Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - 3D SYSTEMS CORP | f8k_021711.htm |

| EX-99 - EXHIBIT 99.1 - 3D SYSTEMS CORP | exh_991.htm |

Copyright 3D Systems Corporation All Rights Reserved

3D Systems

www.3dsystems.com

NASDAQ:TDSC

Conference Call

& Webcast

& Webcast

February 17, 2011

Fourth

Quarter 2010

Results

Quarter 2010

Results

Copyright 3D Systems Corporation All Rights Reserved

2

2

Participants

• Investor Relations Coordinator

Stacey Witten

• President & Chief Executive

Officer

Officer

Abe Reichental

• Senior Vice President & Chief

Financial Officer

Financial Officer

Damon Gregoire

• Vice President & General Counsel

Bob Grace

Copyright 3D Systems Corporation All Rights Reserved

3

3

Welcome Webcast Viewers

To listen to the conference

via phone and to ask

questions during our Q&A

session, please dial:

via phone and to ask

questions during our Q&A

session, please dial:

• 1-888-626-7452 in the

United States

United States

• 1-201-604-5102 from

outside the United States

outside the United States

Copyright 3D Systems Corporation All Rights Reserved

4

4

Forward Looking Statements

Certain statements made in this presentation that are not statements of historical or current facts are forward-

looking statements within the meaning of the Private Securities Litigation Reform Act of 1995.

looking statements within the meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements may involve known and unknown risks, uncertainties and other factors that may

cause the actual results, performance or achievements of the company to be materially different from

historical results or from any future results expressed or implied by such forward-looking statements.

cause the actual results, performance or achievements of the company to be materially different from

historical results or from any future results expressed or implied by such forward-looking statements.

In addition to statements which explicitly describe such risks and uncertainties, readers are urged to consider

statements in the future or conditional tenses or that include the terms “believes,” “belief,” “estimates,”

“expects,” “intends,” “anticipates” or “plans” to be uncertain and forward-looking. Forward-looking

statements may include comments as to the company’s beliefs and expectations as to future events and

trends affecting its business.

statements in the future or conditional tenses or that include the terms “believes,” “belief,” “estimates,”

“expects,” “intends,” “anticipates” or “plans” to be uncertain and forward-looking. Forward-looking

statements may include comments as to the company’s beliefs and expectations as to future events and

trends affecting its business.

Forward-looking statements are based upon management’s current expectations concerning future events and

trends and are necessarily subject to uncertainties, many of which are outside the control of the company.

trends and are necessarily subject to uncertainties, many of which are outside the control of the company.

The factors stated under the headings “Forward-Looking Statements,” “Cautionary Statements and Risk

Factors,” and “Risk Factors” that appear in the company’s periodic filings with the Securities and Exchange

Commission, as well as other factors, could cause actual results to differ materially from those reflected or

predicted in forward-looking statements.

Factors,” and “Risk Factors” that appear in the company’s periodic filings with the Securities and Exchange

Commission, as well as other factors, could cause actual results to differ materially from those reflected or

predicted in forward-looking statements.

Abe Reichental President & CEO

Copyright 3D Systems Corporation All Rights Reserved

6

6

We are pleased with our performance and

results for the fourth quarter and full year

results for the fourth quarter and full year

We achieved record revenue growth from all

revenue buckets

revenue buckets

We exceeded the first revenue goal post of our

operating model and achieved our operating

income target

operating model and achieved our operating

income target

Fourth Quarter and Full Year 2010 Overview

We expanded our gross profit and gross

profit margin over comparable periods and

sequentially

profit margin over comparable periods and

sequentially

Damon Gregoire Senior Vice President & CFO

Copyright 3D Systems Corporation All Rights Reserved

8

Across-The-Board Revenue Growth

2009

2009

2009

2009

38%

74%

88%

46%

16%

$32.4

$11.8

$22.3

$32.0

$46.8

$50.3

$58.4

$15.7

$21.6

($ in millions)

Copyright 3D Systems Corporation All Rights Reserved

9

9

Fourth Quarter 2010 Operating Results

- Percents are rounded to the nearest whole number

Copyright 3D Systems Corporation All Rights Reserved

10

10

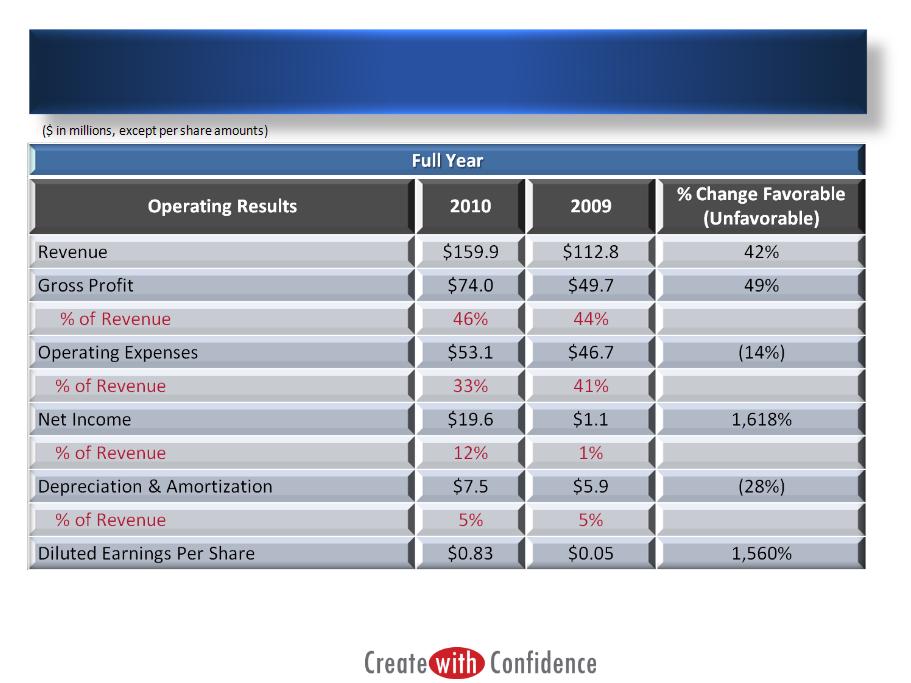

Full Year 2010 Operating Results

- Percents are rounded to the nearest whole number

Copyright 3D Systems Corporation All Rights Reserved

11

11

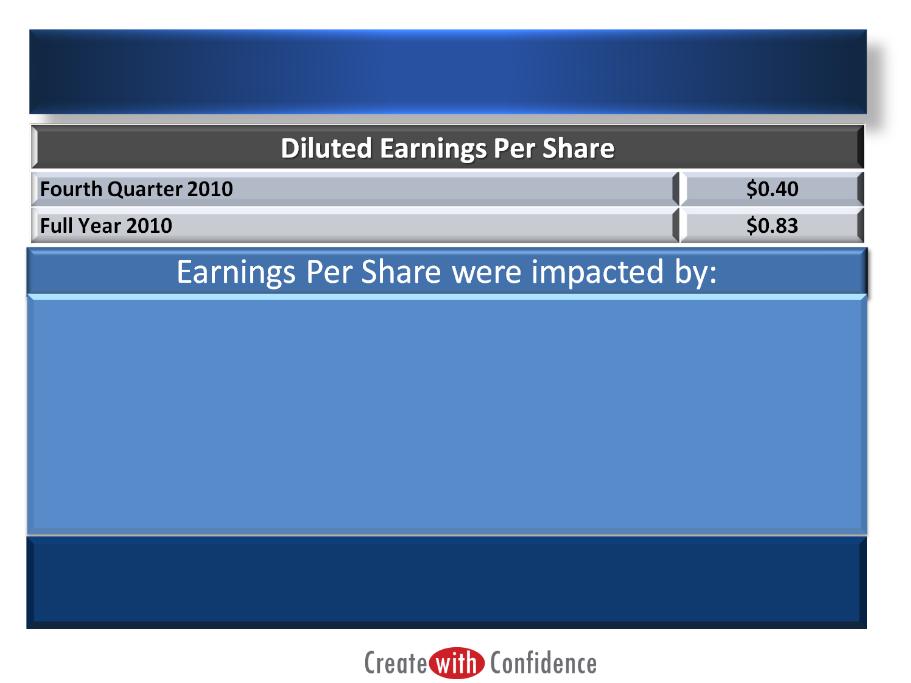

Factors Affecting Earnings Per Share

• Planned V-Flash® ramp up reduced EPS by 2 cents per share for the quarter

and 7 cents per share for the year

and 7 cents per share for the year

• Legal costs reduced EPS by 8 cents per share for the quarter and 25 cents per

share for the year

share for the year

• Releasing a portion of our valuation allowance on deferred tax assets (DTA)

increased EPS by 5 cents per share for both the fourth quarter and the full

year 2010

increased EPS by 5 cents per share for both the fourth quarter and the full

year 2010

Future performance may result in release of additional portions of our valuation

allowance on DTA. We expect to periodically evaluate the timing and amounts of future

releases of valuation allowances as required

allowance on DTA. We expect to periodically evaluate the timing and amounts of future

releases of valuation allowances as required

Copyright 3D Systems Corporation All Rights Reserved

12

12

Full Year Revenue by Category and Region

Services

Materials

Printers &

Other

Other

2009

2010

2009

2010

Revenue Buckets

Geography

Copyright 3D Systems Corporation All Rights Reserved

13

13

Fourth Quarter Gross Profit and Margin

Q1-10

45.3%

45.3%

Q3-10

45.4%

45.4%

Q4-10

48.2%

48.2%

*Core services without 3Dproparts™ was 47% for Q4 2010 compared to 41% for Q4 2009

Copyright 3D Systems Corporation All Rights Reserved

14

14

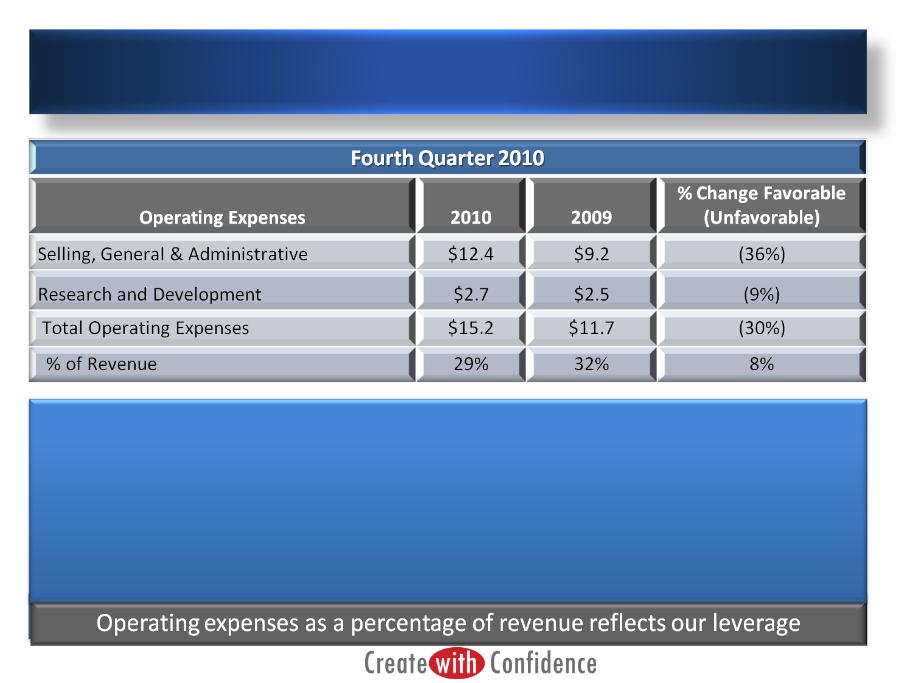

Fourth Quarter Operating Expenses

• Total operating expenses increased primarily due to:

• Compensation costs related to higher commissions from increased revenue and

acquisitions

acquisitions

• Legal expenses of $1.8 million primarily due to litigation concentration and

timing

timing

• Selling, general & administrative expenses decreased as a percent of revenue to 24%

for the quarter from 25% in the fourth quarter of 2009

for the quarter from 25% in the fourth quarter of 2009

- Columns may not foot due to rounding

($ Millions)

Copyright 3D Systems Corporation All Rights Reserved

15

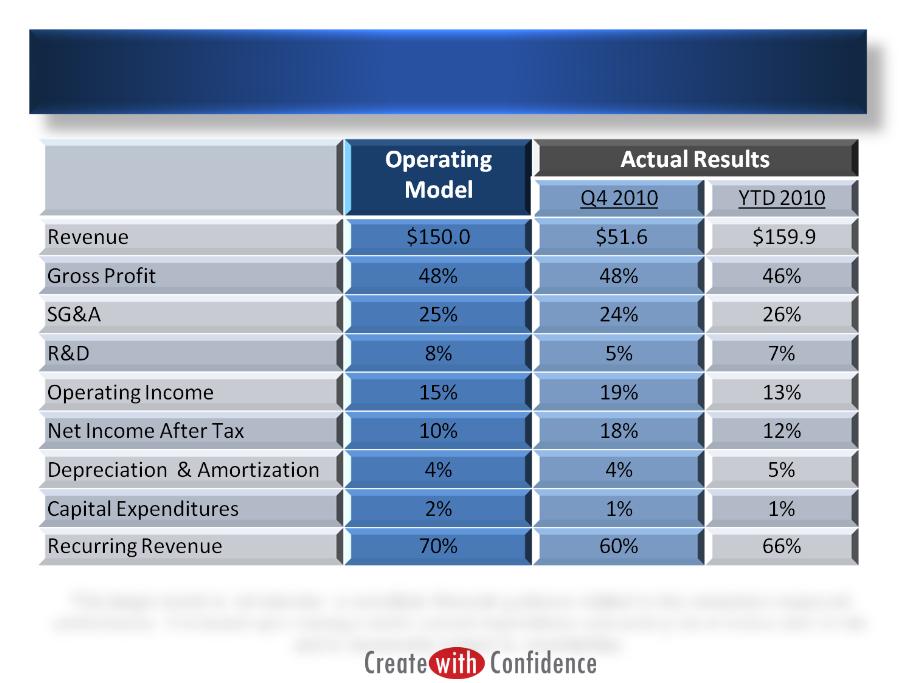

Progress Towards Long Term Operating Model

($ Millions)

This target model is not intended to constitute financial guidance related to the company’s expected

performance. It is based upon management’s current expectations concerning future events and trends

and is necessarily subject to uncertainties.

performance. It is based upon management’s current expectations concerning future events and trends

and is necessarily subject to uncertainties.

Copyright 3D Systems Corporation All Rights Reserved

16

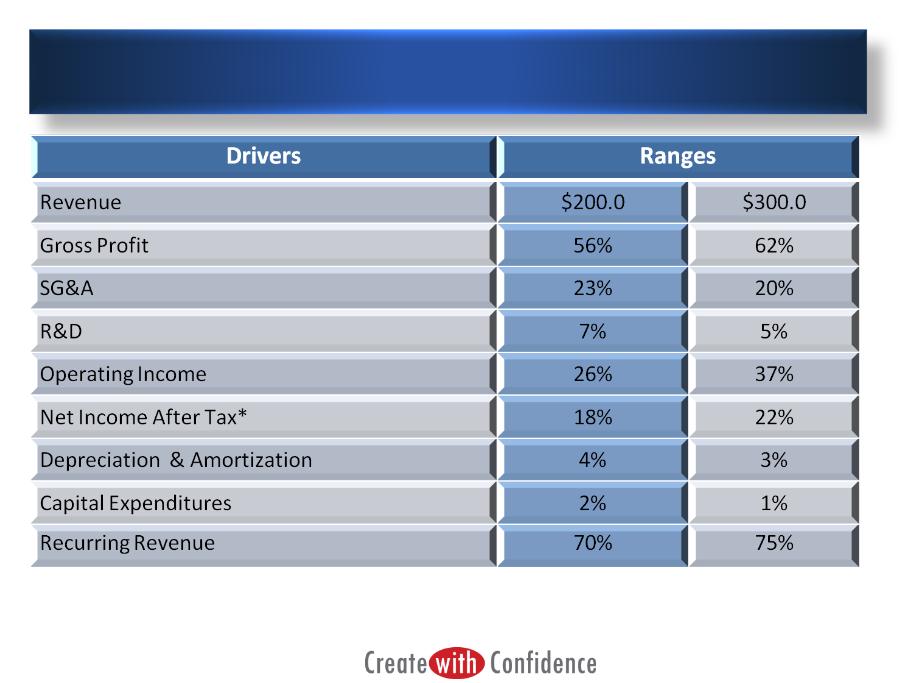

Revised Target Operating Model

($ Millions)

*Net income is inclusive of the estimated fully-burdened tax rate.

-The Company’s current NOLs reduce the cash taxes to the portion relating to the Non-U.S. obligations.

This target model is not intended to constitute financial guidance related to the company’s expected performance. It is based upon

management’s current expectations concerning future events and trends and is necessarily subject to uncertainties.

management’s current expectations concerning future events and trends and is necessarily subject to uncertainties.

Abe Reichental President & CEO

Copyright 3D Systems Corporation All Rights Reserved

18

We continued to expand our

3Dproparts™ services by:

3Dproparts™ services by:

• Acquiring Provel in Italy

• Consolidating and adding capabilities and

capacity as required

capacity as required

We expanded our personal and

professional 3D printer reach

and technology breadth by

acquiring Bits From Bytes and

launching several new ProJet™

printers at Euromold

professional 3D printer reach

and technology breadth by

acquiring Bits From Bytes and

launching several new ProJet™

printers at Euromold

We grew our healthcare solutions

revenue and installed base year

over year and received production

printer orders for delivery in future

periods

revenue and installed base year

over year and received production

printer orders for delivery in future

periods

We expanded our reseller

channel and grew personal and

professional printer revenues by

103% over the comparable 2009

quarter

channel and grew personal and

professional printer revenues by

103% over the comparable 2009

quarter

Recent Developments

Copyright 3D Systems Corporation All Rights Reserved

19

19

We entered the first quarter of 2011 with a strong sales funnel and

we expect revenue growth over the prior year quarter for the first

quarter of 2011

we expect revenue growth over the prior year quarter for the first

quarter of 2011

We expect strong demand for our personal, professional and

production printers helped by our expanding channel and expanding

portfolio

production printers helped by our expanding channel and expanding

portfolio

We expect 3Dproparts™ revenue growth from a combination of

organic growth and additional acquisitions

organic growth and additional acquisitions

We expect healthcare solutions revenue growth benefiting from our

expanding solutions portfolio and growing installed base

expanding solutions portfolio and growing installed base

Revenue Outlook

Copyright 3D Systems Corporation All Rights Reserved

20

20

Gross Profit and Operating Expenses Outlook

We expect our gross profit margin to improve over time but expect it

to be susceptible to:

to be susceptible to:

• Potential adverse printers mix in favor of lower margin personal printers

• Impact of Integration costs of acquired businesses

• Remaining V-Flash® drag that is expected to decrease and end all together during

the second quarter of 2011

the second quarter of 2011

We expect operating SG&A expenses for 2011 to be in the range of

$47.0 - $50.0 million:

$47.0 - $50.0 million:

• Inclusive of our anticipated litigation expenses as we currently understand them

• Increased operating costs associated with 3Dproparts™ acquisitions we made thus

far

far

We expect R&D expenses for 2011 to increase and be in the range of

$11.5 - $13.5 million reflecting our expanding print engine portfolio

and planned new product introductions throughout the year

$11.5 - $13.5 million reflecting our expanding print engine portfolio

and planned new product introductions throughout the year

Copyright 3D Systems Corporation All Rights Reserved

21

Our sales funnel remains robust and our backlog

reflects the strength of our business model

reflects the strength of our business model

Our personal, professional and production printers

and print services are expected to generate

increased customer demand

and print services are expected to generate

increased customer demand

Our business model is built around significant

recurring revenue components that generate

improved margins

recurring revenue components that generate

improved margins

We remain committed to our long-term growth

objectives and confident in our ability to provide

value to our customers and stockholders

objectives and confident in our ability to provide

value to our customers and stockholders

Bottom Line

Copyright 3D Systems Corporation All Rights Reserved

22

22

Q&A Session

Out of respect for other conference call participants,

please ask one question and then return to the queue to

ask additional questions.

please ask one question and then return to the queue to

ask additional questions.

Please direct all questions through the teleconference

portion of this call.

portion of this call.

• U.S.: 1-888-626-7452

• International: 1-201-604-5102

To ask

questions:

questions:

Replay available at www.3dsystems.com/ir