Attached files

| file | filename |

|---|---|

| EX-32.2 - Sunway Global Inc. | v211602_ex32-2.htm |

| EX-32.1 - Sunway Global Inc. | v211602_ex32-1.htm |

| EX-31.1 - Sunway Global Inc. | v211602_ex31-1.htm |

| EX-31.2 - Sunway Global Inc. | v211602_ex31-2.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-K/A

Amendment

No. 2

(Mark

One)

x

ANNUAL REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT

OF 1934

For

the Fiscal Year Ended December 31, 2008

o

TRANSITION REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE

ACT OF 1934

For

the transition period from _________ to __________

Commission

file number: 000-27159

SUNWAY GLOBAL

INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

65-0439467

|

|

|

(State

or other jurisdiction of incorporation or organization)

|

(IRS

Employer Identification

No.)

|

Daqing Hi-Tech Industry

Development Zone

Daqing, Heilongjiang, Post

Code 163316

People’s Republic of

China

(Address

of principal executive offices)

86-459-604-6043

(Registrant's

telephone number, including area code)

(Former

name, former address and former fiscal year, if changed since last

report)

Copies

to:

Marc

Ross, Esq.

Sichenzia

Ross Friedman Ference LLP

61

Broadway

New York,

New York 10006

Phone:

(212) 930-9700

Fax:

(212) 930-9725

Securities

registered under Section 12(b) of the Exchange Act: None.

Securities

registered pursuant to Section 12(g) of the Act: Common Stock, par value

$.0000001

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes o No x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act Yes x No o

(COVER

CONTINUES ON FOLLOWING PAGE)

Indicate

by check mark whether the Registrant: (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

past 12 months (or for such shorter period that the registrant was required to

file such reports), and (2) has been subject to such filing requirements for the

past 90 days. Yes x

No o

Indicate

by check mark if disclosure of delinquent filers in response to Item 405 of

Regulation S-K (§229.405) is not contained herein, and will not be contained, to

the best of the Registrant's knowledge, in definitive proxy or information

statements incorporated by reference in Part III of this Form 10-K or any

amendment to this Form 10-K. o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b2 of the Exchange Act.

|

Large

accelerated filer o

|

Accelerated

filer o

|

|

Non-accelerated

filer o

(Do not check if a smaller reporting company)

|

Smaller

reporting company x

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Act). Yes o No x

State the

aggregate market value of the voting and non-voting common equity held by

non-affiliates computed by reference to the price at which the common equity was

last sold, or the average bid and asked price of such common equity, as of the

last business day of the registrant’s most recently completed second fiscal

quarter.

Note – If a determination as

to whether a particular person or entity is an affiliate cannot be made without

involving unreasonable effort and expense, the aggregate market value of the

common stock held by non-affiliates may be calculated on the basis of

assumptions reasonable under the circumstances, provided that the assumptions

are set forth in this Form.

The

aggregate market value of the voting and non-voting common stock of the issuer

held by non-affiliates as of March 24, 2009 was approximately $1,742,906 based

upon the closing price of the common stock of $3.50 as quoted by Nasdaq OTC

Bulletin Board on June 30, 2008.

APPLICABLE

ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS

DURING THE PRECEDING FIVE YEARS:

Indicate

by check mark whether the registrant has filed all documents and reports

required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act

of 1934 subsequent to the distribution of securities under a plan confirmed by a

court. Yes o

No o

(APPLICABLE

ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant’s classes of

common stock, as of the latest practicable date.

As of

March 24, 2009, there were 18,499,736 issued and outstanding shares of the

issuer’s common stock.

DOCUMENTS

INCORPORATED BY REFERENCE

List

hereunder the following documents if incorporated by reference and the Part of

the Form 10-K (e.g. Part I, Part II, etc.) into which the document is

incorporated: (1) Any annual report to security holders; (2) Any proxy or

information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or

(c) under the Securities Act of 1933. The listed documents should be

clearly described for identification purposes (e.g. annual report to security

holders for fiscal years ended December 24, 1980).

EXPLANATORY

NOTE

The

Amendment No. 2 to Sunway Global Inc., (the “Company”, “Sunway”)’s Annual report

on Form 10K/A for the year ended December 31, 2008 (the “Amended 10-K”) is being

made as a result of the Company’s recent discovery of certain incorrect

classifications of paid-in capital and retained earnings.

This

Amended 10-K is being filed to amend the basic and diluted earnings per share,

the paid-in capital and retained earnings accounts in the Balance Sheet as of

December 31, 2007 and 2008, and the Statements of Shareholders’ Equity for the

year ended December 31, 2007 and 2008. In addition, this Amended 10-K includes

changes to the net profit, and the calculation of basic and diluted earnings per

share for 2007. This Amended 10-Kalso includes corrections to certain

typographical errors in the Index to Financial Statements

and provides a supplementary additional income tax reconciliation

disclosure to Note 13. This Amended 10-K also includes changes to Item 9A -

Evaluation of Disclosure Controls and Procedures. In addition, this Amended 10-K

includes an adjustment to the audit report of the Company’s independent

registered accountants to reflect certain changes to Notes 14 and 20 of the

financial statements. No other information included in the original Form 10-K or

Amendment No. 1 on Form 10-K/A are amended hereby.

For

convenience and ease of reference, the Company is filing the annual report in

its entirety with applicable changes. Unless otherwise stated, all information

contained in this Amended 10-K is as of March 30, 2009, the filing date of the

original Annual Report. Except as stated herein, this Amendment No.2 to Form

10-K/A does not reflect events or transactions occurring after such filing date

or modify or update those disclosure in the Annual Report that may have been

affected by events or transactions occurring subsequent to such filing date. No

information in the Annual Report other than as set forth above is amended

hereby.

FORWARD

LOOKING STATEMENTS

In this

annual report, references to “Sunway Global,” “Sunway,” “SUWG,” “the Company,”

“we,” “us,” and “our” refer to Sunway Global Inc.

This

Amendment No. 2 to the Annual Report on Form 10-K/A (including the section

regarding Management's Discussion and Analysis or Plan of Operation) contains

forward-looking statements regarding our business, financial condition, results

of operations and prospects. Words such as "expects," "anticipates," "intends,"

"plans," "believes," "seeks," "estimates" and similar expressions or variations

of such words are intended to identify forward-looking statements, but are not

deemed to represent an all-inclusive means of identifying forward-looking

statements as denoted in this Amendment No. 2 to our Annual Report on Form

10-K/A. Additionally, statements concerning future matters are forward-looking

statements.

Although

forward-looking statements in this Annual Report on Form 10-K/A reflect the good

faith judgment of our Management, such statements can only be based on facts and

factors currently known by us. Consequently, forward-looking statements are

inherently subject to risks and uncertainties and actual results and outcomes

may differ materially from the results and outcomes discussed in or anticipated

by the forward-looking statements. Factors that could cause or contribute to

such differences in results and outcomes include, without limitation, those

specifically addressed under the heading "Risks Related to Our Business" below,

as well as those discussed elsewhere in this Annual Report on Form 10-K/A.

Readers are urged not to place undue reliance on these forward-looking

statements, which speak only as of the date of this Annual Report on Form

10-K/A. We file reports with the Securities and Exchange Commission ("SEC"). We

make available on our website under "Investor Relations/SEC Filings," free of

charge, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current

reports on Form 8-K and amendments to those reports as soon as reasonably

practicable after we electronically file such materials with or furnish them to

the SEC. Our website address is www.sunwaytech.com.cn/. You can also read

and copy any materials we file with the SEC at the SEC's Public Reference Room

at 100 F Street, NE, Washington, DC 20549. You can obtain additional information

about the operation of the Public Reference Room by calling the SEC at

1-800-SEC-0330. In addition, the SEC maintains an Internet site (www.sec.gov)

that contains reports, proxy and information statements, and other information

regarding issuers that file electronically with the SEC, including

us.

We

undertake no obligation to revise or update any forward-looking statements in

order to reflect any event or circumstance that may arise after the date of this

Annual Report on Form 10-K/A, except as required by law. Readers are urged to

carefully review and consider the various disclosures made throughout the

entirety of this Annual Report, which are designed to advise interested parties

of the risks and factors that may affect our business, financial condition,

results of operations and prospects.

TABLE OF

CONTENTS

|

Page

|

||

|

PART

I

|

||

|

Item

1.

|

BUSINESS

|

3

|

|

Item

1A

|

RISK

FACTORS

|

11

|

|

Item

1B

|

UNRESOLVED

STAFF COMMENTS

|

21

|

|

Item

2.

|

PROPERTIES

|

21

|

|

Item

3.

|

LEGAL

PROCEEDINGS

|

22

|

|

Item

4.

|

SUBMISSION

OF MATTERS TO A VOTE OF SECURITY HOLDERS

|

22

|

|

PART

II

|

||

|

Item

5.

|

MARKET

FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER

PURCHASES OF EQUITY SECURITIES

|

22

|

|

Item

6

|

SELECTED

FINANCIAL DATA

|

23

|

|

Item

7.

|

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

|

23

|

|

Item

7A

|

QUANTITATIVE

AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

27

|

|

Item

8.

|

FINANCIAL

STATEMENTS AND SUPPLEMENTARY DATA

|

28

|

|

Item

9.

|

CHANGES

IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL

DISCLOSURE

|

29

|

|

Item

9A.

|

CONTROLS

AND PROCEDURES

|

29

|

|

Item

9B.

|

OTHER

INFORMATION

|

30

|

|

PART

III

|

||

|

Item

10.

|

DIRECTORS,

EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE

|

30

|

|

Item

11.

|

EXECUTIVE

COMPENSATION

|

33

|

|

Item

12.

|

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED

STOCKHOLDER MATTERS

|

34

|

|

Item

13.

|

CERTAIN

RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR

INDEPENDENCE

|

35

|

|

Item

14.

|

PRINCIPAL

ACCOUNTANT FEES AND SERVICES

|

35

|

|

PART

IV

|

||

|

Item

15.

|

EXHIBITS,

FINANCIAL STATEMENT SCHEDULES

|

36

|

|

SIGNATURES

|

37

|

|

2

PART

I

ITEM

1. BUSINESS.

Our

Business

As a

result of the consummation of a reverse merger, discussed below, we are engaged

in the business of designing, manufacturing and selling logistic transport

systems and medicine dispensing systems and equipment. Our principal product is

a pneumatic tube logistic transport system used in hospitals and other medical

facilities. We recently developed an automatic medicine dispensing and packing

system, which we introduced to the market in the first quarter

of 2008 for use in hospitals and medical facilities.

Our

customers are primarily hospitals and medical appliance companies in the

People’s Republic of China (the “PRC”). As the market for pneumatic transport

systems (“PTS”) and Sunway Automatic Dispensing and Packing (“SADP”) are still

an emerging market, official data about the industry in general and competition

in particular have not been readily available. Based on information we have

collected from bids, the internet and other market intelligence, it is our

estimate that among the hospitals that have adopted pneumatic transport systems

and medicine dispensing system in China, we were the supplier to the largest

number of hospitals in 2005, 2006, 2007 and 2008. In 2005, we sold 1,105 units

PTS to 43 hospitals and medical facilities and recognized revenue of $5,047,365.

In 2006, we sold 1,930 units PTS to 65 hospitals and medical facilities and

recognized revenue of $8,914,139. In 2007, we sold 2,575 units PTS to 87

hospitals and medical facilities and recognized revenue of $11,865,138. In 2008,

we sold 3,669 units PTS and 5 units SADP to 96 hospitals. We sell our products

both directly, through our sales employees and direct sales office and

indirectly, through thirteen independent sales agents and four direct sales

office. Our sales network covers Beijing, Shanghai, Guangzhou Chengdu, Xian and

13 other provinces in the PRC.

We

generate our revenues from sales in five product categories: Type A

workstations, Type B workstations, Type C workstations, SADP and spare part. The

PTS have the same function and price but with different product designs. Having

three types of workstations enables us to provide more options and flexibility

to our customers to accommodate their aesthetic taste, space restrictions and

other requirements.

3

About

Us

We are a Nevada corporation which was formed on

October 18, 1971. Prior to June 6, 2007, we were a shell company. On June 6,

2007, we consummated (i) a reverse merger transaction, in which we acquired

control over an operating company in the PRC and (ii) a private sale of our

restricted stock, in which we received an aggregate of $6.7 million of

financing. Through these transactions, we ceased to be a shell company and,

through our subsidiaries, entered into the business of manufacturing and selling

logistic transport systems and medicine dispensing and system in the

PRC.

On June

6, 2007, the Company acquired World Through Limited, a British Virgin Islands

Corporation (“WTL”) through a share exchange transaction with WTL and Rise Elite

International Limited (“Rise Elite”), a company incorporated under the laws of

the British Virgin Islands and the owner of 100% of the outstanding voting stock

of WTL. WTL owns all of the stock of Sunway World Through Technology (Daqing)

Co., Ltd. (“SWT”), a wholly foreign-owned enterprise (“WFOE”) organized under

the laws of the PRC. SWT has a series of contracts with the Company’s operating

company, Daqing Sunway Technology Co., Ltd. (“Daqing Sunway”), a company

organized under the laws of the PRC, which gives it control over Daqing Sunway’s

business, personnel and finances as if it were a wholly owned subsidiary of SWT.

The transaction was structured in this way because PRC regulations require that

Daqing Sunway be acquired for cash and the natural person in control of WTL was

unable to raise sufficient funds to pay the full value for Daqing Sunway’s

shares of assets in cash prior to the acquisition.

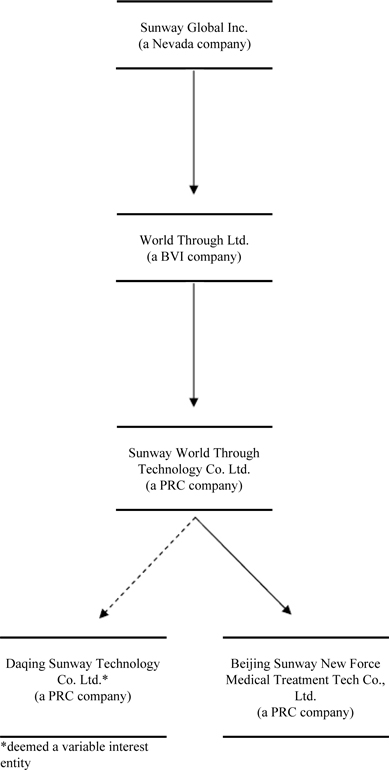

On March

16, 2008, SWT acquired Beijing Sunway New-force Medical Treatment Tech Co., Ltd.

(“Beijing Sunway”) as its wholly-owned subsidiary. Beijing Sunway was

incorporated in Beijing, PRC on May 24, 2007. The current structure

of the Company and its subsidiaries is set forth below:

The

Company, through its subsidiaries and Daqing Sunway, is now in the business of

designing, manufacturing and selling logistic transport systems and medicine

dispensing systems and equipment.

As

contemplated by the reverse merger and approved by a majority of shareholders on

June 28, 2007, the Company effected a 86.3035-for-one reverse split that took

effect on February 7, 2008.

Also on

February 7, 2008, the Company changed its name from National Realty and

Mortgage, Inc. to Sunway Global Inc.

4

Description

of Our Products and Services

Medical

Transport Systems

The

Company’s principal product has been the SUNTRANS-160 pneumatic tube transport

system (“PTS”) used in hospitals and medical facilities. Pneumatic tube material

transport systems are used in over 140 countries throughout the world with many

of the systems used in hospitals and medical facilities. Our annual PTS sales in

2004, 2005, 2006, 2007 and 2008 were 785, 1,105, 1,930, 2,575 and 3,669 units

(each unit consists of one workstation in a PTS), respectively. The average

price of our PTS is approximately $150,810 (consisting of 30 workstations on

average).

Our PTS

transports small materials weighing up to five kilograms in capsules at

high-speed through a network of tubing and transfer units that connect hundreds

of working departments of a hospital, including nurse stations, operation

departments, medicine dispensing centers, testing centers and disinfection

stations, each designated as a user workstation. The high speed transmission of

the materials in the tubing network is through pneumatic air flow powered by air

compressors and the path of a capsule can be switched and redirected through

transfer units. Typical applications for our PTS are the transport of items from

a user workstation to another user workstation at a users’ request.

Our PTS

provides two-way carrier travel between send/receive user workstations through a

single interconnecting tube. It can deliver anything that fits in a capsule to a

remote location - even on different floors or in other buildings - in a few

seconds at speeds up to 8 meters per second on a stream of compressed air in the

transmission tubes. Capsules can be transmitted up to 1,800 meters horizontally

and 120 meters vertically. Each pneumatic tube transport system can have up to

eight sub-systems with up to 64 send/receive workstations under control by each

sub-system.

The

control units for user workstations and transfer units contain self-diagnostic

and troubleshooting software. When an operating error occurs, the applicable

control unit will send error message to each user workstation and the system

control center. When a receiving user workstation malfunctions, the system will

automatically return the transmission carrier to its originating user

workstation.

A PTS

primarily consists of send/receive user workstations, transfer units, tubing

network, capsules, air compressors, system blower and system control

centers.

User

Workstations

User

Workstations are combined sending and receiving units that send and receive

capsules carrying the items transported. Each workstation has an easy-to-use

control panel equipped with a 5-inch LCD screen. It displays the real-time

operating status of all workstations, capsules, transfer units and air

compressors throughout a PTS and also monitors capsules in transit, indicates

the sequence of transport requests and displays destinations of a transport. It

has a heightened security system that can discern and prevent the entry of any

foreign items that are not requested to be transported by the system. Each

workstation has a voice function that announces the arrival of a capsule as well

as its originating workstation. When error occurs in one user workstation, such

user workstation can automatically shut down without interfering with the

operation of other user workstations.

Transfer

Units

Transfer

units are switching devices used at branching points in a tubing system to

direct and redirect the path of a capsule from one route into another route

until it gets to its final destination.

Tubing

network

The

tubing and bends in a PTS are made from strong, lightweight, non-corroding,

dent-resistant U-PVC that can withstand adverse exterior weather conditions as

well as a numerous harsh conditions between buildings, through existing

utilities and underground. Generally, the diameter of a straight tube is 160mm

and the radius of a bend is 850 mm and the tube wall is 3.2mm

thick.

System

Control Centers

A system

control center consists of one computer that controls the control units of all

other components of the PTS connected through communication cables, and it

configures the sub-systems, monitors system operations and troubleshoots system

errors. It has a graphical user interface, dynamic system monitoring and

administration, real-time tracking of capsules, event reporting and

self-diagnostic systems and a security system to prevent unauthorized use. The

system control centers can also store current and historical transport data and

instructions entered into the system, which can be retrieved for research and

other purposes. In the event of a system shut-down due to a blackout, the system

can resume operation without loosing any data or instructions and complete

transport requests given prior to the shut-down when the power supply

resumes.

5

Capsules

Capsules

are the transporting “vehicle” for medical items within the hospital. A capsule

is a tube-like bottle made from transparent Plexiglas with leak-resistant caps

at both ends. Each capsule can carry a load weigh up to five

kilograms.

Air

Compressors and System Blower

Air

compressors and the system blower compress and pressurize air which creates

pneumatic force that moves capsules through the tubing system.

Execution

and Transmission Flow of a Transport Request

A

transport request is typically executed as follows: At an originating user

workstation, a user places the item to be transmitted in a capsule and puts the

capsule in the input basket of the originating user workstation. The user then

enters a transmission request on the control panel of the workstation for the

capsule to be delivered to another designated user workstation. The request will

then be transmitted to the system control center. Upon receipt of the

transmission request, the system control center will check whether there is any

item currently in transit in the applicable route. If not, the system control

center will instruct the originating user workstation to allow the capsule to

enter the tube. Upon the capsule’s entry into the tube, the air compressor and

system blower will be turned on. The system blower will provide vacuum to suck

the capsule into the transfer unit and the transfer unit will then switch to the

path leading to the destination workstation. The system blower will then provide

positive pressure in the tube that will carry the capsule to its destination.

Upon arrival of the capsule at the destination workstation, the destination

workstation will automatically release the capsule into its output basket. At

the same time, the destination workstation will make a voice announcement to

alert the arrival of the capsule and the system control center records and

stores all the information regarding the transport operation.

Installation

Send/receive

workstations with built-in air compressors can sit on desks or tables, or mount

easily in a minimum of space on walls, building columns, or any convenient flat

surface, without using prime locations. Tubing may be installed indoors or

outdoors and fire prevention measures can be added. Our outdoor installation

utilizes antifreeze and is waterproof. Tubes can be installed through floors and

walls with fireproof insulation casing.

Our PTS

has three types: Type A Workstations, Type B Workstations and Type C

Workstations. The three types of workstations are priced the same with similar

functions. The differences between the three types lie in the mechanism of

sending and receiving items as well as size and method of installation. Having

three types of workstations enables us to provide more options and flexibility

to our customers to accommodate their aesthetic taste, space restrictions and

other requirements.

Medicine

Dispensing Systems

We have

developed a new medicine dispensing system (“SADP”) primarily for hospital use,

which we launched commercially in the first quarter of 2008. Our SAPD

is a computerized system that can automatically fill medical prescriptions for

oral medications in single or multiple dosages with high efficiency. Based on

the prescriptions entered into the system by pharmacists, the system

automatically dispenses and packages the prescribed amount of medication with

printed labels that provides a patient’s name, location in the hospital,

hospital bed identification, name of medication, quantity of medication and

instructions for taking the medication. The prescription information can be

stored in medicine dispensing system for up to one year for future reference.

Each medicine dispensing system is connected with hospital computer network and

can retrieve information from the network when necessary. Our SADP is capable of

dispensing and packaging up to 60 prescriptions in one minute and can fill the

prescriptions and package medication for 500 patients based on three doses per

day in approximately 30 minutes.

Each of

our SADPs has the capacity to house between 240 to 500 medicine storage bins,

which allows for the dispensing and packaging of between 240 and 500 different

types of medication at any given time. Each medicine storage bin has a CPU which

controls the precise dosage dispensed in accordance with the prescription. The

interior of the medicine storage bins are specifically designed to hold

different types of medications based on the specifications provided by

hospitals. Our SADP also comes with a back-up medicine bin which can house up to

40 different types of medications. When a medication that is not stored in any

of the storage bins is prescribed or if a non-standard dosage of a medication is

prescribed (for example, one-half of a tablet may be prescribed), a pharmacist

can mix and prepare the medication and place it in the back-up medicine bin for

dispensing by our SADP system together with the rest of the prescribed

medication.

The

central control system controls of an SADP monitors the operating status of each

storage bin. It also automatically recognizes and tracks the locations to which

each medication was transmitted and the quantities of medication in each bin.

Pharmacists can give operate the SADP with its touch screen.

Medical

treatment mistakes are often caused by human errors made by medical

professionals in prescribing and dispensing medicine because of lack of

historical information on patients and the medication that the patients have

been taking. We believe that the SAPD, which retains information about patients

medications can help reduce the number of such errors. In Europe and the United

States, approximately 80% of hospitals already use some form of automatic drug

dispensation system. However, the use of such systems has just started in the

PRC.

6

Manufacture

and Quality Control

We

manufacture the main components of our products, such as tube diverters and

pneumatic direction diverters, in our own facility. We outsource the

manufacturing of certain other parts such as workstations. We assemble all the

components and parts into finished products. In choosing our suppliers, we focus

on the quality of raw material supplied. We conduct our manufacturing procedures

and quality testing based on ISO 9000 or CE Quality Standard and ISO

Environmental Standards. We have received ISO 9000 certification since August

2004.

We

usually provide a standard 12-month product warranty to our customers. During

the warranty period, we replace defective products for our customers without

charge.

Our

Product/Marketing Strategy

Our

product/marketing strategy focuses on using our human resources and intellectual

capital to design new and better hardware and software products with a variety

of applications for many markets. Currently, we are focused on logistics

products for the hospital and medical markets, but believe that we can expand

into other markets.

Implementing

our product/marketing strategy involves the following:

Expand and

Strengthen Our Product Lines. Currently, we offer two main products:

medical transport systems and medicine dispensing systems. We hope to leverage

the existing technologies that we own and our technical expertise to expand our

product offerings in developing new logistics products and new medical and

hospital products.

Expand and

Strengthen Our Markets for our Current Product Lines in the PRC and then outside

of the PRC. Our medical transport systems and medicine dispensing systems

are designed principally for hospital use. Currently, we are conducting research

and development to expand the use of our products in banks, industrial companies

and office buildings. We believe that our low cost structure that comes with

operating in the PRC can allow us to expand into other countries and

successfully compete based on our cost and price advantages.

Expand and

Strengthen Our Distribution Network in the PRC and then outside of the

PRC. We own the technologies used in our existing products, and

therefore, our cost of sales and the prices for our products are lower than

those of other companies which must pay licensing fees and royalties. As result,

we have been able to capture significant market share in the PRC (approximately

50% of hospitals and medical facilities that use pneumatic tube systems). In

order to leverage this strength, we will seek to build our own distribution

service centers in strategic locations in the PRC.

Sales

and Marketing

We sell

our products directly through our sales employees and direct sales offices or

indirectly through independent sales agents. As of the date of this report, we

have thirteen independent sales agents and four direct sales office covering

Beijing, Shanghai, Guangzhou, Chengdu, Xi’an and 13 other provinces, and 16

sales employees. Our sales agents purchase products from us and resell them at

higher prices.

Materials

and Suppliers

The

principal supplies purchased for our business are composite panels, aluminum

frames, micro processors and other IC chips, power supplies, LCD panels, fans,

U-PVC tubes and equipment chassis. Except for LCD panels, which we purchase from

Truly Semiconductors Limited, a Japanese manufacturer, we have at least two

suppliers for each of the supplies we purchase for our business. We generally

have long-term relationships with our suppliers but no written contracts with

them as the materials we need are generally available in the

market.

7

Customers

Our

customers are primarily hospitals and medical appliance companies. The following

table presents, for the periods indicated, our largest customers by

revenue:

|

|

Percentage of Sales

|

|||||||

|

|

Fiscal year ended December 31,

|

|||||||

|

Customers

|

2008

|

2007

|

||||||

|

|

|

|||||||

|

Customer

A

|

-

|

%

|

11.13

|

%

|

||||

|

Customer

B

|

-

|

%

|

10.89

|

%

|

||||

|

Customer

D

|

9.65

|

%

|

-

|

|||||

|

Customer

E

|

10.46

|

%

|

-

|

|||||

|

Customer

F

|

9.63

|

%

|

-

|

|||||

|

Customer

G

|

10.46

|

%

|

-

|

|||||

|

Customer

F

|

11.53

|

%

|

-

|

|||||

|

Total

|

51.73

|

%

|

22.02

|

%

|

||||

The

payment terms of our standard sales agreement generally require a cash payment

of 30% of the total purchase price within 5 days of the signing of the

agreement, a cash payment of 30% of the total purchase price upon receipt of the

products if there is no exterior damage to the products, and a cash payment of

40% of the total purchase price upon installation, completion of testing, and

acceptance of the products. The purchase price generally does not contain

shipping expenses. If a shipment is delayed in breach of a sales agreement, we

are required to pay 1.0% of the total purchase price for each day delayed up to

10% of the total purchase price.

Technology

and Research and Development

We have

developed and own the intellectual property used in our products. Currently we

hold thirteen PRC patents for our medical transport systems. In September 1999,

Daqing Sunway was designated as a New-and-High-Technology Enterprise in

Heilongjiang Province by the Science and Technology Commission of Heilongjiang

Province.

We have

12 full-time employees engaged in research and development (“R&D”) efforts.

Our R&D personnel specialize in the fields of software development,

electronic engineering, machinery design and manufacture, electronic information

technology, communication technology and application, automatic control

technology and optoelectronic technology. Most of our R&D personnel have

more than 5 years experience in their fields of specialty. We also outsource

certain software development projects to third party software

developers.

Currently,

we are conducting R&D on products for use in banks, industrial companies and

commercial use office buildings.

For the

fiscal years ended December 31, 2008 and 2007, respectively, we expended

approximately $36,138 and $175,567 on R&D activities.

Competition

and Competitive Advantages

Pneumatic

Transport System

Our main

competitors in the supply of PTS are Beijing Chuansheng Weiye Science Trade Co.,

Ltd., Hainan Lingjing Medical Purification Project Co., Ltd., and Beijing Ruize

Network Co., Ltd. While we are both a manufacturer and distributor of our

medical transport systems, our competitors are distributors of imported

pneumatic transport systems. Among these companies, Hainan Lingjing Medical

Purification Project Co., Ltd. is a distributor of Swisslog’s pneumatic force

transportation products, and Beijing Ruize Network Co., Ltd. is a distributor

for Sumetzberger GMBH, an Austrian company.

As the

market for pneumatic transport systems is still an emerging market in the PRC,

official data about the industry in general, and competition in particular, have

not been readily available. Based on the information we collected from

competitive bids, the internet and other market intelligence, it is our estimate

that among suppliers of pneumatic transport systems in the PRC, we were the

supplier to the largest number of hospitals in the fiscal years ended December

31, 2007 and 2008.

8

The

following table sets forth our estimates, based on information we have

collected from bids, the internet and other market intelligence, of the relative

number of hospitals and medical facilities in the PRC supplied with pneumatic

transport systems by us and our major competitors in 2007 and 2008:

|

Time of PRC

|

Percentage of

PRC Hospitals

Adopting PTS

|

||||||||

|

Name

|

Brand

|

Market Entry

|

2008

|

2007

|

|||||

|

Daqing

Sunway Technology Co. Ltd.

|

Suntrans

|

2002

|

48

|

%

|

48.5

|

%

|

|||

|

Company

A

|

Brand

A

|

1999

|

4

|

%

|

3.5

|

%

|

|||

|

Company

B

|

Brand

B

|

1998

|

20

|

%

|

20

|

%

|

|||

|

Company

C

|

Brand

C

|

1996

|

15

|

%

|

15

|

%

|

|||

|

Company

D

|

Brand

D

|

2001

|

7

|

%

|

7

|

%

|

|||

|

Company

E

|

Brand

E

|

1999

|

6

|

%

|

6

|

%

|

|||

Medicine

Dispensing Systems

We

introduced our medicine dispensing systems to the market in May 2007. Currently,

we face competition from Japanese manufacturers, Yuyama Manufacturing Co., Tosho

Co., Inc. and Sany Co., Ltd., and a South Korean company, JV Medi Co., Ltd.,

whose products are imported into the PRC and sold through distributors. Since

the introduction of our medical dispensing system to the market in January 2008,

we have received orders to purchase eight units. We have sold and delivered five

units - in 2008.

.

Competitive

Advantages

We

believe that we have the following competitive advantages over our

competitors:

Cost : We have cost

advantages because we source our supplies domestically and our products are

manufactured domestically using technologies developed by us. Our major

competitors are domestic distributors of imported products that cost more in

both materials and labor and, additionally, are subject to customs duties. As a

result, our PTS is generally priced lower than our competitors’ products - our

PTS is priced at approximately $150,810 per unit while our cost of sales is

approximately $41,422 per unit, representing a gross margin of approximately

72.53%. We estimate that similar products of our competitors are priced at

approximately $210,000 per unit. Our medicine dispensing system, which we

launched in 2008, is priced at $272,902 per unit while our cost of sales is

approximately $107,128, representing a gross margin of approximately 60.74%. We

estimate that our competitors’ prices range from $315,900 to

$402,170.

Large Existing Customer Base and

Customer Loyalty: As of the end of 2008, we estimate, based on

information we have collected through competitive bids, internet research and

other market sources, that we had an approximate 50% share in

hospitals and medical facilities using pneumatic tube systems in the PRC market

based on the number of hospitals and medical facilities that have adopted

pneumatic tube transport systems in China, as compared to an approximate

20% for our largest competitor, Swisslog. Our large existing customer base,

which includes approximately 268 hospitals as our end users, provides us an

advantage in the marketing and sales of additional products and services, both

because existing customers are an important source of new orders, and

because we are frequently referred to new customers by our existing

customers due to our cost advantage, localized technology and excellent

service.

Localized and Customized

Technology : We are the only provider of PTS with localized interfaces in

Chinese language specifically designed based on the needs of PRC customers.

Daqing Sunway’s PTS is therefore more user friendly for Chinese speaking

customers. Our competitors’ products are based on English language interfaces.

As the general population in the PRC is not proficient in English, purchasers of

our competitors’ products are required to employ highly educated and specially

trained English speaking personnel to operate their systems, which represent an

additional expense adding to their already higher prices. In addition, as the

technologies used in our systems are developed by us, we have the capacity and

flexibility to easily and quickly adapt our products to specific customer

requirements and changing market trends.

Extensive After-Sales Service

Coverage: We believe that we are more accessible to our

customers than our competitors because we are the only manufacturer in

the PRC, as opposed to distributor, of pneumatic tube systems. As a

manufacturer, we believe we are in a better position to provide pre-sale

consultation and post-sale services than our competitors, all of which are

distributors of imported systems. We are available to provide pre-sale

consultation to help potential customers determine their specific needs and

design their transportation networks using PTS, and post-sale services such as

on-site diagnostic tests to identify and prevent any potential problems, and

maintenance and repair services. Our competitors’ customers do not have

such easy access to the manufacturers because they must rely

on the distributors to provide that access indirectly. Often, parts needed

for maintenance are not available in the PRC and must be ordered from overseas

for replacement, with a lag time for delivery.

9

Intellectual

Property

Patents

Our

products use patented technologies developed by us. Currently, we hold thirteen

PRC patents used in our products. The following is a list of the patents we

hold:

|

No.

|

Certificate No.

|

Issuer

|

Name of the Patent

|

Registered No.

|

Application

Date

|

Valid

Term

|

||||||

|

1

|

523933

|

State

Intellectual Property Office (SIPO)

|

Pneumatic

tube material transport facility

|

ZL

01 2 71975 7

|

12/02/2001

|

10

|

||||||

|

2

|

532336

|

SIPO

|

Tube

air flow direction converter

|

ZL

02 2 09902 6

|

1/22/2002

|

10

|

||||||

|

|

||||||||||||

|

3

|

534389

|

SIPO

|

One

type of tube direction converter

|

ZL

02 2 09901 8

|

1/22/2002

|

10

|

||||||

|

|

||||||||||||

|

4

|

556112

|

SIPO

|

Pneumatic

tube material transport sending and receiving box

|

ZL

02 2 73509 7

|

5/23/2002

|

10

|

||||||

|

5

|

275295

|

SIPO

|

Pneumatic

tube material transport sending and receiving box (exterior

design)

|

ZL

02 3 52960 1

|

5/23/2002

|

10

|

||||||

|

6

|

567890

|

SIPO

|

Pneumatic

tube material transport air sender

|

ZL

02 2 73510 0

|

5/23/2002

|

10

|

||||||

|

7

|

655292

|

SIPO

|

Pneumatic

tube material transport sending and receiving box of parallel changing

mode

|

ZL

03 2 60602 8

|

9/24/2003

|

10

|

||||||

|

8

|

719650

|

SIPO

|

Self

motivating rail car for material transport system

|

ZL

2004 2 0070058 5

|

7/28/2004

|

10

|

||||||

|

9

|

719482

|

SIPO

|

Car

rail of material transport system

|

ZL

2004 2 0070057 0

|

7/08/2004

|

10

|

||||||

|

|

||||||||||||

|

10

|

732675

|

SIPO

|

Pneumatic

tube material transport sending and receiving box of parallel changing

mode

|

ZL

2004 2 0063538 9

|

10/11/2004

|

10

|

||||||

|

11

|

743362

|

SIPO

|

Material

flow tube router

|

ZL

2004 2 0063537 4

|

10/11/2004

|

10

|

||||||

|

12

|

738892

|

SIPO

|

One

type of tube air flow direction converter

|

ZL

2004 2 0063535 5

|

10/11/2004

|

10

|

||||||

|

13

|

|

739042

|

|

SIPO

|

|

One

type of tube direction converter

|

|

ZL

2004 2 0063536 X

|

|

10/11/2004

|

|

10

|

The PRC

Patent Law was adopted by the National People's Congress, the parliament in the

PRC, in 1984 and was subsequently amended in 1992 and 2000. The Patent Law aims

to protect and encourage invention, foster application of inventions and promote

the development of science and technology. To be patentable, an invention must

meet three conditions: novelty, inventiveness and practical applicability.

Certain items are not patentable under the Patent Law, which include scientific

discoveries, rules and methods for intellectual activities; methods used to

diagnose or treat diseases, animal and plant breeds or substances obtained by

means of nuclear transformation. The Patent Office under the State Council is

responsible for receiving, examining and approving patent applications. A patent

is valid for a term of twenty years in the case of an invention and a term of

ten years in the case of utility models and designs. Our patents are all utility

models and subject to the ten years' protection. Any use of patent without

consent or a proper license from the patent owner constitutes an infringement of

patent rights which is actionable in court in the PRC.

Registered

software

We own

the following software used in our products:

|

No.

|

Certificate No

|

Software

|

Issued by

|

Issuance date

|

Term

(year)

|

|||||

|

1

|

|

HEI DGY-2003

0005

|

|

Daqing Sunway material transport control

software V 1.0 (Daqing Sunway material

transport imbedded software)

|

|

Heilongjiang

Software Industry

Association

|

|

4/16/2008

|

|

5

|

Trademarks

We have

two trademarks registered with the Trademark Office of the State Administration

for Industry and Commerce in PRC as follows:

|

No.

|

Trademark number

|

Issuer

|

Classification

|

Term

|

||||

|

1

|

1102674

|

State Trademark Bureau

|

10

|

Sep.14,2007 — Sep.13, 2017

|

||||

|

2

|

|

3205734

|

|

State Trademark Bureau

|

|

10

|

|

Dec.14 , 2003 — Dec.13, 2013

|

10

Under the

PRC Trademark Law, which was adopted in 1982, and revised in 2001, registered

trademarks are granted a term of ten years protection, renewable for further

terms. Each renewal is limited to ten years term and the registrant must

continue to use the trademark and apply for a renewal within six months prior to

the expiration of the current term.

Other Intellectual Property Rights

Protections in the PRC

In

addition to patent, trademark and trade secret protection law in the PRC, we

also rely on contractual confidentiality provisions to protect our intellectual

property rights and our brand. Our R&D personnel and executive officers are

subject to confidentiality agreements to keep our proprietary information

confidential. In addition, they are subject to a one-year covenant not to

compete following the termination of employment with our company. Further, they

agree that any work product belongs to our company.

Insurance

We

currently do not carry any product liability or other similar insurance, nor do

we have property insurance covering our plant, manufacturing equipment and

office building. While product liability lawsuits in the PRC are rare and Daqing

Sunway has never experienced significant failures or accidents, there can be no

assurance that Daqing Sunway would not face liability in the event of any

failure or accident.

Daqing

Sunway maintains social insurance for their staff and employees in accordance

with relevant compulsory requirements under the PRC laws and has compulsory

insurance and fixed-sum insurance for cars and other vehicles.

Employees

Presently

we have 228 full-time employees and contractors, out of which 35 are management

and accounting personnel, 12 are R&D personnel, 16 are marketing

and sales personnel and 165 manufacturing personnel.

Government

Regulation

Under

certain regulations in the form of public notices issued by the PRC State

Administration of Foreign Exchange, or SAFE, our shareholders who are PRC

resident entities or individuals are subject to certain registration

requirements due to the status of WTL as “SPC”s (as defined under the public

notice issued by SAFE on October 21, 2005). These regulations would prohibit SWT

distributing dividends or profits to WTL and/or SWT as “SPC”s unless the

registration requirements are complied with. The registration procedures were

completed and SWT obtained a SAFE certificate from SAFE’s Heilongjiang office on

March 30, 2007. Our PRC counsel advised us that the SAFE certificate will allow

SWT to distribute dividends and profits out of the PRC.

Medical

Appliance manufacturing companies in the PRC are required to obtain Medical

Appliance Manufacturing permits. Daqing Sunway holds a Medical Appliance

registration certificate and Medical Appliance Manufacturing Permit issued by

Heilongjiang Province Food and Drug Supervision Administration

Bureau.

Pursuant

to the tax laws of PRC, general enterprises are subject to income tax at an

effective rate of 33%. Companies qualified as hi-technology companies are

subject to certain preferential tax treatment. Daqing Sunway was approved as a

domestic hi-technology company and enjoys a 15% corporate income tax rate

according to National New and High Tech Develop Zone Taxes Policy.

Other

than the foregoing, Daqing Sunway is not subject to any other significant

government regulation of its business or production, or any other government

permits or approval requirements, except for the laws and regulations of general

applicability for corporations formed under the laws of the PRC.

ITEM

1A. RISK

FACTORS.

An

investment in our securities involves a high degree of risk. In determining

whether to purchase our securities, you should carefully consider all of the

material risks described below, together with the other information contained in

this prospectus before making a decision to purchase our securities. You should

only purchase our securities if you can afford to suffer the loss of your entire

investment.

Risks Related to Our

Business

We

operate in an emerging industry and an unsettled market.

The

automated material transport system and medication distribution industries in

which we operate in the PRC are in an early stage of development. While we

believe that the potential advantages of this situation, including a strong

potential for growth, are significant, there are also related risks. In a

rapidly-growing market, our competitors could develop new technologies or new

variations of existing technologies that could gain popularity quickly. While we

believe that we understand the needs and preferences of our potential customers,

especially hospitals, for the kinds of systems we produce, these needs and

preferences could change in ways that our competitors anticipate or adapt to

more rapidly than we do. While we believe that our relatively large customer

base is one of our strengths, in a rapidly growing market, our industry could

gain so many new customers that the number of our existing customers could

become insignificant. If any of these risks materialize, our competitive

position, results of operations and financial condition could be significantly

impaired.

11

Our limited operating history may

not serve as an adequate basis to judge our future prospects and results of

operations.

We

commenced our current line of business operations in recent years. Our limited

operating history may not provide a meaningful basis on which to evaluate our

business. Although our revenues have grown rapidly since inception, we cannot

assure you that we will maintain our profitability or that we will not incur net

losses in the future. We expect that our operating expenses will increase as we

expand. Any significant failure to realize anticipated revenue growth could

result in significant operating losses. We will continue to encounter risks and

difficulties frequently experienced by companies at a similar stage of

development, including our potential failure to:

|

|

·

|

raise adequate capital for

expansion and operations;

|

|

|

·

|

implement our business model and

strategy and adapt and modify them as

needed;

|

|

|

·

|

increase awareness of our brands,

protect our reputation and develop customer

loyalty;

|

|

|

·

|

manage our expanding operations

and service offerings, including the integration of any future

acquisitions;

|

|

|

·

|

maintain adequate control of our

expenses;

|

|

|

·

|

anticipate and adapt to changing

conditions in the transport and distribution systems markets in which we

operate as well as the impact of any changes in government regulations,

mergers and acquisitions involving our competitors, technological

developments and other significant competitive and market

dynamics.

|

If we are

not successful in addressing any or all of these risks, our business may be

materially and adversely affected.

Our

failure to compete effectively may adversely affect our ability to generate

revenue.

We

compete primarily on the basis of our price advantage, cost advantage, our

technology and product features that are specifically designed for the PRC

market, our extensive after-sales service coverage and such after-sales services

being easily accessible to our clients. These competitive advantages are in part

based on our being a local manufacturer while our competitors are generally

distributors of foreign products with much higher costs and less accessible

after-sales services. There can be no assurance that we will maintain these

advantages in the future. Our foreign competitors may establish manufacturing

capabilities in the PRC to lower their costs and improve accessibility of

after-sales services. Our local competitors may gain larger market share and

reduce their costs by taking advantage of economies of scale. Developments of

this kind could have a material adverse effect on our business, results of

operations and financial condition. Further, our business requires large amounts

of working capital to fund our operations. Our competitors may have better

resources and better strategies to raise capital which could also have a

material adverse effect on our business, results of operations or financial

condition.

We

rely on sales to a single kind of customer in a single industry. Our long-term

growth may be impaired if we are unable to expand our customer base beyond the

hospital industry.

Nearly

all of our sales are made to hospitals and medical facilities in the PRC. If the

medical industry in the PRC shrinks or loses steam, our customer base and

potential customers will have fewer resources for the purchase of our products,

and our business, results of operations and financial condition could be

adversely affected.

Although

we intend to expand our business to make products that will be used by customers

in other industries, there is no guarantee that we will succeed. If we are

unable to expand beyond the hospital industry, our long-term growth could fall

short of expectations.

If

we are unable to fund our capital requirements for research and development, our

growth and profitability may be adversely affected.

Pneumatic

tube transport systems and medicine dispensing systems are the only two products

from which we generate or expect to generate substantial revenues. Both of our

product lines are designed for use in hospitals and medical facilities. Our

long-term growth and profitability could depend on our ability to expand beyond

the medical industry. This expansion may require us to make substantial and

long-term investments in research and development to develop new products or new

features for our existing products. If we are unable to fund such research and

development efforts, our long-term market potential, income and financial

condition could be impaired.

12

We do not have written

contracts with our suppliers and could be hurt by a change in the market for our

supplies.

We have

at least two suppliers for most of the principal supplies used in the

manufacture of our products, including composite panels, aluminum frames, micro

processors and other IC chips, power supplies, fans, U-PVC tubes and equipment

chassis. The suppliers of these supplies are PRC companies. We purchase LCD

panels from one supplier only, Truly Semiconductors Limited, a Japanese

manufacturer. Although we believe that our supplies are generally available in

the market and that we are not at great risk of disruption to these supply

chains, there can be no guarantee that the markets for these supplies will not

be disrupted, for business or economic reasons relating to a particular

manufacturing sector, or for economic or political reasons affecting the PRC

more generally.

We

are responsible for the indemnification of our officers and

directors.

Our

bylaws provide for the indemnification of our directors, officers, employees,

and agents, under certain circumstances, against costs and expenses incurred by

them in any litigation to which they become a party arising from their

association with or activities on behalf of us. This indemnification policy

could result in substantial expenditures, which we may be unable to

recoup.

We

may not be able to effectively protect our proprietary technology and other

intellectual property, which could harm our business and competitive

position.

We have

13 PRC patents on proprietary technology used in the manufacture of our

products. We also have a registered software program and two registered

trademarks. Our success depends in part on our ability to protect our

proprietary technologies. Although we believe we are protected from intellectual

property infringement both by our patents and by the complexity of our designs,

which we believe makes them difficult to copy, we cannot assure you that we will

be able to effectively protect our technology, or that our current or potential

competitors do not have, or will not obtain or develop, similar

technology.

We also

rely on trade secrets, non-patented proprietary expertise and continuing

technological innovation that we seek to protect, in part, by entering into

confidentiality agreements with licensees, suppliers, employees and consultants.

These agreements may be breached and there may not be adequate remedies in the

event of a breach. Disputes may arise concerning the ownership of intellectual

property or the applicability of confidentiality agreements. Moreover, our trade

secrets and proprietary technology may otherwise become known or be

independently developed by our competitors. If patents are not issued with

respect to products arising from research, we may not be able to maintain the

confidentiality of information relating to these products.

Implementation

of PRC intellectual property-related laws has historically been problematic,

primarily because of ambiguities in the PRC laws and difficulties in

enforcement. Accordingly, intellectual property rights and confidentiality

protections in China may not be as effective as in the United States or other

countries. Policing unauthorized use of proprietary technology is difficult and

expensive, and we might need to resort to litigation to enforce or defend

patents issued to us or to determine the enforceability, scope and validity of

our proprietary rights or those of others. Such litigation may require

significant expenditure of cash and management efforts and could harm our

business, financial condition and results of operations. An adverse

determination in any such litigation will impair our intellectual property

rights and may harm our business, competitive position, business prospects and

reputation.

We

may be exposed to intellectual property infringement and other claims by third

parties, which, if successful, could cause us to pay significant damage awards

and incur other costs.

We use

our own patented proprietary technology in manufacturing our products. However,

as litigation becomes more common in China in resolving commercial disputes, we

face a higher risk of being the subject of intellectual property infringement

claims brought by others. The outcome of claims relating to our logistic

transport systems could involve complex technical, legal and factual questions

and analysis and, therefore, may be highly uncertain. The defense and

prosecution of intellectual property suits, patent opposition proceedings and

related legal and administrative proceedings can be both costly and time

consuming and may significantly divert the efforts and resources of our

technical and management personnel. An adverse determination in any such

litigation or proceedings to which we may become a party could subject us to

significant liability, including damage awards, to third parties, require us to

seek licenses from third parties, to pay ongoing royalties, or to redesign our

products or subject us to injunctions preventing the manufacture and sale of our

products. Protracted litigation could also result in our customers or potential

customers deferring or limiting their purchase or use of our products until

resolution of such litigation.

Potential

environmental liability could have a material adverse effect on our operations

and financial condition.

To the

knowledge of our management team, the manufacture of our products does not

require us to comply with PRC environmental laws other than PRC environmental

laws of general applicability. It has not been alleged that we have violated any

current environmental regulations by PRC government officials; however, there

can be no assurance that the Chinese government will not amend its current

environmental protection laws and regulations. Our business and operating

results could be materially and adversely affected if we were to increase

expenditures in order to comply with environmental regulations affecting our

operations.

13

We

may not be able to hire and retain qualified personnel to support our growth and

if we are unable to retain or hire such personnel in the future, our ability to

improve our products and implement our business objectives could be adversely

affected.

Our

future success depends heavily upon the continuing services of the members of

our senior management team, in particular our President and Chief Executive

Officer, Mr. Liu Bo; our Chief Financial Officer, Mr. Samuel Sheng; and our

Chief Operating Officer and Secretary, Mr. Sun Weishan. If one or more of our

senior executives or other key personnel are unable or unwilling to continue in

their present positions, we may not be able to replace them easily or at all,

and our business may be disrupted and our financial condition and results of

operations may be materially and adversely affected. Competition for senior

management and senior technology personnel is intense, the pool of qualified

candidates is very limited, and we may not be able to retain the services of our

senior executives or senior technology personnel, or attract and retain

high-quality senior executives or senior technology personnel in the future.

Such failure could materially and adversely affect our future growth and

financial condition.

We

do not presently maintain product liability insurance, and our property

equipment insurance does not cover their full value, which leaves us with

exposure in the event of loss or damage to our properties or claims filed

against us.

We

currently do not carry any product liability or other similar insurance. While

product liability lawsuits in the PRC are rare and we have never experienced

significant failures of our products, we cannot assure you that we would not

face liability in the event of the failure of any of our products. We do not

carry any property insurance to cover our real property or manufacturing

equipment, nor do we have other insurance such as business liability or

disruption insurance coverage for our operations in the PRC.

Risks Related to Doing

Business in the PRC

Adverse

changes in political and economic policies of the Chinese government could have

a material adverse effect on the overall economic growth of China, which could

reduce the demand for our products and materially and adversely affect our

competitive position.

Our

business, financial condition, results of operations and prospects are affected

significantly by economic, political and legal developments in China. The

Chinese economy differs from the economies of most developed countries in many

respects, including:

|

Ÿ

|

the amount of government

involvement;

|

|

Ÿ

|

the level of

development;

|

|

Ÿ

|

the growth

rate;

|

|

Ÿ

|

the control of foreign

exchange; and

|

|

Ÿ

|

the allocation of

resources.

|

While the

Chinese economy has grown significantly in the past 20 years, the growth

has been uneven, both geographically and among various sectors of the economy.

The Chinese government has implemented various measures to encourage

economic growth and guide the allocation of resources. Some of these measures

benefit the overall Chinese economy, but may also have a negative effect on us.

For example, our financial condition and results of operations may be adversely

affected by government control over capital investments or changes in tax

regulations that are applicable to us, as well as its ability to control prices,

including the price of coal, which is a principal raw material for our

business.

The

Chinese economy has been transitioning from a planned economy to a more

market-oriented economy. Although in recent years the Chinese government has

implemented measures emphasizing the utilization of market forces for economic

reform, the reduction of state ownership of productive assets and the

establishment of sound corporate governance in business enterprises, a

substantial portion of the productive assets in China is still owned by the

Chinese government. Further, there is no private ownership of land in China.

Rather, land is owned by the government and the government issues land use

rights. Although the land use rights are transferable, it is necessary to obtain

government approval for a transfer. The continued control of these assets and

other aspects of the national economy by the Chinese government could materially

and adversely affect our business. The Chinese government also exercises

significant control over Chinese economic growth through the allocation of

resources, controlling payment of foreign currency-denominated obligations,

setting monetary policy and providing preferential treatment to particular

industries or companies.

Any adverse change in the economic

conditions or government policies, policy interpretations, imposition of

confiscatory taxation, restrictions on currency conversion, exports,

devaluations of currency, the nationalization or other expropriation of private

enterprises in China could have a material adverse effect on the overall

economic growth and the level of investments and expenditures in China, which in

turn could lead to a reduction in demand for our products in both the Chinese

and international markets.

14

The PRC laws and regulations governing

our current business operations are sometimes vague and uncertain. Any changes

in such PRC laws and regulations may have a material and adverse effect on our

business.

There are

substantial uncertainties regarding the interpretation and application of PRC

laws and regulations, including but not limited to the laws and regulations

governing our business, or the enforcement and performance of our arrangements

with customers in the event of the imposition of statutory liens, death,

bankruptcy and criminal proceedings. We and any future subsidiaries are

considered foreign persons or foreign funded enterprises under PRC laws, and as

a result, we are required to comply with PRC laws and regulations. These laws

and regulations are sometimes vague and may be subject to future changes, and

their official interpretation and enforcement may involve substantial

uncertainty. The effectiveness of newly enacted laws, regulations or amendments

may be delayed, resulting in detrimental reliance by foreign investors. New laws

and regulations that affect existing and proposed future businesses may also be

applied retroactively. We cannot predict what effect the interpretation of

existing or new PRC laws or regulations may have on our businesses.

Additionally, if the relevant authorities find us in violation of PRC laws or

regulations, they would have broad discretion in dealing with such a violation,

including, without limitation:

|

|

·

|

levying

fines;

|

|

|

·

|

revoking our business and other

licenses;

|

|

|

·

|

requiring that we restructure our

ownership or operations; and

|

|

|

·

|

to the extent that we use the

Internet for marketing and providing information on our products and

services, requiring that we discontinue any portion or all of our Internet

related business.

|

A

slowdown or other adverse developments in the PRC economy may materially and

adversely affect our customers, demand for our services and our

business.

All of

our operations are conducted in the PRC and all of our revenues are generated

from sales in the PRC. Although the PRC economy has grown significantly in

recent years, we cannot assure you that such growth will continue. A slowdown in

overall economic growth, an economic downturn or recession or other adverse

economic developments in the PRC may materially reduce the demand for our

products and materially and adversely affect our business.