8 | |||||||

| Operating expenses: |

||||||||||||||||

| Fuel |

675.5 | 211.1 | 0 | 886.6 | ||||||||||||

| Purchased power and transmission |

26.4 | 1,702.8 | (1,227.2 | ) | 502.0 | |||||||||||

| Deferred energy costs, net |

0 | (64.4 | ) | 0 | (64.4 | ) | ||||||||||

| Operations and maintenance |

247.0 | 445.9 | (5.8 | ) | 687.1 | |||||||||||

| Depreciation and amortization |

106.8 | 177.1 | (1.8 | ) | 282.1 | |||||||||||

| Taxes other than income taxes |

47.2 | 166.4 | 0 | 213.6 | ||||||||||||

| Total operating expenses |

1,102.9 | 2,638.9 | (1,234.8 | ) | 2,507.0 | |||||||||||

| Operating income |

505.7 | 412.3 | 1.8 | 919.8 | ||||||||||||

| Other income (expense), net |

1.0 | 17.1 | (11.1 | ) | 7.0 | |||||||||||

| Interest expense |

134.9 | 157.4 | (1.2 | ) | 291.1 | |||||||||||

| Income before income taxes |

371.8 | 272.0 | (8.1 | ) | 635.7 | |||||||||||

| Income tax expense |

128.8 | 112.8 | 0 | 241.6 | ||||||||||||

| Net income |

243.0 | 159.2 | (8.1 | ) | 394.1 | |||||||||||

| Net income attributable to noncontrolling interests |

(9.0 | ) | (1.3 | ) | 9.0 | (1.3 | ) | |||||||||

| Net income attributable to Allegheny Energy, Inc. |

$ | 234.0 | $ | 157.9 | $ | 0.9 | $ | 392.8 | ||||||||

10

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

CONSOLIDATED DATA FOR THE THREE MONTHS ENDED DECEMBER 31, 2010 AND 2009

(in millions, except per share data)

(unaudited)

| THREE MONTHS ENDED DECEMBER 31, 2010 |

INCOME BEFORE INCOME TAXES |

NET INCOME ATTRIBUTABLE TO ALLEGHENY ENERGY, INC. |

DILUTED EARNINGS PER SHARE |

|||||||||

| Calculation of Adjusted Income: |

||||||||||||

| Income - GAAP Basis |

$ | 117.0 | $ | 88.2 | $ | 0.52 | ||||||

| Adjustments: |

||||||||||||

| Net unrealized loss associated with economic hedges1 |

25.4 | 15.5 | ||||||||||

| Expense associated with the planned merger2 |

3.2 | 1.9 | ||||||||||

| Gain on sale of Virginia distribution business3 |

0.5 | 0.3 | ||||||||||

| Adjusted Income |

$ | 146.1 | $ | 105.9 | $ | 0.62 | ||||||

| Calculation of Adjusted EBITDA: |

||||||||||||

| Net Income attributable to Allegheny Energy, Inc. - GAAP basis |

$ | 88.2 | ||||||||||

| Interest expense |

76.3 | |||||||||||

| Income tax expense |

28.8 | |||||||||||

| Depreciation and amortization |

81.8 | |||||||||||

| EBITDA |

275.1 | |||||||||||

| Net unrealized loss associated with economic hedges1 |

25.4 | |||||||||||

| Expense associated with the planned merger2 |

3.2 | |||||||||||

| Gain on sale of Virginia distribution business3 |

0.5 | |||||||||||

| Adjusted EBITDA |

$ | 304.2 | ||||||||||

| THREE MONTHS ENDED DECEMBER 31, 2009 |

INCOME BEFORE INCOME TAXES |

NET INCOME ATTRIBUTABLE TO ALLEGHENY ENERGY, INC. |

DILUTED EARNINGS PER SHARE |

|||||||||

| Calculation of Adjusted Income: |

||||||||||||

| Income - GAAP Basis |

$ | 156.2 | $ | 109.3 | $ | 0.64 | ||||||

| Adjustments: |

||||||||||||

| Net unrealized gain associated with economic hedges1 |

(7.9 | ) | (4.8 | ) | ||||||||

| Expense associated with Allegheny Energy Supply’s purchase of outstanding notes4 |

13.4 | 8.2 | ||||||||||

| Adjusted Income |

$ | 161.7 | $ | 112.7 | $ | 0.66 | ||||||

| Calculation of Adjusted EBITDA: |

||||||||||||

| Net Income attributable to Allegheny Energy, Inc. - GAAP basis |

$ | 109.3 | ||||||||||

| Interest expense |

89.7 | |||||||||||

| Income tax expense |

46.4 | |||||||||||

| Depreciation and amortization |

74.9 | |||||||||||

| EBITDA |

320.3 | |||||||||||

| Net unrealized gain associated with economic hedges1 |

(7.9 | ) | ||||||||||

| Adjusted EBITDA |

$ | 312.4 | ||||||||||

See accompanying Notes to Reconciliation of Non-GAAP Financial Measures

11

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

SEGMENT DATA FOR THE THREE MONTHS ENDED DECEMBER 31, 2010 AND 2009

(in millions)

(unaudited)

| MERCHANT GENERATION | REGULATED OPERATIONS | |||||||||||||||

| THREE MONTHS ENDED DECEMBER 31, 2010 |

INCOME BEFORE INCOME TAXES |

NET INCOME ATTRIBUTABLE TO ALLEGHENY ENERGY, INC. |

INCOME BEFORE INCOME TAXES |

NET INCOME ATTRIBUTABLE TO ALLEGHENY ENERGY, INC. |

||||||||||||

| Calculation of Adjusted Income: |

||||||||||||||||

| Income - GAAP Basis |

$ | 25.0 | $ | 7.8 | $ | 93.6 | $ | 80.2 | ||||||||

| Adjustments: |

||||||||||||||||

| Net unrealized loss associated with economic hedges1 |

25.4 | 15.5 | — | — | ||||||||||||

| Expense associated with the planned merger2 |

1.2 | 0.7 | 2.0 | 1.2 | ||||||||||||

| Gain on sale of Virginia distribution business3 |

— | — | 0.5 | 0.3 | ||||||||||||

| Adjusted Income |

$ | 51.6 | $ | 24.0 | $ | 96.1 | $ | 81.7 | ||||||||

| Calculation of Adjusted EBITDA: |

||||||||||||||||

| Net income attributable to Allegheny Energy, Inc. - GAAP basis |

$ | 7.8 | $ | 80.2 | ||||||||||||

| Interest expense |

32.8 | 43.9 | ||||||||||||||

| Income tax expense |

15.4 | 13.4 | ||||||||||||||

| Depreciation and amortization |

32.6 | 49.6 | ||||||||||||||

| EBITDA |

88.6 | 187.1 | ||||||||||||||

| Net unrealized loss associated with economic hedges1 |

25.4 | — | ||||||||||||||

| Expense associated with the planned merger2 |

1.2 | 2.0 | ||||||||||||||

| Gain on sale of Virginia distribution business3 |

— | 0.5 | ||||||||||||||

| Adjusted EBITDA |

$ | 115.2 | $ | 189.6 | ||||||||||||

| MERCHANT GENERATION | REGULATED OPERATIONS | |||||||||||||||

| THREE MONTHS ENDED DECEMBER 31, 2009 |

INCOME BEFORE INCOME TAXES |

NET INCOME ATTRIBUTABLE TO ALLEGHENY ENERGY, INC. |

INCOME BEFORE INCOME TAXES |

NET INCOME ATTRIBUTABLE TO ALLEGHENY ENERGY, INC. |

||||||||||||

| Calculation of Adjusted Income: |

||||||||||||||||

| Income - GAAP Basis |

$ | 95.2 | $ | 74.3 | $ | 62.9 | $ | 34.8 | ||||||||

| Adjustments: |

||||||||||||||||

| Net unrealized gain associated with economic hedges1 |

(7.9 | ) | (4.8 | ) | — | — | ||||||||||

| Expense associated with Allegheny Energy Supply’s purchase of outstanding notes4 |

13.4 | 8.2 | — | — | ||||||||||||

| Adjusted Income |

$ | 100.7 | $ | 77.7 | $ | 62.9 | $ | 34.8 | ||||||||

| Calculation of Adjusted EBITDA: |

||||||||||||||||

| Net income attributable to Allegheny Energy, Inc. - GAAP basis |

$ | 74.3 | $ | 34.8 | ||||||||||||

| Interest expense |

50.6 | 39.6 | ||||||||||||||

| Income tax expense |

18.8 | 27.6 | ||||||||||||||

| Depreciation and amortization |

30.6 | 44.8 | ||||||||||||||

| EBITDA |

174.3 | 146.8 | ||||||||||||||

| Net unrealized gain associated with economic hedges1 |

(7.9 | ) | — | |||||||||||||

| Adjusted EBITDA |

$ | 166.4 | $ | 146.8 | ||||||||||||

See accompanying Notes to Reconciliation of Non-GAAP Financial Measures

12

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

CONSOLIDATED DATA FOR THE YEAR ENDED DECEMBER 31, 2010 AND 2009

(in millions, except per share data)

(unaudited)

| YEAR ENDED DECEMBER 31, 2010 |

INCOME BEFORE INCOME TAXES |

NET INCOME ATTRIBUTABLE TO ALLEGHENY ENERGY, INC. |

DILUTED EARNINGS PER SHARE |

|||||||||

| Calculation of Adjusted Income: |

||||||||||||

| Income - GAAP Basis |

$ | 628.4 | $ | 411.7 | $ | 2.42 | ||||||

| Adjustments: |

||||||||||||

| Net unrealized loss associated with economic hedges1 |

29.1 | 17.7 | ||||||||||

| Expense associated with the planned merger2 |

39.9 | 24.5 | ||||||||||

| Gain on sale of Virginia distribution business3 |

(44.6 | ) | (27.7 | ) | ||||||||

| Expense associated with Allegheny Energy Supply’s purchase of outstanding notes4 |

7.3 | 4.4 | ||||||||||

| Adjusted Income |

$ | 660.1 | $ | 430.6 | $ | 2.53 | ||||||

| Calculation of Adjusted EBITDA: |

||||||||||||

| Net Income attributable to Allegheny Energy, Inc. - GAAP basis |

$ | 411.7 | ||||||||||

| Interest expense |

316.4 | |||||||||||

| Income tax expense |

216.7 | |||||||||||

| Depreciation and amortization |

323.5 | |||||||||||

| EBITDA |

1,268.3 | |||||||||||

| Net unrealized loss associated with economic hedges1 |

29.1 | |||||||||||

| Expense associated with the planned merger2 |

39.9 | |||||||||||

| Gain on sale of Virginia distribution business3 |

(44.6 | ) | ||||||||||

| Adjusted EBITDA |

$ | 1,292.7 | ||||||||||

| YEAR ENDED DECEMBER 31, 2009 |

INCOME BEFORE INCOME TAXES |

NET INCOME ATTRIBUTABLE TO ALLEGHENY ENERGY, INC. |

DILUTED EARNINGS PER SHARE |

|||||||||

| Calculation of Adjusted Income: |

||||||||||||

| Income - GAAP Basis |

$ | 635.7 | $ | 392.8 | $ | 2.31 | ||||||

| Adjustments: |

||||||||||||

| Net unrealized gain associated with economic hedges1 |

(26.6 | ) | (16.3 | ) | ||||||||

| Expense associated with Allegheny Energy Supply’s purchase of outstanding notes4 |

32.7 | 20.1 | ||||||||||

| Adjusted Income |

$ | 641.8 | $ | 396.6 | $ | 2.33 | ||||||

| Calculation of Adjusted EBITDA: |

||||||||||||

| Net Income attributable to Allegheny Energy, Inc. - GAAP basis |

$ | 392.8 | ||||||||||

| Interest expense |

291.1 | |||||||||||

| Income tax expense |

241.6 | |||||||||||

| Depreciation and amortization |

282.1 | |||||||||||

| EBITDA |

1,207.6 | |||||||||||

| Net unrealized gain associated with economic hedges1 |

(26.6 | ) | ||||||||||

| Adjusted EBITDA |

$ | 1,181.0 | ||||||||||

See accompanying Notes to Reconciliation of Non-GAAP Financial Measures

13

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

SEGMENT DATA FOR THE YEAR ENDED DECEMBER 31, 2010 AND 2009

(in millions)

(unaudited)

| MERCHANT GENERATION | REGULATED OPERATIONS | |||||||||||||||

| YEAR ENDED DECEMBER 31, 2010 |

INCOME BEFORE INCOME TAXES |

NET INCOME ATTRIBUTABLE TO ALLEGHENY ENERGY, INC. |

INCOME BEFORE INCOME TAXES |

NET INCOME ATTRIBUTABLE TO ALLEGHENY ENERGY, INC. |

||||||||||||

| Calculation of Adjusted Income: |

||||||||||||||||

| Income - GAAP Basis |

$ | 270.4 | $ | 163.1 | $ | 365.7 | $ | 247.7 | ||||||||

| Adjustments: |

||||||||||||||||

| Net unrealized loss associated with economic hedges1 |

29.1 | 17.7 | — | — | ||||||||||||

| Expense associated with the planned merger2 |

13.6 | 8.4 | 26.3 | 16.1 | ||||||||||||

| Gain on sale of Virginia distribution business3 |

— | — | (44.6 | ) | (27.7 | ) | ||||||||||

| Expense associated with Allegheny Energy Supply’s purchase of outstanding notes4 |

7.3 | 4.4 | — | — | ||||||||||||

| Adjusted Income |

$ | 320.4 | $ | 193.6 | $ | 347.4 | $ | 236.1 | ||||||||

| Calculation of Adjusted EBITDA: |

||||||||||||||||

| Net income attributable to Allegheny Energy, Inc. - GAAP basis |

$ | 163.1 | $ | 247.7 | ||||||||||||

| Interest expense |

145.8 | 173.7 | ||||||||||||||

| Income tax expense |

98.7 | 118.0 | ||||||||||||||

| Depreciation and amortization |

129.7 | 195.5 | ||||||||||||||

| EBITDA |

537.3 | 734.9 | ||||||||||||||

| Net unrealized loss associated with economic hedges1 |

29.1 | — | ||||||||||||||

| Expense associated with the planned merger2 |

13.6 | 26.3 | ||||||||||||||

| Gain on sale of Virginia distribution business3 |

— | (44.6 | ) | |||||||||||||

| Adjusted EBITDA |

$ | 580.0 | $ | 716.6 | ||||||||||||

| MERCHANT GENERATION | REGULATED OPERATIONS | |||||||||||||||

| YEAR ENDED DECEMBER 31, 2009 |

INCOME BEFORE INCOME TAXES |

NET INCOME ATTRIBUTABLE TO ALLEGHENY ENERGY, INC. |

INCOME BEFORE INCOME TAXES |

NET INCOME ATTRIBUTABLE TO ALLEGHENY ENERGY, INC. |

||||||||||||

| Calculation of Adjusted Income: |

||||||||||||||||

| Income - GAAP Basis |

$ | 371.8 | $ | 234.0 | $ | 272.0 | $ | 157.9 | ||||||||

| Adjustments: |

||||||||||||||||

| Net unrealized gain associated with economic hedges1 |

(26.6 | ) | (16.3 | ) | — | — | ||||||||||

| Expense associated with Allegheny Energy Supply’s purchase of outstanding notes4 |

32.7 | 20.1 | — | — | ||||||||||||

| Adjusted Income |

$ | 377.9 | $ | 237.8 | $ | 272.0 | $ | 157.9 | ||||||||

| Calculation of Adjusted EBITDA: |

||||||||||||||||

| Net income attributable to Allegheny Energy, Inc. - GAAP basis |

$ | 234.0 | $ | 157.9 | ||||||||||||

| Interest expense |

134.9 | 157.4 | ||||||||||||||

| Income tax expense |

128.8 | 112.8 | ||||||||||||||

| Depreciation and amortization |

106.8 | 177.1 | ||||||||||||||

| EBITDA |

604.5 | 605.2 | ||||||||||||||

| Net unrealized gain associated with economic hedges1 |

(26.6 | ) | — | |||||||||||||

| Adjusted EBITDA |

$ | 577.9 | $ | 605.2 | ||||||||||||

See accompanying Notes to Reconciliation of Non-GAAP Financial Measures

14

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

SUMMARY OF ADJUSTMENTS

(in millions)

(unaudited)

| ADJUSTED OPERATING REVENUE |

THREE MONTHS ENDED DEC 31, 2010 |

THREE MONTHS ENDED DEC 31, 2009 |

||||||

| Operating revenue: |

||||||||

| As reported |

$ | 864.6 | $ | 861.1 | ||||

| Net unrealized loss/(gain) associated with economic hedges1 |

25.4 | (7.9 | ) | |||||

| As Adjusted |

$ | 890.0 | $ | 853.2 | ||||

| ADJUSTED OPERATIONS AND MAINTENANCE EXPENSE |

THREE MONTHS ENDED DEC 31, 2010 |

THREE MONTHS ENDED DEC 31, 2009 |

||||||

| Operations and maintenance expense: |

||||||||

| As reported |

$ | 159.5 | $ | 168.2 | ||||

| Expense associated with the planned merger2 |

(3.2 | ) | — | |||||

| As Adjusted |

$ | 156.3 | $ | 168.2 | ||||

| ADJUSTED INTEREST EXPENSE |

THREE MONTHS ENDED DEC 31, 2010 |

THREE MONTHS ENDED DEC 31, 2009 |

||||||

| Interest expense: |

||||||||

| As reported |

$ | 76.3 | $ | 89.7 | ||||

| Expense associated with Allegheny Energy Supply’s purchase of outstanding notes4 |

— | (13.4 | ) | |||||

| As Adjusted |

$ | 76.3 | $ | 76.3 | ||||

| ADJUSTED INCOME TAX EXPENSE |

THREE MONTHS ENDED DEC 31, 2010 |

THREE MONTHS ENDED DEC 31, 2009 |

||||||

| Income taxes: |

||||||||

| As reported |

$ | 28.8 | $ | 46.4 | ||||

| Income taxes related to net unrealized losses/(gains) associated with economic hedges1 |

9.9 | (3.1 | ) | |||||

| Income taxes related to expense associated with the planned merger2 |

1.3 | — | ||||||

| Income taxes related to gain on sale of the Virginia distribution business3 |

0.2 | — | ||||||

| Income taxes associated with Allegheny Energy Supply’s purchase of outstanding notes4 |

— | 5.2 | ||||||

| As Adjusted |

$ | 40.2 | $ | 48.5 | ||||

See accompanying Notes to Reconciliation of Non-GAAP Financial Measures

15

Notes to Reconciliation of Non-GAAP Financial Measures:

| (1) | Adjustments relating to certain unrealized losses/(gains) included in GAAP operating revenues: |

| THREE MONTHS ENDED DEC 31, 2010 |

THREE MONTHS ENDED DEC 31, 2009 |

|||||||

| Financial transmission rights |

($ | 1.2 | ) | ($ | 11.9 | ) | ||

| Power hedges |

20.8 | (3.7 | ) | |||||

| Hedging strategy relating to a natural gas transportation contract |

5.8 | 7.7 | ||||||

| Total adjustments |

$ | 25.4 | ($ | 7.9 | ) | |||

| YEAR ENDED DEC 31, 2010 |

YEAR ENDED DEC 31, 2009 |

|||||||

| Financial transmission rights |

($ | 21.9 | ) | ($ | 33.2 | ) | ||

| Power hedges |

19.0 | 10.1 | ||||||

| Hedging strategy relating to a natural gas transportation contract |

32.0 | (3.5 | ) | |||||

| Total adjustments |

$ | 29.1 | ($ | 26.6 | ) | |||

| (2) | In February, 2010, Allegheny Energy, Inc. and FirstEnergy Corp. entered into an Agreement and Plan of Merger. Incremental merger costs were included in operations and maintenance expense on the Consolidated Statements of Income. |

| (3) | On June 1, 2010, Potomac Edison sold its electric distribution operations in Virginia (the “Virginia distribution business”) to Rappahannock Electric Cooperative and Shenandoah Valley Electric Cooperative, resulting in a pre-tax gain of approximately $45.1 million. In December 2010, a true-up to the gain of ($0.5 million) was recognized resulting in an overall transaction net pre-tax gain of approximately $44.6 million. The gain on sale is presented as “Gain on sale of Virginia distribution business” on the Consolidated Statements of Income. |

| (4) | In July, 2010, Allegheny Energy Supply redeemed all $150.5 million of its outstanding 7.80% Medium Term Notes due 2011. The osts associated with this purchase in the amount of $7.3 million were charged to interest expense in the GAAP basis Consolidated Statements of Income. |

In September, 2009, Allegheny Energy Supply purchased its outstanding 7.80% Notes due 2011 and its 8.25% Notes due 2012 in the aggregate principal amount of $244.3 million, pursuant to a cash tender offer. The costs associated with this purchase in the amount of $19.3 million were charged to interest expense in the GAAP basis Consolidated Statements of Income.

In October, 2009, Allegheny Energy Supply purchased its outstanding 7.80% Medium Term Notes due 2011 in the aggregate principal amount of $152.0 million, pursuant to a cash tender offer. The costs associated with this purchase in the amount of $13.4 million were charged to interest expense in the GAAP basis Consolidated Statements of Income.

16

ALLEGHENY ENERGY, INC. AND SUBSIDIARIES

OPERATING STATISTICS

(unaudited)

Three Months Ended December 31,

| Actual | Actual | Excluding Virginia Operations* | ||||||||||||||||||||||

| 2010 | 2009 | Change | 2010 | 2009 | Change | |||||||||||||||||||

| REGULATED OPERATIONS |

||||||||||||||||||||||||

| Retail electricity sales (thousand MWh): |

||||||||||||||||||||||||

| Residential |

4,070 | 4,283 | -5.0 | % | 4,070 | 3,953 | 3.0 | % | ||||||||||||||||

| Commercial |

2,558 | 2,691 | -4.9 | % | 2,558 | 2,513 | 1.8 | % | ||||||||||||||||

| Industrial and other |

3,536 | 3,533 | 0.1 | % | 3,536 | 3,310 | 6.8 | % | ||||||||||||||||

| Total |

10,164 | 10,507 | -3.3 | % | 10,164 | 9,776 | 4.0 | % | ||||||||||||||||

| Usage per customer (KWh): |

||||||||||||||||||||||||

| Residential |

3,163 | 3,129 | 1.1 | % | 3,163 | 3,082 | 2.6 | % | ||||||||||||||||

| Commercial |

14,776 | 14,413 | 2.5 | % | 14,776 | 14,611 | 1.1 | % | ||||||||||||||||

| Industrial |

134,884 | 128,187 | 5.2 | % | 134,884 | 127,400 | 5.9 | % | ||||||||||||||||

| Regulated generation (thousand MWh): |

||||||||||||||||||||||||

| Supercritical coal |

2,348 | 975 | 140.8 | % | ||||||||||||||||||||

| Other coal |

185 | 108 | 71.3 | % | ||||||||||||||||||||

| Hydro and other |

120 | 136 | -11.8 | % | ||||||||||||||||||||

| Total |

2,653 | 1,219 | 117.6 | % | ||||||||||||||||||||

| MERCHANT GENERATION |

||||||||||||||||||||||||

| Generation (thousand MWh): |

||||||||||||||||||||||||

| Supercritical coal |

5,616 | 5,764 | -2.6 | % | ||||||||||||||||||||

| Other coal |

521 | 479 | 8.8 | % | ||||||||||||||||||||

| Gas |

206 | 321 | -35.8 | % | ||||||||||||||||||||

| Hydro and other |

314 | 330 | -4.8 | % | ||||||||||||||||||||

| Total |

6,657 | 6,894 | -3.4 | % | ||||||||||||||||||||

| Net capacity factor: |

||||||||||||||||||||||||

| Supercritical coal |

57 | % | 58 | % | -1.0 | % | ||||||||||||||||||

| All coal |

53 | % | 54 | % | -1.0 | % | ||||||||||||||||||

| Equivalent availability factor: |

||||||||||||||||||||||||

| Supercritical coal |

77 | % | 83 | % | -6.0 | % | ||||||||||||||||||

| All coal |

76 | % | 84 | % | -8.0 | % | ||||||||||||||||||

| DEGREE DAYS |

||||||||||||||||||||||||

| Heating |

2,130 | 1,882 | 13.2 | % | ||||||||||||||||||||

| Cooling |

6 | 3 | 100.0 | % | ||||||||||||||||||||

| * | Represents actual results for both 2010 and 2009 excluding amounts relating to the Virginia distribution operations that were sold on June 1, 2010. |

17

ALLEGHENY ENERGY, INC. AND SUBSIDIARIES

OPERATING STATISTICS

(unaudited)

Twelve Months Ended December 31,

| Actual | Actual | Excluding Virginia Operations* | ||||||||||||||||||||||

| 2010 | 2009 | Change | 2010 | 2009 | Change | |||||||||||||||||||

| REGULATED OPERATIONS |

||||||||||||||||||||||||

| Retail electricity sales (thousand MWh): |

||||||||||||||||||||||||

| Residential |

17,008 | 16,892 | 0.7 | % | 16,417 | 15,593 | 5.3 | % | ||||||||||||||||

| Commercial |

10,923 | 11,141 | -2.0 | % | 10,622 | 10,396 | 2.2 | % | ||||||||||||||||

| Industrial and other |

14,458 | 14,007 | 3.2 | % | 14,068 | 13,111 | 7.3 | % | ||||||||||||||||

| Total |

42,389 | 42,040 | 0.8 | % | 41,107 | 39,100 | 5.1 | % | ||||||||||||||||

| Usage per customer (KWh): |

||||||||||||||||||||||||

| Residential |

12,887 | 12,356 | 4.3 | % | 12,771 | 12,170 | 4.9 | % | ||||||||||||||||

| Commercial |

61,197 | 59,857 | 2.2 | % | 61,549 | 60,636 | 1.5 | % | ||||||||||||||||

| Industrial |

540,820 | 509,987 | 6.0 | % | 539,054 | 506,355 | 6.5 | % | ||||||||||||||||

| Regulated generation (thousand MWh): |

||||||||||||||||||||||||

| Supercritical coal |

9,552 | 6,596 | 44.8 | % | ||||||||||||||||||||

| Other coal |

720 | 392 | 83.7 | % | ||||||||||||||||||||

| Hydro and other |

627 | 538 | 16.5 | % | ||||||||||||||||||||

| Total |

10,899 | 7,526 | 44.8 | % | ||||||||||||||||||||

| MERCHANT GENERATION |

||||||||||||||||||||||||

| Generation (thousand MWh): |

||||||||||||||||||||||||

| Supercritical coal |

26,625 | 22,375 | 19.0 | % | ||||||||||||||||||||

| Other coal |

2,906 | 1,504 | 93.2 | % | ||||||||||||||||||||

| Gas |

1,049 | 828 | 26.7 | % | ||||||||||||||||||||

| Hydro and other |

1,471 | 1,297 | 13.4 | % | ||||||||||||||||||||

| Total |

32,051 | 26,004 | 23.3 | % | ||||||||||||||||||||

| Net capacity factor: |

||||||||||||||||||||||||

| Supercritical coal |

69 | % | 58 | % | 11.0 | % | ||||||||||||||||||

| All coal |

65 | % | 53 | % | 12.0 | % | ||||||||||||||||||

| Equivalent availability factor: |

||||||||||||||||||||||||

| Supercritical coal |

82 | % | 80 | % | 2.0 | % | ||||||||||||||||||

| All coal |

82 | % | 81 | % | 1.0 | % | ||||||||||||||||||

| DEGREE DAYS |

||||||||||||||||||||||||

| Heating |

5,327 | 5,225 | 2.0 | % | ||||||||||||||||||||

| Cooling |

1,208 | 816 | 48.0 | % | ||||||||||||||||||||

| * | Represents actual results for both 2010 and 2009 excluding amounts relating to the Virginia distribution operations that were sold on June 1, 2010. |

18

Exhibit 1

Exhibit 2

19

Exhibit 3

20