Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Encompass Health Corp | form8k-20104q.htm |

| EX-99.1 - EXHIBIT 99.1 - Encompass Health Corp | exhibit_99-1.htm |

Fourth Quarter 2010 Earnings Call

Supplemental Slides

Exhibit 99.2

The information contained in this presentation includes certain estimates, projections and other forward-

looking information that reflect our current views with respect to future events, strategy, capital

expenditures and financial performance. These estimates, projections and other forward-looking

information are based on assumptions that HealthSouth believes, as of the date hereof, are reasonable.

Inevitably, there will be differences between such estimates and actual events or results, and those

differences may be material.

looking information that reflect our current views with respect to future events, strategy, capital

expenditures and financial performance. These estimates, projections and other forward-looking

information are based on assumptions that HealthSouth believes, as of the date hereof, are reasonable.

Inevitably, there will be differences between such estimates and actual events or results, and those

differences may be material.

There can be no assurance that any estimates, projections or forward-looking information will be realized.

All such estimates, projections and forward-looking information speak only as of the date hereof.

HealthSouth undertakes no duty to publicly update or revise the information contained herein.

HealthSouth undertakes no duty to publicly update or revise the information contained herein.

You are cautioned not to place undue reliance on the estimates, projections and other forward-looking

information in this presentation as they are based on current expectations and general assumptions and

are subject to various risks, uncertainties and other factors, including those set forth in the Form 10-K for the

year ended December 31, 2010, when filed, our Form 10-Q for the quarters ended March 31, 2010, June 30,

2010, and September 30, 2010, and in other documents we previously filed with the SEC, many of which are

beyond our control, that may cause actual events or results to differ materially from the views, beliefs and

estimates expressed herein.

information in this presentation as they are based on current expectations and general assumptions and

are subject to various risks, uncertainties and other factors, including those set forth in the Form 10-K for the

year ended December 31, 2010, when filed, our Form 10-Q for the quarters ended March 31, 2010, June 30,

2010, and September 30, 2010, and in other documents we previously filed with the SEC, many of which are

beyond our control, that may cause actual events or results to differ materially from the views, beliefs and

estimates expressed herein.

Note Regarding Presentation of Non-GAAP Financial Measures

The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G

under the Securities Exchange Act of 1934. Schedules are attached that reconcile the non-GAAP financial

measures included in the following presentation to the most directly comparable financial measures

calculated and presented in accordance with Generally Accepted Accounting Principles in the United

States. Our Form 8-K, dated February 17, 2011, to which the following supplemental slides are attached as

Exhibit 99.2, provides further explanation and disclosure regarding our use of non-GAAP financial measures

and should be read in conjunction with these supplemental slides.

The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G

under the Securities Exchange Act of 1934. Schedules are attached that reconcile the non-GAAP financial

measures included in the following presentation to the most directly comparable financial measures

calculated and presented in accordance with Generally Accepted Accounting Principles in the United

States. Our Form 8-K, dated February 17, 2011, to which the following supplemental slides are attached as

Exhibit 99.2, provides further explanation and disclosure regarding our use of non-GAAP financial measures

and should be read in conjunction with these supplemental slides.

Forward-Looking Statements

2

Exhibit 99.2

Table of Contents

3

Exhibit 99.2

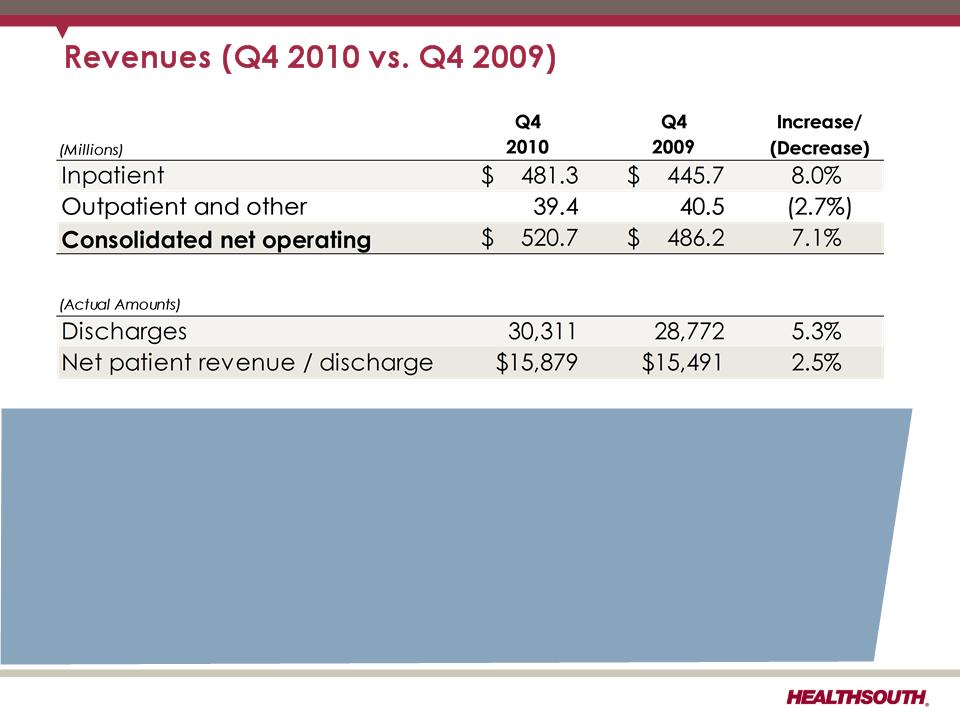

Q4 2010 Summary (Q4 2010 vs. Q4 2009)

ü Revenue growth of 7.1%

― Inpatient revenue growth of 8.0% driven by volume and price

§ Discharge growth 5.3%; same-store discharge growth 2.9%

• Continued market share gains, including new hospitals

§ Higher revenue per discharge of 2.5% predominantly driven by Medicare

and managed care price increases

and managed care price increases

― Outpatient and other revenue declined 2.7% on 8 fewer outpatient clinics

|

Location

|

# of Beds

|

Transaction

|

Date

|

Same store

|

|

Mesa, AZ

|

40

|

De Novo

|

Q3 2009

|

Yes

|

|

Altoona, PA

|

0

|

Acquired unit through JV

|

Q4 2009

|

Yes

|

|

FT. Smith, AR

|

0

|

Acquired unit (consolidation)

|

Q3 2010

|

Yes

|

|

Loudoun County, VA

|

40

|

De Novo

|

Q2 2010

|

No

|

|

Las Vegas, NV

|

50

|

Acquired new IRF

|

Q2 2010

|

No

|

|

Bristol, VA

|

25

|

De Novo

|

Q3 2010

|

No

|

|

Houston, TX

|

50

|

Acquired new IRF

|

Q3 2010

|

No

|

4

Exhibit 99.2

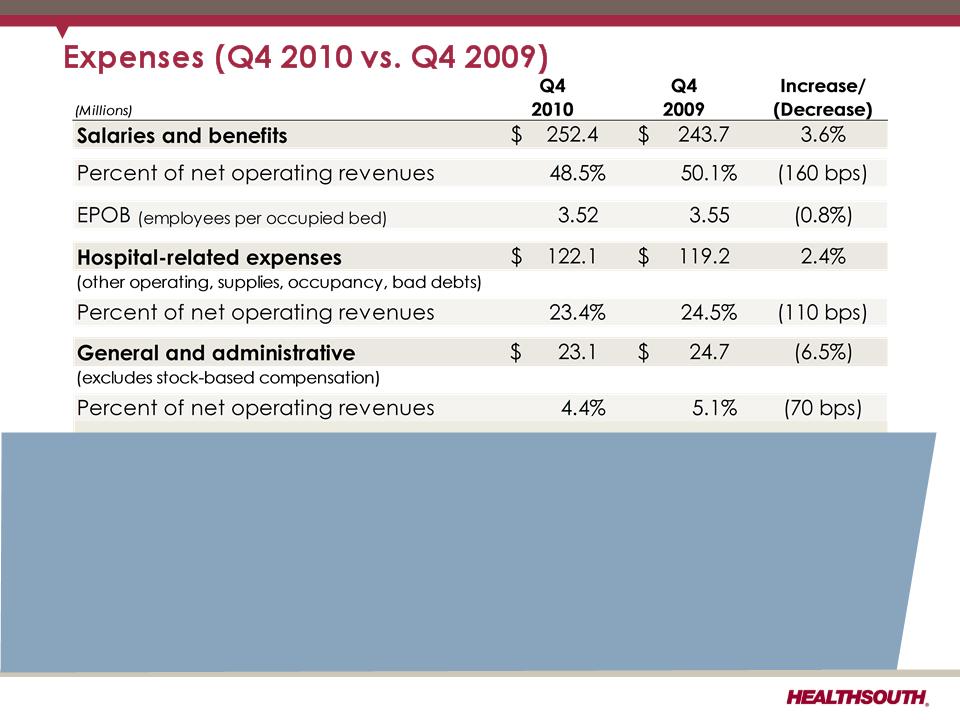

Q4 2010 Summary (Q4 2010 vs. Q4 2009) (cont.)

ü SWB as a percent of revenue decreased 160 bps.

― Improved productivity as measured by EPOB

― Improved occupancy at new hospitals

― Benefited from lower workers’ compensation self-insurance costs

ü Hospital-related expenses decreased 110 bps.

― Lower than expected bad debt expense

§ Fewer than anticipated Medicare denials

§ Enhanced process for bad debt claims capture

§ Recovery of prior period write-offs

― Offset by higher other operating costs mainly attributable to higher professional &

general liability self-insurance costs

general liability self-insurance costs

ü Adjusted EBITDA(1) grew 23.3%.

― Revenue growth driven by volume and pricing

― Continued disciplined expense management and lower bad debt

(1) Reconciliation to GAAP provided on slides 33 and 36 through 39.

5

Exhibit 99.2

Q4 2010 Summary (Q4 2010 vs. Q4 2009) (cont.)

ü Continued strong adjusted free cash flow generation (1)

― Q4 2010 benefited from a shift in timing of interest payments related to the Q4

2010 refinancing.

2010 refinancing.

― Offset by the $6.9 million unwind fee related to the termination of two forward-

starting interest rate swaps

starting interest rate swaps

ü Significant capital structure enhancements

― Completed the issuance of two new senior notes

― Completed the syndication of a new credit facility/agreement with up to $500

million borrowing capacity maturing in 2015

million borrowing capacity maturing in 2015

― Utilized proceeds along with cash on hand to payoff the two term loans

(1) Reconciliation to GAAP provided on slide 34.

6

Exhibit 99.2

Q4 2010 Summary (Q4 2010 vs. Q4 2009) (cont.)

ü Adjusted EPS(1) increased 68.2%.

― Driven by higher Adjusted EBITDA

― Offset by higher interest expense

ü A significant portion of the valuation allowance against deferred income tax

assets was released in Q4 2010.

assets was released in Q4 2010.

― Income statement includes a tax benefit of $736.2 million.

― Balance sheet now includes $707.4 million in deferred income tax assets.

― Reported net income and EPS will reflect a tax rate of approximately 40%.

― No effect on cash taxes which are expected to be approximately $6 to $8

million per year.

million per year.

― Shareholders’ deficit reduced to $2.2 million

(1) Adjusted income from continuing operations; reconciliation to GAAP provided on slides 36 through 39.

7

Exhibit 99.2

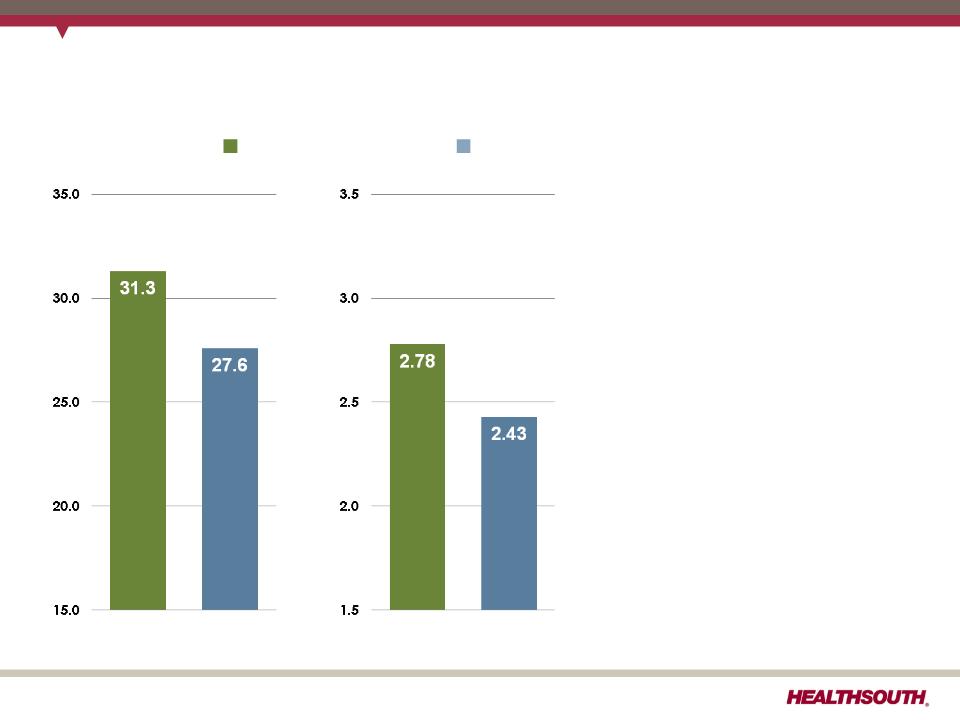

HealthSouth Functional Outcomes Continue to Outpace Industry Average

HealthSouth Average

UDS Average*

FIM Gain

LOS Efficiency

* Average = Expected, Risk-adjusted

Source: UDSmr Database - On Demand Report: Q4 2010 Report

FIM Gain

Change in Functional

Independence

Measurement (based

Independence

Measurement (based

on an 18 point

assessment) from

admission to discharge.

assessment) from

admission to discharge.

LOS Efficiency

Functional gain divided

by length of stay.

by length of stay.

High-Quality Care

8

Exhibit 99.2

• Inpatient revenue growth was driven by:

– Discharge growth of 5.3%; same-store discharge growth of 2.9%

§ Continued market share gains, including new hospitals

– Higher revenue per discharge of 2.5%, predominantly driven by Medicare

and managed care price increases

and managed care price increases

• Outpatient revenue declined primarily as a result of 8 fewer outpatient

rehabilitation satellite clinics quarter over quarter.

rehabilitation satellite clinics quarter over quarter.

9

Exhibit 99.2

• SWB as a percent of revenue decreased 160 bps.

– Improved productivity as measured by EPOB and improved occupancy at new hospitals

– Benefited from lower workers’ compensation self-insurance costs

• Hospital-related expenses decreased 110 bps.

– Lower than expected bad debt expense

§ Fewer than expected Medicare denials

§ Enhanced process for bad debt claims capture

§ Recovery of prior period denials

– Offset by higher operating costs mainly attributable to higher professional & general liability

self-insurance costs.

self-insurance costs.

10

Exhibit 99.2

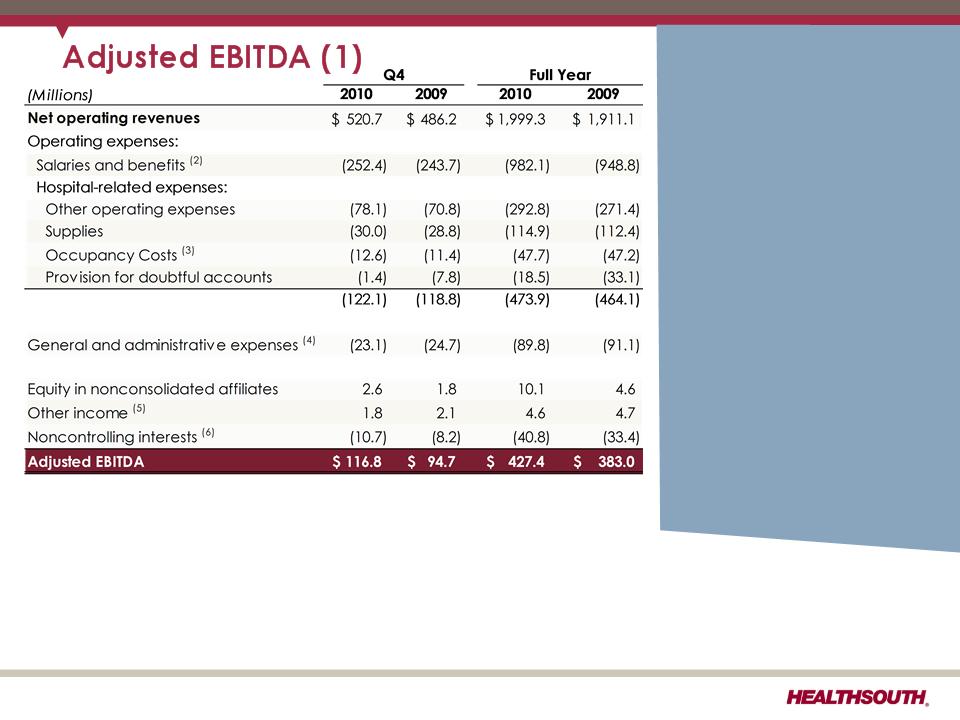

Adjusted EBITDA Change

Q4 Full Year

+$22.1M +$44.4M

+23.3% +11.6%

Improvements driven by:

• Revenue growth

• Disciplined expense

management

management

• New hospitals

Improvements benefited from:

• Lower bad debt expense

Offset by:

• Higher professional & general

liability self-insurance costs

liability self-insurance costs

• TeamWorks investment

(1) Reconciliation to GAAP provided on slides 33 and 36 through 39.

In arriving at Adjusted EBITDA, the following were excluded:

(2) Restructuring charges of $0.0, $0.0, $0.2,and $0.0 million, respectively.

(3) Restructuring charges associated with closed outpatient satellite clinics of $0.0, $0.4, $0.0, and $0.4 million, respectively.

(4) Stock-based compensation expense of $5.2, $3.4, $16.4 and $13.4 million, respectively.

(5) Impairments related to investments of $0.0, $0.02, $0.0, and $1.4 million, respectively.

(6) Noncontrolling interests related to discontinued operations of $0.0, $0.01, $0.0, and $0.6 million, respectively.

11

Exhibit 99.2

Adjusted EPS(1) (Q4 2010 vs. Q4 2009)

(1) Adjusted income from continuing operations; reconciliation to GAAP provided on slides 36 through 39.

• Adjusted EPS(1) increased 68.2%

– Higher Adjusted EBITDA

– Lower loss on early extinguishment of debt

– Offset by higher interest expense and higher stock-based compensation

12

Exhibit 99.2

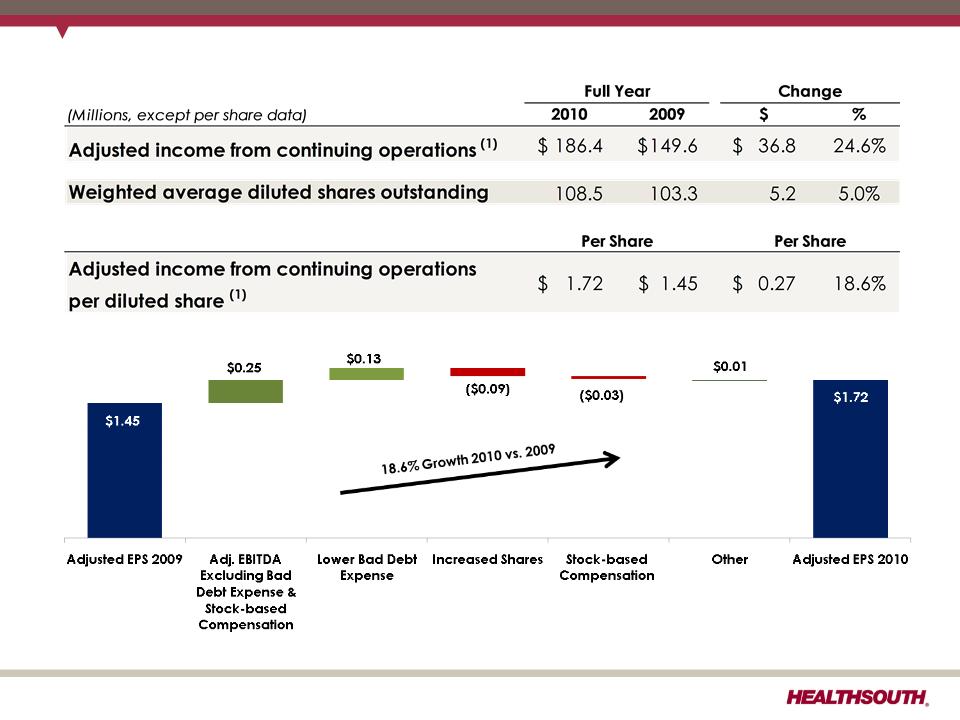

Adjusted EPS(1) (2010 vs. 2009)

(1) Adjusted income from continuing operations; reconciliation to GAAP provided on slides 36 through 39.

13

Exhibit 99.2

Adjusted Free Cash Flow (Q4 2010 vs. Q4 2009)

(1) The $6.9 million unwind fee is included in cash provided by operating activities and is not included in the net settlements on interest

rate swaps.

rate swaps.

(2) For additional information on non-recurring items, see slide 34.

– Q4 2010 operating cash flow benefited from the timing of interest payments related to the

refinancing in Q4 2010.

refinancing in Q4 2010.

– Offset by the $6.9 million unwind fee related to the termination of the two forward-starting

interest rate swaps (1)

interest rate swaps (1)

14

Exhibit 99.2

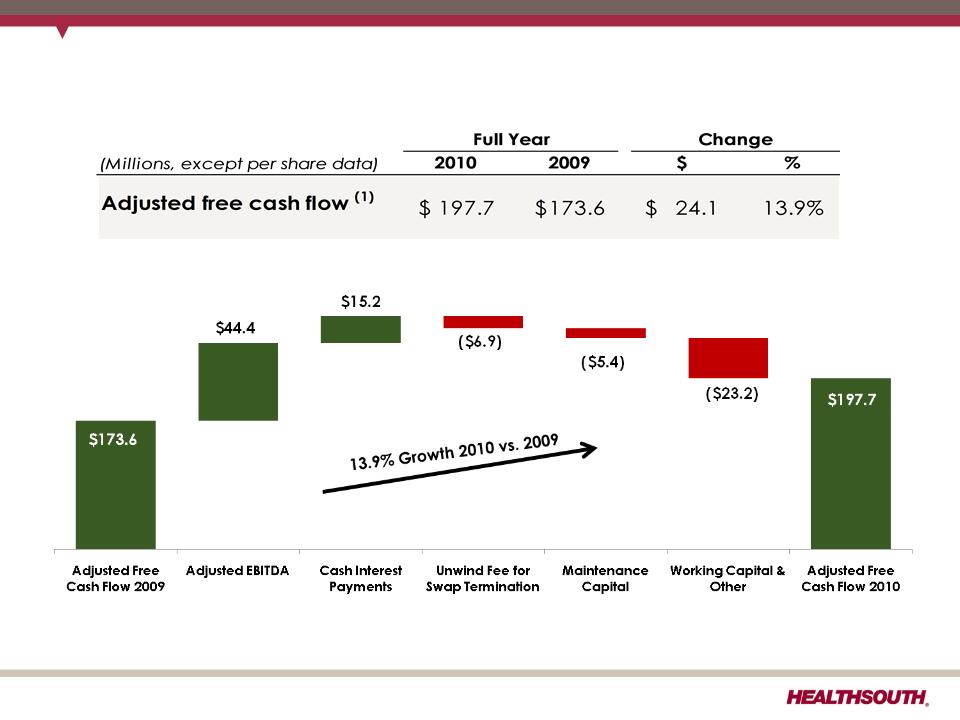

Adjusted Free Cash Flow(1) (2010 vs. 2009)

(1) Reconciliation to GAAP provided on slide 34.

15

Exhibit 99.2

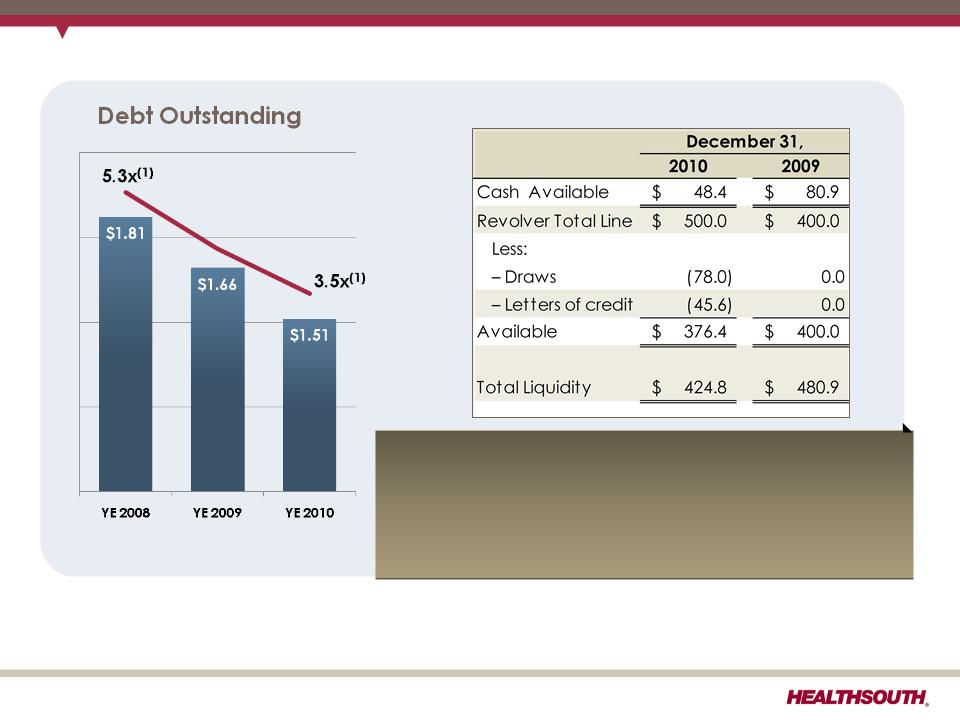

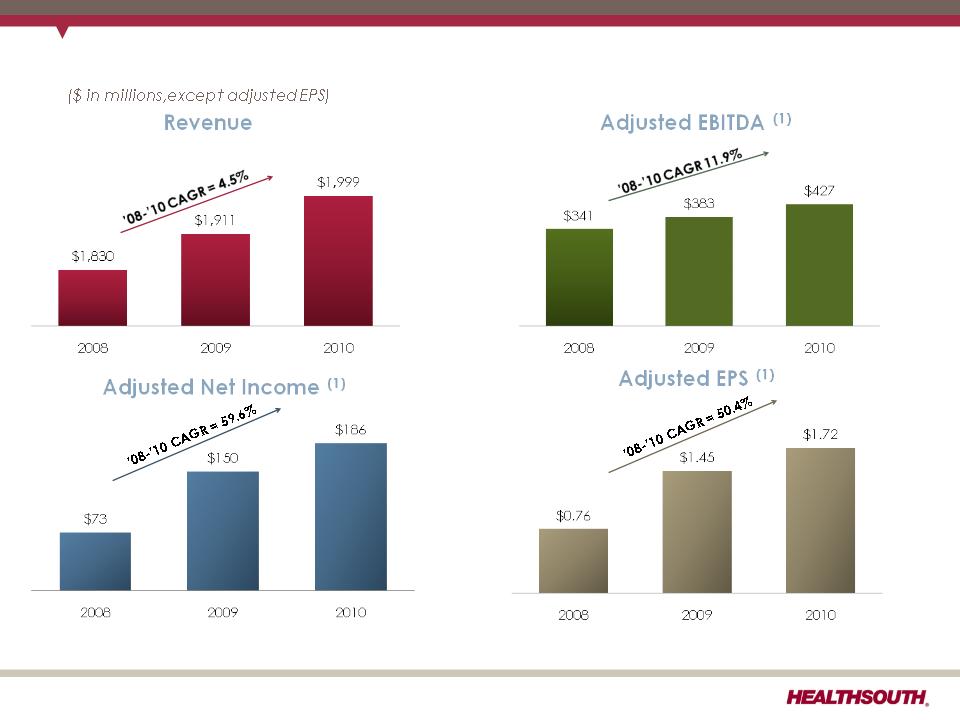

(1) Based on 2008 and 2010 Adjusted EBITDA of $341.2 million and $427.4 million, respectively; reconciliation to GAAP provided on slides 33

and 36 through 39.

and 36 through 39.

(2) Cash settlements flow through investing activities for swaps that do not qualify for hedge accounting. Net notional amount of $884 million

receives 3-month LIBOR and pays 5.22% fixed until expiration in March of 2011.

receives 3-month LIBOR and pays 5.22% fixed until expiration in March of 2011.

(3) Forward-starting interest rate swaps (designated as cash flow hedges) were terminated as part of the refinancing in October of 2010.

Debt, Liquidity, and Swaps

Swaps (2)(3)

The final cash settlement on our net $884 million swaps

for $10.9 million will be made in Q1 2011.

for $10.9 million will be made in Q1 2011.

Liquidity

16

Exhibit 99.2

Our Track Record

(1)Reconciliation to GAAP provided on slides 33 and 36 through 39.

17

Exhibit 99.2

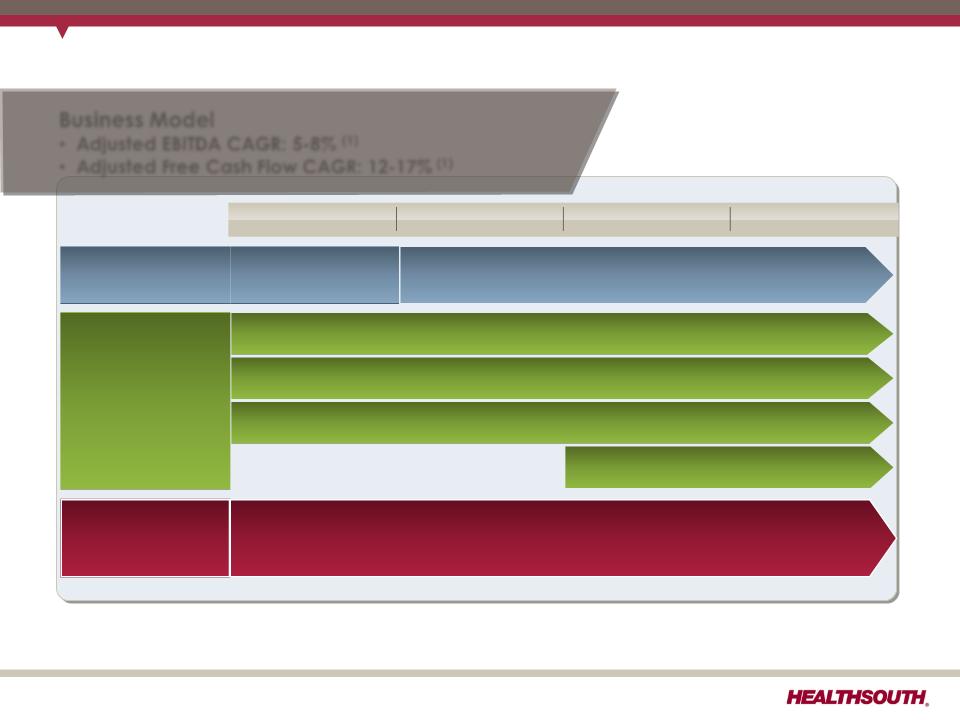

Business Outlook: 2011 to 2013

Business Model

• Adjusted EBITDA CAGR: 5-8% (1)

• Adjusted Free Cash Flow CAGR: 12-17% (1)

Strategy

2010

2011

2012

2013

Deleveraging(2)

Goal: < 4.0x

debt to EBITDA

debt to EBITDA

Longer-Term Goal: ~ 3.0x

debt to EBITDA (3.5x goal achieved at year-end 2010)

debt to EBITDA (3.5x goal achieved at year-end 2010)

Growth

Organic growth (includes capacity expansions)

De novos (~ 2-3/year)

IRF acquisitions (~ 2-3/year)

Opportunistic, disciplined acquisitions

of complementary post-acute services

of complementary post-acute services

Key Operational

Initiatives

Initiatives

• Beacon (Management Reporting Software) = Labor / outcomes / quality optimization

• TeamWorks = Care Management

• “CPR” (Comfort, Professionalism, Respect) Initiative

(1) Reconciliation to GAAP provided on slides 33, 34, and 36 through 39.

(2) Exclusive of any E&Y recovery.

18

Exhibit 99.2

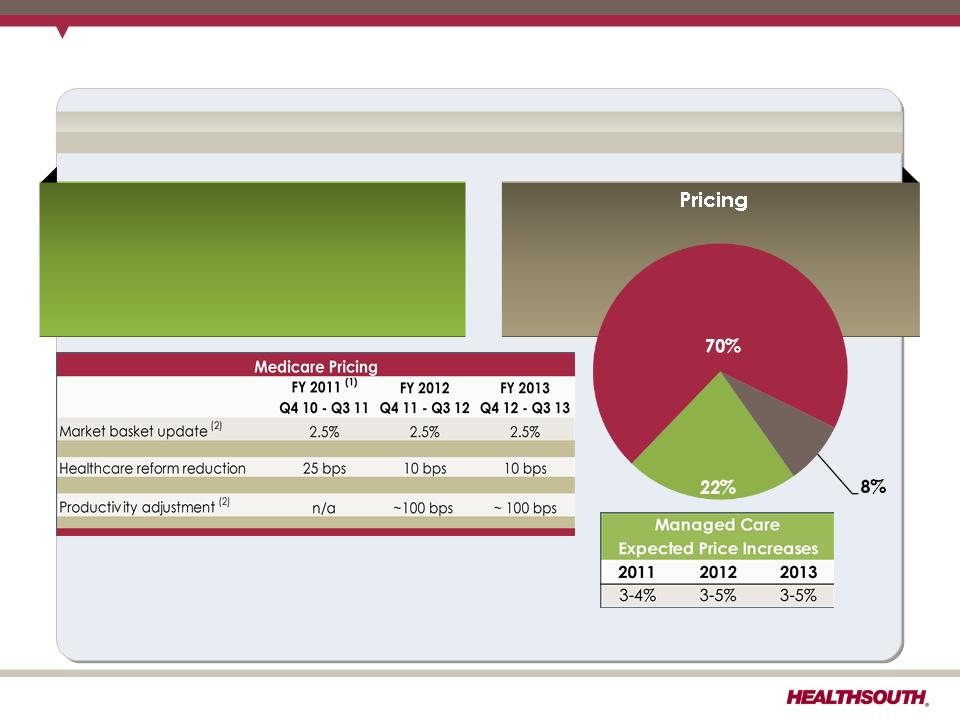

Business Outlook: Revenue Assumptions

Revenue

Volume

• 2.5% to 3.5% annual growth (excludes

acquisitions)

acquisitions)

• Includes bed expansions, de novos

and unit consolidations

and unit consolidations

Medicare

Managed

Care

Care

Other

(1) We believe based on the 2011 Medicare rule for IRFs, HealthSouth should realize an increase of approximately 2.1%

annually.

annually.

(2) Management estimates

19

Exhibit 99.2

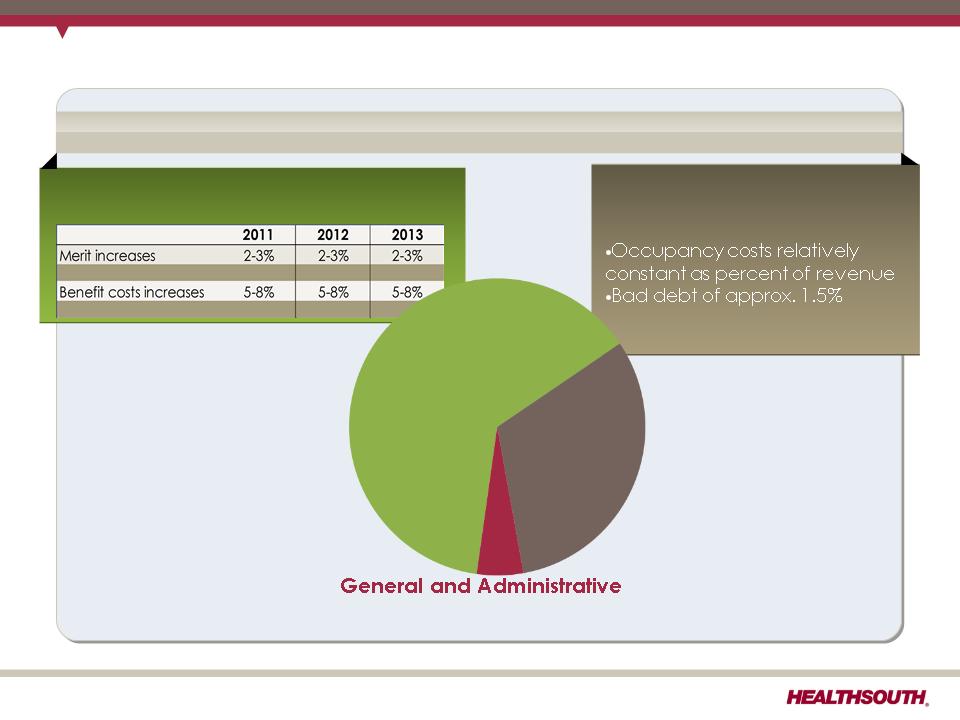

Business Outlook: Expense Assumptions

Expense

Salaries & Benefits (1)

Hospital Expenses

• Other operating and supplies

tracking with inflation

tracking with inflation

4.5% of revenue

(excludes stock-based compensation)

Salaries

& Benefits

Hospital

Expenses

Expenses

(1) Salaries, Wages and Benefits: 85% Salaries and Wages; 15% Benefits

20

Exhibit 99.2

2011 Guidance - Adjusted EBITDA

Adjusted EBITDA (1)

$440 million to $450 million

(1) Reconciliation to GAAP provided on slides 33 and 36 through 39.

Considerations:

ü 2010 bad debt expense was 0.9% of revenue; expect 2011 bad debt expense to

be approximately 1.5% of revenue, in line with historical average

be approximately 1.5% of revenue, in line with historical average

ü Medicare pricing in Q4 2011 will be reduced by a TBD productivity adjustment,

which we estimate to be 100 basis points.

which we estimate to be 100 basis points.

ü Outpatient revenues subject to approximately $1.4 million reduction related to

the 25% rate reduction for reimbursement of therapy expenses for multiple

the 25% rate reduction for reimbursement of therapy expenses for multiple

therapy services (Medicare physician fee schedule for calendar year 2011CMS).

Reflects:

• 2.9% to 5.3% growth over 2010

• 7.2% to 8.4% CAGR over 2009

21

Exhibit 99.2

Business Outlook: Income Tax Considerations

|

GAAP Considerations:

• Valuation allowance reduced by approximately $825 million resulting in a $736.6

million benefit to 2010 income tax provision. • As of 12/31/10, the Company had a remaining valuation allowance of approximately

$113 million, primarily related to state NOLs. Future Cash Tax Payments:

• Expects to pay approximately $6-8 million per year of income tax.

• Does not expect to pay significant federal income taxes for up to 10 years.

• HealthSouth is not currently subject to an annual use limitation (“AUL”) under Internal

Revenue Code Section 382 (“Section 382”). A “change of ownership,” as defined by Section 382, would subject us to an AUL, which is equal to the market capitalization of the Company at the time of the “change of ownership” multiplied by the long-term tax exempt rate. |

22

Exhibit 99.2

Business Outlook: Adjusted Free Cash Flow (1)

(1) Reconciliation to GAAP provided on slide 34.

• Items that will affect Adjusted Free Cash Flow in 2011:

+ Cash settlements for interest rate swaps will be $33.8 million lower in 2011.

+ Interest expense will be reduced with any repayment/refinancing of 10.75% senior notes

callable in June 2011.

callable in June 2011.

– Maintenance capital expenditures are estimated to be approximately $20 million higher

in 2011 than 2010.

in 2011 than 2010.

– Interest expense will be approximately $4 million per quarter higher in 2011 than 2010,

prior to any repayment/refinancing of the 10.75% senior notes.

prior to any repayment/refinancing of the 10.75% senior notes.

• 2010 working capital benefited from a shift in timing of interest payments related to the

refinancing in Q4 2010, offset by the $6.9 million unwind fee related to the termination of

the two forward-starting interest rate swaps.

refinancing in Q4 2010, offset by the $6.9 million unwind fee related to the termination of

the two forward-starting interest rate swaps.

HealthSouth’s GAAP income statement will be affected by a

number of items that will not affect cash flow from operating

activities or adjusted free cash flow:

number of items that will not affect cash flow from operating

activities or adjusted free cash flow:

• Normalized GAAP tax rate resulting from the valuation

allowance reversal in Q4 2010.

allowance reversal in Q4 2010.

• Loss on early extinguishment of debt

Multi-Year Adjusted Free Cash Flow 12% to 17% CAGR

23

Exhibit 99.2

|

Sources

|

$ Million (1)

|

Assumed

Call Price (3) |

Annual

Interest Savings |

|

Cash on hand

|

$100.0

|

105.375

|

$10.2

|

|

|

|

|

|

|

Revolving credit facility (LIBOR + 350 bps)(2)

|

$100.0

|

105.375

|

$6.4

|

|

|

|

|

|

|

New senior notes (assumed coupon of 7.50%)

|

$100.0

|

105.375

|

$2.7

|

|

Accounting effect for early repayment/ refinancing :

|

|||

|

“Loss on early extinguishment of debt” = ~$8 million per $100 million of the 10.75% senior notes.

|

|||

|

|

|||

Options for Addressing the 10.75% Senior Notes

(millions)

(1) Illustrative only

(2) Assumes 3M LIBOR of 0.302%

(3) Call schedule: June 15, 2011 (price 105.375); June 15, 2012 (price 103.583); June 15, 2013 (price 101.792); June 15, 2014 and

thereafter (price 100.000)

thereafter (price 100.000)

We can utilize a number of sources to repay/refinance the 10.75% notes.

Illustration of Potential Interest Expense Reduction by Funding Source

24

Exhibit 99.2

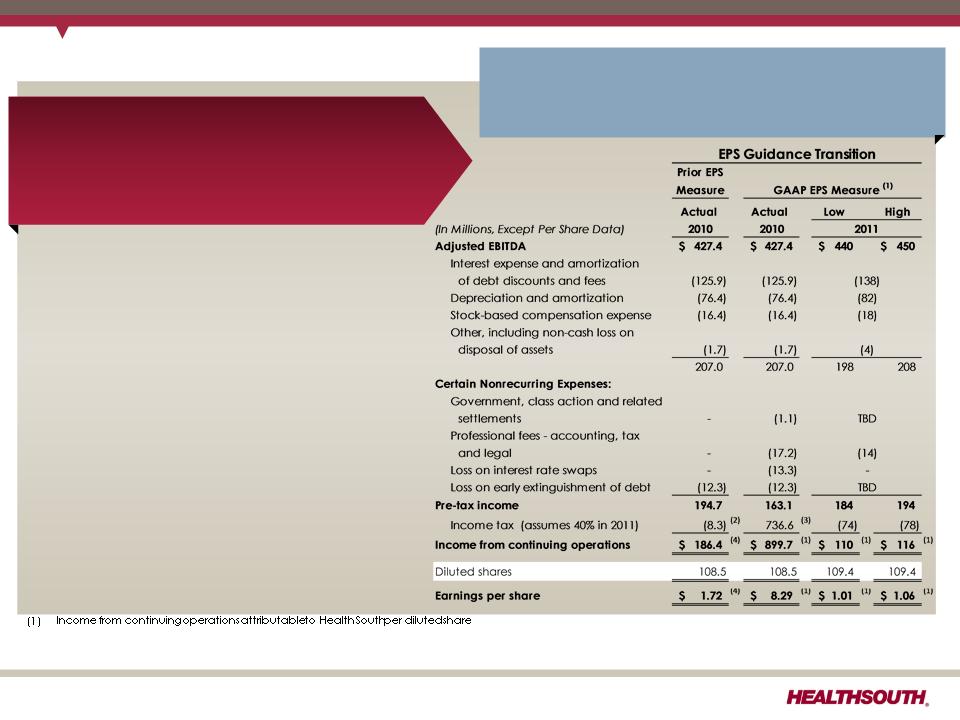

2011 Guidance - EPS

Diluted Earnings per Share from

Continuing Operations Attributable

to HealthSouth (1)

Continuing Operations Attributable

to HealthSouth (1)

$1.01 to $1.06

Considerations:

ü Assumes provision for income tax of 40%;

cash taxes expected to be $6-$8 million.

cash taxes expected to be $6-$8 million.

ü Guidance does not include any

repayment/refinancing of the 10.75%

repayment/refinancing of the 10.75%

senior notes callable in June 2011, which

would affect the following items:

• Interest expense which is currently

forecasted to be approximately $4

million per quarter higher in Q1, Q2,

forecasted to be approximately $4

million per quarter higher in Q1, Q2,

and Q3 2011 vs. prior periods in 2010.

• Does not include “loss on early

extinguishment of debt” (non-cash)

extinguishment of debt” (non-cash)

• Depreciation is estimated to be

higher as a result of capital

expenditures in prior periods.

HealthSouth is transitioning EPS guidance to a

GAAP measure.

GAAP measure.

(2) Current period amounts in income tax provision; see slides 36 and 39

(3) Total income tax provision for full-year 2010, including the reversal of a substantial portion of the Company's valuation allowance against deferred tax assets.

(4) Adjusted income from continuing operations; see slides 36 and 39

25

Exhibit 99.2

Appendix

Exhibit 99.2

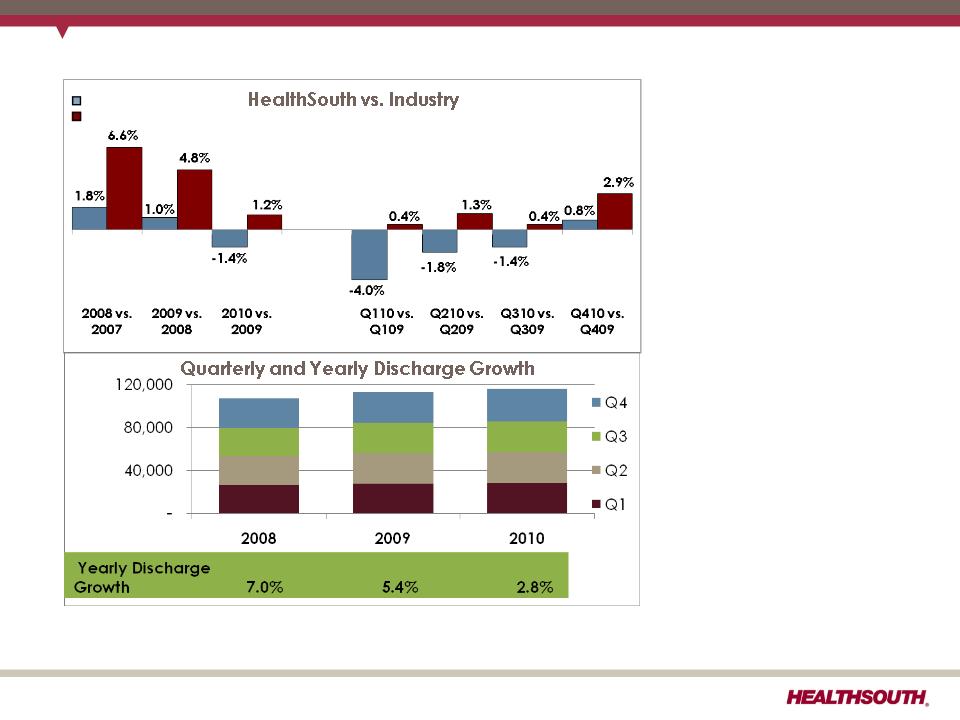

(1) Data provided by UDSMR, a data gathering and analysis organization for the rehabilitation industry; represents ~ 65-70% of industry,

including HealthSouth sites.

including HealthSouth sites.

(2) Includes consolidated HealthSouth inpatient rehabilitation hospitals and long-term acute care hospitals classified as same store during

that time period.

that time period.

Historic Discharge Growth vs. Industry

• HealthSouth’s

volume growth has

outpaced

competitors’.

volume growth has

outpaced

competitors’.

• TeamWorks =

standardized and

enhanced sales &

marketing

standardized and

enhanced sales &

marketing

• Bed additions will

help facilitate

continued organic

growth.

help facilitate

continued organic

growth.

UDS Industry Sites (1)

HLS Same Store (2)

10.7%

9.4%

5.6%

2.6%

4.6%

5.5%

5.8%

5.8%

5.3%

2.5%

2.2%

1.1%

27

Exhibit 99.2

Debt Schedule and Interest Expense

(1) Based on 2010 and 2009 Adjusted EBITDA of $427.4 million and $383.0 million, respectively; reconciliation to GAAP provided on slides 33

and 36 through 39.

and 36 through 39.

(2) Based on debt balances as of December 31, 2010 and assumes 3 month LIBOR of 0.302%.

28

Exhibit 99.2

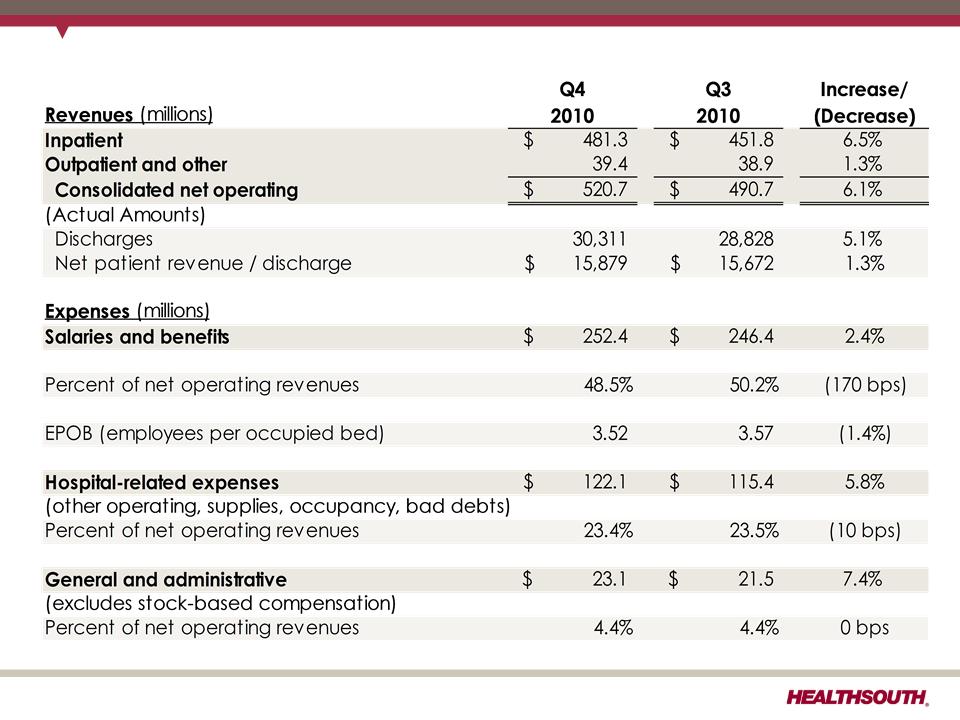

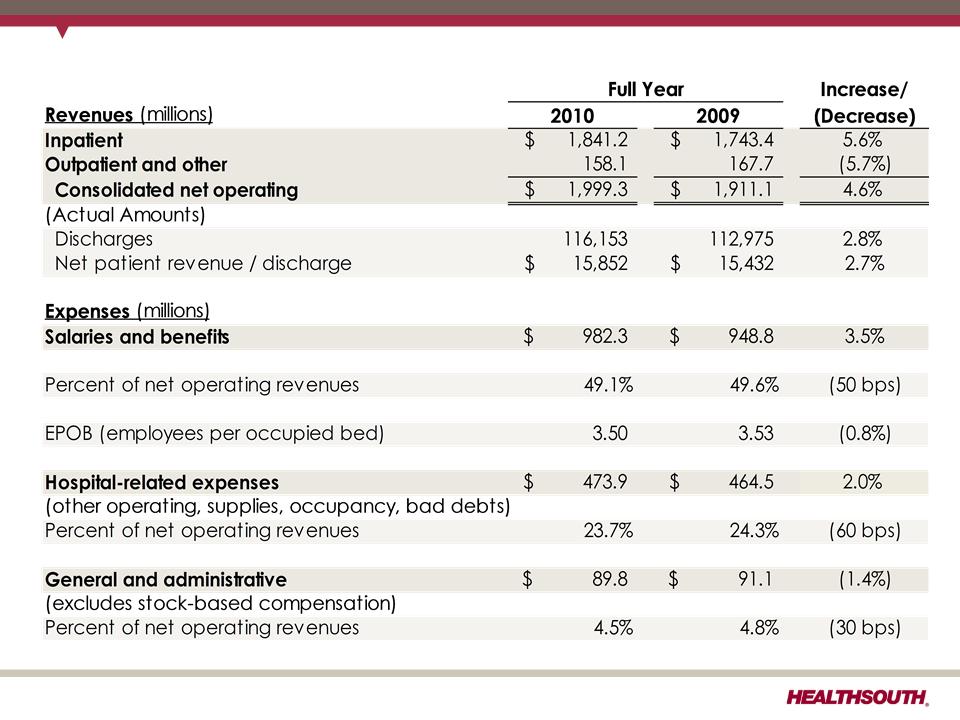

Revenues & Expenses (Sequential)

29

Exhibit 99.2

Revenues & Expenses (Year over Year)

30

Exhibit 99.2

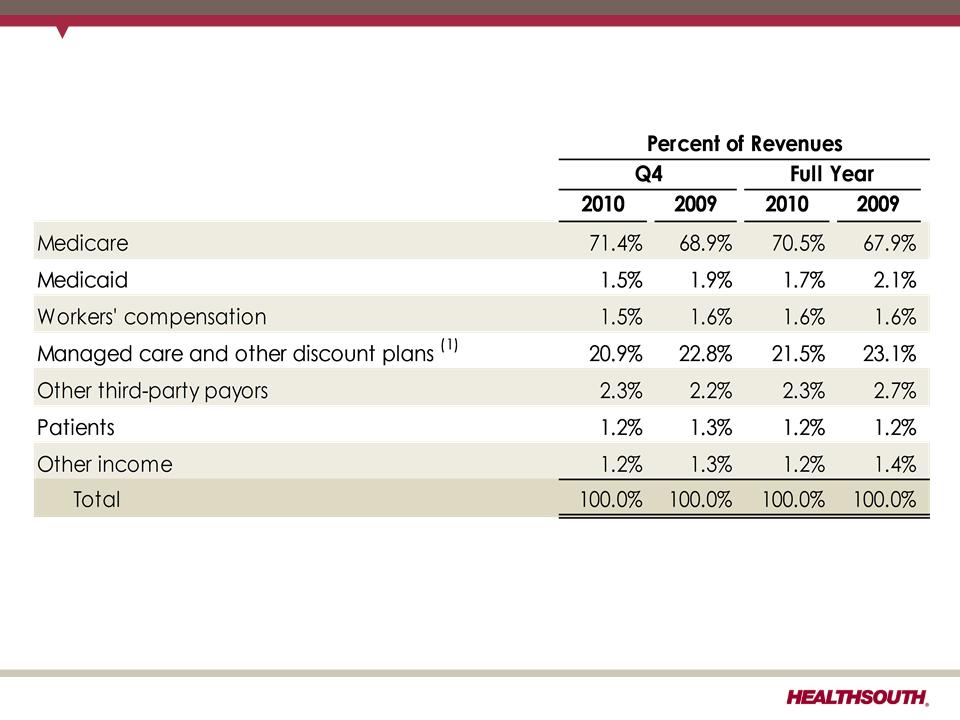

Payment Sources

(1) Managed Medicare revenues represent ~ 8%, 7%, 8%, and 8% of total revenues for Q4 2010, Q4 2009, 2010, and 2009, respectively, and

are included in “Managed care and other discount plans.”

are included in “Managed care and other discount plans.”

31

Exhibit 99.2

(3) Excludes approximately 400 full-time equivalents, who are considered part of corporate overhead with their salaries and benefits

included in general and administrative expenses in the Company’s consolidated statements of operations. Full-time equivalents

included in the above table represent HealthSouth employees who participate in or support the operations of the Company’s

hospitals.

included in general and administrative expenses in the Company’s consolidated statements of operations. Full-time equivalents

included in the above table represent HealthSouth employees who participate in or support the operations of the Company’s

hospitals.

(4) Employees per occupied bed, or “EPOB,” is calculated by dividing the number of full-time equivalents, including an estimate of full-

time equivalents from the utilization of contract labor, by the number of occupied beds during each period. The number of occupied

beds is determined by multiplying the number of licensed beds by the Company’s occupancy percentage.

time equivalents from the utilization of contract labor, by the number of occupied beds during each period. The number of occupied

beds is determined by multiplying the number of licensed beds by the Company’s occupancy percentage.

32

Exhibit 99.2

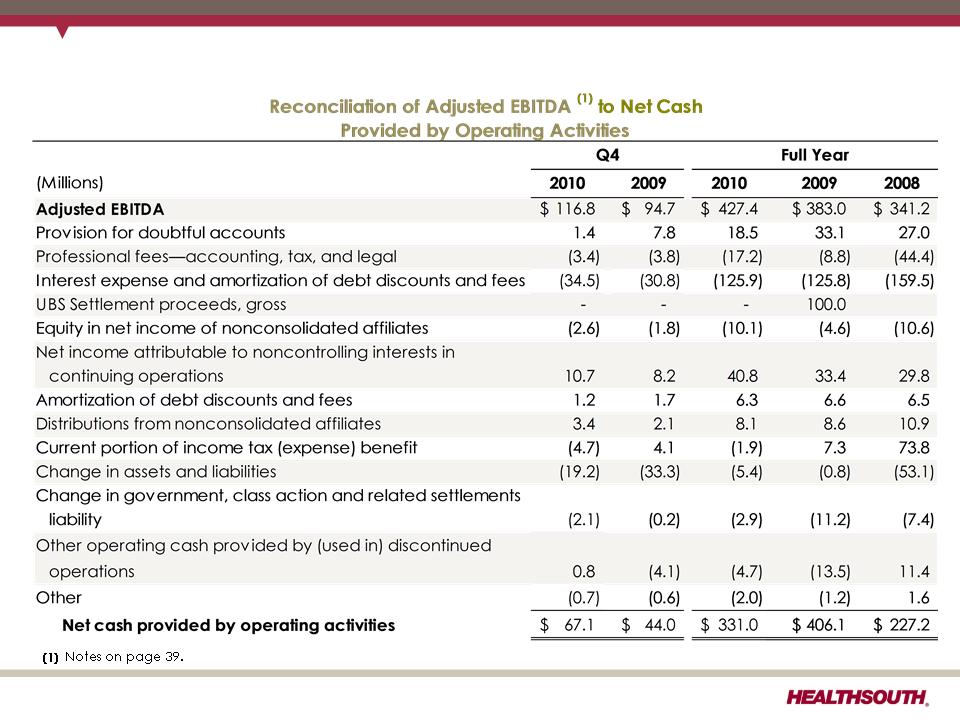

Net Cash Provided by Operating Activities

33

Exhibit 99.2

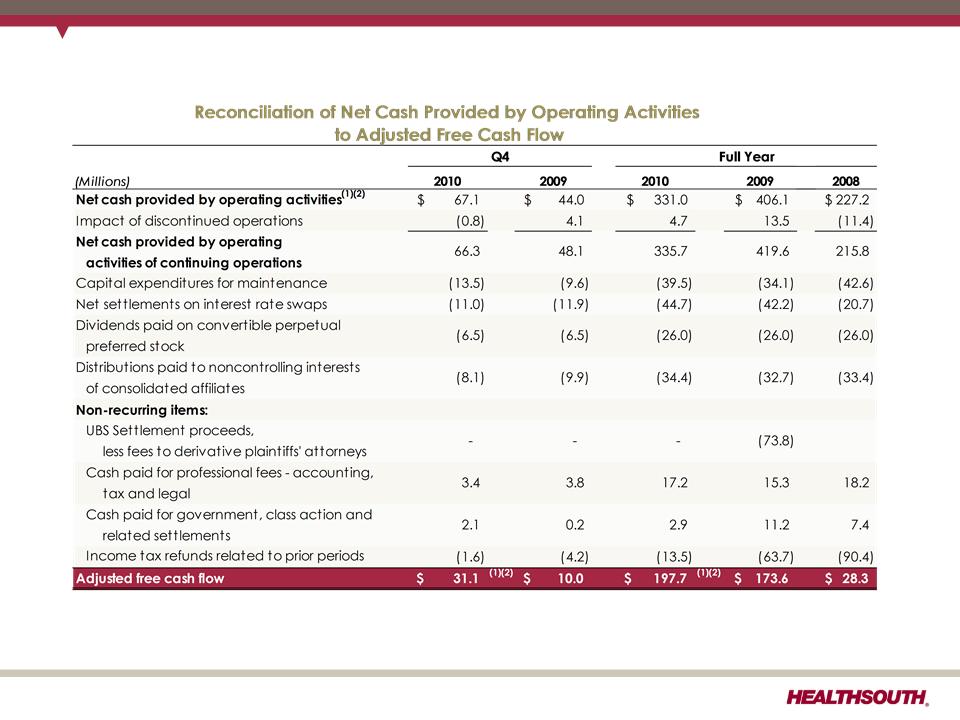

Adjusted Free Cash Flow

(1) Q4 2010 and full-year 2010 working capital benefited from a shift in timing of interest payments related to the refinancing in Q4 2010.

(2) Q4 2010 and full-year 2010 were negatively affected by the $6.9 million unwind fee related to the termination of two forward-starting

interest rate swaps, which is included in cash provided by operating activities and not included in the net settlements on interest rate

swaps.

interest rate swaps, which is included in cash provided by operating activities and not included in the net settlements on interest rate

swaps.

34

Exhibit 99.2

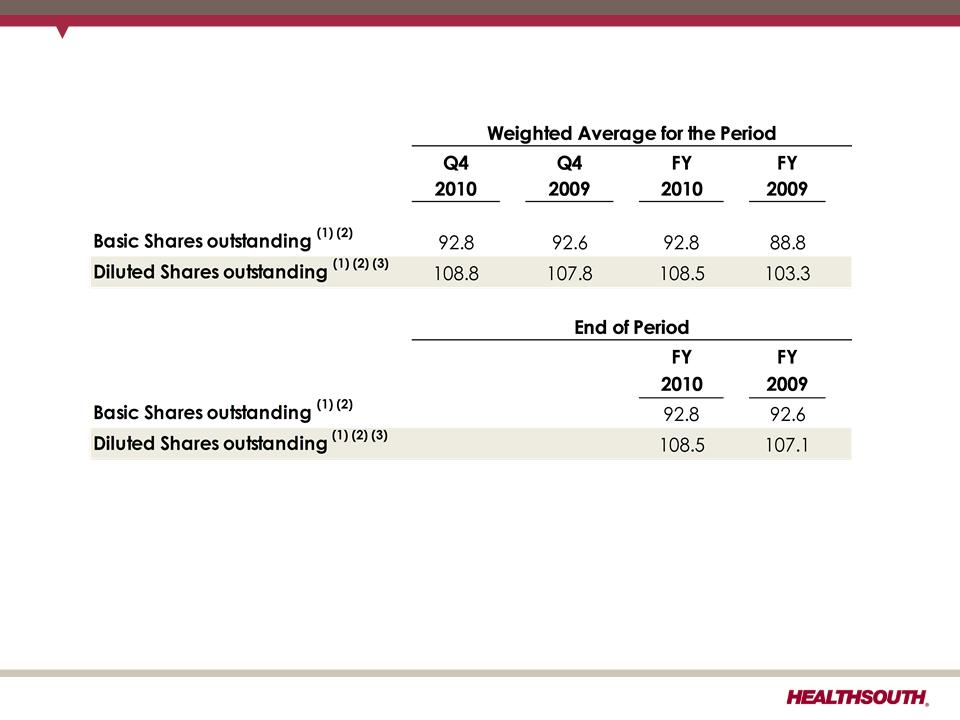

Outstanding Share Summary

(Millions)

(Millions)

Notes:

(1) Does not include 2.0 million warrants issued in connection with a January 2004 loan repaid to Credit Suisse First Boston. In connection

with this transaction, we issued warrants to the lender to purchase two million shares of our common stock. Each warrant has a term

of ten years from the date of issuance and an exercise price of $32.50 per share. The warrants were not assumed exercised for

dilutive shares outstanding because they were antidilutive in the periods presented.

with this transaction, we issued warrants to the lender to purchase two million shares of our common stock. Each warrant has a term

of ten years from the date of issuance and an exercise price of $32.50 per share. The warrants were not assumed exercised for

dilutive shares outstanding because they were antidilutive in the periods presented.

(2) The agreement to settle our class action securities litigation received final court approval in January 2007. These shares of common

stock and warrants were issued on September 30, 2009. The 5.0 million of common shares are now included in the outstanding shares.

The warrants to purchase approx. 8.2 million shares of common stack at a strike price of $41.40 were not assumed exercised for the

dilutive shares outstanding because they are anti-dilutive in the periods presented.

stock and warrants were issued on September 30, 2009. The 5.0 million of common shares are now included in the outstanding shares.

The warrants to purchase approx. 8.2 million shares of common stack at a strike price of $41.40 were not assumed exercised for the

dilutive shares outstanding because they are anti-dilutive in the periods presented.

(3) The difference between the basic and diluted shares outstanding is primarily related to our convertible perpetual preferred stock.

35

Exhibit 99.2

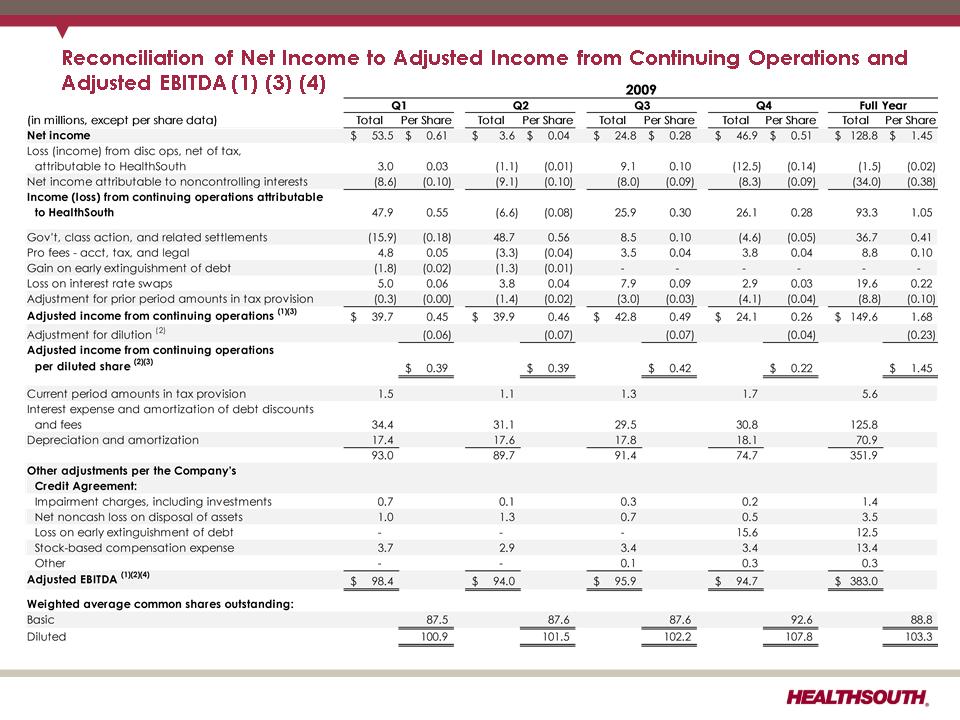

Reconciliation of Net Income to Adjusted Income from Continuing Operations and

Adjusted EBITDA (1) (3) (4)

Adjusted EBITDA (1) (3) (4)

36

Exhibit 99.2

(1) (2) (3) (4) - Notes on page 39.

37

Exhibit 99.2

(1) (2) (3) (4) - Notes on page 39.

38

Exhibit 99.2

Reconciliation Notes

1. Adjusted income from continuing operations and Adjusted EBITDA are non-GAAP

financial measures. The Company’s leverage ratio (total consolidated debt to

Adjusted EBITDA for the trailing four quarters) is, likewise, a non-GAAP financial

measure. Management and some members of the investment community utilize

adjusted income from continuing operations as a financial measure and Adjusted

EBITDA and the leverage ratio as liquidity measures on an ongoing basis. These

measures are not recognized in accordance with GAAP and should not be viewed as

an alternative to GAAP measures of performance or liquidity. In evaluating these

adjusted measures, the reader should be aware that in the future HealthSouth may

incur expenses similar to the adjustments set forth above.

financial measures. The Company’s leverage ratio (total consolidated debt to

Adjusted EBITDA for the trailing four quarters) is, likewise, a non-GAAP financial

measure. Management and some members of the investment community utilize

adjusted income from continuing operations as a financial measure and Adjusted

EBITDA and the leverage ratio as liquidity measures on an ongoing basis. These

measures are not recognized in accordance with GAAP and should not be viewed as

an alternative to GAAP measures of performance or liquidity. In evaluating these

adjusted measures, the reader should be aware that in the future HealthSouth may

incur expenses similar to the adjustments set forth above.

2. Per share amounts for each period presented are based on basic weighted average

common shares outstanding for all amounts except adjusted income from continuing

operations per diluted share, which is based on diluted weighted average shares

outstanding. The difference in shares between the basic and diluted shares

outstanding is primarily related to our convertible perpetual preferred stock.

common shares outstanding for all amounts except adjusted income from continuing

operations per diluted share, which is based on diluted weighted average shares

outstanding. The difference in shares between the basic and diluted shares

outstanding is primarily related to our convertible perpetual preferred stock.

3. Adjusted income from continuing operations per diluted share and Adjusted EBITDA

are two components of our historical guidance.

are two components of our historical guidance.

4. The Company’s credit agreement allows certain other items to be added to arrive at

Adjusted EBITDA, and there may be certain other deductions required.

Adjusted EBITDA, and there may be certain other deductions required.

39

Exhibit 99.2