Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q/A

(Mark One)

x | QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE OF 1934 |

For the quarterly period ended March 31, 2010

or

o | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE OF 1934 |

For the transition period from _______ to _______

Commission file number: 000-30311

GOLD HORSE INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

Florida | 22-3719165 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

No. 31 Tongdao South Road, Hohhot, Inner Mongolia, China | 010030 |

(Address of principal executive offices) | (Zip Code) |

86 (471) 339 7999

(Registrant's telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Indicated by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company:

Large accelerated filer | o | Accelerated filer | o |

Non-accelerated filer | o | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

Indicate the number of shares outstanding of each of the issuer's classes of common equity, as of the latest practicable date: 77,395,128 shares at May 20, 2010.

EXPLANATORY PARAGRAPH

This quarterly report on Form 10-Q is being filed as Amendment No. 1 to our Quarterly report on Form 10-Q which was originally filed on May 21, 2010. On September 8, 2010, we determined that we did not properly record certain common stock purchase warrants and conversion options related to convertible debt as derivative liabilities in accordance with Derivative and Hedging Topic of the FASB Accounting Standards Codification Topic 815 ("ASC 815"), which became effective for us on July 1, 2009, and furthermore, we did not properly record the subsequent accounting for the changes in the fair value of the associated liabilities at March 31, 2010. Accordingly, we restated our unaudited interim consolidated balance sheet, statement of operations, and statement of cash flows as of and for the period ended March 31, 2010 herein. All of the respective restatement adjustments are non-cash in nature and not related to the operations of the Jin Ma Companies. The correction of these accounting errors resulted in an increase in our total liabilities as of March 31, 2010. In addition, the correction of these accounting errors resulted in a gain (loss) on derivative liabilities in the three and nine months ended March 31, 2010, all of which impacted our net income in the period. The derivative liabilities and gain (loss) on change in fair value of the derivative liabilities are now correctly recorded and presented in accordance with ASC 815 on our consolidated balance sheet, consolidated statement of income and comprehensive income, and consolidated statement of cash flows included herein. Additionally, we restated the diluted earnings (loss) per share calculation for the periods herein and certain disclosure in the notes to the condensed consolidated financial statements and management’s discussion and analysis. We have also revised the disclosure under Part I Item 4 regarding Controls and Procedures.

Please see Note 21 - Restatement contained in the Notes to Consolidated Financial Statements appearing later in this Form 10-Q/A which further describes the effect of this restatement.

This Amendment No. 1 to the Form 10-Q for the period ended March 31, 2010 contains currently dated certifications as Exhibits 31.1, 31.2, 32.1 and 32.2. No attempt has been made in this Amendment No. 1 to the Form 10-Q for the period ended March 31, 2010 to modify or update the other disclosures presented in the Form 10-Q as previously filed, except as required by the restatement. This Amendment No. 1 on Form 10-Q/A does not reflect events occurring after the filing of the original Form 10-Q or modify or update those disclosures that may be affected by subsequent events. Accordingly, this Amendment No. 1 should be read in conjunction with our other filings with the SEC.

GOLD HORSE INTERNATIONAL, INC. AND SUBSIDIARIES

FORM 10-Q/A

QUARTERLY PERIOD ENDED MARCH 31, 2010

INDEX

|

| Page |

PART I - FINANCIAL INFORMATION |

| |

Item 1. | Financial Statements. |

|

| Condensed Consolidated Balance Sheets: As of March 31, 2010 (Unaudited) and June 30, 2009 | 3 |

| Condensed Consolidated Statements of Income and Comprehensive Income : For the Three and Nine Months Ended March 31, 2010 and 2009 (Unaudited) | 4 |

| Condensed Consolidated Statements of Cash Flows: For the Nine Months Ended March 31, 2010 and 2009 (Unaudited) | 5 |

| Notes to Condensed Consolidated Financial Statements | 6 |

Item 2. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 37 |

Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 53 |

Item 4. | Controls and Procedures | 53 |

|

|

|

PART II - OTHER INFORMATION |

| |

Item 1 | Legal Proceedings | 54 |

Item 1A. | Risk Factors | 54 |

Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 54 |

Item 3. | Defaults Upon Senior Securities | 55 |

Item 4. | (Removed and Reserved) | 55 |

Item 5. | Other Information | 55 |

Item 6. | Exhibits | 55 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This report contains forward-looking statements. These forward-looking statements are subject to known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These forward-looking statements were based on various factors and were derived utilizing numerous assumptions and other factors that could cause our actual results to differ materially from those in the forward-looking statements. These factors include, but are not limited to, the amount of funds owed us by the Jin Ma Companies, the enforceability of our contractual arrangements with the Jin Ma Companies, the risk of doing business in the People’s Republic of China (“PRC”), our ability to implement our strategic initiatives, our access to sufficient capital, the impact of reduced availability of bank loans in China on the Jin Ma Companies’ operations, our ability to satisfy our obligations as they become due, economic, political and market conditions and fluctuations, government and industry regulation, Chinese and global competition, and other factors. Most of these factors are difficult to predict accurately and are generally beyond our control.

You should consider the areas of risk described in connection with any forward-looking statements that may be made in our report as filed with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements and readers should carefully review this quarterly report and our annual report on Form 10-K for the year ended June 30, 2009, including the risks described in Item 1A. - Risk Factors, in their entirety. Except for our ongoing obligations to disclose material information under the Federal securities laws, we undertake no obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events. These forward-looking statements speak only as of the date of this quarterly report, and you should not rely on these statements without also considering the risks and uncertainties associated with these statements and our business.

OTHER PERTINENT INFORMATION

Our web site is www.goldhorseinternational.com. The information which appears on our web site is not part of this report.

Our business is conducted in China, using RMB, the currency of China, and our financial statements are presented in United States dollars. In this report, we refer to assets, obligations, commitments and liabilities in our financial statements in United States dollars. These dollar references are based on the exchange rate of RMB to United States dollars, determined as of a specific date. Changes in the exchange rate will affect the amount of our obligations and the value of our assets in terms of United States dollars which may result in an increase or decrease in the amount of our obligations (expressed in dollars) and the value of our assets, including accounts receivable (expressed in dollars).

Unless specifically set forth to the contrary, when used in this prospectus the terms:

| • | "Gold Horse International," the "Company," "we," "us," "ours," and similar terms refers to Gold Horse International, Inc., a Florida corporation, |

|

|

|

| • | "Gold Horse Nevada" refers to Gold Horse International, Inc., a Nevada corporation and wholly-owned subsidiary of Gold Horse International, |

|

|

|

| • | "Global Rise" refers to Global Rise International, Limited, a Cayman Islands corporation and wholly-owned subsidiary of Gold Horse Nevada, |

|

|

|

| • | "IMTD" refers to Inner Mongolia (Cayman) Technology & Development Ltd., a Chinese company and wholly-owned subsidiary of Global Rise, |

|

|

|

| • | "Jin Ma Real Estate" refers to Inner Mongolia Jin Ma Real Estate Development Co., Ltd., a Chinese company, |

|

|

|

| • | "Jin Ma Construction” refers to Inner Mongolia Jin Ma Construction Co., Ltd., a Chinese company, |

|

|

|

| • | “Jin Ma Hotel” refers to Inner Mongolia Jin Ma Hotel Co., Ltd., a Chinese company, |

|

|

|

| • | “Jin Ma Companies” collectively refers to Jin Ma Real Estate, Jin Ma Construction and Jin Ma Hotel, and |

|

|

|

| • | "PRC" or "China" refers to the People's Republic of China. |

2

GOLD HORSE INTERNATIONAL, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| March 31, 2010 |

| June 30, 2009 |

| ||

| (Unaudited) |

|

|

| ||

| (As Restated) |

|

|

|

| |

ASSETS |

|

|

|

|

|

|

Current Assets: |

|

|

|

|

|

|

Cash and cash equivalents | $ | 452,189 |

| $ | 112,134 |

|

Accounts receivable, net |

| 14,940,248 |

|

| 11,943,996 |

|

Note receivable on sales type lease - current portion |

| 1,145,705 |

|

| 157,923 |

|

Inventories, net |

| 51,718 |

|

| 27,838 |

|

Advances to suppliers |

| 324,021 |

|

| 200,570 |

|

Prepaid expenses |

| 300,000 |

|

| — |

|

Other receivable, net |

| 95,675 |

|

| 1,197,705 |

|

Due from related parties |

| — |

|

| 33,283 |

|

Cost and estimated earnings in excess of billings |

| 51,796 |

|

| 16,539 |

|

Construction in progress - current portion |

| 4,872,699 |

|

| 3,286,722 |

|

Prepaid land use rights for resale |

| — |

|

| 1,625,708 |

|

|

|

|

|

|

|

|

Total Current Assets |

| 22,234,051 |

|

| 18,602,418 |

|

|

|

|

|

|

|

|

Property and equipment, net |

| 8,884,131 |

|

| 9,383,982 |

|

Construction in progress - non-current portion |

| — |

|

| 7,273,392 |

|

Deposit on land use right |

| 2,418,456 |

|

| 2,415,382 |

|

Note receivable on sales type lease - non-current portion |

| 15,789,545 |

|

| 8,654,311 |

|

|

|

|

|

|

|

|

Total Assets | $ | 49,326,183 |

| $ | 46,329,485 |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

Convertible debt, net | $ | 409,666 |

| $ | — |

|

Loans payable - current portion |

| 3,108,498 |

|

| 4,420,290 |

|

Accounts payable |

| 7,736,533 |

|

| 7,966,488 |

|

Due to related parties |

| 1,170,889 |

|

| — |

|

Accrued expenses |

| 501,693 |

|

| 1,251,843 |

|

Taxes payable |

| 803,165 |

|

| 1,678,084 |

|

Advances from customers |

| 2,848,995 |

|

| 246,191 |

|

Derivative liabilities |

| 924,132 |

|

| — |

|

Billings in excess of costs and estimated earnings |

| 65,453 |

|

| 37,498 |

|

|

|

|

|

|

|

|

Total Current Liabilities |

| 17,569,024 |

|

| 15,600,394 |

|

|

|

|

|

|

|

|

Loans payable - net of current portion |

| 343,763 |

|

| 379,850 |

|

|

|

|

|

|

|

|

Total Liabilities |

| 17,912,787 |

|

| 15,980,244 |

|

|

|

|

|

|

|

|

Commitments (Note 18) |

| — |

|

| — |

|

|

|

|

|

|

|

|

Stockholders' Equity: |

|

|

|

|

|

|

Preferred stock ($.0001 par value; 20,000,000 shares authorized; none issued and outstanding) |

| — |

|

| — |

|

Common stock ($.0001 par value; 300,000,000 shares authorized; 69,569,204 and 52,668,603 shares issued and outstanding at March 31, 2010 and June 30, 2009, respectively) |

| 6,957 |

|

| 5,266 |

|

Non-controlling interest in variable interest entities |

| 6,095,314 |

|

| 6,095,314 |

|

Additional paid-in capital |

| 6,471,712 |

|

| 6,878,166 |

|

Statutory reserve |

| 2,330,446 |

|

| 2,040,899 |

|

Retained earnings |

| 14,007,600 |

|

| 12,866,842 |

|

Other comprehensive income |

| 2,501,367 |

|

| 2,462,754 |

|

|

|

|

|

|

|

|

Total Stockholders' Equity |

| 31,413,396 |

|

| 30,349,241 |

|

|

|

|

|

|

|

|

Total Liabilities and Stockholders' Equity | $ | 49,326,183 |

| $ | 46,329,485 |

|

See accompanying notes to unaudited condensed consolidated financial statements

3

GOLD HORSE INTERNATIONAL, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

|

| For the Three Months Ended March 31, |

| For the Nine Months Ended March 31, |

| ||||||||

|

| 2010 |

| 2009 |

| 2010 |

| 2009 |

| ||||

|

| (Unaudited) |

| (Unaudited) |

| (Unaudited) |

| (Unaudited) |

| ||||

|

| (As Restated) |

|

|

|

| (As Restated) |

|

|

|

| ||

NET REVENUES |

|

|

|

|

|

|

|

|

|

|

|

|

|

Construction |

| $ | 11,143,476 |

| $ | 8,376,388 |

| $ | 20,739,488 |

| $ | 48,649,659 |

|

Hotel |

|

| 749,749 |

|

| 922,826 |

|

| 2,262,578 |

|

| 2,610,290 |

|

Real estate |

|

| 227,917 |

|

| 362 |

|

| 386,898 |

|

| 382,552 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Revenues |

|

| 12,121,142 |

|

| 9,299,576 |

|

| 23,388,964 |

|

| 51,642,501 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COST Of REVENUES |

|

|

|

|

|

|

|

|

|

|

|

|

|

Construction |

|

| 9,559,477 |

|

| 7,175,985 |

|

| 17,889,157 |

|

| 41,766,632 |

|

Hotel |

|

| 478,135 |

|

| 472,956 |

|

| 1,486,994 |

|

| 1,394,491 |

|

Real estate |

|

| 168,805 |

|

| 284 |

|

| 335,855 |

|

| 300,587 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Cost of Revenues |

|

| 10,206,417 |

|

| 7,649,225 |

|

| 19,712,006 |

|

| 43,461,710 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GROSS PROFIT |

|

| 1,914,725 |

|

| 1,650,351 |

|

| 3,676,958 |

|

| 8,180,791 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other hotel operating expenses |

|

| (26,052 | ) |

| 11,046 |

|

| 77,307 |

|

| 43,336 |

|

Bad debt (recovery) expenses |

|

| (109,535 | ) |

| 22,550 |

|

| (215,090 | ) |

| (171,351 | ) |

Salaries and employee benefits |

|

| 290,845 |

|

| 278,047 |

|

| 683,280 |

|

| 579,895 |

|

Depreciation and amortization |

|

| 198,081 |

|

| 206,670 |

|

| 583,202 |

|

| 644,927 |

|

Selling, general and administrative |

|

| 113,126 |

|

| 64,434 |

|

| 365,689 |

|

| 358,913 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Operating Expenses |

|

| 466,465 |

|

| 582,747 |

|

| 1,494,388 |

|

| 1,455,720 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME FROM OPERATIONS |

|

| 1,448,260 |

|

| 1,067,604 |

|

| 2,182,570 |

|

| 6,725,071 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER INCOME (EXPENSES): |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) Gain from change in fair value of derivative liabilities |

|

| (298,283 | ) |

| — |

|

| 1,704,654 |

|

| — |

|

Gain from debt extinguishment |

|

| 270,101 |

|

| — |

|

| 1,893,310 |

|

| — |

|

Gain on sale of land use rights |

|

| 55 |

|

| — |

|

| 449,528 |

|

| — |

|

Other income |

|

| — |

|

| 3 |

|

| — |

|

| 2,381 |

|

Interest income |

|

| 731,521 |

|

| 559 |

|

| 1,274,716 |

|

| 552,877 |

|

Interest expense |

|

| (394,667 | ) |

| (889,529 | ) |

| (2,711,743 | ) |

| (2,225,755 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Other Income (Expenses) |

|

| 308,727 |

|

| (888,967 | ) |

| 2,610,465 |

|

| (1,670,497 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME BEFORE PROVISION FOR INCOME TAX |

|

| 1,756,987 |

|

| 178,637 |

|

| 4,793,035 |

|

| 5,054,574 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROVISION FOR INCOME TAXES |

|

| 550,772 |

|

| 266,717 |

|

| 865,550 |

|

| 1,767,459 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME (LOSS) |

| $ | 1,206,215 |

| $ | (88,080 | ) | $ | 3,927,485 |

| $ | 3,287,115 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPREHENSIVE INCOME (LOSS): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

| $ | 1,206,215 |

| $ | (88,080 | ) | $ | 3,927,485 |

| $ | 3,287,115 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER COMPREHENSIVE INCOME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized foreign currency translation gain |

|

| 4,753 |

|

| 29,935 |

|

| 38,613 |

|

| 93,659 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPREHENSIVE INCOME (LOSS) |

| $ | 1,210,968 |

| $ | (58,145 | ) | $ | 3,966,098 |

| $ | 3,380,774 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME (LOSS) PER COMMON SHARE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

| $ | 0.02 |

| $ | (0.00 | ) | $ | 0.06 |

| $ | 0.06 |

|

Diluted |

| $ | 0.02 |

| $ | (0.00 | ) | $ | 0.06 |

| $ | 0.06 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE COMMON SHARES OUTSTANDING: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

| 68,093,431 |

|

| 52,668,603 |

|

| 61,242,192 |

|

| 52,612,486 |

|

Diluted |

|

| 68,467,151 |

|

| 52,668,603 |

|

| 61,958,272 |

|

| 58,958,416 |

|

See accompanying notes to unaudited condensed consolidated financial statements.

4

GOLD HORSE INTERNATIONAL, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

|

| For the Nine Months Ended March 31, |

| ||||

|

| 2010 |

| 2009 |

| ||

|

| (Unaudited) |

| (Unaudited) |

| ||

|

| (As Restated) |

|

|

|

| |

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

Net income |

| $ | 3,927,485 |

| $ | 3,287,115 |

|

Adjustments to reconcile net income to net cash used in operating activities: |

|

|

|

|

|

|

|

Depreciation |

|

| 583,202 |

|

| 644,927 |

|

Stock-based compensation |

|

| 232,500 |

|

| — |

|

Common stock issued for interest |

|

| 28,039 |

|

| — |

|

Rent expense associated with prepaid land use rights |

|

| — |

|

| 2,681 |

|

Bad debt recovery |

|

| (215,091 | ) |

| (171,351 | ) |

Interest expense from amortization of debt discount |

|

| 2,183,000 |

|

| 1,227,938 |

|

Amortization of debt issuance costs |

|

| — |

|

| 115,110 |

|

Recognition of unearned gain |

|

| — |

|

| (51,784 | ) |

Gain from change in fair value of derivative liabilities |

|

| (1,704,654 | ) |

| — |

|

Gain from debt extinguishment |

|

| (1,893,310 | ) |

| — |

|

Gain on sale of land use right |

|

| (449,528 | ) |

| — |

|

Changes in assets and liabilities: |

|

|

|

|

|

|

|

Accounts receivable |

|

| (2,844,223 | ) |

| (4,247,794 | ) |

Note receivable |

|

| 313,995 |

|

| 200,568 |

|

Inventories |

|

| (23,839 | ) |

| 13,059 |

|

Other receivables |

|

| 1,182,265 |

|

| 46,206 |

|

Advance to suppliers |

|

| (123,167 | ) |

| (2,040 | ) |

Costs and estimated earnings in excess of billings |

|

| (35,228 | ) |

| 174,040 |

|

Real estate held for sale |

|

| — |

|

| 125,531 |

|

Construction in progress |

|

| (2,724,368 | ) |

| (9,495,098 | ) |

Refundable performance deposit |

|

| — |

|

| 146,058 |

|

Accounts payable and accrued expenses |

|

| (721,044 | ) |

| 3,853,631 |

|

Taxes payable |

|

| (876,846 | ) |

| (1,736,158 | ) |

Advances from customers |

|

| 2,601,870 |

|

| 118,887 |

|

Billings in excess of costs and estimated earnings |

|

| 27,901 |

|

| 103,498 |

|

NET CASH USED IN OPERATING ACTIVITIES |

|

| (531,041 | ) |

| (5,644,976 | ) |

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

Repayment of amounts due from related party |

|

| — |

|

| 1,689,469 |

|

Proceeds from sale of land use right |

|

| 2,193,710 |

|

| — |

|

Proceeds from return of deposit on prepaid land use rights |

|

| — |

|

| 2,249,295 |

|

Purchase of property and equipment |

|

| (188,324 | ) |

| (17,400 | ) |

NET CASH PROVIDED BY INVESTING ACTIVITIES |

|

| 2,005,386 |

|

| 3,921,364 |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

Repayment of loans payable |

|

| (1,353,666 | ) |

| — |

|

Proceeds from advances from related party |

|

| 1,203,928 |

|

| — |

|

Proceeds from loan |

|

| — |

|

| 146,058 |

|

Proceeds from sale of common stock |

|

| — |

|

| 118,000 |

|

Repayment of convertible debt |

|

| (983,550 | ) |

| — |

|

NET CASH (USED IN) PROVIDED BY FINANCING ACTIVITIES |

|

| (1,133,288 | ) |

| 264,058 |

|

|

|

|

|

|

|

|

|

EFFECT OF EXCHANGE RATE ON CASH |

|

| (1,002 | ) |

| 11,779 |

|

|

|

|

|

|

|

|

|

NET INCREASE (DECREASE) IN CASH & CASH EQUIVALENTS |

|

| 340,055 |

|

| (1,447,775 | ) |

|

|

|

|

|

|

|

|

CASH & CASH EQUIVALENTS - beginning of period |

|

| 112,134 |

|

| 1,637,986 |

|

|

|

|

|

|

|

|

|

CASH & CASH EQUIVALENTS - end of the period |

| $ | 452,189 |

| $ | 190,211 |

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: |

|

|

|

|

|

|

|

Cash paid for: |

|

|

|

|

|

|

|

Interest |

| $ | 869,718 |

| $ | 399,906 |

|

Income taxes |

| $ | 1,391,109 |

| $ | 2,801,659 |

|

|

|

|

|

|

|

|

|

Non-cash investing and financing activities: |

|

|

|

|

|

|

|

Common stock issued for compensation |

| $ | 548,000 |

| $ | — |

|

Common stock issued for conversion of convertible debt |

| $ | 789,784 |

| $ | — |

|

Reclassification of warrants and conversion options to derivative liabilities |

| $ | 4,680,179 |

| $ | — |

|

Common stock issued for accrued interest |

| $ | 21,830 |

| $ | — |

|

See accompanying notes to unaudited condensed consolidated financial statements.

5

GOLD HORSE INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2010

NOTE 1 – ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Organization

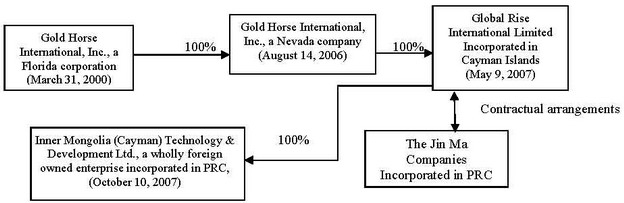

Gold Horse International, Inc. (the “Company”, “we”, “us”, “our”) was incorporated on March 21, 2000 under the laws of the State of New Jersey under its former name “Segway III”. In November 2007, the Company filed a Certificate of Domestication in the State of Florida whereby the Company domesticated as a Florida corporation under the name Gold Horse International, Inc.

On June 29, 2007, the Company executed a Share Exchange Agreement (“Share Exchange Agreement”) with Gold Horse International, Inc. (“Gold Horse Nevada”), a Nevada corporation, whereby the Company acquired all of the outstanding common stock of Gold Horse Nevada in exchange for newly-issued stock of the Company to Gold Horse Nevada shareholders. Gold Horse Nevada was incorporated on August 14, 2006 in the State of Nevada.

Under the Share Exchange Agreement, on June 29, 2007, the Company issued 48,500,000 shares of its common stock to the Gold Horse Nevada Stockholders and their assignees in exchange for 100% of the common stock of Gold Horse Nevada. Additionally, the Company’s prior President, CEO and sole director, cancelled 9,655,050 of the Company’s common stock he owned immediately prior to the closing. After giving effect to the cancellation of shares, the Company had a total of 1,500,002 shares of common stock outstanding immediately prior to Closing. After the Closing, the Company had a total of 50,000,002 shares of common stock outstanding, with the Gold Horse Nevada Stockholders and their assignees owning 97% of the total issued and outstanding shares of the Company's common stock.

Gold Horse Nevada owns 100% of Global Rise International, Limited (“Global Rise”), a Cayman Islands corporation incorporated on May 9, 2007. Through Global Rise, Gold Horse Nevada operates, controls and beneficially owns the construction, hotel and real estate development businesses in China under a series of contractual arrangements (the “Contractual Arrangements”) with Inner Mongolia Jin Ma Real Estate Development Co., Ltd. (“Jin Ma Real Estate”), Inner Mongolia Jin Ma Construction Co., Ltd. (“Jin Ma Construction”) and Inner Mongolia Jin Ma Hotel Co., Ltd. (“Jin Ma Hotel”), (collectively referred to as the “Jin Ma Companies”). Other than the Contractual Arrangements with the Jin Ma Companies, the Company, Gold Horse Nevada or Global Rise has no business or operations. The Contractual Arrangements are discussed below.

On October 10, 2007, the Company established Inner Mongolia (Cayman) Technology & Development Ltd. ("IMTD"), a wholly-foreign owned enterprise incorporated in the PRC and wholly-owned subsidiary of Global Rise.

The relationship among the above companies as follows:

As a result of these Contractual Arrangements, the acquisition of Gold Horse Nevada and the Jin Ma Companies by the Company was accounted for as a reverse merger because on a post-merger basis, the former shareholders of Gold Horse Nevada held a majority of the outstanding common stock of the Company on a voting and fully-diluted basis. As a result, Gold Horse Nevada is deemed to be the acquirer for accounting purposes. Accordingly, the consolidated financial statement data presented are those of the Jin Ma Companies for all periods prior to the Company's acquisition of Gold Horse Nevada on June 29, 2007, and the financial statements of the consolidated companies from the acquisition date forward.

6

GOLD HORSE INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2010

NOTE 1 – ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

PRC law currently places certain limitations on foreign ownership of Chinese companies. To comply with these foreign ownership restrictions, the Company, through its wholly-owned subsidiary, Global Rise, operates its business in China through the Jin Ma Companies, each of which is a limited liability company headquartered in Hohhot, the capital city of the Autonomous Region of Inner Mongolia in China, and organized under PRC laws. Each of the Jin Ma Companies has the relevant licenses and approvals necessary to operate the Company’s businesses in China and none of them is exposed to liabilities incurred by the other party. Global Rise has Contractual Arrangements with each of the Jin Ma Companies and their shareholders (collectively the Jin Ma Companies Shareholders”) pursuant to which Global Rise provides business consulting and other general business operation services to the Jin Ma Companies. Through these Contractual Arrangements, Global Rise also has the ability to control the daily operations and financial affairs of the Jin Ma Companies, appoint each of their senior executives and approve all matters requiring shareholder approval. As a result of these Contractual Arrangements, which enable Global Rise to control the Jin Ma Companies, the Company is considered the primary beneficiary of the Jin Ma Companies. Accordingly, the Company consolidates the Jin Ma Companies' results, assets and liabilities in its financial statements

The Contractual Arrangements are comprised of a series of agreements, including a Consulting Services Agreement and an Operating Agreement, through which Global Rise has the right to advise, consult, manage and operate each of the Jin Ma Companies, and collect and own all of their respective net profits. Additionally, under a Shareholders' Voting Rights Proxy Agreement, the Jin Ma Companies Shareholders have vested their voting control over the Jin Ma Companies to Global Rise. In order to further reinforce the Company’s rights to control and operate the Jin Ma Companies, these companies and their shareholders have granted Global Rise, under an Option Agreement, the exclusive right and option to acquire all of their equity interests in the Jin Ma Companies or, alternatively, all of the assets of the Jin Ma Companies. Further the Jin Ma Companies Shareholders have pledged all of their rights, titles and interests in the Jin Ma Companies to Global Rise under an Equity Pledge Agreement.

Gold Horse Nevada entered into the Contractual Arrangements with each of the Jin Ma Companies and their respective shareholders on August 31, 2006. On June 29, 2007, concurrently with the closing of the Share Exchange Transaction, the Contractual Arrangements were amended and restated by and among Gold Horse Nevada and Global Rise, the Company’s wholly-owned subsidiaries, and the Company on the one hand, and each of the Jin Ma Companies and their respective shareholders on the other hand, pursuant to which the Company was made a party to the Contractual Arrangements.

Inner Mongolia Jin Ma Construction Company Ltd.

Jin Ma Construction is an engineering and construction company that offers general contracting, construction management and building design services primarily in Hohhot City, the Autonomous Region of Inner Mongolia in China. In operation since 1980, Jin Ma Construction was formally registered as a limited liability company in Hohhot City in March 2002.

Inner Mongolia Jin Ma Real Estate Development Co. Ltd.

Jin Ma Real Estate, established in 1999, was formally registered as a limited liability company in Hohhot City in February 2004. Jin Ma Real Estate develops residential and commercial properties in the competitive and growing real estate market in Hohhot.

Inner Mongolia Jin Ma Hotel Co. Ltd.

Jin Ma Hotel was founded in 1999 and formally registered in April 2004 as a limited liability company in Hohhot City. Jin Ma Hotel presently owns, operates and manages the Inner Mongolia Jin Ma Hotel (the “Hotel”), a 22-room full service hotel with a restaurant and banquet facilities situated in Hohhot City approximately 15 kilometers from the Hohhot Baita Airport.

Inner Mongolia (Cayman) Technology & Development Ltd.

IMTD, a wholly foreign owned enterprise incorporated in PRC, provides administrative support services to the Jin Ma Companies.

7

GOLD HORSE INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2010

NOTE 1 – ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Basis of presentation

Management acknowledges its responsibility for the preparation of the accompanying interim condensed consolidated financial statements which reflect all adjustments, consisting of normal recurring adjustments, considered necessary in its opinion for a fair statement of its condensed consolidated financial position and the results of its operations for the interim period presented. These condensed consolidated financial statements should be read in conjunction with the summary of significant accounting policies and notes to condensed consolidated financial statements included in the Company’s Form 10-K annual report for the year ended June 30, 2009.

The accompanying unaudited condensed consolidated financial statements for Gold Horse International, Inc., its wholly owned subsidiaries, and its variable interest entities, have been prepared in accordance with accounting principles generally accepted in the United States of America (the “U.S. GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 8-03 of Regulation S-X. Operating results for interim periods are not necessarily indicative of results that may be expected for the fiscal year as a whole. This basis differs from that used in the statutory accounts of our subsidiaries in China, which were prepared in accordance with the accounting principles and relevant financial regulations applicable to enterprises in the PRC. All necessary adjustments have been made to present the financial statements in accordance with U.S. GAAP.

The Company’s consolidated financial statements include the financial statements of its wholly-owned subsidiaries, Gold Horse Nevada, Global Rise and IMTD, as well as the financial statements of the Jin Ma Companies. All significant intercompany accounts and transactions have been eliminated in consolidation.

The Jin Ma Companies are considered variable interest entities (“VIE”), and the Company is the primary beneficiary. The Company’s relationships with the Jin Ma Companies and their shareholders are governed by a series of contractual arrangements between Gold Horse Nevada, Global Rise, and each of the Jin Ma Companies, which are the operating companies of the Company in the PRC. Under PRC laws, each of IMTD, Jin Ma Construction, Jin Ma Real Estate and Jin Ma Hotel is an independent legal person and none of them is exposed to liabilities incurred by the other parties. The contractual arrangements constitute valid and binding obligations of the parties of such agreements. Each of the contractual arrangements and the rights and obligations of the parties thereto are enforceable and valid in accordance with the laws of the PRC. On June 29, 2007, the Company entered into the following contractual arrangements with each of the Jin Ma Companies:

Consulting Services Agreements. Pursuant to the exclusive Consulting Services Agreements with each of the Jin Ma Companies, the Company, through its subsidiary, Global Rise, exclusively provides to the Jin Ma Companies general business operations services and consulting services as well as general business operation advice and strategic planning (the “Services”). Each of the Jin Ma Companies shall pay a quarterly consulting service fees in Renminbi (“RMB”) to Global Rise that is equal to all of its net profit for such quarter.

Operating Agreements. Pursuant to the Operating Agreements with the Jin Ma Companies and their respective shareholders, Global Rise provides guidance and instructions on the Jin Ma Companies' daily operations, financial management and employment issues. The Jin Ma Companies Shareholders must designate the candidates recommended by Global Rise as their representatives on each of the Jin Ma Companies' board of directors. Global Rise has the right to appoint senior executives of the Jin Ma Companies. In addition, Global Rise agreed to guarantee the Jin Ma Companies' performance under any agreements or arrangements relating to the Jin Ma Companies' business arrangements with any third party. Each of the Jin Ma Companies, in return, agrees to pledge its accounts receivable and all of its assets to Global Rise. Moreover, each of the Jin Ma Companies agrees that without Global Rise’s prior consent, it will not engage in any transactions that could materially affect its assets, liabilities, rights or operations, including, without limitation, incurrence or assumption of any indebtedness, sale or purchase of any assets or rights, incurrence of any encumbrance on any of its assets or intellectual property rights in favor of a third party or transfer of any agreements relating to its business operation to any third party. The term of this agreement is ten (10) years and may be extended only upon our written confirmation prior to the expiration of this agreement, with the extended term to be mutually agreed upon by the parties.

8

GOLD HORSE INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2010

NOTE 1 – ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Equity Pledge Agreements. Under the Equity Pledge Agreements, the shareholders of the Jin Ma Companies pledged all of their equity interests in the Jin Ma Companies to Global Rise to guarantee the Jin Ma Companies' performance of their obligations under the exclusive consulting services agreements. If the Jin Ma Companies or its shareholders breach their respective contractual obligations, Global Rise, as pledgee, will be entitled to certain rights, including the right to sell the pledged equity interests. The shareholders of the Jin Ma Companies also agreed that upon occurrence of any event of default, Global Rise shall be granted an exclusive, irrevocable power of attorney to take actions in the place and stead of the shareholders of the Jin Ma Companies to carry out the security provisions of the equity pledge agreement and take any action and execute any instrument that Global Rise may deem necessary or advisable to accomplish the purposes of the equity pledge agreement. The shareholders of the Jin Ma Companies agreed not to dispose of the pledged equity interests or take any actions that would prejudice our interest. The equity pledge agreement will expire two (2) years after the Jin Ma Companies' obligations under the exclusive consulting services agreements have been fulfilled.

Option Agreements. Under the Option Agreements, the shareholders of the Jin Ma Companies irrevocably granted us or our designee an exclusive option to purchase, to the extent permitted under PRC law, all or part of the equity interests in the Jin Ma Companies for the cost of the initial contributions to the registered capital or the minimum amount of consideration permitted by applicable PRC law. Global Rise, or its designee, has sole discretion to decide when to exercise the option, whether in part or in full. The term of this agreement is ten (10) years and may be extended prior to its expiration by written agreement of the parties.

Proxy Agreements. Pursuant to the Proxy Agreements, the shareholders of the Jin Ma Companies agreed to irrevocably grant a person to be designated by Global Rise with the right to exercise their voting rights and their other rights, in accordance with applicable laws and their respective Article of Association, including but not limited to the rights to sell or transfer all or any of their equity interests of the Jin Ma Companies, and appoint and vote for the directors and chairman as the authorized representative of the shareholders of the Jin Ma Companies.

The accounts of the Jin Ma Companies are consolidated in the accompanying financial statements pursuant to the Financial Accounting Standards Board Accounting Standard Codification (ASC) Topic 810 and related subtopics related to the consolidation of variable interest entities. As a VIE, the Jin Ma Companies sales are included in the Company’s total revenues, its income from operations is consolidated with the Company’s, and the Company’s net income includes all of the Jin Ma Companies net income. The Company does not have any non-controlling interests and accordingly, did not subtract any net income in calculating the net income attributable to the Company. Because of the contractual arrangements, the Company had a pecuniary interest in the Jin Ma Companies that require consolidation of the Company’s and the Jin Ma Companies financial statements.

Use of estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles (“GAAP”) requires management to make estimates and assumptions that affect certain reported amounts and disclosures. Accordingly, actual results could differ from those estimates. Significant estimates for the nine months ended March 31, 2010 and 2009 include the allowance for doubtful accounts, the useful life of property and equipment and intangible assets, assumptions used in assessing impairment of long-term asset, and valuation of deferred tax assets, costs and estimated earnings in excess of billings and billings in excess of costs and estimated earnings, and the calculation of the value of any beneficial conversion feature and warrants related to convertible debt.

9

GOLD HORSE INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2010

NOTE 1 – ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Financial instruments

The accounting standard governing financial instruments adopted by the Company on July 1, 2009 defines financial instruments and requires fair value disclosures about those instruments. It defines fair value, establishes a three-level valuation hierarchy for disclosures of fair value measurement and enhances disclosure requirements for fair value measures. Cash, investments, receivables, payables, short term loans and convertible debt all qualify as financial instruments. Management concluded cash, receivables, payables and short term loans approximate their fair values because of the short period of time between the origination of such instruments and their expected realization and, if applicable, their stated rates of interest are equivalent to rates currently available.

The three levels of valuation hierarchy are defined as follows:

· | Level 1 inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets. |

|

|

· | Level 2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument. |

|

|

· | Level 3 inputs to the valuation methodology are unobservable and significant to the fair value measurement. |

The Company analyzes all financial instruments with features of both liabilities and equity under the FASB’s accounting standard for such instruments. Under this standard, financial assets and liabilities are classified in their entirety based on the lowest level of input that is significant to the fair value measurement. Depending on the product and the terms of the transaction, the fair value of notes payable and derivative liabilities were modeled using a series of techniques, including closed-form analytic formula, such as the Black-Scholes option-pricing model. The following table presents a reconciliation of the derivative liability measured at fair value on a recurring basis using significant unobservable input (Level 3) from July 1, 2009 to March 31, 2010:

| Conversion feature |

| Warrant liability |

| ||

Balance at July 1, 2009 | $ | — |

| $ | — |

|

Recognition of derivative liability |

| 3,224,484 |

|

| 1,455,695 |

|

Exercise of warrants |

| — |

|

| (158,084 | ) |

Extinguishment of derivative liability upon conversion of debt to equity |

| (1,893,310 | ) |

| — |

|

Change in fair value included in earnings |

| (1,112,977 | ) |

| (591,676 | ) |

Balance at March 31, 2010 | $ | 218,197 |

| $ | 705,935 |

|

The Company did not identify any other non-recurring assets and liabilities that are required to be presented on the consolidated balance sheets at fair value in accordance with the relevant accounting standards.

See Note 13 for more information on these financial instruments.

ASC 825-10 “Financial Instruments”, allows entities to voluntarily choose to measure certain financial assets and liabilities at fair value (fair value option). The fair value option may be elected on an instrument-by-instrument basis and is irrevocable, unless a new election date occurs. If the fair value option is elected for an instrument, unrealized gains and losses for that instrument should be reported in earnings at each subsequent reporting date. The Company did not elect to apply the fair value option to any outstanding instruments.

10

GOLD HORSE INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2010

NOTE 1 – ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Derivative financial instruments

The Company evaluates all of its financial instruments to determine if such instruments are derivatives or contain features that qualify as embedded derivatives. For derivative financial instruments that are accounted for as liabilities, the derivative instrument is initially recorded at its fair value and is then re-valued at each reporting date, with changes in the fair value reported in the consolidated statements of income. For stock-based derivative financial instruments, the Company uses the Black-Scholes-Merton option-pricing model to value the derivative instruments at inception and on subsequent valuation dates. The classification of derivative instruments, including whether such instruments should be recorded as liabilities or as equity, is evaluated at the end of each reporting period. Derivative instrument liabilities are classified in the balance sheets as current or non-current based on whether or not net-cash settlement of the derivative instrument could be required within 12 months of the balance sheet date.

Cash and cash equivalents

For purposes of the consolidated statements of cash flows, the Company considers all highly liquid instruments purchased with a maturity of three months or less and money market accounts to be cash equivalents. The Company maintains cash and cash equivalents with various financial institutions mainly in the PRC and the United States. Balances in the United States are insured up to $250,000 at each bank. Balances in banks in the PRC are uninsured.

Concentrations of credit risk

The Company's operations are carried out in the PRC. Accordingly, the Company's business, financial condition and results of operations may be influenced by the political, economic and legal environment in the PRC, and by the general state of the PRC's economy. The Company's operations in the PRC are subject to specific considerations and significant risks not typically associated with companies in North America. The Company's results may be adversely affected by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation, among other things.

Financial instruments which potentially subject the Company to concentrations of credit risk consist principally of cash and trade accounts receivable. Substantially all of the Company’s cash is maintained with state-owned banks within the PRC, and no deposits are covered by insurance. The Company has not experienced any losses in such accounts and believes it is not exposed to any risks on its cash in bank accounts. A significant portion of the Company's sales are credit sales which are primarily to customers whose ability to pay is dependent upon the industry economics prevailing in these areas; however, concentrations of credit risk with respect to trade accounts receivables is limited due to generally short payment terms. The Company also performs ongoing credit evaluations of its customers to help further reduce credit risk.

At March 31, 2010 and June 30, 2009, the Company’s cash and cash equivalents by geographic area were as follows:

|

| March 31, 2010 |

| June 30, 2009 | ||||||

|

| (Unaudited) |

|

| ||||||

Country: |

|

|

|

|

|

|

|

|

|

|

United States |

| $ | 2,650 |

| 0.6% |

| $ | 39,956 |

| 35.6% |

China |

|

| 449,539 |

| 99.4% |

|

| 72,178 |

| 64.4% |

Total cash and cash equivalents |

| $ | 452,189 |

| 100.0% |

| $ | 112,134 |

| 100.0% |

11

GOLD HORSE INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2010

NOTE 1 – ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Accounts and other receivables

The Company has a policy of reserving for uncollectible accounts based on its best estimate of the amount of probable credit losses in its existing accounts receivable. The Company periodically reviews its accounts receivable and other receivables to determine whether an allowance is necessary based on an analysis of past due accounts and other factors that may indicate that the realization of an account may be in doubt. Account balances deemed to be uncollectible are charged to the allowance after all means of collection have been exhausted and the potential for recovery is considered remote. At March 31, 2010 and June 30, 2009, the Company has established, based on a review of its outstanding accounts receivable balances, an allowance for doubtful accounts in the amount of $867,747 and $1,002,621, respectively, on its total accounts receivable.

Other receivables amounts were primarily related to advances made to various vendors and other parties in the normal course of business and the allowance was established when those parties deemed to be unlikely to repay the amounts. At March 31, 2010 and June 30, 2009, the Company has established, based on a review of its outstanding other receivable balances, an allowance for doubtful accounts in the amount of $65,165 and $143,974, respectively. At such time as management exhausts all collection efforts, the other receivable balance will be netted against the allowance account. The activities in the allowance for doubtful accounts for accounts receivable and other receivables for the nine months ended March 31, 2010 are as follows:

|

| Allowance for doubtful accounts for accounts receivable |

|

| Allowance for doubtful accounts for other receivable |

|

| Total |

| |||

Balance – June 30, 2009 |

| $ | 1,002,621 |

|

| $ | 143,974 |

|

| $ | 1,146,595 |

|

Reduction in allowance |

|

| (136,149 | ) |

|

| (78,992 | ) |

|

| (215,141 | ) |

Foreign currency translation adjustments |

|

| 1,275 |

|

|

| 183 |

|

|

| 1,458 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance – March 31, 2010 (Unaudited) |

| $ | 867,747 |

|

| $ | 65,165 |

|

| $ | 932,912 |

|

Inventories

Inventories, consisting of consumable goods related to the Company’s hotel operations are stated at the lower of cost or market utilizing the first-in, first-out method.

Prepaid land use rights for resale

Prepaid land use rights for resale are accounted for at the lower of cost or market. These are considered as current assets and free of amortization as management considers these can be sold within a year from the date of balance sheet.

Advances to suppliers

The Company advances to certain vendors for purchase of construction materials and services. The advances to suppliers are interest free and unsecured. The advances to suppliers amounted to $324,021 and $200,570 at March 31, 2010 and June 30, 2009, respectively.

Property and equipment

Property and equipment are carried at cost and are depreciated on a straight-line basis over the estimated useful lives of the assets. The cost of repairs and maintenance is expensed as incurred; major replacements and improvements are capitalized. When assets are retired or disposed of, the cost and accumulated depreciation are removed from the accounts, and any resulting gains or losses are included in income in the year of disposition. The Company examines the possibility of decreases in the value of fixed assets when events or changes in circumstances reflect the fact that their recorded value may not be recoverable.

12

GOLD HORSE INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2010

NOTE 1 – ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Real estate held for sale

The Company capitalizes as real estate held for sale the direct construction and development costs, property taxes, interest incurred on costs related to land under development and other related costs (i.e. engineering, surveying, landscaping, etc.) until the property reaches its intended use. At March 31, 2010 and June 30, 2009, the Company did not have any real estate held for sale.

Construction in process

Properties currently under development are accounted for as construction-in-process. Construction-in-process is recorded at acquisition cost, including land use rights cost, development expenditure, professional fees and the interest expenses capitalized during the course of construction for the purpose of financing the project. Upon completion and readiness for use of the project, the cost of construction-in-progress is to be transferred to an appropriate asset. Construction in progress is valued at the lower of cost or market. Management evaluates the market value of its properties on a periodic basis for impairment. As of March 31, 2010 and June 30, 2009, construction in process amounted to $4,872,699 and $10,560,114, respectively.

Impairment of long-lived assets

In accordance with ASC Topic 360, the Company periodically reviews its long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of the assets may not be fully recoverable. The Company recognizes an impairment loss when the sum of expected undiscounted future cash flows is less than the carrying amount of the asset. The amount of impairment is measured as the difference between the asset’s estimated fair value and its book value. The Company did not record any impairment charges during the nine months ended March 31, 2010 and 2009.

Income taxes

The Company is governed by the Income Tax Law of the People’s Republic of China. The Company accounts for income taxes using the liability method prescribed by ASC 740 “Income Taxes”. Under this method, deferred tax assets and liabilities are determined based on the difference between the financial reporting and tax bases of assets and liabilities using enacted tax rates that will be in effect in the year in which the differences are expected to reverse. The Company records a valuation allowance to offset deferred tax assets if based on the weight of available evidence, it is more-likely-than-not that some portion, or all, of the deferred tax assets will not be realized. The effect on deferred taxes of a change in tax rates is recognized as income or loss in the period that includes the enactment date. At March 31, 2010 and June 30, 2009, there were no significant book and tax basis differences. Pursuant to the PRC Income Tax Laws, the Company is subject to income tax at a statutory rate of 25%.

Pursuant to accounting standards related to the accounting for uncertainty in income taxes, the evaluation of a tax position is a two-step process. The first step is to determine whether it is more likely than not that a tax position will be sustained upon examination, including the resolution of any related appeals or litigation based on the technical merits of that position. The second step is to measure a tax position that meets the more-likely-than-not threshold to determine the amount of benefit to be recognized in the financial statements. A tax position is measured at the largest amount of benefit that is greater than 50% likelihood of being realized upon ultimate settlement. Tax positions that previously failed to meet the more-likely-than-not recognition threshold should be recognized in the first subsequent period in which the threshold is met. Previously recognized tax positions that no longer meet the more-likely-than-not criteria should be de-recognized in the first subsequent financial reporting period in which the threshold is no longer met. The accounting standard also provides guidance on de-recognition, classification, interest and penalties, accounting in interim periods, disclosures, and transition.

Advances from customers

Advances from customers at March 31, 2010 and June 30, 2009 of $2,848,995 and $246,191, respectively, consist of prepayments from third party customers to the Company for construction and real estate transactions to ensure sufficient funds are available to complete the real estate and construction projects. The Company will recognize the advances as revenue upon transfer of title to the buyer, in compliance with its revenue recognition policy.

13

GOLD HORSE INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2010

NOTE 1 – ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Net income (loss) per common share

Net income (loss) per common share is calculated in accordance with the ASC Topic 260. Basic net income (loss) per common share is computed by dividing net income (loss) by the weighted average number of shares of common stock outstanding during the period. Diluted net income per common share is computed by dividing net income by the weighted average number of shares of common stock, common stock equivalents and potentially dilutive securities outstanding during each period. Potentially dilutive common shares consist of the common shares issuable upon the conversion of convertible debt (using the if-converted method) and common stock warrants (using the treasury stock method). For the three months ended March 31, 2009, common stock equivalents were excluded from the computation of diluted shares outstanding as they would have had an anti-dilutive impact. In period where the Company has a net loss, all dilutive securities are excluded.

The following table presents a reconciliation of basic and diluted net income per common share:

|

| Three Months Ended March 31, |

| Nine Months Ended March 31, | ||||

|

| 2010 |

| 2009 |

| 2010 |

| 2009 |

|

| (Restated) |

|

|

| (Restated) |

|

|

Net income (loss) used for basic and diluted net income (loss) per common share | $ | 1,206,215 | $ | (88,080) | $ | 3,927,485 | $ | 3,287,115 |

|

|

|

|

|

|

|

| |

Weighted average common shares outstanding – basic |

| 68,093,431 |

| 52,668,603 |

| 61,242,192 |

| 52,612,486 |

Effect of dilutive securities: |

|

|

|

|

|

|

|

|

Unexercised warrants |

| 373,720 |

| — |

| 716,080 |

| — |

Convertible debentures |

| — |

| — |

| — |

| 6,345,930 |

Weighted average common shares outstanding – diluted |

| 68,467,151 |

| 52,668,603 |

| 61,958,272 |

| 58,958,416 |

Net income (loss) per common share – basic | $ | 0.02 | $ | (0.00) | $ | 0.06 | $ | 0.06 |

Net income (loss) per common share – diluted | $ | 0.02 | $ | (0.00) | $ | 0.06 | $ | 0.06 |

The diluted earnings per share calculation for the three and nine months ended March 31, 2010 and 2009 did not include the effect of convertible debentures because their effect was anti-dilutive.

The Company's aggregate common stock equivalents at March 31, 2010 and 2009 include the following:

|

| March 31, 2010 |

| March 31, 2009 |

Warrants |

| 7,847,790 |

| 6,853,604 |

Convertible debentures |

| 4,096,657 |

| 6,345,930 |

Total |

| 11,944,447 |

| 13,199,534 |

Revenue recognition

The Company follows the guidance of ASC Topic 605 and Topic 360 for revenue recognition. In general, the Company records revenue when persuasive evidence of an arrangement exists, services have been rendered or product delivery has occurred, the sales price to the customer is fixed or determinable, and collectability is reasonably assured. The following policies reflect specific criteria for the various revenues streams of the Company:

Real estate sales which primarily involve the sale of multi-family units and community environments are reported in accordance with ASC Topic 360. Generally, profits from the sale of development properties, less 5% business tax, are recognized by the full accrual method when the sale is consummated. A sale is not considered consummated until (1) the parties are bound by the terms of a contract, (2) all consideration has been exchanged, (3) any permanent financing of which the seller is responsible has been arranged, (4) all conditions precedent to closing have been performed, (5) the seller does not have substantial continuing involvement with the property, and (6) the usual risks and rewards of ownership have been transferred to the buyer.

14

GOLD HORSE INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2010

NOTE 1 – ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

In 2007 and 2008, entered into agreements to construct new dormitories as follows:

| a) | In November 2007, Jin Ma Real Estate entered into an agreement to construct new dormitories for the Inner Mongolia Electrical Vocational Technical School (“Vocational School”). Pursuant to the terms of the agreement, Jin Ma Real Estate constructed the buildings and, upon completion, pursuant to a sales-type capital lease, leased the buildings to the Vocational School and will receive payments for a period of 26 years at an amount of 4,800,000 RMB or approximately $700,000 per annum. In November 2008, Jin Ma Real Estate completed the construction. In December 2008 and October 2009, Jin Ma Real Estate received the first and second payment of 4,800,000 RMB, respectively. Since the agreement did not have a stated interest rate, the Company used an imputed interest rate of interest of 6.12% and is reflecting payments due under the agreement as a note receivable on the accompanying balance sheets. The property sold had an imputed sales value of 61,691,138 RMB (approximately $9,000,000). The deferred gain on the sale of the property was approximately $52,000 of which for the nine months ended March 31, 2010 and 2009, $914 and $859 was recognized pursuant to the installment method and is reflected in the accompanying statements of income. |

|

|

|

| b) | In 2008, Jin Ma Real Estate and Inner Mongolia Chemistry College entered an oral agreement and on September 29, 2009, formalized a written agreement for the construction of student apartments for the Inner Mongolia Chemistry College (“Chemistry College”) situated in Inner Mongolia University City, a compound where many higher education institutions are located. Jin Ma Construction began developing the 51,037 square-meter project in July 2008 and completed the construction in October 2009. Jin Ma Real Estate leased the buildings to the Chemistry College for a period of 20 years. The annual lease payments are RMB 10.62 million (approximately $1.55 million) for 5 years (from fiscal 2010 to fiscal 2014), and the annual lease payment is RMB 5.42 million (approximately $0.79 million) for 15 years (from fiscal 2015 to fiscal 2029). As of March 31, 2010, Jin Ma Real Estate received a partial initial annual installment from Inner Mongolia Chemistry College of 6,559,548 RMB (approximately $960,000). Since the agreement did not have a stated interest rate, the Company used an imputed interest rate of interest of 5.94% and is reflecting payments due under the agreement as a note receivable on the accompanying balance sheets. The property sold had an imputed sales value of 84,196,104 RMB (approximately $12 million). The deferred gain on the sale of the property was approximately $3,900,000 of which for the nine months ended March 31, 2010, $71,989 was recognized pursuant to the installment method and is reflected in the accompanying statements of income. |

In accordance with ASC Topic 360, the initial gains from the sales of the Vocational School and Chemistry College were deferred because the minimum initial investment by the buyer was less than the required 20% initial investment expressed as a percentage of the sales value (ASC Topic 360). Therefore the gains are being recognized into income as payments are received using the installment method. The installment method apportions each cash receipt and principal payment by the buyer between cost recovered and profit. The apportionment is in the same ratio as total cost and total profit bear to the sales value. Accordingly, revenues and cost of sales are recognized based on the apportionments, and the Company recognized imputed interest income on the accompanying consolidated statements of income as summarized below.

As of March 31, 2010, the remaining deferred gains for Vocational School and Chemistry College leases of $50,089 and $3,818,517, respectively, is reflected as a discount of notes receivable in the accompanying balance sheet. As of June 30, 2009, the remaining deferred gains for Vocational School and Chemistry College leases of $50,938 and $0, respectively, is reflected as a discount of notes receivable in the accompanying balance sheet. The recorded imputed interest discount will be realized as the balances due are collected. In the event of early liquidation, interest is recognized on the simple interest method (See Note 2).

The deferred gains were recognized pursuant to the installment method and are reflected in the accompanying consolidated statements of income follows:

|

| For the nine months ended March 31, 2010 |

| For the nine months ended March 31, 2009 |

Revenues | $ | 386,936 | $ | 149,637 |

Cost of sales |

| 314,033 |

| 148,784 |

Gross profit recognized | $ | 72,903 | $ | 853 |

15

GOLD HORSE INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2010

NOTE 1 – ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Jin Ma Real Estate receives annual payments of principal and the related imputed interest from the Vocational School and Chemistry College. During the nine months ended March 31, 2010 and 2009, the Company allocated the payments received as follows:

|

| 2010 |

| 2009 |

Amount applied to principal balance of note receivable | $ | 386,898 | $ | 149,495 |

Interest income recognized on consolidated statement of income |

| 1,274,406 |

| 550,920 |

Total payment received | $ | 1,661,304 | $ | 700,415 |

Revenue from the performance of general contracting, construction management and design-building services is recognized upon completion of the service.

In accounting for long-term engineering and construction-type contracts, the Company follows the provisions of ASC Topic 605. The Company recognizes revenues using the percentage of completion method of accounting by relating contract costs incurred to date to the total estimated costs at completion. Contract price and cost estimates are reviewed periodically as work progresses and adjustments proportionate to the percentage of completion are reflected in contract revenues and gross profit in the reporting period when such estimates are revised. This method of revenue recognition requires the Company to prepare estimates of costs to complete contracts in progress. In making such estimates, judgments are required to evaluate contingencies such as potential variances in schedule, the cost of materials and labor, and productivity; and the impact of change orders, liability claims, contract disputes, and achievement of contractual performance standards which may result in revisions to costs and income and are recognized in the period in which the revisions are determined. Provisions for estimated losses on uncompleted contracts are made in the period in which such losses are determined.

The asset, "costs and estimated earnings in excess of billings," represents revenues recognized in excess of amounts billed. The liability, "billings in excess of costs and estimated earnings," represents billings in excess of revenues recognized.

Revenue primarily derived from hotel operations, including the rental of rooms and food and beverage sales, is recognized when rooms are occupied and services have been rendered.

Foreign currency translation and comprehensive income

The reporting currency of the Company is the U.S. dollar. The functional currency of the parent company is the U.S. dollar and the functional currency of the Company’s operating subsidiaries and affiliates is the Chinese Renminbi (“RMB”). For the subsidiaries and affiliates whose functional currencies are the RMB, results of operations and cash flows are translated at average exchange rates during the period, assets and liabilities are translated at the unified exchange rate at the end of the period, and equity is translated at historical exchange rates. Translation adjustments resulting from the process of translating the local currency financial statements into U.S. dollars are included in determining comprehensive income. The cumulative translation adjustment and effect of exchange rate changes on cash for the nine months ended March 31, 2010 and 2009 amounted to $(1,002) and $11,779, respectively. Transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred. All of the Company’s revenue transactions are transacted in the functional currency. The Company does not enter any material transaction in foreign currencies and accordingly, transaction gains or losses have not had, and are not expected to have, a material effect on the results of operations of the Company.