Attached files

| file | filename |

|---|---|

| 8-K/A - FORM 8-K/A - Mickland, Inc. | chcn_8ka.htm |

Exhibit 10.1

CAPITAL STOCK PURCHASE AGREEMENT

THIS CAPITAL STOCK PURCHASE AGREEMENT ("Purchase Agreement") is entered into by and among Robert D. Rochell ("Seller"), CORE Health Care Network, Inc. or its designee ("Purchaser") and MEDTECH CORPORATION, Inc. ("Corporation" and Seller, Purchaser and Corporation, collectively, the "Parties") a corporation organized and existing under the laws of the State of Nevada and domesticated in the state of Oklahoma, as of the 10th day of January, 2011, ("Effective Date").

WHEREAS, Seller owns or controls one-hundred percent (100%) of all capital stock (shares) to include but not limited to; common and preferred classes of MEDTECH CORPORATION, Inc.

WHEREAS, Purchaser desires to purchase and Seller desires to sell one hundred percent (100%) of all capital stock (shares) to include but not limited to; common and preferred classes of Corporation ("Shares");

NOW, THEREFORE, in consideration of the foregoing and the mutual covenants contained herein, the Parties hereby covenant and agree as follows

1. Purchase and Sale. Seller shall sell to Purchaser, and Purchaser shall purchase from Seller, the Shares under the terms and conditions set forth herein.

2. Earnest Money. As of the Effective Date, Purchaser shall pay to Seller TEN AND 00/100 DOLLARS ($10.00) ("Earnest Money") to be held by Purchaser pending Closing (as such term is defined below). In the event the Closing does not occur by the Closing Date and an amendment to extend the Closing has not been executed by the Parties, Purchaser shall retain the Earnest Money, the Purchase Agreement will be void and there will be no further force and effect to the Parties.

3. Time and Place of Closing. The consummation of the transactions contemplated by this Agreement (the "Closing") shall take place in Oklahoma City, Oklahoma at a location to be determined on or before January 28, 2011 (the "Closing Date") assuming all "Conditions Precedent to Closing" listed in Section 9 have been satisfied at the sole discretion of Purchaser.

4. Purchase Price. The purchase price ("Purchase Price") for the Shares shall be ONE MILLION FIVE HUNDRED THOUSAND (1,500,000) Shares of Common Stock of CORE Health Care Network, Inc.

5. Tender of Shares. Simultaneously with the tender of CORE Healthcare Network Inc., Common Stock, Seller shall deliver to Purchaser a Stock Power transferring one hundred (100%) of the total Shares of Corporation authorized to Purchaser.

1

6. Seller's Warranties. Seller represents and warrants, to the best of Seller's knowledge, that:

a. Organization and Authority. Corporation is duly organized and validly existing under the laws of Nevada; Corporation is duly qualified to conduct business in all jurisdictions where it is required to qualify; Seller has the authority to execute, deliver and perform this Purchase Agreement and any other agreement or document executed by Seller under or in connection with this Purchase Agreement; and Seller has taken all necessary action to authorize the execution, delivery, and performance of the Purchase Agreement and any other agreement or document.

b. Binding Obligation. This Purchase Agreement constitutes, and any such other agreement or document when executed will constitute, the legal, valid and binding obligations of Seller enforceable against Seller in accordance with their respective terms.

c. No Violation or Adverse Effect. Neither the execution nor delivery of this Purchase Agreement nor the transactions contemplated herein, nor compliance with the terms and conditions of this Purchase Agreement will:

(i) contravene any provision of law or any statute, decree, rule, or regulation binding upon Seller or contravene any judgment, decree, franchise, order or permit applicable to Seller or Corporation: or

(ii) conflict with or result in any breach of any terms, covenants, conditions or provisions of, or constitute a default (with or without the giving of notice or passage of time or both) under the Articles of Incorporation or By-Laws of Corporation or material agreement or other instrument to which Seller or Corporation is a party or by which either is bound, or result in the creation or imposition of any lien, security interest, charge or encumbrance upon any of the assets, rights, contracts or other property of Corporation.

d. Authorizations, Consents and Approvals. All authorizations, consents or approvals of, or exemptions by, any governmental, judicial or public body or authority, if any, required to authorize, or required in connection with (i) the execution, delivery and performance of this Purchase Agreement by Seller, or (ii) any of the transactions contemplated by this Purchase Agreement, or (iii) any of the certificates, instruments, or agreements executed by Seller in connection with this Purchase Agreement, or (iv) the taking of any action by Seller, have been obtained and will be in full force and effect.

e. Corporate Documentation. True and complete copies of the Articles of Incorporation and By-Laws of Corporation are attached to Schedule 6.e hereto, and the same have not been amended and are and shall be in full force and effect at Closing.

2

f. Financial Statements. As of the date of the last financial statements and accounts payable reports and ledgers provided to Purchaser ("Financial Statements") Corporation did not have any liabilities (contingent or otherwise) or assets which are not disclosed in the Financial Statements or, in the case of liabilities, reserved against therein. Since the dates of the Financial Statements (i) there have been no materially adverse changes in the business or financial condition of Corporation, and Corporation has conducted its business in accordance with its normal and past practices; (ii) Corporation has not incurred any additional obligations or liabilities except trade debts in the ordinary course or business, and (iii) all judgments against or in favor of Corporation within the last ten (10) years are identified on Schedule 6.f.

g. Potential Litigation or Claims. Seller has no knowledge of any (i) threatened litigation; (ii) material, unasserted claims (considered by management to be probable of assertion); and (iii) potential, material adverse claims.

h. Dividends, Distributions or Redemption. Corporation has not declared or paid any dividend or made or agreed to make any other distribution or payment in respect of any of its Shares or otherwise to any of its shareholders, and Corporation has not purchased or redeemed or agreed to purchase or redeem any of its outstanding Shares.

i. Employees. With respect to the business of Corporation:

(1) except for Seller, no employee of Corporation (i) has any present intention to terminate his or her employment, or (ii) is a party to any confidentiality, non-competition, proprietary rights or other such agreement between such employee and any person besides Corporation that would be material to the performance of such employee's duties, or the ability of Corporation or Purchaser to conduct the business of Corporation;

(2) there are no pending, and during the past three (3) years there have been no workman's compensation claims or liability.

(3) there is no employment-related charge, complaint, grievance, investigation, inquiry or obligation of any kind, pending or threatened in any forum, relating to an alleged violation of breach by Corporation (or its officers or directors) of any law, regulation

or contract;

(4) no employee or agent of Corporation has committed any act or omission giving rise to material liability for any violation or breach identified in subsection (3) above;

(5) Except as set forth on Schedule 6.i, (i) there are no employment contracts or severance agreements with any employees of Corporation, and (ii) there are no written personnel policies, rules, or procedures applicable to employees of Corporation. True and complete copies of all such documents have been provided to Purchaser prior to the date of this agreement; and

3

j. Employee Benefit Plans. With respect to the business of Corporation:

(1) Schedule 6.j to this Purchase Agreement lists each Employee Benefit Plan (as such term is defined in 3(3) of the Employment Retirement Income Security Act of 1974 ("ERISA")) that Corporation maintains, to which Corporation contributes or has any obligations to contribute, or with respect to which Corporation has any liability.

(2) Each such Employee Benefit Plan (and each related trust, insurance contract, or fund) has been maintained, funded and administered in accordance with the terms of such Employees Benefit Plan and complies in form and in operation in all respects with the applicable requirements of ERISA, the Code, and other applicable laws.

(3) All required reports and descriptions (including Form 5500 annual reports, summary annual reports and summary plan descriptions) have been timely filed and/or distributed in accordance with the applicable requirements of ERISA and the Code (as such term is defined below) with respect to each such Employee Benefit Plan.

(4) Each such Employee Benefit Plan that is intended to meet the requirements of a "qualified plan" under Code 401(a) has received a determination from the IRS that such Employee Benefit Plan is so qualified, and nothing has occurred since the date of such determination that could adversely affect the qualified status of any Employee Benefit Plan. All such Employee Benefit Plans have been timely amended for the requirements of the federal tax legislation commonly know as "GUST" and "EGTRRA" and have been or will be submitted to the IRS for a favorable determination letter on the GUST and EGTRRA requirements within the applicable remedial amendment period.

(5) The have been no Prohibited Transactions (as such term is defined in ERISA 406) with respect to any such Employee Benefit Plan or any Employee Benefit Plan maintained by an ERISA Affiliate. No Fiduciary (as such term is defined in ERISA 3(21) has any liability for breach of fiduciary duty or other failure to act or comply in connection with the administration or investment of assets of any such Employee Benefit Plan. No action, suit, proceeding, hearing, or investigation with respect to the administration or the investment of the assets of any such Employee Benefit Plan (other than routine claims for benefits) is pending or threatened. None of the Seller, the directors, or officers (and employees with responsibility for employee benefits matters) of Corporation has any actual knowledge, or should know, of any basis of any such action, suit, proceeding, hearing, or investigation.

4

(6) The Corporation does not maintain, contribute to or have an obligation to contribute to, or have any liability with respect to, any Employee Welfare Benefit Plan (as such term is defined in ERISA 3(1)) providing health or life insurance or other welfare-type benefits for the current or future retired or terminated, directors, officers, employees (or any spouse or other dependent thereof) of Corporation or of any other person other than in accordance with COBRA.

k. Taxes.

(1) The Corporation has duly filed (and until Closing will so file) all tax returns required to be filed in respect of any United States federal, state, local, or foreign Taxes and have duly paid (and until the Closing will so pay) all such taxes due and payable. All tax returns filed by Corporation are true, correct, and complete. The Corporation has established (and until the Closing will establish) on its books and records reserves that are adequate for the payment of all taxes incurred, but not yet due and payable, in respect of the Corporation through such date. The Corporation is not a party to, and does not have any liabilities under, any tax sharing agreements or similar agreements.

(2) None of the Tax Returns of the Corporation have been audited by the Internal Revenue Service, or any other United States federal, state, local or foreign Governmental Authority within the past six years. There are no audits or other proceedings presently pending or expected nor any other disputes pending or expected with respect to, or claims asserted for, taxes upon Corporation, nor regarding the application of any statue of limitations with respect to any taxes or tax returns, There are no liens for taxes upon Corporation Assets, excepts liens for taxes due but not yet payable for which adequate accruals have been made (as determined in accordance with GAAP). Seller has complied (and until the Closing will comply) in all respects with the applicable laws relating to the payment and withholding of taxes.

(3) The Corporation (i) has not requested any extension of time within which to file any tax return which tax return has not since been timely filed; (ii) is not a party to any agreement providing for the indemnification, allocation or sharing of taxes; (iii) is not required to include in income any adjustment by reason of a voluntary change in accounting method initiated by Corporation (nor has an governmental authority proposed any such adjustment or change of accounting method); (iv) has not filed a consent with any governmental authority pursuant to which Corporation has agreed to recognize gain (in any manner) relating to or as a result of this Purchase Agreement or the transactions contemplated hereby; and (v) has not been a member of an affiliated group.

5

l. Property. Schedule 6.1 attached hereto sets forth all of the property and assets of Corporation, including, but not limited to, all real and personal property, and all intellectual property of any kind, including, but not limited to, patent applications, patents, copyrights, trademarks, service marks, and technical information disclosures of Corporation, or other assets of any kind, wherever located (all the foregoing being "Property", and the Property together with the Materials Contracts ( as defined below), the "Corporation Assets"). All information concerning Corporation Assets contained in Schedule 6.1 is true and correct. Corporation owns all the rights in and to Corporation Assets. Apart from Corporation Assets and other assets set forth in the financial statements, Corporation has no assets, rights or other property.

m. Material Contracts. Schedule 6.m sets forth a list of all of the material contracts to include but not limited to Medicare and Private Insurance to which Corporation is a party ("Material Contracts"). The contracts set forth in Schedule 6.m are in full force and effect, are enforceable in accordance with their terms, and no material default by any party thereto, or event which with the giving of notice or passage of time or both would constitute a material default, exists thereunder. No amounts due and owning under said contracts are past due: and none of said contracts and none of the rights of Corporation thereunder has been sold, assigned, encumbered or transferred in any way. Corporation is not a party to any other material contract.

n. Title to Corporation Assets. Other than those listed on Schedule 6.n, none of the rights in or to any Corporation Assets has been sold, leased, assigned, encumbered or transferred in any way, and there are no rights, options or privileges outstanding with respect to any Corporation Assets. All leases, assignments, encumbrances, options or privileges outstanding will be satisfied at Closing and Seller will convey clear title of all Corporation Assets.

o. No Litigation; Compliance with Applicable Law. There is no pending litigation or arbitration or administrative proceeding or material claim asserted, pending or threatened respecting or involving Corporation, the business of Corporation or any Corporation Assets or other assets of Corporation. There is no order, writ, injunction or decree of any court, government or governmental agency or any arbitration award against Corporation or any Corporation Assets other than those disclosed on Schedule 6.0. Corporation and its assets and operations are in material compliance with all applicable laws, rules, regulations and ordinances.

p. Bank Accounts. Schedule 6.p hereto contains a list of all the banks which Corporation has accounts, the account numbers of such accounts and the authorized signatories on such accounts.

q. Insurance. Schedule 6.q hereto contains a description of all insurances maintained by Corporation; no default exists with respect to any insurances and all of such insurances are in full force and effect.

6

r. Shares. Seller is the sole owner and or controls 100% of the Shares and of all rights in and to the Shares; all Shares are represented by one or more share certificates, and Seller may sell the Shares to Purchaser pursuant to this Purchase Agreement without the consent or approval of any person, corporation, partnership, governmental authority, or other entity; the Shares are fully paid and non-assessable and, except as provided in this Purchase Agreement, Seller has not sold, transferred or assigned any of its rights in or to any of the Shares; the Shares when conveyed at Closing will be free and clear of any liens, claims, encumbrances, and restrictions, of any kind except for the approvals noted above.

s. Unissued Shares. There is no option, warrant, privilege, or right outstanding with respect to any unissued Shares of Corporation.

t. Licenses and Permits. The business operates as a Durable Medical Equipment Company (DME) and is licensed by the State of Oklahoma. Seller will continue to keep all licenses and permits (including Medicare) in good standing and in force and effect at all times.

7. Purchaser's Warranties. Purchaser represents and warrants, to the best of Seller's knowledge, that:

Organization and Authority. Corporation is duly organized and validly existing under the laws of Nevada; Corporation is duly qualified to conduct business in all jurisdictions where it is required to qualify; Purchaser has the authority to execute, deliver and perform this Purchase Agreement and any other agreement or document executed by Purchaser under or in connection with this Purchase Agreement; and Purchaser has taken all necessary action to authorize the execution, delivery, and performance of the Purchase Agreement and any other agreement or document.

7

b. Binding Obligation. This Purchase Agreement constitutes, and any such other agreement or document when executed will constitute, the legal, valid and binding obligations of Purchaser enforceable against Purchaser in accordance with their respective terms.

c. No Violation or Adverse Effect. Neither the execution nor delivery of this Purchase Agreement nor the transactions contemplated herein, nor compliance with the terms and conditions of this Purchase Agreement will:

(i) contravene any provision of law or any statute, decree, rule, or regulation binding upon Purchaser or contravene any judgment, decree, franchise, order or permit applicable to Purchaser or Corporation: or

(ii) conflict with or result in any breach of any terms, covenants, conditions or provisions of, or constitute a default (with or without the giving of notice or passage of time or both) under the Articles of Incorporation or By-Laws of Corporation or material agreement or other instrument to which Purchaser or Corporation is a party or by which either is bound, or result in the creation or imposition of any lien, security interest, charge or encumbrance upon any of the assets, rights, contracts or other property of Corporation.

d. Authorizations, Consents and Approvals. All authorizations, consents or approvals of, or exemptions by, any governmental, judicial or public body or authority, if any, required to authorize, or required in connection with (i) the execution, delivery and performance of this Purchase Agreement by Purchaser, or (ii) any of the transactions contemplated by this Purchase Agreement, or (iii) any of the certificates, instruments, or agreements executed by Purchaser in connection with this Purchase Agreement, or (iv) the taking of any action by Purchaser, have been obtained and will be in full force and effect.

e. Corporate Documentation. Articles of Incorporation and By-Laws of Corporation are attached to Schedule 7.e hereto, and the same have not been amended and are and shall be in full force and effect at Closing.

f. Financial Statements. As a publicly registered Company, Purchaser may only disclose financial information in its quarterly 10-Q filing. Financial Information is available via the Securities and Exchange Commission (SEC) website. Purchaser has attached to Schedule 7.f the 10-Q for September 30, 2010.

g. Potential Litigation or Claims. Seller has no knowledge of any (i) threatened litigation; (ii) material, unasserted claims (considered by management to be probable of assertion); and (iii) potential, material adverse claims.

8

8. Survival of Warranties. All warranties herein shall survive the delivery of the Shares sold hereunder for three (3) years following the date hereof.

9. Conditions Precedent to Closing:

a. Compliance. Satisfactory determination that the acquisition and prospective business operations by Purchaser of Seller's business will comply with all applicable laws and regulations, including license, antitrust and competition laws.

b. Delivery of Legal Opinions. Customary legal opinions must be delivered, the content of which shall be mutually agreed upon.

c. Environmental. An environmental inspection by a licensed environmental inspection firm contracted by Purchaser must show the assets of Seller to be free from significant environmental liabilities. Purchaser shall be given access to the property of Seller and documents as necessary for Purchaser and its agents to conduct the inspection and prepare the reports at the Purchaser's cost. Seller shall represent and warrant as a condition of closing that to the best of their knowledge there are no material adverse environmental liabilities associated with the Seller or the property it owns.

d. Real Property Lease. Seller will cause Corporation to maintain a real property lease for office space currently occupied by the business (a square footage amount to be determined). The lease will be a Gross Lease (all real property and grounds maintenance and repairs, property taxes, and insurance - excluding utilities) for a term of five (5) years with monthly lease payments to be determined but not to exceed comparable gross lease rates for medical or commercial office space within the market area. Purchaser will have the option to renew the lease at market rate at the end of the lease term. If the Property has been pledged under a mortgage Seller will remove or make the Property owner (if owned by a different entity) remove any provisions in the mortgage that could make the lease invalid or require an increase of rent and decrease in term including but not limited to any Due on Sale provisions. In the event of a sale, or refinance of the Property prior to the end of the lease term the Seller will force by contract the new Property owner or Mortgagee to be bound by the rate, terms and conditions of the lease.

e. Accounts Receivable, Payable, and Cash. All cash and accounts receivable and accounts payable will remain property of the Corporation.

f. Power of Attorney. List on Schedule 9.f all outstanding Powers of Attorney.

9

g. Officer or Employee Loans. List on Schedule 9.g a description of amounts and other terms of any indebtedness or other obligations of or to the Company to or from any of its officers, directors, employees, consultants or other insiders.

h. Employment and Compensation Agreements. List on Schedule 9.h a description and copy of all written and oral employment agreements by which the Company is bound or affected including but not limited to, bonus, deferred compensation, stock option, stock purchase and annuity plans, of or covering employees of the Company. Use of Corporation assets (facility, automobiles, office equipment, etc.)

i. Consulting Agreements. List of Schedule 9.i all consulting and management agreements and arrangements of the Company.

j. Insurance Claims. List on Schedule 9.j a description of insurance claims history of the Company since its organization, including date of claim, nature of loss, payment and/or reserve, and description of experience under workers' compensation, including cost.

k. Contingent Agreement. This Agreement is contingent upon satisfactory Due Diligence at the sole discretion of Purchaser. Due Diligence to be completed on or before January 28, 2011 unless extended in writing by both Parties. Upon completion of Due Diligence should Purchaser desire to move toward Closing a Letter of Satisfaction will be delivered to Seller with a Closing date and time.

10. Conditions Subsequent to Closing.

a. Officer and Director Resolution. As of the effective date hereof, Purchaser and Seller shall select new Officers and Directors to conduct the business of the Corporation. The board will comprise three seats. Purchaser will retain two seats and Seller one seat.

b. Employment Contracts. As of the effective date all officer and employee contracts shall be reviewed for reinstatement or termination.

c. Seller Employment Contract. As of the Closing date Seller will enter into a five-year (5) employment agreement as Chief Executive Officer. Annual compensation will be $75,000 plus two percent (2%) of the Corporation's gross revenue in excess of $500,000 annually.

11. Acquisition and Broker Fees. Seller and Purchaser warrant that there were no Brokers or Intermediaries involved in the transaction other than those listed on Schedule 11 a.

10

12. Covenant Not to Complete; Non-solicitation; and Confidential Information. As a material inducement to sign this Purchase Agreement, Seller agrees that he will not, directly or indirectly, Compete with Corporation for a five (5) year period following the date hereof. "Compete" and "Compete with Corporation" both mean to engage in the same or similar business as Corporation in any manner whatsoever, including competing as a proprietor, partner, investor, stockholder, director, officer, employee, consultant, independent contractor, or otherwise, within a geographic area within one hundred (100) miles of any of the facilities in which Corporation is operating as of the date hereof except as a partner, stockholder, investor, or manager with or for Purchaser. A "Customer" of Corporation is any person for whom Corporation has performed or attempted to perform services or sold or attempted to sell any products or service, whether or not for compensation, and regardless of the date of such rendition, sale, or attempted rendition or sale. Seller recognizes that Corporation has spent significant amounts of time and money developing a list of its customers, which list is not available to the general public or Corporation's ordinary employees, and that this list contains other information about the customers not available to the general public and that Seller has been privileged to the list. Seller also acknowledges that Corporation's competitors could not recreate this list without substantial efforts, and Corporation's business would be irreparably and greatly damaged by the use of this information other than for its benefit. Therefore, as a material inducement to signing this Purchase Agreement, Seller will not solicit or do business with, or attempt to solicit or do business with any of Corporation's Customers during the five (5) year period following the date hereof except as a partner, stockholder, investor, or manager with or for Purchaser. Seller has had access to and is aware of the confidential information an trade secrets including Customer data, files, and business techniques not generally available to the public, and this confidential information has been compiled by Corporation at great expense and over a great amount of time. The Parties acknowledge that this confidential information gives Corporation a competitive advantage over other businesses in its field of endeavor and the Corporation's business will be greatly and irreparably damaged by the release or use of this confidential information outside of its own business. Therefore, as a material inducement to signing this Purchase Agreement, Seller will not, during five (5) years following the date hereof, either disclose or divulge this confidential information to anyone or use this confidential information in any manner to Compete with Corporation.

13. Interpretation - No Presumption. It is acknowledged by the Parties that this Purchase Agreement is the result of negotiated suggestions of all Parties, and therefore, no presumptions shall arise favoring any Party by virtue of the authorship of any of the provisions herein or the modification, addition, or deletion of provisions in prior drafts hereof.

14. Indemnity. Seller shall indemnify Purchaser against all loss, damage, costs, and expenses (including any reasonable cost of legal representation) reasonably determined to be a consequence of a breach of any provision, covenant, or warranty in this Purchase Agreement. Seller and Purchaser agree to treat any indemnity payment made pursuant to this Purchase Agreement as an adjustment to the Purchase Price for all income tax purposes. If, not withstanding the treatment required by the preceding is determined to be taxable to Purchaser by any taxing authority, Seller shall also indemnify Purchaser for any taxes incurred by reason of the receipt of such payment and any losses incurred by Purchaser in connection with such Taxes (or any asserted deficiency, claim, demand, action, suit, proceeding, judgment, or assessment, including the defense or settlement thereof, relating to such taxes).

11

15. Governing Law. This Purchase Agreement shall be governed and interpreted under the internal laws of the state of Nevada.

16. Binding Effect. This Purchase Agreement shall be binding upon and shall inure to the benefits of the parties hereto and assigns.

17. Survival. The terms and provisions of this Purchase Agreement shall survive the Closing.

18. Counterpart. This Purchase Agreement may be executed in one or more counterparts, each of which shall be considered an original, and all of which together shall be considered one and the same document.

19. Affidavit. Attached as Schedule 19.a.

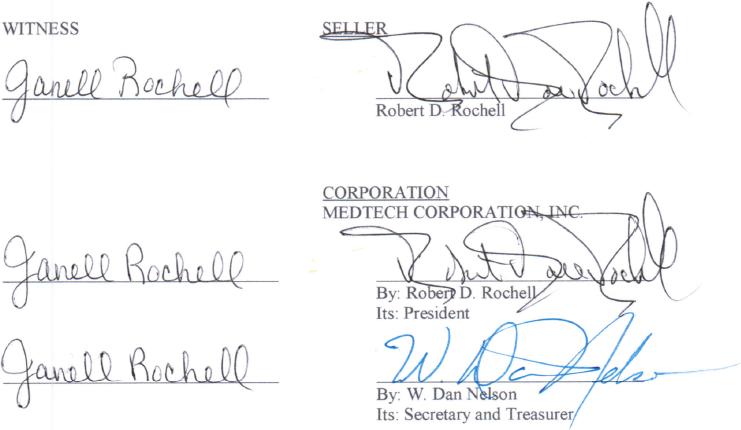

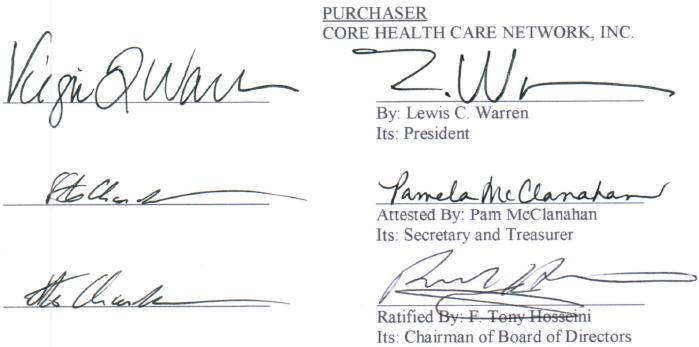

(signatures on next page)

12

IN WITNESS WHEREOF, the Parties have executed this Purchase Agreement as of the Effective Date.

13