Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SUSQUEHANNA BANCSHARES INC | d8k.htm |

Sterne Agee 2011

Financial Institutions

Investor Conference

February 17, 2011

Exhibit 99.1 |

Investor Presentation

February 17, 2011

Investor Presentation

February 17, 2011

Susquehanna Bancshares, Inc.

Lititz, Pennsylvania

William J. Reuter –

Chairman and CEO

Drew K. Hostetter –

Chief Financial Officer

2 |

Forward-Looking Statements

Forward-Looking Statements

During the course of this conference call, we may make projections and other

forward-looking statements regarding events or the future financial performance

of Susquehanna, including the impact of the announced acquisition of

Abington Bancorp. We wish to caution you that these

forward-looking statements may differ materially from actual results due

to a number of risks and uncertainties. For a more detailed

description of the factors that may affect Susquehanna’s operating

results, we refer you to our filings with the Securities & Exchange

Commission, including our quarterly report on Form 10-Q for the quarter ended

September 30, 2010, and our annual report on Form 10-K for the year

ended December 31, 2009. Susquehanna assumes no obligation to update the

forward-looking statements made during this presentation.

For more information, please visit our Web site at:

www.susquehanna.net

3 |

Susquehanna Profile

Susquehanna Profile

4

Headquartered in Lititz, PA

Offers tailored products and services through its community bank, trust

and investment company, asset management, P&C insurance brokerage,

and leasing companies

222 branches in PA, NJ, MD, WV

$14.0 billion in assets

$9.2 billion in deposits

$6.3 billion in assets under management & administration

130.0 million shares outstanding

28,100 shareholders (record and street)

67% institutional holders (as of 9/30/10)

Overview

Geography

Size

Shareholder

base |

November

2008

Received

$300mm

TARP

preferred

equity

April 2002

Announced

acquisition

of Addis

Group

(Deal

value:

$17mm)

April 1998

Announced

acquisition

of Cardinal

Bancorp

(Deal

value:

$49mm)

April 1998

Announced

acquisition

of First

Capitol

Bank

(Deal

value:

$27mm)

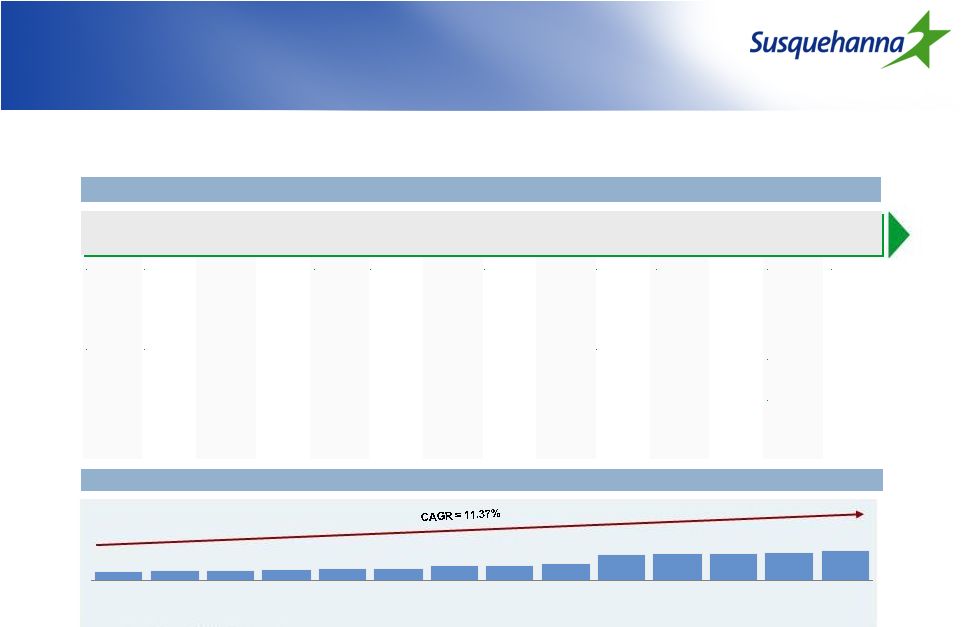

Susquehanna has built a strong

franchise over time

Susquehanna has built a strong

franchise over time

Assets ($ millions)

Source: Company filings, FactSet, SNL Financial

¹

Pro forma for Abington acquisition

1998

2000

2001

November

1999

Announced

acquisition

of Hann

Finl. Corp.

(Deal value:

$42mm)

December

1999

Announced

acquisition

of Valley

Forge Asset

Mgmt

(Deal value:

$19mm)

2002

2004

December

2003

Announced

acquisition

of Patriot

Bank

(Deal value:

$210mm)

2006

2003

November

2005

Announced

acquisition

of Minotola

Bank

(Deal value

$166mm)

2005

2007

April 2007

Announced

acquisition

of

Community

Banks

(Deal value

$852mm)

December

2007

Announced

acquisition

of Stratton

Holding

Company

2008

2009

2010

5

2011

January

2011

Announced

acquisition

of Abington

Bancorp

(Deal value:

$268mm)

1999

March 2010

Raised

$345mm in

common

equity and

$50mm of

Trust

preferred

securities

April 2010

Repaid

$200mm

TARP

December

2010

Repaid the

remaining

$100mm

TARP

$13,954

$15,201

$4,176

$4,805

$4,793

$5,089

$5,545

$5,953

$7,475

$7,466

$8,225

$13,078

$13,683

$13,689

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2010 pro

forma¹ |

Strong

organic growth supported by acquisitions

Strong organic growth supported by

acquisitions

$2,767

$3,314

$3,278

$3,364

$3,675

$4,108

$4,463

$4,433

$4,281

$4,913

$5,815

$5,988

$5,794

$790

$786

$1,280

$3,839

$3,839

$3,839

$3,839

$80

$156

$156

$156

$156

$156

$2,847

$3,470

$3,434

$3,520

$3,831

$4,264

$5,253

$5,219

$5,561

$8,752

$9,633

$9,827

$9,654

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

Organic loans

Acquired loans

Loan growth ($mm)

Deposit growth ($mm)

$3,103

$2,983

$3,051

$3,286

$3,633

$3,936

$4,292

$4,470

$4,500

$5,038

$5,159

$5,067

$5,284

$3,907

$3,907

$3,907

$3,907

$1,378

$839

$839

$198

$198

$198

$198

$198

$114

$9,191

$5,878

$5,309

$5,131

$4,134

$3,831

$3,484

$3,249

$3,181

$3,217

$8,945

$9,066

$8,974

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

Organic deposits

Acquired deposits

Loan growth (%)

CAGR

1998-2010

Organic

6.4%

Total

10.7%

Deposit growth (%)

CAGR

1998-2010

Organic

4.5%

Total

9.1%

Source: Company filings, SNL Financial

6 |

Improved Market Position in Focus

Markets

Improved Market Position in Focus

Markets

Sorted by 2010 market rank

7

Market share

MSA rank by market share

MSA

2005

2010

% change

2005

2010

Change

Current rank 1-3

Cumberland, MD-WV

24.8%

32.2%

7.4%

2

1

+ 1

Sunbury, PA

18.7%

23.1%

4.4%

1

1

Flat

Hagerstown-Martinsburg, MD-WV

19.0%

18.5%

(0.5%)

1

1

Flat

Lancaster, PA

12.9%

18.2%

5.3%

3

2

+ 1

Williamsport, PA

14.2%

13.2%

(1.0%)

3

2

+ 1

York-Hanover, PA

3.5%

12.3%

8.9%

11

2

+ 9

Chambersburg, PA

13.4%

17.3%

3.9%

5

2

+ 3

Vineland-Millville-Bridgeton, NJ

0.0%

16.3%

16.3%

NA

3

NA

Gettysburg, PA

0.0%

10.5%

10.5%

NA

3

NA

Current rank 4-8

Selinsgrove, PA

8.4%

12.2%

3.9%

5

4

+ 1

Pottsville, PA

0.0%

11.1%

11.1%

NA

4

NA

Lewisburg, PA

2.5%

2.4%

(0.1%)

7

7

Flat

Atlantic City-Hammonton, NJ

0.0%

5.8%

5.8%

NA

8

NA

Reading, PA

2.9%

4.7%

1.8%

9

8

+ 1

Baltimore-Towson, MD

2.0%

1.7%

(0.3%)

9

8

+ 1

Other

Ocean Pines, MD

2.0%

3.1%

1.2%

9

10

-

1

Harrisburg-Carlisle, PA

0.0%

4.3%

4.3%

NA

11

NA

Allentown-Bethlehem-Easton, PA-NJ

1.7%

1.5%

(0.2%)

13

18

-

5

Philadelphia-Camden-Wilmington, PA-NJ-DE-MD

0.4%

0.6%

0.1%

24

18

+ 6

Scranton-Wilkes-Barre, PA

0.0%

1.2%

1.2%

NA

19

NA

Source: SNL Financial |

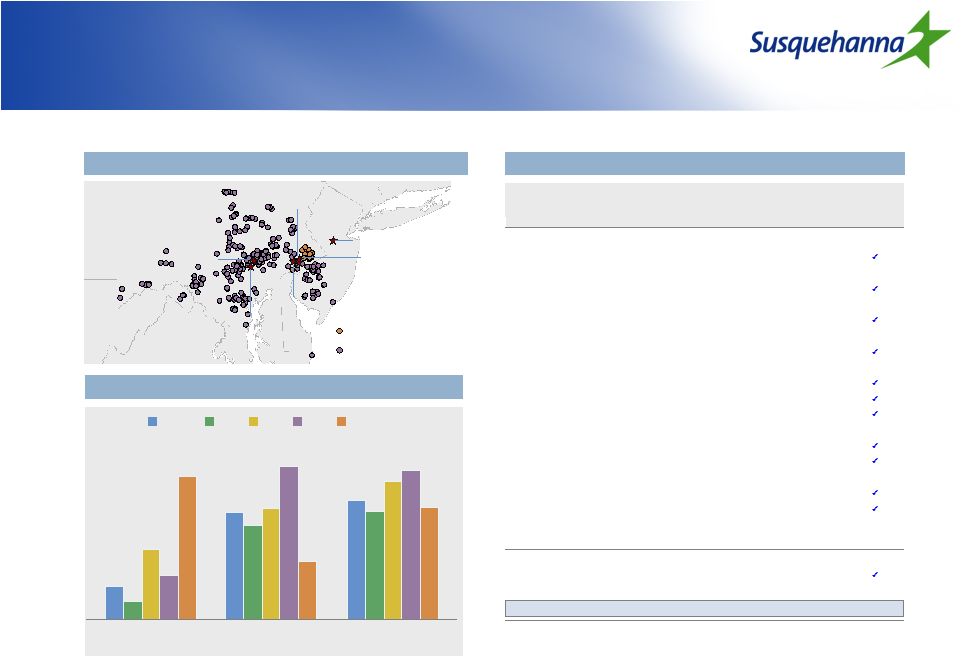

Footprint overview

Footprint overview

SUSQ

PA

MD

NJ

US

8

Source: SNL Financial

Note: Susquehanna demographics pro-forma for Abington

SUSQ / ABBC branch map

ABBC (20 branches)

SUSQ (222 branches)

NJ

DE

PA

VA

WV

MD

Susquehanna Demographics

Projected population

change 2010-2015

0.9%

0.5%

1.9%

1.2%

3.9%

Projected HH income

change 2010-2015

13.6%

13.3%

13.7%

14.7%

12.4%

$58.1

$52.7

$66.9

$72.5

$54.4

Median HH income

2010 ($000)

Deposits in

Percent of

Market

Branches in

MSA

Franchise

Presence

MSA

Rank

MSA

($mm)

(%)

strength¹

Philadelphia, PA²

18

54

$2,193

21.8%

Lancaster, PA

2

41

1,736

17.3%

Baltimore-Towson, MD

8

24

1,003

10.0%

York-Hanover, PA

2

19

768

7.6%

Harrisburg-Carlisle, PA

11

14

466

4.6%

Hagerstown-Martinsburg, MD-WV

1

13

595

5.9%

Reading, PA

8

9

368

3.7%

Sunbury, PA

1

8

289

2.9%

Allentown-Bethlehem-Easton, PA-NJ

18

7

220

2.2%

Williamsport, PA

2

6

247

2.5%

Pottsville, PA

4

6

216

2.2%

Chambersburg, PA

2

6

325

3.2%

Atlantic City-Hammonton, NJ

8

6

271

2.7%

Vineland-Millville-Bridgeton, NJ

3

6

415

4.1%

Cumberland, MD-WV

1

5

300

3.0%

Scranton-Wilkes-Barre, PA

19

3

126

1.3%

Selinsgrove, PA

4

3

71

0.7%

Gettysburg, PA

3

3

125

1.2%

Lewisburg, PA

7

1

16

0.2%

Ocean Pines, MD

10

1

40

0.4%

Counties (not in any MSA)

Bedford, PA

1

5

$173

1.7%

Garrett, MD

3

2

82

0.8%

Total Pro Forma

242

$10,045

100.0%

Source: SNL Financial; company filings; deposit and branch data as of June 30, 2010

¹ Greater than 10% of deposits in market

² Pro forma for Abington acquisition

Strength of presence (sorted by # of branches)

Susquehanna

Bank

Valley Forge

Addis Group

Stratton

Management

Hann

Financial

Susquehanna Trust

& Investment |

Few

remaining players of scale Few remaining players of scale

9

Total PA/MD/NJ

Deposits in

# of branches

Rank

Company

Deposits

% of total deposits

# of branches

PA

MD

NJ

PA

MD

NJ

1

Fulton

$11.7

95%

254

$7.1

$1.7

$2.9

137

41

76

2

Susquehanna

10.0

99%

239¹

6.6

2.0

1.4

165

44

30

3

F.N.B.

6.9

100%

238

6.9

0.0

0.0

238

0

0

4

National Penn

6.4

98%

130

6.4

0.0

0.0

129

1

0

5

Provident

4.9

100%

83

0.0

0.0

4.9

0

0

83

6

First Commonwealth

4.8

100%

115

4.8

0.0

0.0

115

0

0

7

S&T

3.3

100%

54

3.3

0.0

0.0

54

0

0

8

Sun

3.0

100%

67

0.0

0.0

3.0

0

0

67

9

Sandy Spring

2.5

96%

38

0.0

2.5

0.0

0

38

0

10

Tower

2.3

100%

51

2.2

0.1

0.0

48

3

0

11

Lakeland

2.2

100%

49

0.0

0.0

2.2

0

0

49

12

Kearny

2.1

100%

40

0.0

0.0

2.1

0

0

40

13

Metro

1.9

100%

33

1.9

0.0

0.0

33

0

0

14

OceanFirst

1.5

100%

23

0.0

0.0

1.5

0

0

23

15

Oritani

1.3

100%

23

0.0

0.0

1.3

0

0

23

Source: SNL Financial

Note: Regulatory deposit data as of June 30, 2010; Susquehanna pro forma for Abington acquisition;

banks and thrifts with PA/MD/NJ deposits = 90% of total deposits ¹ Susquehanna has 3

additional branches in West Virginia Sorted by deposits

|

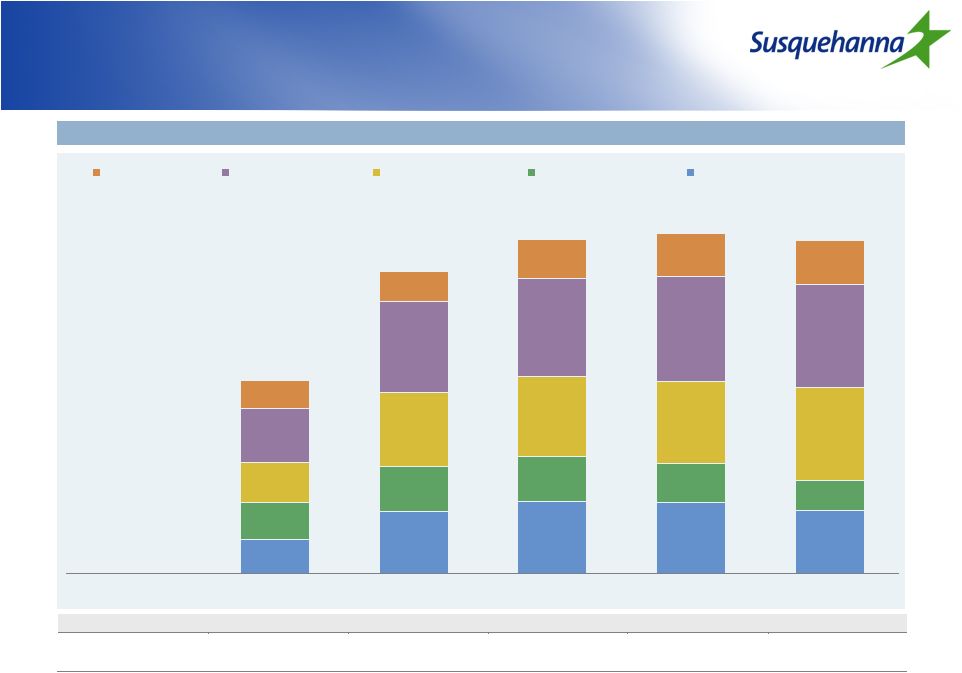

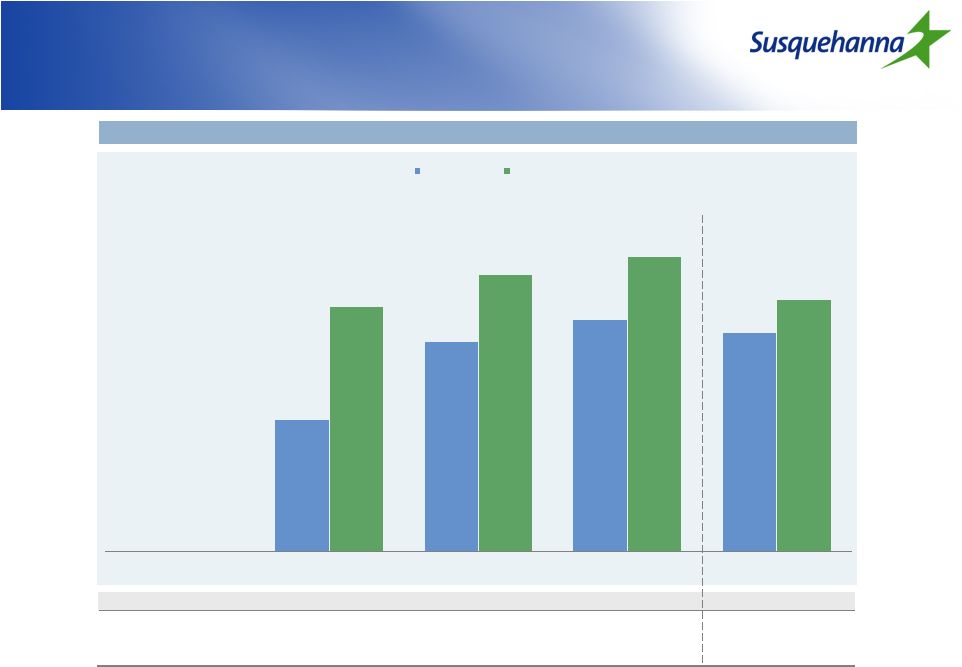

2006

2007

2008

2009

2010

Loan trends

Loan trends

$5,561

$8,752

$9,654

$9,827

$9,633

17.6%

20.4%

21.4%

20.9%

18.9%

19.1%

14.8%

13.6%

11.3%

9.1%

20.6%

24.6%

23.8%

24.1%

27.7%

30.4%

29.8%

31.1%

31.1%

14.3%

9.9%

11.4%

12.5%

13.2%

28.4%

2006Y

2007Y

2008Y

2009Y

2010Y

Yield on loans

7.37%

7.48%

6.49%

5.70%

5.23%

Loans/deposits

95%

98%

106%

109%

105%

Source: Company filings

10

Commercial financial and agricultural

Real estate -

construction

Real estate -

residential

Real estate -

commercial

Consumer & leases |

Deposit Trends

Deposit Trends

11

2006

2007

2008

2009

2010

$5,878

$8,945

$9,066

$8,974

$9,191

16.3%

14.5%

13.3%

14.1%

14.9%

34.1%

31.6%

27.9%

36.4%

39.7%

26.0%

30.8%

33.6%

28.3%

23.6%

15.2%

17.6%

13.0%

13.4%

15.4%

2006Y

2007Y

2008Y

2009Y

2010Y

Cost of int. bearing deposits

3.27%

3.54%

2.66%

2.05%

1.13%

Loans/deposits

95%

98%

106%

109%

105%

Source: Company filings

Jumbo time

Retail time

Savings

Interest bearing demand

Demand

8.1%

8.0%

7.7%

8.3%

8.4% |

Earnings Trends

Earnings Trends

2010

2010

2006

2007

2008

2009

1st Q

2nd Q

3rd Q

4th Q

full year

Net interest income

$256.8

$275.9

$398.3

$408.8

$108.3

$106.2

$105.4

$106.6

$426.5

Net interest margin (%)

3.77%

3.67%

3.62%

3.58%

3.80%

3.69%

3.58%

3.61%

3.67%

Non-interest income

136.3

120.7

142.3

163.7

38.7

38.3

35.4

39.8

152.1

Non-interest expense

262.8

277.0

367.2

382.5

94.3

96.2

96.2

96.0

382.7

Pre-provision, pre-tax income

$130.3

$119.6

$173.4

$190.0

$52.7

$48.3

$44.6

$50.4

$196.0

Provision expense

8.7

21.8

63.8

188.0

45.0

43.0

40.0

35.0

163.0

Pre-tax income

$121.6

$97.8

$109.6

$2.0

$7.7

$5.3

$4.6

$15.4

$33.0

Source: Company filings

12

($mm) |

Fee

Generating

Subsidiaries

13 |

Valley Forge Asset Management

Valley Forge Asset Management

Offers investment advisory, asset management and brokerage

services for institutional and high net worth individuals

$2.8 billion in assets under management

14

Revenue (In millions)

2006

2007

2008

2009

2010

$19.3

$20.9

$15.6

$13.8

$14.4 |

Stratton Management

Stratton Management

Focuses on institutions, pensions, endowments

and high net worth individuals

Manages and advises the Stratton Mutual Funds

which includes Morningstar rated:

Stratton Small-Cap Value Fund, 4 star

Stratton Multi-Cap Fund, 3 star

Stratton Monthly Dividend REIT Shares, 5 star

$2.0 billion in assets under management

2008

2009

2010

$14.8

$12.2

$13.1

Revenue (In millions)

15 |

Susquehanna Trust & Investment

Company

Susquehanna Trust & Investment

Company

Offers traditional trust and custodial services to high net worth individuals,

businesses and non-profit entities

$902 million in assets under management

$ 519 million in assets under administration

16

Revenue (In millions)

2006

2007

2008

2009

2010

$11.0

$13.2

$15.6

$15.7

$15.2 |

Hann

Financial Service Corporation Hann Financial Service Corporation

Provides comprehensive consumer vehicle financing services to

customers in New Jersey, eastern Pennsylvania and southeastern

New York

$850 million portfolio serviced for others

17

Revenue (In millions)¹

2006

2007

2008

2009

2010

$30.9

$27.3

$23.9

$29.9

$35.6

¹

Includes benefit of spread income earned |

The

Addis Group The Addis Group

Provides tailored insurance products to medium and large sized

companies primarily located in southeastern Pennsylvania,

southern New Jersey and northern Delaware

18

Revenue (In millions)

2006

2007

2008

2009

2010

$12.7

$12.8

$12.7

$12.6

$12.0 |

Credit

Quality

19 |

Aggressive actions taken to offset

weak economic backdrop

Aggressive actions taken to offset

weak economic backdrop

Redesigned processes to handle weak economic outlook

Loan Review given dual focus of evaluating the greatest risk in the portfolio on a

quarterly

basis

and

continuing

their

18

month

cycle

of

review

of

credits

deemed

to

have low risk to the company.

Asset Recovery focus on prevention of negative migration and reduction of NPA

through Note Sales, enhance work out strategies and TDR’s.

Enhanced

Loan

Quality

Meetings

focusing

on

the

categories

titled

WATCH;

Other

Assets Especially Mentioned and Substandard Loans categories. The Primary

Regulator attends once a year prior to their annual review.

Implementation of SunGard’s Risk Rating System to automate the rating process

and to assist in the analysis of the each loan’s Probability of Default

and Loss Given Probability of Default for “Point in Time and Point In

Time Through The Cycle”. 20 |

Summary of Credit Metrics

Summary of Credit Metrics

21

($mm)

2010

2010

2006

2007

2008

2009

1st Q

2nd Q

3rd Q

4th Q

Full year

Provision

$8.7

$21.8

$63.8

$188.0

$45.0

$43.0

$40.0

$35.0

$163.0

Net charge-offs (NCO)

5.3

15.0

38.7

129.4

38.5

36.0

34.7

34.3

143.5

Non-performing assets (NPA)

31.9

68.7

115.6

243.8

268.4

254.8

246.3

215.4

215.4

Reserves

62.6

88.6

113.7

172.4

178.8

185.8

191.1

191.8

191.8

NPA generation

17.1

51.8

85.6

257.6

63.1

22.4

26.2

3.4

115.1

Key ratios:

NCO / Avg. Loans and Leases

SUSQ

0.10%

0.25%

0.42%

1.32%

1.56%

1.46%

1.42%

1.42%

1.46%

In-market peer median

0.09%

0.26%

0.49%

1.21%

1.32%

1.69%

1.44%

1.64%

1.57%

NPA

/ Total Loans and Leases + OREO

SUSQ

0.57%

0.78%

1.20%

2.48%

2.69%

2.60%

2.53%

2.23%

2.23%

In-market peer median

0.35%

0.73%

1.51%

2.17%

2.23%

2.40%

2.60%

2.60%

2.60%

Source: Company filings and SNL Financial

Note: In-market peers include FULT, WL, NPBC

1

Excludes renegotiated loans

1

1 |

Credit Migration by Portfolio Type

Credit Migration by Portfolio Type

Year ended

3 months ended

Non-performing Loans (%)

12/31/2007

12/31/2008

12/31/2009

3/31/2010

6/30/2010

9/30/2010

12/31/2010

Commercial, financial and agricultural

0.29

0.80

0.99

1.17

1.32

1.23

1.10

Real estate construction

1.62

3.79

8.77

8.97

9.45

8.35

6.59

Real estate secured -residential

0.55

0.79

1.57

2.01

1.82

1.79

1.91

Real estate secured -commercial

0.69

0.81

1.93

2.33

2.33

2.58

2.18

Consumer & leases

0.34

0.01

0.42

0.32

0.32

0.24

0.22

Total

0.68

1.12

2.23

2.49

2.43

2.35

2.04

Total Past Due Loans (%)

Commercial, financial and agricultural

1.61

1.39

0.99

1.08

0.51

0.58

0.63

Real estate construction

2.91

1.57

0.73

1.31

0.40

0.35

0.69

Real estate secured -residential

1.39

1.65

1.52

1.56

0.98

1.44

1.43

Real estate secured -commercial

0.90

1.90

0.94

1.84

0.57

0.58

0.79

Consumer & leases

1.25

1.30

1.65

1.36

1.27

1.41

2.07

Total

1.50

1.62

1.16

1.50

0.74

0.90

1.10

Net Charge-offs (Annualized) (%)

Commercial, financial and agricultural

0.28

0.78

1.42

0.78

1.63

0.93

0.33

Real estate construction

0.19

0.68

5.80

4.23

5.00

6.51

9.32

Real estate secured -residential

0.11

0.16

0.30

0.93

0.46

0.46

0.81

Real estate secured -commercial

0.22

0.06

0.49

1.94

1.39

1.33

0.55

Consumer & leases

0.64

0.75

1.10

0.95

0.93

0.66

0.79

Total

0.25

0.42

1.32

1.56

1.46

1.42

1.42

22 |

Liquidity

and capital position

23 |

Strong liquidity position

Strong liquidity position

24

As of December 31, 2010

Unused

(In billions)

Capacity

Outstanding

Capacity

Brokered CDs

$

0.9

$

0.3

$

0.6

FRB -

Discount Window

0.9

0.0

0.9

Federal Funds Purchased

1.3

0.4

0.9

FHLB Advances

2.1

1.1

1.0

Subtotal

$

5.2

$

1.8

$

3.4

Repos

0.3

Long-term Debt Other

0.5

Total Outstanding

$

2.6 |

Conservative investment portfolio

Conservative investment portfolio

2008

2009

2010

SUSQ OTTI

$17.6

$1.1

$3.9

SUSQ cumulative OTTI

17.6

18.7

22.6

SUSQ cumulative OTTI as % of 2007 securities portfolio¹

0.85%

0.91%

1.10%

Peer median² cumulative OTTI as % of 2007 securities portfolio

2.94%

3.16%

3.21%

Source: SNL Financial, company filings

¹ 2007 securities portfolio of $2.06bn

² Peers include WBS, FULT, VLY, FMER, WL, NPBC, FNFG; 4Q 2010 OTTI included for peers where

available 25

Amortized

Fair

cost

value

Difference

Available-for-sale:

U.S. Government agencies

$268.8

$268.2

($0.6)

State and municipal

397.8

396.7

(1.1)

Agency residential mortgage-backed

1,321.8

1,323.5

1.7

Non-agency residential mortgage-backed

129.2

116.8

(12.4)

Commercial mortgage-backed

99.5

104.8

5.3

Other¹

66.5

53.5

(13.0)

Equities

146.0

145.4

(0.6)

Subtotal

$2,429.6

$2,408.9

($20.7)

Held-to-maturity:

$8.7

$8.7

$0.0

Total investment securities

$2,438.3

$2,417.6

($20.7)

Source: Company information

¹ Includes other structured financial products, and other debt securities

Securities portfolio 12/31/10 ($mm)

Other than temporary impairments ($mm) |

Strong Capital Position

Strong Capital Position

6.03%

9.58%

10.58%

10.01%

11.17%

12.65%

13.45%

11.49%

2009

2010

Pro forma ABBC

Peer median

Tier 1 common

Tier 1

26

Source: SNL Financial

¹

Peers include WBS, VLY, WL, NPBC, FNFG; FULT and FMER regulatory ratios are 3Q as

4Q not yet disclosed ²

Includes deferred tax liability associated with intangibles

(%)

2009

2010

Pro forma ABBC

Peer median¹

TCE / TA

4.97

7.56²

8.16²

7.46

Leverage

9.73

10.27

10.67

8.31

Total Risk-based Capital

13.48

14.72

15.42

13.99

|

Strategic Acquisition of

Abington Bancorp

27 |

Transaction highlights

Transaction highlights

Strong Strategic

Rationale

Attractive Financial

Returns

Low Risk

Low-risk fill-in acquisition of an in-market community bank in

Montgomery and Bucks counties

—

Adds 20 branches and $900mm of deposits; no branch overlap

Strengthens presence in attractive Montgomery and Delaware counties and provides

entry into Bucks County

—

Top

10

market

share

in

Montgomery

County

–

20

th

wealthiest

in

U.S.

—

3 counties rank among top 5 highest HHI in PA

Tremendous opportunity for deposit, loan and fee income growth

—

Wealth management and insurance subsidiaries (Valley Forge, Stratton, and

Addis) located in Montgomery County with strong customer contacts

—

Expand Susquehanna’s in-market mortgage origination capability

—

Potential for commercial loan growth

20% IRR

100bps accretive to Tier I common at close

Breakeven to 2012 EPS, without considering benefits of excess capital

Comprehensive due diligence process

In-market transaction with similar demographics

Proven track record of integrating acquisitions

28 |

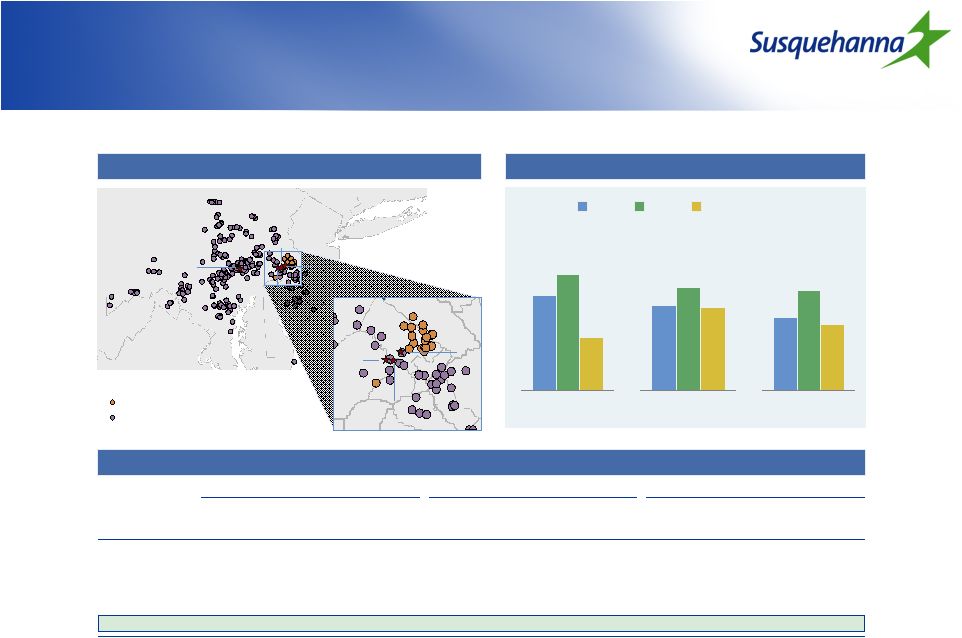

Expands

Susquehanna into attractive markets

Expands Susquehanna into attractive

markets

SUSQ

ABBC

Projected population

change 2010-2015

Pennsylvania

Projected HH income

change 2010-2015

Median HH income

2010 ($000)

Source: SNL Financial

Note: Branch and deposit data as of June 2010

0.9%

1.1%

0.5%

13.3%

16.4%

13.6%

$52.7

$79.7

$58.6

ABBC (20 branches)

SUSQ (222 branches)

NJ

DE

PA

VA

WV

MD

Bucks

Montgomery

Chester

Philadelphia

Delaware

Susquehanna

Bank

Valley

Forge

Addis

Group

Stratton Management

Susquehanna

Abington

Pro forma

Deposit mkt

Deposit mkt

Deposit mkt

Market

Deposits

share

Market

Deposits

share

Market

Deposits

share

rank

Branches

($mm)

(%)

rank

Branches

($mm)

(%)

rank

Branches

($mm)

(%)

Montgomery, PA

18

6

$271

1.2%

8

14

$728

3.3%

7

20

$999

4.6%

Bucks, PA

-

-

-

-

22

5

155

1.1%

22

5

155

1.1%

Delaware, PA

16

3

138

1.2%

29

1

31

0.3%

14

4

169

1.5%

All other counties

213

8,723

0

0

213

8,723

Pro forma franchise

222

$9,132

20

$913

242

$10,045

29

S.M

A.G

V.F

SUSQ / ABBC branch map

Susquehanna Demographics

Pro forma market share by county |

Pro

forma financial impact Pro forma financial impact

Attractive financial returns:

20% IRR

60 bps accretive to TCE and 100bps to Tier I common

Breakeven accretion to SUSQ normalized EPS without considering any benefit from

excess capital; 3% accretive to SUSQ current 2012 median analyst

estimate¹ Tangible book value dilution less than 2%

Strong

pro

forma

capital

position

(approximately

$95mm

capital

accretive):

Assumptions:

8.5% cumulative lifetime credit losses through the cycle (since 2008)

Cost savings of $8.1mm or 31%², phased in 50% in 2011 and 100% in 2012

One time pre-tax restructuring charge of $21mm

30

12/31/2010

Actual (%)

Pro forma (%)

TCE/TA

7.6%

8.2%

Tier I common

9.6%

10.6%

Tier I

12.7%

13.5%

Note: Based on SUSQ and ABBC stock prices at announcement

¹

Susquehanna normalized analyst estimate of $0.80 and 2012 analyst estimate of

$0.66 ²

Excluding stock based compensation expenses, core cost synergies are approximately

24% of non interest expenses |

Pricing metrics

Pricing metrics

31

Based on Jan. 26, 2011

(Announcement date)

1 day

Deal price per share ($)

$12.80

Implied premium (%)

10.3%

Price / 4Q net income (adjusted for excess capital)¹

24.1x

Price / Tangible book value

1.2x

Price / Adjusted tangible book value²

1.3x

Core deposit premium³

8.2%

Memo:

Susquehanna price per share ($)

$9.70

Financial information as of December 31, 2010

¹4Q 2010 net income annualized; price and earnings adjusted for excess capital of $95mm; assumes

1% pre-tax earnings on excess capital ²Adjusted for credit marks of $31mm and loan loss

reserve of $4mm ³ Core deposits of $680 excludes time deposits >$100mm

|

Transaction Summary

Transaction Summary

32

Low-risk, fill-in transaction expanding Susquehanna’s footprint into

highly attractive demographic markets

Significant opportunity for deposit, loan, and fee income generation

by delivering on Susquehanna’s full-service platform to wealthy

markets

Capital accretive transaction; potential to drive earnings accretion

through deployment of excess capital |

Reasons to invest in Susquehanna

Reasons to invest in Susquehanna

33

Diversified financial holding company

Strong fee income generating subsidiaries

Well positioned in attractive growth markets (Philadelphia, Baltimore)

Fortress balance sheet with strong capital position

Current stock price not reflective of underlying franchise potential

|

|