Attached files

| file | filename |

|---|---|

| 8-K - WESTFIELD FINANCIAL, INC. 8-K - Western New England Bancorp, Inc. | a6613621.htm |

Exhibit 99.1

Sterne Agee Financial Institutions Investor Conference Investor Handouts February 17 & 18, 2011 1

FORWARD – LOOKING STATEMENTS Today’s presentation may contain “forward-looking statements” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” and “potential.” Examples of forward-looking statements include, but are not limited to, estimates with respect to our financial condition and results of operation and business that are subject to various factors which could cause actual results to differ materially from these estimates. These factors include, but are not limited to: general and local economic conditions; changes in interest rates, deposit flows, demand for mortgages and other loans, real estate values, and competition; changes in accounting principles, policies, or guidelines; changes in legislation or regulation; and other economic, competitive, governmental, regulatory, and technological factors affecting our operations, pricing, products, and services. Any or all of our forward-looking statements in today’s presentation or in any other public statements we make may turn out to be wrong. They can be affected by inaccurate assumptions we might make or known or unknown risks and uncertainties. Consequently, no forward-looking statements can be guaranteed. We disclaim any obligation to subsequently revise any forward-looking statements to reflect events or circumstances after the date of such statements, or to reflect the occurrence of anticipated or unanticipated events 2

3 OVERVIEW Headquartered in Westfield, MA 11 branches offices located throughout Hampden County Preferred SBA Lender Did not participate in TARP

4 STRATEGY Main focus on Commercial & Industrial and Commercial Real Estate portfolios by targeting businesses in Western Massachusetts and Northern Connecticut. C & I relationships include transactional deposit account relationships. Growth in residential real estate portfolio to diversify risk and deepen customer relationships. Maintain arrangement with a third-party mortgage company which underwrites and services residential loans, thereby reducing overhead cost for Westfield Bank.

5 2010 HIGHLIGHTS Very well capitalized. Stockholders’ equity/total asset ratio of 17.85% High credit quality. Nonperforming loans of 0.63% Deposits increased by $52.3 million, or 8% Total loans increased by 7%, with residential mortgages increasing by $49.7 million

2010 HIGHLIGHTS Hired new head of Branch Administration/Retail Banking in January 2010. 25 years experience in commercial bank environment Developed business development skills of Branch Managers: Business Banking Calling Programs Introduced Bank @ Work program Enhanced the bank-at-college program Redefined product set: relationship-based, tailored to customers’ stage in life 6

ELECTRONIC BANKING Enhanced electronic banking capabilities including mobile banking and financial management tools. Added billing and invoice, payroll and online merchant service processing options for small businesses. Expanded ATM network with 5 new machines, 3 of which are on a university campus. 7

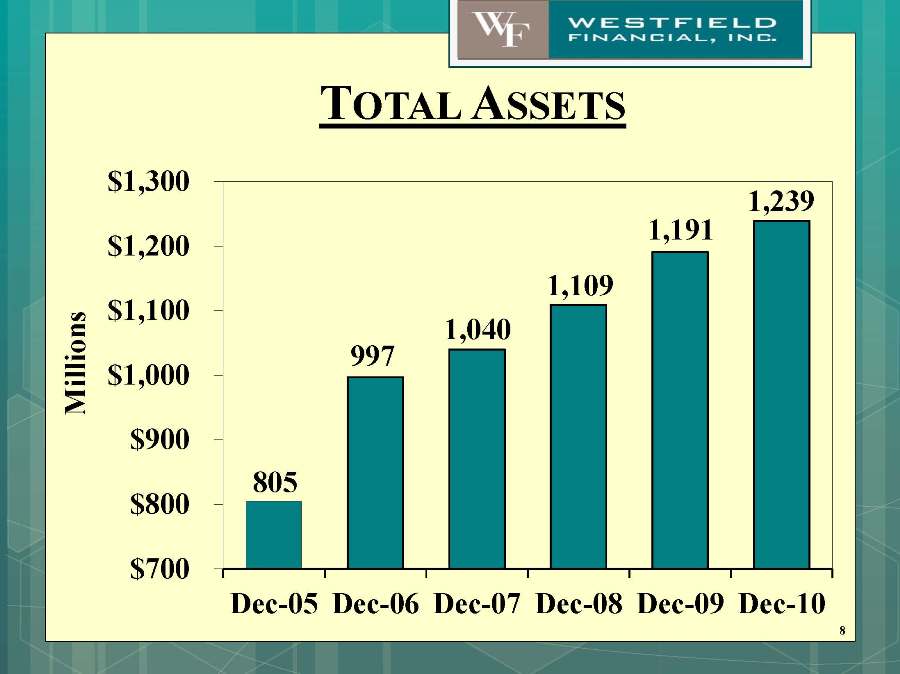

TOTAL ASSETS 805 997 1,040 1,109 1,191 1,239 $700 $800 $900 $1,000 $1,100 $1,200 $1,300 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 8

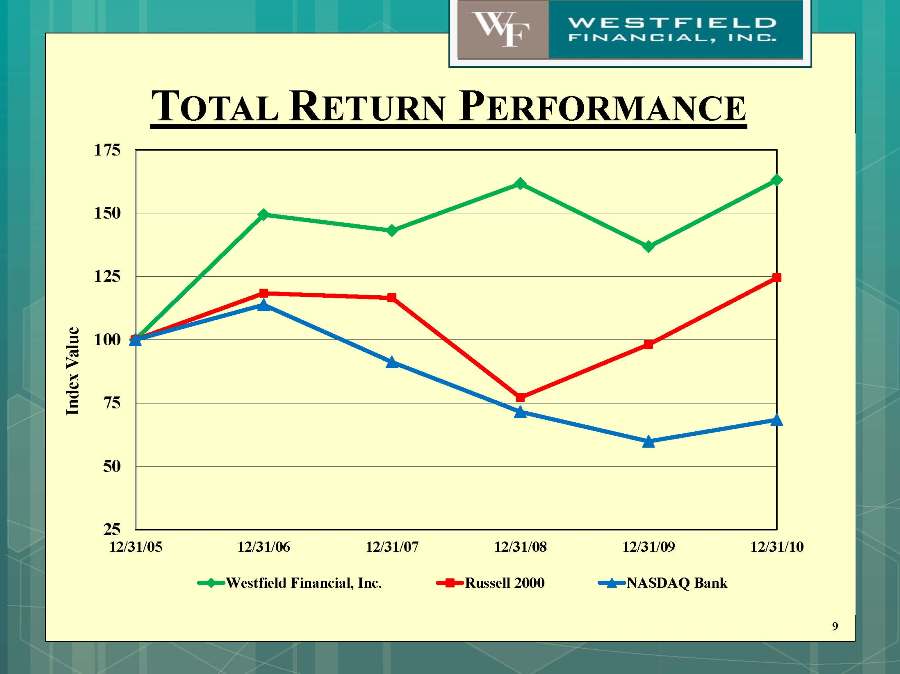

TOTAL RETURN PERFORMANCE 9 25 50 75 100 125 150 175 12/31/05 12/31/06 12/31/07 12/31/08 12/31/09 12/31/10 Index Value Westfield Financial, Inc. Russell 2000 NASDAQ Bank

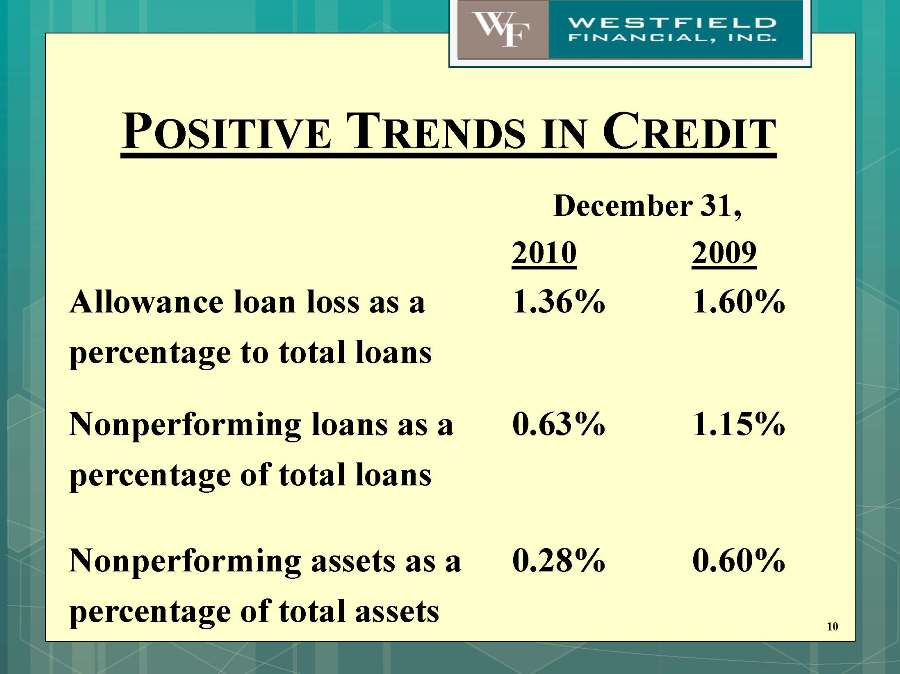

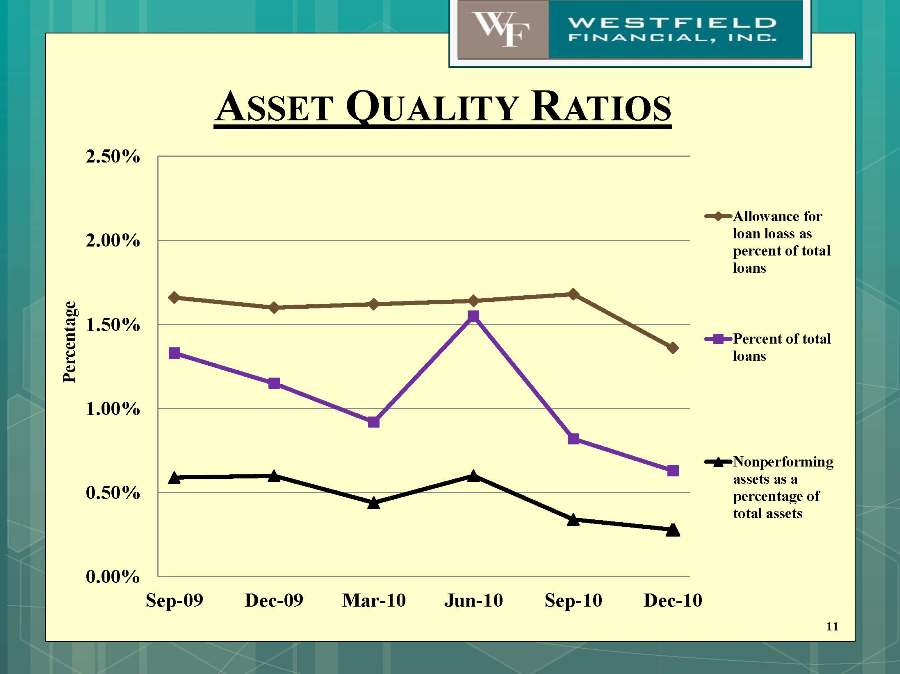

POSITIVE TRENDS IN CREDIT December 31, 2010 2009 Allowance loan loss as a 1.36% 1.60% percentage to total loans Nonperforming loans as a 0.63% 1.15% percentage of total loans Nonperforming assets as a 0.28% 0.60% percentage of total assets 10

ASSET QUALITY RATIOS 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% Sep-09 Dec-09 Mar-10 Jun-10 Sep-10 Dec-10 Percentage Allowance for loan loass as percent of total loans Percent of total loans Nonperforming assets as a percentage of total assets 11

NONPERFORMING & DELINQUENT LOANS Nonperforming loans of $3.2 million or 0.63% of total loans Primarily made up of 3 borrowers totaling $2.4 million Loans delinquent 30-89 days totaling $16.8 million Primarily made up of one borrower totaling $15.0 million 12

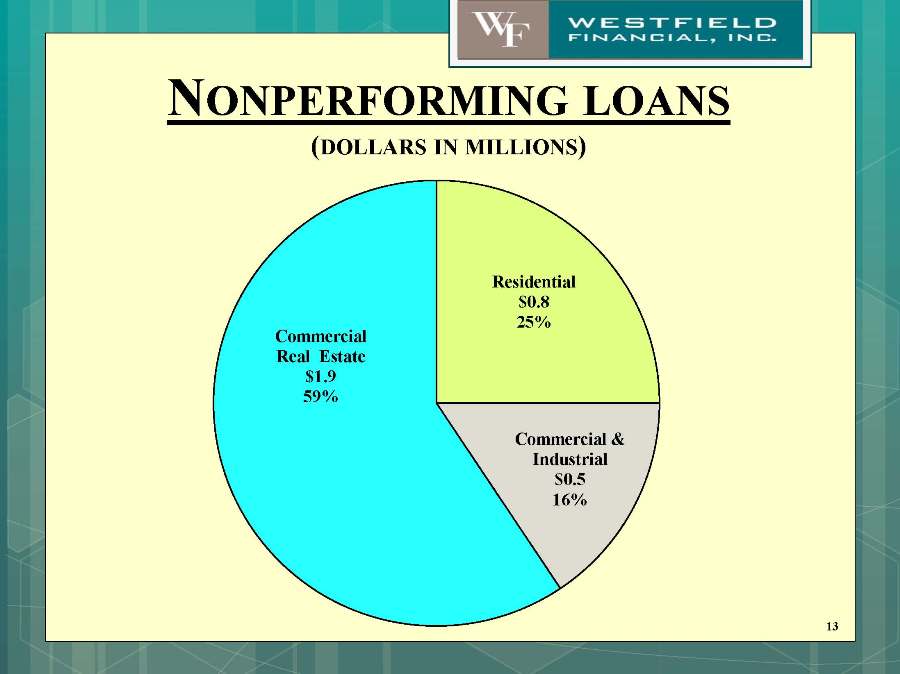

NONPERFORMING LOANS (DOLLARS IN MILLIONS) Residential $0.8 25% Commercial & Industrial $0.5 16% Commercial Real Estate $1.9 59% 13

CAPITAL MANAGEMENT Possible uses of capital: Pay dividends to shareholders Repurchase shares of our common stock Fund organic growth or leverage the balance sheet Finance acquisitions of other financial institutions or other businesses related to banking 14

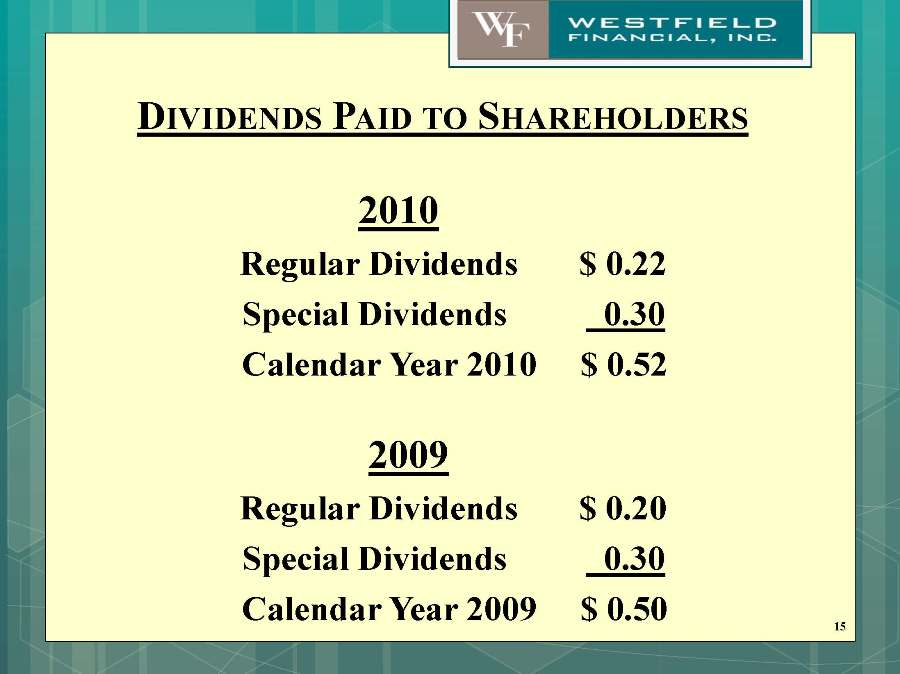

DIVIDENDS PAID TO SHAREHOLDERS 2010 Regular Dividends $ 0.22 Special Dividends 0.30 Calendar Year 2010 $ 0.52 2009 Regular Dividends $ 0.20 Special Dividends 0.30 Calendar Year 2009 $ 0.50 15

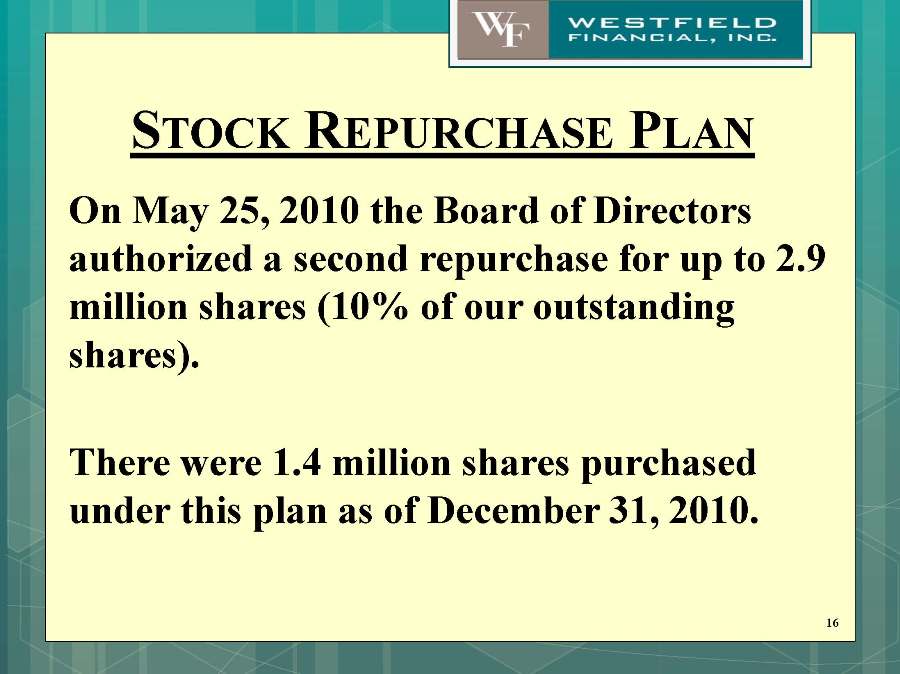

STOCK REPURCHASE PLAN On May 25, 2010 the Board of Directors authorized a second repurchase for up to 2.9 million shares (10% of our outstanding shares). There were 1.4 million shares purchased under this plan as of December 31, 2010. 16

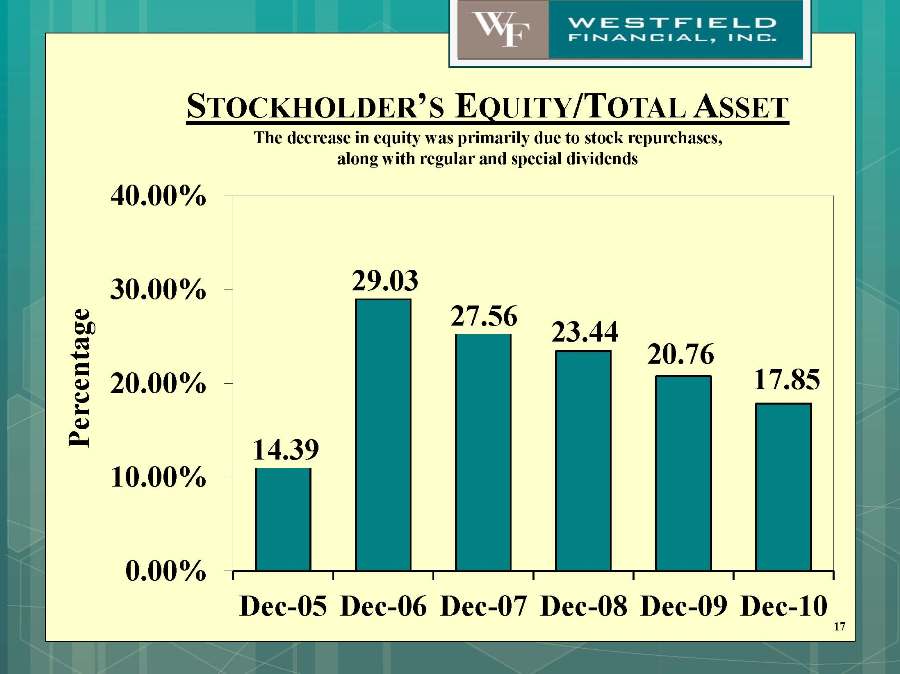

STOCKHOLDER’S EQUITY/TOTAL ASSET The decrease in equity was primarily due to stock repurchases, along with regular and special dividends 14.39 29.03 27.56 23.44 20.76 17.85 0.00% 10.00% 20.00% 30.00% 40.00% Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Percentage 17

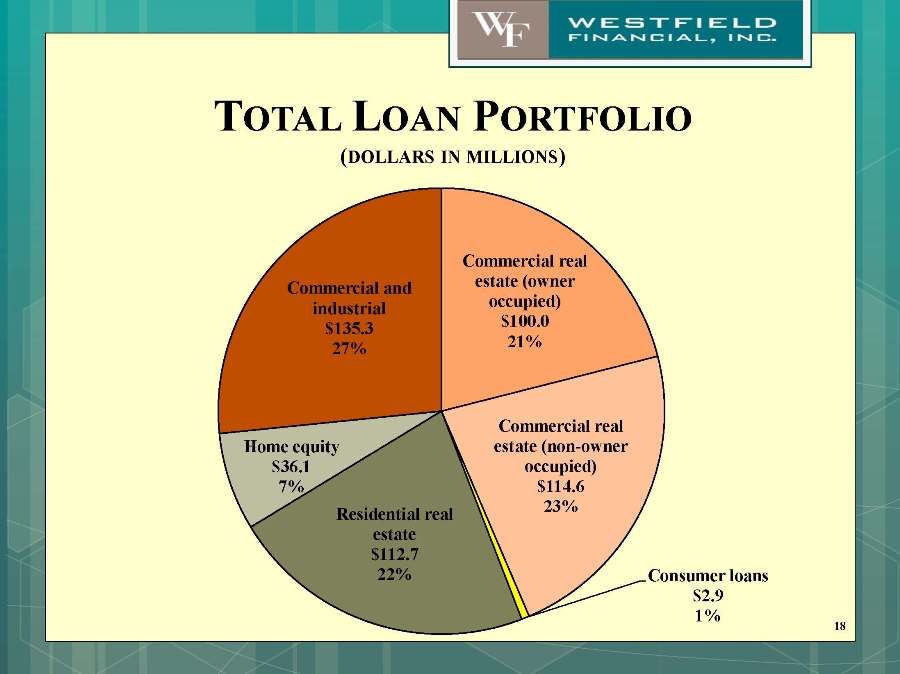

TOTAL LOAN PORTFOLIO (DOLLARS IN MILLIONS) Commercial real estate (owner occupied) $100.0 21% Commercial real estate (non-owner occupied) $114.6 23% Consumer loans $2.9 1% Residential real estate $112.7 22% Home equity $36.1 7% Commercial and industrial $135.3 27% 18

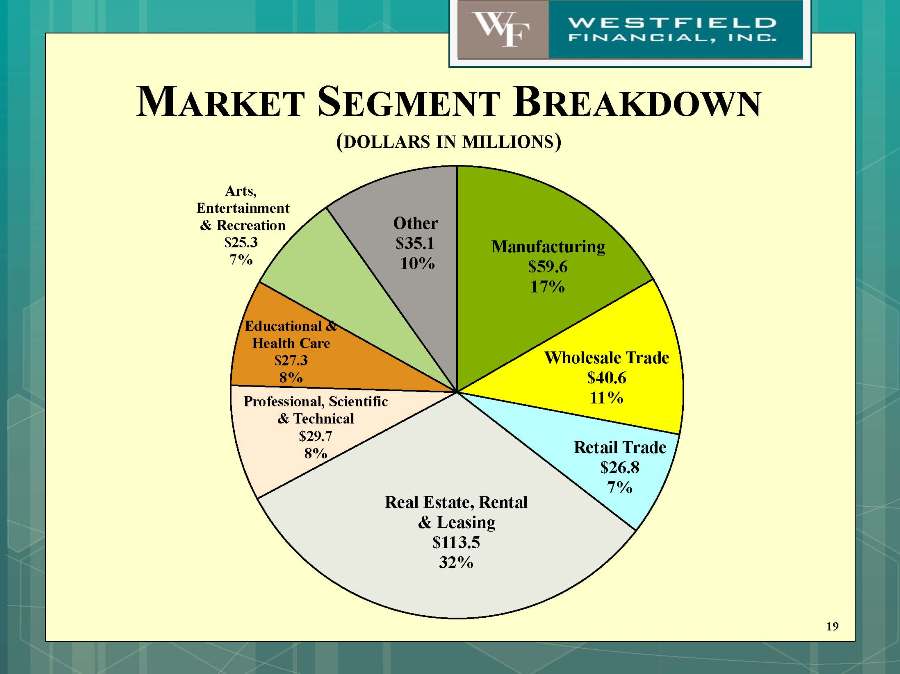

MARKET SEGMENT BREAKDOWN (DOLLARS IN MILLIONS) Manufacturing $59.6 17% Wholesale Trade $40.6 11% Retail Trade $26.8 7% Real Estate, Rental & Leasing $113.5 32% Professional, Scientific & Technical $29.7 8% Educational & Health Care $27.3 8% Arts, Entertainment & Recreation $25.3 7% Other $35.1 10% 19

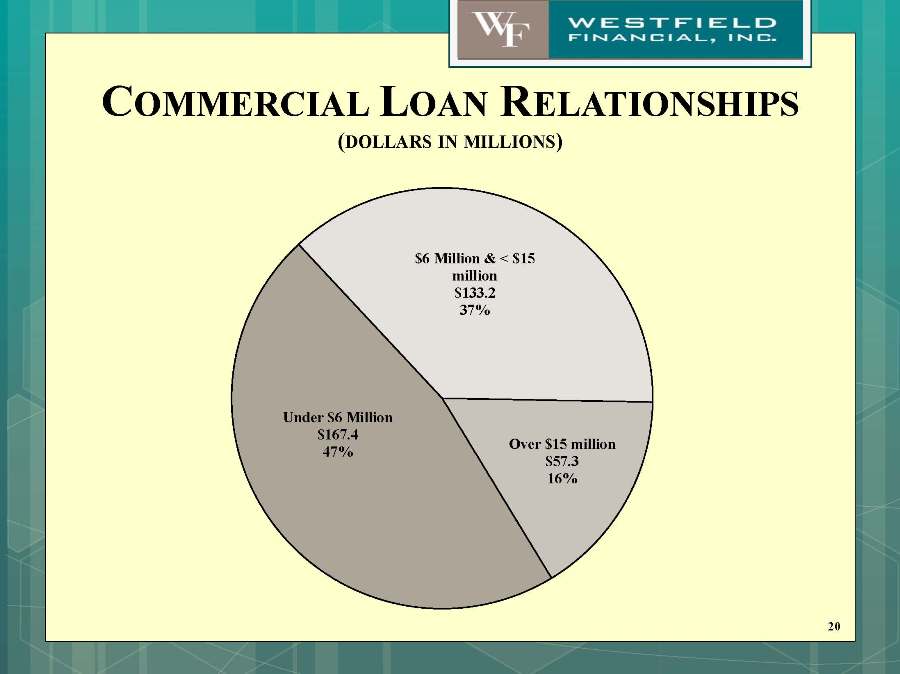

COMMERCIAL LOAN RELATIONSHIPS (DOLLARS IN MILLIONS) $6 Million & < $15 million $133.2 37% Over $15 million $57.3 16% Under $6 Million $167.4 47% 20

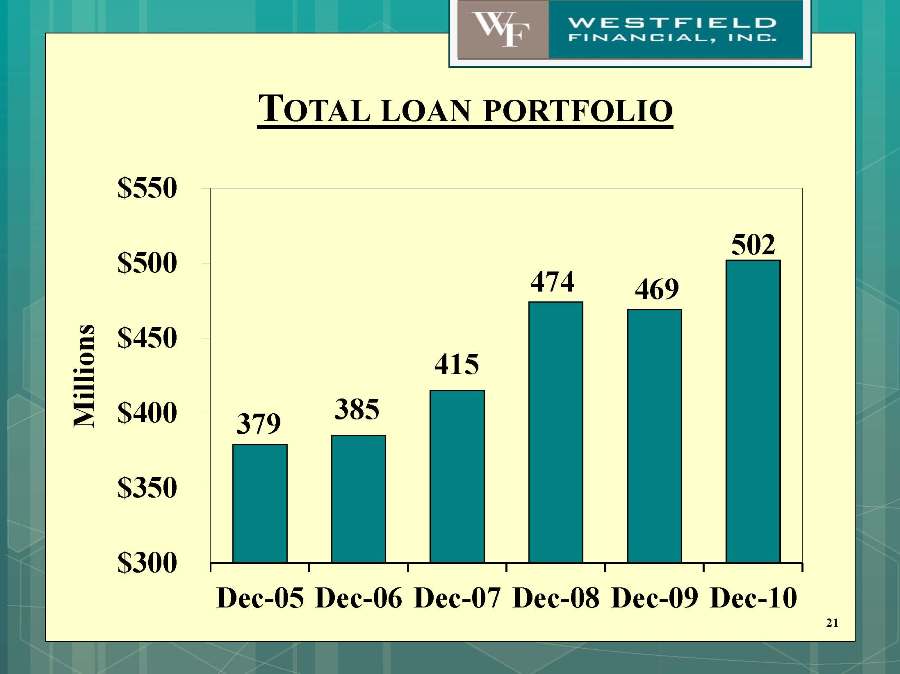

TOTAL LOAN PORTFOLIO 379 385 415 474 469 502 $300 $350 $400 $450 $500 $550 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Millions 21

COMMERCIAL & INDUSTRIAL LOANS 100 100 117 154 145 135 $0 $30 $60 $90 $120 $150 $180 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Millions 22

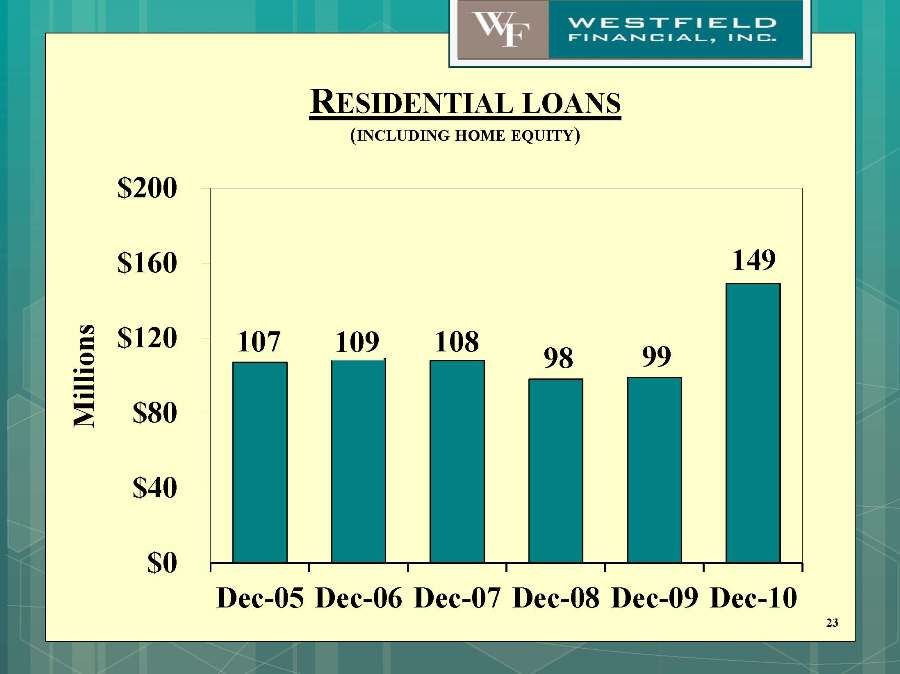

RESIDENTIAL LOANS (INCLUDING HOME EQUITY) 107 109 108 98 99 149 $0 $40 $80 $120 $160 $200 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Millions 23

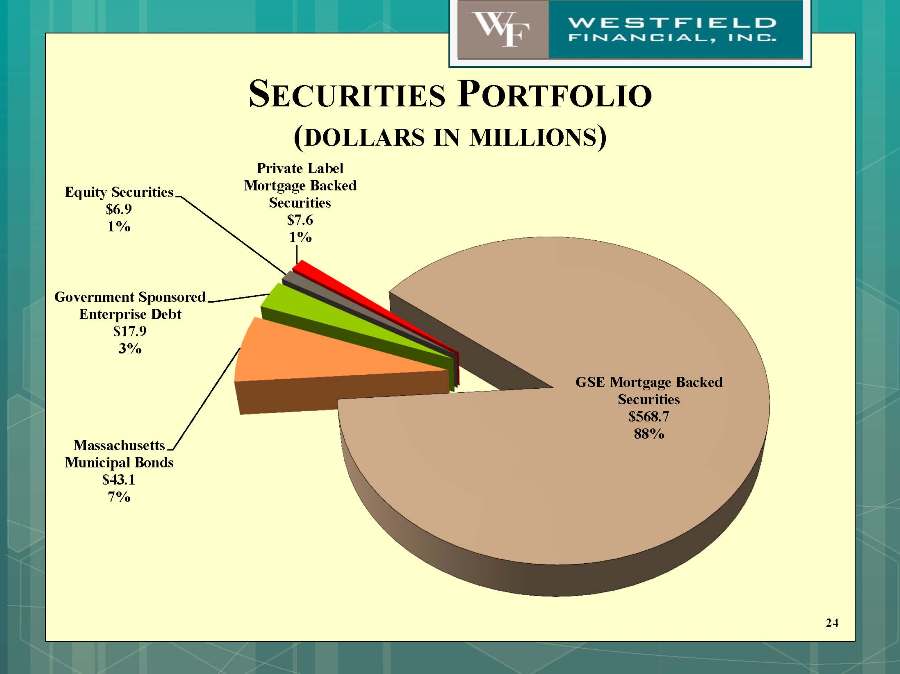

SECURITIES PORTFOLIO (DOLLARS IN MILLIONS) Government Sponsored Enterprise Debt $17.9 3% Equity Securities $6.9 1% Private Label Mortgage Backed Securities $7.6 1% GSE Mortgage Backed Securities $568.7 88% Massachusetts Municipal Bonds $43.1 7% 24

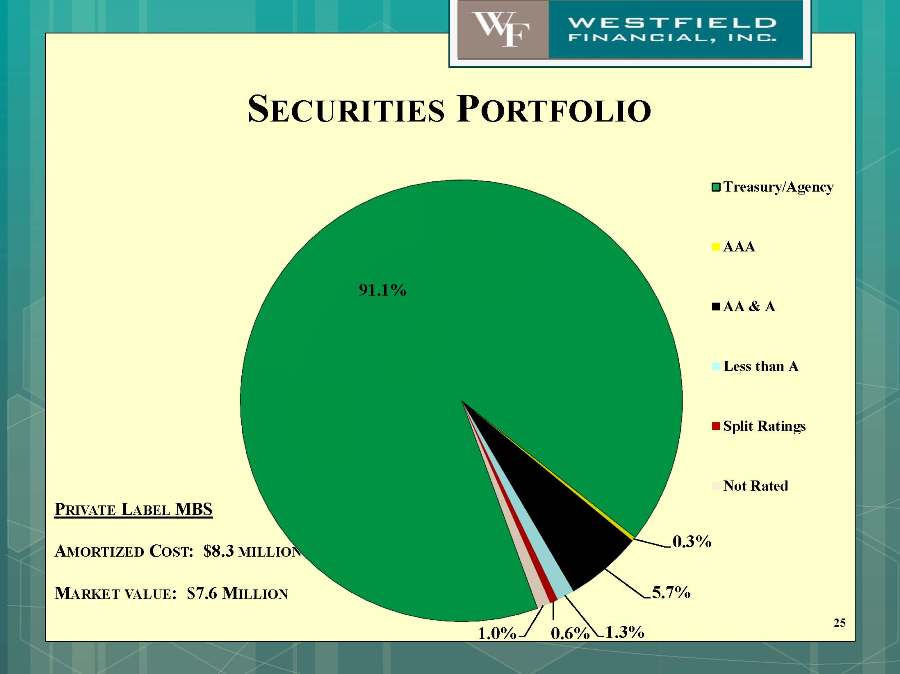

SECURITIES PORTFOLIO PRIVATE LABEL MBS AMORTIZED COST: $8.3 MILLION MARKET VALUE: $7.6 MILLION 25 Treasury/Agency AAA AA & A Less than A Split Ratings Not Rated 0.3% 5.7% 1.3% 0.6% 1.0% 91.1%

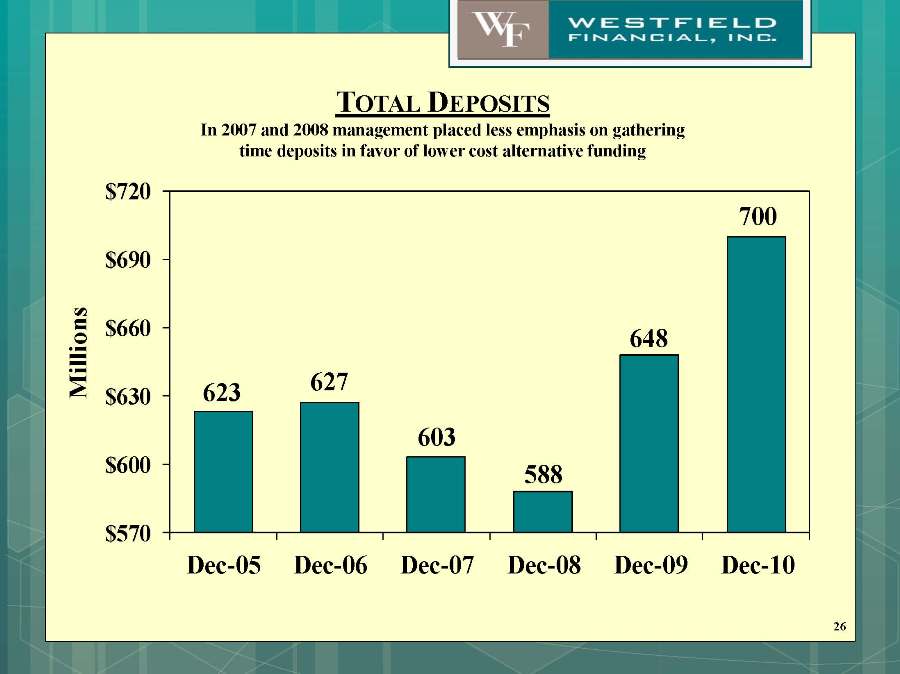

TOTAL DEPOSITS In 2007 and 2008 management placed less emphasis on gathering time deposits in favor of lower cost alternative funding 26 623 627 603 588 648 700 $570 $600 $630 $660 $690 $720 Millions Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10

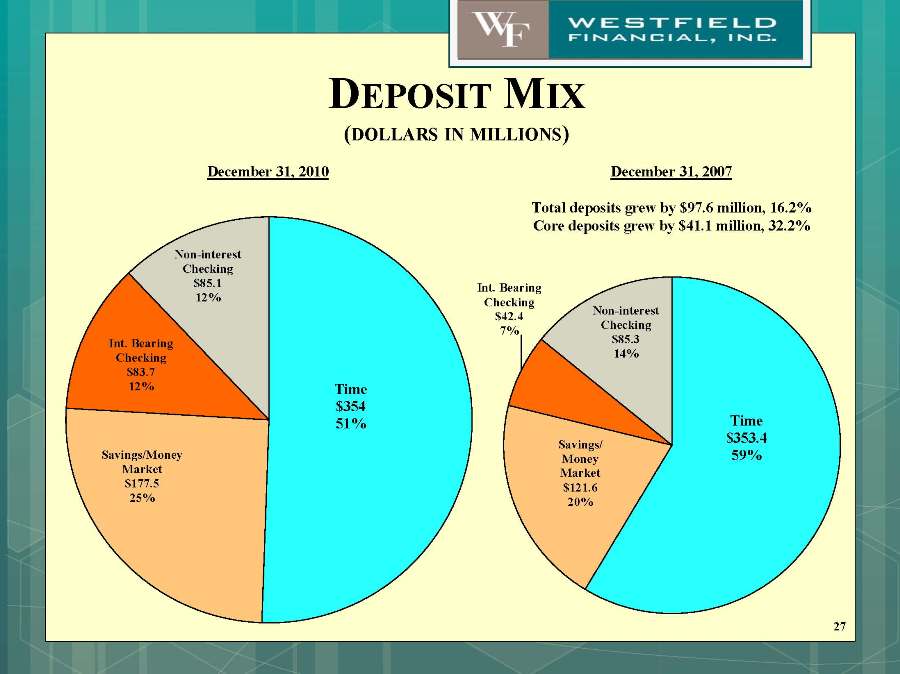

DEPOSIT MIX (DOLLARS IN MILLIONS) December 31, 2007 Total deposits grew by $97.6 million, 16.2% Core deposits grew by $41.1 million, 32.2% December 31, 2010 27 Int. Bearing Checking $42.4 7% Non-interest Checking $85.3 14% Time $353.4 59% Savings/Money Market $121.6 20% Time $354 51% Savings/Money Market $177.5 25% Int. Bearing Checking $83.7 12% Non-interest Checking $85.1 12%

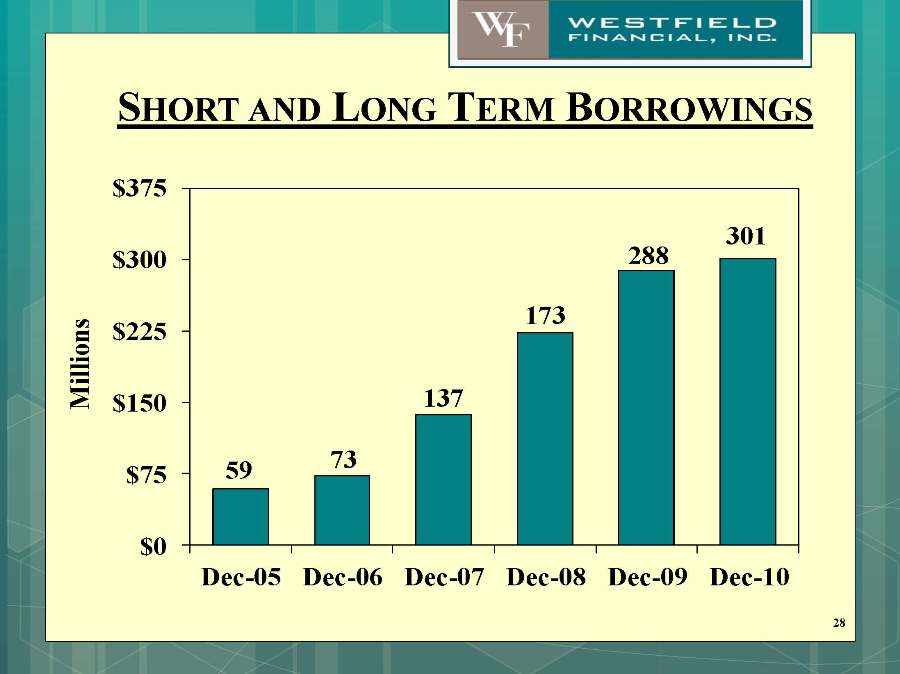

SHORT AND LONG TERM BORROWINGS 59 73 137 173 288 301 $0 $75 $150 $225 $300 $375 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Millions 28

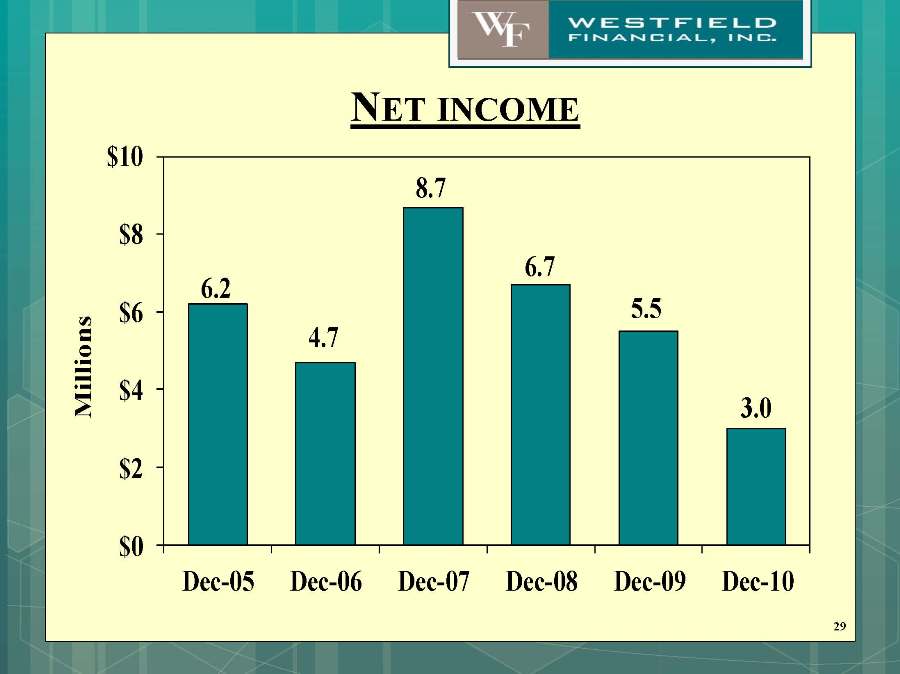

NET INCOME $10 $8 $6 $4 $2 $0 6.2 4.7 8.7 6.7 5.5 3.0 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 29 Millions

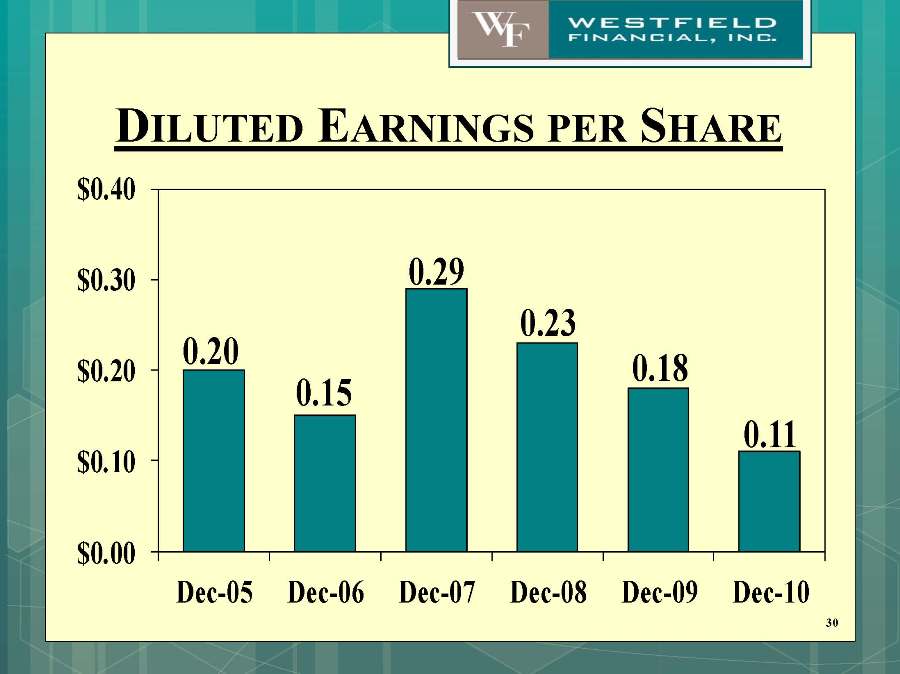

DILUTED EARNINGS PER SHARE 30 0.20 0.15 0.29 0.23 0.18 0.11 $0.00 $0.10 $0.20 $0.30 $0.40 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10

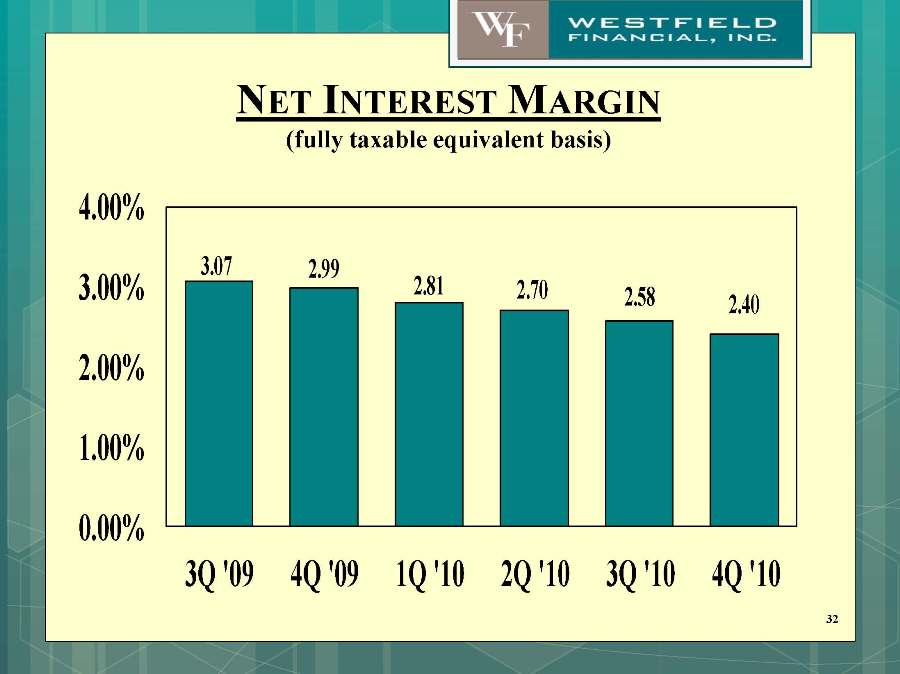

MARGIN PRESSURE IN 2010 BUT TRENDING POSITIVE INTO 2011 Faced margin pressure in 2010 resulting from declining rate environment. Historically low mortgage rates lead to heavy prepayments in mortgage-backed securities which were reinvested in a lower rate environment, thus reducing yields. As rates increased late in the fourth quarter, management observed a positive trend in net interest income, particularly in December. The trend continues in early 2011. 31

NET INTEREST MARGIN (fully taxable equivalent basis) 32 4.00% 3.00% 2.00% 1.00% 0.00% 3.07 2.99 2.81 2.70 2.58 2.40 3Q 4Q ’09 1Q ’10 2Q ’10 3Q ’10 4Q ‘10

Thank You 33