Attached files

Table of Contents

As filed with Securities and Exchange Commission on February 17, 2011

Registration No. 333-166807

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 4

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

TMS International Corp.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 3310 | 20-5899976 | ||

| (State of Incorporation) | (Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

12 Monongahela Avenue

P.O. Box 2000

Glassport, PA 15045

(412) 678-6141

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Joseph Curtin

President and Chief Executive Officer

TMS International Corp.

12 Monongahela Avenue

P.O. Box 2000

Glassport, PA 15045

(412) 678-6141

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

| Joel I. Greenberg, Esq. Derek Stoldt, Esq. Kaye Scholer LLP 425 Park Avenue New York, New York 10022 (212) 836-8000 |

Thomas E. Lippard, Esq. TMS International Corp. 12 Monongahela Avenue P.O. Box 2000 Glassport, PA 15045 (412) 678-6141 |

Valerie Ford Jacob, Esq. Daniel J. Bursky, Esq. Fried, Frank, Harris, Shriver & Jacobson LLP One New York Plaza New York, New York 10004 (212) 859-8000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer þ | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) | ||||||

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to Be Registered | Proposed Maximum Aggregate Offering Price (1)(2) |

Amount of Registration Fee (3) | ||

| Class A common stock, par value $0.001 per share |

$150,000,000 | $10,695 | ||

| (1) | Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Includes the offering price of shares of class A common stock that may be purchased by the underwriters upon the exercise of their overallotment option. |

| (3) | Previously paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), shall determine.

Table of Contents

The information in this prospectus is not complete and may be changed. Neither we nor the selling stockholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated February 17, 2011

P R O S P E C T U S

Shares

TMS INTERNATIONAL CORP.

Class A Common Stock

This is TMS International Corp.’s initial public offering. We are selling shares of our class A common stock, and the selling stockholders are selling shares of class A common stock. We will not receive any proceeds from the sale of shares by the selling stockholders.

We expect the public offering price to be between $ and $ per share. Currently, no public market exists for the shares. We have applied for listing of our class A common stock on the New York Stock Exchange under the symbol “TMS.”

Our class A common stock and class B common stock vote as a single class on all matters, except as otherwise provided in our restated certificate of incorporation or as required by law, with each share of class A common stock entitling its holder to one vote and each share of class B common stock entitling its holder to ten votes.

Upon completion of this offering, Onex Corporation and its affiliates will beneficially own approximately % of the aggregate voting power of our class A common stock and class B common stock, or approximately % if the underwriters exercise their overallotment option in full. Accordingly, we will be a “controlled company” under the rules of the New York Stock Exchange.

Investing in the class A common stock involves risks, including those in the “Risk Factors” section beginning on page 16 of this prospectus.

| Per Share |

Total |

|||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| Proceeds, before expenses, to the selling stockholders |

$ | $ | ||||||

The underwriters may also purchase up to an additional and shares of class A common stock from us and the selling stockholders, respectively, at the public offering price, less the underwriting discount, within 30 days from the date of this prospectus to cover overallotments, if any. The number of shares that the underwriters purchase from us and the selling stockholders shall be allocated pro rata based upon the number of shares initially sold in connection with this offering.

Neither the Securities and Exchange Commission, or SEC, nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The shares will be ready for delivery on or about , 2011.

| BofA Merrill Lynch | Credit Suisse | J.P. Morgan |

The date of this prospectus is , 2011

Table of Contents

Table of Contents

| Page | ||||

| 1 | ||||

| 16 | ||||

| 36 | ||||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| 42 | ||||

| 44 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

48 | |||

| 77 | ||||

| 94 | ||||

| 100 | ||||

| 105 | ||||

| 123 | ||||

| 125 | ||||

| 128 | ||||

| 132 | ||||

| 135 | ||||

| 137 | ||||

| 141 | ||||

| 148 | ||||

| 148 | ||||

| 148 | ||||

| G-1 | ||||

| F-1 | ||||

You should rely only on the information contained in this document and any free writing prospectus prepared by or on behalf of us that we have referred to you. We have not, the selling stockholders have not and the underwriters have not authorized anyone to provide you with additional or different information from that contained in this prospectus. If anyone provides you with additional, different or inconsistent information, you should not rely on it. We and the selling stockholders are offering to sell, and seeking offers to buy, shares of our class A common stock only in jurisdictions where offers and sales are permitted. The information in this document may only be accurate on the date of this document, regardless of its time of delivery or of any sales of shares of our class A common stock. Our business, financial condition, results of operations or cash flows may have changed since such date.

This prospectus contains trademarks and registered marks. Unless otherwise indicated, TMS International Corp. or a subsidiary thereof owns such registered marks, including: Tube City IMS®, We Create Value®, Scrap Optimiser®, Genblend®, The Evolution of Value® and certain related designs and logos.

i

Table of Contents

ABOUT THIS PROSPECTUS

Unless the context otherwise indicates or requires, as used in this prospectus:

| • | “Company,” “we,” “our” or “us” refers to TMS International Corp. and its consolidated subsidiaries; |

| • | “Mill Services Group” refers to the mill services group segment of the Company; |

| • | “Onex” refers to Onex Partners II LP, collectively with other entities affiliated with Onex Corporation; |

| • | “Onex Acquisition” refers to the acquisition of the Predecessor Company on January 25, 2007 by Onex and members of management and the board of directors of Tube City IMS Corporation, a wholly owned subsidiary of the Company; |

| • | “Predecessor Company” refers to Tube City IMS Corporation and its subsidiaries prior to the Onex Acquisition; |

| • | “Raw Material and Optimization Group” refers to the raw material and optimization group segment of the Company; and |

| • | “Successor Company” refers to the Company after the Onex Acquisition. |

INDUSTRY, MARKET AND GEOGRAPHICAL DATA

This prospectus includes industry data that we obtained from periodic industry studies and reports, including from The World Steel Association, J.D. Power & Associates, CRU International Ltd., Metals Service Center Institute, IBIS World, Inc., F.W. Dodge, Federal Reserve Statistical Release, Livingston Survey and the American Iron and Steel Institute. In addition, this prospectus includes market share and industry data that we prepared primarily based on our knowledge of the industry in which we operate. The basis of our belief regarding such statements includes the extensive knowledge that our management team has of the outsourced steel services industry, regulatory filings and other publicly-available information about our competitors and market information provided by customers. Statements as to our market position relative to our competitors are approximated by management and are based on the above-mentioned third-party data and internal analyses and estimates.

Where applicable, we report market and other data on the basis of Revenue After Raw Materials Costs, a non-GAAP financial measure that we believe is useful in measuring the operating performance of companies that have procurement businesses, because it excludes the fluctuations in market prices of raw materials procured for and sold to customers that offset on a procurement company’s income statement.

Unless otherwise noted, all information regarding our market share is based on the latest data available to us, and all dollar amounts refer to U.S. dollars. References in this prospectus to a “ton” of material refer to a weight measurement of 2,000 pounds of that material, and references to a “metric ton” of material refer to a weight measurement of 2,204.6 pounds of that material. We have provided definitions for certain steel and outsourced steel services industry terms used in this prospectus in the “Glossary of Selected Industry Terms” on page G-1 of this prospectus.

When we use the term “North America” in this prospectus, we are referring to the United States and Canada. When we use the term “international,” we are referring to countries other than the United States and Canada. When we use the term “Latin America,” we are referring to Mexico, Central America, South America and the Caribbean, including Trinidad & Tobago.

ii

Table of Contents

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information that you may want to consider before making an investment decision. You should read the entire prospectus carefully, including the section describing the risks of investing in shares of our class A common stock under the caption “Risk Factors” and the consolidated financial statements and related notes included elsewhere in this prospectus, before making an investment decision. Some of the statements in this summary are forward-looking statements. For more information, please see “Forward-Looking Statements.”

Our Company

We are the largest provider of outsourced industrial services to steel mills in North America as measured by revenue and have a substantial and growing international presence. We offer the most comprehensive suite of outsourced industrial services to the steel industry. Our employees and equipment are embedded at customer sites and are integral throughout the steel production process other than steel making itself. Our services are critical to our customers’ 24-hour-a-day operations, enabling them to generate substantial operational efficiencies and cost savings while focusing on their core business of steel making. We operate at 73 customer sites in nine countries and our global raw materials procurement network spans five continents. Over the past 80 years we have established long-standing customer relationships and have served our top 10 customers, on average, for over 28 years. Our diversified customer base includes 12 of the top 15 largest global steel producers, including United States Steel, ArcelorMittal, Gerdau, Nucor, Baosteel, POSCO and Tata Steel. For the year ended December 31, 2010, our Total Revenue, Revenue After Raw Materials Costs and Adjusted EBITDA were $2,030.6 million, $466.1 million and $119.9 million, respectively. For a reconciliation of Total Revenue to Revenue After Raw Materials Costs, see “—Summary Consolidated Financial Data.”

Our range of specialized, value-added services is the broadest of any of our competitors and includes: (i) scrap management and preparation; (ii) semi-finished and finished material handling; (iii) metal recovery and slag handling, processing and sales; (iv) surface conditioning; (v) raw materials procurement and logistics; and (vi) proprietary software-based raw materials cost optimization. We combine this full suite of industrial services with a multi-faceted workforce, a large and diverse equipment fleet and rigorous safety and environmental compliance to deliver a differentiated service offering.

Our business model is characterized by long-term contracts and a highly variable cost structure, which enable us to generate strong Free Cash Flow. In 2010, 91% of our Revenue After Raw Materials Costs was generated from long-term contracts under which we provide one or more services. Our earnings are primarily driven by the steel production volumes of our customers rather than by steel prices. Based on production volumes for the year ended December 31, 2010, we estimate our existing contracts would generate approximately $1.7 billion of future Revenue After Raw Materials Costs over their remaining terms. More than 92% of such revenue would be generated from contracts that expire after 2013, and the weighted average remaining term of our contracts is approximately 4.0 years. Our cost structure is highly flexible, with approximately 80% of our cash operating costs being variable, enabling us to respond quickly to changes in market conditions.

Over the last six years, we have expanded from primarily serving North American steel companies to having 19% of our 2010 Revenue After Raw Materials Costs generated internationally. Further, we have grown our scale and diversity by expanding the number of customer sites at which we operate from 64 to 73 and our raw materials procurement locations from 11 to 25, and we have increased the average number of services offered at our customer sites from 2.0 to 2.3. Our growth plans include the following key elements: (i) continue to grow in international markets by leveraging our existing infrastructure, customer relationships, expertise and market credibility; (ii) continue to increase the number of our services offered to our existing customers through cross-selling; and (iii) grow through prudent acquisitions and selective additions to our service offerings.

1

Table of Contents

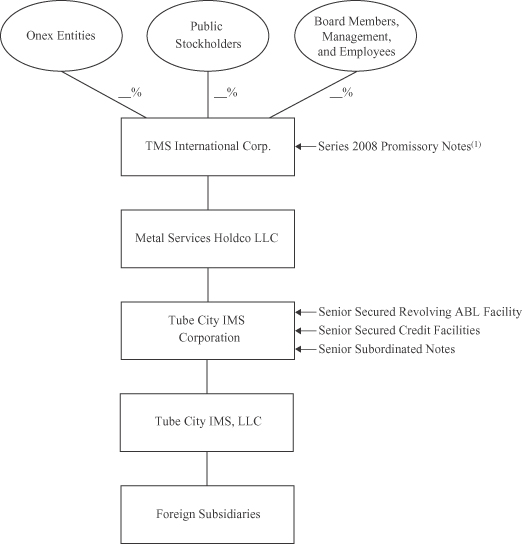

We are a holding company controlled by Onex, and we operate through our wholly-owned subsidiaries, including our primary operating company Tube City IMS, LLC.

Our Services

We provide a broad range of services through two segments: our Mill Services Group and our Raw Material and Optimization Group. For the year ended December 31, 2010, we generated Adjusted EBITDA of $111.3 million and $42.0 million from our Mill Services Group and our Raw Material and Optimization Group, respectively, before total Administrative segment costs of $33.4 million. By comparison, for the year ended December 31, 2009, we generated Adjusted EBITDA of $79.3 million and $31.7 million from our Mill Services Group and our Raw Material and Optimization Group, respectively, before total Administrative segment costs of $27.2 million.

Mill Services Group:

| • | Scrap Management and Preparation. We provide mills with inspection, preparation and delivery of raw materials, primarily scrap, as well as inventory control through logistics management. Our services include receiving, inspecting, sorting, cleaning, shearing, burning, shredding and baling of primarily ferrous scrap and scrap substitutes (such as pig iron) according to customer specifications. |

| • | Semi-Finished and Finished Material Handling. We handle and transport semi-finished and finished steel products such as steel slabs, billets and plates. Our skilled operators use large slab and billet pallet carriers, forklifts or tractor trailers to transport thousands of tons of materials. |

| • | Metal Recovery and Slag Handling, Processing and Sales. We recycle and process a steel making co-product, known as slag, to recover valuable metallic material that is either reused in the production of steel by the host mill or sold to other end users. The remaining non-metallic materials typically are sold to third parties as aggregates for use in cement production, road construction, agriculture and other applications. |

| • | Surface Conditioning. We pioneered the North American commercial application of robotic surface conditioning. Surface conditioning is a value-added process that removes imperfections from semi-finished steel products to be used in high-value applications that require unblemished finishes such as household appliances and automobiles. |

Raw Material and Optimization Group:

| • | Raw Materials Procurement and Logistics. We operate a worldwide procurement and logistics network to act on behalf of our customers, purchasing approximately nine million tons of raw material inputs annually, including ferrous scrap, scrap substitutes, coke, coal, ferro-alloys and other raw materials used in steel making. In addition to sourcing raw materials for our customers, we arrange point-to-point delivery logistics, providing our customers with a seamless solution globally. We represent certain customers on an exclusive basis globally in the purchase of their ferrous scrap requirements, and represent a number of customers on a non-exclusive basis in the purchase and sale of their scrap products used or generated in the steel and iron making processes while taking minimal inventory or price risk. We occasionally take measured market risk in connection with our raw materials procurement services by either purchasing raw materials at a fixed price without an immediate corresponding sale order or agreeing to sell raw materials at a fixed price before having procured such materials. |

2

Table of Contents

| • | Proprietary Software-Based Raw Materials Cost Optimization. Our raw materials cost optimization service allows our customers to achieve significant savings by optimizing their use of input materials (specifically ferrous scrap and scrap substitutes) to obtain the lowest liquid steel cost for a specified chemistry of steel. Our proprietary software applications aid mills in the planning, procurement and utilization of ferrous scrap and scrap substitutes, determining the lowest cost input mix based on market conditions, raw materials availability, on-site inventory levels and each steel mill’s unique operating characteristics. |

In addition, we provide other services that complement our primary offerings. We leverage our excellent customer relationships to actively pursue new types of service offerings to grow our business.

Our Market Opportunity

Efficient production of steel requires constant operation due to the high costs required to start up and heat the furnaces to the required temperatures. In addition, strict production schedules are essential in order to maximize utilization and productivity and to ensure a competitive cost position. Failures by outsourced service providers can result in significant losses for their customers due to delays in the steel production process or poor product quality. As a result, steel producers generally prefer to contract with proven outsourced service providers who have track records of reliable operational expertise, employee safety, environmental compliance and financial stability.

We believe the following key dynamics will drive the continued growth of the market for outsourced industrial services to the steel making industry:

| • | Increased Outsourcing, Especially in Developing Markets. The provision of critical industrial services is generally not a core competency of steel producers, yet it is essential to the efficient operation of their complex facilities. We believe that steel producers will increasingly utilize outsourced service providers in order to reduce costs and improve operational efficiency, enabling them to focus their human and capital resources on their core business of steel making. Steel producers in more developed markets such as North America and Western Europe have historically outsourced more industrial services than steel producers in developing markets such as Latin America, Eastern Europe, Asia and the Middle East. However, we believe that as the steel industries in developing markets mature, competition among steel producers will increase and cost and operational efficiencies will become more important, which will increase the amount of outsourcing in these markets. |

| • | Consolidation of Steel Producers Driving Outsourcing. The global steel industry has undergone significant consolidation over the last ten years. We believe that the evolution into a more consolidated, stable and competitive global steel industry has led to more sophisticated management practices, which have significantly increased the international adoption of outsourced industrial services by the steel industry. |

| • | Concentration of Outsourced Services with Fewer, Well-Established Service Providers. The outsourced industrial services market in which we operate is highly fragmented with a large number of small, local and regional service providers, and very few large providers with global capabilities. Many of our large global customers require a full suite of outsourced industrial services at multiple facilities across broad geographies. In addition, we believe these customers are seeking to decrease the administrative burden of managing multiple outsourced providers by reducing the number of vendors they engage to a manageable group of leading service providers differentiated by scale, breadth of service offering, proven service quality and safety. |

3

Table of Contents

| • | Increased Emphasis on Worker Safety and Environmental Compliance. Our customers are increasingly focused on worker safety and environmental compliance. Accordingly, our customers select industrial service providers with strong safety and environmental track records such as us. |

Current Conditions in the Steel Industry

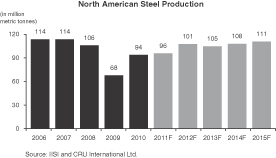

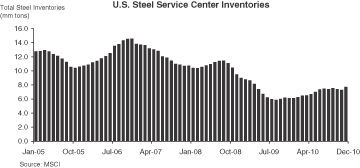

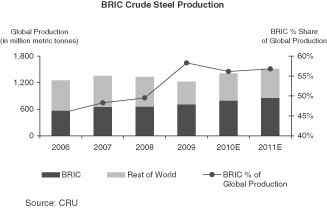

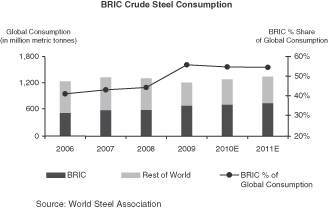

Global steel production is expected to grow at a compound annual growth rate, or CAGR, of 6.1% between 2010 and 2015, according to CRU International Ltd, driven by continued growth in emerging economies and the economic rebound in the developed economies. Steel production growth in North America, our largest market, has begun to recover from the lows of 2009 driven by economic recovery and re-stocking of inventories.

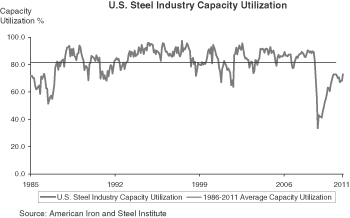

North American steel production declined precipitously during the last quarter of 2008 and the first quarter of 2009 as a result of the global economic crisis. Steel producers responded to the crisis by idling capacity to better align supply with demand, preserve liquidity and reduce costs. Since April 2009, steel production in North America has gradually improved in line with improving economic fundamentals. The U.S. steel industry production capacity utilization rate increased to 74% by the end of January 2011 from a low of 34% in December 2008, according to the American Iron and Steel Institute. North American production capacity utilization levels remain below 25-year average levels of 81%.

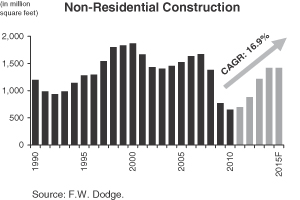

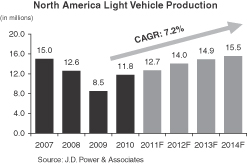

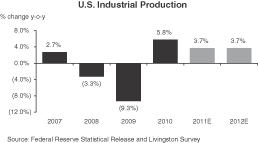

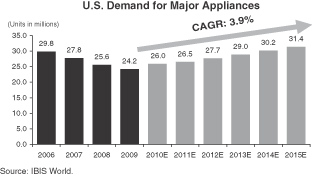

Steel demand in North America is driven primarily by applications in non-residential construction, automotive, industrial equipment and consumer appliance end markets, which appear to be in various stages of recovery and resumed growth at this time. Non-residential construction markets remained at cyclical lows in 2010, but are expected to start recovering in 2011 and grow at a CAGR of 16.9% between 2010 and 2015, according to F.W. Dodge Corporation. The North American automotive end-market experienced a strong rebound in 2010, posting a 38% increase in light vehicle production to 11.8 million units when compared to 2009, and is expected to continue to improve for the next several years, growing at a CAGR of 7.2% between 2010 and 2014, as per J.D. Power & Associates.

Our Competitive Strengths

| • | Leading Market Position. We are the largest provider of outsourced industrial services to steel mills in North America as measured by revenue and have a substantial and growing international presence. In North America, the largest outsourced steel services market, we are the largest provider of five of our six primary services, and we are the second largest provider of raw materials procurement services. In North America, we operate at more customer sites than any of our competitors, providing mill services at approximately 48% of steel producing sites, and arranging raw material transactions on behalf of nearly all major steel producers. Our scale and market position create economies of scale, purchasing power and an ability to rapidly deploy resources and equipment, enabling us to bid competitively on contracts globally. Over the past six years, we have built a substantial presence in Europe and Latin America and have the infrastructure required to offer all of our primary mill services. We have also built a substantial procurement presence in Asia and Europe and are able to offer our procurement services globally. |

| • | Broadest Portfolio of Services Globally. We provide the industry’s most comprehensive suite of outsourced industrial services to steel mills, enabling our customers to generate substantial cost savings through operational efficiencies while focusing on their core business of steel making. Our diversified offering of services and international presence afford us multiple entry opportunities for acquiring new customers and cross-selling. Approximately 54% of our 35 new contracts won since |

4

Table of Contents

| the beginning of 2005 were the result of selling new services to existing customers. As a result, we have increased the average number of our services offered at our customer sites from 2.0 services in 2005 to 2.3 services in 2010. |

| • | Long-Standing Relationships with Leading Steel Producers. We have established long-standing customer relationships and have served our top 10 customers, based on Revenue After Raw Materials Costs for the year ended December 31, 2010, on average for over 28 years. In addition, our customer base includes 12 of the top 15 largest global steel producers. Our services are critical to our customers’ operations, and we believe we are able to provide these services in a more cost-effective manner than if they performed them in-house. Our Mill Services Group employees and equipment are typically embedded at customer sites and have daily interaction with customer personnel, and our Raw Material and Optimization Group is the exclusive purchasing agent for scrap and scrap substitutes for certain of our largest customers. Our deep operational integration, combined with our record of excellent performance and customer service, has driven strong customer loyalty. In addition, our customer relationships are underpinned by an industry-recognized safety record that is consistently better than industry averages. As a result, our contract renewal rate has been greater than 96% from 2005 to 2010 based on Revenue After Raw Materials Costs. |

| • | Long-Term Contracted Revenue and Variable Cost Structure. We provide our services through long-term contracts with our customers, which are typically structured on a fee-per-ton basis tied to production volumes and are not based on the underlying price of steel. In addition, our contracts typically include tiered pricing structures, with unit prices that increase as volumes decline, and/or minimum monthly fees, each of which stabilizes our revenue in the event of volume fluctuations. They also typically provide for price adjustments based on published indices which pass defined increases or decreases in key operating costs through to our customers. We also have a highly scalable cost structure with approximately 80% of our cash operating costs being variable, which protects our profitability during more difficult market conditions such as we experienced during 2009. |

| • | Strong Cash Flow Generation Drives Earnings Growth. Our business model and cost structure enable us to generate strong Free Cash Flow to fund Capital Expenditures and drive earnings growth. We enter into long-term contracts requiring Growth Capital Expenditures only if we determine that they will produce targeted returns on investment. This discipline assures that we deploy our Free Cash Flow in a focused manner to drive stockholder returns. Throughout the recent economic downturn, we continued to enter into new long-term contracts and invest growth capital, thereby positioning us to generate strong earnings growth as steel production volumes continue to recover. |

| • | Experienced, Proven Management Team. Our executive management team has extensive experience, with the members having an average of over 25 years in our industry and over 18 years with us. Our management team successfully integrated the legacy Tube City and IMS businesses, which combined in 2004, and has continued to grow our customer base while consistently improving our industry-leading safety record. In addition, our management team has executed upon our strategic plan to build our international business, increasing the contribution of international Adjusted EBITDA as a percentage of total Adjusted EBITDA from 2% in 2005 to 16% in 2010. In 2009, one of the worst years on record for steel production, our management team responded rapidly, realizing meaningful overhead cost reductions that we believe are sustainable, and carefully managed equipment deployment and Maintenance Capital Expenditures, collectively resulting in expanded Adjusted EBITDA Margins and significant Free Cash Flow. |

5

Table of Contents

Our Growth Strategy

| • | Continue to Grow in International Markets. We believe we have substantial international growth opportunities which will be driven by expansion of our existing market share and continued growth in outsourcing in developing markets, such as Latin America, Eastern Europe, Asia and the Middle East, as steel producers discover that outsourcing certain functions enables them to be performed more cost effectively, allowing them to concentrate their attention and resources on steel making. As steel production in developing markets continues to mature and outsourcing of the services that we offer becomes more prevalent, we believe that we are well positioned to capitalize on opportunities due to our scale, existing infrastructure, proven track record and marketplace intelligence. In more developed international markets, outsourcing is common, but we believe steel producers desire more competition from proven operators such as ourselves, providing opportunities to gain market share. |

| • | Increase Penetration of Existing Customers. We believe we are in a unique position to leverage our existing relationships and embedded operations at our customers’ sites to cross-sell additional service offerings. Approximately 54% of our 35 new contracts won since the beginning of 2005 were the result of cross-selling, driven by our customers’ high satisfaction with our existing services, their desire to consolidate services with their best providers and our focus on offering our full array of services to our customers. Over one-half of the new cross-sell contracts we secured since the beginning of 2005 were the result of displacing the incumbent provider, and we will seek to continue to grow through these types of market share gains. On average, we provide approximately 2.3 out of our six primary services at each customer site where we currently operate (up from 2.0 in 2005), representing a significant opportunity to grow within our existing customer base. |

| • | Selectively Expand Service Offerings. We will continue to identify opportunities to leverage our competencies to provide value-added services beyond our existing service offerings that fulfill our customers’ needs. Our embedded on-site presence and daily operational integration with our customers create unique relationships, often allowing us the first opportunity to propose additional outsourced services. We will also continue to expand our global Raw Material and Optimization Group into commodities that we do not currently handle in large quantities. |

| • | Maximize Profit Potential. We will continue to commit growth capital to contracts where we believe our returns will drive future profitability. We will also continue to streamline our cost structure and pay down debt in order to improve operating margins and grow earnings. In addition, our goal is to continue to optimize our equipment utilization to reduce maintenance costs and drive higher cash flow, providing us flexibility to make new growth investments. |

| • | Selectively Pursue Acquisitions and Partnerships. We will selectively pursue strategic acquisitions and partnerships that will diversify our existing portfolio of products and services, expand our geographic footprint and build new customer relationships. Our management team has significant international operating experience in providing outsourced services to the steel industry and strong relationships with leading global and regional steel producers. We believe this will enable us to identify and pursue attractive acquisitions and partnerships. |

Risk Factors

An investment in our class A common stock is subject to substantial risks and uncertainties. Before investing in our class A common stock, you should carefully consider the following, as well as the more detailed discussion of risk factors and other information included in this prospectus:

| • | North American and global steel production volumes and demand for steel are impacted by regional and global economic conditions and by conditions in our key end markets, including automotive, consumer appliance, general industrial and construction markets; |

6

Table of Contents

| • | we rely on a number of significant customers and contracts, the loss of any of which could have a material adverse effect on our results of operations; |

| • | some of our operations are subject to market price and inventory risk arising from changes in commodity prices; |

| • | if we fail to make accurate estimates in bidding for long-term contracts, our profitability and cash flow could be materially adversely affected; |

| • | operating in various international jurisdictions subjects us to a variety of risks; |

| • | our business involves a number of personal injury and other operating risks, and our failure to properly manage these risks could result in liabilities not covered by insurance and loss of future business, and could have a material adverse effect on our results of operations; and |

| • | our business is subject to environmental regulations that could expose us to liability, increase our cost of operations and otherwise have a material adverse effect on our results of operations. |

History and Corporate Information

We operate through our wholly-owned subsidiaries, including our primary operating company Tube City IMS, LLC, a Delaware limited liability company. The Raw Material and Optimization Group traces its roots to Tube City Iron & Metal, or Tube City, formed in 1926 as a scrap metal dealer and processor in McKeesport, Pennsylvania. The Mill Services Group traces its roots to International Mill Service, or IMS, which started in the Cleveland, Ohio area in 1936 in the sand and gravel business and evolved into the slag processing and metal recovery business. Tube City and IMS were combined in 2004.

We currently have approximately 3,500 employees and operate at 73 customer sites around the world. Our principal executive offices are located at 12 Monongahela Avenue, Glassport, Pennsylvania 15045, and our telephone number is (412) 678-6141. Our website address is www.tubecityims.com. Information contained on our website is not a part of this prospectus.

Our Controlling Stockholder

We were formed by Onex on October 31, 2006 in connection with the acquisition in January 2007 of Tube City IMS Corporation from its previous owners. Onex is one of North America’s oldest and most successful investment firms committed to acquiring and building high-quality businesses in partnership with talented management teams. Onex makes private equity investments through the Onex Partners and ONCAP families of funds and has completed more than 290 acquisitions valued at approximately $49 billion. Over Onex’s history, it has had extensive experience investing in outsourcing-focused and industrial businesses. Onex’s recent investments include Spirit AeroSystems, Inc., Allison Transmission, Inc., Husky Injection Molding Systems Ltd., Carestream Health, Inc. and Emergency Medical Services Corporation. Onex’s businesses generate annual revenues of C$37 billion, have assets of C$42 billion and employ over 240,000 people worldwide. Onex shares trade on the Toronto Stock Exchange under the stock symbol “OCX.”

7

Table of Contents

The Offering

| Class A common stock offered by us |

shares |

| Class A common stock offered by the selling stockholders |

shares |

| Shares of class A common stock to be outstanding after the offering |

shares |

| Shares of class B common stock to be outstanding after the offering |

shares |

| Overallotment option |

The underwriters may also purchase up to an additional and shares of class A common stock from us and the selling stockholders, respectively, at the public offering price, less the underwriting discount, within 30 days from the date of this prospectus to cover overallotments, if any. The number of shares that the underwriters purchase from us and the selling stockholders shall be allocated pro rata based upon the number of shares initially sold in connection with this offering. |

| Use of proceeds |

We estimate that the net proceeds from this offering, after deducting underwriting discounts and commissions and estimated offering expenses, will be $ million to us and $ million to the selling stockholders, assuming the shares are offered at $ per share (the mid-point of the price range set forth on the cover of this prospectus). We intend to use the net proceeds to us from this offering for the repayment of certain debt and general corporate purposes. We will not receive any proceeds from the sale of shares by the selling stockholders. See “Use of Proceeds.” |

| Dividends |

We do not anticipate paying any dividends to our stockholders for the foreseeable future. See “Dividend Policy.” |

| Special voting rights |

Each share of our class B common stock will automatically convert into a share of our class A common stock upon a transfer thereof to any person other than the holders of our class B common stock on the date of this offering or their respective affiliates, including upon the sale of any shares in this offering by any selling stockholders. Our class A common stock and class B common stock vote as a single class on all matters, except as otherwise provided in our restated certificate of incorporation or as required by law, with each share of class A common stock entitling its holder to one vote and, prior to the Transition Date (defined below), each share of class B common stock entitling its holder to ten votes. If the Transition Date occurs, the number of votes per share of class B common stock will be reduced automatically to one vote per share. The “Transition Date” will occur when the total number of outstanding shares of class B common stock is less than 10% of the total number of shares of class A common stock and class B common stock outstanding. After giving effect to |

8

Table of Contents

| this offering, holders of our class B common stock will control % of the combined voting power of our outstanding common stock. See “Principal and Selling Stockholders” and “Description of Capital Stock.” |

| NYSE symbol |

We have applied for listing of our shares of class A common stock on the New York Stock Exchange (“NYSE”) under the symbol “TMS.” |

| Risk factors |

See “Risk Factors” beginning on page 16 of this prospectus for a discussion of material risks that prospective purchasers of our common stock should consider. |

The number of shares to be outstanding after this offering is based on shares of class A common stock and shares of class B common stock outstanding as of , 2011, and excludes shares of class B common stock to be granted under our Restricted Stock Plan concurrently with this offering and shares of class A common stock reserved for future issuance under our Long-Term Incentive Plan. Concurrently with this offering, we will award options to purchase shares of class A common stock at an exercise price equal to the public offering price of the class A common stock. We are not registering the offering of shares of class A common stock into which the shares of class B common stock may be converted following this offering.

Unless we specifically state otherwise, the information in this prospectus assumes:

| • | that our class A common stock will be sold at $ per share, which is the mid-point of the price range set forth on the front cover page of this prospectus; |

| • | that the underwriters will not exercise their overallotment option; |

| • | the conversion of all outstanding shares of our class A preferred stock into shares of our class B common stock concurrently with the completion of this offering, using the assumptions set forth below; |

| • | a -for-one split of shares of our common stock, which was effective on , 2011; |

| • | the recapitalization of our existing common stock into class B common stock, which was effective as of , 2011; and |

| • | the effectiveness of our second amended and restated certificate of incorporation upon the completion of this offering. |

The conversion of our class A preferred stock assumes (i) a conversion date of , 2011, and (ii) a conversion price of $ (which is the mid-point of the price range set forth on the front cover page of this prospectus). Concurrently with this offering, each share of our class A preferred stock will convert into the number of shares of class B common stock equal to the liquidation value of such share of class A preferred stock at the time of conversion, plus accrued dividends, divided by the public offering price per share of class A common stock in this offering. A $1.00 increase in the assumed initial public offering price of $ per share would decrease the number of shares of class B common stock issuable upon the conversion of the class A preferred stock by approximately shares, and a $1.00 decrease in the assumed initial public offering price would increase the number of shares of class B common stock issuable upon the conversion of the class A preferred stock by approximately shares.

9

Table of Contents

The purpose of the recapitalization of our existing common stock into class B common stock is to provide our current common stockholders with class B common stock, each share of which entitles its holder to 10 votes for so long as the class B common stock equals or exceeds 10% of the total class A and class B common stock then outstanding. The impact of the share recapitalization will be that, upon completion of this offering, Onex will, for the foreseeable future, continue to have significant influence over our management and affairs and be able to control virtually all matters requiring stockholder approval even if its equity ownership falls below 50%, including the election and removal of directors, the adoption or amendment of our certificate of incorporation and bylaws, possible mergers, corporate control contests and significant corporate transactions. Onex may also delay or prevent a change of control of us, even if that change of control would benefit our stockholders, which could deprive you of the opportunity to receive a premium for your class A common stock.

10

Table of Contents

Our Corporate Structure

After giving effect to this offering, the chart below summarizes our corporate structure:

| (1) | We intend to redeem in full the series 2008 promissory notes with a portion of the net proceeds of this offering. |

11

Table of Contents

Summary Consolidated Financial Data

The summary consolidated historical statement of operations data for the years ended December 31, 2010, 2009 and 2008 have been derived from our audited consolidated financial statements included elsewhere in this prospectus.

The balance sheet data as of December 31, 2010 and December 31, 2009 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. The balance sheet data as of December 31, 2008 has been derived from our audited financial statements not included in this prospectus.

The summary consolidated financial data set forth below should be read together with “Capitalization,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated historical financial statements and the notes to those financial statements included elsewhere in this prospectus.

| (dollars in thousands) |

Year

ended December 31, 2008 |

Year

ended December 31, 2009 |

Year ended December 31, 2010 |

|||||||||

| Statement of Operations Data: |

||||||||||||

| Revenue: |

||||||||||||

| Revenue from Sale of Materials |

$ | 2,595,608 | $ | 986,304 | $ | 1,629,119 | ||||||

| Service Revenue |

387,305 | 312,035 | 401,511 | |||||||||

| Total Revenue |

2,982,913 | 1,298,339 | 2,030,630 | |||||||||

| Costs and expenses: |

||||||||||||

| Cost of Raw Materials Shipments |

2,515,425 | 939,993 | 1,564,504 | |||||||||

| Site Operating Costs |

298,394 | 233,120 | 293,003 | |||||||||

| Selling, General and Administrative Expenses |

56,750 | 44,638 | 53,139 | |||||||||

| Provision for (Recovery of) Bad Debts |

9,166 | (5,419 | ) | 64 | ||||||||

| Provision for Transition Agreement |

— | 2,243 | — | |||||||||

| Depreciation |

61,108 | 57,567 | 49,317 | |||||||||

| Amortization |

11,972 | 12,193 | 12,191 | |||||||||

| Gain on Debt Extinguishment |

— | 1,505 | — | |||||||||

| Goodwill Impairment |

— | (55,000 | ) | — | ||||||||

| Disposition of Cumulative Translation Adjustment |

— | (1,560 | ) | — | ||||||||

| Interest Expense, Net |

(38,079 | ) | (44,825 | ) | (40,361 | ) | ||||||

| Income (Loss) Before Income Taxes |

(7,981 | ) | (85,876 | ) | 18,051 | |||||||

| Income Tax (Expense) Benefit |

1,891 | 6,885 | (10,903 | ) | ||||||||

| Net Income (Loss) |

$ | (6,090 | ) | $ | (78,991 | ) | $ | 7,148 | ||||

| Net Loss Attributable to Common Stock |

$ | (25,591 | ) | $ | (100,060 | ) | $ | (15,676 | ) | |||

12

Table of Contents

| (dollars in thousands) |

Year

ended December 31, 2008 |

Year

ended December 31, 2009 |

Year

ended December 31, 2010 |

|||||||||

| Cash Flow Data: |

||||||||||||

| Cash Provided by Operating Activities |

$ | 36,479 | $ | 73,223 | $ | 86,595 | ||||||

| Net Cash Used in Investing Activities |

(80,124 | ) | (36,140 | ) | (37,875 | ) | ||||||

| Net Cash (Used in) Provided by Financing Activities |

47,461 | (13,061 | ) | (29,042 | ) | |||||||

| Balance Sheet Data (at year end): |

||||||||||||

| Cash and Cash Equivalents |

$ | 5,792 | $ | 29,814 | $ | 49,492 | ||||||

| Working Capital(1) |

38,332 | 9,832 | 8,837 | |||||||||

| Goodwill and Other Intangible Assets |

480,606 | 420,418 | 407,443 | |||||||||

| Total Assets |

856,865 | 824,389 | 878,905 | |||||||||

| Long-term Debt, Including Current Portion and Indebtedness to Related Parties |

454,367 | 449,612 | 426,641 | |||||||||

| Redeemable Preferred Stock and Stockholders’ Deficit |

190,120 | 122,874 | 125,891 | |||||||||

| Other Financial Data: |

||||||||||||

| Revenue After Raw Materials Costs(2) |

$ | 467,488 | $ | 358,346 | $ | 466,126 | ||||||

| Adjusted EBITDA(3) |

103,178 | 83,764 | 119,920 | |||||||||

| Adjusted EBITDA Margin(4) |

22.1 | % | 23.4 | % | 25.7 | % | ||||||

| Capital Expenditures(5) |

$ | 62,852 | $ | 37,635 | $ | 39,816 | ||||||

| Growth Capital Expenditures(5) |

26,966 | 23,186 | 9,475 | |||||||||

| Maintenance Capital Expenditures(5) |

35,886 | 15,792 | 31,158 | |||||||||

| Free Cash Flow(6) |

67,292 | 67,972 | 88,762 | |||||||||

| (1) | Working capital is calculated as current assets, excluding cash, less current liabilities, excluding the current portion of long-term debt and revolving borrowings. |

| (2) | Revenue After Raw Materials Costs represents Total Revenue minus Cost of Raw Materials Shipments. We believe Revenue After Raw Materials Costs is useful in measuring our operating performance because it excludes the fluctuations in the market prices of the raw materials we procure for and sell to our customers. We subtract the Cost of Raw Materials Shipments from Total Revenue because market prices of the raw materials we procure for and generally concurrently sell to our customers are offset on our statement of operations. By subtracting the Cost of Raw Materials Shipments, we isolate the margin that we make on our raw materials procurement and logistics services and we are better able to evaluate our operating performance. Revenue After Raw Materials Costs is not a recognized financial measure under GAAP and may not be comparable to similarly titled measures used by other companies in our industry. Revenue After Raw Materials Costs should not be considered in isolation from or as an alternative to any other performance measures determined in accordance with GAAP. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Measures We Use to Evaluate Our Company.” |

The following table sets forth our calculation of Revenue After Raw Materials Costs:

| (dollars in thousands) |

Year ended December 31, 2008 |

Year ended December 31, 2009 |

Year ended December 31, 2010 |

|||||||||

| Revenue After Raw Materials Costs |

||||||||||||

| Total Revenue |

$ | 2,982,913 | $ | 1,298,339 | $ | 2,030,630 | ||||||

| Cost of Raw Materials Shipments |

(2,515,425 | ) | (939,993 | ) | (1,564,504 | ) | ||||||

| Revenue After Raw Materials Costs |

$ | 467,488 | $ | 358,346 | $ | 466,126 | ||||||

13

Table of Contents

| (3) | Adjusted EBITDA represents net income (loss) before income taxes, Interest Expense, Net, Depreciation and Amortization and certain other items, such as losses or gains in respect of debt extinguishment, goodwill impairment charges and dispositions of cumulative translation adjustments. We use Adjusted EBITDA to benchmark the performance of our business against expected results, to analyze year-over-year trends, and to compare our operating performance to that of our competitors. We also use Adjusted EBITDA as a performance measure because it excludes the impact of tax provisions and Depreciation and Amortization, which are difficult to compare across periods due to the impact of accounting for business combinations and the impact of tax net operating losses on cash taxes paid. We believe the presentation of Adjusted EBITDA enhances our investors’ overall understanding of the financial performance of and prospects for our business. Adjusted EBITDA is not a recognized financial measure under GAAP, and may not be comparable to similarly titled measures used by other companies in our industry. Adjusted EBITDA should not be considered in isolation from or as an alternative to net income, operating income (loss) or any other performance measures derived in accordance with GAAP. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Measures We Use to Evaluate Our Company.” |

The following table reconciles Net Income (Loss) to Adjusted EBITDA:

| (dollars in thousands) |

Year ended December 31, 2008 |

Year ended December 31, 2009 |

Year ended December 31, 2010 |

|||||||||

| Adjusted EBITDA |

||||||||||||

| Net Income (Loss) |

$ | (6,090 | ) | $ | (78,991 | ) | $ | 7,148 | ||||

| Income Tax (Benefit) Expense |

(1,891 | ) | (6,885 | ) | 10,903 | |||||||

| Interest Expense, Net |

38,079 | 44,825 | 40,361 | |||||||||

| Depreciation and Amortization |

73,080 | 69,760 | 61,508 | |||||||||

| EBITDA |

$ | 103,178 | $ | 28,709 | $ | 119,920 | ||||||

| Loss (Gain) on Debt Extinguishment |

— | (1,505 | ) | — | ||||||||

| Goodwill Impairment Charge |

— | 55,000 | — | |||||||||

| Disposition of Cumulative Translation Adjustment |

— | 1,560 | — | |||||||||

| Adjusted EBITDA |

$ | 103,178 | $ | 83,764 | $ | 119,920 | ||||||

| (4) | Adjusted EBITDA Margin is calculated by dividing our Adjusted EBITDA by our Revenue After Raw Materials Costs. We believe our Adjusted EBITDA Margin is useful in measuring our profitability and our control of cash operating costs relative to Revenue After Raw Materials Costs. Adjusted EBITDA Margin is not a recognized financial measure under GAAP, and may not be comparable to similarly titled measures used by other companies in our industry. Adjusted EBITDA Margin should not be considered in isolation from or as an alternative to any other performance measures determined in accordance with GAAP. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Measures We Use to Evaluate Our Company.” |

| (5) | We separate our Capital Expenditures into two categories: (1) Growth Capital Expenditures and (2) Maintenance Capital Expenditures. We believe that Growth Capital Expenditures and Maintenance Capital Expenditures are useful in measuring our operating performance. We incur Growth Capital Expenditures in connection with the establishment of our operations at new customer sites, the performance of additional services or significant productivity improvements at existing customer sites. We incur Maintenance Capital Expenditures as part of our ongoing operations, and Maintenance Capital Expenditures generally include the cost of normal replacement of capital equipment used at existing sites on existing contracts, additional capital expenditures made in connection with the extension of an existing contract and capital costs associated with acquiring previously leased equipment. Growth Capital Expenditures and Maintenance Capital Expenditures are not recognized financial measures under GAAP and may not be comparable to similarly titled measures used by other companies in our industry. Growth Capital Expenditures and Maintenance Capital Expenditures should not be considered in isolation from or as an alternative to any other performance measures determined in accordance with GAAP. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Measures We Use to Evaluate Our Company.” |

14

Table of Contents

The following table sets forth our total Capital Expenditures, Growth Capital Expenditures and Maintenance Capital Expenditures:

| (dollars in thousands) |

Year ended December 31, 2008 |

Year ended December 31, 2009 |

Year ended December 31, 2010 |

|||||||||

| Total Capital Expenditures | ||||||||||||

| Growth Capital Expenditures |

$ | 26,966 | $ | 23,186 | $ | 9,475 | ||||||

| Maintenance Capital Expenditures |

35,886 | 15,792 | 31,158 | |||||||||

| Capital Leases |

— | (1,343 | ) | (322 | ) | |||||||

| Total Mill Services acquired assets |

— | — | (495 | ) | ||||||||

| Total Capital Expenditures |

$ | 62,852 | $ | 37,635 | $ | 39,816 | ||||||

| (6) | Free Cash Flow is calculated as our Adjusted EBITDA minus our Maintenance Capital Expenditures. We believe Free Cash Flow is useful in measuring our liquidity. Free Cash Flow is not a recognized financial measure under GAAP, and may not be comparable to similarly titled measures used by other companies in our industry. Free Cash Flow should not be considered in isolation from or as an alternative to any other performance measures determined in accordance with GAAP. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Measures We Use to Evaluate Our Company.” |

The following table sets forth our calculation of Free Cash Flow:

| (dollars in thousands) |

Year ended December 31, 2008 |

Year ended December 31, 2009 |

Year ended December 31, 2010 |

|||||||||

| Free Cash Flow |

||||||||||||

| Adjusted EBITDA |

$ | 103,178 | $ | 83,764 | $ | 119,920 | ||||||

| Maintenance Capital Expenditures |

(35,886 | ) | (15,792 | ) | (31,158 | ) | ||||||

| Free Cash Flow |

$ | 67,292 | $ | 67,972 | $ | 88,762 | ||||||

The following table reconciles Free Cash Flow to net cash provided by (used in) operating activities:

| (dollars in thousands) |

Year ended December 31, 2008 |

Year ended December 31, 2009 |

Year ended December 31, 2010 |

|||||||||

| Free Cash Flow |

$ | 67,292 | $ | 67,972 | $ | 88,762 | ||||||

| Maintenance Capital Expenditures |

35,886 | 15,792 | 31,158 | |||||||||

| Cash interest expense |

(36,165 | ) | (35,383 | ) | (33,521 | ) | ||||||

| Cash income taxes |

(2,501 | ) | (2,461 | ) | (3,266 | ) | ||||||

| Change in accounts receivable |

39,202 | (22,479 | ) | (42,652 | ) | |||||||

| Change in inventory |

26,386 | (13,229 | ) | (6,799 | ) | |||||||

| Change in accounts payable |

(77,360 | ) | 59,673 | 48,157 | ||||||||

| Change in other current assets and liabilities |

(9,171 | ) | 365 | 4,231 | ||||||||

| Other operating cash flows |

(7,090 | ) | 2,973 | 525 | ||||||||

| Net cash provided by operating activities |

$ | 36,479 | $ | 73,223 | $ | 86,595 | ||||||

15

Table of Contents

Investing in our class A common stock involves a high degree of risk. You should carefully consider the risks described below before making a decision to buy our class A common stock. The risks and uncertainties described below are not the only ones we face. If any of the following risks actually occurs, our business, results of operations, financial condition or cash flows could be materially adversely affected. In that case, the trading price of our class A common stock could decline, and you might lose all or part of your investment in our class A common stock. In deciding whether to invest in our class A common stock, you should also refer to the other information set forth in this prospectus, including “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes.

Risks Relating to Our Business

North American and global steel production volumes and demand for steel are impacted by regional and global economic conditions and by conditions in our key end markets, including automotive, consumer appliance, general industrial and construction markets.

Global steel production volumes and the demand for steel in North America and worldwide is impacted by, and will continue to be impacted by, global economic conditions and conditions in key end markets, including automotive, consumer appliance, general industrial and construction markets. We derive a substantial portion of our Revenue After Raw Materials Costs from providing services to North American steel mills. Our Revenues After Raw Materials Costs and earnings are primarily driven by the volume of steel production at our customers’ mills; accordingly, declines in our customers’ production volumes have a direct negative impact on our Revenue After Raw Materials Costs and other results of operations.

Many factors may materially adversely affect production by our steel customers, including, but not limited to:

| • | decreases in demand for steel or failure of demand to increase to the extent forecasted, particularly in key end markets, including automotive, consumer appliance, general industrial and construction markets; |

| • | failure of the economy to fully recover from the recession that commenced in 2008, or the advent of any future recessions; and |

| • | increases in imports of steel that may result in an oversupply of steel in North America, our largest market, and may displace our North American customers’ steel production, including increases resulting from changes in currency rates, import tariffs or other trade regulations. |

We cannot predict the impact of global economic conditions and conditions in key end markets, such as automotive, consumer appliance, general industrial and construction markets, on the demand for and production of steel in North America and worldwide.

During a material economic downturn in the steel industry or due to company-specific events, some of our customers could experience financial difficulties and close operations or significantly decrease production permanently or for an extended period at sites that we service. The resulting decrease in business volumes could result in a decreased need for our services and materially adversely impact our business, financial condition, results of operations and cash flows. For example, during the first half of 2009, many of our customers significantly reduced or altogether stopped producing steel at certain facilities.

16

Table of Contents

We rely on a number of significant customers and contracts, the loss of any of which could have a material adverse effect on our results of operations.

For the year ended December 31, 2010, our largest customer, United States Steel (together with its affiliates), accounted for approximately 28% of our Revenue After Raw Materials Costs, and our top 10 customers accounted for 81% of our Revenue After Raw Materials Costs. A reduction in activity by a customer at one or more sites that we service (or its decision to idle or permanently close any customer site we service) would reduce the revenue we receive from such customer at those sites. A loss of a significant customer or the partial loss of a customer’s business through the termination or non-renewal of one of its significant contracts with us, or temporary or permanent shut down of one or more sites, could have a material adverse effect on our revenue and other results of operations. In general, our contracts are not terminable without cause. However, certain of our contracts, including contracts with our largest customers, contain provisions providing for the right to terminate for convenience through the payment of significant scheduled termination fees based on the remaining terms of the contracts. Further, notwithstanding our contractual rights, we may not have an effective remedy if one of our largest customers attempts to unilaterally change the terms in our contracts.

In addition, because our business is conducted under long-term contracts (often servicing the same steel company under separate, site-specific or service-specific contracts) and is highly dependent on business relationships, it could be very difficult to replace a current customer or contract with a new customer or contract. Even if we were to replace a significant customer or contract, we might not be able to find another customer or enter into a replacement contract that would provide us with comparable revenue. We may lose significant customers or contracts in the future, and any resulting losses could materially adversely affect results of operations. Contracts and contract renewals we enter into in the future may not include tiered pricing structures and/or minimum monthly fees, each of which stabilizes our revenue in the event of volume fluctuations.

Some of our operations are subject to market price and inventory risk arising from changes in commodity prices.

Although significant portions of our operations are more sensitive to changes in the volume of steel production than to changes in prices, certain of our operations subject us directly to price and/or inventory risk. In particular:

| • | we routinely maintain a limited quantity of unsold scrap inventory; |

| • | there are occasions when we may purchase quantities of raw materials in excess of immediate sales commitments. Similarly, we may have contractual commitments to provide certain raw materials to customers without a corresponding right to purchase all of the materials required to fulfill our commitment; |

| • | we typically have the right to sell for our own account, subject to royalty payments to the host mill, slag and certain other co-products under our contracts; and |

| • | we generate a portion of our revenue in our raw materials procurement activities from procurement fees that can be influenced by changes in prices, market conditions and competition. |

Our global raw materials procurement business is structured such that our purchases of raw materials are typically matched with customer orders, which minimizes inventory and price risk. However, we will from time to time take measured positions in raw materials inventory or experience a delay between the time all or a portion of the raw materials are purchased or sold by us and the time the raw materials are matched to customer purchase or sale orders. As a result, we may be subject to losses arising from changes in commodity prices.

If we are unable to manage inventory or price risk, our results of operations and profitability could be materially adversely affected.

17

Table of Contents

If we fail to make accurate estimates in bidding for long-term contracts, our profitability and cash flow could be materially adversely affected.

The majority of our Revenue After Raw Materials Costs is derived from customers’ sites where we have long-term contracts that typically have a term of five to 10 years. When bidding for a job, we are required to estimate the amount of production at a particular steel mill and the costs of providing services at that mill. In general, the higher the estimated volume of steel production at a customer site, the lower the unit price per volume of product handled or service provided that we can offer. Other estimates that will determine the unit price per volume that we can offer include local labor, transportation and equipment costs. If our volume estimates for a contract ultimately prove to be too high, or our cost estimates prove to be too low, our profitability and cash flows under that contract will be adversely affected.

Operating in various international jurisdictions subjects us to a variety of risks.

We currently operate in 14 countries, and during 2010 we derived approximately 19% of our Revenue After Raw Materials Costs from providing services and products to steel mills outside of North America. Due to the extensive diversification of our international operations, we are subject to a higher level of risk than some other companies relating to international conflicts, wars, internal civil unrest, trade embargoes and acts of terrorism. As we expand internationally, we will further become exposed to a variety of risks that may materially adversely affect results of operations, cash flows or financial position. These include the following:

| • | periodic economic downturns in the countries in which we do business; |

| • | fluctuations in currency exchange rates; |

| • | customs matters and changes in trade policy or tariff regulations or other impositions of export restrictions; |

| • | imposition of or increases in currency exchange controls and hard currency shortages; |

| • | changes in regulatory requirements in the countries in which we do business; |

| • | labor relations and works’ council and other labor requirements; |

| • | higher tax rates and potentially adverse tax consequences, including restrictions on repatriating earnings, adverse tax withholding requirements and double taxation; |

| • | longer payment cycles and difficulty in collecting accounts receivable; |

| • | complications in complying with a variety of foreign laws and regulations; |

| • | political, economic and social instability, civil unrest, terrorism and armed hostilities in the countries in which we do business; |

| • | risk of nationalization of steel mills and/or cancellation of our contracts without adequate remedy; |

| • | inflation rates in the countries in which we do business; |

| • | laws in various international jurisdictions that limit the right and ability of subsidiaries to pay dividends and remit earnings to affiliated companies unless specified conditions are met; |

| • | risks arising from having our employees and equipment embedded at customer sites, such as risks relating to our ability to access or retrieve our equipment in the event a customer enters into an insolvency proceeding; and |

| • | uncertainties arising from local business practices, cultural considerations and international political and trade tensions. |

18

Table of Contents

If we are unable to successfully manage the risks associated with our increasingly global business, our financial condition, cash flows and results of operations may be materially adversely affected.

Our international expansion strategy may be difficult to implement and may not be successful.

Beginning in 2006, we implemented a number of international initiatives to expand our global footprint to countries that we do not serve throughout Europe, Latin America and Asia. We cannot assure you that outsourcing will become a prevalent practice in these developing countries or that our initiatives will be successful. If we are able to expand into new international markets, we will further become exposed to a variety of risks and uncertainties that may materially adversely affect our results of operations, cash flows or financial position. These include all of the risks and uncertainties that we are currently exposed to in connection with our existing international operations, as well as risks and difficulties inherent in expanding to new jurisdictions, such as establishing new relationships and conducting business in legal and cultural climates with which we have limited or no experience. Furthermore, the success of our international growth strategy depends on our ability to attract key management with business contacts and favorable reputations in our target markets. We will also incur additional costs and expenses in connection with our efforts to execute an international growth strategy, and we cannot assure you that we will be profitable or successful in expanding our operations into new international markets. If we are unable to successfully manage the risks associated with the expansion of our operations into new international markets, our financial condition, cash flows and results of operations may be materially adversely affected.

Our business involves a number of personal injury and other operating risks, and our failure to properly manage these risks could result in liabilities not fully covered by insurance, and loss of future business and could have a material adverse effect on results of operations.

Our business activities involve certain operating hazards that can result in personal injury and loss of life, damage and destruction of operating equipment, damage to the surrounding areas, interruption or suspension of operations at a customer site and loss of revenue and future business. Under certain circumstances, we may be required to indemnify our customers against such losses even though we may not be at fault. While we have in place policies to minimize the risk of serious injury or death to our employees or other visitors to our operations, we may nevertheless be unable to avoid material liabilities for any such death or injury that may occur in the future, and these types of incidents may have a material adverse effect on our financial condition. Although we believe that we maintain adequate insurance against these risks, there can be no assurance that our insurance will be sufficient or effective under all circumstances or against all claims or hazards to which we may be subject or that we will be able to continue to obtain adequate insurance protection. A successful claim for damage resulting from a hazard for which we are not fully insured could materially adversely affect our results of operations. In addition, if a customer concluded that we were responsible for an accident at one of our customer sites that resulted in significant losses to them and/or an interruption or suspension of their operations, we could lose such customer’s business. Moreover, such events may adversely affect our reputation in the steel industry, which may make it difficult to renew or extend existing contracts or gain new customers.

We are subject to concentrated credit risk and could become subject to constraints on our ability to fund our planned capital investments and/or maintain adequate levels of liquidity and working capital under our senior secured ABL facility as a result of concentrated credit risk, declines in raw material selling prices or declines in steel production volumes.

As of December 31, 2010, our largest customer, United States Steel (together with its affiliates), accounted for 29% of our accounts receivable, and our top 10 customers accounted for 54% of our accounts receivable. We are party to multiple long-term contracts with many of our customers, including a number of contracts with United States Steel and its affiliates. Our relative concentration of significant customers, combined with the risk of customer financial difficulties and resulting impacts on us as described above, exposes us to concentrated credit risk or the risk of reduced borrowing capacity under our senior secured ABL facility. Further consolidation among any of the steel industry’s larger companies, many of which are our customers, could further increase the concentration of credit risk we face.

19

Table of Contents

If our customers suffer significant financial difficulty, they also may not pay us for work we perform or the products we procure, which could have a material adverse effect on our results of operations. It is possible that customers may reject their contractual obligations to us under bankruptcy laws or otherwise. Significant customer bankruptcies could further adversely impact our Revenue After Raw Materials Costs and increase our operating expenses by requiring larger provisions for bad debt. In addition, even when our contracts with these customers are not rejected, if customers are unable to meet their obligations on a timely basis, it could adversely impact our ability to collect receivables, the valuation of inventories and the valuation of long-lived assets of our business, as well as negatively affect the forecasts used in performing our goodwill impairment testing under FASB ASC Topic 350, Goodwill and Other Intangible Assets. Further, we may have to negotiate significant discounts and/or extended financing terms with these customers in such a situation, each of which could have a material adverse effect on our business, financial condition, results of operations and cash flows.